SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the registrant ■

Filed by a party other than the registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ■ | Definitive proxy statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material pursuant to §240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

N/A

| (2) | Aggregate number of securities to which transactions applies: |

N/A

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A

| (4) | Proposed maximum aggregate value of transaction: |

N/A

N/A

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

N/A

| (2) | Form, Schedule or Registration Statement No.: |

N/A

N/A

N/A

[Delanco Bancorp, Inc. Logo]

July 15, 2009

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Delanco Bancorp, Inc. (the “Company”). The meeting will be held at the Company’s offices, 615 Burlington Avenue, Delanco, New Jersey, on Monday, August 17, 2009 at 5:00 p.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. During the meeting, we will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of Connolly, Grady & Cha, P.C., the Company’s independent registered public accounting firm, will be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to complete and mail the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously voted.

We look forward to seeing you at the meeting.

| Sincerely, |

| |

| /s/ James E. Igo |

| |

| James E. Igo |

| President and Chief Executive Officer |

DELANCO BANCORP, INC.

615 BURLINGTON AVENUE

DELANCO, NEW JERSEY 08075

(856) 461-0611

NOTICE OF 2009 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE | | 5:00 p.m., local time, on Monday, August 17, 2009 |

| | | |

| PLACE | | Company’s offices, 615 Burlington Avenue, Delanco, New Jersey |

| | | | |

| ITEMS OF BUSINESS | | (1) | To elect two directors to serve for a term of three years. |

| | | | |

| | | (2) | To ratify the selection of Connolly, Grady & Cha, P.C. as our independent registered public accounting firm for fiscal year 2010. |

| | | | |

| | | (3) | To transact such other business as may properly come before the meeting and any adjournment or postponement of the meeting. |

| | | | |

| RECORD DATE | | To vote, you must have been a stockholder at the close of business on July 6, 2009. |

| | | |

| PROXY VOTING | | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy or voting instruction card and included in the accompanying proxy statement. You can revoke a proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. |

| | | /s/ Douglas R. Allen, Jr. |

| | | Douglas R. Allen, Jr. |

| | | Corporate Secretary |

| | | July 15, 2008 |

DELANCO BANCORP, INC.

PROXY STATEMENT

General Information

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of Delanco Bancorp, Inc. for the 2009 annual meeting of stockholders and for any adjournment or postponement of the meeting. In this proxy statement, we may also refer to Delanco Bancorp, Inc. as “Delanco Bancorp,” the “Company,” “we,” “our” or “us.”

Delanco Bancorp is the holding company for Delanco Federal Savings Bank. In this proxy statement, we may also refer to Delanco Federal Savings Bank as “Delanco Federal” or the “Bank.”

We are holding the 2009 annual meeting at the Company’s offices, 615 Burlington Avenue, Delanco, New Jersey, on Monday, August 17, 2009 at 5:00 p.m., local time.

We intend to mail this proxy statement and the enclosed proxy card to stockholders of record beginning on or about July 15, 2009.

Important Notice Regarding the Availability of Proxy Materials for the 2009 Annual Meeting of Stockholders to be held on August 17, 2009

This proxy statement and our 2009 Annual Report on Form 10-K are available electronically at www.cfpproxy.com/6184.

Information About Voting

Who Can Vote at the Meeting

You are entitled to vote the shares of Delanco Bancorp common stock that you owned as of the close of business on July 6, 2009. As of the close of business on July 6, 2009, a total of 1,634,725 shares of Delanco Bancorp common stock were outstanding, including 899,099 shares of common stock held by Delanco MHC (“Delanco MHC”). Each share of common stock has one vote.

The Company’s charter provides that, until March 30, 2012, record holders of the Company’s common stock, other than Delanco MHC, who beneficially own, either directly or indirectly, in excess of 10% of the Company’s outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit.

Ownership of Shares; Attending the Meeting

You may own shares of Delanco Bancorp in one of the following ways:

| | · | Directly in your name as the stockholder of record; |

| | · | Indirectly through a broker, bank or other holder of record in “street name”; or |

| | · | Indirectly through the Delanco Federal Savings Bank Employee Stock Ownership Plan (the “ESOP”). |

If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the meeting.

If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction form that accompanies your proxy materials. Your broker, bank or other holder of record may allow you to provide voting instructions by telephone or by the Internet. Please see the instruction form provided by your broker, bank or other holder of record that accompanies this proxy statement. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Delanco Bancorp common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or other nominee who is the record holder of your shares.

Quorum and Vote Required

Quorum. We will have a quorum and will be able to conduct the business of the annual meeting if the holders of a majority of the outstanding shares of common stock entitled to vote are present at the meeting, either in person or by proxy.

Votes Required for Proposals. At this year’s annual meeting, stockholders will elect two directors to serve a term of three years. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to all nominees or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected.

In voting on the ratification of the appointment of Connolly, Grady & Cha, P.C. as the Company’s independent registered public accounting firm, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To ratify the selection of Connolly, Grady & Cha, P.C. as our independent registered public accounting firm for 2010, the affirmative vote of a majority of the shares represented at the meeting and entitled to vote is required.

Routine and Non-Routine Proposals. Rules applicable to essentially all brokers determine whether proposals presented at stockholder meetings are routine or non-routine. If a proposal is routine, a broker may vote on the proposal without receiving voting instructions from the owner. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the owner has provided voting instructions. A broker non-vote occurs when a broker or other entity is unable to vote on a particular proposal and has not received voting instructions from the beneficial owner. The election of directors and the ratification of Connolly, Grady & Cha, P.C. as our independent public accounting firm for 2010 are currently considered routine matters.

How We Count Votes. If you return valid proxy instructions or attend the meeting in person, we will count your shares to determine whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted to determine the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the proposal to ratify the selection of the independent registered public accounting firm, abstentions will have the same effect as a negative vote while broker non-votes will have no effect on the proposal.

Because Delanco MHC owns in excess of 50% of the outstanding shares of Delanco Bancorp common stock, the votes it casts will ensure the presence of a quorum and determine the outcome of Item 1 (Election of Directors) and Item 2 (Ratification of the Independent Registered Public Accounting Firm).

Voting by Proxy

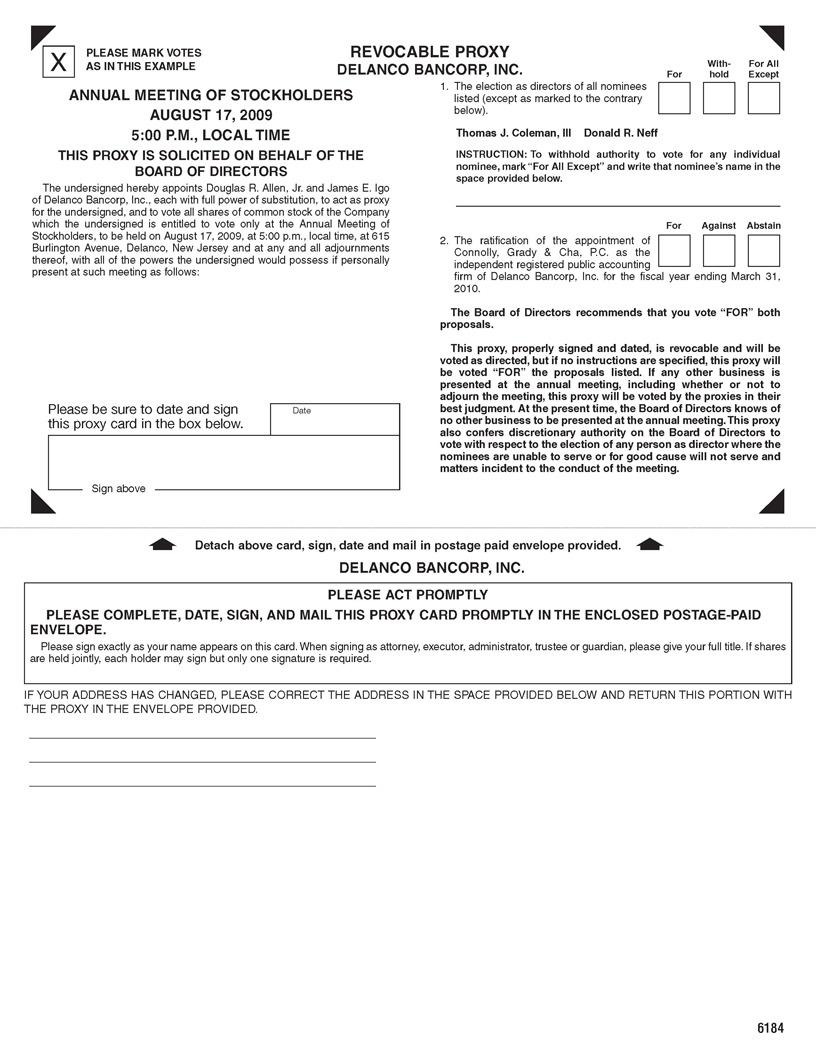

The Board of Directors of Delanco Bancorp is sending you this proxy statement to request that you allow your shares of Delanco Bancorp common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Delanco Bancorp common stock represented at the annual meeting by properly executed and dated proxy cards will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends a vote “FOR” each of the nominees for director and “FOR” ratification of Connolly, Grady & Cha, P.C. as the independent registered public accounting firm.

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your Delanco Bancorp common stock may be voted by the persons named in the proxy card on the new annual meeting date as well, unless you have revoked your proxy. We do not know of any other matters to be presented at the annual meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must either advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

Participants in the ESOP

If you participate in the ESOP, you will receive a voting instruction card for the ESOP that will reflect all the shares that you may direct the trustee to vote on your behalf under the ESOP. Under the terms of the ESOP, all allocated shares of Delanco Bancorp common stock held by the ESOP are voted by the ESOP trustee, as directed by plan participants. All unallocated shares of Delanco Bancorp common stock held by the ESOP and all allocated shares for which no timely voting instructions are received are voted by the ESOP trustee in the same proportion as shares for which the trustee has received voting instructions, subject to the exercise of its fiduciary duties. The deadline for returning your voting instruction card is August 10, 2009.

Corporate Governance

Director Independence

The Company’s Board of Directors currently consists of nine members, all of whom are independent under the listing standards of The NASDAQ Stock Market, except for Robert M. Notigan, who served as an employee of Delanco Bancorp and Delanco Federal until March 31, 2008. In determining the independence of its directors, the Board considered transactions, relationships and arrangements between the Company and its directors that are not required to be disclosed in this proxy statement under the heading “Transactions with Related Persons,” including loans or lines of credit that the Bank has directly or indirectly made to Directors Thomas J. Coleman, III, Robert H. Jenkins, Jr. and Donald R. Neff. The business relationships between the Company and its directors or the directors’ affiliated companies that were considered by the Board were: the law firm of Raymond & Coleman, LLP, of which Thomas J. Coleman, III is a partner, provided legal services to the Company; John A. Latimer and Robert H. Jenkins, Jr. are employed by The Barclay Group, Delanco Federal’s insurance broker; and William C. Jenkins is the owner of a technical writing firm, the White Stone Group, which provides maintenance services for Delanco Federal’s website.

Committees of the Board of Directors

The Company maintains an Audit Committee consisting of directors James W. Verner (Chairperson), Donald R. Neff, John W. Latimer and Renee C. Vidal. The Audit Committee meets periodically with independent auditors and management to review accounting, auditing, internal control structure and financial reporting matters. Each member of the Audit Committee is independent in accordance with the listing standards of The NASDAQ Stock Market. The Board of Directors has determined that the Audit Committee does not have a member who is an “audit committee financial expert.” While the Board recognizes that no individual Board member meets the qualifications required of an “audit committee financial expert,” the Board believes that appointment of a new director to the Board and to the Audit Committee at this time is not necessary as the level of financial knowledge and experience of the current members of the Audit Committee, including the ability to read and understand fundamental financial statements, is cumulatively sufficient to discharge adequately the Audit Committee’s responsibilities. The Audit Committee operates under a written charter which is available to the public under “Investors” at www.delancofsb.com.

The Company does not maintain separately designated compensation or nominating committees. Based on the number of independent directors currently serving on the Board, the Company believes that the functions customarily attributable to these committees are sufficiently performed by our full Board of Directors.

Each member of our Board of Directors participates in the consideration of executive officer and director compensation. James E. Igo, the Company’s President and Chief Executive Officer, does not participate in Board discussions or the review of Board documents relating to the determination of his compensation. The Board of Directors is responsible for determining annual grade and salary levels for employees and establishing personnel policies.

The Board of Directors is responsible for the annual selection of management’s nominees for election as directors and developing and implementing policies and practices relating to corporate governance. See “—Nominating Procedures.”

Nominating Procedures

It is the policy of the Board of Directors of the Company to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Board may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Board does not perceive a need to increase the size of the Board of Directors. To avoid the unnecessary use of the Board’s resources, the Board will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders. To submit a recommendation of a director candidate to the Board of Directors, a stockholder should submit the following information in writing, addressed to the Chairperson of the Board, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| 4. | The name and address of the stockholder making the recommendation, as they appear on the Company’s books; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Board of Directors at least 30 days before the date of the annual meeting.

Process for Identifying and Evaluating Nominees. The process that the Board follows when it identifies and evaluates individuals to be nominated for election to the Board of Directors is as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Board relies on personal contacts of the members of the Board of Directors, as well as their knowledge of members of the communities served by Delanco Bancorp. The Board also will consider director candidates recommended by stockholders in accordance with the policy and procedures set forth above. The Board has not used an independent search firm to identify nominees.

Evaluation. In evaluating potential nominees, the Board determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria, which are discussed in more detail below. If such individual fulfills these criteria, the Board will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Minimum Qualifications. The Board has adopted a set of criteria that it considers when it selects individuals not currently on the Board of Directors to be nominated for election to the Board of Directors. A candidate must meet the eligibility requirements set forth in the Company’s Bylaws, which include a stock ownership requirement and a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate must also meet any qualification requirements set forth in any Board or committee governing documents.

If the candidate is deemed eligible for election to the Board of Directors, the Board will then evaluate the prospective nominee to determine if he or she possesses the following qualifications, qualities or skills:

| · | contributions to the range of talent, skill and expertise appropriate for the Board; |

| · | financial, regulatory and business experience, knowledge of the banking and financial service industries, familiarity with the operations of public companies and ability to read and understand financial statements; |

| · | familiarity with the Company’s market area and participation in and ties to local businesses and local civic, charitable and religious organizations; |

| · | personal and professional integrity, honesty and reputation; |

| · | the ability to represent the best interests of the stockholders of the Company and the best interests of the institution; |

| · | the ability to devote sufficient time and energy to the performance of his or her duties; |

| · | independence under applicable Securities and Exchange Commission and listing definitions; and |

| · | current equity holdings in the Company. |

The Board will also consider any other factors it deems relevant, including age, diversity, size of the Board of Directors and regulatory disclosure obligations.

With respect to nominating an existing director for re-election to the Board of Directors, the Board will consider and review an existing director’s Board and committee attendance and performance; length of Board service; experience, skills and contributions that the existing director brings to the Board; and independence.

Pursuant to the Bank’s Supervisory Agreement with the Office of Thrift Supervision, the Bank must receive the non-objection of the Office of Thrift Supervision before adding or replacing any Bank Board member.

Board and Committee Meetings

During the year ended March 31, 2009, the Boards of Directors of the Company and the Bank held 14 meetings, respectively. No director attended fewer than 75% of the meetings of the Board of Directors and Board committees on which they served.

Director Attendance at Annual Meeting of Stockholders

The Board of Directors encourages directors to attend the annual meeting of stockholders. All directors attended the 2008 annual meeting of stockholders.

Audit Committee Report

The Company’s management is responsible for the Company’s internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles. The Audit Committee oversees the Company’s internal control over financial reporting on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management. In concluding that the independent registered public accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal control over financial reporting and the overall quality of the Company’s financial reporting process.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm who, in their report, express an opinion on the conformity of the Company’s financial statements to U.S. generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal control over financial reporting designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board (United States) or that the Company’s independent registered public accounting firm is in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2009 for filing with the Securities and Exchange Commission. The Audit Committee has appointed Connolly, Grady & Cha, P.C. to be the Company’s independent registered public accounting firm for the 2010 fiscal year, subject to stockholder ratification.

Audit Committee of the Delanco Bancorp, Inc. Board of Directors

James W. Verner – Chairperson

Donald R. Neff

John A. Latimer

Renee C. Vidal

Directors’ Compensation

The following table provides the compensation received by individuals who served as non-employee directors of the Company during the 2009 fiscal year.

| Name | | Fees Earned or Paid in Cash | |

| | | | |

| Thomas J. Coleman, III | | $ | 8,375 | |

| Robert H. Jenkins, Jr. | | | 7,700 | |

| William C. Jenkins | | | 6,025 | |

| John A. Latimer | | | 7,100 | |

| Donald R. Neff | | | 10,125 | |

| Robert M. Notigan | | | 6,875 | |

| John W. Seiber | | | 12,200 | |

| James W. Verner | | | 7,100 | |

| Renee C. Vidal | | | 7,425 | |

Director Retirement Plan. Delanco Federal sponsors a director retirement plan for the benefit of members of the Board of Directors. All directors serving on or after the plan’s effective date of January 1, 2002 participate in the plan. Under the plan, directors receive a monthly retirement benefit equal to 4% of their fees (including any annual retainer) multiplied by their completed years of service, up to a maximum of 80% of the final fee amount. Directors must complete at least ten years of service as an employee and/or director in order to receive a retirement benefit under the plan. Director retirement benefits are payable in equal monthly installments during the director’s lifetime, unless the director elects to receive an actuarially equivalent benefit in the form of an annuity. No benefits are payable under the plan upon a participating director’s death, unless the participant selected the annuity form of payment, in which case the director’s designated beneficiary would receive continued payments in accordance with the director’s election.

Non-Qualified Retirement Program Agreement with John W. Seiber. Delanco Federal has entered into a Non-Qualified Retirement Program Selective Incentive Plan agreement with John W. Seiber, former President and Chief Executive Officer and current Chairman of the Board of Directors, which provides him with certain retirement benefits. Delanco Federal agreed to provide Mr. Seiber with 120 monthly payments of $1,417 over the 10 year period following his retirement in 2004. In the event of Mr. Seiber’s death, Delanco Federal will make any remaining payments to his beneficiary. Under the agreement, the Bank may suspend payment of the retirement benefits if Mr. Seiber becomes an officer, director, owner or employee of a business that competes with the Bank or any of its affiliates within a 30 mile radius of the Bank’s principal office. Upon a change in control, the Bank is required to obtain from its successor a commitment to assume the terms of the agreement with Mr. Seiber.

Cash Retainer and Meeting Fees for Non-Employee Directors. The following table sets forth the applicable retainers and fees that are paid to non-employee directors for their service on the Board of Directors of Delanco Federal. Directors do not receive any fees for their service on the Boards of Directors of Delanco Bancorp or Delanco MHC. Each director receives two paid absences on an annual basis.

| Board of Directors of Delanco Federal: | | | |

| Annual Retainer for Chairman of the Board | | $ | 3,000 | |

| Fee per Board Meeting | | | 625 | |

| Fee per Committee Meeting: | | | | |

| Executive Committee | | | 250 | |

| All Others Committees | | | 175 | |

The following table provides information as of June 30, 2009 with respect to persons and entities known to the Company to be the beneficial owner of more than 5% of the Company’s outstanding common stock. A person or entity may be considered to beneficially own any shares of common stock over which the person or entity has, directly or indirectly, sole or shared voting or investing power.

| | | | | Percent of Common Stock Outstanding | |

| | | | | | | | | |

615 Burlington Avenue Delanco, New Jersey 08075 | | | 899,099 | | | | 55.0 | % |

| (1) | The members of the Board of Directors of Delanco Bancorp and Delanco Federal also constitute the Board of Directors of Delanco MHC. |

The following table provides information as of June 30, 2009 with respect to shares of Delanco Bancorp common stock that may be considered to be owned by each director, each executive officer named in the Summary Compensation Table and by all directors and executive officers of the Company as a group. A person may be considered to own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting power and sole investment power with respect to the shares shown. The number of shares beneficially owned by all directors and executive officers as a group totaled 3.0% of our outstanding common stock as of June 30, 2009. Each director and named executive officer owned less than 1.0% of our outstanding common stock as of that date.

| Name | | Number of Shares Owned | |

| Douglas R. Allen, Jr. | | | 5,640 | (1) |

| Thomas J. Coleman, III | | | 5,000 | |

| James E. Igo | | | 4,000 | |

| Robert H. Jenkins, Jr. | | | 3,500 | |

| William C. Jenkins | | | 5,000 | |

| John A. Latimer | | | 5,000 | |

| Donald R. Neff | | | 3,000 | (2) |

| Robert M. Notigan | | | 7,826 | (3) |

| John W. Seiber | | | 5,000 | |

| James W. Verner | | | 2,500 | |

| Renee C. Vidal | | | 2,500 | |

| | | | | |

All directors and executive officers as a group (11 persons) | | | 48,966 | |

| (1) | Includes 640 allocated shares held in ESOP trust. |

| (2) | Includes 500 shares held by Mr. Neff’s spouse. |

| (3) | Includes 1,500 shares held by the individual retirement account of Mr. Notigan’s spouse and 326allocated shares held in ESOP trust. |

Items to be Voted on by Stockholders

Item 1 – Election of Directors

The Company’s Board of Directors currently consists of nine members. The Board is divided into three classes with three-year staggered terms, with one-third of the directors elected each year. The Board of Directors’ nominees for election this year, to serve for a three-year term or until their respective successors have been elected and qualified, are Thomas J. Coleman, III and Donald R. Neff.

Robert H. Jenkins, Jr. has resigned from the Board of Directors effective as of the 2009 annual meeting date. Upon completion of the annual meeting, the size of the Board of Directors will be reduced to seven members.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the nominees named above. If any nominee is unable to serve, the persons named in the proxy card would vote your shares to approve the election of any substitute nominee proposed by the Board of Directors. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

The Board of Directors recommends a vote “FOR” the election of all of the nominees.

Information regarding the nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his or her current occupation for the last five years. The age indicated in each individual’s biography is as of March 31, 2009. There are no family relationships among the directors or executive officers. The indicated period for service as a director includes service as a director of Delanco Federal.

Board Nominees for Terms Ending in 2012

Thomas J. Coleman, III has been a managing partner of the law firm of Raymond & Coleman, LLP since 2001. Age 45. Director since 2005.

Donald R. Neff is a retired businessman. Age 74. Director of Delanco Federal since 1980 and director of Delanco MHC and Delanco Bancorp since their formation in 2002.

Directors with Terms Ending in 2010

William C. Jenkins has been the sole owner of a technical writing firm, the White Stone Group, since 1990. He has been employed as a technical writer for Sarnoff Corporation since 2008. Age 61. Director of Delanco Federal since 1995 and director of Delanco MHC and Delanco Bancorp since their formation in 2002.

John A. Latimer has served as the President of three insurance brokers, including The Barclay Group, J.S. Braddock Agency and Conrad Insurance Agency, since 1991, 2000 and 2006, respectively. Mr. Latimer also serves as a director of Proformance Insurance Company, a subsidiary of National Atlantic Holdings Corporation (Nasdaq: NAHC). Age 46. Director since 2006.

James W. Verner has served as a Section Supervisor with the New Jersey State Department of Education since 1979. Age 57. Director of Delanco Federal since 1978 and director of Delanco MHC and Delanco Bancorp since their formation in 2002.

Directors with Terms Ending in 2011

John W. Seiber has served as Chairman of the Board of Delanco MHC, Delanco Bancorp and Delanco Federal since 2004. From 1992 until 2004, Mr. Seiber served as President and Chief Executive Officer of Delanco Federal. Mr. Seiber also served as President and Chief Executive Officer of Delanco MHC and Delanco Bancorp from 2002 until 2004. Age 69. Director of Delanco Federal Savings Bank since 1999 and director of Delanco MHC and Delanco Bancorp since their formation in 2002.

Renee C. Vidal is a partner in the law firm of Flaster/Greenberg P.C. in Cherry Hill, New Jersey. Prior to joining Flaster/Greenberg P.C. in January, 2008, Ms. Vidal served as a partner in the law firm of Cureton Caplan, PC. Ms. Vidal began her employment with Cureton Caplan in 1994. Age 41. Director since 2006.

Item 2 – Ratification of the Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed Connolly, Grady & Cha, P.C. to be the Company’s independent registered public accounting firm for the 2010 fiscal year, subject to ratification by stockholders. A representative of Connolly, Grady & Cha, P.C. is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accounting firm is not approved by a majority of the shares represented at the annual meeting and entitled to vote, the Audit Committee of the Board of Directors will consider other independent registered public accounting firms.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of the independent registered public accounting firm.

Audit Fees. The following table sets forth the fees billed to the Company for the years ended March 31, 2009 and 2008 by Connolly, Grady & Cha, P.C.:

| | | | | | | |

| | | | | | | |

| | $ | 64,901 | | | $ | 62,459 | |

| | | 19,483 | | | | 41,942 | |

| | | 5,664 | | | | 3,498 | |

| | | — | | | | — | |

| | (1) | Includes fees for the annual financial statement audit. |

| | (2) | Include fees for the review of annual and quarterly reports. |

| | (3) | Represents services rendered for tax compliance, tax advice and tax planning, including the preparation of the annual tax returns and quarterly tax payments. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services by the Independent Registered Public Accounting Firm. The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent registered public accounting firm. Such approval process ensures that the external auditor does not provide any non-audit services to the Company that are prohibited by law or regulation.

In addition, the Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent registered public accounting firm. Requests for services by the independent registered public accounting firm for compliance with the auditor services policy must be specific as to the particular services to be provided.

The request may be made with respect to either specific services or a type of service for predictable or recurring services.

During the year ended March 31, 2009, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

Summary Compensation Table

The following information is furnished for the individuals serving as the principal executive officer during the 2009 fiscal year.

Name and Principal Position | | | | | | | | | | | | |

President and Chief Executive Officer | | | | | $ | 129,808 | | | $ | 483 | (2) | | $ | 130,291 | |

| | | | | | | | | | | | | | | | |

Current Senior Vice President and Former President, Chief Executive Officer and Chief Financial Officer | | 2009 2008 | | | $ | 100,000 92,576 | | | $ | 4,134 1,857 | (4) | | $ | 104,134 94,433 | |

| (1) | Mr. Igo was not a named executive officer in 2008 and, therefore, his compensation information for that year is omitted. |

| (2) | Reflects the amount paid by the Company for life insurance premiums. |

| (3) | Mr. Allen served as President, Chief Executive Officer and Chief Financial Officer of the Company and the Bank until Mr. Igo’s appointment to President and Chief Executive Officer on March 4, 2009. |

| (4) | Reflects the amount paid by the Company for life insurance premiums and the market value of ESOP allocations. |

Delanco Federal and Delanco Bancorp maintain employment agreements with Messrs. Igo and Allen (the “executives”). Under the agreements, which have essentially identical provisions, Delanco Bancorp will make any payments not made by Delanco Federal under its agreement with the executives, but the executives will not receive any duplicative payments. The employment agreements were entered into effective March 30, 2007 and August 1, 2008, for Messrs. Allen and Igo, respectively, and had an initial term of three years. On each anniversary of the date of the agreement, the Board of Directors may extend the agreement for an additional year, unless the executive elects not to extend the term. Under the agreements, Mr. Igo will serve as President and Chief Executive Officer of the Company and the Bank and Mr. Allen will serve as Senior Vice President of the Company and the Bank. The current base salaries under the employment agreements for Mr. Igo and Mr. Allen are $135,000 and $100,000, respectively. In addition to the base salary, among other things, the agreements provide for participation in discretionary bonuses or other incentive compensation provided to senior management, and participation in stock benefit plans and other fringe benefits applicable to executive personnel.

The Company and the Bank have agreed to pay the executives for reasonable costs and attorneys’ fees associated with the successful legal enforcement of our obligations under the employment agreements. The employment agreements also provide for the indemnification of the executives to the fullest extent legally permissible. Upon termination of employment other than involuntary termination in connection with a change in control, the executives will be required to adhere to a one-year non-competition provision. See “Potential Post-Termination Benefits” for a discussion of the benefits and payments the executives may receive under their agreements upon termination of employment.

Potential Post-Termination Benefits

Payments Made Upon Termination for Cause. If the executives are terminated for cause, they will receive their base salary through the date of termination and retain the rights to any vested benefits subject to the terms of the plan or agreement under which those benefits are provided.

Payments Made Upon Termination without Cause or for Good Reason. The executives’ employment agreements provide for termination for cause, as defined in the employment agreements, at any time. If Delanco Bancorp or Delanco Federal terminates the executives for reasons other than for cause, or if the executives resign after specified circumstances that would constitute constructive termination, the executives (or, in the event of their death, their beneficiaries) are entitled to a lump sum severance payment equal to the base salary payments due for the remaining term of the employment agreements. In addition, Delanco Federal or Delanco Bancorp would continue and/or pay for the executives’ life, medical, disability and dental coverage for the remaining term of the employment agreement.

Payments Made Upon Disability. Under the executives’ employment agreements, if they become disabled and their employment is terminated, they will be entitled to disability pay equal to 100% of their base salary in effect at the date of termination. They would continue to receive disability payments until the earlier of: (1) the date they return to full employment with us; (2) their death; (3) attainment of age 65; or (4) the date the term of the agreements would have otherwise expired. All disability payments would be reduced by the amount of any disability benefits payable under our disability plans. In addition, the executives would continue to be covered to the greatest extent possible under all benefit plans in which they participated before their disability as if they were actively employed by us.

Payments Made Upon Death. Under their employment agreements, the executives’ estates are entitled to receive the compensation due to them through the end of the month in which their death occurs.

Payments Made Upon a Change in Control. The executives’ employment agreements provide that in the event of a change in control followed by voluntary termination of employment (upon circumstances discussed in the agreement) or involuntary termination of employment for reasons other than cause, the executives will receive a severance payment equal to three times the average of their five preceding taxable years’ annual taxable compensation (“base amount”). The Company or the Bank will also continue to pay the executives’ life, health and dental insurance premiums for up to 36 months following termination in connection with a change in control. Section 280G of the Internal Revenue Code provides that payments related to a change in control that equal or exceed three times the individual’s “base amount” (defined as average annual taxable compensation over the five preceding calendar years) constitute “excess parachute payments.” Individuals who receive excess parachute payments are subject to a 20% excise tax on the amount that exceeds the base amount, and the employer may not deduct such amounts. The executives’ employment agreements provide that if the total value of the benefits provided and payments made to him in connection with a change in control, either under their employment agreements alone or together with other payments and benefits that they have the right to receive from the Company and the Bank, exceed three times their base amount (“280G Limit”), their severance payment will be reduced or revised so that the aggregate payments do not exceed their 280G Limit.

Under the terms of the ESOP, upon a change in control (as defined in the plan), the plan will terminate and the plan trustee will repay in full any outstanding acquisition loan. After repayment of the acquisition loan, all remaining shares of our stock held in the loan suspense account, all other stock or securities, and any cash proceeds from the sale or other disposition of any shares of our stock held in the loan suspense account will be allocated among the accounts of all participants in the plan who were employed by us on the date immediately preceding the effective date of the change in control. The allocations of shares or cash proceeds will be credited to each eligible participant in proportion to the opening balances in their accounts as of the first day of the valuation period in which the change in control occurred. Payments under the ESOP are not categorized as parachute payments and, therefore, do not count towards an executive’s 280G Limit.

Other Information Relating to Directors and Executive Officers

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Executive officers, directors and greater than 10% stockholders are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on its review of the copies of the reports it has received and written representations provided to the Company from the individuals required to file the reports, the Company believes that each of its executive officers and directors has complied with applicable reporting requirements for transactions in Delanco Bancorp common stock during the year ended March 31, 2009.

Transactions with Related Persons

The Sarbanes-Oxley Act of 2002 generally prohibits loans by Delanco Bancorp to its executive officers and directors. However, the Sarbanes-Oxley Act contains a specific exemption from such prohibition for loans by Delanco Federal to its executive officers and directors in compliance with federal banking regulations. Federal regulations require that all loans or extensions of credit to executive officers and directors of insured financial institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and must not involve more than the normal risk of repayment or present other unfavorable features. Delanco Federal is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public. Notwithstanding this rule, federal regulations permit Delanco Federal to make loans to executive officers and directors at reduced interest rates if the loan is made under a benefit program generally available to all other employees and does not give preference to any executive officer or director over any other employee.

Delanco Federal maintains a program that enables all full-time employees to obtain a residential mortgage loan on a primary residence at a reduction of 1% from the rates available to the public. Mr. Allen has a mortgage loan from Delanco Federal that was made under this program at a rate of 3.875%. The largest amount of principal outstanding during the 2009 fiscal year on this loan was approximately $195,000 and the outstanding balance at March 31, 2009 was $192,213. The total principal and interest paid on this loan during the 2009 fiscal year was approximately $2,787 and $9,130, respectively.

In accordance with banking regulations, the Board of Directors reviews all loans made to a director or executive officer in an amount that, when aggregated with the amount of all other loans to such person and his or her related interests, exceed the greater of $25,000 or 5% of Delanco Federal’s capital and surplus (up to a maximum of $500,000) and such loan must be approved in advance by a majority of the disinterested members of the Board of Directors.

Submission of Business Proposals

and Stockholder Nominations

The Company must receive proposals that stockholders seek to have included in the proxy statement for the Company’s next annual meeting no later than March 17, 2010. If next year’s annual meeting is held on a date more than 30 calendar days from August 17, 2010, a stockholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation materials. Any stockholder proposals will be subject to the requirements of the proxy rules adopted by the Securities and Exchange Commission.

The Company’s Bylaws provide that in order for a stockholder to make nominations for the election of directors or proposals for business to be brought before a meeting of stockholders, a stockholder must deliver written notice of such nominations and/or proposals to the Corporate Secretary not less than 30 days before the date of the meeting; provided that if less than 40 days notice or prior public disclosure of the meeting is given or made to stockholders, such notice must be delivered not later than the close of the tenth day following the day on which notice of the meeting was mailed to stockholders or such public disclosure was made.

Stockholder Communications

The Company encourages stockholder communications to the Board of Directors and/or individual directors. Stockholders who wish to communicate with the Board of Directors or an individual director should send their communications to the care of Douglas R. Allen, Jr., Corporate Secretary, Delanco Bancorp, Inc., 615 Burlington Avenue, Delanco, New Jersey 08075. Communications regarding financial or accounting policies should be sent to the attention of the Chairperson of the Audit Committee.

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Company. In addition to soliciting proxies by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone. None of these persons will receive additional compensation for these activities.

The Company’s Annual Report on Form 10-K has been mailed to all persons who were stockholders as of the close of business on July 6, 2009. Any stockholder who has not received a copy of the Annual Report may obtain a copy by writing to the Chief Financial Officer of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated in this proxy statement by reference.

If you and others who share your address own your shares in “street name,” your broker or other holder of record may be sending only one annual report and proxy statement to your address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a shareholder residing at such an address wishes to receive a separate annual report or proxy statement in the future, he or she should contact the broker or other holder of record. If you own your shares in “street name” and are receiving multiple copies of our annual report and proxy statement, you can request householding by contacting your broker or other holder of record.

[Delanco Bancorp, Inc. Letterhead]

Dear ESOP Participant:

On behalf of the Board of Directors, please find enclosed a voting instruction card for the purpose of conveying your voting instructions to the trustee of the Delanco Federal Savings Bank Employee Stock Ownership Plan (the “ESOP”), on the proposals presented at the Annual Meeting of Stockholders of Delanco Bancorp, Inc. (the “Company”) on August 17, 2009. Also enclosed is a Notice and Proxy Statement for the Company’s Annual Meeting of Stockholders and the Company’s Annual Report to Stockholders.

As a participant in the ESOP, you are entitled to instruct the trustee how to vote the shares of Company common stock allocated to your account as of July 6, 2009, the record date for the Annual Meeting. All allocated shares of Company common stock will be voted as directed by participants, so long as participant instructions are received by the trustee on or before August 10, 2009. If you do not direct the trustee as to how to vote the shares of Company common stock allocated to your ESOP account, the trustee will vote your shares in a manner calculated to most accurately reflect the instructions it receives from other participants, subject to its fiduciary duties.

The ESOP trustee will vote the unallocated shares of common stock held in the ESOP trust in a manner calculated to most accurately reflect the voting instructions received from ESOP participants, subject to its fiduciary duties. Your vote will not be revealed, directly or indirectly, to any employee or director of the Company or Delanco Federal Savings Bank.

Please complete, sign and return the enclosed ESOP voting instruction card in the accompanying postage paid envelope.

| Sincerely, |

| |

| /s/ James E. Igo |

| |

| James E. Igo |

| President and Chief Executive Officer |