Orexigen announces acquisition of all U.S. Contrave® rights March 15th 2016 Exhibit 99.2

Forward Looking Statements This presentation contains forward-looking statements about Orexigen Therapeutics, Inc. and Contrave®. Words such as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “should,” “intends,” “potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to identify forward‐looking statements. These statements are based on the Company‘s current beliefs and expectations. These forward‐looking statements include statements regarding: the potential for greater profitability and shareholder value through the sole ownership of U.S. rights to commercialize Contrave® in the United States; the potential success of marketing and commercialization of Contrave in the United States; the potential for Contrave and Mysimba® to achieve commercial success globally; the potential for Orexigen to enter into successful partnership arrangements for Contrave/Mysimba in additional territories outside the United States; the potential growth of the anti-obesity market through 2018 and the potential growth of Orexigen’s share of such market through 2018; the potential improvement in profitability per Contrave prescription by 2018; the potential for the Company to be profitable by 2019; the potential for Orexigen to achieve commercial success for Contrave in the United States without a partner; the potential for Contrave to achieve the prescription and profitability models in 2017 and 2018; the sales force capacity for Contrave; the Company’s strategic plans and initiatives; and the potential to maintain and strengthen the intellectual property protection for Contrave/Mysimba globally. The inclusion of financial modeling, forward‐looking statements and potential financing and transaction plans and terms should not be regarded as a representation by Orexigen that any of its plans will be achieved. Actual results may differ materially from those expressed or implied in this presentation due to the risk and uncertainties inherent in the Orexigen business, including, without limitation: the potential that the marketing and commercialization of Contrave/Mysimba will not be successful, particularly, with respect to Contrave, in the U.S. following the transition from Takeda; the Company’s ability to obtain partnerships and marketing authorization globally; additional analysis of the interim results or the final data from the terminated Light Study, including safety-related data, and the additional CVOT may produce negative or inconclusive results, or may be inconsistent with the conclusion that the interim analysis was successful; our ability to adequately inform consumers about Contrave; our ability to successfully commercialize Contrave with a specialty sales force in the United States; the therapeutic and commercial value of Contrave/Mysimba; competition in the global obesity market, particularly from existing therapies; the Company’s failure to successfully acquire, develop and market additional product candidates or approved products; the estimates of the capacity of manufacturing and the company’s ability to secure additional manufacturing capabilities; our ability to obtain and maintain global intellectual property protection for Contrave and Mysimba; legal or regulatory proceedings against Orexigen, as well as potential reputational harm, as a result of misleading public claims about Orexigen; our ability to maintain sufficient capital to fund our operations for the foreseeable future; the potential for a Delaware court to determine that one or more of the patents are not valid or that Actavis' proposed generic product is not infringing each of the patents at issue; and other risks described in Orexigen’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date hereof, and Orexigen undertakes no obligation to revise or update this news release to reflect events or circumstances after the date hereof. Further information regarding these and other risks is included under the heading "Risk Factors" in Orexigen's Current Report on Form 10-K filed with the Securities and Exchange Commission on February 26, 2016 and its other reports, which are available from the SEC's website (www.sec.gov) and on Orexigen's website (www.orexigen.com) under the heading "Investors." All forward‐looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

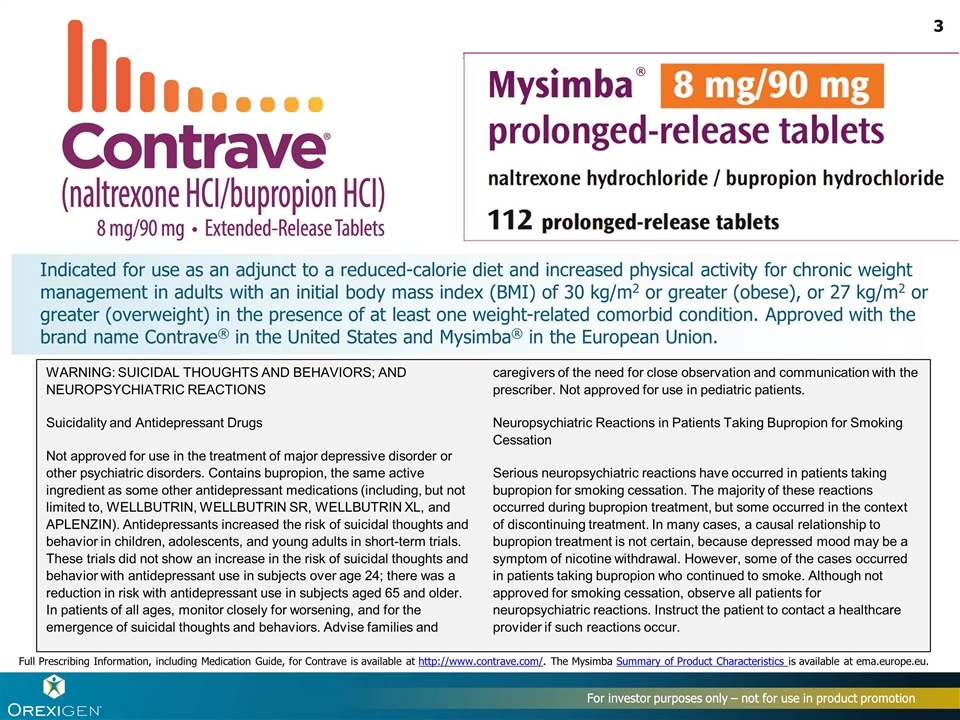

Indicated for use as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adults with an initial body mass index (BMI) of 30 kg/m2 or greater (obese), or 27 kg/m2 or greater (overweight) in the presence of at least one weight-related comorbid condition. Approved with the brand name Contrave® in the United States and Mysimba® in the European Union. WARNING: SUICIDAL THOUGHTS AND BEHAVIORS; AND NEUROPSYCHIATRIC REACTIONS Suicidality and Antidepressant Drugs Not approved for use in the treatment of major depressive disorder or other psychiatric disorders. Contains bupropion, the same active ingredient as some other antidepressant medications (including, but not limited to, WELLBUTRIN, WELLBUTRIN SR, WELLBUTRIN XL, and APLENZIN). Antidepressants increased the risk of suicidal thoughts and behavior in children, adolescents, and young adults in short-term trials. These trials did not show an increase in the risk of suicidal thoughts and behavior with antidepressant use in subjects over age 24; there was a reduction in risk with antidepressant use in subjects aged 65 and older. In patients of all ages, monitor closely for worsening, and for the emergence of suicidal thoughts and behaviors. Advise families and caregivers of the need for close observation and communication with the prescriber. Not approved for use in pediatric patients. Neuropsychiatric Reactions in Patients Taking Bupropion for Smoking Cessation Serious neuropsychiatric reactions have occurred in patients taking bupropion for smoking cessation. The majority of these reactions occurred during bupropion treatment, but some occurred in the context of discontinuing treatment. In many cases, a causal relationship to bupropion treatment is not certain, because depressed mood may be a symptom of nicotine withdrawal. However, some of the cases occurred in patients taking bupropion who continued to smoke. Although not approved for smoking cessation, observe all patients for neuropsychiatric reactions. Instruct the patient to contact a healthcare provider if such reactions occur. Full Prescribing Information, including Medication Guide, for Contrave is available at http://www.contrave.com/. The Mysimba Summary of Product Characteristics is available at ema.europe.eu. For investor purposes only – not for use in product promotion ®

Acquisition of U.S. Contrave® (naltrexone HCl / bupropion HCl) rights transformational for Orexigen Orexigen acquires all U.S. rights to Contrave, pending HSR clearance Rare opportunity for non-competitive acquisition of most prescribed brand in a growing market at an ideal point in the product’s life cycle Acquisition of U.S. rights significantly magnifies projected long-term profitability and opens multiple paths to shareholder value creation U.S. commercialization of Contrave funded by sale of $165 million in convertible senior secured notes to investor syndicate led by The Baupost Group L.L.C. Orexigen believes that with this investment the company has sufficient capital to fund its US commercialization plan for Contrave and to achieve projected profitability for full year 2019

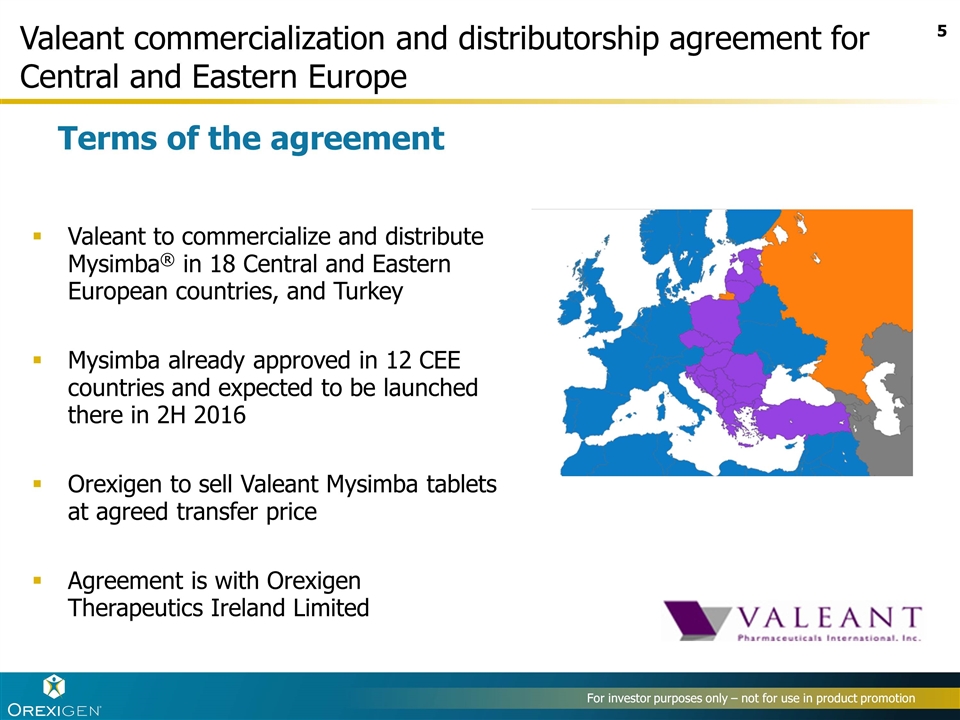

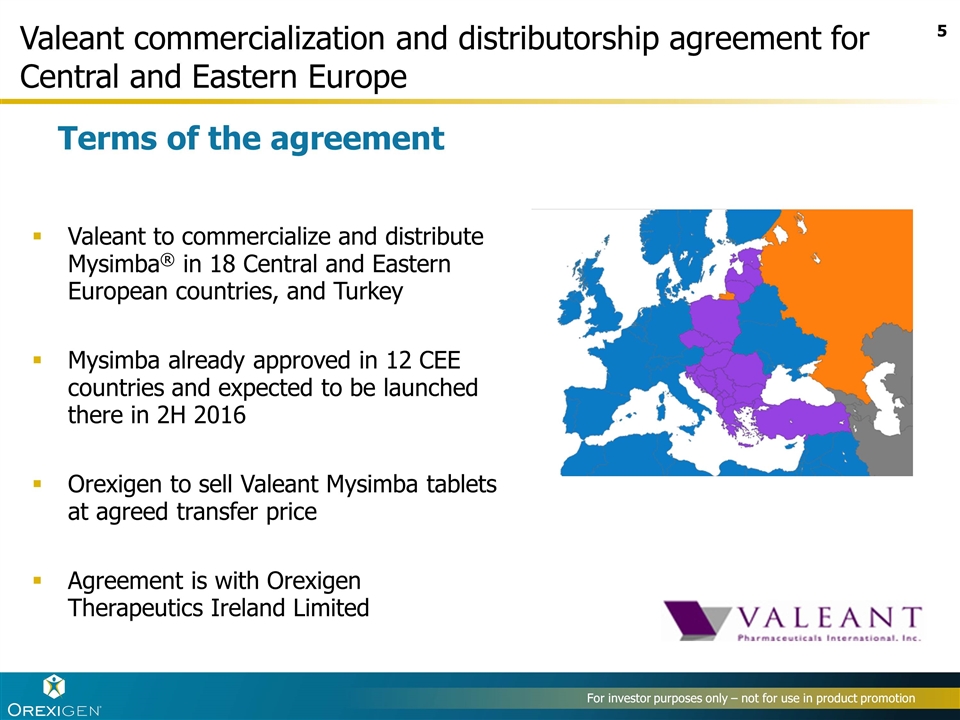

For investor purposes only – not for use in product promotion Valeant commercialization and distributorship agreement for Central and Eastern Europe Terms of the agreement Valeant to commercialize and distribute Mysimba® in 18 Central and Eastern European countries, and Turkey Mysimba already approved in 12 CEE countries and expected to be launched there in 2H 2016 Orexigen to sell Valeant Mysimba tablets at agreed transfer price Agreement is with Orexigen Therapeutics Ireland Limited

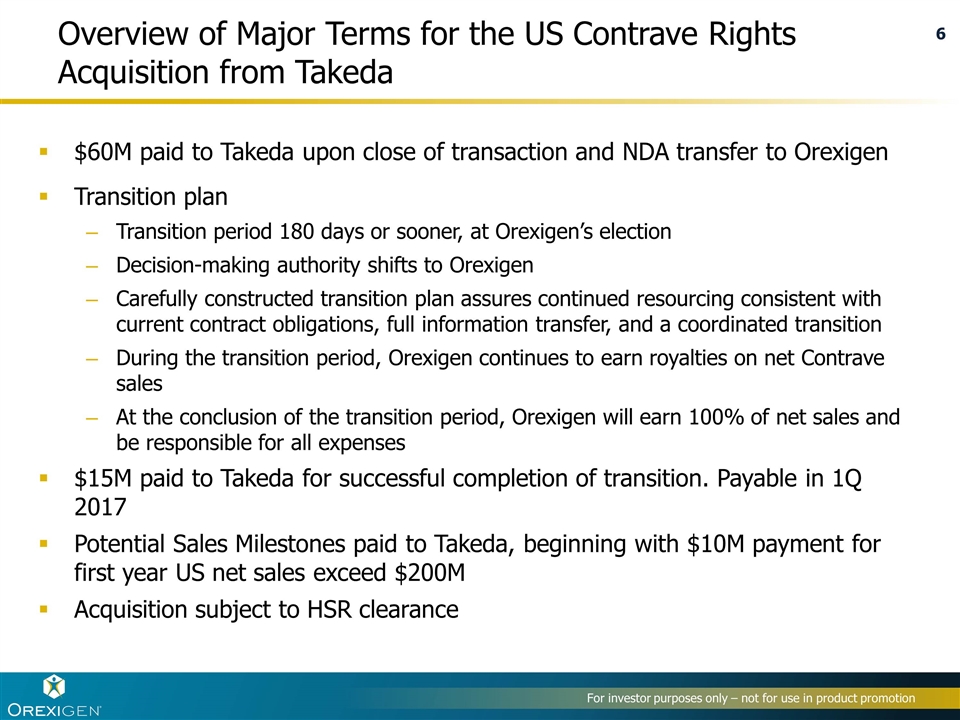

Overview of Major Terms for the US Contrave Rights Acquisition from Takeda $60M paid to Takeda upon close of transaction and NDA transfer to Orexigen Transition plan Transition period 180 days or sooner, at Orexigen’s election Decision-making authority shifts to Orexigen Carefully constructed transition plan assures continued resourcing consistent with current contract obligations, full information transfer, and a coordinated transition During the transition period, Orexigen continues to earn royalties on net Contrave sales At the conclusion of the transition period, Orexigen will earn 100% of net sales and be responsible for all expenses $15M paid to Takeda for successful completion of transition. Payable in 1Q 2017 Potential Sales Milestones paid to Takeda, beginning with $10M payment for first year US net sales exceed $200M Acquisition subject to HSR clearance

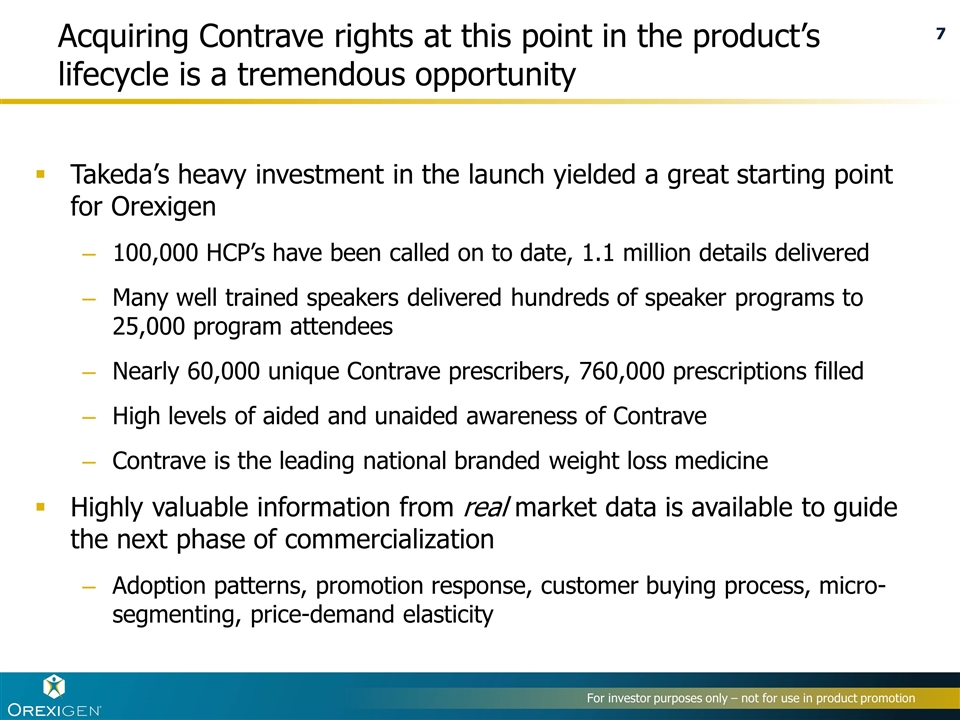

Acquiring Contrave rights at this point in the product’s lifecycle is a tremendous opportunity Takeda’s heavy investment in the launch yielded a great starting point for Orexigen 100,000 HCP’s have been called on to date, 1.1 million details delivered Many well trained speakers delivered hundreds of speaker programs to 25,000 program attendees Nearly 60,000 unique Contrave prescribers, 760,000 prescriptions filled High levels of aided and unaided awareness of Contrave Contrave is the leading national branded weight loss medicine Highly valuable information from real market data is available to guide the next phase of commercialization Adoption patterns, promotion response, customer buying process, micro-segmenting, price-demand elasticity

Summary of Post-Transition US Commercial Opportunity

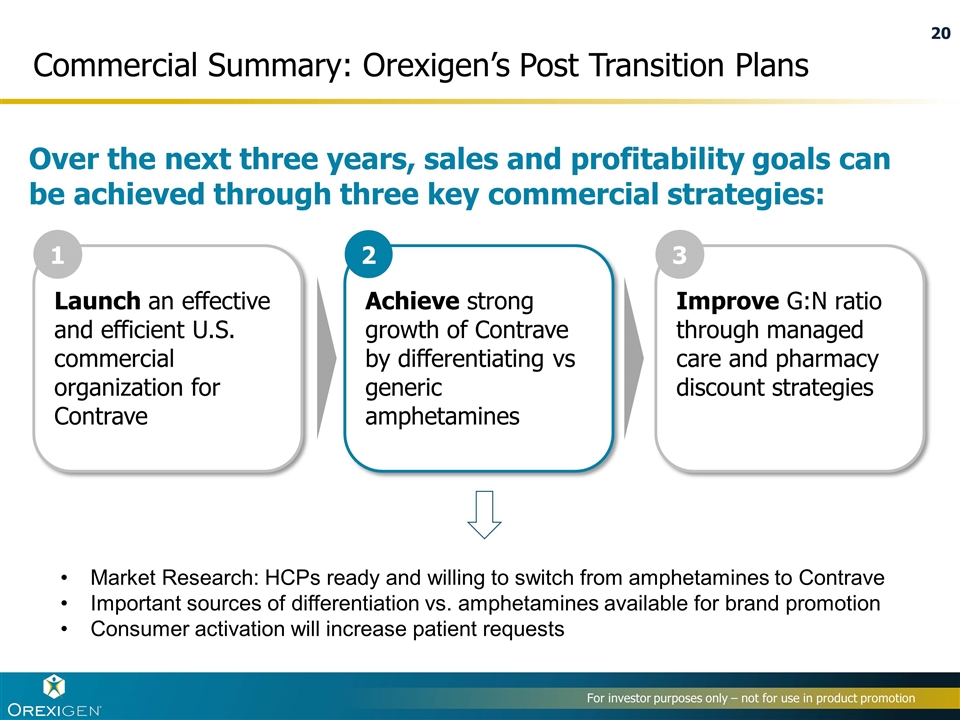

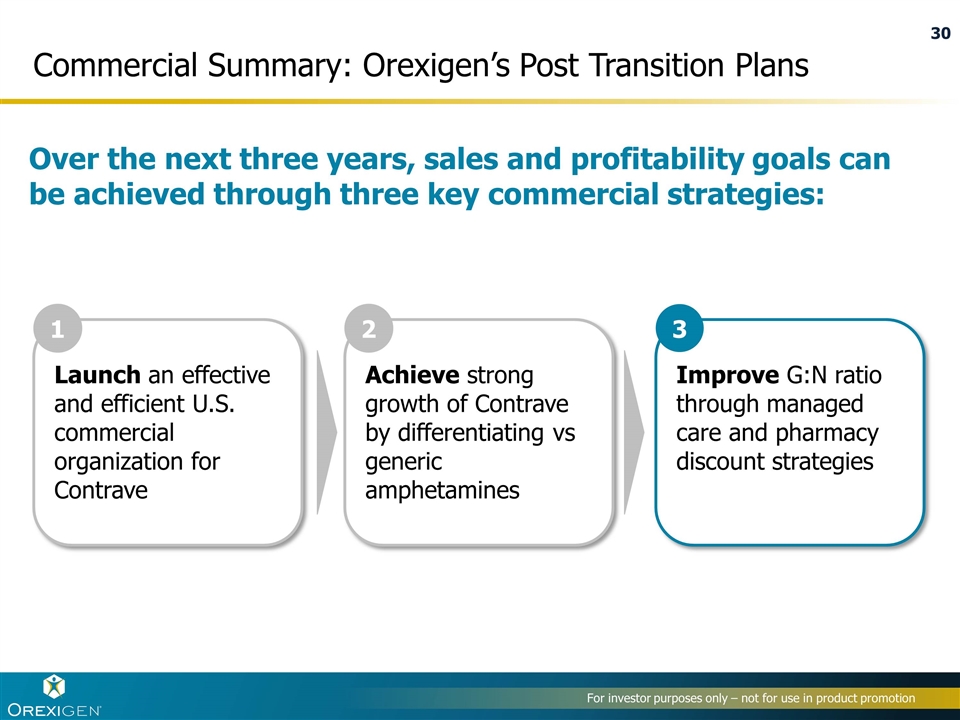

Commercial Summary: Orexigen’s Post Transition Plans Over the next three years, sales and profitability goals can be achieved through three key commercial strategies: Launch an effective and efficient U.S. commercial organization for Contrave Achieve strong growth of Contrave by differentiating vs generic amphetamines Improve G:N ratio through managed care and pharmacy discount strategies 1 2 3

Product lifecycles follow predictable phases Sales Time Launch Growth Maintain Maximize Profit

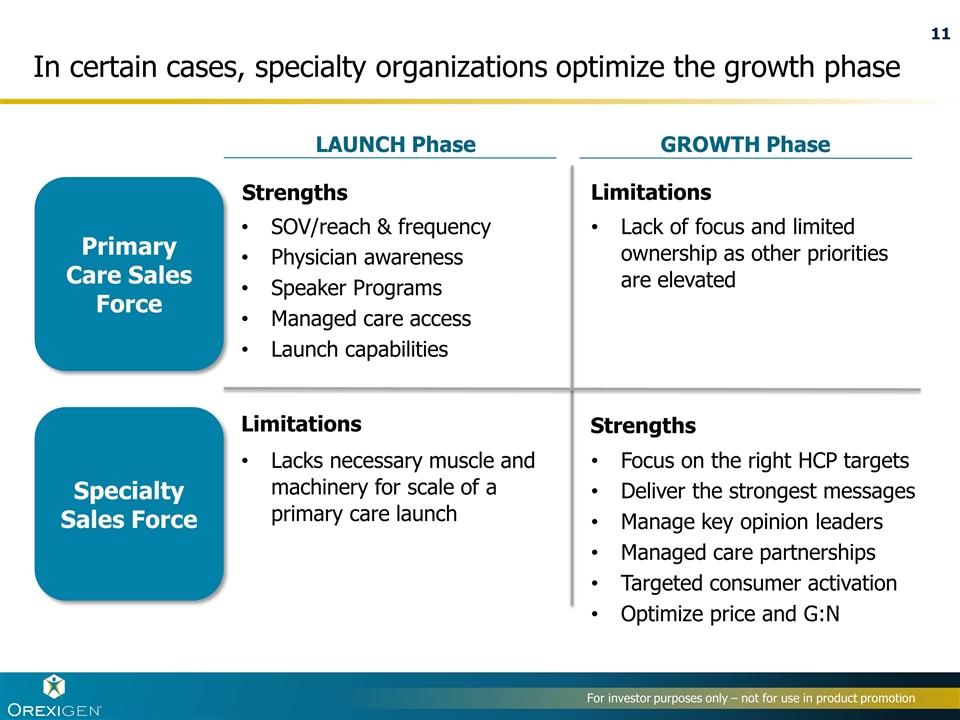

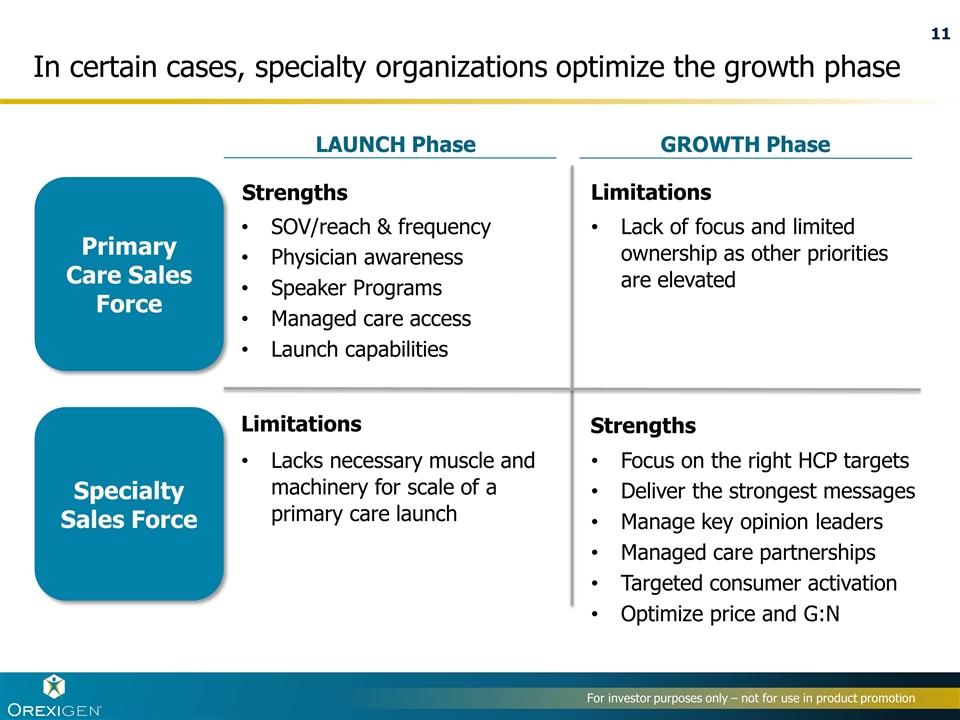

In certain cases, specialty organizations optimize the growth phase Primary Care Sales Force Specialty Sales Force LAUNCH Phase GROWTH Phase SOV/reach & frequency Physician awareness Speaker Programs Managed care access Launch capabilities Lack of focus and limited ownership as other priorities are elevated Lacks necessary muscle and machinery for scale of a primary care launch Focus on the right HCP targets Deliver the strongest messages Manage key opinion leaders Managed care partnerships Targeted consumer activation Optimize price and G:N Strengths Limitations Strengths Limitations

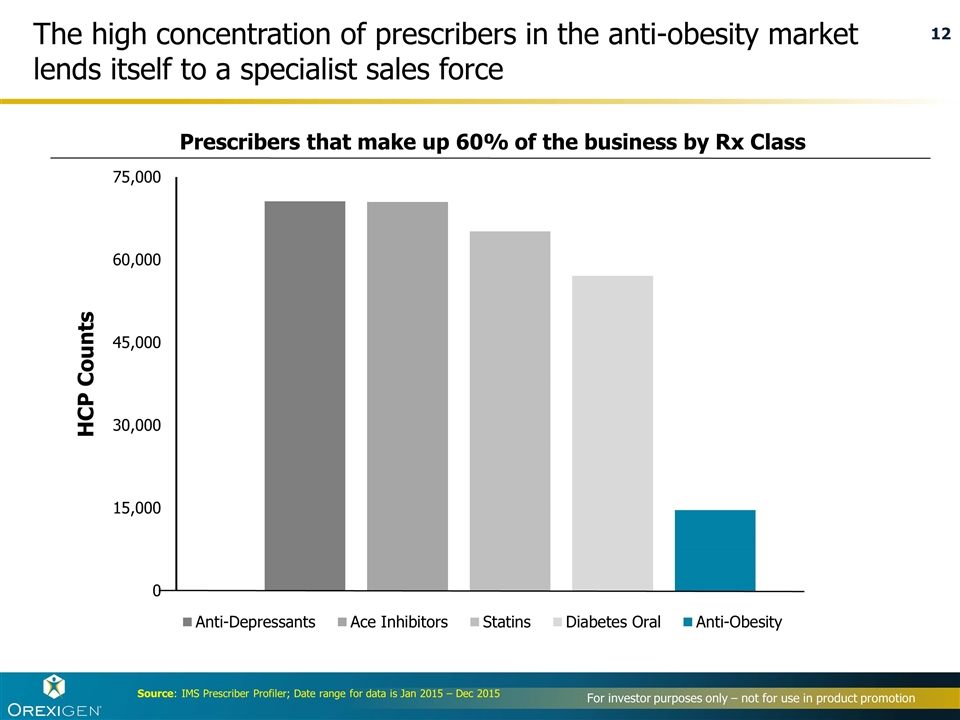

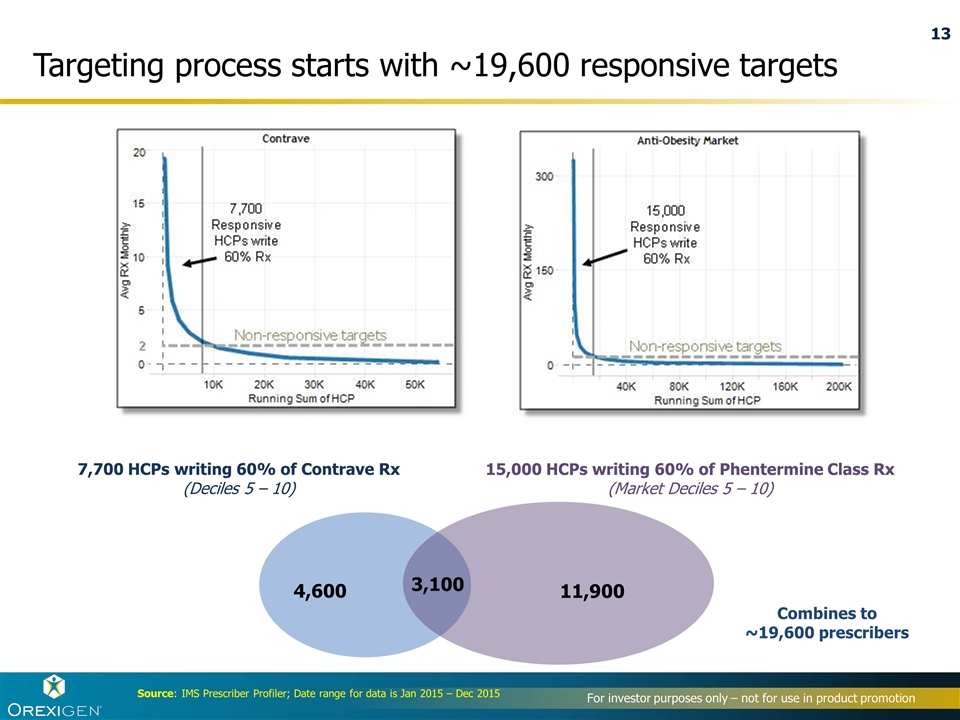

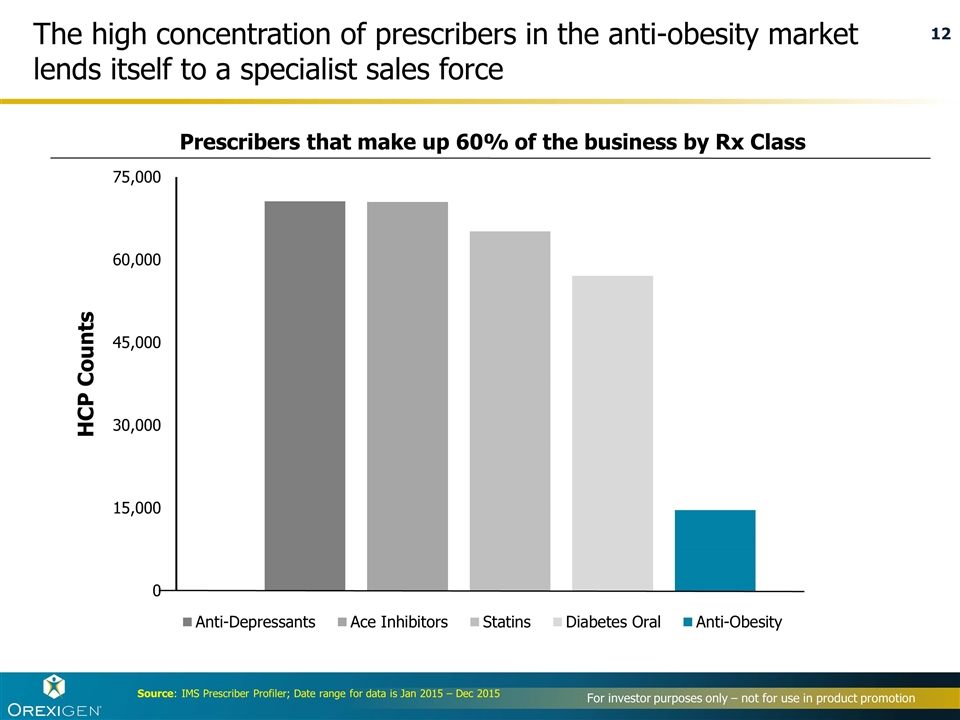

The high concentration of prescribers in the anti-obesity market lends itself to a specialist sales force Source: IMS Prescriber Profiler; Date range for data is Jan 2015 – Dec 2015 Prescribers that make up 60% of the business by Rx Class HCP Counts

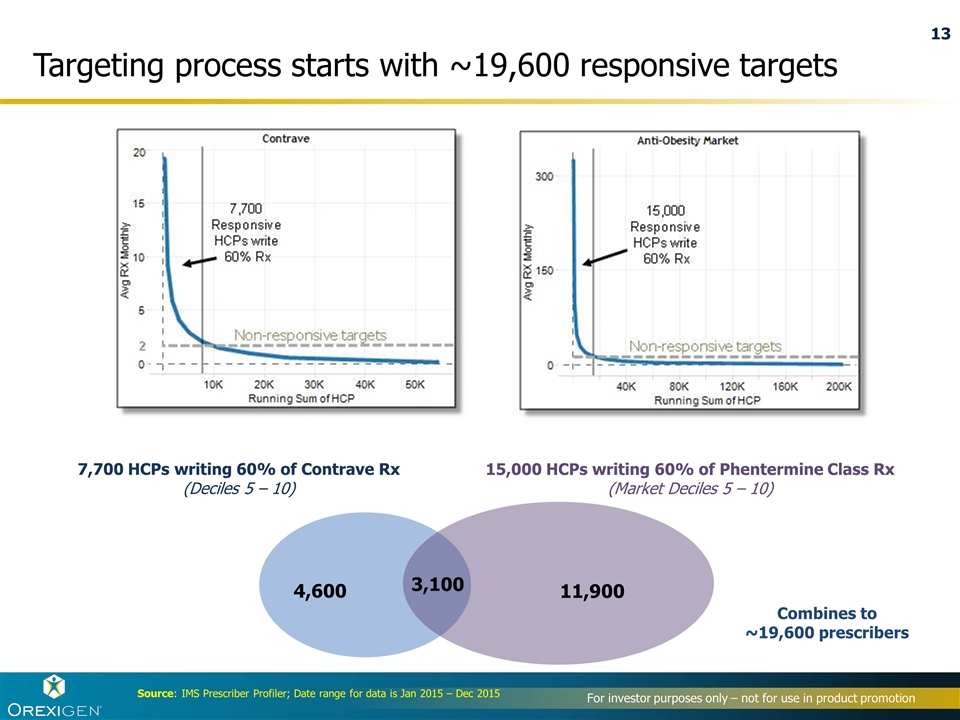

Targeting process starts with ~19,600 responsive targets Source: IMS Prescriber Profiler; Date range for data is Jan 2015 – Dec 2015 4,600 3,100 7,700 HCPs writing 60% of Contrave Rx (Deciles 5 – 10) 15,000 HCPs writing 60% of Phentermine Class Rx (Market Deciles 5 – 10) 11,900 Combines to ~19,600 prescribers Non-responsive targets Non-responsive targets

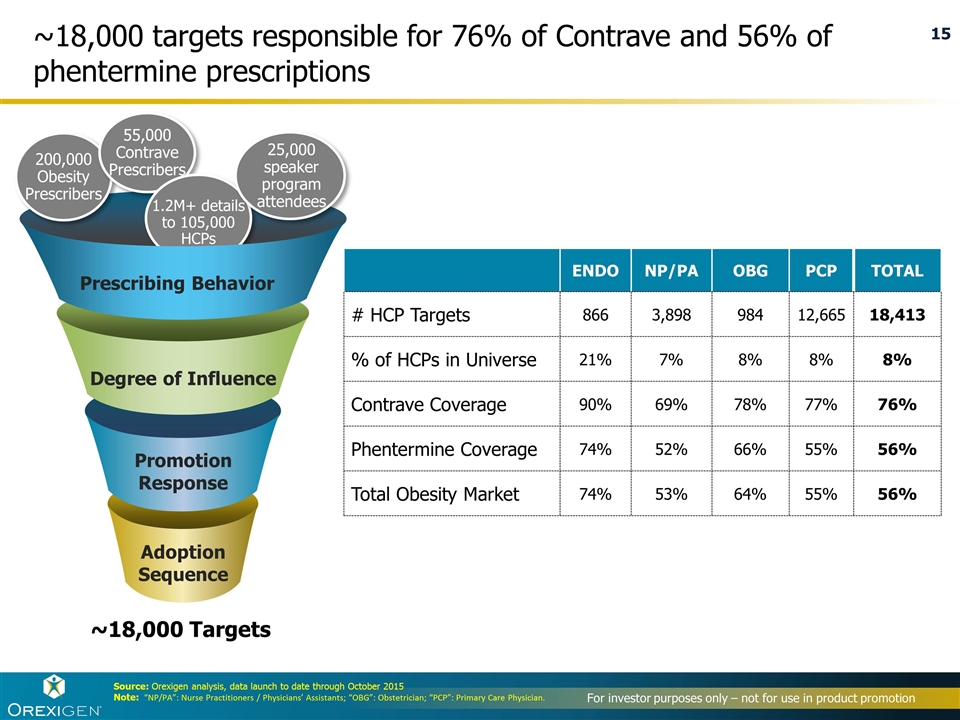

Identifying the ~18,000 most promotion responsive and profitable sales force targets 19,600 highest prescribers of Contrave & Obesity Rx ~2,000 ~5,000 ~2,000 19,600 top anti-obesity and Contrave prescribers 2. REMOVE 3. ADD Low promotion response and/or inaccessible targets (become MCM targets) Physicians with influence not already included 4. ADD Early majority high phentermine writers not already included 1. STARTING POINT Source: IMS Exponent Prescriber data, 2015 Combines to ~18,000 prescribers

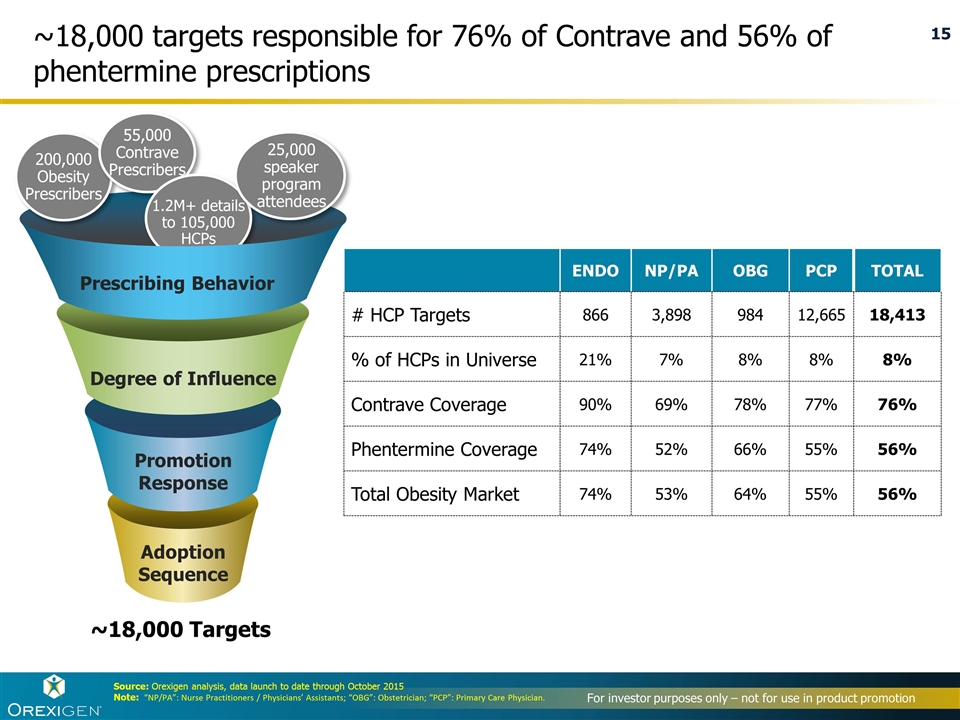

~18,000 targets responsible for 76% of Contrave and 56% of phentermine prescriptions ~18,000 Targets Degree of Influence Promotion Response Adoption Sequence 200,000 Obesity Prescribers 55,000 Contrave Prescribers 1.2M+ details to 105,000 HCPs Prescribing Behavior 25,000 speaker program attendees Source: Orexigen analysis, data launch to date through October 2015 Note: “NP/PA”: Nurse Practitioners / Physicians’ Assistants; “OBG”: Obstetrician; “PCP”: Primary Care Physician. ENDO NP/PA OBG PCP TOTAL # HCP Targets 866 3,898 984 12,665 18,413 % of HCPs in Universe 21% 7% 8% 8% 8% Contrave Coverage 90% 69% 78% 77% 76% Phentermine Coverage 74% 52% 66% 55% 56% Total Obesity Market 74% 53% 64% 55% 56%

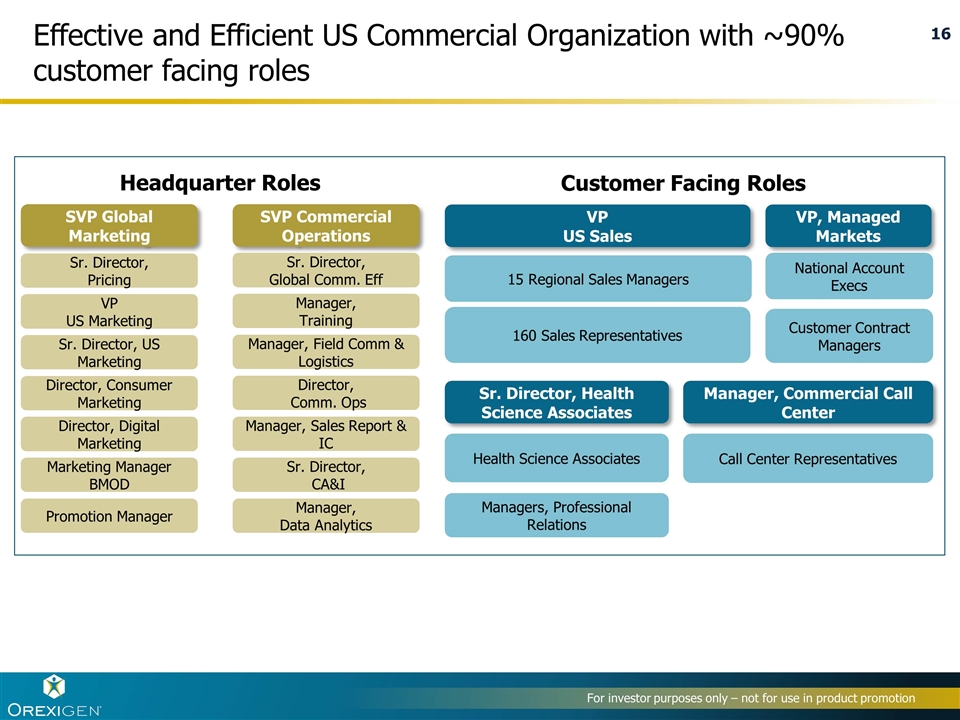

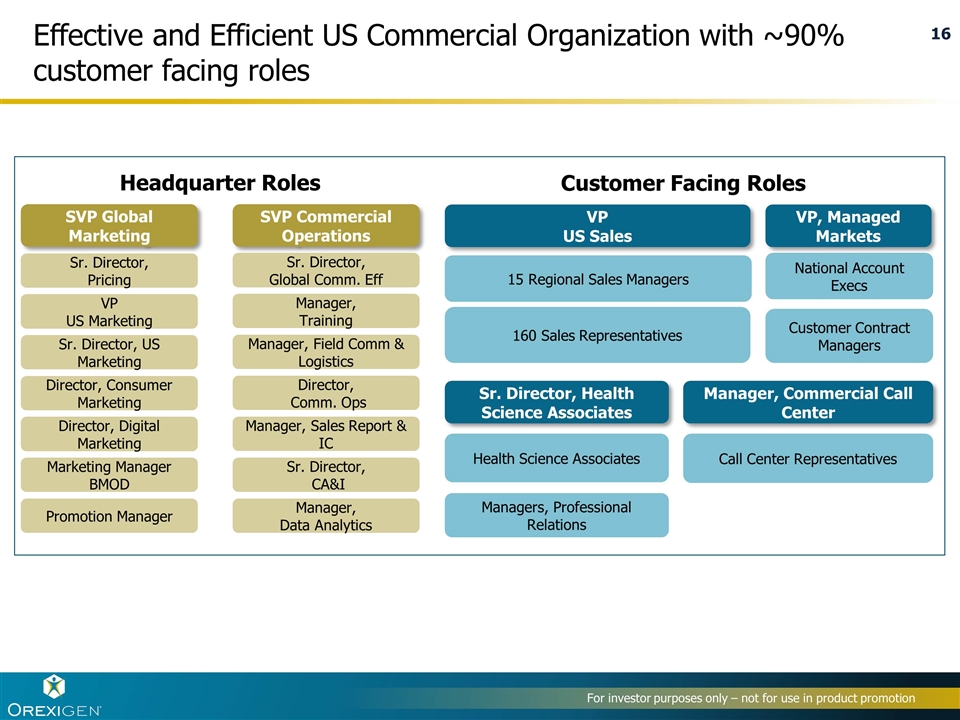

Effective and Efficient US Commercial Organization with ~90% customer facing roles Director, Comm. Ops Sr. Director, Global Comm. Eff Sr. Director, CA&I Manager, Sales Report & IC Manager, Training Manager, Field Comm & Logistics Sr. Director, US Marketing VP US Marketing Director, Consumer Marketing Marketing Manager BMOD Sr. Director, Pricing Promotion Manager SVP Global Marketing SVP Commercial Operations Headquarter Roles Customer Facing Roles VP US Sales 15 Regional Sales Managers Sr. Director, Health Science Associates Call Center Representatives Manager, Commercial Call Center Health Science Associates VP, Managed Markets Customer Contract Managers National Account Execs Managers, Professional Relations 160 Sales Representatives Manager, Data Analytics Director, Digital Marketing

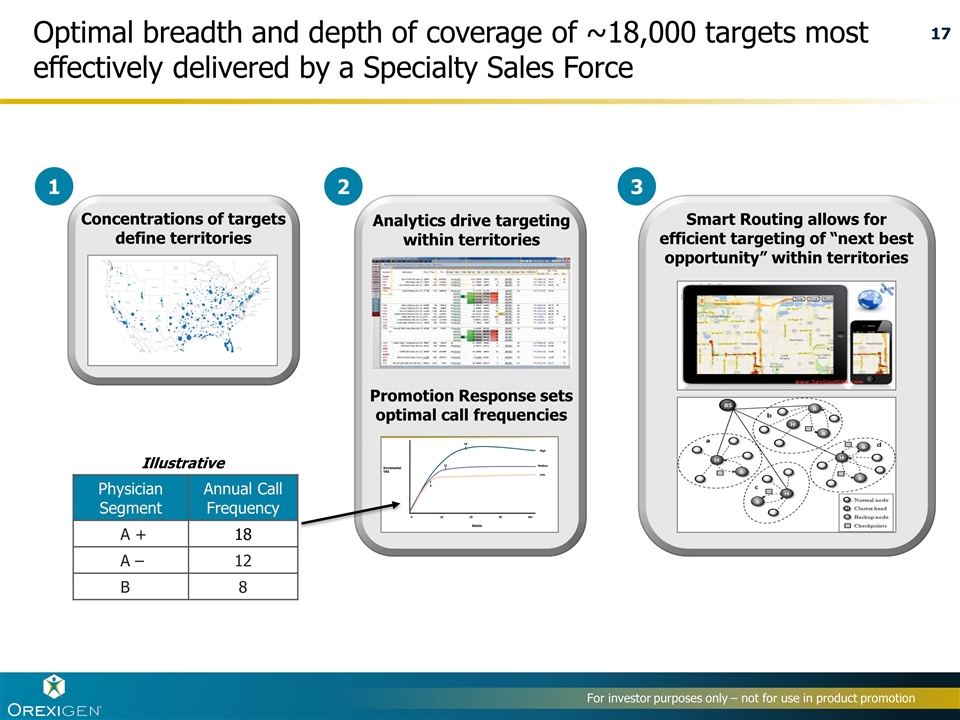

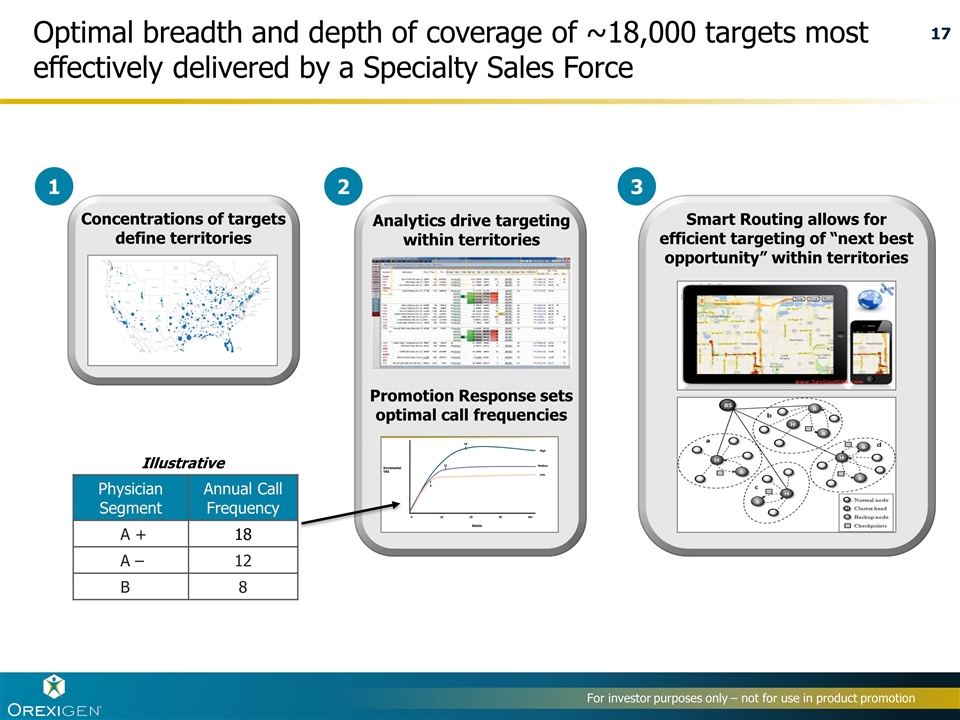

Concentrations of targets define territories Smart Routing allows for efficient targeting of “next best opportunity” within territories 1 2 3 Physician Segment Annual Call Frequency A + 18 A – 12 B 8 Analytics drive targeting within territories Promotion Response sets optimal call frequencies Illustrative Optimal breadth and depth of coverage of ~18,000 targets most effectively delivered by a Specialty Sales Force

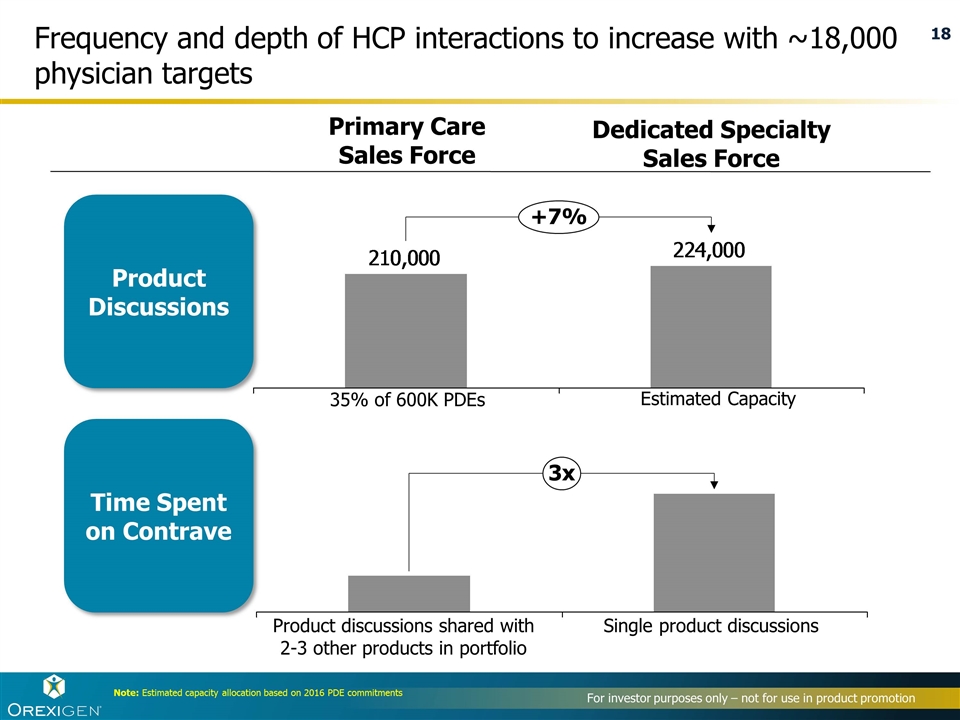

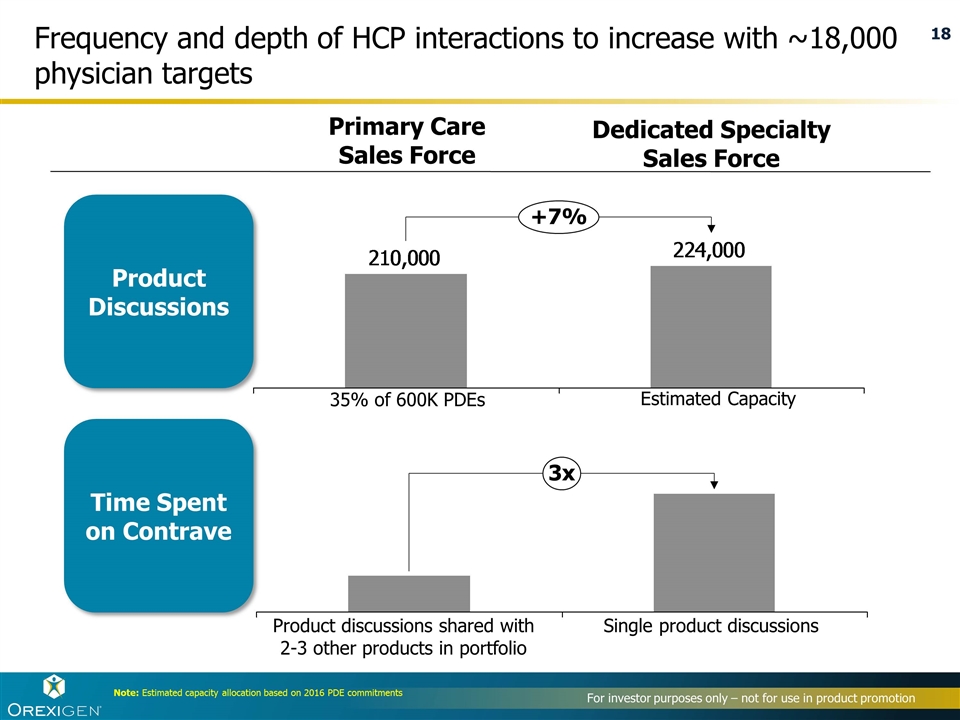

Frequency and depth of HCP interactions to increase with ~18,000 physician targets Primary Care Sales Force Dedicated Specialty Sales Force 35% of 600K PDEs Product discussions shared with 2-3 other products in portfolio Single product discussions Estimated Capacity Product Discussions Time Spent on Contrave Note: Estimated capacity allocation based on 2016 PDE commitments 3x

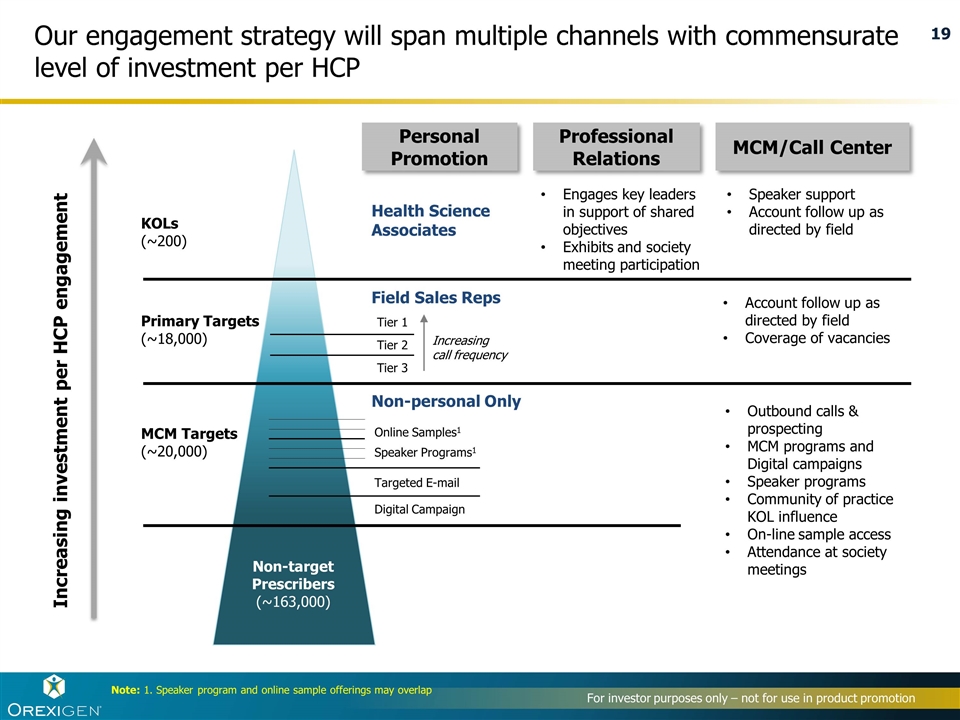

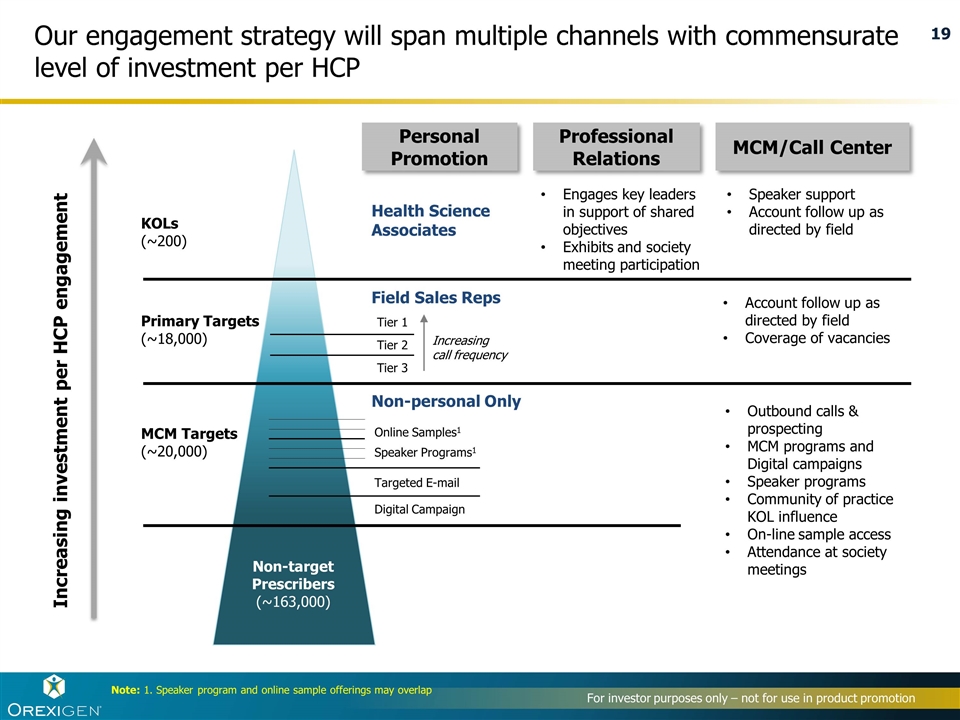

Note: 1. Speaker program and online sample offerings may overlap Targeted E-mail Speaker Programs1 Online Samples1 Digital Campaign Non-target Prescribers (~163,000) Primary Targets (~18,000) KOLs (~200) Account follow up as directed by field Coverage of vacancies Outbound calls & prospecting MCM programs and Digital campaigns Speaker programs Community of practice KOL influence On-line sample access Attendance at society meetings Speaker support Account follow up as directed by field Engages key leaders in support of shared objectives Exhibits and society meeting participation Field Sales Reps Health Science Associates Personal Promotion MCM/Call Center Professional Relations Increasing investment per HCP engagement MCM Targets (~20,000) Our engagement strategy will span multiple channels with commensurate level of investment per HCP Increasing call frequency Tier 1 Tier 2 Tier 3 Non-personal Only

Over the next three years, sales and profitability goals can be achieved through three key commercial strategies: Launch an effective and efficient U.S. commercial organization for Contrave Achieve strong growth of Contrave by differentiating vs generic amphetamines Improve G:N ratio through managed care and pharmacy discount strategies 1 2 3 Market Research: HCPs ready and willing to switch from amphetamines to Contrave Important sources of differentiation vs. amphetamines available for brand promotion Consumer activation will increase patient requests Commercial Summary: Orexigen’s Post Transition Plans

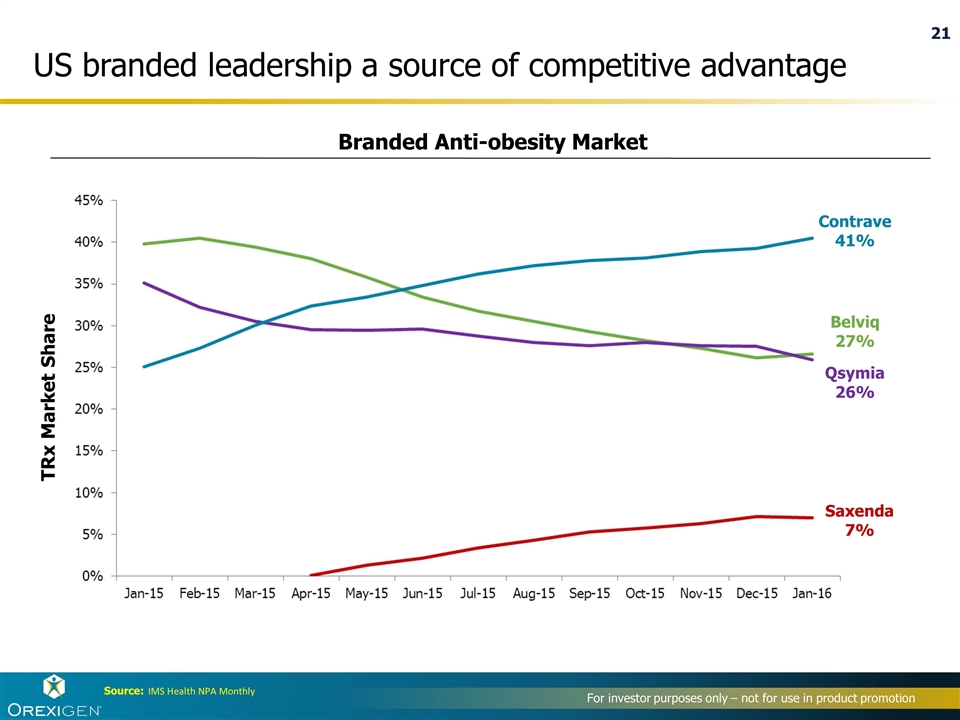

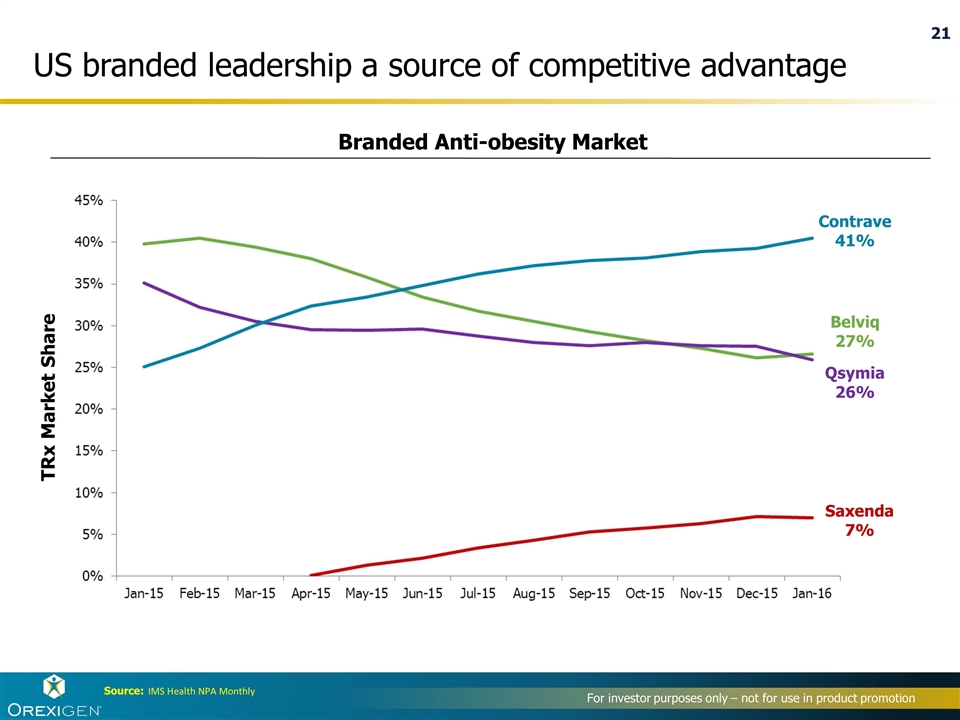

TRx Market Share Contrave 41% Belviq 27% Qsymia 26% Saxenda 7% Source: IMS Health NPA Monthly Branded Anti-obesity Market US branded leadership a source of competitive advantage

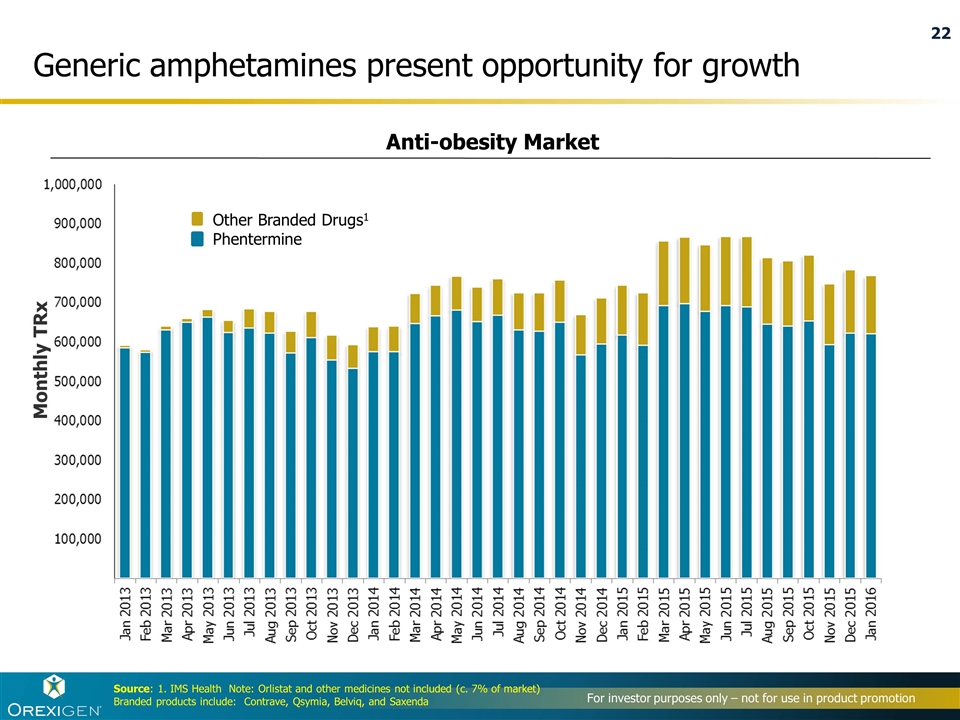

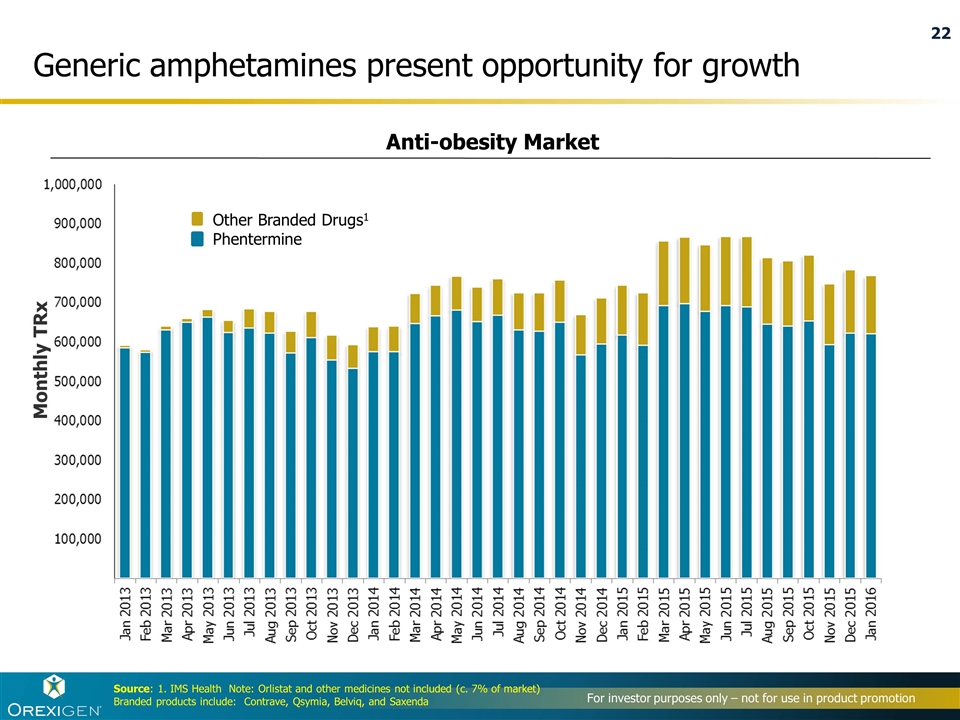

Source: 1. IMS Health Note: Orlistat and other medicines not included (c. 7% of market) Branded products include: Contrave, Qsymia, Belviq, and Saxenda Generic amphetamines present opportunity for growth Monthly TRx Other Branded Drugs1 Phentermine Anti-obesity Market

Rx for 1st Time Rx for 4thTime Rx for 3rd Time Rx for 2nd Time Q126. In the previous question, you indicated that you have prescribed phentermine to some of your overweight/obese patients in the past 3 months. What % of them fall within the following categories? The total must sum up to 100% Quantitative physician research shows that 56% of patients receiving phentermine have tried it previously 28% 18% 10% 56% of patients have tried phentermine previously Patients who received phentermine within the past 3 months (n = 121) Source: Feb 2016 ATU Wave 2.5, Qualtrics internet survey, n=121

Q26. You indicate that you prescribe phentermine to your overweight and/or obese patients. Based on your experience, what % of those patients on phentermine eventually reach their weight loss goals? Q27. You mentioned that % of your phentermine patients reach their weight loss goals. For your patients who do not reach their goals, what % did you switch to another prescription weight loss medication? Q28. For the phentermine patients you switch to another Rx weight loss medication, what product did you switch them to or plan to switch them to of the following products? Your total must equal 100% HCP distribution: 51% PCP, 18% ENDO, 18% MLP, 13% OBGYN. This series of questions were only asked to physicians who stated that they prescribed phentermine in the past 3 months with no new stimuli (n=121 out of 167 physicians which represented 72% of the sample) Physician receptivity to switching Based on current HCP perceptions (not exposed to new info) n=121 Source: Feb 2016 ATU Wave 2.5, Qualtrics, physicians internet survey 66% 34% Contrave preferred switch agent % phentermine patients you would switch to another Rx medication 35% 35%

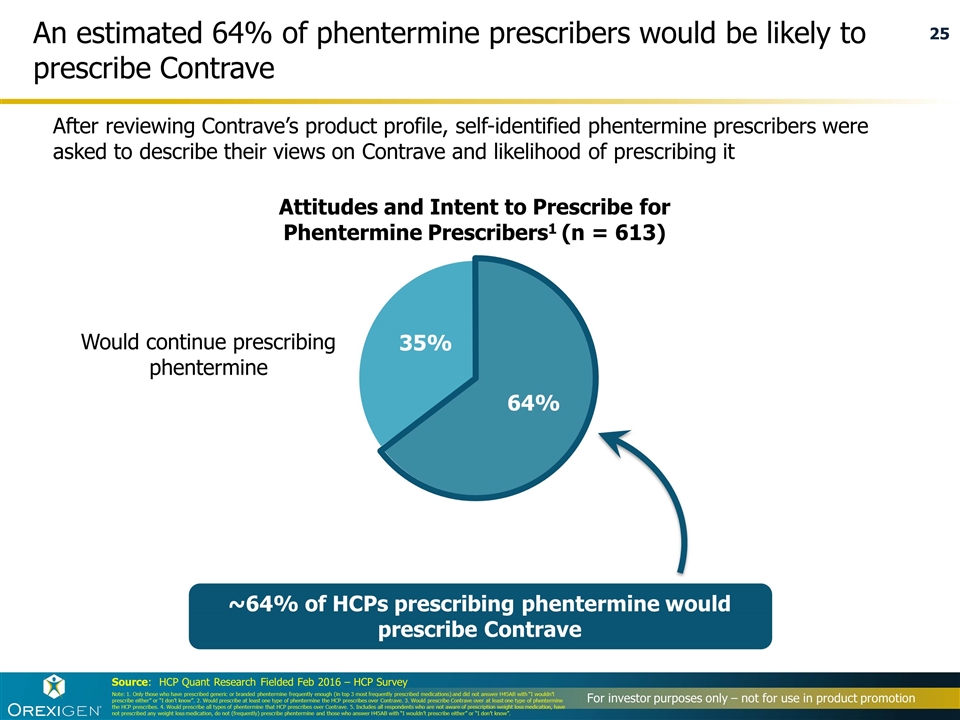

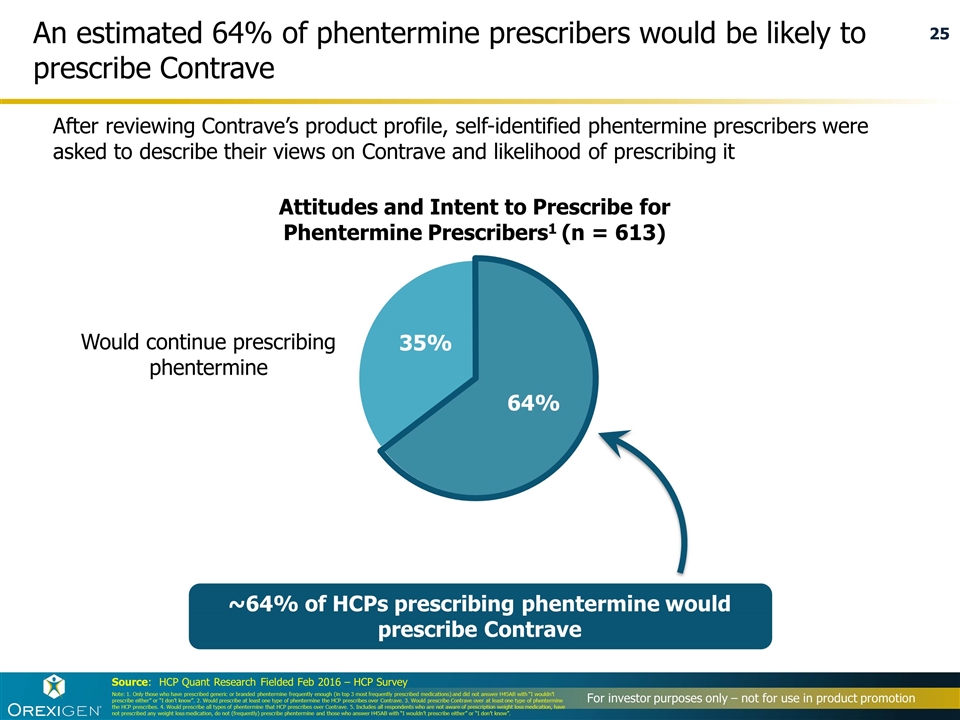

Source: HCP Quant Research Fielded Feb 2016 – HCP Survey An estimated 64% of phentermine prescribers would be likely to prescribe Contrave After reviewing Contrave’s product profile, self-identified phentermine prescribers were asked to describe their views on Contrave and likelihood of prescribing it Attitudes and Intent to Prescribe for Phentermine Prescribers1 (n = 613) Note: 1. Only those who have prescribed generic or branded phentermine frequently enough (in top 3 most frequently prescribed medications) and did not answer H45AB with “I wouldn’t prescribe either” or “I don’t know”. 2. Would prescribe at least one type of phentermine the HCP prescribes over Contrave. 3. Would prescribe Contrave over at least one type of phentermine the HCP prescribes. 4. Would prescribe all types of phentermine that HCP prescribes over Contrave. 5. Includes all respondents who are not aware of prescription weight loss medication, have not prescribed any weight loss medication, do not (frequently) prescribe phentermine and those who answer H45AB with “I wouldn’t prescribe either” or “I don’t know”. ~64% of HCPs prescribing phentermine would prescribe Contrave Would continue prescribing phentermine 25 64%

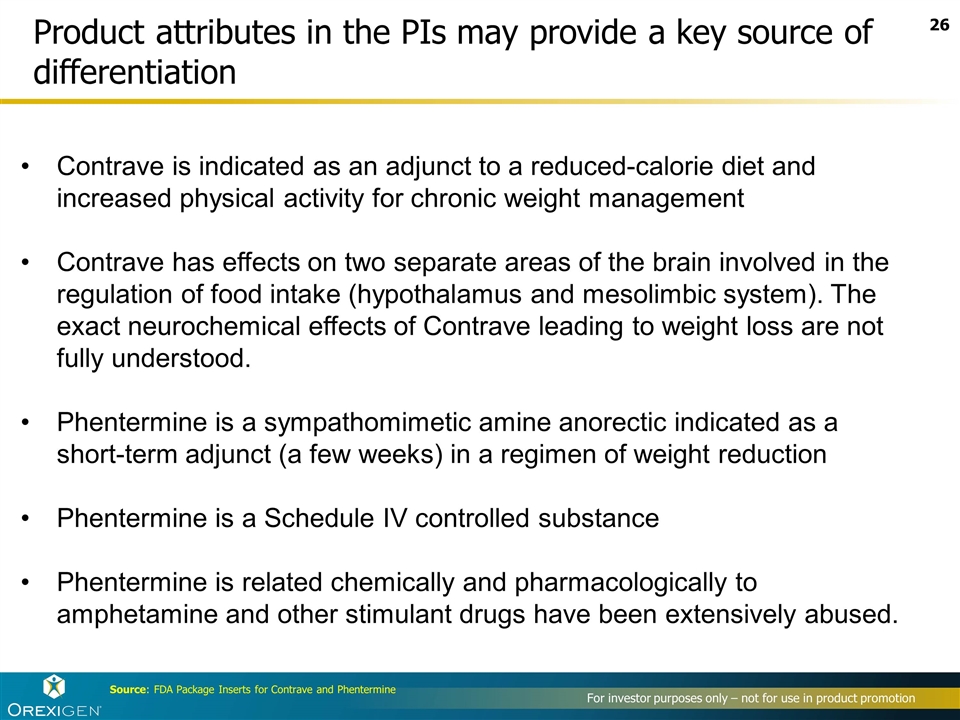

Product attributes in the PIs may provide a key source of differentiation Contrave is indicated as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management Contrave has effects on two separate areas of the brain involved in the regulation of food intake (hypothalamus and mesolimbic system). The exact neurochemical effects of Contrave leading to weight loss are not fully understood. Phentermine is a sympathomimetic amine anorectic indicated as a short-term adjunct (a few weeks) in a regimen of weight reduction Phentermine is a Schedule IV controlled substance Phentermine is related chemically and pharmacologically to amphetamine and other stimulant drugs have been extensively abused. Source: FDA Package Inserts for Contrave and Phentermine

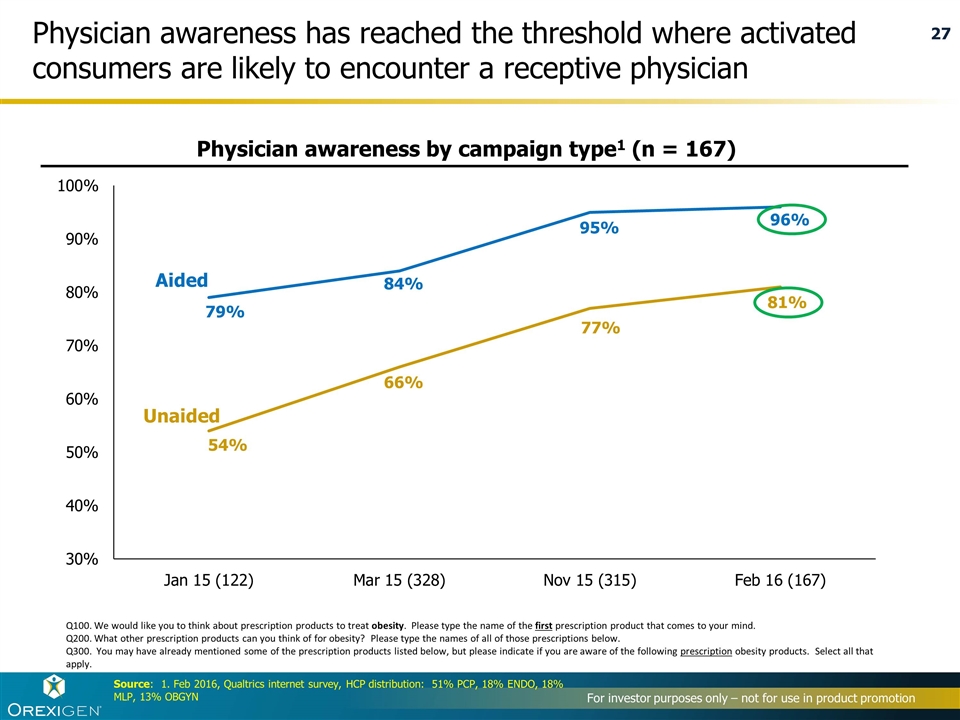

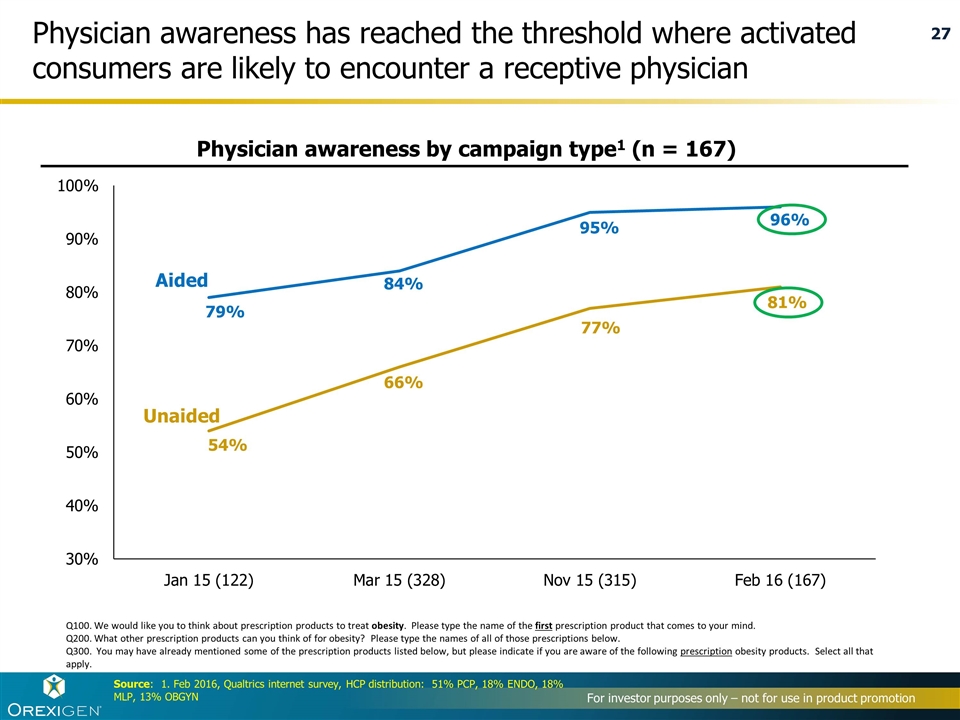

Physician awareness has reached the threshold where activated consumers are likely to encounter a receptive physician Source: 1. Feb 2016, Qualtrics internet survey, HCP distribution: 51% PCP, 18% ENDO, 18% MLP, 13% OBGYN Q100. We would like you to think about prescription products to treat obesity. Please type the name of the first prescription product that comes to your mind. Q200. What other prescription products can you think of for obesity? Please type the names of all of those prescriptions below. Q300. You may have already mentioned some of the prescription products listed below, but please indicate if you are aware of the following prescription obesity products. Select all that apply. Aided Unaided Physician awareness by campaign type1 (n = 167)

Patient insight: two separate areas of brain involved in the regulation of food intake Objective: encourage patients to ask their doctor about new Rx medicines that might be right for them hypothalamus (appetite regulatory center) mesolimbic dopamine circuit (reward system) 28

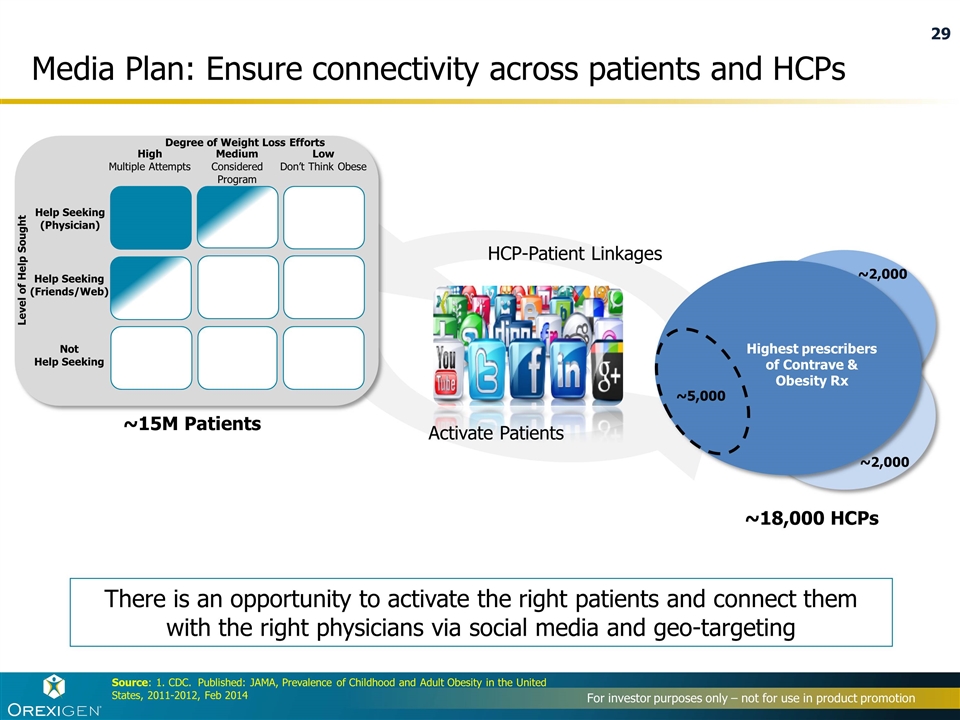

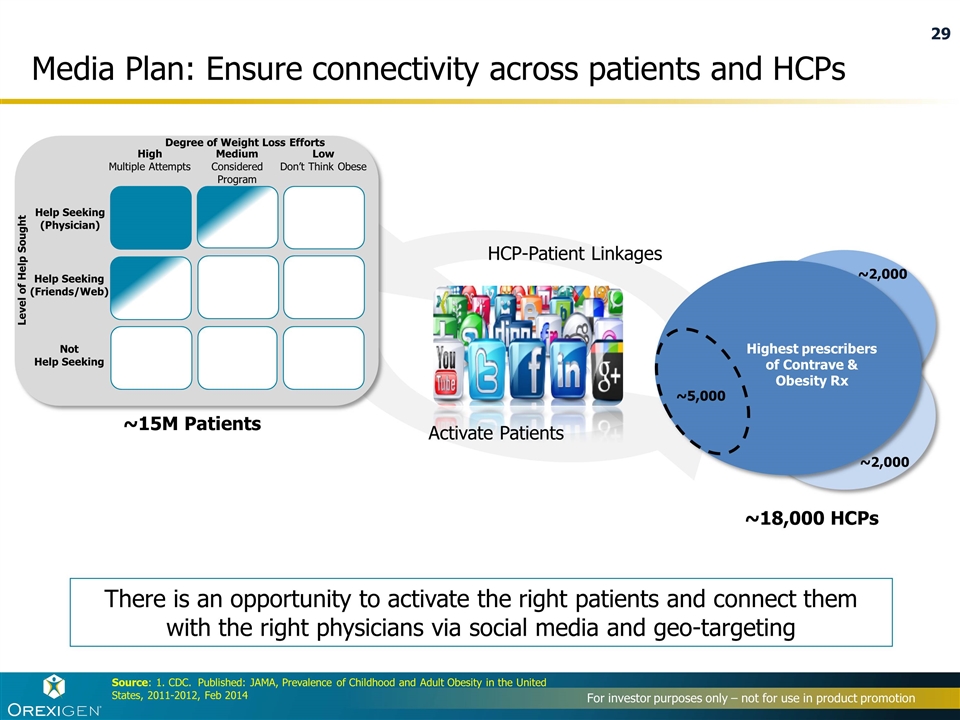

Media Plan: Ensure connectivity across patients and HCPs There is an opportunity to activate the right patients and connect them with the right physicians via social media and geo-targeting Help Seeking (Physician) Help Seeking (Friends/Web) Not Help Seeking High Multiple Attempts Medium Considered Program Low Don’t Think Obese Degree of Weight Loss Efforts Level of Help Sought ~15M Patients ~18,000 HCPs Activate Patients HCP-Patient Linkages Source: 1. CDC. Published: JAMA, Prevalence of Childhood and Adult Obesity in the United States, 2011-2012, Feb 2014 Highest prescribers of Contrave & Obesity Rx ~2,000 ~5,000 ~2,000

Over the next three years, sales and profitability goals can be achieved through three key commercial strategies: Launch an effective and efficient U.S. commercial organization for Contrave Achieve strong growth of Contrave by differentiating vs generic amphetamines Improve G:N ratio through managed care and pharmacy discount strategies 1 2 3 Commercial Summary: Orexigen’s Post Transition Plans

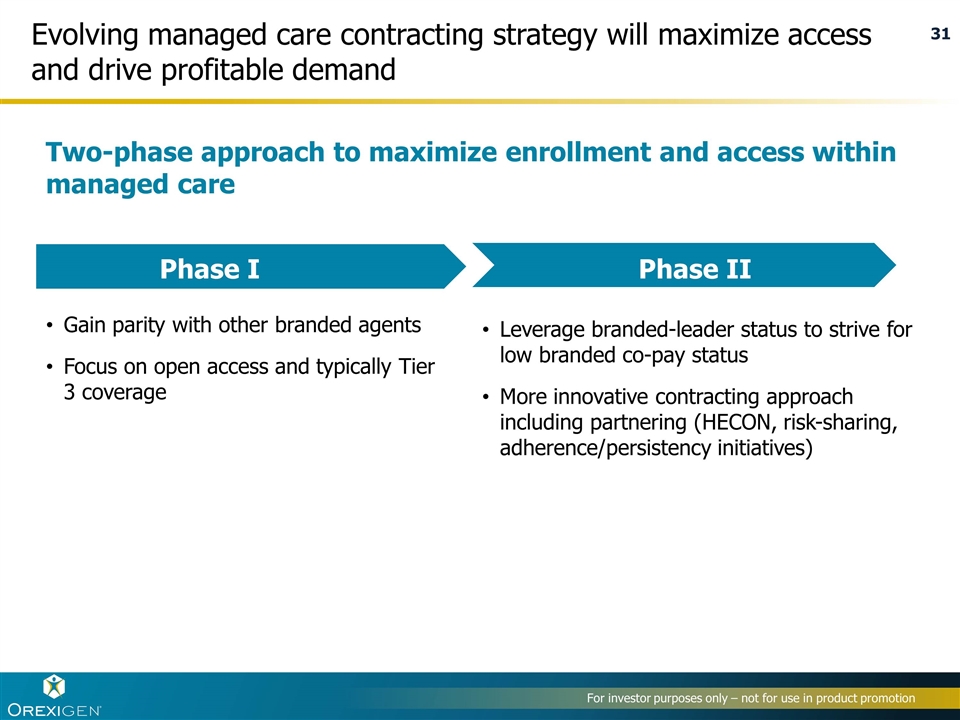

Evolving managed care contracting strategy will maximize access and drive profitable demand Two-phase approach to maximize enrollment and access within managed care Gain parity with other branded agents Focus on open access and typically Tier 3 coverage Leverage branded-leader status to strive for low branded co-pay status More innovative contracting approach including partnering (HECON, risk-sharing, adherence/persistency initiatives) Phase I Phase II

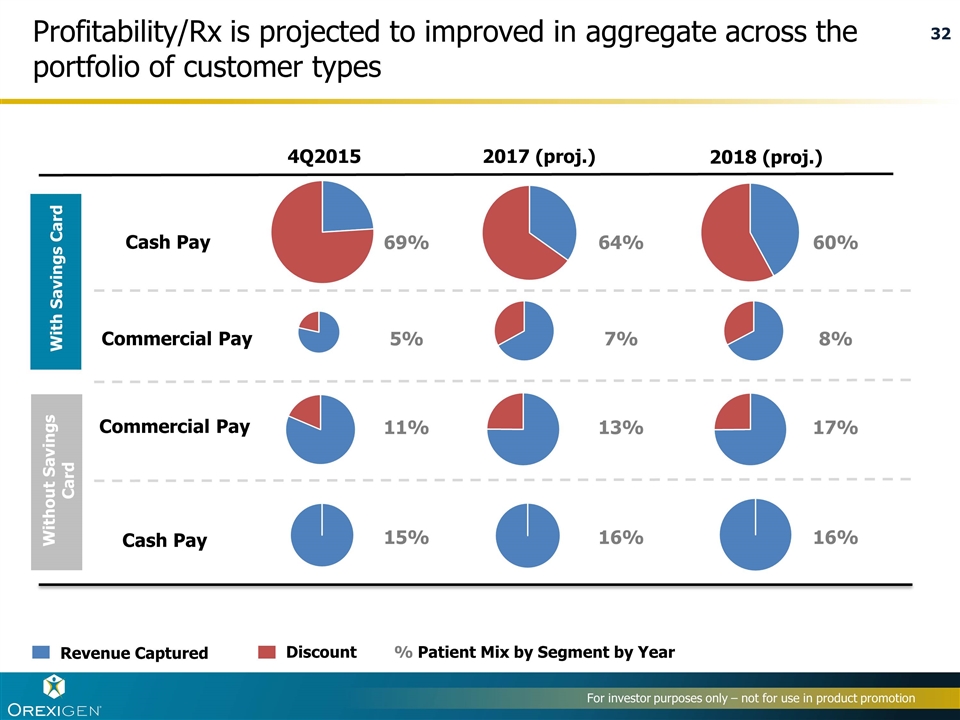

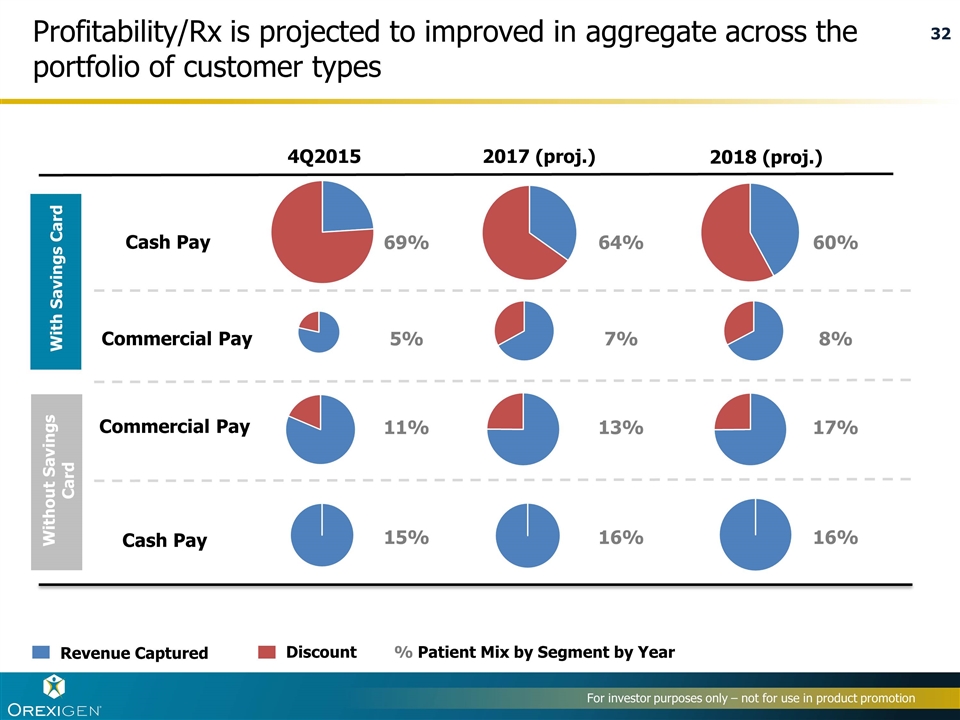

Profitability/Rx is projected to improved in aggregate across the portfolio of customer types Revenue Captured Discount Cash Pay Commercial Pay 4Q2015 2017 (proj.) 2018 (proj.) Cash Pay Commercial Pay With Savings Card Without Savings Card 69% 64% 60% 5% 7% 8% 11% 13% 17% 15% 16% 16% % Patient Mix by Segment by Year

Summary Over the next three years, sales and profitability goals can be achieved through three key commercial strategies: Launch an effective and efficient U.S. commercial organization for Contrave Achieve strong growth of Contrave by differentiating vs generic amphetamines Improve G:N ratio through managed care and pharmacy discount strategies 1 2 3

Financial implications and conclusions

Financial implications Orexigen believes acquisition of Contrave maintains path to profitability by full year 2019 with overall potential long-term profitability magnified significantly To achieve 2019 profitability goals, Orexigen assumes: The overall anti-obesity market grows an average 5-10% through 2018 Contrave’s share of the overall anti-obesity market grows ~3 percentage points to 10-11% in 2018 Profitability per prescription improves with gross-to-net adjustments moving to 40-45% by 2018 Orexigen expects to provide additional financial guidance in coming months

Acquisition of U.S. Contrave rights transformational for Orexigen Rare opportunity for non-competitive acquisition of most prescribed brand in a growing market at an ideal point in the product’s life cycle Acquisition of U.S. rights significantly magnifies overall potential profitability and creates valuable new strategic opportunities Orexigen’s team will deploy laser focus, accountability and renewed creativity with a sense of real “ownership” to deploy a targeted “growth phase” strategy for Contrave Orexigen projects that the company has sufficient capital to fund its US commercialization plan for Contrave and to achieve projected profitability for full year 2019 We look forward to providing additional details of our commercialization plans in coming months!

Additional slides

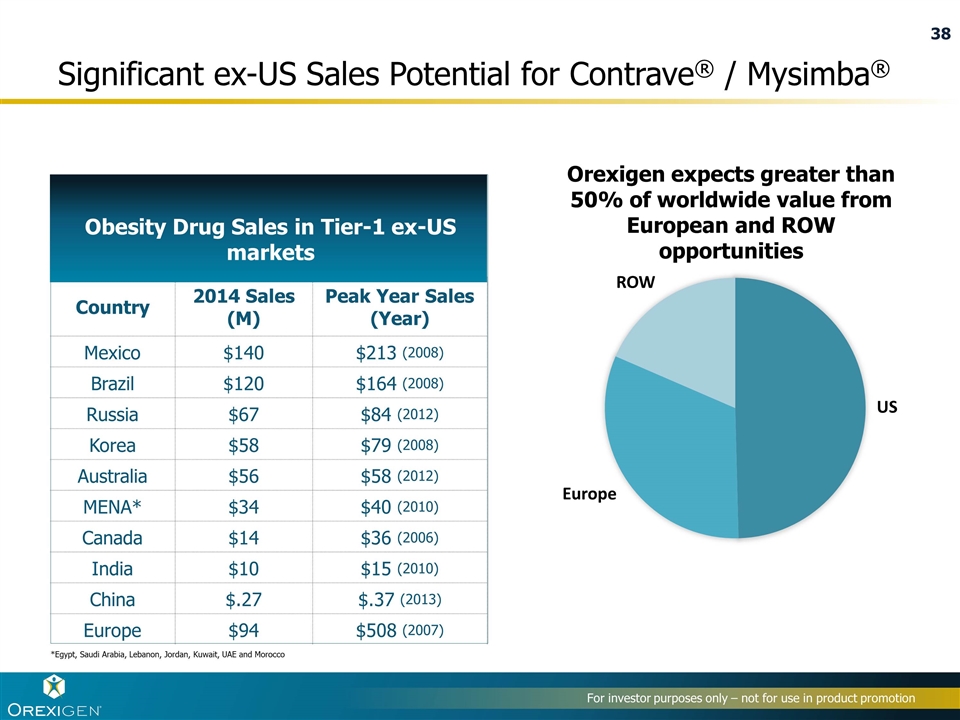

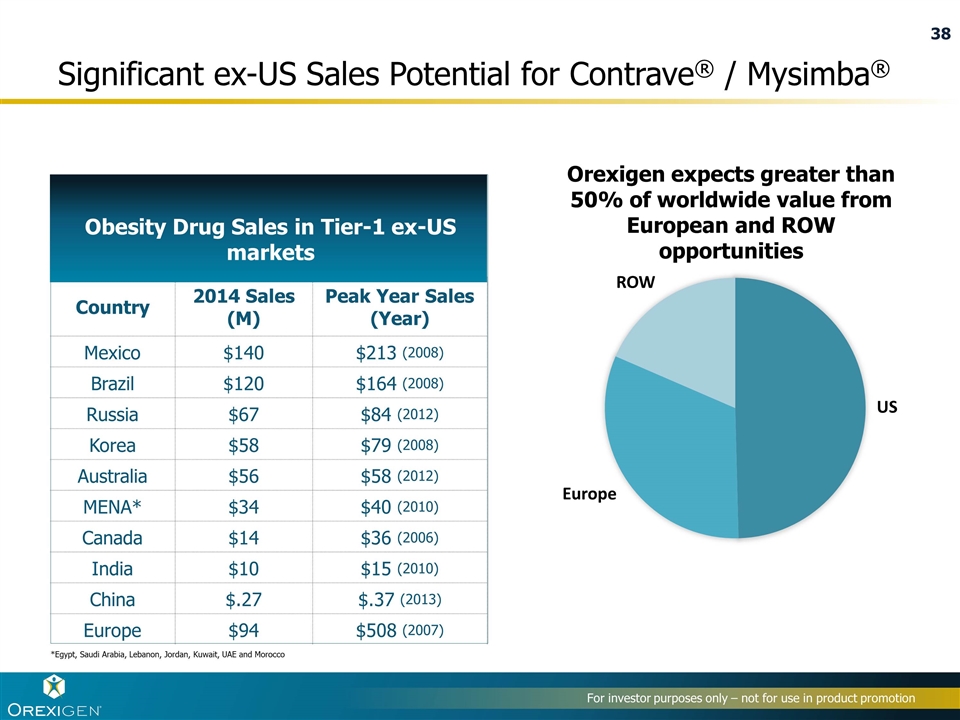

Country 2014 Sales (M) Peak Year Sales (Year) Mexico $140 $213 (2008) Brazil $120 $164 (2008) Russia $67 $84 (2012) Korea $58 $79 (2008) Australia $56 $58 (2012) MENA* $34 $40 (2010) Canada $14 $36 (2006) India $10 $15 (2010) China $.27 $.37 (2013) Europe $94 $508 (2007) Significant ex-US Sales Potential for Contrave® / Mysimba® Obesity Drug Sales in Tier-1 ex-US markets *Egypt, Saudi Arabia, Lebanon, Jordan, Kuwait, UAE and Morocco Orexigen expects greater than 50% of worldwide value from European and ROW opportunities

Kwang Dong Distributorship Agreement is example of Orexigen’s preferred ROW partnership strategy Terms of the agreement Kwang Dong is responsible for obtaining regulatory approval and for all commercialization activities and expenses Orexigen will supply Contrave® tablets to Kwang Dong for a $7 million upfront payment, approximately 35 – 40% of net sales, potential sales-based milestone payments, and other fees Kwang Dong expects to begin marketing Contrave® in the second half of 2016, if regulatory approval is obtained Agreement is with Orexigen Therapeutics Ireland Limited For investor purposes only – not for use in product promotion

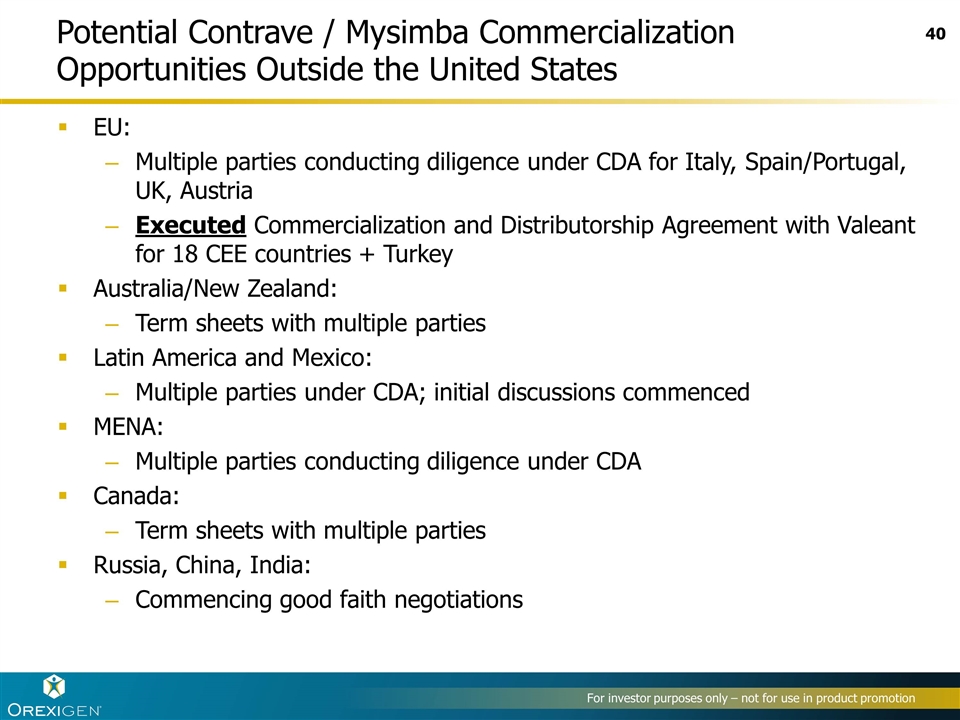

Potential Contrave / Mysimba Commercialization Opportunities Outside the United States EU: Multiple parties conducting diligence under CDA for Italy, Spain/Portugal, UK, Austria Executed Commercialization and Distributorship Agreement with Valeant for 18 CEE countries + Turkey Australia/New Zealand: Term sheets with multiple parties Latin America and Mexico: Multiple parties under CDA; initial discussions commenced MENA: Multiple parties conducting diligence under CDA Canada: Term sheets with multiple parties Russia, China, India: Commencing good faith negotiations

Global Partnership Strategy Rest of World: Seeking full partnership agreements (Kwang Dong is model) EU, MENA: Seeking co-marketing and distribution agreements

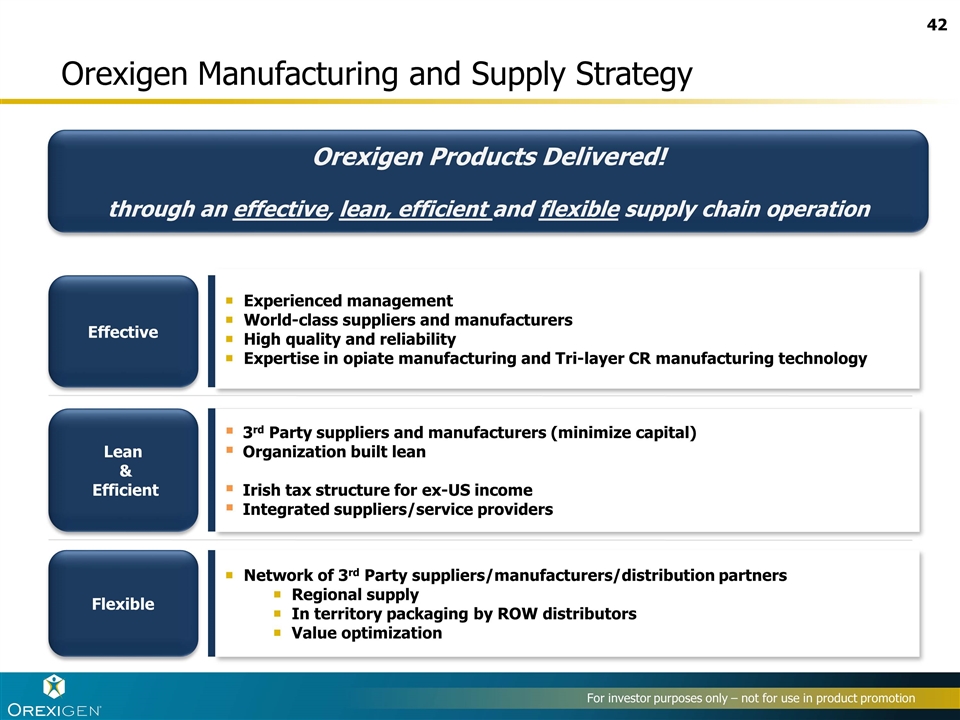

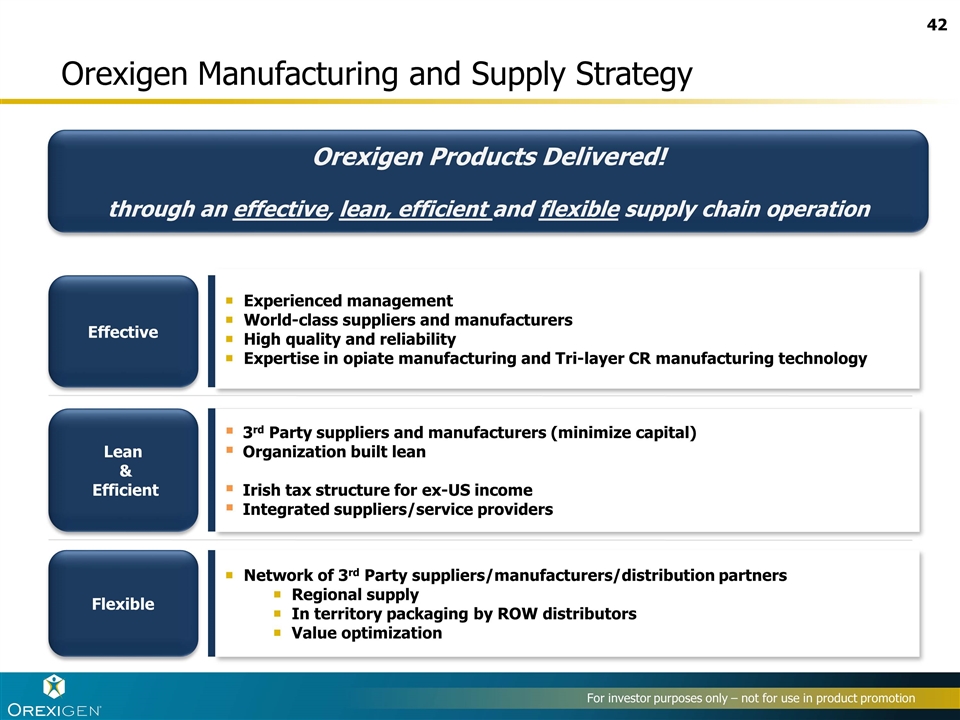

Orexigen Manufacturing and Supply Strategy Effective Lean & Efficient Flexible Experienced management World-class suppliers and manufacturers High quality and reliability Expertise in opiate manufacturing and Tri-layer CR manufacturing technology Network of 3rd Party suppliers/manufacturers/distribution partners Regional supply In territory packaging by ROW distributors Value optimization 3rd Party suppliers and manufacturers (minimize capital) Organization built lean Irish tax structure for ex-US income Integrated suppliers/service providers Orexigen Products Delivered! through an effective, lean, efficient and flexible supply chain operation

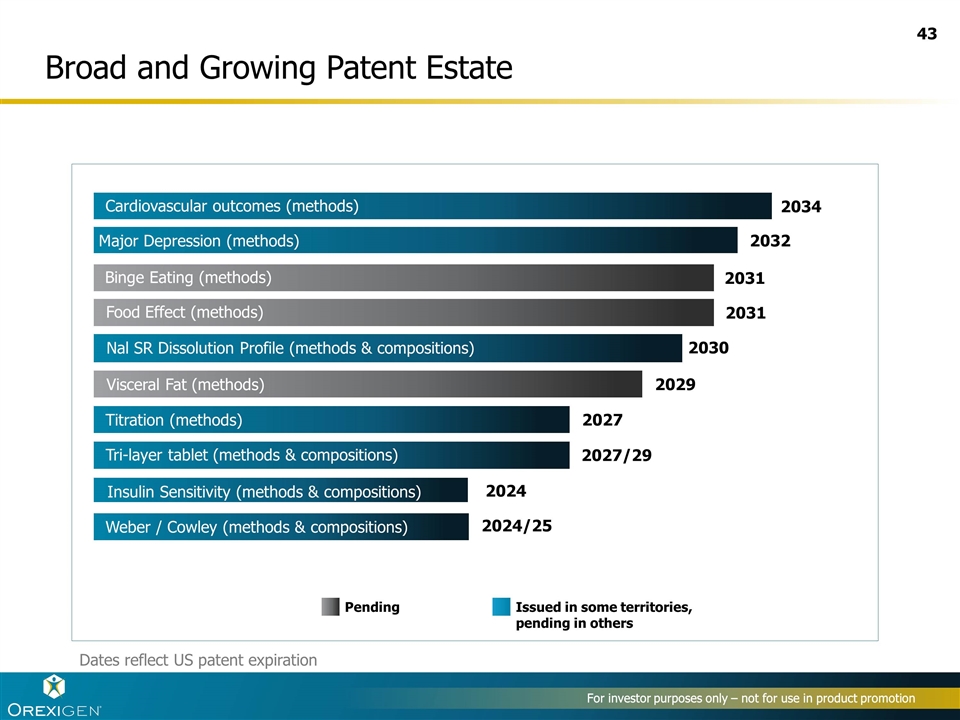

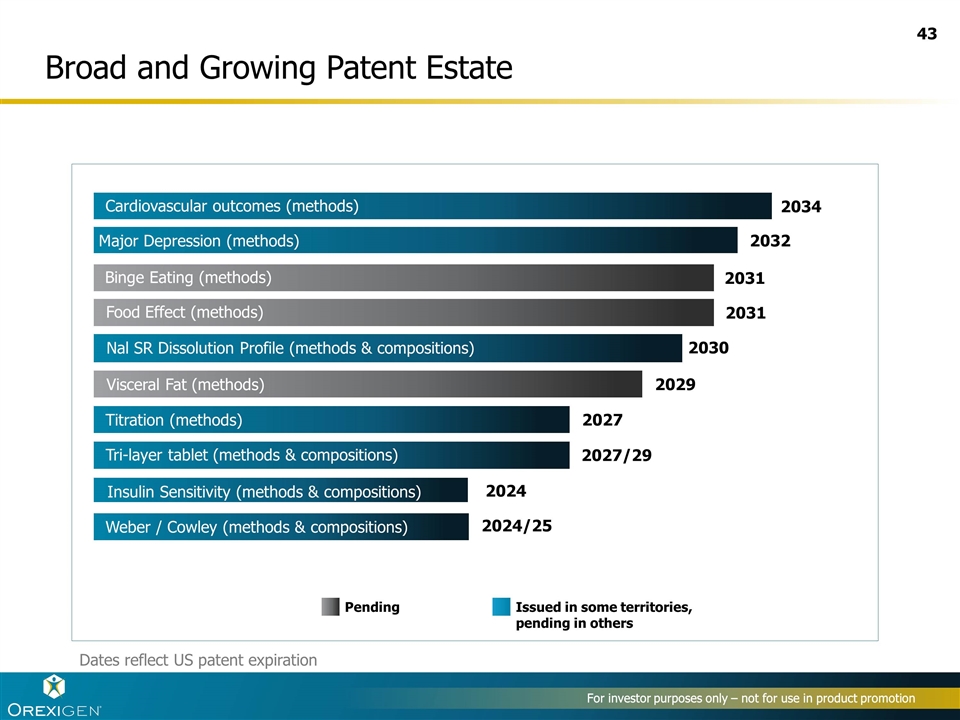

Broad and Growing Patent Estate 2034 2031 2032 2029 2027 2027/29 2024 2024/25 Binge Eating (methods) Major Depression (methods) Visceral Fat (methods) Titration (methods) Tri-layer tablet (methods & compositions) Insulin Sensitivity (methods & compositions) Weber / Cowley (methods & compositions) Pending Issued in some territories, pending in others 2030 Nal SR Dissolution Profile (methods & compositions) For investor purposes only – not for use in product promotion Dates reflect US patent expiration Cardiovascular outcomes (methods) Major Depression (methods) 2031 Food Effect (methods)