Business Update For Investors March 7, 2017 We help improve the health and lives of patients struggling to lose weight Exhibit 99.1

This presentation contains forward-looking statements about Orexigen Therapeutics, Inc. and Contrave® and Mysimba®. Words such as “believes,”“anticipates,” “plans,” “expects,” “indicates,” “will,” “should,” “intends,” “potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to identify forward‐looking statements. These statements are based on Orexigen’s current beliefs and expectations. These forward‐looking statements include statements regarding: the potential success of marketing and commercialization of Contrave in the United States, including the recently-launched patient-focused marketing campaign; the potential for Contrave and Mysimba® to achieve commercial success globally; the potential for Orexigen and its partners to obtain regulatory approvals for Contrave and Mysimba in additional markets outside the United States; the potential for Orexigen to achieve commercial success for Contrave in the United States without a partner; the sales force capacity, effectiveness and efficiency for commercialization of Contrave in the United States; the Company’s strategic plans and initiatives; Orexigen’s ability to manage its expenses, including by implementing a CVOT that achieves significant cost savings; the potential to acquire, develop and market additional product candidates or approved products; and Orexigen’s preclinical development plans and ability to perform IND-enabling studies successfully. The inclusion of financial modeling, forward‐looking statements and potential transaction plans and terms should not be regarded as a representation by Orexigen that any of its plans will be achieved. Actual results may differ materially from those expressed or implied in this presentation due to the risk and uncertainties inherent in the Orexigen business, including, without limitation: the potential that the marketing and commercialization of Contrave/Mysimba will not be successful, particularly, with respect to Contrave, in the U.S. following the launch of the patient-focused marketing campaign; the Company’s ability to obtain and maintain partnerships and marketing authorization globally; our ability to adequately inform consumers about Contrave; our ability to successfully commercialize Contrave with a specialty sales force in the United States; our ability to successfully complete the post-marketing requirement studies for Contrave; the capabilities and performance of various third parties on which we rely for a number of activities related to the manufacture, development and commercialization of Contrave/Mysimba; the therapeutic and commercial value of Contrave/Mysimba; competition in the global obesity market, particularly from existing and generic therapies; the Company’s failure to successfully acquire, develop and market additional product candidates or approved products; our ability to obtain and maintain global intellectual property protection for Contrave and Mysimba; legal or regulatory proceedings against Orexigen, as well as potential reputational harm, as a result of misleading public claims about Orexigen; our ability to maintain sufficient capital to fund our operations for the foreseeable future; the potential for a Delaware court to determine that one or more of the patents are not valid or that Actavis' proposed generic product is not infringing each of the patents at issue; and other risks described in Orexigen’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date hereof, and Orexigen undertakes no obligation to revise or update this news release to reflect events or circumstances after the date hereof. Further information regarding these and other risks is included under the heading "Risk Factors" in Orexigen's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 7, 2016 and its other reports, which are available from the SEC's website (www.sec.gov) and on Orexigen's website (www.orexigen.com) under the heading "Investors." All forward‐looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995. Forward Looking Statements

Indicated for use as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adults with an initial body mass index (BMI) of 30 kg/m2 or greater (obese), or 27 kg/m2 or greater (overweight) in the presence of at least one weight-related comorbid condition. Approved with the brand name Contrave in the United States and Mysimba in the European Union. WARNING: SUICIDAL THOUGHTS AND BEHAVIORS; AND NEUROPSYCHIATRIC REACTIONS Suicidality and Antidepressant Drugs Not approved for use in the treatment of major depressive disorder or other psychiatric disorders. Contains bupropion, the same active ingredient as some other antidepressant medications (including, but not limited to, WELLBUTRIN, WELLBUTRIN SR, WELLBUTRIN XL, and APLENZIN). Antidepressants increased the risk of suicidal thoughts and behavior in children, adolescents, and young adults in short-term trials. These trials did not show an increase in the risk of suicidal thoughts and behavior with antidepressant use in subjects over age 24; there was a reduction in risk with antidepressant use in subjects aged 65 and older. In patients of all ages, monitor closely for worsening, and for the emergence of suicidal thoughts and behaviors. Advise families and caregivers of the need for close observation and communication with the prescriber. Not approved for use in pediatric patients. Neuropsychiatric Reactions in Patients Taking Bupropion for Smoking Cessation Serious neuropsychiatric reactions have occurred in patients taking bupropion for smoking cessation. The majority of these reactions occurred during bupropion treatment, but some occurred in the context of discontinuing treatment. In many cases, a causal relationship to bupropion treatment is not certain, because depressed mood may be a symptom of nicotine withdrawal. However, some of the cases occurred in patients taking bupropion who continued to smoke. Although not approved for smoking cessation, observe all patients for neuropsychiatric reactions. Instruct the patient to contact a healthcare provider if such reactions occur. Full Prescribing Information, including Medication Guide, for Contrave is available at http://www.contrave.com/. The Mysimba Summary of Product Characteristics is available at ema.europe.eu. ®

Obesity: An Unprecedented Health Crisis and a Very Large Market Opportunity… but Progress Has Been Elusive Sources: Patients with BMI of 30+, BMI 27-29 with co-morbidities. Orexigen Segmentation Research based on CDC data. National Center for Health Statistics: Obesity/Overweight. 2015. https://www.cdc.gov/nchs/fastats/obesity-overweight.htm. Accessed on December 27, 2016 QuintilesIMS, NPA Market Dynamics data as of November 2016 Market potential of ~110M patients in the US1 Yet only ~3% are treated with a prescription weight loss therapy2 = 1 million patients

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

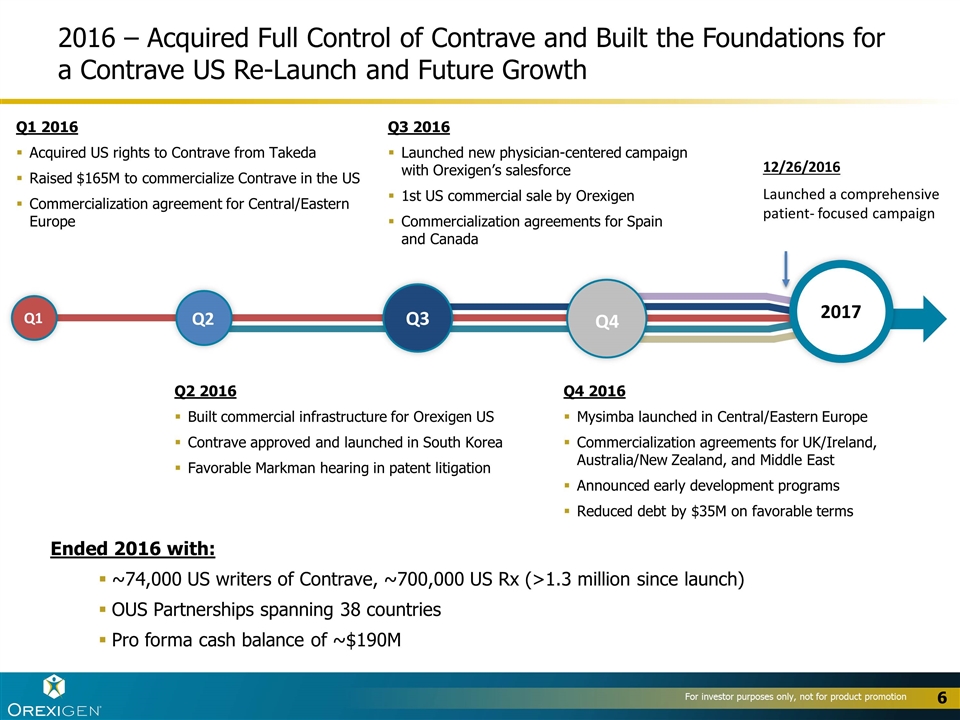

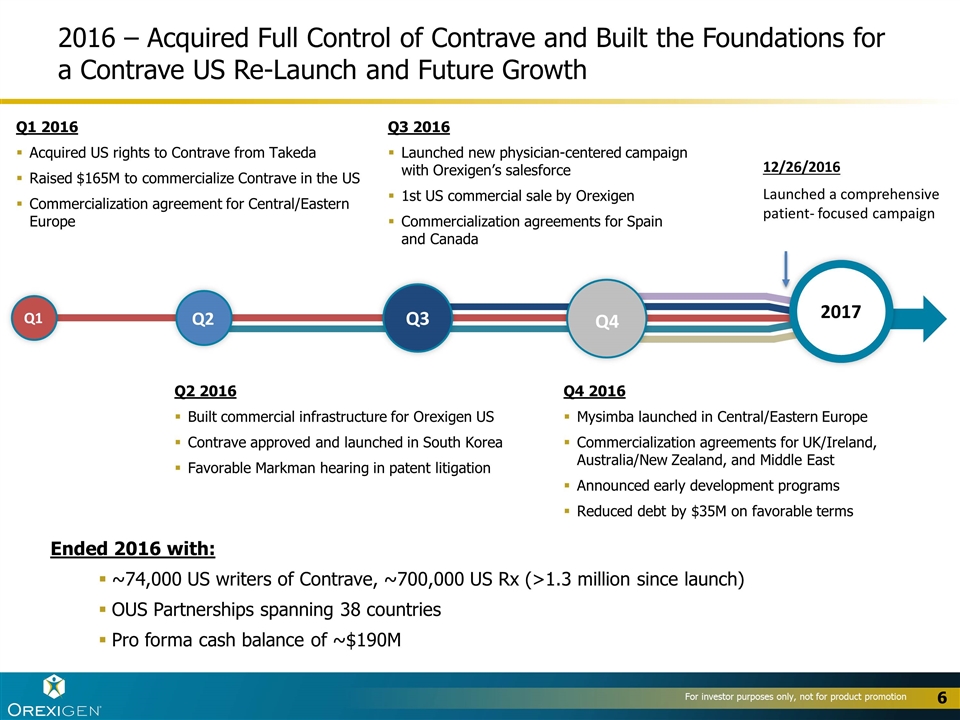

Q1 2016 Acquired US rights to Contrave from Takeda Raised $165M to commercialize Contrave in the US Commercialization agreement for Central/Eastern Europe 2017 Q1 Q2 Q3 Q4 Q2 2016 Built commercial infrastructure for Orexigen US Contrave approved and launched in South Korea Favorable Markman hearing in patent litigation Q3 2016 Launched new physician-centered campaign with Orexigen’s salesforce 1st US commercial sale by Orexigen Commercialization agreements for Spain and Canada Q4 2016 Mysimba launched in Central/Eastern Europe Commercialization agreements for UK/Ireland, Australia/New Zealand, and Middle East Announced early development programs Reduced debt by $35M on favorable terms Ended 2016 with: ~74,000 US writers of Contrave, ~700,000 US Rx (>1.3 million since launch) OUS Partnerships spanning 38 countries Pro forma cash balance of ~$190M 2016 – Acquired Full Control of Contrave and Built the Foundations for a Contrave US Re-Launch and Future Growth 12/26/2016 Launched a comprehensive patient- focused campaign

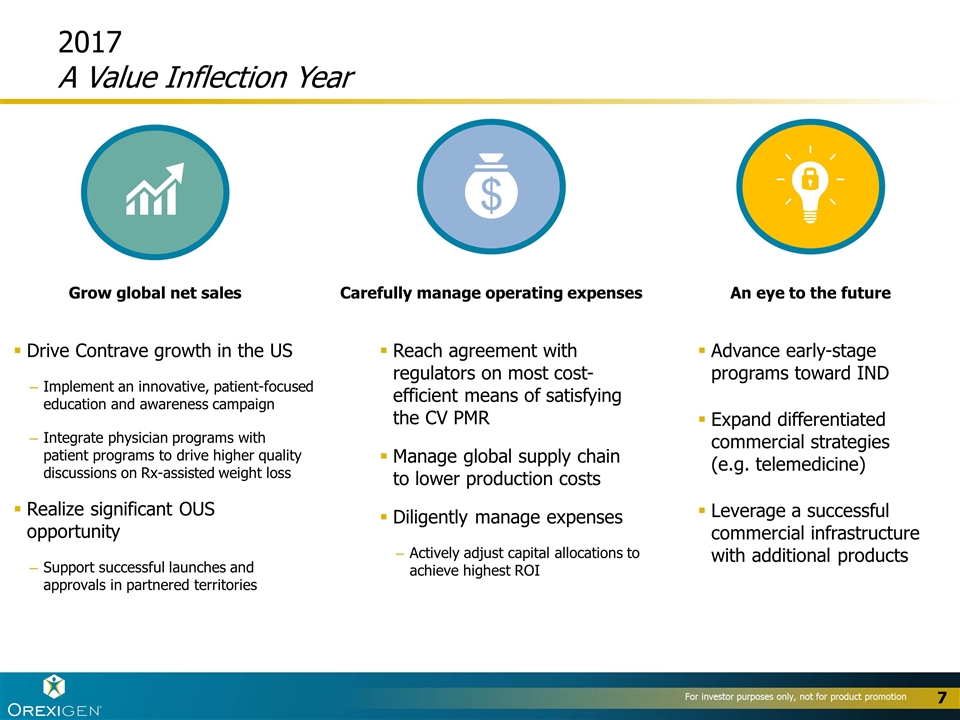

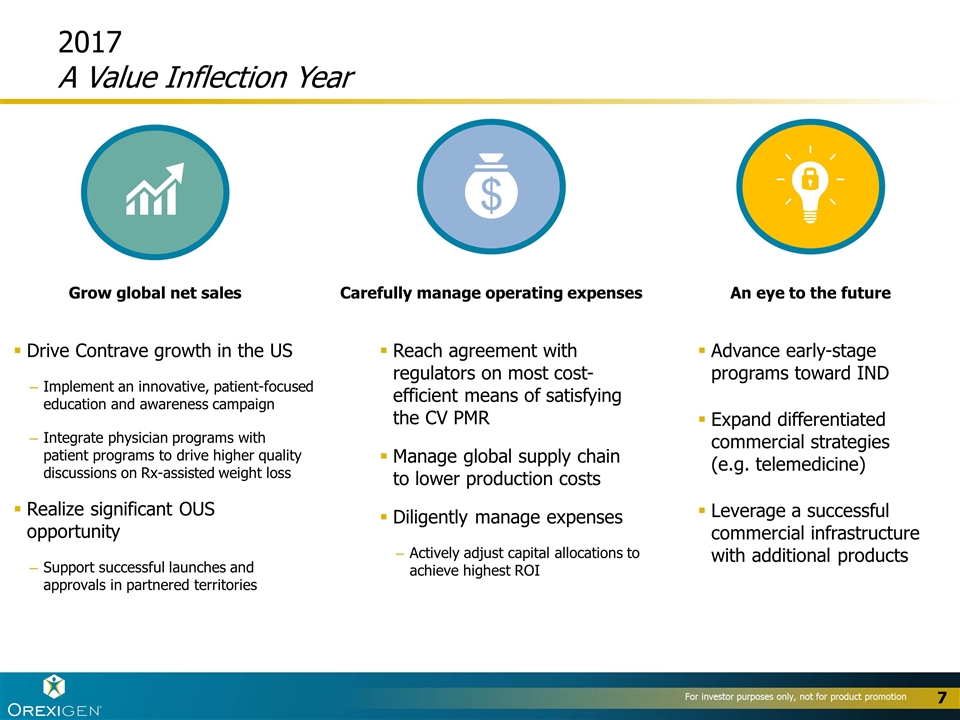

Drive Contrave growth in the US Implement an innovative, patient-focused education and awareness campaign Integrate physician programs with patient programs to drive higher quality discussions on Rx-assisted weight loss Realize significant OUS opportunity Support successful launches and approvals in partnered territories 2017 A Value Inflection Year Advance early-stage programs toward IND Expand differentiated commercial strategies (e.g. telemedicine) Leverage a successful commercial infrastructure with additional products Reach agreement with regulators on most cost-efficient means of satisfying the CV PMR Manage global supply chain to lower production costs Diligently manage expenses Actively adjust capital allocations to achieve highest ROI Carefully manage operating expenses Grow global net sales An eye to the future

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

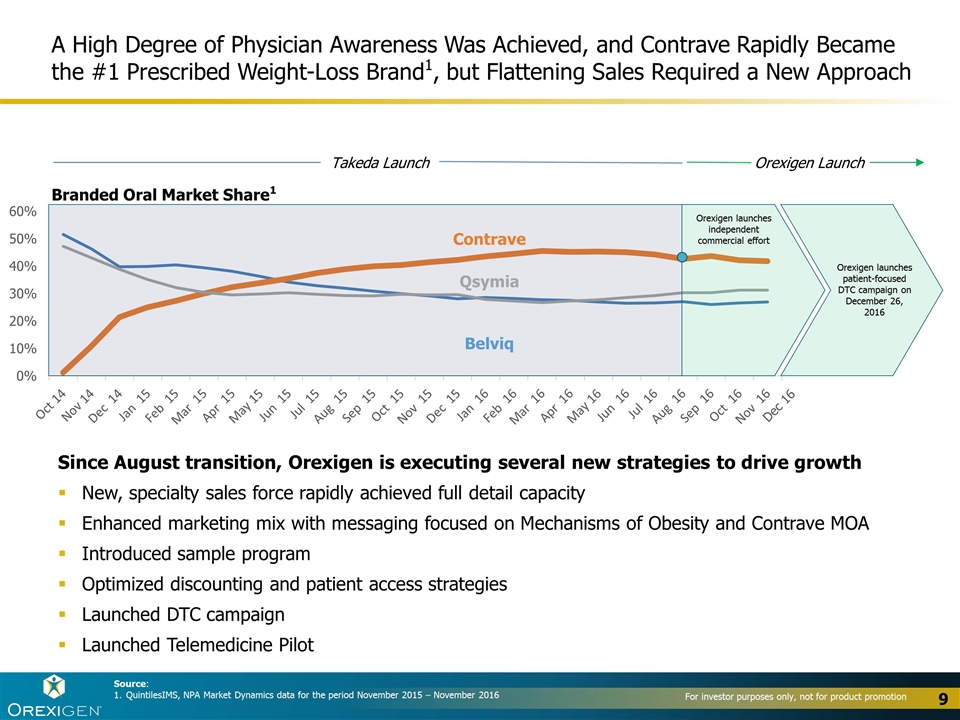

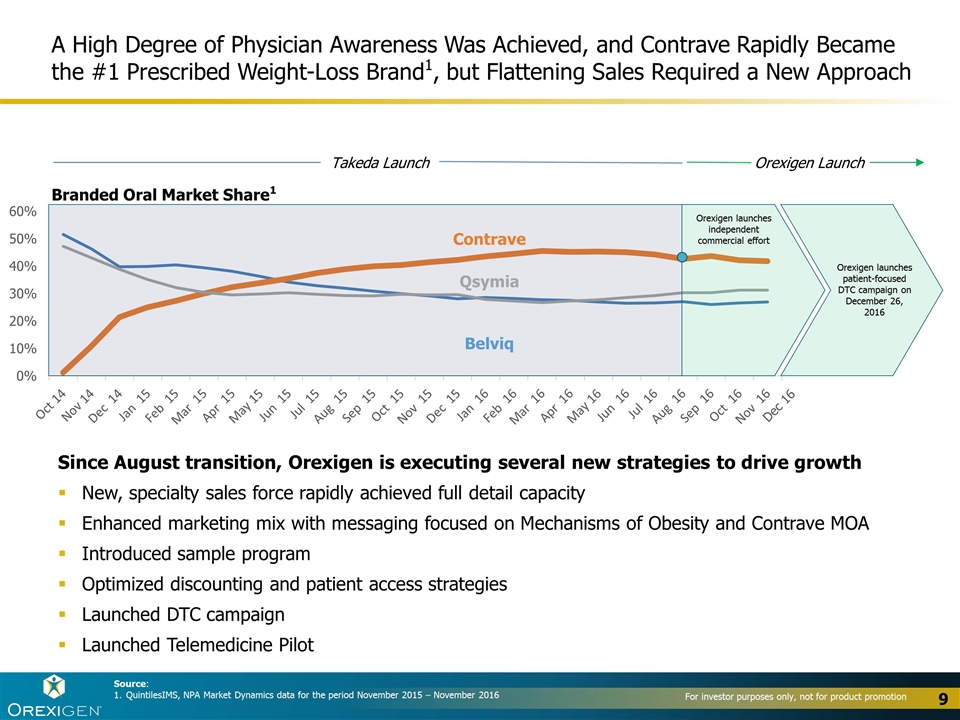

A High Degree of Physician Awareness Was Achieved, and Contrave Rapidly Became the #1 Prescribed Weight-Loss Brand1, but Flattening Sales Required a New Approach Source: QuintilesIMS, NPA Market Dynamics data for the period November 2015 – November 2016 Since August transition, Orexigen is executing several new strategies to drive growth New, specialty sales force rapidly achieved full detail capacity Enhanced marketing mix with messaging focused on Mechanisms of Obesity and Contrave MOA Introduced sample program Optimized discounting and patient access strategies Launched DTC campaign Launched Telemedicine Pilot Contrave Belviq Branded Oral Market Share1 9 Takeda Launch Orexigen Launch Qsymia Orexigen launches independent commercial effort Orexigen launches patient-focused DTC campaign on December 26, 2016 Dec 16

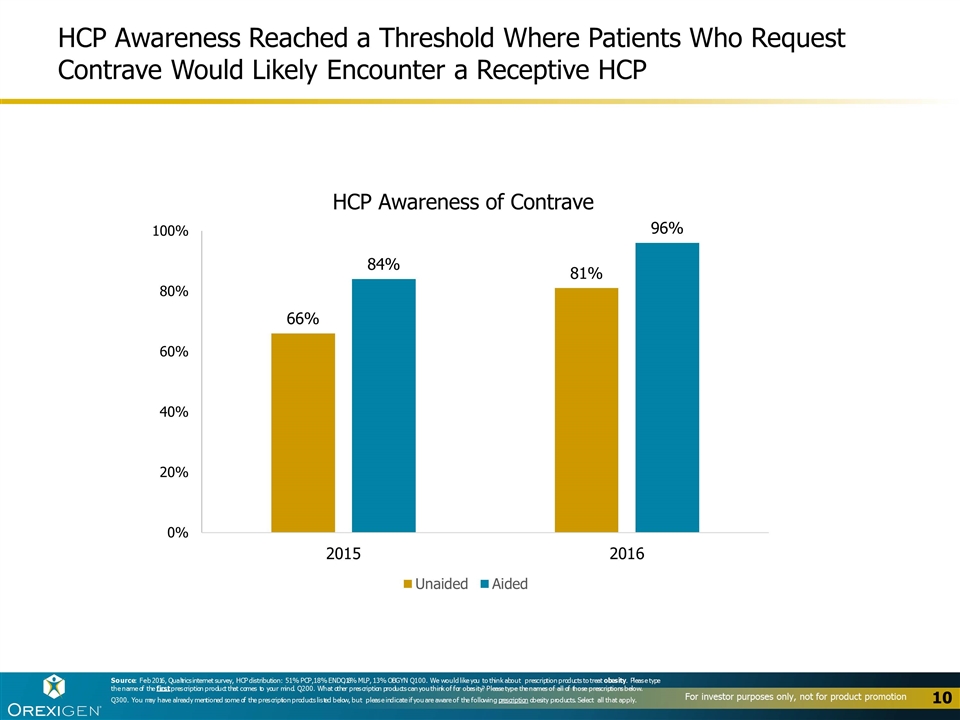

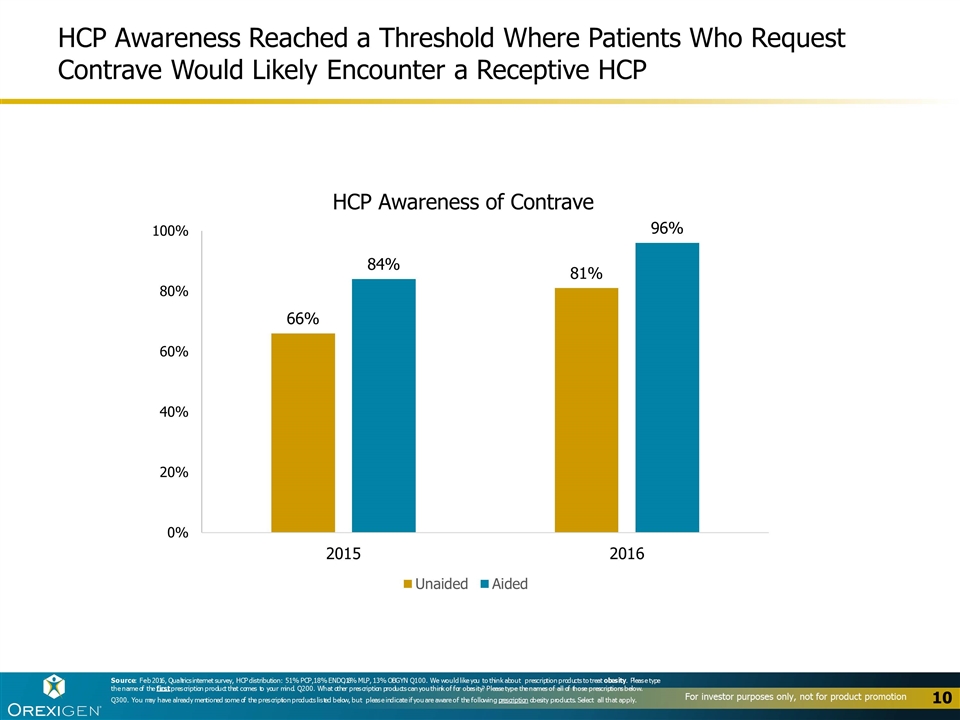

HCP Awareness Reached a Threshold Where Patients Who Request Contrave Would Likely Encounter a Receptive HCP Source: Feb 2016, Qualtrics internet survey, HCP distribution: 51% PCP, 18% ENDO, 18% MLP, 13% OBGYN Q100. We would like you to think about prescription products to treat obesity. Please type the name of the first prescription product that comes to your mind. Q200. What other prescription products can you think of for obesity? Please type the names of all of those prescriptions below. Q300. You may have already mentioned some of the prescription products listed below, but please indicate if you are aware of the following prescription obesity products. Select all that apply.

Patients Are Receptive to Rx-Aided Weight Loss, but Awareness Is Low Sources: 1. Orexigen Pre-DTC Baseline study, n=1,000 2. Orexigen Pre-DTC Baseline study, n=1,000, aided and unaided awareness Only 9% of target patients struggling to lose weight are aware of Contrave2 45% 45% of motivated patient population would consider Rx for weight loss1 9% Patients want to lose weight and are open to Rx options DTC could expand awareness of treatment options

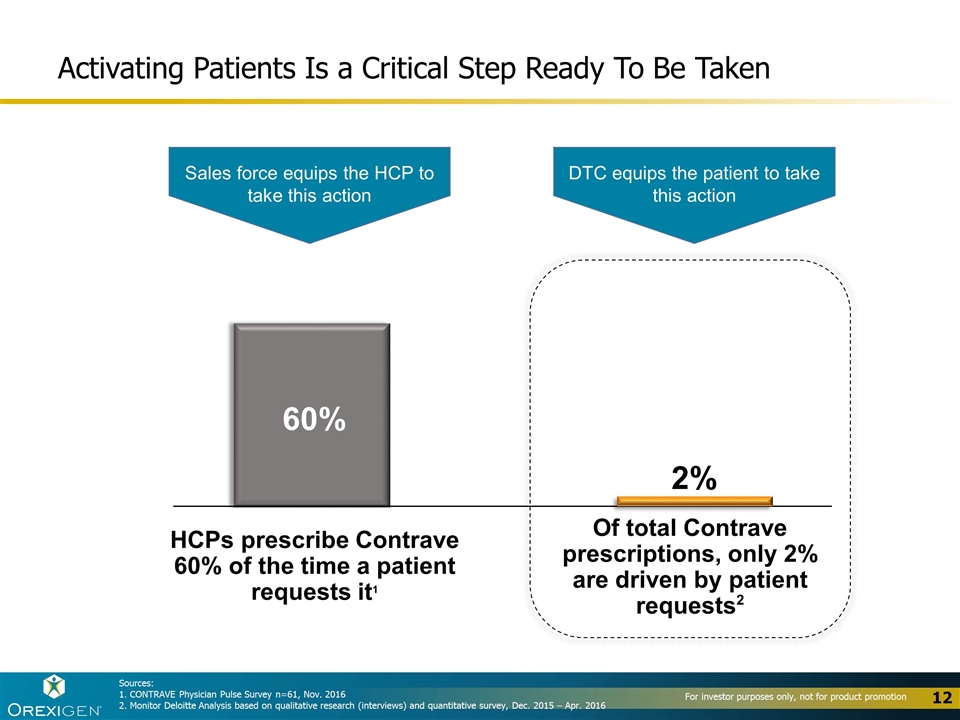

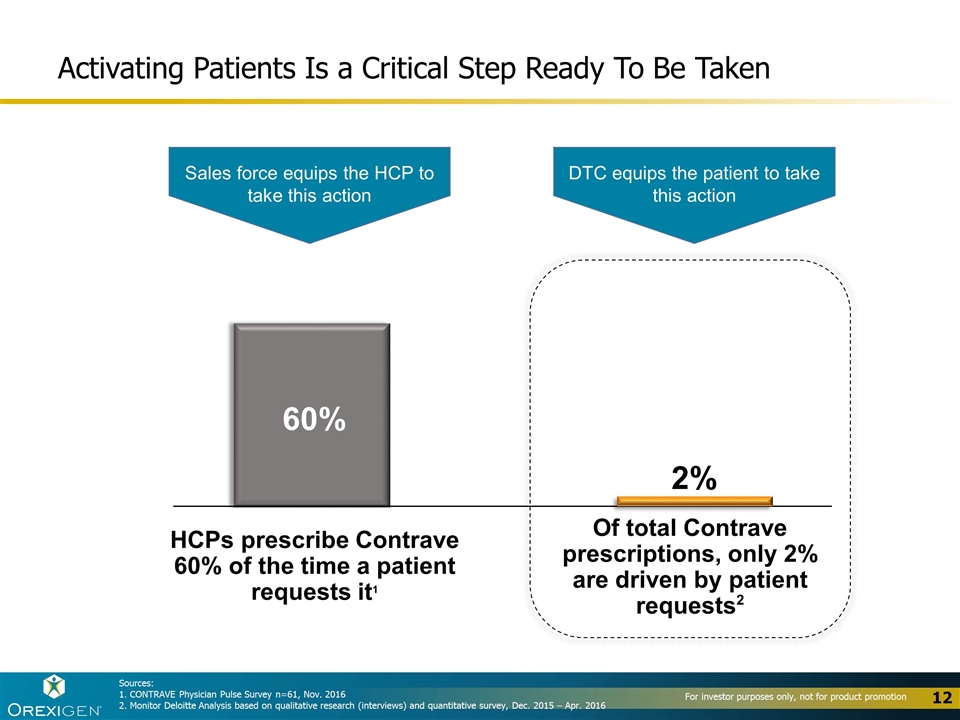

Activating Patients Is a Critical Step Ready To Be Taken 60% HCPs prescribe Contrave 60% of the time a patient requests it1 2% Of total Contrave prescriptions, only 2% are driven by patient requests2 Sales force equips the HCP to take this action DTC equips the patient to take this action Sources: 1. CONTRAVE Physician Pulse Survey n=61, Nov. 2016 2. Monitor Deloitte Analysis based on qualitative research (interviews) and quantitative survey, Dec. 2015 – Apr. 2016

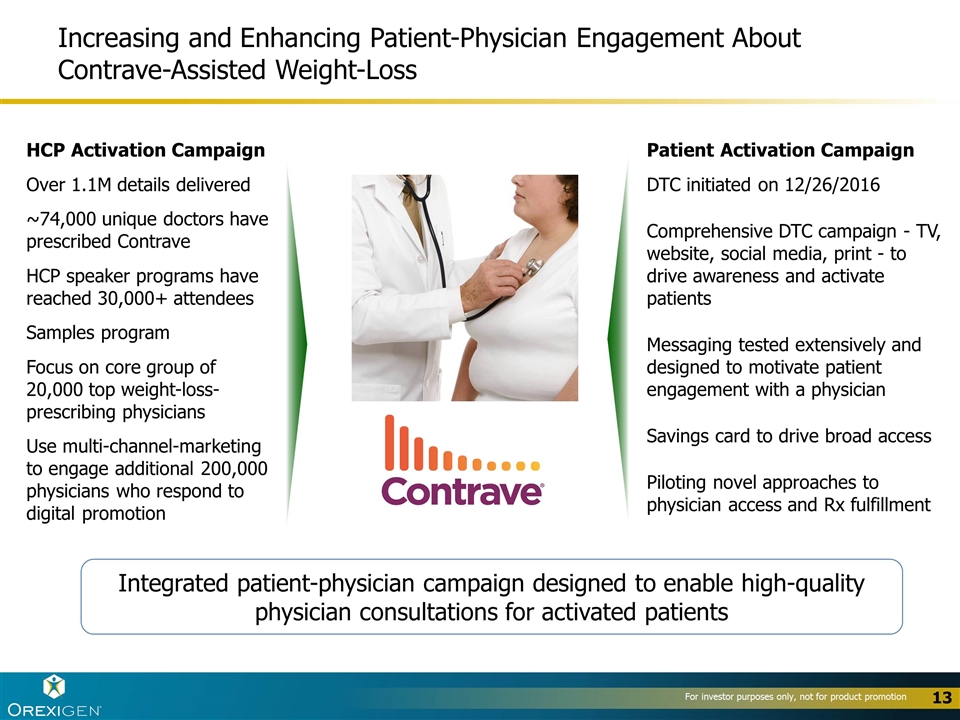

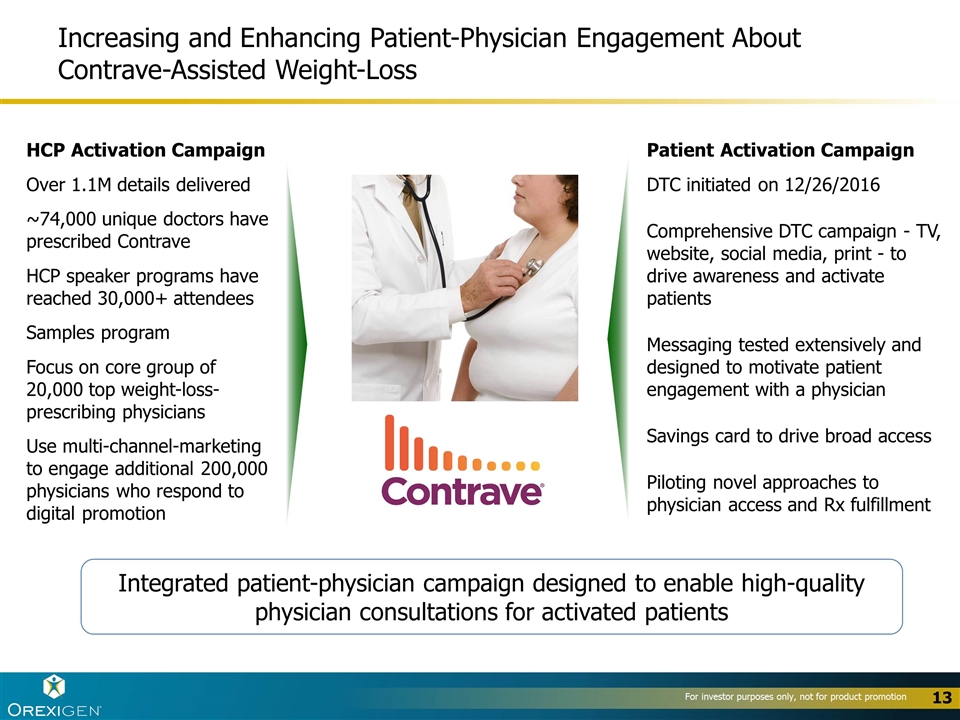

Increasing and Enhancing Patient-Physician Engagement About Contrave-Assisted Weight-Loss HCP Activation Campaign Over 1.1M details delivered ~74,000 unique doctors have prescribed Contrave HCP speaker programs have reached 30,000+ attendees Samples program Focus on core group of 20,000 top weight-loss-prescribing physicians Use multi-channel-marketing to engage additional 200,000 physicians who respond to digital promotion Patient Activation Campaign DTC initiated on 12/26/2016 Comprehensive DTC campaign - TV, website, social media, print - to drive awareness and activate patients Messaging tested extensively and designed to motivate patient engagement with a physician Savings card to drive broad access Piloting novel approaches to physician access and Rx fulfillment Integrated patient-physician campaign designed to enable high-quality physician consultations for activated patients

Orexigen Re-Launch of Contrave: Aim to Significantly Grow Sales with a Lower Overall Sales and Marketing Spend by Changing the Approach $187M $127M $80-90M Reps: $112M Reps: $77M Reps HCP Mktg. HCP Mktg.: $67M HCP Mktg.: $42M Patient Mktg. Note: Year 1 and 2 base sales expense assume $125 per PDE with 800K and 600K PDEs, respectively with sales training and logistic expenses added incrementally ($12M and $2M); 2. Year 1 and 2 HCP Promotion and DTC spend is an estimated split based on guidance provided in previous Takeda reporting; 3. Year 2 marketing spend estimated to be flat to contractual obligations of $50M Partner Orexigen Sales and Marketing Expense ($mm) Year 1 (9/14-8/15) Partner Year 2 (9/15-8/16) 2017 Projection 50/50 spend mix

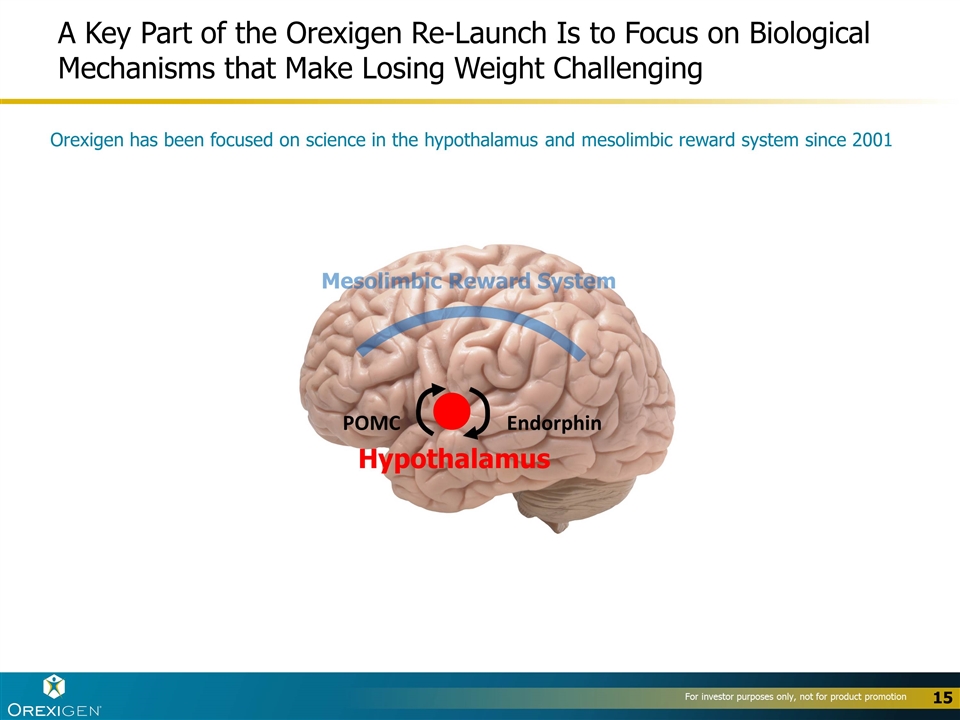

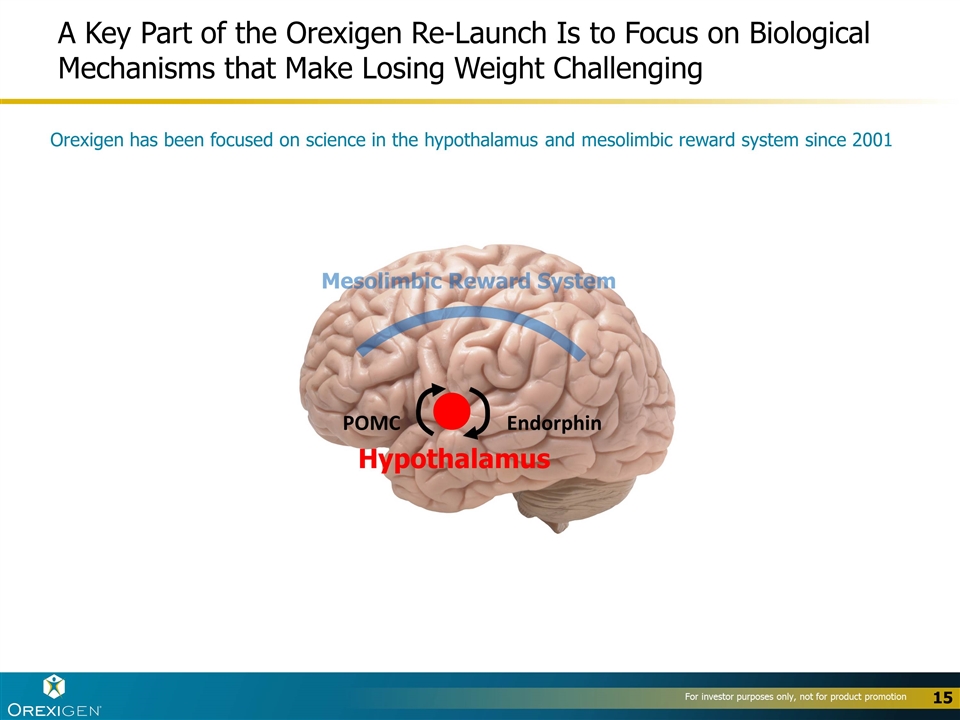

A Key Part of the Orexigen Re-Launch Is to Focus on Biological Mechanisms that Make Losing Weight Challenging POMC Endorphin Hypothalamus Mesolimbic Reward System Orexigen has been focused on science in the hypothalamus and mesolimbic reward system since 2001

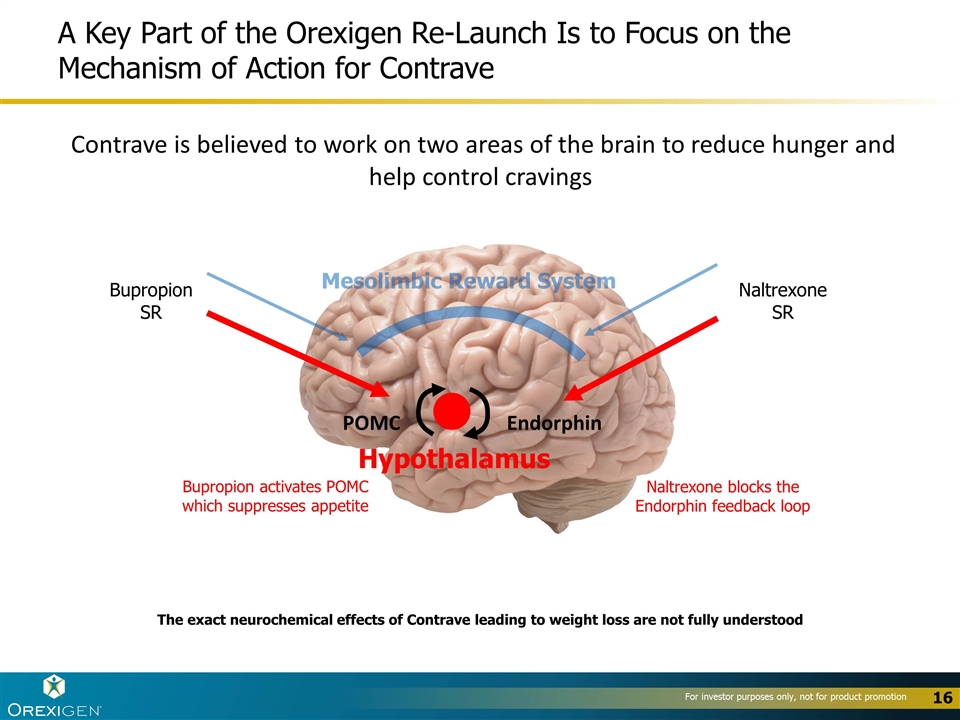

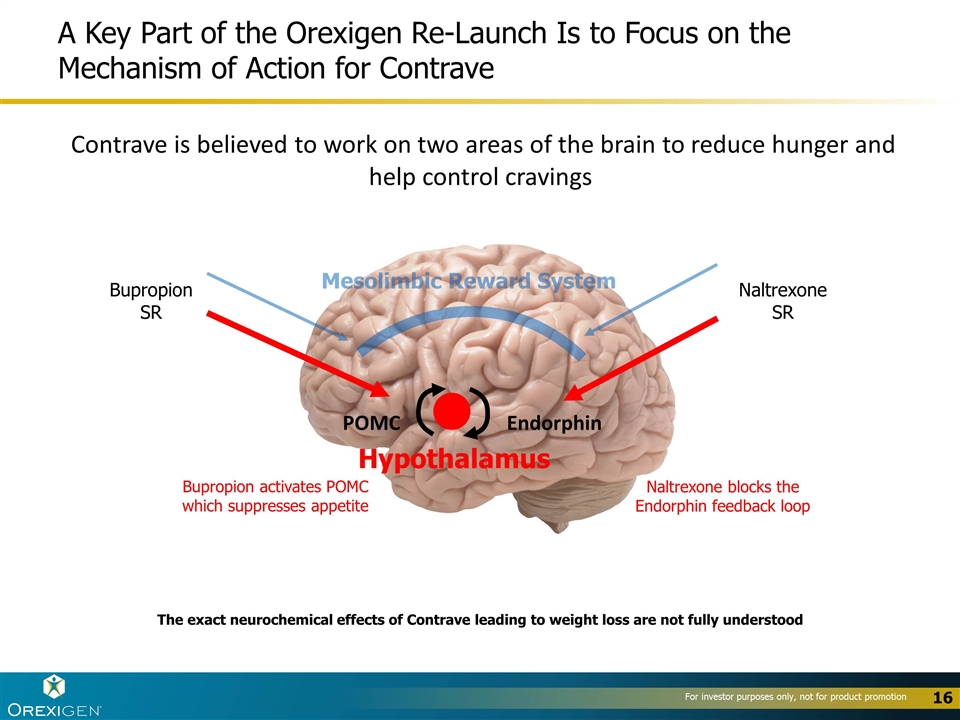

A Key Part of the Orexigen Re-Launch Is to Focus on the Mechanism of Action for Contrave POMC Endorphin Hypothalamus Mesolimbic Reward System Bupropion activates POMC which suppresses appetite Naltrexone blocks the Endorphin feedback loop Contrave is believed to work on two areas of the brain to reduce hunger and help control cravings Bupropion SR Naltrexone SR The exact neurochemical effects of Contrave leading to weight loss are not fully understood

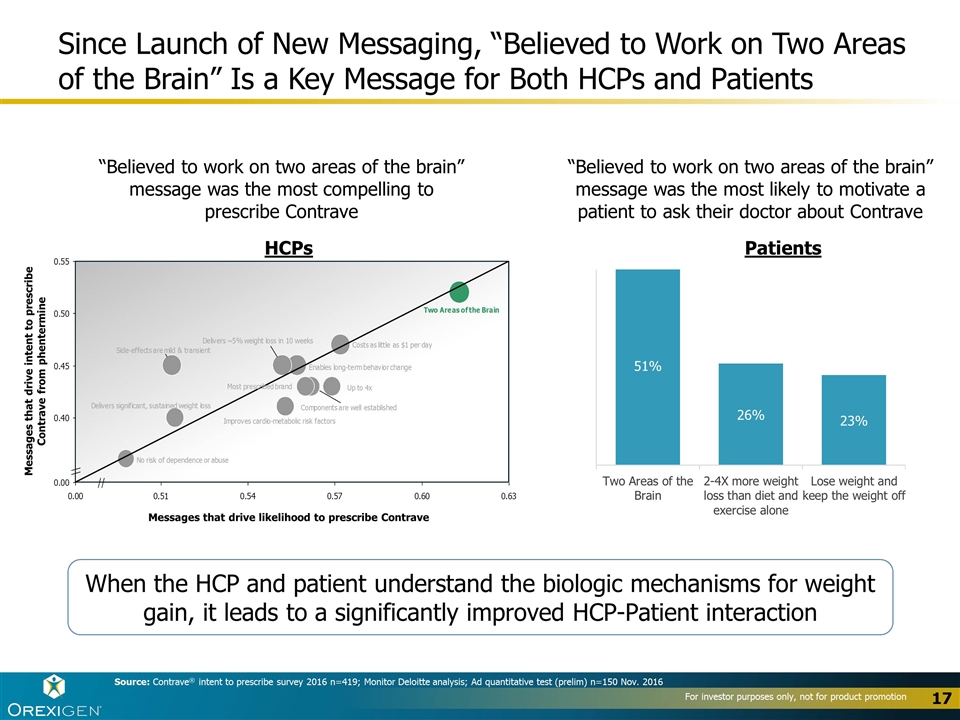

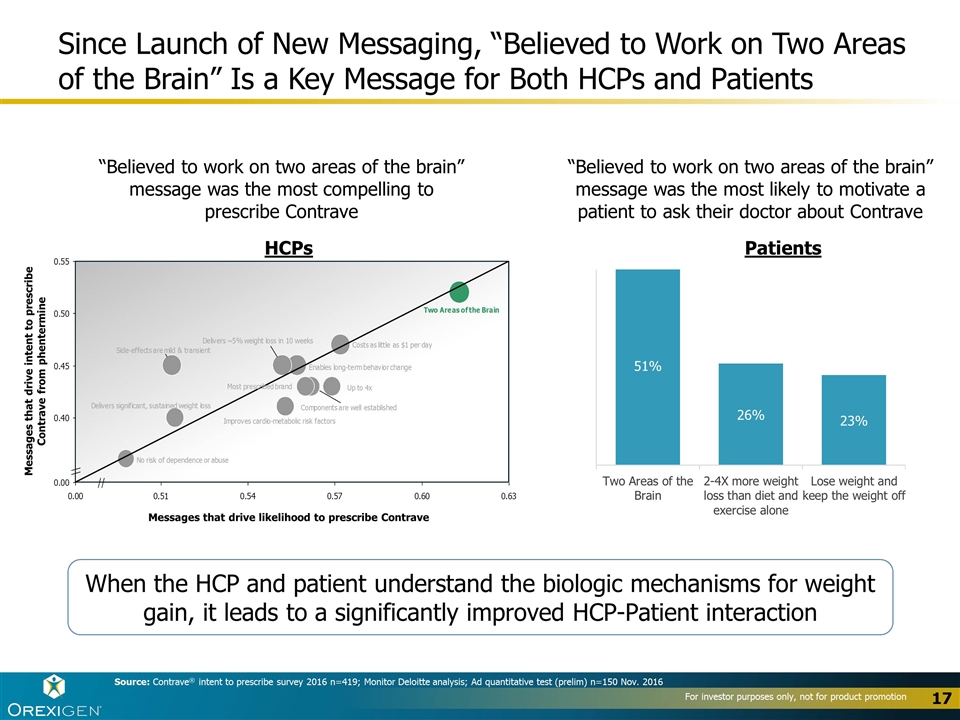

Since Launch of New Messaging, “Believed to Work on Two Areas of the Brain” Is a Key Message for Both HCPs and Patients Source: Contrave® intent to prescribe survey 2016 n=419; Monitor Deloitte analysis; Ad quantitative test (prelim) n=150 Nov. 2016 Messages that drive intent to prescribe Contrave from phentermine Messages that drive likelihood to prescribe Contrave HCPs Patients “Believed to work on two areas of the brain” message was the most likely to motivate a patient to ask their doctor about Contrave “Believed to work on two areas of the brain” message was the most compelling to prescribe Contrave When the HCP and patient understand the biologic mechanisms for weight gain, it leads to a significantly improved HCP-Patient interaction

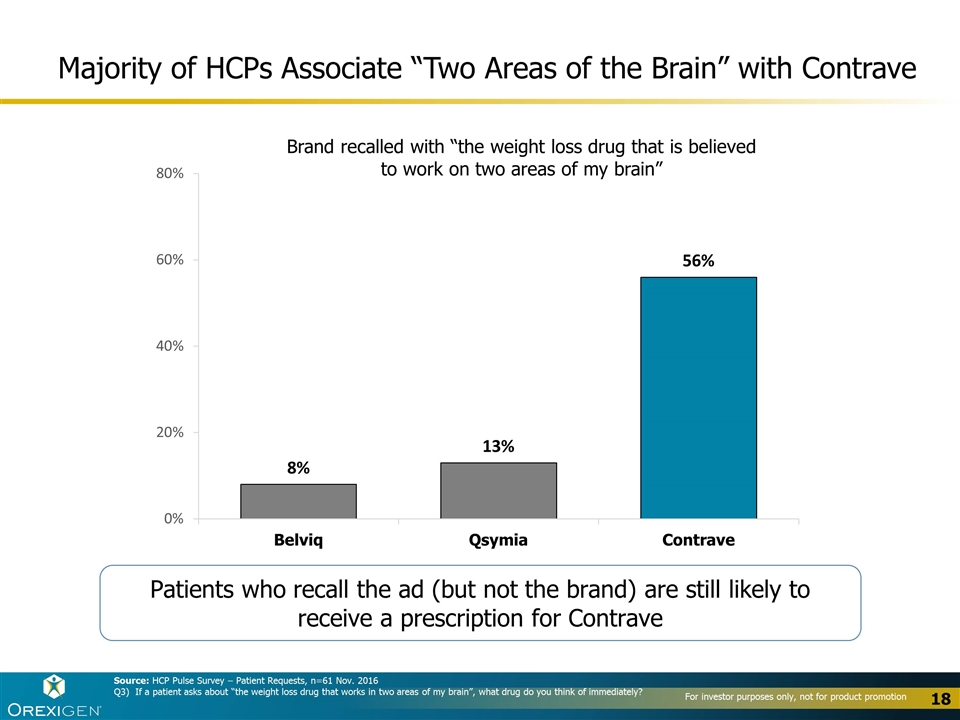

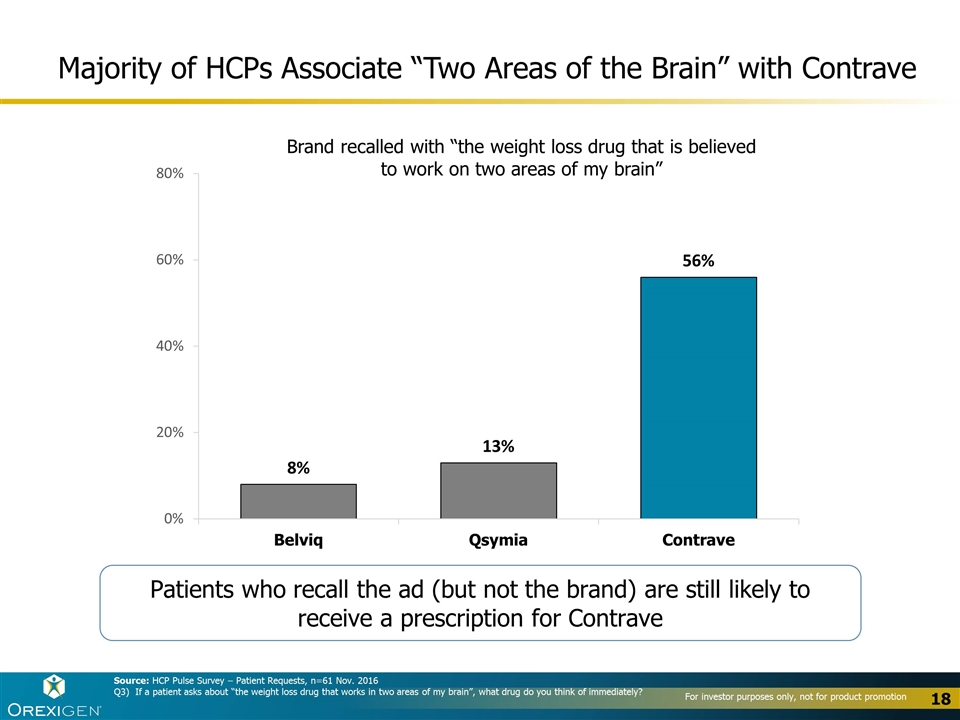

Majority of HCPs Associate “Two Areas of the Brain” with Contrave Brand recalled with “the weight loss drug that is believed to work on two areas of my brain” Source: HCP Pulse Survey – Patient Requests, n=61 Nov. 2016 Q3) If a patient asks about “the weight loss drug that works in two areas of my brain”, what drug do you think of immediately? Patients who recall the ad (but not the brand) are still likely to receive a prescription for Contrave

Broadcast DTC Ad Provides Helpful and Compelling Information Which Activates Patients to Talk About Contrave with a Doctor Ad Messages that Establish Efficacy: “Across three long term studies, Contrave patients lost approximately 2–4X more weight than diet and exercise alone” “…help adults who are overweight or struggle with obesity lose weight and keep it off” Ad Messages that Differentiate by leveraging MOA: “Contrave is believed to work on two areas of the brain. Your hunger center …and your reward system” “To reduce hunger and to help control cravings” Ad Messages that Establish Trust: “Contrave is an FDA approved weight loss medicine” “ Contrave. The #1 prescribed weight loss brand” The entire campaign incorporates key safety and risk information including the boxed warning for suicidal thoughts and behaviors and neuropsychiatric reaction

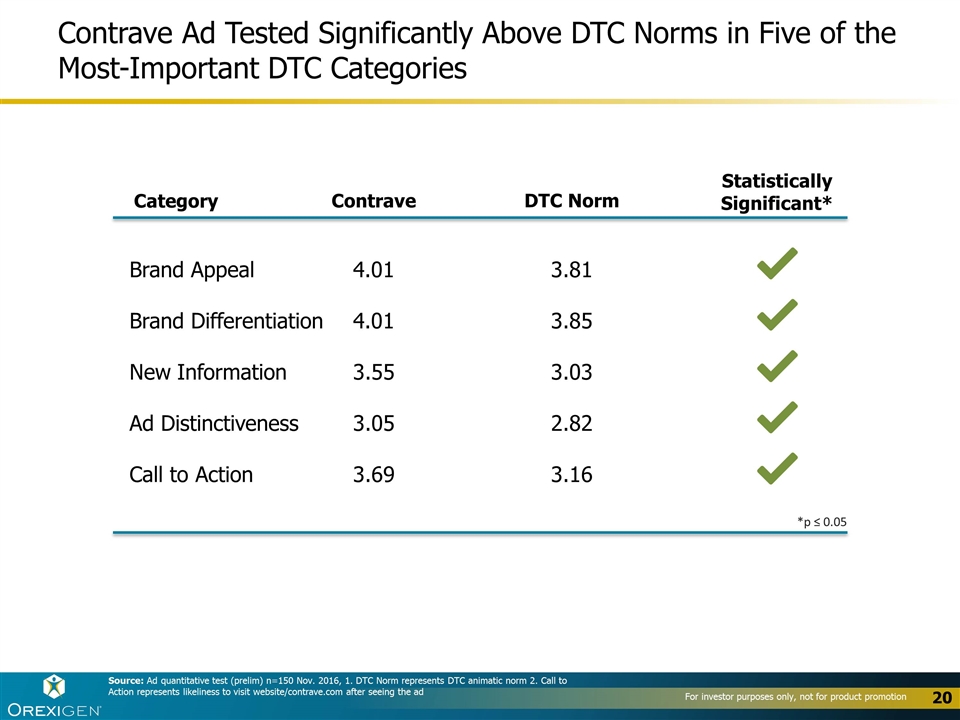

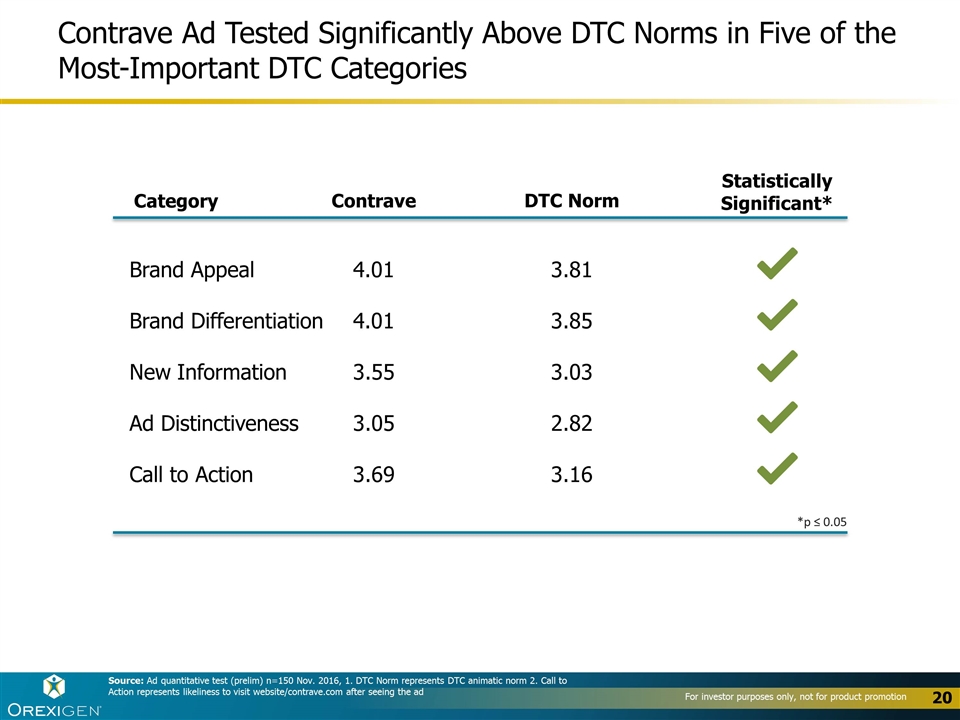

Contrave Ad Tested Significantly Above DTC Norms in Five of the Most-Important DTC Categories Brand Appeal Brand Differentiation New Information Ad Distinctiveness Call to Action Category Contrave DTC Norm 4.01 4.01 3.55 3.05 3.69 3.81 3.85 3.03 2.82 3.16 Source: Ad quantitative test (prelim) n=150 Nov. 2016, 1. DTC Norm represents DTC animatic norm 2. Call to Action represents likeliness to visit website/contrave.com after seeing the ad Statistically Significant* *p ≤ 0.05

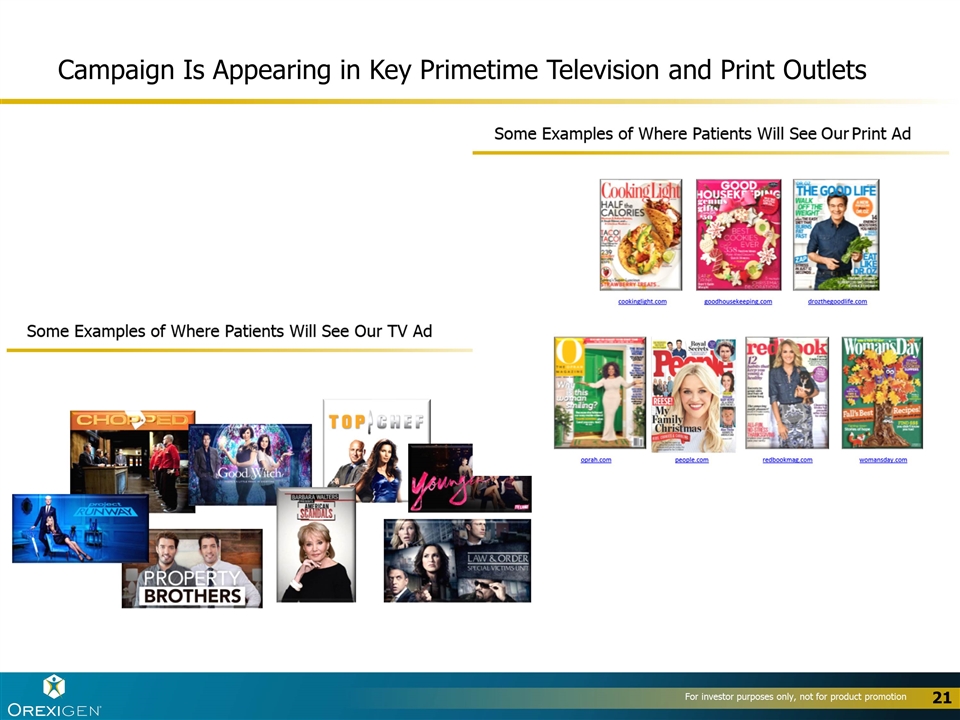

Campaign Is Appearing in Key Primetime Television and Print Outlets

360° Patient-Centric Multimedia Campaign Print HCP Office Social Media Website Digital Banners And Video In-office Brochure TV Find a Doctor Doctor Discussion Guide Telemedicine Doctor Discussion Guide

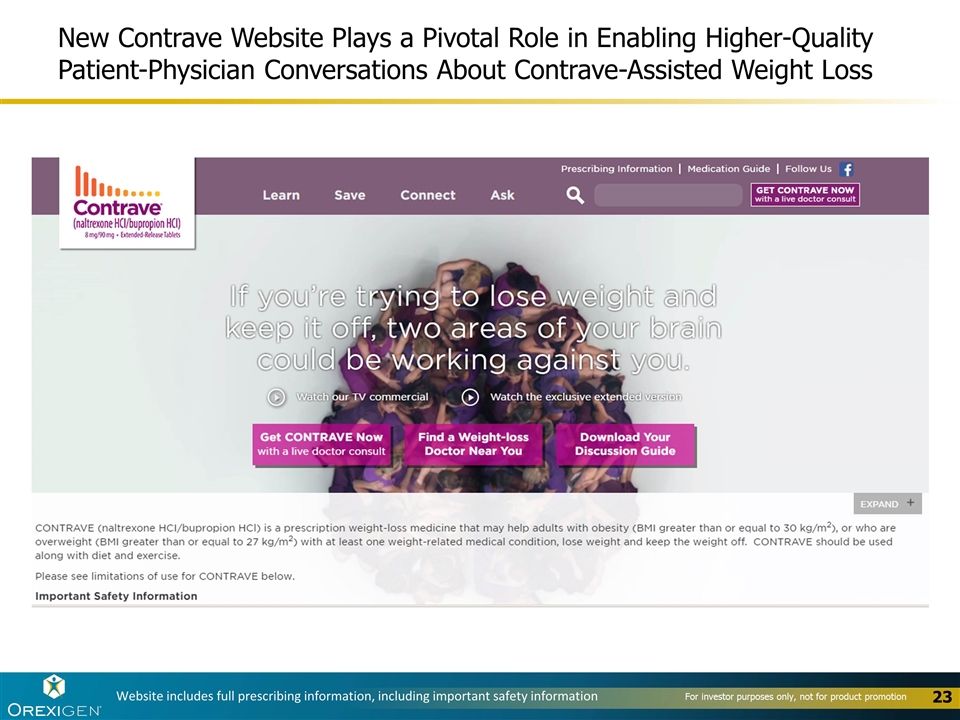

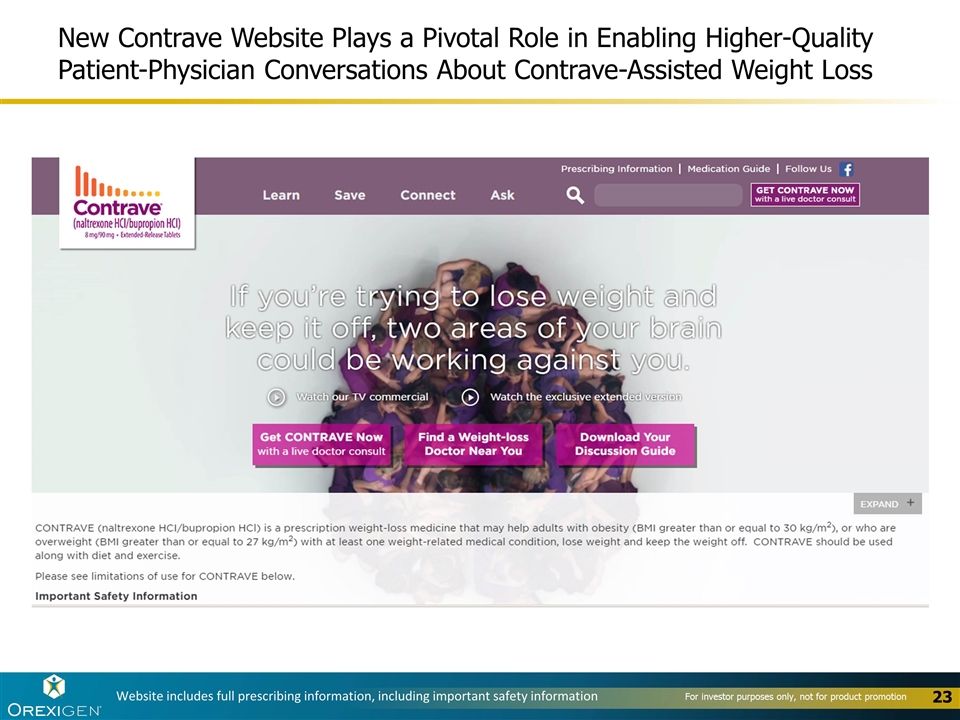

New Contrave Website Plays a Pivotal Role in Enabling Higher-Quality Patient-Physician Conversations About Contrave-Assisted Weight Loss Website includes full prescribing information, including important safety information

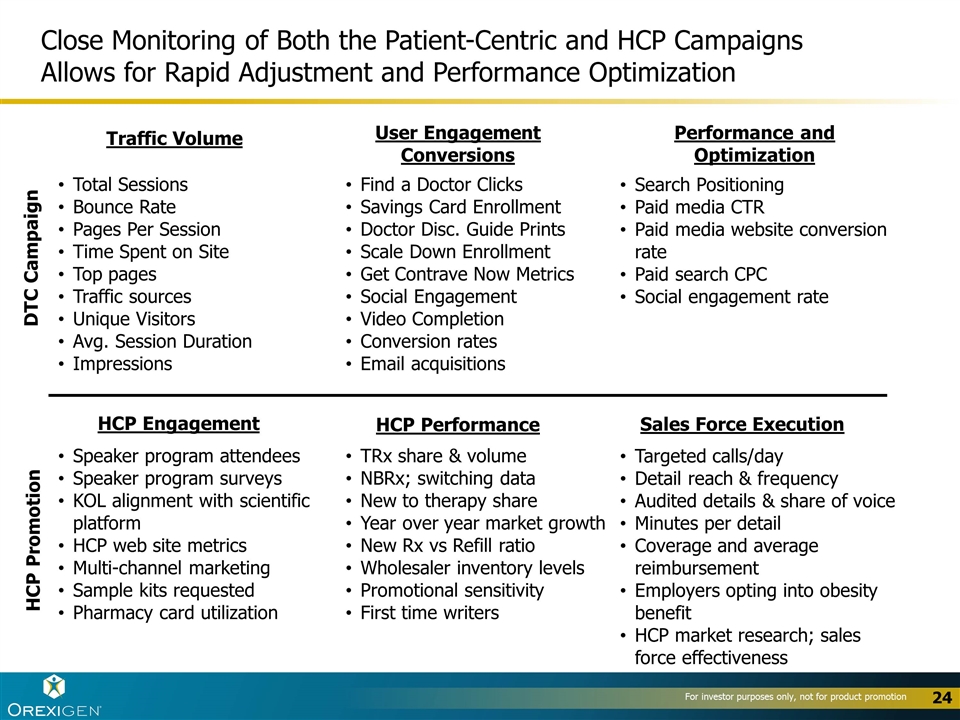

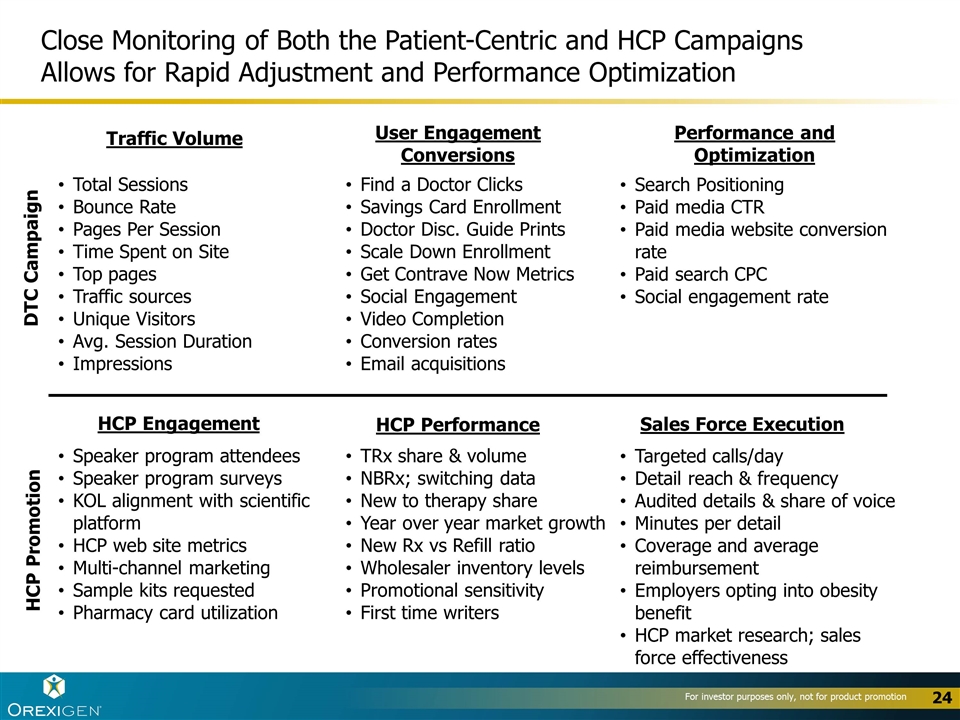

Close Monitoring of Both the Patient-Centric and HCP Campaigns Allows for Rapid Adjustment and Performance Optimization DTC Campaign Total Sessions Bounce Rate Pages Per Session Time Spent on Site Top pages Traffic sources Unique Visitors Avg. Session Duration Impressions Find a Doctor Clicks Savings Card Enrollment Doctor Disc. Guide Prints Scale Down Enrollment Get Contrave Now Metrics Social Engagement Video Completion Conversion rates Email acquisitions Search Positioning Paid media CTR Paid media website conversion rate Paid search CPC Social engagement rate Traffic Volume User Engagement Conversions Performance and Optimization Speaker program attendees Speaker program surveys KOL alignment with scientific platform HCP web site metrics Multi-channel marketing Sample kits requested Pharmacy card utilization TRx share & volume NBRx; switching data New to therapy share Year over year market growth New Rx vs Refill ratio Wholesaler inventory levels Promotional sensitivity First time writers Targeted calls/day Detail reach & frequency Audited details & share of voice Minutes per detail Coverage and average reimbursement Employers opting into obesity benefit HCP market research; sales force effectiveness HCP Engagement HCP Performance Sales Force Execution HCP Promotion

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

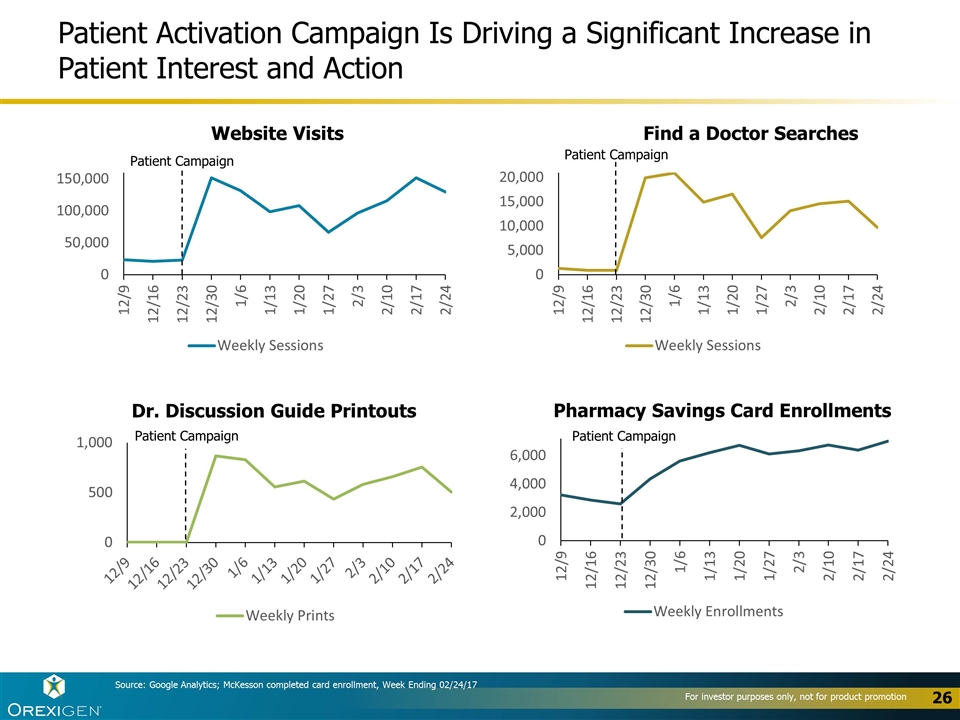

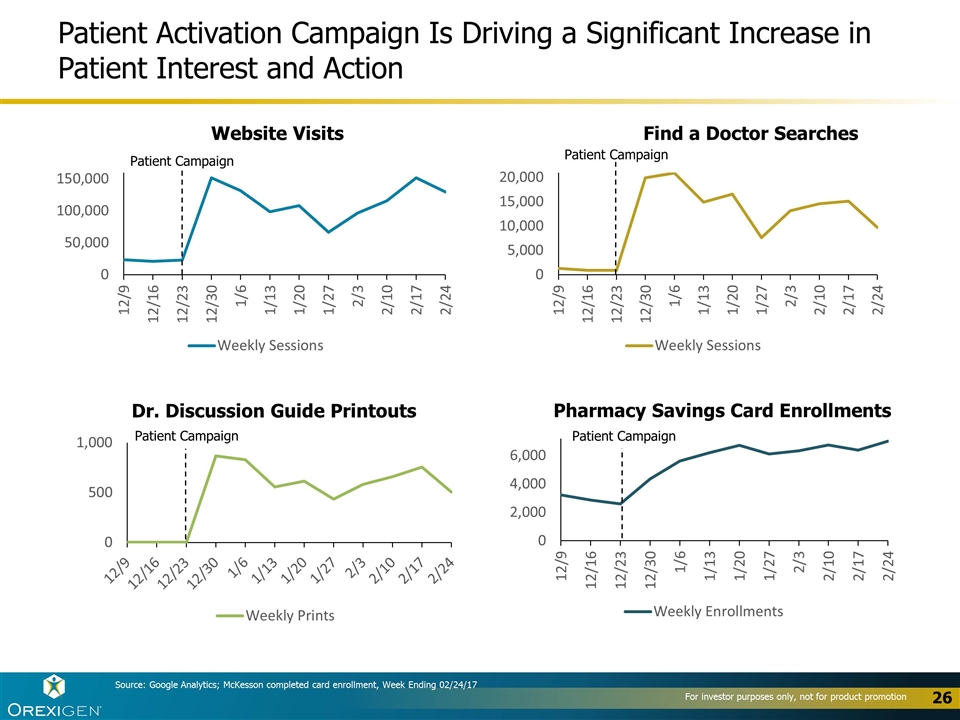

26 Patient Activation Campaign Is Driving a Significant Increase in Patient Interest and Action Website Visits Find a Doctor Searches Dr. Discussion Guide Printouts Patient Campaign Patient Campaign Patient Campaign Pharmacy Savings Card Enrollments Patient Campaign Source: Google Analytics; McKesson completed card enrollment, Week Ending 02/24/17

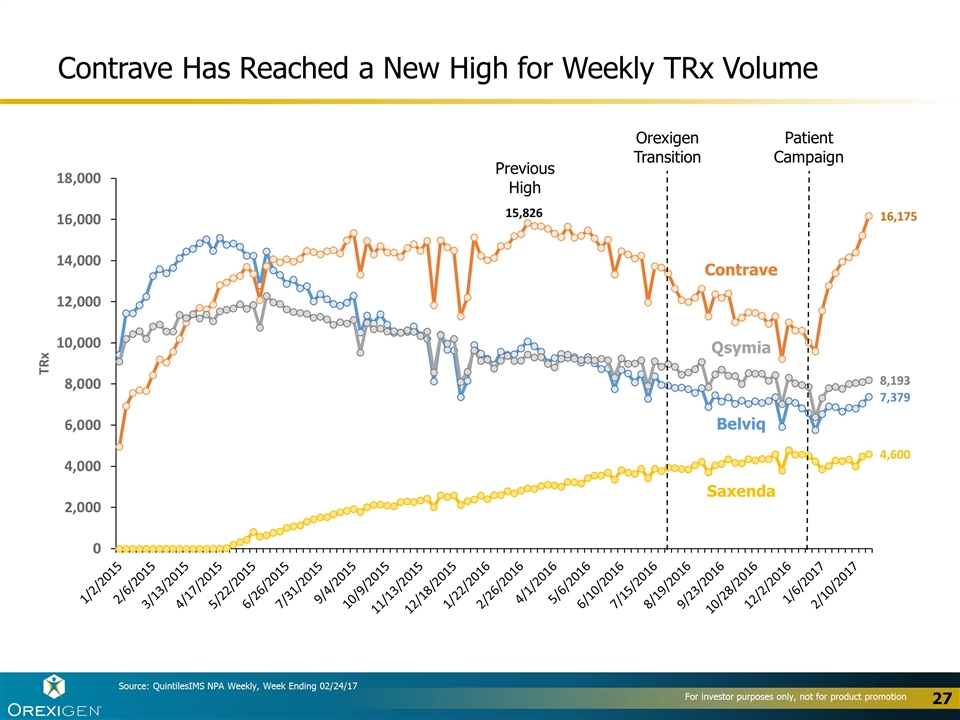

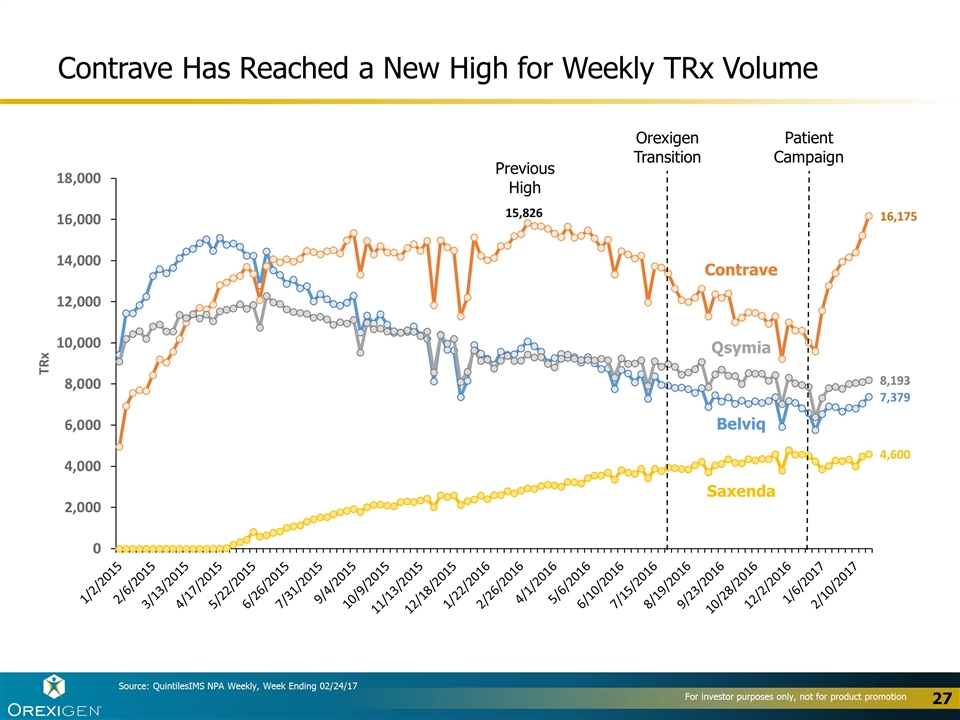

Contrave Has Reached a New High for Weekly TRx Volume Contrave Belviq Qsymia Saxenda Source: QuintilesIMS NPA Weekly, Week Ending 02/24/17 Orexigen Transition Patient Campaign Previous High

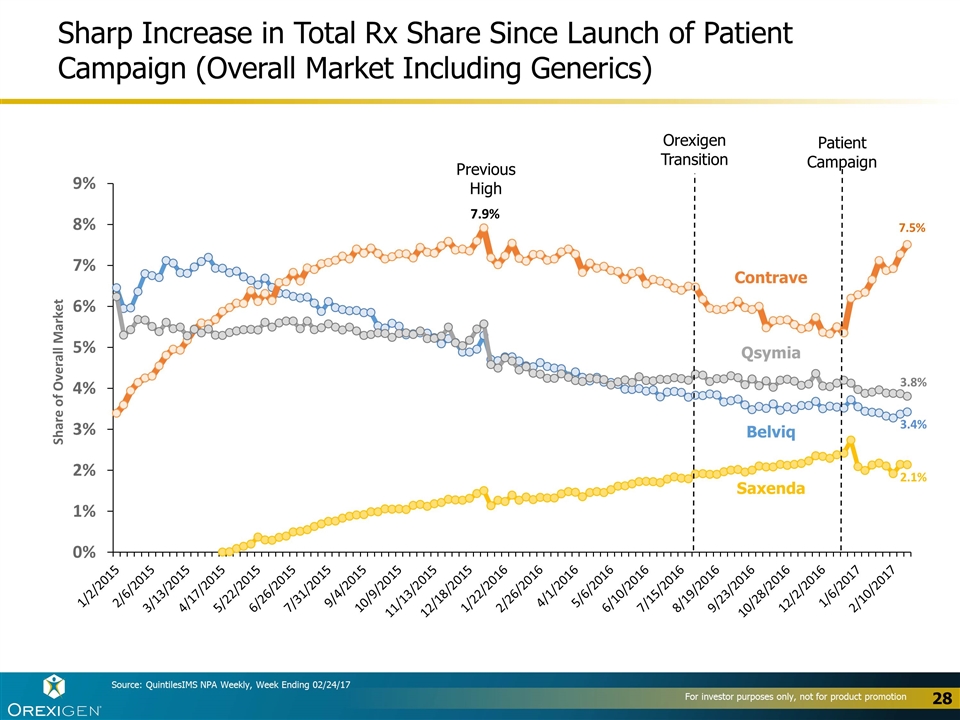

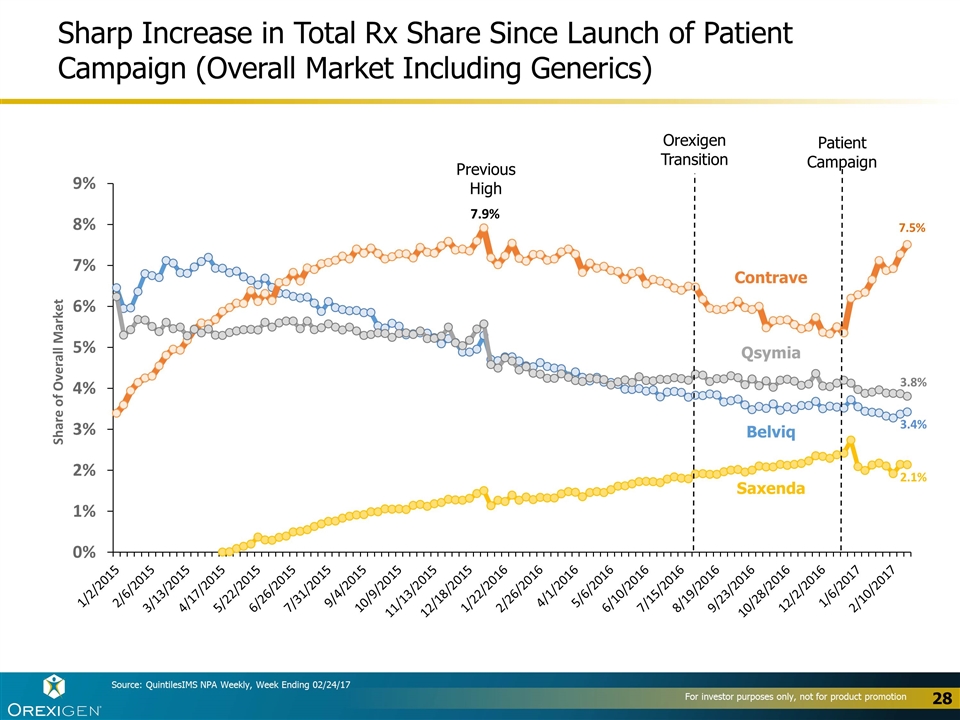

Sharp Increase in Total Rx Share Since Launch of Patient Campaign (Overall Market Including Generics) Contrave Belviq Qsymia Saxenda Source: QuintilesIMS NPA Weekly, Week Ending 02/24/17 Orexigen Transition Patient Campaign Previous High

Contrave Has Reached a New High for Total Rx Share of the Branded Market Contrave Belviq Saxenda Source: QuintilesIMS NPA Weekly, Week Ending 02/24/17 Orexigen Transition Patient Campaign Qsymia Previous High

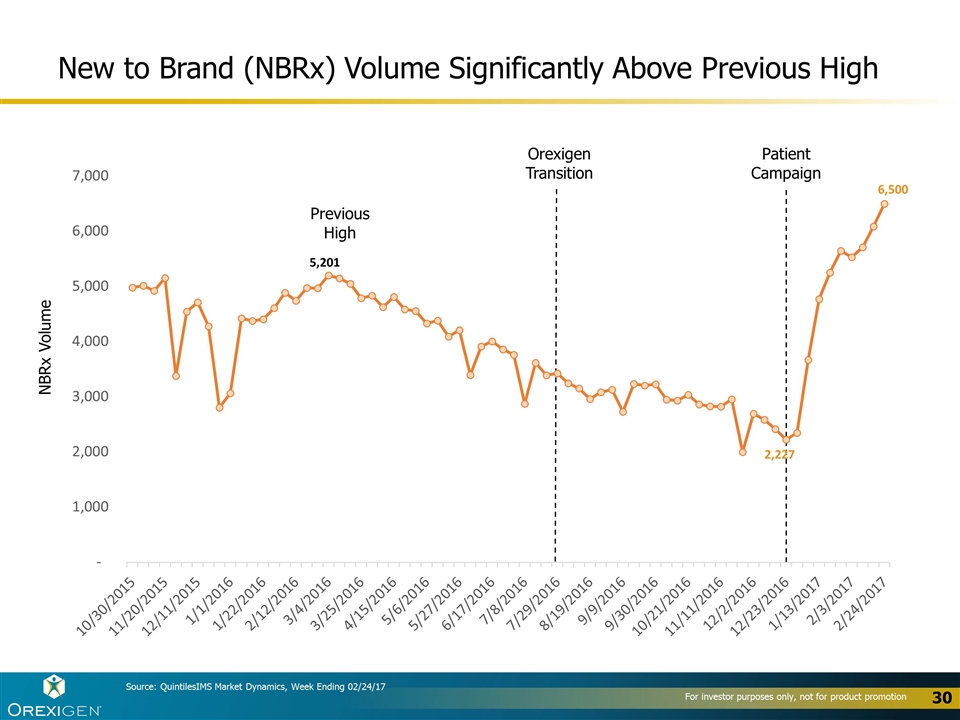

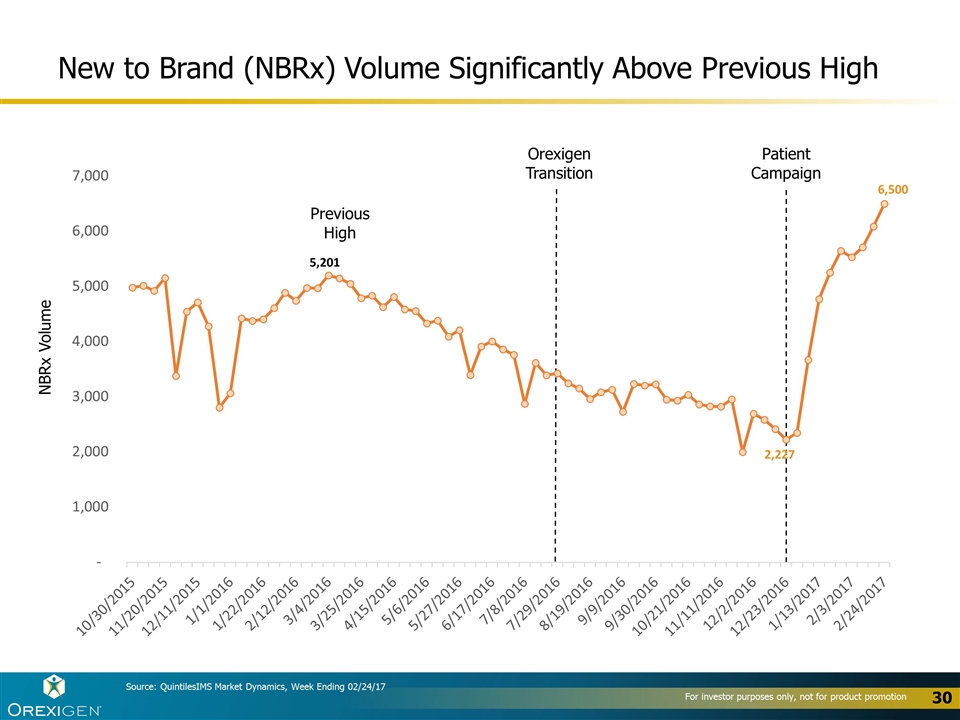

New to Brand (NBRx) Volume Significantly Above Previous High NBRx Volume Source: QuintilesIMS Market Dynamics, Week Ending 02/24/17 Orexigen Transition Patient Campaign Previous High

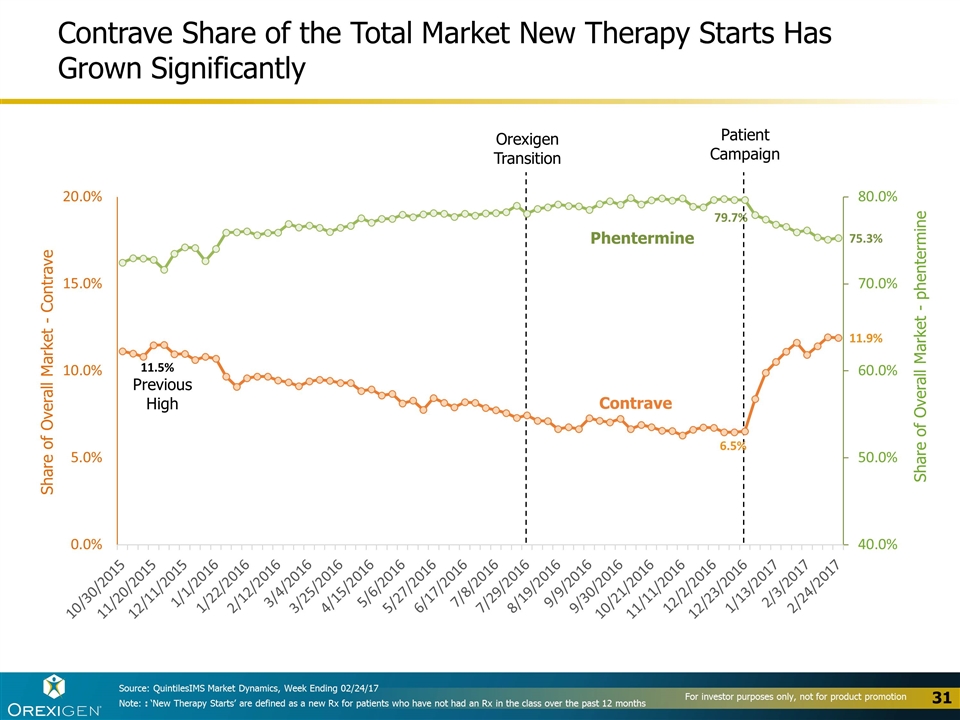

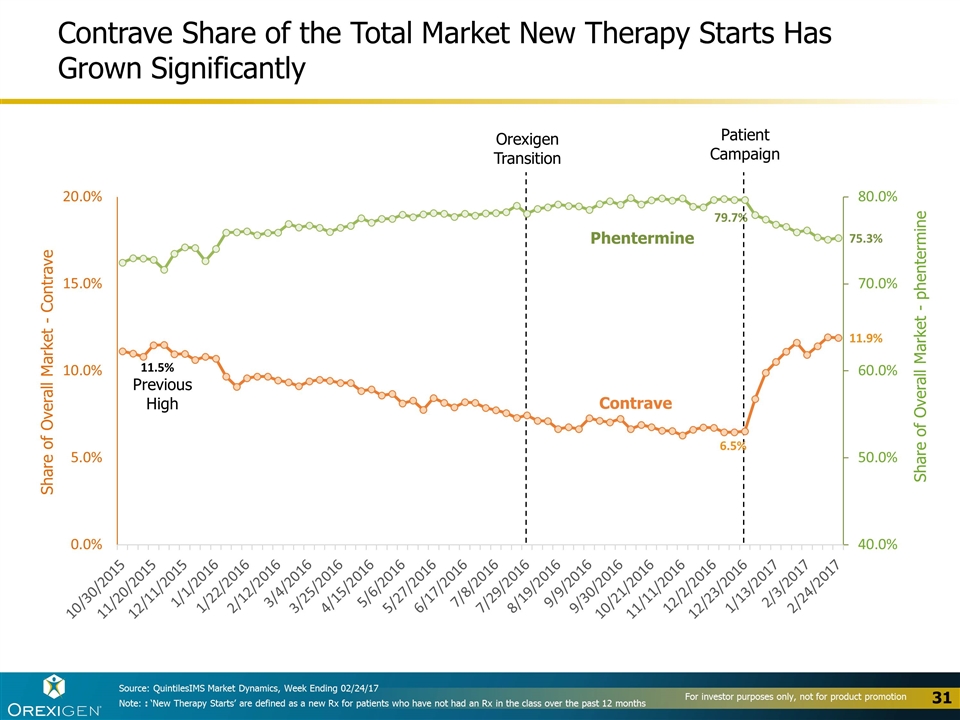

Contrave Share of the Total Market New Therapy Starts Has Grown Significantly Share of Overall Market - phentermine Share of Overall Market - Contrave Contrave Phentermine Source: QuintilesIMS Market Dynamics, Week Ending 02/24/17 Orexigen Transition Patient Campaign Previous High Note: : ‘New Therapy Starts’ are defined as a new Rx for patients who have not had an Rx in the class over the past 12 months

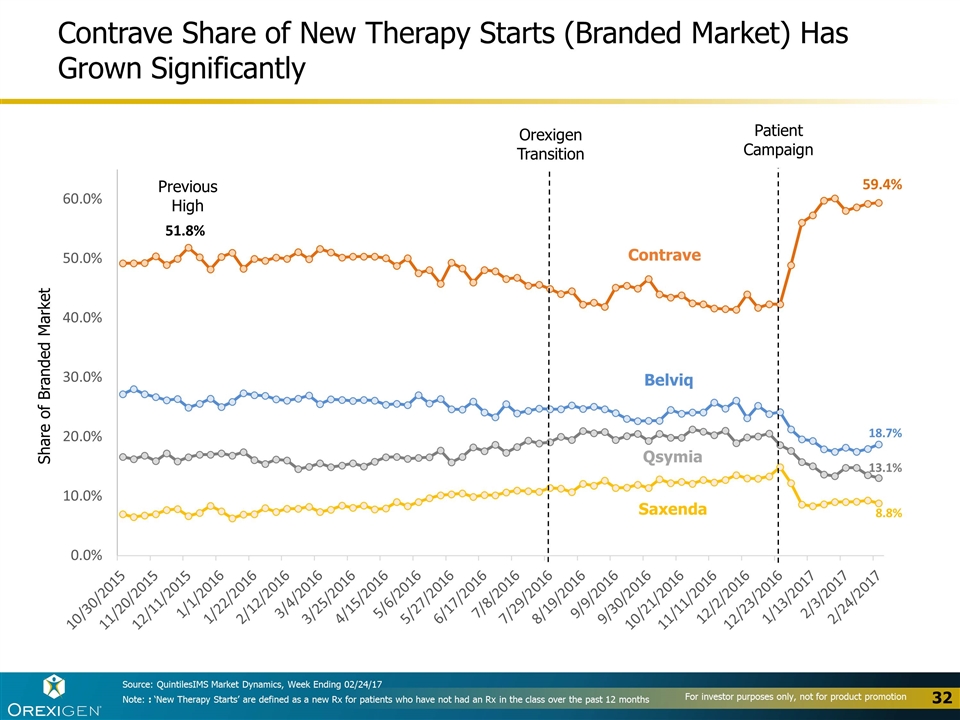

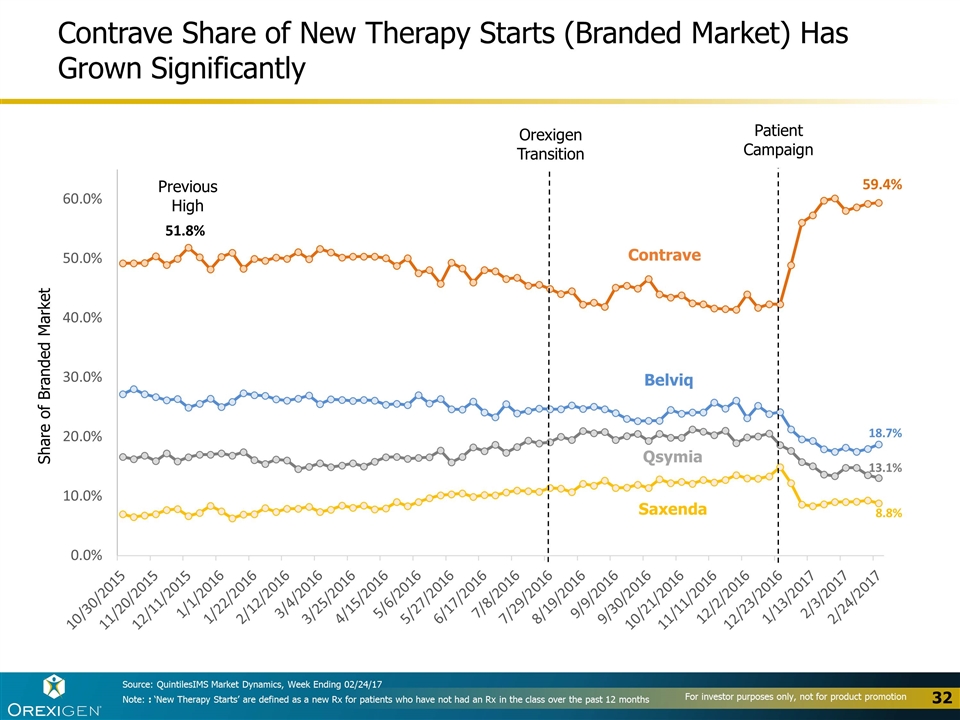

Contrave Share of New Therapy Starts (Branded Market) Has Grown Significantly Contrave Previous High Orexigen Transition Patient Campaign Belviq Qsymia Saxenda Share of Branded Market Source: QuintilesIMS Market Dynamics, Week Ending 02/24/17 Note: : ‘New Therapy Starts’ are defined as a new Rx for patients who have not had an Rx in the class over the past 12 months

Switches to Contrave Have Increased Relative to Generic Agents Since the Launch of the Patient Campaign (Overall Market) Share of Overall Market (Switches) Orexigen Transition Patient Campaign Source: QuintilesIMS Market Dynamics, Week Ending 02/24/17 Note: Switch data includes add-ons 5.3% 5.7% 6.4% 6.7%

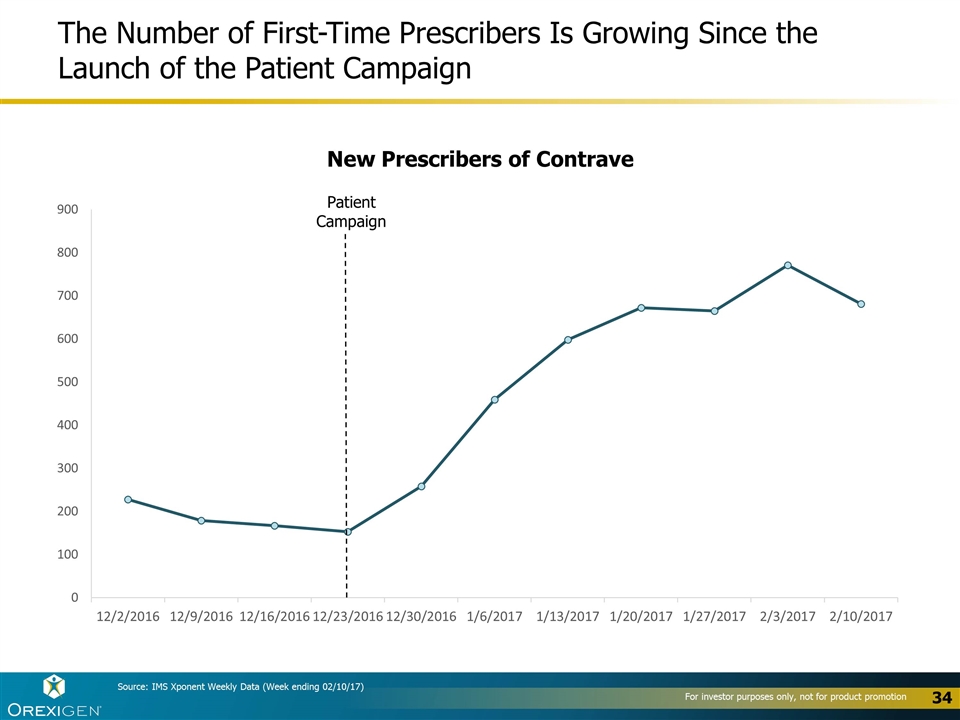

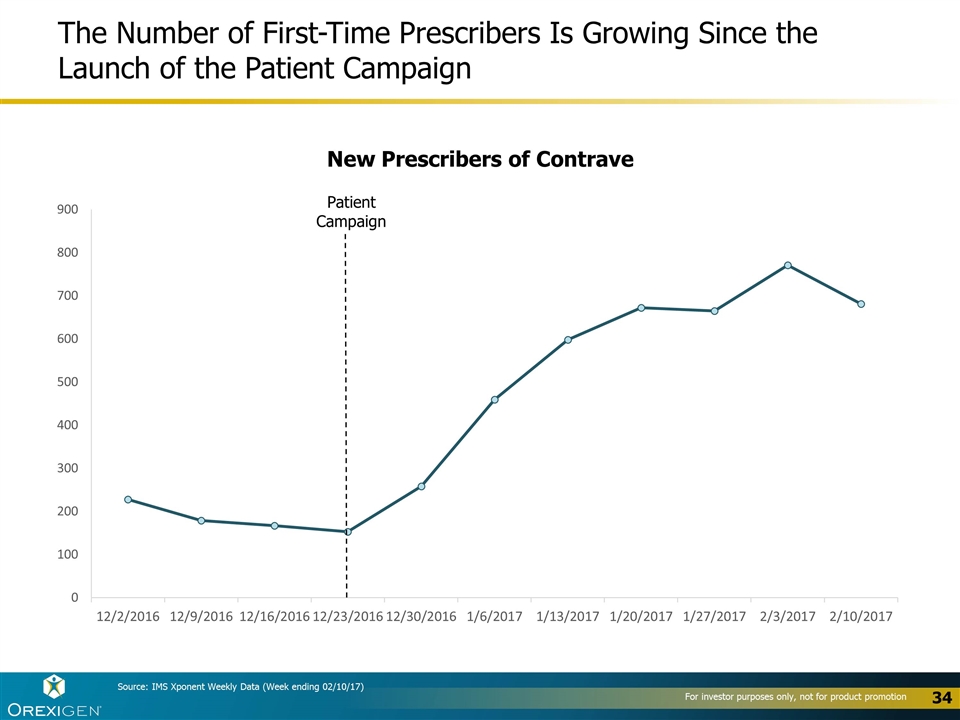

The Number of First-Time Prescribers Is Growing Since the Launch of the Patient Campaign Patient Campaign New Prescribers of Contrave Source: IMS Xponent Weekly Data (Week ending 02/10/17)

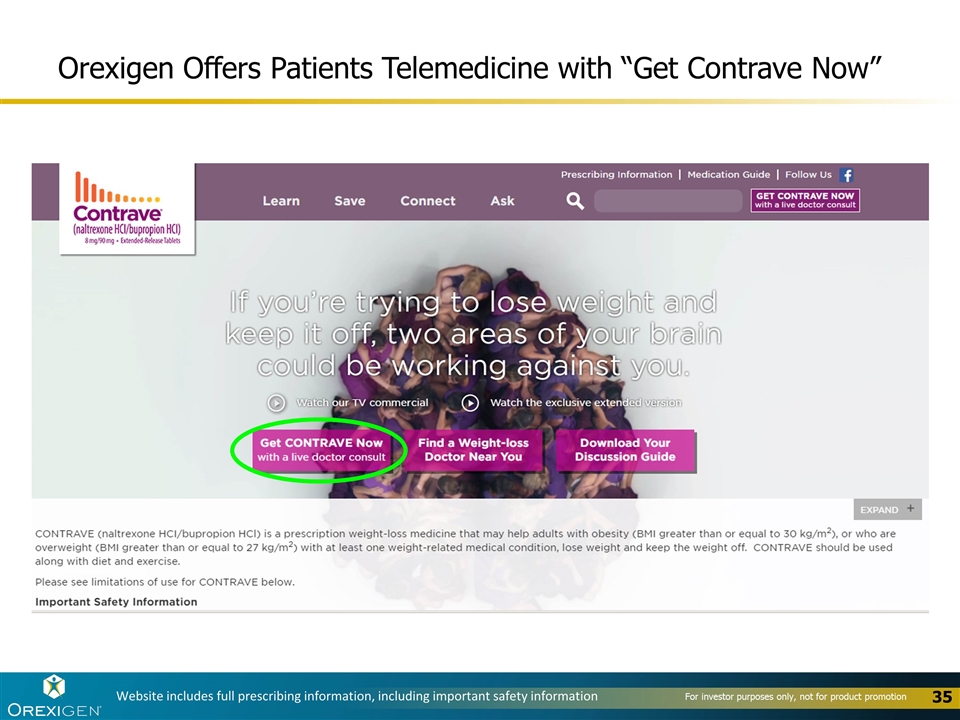

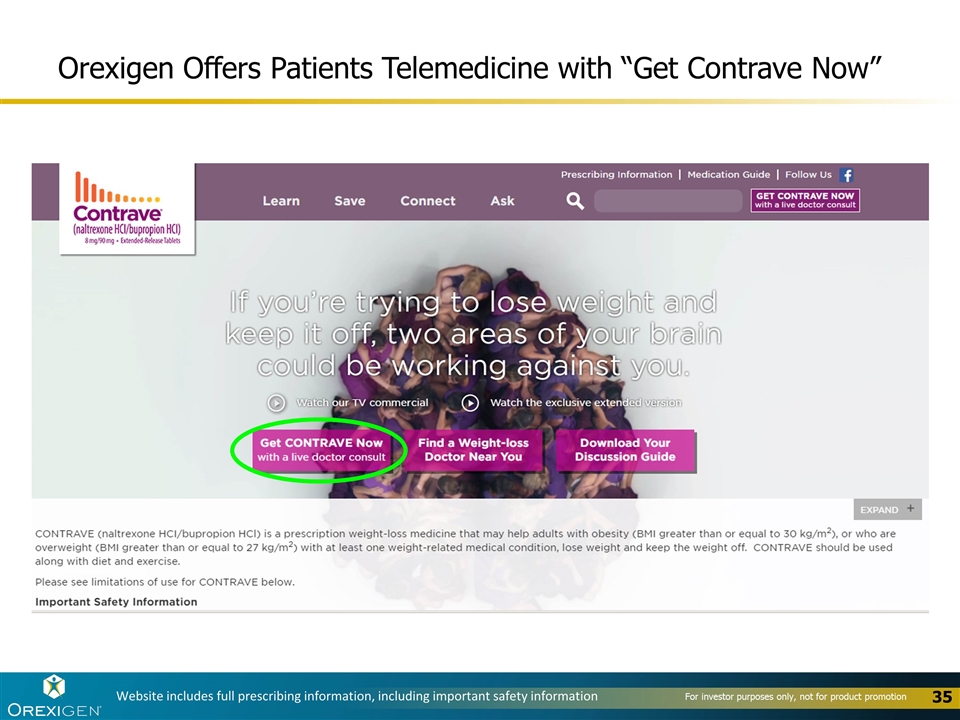

Orexigen Offers Patients Telemedicine with “Get Contrave Now” Website includes full prescribing information, including important safety information

Many patients are struggling with weight loss: Prefer a telemedicine option because of convenience and anonymity Are already part of online weight loss communities for diet and exercise (and can be accessed efficiently) Straightforward diagnosis and assessment: Indicated: BMI, risk factors Exclusion Criteria: age, uncontrolled b.p., contraindicated meds, etc. Contrave is not a DEA scheduled, controlled substance Telemedicine has become widely available and cost-effective DTC campaign and website are effectively providing patients with the telemedicine option Why Telemedicine for Contrave?

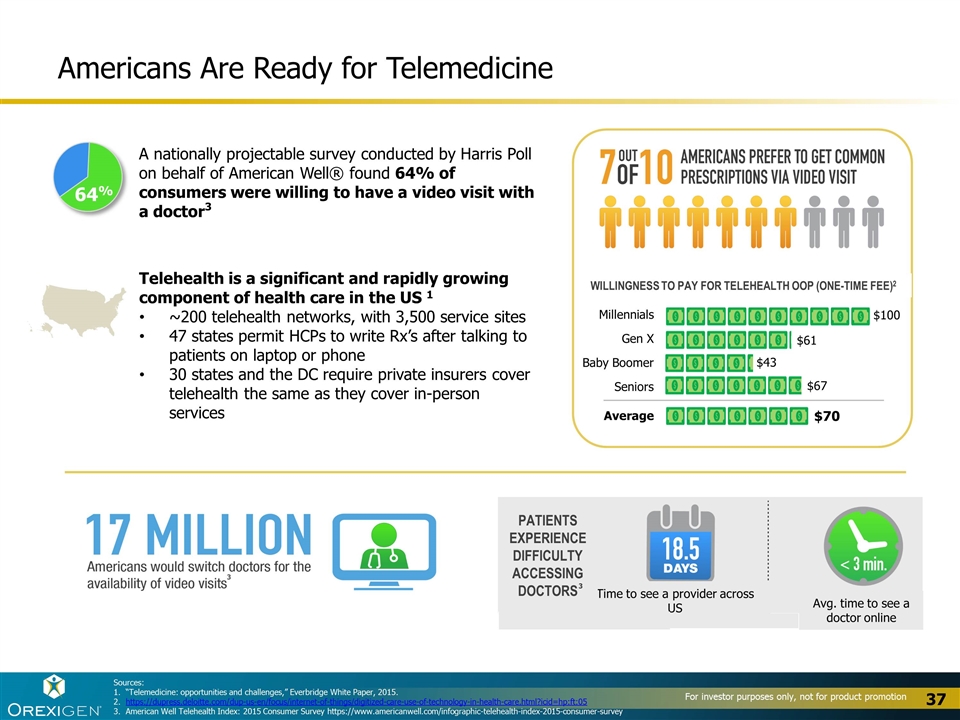

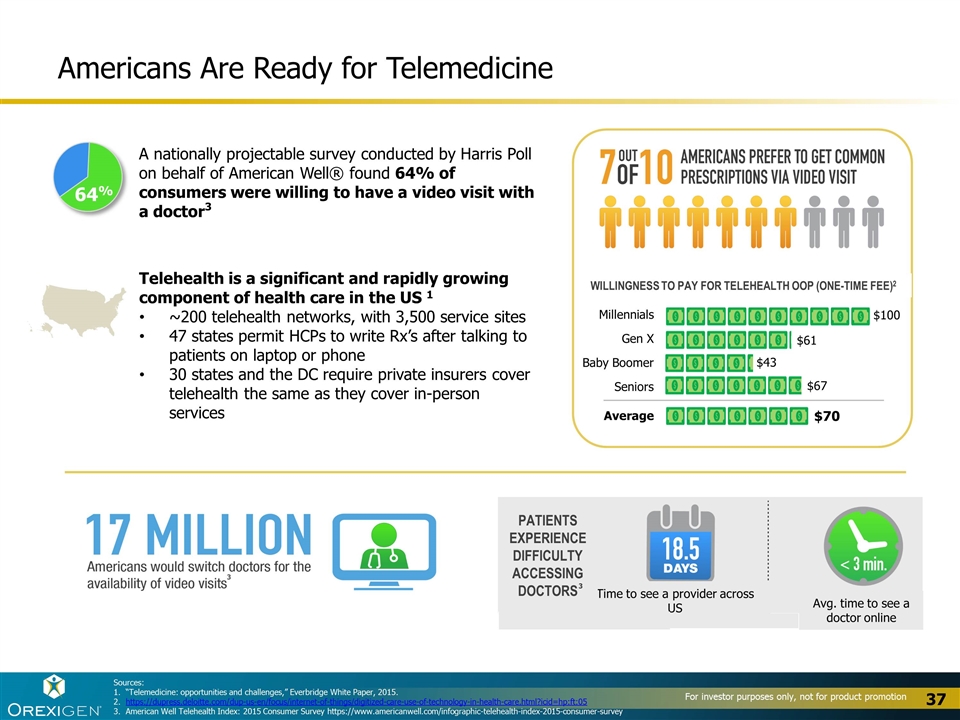

Americans Are Ready for Telemedicine Telehealth is a significant and rapidly growing component of health care in the US 1 ~200 telehealth networks, with 3,500 service sites 47 states permit HCPs to write Rx’s after talking to patients on laptop or phone 30 states and the DC require private insurers cover telehealth the same as they cover in-person services 64% A nationally projectable survey conducted by Harris Poll on behalf of American Well® found 64% of consumers were willing to have a video visit with a doctor3 Time to see a provider across US Avg. time to see a doctor online Patients experience difficulty accessing doctors Millennials Gen X Baby Boomer Seniors Average Willingness to pay for telehealth OOP (one-time fee)2 $70 $43 $61 $100 $67 Sources: “Telemedicine: opportunities and challenges,” Everbridge White Paper, 2015. https://dupress.deloitte.com/dup-us-en/focus/internet-of-things/digitized-care-use-of-technology-in-health-care.html?icid=hp:ft:05 American Well Telehealth Index: 2015 Consumer Survey https://www.americanwell.com/infographic-telehealth-index-2015-consumer-survey 3 3

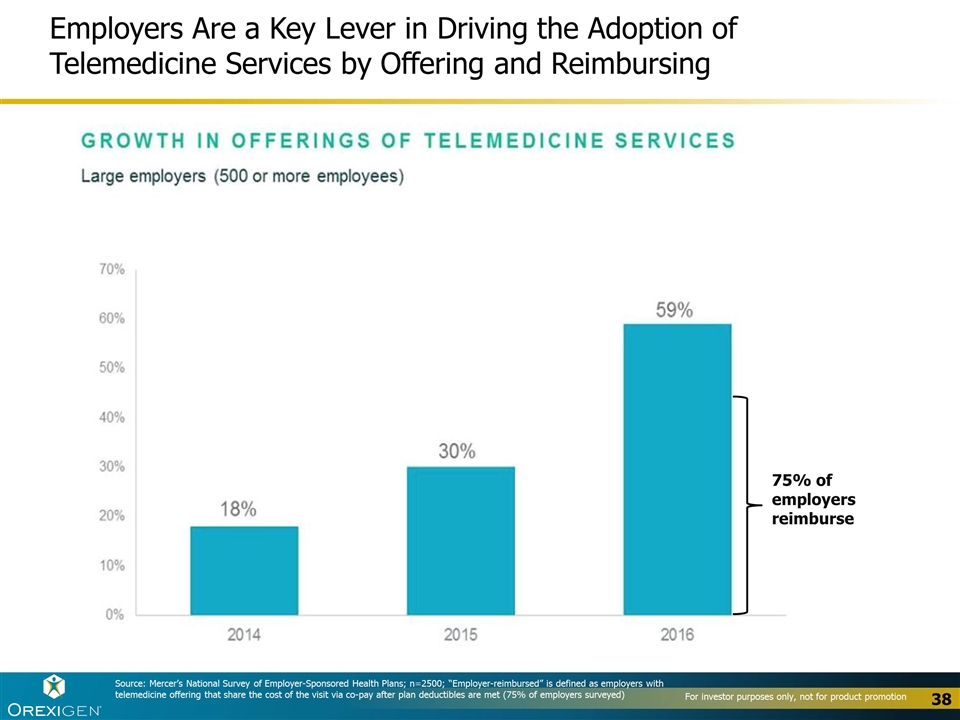

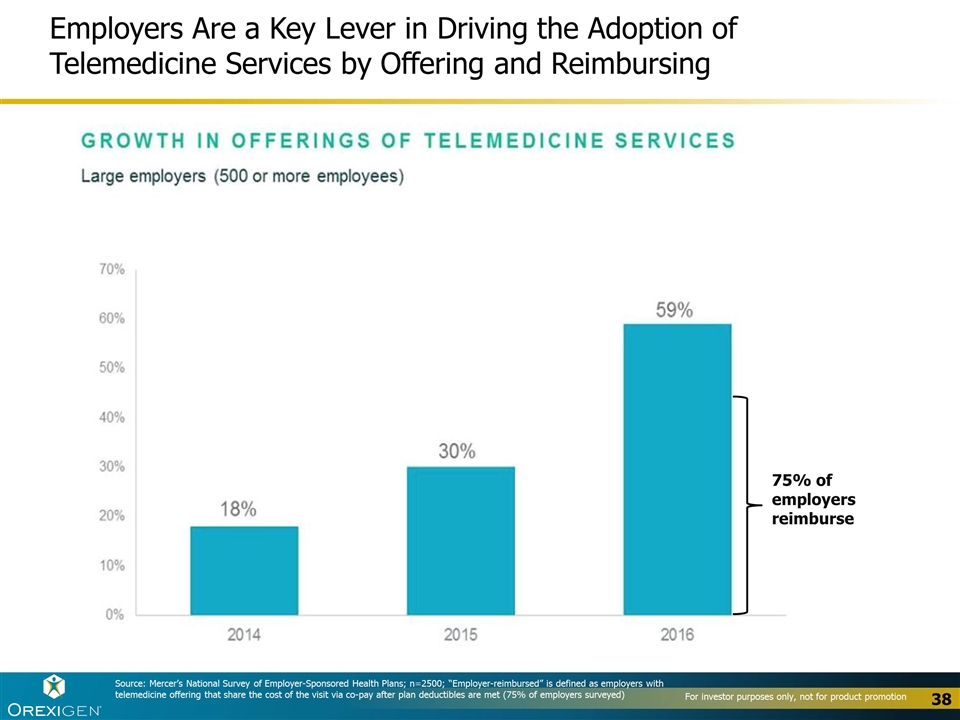

Employers Are a Key Lever in Driving the Adoption of Telemedicine Services by Offering and Reimbursing Source: Mercer’s National Survey of Employer-Sponsored Health Plans; n=2500; “Employer-reimbursed” is defined as employers with telemedicine offering that share the cost of the visit via co-pay after plan deductibles are met (75% of employers surveyed) 75% of employers reimburse

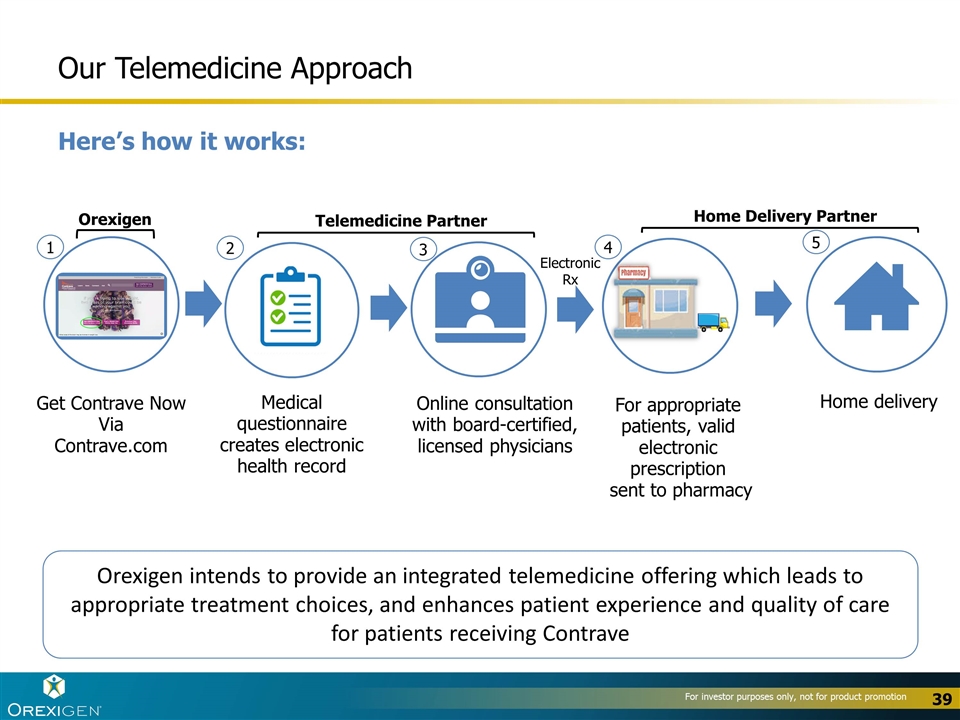

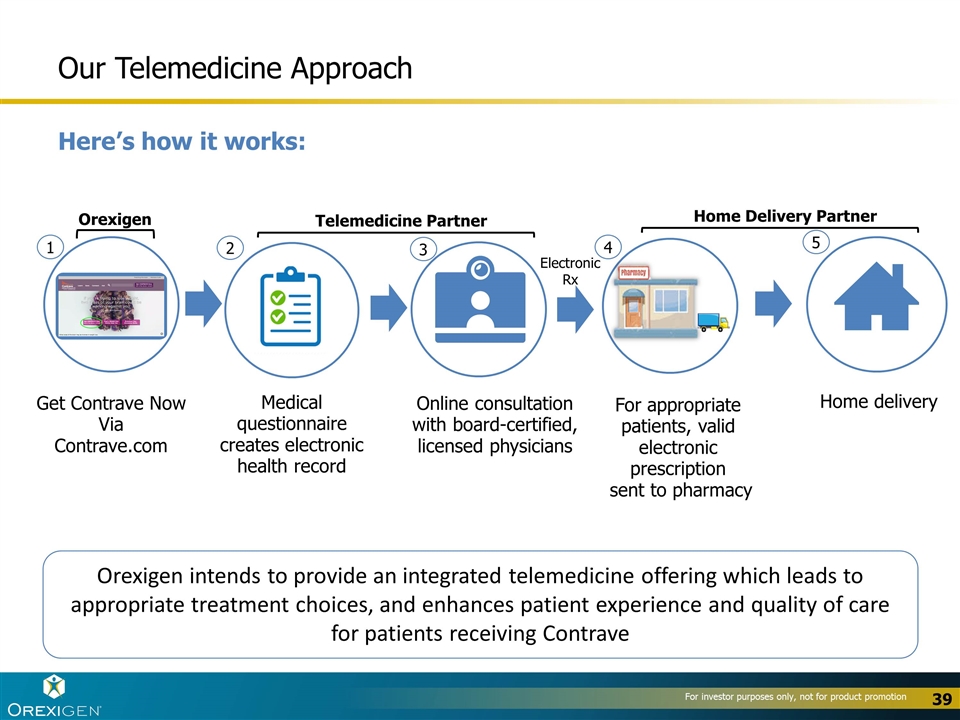

Our Telemedicine Approach Here’s how it works: Get Contrave Now Via Contrave.com Medical questionnaire creates electronic health record Home delivery Online consultation with board-certified, licensed physicians For appropriate patients, valid electronic prescription sent to pharmacy 1 2 3 4 5 Orexigen intends to provide an integrated telemedicine offering which leads to appropriate treatment choices, and enhances patient experience and quality of care for patients receiving Contrave Electronic Rx Orexigen Telemedicine Partner Home Delivery Partner

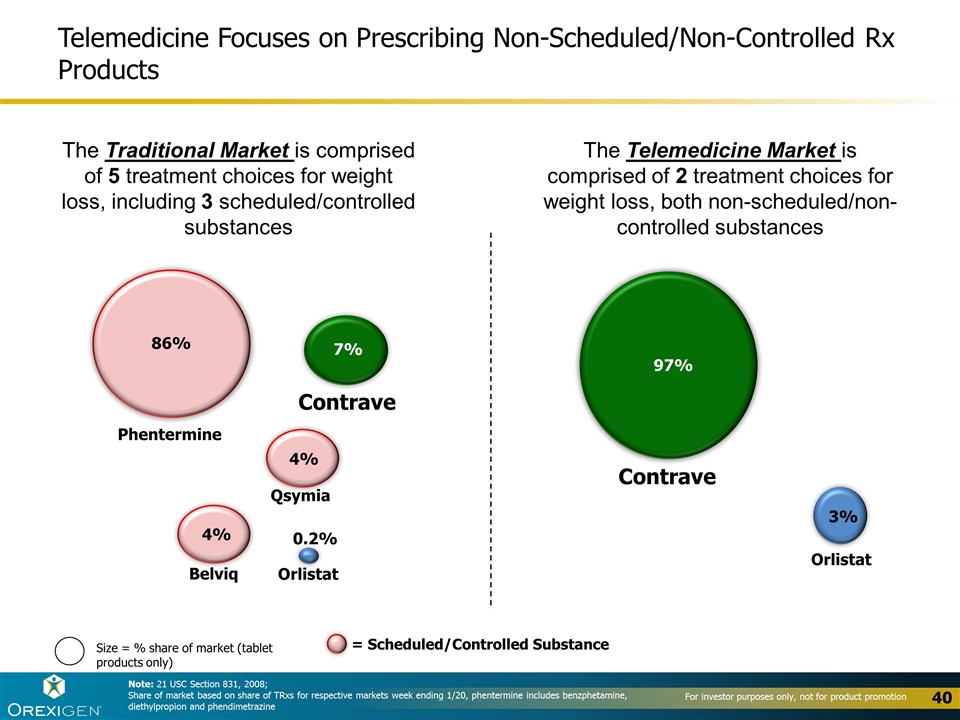

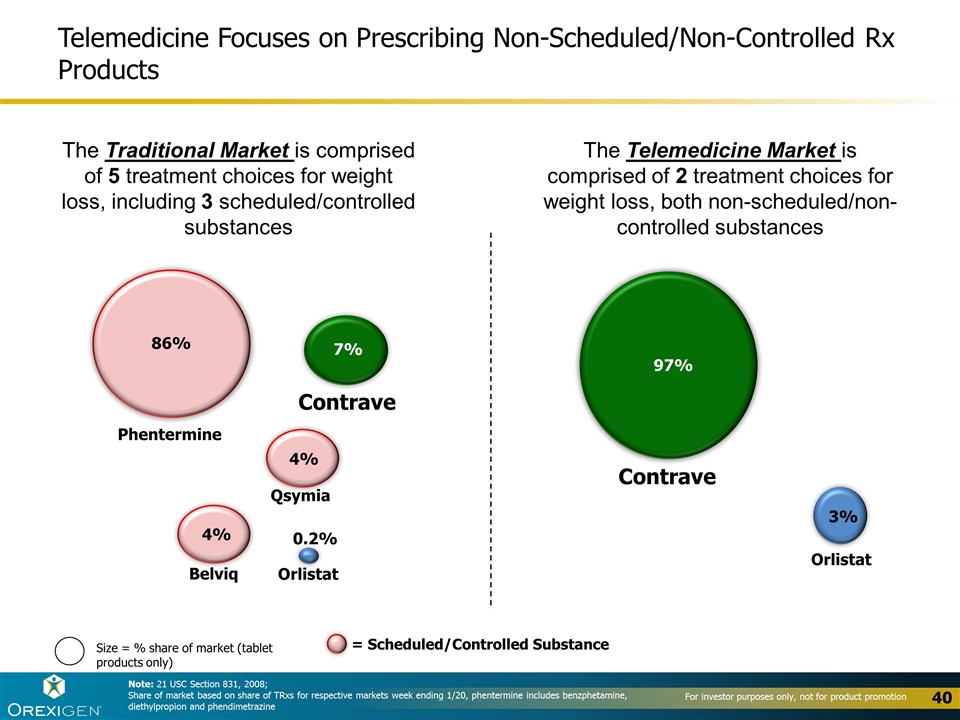

Telemedicine Focuses on Prescribing Non-Scheduled/Non-Controlled Rx Products Note: 21 USC Section 831, 2008; Share of market based on share of TRxs for respective markets week ending 1/20, phentermine includes benzphetamine, diethylpropion and phendimetrazine Size = % share of market (tablet products only) The Traditional Market is comprised of 5 treatment choices for weight loss, including 3 scheduled/controlled substances Phentermine Contrave Belviq Qsymia Orlistat Orlistat Contrave 86% 7% 4% 4% 0.2% 97% 3% The Telemedicine Market is comprised of 2 treatment choices for weight loss, both non-scheduled/non-controlled substances = Scheduled/Controlled Substance

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

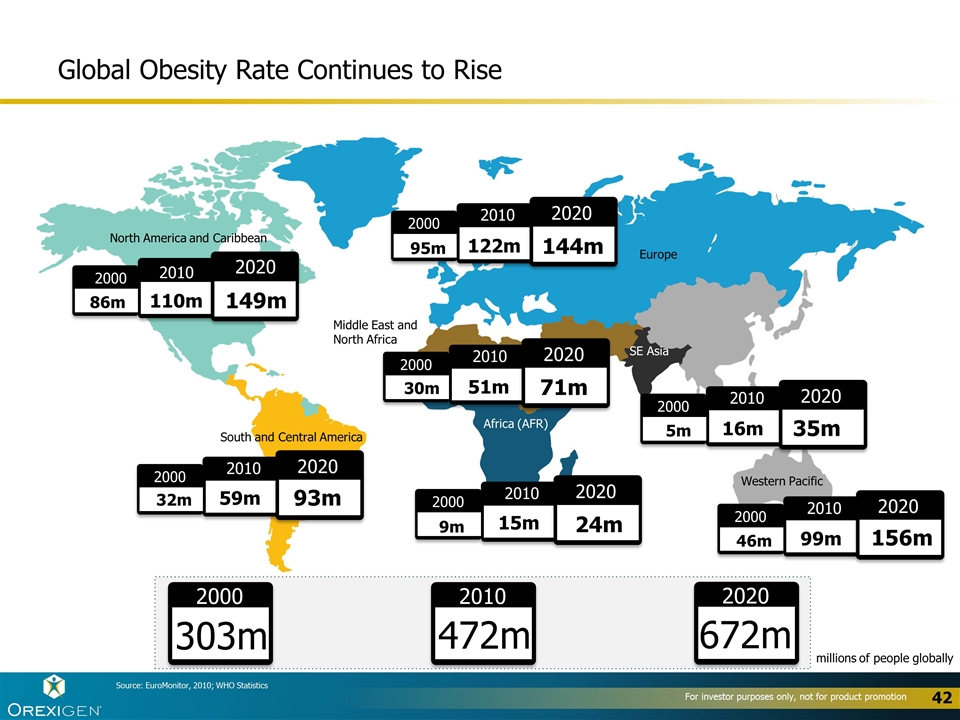

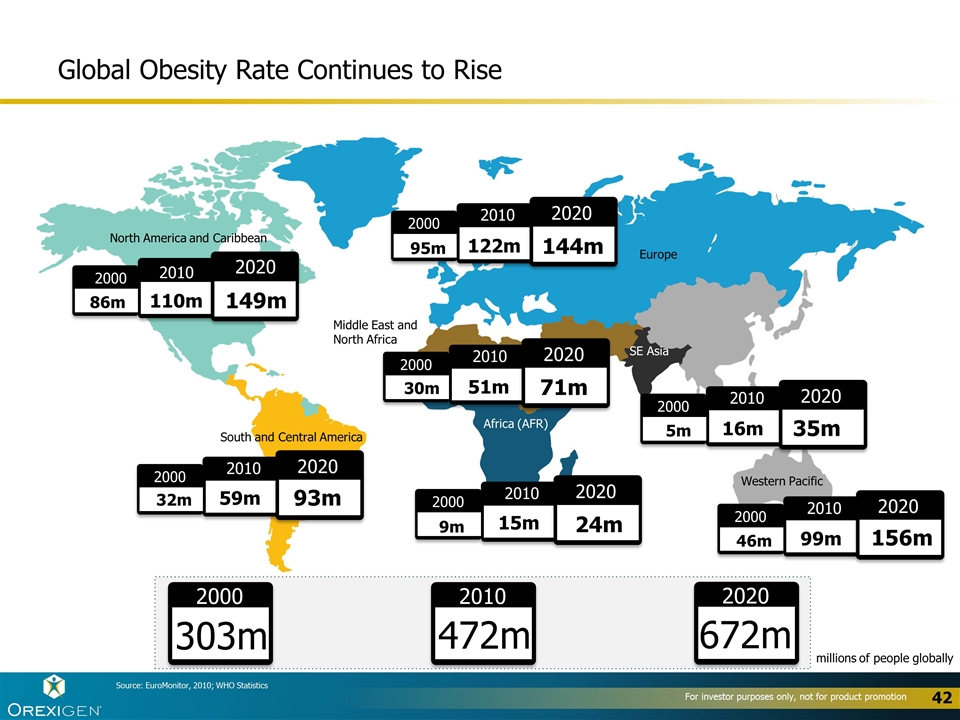

2010 2000 472m 303m 2020 672m 2000 86m 2010 110m 2020 149m North America and Caribbean South and Central America Africa (AFR) Western Pacific SE Asia Europe Source: EuroMonitor, 2010; WHO Statistics Middle East and North Africa millions of people globally 2000 2020 2000 2010 2020 122m 144m 95m 2000 2000 2010 2020 51m 71m 30m 2000 2000 2010 2020 16m 35m 5m 2000 2000 2010 2020 99m 156m 46m 2000 2000 2010 2020 15m 24m 9m 2000 2000 2010 2020 59m 93m 32m Global Obesity Rate Continues to Rise

Increased Pace of OUS Deal Signings in 2016 South Korea Central & Eastern Europe: Spain Canada Australia/ New Zealand South Africa 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 UK Ireland Middle East: Turkey Greece Poland Slovenia Slovakia Czech Hungary Croatia Lithuania Estonia Latvia Bulgaria Romania Serbia Bosnia and Herzegovina Albania Kosovo Macedonia Montenegro Cyprus Saudi Arabia Bahrain UAE Iran Iraq Lebanon Jordan Qatar Oman Kuwait 2015 2016

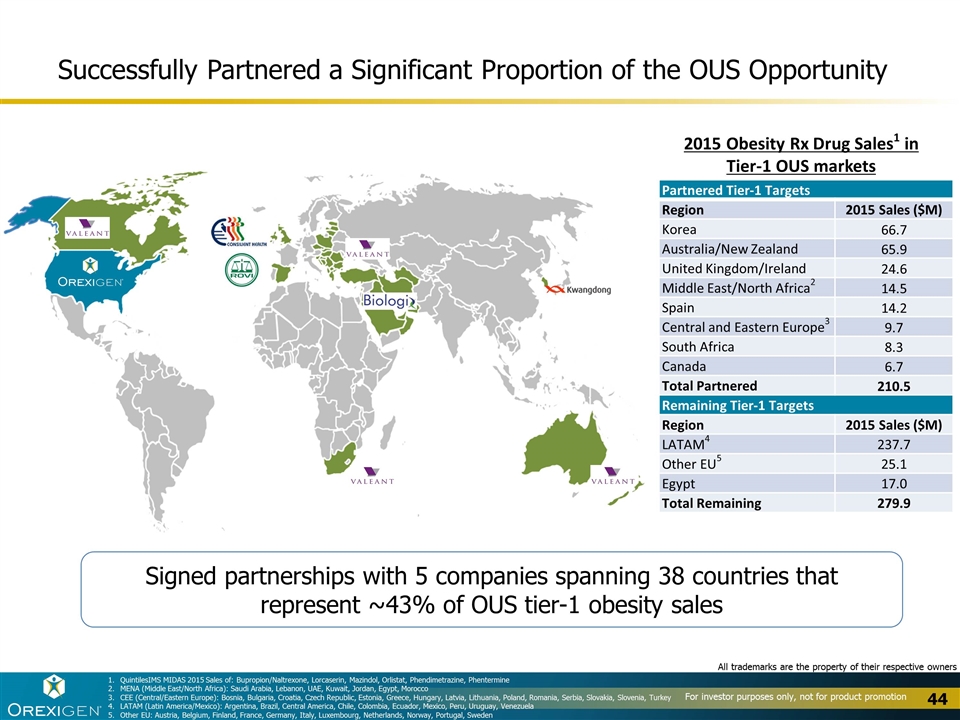

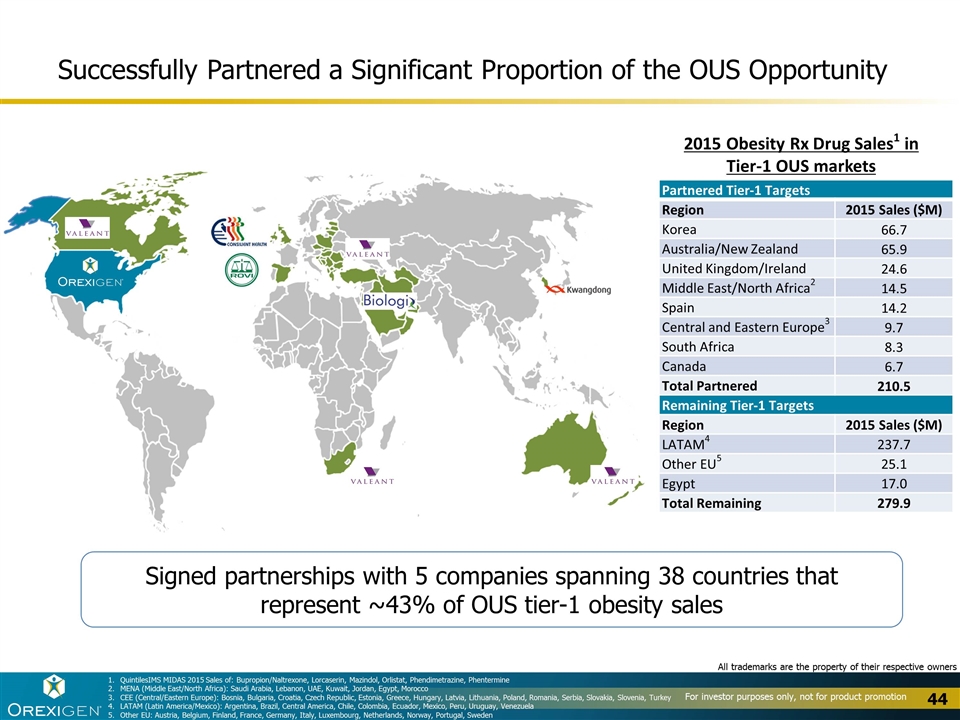

Signed partnerships with 5 companies spanning 38 countries that represent ~43% of OUS tier-1 obesity sales 2015 Obesity Rx Drug Sales1 in Tier-1 OUS markets Successfully Partnered a Significant Proportion of the OUS Opportunity Partnered Tier-1 Targets Region 2015 Sales ($M) Korea 66.7 Australia/New Zealand 65.9 United Kingdom/Ireland 24.6 Middle East/North Africa2 14.5 Spain 14.2 Central and Eastern Europe3 9.7 South Africa 8.3 Canada 6.7 Total Partnered 210.5 Remaining Tier-1 Targets Region 2015 Sales ($M) LATAM4 237.7 Other EU5 25.1 Egypt 17.0 Total Remaining 279.9 QuintilesIMS MIDAS 2015 Sales of: Bupropion/Naltrexone, Lorcaserin, Mazindol, Orlistat, Phendimetrazine, Phentermine MENA (Middle East/North Africa): Saudi Arabia, Lebanon, UAE, Kuwait, Jordan, Egypt, Morocco CEE (Central/Eastern Europe): Bosnia, Bulgaria, Croatia, Czech Republic, Estonia, Greece, Hungary, Latvia, Lithuania, Poland, Romania, Serbia, Slovakia, Slovenia, Turkey LATAM (Latin America/Mexico): Argentina, Brazil, Central America, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay, Venezuela Other EU: Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, Netherlands, Norway, Portugal, Sweden All trademarks are the property of their respective owners

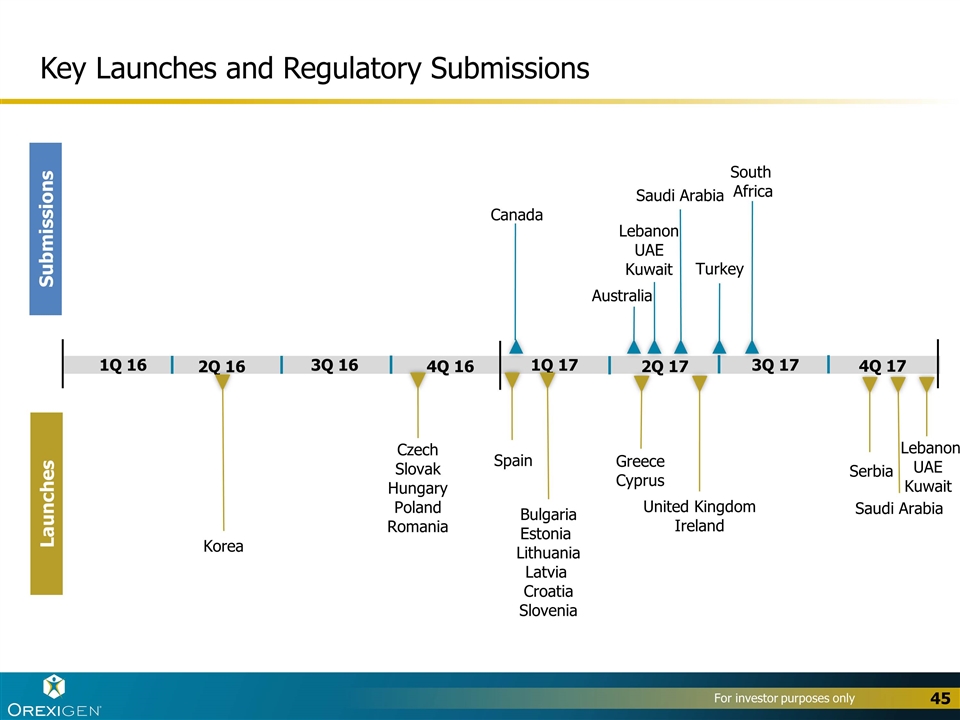

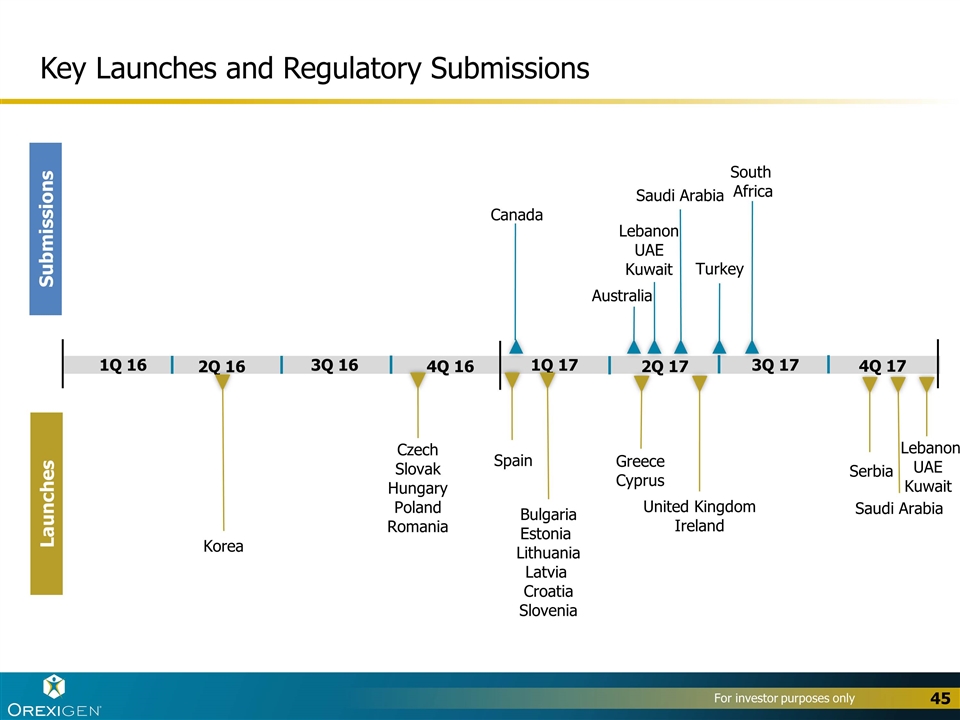

Key Launches and Regulatory Submissions Submissions Launches 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 Saudi Arabia Lebanon UAE Kuwait Serbia South Africa Saudi Arabia Australia Canada Lebanon UAE Kuwait Greece Cyprus United Kingdom Ireland Spain Bulgaria Estonia Lithuania Latvia Croatia Slovenia Korea Czech Slovak Hungary Poland Romania Turkey

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

PMR 2017 2018 2019 2020 2021 2022 2024 DDI ◊ Juvenile Tox ◊ TQT ◊ Renal/Hepatic/Adolescent/Children PK ◊ x x x BE – Pediatric Formulation x Pediatric Phase III (Adolescents/Children) x x Drug Utilization x Observational Database x CVOT (Cardiovascular Outcomes Trial) x Post-Marketing Development Programs on Track ◊ = To date all studies have been completed to agreed regulatory protocols and timelines X = Deliverable due date Engaged with regulatory agencies to determine the most cost-efficient means of delivering high-quality data to satisfy the post-marketing requirements, including the CVOT

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

In 2015 Orexigen exclusively licensed two compound series from Bath University (UK) Extensive preclinical assessments have demonstrated meaningful therapeutic potential Moving both programs forward to key preclinical milestones in 2017 and exploring options for advancing to IND and into clinical trials Orexigen’s Pre-Clinical Analgesic and Addiction-Management Programs

Sources: NEJM 2016;374:154-63; CDC Wonder Addiction Management: Public Health Epidemics Beyond Obesity In 2014 there were 18.9k deaths from prescription-opioid overdose and 10.6k deaths from heroin overdose Opioid addiction is recognized as an urgent public health epidemic in the US Medication-assisted treatment of opioid addiction: market currently valued at >$2B

Medication-Assisted Treatment of Drug Addiction Target Product Profile: opioid and possible cocaine addiction treatment, with clinical efficacy on par with buprenorphine and an improved tolerability and abuse-liability profile NCE: Orvinol/Thevinol derivative with lower activity at the Mu opioid receptor than buprenorphine Preliminary Key Data: Significant inhibition of drug and stress induced relapse behaviors in preclinical studies Activity at Mu Opioid Receptor Binding (nM) Relative Activity Buprenorphine 0.13 ± 0.02 20 ± 6% Orex-1019 0.10 ± 0.02 2 ± 4% OREX-1019 Orex-1019 has equivalent Affinity to Mu Opioid Rec but significantly lower activity than Buprenorphine A buprenorphine analog attenuates drug-primed and stress-induced cocaine reinstatement. T.M. Hillhouse, J.E. Hallahan, E.M. Jutkiewicz, S.M. Husbands, J.R. Traynor. Neuroscience 2016

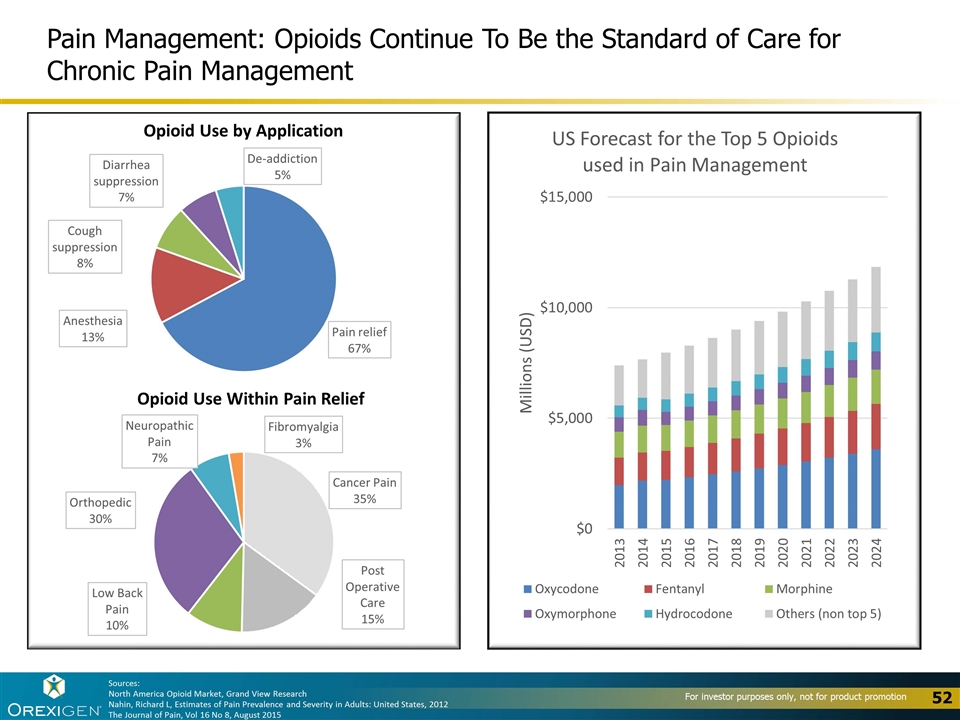

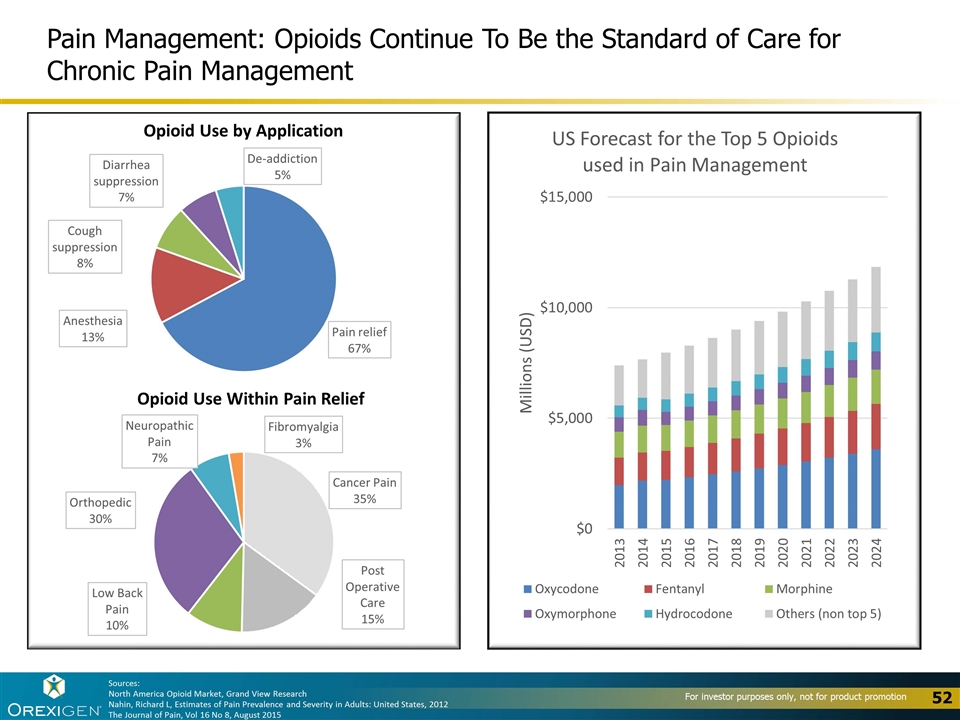

Sources: North America Opioid Market, Grand View Research Nahin, Richard L, Estimates of Pain Prevalence and Severity in Adults: United States, 2012 The Journal of Pain, Vol 16 No 8, August 2015 Pain Management: Opioids Continue To Be the Standard of Care for Chronic Pain Management

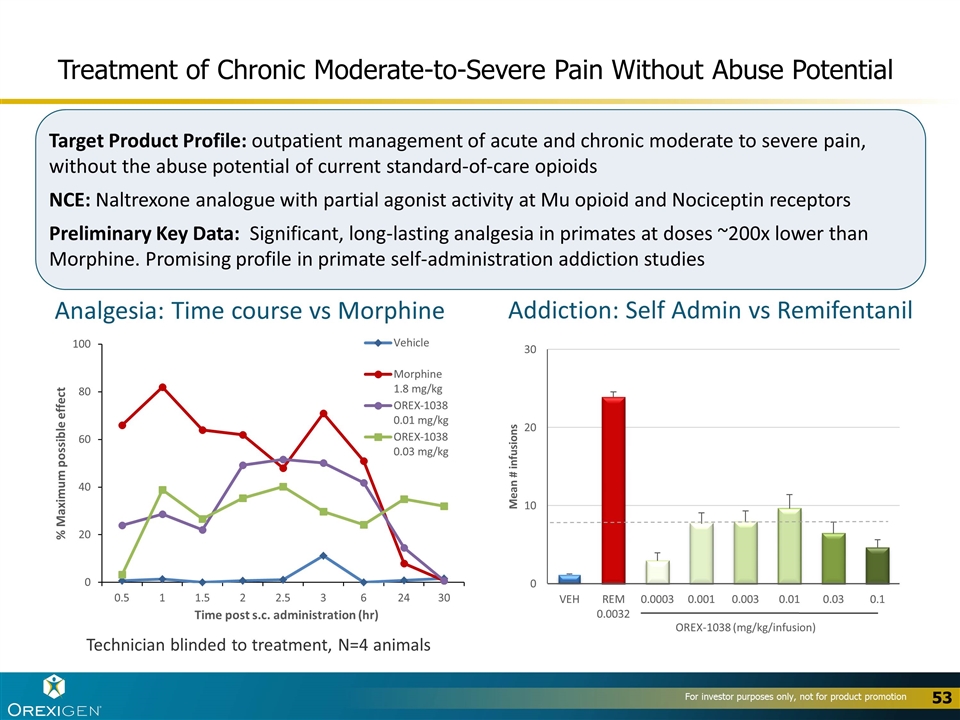

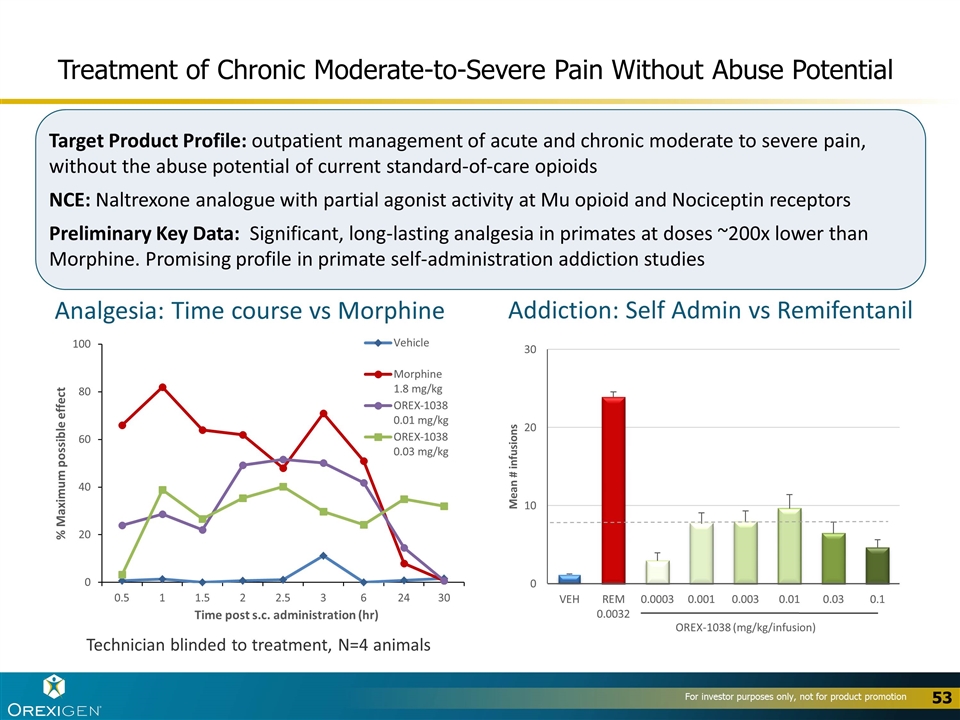

Treatment of Chronic Moderate-to-Severe Pain Without Abuse Potential Target Product Profile: outpatient management of acute and chronic moderate to severe pain, without the abuse potential of current standard-of-care opioids NCE: Naltrexone analogue with partial agonist activity at Mu opioid and Nociceptin receptors Preliminary Key Data: Significant, long-lasting analgesia in primates at doses ~200x lower than Morphine. Promising profile in primate self-administration addiction studies Technician blinded to treatment, N=4 animals Addiction: Self Admin vs Remifentanil Analgesia: Time course vs Morphine

Review of 2016 and Preview of 2017 Strategy for Orexigen Re-Launch of Contrave Early Results for Orexigen Commercialization of Contrave Global Partnering Progress Post-Marketing Studies Early Program Development Summary

Drive Contrave growth in the US Implement an innovative, patient-focused education and awareness campaign Integrate physician programs with patient programs to drive higher quality discussions on Rx-assisted weight loss Realize significant OUS opportunity Support successful launches and approvals in partnered territories 2017 A Value Inflection Year Advance early-stage programs toward IND Expand differentiated commercial strategies (e.g. telemedicine) Leverage a successful commercial infrastructure with additional products Reach agreement with regulators on most cost-efficient means of satisfying the CV PMR Manage global supply chain to lower production costs Diligently manage expenses Actively adjust capital allocations to achieve highest ROI Carefully manage operating expenses Grow global net sales An eye to the future

www.contrave.com