Cantor Fitzgerald Healthcare Conference Michael Narachi Chief Executive Officer September 27, 2017 Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements about Orexigen Therapeutics, Inc. and its Contrave® product. Words such as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “should,” “intends,” “potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to identify forward‐looking statements. These statements are based on the Company‘s current beliefs and expectations. These forward‐looking statements include statements regarding: the potential success of marketing and commercialization efforts for Contrave in the United States; the potential for Contrave and MysimbaTM to achieve commercial success globally, including through potential partnership arrangements outside the United States, and the potential timing of related regulatory filings; the Company’s future financial and sales projections, including future expectations regarding net sales, cash operating expense and market share, its expectation for profitable operations by 2019 and its sales growth projections through 2019; and the status of various strategic plans and initiatives. The inclusion of financial modeling, forward‐looking statements and potential financing and transaction plans and terms should not be regarded as a representation by Orexigen that any of its plans will be achieved. Actual results may differ materially from those expressed or implied in this presentation due to the risk and uncertainties inherent in the Orexigen business, including, without limitation: the potential that the marketing and commercialization of Contrave/Mysimba will not be successful; the Company’s ability to obtain and maintain partnerships and the ability of it or its partners to maintain marketing authorization globally; the Company’s ability to adequately inform consumers about Contrave; the Company‘s ability to successfully commercialize Contrave with a specialty sales force in the United States; the capabilities and performance of various third parties on which it relies for a number of activities related to the manufacture, development and commercialization of Contrave/Mysimba; the estimates of the capacity of manufacturing and the Company’s ability to secure additional manufacturing capabilities; the Company’s ability to successfully complete the post-marketing requirement studies for Contrave; the therapeutic and commercial value of Contrave/Mysimba; competition in the global obesity market, particularly from existing therapies; the Company’s failure to successfully acquire, develop and market additional product candidates or approved products; the Company’s ability to obtain and maintain global intellectual property protection for Contrave and Mysimba; the potential for a Delaware court to determine that one or more of the Company’s patents is not valid or that Actavis' proposed generic product is not infringing each of the patents at issue; other legal or regulatory proceedings against Orexigen, as well as potential reputational harm, as a result of misleading public claims about Orexigen; the Company’s ability to maintain sufficient capital to fund its operations for the foreseeable future; the Company’s ability to satisfy covenants in the indentures for its outstanding indebtedness, including one requirement that the Company generate consolidated net product sales of least $100 million for fiscal 2017; the Company’s ability to satisfy the applicable listing standards of the NASDAQ Global Market; and other risks described in Orexigen’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date hereof, and Orexigen undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Further information regarding these and other risks is included under the heading "Risk Factors" in Orexigen's Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission on August 9, 2017 and its other reports, which are available from the SEC's website (www.sec.gov) and on Orexigen's website (www.orexigen.com) under the heading "Investors." All forward‐looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995.

Indicated for use as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adults with an initial body mass index (BMI) of 30 kg/m2 or greater (obese), or 27 kg/m2 or greater (overweight) in the presence of at least one weight-related comorbid condition. Approved with the brand name Contrave® in the United States and Mysimba® in the European Union. WARNING: SUICIDAL THOUGHTS AND BEHAVIORS Suicidality and Antidepressant Drugs CONTRAVE® is not approved for use in the treatment of major depressive disorder or other psychiatric disorders. CONTRAVE contains bupropion, the same active ingredient as some other antidepressant medications (including, but not limited to, WELLBUTRIN, WELLBUTRIN SR, WELLBUTRIN XL, and APLENZIN). Antidepressants increased the risk of suicidal thoughts and behavior in children, adolescents, and young adults in short-term trials. These trials did not show an increase in the risk of suicidal thoughts and behavior with antidepressant use in subjects over age 24; there was a reduction in risk with antidepressant use in subjects aged 65 and older. In patients of all ages, monitor closely for worsening, and for the emergence of suicidal thoughts and behaviors. Advise families and caregivers of the need for close observation and communication with the prescriber. Not approved for use in pediatric patients. Full Prescribing Information, including Medication Guide, for Contrave is available at http://www.contrave.com/. The Mysimba summary of product characteristics is available at ema.europe.eu. ®

First year results after re-purchasing US rights from our former partner are very positive, with about half of the prior spend Aided by Orexigen’s consumer-focused campaign, Contrave achieved new all time highs in volume, share, and net revenue per Rx Reported strong Q1 and Q2 net sales and TRx growth, and projecting strong Q3 and Q4 2017 performance as compared to 2016 Learning from our first year of commercialization, we have begun our second year with innovative strategies that we believe will drive even greater efficiencies Projecting strong 2018 net sales growth, building from a new, larger base of consumer awareness and overall demand Projecting lower operating expenses for 2018 and Long Range Plan Remain on track for profitability by 2019 Overall Business Performance: Key Takeaways

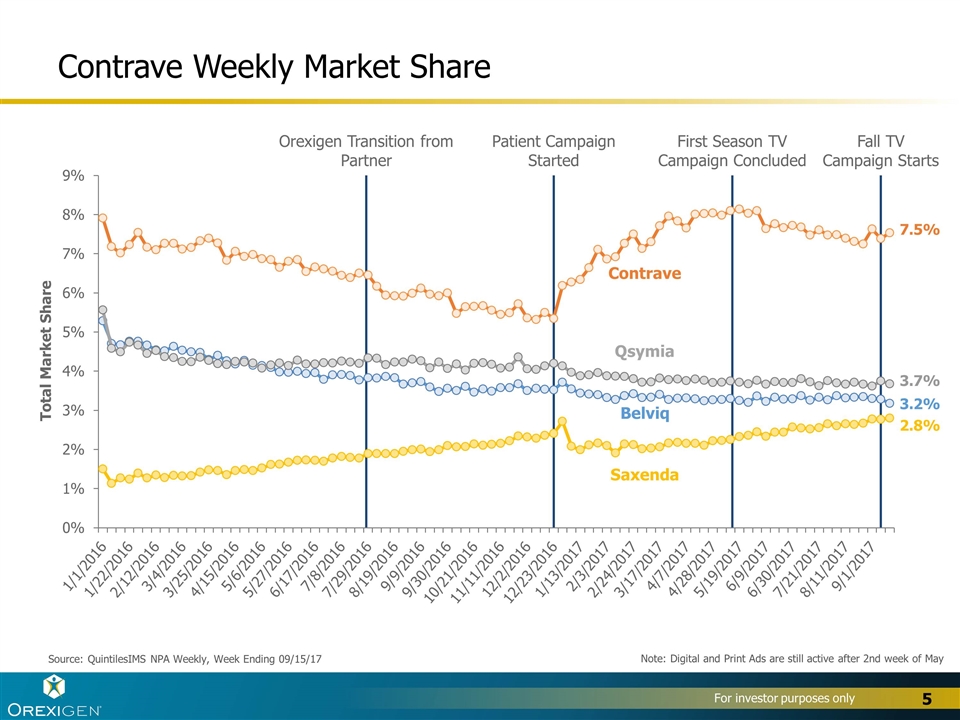

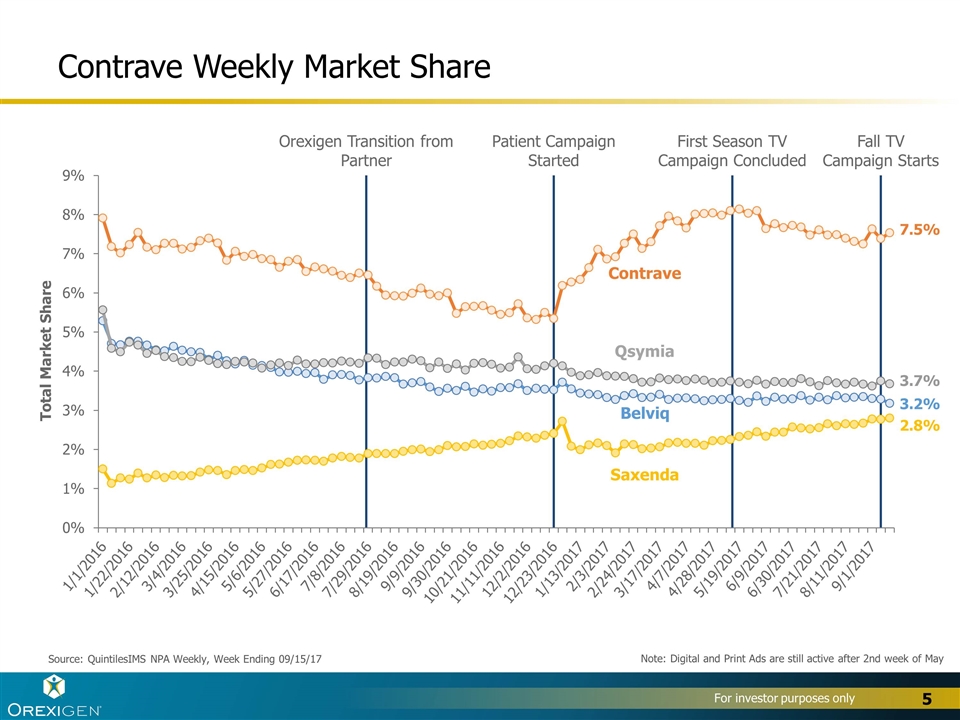

Contrave Weekly Market Share Source: QuintilesIMS NPA Weekly, Week Ending 09/15/17 Contrave Belviq Qsymia Saxenda Note: Digital and Print Ads are still active after 2nd week of May

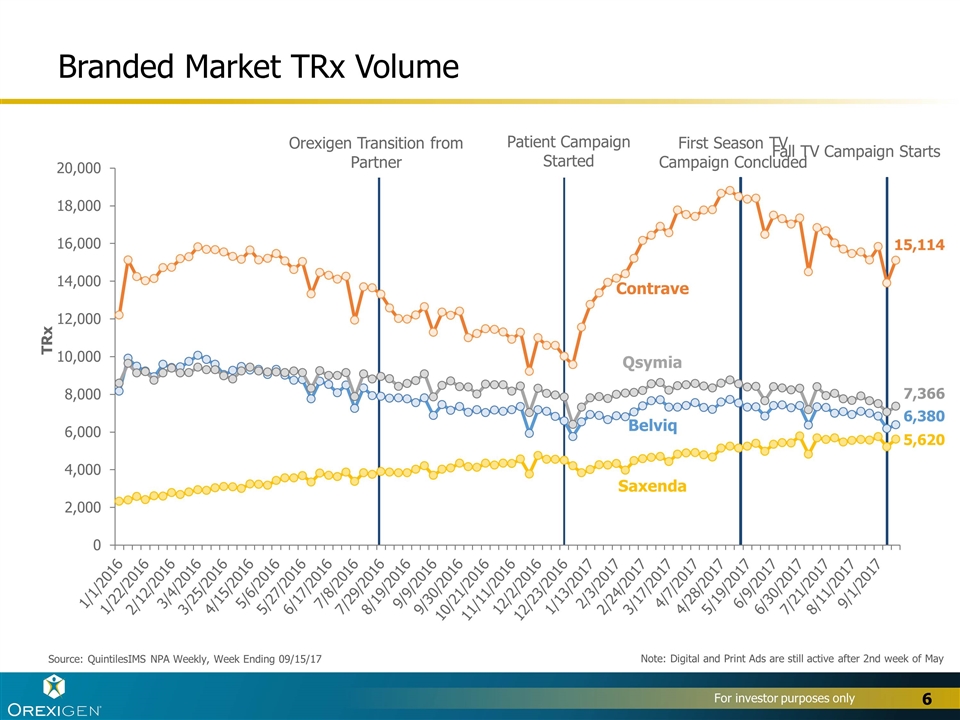

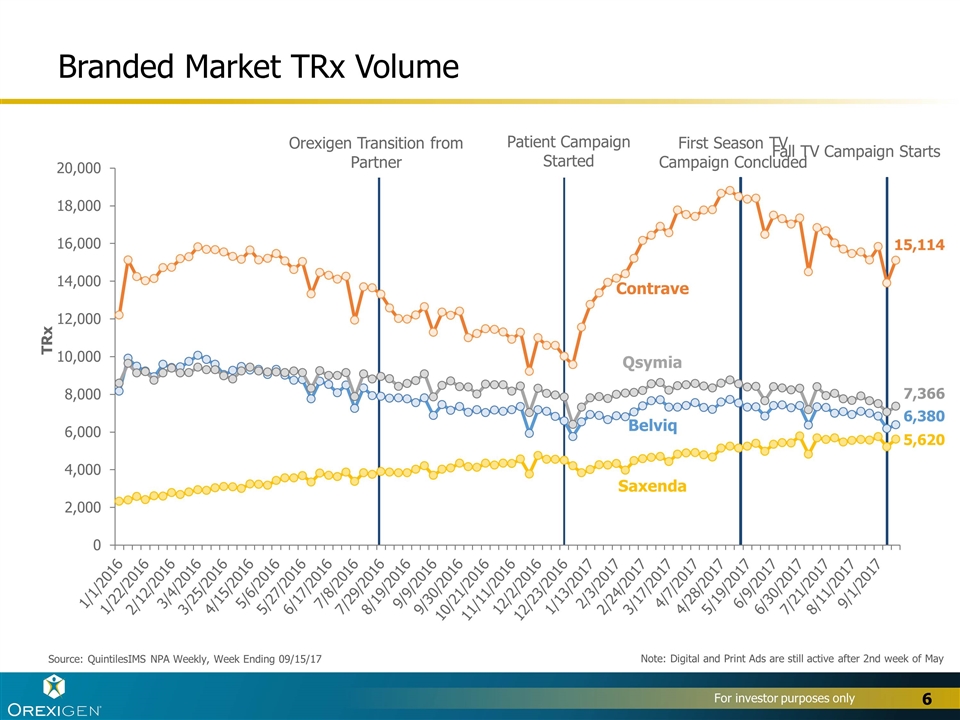

Branded Market TRx Volume Source: QuintilesIMS NPA Weekly, Week Ending 09/15/17 Contrave Belviq Qsymia Saxenda Note: Digital and Print Ads are still active after 2nd week of May

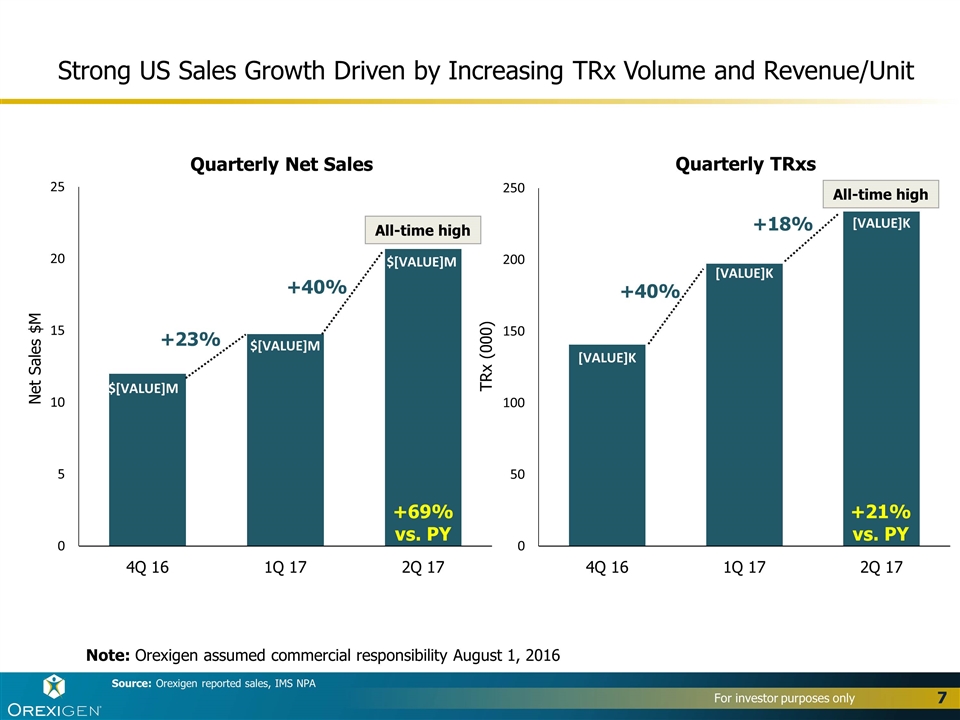

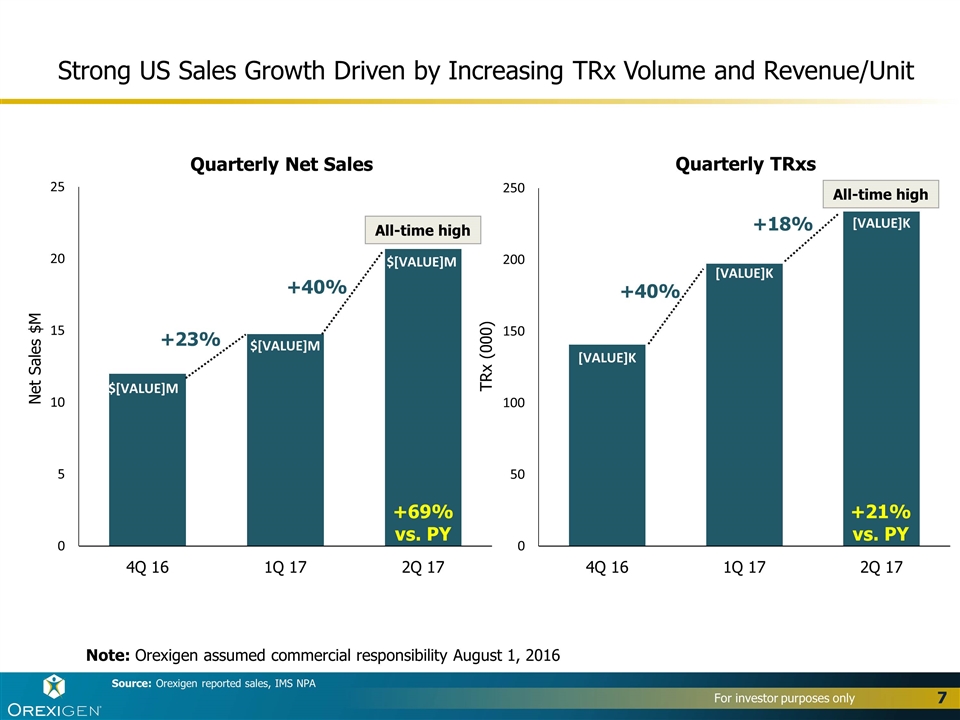

Strong US Sales Growth Driven by Increasing TRx Volume and Revenue/Unit Net Sales $M Note: Orexigen assumed commercial responsibility August 1, 2016 Quarterly Net Sales TRx (000) Quarterly TRxs +40% +18% +23% +40% +21% vs. PY +69% vs. PY Source: Orexigen reported sales, IMS NPA All-time high All-time high

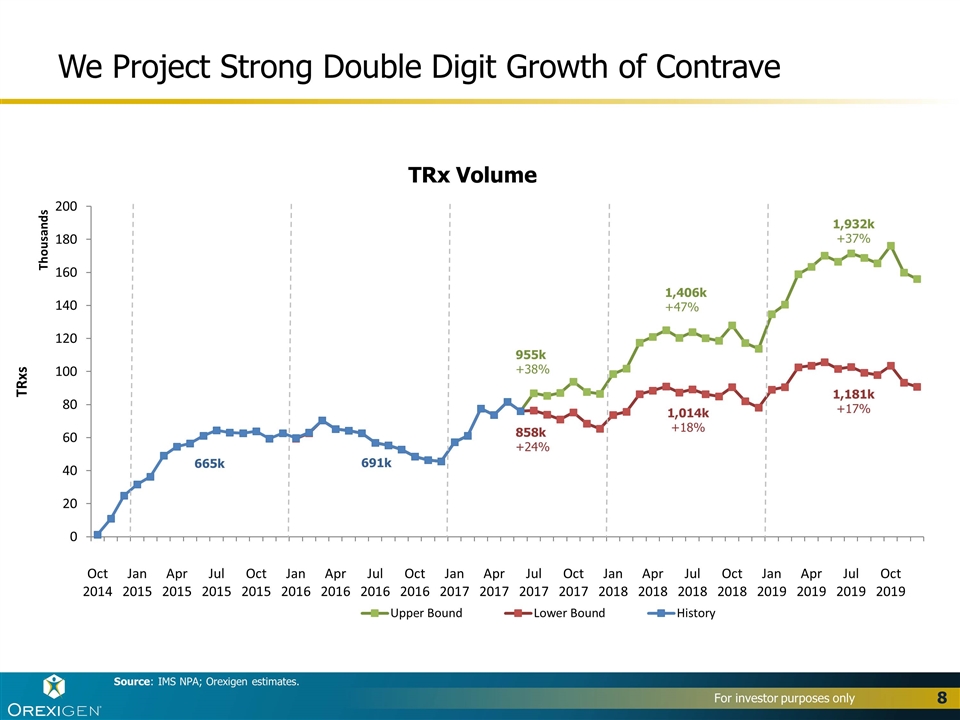

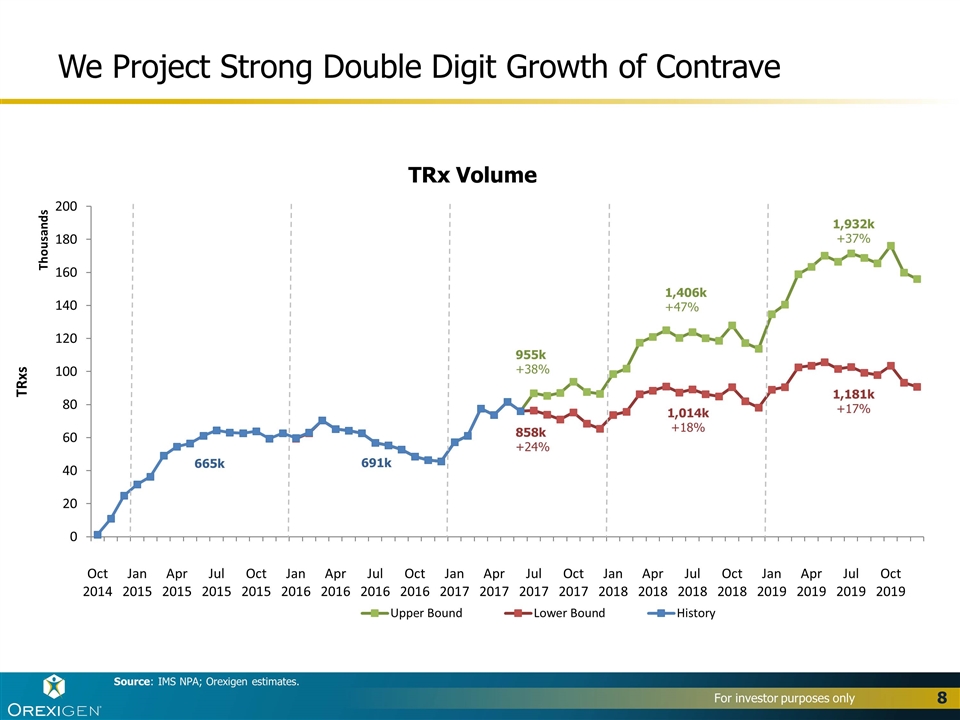

We Project Strong Double Digit Growth of Contrave Source: IMS NPA; Orexigen estimates. TRx Volume

September 2017: Applying Our First Year Learnings to Our Second Year

Plan to activate patients during the Fall season where “back to school, back to routine, back to you” themes can activate weight loss patients Focus patients on Telemedicine and Free Home Delivery via “Get Contrave Now” Main activity runs from mid August to mid October Key Elements of Plan: Fall Season TV Advertising Campaign New Call to Action for Television Ad New Digital/Social Executions New Targeting Strategy Customer Relationship Database e-blasts Sales Force Messaging Aligned with Campaign Active promotion of Free Home Delivery for all customers Learnings to be applied to launch of 2018 season – start 2018 from a higher base of awareness and demand September 2017 Commercial Campaign

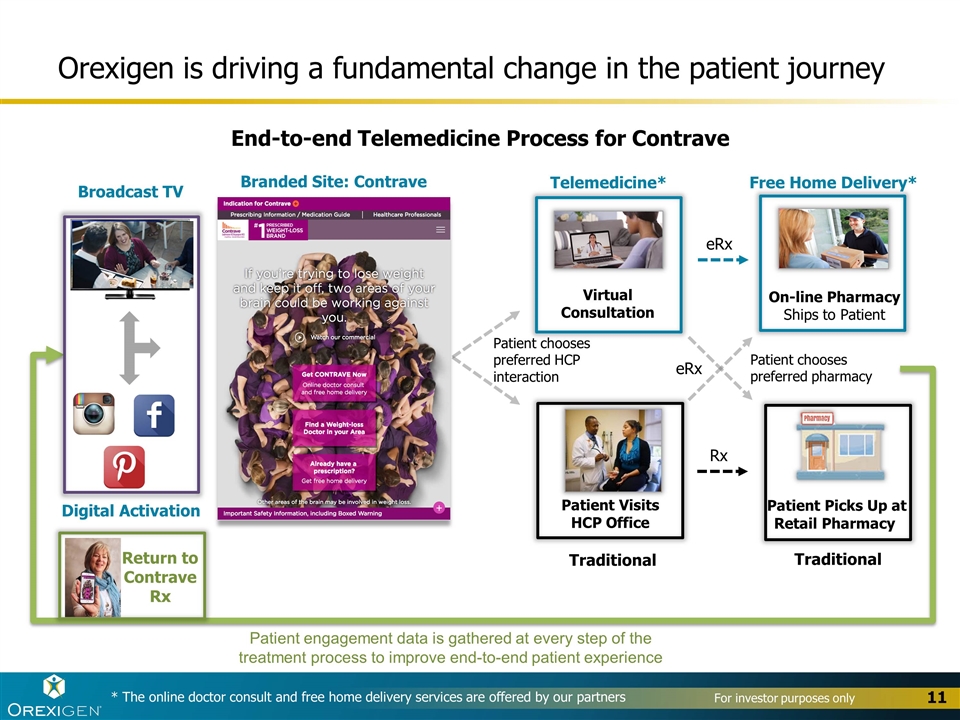

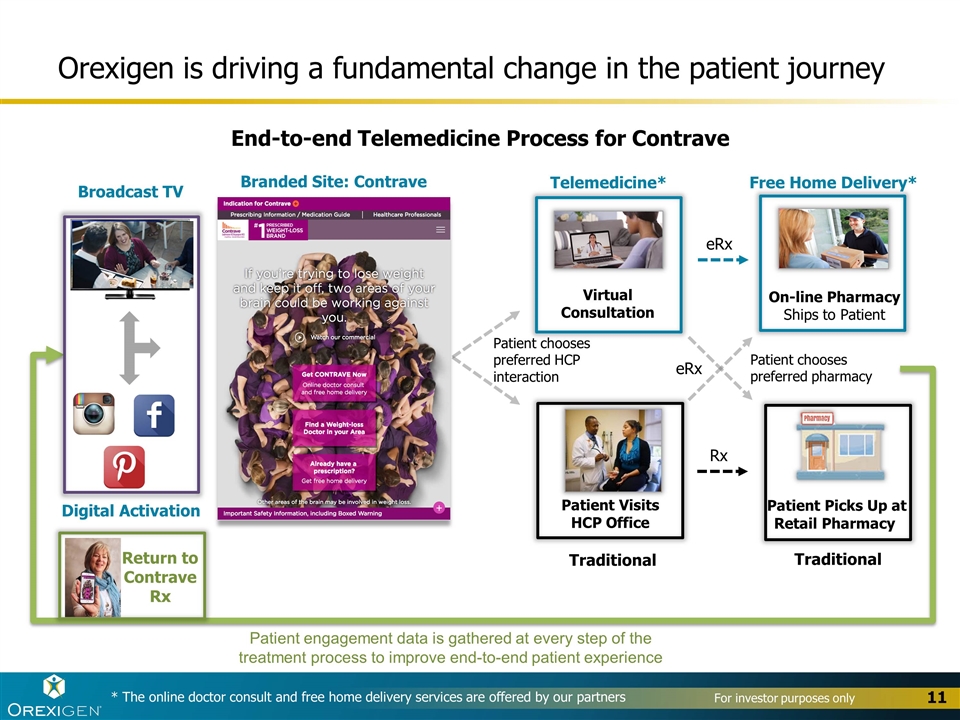

Orexigen is driving a fundamental change in the patient journey Branded Site: Contrave Digital Activation Broadcast TV * The online doctor consult and free home delivery services are offered by our partners Patient chooses preferred HCP interaction Patient Visits HCP Office Traditional eRx Patient Picks Up at Retail Pharmacy Traditional Patient chooses preferred pharmacy eRx Virtual Consultation Telemedicine* On-line Pharmacy Ships to Patient Free Home Delivery* Rx Patient engagement data is gathered at every step of the treatment process to improve end-to-end patient experience End-to-end Telemedicine Process for Contrave Return to Contrave Rx

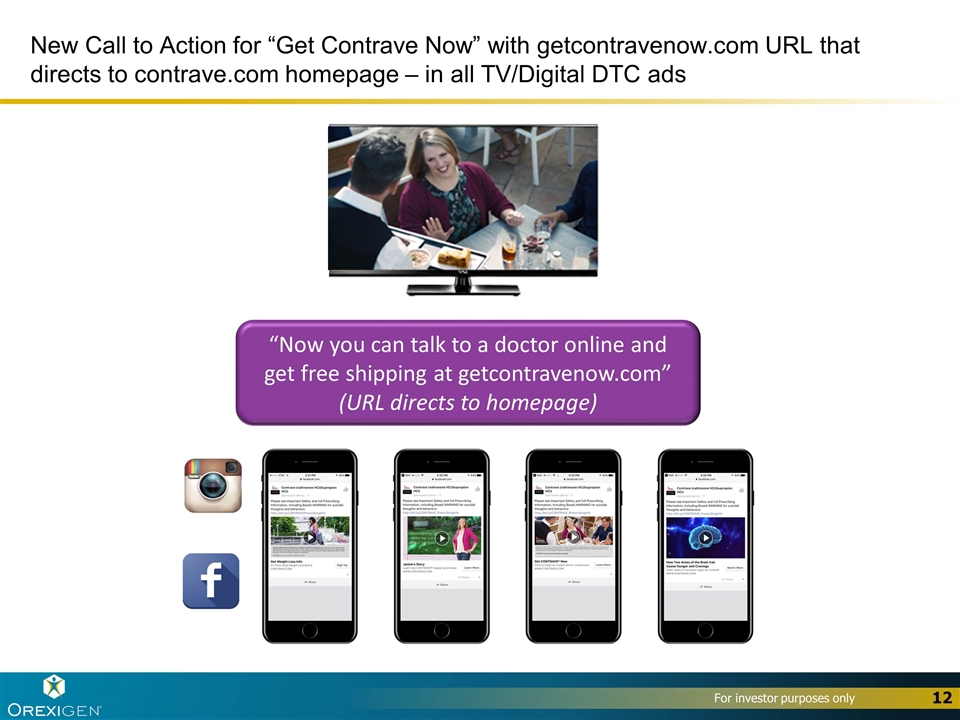

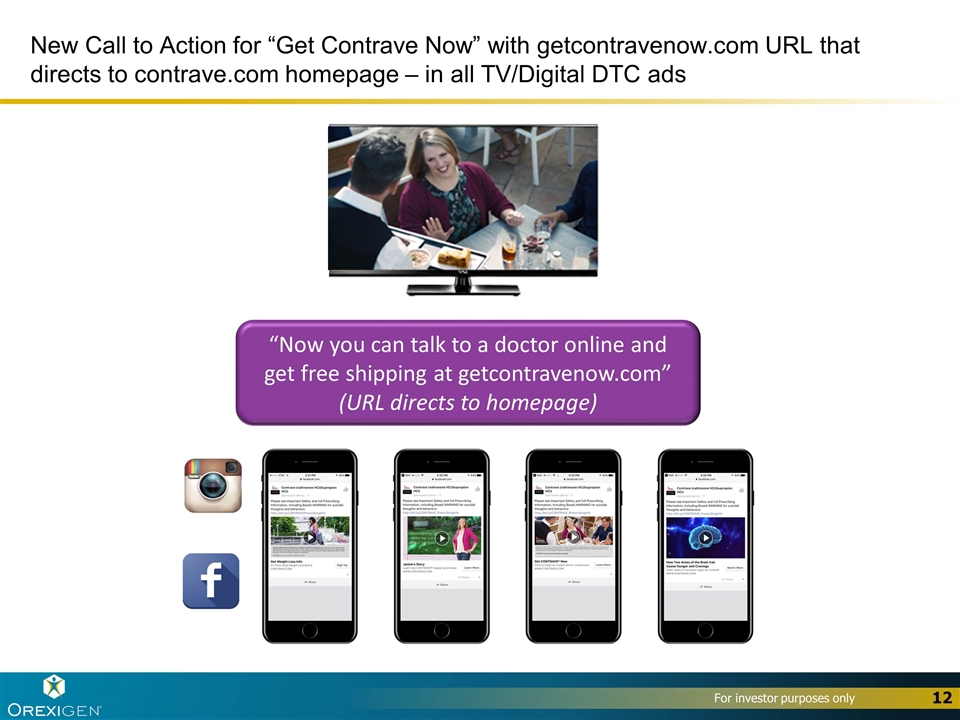

New Call to Action for “Get Contrave Now” with getcontravenow.com URL that directs to contrave.com homepage – in all TV/Digital DTC ads Broadcast TV “Now you can talk to a doctor online and get free shipping at getcontravenow.com” (URL directs to homepage)

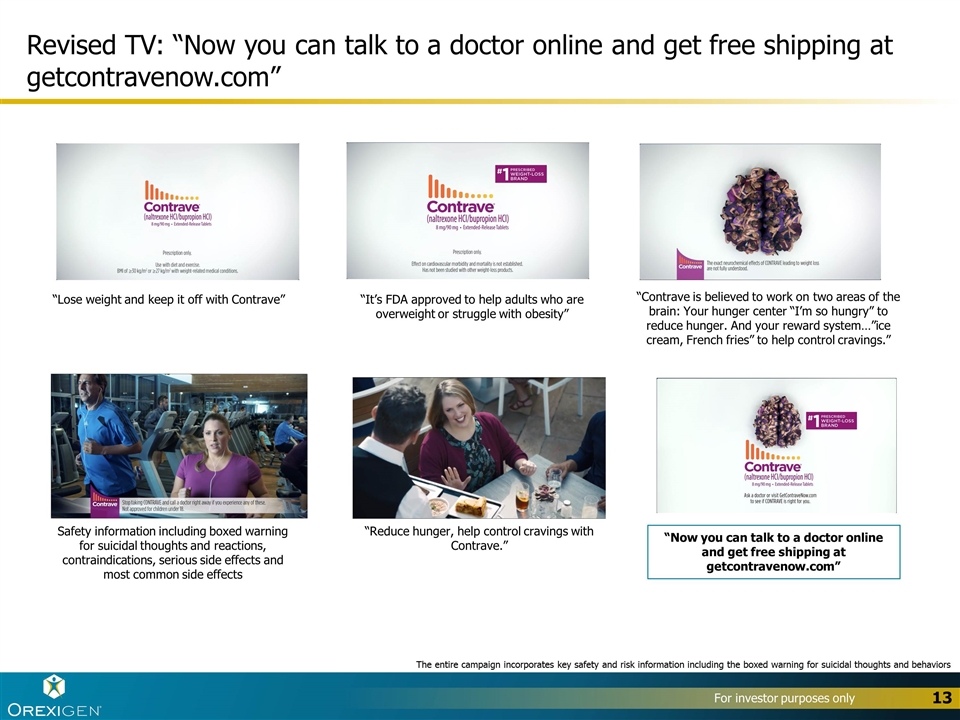

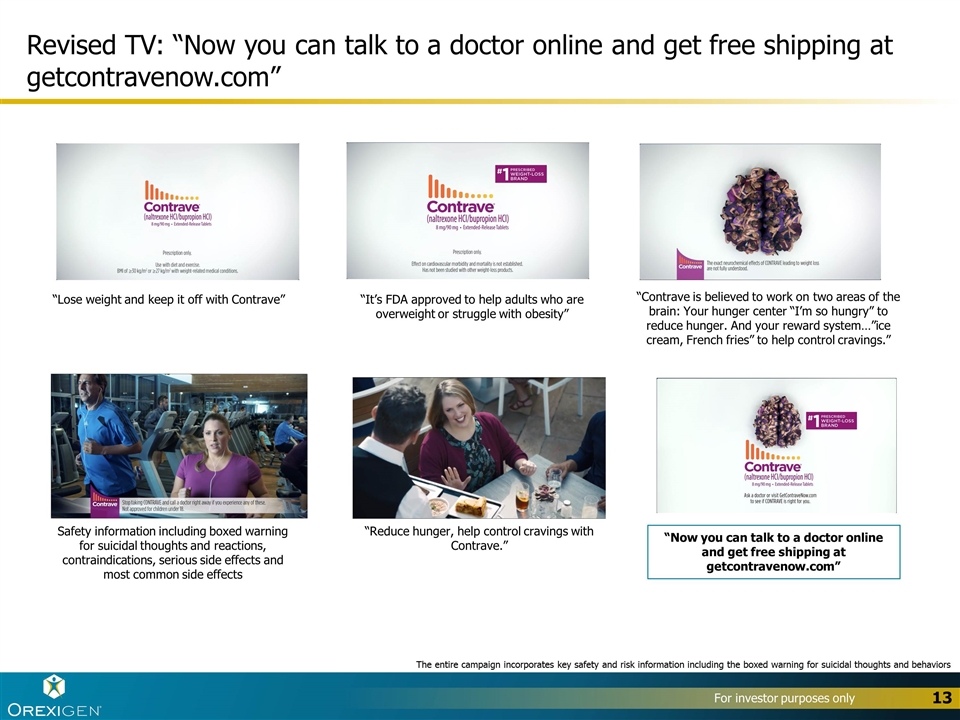

Revised TV: “Now you can talk to a doctor online and get free shipping at getcontravenow.com” “Lose weight and keep it off with Contrave” “Contrave is believed to work on two areas of the brain: Your hunger center “I’m so hungry” to reduce hunger. And your reward system…”ice cream, French fries” to help control cravings.” “It’s FDA approved to help adults who are overweight or struggle with obesity” “Reduce hunger, help control cravings with Contrave.” “Now you can talk to a doctor online and get free shipping at getcontravenow.com” Safety information including boxed warning for suicidal thoughts and reactions, contraindications, serious side effects and most common side effects The entire campaign incorporates key safety and risk information including the boxed warning for suicidal thoughts and behaviors

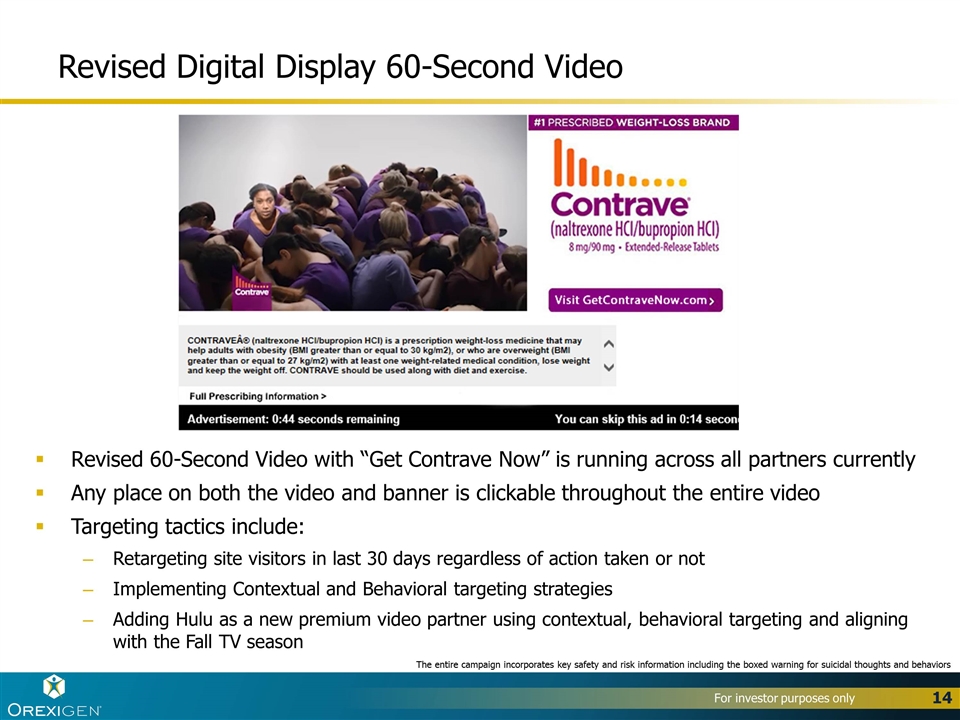

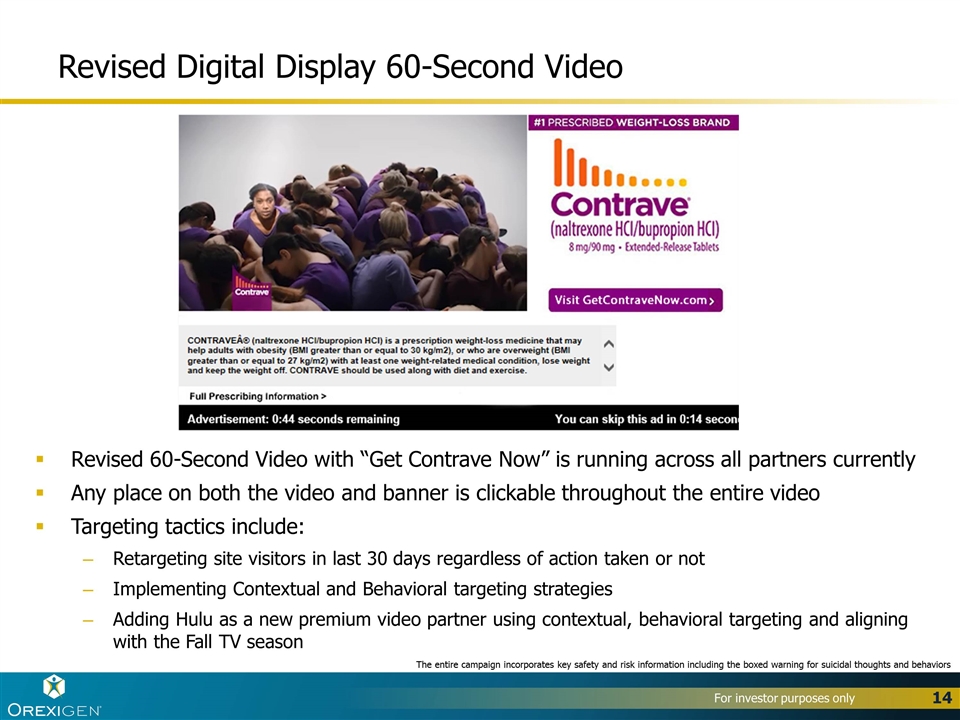

Revised Digital Display 60-Second Video Revised 60-Second Video with “Get Contrave Now” is running across all partners currently Any place on both the video and banner is clickable throughout the entire video Targeting tactics include: Retargeting site visitors in last 30 days regardless of action taken or not Implementing Contextual and Behavioral targeting strategies Adding Hulu as a new premium video partner using contextual, behavioral targeting and aligning with the Fall TV season The entire campaign incorporates key safety and risk information including the boxed warning for suicidal thoughts and behaviors

CONTRAVE Targeting Conquesting Intercept consumers who researched, purchased, or showed intent of a non-Rx or Rx competitor Site Retargeting Consumer Visits CONTRAVE.com, may or may not take a key action or high value conversion Retargeting partner finds consumer during online activity Lookalike/Prospecting Audiences based on behaviors and demographics that are similar to current converters Creative Retargeting Consumer has watched our :60 spot online, yet has not taken an action, consumer is retargeted with banners Contextual Consumer is reading an article about weight-loss, obesity, or dieting Keyword Leverage keywords or phrases relevant to CONTRAVE to ensure ads appear when consumer use search on Google and Bing Behavioral Consumer browses for ‘weight-loss tips’ (Search Data*) Consumer purchases a weight-loss product online (Shopper & Email Data*) Consumer is recognized as a CONTRAVE prospect OR

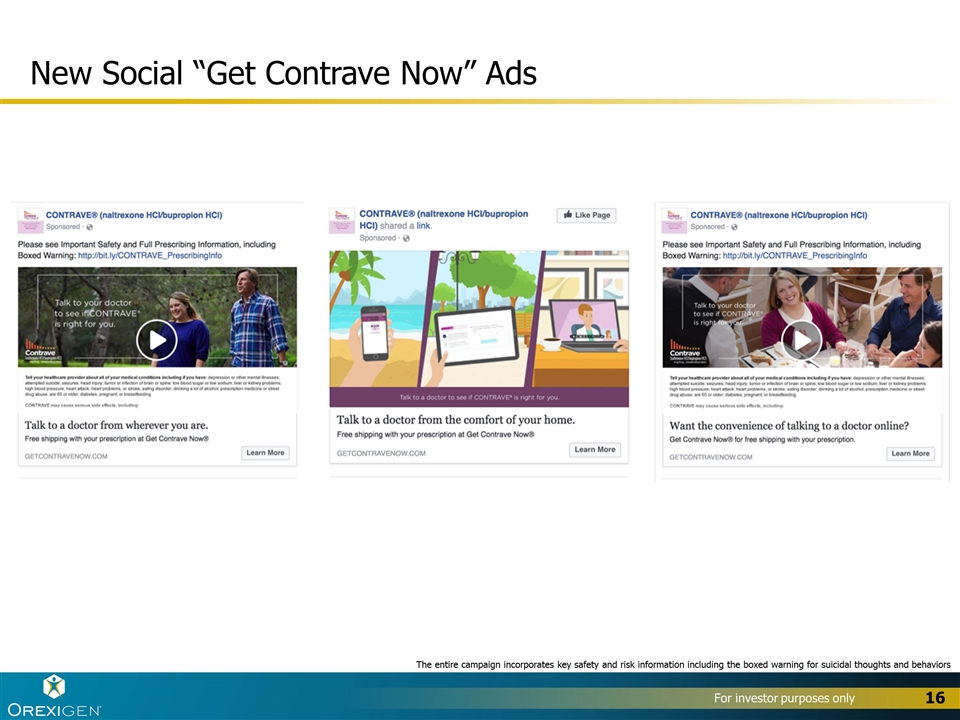

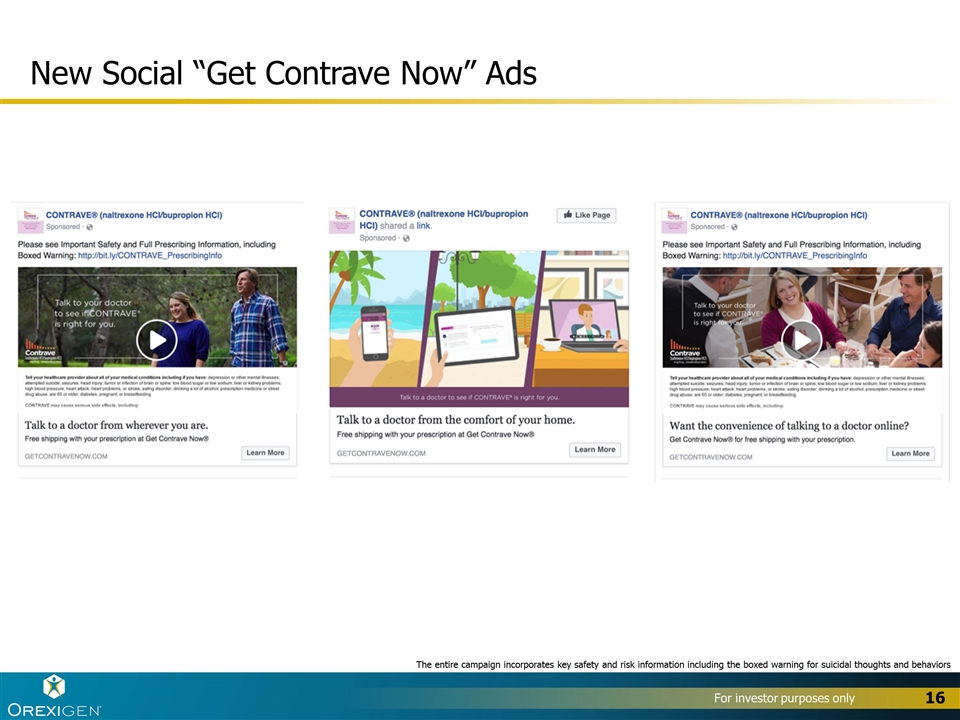

New Social “Get Contrave Now” Ads 16 The entire campaign incorporates key safety and risk information including the boxed warning for suicidal thoughts and behaviors

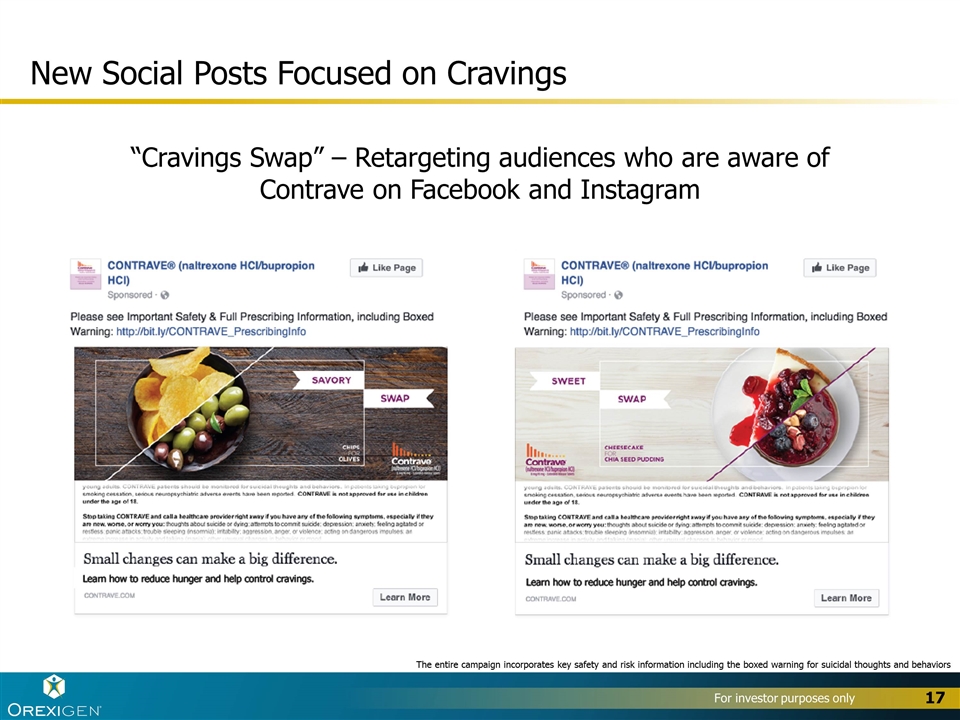

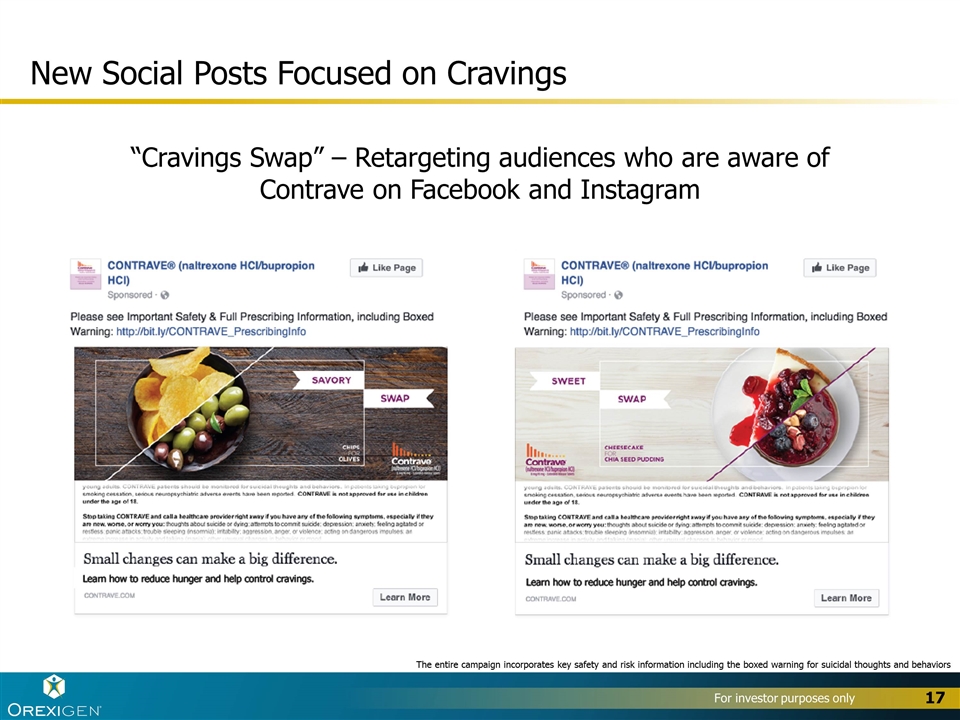

“Cravings Swap” – Retargeting audiences who are aware of Contrave on Facebook and Instagram New Social Posts Focused on Cravings 17 The entire campaign incorporates key safety and risk information including the boxed warning for suicidal thoughts and behaviors

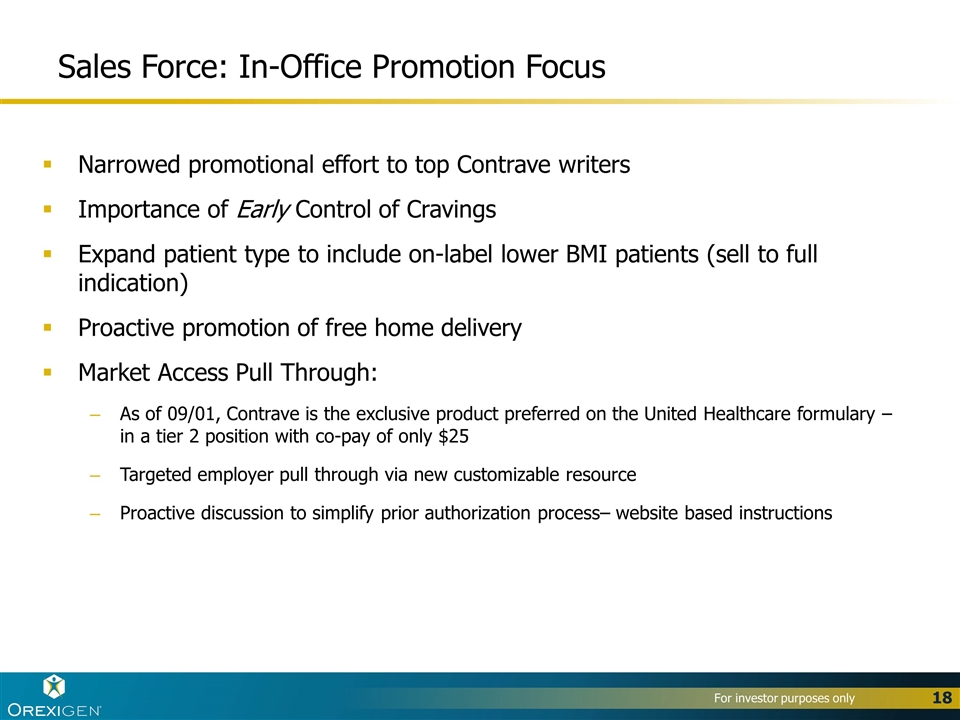

Narrowed promotional effort to top Contrave writers Importance of Early Control of Cravings Expand patient type to include on-label lower BMI patients (sell to full indication) Proactive promotion of free home delivery Market Access Pull Through: As of 09/01, Contrave is the exclusive product preferred on the United Healthcare formulary – in a tier 2 position with co-pay of only $25 Targeted employer pull through via new customizable resource Proactive discussion to simplify prior authorization process– website based instructions Sales Force: In-Office Promotion Focus

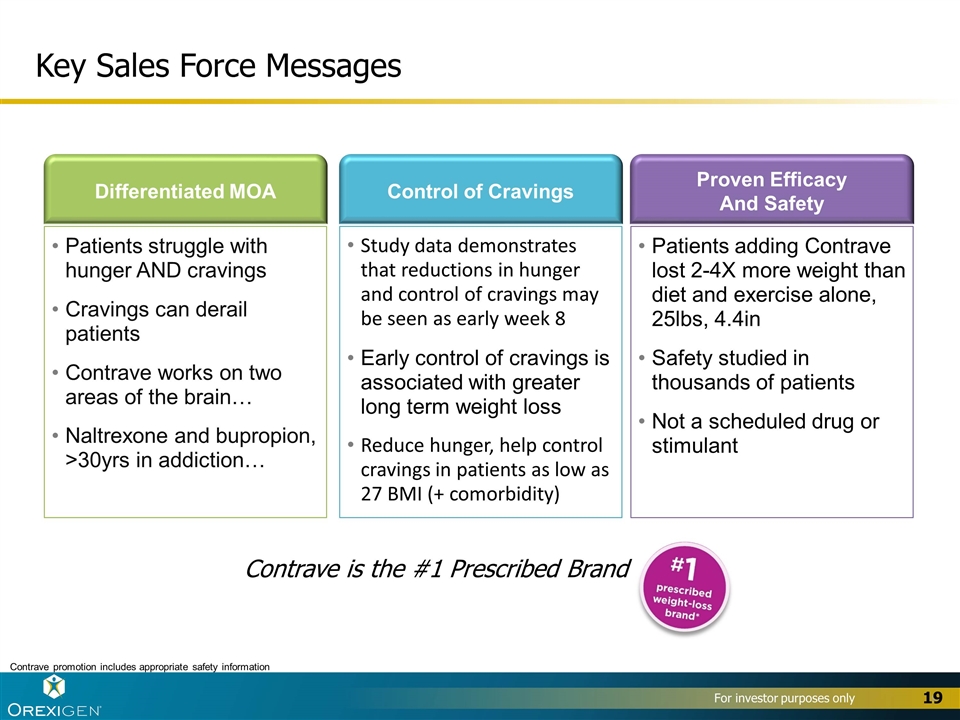

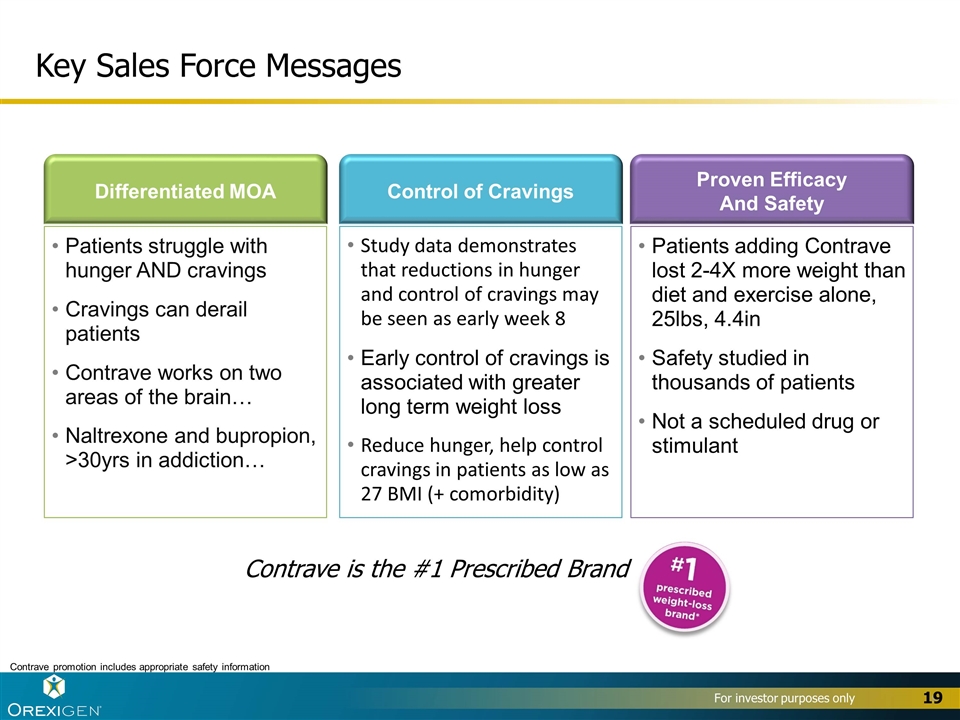

Key Sales Force Messages Patients struggle with hunger AND cravings Cravings can derail patients Contrave works on two areas of the brain… Naltrexone and bupropion, >30yrs in addiction… Differentiated MOA Patients adding Contrave lost 2-4X more weight than diet and exercise alone, 25lbs, 4.4in Safety studied in thousands of patients Not a scheduled drug or stimulant Proven Efficacy And Safety Study data demonstrates that reductions in hunger and control of cravings may be seen as early week 8 Early control of cravings is associated with greater long term weight loss Reduce hunger, help control cravings in patients as low as 27 BMI (+ comorbidity) Control of Cravings Contrave promotion includes appropriate safety information Contrave is the #1 Prescribed Brand 19

Fall Campaign: Early Results

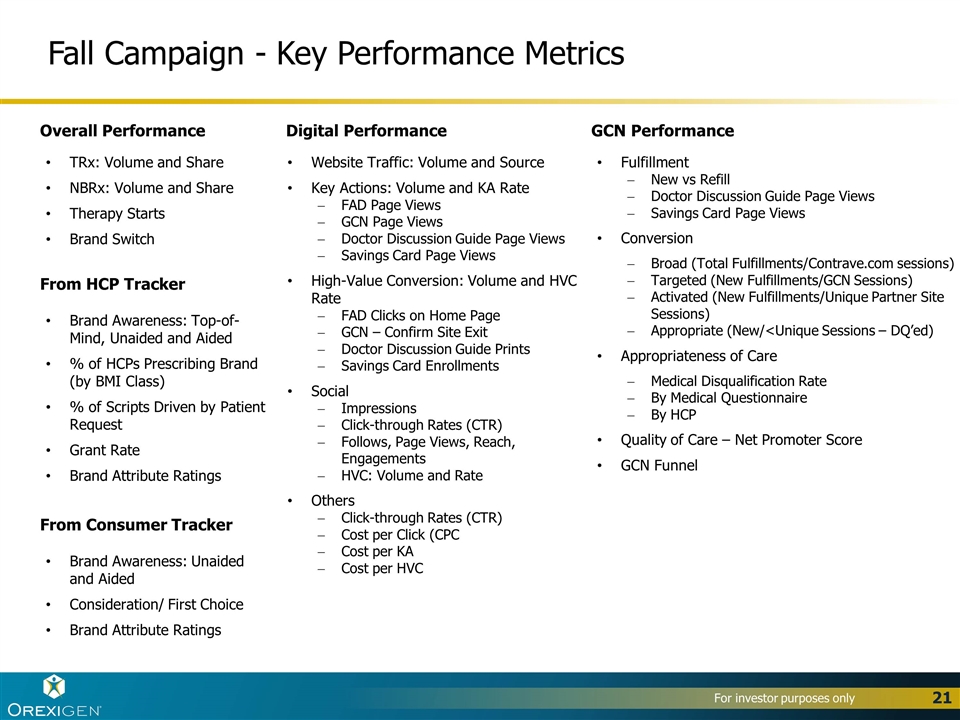

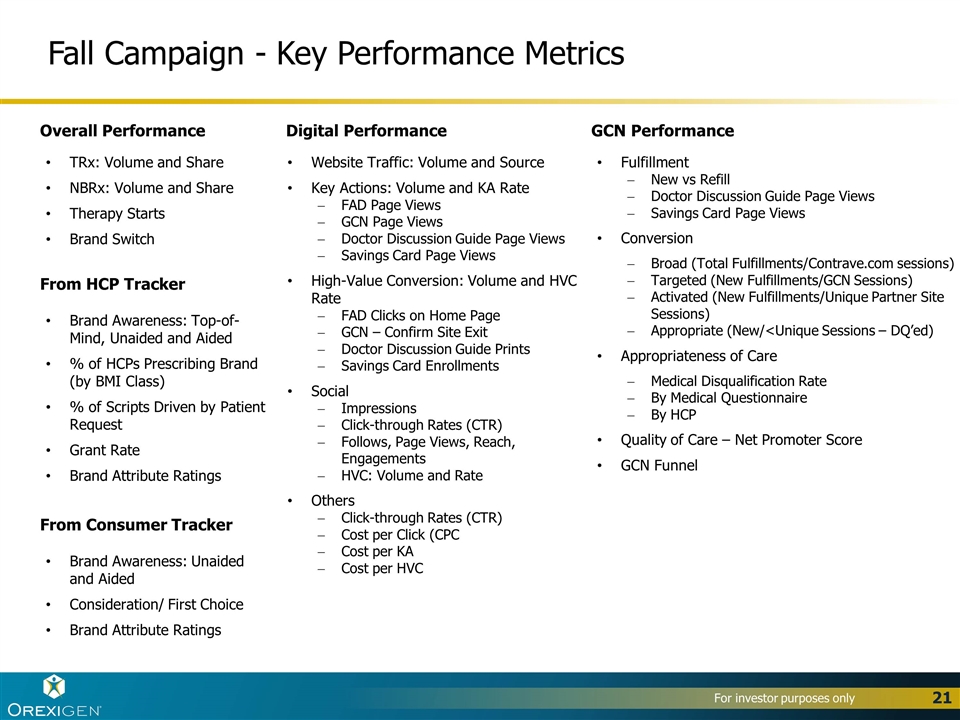

Fall Campaign - Key Performance Metrics Overall Performance TRx: Volume and Share NBRx: Volume and Share Therapy Starts Brand Switch Digital Performance Website Traffic: Volume and Source Key Actions: Volume and KA Rate FAD Page Views GCN Page Views Doctor Discussion Guide Page Views Savings Card Page Views High-Value Conversion: Volume and HVC Rate FAD Clicks on Home Page GCN – Confirm Site Exit Doctor Discussion Guide Prints Savings Card Enrollments Social Impressions Click-through Rates (CTR) Follows, Page Views, Reach, Engagements HVC: Volume and Rate Others Click-through Rates (CTR) Cost per Click (CPC Cost per KA Cost per HVC GCN Performance Fulfillment New vs Refill Doctor Discussion Guide Page Views Savings Card Page Views Conversion Broad (Total Fulfillments/Contrave.com sessions) Targeted (New Fulfillments/GCN Sessions) Activated (New Fulfillments/Unique Partner Site Sessions) Appropriate (New/<Unique Sessions – DQ’ed) Appropriateness of Care Medical Disqualification Rate By Medical Questionnaire By HCP Quality of Care – Net Promoter Score GCN Funnel From Consumer Tracker Brand Awareness: Unaided and Aided Consideration/ First Choice Brand Attribute Ratings From HCP Tracker Brand Awareness: Top-of-Mind, Unaided and Aided % of HCPs Prescribing Brand (by BMI Class) % of Scripts Driven by Patient Request Grant Rate Brand Attribute Ratings

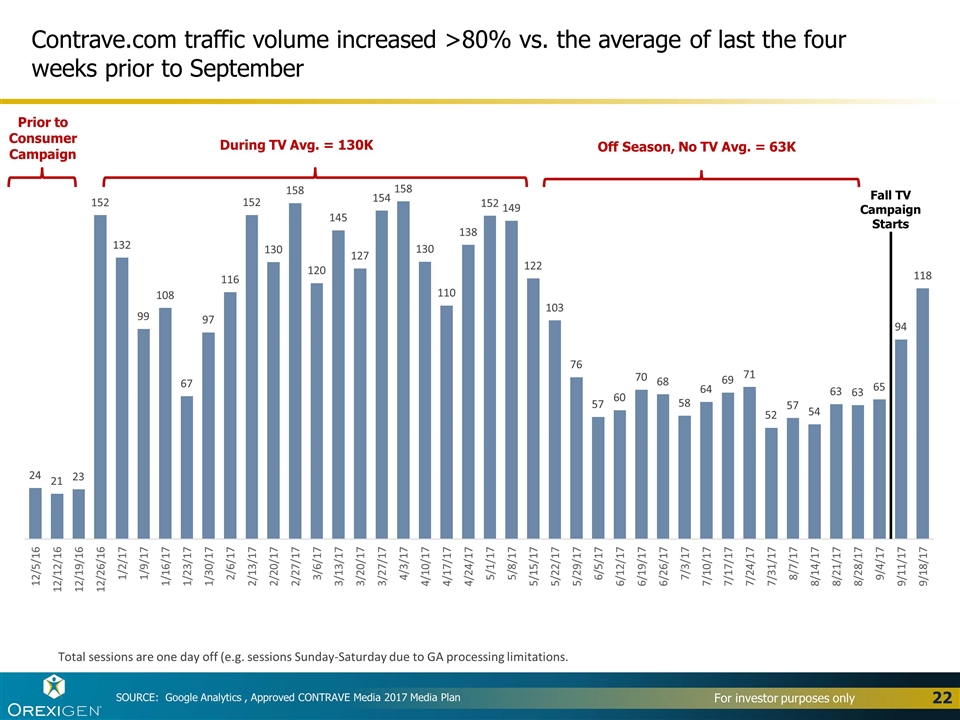

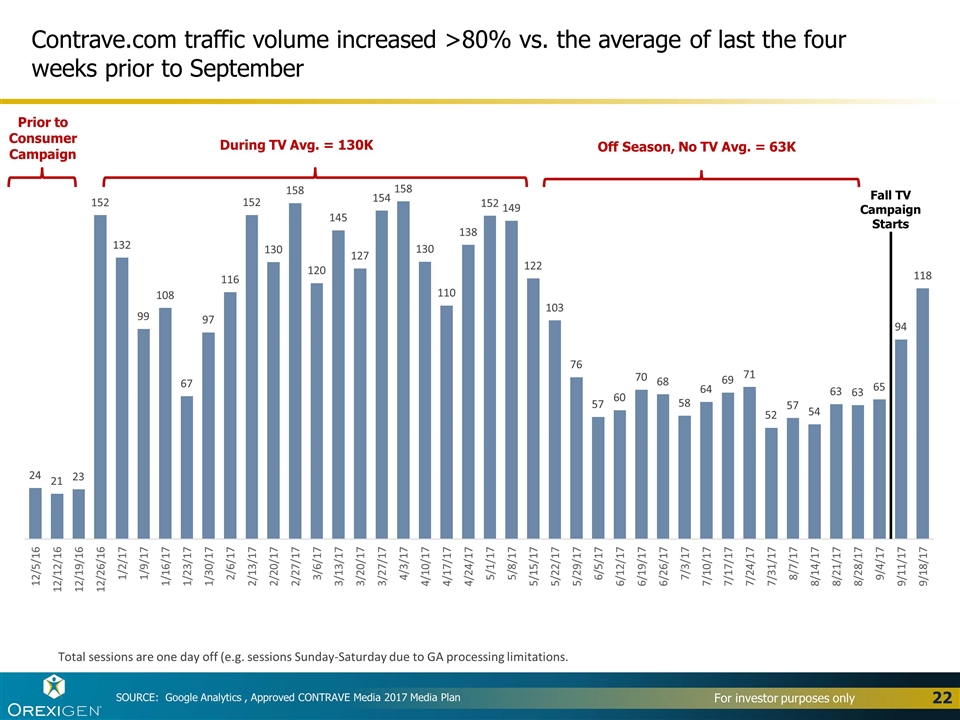

Contrave.com traffic volume increased >80% vs. the average of last the four weeks prior to September SOURCE: Google Analytics , Approved CONTRAVE Media 2017 Media Plan Total sessions are one day off (e.g. sessions Sunday-Saturday due to GA processing limitations. Off Season, No TV Avg. = 63K During TV Avg. = 130K Prior to Consumer Campaign Fall TV Campaign Starts

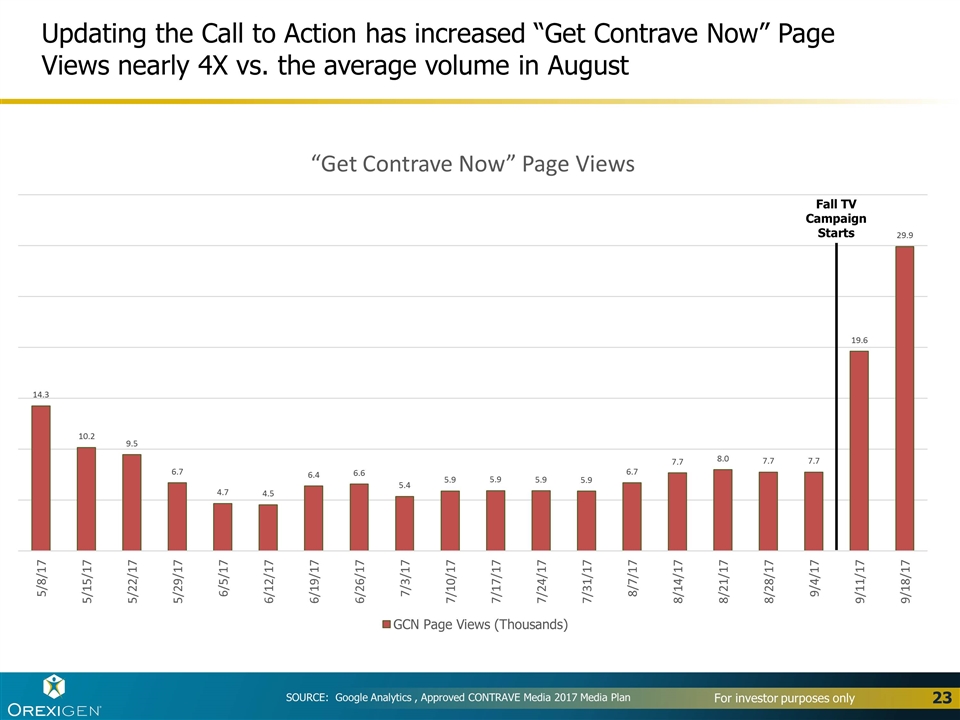

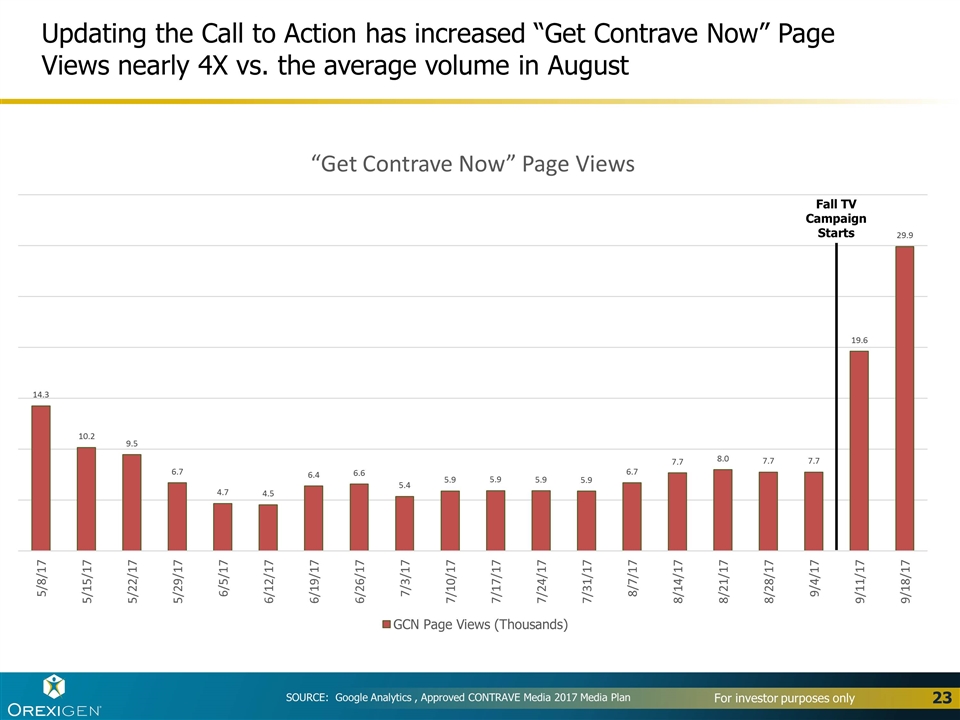

SOURCE: Google Analytics , Approved CONTRAVE Media 2017 Media Plan Updating the Call to Action has increased “Get Contrave Now” Page Views nearly 4X vs. the average volume in August Fall TV Campaign Starts

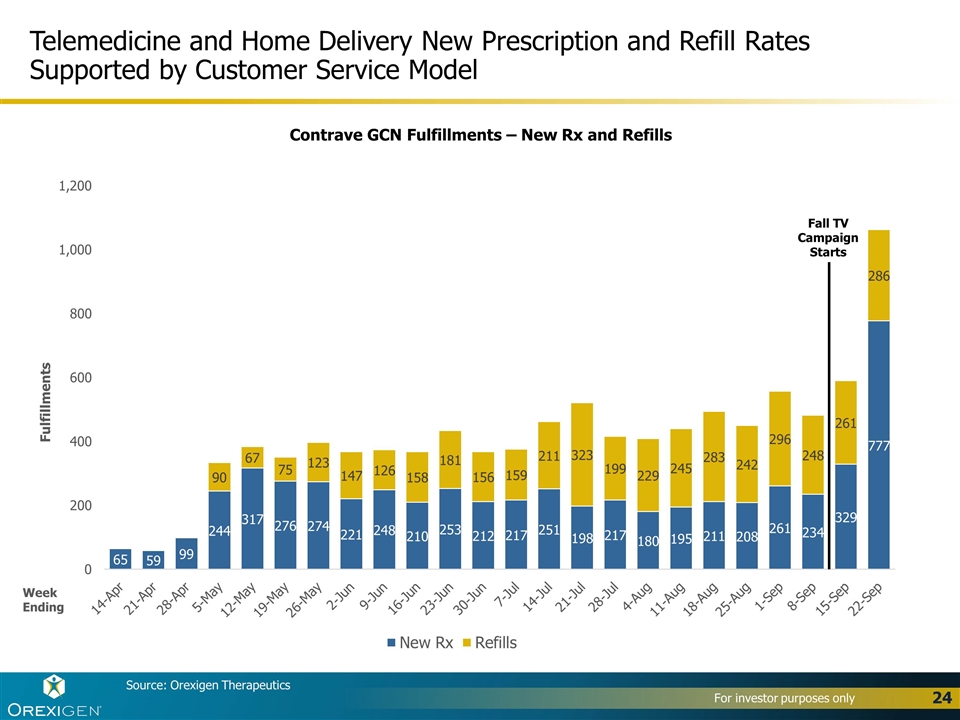

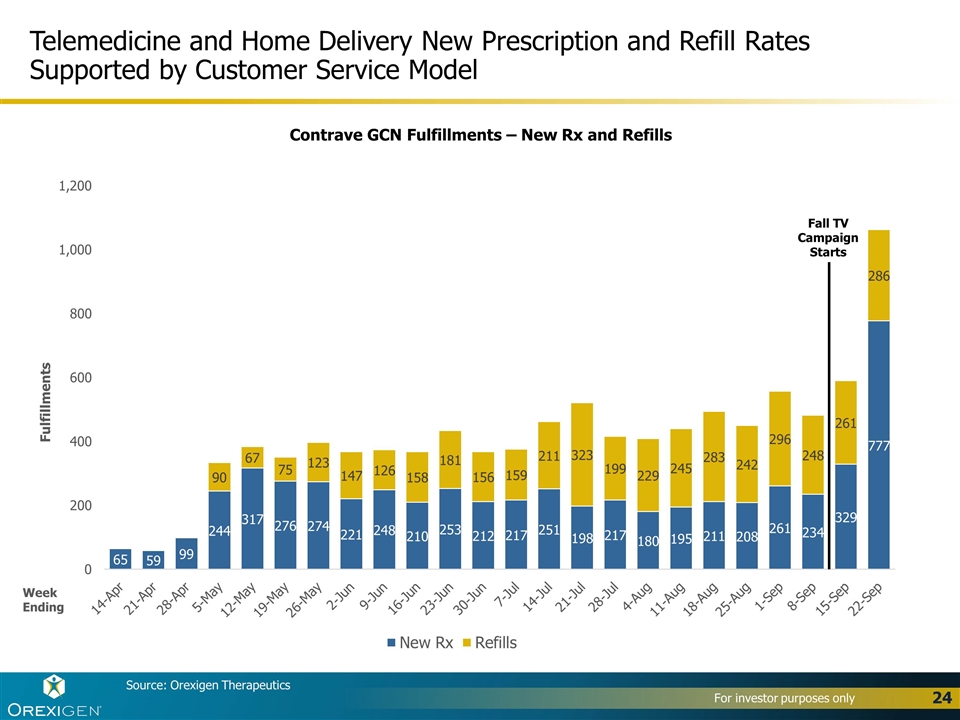

Source: Orexigen Therapeutics Telemedicine and Home Delivery New Prescription and Refill Rates Supported by Customer Service Model Week Ending Contrave GCN Fulfillments – New Rx and Refills Fall TV Campaign Starts

OUS Commercial Update

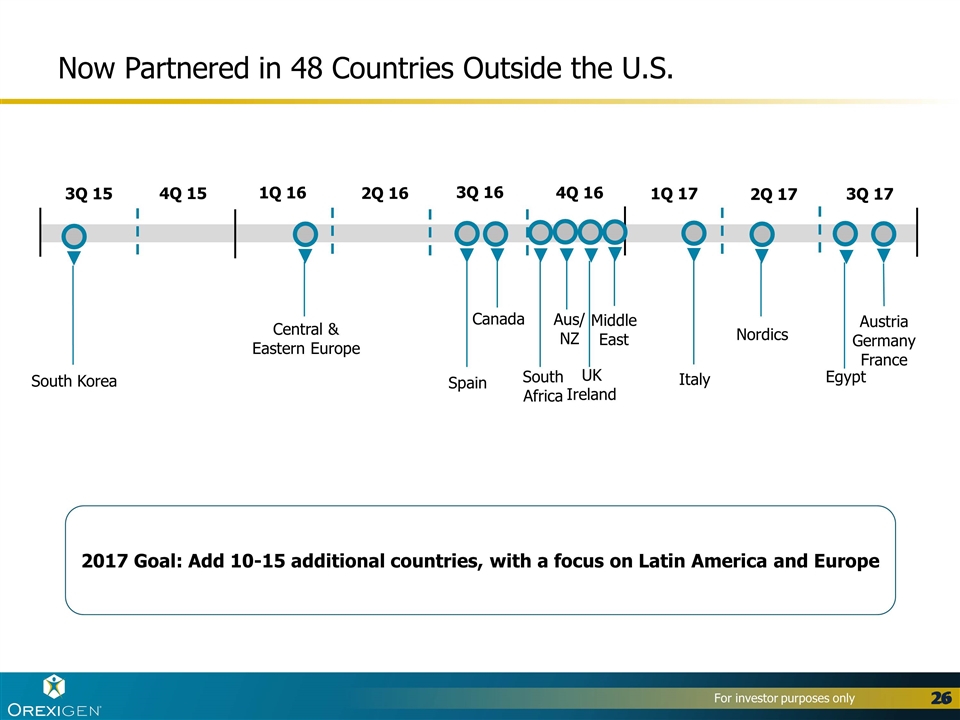

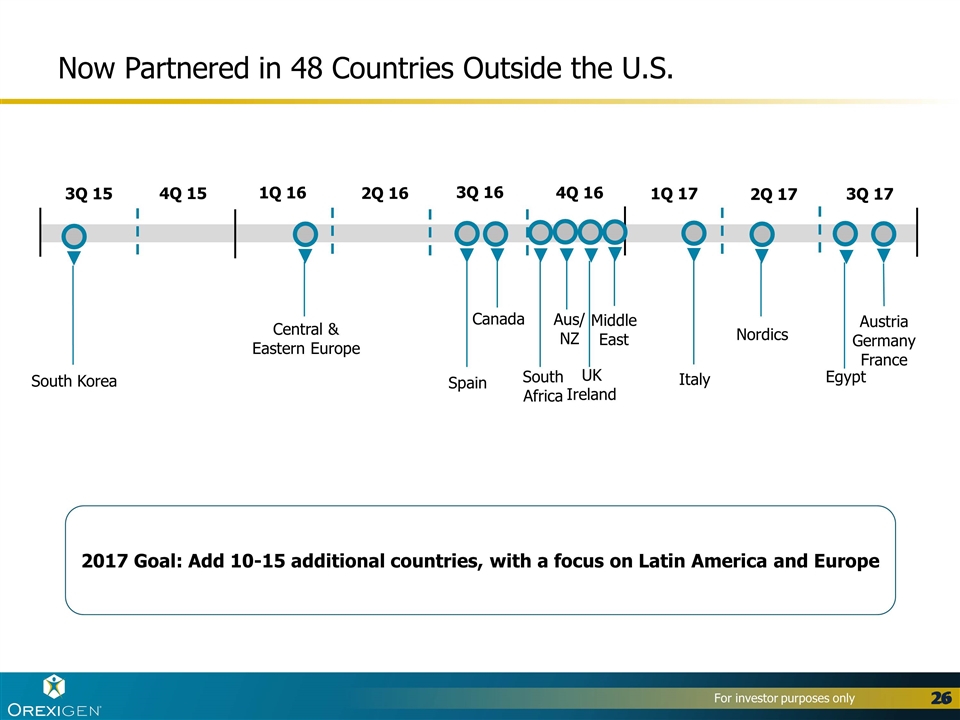

Now Partnered in 48 Countries Outside the U.S. South Korea Central & Eastern Europe Spain Canada Aus/ NZ South Africa 3Q 15 4Q 15 1Q 16 2Q 16 3Q 16 4Q 16 UK Ireland Middle East 2017 Goal: Add 10-15 additional countries, with a focus on Latin America and Europe 2Q 17 Italy 1Q 17 Nordics 3Q 17 Egypt Austria Germany France

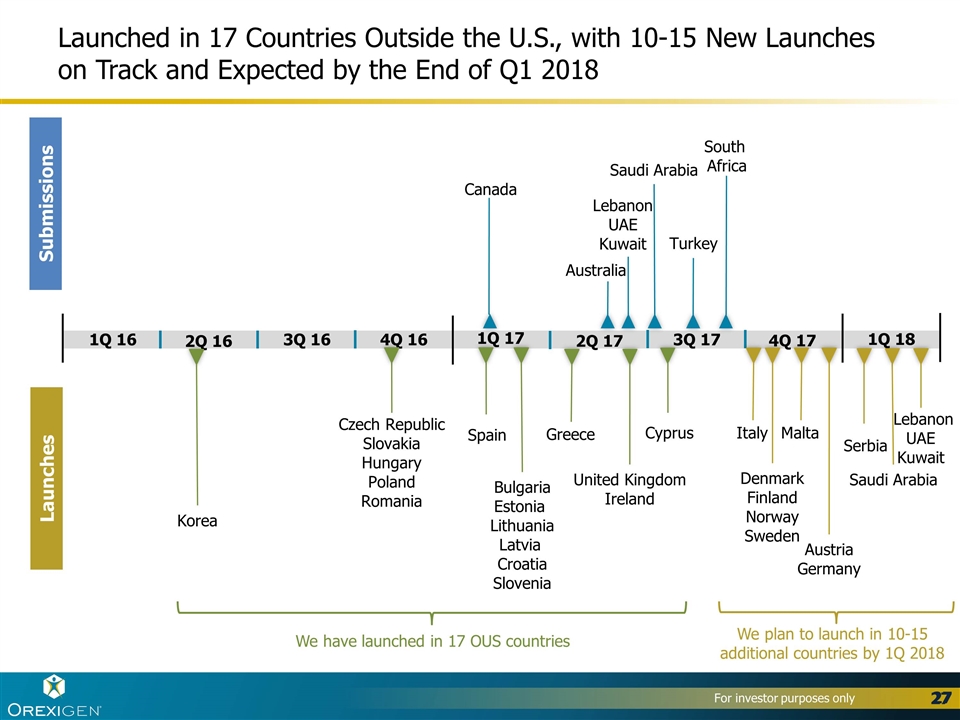

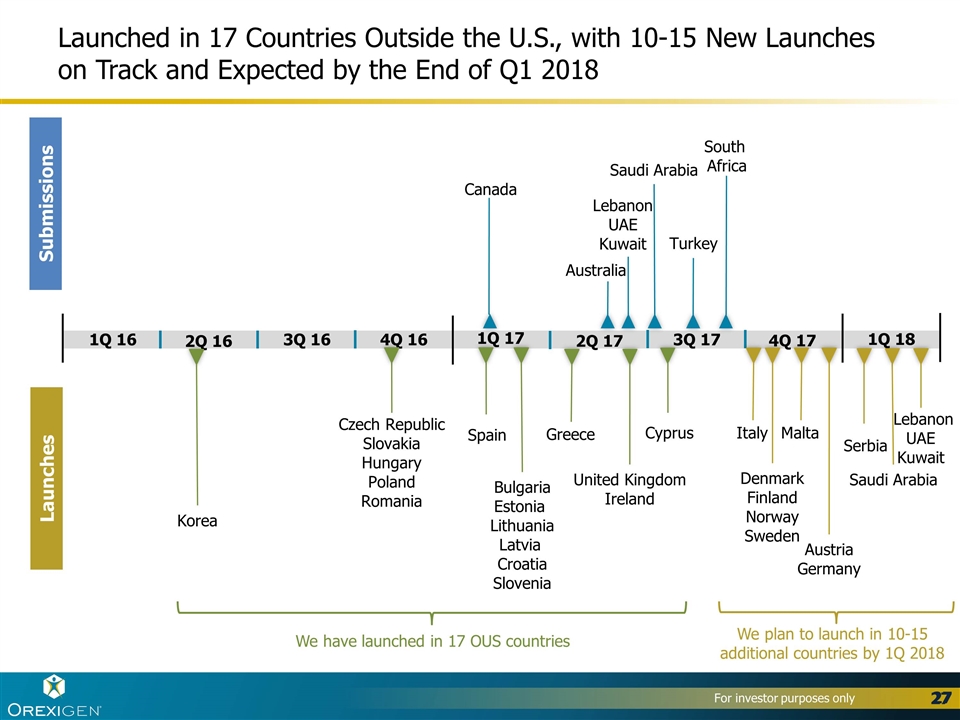

Submissions Launches 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 1Q 16 Saudi Arabia Lebanon UAE Kuwait Serbia South Africa Saudi Arabia Australia Canada Lebanon UAE Kuwait Greece United Kingdom Ireland Spain Bulgaria Estonia Lithuania Latvia Croatia Slovenia Korea Czech Republic Slovakia Hungary Poland Romania Turkey We have launched in 17 OUS countries We plan to launch in 10-15 additional countries by 1Q 2018 1Q 18 Italy Denmark Finland Norway Sweden Malta Launched in 17 Countries Outside the U.S., with 10-15 New Launches on Track and Expected by the End of Q1 2018 Austria Germany Cyprus

Financial Update

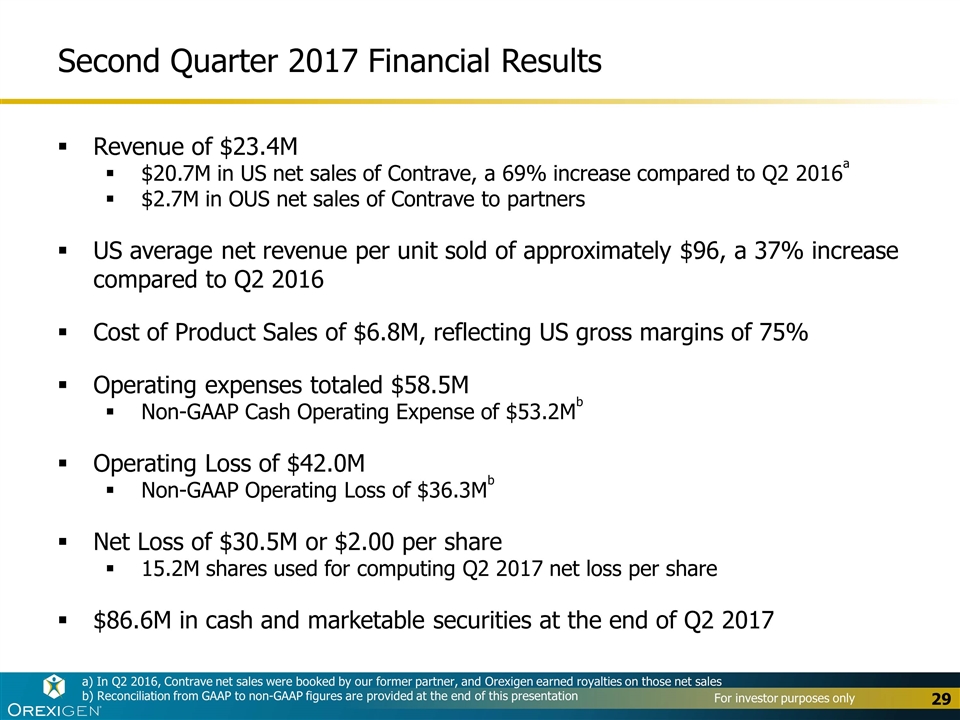

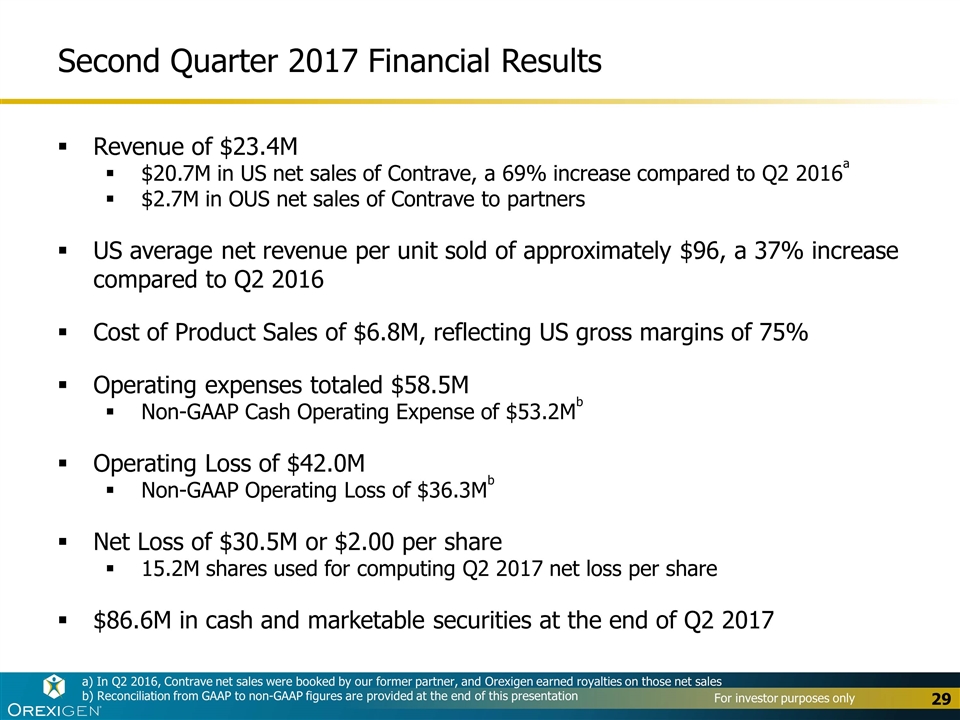

Second Quarter 2017 Financial Results Revenue of $23.4M $20.7M in US net sales of Contrave, a 69% increase compared to Q2 2016a $2.7M in OUS net sales of Contrave to partners US average net revenue per unit sold of approximately $96, a 37% increase compared to Q2 2016 Cost of Product Sales of $6.8M, reflecting US gross margins of 75% Operating expenses totaled $58.5M Non-GAAP Cash Operating Expense of $53.2Mb Operating Loss of $42.0M Non-GAAP Operating Loss of $36.3Mb Net Loss of $30.5M or $2.00 per share 15.2M shares used for computing Q2 2017 net loss per share $86.6M in cash and marketable securities at the end of Q2 2017 a) In Q2 2016, Contrave net sales were booked by our former partner, and Orexigen earned royalties on those net sales b) Reconciliation from GAAP to non-GAAP figures are provided at the end of this presentation

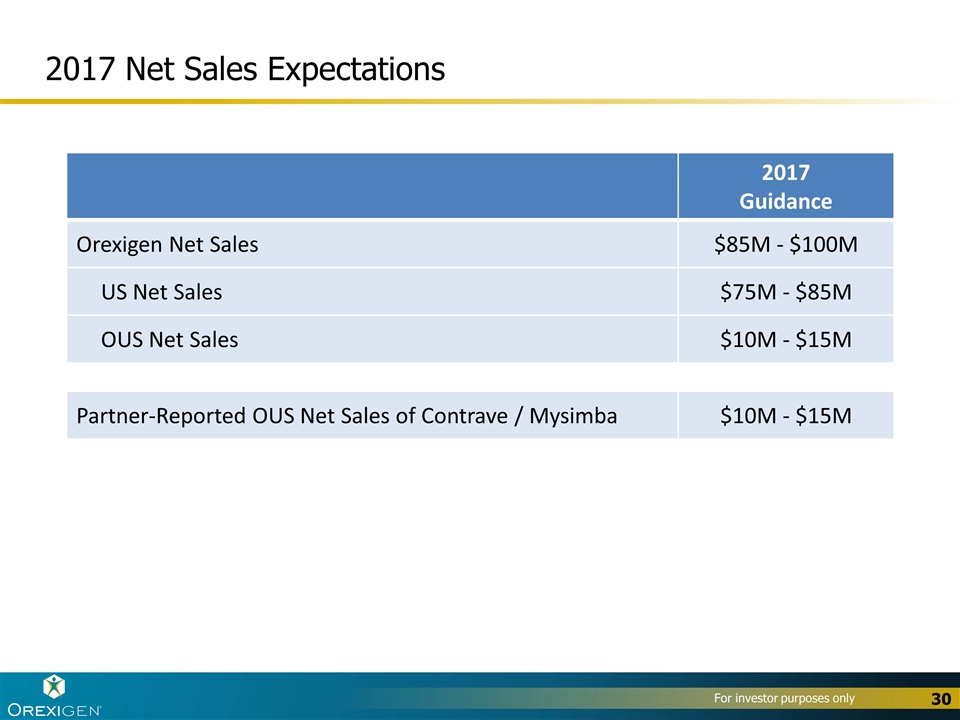

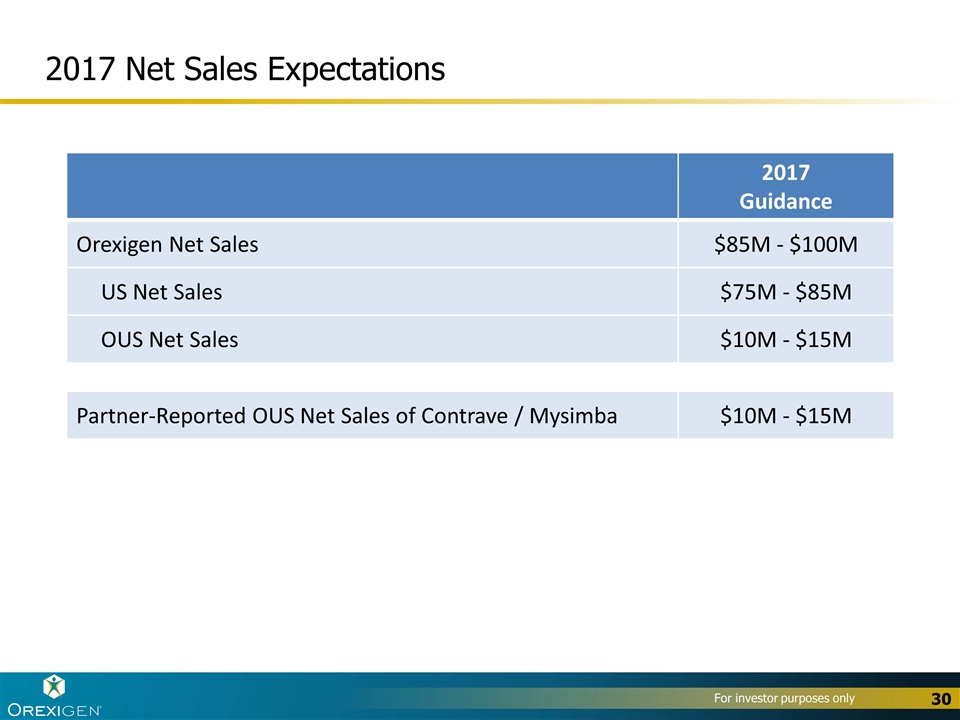

2017 Net Sales Expectations 2017 Guidance Orexigen Net Sales $85M - $100M US Net Sales $75M - $85M OUS Net Sales $10M - $15M Partner-Reported OUS Net Sales of Contrave / Mysimba $10M - $15M

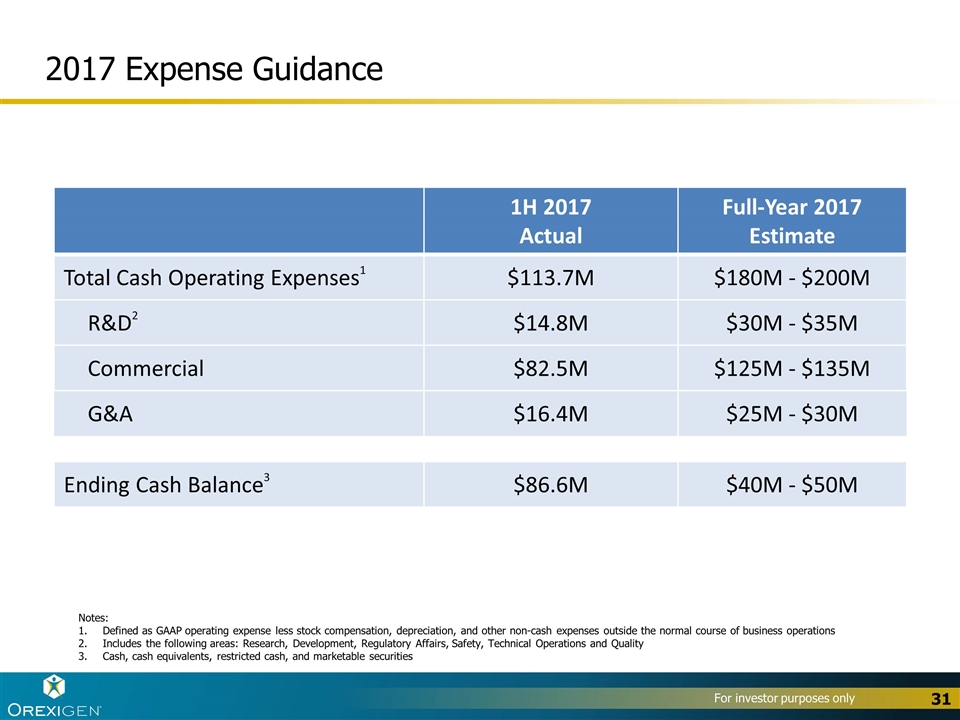

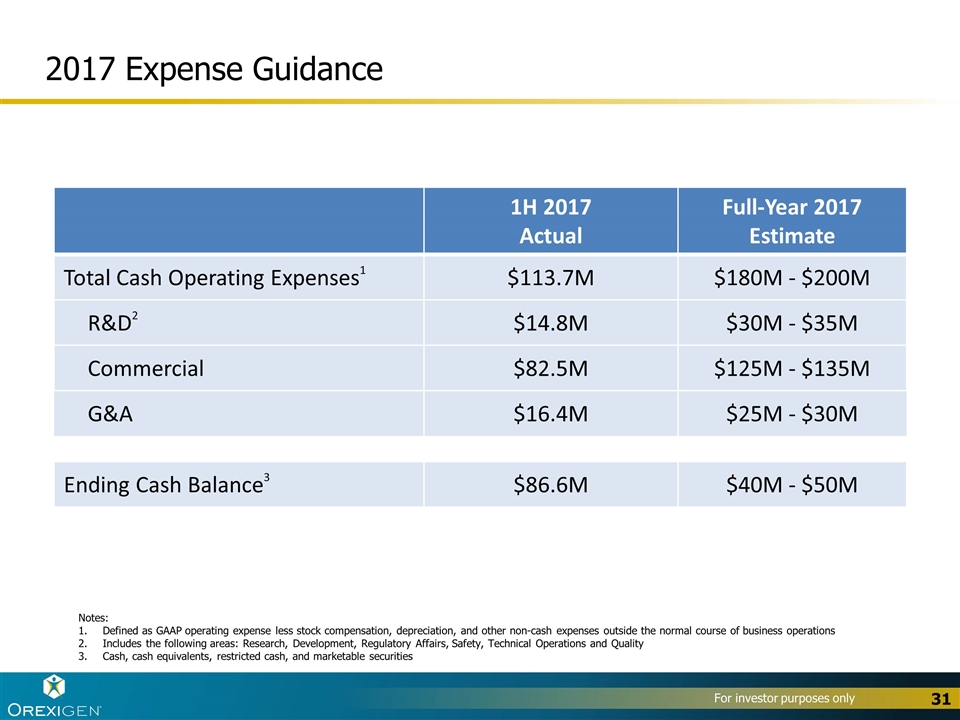

2017 Expense Guidance Notes: Defined as GAAP operating expense less stock compensation, depreciation, and other non-cash expenses outside the normal course of business operations Includes the following areas: Research, Development, Regulatory Affairs, Safety, Technical Operations and Quality Cash, cash equivalents, restricted cash, and marketable securities 1H 2017 Actual Full-Year 2017 Estimate Total Cash Operating Expenses1 $113.7M $180M - $200M R&D2 $14.8M $30M - $35M Commercial $82.5M $125M - $135M G&A $16.4M $25M - $30M Ending Cash Balance3 $86.6M $40M - $50M

First year results after re-purchasing US rights from our former partner are very positive, with about half of the prior spend Aided by Orexigen’s consumer-focused campaign, Contrave achieved new all time highs in volume, share, and net revenue per Rx Reported strong Q1 and Q2 net sales and TRx growth, and projecting strong Q3 and Q4 2017 performance as compared to 2016 Learning from our first year of commercialization, we have begun our second year with innovative strategies that we believe will drive even greater efficiencies Projecting strong 2018 net sales growth, building from a new, larger base of consumer awareness and overall demand Projecting lower operating expenses for 2018 and Long Range Plan Remain on track for profitability by 2019 Overall Business Performance: Key Takeaways

Appendix

This presentation includes information relating to non-GAAP operating expense and non-GAAP operating results, which the Securities and Exchange Commission has defined as "non-GAAP financial measures." Non-GAAP operating expense and non-GAAP operating results have been included in this presentation because they have been adjusted for non-cash items such as depreciation, amortization and stock-based compensation, as well as certain one-time non-recurring accounting charges. These metrics aid Orexigen management and its board of directors in understanding and comparing the financial performance for the quarter to core operating performance and trends, and to develop short- and long-term operational plans. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Non-GAAP operating expense and non-GAAP operating results have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of Orexigen’s financial results as reported under GAAP. Because of these limitations, you should consider non-GAAP operating expense and non-GAAP operating results alongside other financial performance measures, including GAAP operating expense and GAAP operating results. For a reconciliation of non-GAAP financial measures to the nearest comparable GAAP measures, see the non-GAAP reconciliations included at the end of this presentation. Non-GAAP Financial Measures

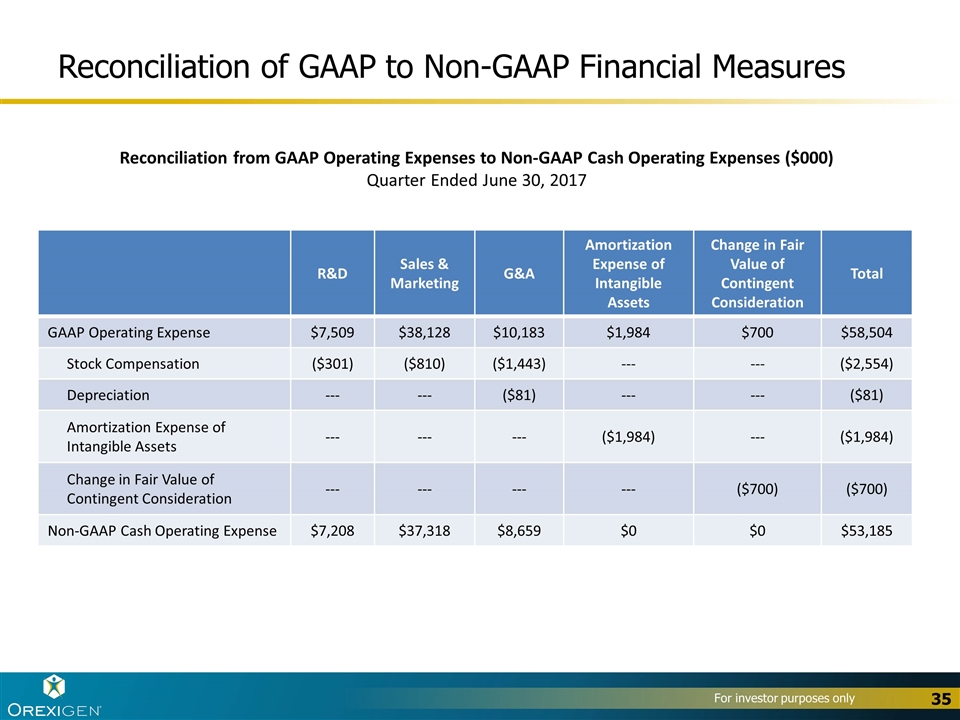

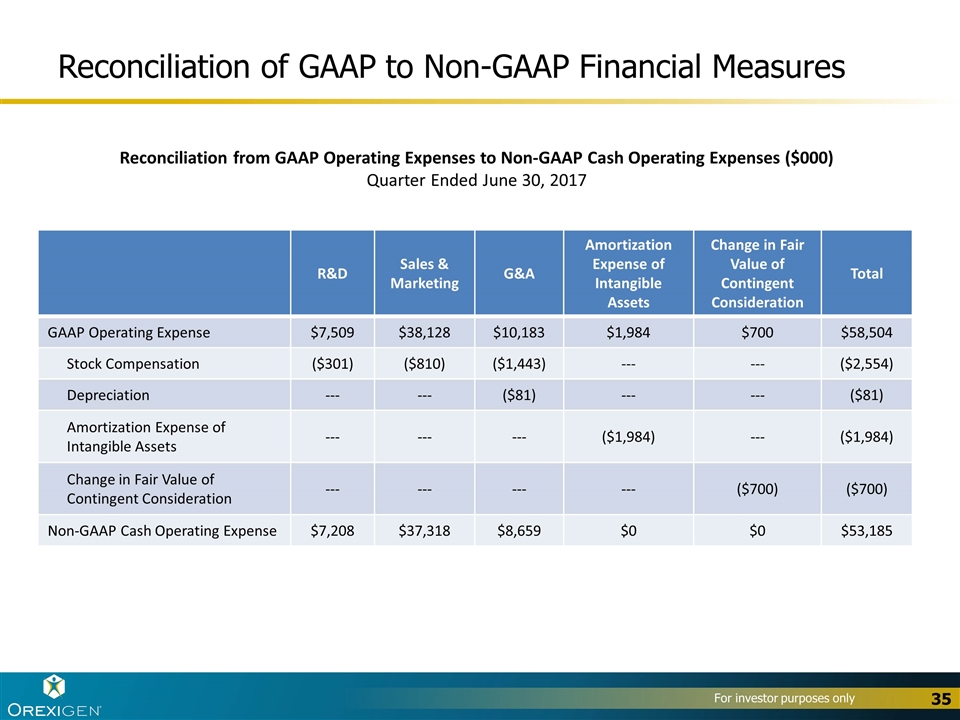

Reconciliation of GAAP to Non-GAAP Financial Measures R&D Sales & Marketing G&A Amortization Expense of Intangible Assets Change in Fair Value of Contingent Consideration Total GAAP Operating Expense $7,509 $38,128 $10,183 $1,984 $700 $58,504 Stock Compensation ($301) ($810) ($1,443) --- --- ($2,554) Depreciation --- --- ($81) --- --- ($81) Amortization Expense of Intangible Assets --- --- --- ($1,984) --- ($1,984) Change in Fair Value of Contingent Consideration --- --- --- --- ($700) ($700) Non-GAAP Cash Operating Expense $7,208 $37,318 $8,659 $0 $0 $53,185 Reconciliation from GAAP Operating Expenses to Non-GAAP Cash Operating Expenses ($000) Quarter Ended June 30, 2017

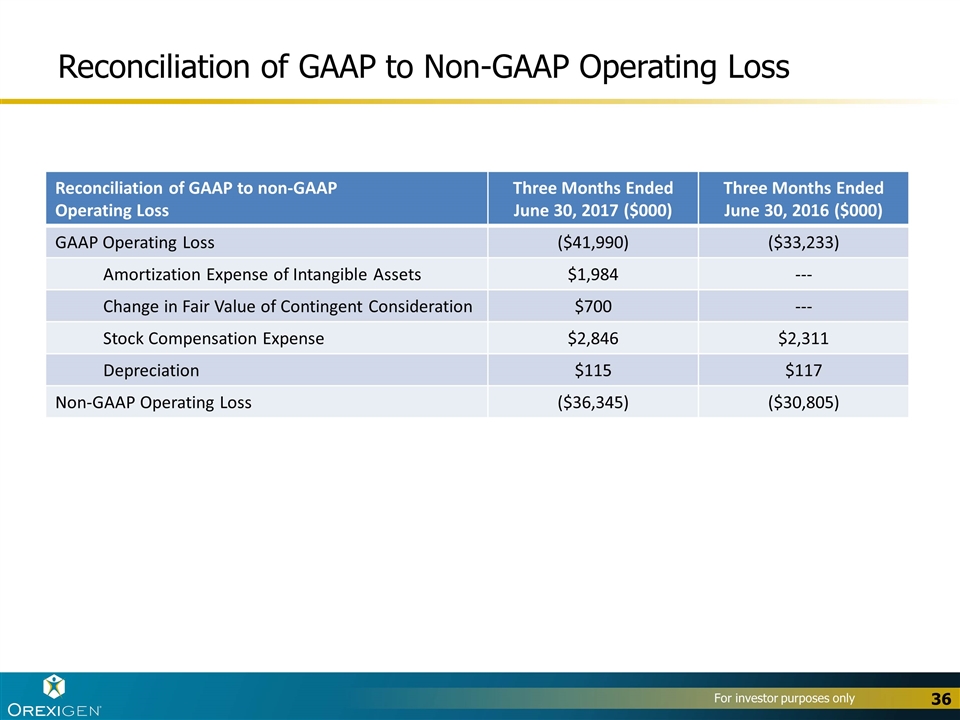

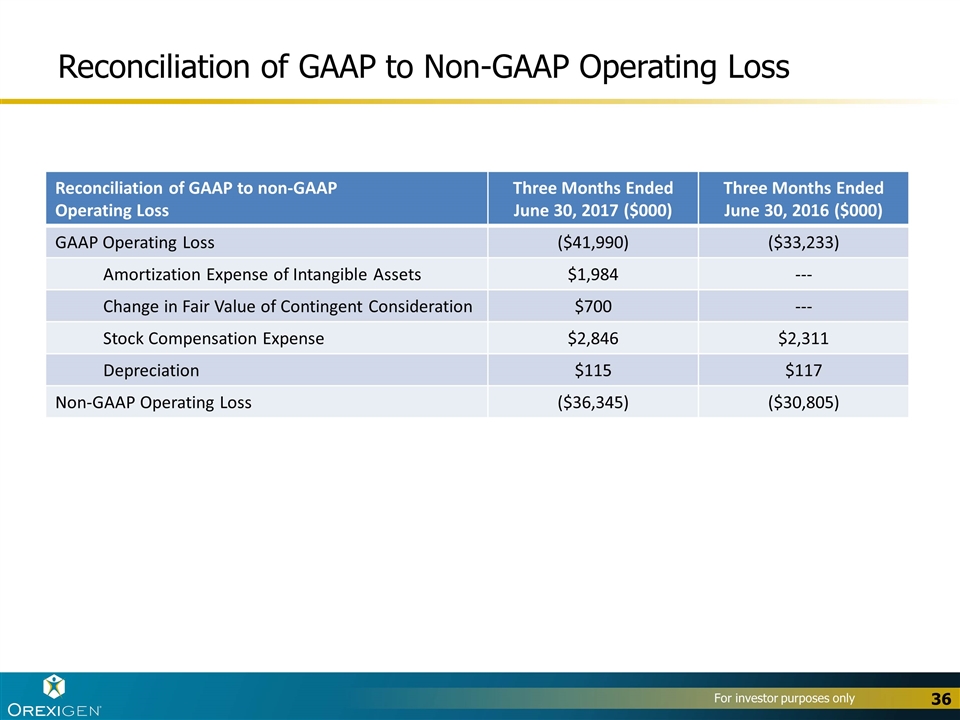

Reconciliation of GAAP to Non-GAAP Operating Loss Reconciliation of GAAP to non-GAAP Operating Loss Three Months Ended June 30, 2017 ($000) Three Months Ended June 30, 2016 ($000) GAAP Operating Loss ($41,990) ($33,233) Amortization Expense of Intangible Assets $1,984 --- Change in Fair Value of Contingent Consideration $700 --- Stock Compensation Expense $2,846 $2,311 Depreciation $115 $117 Non-GAAP Operating Loss ($36,345) ($30,805)