Exhibit 99.1

Foundation for the Future

Annual Meeting of Stockholders

May 8, 2008

Safe Harbor Statement

Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which ESSA Bancorp, Inc. (the “Company”) operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company’s financial performance and could cause the Company’s actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated event.

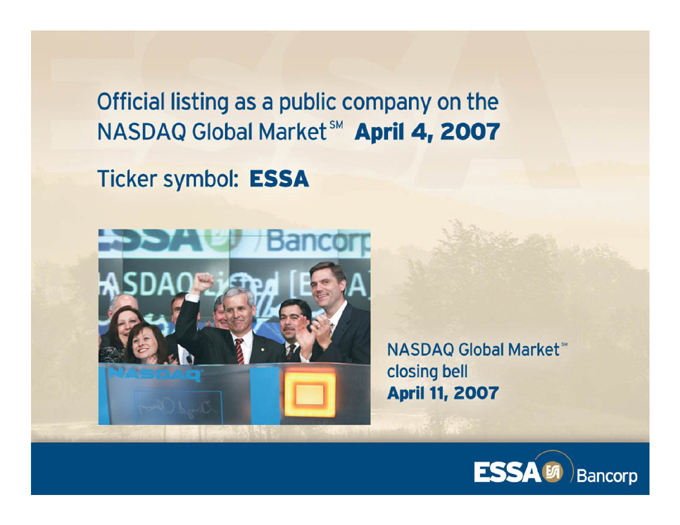

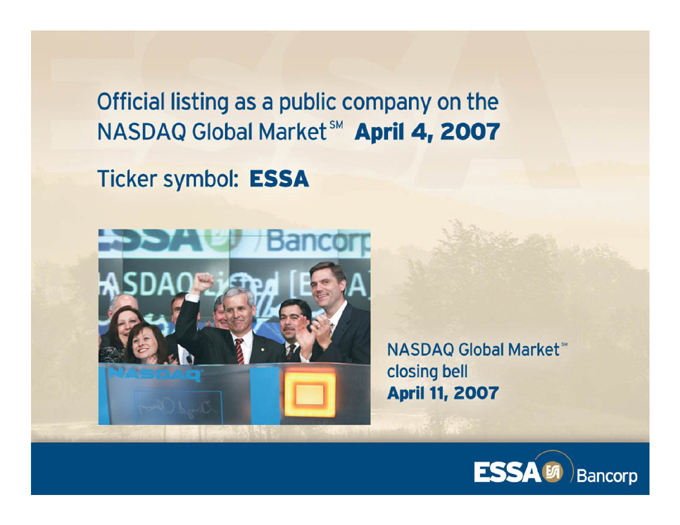

Official listing as a public company on the NASDAQ Global MarketSM April 4, 2007

Ticker symbol: ESSA

NASDAQ Global MarketSM

closing bell

April 11, 2007

Foundation for the Future

Our most historic year ever:

Converted to a NASDAQ-traded company

Conversion provided capital for future expansion, customer growth, and extended product lines

Contributed to commercial loan growth (up 23% in 2007)

Created branch of the future with the opening of Tannersville free standing branch

Improved technology and security

Introduced ACH origination; planning implementation of remote deposit capture

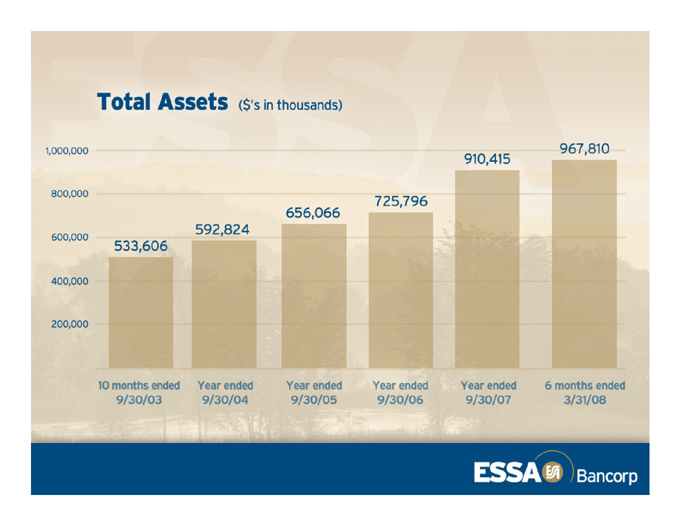

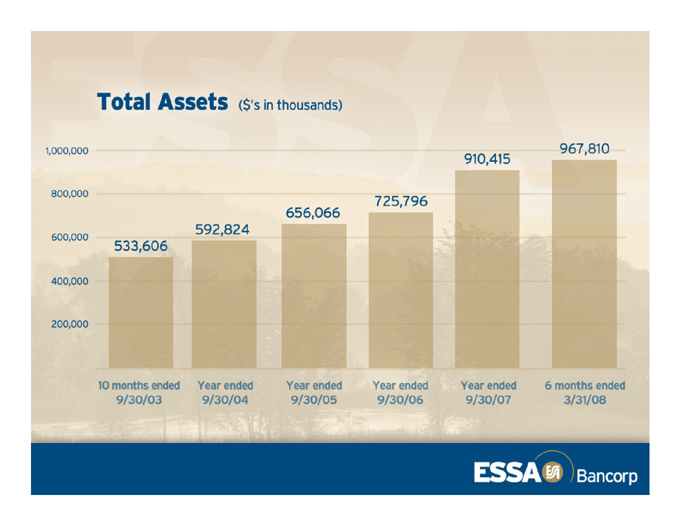

Total Assets ($’s in thousands)

1,000,000 800,000 600,000 400,000 200,000

533,606 592,824 656,066 725,796 910,415 967,810

10 months ended 9/30/03 Year ended 9/30/04 Year ended 9/30/05 Year ended 9/30/06 Year ended 9/30/07 6 months ended 3/31/08

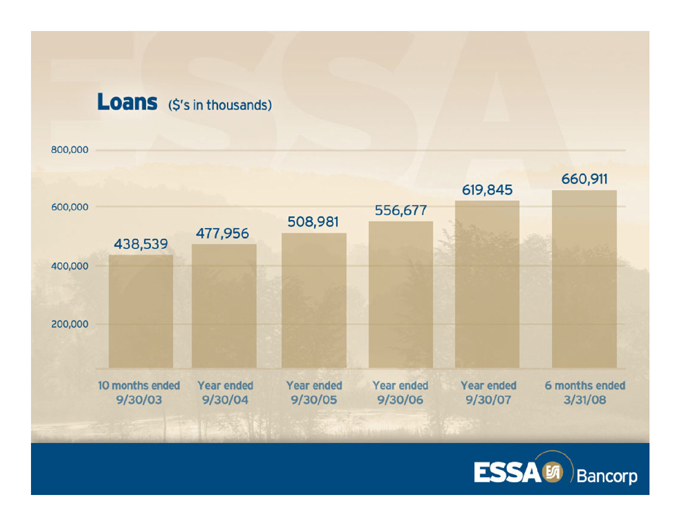

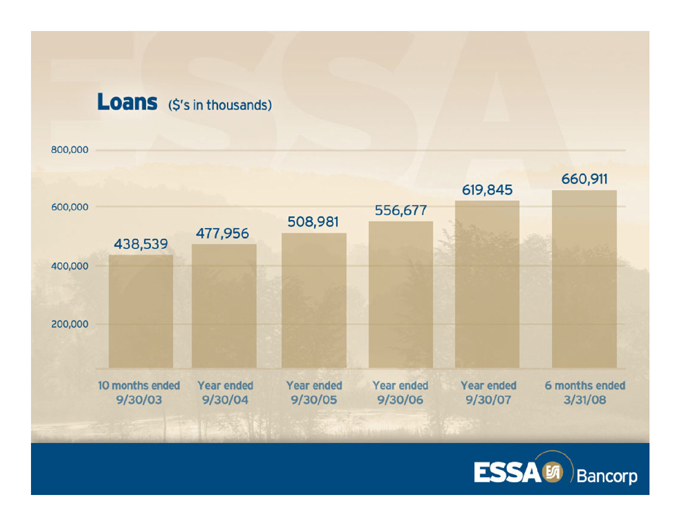

Loans ($’s in thousands)

800,000 600,000 400,000 200,000

438,539 477,956 508,981 556,677 619,845 660,911

10 months ended 9/30/03 Year ended 9/30/04 Year ended 9/30/05 Year ended 9/30/06 Year ended 9/30/07 6 months ended 3/31/08

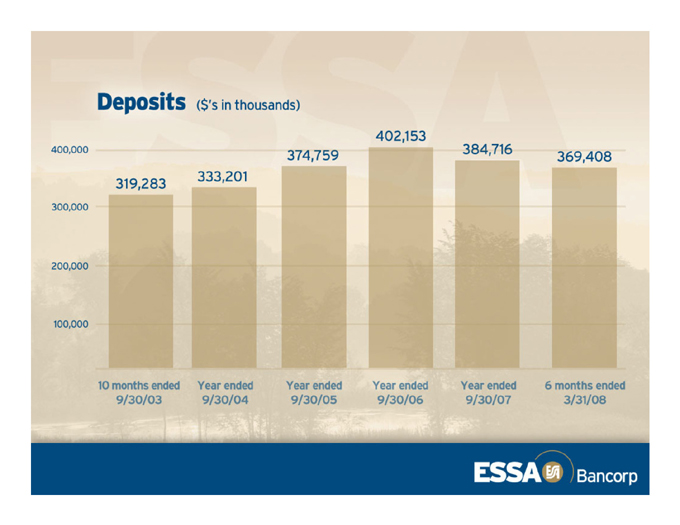

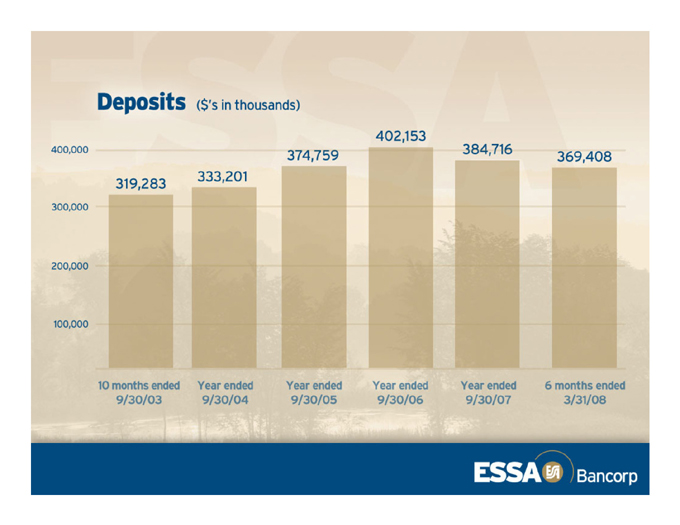

Deposits ($’s in thousands)

400,000 300,000 200,000 100,000

319,283 333,201 374,759 402,153 384,716 369,408

10 months ended 9/30/03

Year ended 9/30/04

Year ended 9/30/05

Year ended 9/30/06

Year ended 9/30/07

6 months ended 3/31/08

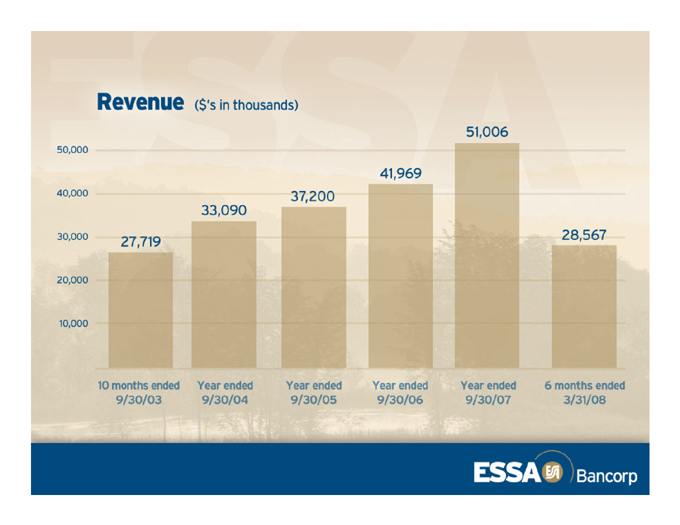

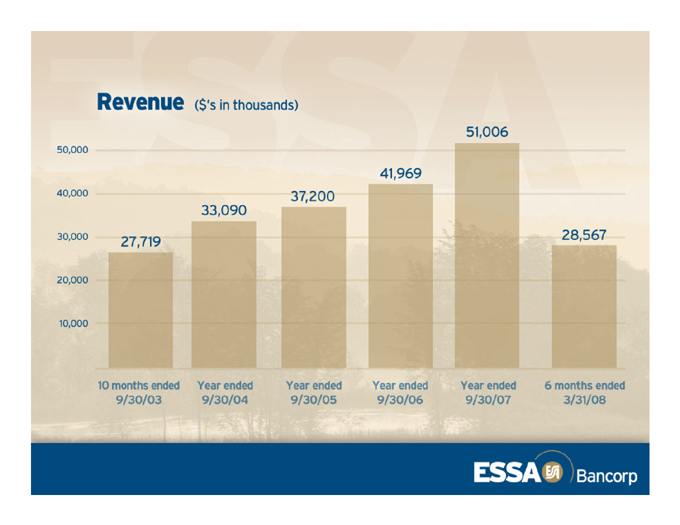

Revenue ($’s in thousands)

50,000 40,000 30,000 20,000 10,000

27,719 33,090 37,200 41,969 51,006 28,567

10 months ended 9/30/03

Year ended 9/30/04

Year ended 9/30/05

Year ended 9/30/06

Year ended 9/30/07

6 months ended 3/31/08

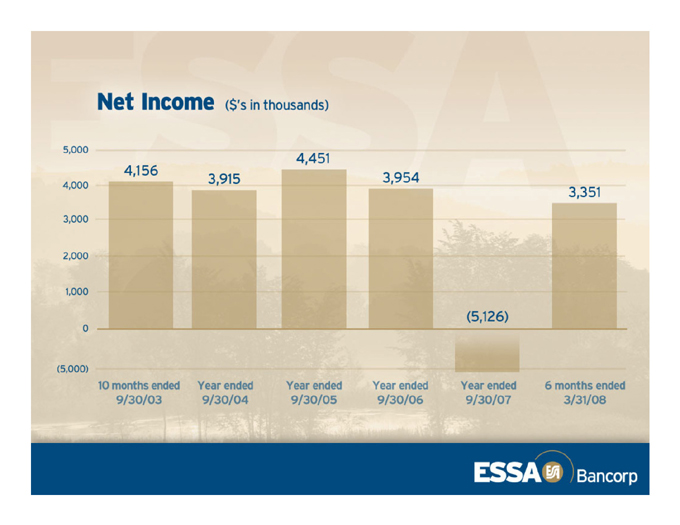

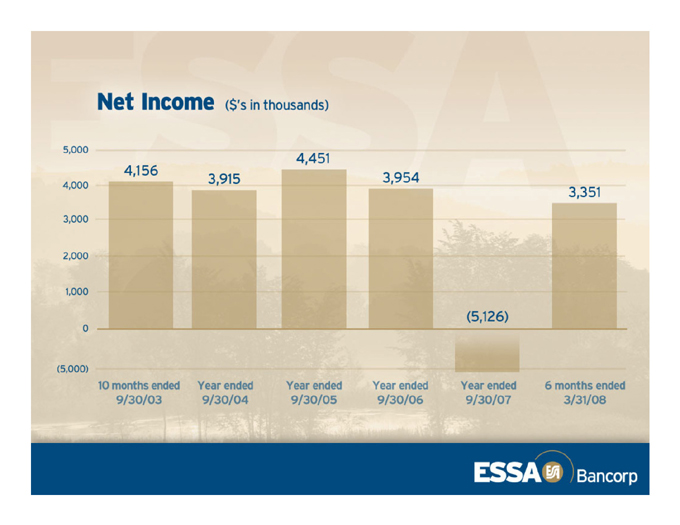

Net Income ($’s in thousands)

5,000 4,000 3,000 2,000 1,000 0 (5,000)

4,156 3,915 4,451 3,954 (5,126) 3,351

10 months ended 9/30/03

Year ended 9/30/04

Year ended 9/30/05

Year ended 9/30/06

Year ended 9/30/07

6 months ended 3/31/08

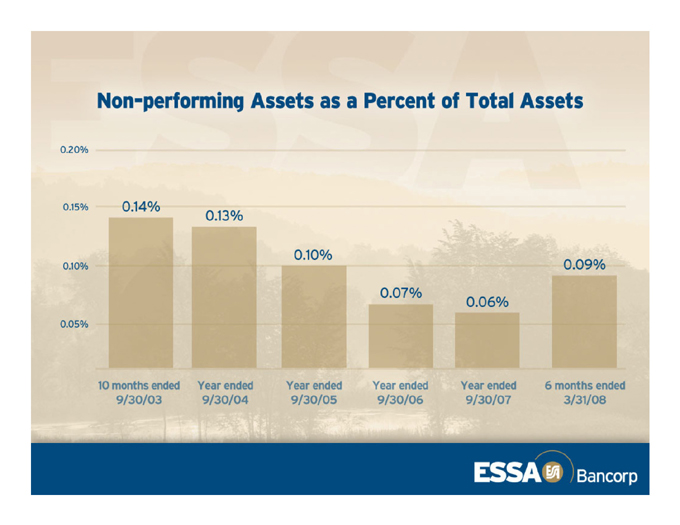

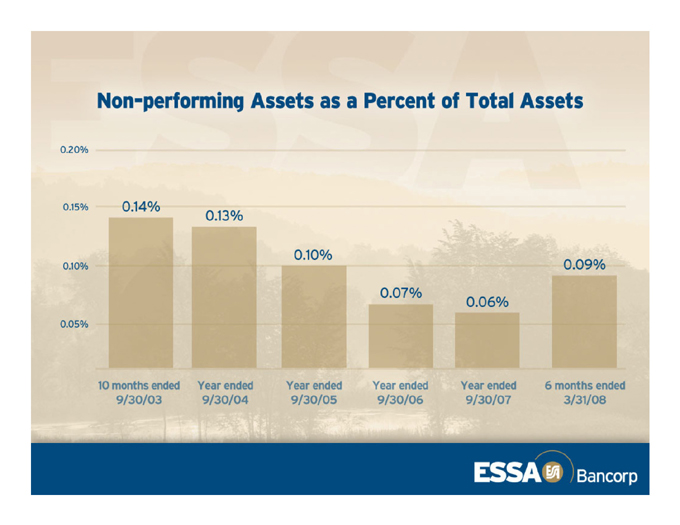

Non-performing Assets as a Percent of Total Assets

0.20% 0.15% 0.10% 0.05%

0.14% 0.13% 0.10% 0.07% 0.06% 0.09%

10 months ended 9/30/03

Year ended 9/30/04

Year ended 9/30/05

Year ended 9/30/06

Year ended 9/30/07

6 months ended 3/31/08

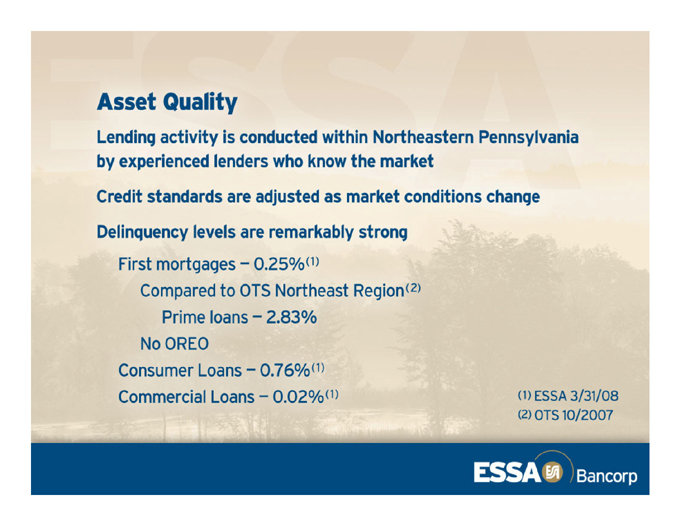

Asset Quality

Lending activity is conducted within Northeastern Pennsylvania

by experienced lenders who know the market

Credit standards are adjusted as market conditions change

Delinquency levels are remarkably strong

First mortgages – 0.25%(1)

Compared to OTS Northeast Region(2)

Prime loans – 2.83%

No OREO

Consumer Loans – 0.76%(1)

Commercial Loans – 0.02%(1)

Strong Market Share and Market Presence

Serving 22,400 households through 13-branch network

16,320 (73%) in Monroe County

27% of all Monroe County households

Deposit market share

#2 of 17 financial institutions in Monroe County with 19%

Mortgage and home equity loan market share(1)

#1 local mortgage lender in Monroe County

#8 of 475 lenders in loans closed

#11 of 475 lenders in dollars loaned

(1) HMDA 2006

Expanded Delivery Channel Options and Usage

Tannersville Office – March 2007

Prototype for future locations

New job opportunities

Expanded banking convenience

Welcoming environment

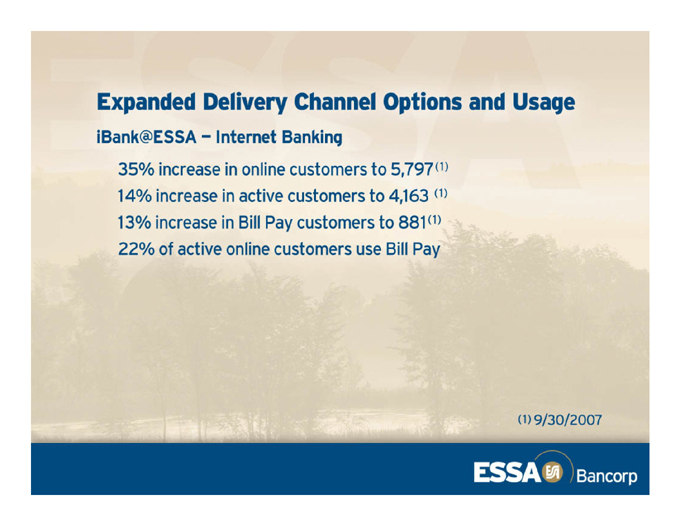

Expanded Delivery Channel Options and Usage

iBank@ESSA – Internet Banking

35% increase in online customers to 5,797(1)

14% increase in active customers to 4,163(1)

13% increase in Bill Pay customers to 881(1)

22% of active online customers use Bill Pay

(1) 9/30/2007

Buybacks/Dividends

Having officially been a public company for more than one year, ESSA Bancorp’s board will now be considering buybacks and dividends.

ESSA bank & Trust Foundation

Originally formed in 1998

Celebrating 10 years of giving in 2008

Conversion proceeds provided permanent funding

1,110,900 shares of stock

$1.6 million in cash

Over $700,000 in commitments in FY2007

Almost $5.5 million in commitments in 10 years

ESSA Bank & Trust Foundation

Board of Directors

John E. Burrus, President

Suzie T. Farley, Vice President/Treasurer/Secretary

Gary S. Olson

Elizabeth B. Weekes

Dr. Isaac W. Sanders

Lois Brownsey-Heckman