Exhibit 99.1

| | |

| Date: | | November 18, 2013 |

| |

| Contacts: | | ESSA Bancorp, Inc. - Gary S. Olson, President & CEO |

| | (570) 421-0531 |

| |

| | Franklin Security Bancorp, Inc. – Richard F. Mebane, President & CEO |

| | (570) 825-9800 |

ESSA BANCORP, INC., AND FRANKLIN SECURITY BANCORP ANNOUNCE

SIGNING OF MERGER AGREEMENT

Stroudsburg, Pennsylvania and Wilkes-Barre, Pennsylvania, November 18, 2013 — ESSA Bancorp, Inc. (NASDAQ Global Select MarketSM:ESSA) (“ESSA Bancorp”), the holding company for ESSA Bank & Trust, and Franklin Security Bancorp, Inc. (“FSB”) announced today they have executed a definitive agreement whereby ESSA Bancorp will acquire FSB and its wholly owned subsidiary, Franklin Security Bank, through an all cash transaction.

Under the terms of the merger agreement, stockholders of FSB will receive $9.75 per share or an aggregate of approximately $15.7 million. Pending the satisfaction of customary closing conditions, including the receipt of all regulatory approvals and the approval of stockholders of FSB, the transaction is expected to close in the second quarter of 2014. The merger is expected to be immediately accretive to ESSA Bancorp’s earnings upon closing.

With two banking facilities serving Scranton and Wilkes-Barre, Pennsylvania, Franklin Security Bank reported assets of $225.65 million at September 30, 2013, total loans of $148.88 million and total deposits of $168.25 million.

ESSA Bank & Trust, with assets of $1.37 billion, provides a full range of retail and commercial financial services, and financial advisory and wealth management capabilities to the Greater Pocono and Lehigh Valley areas in northeast Pennsylvania through 26 community offices.

Gary S. Olson, President and CEO of ESSA Bank & Trust, commented: “Partnering with Franklin Security Bank provides a platform for ESSA Bank & Trust to expand its presence northward to an adjacent regional market. Franklin Security Bank’s strong commercial banking and indirect auto lending businesses will provide added diversification to ESSA Bank’s balance sheet and complement ESSA Bank & Trust’s existing capabilities in retail and commercial banking. ESSA Bank & Trust will join forces with Franklin Security Bank’s team to expand ESSA Bank & Trust’s consumer and mortgage banking operations in Franklin Security Bank’s markets. As a small business oriented community bank, Franklin Security Bank has had particular success in rolling out products such as remote check deposit capture, and we look forward to leveraging their capabilities. Additionally, we are pleased to have continued access to the expertise of Richard F. Mebane, President and CEO of Franklin Security Bank, who will serve as ESSA Bank & Trust’s Market President when the acquisition is concluded.”

Mebane added: “We are excited to join forces with a larger financial institution with ESSA’s rich tradition of serving northeast Pennsylvania. We are confident this merger will benefit our customers and the communities we serve. We look forward to expanding product and service offerings to customers in our markets, and to leverage Franklin’s commercial and auto lending expertise to enhance ESSA’s overall banking platform.”

RP Financial, LC served as financial advisor to ESSA Bancorp and Luse Gorman Pomerenk & Schick, P.C. served as legal counsel to ESSA Bancorp. Ambassador Financial Group served as financial advisor to FSB, Boenning & Scattergood provided a fairness opinion to FSB and Elias, Matz, Tiernan & Herrick L.L.P. served as legal counsel to FSB.

ESSA Bank & Trust, a wholly-owned subsidiary of ESSA Bancorp, Inc., has total assets of over $1.3 billion and is the leading service-oriented financial institution headquartered in Stroudsburg, Pennsylvania. ESSA Bank & Trust maintains its corporate headquarters in downtown Stroudsburg, Pennsylvania and has 26 community offices throughout the Greater Pocono and Lehigh Valley areas in Pennsylvania. In addition to being one of the region’s largest mortgage lenders, ESSA Bank & Trust offers a full range of retail, commercial financial services, and financial advisory and asset management capabilities. ESSA Bancorp, Inc. stock trades on The NASDAQ Global Select MarketSM under the symbol “ESSA.”

Forward-Looking Statements

Certain statements contained herein are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods, or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “estimate,” “anticipate,” “continue,” or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the economic environment, particularly in the market areas in which the companies operate, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting financial institutions, including compliance costs and capital requirements, changes in prevailing interest rates, acquisitions and the integration of acquired businesses, credit risk management, asset-liability management, the financial and securities markets and the availability of and costs associated with sources of liquidity.

Readers should not place undue reliance on any such forward-looking statements, which speak only as of the date made. Readers are advised that the factors listed above could affect our financial performance and could cause our actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. We do not undertake and specifically decline any obligation to publicly release the result of any revisions, that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Transaction Data

| | • | | Cash purchase price is $9.75 per share |

| | • | | Deal value will be $15.7 million based on 1,610,000 Franklin Security Bancorp shares outstanding |

| | • | | All outstanding stock options will be cancelled |

| | • | | The preferred stock issued to the United States Department of the Treasury by Franklin Security Bancorp pursuant to the Small Business Lending Fund Program is expected to be redeemed concurrent with the closing of the transaction |

| | • | | Aggregate deal value is 86.48% of tangible book value per common share as of September 30, 2013 |

| | • | | Aggregate deal value is 26.1x annualized common earnings per share for the nine months ended September 30, 2013. |

| | • | | Immediately accretive to earnings, absent transaction related expenses. Targeting earnings per share accretion of $0.03 per share in the first clean quarter (0.13 per share on an annualized basis). |

| | • | | Improves both return on assets and return on equity measures |

| | • | | Cost savings in the range of 20% of Franklin Security Bancorp’s pre-transaction operating expenses expected to be realized within the first year following the transaction |

| | • | | Tangible book value dilution of 1.1% is estimated based on current market conditions |

| | • | | Dilution to tangible book value is projected to be recovered through new earnings in slightly more than one year |

| | • | | Pro-forma tangible capital-to-tangible assets of 9.84% |

Key Rationales for the Transaction

| | • | | Provides market expansion into the Scranton and Wilkes-Barre market which is an adjacent market to ESSA Bancorp’s current markets |

| | • | | Will leverage on Franklin Security’s strong commercial banking franchise |

| | • | | ESSA Bancorp expects to retain Franklin Security’s seasoned commercial lenders including Richard Mebane, Franklin Security’s CEO who will be a Market President |

| | • | | The acquired indirect auto lending platform will enhance the ability to generate high credit quality loans with relatively short terms to maturity |

| | • | | Franklin Security has recently commenced a government banking program which ESSA Bancorp will seek to expand |

| | • | | Franklin Security’s non-performing assets are low and non-performing assets/assets equaled 1.08% as of September 30, 2013 |

| | • | | ESSA Bancorp will be able to offer its broader array of products and services to Franklin Security’s customers in the Scranton Wilkes-Barre markets including: |

| | • | | Single family mortgage first and second mortgage loans and home equity loans |

| | • | | Wealth management and trust services |

| | • | | Insurance and other related benefit services |

Other Transaction Considerations

| | • | | Closing anticipated in the second calendar quarter of 2014 |

| | • | | Break-up fee payable to ESSA Bancorp is $600,000 |

| | • | | Both parties have the right to terminate the transaction if it has not closed by July 31, 2014. |

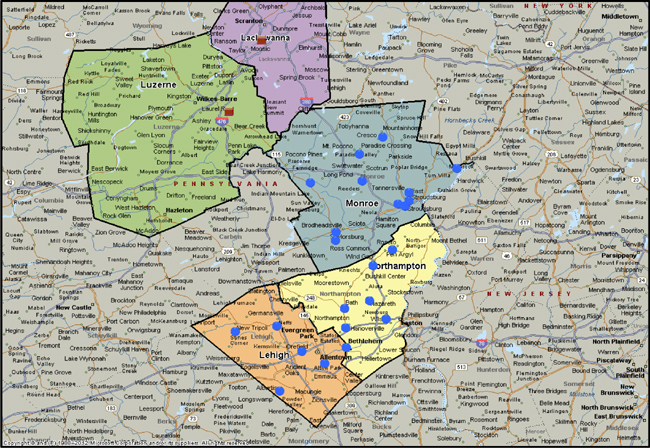

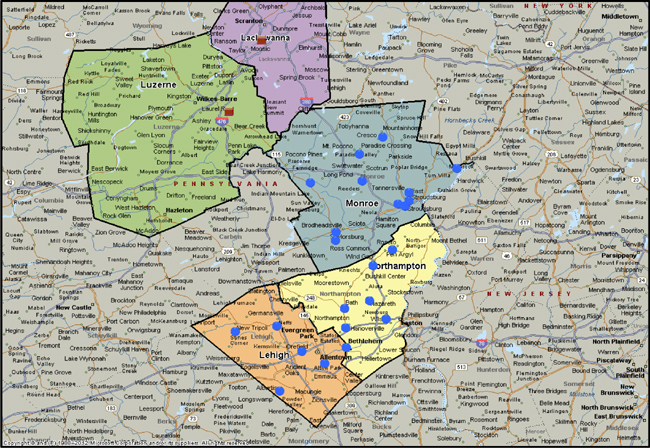

ESSA Banks and Trust and Franklin Security Bank

Branch Map