- SCNX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Scienture (SCNX) DEF 14ADefinitive proxy

Filed: 9 Nov 22, 4:30pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by party other than the registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, for use of the Commission only |

| (as permitted by Rule 14a-6(e)(2)). | |||

| ☒ | Definitive Proxy Statement | ||

| ☐ | Definitive additional materials. | ||

| ☐ | Soliciting material under Rule 14a-12. |

TRXADE HEALTH, INC.

(Name of Registrant as Specified in Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

TRxADE HEALTH, INC.

2420 Brunello Trace

Lutz, Florida 33558

November 9, 2022

Dear Fellow Stockholder,

I am pleased to invite you to attend a special meeting of stockholders (the “Special Meeting”) of TRxADE HEALTH, INC. (“TRxADE”, “we”, “us” or the “Company”) to be held (subject to postponement(s) or adjournment(s) thereof):

| Date: | Tuesday, December 20, 2022 | |

| Time: | 10:00 A.M. Eastern Time | |

| Virtual Meeting Site: | https://agm.issuerdirect.com/MEDS |

You will not be able to attend the Special Meeting physically. The Special Meeting will be held via an audio teleconference and all stockholders are invited to attend the meeting virtually. Stockholders may attend the Special Meeting via the Internet by logging in at https://agm.issuerdirect.com/MEDS (please note this link is case sensitive), with your Control ID, and thereafter following the instructions to join the virtual meeting. In addition to voting by submitting your proxy prior to the Special Meeting and/or voting online as discussed herein, you also will be able to vote your shares electronically during the Special Meeting with your Request ID.

Details regarding the Special Meeting, the business to be conducted at the Special Meeting, and information about the Company that you should consider when you vote your shares are described in the enclosed Notice of Special Meeting of Stockholders and proxy statement.

At the Special Meeting, you will be asked to approve the issuance of shares of our common stock in accordance with Nasdaq Listing Rule 5635(d) upon the exercise of warrants to purchase 2,663,045 shares of common stock of the Company (the “Private Placement Warrants”), and to approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the proposal to approve the proposal described above.

Our Board of Directors unanimously recommends that you vote “FOR” each of the foregoing proposals.

Your vote is very important. The approval of the issuance of shares of common stock upon exercise of the Private Placement Warrants in accordance with Nasdaq Listing Rule 5635(d) and the adjournment of the Special Meeting, if necessary to solicit additional proxies if there are not sufficient votes in favor of the proposal to approve the issuance of shares of common stock upon exercise of the Private Placement Warrants in accordance with Nasdaq Listing Rule 5635(d), each require approval by the affirmative vote of the holders of a majority of the voting shares of TRxADE present at the Special Meeting or by proxy and entitled to vote on the matter at the Special Meeting. Whether or not you plan to attend the Special Meeting, please vote your shares by, telephone, fax, over the Internet or by signing and returning the enclosed proxy card as soon as possible or otherwise voting pursuant to the instructions in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card, to make sure that your shares are represented at the Special Meeting.

The accompanying proxy statement provides you with information about the Private Placement Warrants, the Special Meeting and the other business to be considered by TRxADE’s stockholders. We encourage you to read the entire proxy statement and the form of Common Stock Purchase Warrant dated October 7, 2022, describing the terms of the Private Placement Warrants and rights of the holders thereof, carefully. A copy of the Private Placement Warrants is attached as Annex A to the accompanying proxy statement. You may also obtain more information about TRxADE from documents we have filed with the U.S. Securities and Exchange Commission.

We are providing our proxy materials to our stockholders over the Internet. This reduces our environmental impact and our costs while ensuring our stockholders have timely access to this important information. Accordingly, stockholders of record at the close of business on October 31, 2022 will receive a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) with details on accessing these materials. Beneficial owners of Company common stock at the close of business on October 31, 2022 will receive separate notices on behalf of their brokers, banks or other intermediaries through which they hold shares.

On behalf of the Board of Directors of TRxADE, we would like to thank you for being a stockholder and express our appreciation for your ongoing support and continued interest in TRxADE.

Very truly yours,

/s/ Suren Ajjarapu

Chief Executive Officer and Chairman

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to Be Held on Tuesday, December 20, 2022.

Our proxy statement is available at the following cookies-free website that can be accessed anonymously: https://www.iproxydirect.com/MEDS.

| i |

TRxADE HEALTH, INC.

2420 Brunello Trace

Lutz, Florida 33558

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders of TRxADE HEALTH, INC. (“TRxADE”, “we”, “us” or the “Company”) to be held (subject to postponement(s) or adjournment(s) thereof):

| Date: | Tuesday, December 20, 2022 | |

| Time: | 10:00 A.M. Eastern Time | |

| Virtual Meeting Site: | https://agm.issuerdirect.com/MEDS |

A proxy card and a proxy statement for the Special Meeting are enclosed.

The purpose of the Special Meeting is to consider and act upon the following proposals:

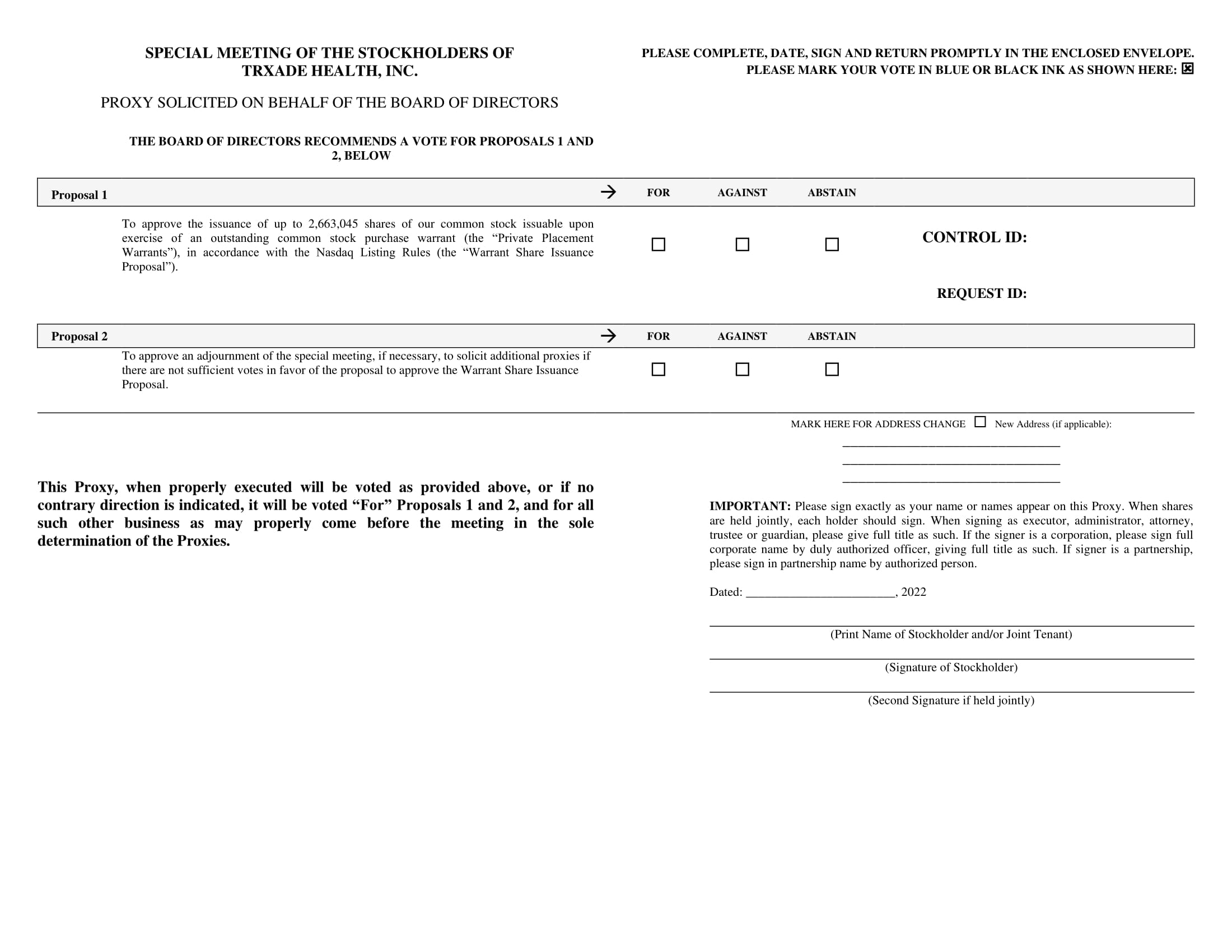

1. To approve the issuance of 2,663,045 shares of our common stock issuable upon the exercise of a Common Stock Purchase Warrant dated October 7, 2022 (the “Private Placement Warrants”), in accordance with Nasdaq Listing Rule 5635(d) (the “Warrant Share Issuance Proposal”); and

2. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the proposal above (the “Adjournment Proposal”).

Because Nasdaq Stock Market listing standards (Listing Rule 5635(d)) state that, in certain circumstances, an issuer is required to obtain stockholder approval before the issuance or potential issuance of a number of shares of common stock equal to 20% or more of its common stock outstanding before the issuance, the Common Stock Purchase Warrant evidencing the Private Placement Warrants (the “Warrant Agreement”) currently prohibits the issuance of common stock upon exercise of the Private Placement Warrants until or unless the Company has received stockholder approval for the issuance of more than 19.99% of the common stock outstanding as of October 7, 2022, or 1,679,741 shares of common stock, which we refer to as the “Exchange Cap”. Stockholder approval of the Warrant Share Issuance Proposal at the Special Meeting would eliminate the Exchange Cap.

The Board of Directors of TRxADE unanimously determined that the issuance of shares of our common stock upon exercise of the Private Placement Warrants is in the best interests of TRxADE and its stockholders and recommends that you vote “FOR” such approval and “FOR” an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the proposal to approve such proposal.

Only holders of record of shares of TRxADE’s common stock at the close of business on October 31, 2022, are entitled to notice of, and to vote at, the Special Meeting and any postponements or adjournments thereof. At the close of business on the record date, 9,318,708 shares of our common stock were outstanding, which each vote one voting share, and as such, a total of 9,318,708 voting shares are eligible to be voted at the Special Meeting. Other than our common stock, we have no other voting securities currently outstanding.

| ii |

Your vote is very important. All stockholders of TRxADE are cordially invited to attend the Special Meeting. However, even if you plan to attend the Special Meeting, we request that you complete, date, sign and return the enclosed proxy card in the postage-paid envelope or vote your shares by telephone, fax or through the Internet as instructed in these materials as promptly as possible prior to the Special Meeting to ensure that your shares of TRxADE’s common stock will be represented at the Special Meeting if you are unable to attend. If you sign, date and mail your proxy card without indicating how you wish to vote, all of your shares will be voted “FOR” Proposal Nos. 1 and 2. If you fail to return your proxy card as instructed on the enclosed proxy card or fail to submit your proxy by telephone, fax or through the Internet and do not vote at the Special Meeting, your shares will not be counted for purposes of determining whether a quorum is present at the Special Meeting and will have no effect with respect to the vote on Proposals Nos. 1 and 2, except to the extent that we fail to either reach the required quorum to hold the Special Meeting, or that your failure to vote your shares results in us not receiving the required approval of shares represented at the Special Meeting or by proxy at the Special Meeting to approve the proposals. If you do attend the Special Meeting and wish to vote, you may withdraw your proxy and vote through the meeting portal.

The accompanying proxy statement provides you with detailed information about the proposals to be considered by you at the Special Meeting. We encourage you to read the accompanying proxy statement and Annex A thereto (which is incorporated by reference therein) carefully and in its entirety. If you have any questions concerning the proposals, the Special Meeting or the accompanying proxy statement, would like additional copies of the accompanying proxy statement or additional proxy cards, please contact:

Janet Huffman, Corporate Secretary

2420 Brunello Trace

Lutz, Florida 33558

Telephone: (800) 261-0281

Email: jhuffman@trxade.com

By Order of the Board of Directors,

/s/ Suren Ajjarapu

Suren Ajjarapu

Chairman

Houston, Texas

November 9, 2022

IMPORTANT: If you hold shares of common stock of TRxADE through an account with a broker, dealer, bank or other nominee please follow the instructions you receive from them to vote your shares.

| iii |

TRxADE HEALTH, INC.

2420 Brunello Trace

Lutz, Florida 33558

PROXY STATEMENT FOR

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, DECEMBER 20, 2022

This proxy statement and related proxy solicitation materials are being first mailed, sent or given on or about November 9, 2022, to stockholders of TRxADE HEALTH, INC. (“TRxADE”, “we”, “us” or the “Company”) in connection with the solicitation of proxies by the Board of Directors of TRxADE (the “Board of Directors” or the “Board”) for a special meeting of TRxADE’s stockholders and any adjournment or postponement thereof (the “Special Meeting”) for the purposes set forth in the accompanying Notice of Special Meeting. The Special Meeting will be held on Tuesday, December 20, 2022 at 10:00 A.M. Eastern Standard time, via an audio teleconference at https://agm.issuerdirect.com/MEDS (please note this link is case sensitive), subject to any postponement(s) or adjournment(s) thereof. The Board of Directors encourages you to read this proxy statement and Annex A thereto (which is incorporated by reference herein) carefully and, in their entirety, and to take the opportunity to submit a proxy to vote your shares on the matters to be decided at the Special Meeting.

Only holders of record of shares of TRxADE’s common stock at the close of business on October 31, 2022, are entitled to notice of, and to vote at, the Special Meeting and any postponements or adjournments thereof. At the close of business on the record date, 9,318,708 shares of our common stock were outstanding, which each vote one voting share, and as such, a total of 9,318,708 voting shares are eligible to be voted at the Special Meeting. Other than our common stock, we have no other voting securities currently outstanding.

If you have any questions concerning the Special Meeting or this proxy statement, or would like additional copies of the proxy statement or additional proxy cards, please contact:

Janet Huffman, Chief Financial Officer

2420 Brunello Trace

Lutz, Florida 33558

Telephone: (800) 261-0281

Email: jhuffman@trxade.com

The date of this proxy statement is November 9, 2022.

ABOUT THIS PROXY STATEMENT

This proxy statement constitutes a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended. You should rely only on the information contained in this proxy statement. No one has been authorized to provide you with information that is different from the information contained in, or incorporated by reference into, this proxy statement. You should not assume that the information contained in, or incorporated by reference into, this proxy statement is accurate as of any date other than that date (or, in the case of incorporated documents, their respective dates). Our mailing of the Notice of Internet Available of this Proxy Statement and/or this proxy statement to the TRxADE stockholders will not create any implication to the contrary.

| iv |

| Annex A - | Form of Common Stock Purchase Warrant to purchase up to 2,663,045 shares of common stock, dated October 7, 2022 |

The Special Meeting will be held on Tuesday, December 20, 2022 at 10:00 A.M. Eastern Standard Time, via an audio teleconference at https://agm.issuerdirect.com/MEDS (please note this link is case sensitive), subject to any postponement(s) or adjournment(s) thereof.

Matters to be Considered at the Special Meeting

At the Special Meeting, holders of TRxADE’s common stock as of the Record Date (defined below) will consider and vote upon:

| ● | the Warrant Share Issuance Proposal; and | |

| ● | the Adjournment Proposal. |

Record Date and Shares Entitled to Vote

Holders of TRxADE’s common stock as of the close of business on October 31, 2022, the record date for the Special Meeting (the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting and any postponements or adjournments of the Special Meeting.

At the close of business on the Record Date, there were 9,318,708 shares of our common stock outstanding. The common stock shares each vote one vote on all stockholder matters to come before the Meeting and as such, a total of 9,318,708 voting shares are eligible to be voted at the Special Meeting. Other than our common stock, we have no other voting securities currently outstanding.

Instructions for the Virtual Meeting

The Special Meeting will be a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted via live audio webcast.

To participate in the virtual meeting, visit https://agm.issuerdirect.com/MEDS (please note this link is case sensitive) and enter the control number in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card.

We recommend you check in/log in to the Special Meeting 15 minutes before the meeting is scheduled to start so that any technical difficulties may be addressed before the meeting begins.

You may vote during the meeting with your Request ID in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card, by following the instructions available on the meeting website during the meeting. To the best of our knowledge, the virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection wherever they intend to participate in the meeting. Participants should also allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

Technicians will be available to assist you if you experience technical difficulties accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call 844-399-3386 for assistance.

Conduct at the Special Meeting

The Chairman of the Special Meeting has broad responsibility and legal authority to conduct the Special Meeting in an orderly and timely manner. This authority includes establishing rules for stockholders who wish to address the meeting. Only stockholders or their valid proxy holders may address the meeting. Copies of these rules will be available at the meeting. The Chairman may also exercise broad discretion in recognizing stockholders who wish to speak and in determining the extent of discussion on each item of business.

| 1 |

Voting Requirements for Each of the Proposals

| Proposal | Vote Required | Broker Discretionary Voting Allowed* | ||||

| 1 | Approval of the issuance of shares of our common stock issuable upon the exercise of warrants to purchase up to 2,663,045 shares of common stock in accordance with Nasdaq Listing Rule 5635(d) (the “Warrant Share Issuance Proposal”). | Majority of the votes cast on the proposal | No | |||

| 2 | Approval of the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Warrant Share Issuance Proposal (the “Adjournment Proposal”). | Majority of the votes cast on the proposal | No |

It is anticipated that representatives of Issuer Direct Corporation will tabulate the votes and act as inspector of election at the Special Meeting.

Stockholders Entitled to Vote at the Meeting

A complete list of stockholders entitled to vote at the Special Meeting will be available at our principal executive offices, for any purpose germane to the Special Meeting, during ordinary business hours, for a period of ten days prior to the Special Meeting.

Your vote is very important. Whether or not you plan to attend the Special Meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on your in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card.

Independent inspectors count the votes. Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy card will be sent to us if you write comments on the card, as necessary to meet applicable legal requirements, or to assert or defend claims for or against the Company.

The preliminary voting results will be announced at the Special Meeting. The final voting results will be tallied by the inspector of voting and published in the Company’s Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the Special Meeting.

| 2 |

In addition to solicitation by use of the mails, certain of our officers and employees may solicit the return of proxies personally or by telephone, electronic mail or facsimile. We have not and do not anticipate retaining a third-party proxy solicitation firm to solicit proxies on behalf of the Board. The cost of any solicitation of proxies will be borne by us. Arrangements may also be made with brokerage firms and other custodians, nominees and fiduciaries for the forwarding of material to, and solicitation of proxies from, the beneficial owners of our securities held of record at the close of business on the Record Date by such persons. We will reimburse such brokerage firms, custodians, nominees and fiduciaries for the reasonable out-of-pocket expenses incurred by them in connection with any such activities.

Important Notice Regarding the Availability of Proxy Materials

The proxy statement is available at https://www.iproxydirect.com/MEDS.

In accordance with U.S. Securities and Exchange Commission (the “SEC”) rules, we are providing access to our proxy materials over the Internet to our stockholders rather than in paper form, which reduces the environmental impact of our annual meeting and our costs.

Accordingly, if you are a stockholder of record, a one-page Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) has been mailed to you on or about November 9, 2022. Stockholders of record may access the proxy materials on the website listed above or request a printed set of the proxy materials be sent to them by following the instructions in the Notice of Internet Availability. The Notice of Internet Availability also explains how you may request that we send future proxy materials to you by e-mail or in printed form by mail. If you choose the e-mail option, you will receive an e-mail next year with links to those materials and to the proxy voting site. We encourage you to choose this e-mail option, which will allow us to provide you with the information you need in a timelier manner, will save us the cost of printing and mailing documents to you and will conserve natural resources. Your election to receive proxy materials by e-mail or in printed form by mail will remain in effect until you terminate it.

If you are a beneficial owner, you will not receive a Notice of Internet Availability directly from us, but your broker, bank or other intermediary will forward you a notice with instructions on accessing our proxy materials and directing that organization how to vote your shares, as well as other options that may be available to you for receiving our proxy materials.

The Notice of Internet Availability contains a control number and Request ID that you will need to attend the Special Meeting and vote your shares, respectively. Please keep the Notice of Internet Availability for your reference through the meeting date.

The mailing address of our principal executive offices is 2420 Brunello Trace, Lutz, Florida 33558.

* * * * *

For additional information regarding the Special Meeting, see the section entitled “Questions and Answers about the Special Meeting”, below.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following are some questions that you, as a stockholder of TRxADE, may have regarding the Special Meeting, together with brief answers to those questions. We urge you to read carefully the remainder of this proxy statement, including Annex A hereto (which is incorporated by reference herein) and other documents referred to in this proxy statement, because the information in this section may not provide all of the information that might be important to you with respect to the Special Meeting or the proposals relating thereto.

Q. What are the Private Placement Warrants and in connection with what transaction were they granted?

A. On October 4, 2022, we entered into a securities purchase agreement (the “Purchase Agreement”) with a certain institutional investor (the “Purchaser”). The Purchase Agreement provided for the sale and issuance by the Company of an aggregate of: (i) 920,000 shares (the “Shares”) of the Company’s common stock, $0.00001 par value, (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 601,740 shares of common stock, and (iii) warrants (the “Private Placement Warrants” and, together with the Shares and the Pre-Funded Warrants, the “Securities”) to purchase up to 2,663,045 shares of common stock. The offering price per Share was $1.15 and the offering price per Pre-Funded Warrant was $1.14999. The Private Placement Warrants were sold in a concurrent private placement (the “Private Placement”), exempt from registration pursuant to Section 4(a)(2) and/or Rule 506 of the Securities Act of 1933, as amended (the “Securities Act”).

The Pre-Funded Warrants were immediately exercisable, have an exercise price of $0.00001 per share, and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

Each Private Placement Warrant has an exercise price of $1.50 per share, will be exercisable following Stockholder Approval (as defined below) and will expire on the fifth anniversary of the date on which the Private Placement Warrants become exercisable. The Private Placement Warrants contain standard adjustments to the exercise price including for stock splits, stock dividend, rights offerings and pro rata distributions, and include full ratchet anti-dilutive rights in the event the Company issues shares of common stock or common stock equivalents within fifteen months of the initial exercise date, with a value less than the then exercise price of such Private Placement Warrants, subject to certain customary exceptions, and further subject to a minimum exercise price of $0.232 per share. The Private Placement Warrants also include certain rights upon ‘fundamental transactions’ as described in the Private Placement Warrants, including allowing the holders thereof to require that the Company re-purchase such Private Placement Warrants at the Black Scholes Value of such securities.

The Pre-Funded Warrants have cashless exercise rights and to the extent the shares of common stock underlying the Private Placement Warrants are not registered under the Securities Act, the Private Placement Warrants include cashless exercise rights.

| 3 |

If we fail for any reason to deliver shares of common stock upon the valid exercise of the Pre-Funded Warrants or Private Placement Warrants, subject to our receipt of a valid exercise notice and the aggregate exercise price, by the time period set forth in the Pre-Funded Warrants or Private Placement Warrants, we are required to pay the applicable holder, in cash, as liquidated damages as set forth in the Pre-Funded Warrants and Private Placement Warrants. The Pre-Funded Warrants and Private Placement Warrants also include customary buy-in rights in the event we fail to deliver shares of common stock upon exercise thereof within the time periods set forth in the Pre-Funded Warrants and Private Placement Warrants.

Under the terms of the Pre-Funded Warrants and Private Placement Warrants, a holder will not be entitled to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate number of shares of common stock beneficially owned by the holder (together with its affiliates, any other persons acting as a group together with the holder or any of the holder’s affiliates, and any other persons whose beneficial ownership of common stock would or could be aggregated with the holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended) would exceed 4.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of such warrant, which percentage may be increased at the holder’s election upon 61 days’ notice to the Company subject to the terms of such warrants, provided that such percentage may in no event exceed 9.99%, and provided further that the Purchaser has elected to increase the ownership limitation to 9.99% in connection with the initial issuance of the Pre-Funded Warrants.

The Private Placement Warrants may not be exercised by the holder thereof until or unless the Company’s stockholders have approved the issuance of shares of common stock upon the exercise of such Private Placement Warrants pursuant to the applicable rules and regulations of the Nasdaq Stock Market, including the issuance of the shares of common stock issuable upon exercise of the Private Placement Warrants in excess of 19.99% of the issued and outstanding common stock on the closing date of the offering (the “Exchange Cap” and “Stockholder Approval”), which Stockholder Approval we are seeking pursuant to the Warrant Share Issuance Proposal at the Special Meeting.

As an additional requirement to the offering, all of the officers and directors of the Company were required to enter into an agreement agreeing to vote all common stock over which such persons have voting control as of the record date for the meeting of stockholders of the Company (the “Voting Agreements”), which Voting Agreements have been entered into by such required persons.

The offering of the Shares, Pre-Funded Warrants and Private Placement Warrants resulted in gross proceeds to the Company of approximately $1.75 million. The net proceeds to the Company from the offering are expected to be approximately $1.5 million, after deducting placement agent fees and expenses and estimated offering expenses payable by the Company. The Company intends to use the net proceeds from the offering for general corporate purposes. On October 4, 2022, the Company also entered into a placement agent agreement (the “Placement Agent Agreement”) with Maxim Group LLC (the “Placement Agent”). Pursuant to the terms of the Placement Agent Agreement, the Placement Agent agreed to use its reasonable best efforts to arrange for the sale of the Securities. The Company will pay the Placement Agent a cash fee equal to 7.0% of the gross proceeds generated from the sale of the Shares and Pre-Funded Warrants and will reimburse the Placement Agent for certain of its expenses in an aggregate amount up to $35,000.

The transactions contemplated by the Purchase Agreement closed on October 7, 2022.

We agreed pursuant to the Purchase Agreement that as soon as practicable (and in any event within 60 calendar days of the date of Purchase Agreement), that we would file a registration statement on Form S-1 providing for the resale by the Purchaser of the shares of common stock issuable upon exercise of the Private Placement Warrants, use commercially reasonable efforts to cause such registration statement to become effective within 181 days following the closing date of the offerings and to keep such registration statement effective at all times until no Purchaser owns any Private Placement Warrants or shares of common stock issuable upon exercise thereof. The date such required registration statement is declared effective is defined herein as the “Effective Date”.

| 4 |

We also agreed to hold a special meeting of stockholders or take action via written consent of stockholders, at the earliest practical date, but no later than December 20, 2022, for the purpose of obtaining Shareholder Approval, with the recommendation of the Company’s Board of Directors that such proposal be approved, and to solicit proxies from our stockholders in connection therewith. We are required to use our reasonable best efforts to obtain such Shareholder Approval. If we do not obtain Shareholder Approval at the first meeting, we are required to call a meeting every six months thereafter to seek Shareholder Approval until the earlier of the date Shareholder Approval is obtained or the Private Placement Warrants are no longer outstanding. As discussed above, the Special Meeting is being called to satisfy the above requirement of the Purchase Agreement.

Pursuant to the Purchase Agreement the Company has agreed that, subject to certain exceptions, (i) it will not issue any shares of common stock for a period of 90 days following the later of (A) the date of Stockholder Approval and (B) the Effective Date, subject to certain customary and pre-agreed exceptions and that (ii) it will not enter into a variable rate transaction for a period of nine months following the Effective Date.

We also agreed to provide the Purchaser a right of participation for 12 months following the closing date to participate up to 25% in any subsequent offering we may undertake of equity or debt.

The offering of the Shares, Pre-Funded Warrants and the shares of common stock issuable upon exercise of the Pre-Funded Warrants are being made pursuant to a registration statement on Form S-3 (File No. 333- 266432), which was filed by the Company with the Securities and Exchange Commission on July 29, 2022, and declared effective on August 8, 2022, as supplemented by a prospectus supplement dated October 4, 2022.

The Private Placement Warrants and the shares of common stock issuable upon exercise of the Private Placement Warrants are not registered under the registration statement discussed above, and are instead being sold in a private transaction, exempt from registration under the Securities Act.

Q. Why is TRxADE requesting stockholder approval for the Warrant Share Issuance Proposal?

A. Pursuant to the Private Placement Warrants, until such time as the Company’s stockholders have approved the issuance of more than 19.99% of our common stock issuable upon exercise of the Private Placement Warrants (i.e., 1,679,741 shares, as of the date of the grant of the Private Placement Warrants and the entry into the Purchase Agreement) in accordance with the rules of The Nasdaq Capital Market, the Private Placement Warrants are not exercisable into shares of common stock. Furthermore, as discussed above, the Company is required pursuant to the terms of the Purchase Agreement to seek the Stockholder Approval. As such, the Company is seeking stockholder approval in accordance with Nasdaq Listing Rule 5635(d), to allow for the exercise of the Private Placement Warrants into common stock of the Company pursuant to the terms of the Indenture and to remove the Exchange Cap.

Q. Why am I receiving these materials?

A. As discussed above, we are seeking approval for the Warrant Share Issuance Proposal. TRxADE is sending these materials to you to help you decide how to vote your shares of TRxADE’s common stock with respect to the Warrant Share Issuance Proposal and the other matters to be considered at the Special Meeting. This proxy statement contains important information about the Warrant Share Issuance Proposal, the Special Meeting and the Adjournment Proposal, and you should read it carefully.

Q. What stockholder approval is required to approve the Warrant Share Issuance Proposal?

A. Approval of the Warrant Share Issuance Proposal requires the affirmative vote of a majority of the holders of shares of the Company’s common stock (which each vote one voting share) present at the Special Meeting or by proxy at the Special Meeting, voting as a class, provided that a quorum of stockholders exists at the Special Meeting (meaning that of the shares of common stock represented at the Special Meeting and entitled to vote, a majority of them must be voted “FOR” these proposals for them to be approved).

| 5 |

Q. Have any stockholders already agreed to vote in favor of the Warrant Share Issuance Proposal?

A. Yes, as an additional requirement to the offering, all of the officers and directors of the Company were required to enter into an agreement agreeing to vote all common stock over which such persons have voting control as of the record date for the meeting of stockholders of the Company, which Voting Agreements have been entered into by such required persons. As a result, each of our officers and directors have agreed to vote all of the voting shares which they hold as of the Record Date, a total of 4,525,591 or 48.6% of our total voting shares as of the Record Date, in favor of the Warrant Share Issuance Proposal.

Q. If stockholder approval is obtained, what is the impact on the rights of existing stockholders?

If stockholder approval of the Warrant Share Issuance Proposal is obtained, the Private Placement Warrants may, pursuant to their terms, be exercised for shares of common stock of the Company and the Exchange Cap would be removed. The term of the Private Placement Warrants do not begin until Stockholder Approval is received, and continue for five years after Stockholder Approval, and we agreed pursuant to the Purchase Agreement, subject to certain exceptions, (i) that we would not issue any shares of common stock for a period of 90 days following the later of (A) the date of Stockholder Approval and (B) the Effective Date, subject to certain customary and pre-agreed exceptions and that (ii) we would not enter into a variable rate transaction for a period of nine months following the Effective Date.

As a result, the rights under the Private Placement Warrants will continue indefinitely (provided that such Private Placement Warrants would not be exercisable during such period) until or unless Stockholder Approval is received for the issuance of shares of common stock upon exercise thereof and the removal of the Exchange Cap, and in the event that such stockholder approval is not received, we would continue to be prohibited from issuing any shares of common stock.

The continued extension in the term of the Private Placement Warrants would result in a longer period for the anti-dilutive rights of the Private Placement Warrants to potentially result in a decrease in the exercise price of the Private Placement Warrants, resulting in the Company receiving less consideration upon exercise thereof. Additionally, the extension of the prohibition on our ability to issue additional shares of common stock, other than pursuant to certain customary exceptions, could limit our ability to raise additional funding in the future, complete transactions which would otherwise be accretive to stockholders or otherwise use equity as a form of compensation in certain future transactions affecting the Company. Any of the above could have a material adverse effect on the Company and/or the value of our securities.

The rights and privileges associated with the common stock potentially issuable through exercise of the Private Placement Warrants would be identical to the rights and privileges associated with the common stock held by our existing stockholders.

Q. What will happen if the Warrant Share Issuance Proposal is not approved by TRxADE’s stockholders?

A. If we fail to obtain stockholder approval at the Special Meeting of the Warrant Share Issuance Proposal, the Exchange Cap will remain in place and the Private Placement Warrants will not be exercisable for shares of our common stock. Additionally, the anti-dilutive rights under the Private Placement Warrants will continue in effect until or unless Stockholder Approval is received for the issuance of shares of common stock upon exercise thereof and the removal of the Exchange Cap, and if such stockholder approval is not received, we would continue to be prohibited from issuing any shares of common stock. Finally, if we do not obtain Shareholder Approval at the Special Meeting, we are required to call a meeting every six months thereafter to seek Shareholder Approval until the earlier of the date Shareholder Approval is obtained or the Private Placement Warrants are no longer outstanding. The calling of a Special Meeting is costly and resource intensive for management, and in the event Stockholder Approval was not received at the Special Meeting or any meeting held thereafter, the costs of the preparation, printing and mailing of this Proxy Statement (and any future Proxy Statement) will be lost, which could have a material adverse effect on our results of operations and cash flow.

| 6 |

Q. Are there any other proposals to be considered and approved at the Special Meeting?

A. Yes. In addition to the Warrant Share Issuance Proposal, TRxADE is also asking its stockholders to approve the Adjournment Proposal, which requires the affirmative vote of the holders of a majority of TRxADE’s common stock (which each vote one vote on all stockholder matters) present at the Special Meeting or by proxy and entitled to vote on the matter at the Special Meeting, voting as a single class (meaning that of the shares of common stock represented at the Special Meeting and entitled to vote, a majority of them must be voted “FOR” the proposal for it to be approved).

Q: How does the Board of Directors recommend that TRxADE’s stockholders vote with respect to each of the Proposals?

A: The Board of Directors unanimously determined that the Warrant Share Issuance Proposal is in the best interests of TRxADE and its stockholders and recommends that you vote “FOR” the Warrant Share Issuance Proposal, and “FOR” the Adjournment Proposal.

Q. Do I have appraisal rights in connection with the Warrant Share Issuance Proposal?

A. No. Under the Delaware General Business Law, appraisal and dissenters’ rights are not available to any stockholder in connection with the Warrant Share Issuance Proposal, regardless of whether such stockholder votes for or against the approval of the Warrant Share Issuance Proposal.

Q. When and where will the Special Meeting take place?

A. The meeting will be held on Tuesday, December 20, 2022 at 10:00 A.M. Eastern Standard Time, via an audio teleconference at https://agm.issuerdirect.com/MEDS (please note this link is case sensitive), subject to any postponement(s) or adjournment(s) thereof.

Q. Who can attend and vote at the Special Meeting?

A. Holders of common stock of TRxADE as of the close of business on October 31, 2022, the Record Date for the Special Meeting, are entitled to notice of, and to vote at, the Special Meeting. At the close of business on the Record Date, 9,318,708 shares of our common stock were outstanding, which each vote one voting share, voting as a single class, and as such, a total of 9,318,708 voting shares are eligible to be voted at the Special Meeting.

Q: What do I need to do now and how do I vote?

A: TRxADE encourages you to read this proxy statement carefully, and to consider how the Warrant Share Issuance Proposal may affect you.

If your shares of TRxADE’s common stock are registered directly in your name with TRxADE’s transfer agent, you are considered, with respect to those shares, to be the “stockholder of record,” and the proxy materials and Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card are being sent directly to you by TRxADE. There are five methods by which you may vote your shares at the Special Meeting:

| ● | At the virtual Special Meeting. You may vote during the meeting by following the instructions available on the meeting website during the meeting, by using the Request ID found in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card. |

| ● | Via the Internet. You may vote by proxy via the Internet by following the instructions provided in your Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card. |

| 7 |

| ● | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the proxy card. |

| ● | By Fax. If you request printed copies of the proxy materials by mail, you may vote by proxy by faxing your proxy to the number found on the proxy card. |

| ● | By Mail. If you request printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and returning it in the envelope provided. |

Q: If my shares of TRxADE’s common stock are held in “street name” by my broker, dealer, bank or other nominee, will my broker, dealer, bank or nominee vote my shares for me and may I vote at the Special Meeting?

A: If your shares of TRxADE’s common stock are held through an account with a broker, dealer, bank or nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you together with a voting instruction card, a Notice of Internet Availability of Proxy Materials. You must provide the record holder of your shares with instructions on how to vote your shares. Please follow the voting instructions provided by your broker, dealer, bank or other nominee. Please note that you may not vote shares held in street name by returning a proxy card directly to TRxADE.

As the beneficial owner, you are also invited to attend the Special Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares at the Special Meeting unless you obtain a “legal proxy” from the broker, dealer, bank or other nominee that holds your shares giving you the right to vote the shares at the Special Meeting.

Q. What happens if I do not sign and return my proxy card or vote by telephone, fax, through the Internet or at the Special Meeting or I do not otherwise provide proxy instructions?

A. If you are a stockholder of record of TRxADE’s common stock and you do not sign and return your proxy card as discussed herein, your shares will not be voted at the Special Meeting and will not be counted as present for the purpose of determining the presence of a quorum, which is required to transact business at the Special Meeting. Assuming the presence of a quorum, the failure to return your proxy card or otherwise vote your shares at the Special Meeting will have no effect on the outcome of the Warrant Share Issuance Proposal or the Adjournment Proposal (except to the extent that your failure to vote prevents the Company from obtaining a quorum at the Special Meeting, or prevents the Company from obtaining the majority vote of shares present or via proxy at the Special Meeting).

If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be counted as present for the purpose of determining the presence of a quorum for the Special Meeting and all of your shares will be voted “FOR” each proposal.

Q. What if I abstain from voting?

A. If you attend the Special Meeting or submit a proxy card, but affirmatively elect to abstain from voting, your proxy will be counted as present for the purpose of determining the presence of a quorum for the Special Meeting, but will not be voted at the Special Meeting. As a result, your abstention will have the same effect as voting “AGAINST” each proposal.

| 8 |

Q. What is a “broker non-vote?”

A. “Broker non-votes” are shares held in “street name” by brokers, dealers, banks and other nominees that are present or represented by proxy at the Special Meeting, but with respect to which the broker, dealer, bank or other nominee is not instructed by the beneficial owner of such shares how to vote on a particular proposal and such broker, dealer, bank or nominee does not have discretionary voting power on such proposal. Because brokers, dealers, banks and other nominees holding shares in “street name” do not have discretionary voting authority with respect to the Warrant Share Issuance Proposal, but do have discretion to vote in connection with the Adjournment Proposal, each described in this proxy statement, if a beneficial owner of shares of TRxADE’s common stock held in “street name” does not give voting instructions to the broker, dealer, bank or other nominee, then those shares will not be counted as present or by proxy at the Special Meeting with respect to those proposals. The failure to issue voting instructions to your broker, dealer, bank or other nominee will have no effect on the outcome of the Warrant Share Issuance Proposal or the Adjournment Proposal.

Q: May I revoke or change my vote after I have provided proxy instructions?

A: Yes. You may revoke or change your vote at any time before your proxy is voted at the Special Meeting. You can do this in one of three ways: (i) delivering written notice to the Secretary of the Company at TRxADE’s principal executive offices prior to the Special Meeting, (ii) executing and delivering a proxy bearing a later date to the Secretary of the Company at TRxADE’s principal executive office prior to the Special Meeting, or (iii) voting at the Special Meeting through the meeting portal. Your attendance at the Special Meeting without further action on your part will not automatically revoke your proxy. If you have instructed your broker, dealer, bank or other nominee to vote your shares, you must follow directions received from your broker, dealer, bank or other nominee in order to change those instructions.

Q. What constitutes a quorum for the Special Meeting?

A. The presence at the Special Meeting of the holders of a majority of the outstanding shares of voting stock entitled to vote at the Special Meeting is necessary to constitute a quorum, which is necessary to conduct the Special Meeting. Your shares will be counted toward the quorum if you submit a properly executed proxy or vote at the Special Meeting. In addition, abstentions and broker non-votes will be treated as present for the purpose of determining the presence of a quorum for the transaction of business at the Special Meeting. If there is no quorum, then either the chairman of the meeting or the holders of a majority in voting power of the shares of common stock that are entitled to vote at the meeting, present at the Special Meeting or by proxy, may adjourn the meeting until a quorum is present or represented.

Q. What does it mean if I received more than one Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card?

A. If you received more than one Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card, your shares are likely registered in more than one name or are held in more than one account. These should each be voted and returned separately in order to ensure that all of your shares of TRxADE’s common stock are voted.

Q. Whom should I contact if I have any questions about the Warrant Share Issuance Proposal or the Special Meeting?

A. If you have any questions about the Warrant Share Issuance Proposal or the Special Meeting, please contact:

Janet Huffman, Chief Financial Officer

2420 Brunello Trace

Lutz, Florida 33558

Telephone: (800) 261-0281

Email: jhuffman@trxade.com

If you need assistance in submitting your proxy or voting your shares or need additional copies of this proxy statement or the enclosed proxy card, please contact Issuer Direct, at the address, email and telephone number listed below:

1 Glenwood Avenue

Suite 1001

Raleigh, North Carolina 27603

Email: proxy@issuerdirect.com

Phone: (919) 447-3740

| 9 |

If your shares are held through an account with a broker, dealer, bank or other nominee, you should call your broker, dealer, bank or other nominee for additional information.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement and the other documents referred to in this proxy statement contain or may contain “forward-looking statements” of TRxADE within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For this purpose, any statements contained herein, other than statements of historical fact, may be forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Statements that include words such as “may”, “will”, “project”, “might”, “expect”, “believe”, “anticipate”, “intend”, “could”, “would”, “estimate”, “continue” or “pursue” or the negative of these words or other words or expressions of similar meaning may identify forward-looking statements. These forward-looking statements are found at various places throughout this proxy statement and the other documents referred to herein and relate to a variety of statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of our management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in this proxy statement and those that are referred to in this proxy statement. All of these risks and uncertainties could potentially have an adverse impact on TRxADE’s business and financial performance, and could cause a decline in the value of TRxADE’s securities.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement or, in the case of documents referred to in this proxy statement, as of the date of those documents. The Company disclaims any obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this proxy statement or to reflect the occurrence of unanticipated events, except as required by law.

More information about other potential factors that could affect TRxADE’s business and financial results is included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in TRxADE’s Annual Report on Form 10-K for the year ended December 31, 2021 and TRxADE’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, which are on file with the SEC and available on the SEC’s website at www.sec.gov. See the section of this proxy statement entitled “Where You Can Find Additional Information”, beginning on page 27.

APPROVAL OF THE ISSUANCE OF SHARES OF OUR COMMON STOCK UPON THE EXERCISE OF WARRANTS TO PURCHASE UP TO 2,663,045 SHARES OF COMMON STOCK IN ACCORDANCE WITH NASDAQ LISTING RULE 5635(D)

The discussion of the Private Placement Warrants and the holders thereof as set forth in this proxy statement is qualified in its entirety by reference to the form of Common Stock Purchase Warrant evidencing the Private Placement Warrants, which sets forth the terms, conditions and rights of the Private Placement Warrants, a copy of which is attached to this proxy statement as Annex A and hereby incorporated by reference into this proxy statement. We encourage you to read form of Common Stock Purchase Warrant evidencing the Private Placement Warrants carefully and, in its entirety, as it is the legal document that governs the Private Placement Warrants.

We are asking stockholders to approve the issuance of shares of our common stock upon the exercise of the Private Placement Warrants, discussed below, in accordance with Nasdaq Listing Rule 5635(d), as described in more detail below.

| 10 |

Private Placement Warrants

On October 4, 2022, we entered into a securities purchase agreement with a certain institutional investor. The Purchase Agreement provided for the sale and issuance by the Company of an aggregate of: (i) 920,000 shares of the Company’s common stock, $0.00001 par value, (ii) pre-funded warrants to purchase up to 601,740 shares of common stock and (iii) warrants to purchase up to 2,663,045 shares of common stock (the Private Placement Warrants). The offering price per Share was $1.15 and the offering price per Pre-Funded Warrant was $1.14999. The Private Placement Warrants were sold in a concurrent Private Placement, exempt from registration pursuant to Section 4(a)(2) and/or Rule 506 of the Securities Act.

The Pre-Funded Warrants were immediately exercisable, have an exercise price of $0.00001 per share, and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

Each Private Placement Warrant has an exercise price of $1.50 per share, will be exercisable following Stockholder Approval and will expire on the fifth anniversary of the date on which the Private Placement Warrants become exercisable. The Private Placement Warrants contain standard adjustments to the exercise price including for stock splits, stock dividend, rights offerings and pro rata distributions, and include full ratchet anti-dilutive rights in the event the Company issues shares of common stock or common stock equivalents within fifteen months of the initial exercise date, with a value less than the then exercise price of such Private Placement Warrants, subject to certain customary exceptions, and further subject to a minimum exercise price of $0.232 per share. The Private Placement Warrants also include certain rights upon ‘fundamental transactions’ as described in the Private Placement Warrants, including allowing the holders thereof to require that the Company re-purchase such Private Placement Warrants at the Black Scholes Value of such securities.

The Pre-Funded Warrants have cashless exercise rights and to the extent the shares of common stock underlying the Private Placement Warrants are not registered under the Securities Act, the Private Placement Warrants include cashless exercise rights.

If we fail for any reason to deliver shares of common stock upon the valid exercise of the Pre-Funded Warrants or Private Placement Warrants, subject to our receipt of a valid exercise notice and the aggregate exercise price, by the time period set forth in the Pre-Funded Warrants or Private Placement Warrants, we are required to pay the applicable holder, in cash, as liquidated damages as set forth in the Pre-Funded Warrants and Private Placement Warrants. The Pre-Funded Warrants and Private Placement Warrants also include customary buy-in rights in the event we fail to deliver shares of common stock upon exercise thereof within the time periods set forth in the Pre-Funded Warrants and Private Placement Warrants.

Under the terms of the Pre-Funded Warrants and Private Placement Warrants, a holder will not be entitled to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate number of shares of common stock beneficially owned by the holder (together with its affiliates, any other persons acting as a group together with the holder or any of the holder’s affiliates, and any other persons whose beneficial ownership of common stock would or could be aggregated with the holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended) would exceed 4.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of such warrant, which percentage may be increased at the holder’s election upon 61 days’ notice to the Company subject to the terms of such warrants, provided that such percentage may in no event exceed 9.99%, and provided further that the Purchaser has elected to increase the ownership limitation to 9.99% in connection with the initial issuance of the Pre-Funded Warrants.

The Private Placement Warrants may not be exercised by the holder thereof until or unless the Company’s stockholders have approved the issuance of shares of common stock upon the exercise of such Private Placement Warrants pursuant to the applicable rules and regulations of the Nasdaq Stock Market, including the issuance of the shares of common stock issuable upon exercise of the Private Placement Warrants in excess of 19.99% of the issued and outstanding common stock on the closing date of the offering, which Stockholder Approval we are seeking pursuant to the Warrant Share Issuance Proposal at the Special Meeting. Subject to the rules and regulations of the Nasdaq Capital Market, the Company may at any time during the term of the Private Placement Warrants, reduce the then current exercise price thereof to any amount and for any period of time deemed appropriate by the Board of Directors of the Company.

| 11 |

As an additional requirement to the offering, all of the officers and directors of the Company were required to enter into an agreement agreeing to vote all common stock over which such persons have voting control as of the record date for the meeting of stockholders of the Company, which Voting Agreements have been entered into by such required persons. As a result, each of our officers and directors have agreed to vote all of the voting shares which they hold as of the Record Date, a total of 4,525,591 or 48.6% of our total voting shares as of the Record Date, in favor of the Warrant Share Issuance Proposal.

The offering of the Shares, Pre-Funded Warrants and Private Placement Warrants resulted in gross proceeds to the Company of approximately $1.75 million. The net proceeds to the Company from the offering are expected to be approximately $1.5 million, after deducting placement agent fees and expenses and estimated offering expenses payable by the Company. The Company intends to use the net proceeds from the offering for general corporate purposes. On October 4, 2022, the Company also entered into a placement agent agreement with Maxim Group LLC. Pursuant to the terms of the Placement Agent Agreement, the Placement Agent agreed to use its reasonable best efforts to arrange for the sale of the Securities. The Company will pay the Placement Agent a cash fee equal to 7.0% of the gross proceeds generated from the sale of the Shares and Pre-Funded Warrants and will reimburse the Placement Agent for certain of its expenses in an aggregate amount up to $35,000.

The transactions contemplated by the Purchase Agreement closed on October 7, 2022.

We agreed pursuant to the Purchase Agreement that as soon as practicable (and in any event within 60 calendar days of the date of Purchase Agreement), that we would file a registration statement on Form S-1 providing for the resale by the Purchaser of the shares of common stock issuable upon exercise of the Private Placement Warrants, use commercially reasonable efforts to cause such registration statement to become effective within 181 days following the closing date of the offerings and to keep such registration statement effective at all times until no Purchaser owns any Private Placement Warrants or shares of common stock issuable upon exercise thereof.

We also agreed to hold a special meeting of stockholders or take action via written consent of stockholders, at the earliest practical date, but no later than December 20, 2022, for the purpose of obtaining Shareholder Approval, with the recommendation of the Company’s Board of Directors that such proposal be approved, and to solicit proxies from our stockholders in connection therewith. We are required to use our reasonable best efforts to obtain such Shareholder Approval. If we do not obtain Shareholder Approval at the first meeting, we are required to call a meeting every six months thereafter to seek Shareholder Approval until the earlier of the date Shareholder Approval is obtained or the Private Placement Warrants are no longer outstanding. As discussed above, the Special Meeting is being called to satisfy the above requirement of the Purchase Agreement.

Pursuant to the Purchase Agreement the Company has agreed that, subject to certain exceptions, (i) it will not issue any shares of common stock for a period of 90 days following the later of (A) the date of Stockholder Approval and (B) the Effective Date, subject to certain customary and pre-agreed exceptions and that (ii) it will not enter into a variable rate transaction for a period of nine months following the Effective Date.

We also agreed to provide the Purchaser a right of participation for 12 months following the closing date to participate up to 25% in any subsequent offering we may undertake of equity or debt.

The offering of the Shares, Pre-Funded Warrants and the shares of common stock issuable upon exercise of the Pre-Funded Warrants are being made pursuant to a registration statement on Form S-3 (File No. 333- 266432), which was filed by the Company with the Securities and Exchange Commission on July 29, 2022, and declared effective on August 8, 2022, as supplemented by a prospectus supplement dated October 4, 2022.

| 12 |

The Private Placement Warrants and the shares of common stock issuable upon exercise of the Private Placement Warrants are not registered under the registration statement discussed above, and are instead being sold in a private transaction, exempt from registration under the Securities Act.

Pursuant to the Purchase Agreement, the Company agreed to hold a special meeting of stockholders or take action via written consent of stockholders, at the earliest practical date, but no later than December 20, 2022, for the purpose of obtaining Shareholder Approval, with the recommendation of the Company’s Board of Directors that such proposal be approved, and to solicit proxies from our stockholders in connection therewith. We are required to use our reasonable best efforts to obtain such Shareholder Approval. If we do not obtain Shareholder Approval at the first meeting, we are required to call a meeting every six months thereafter to seek Shareholder Approval until the earlier of the date Shareholder Approval is obtained or the Private Placement Warrants are no longer outstanding. As discussed above, the Special Meeting is being called to satisfy the above requirement of the Purchase Agreement.

A vote in favor of the Warrant Share Issuance Proposal is a vote “for” approval of all shares of common stock issuable upon exercise of the Private Placement Warrants.

Exercise of the Private Placement Warrants could result in the issuance of 20% or more of our common stock outstanding as of October 7, 2022, the date that the Private Placement Warrants were granted by the Company. Because NASDAQ Stock Market listing standards (Listing Rule 5635(d)) state, as described below, that, in certain circumstances, an issuer is required to obtain stockholder approval before the issuance or potential issuance of a number of shares of common stock equal to 20% or more of its common stock outstanding before the issuance, the agreement evidencing the Private Placement Warrants currently prohibits the issuance of common stock upon exercise of the Private Placement Warrants until or unless the Company has received stockholder approval for the issuance of more than 19.99% of the common stock outstanding as of October 7, 2022, or 1,679,741 shares of common stock, which we refer to as the “Exchange Cap”. Stockholder approval of the Warrant Share Issuance Proposal at the Special Meeting would eliminate the Exchange Cap.

Specifically, Nasdaq Listing Rule 5635(d), requires stockholder approval in connection with a transaction other than a public offering involving the sale, issuance, or potential issuance by the issuer of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for a price that is less than the lower of (i) the Nasdaq closing price immediately preceding the signing of the binding agreement, or (ii) the average of the Nasdaq closing price for the five trading days immediately preceding the signing of the binding agreement. Pursuant to Nasdaq rules, the presence of any provision that could cause the conversion or exercise price of a convertible security to be reduced to below the Minimum Price immediately before the entering into of the binding agreement will cause the transaction to be viewed as a discounted issuance. Because the 2,663,045 shares of common stock issuable upon exercise of the Private Placement Warrants total more than 19.99% of the Company’s outstanding shares of common stock on the date the Private Placement Warrants were granted and because the Private Placement Warrants have anti-dilutive rights, and were deemed sold at below the Minimum Price, the Company is seeking stockholder approval for removal of the Exchange Cap, and for the issuance of the shares of common stock upon exercise of the Private Placement Warrants, as described in greater detail above, pursuant to Nasdaq Listing Rule 5635(d).

The summary of the terms of the Private Placement Warrants above is qualified in its entirety by reference to the copy of the form of Common Stock Purchase Warrant evidencing the Private Placement Warrants which is included herewith as Annex A, which is incorporated herein by reference. You should read this summary together with the form of Common Stock Purchase Warrant evidencing the Private Placement Warrants.

| 13 |

Potential Adverse Effects — Dilution and Impact on Existing Stockholders

The issuance of shares of common stock upon exercise of the Private Placement Warrants will have a dilutive effect on current stockholders in that the percentage ownership of the Company held by such current stockholders will decline as a result of the issuance of the common stock issuable upon exercise of the Private Placement Warrants. This means also that our current stockholders will own a smaller interest in us as a result of the exercise of the Private Placement Warrants and therefore have less ability to influence significant corporate decisions requiring stockholder approval. Issuance of the common stock issuable upon exercise of the Private Placement Warrants could also have a dilutive effect on the book value per share and any future earnings per share. Dilution of equity interests could also cause prevailing market prices for our common stock to decline.

If the Private Placement Warrants are exercised in full for cash, a total of 2,663,045 shares of common stock will be issuable to the holder of the Private Placement Warrants and this dilutive effect may be material to current stockholders of the Company.

Risks Related to the Private Placement Warrants

If we do not maintain a current and effective prospectus relating to the common stock issuable upon exercise of the Private Placement Warrants, holders may exercise such Private Placement Warrants on a “cashless basis.”

Assuming Stockholder Approval is received, if we do not maintain a current and effective prospectus relating to the shares of common stock issuable upon exercise of the Private Placement Warrants at the time that holders wish to exercise such warrants, they will be able to exercise them on a “cashless basis”. As a result, the number of shares of common stock that holders will receive upon exercise of the Private Placement Warrants will be fewer than it would have been had such holders exercised their Private Placement Warrants for cash. Under the terms of the Purchase Agreement, we have agreed to file a registration statement to register the Private Warrant Shares, as soon as practicable (and in any event within 60 calendar days of the date of the Purchase Agreement), and use commercially reasonable efforts to cause such registration statement to become effective within 181 days following the closing date of the offering of the Securities and to keep such registration statement effective at all times until the investor holds no Private Placement Warrants or Private Warrant Shares issuable upon exercise thereof. However, we cannot assure you that we will be able to do so. If the Private Placement Warrants are exercised on a “cashless” basis, we will not receive any consideration from such exercises.

Provisions of the Private Placement Warrants could discourage an acquisition of us by a third party.

Certain provisions of the Private Placement Warrants could make it more difficult or expensive for a third party to acquire us. The Private Placement Warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the Private Placement Warrants. Further, the Private Placement Warrants provide that, in the event of certain transactions constituting “fundamental transactions,” with some exception, holders of such warrants will have the right, at their option, to require us to repurchase such warrants at a price described in such warrants. These and other provisions of the Private Placement Warrants could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

The Private Placement Warrants have certain anti-dilutive rights.

The Private Placement Warrants include full ratchet anti-dilutive rights in the event any shares of common stock or other equity or equity equivalent securities payable in common stock are granted, issued or sold (or the Company enters into any agreement to grant, issue or sell), or in accordance with the terms of the warrant agreement evidencing the Private Placement Warrants, are deemed to have granted, issued or sold, in each case, at a price less than the exercise price, which automatically decreases the exercise price of the Warrants upon the occurrence of such event, as described in greater detail in the warrant agreement, subject to a minimum exercise price of $0.232 per share. Such anti-dilution rights, if triggered, could result in a significant decrease in the exercise price of the Private Placement Warrants, which could result in significant dilution to existing shareholders.

| 14 |

The Private Placement Warrants may be accounted for as liabilities and the changes in value of such Private Placement Warrants may have a material effect on our financial results.

We are currently evaluating the terms of the warrant agreements entered into in connection with sale of the Private Placement Warrants. It is possible that we and/or our auditors will conclude that because of the terms of such Private Placement Warrants, such Private Placement Warrants should be accounted for as liability instruments. As a result, the Company would be required to classify the Private Placement Warrants as liabilities. Under the liability accounting treatment, the Company would be required to measure the fair value of these instruments at the end of each reporting period and recognize changes in the fair value from the prior period in the Company’s operating results for the current period. As a result of the recurring fair value measurement, our financial statements and results of operations may fluctuate quarterly based on factors which are outside our control. In the event the Private Placement Warrants are required to be accounted for under liability accounting treatment, we will recognize noncash gains or losses due to the quarterly fair valuation of these warrants which could be material. The impact of changes in fair value on our earnings may have an adverse effect on the market price of our common stock and/or our stockholders’ equity, which may make it harder for us to, or prevent us from, meeting the continued listing standards of The Nasdaq Capital Market.

The issuance and sale of common stock upon exercise of the Private Placement Warrants may cause substantial dilution to existing stockholders and may also depress the market price of our common stock.

Assuming Stockholder Approval is received, the Private Placement Warrants will be exercisable for up to 2,663,045 shares of common stock, provided that the Private Placement Warrants contain a provision limiting each holder’s ability to exercise the warrants if such exercise would cause the holder’s (or any affiliate of any such holder) holdings in the Company to exceed 4.99% of the Company’s issued and outstanding shares of common stock (which may be increased or decreased with 61 days prior written notice from the holder, to up to 9.99% of the Company’s issued and outstanding shares of common stock). The ownership limitation does not prevent such holder from exercising some of the warrants, selling those shares, and then exercising the rest of the warrants, while still staying below the 4.99% limit. In this way, the holder of the warrants could sell more than this limit while never actually holding more shares than this limit allows. If the holder of the warrants chooses to do this, it will cause substantial dilution to the then holders of our common stock.

If exercises of the warrants and sales of such shares issuable upon exercise thereof take place, the price of our common stock may decline. In addition, the common stock issuable upon exercise of the warrants may represent overhang that may also adversely affect the market price of our common stock. Overhang occurs when there is a greater supply of a company’s stock in the market than there is demand for that stock. When this happens the price of the company’s stock will decrease, and any additional shares which shareholders attempt to sell in the market will only further decrease the share price. If the share volume of our common stock cannot absorb shares sold by the warrant holders, then the value of our common stock will likely decrease.

Required Vote; Recommendation of the Board of Directors

Approval of the Warrant Share Issuance Proposal requires the affirmative vote of the holders of a majority of TRxADE’s common stock (which each vote one voting share on all stockholder matters) present at the Special Meeting or by proxy and entitled to vote on the matter at the Special Meeting (meaning that of the shares of common stock represented at the Special Meeting and entitled to vote, a majority of them must be voted “FOR” the Warrant Share Issuance Proposal for it to be approved). For purposes of the vote on this Warrant Share Issuance Proposal, an abstention will have the same effect as voting “AGAINST” the Warrant Share Issuance Proposal, but the failure to sign and return your proxy card or vote by telephone, fax, over the Internet or at the Special Meeting will have no effect on the outcome of the proposal. Broker non-votes will also have no effect on the outcome of the proposal.

| 15 |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU

VOTE “FOR” THE WARRANT SHARE ISSUANCE PROPOSAL.

THE ADJOURNMENT PROPOSAL