UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21987

ALPS VARIABLE INVESTMENT TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Michelle Stallworth, Assistant Secretary

ALPS Variable Investment Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2021 - June 30, 2021

| Item 1. | Reports to Stockholders. |

Table of Contents

| Disclosure of Fund Expenses | 1 |

| Morningstar ETF Asset Allocation Series | |

| Performance Overview | 3 |

| Schedules of Investments | 9 |

| Statements of Assets and Liabilities | 14 |

| Statements of Operations | 15 |

| Statements of Changes in Net Assets | 16 |

| Financial Highlights | 21 |

| ALPS | Alerian Energy Infrastructure Portfolio |

| Performance Overview | 31 |

| Schedule of Investments | 34 |

| Statement of Assets and Liabilities | 35 |

| Statement of Operations | 36 |

| Statements of Changes in Net Assets | 37 |

| Financial Highlights | 38 |

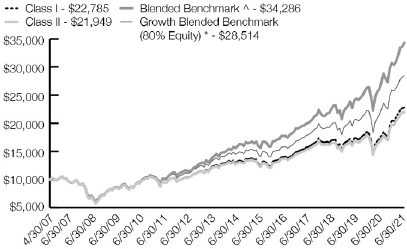

| ALPS | Red Rocks Global Opportunity Portfolio |

| Performance Overview | 40 |

| Schedule of Investments | 44 |

| Statement of Assets and Liabilities | 46 |

| Statement of Operations | 47 |

| Statements of Changes in Net Assets | 48 |

| Financial Highlights | 49 |

| Notes to Financial Statements | 51 |

| Additional Information | 60 |

| Approval of Investment Advisory & Sub-Advisory Agreements | 62 |

| Liquidity Risk Management Program | 68 |

alpsfunds.com

| ALPS Variable Investment Trust | |

| Disclosure of Fund Expenses | June 30, 2021 (Unaudited) |

Examples. As a shareholder of one or more portfolios listed on the following pages, (each a “Portfolio” and collectively, the “Portfolios”) you incur only one of two potential types of costs. You do not incur transaction costs, which include sales charges and redemption fees. However, you do incur ongoing costs, including management fees, distribution (12b-1) and shareholder service fees and other Portfolio expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Portfolios and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on January 1, 2021 and held through June 30, 2021.

Actual Expenses. The first line under each Portfolio of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under each Portfolio of the table under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each Portfolio of the table below provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Portfolio’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table below are meant to highlight ongoing Portfolio costs only. See “Note on Fees” on the following page below the table.

| | Beginning Account Value January 1, 2021 | Ending Account Value June 30, 2021 | Net Expense Ratio(1) | Expenses Paid During Period January 1, 2021 - June 30, 2021(2) |

| Morningstar Conservative ETF Asset Allocation Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,017.20 | 0.53% | $ 2.65 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,022.17 | 0.53% | $ 2.66 |

| Class II | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,016.40 | 0.78% | $ 3.90 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,020.93 | 0.78% | $ 3.91 |

| Morningstar Income and Growth ETF Asset Allocation Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,050.10 | 0.53% | $ 2.69 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,022.17 | 0.53% | $ 2.66 |

| Class II | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,049.00 | 0.78% | $ 3.96 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,020.93 | 0.78% | $ 3.91 |

| Morningstar Balanced ETF Asset Allocation Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,083.80 | 0.53% | $ 2.74 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,022.17 | 0.53% | $ 2.66 |

| Class II | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,082.70 | 0.78% | $ 4.03 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,020.93 | 0.78% | $ 3.91 |

| Morningstar Growth ETF Asset Allocation Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,114.60 | 0.53% | $ 2.78 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,022.17 | 0.53% | $ 2.66 |

| Class II | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,112.60 | 0.78% | $ 4.09 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,020.93 | 0.78% | $ 3.91 |

| ALPS Variable Investment Trust | |

| Disclosure of Fund Expenses (continued) | June 30, 2021 (Unaudited) |

| | Beginning Account Value January 1, 2021 | Ending Account Value June 30, 2021 | Net Expense Ratio(1) | Expenses Paid During Period January 1, 2021 - June 30, 2021(2) |

| Morningstar Aggressive Growth ETF Asset Allocation Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,141.70 | 0.53% | $ 2.81 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,022.17 | 0.53% | $ 2.66 |

| Class II | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,140.20 | 0.78% | $ 4.14 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,020.93 | 0.78% | $ 3.91 |

| ALPS | Alerian Energy Infrastructure Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,420.90 | 0.95% | $ 5.70 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,020.08 | 0.95% | $ 4.76 |

| Class III | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,416.50 | 1.30% | $ 7.79 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,018.30 | 1.30% | $ 6.51 |

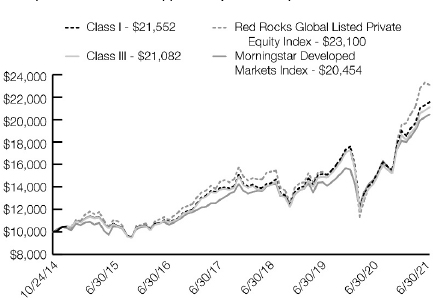

| ALPS | Red Rocks Global Opportunity Portfolio | | | | |

| Class I | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,134.30 | 1.10% | $ 5.82 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,019.34 | 1.10% | $ 5.51 |

| Class III | | | | |

| Actual Fund Return | $ 1,000.00 | $ 1,131.70 | 1.45% | $ 7.66 |

| Hypothetical Fund Return (5% return before expenses) | $ 1,000.00 | $ 1,017.60 | 1.45% | $ 7.25 |

| (1) | Annualized based on the Portfolios' expenses from January 1, 2021 through June 30, 2021. |

| (2) | Expenses are equal to the Portfolios' annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365. |

NOTE ON FEES

If you are an owner of variable annuity contracts or variable life insurance policies (“Contracts”) or a participant in a qualified plan, you may also incur fees associated with the Contract you purchase or the qualified plan, such as transaction costs including sales charges and redemption fees, which are not reflected in the table and example above. Additional information about the cost of investing in a Portfolio is presented in the prospectus for your Contract or disclosure documents for the plan through which the Portfolio’s shares are offered to you.

| Morningstar ETF Asset Allocation Series | |

| Performance Overview | June 30, 2021 (Unaudited) |

Investment Objectives

The Morningstar Conservative ETF Asset Allocation Portfolio seeks to provide investors with current income and preservation of capital.

The Morningstar Income and Growth ETF Asset Allocation Portfolio seeks to provide investors with current income and capital appreciation.

The Morningstar Balanced ETF Asset Allocation Portfolio seeks to provide investors with capital appreciation and some current income.

The Morningstar Growth ETF Asset Allocation Portfolio seeks to provide investors with capital appreciation.

The Morningstar Aggressive Growth ETF Asset Allocation Portfolio seeks to provide investors with capital appreciation.

Economic & Market Overview

Global markets continued to surge higher to finish the six month period ending June 30, 2021. As the COVID driven market decline fades, policy makers are pushing forward with unprecedented stimulus policies designed to return economic growth and employment to pre-pandemic levels. In the U.S., J.P. Morgan estimates that the economy is on track to fully recover from the COVID induced GDP losses of 2020 in the 2nd half of 2021 based on the current pace of growth. Also, corporate earnings are widely expected to hit an all-time high in 2021. Consumers have responded by returning to lower pre-pandemic savings rates and spending levels that satisfy their pent-up demand for many items that were not widely available during the mandated shut-downs that took place in 2020 and the six month period. Still, numerus challenges to a full recovery persist. The increase in demand has caused a supply crunch with many businesses unable to accept orders due to shortages of inputs such as labor and materials. Businesses have had to compete with the Government stimulus efforts to bring back workers by increasing wages. The higher input costs, especially labor, has increased concerns that inflation may not be as temporary as policy makers have broadcast to consumers and investors.

The S&P 500 Index increased 15.25% during the six month period ending June 30, 2021, and reached a new record high level. The more economically sensitive stocks that fall within the value style of investing rallied in the last quarter of 2020 and through the 1st quarter of 2021. However, the growth style, specifically technology and communication services stocks, outpaced cyclical stocks during the 2nd quarter of 2021, based on the Russell 3000 Growth and Value Indexes. Long-term bond yields were somewhat volatile during the six month period. Yields rose in the 1st quarter, which tends to favor value stocks and then proceeded to decline in the 2nd quarter of 2021, which in-turn increased investor sentiment towards duration sensitive assets such as high growth companies. Over the six month period ending June 30, 2021, value stocks outpaced the growth style and U.S. small cap value stocks produced outsized returns relative to other traditional asset classes with the financials and energy sectors leading the way.

Both developed and emerging markets lagged the U.S. market over the six month period ending June 30, 2021. The Morningstar DM ex US Index of foreign developed-market stocks gained 9.7% over the six month period, while emerging markets, as represented by the Morningstar EM Index increased by 8.3% during the same period. International equity markets consist of higher allocations to cyclical sectors than the U.S. equity market. The U.S. equity market has more defensive and high growth exposures that have outperformed cyclicals by a wide margin over the last decade. The broader European region has struggled to regain growth since coming out of the 2008 financial crisis. Currently, select countries within developed international, such as South America, India, U.K., and Europe, are still struggling to contain new COVID cases.

The U.S. Federal Reserve has created large distortions within the fixed income markets by massively expanding its balance sheet in the ongoing quantitative easing part 4 from $4 trillion to $8 trillion as of the 2nd quarter of 2021. International central banks have followed suit with bond purchase programs and other lending facilities in an effort to stimulate their respective economies. Though investors are starting to worry about inflation, the 10 year Treasury yield fell during the 2nd quarter by 0.29% to 1.45%. The Bloomberg Barclays U.S. Aggregate Bond Index has decreased by -1.6% over the six month period ending June 30, 2021. Fixed income investors continue to seek higher yields by allocating more to junk bonds and credit sensitive assets. TIPS and high yield bonds were among the few fixed income asset classes to produce a positive return over the six month period ending June 30, 2021.

Portfolio Positioning

The Morningstar ETF Allocation Series Portfolios (the "Portfolios") were reallocated on February 1, 2021. Since the 1st quarter market decline of 2020, the Portfolios have been positioned with the goal of benefitting from a broader global recovery driven by underlying fundamentals and valuations to support the market prices. The recovery started to take place in the 2nd quarter of 2020 and was largely led by select U.S. firms in the technology and communication services sectors, which the Portfolios were tactically underweight due to what we consider unattractive valuations. The Portfolios' tactical underweight of U.S. equity and the growth style caused the Portfolios to underperform relative to the respective blended benchmarks over that period. At the same time, our value style and international equity overweight lagged during the U.S. growth led rally which took place over the 2nd and 3rd quarter of 2020. Beginning in the 4th quarter of 2020, the more economically sensitive stocks within the value style posted strong performance relative to growth through May of 2021. The tactical tilt to value stocks allowed the Portfolios to outperform the respective primary blended benchmarks over the six month period ending June 30, 2021.

| Morningstar ETF Asset Allocation Series | |

| Performance Overview (continued) | June 30, 2021 (Unaudited) |

As of June 30, 2021, we maintain the Portfolios' exposure to what we believe are relatively more attractive asset classes like energy, staples, and financials that reflect a better reward for risk tradeoff than select growth stocks that we believe appear overvalued. Additionally, we continue to maintain a tactical overweight to select country positions such as Japan, U.K., and Germany in select portfolios across the Portfolios. We believe international stocks offer a better reward for risk profile than U.S. stocks and therefore maintain an overweight across the Portfolios.

Within fixed income, we continue to maintain a diversified mix of credit exposures, EM bonds, and Treasuries at a neutral average weighted duration relative to the respective blended benchmarks. Most fixed income exposures appear unattractive at the current yields, especially credit which offers a low reward for risk tradeoff as of June 30, 2021.

Morningstar Investment Management LLC

The statements and opinions expressed in this commentary are those of the author, are as of the date of this report, are subject to change, and may not reflect the author’s current views. The information, data, and analyses presented in this commentary do not constitute investment advice; are provided solely for informational purposes; and, therefore are not an offer to buy or sell a particular security. The data and/or information noted are from what we believe to be reliable sources; however, Morningstar Investment Management LLC has no control over the methods or means used to collect the data and/or information and therefore cannot guarantee its accuracy or completeness. The opinions and estimates noted are as of a certain date and subject to change.

Past performance does not guarantee future results. There is no assurance that the investment process will consistently lead to successful investing. Asset allocation and diversification do not eliminate the risk of experiencing investment losses.

This commentary contains certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

Morningstar Investment Management LLC (“Morningstar Investment Management”) is a registered investment adviser and subsidiary of Morningstar, Inc. Morningstar Investment Management acts as a sub-adviser to ALPS Advisors, Inc. (“ALPS”) by providing recommendations to ALPS regarding asset allocation targets and selection of securities appropriate for the Morningstar ETF Allocation Series. Morningstar Investment Management selects securities for Morningstar ETF Allocation Series from the universe of investments made available through ALPS.

Morningstar Investment Management LLC is not acting in the capacity of advisor to individual clients. Asset Allocation target allocations are subject to change without notice. Morningstar Investment Management establishes the allocations using its proprietary asset classifications. If alternative classification methods are used, the allocations may not meet the asset allocation targets. Morningstar Investment Management LLC is not affiliated with ALPS Advisors, Inc.

| Morningstar ETF Asset Allocation Series | |

| Performance Overview (continued) | June 30, 2021 (Unaudited) |

MORNINGSTAR ETF ASSET ALLOCATION SERIES PERFORMANCE SUMMARY

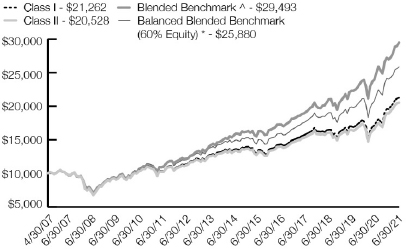

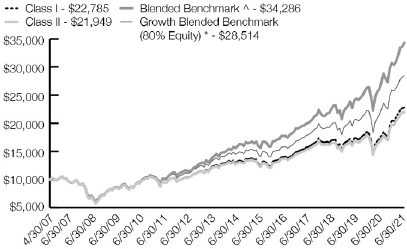

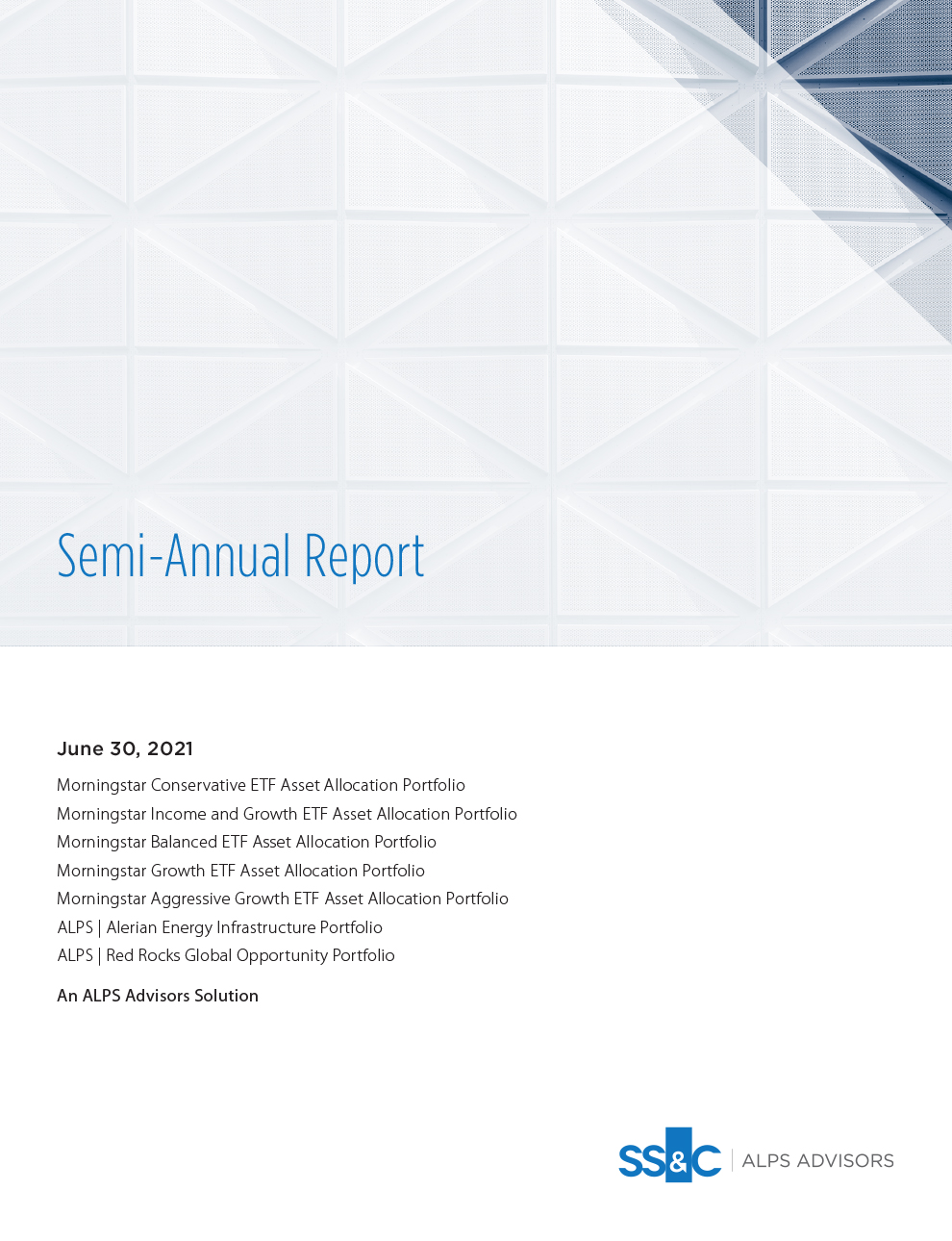

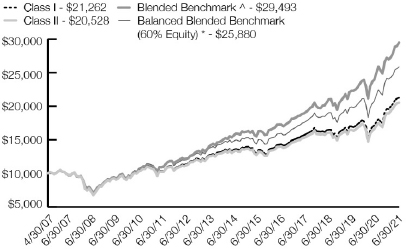

The illustration below is based on a hypothetical $10,000 investment in each of the respective Portfolios since inception (4/30/07). All results shown assume reinvestments of dividends and capital gains.

Conservative (return of $10,000 based on actual performance)

Balanced (return of $10,000 based on actual performance)

Aggressive Growth (return of $10,000 based on actual performance)

Income & Growth (return of $10,000 based on actual performance)

Growth (return of $10,000 based on actual performance)

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Portfolios will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. The graphs and tables on pages 6 and 7 do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Investment performance reflects fee waivers in effect. In the absence of fee waivers, total return would be lower. To obtain performance data current to the most recent month-end, please call 1-866-432-2926. Performance data does not reflect expenses incurred from investing through a separate account or qualified plan and does not reflect variable annuity or life insurance contract charges. If it did, the overall fees and expenses would be higher. |

| Morningstar ETF Asset Allocation Series | |

| Performance Overview (continued) | June 30, 2021 (Unaudited) |

AVERAGE ANNUAL TOTAL RETURNS | FOR THE PERIODS ENDED JUNE 30, 2021

| | | | | | Since Inception | Annualized Expense Ratios as disclosed in current prospectus dated 4/30/21† |

| Portfolio | 6 Months^^ | 1 Year | 5 Year | 10 Year | (4/30/07) | Gross | Net |

| Conservative - Class I | 1.72% | 7.76% | 4.48% | 3.80% | 3.83% | 0.70% | 0.61% |

| Conservative - Class II | 1.64% | 7.56% | 4.24% | 3.54% | 3.55% | 0.95% | 0.86% |

| Conservative Blended Benchmark (20% Equity)*(a) | 1.16% | 8.59% | 5.55% | 4.86% | 4.89% | | |

| Blended Benchmark^(f) | 1.74% | 7.07% | 5.88% | 5.57% | 5.31% | | |

| Income & Growth - Class I | 5.01% | 15.93% | 6.84% | 5.44% | 4.66% | 0.66% | 0.62% |

| Income & Growth - Class II | 4.90% | 15.62% | 6.58% | 5.18% | 4.40% | 0.90% | 0.87% |

| Income & Growth Blended Benchmark (40% Equity)*(b) | 4.08% | 16.30% | 8.25% | 6.82% | 6.00% | | |

| Blended Benchmark^(g) | 5.00% | 14.84% | 8.87% | 7.95% | 6.65% | | |

| Balanced - Class I | 8.38% | 23.89% | 8.87% | 6.96% | 5.47% | 0.63% | 0.63% |

| Balanced - Class II | 8.27% | 23.61% | 8.61% | 6.69% | 5.21% | 0.88% | 0.88% |

| Balanced Blended Benchmark (60% Equity)*(c) | 7.09% | 24.42% | 10.88% | 8.67% | 6.94% | | |

| Blended Benchmark^(h) | 8.32% | 23.03% | 11.85% | 10.33% | 7.93% | | |

| Growth - Class I | 11.46% | 32.30% | 10.98% | 8.20% | 5.99% | 0.64% | 0.64% |

| Growth - Class II | 11.26% | 31.94% | 10.69% | 7.93% | 5.71% | 0.89% | 0.89% |

| Growth Blended Benchmark (80% Equity)*(d) | 10.20% | 32.94% | 13.39% | 10.37% | 7.68% | | |

| Blended Benchmark^(i) | 11.73% | 31.67% | 14.79% | 12.64% | 9.09% | | |

| Aggressive Growth - Class I | 14.17% | 39.91% | 12.44% | 8.95% | 6.17% | 0.68% | 0.66% |

| Aggressive Growth - Class II | 14.02% | 39.52% | 12.14% | 8.67% | 5.89% | 0.93% | 0.91% |

| Aggressive Growth Blended Benchmark (95% Equity)*(e) | 12.65% | 39.64% | 15.30% | 11.67% | 8.20% | | |

| Blended Benchmark^(j) | 14.36% | 38.47% | 16.94% | 14.29% | 9.83% | | |

Since each Portfolio does not seek to replicate its respective Blended benchmark*,^, performance results between the Portfolio and each respective benchmark can differ.

Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Portfolios will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. The graphs and tables above do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Investment performance reflects fee waivers in effect. In the absence of fee waivers, total return would be lower. To obtain performance data current to the most recent month-end, please call 1-866-432-2926.

Performance returns do not reflect expenses incurred from investing through a separate account or qualified plan and do not reflect variable annuity or life insurance contract charges. If they did, the overall fees and expenses would be higher.

| * | (a) The Conservative Benchmark is a blended benchmark consisting of 14% Russell 3000 TR USD/ 6% Morningstar Global Markets ex-US NR Index USD / 58% Bloomberg Barclays U.S. Universal TR USD/ 12% FTSE WGBI NonUSD USD/ 10% ICE BofAML Treasury 3 Month TR Index; (b) The Income and Growth Benchmark is a blended benchmark consisting of 28% Russell 3000 TR USD/ 12% Morningstar Global Markets ex-US NR Index USD/ 46% Bloomberg Barclays U.S. Universal TR USD/ 9% FTSE WGBI NonUSD USD/ 5% ICE BofAML Treasury 3 Month TR Index; (c) The Balanced Benchmark is a blended benchmark consisting of 42% Russell 3000 TR USD/ 18% Morningstar Global Markets ex-US NR Index USD/ 32% Bloomberg Barclays U.S. Universal TR USD/ 6% FTSE WGBI NonUSD USD/ 2% ICE BofAML Treasury 3 Month TR Index; (d) The Growth Benchmark is a blended benchmark consisting of 56% Russell 3000 TR USD/ 24% Morningstar Global Markets ex-US NR Index USD/ 15% Bloomberg Barclays U.S. Universal TR USD/ 3% FTSE WGBI NonUSD USD/ 2% ICE BofAML Treasury 3 Month TR Index; (e) The Aggressive Growth Benchmark is a blended benchmark consisting of 67% Russell 3000 TR USD/ 28% Morningstar Global Markets ex-US NR Index USD/ 3% Bloomberg Barclays U.S. Universal TR USD/ 2% ICE BofAML Treasury 3 Month TR Index. |

| ^ | Blended Benchmark: (f) Blended benchmark of 20% S&P 500® Index/73% Bloomberg Barclays U.S. Aggregate Bond Index /7% ICE BofAML Treasury 3 Month TR Index for the Conservative Portfolio; (g) 40% S&P 500® Index/55% Bloomberg Barclays U.S. Aggregate Bond Index/5% ICE BofAML Treasury 3 Month TR Index for the Income & Growth Portfolio; (h) 60% S&P 500® Index/38% Bloomberg Barclays U.S. Aggregate Bond Index/2% ICE BofAML Treasury 3 Month TR Index for the Balanced Portfolio; (i) 80% S&P 500® Index/20% Bloomberg Barclays U.S. Aggregate Bond Index for the Growth Portfolio; and (j) 95% S&P 500® Index/5% Bloomberg Barclays U.S. Aggregate Bond Index for the Aggressive Growth Portfolio. Each index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in an index. The S&P 500® and the Barclays Indexes reflect the reinvestment of dividends. |

| ^^ | Total return for a period of less than one year is not annualized. |

| † | Also see Notes to Financial Statements (Note 6) for further description of Expense Limitation Agreement in effect and Financial Highlights tables for expense ratios as of June 30, 2021. Note the net expense ratios above, as shown in the current Prospectus, include estimated acquired fund fees, which are not incurred in the expense ratios stated throughout the rest of this report. The Adviser and Sub-Adviser have contractually agreed to jointly waive its management fee and subadvisory fee, respectively, and/or reimburse expenses so that net expense ratios, excluding distribution and/or service (12b-1) fees, shareholder service fees, acquired fund fees and expenses, taxes, brokerage commissions, and extraordinary expenses, do not exceed a maximum of 0.53% of Class I or Class II shares average daily net assets through April 29, 2022. This means that acquired fund fees and expenses and extraordinary expenses may cause the Portfolio’s gross expense ratios shown above to exceed the maximum amounts of 0.53% for Class I or Class II agreed to by the Adviser and Sub-Adviser. |

| Morningstar ETF Asset Allocation Series | |

| Performance Overview (continued) | June 30, 2021 (Unaudited) |

ALPS Portfolio Solutions Distributor, Inc. (the “Distributor”) is the distributor for the Portfolios. The Distributor is not affiliated with the Sub-Adviser.

Morningstar Investment Management LLC (“Morningstar”) utilizes asset allocation models they have developed to allocate each Portfolio’s assets among the underlying exchange-traded funds (“ETFs”). Morningstar starts the investment process by scouring the globe for opportunities. Instead of tracking closely to an index-defined universe, Morningstar looks broadly, investigating asset classes, sub-asset classes, sectors, and securities in markets around the world. Morningstar applies a valuation analysis supported by in-depth fundamental research to find opportunities that are believed to be attractively priced. Morningstar prefers to invest in ideas that go against the market consensus because the only way to outperform is to be different from what the market has already included in the stock price. Morningstar also looks closely at each asset class’ risk, which can be complex, multifaceted, and vary over time. Morningstar believes that one of the best ways to control for risk is to buy fundamentally strong assets that appear to be underpriced. In-depth valuation analysis and contrarian indicators are the key ways Morningstar generates investment ideas. As valuation-driven investors, Morningstar primarily focuses on price changes relative to fair value through time. Given that markets are dynamic, Morningstar reassesses the portfolio given the changes in investment ideas, aggregate risks, and portfolio exposures. This iterative process reconsiders the opportunity set, with a constant eye on fundamental diversification and portfolio allocations.

MORNINGSTAR ETF ASSET ALLOCATION SERIES STRATEGIC ALLOCATION SUMMARY*

The table below shows there were no changes in the strategic allocations provided by Morningstar’s proprietary asset allocation methodology for the period ended June 30, 2021. Portfolio holdings are influenced by the strategic allocations, but actual investment percentages in each category may vary from time to time. See each Portfolio’s Schedule of Investments on the following pages for actual holdings allocations as of June 30, 2021.

| | Conservative as of | Income & Growth as of | Balanced as of | Growth as of | Aggressive Growth

as of |

| Asset Classes | 6/30/2021 | 12/31/2020 | 6/30/2021 | 12/31/2020 | 6/30/2021 | 12/31/2020 | 6/30/2021 | 12/31/2020 | 6/30/2021 | 12/31/2020 |

| U.S. Equity | 12.0% | 12.0% | 24.5% | 24.5% | 36.0% | 36.0% | 47.5% | 47.5% | 57.5% | 57.5% |

| Non-U.S. Equity | 8.0% | 8.0% | 15.5% | 15.5% | 24.0% | 24.0% | 32.5% | 32.5% | 37.5% | 37.5% |

| U.S. Bonds | 70.5% | 70.5% | 54.0% | 54.0% | 35.0% | 35.0% | 20.0% | 20.0% | 5.0% | 5.0% |

| Non-U.S. Bonds | 7.5% | 7.5% | 4.0% | 4.0% | 3.0% | 3.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| Cash Equivalents | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 2.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Each Portfolio allocates investments among multiple ETF asset classes including: U.S. equity, fixed income, real estate, and international ETFs. Asset allocation does not assure a profit or protect against down markets. Equity securities are subject to investment risk, including possible loss of principal amount invested. The stocks of smaller companies are subject to above-average market-price fluctuations. There are specific risks associated with international investing, such as currency fluctuations, foreign taxation, differences in financial reporting practices, and rapid changes in political and economic conditions. Real estate investments are subject to specific risks, such as risks related to general and local economic conditions and risks related to individual properties. Fixed income securities are subject to interest rate risk, prepayment risk, and market risk.

The Morningstar ETF Allocation Series Portfolios are not ETFs; instead, they consist of five risk-based asset allocation portfolios that invest in underlying ETFs, which are typically open-end investment companies or unit investment trusts.

| Morningstar ETF Asset Allocation Series | |

| Performance Overview (continued) | June 30, 2021 (Unaudited) |

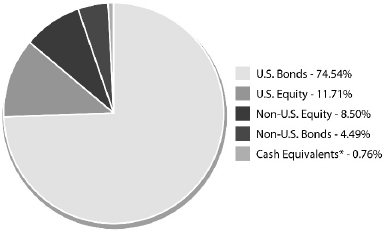

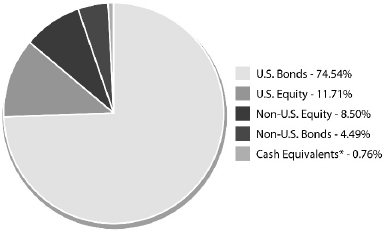

Conservative – Asset Class Allocation#

(as a percentage of net assets)

Balanced – Asset Class Allocation#

(as a percentage of net assets)

Aggressive Growth – Asset Class Allocation#

(as a percentage of net assets)

Income & Growth – Asset Class Allocation#

(as a percentage of net assets)

Growth – Asset Class Allocation#

(as a percentage of net assets)

| # | Portfolio asset classifications used in this chart are employed by one or more widely recognized market indexes or ratings group indexes, and/or are defined by Portfolio management. These classifications have been applied to the securities owned by the underlying ETFs held by each Portfolio as of June 30, 2021 and these underlying securities holdings are shown as a percentage of total Portfolio market value. These asset classifications are unaudited and do not reflect the legal status of any of the investments or companies in which the underlying ETF has invested. Holdings are subject to change and may not reflect the current or future position of the Portfolio. |

| * | Cash position shown includes all amounts related to pending purchases and sales of investment securities as of June 30, 2021. Holdings are subject to change and do not reflect the current or future position of the Portfolio. |

| Morningstar Conservative ETF Asset Allocation Portfolio |

| Schedule of Investments | As of June 30, 2021 (Unaudited) |

| Security Description | | Shares | | | Value | |

| Exchange Traded Funds - 99.24% | | | | | | |

| iShares - 12.13% | | | | | | |

iShares® Broad USD High Yield Corporate Bond ETF | | | 49,395 | | | $ | 2,060,759 | |

| iShares® Core S&P 500® ETF | | | 2,227 | | | | 957,432 | |

| iShares® Core S&P® Mid-Cap ETF | | | 2,100 | | | | 564,333 | |

iShares® JP Morgan USD Emerging Markets Bond ETF | | | 8,314 | | | | 934,993 | |

| | | | | | | | | |

| Total iShares | | | | | | | 4,517,517 | |

| | | | | | | | | |

| Other - 87.11% | | | | | | | | |

| Schwab Fundamental Emerging Markets Large Company Index ETF | | | 11,697 | | | | 377,228 | |

| Schwab Fundamental International Large Company Index ETF | | | 33,237 | | | | 1,106,127 | |

| Schwab US TIPS ETF | | | 32,652 | | | | 2,041,077 | |

VanEck Vectors® J.P. Morgan EM Local Currency Bond ETF | | | 23,479 | | | | 736,771 | |

Vanguard® FTSE Developed Markets ETF | | | 25,221 | | | | 1,299,386 | |

Vanguard® FTSE Emerging Markets ETF | | | 7,022 | | | | 381,365 | |

Vanguard® Intermediate-Term Corporate Bond ETF | | | 23,550 | | | | 2,238,898 | |

Vanguard® Intermediate-Term Government Bond ETF | | | 32,813 | | | | 2,225,050 | |

| Vanguard® Long-Term Bond ETF | | | 14,450 | | | | 1,488,783 | |

Vanguard® Mortgage-Backed Securities ETF | | | 48,710 | | | | 2,599,653 | |

| Vanguard® Short-Term Bond ETF | | | 79,307 | | | | 6,515,863 | |

| Vanguard® Total Bond Market ETF | | | 99,886 | | | | 8,579,209 | |

| Vanguard® Total Stock Market ETF | | | 10,240 | | | | 2,281,677 | |

| Vanguard® Value ETF | | | 4,054 | | | | 557,263 | |

| | | | | | | | | |

| Total Other | | | | | | | 32,428,350 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $34,500,244) | | | | | | | 36,945,867 | |

| | | 7-Day | | | | | | | |

| Security Description | | Yield | | | Shares | | | Value | |

| Short-Term Investments -0.99% | | | | | | | | | |

State Street Institutional

Treasury Plus Money

Market Fund | | | 0.010 | % | | | 368,637 | | | $ | 368,637 | |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $368,637) | | | | | | | | | | | 368,637 | |

| | | | | | | | | | | | | |

| Total Investments -100.23% | | | | | | | | | | | | |

| (Total cost $34,868,881) | | | | | | | | | | | 37,314,504 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.23)% | | | | | | | | (86,224 | ) |

| | | | | | | | | | | | | |

| Net Assets - 100.00% | | | | | | | | | | $ | 37,228,280 | |

See Notes to Financial Statements.

| Morningstar Income and Growth ETF Asset Allocation Portfolio |

| Schedule of Investments | As of June 30, 2021 (Unaudited) |

| Security Description | | Shares | | | Value | |

| Exchange Traded Funds - 98.86% | | | | | | |

| iShares - 16.61% | | | | | | |

| iShares® Broad USD High Yield Corporate Bond ETF | | | 74,532 | | | $ | 3,109,475 | |

| iShares® Core S&P 500® ETF | | | 7,599 | | | | 3,266,962 | |

| iShares® Core S&P® Mid-Cap ETF | | | 11,773 | | | | 3,163,759 | |

| iShares® JP Morgan USD Emerging Markets Bond ETF | | | 5,965 | | | | 670,824 | |

| iShares® MSCI EAFE Small-Cap ETF | | | 9,870 | | | | 731,959 | |

| iShares® MSCI United Kingdom ETF | | | 22,323 | | | | 729,962 | |

| | | | | | | | | |

| Total iShares | | | | | | | 11,672,941 | |

| | | | | | | | | |

| Other - 82.25% | | | | | | | | |

| JPMorgan BetaBuilders Japan ETF | | | 18,267 | | | | 1,031,903 | |

| Schwab Fundamental Emerging Markets Large Company Index ETF | | | 34,448 | | | | 1,110,948 | |

| Schwab Fundamental International Large Company Index ETF | | | 93,788 | | | | 3,121,265 | |

| Schwab US TIPS ETF | | | 49,669 | | | | 3,104,809 | |

| VanEck Vectors® J.P. Morgan EM Local Currency Bond ETF | | | 31,655 | | | | 993,334 | |

| Vanguard® Energy ETF | | | 10,408 | | | | 789,863 | |

| Vanguard® Financials ETF | | | 8,120 | | | | 734,454 | |

| Vanguard® FTSE Developed Markets ETF | | | 74,602 | | | | 3,843,495 | |

| Vanguard® FTSE Emerging Markets ETF | | | 25,809 | | | | 1,401,687 | |

| Vanguard® Intermediate-Term Corporate Bond ETF | | | 36,320 | | | | 3,452,942 | |

| Vanguard® Intermediate-Term Government Bond ETF | | | 39,992 | | | | 2,711,858 | |

| Vanguard® Long-Term Bond ETF | | | 20,400 | | | | 2,101,812 | |

| Vanguard® Mortgage-Backed Securities ETF | | | 31,466 | | | | 1,679,340 | |

| Vanguard® Short-Term Bond ETF | | | 83,812 | | | | 6,885,994 | |

| Vanguard® Small-Cap Value ETF | | | 4,300 | | | | 746,738 | |

| Vanguard® Total Bond Market ETF | | | 188,116 | | | | 16,157,283 | |

| Vanguard® Total Stock Market ETF | | | 27,532 | | | | 6,134,680 | |

| Vanguard® Value ETF | | | 12,900 | | | | 1,773,234 | |

| | | | | | | | | |

| Total Other | | | | | | | 57,775,639 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $60,088,976) | | | | | | | 69,448,580 | |

| | | 7-Day | | | | | | | |

| Security Description | | Yield | | | Shares | | | Value | |

| Short-Term Investments - 1.23% | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | 0.010 | % | | | 862,990 | | | $ | 862,990 | |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $862,990) | | | | | | | | | | | 862,990 | |

| | | | | | | | | | | | | |

| Total Investments -100.09% | | | | | | | | | | | | |

| (Total cost $60,951,966) | | | | | | | | | | | 70,311,570 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.09)% | | | | | | | | (65,278 | ) |

| | | | | | | | | | | | | |

| Net Assets - 100.00% | | | | | | | | | | $ | 70,246,292 | |

See Notes to Financial Statements.

| Morningstar Balanced ETF Asset Allocation Portfolio |

| Schedule of Investments | As of June 30, 2021 (Unaudited) |

| Security Description | | Shares | | | Value | |

| Exchange Traded Funds - 98.95% | | | | | | |

| iShares - 24.65% | | | | | | |

| iShares® Broad USD High Yield Corporate Bond ETF | | | 152,203 | | | $ | 6,349,909 | |

| iShares® Core S&P 500® ETF | | | 41,840 | | | | 17,987,853 | |

| iShares® Core S&P® Mid-Cap ETF | | | 43,653 | | | | 11,730,871 | |

| iShares® JP Morgan USD Emerging Markets Bond ETF | | | 15,681 | | | | 1,763,485 | |

| iShares® MSCI EAFE Small-Cap ETF | | | 51,890 | | | | 3,848,163 | |

| iShares® MSCI Germany ETF | | | 56,150 | | | | 1,942,790 | |

| iShares® MSCI United Kingdom ETF | | | 90,659 | | | | 2,964,549 | |

| | | | | | | | | |

| Total iShares | | | | | | | 46,587,620 | |

| | | | | | | | | |

| Other - 74.30% | | | | | | | | |

| JPMorgan BetaBuilders Japan ETF | | | 63,980 | | | | 3,614,230 | |

| Schwab Fundamental Emerging Markets Large Company Index ETF | | | 124,442 | | | | 4,013,254 | |

| Schwab Fundamental International Large Company Index ETF | | | 401,784 | | | | 13,371,371 | |

| Schwab US TIPS ETF | | | 57,470 | | | | 3,592,450 | |

| VanEck Vectors® J.P. Morgan EM Local Currency Bond ETF | | | 54,705 | | | | 1,716,643 | |

| Vanguard® Energy ETF | | | 56,733 | | | | 4,305,467 | |

| Vanguard® Financials ETF | | | 47,740 | | | | 4,318,083 | |

| Vanguard® FTSE Developed Markets ETF | | | 262,320 | | | | 13,514,726 | |

| Vanguard® FTSE Emerging Markets ETF | | | 101,684 | | | | 5,522,458 | |

| Vanguard® Intermediate-Term Corporate Bond ETF | | | 55,670 | | | | 5,292,547 | |

| Vanguard® Intermediate-Term Government Bond ETF | | | 90,538 | | | | 6,139,382 | |

| Vanguard® Long-Term Bond ETF | | | 33,590 | | | | 3,460,778 | |

| Vanguard® Mortgage-Backed Securities ETF | | | 33,049 | | | | 1,763,825 | |

| Vanguard® Short-Term Bond ETF | | | 43,188 | | | | 3,548,326 | |

| Vanguard® Small-Cap ETF | | | 8,880 | | | | 2,000,486 | |

| Vanguard® Small-Cap Value ETF | | | 12,183 | | | | 2,115,700 | |

| Vanguard® Total Bond Market ETF | | | 409,257 | | | | 35,151,084 | |

| Vanguard® Total Stock Market ETF | | | 89,080 | | | | 19,848,806 | |

| Vanguard® Value ETF | | | 51,769 | | | | 7,116,167 | |

| | | | | | | | | |

| Total Other | | | | | | | 140,405,783 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $150,792,184) | | | | | | | 186,993,403 | |

| | | 7-Day | | | | | | | |

| Security Description | | Yield | | | Shares | | | Value | |

| Short-Term Investments - 1.19% | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | 0.010 | % | | | 2,239,962 | | | $ | 2,239,962 | |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $2,239,962) | | | | | | | | | | | 2,239,962 | |

| | | | | | | | | | | | | |

| Total Investments -100.14% | | | | | | | | | | | | |

| (Total cost $153,032,146) | | | | | | | | | | | 189,233,365 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets -(0.14)% | | | | | | | | (263,137 | ) |

| | | | | | | | | | | | | |

| Net Assets - 100.00% | | | | | | | | | | $ | 188,970,228 | |

See Notes to Financial Statements.

| Morningstar Growth ETF Asset Allocation Portfolio | |

| Schedule of Investments | As of June 30, 2021 (Unaudited) |

| Security Description | | Shares | | | Value | |

| Exchange Traded Funds - 100.17% | | | | | | |

| iShares - 27.38% | | | | | | |

| iShares® Broad USD High Yield Corporate Bond ETF | | | 85,700 | | | $ | 3,575,404 | |

| iShares® Core S&P 500® ETF | | | 67,224 | | | | 28,900,942 | |

| iShares® Core S&P® Mid-Cap ETF | | | 71,215 | | | | 19,137,607 | |

| iShares® MSCI EAFE Small-Cap ETF | | | 85,170 | | | | 6,316,207 | |

| iShares® MSCI Germany ETF | | | 147,557 | | | | 5,105,473 | |

| iShares® MSCI United Kingdom ETF | | | 198,480 | | | | 6,490,296 | |

| | | | | | | | | |

| Total iShares | | | | | | | 69,525,929 | |

| | | | | | | | | |

| Other - 72.79% | | | | | | | | |

| JPMorgan BetaBuilders Japan ETF | | | 125,907 | | | | 7,112,486 | |

| Schwab Fundamental Emerging Markets Large Company Index ETF | | | 203,100 | | | | 6,549,975 | |

| Schwab Fundamental International Large Company Index ETF | | | 603,762 | | | | 20,093,199 | |

| Vanguard® Energy ETF | | | 87,816 | | | | 6,664,356 | |

| Vanguard® Financials ETF | | | 73,340 | | | | 6,633,603 | |

| Vanguard® FTSE Developed Markets ETF | | | 515,266 | | | | 26,546,504 | |

| Vanguard® FTSE Emerging Markets ETF | | | 154,460 | | | | 8,388,723 | |

| Vanguard® Intermediate-Term Corporate Bond ETF | | | 24,370 | | | | 2,316,856 | |

| Vanguard® Intermediate-Term Government Bond ETF | | | 67,953 | | | | 4,607,893 | |

| Vanguard® Short-Term Bond ETF | | | 28,372 | | | | 2,331,044 | |

| Vanguard® Small-Cap ETF | | | 23,331 | | | | 5,256,008 | |

| Vanguard® Small-Cap Value ETF | | | 16,005 | | | | 2,779,428 | |

| Vanguard® Total Bond Market ETF | | | 418,368 | | | | 35,933,628 | |

| Vanguard® Total Stock Market ETF | | | 170,494 | | | | 37,989,473 | |

| Vanguard® Value ETF | | | 84,886 | | | | 11,668,430 | |

| | | | | | | | | |

| Total Other | | | | | | | 184,871,606 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $193,991,887) | | | | | | | 254,397,535 | |

| | | 7-Day | | | | | | | |

| Security Description | | Yield | | | Shares | | | Value | |

| Short-Term Investments - 0.12% | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | 0.010 | % | | | 290,750 | | | $ | 290,750 | |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $290,750) | | | | | | | | | | | 290,750 | |

| | | | | | | | | | | | | |

| Total Investments -100.29% | | | | | | | | | | | | |

| (Total cost $194,282,637) | | | | | | | | | | | 254,688,285 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.29)% | | | | | | | | (727,780 | ) |

| | | | | | | | | | | | | |

| Net Assets - 100.00% | | | | | | | | | | $ | 253,960,505 | |

See Notes to Financial Statements.

| Morningstar Aggressive Growth ETF Asset Allocation Portfolio |

| Schedule of Investments | As of June 30, 2021 (Unaudited) |

| Security Description | | Shares | | | Value | |

| Exchange Traded Funds - 99.91% | | | | | | |

| iShares - 29.48% | | | | | | |

| iShares® Core S&P 500® ETF | | | 41,176 | | | $ | 17,702,386 | |

| iShares® Core S&P® Mid-Cap ETF | | | 45,894 | | | | 12,333,095 | |

| iShares® MSCI EAFE Small- Cap ETF | | | 57,280 | | | | 4,247,885 | |

| iShares® MSCI Germany ETF | | | 103,340 | | | | 3,575,564 | |

| iShares® MSCI United Kingdom ETF | | | 154,909 | | | | 5,065,524 | |

| | | | | | | | | |

| Total iShares | | | | | | | 42,924,454 | |

| | | | | | | | | |

| Other - 70.43% | | | | | | | | |

| JPMorgan BetaBuilders Japan ETF | | | 87,787 | | | | 4,959,087 | |

| Schwab Fundamental Emerging Markets Large Company Index ETF | | | 182,756 | | | | 5,893,881 | |

| Schwab Fundamental International Large Company Index ETF | | | 430,710 | | | | 14,334,029 | |

| Vanguard® Energy ETF | | | 58,629 | | | | 4,449,355 | |

| Vanguard® Financials ETF | | | 56,880 | | | | 5,144,796 | |

| Vanguard® FTSE Developed Markets ETF | | | 335,213 | | | | 17,270,174 | |

| Vanguard® FTSE Emerging Markets ETF | | | 78,912 | | | | 4,285,711 | |

| Vanguard® Small-Cap ETF | | | 19,388 | | | | 4,367,728 | |

| Vanguard® Small-Cap Value ETF | | | 12,953 | | | | 2,249,418 | |

| Vanguard® Total Bond Market ETF | | | 83,652 | | | | 7,184,870 | |

| Vanguard® Total Stock Market ETF | | | 109,679 | | | | 24,438,675 | |

| Vanguard® Value ETF | | | 57,959 | | | | 7,967,044 | |

| | | | | | | | | |

| Total Other | | | | | | | 102,544,768 | |

| | | | | | | | | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $107,923,020) | | | | | | | 145,469,222 | |

| | | 7-Day | | | �� | | | | |

| Security Description | | Yield | | | Shares | | | Value | |

| Short-Term Investments - 0.16% | | | | | | | | | |

| State Street Institutional Treasury Plus Money Market Fund | | | 0.010 | % | | | 229,553 | | | $ | 229,553 | |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $229,553) | | | | | | | | | | | 229,553 | |

| | | | | | | | | | | | | |

| Total Investments - 100.07% | | | | | | | | | | | | |

| (Total cost $108,152,573) | | | | | | | | | | | 145,698,775 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.07)% | | | | | | | (99,542 | ) |

| | | | | | | | | | | | | |

| Net Assets - 100.00% | | | | | | | | | | $ | 145,599,233 | |

See Notes to Financial Statements.

| Morningstar ETF Asset Allocation Series | |

| Statements of Assets and Liabilities | As of June 30, 2021 (Unaudited) |

| | | Morningstar Conservative ETF Asset Allocation Portfolio | | | Morningstar Income and Growth ETF Asset Allocation Portfolio | | | Morningstar Balanced ETF Asset Allocation Portfolio Allocation Portfolio | | | Morningstar ETF Asset Allocation Portfolio | | | Morningstar Growth Aggressive Growth ETF Asset | |

| ASSETS: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Investments, at value | | $ | 37,314,504 | | | $ | 70,311,570 | | | $ | 189,233,365 | | | $ | 254,688,285 | | | $ | 145,698,775 | |

| Receivable for shares sold | | | 1,872 | | | | 5,237 | | | | 14,477 | | | | 79,173 | | | | 11,762 | |

| Dividends receivable | | | – | | | | 6 | | | | 14 | | | | – | | | | – | |

| Other assets | | | 1,553 | | | | 2,824 | | | | 7,794 | | | | 10,431 | | | | 6,007 | |

| Total Assets | | | 37,317,929 | | | | 70,319,637 | | | | 189,255,650 | | | | 254,777,889 | | | | 145,716,544 | |

| | | | | | | | | | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Payable for shares redeemed | | | 47,776 | | | | 7,258 | | | | 136,546 | | | | 631,134 | | | | 10,044 | |

| Payable to advisor | | | 9,972 | | | | 24,153 | | | | 70,483 | | | | 94,905 | | | | 52,918 | |

| Payable for distribution and service fees | | | 6,679 | | | | 13,026 | | | | 32,058 | | | | 29,160 | | | | 11,488 | |

| Payable for audit fees | | | 10,769 | | | | 10,776 | | | | 10,796 | | | | 10,805 | | | | 10,782 | |

| Payable for trustees' fees | | | 61 | | | | 97 | | | | 246 | | | | 323 | | | | 180 | |

| Accrued expenses and other liabilities | | | 14,392 | | | | 18,035 | | | | 35,293 | | | | 51,057 | | | | 31,899 | |

| Total Liabilities | | | 89,649 | | | | 73,345 | | | | 285,422 | | | | 817,384 | | | | 117,311 | |

| Net Assets | | $ | 37,228,280 | | | $ | 70,246,292 | | | $ | 188,970,228 | | | $ | 253,960,505 | | | $ | 145,599,233 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 33,056,431 | | | $ | 56,785,258 | | | $ | 141,928,657 | | | $ | 178,761,555 | | | $ | 100,487,495 | |

| Total distributable earnings | | | 4,171,849 | | | | 13,461,034 | | | | 47,041,571 | | | | 75,198,950 | | | | 45,111,738 | |

| Net Assets | | $ | 37,228,280 | | | $ | 70,246,292 | | | $ | 188,970,228 | | | $ | 253,960,505 | | | $ | 145,599,233 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investments, at Cost | | $ | 34,868,881 | | | $ | 60,951,966 | | | $ | 153,032,146 | | | $ | 194,282,637 | | | $ | 108,152,573 | |

| | | | | | | | | | | | | | | | | | | | | |

| PRICING OF SHARES: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Class I: | | | | | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 4,781,575 | | | $ | 6,808,514 | | | $ | 33,942,794 | | | $ | 113,030,338 | | | $ | 90,079,379 | |

| Shares of beneficial interest outstanding | | | 403,417 | | | | 624,703 | | | | 2,821,003 | | | | 8,676,529 | | | | 6,010,600 | |

| Net assets value, offering and redemption price per share | | $ | 11.85 | | | $ | 10.90 | | | $ | 12.03 | | | $ | 13.03 | | | $ | 14.99 | |

| | | | | | | | | | | | | | | | | | | | | |

| Class II: | | | | | | | | | | | | | | | | | | | | |

| Net Assets | | $ | 32,446,705 | | | $ | 63,437,778 | | | $ | 155,027,434 | | | $ | 140,930,167 | | | $ | 55,519,854 | |

| Shares of beneficial interest outstanding | | | 2,753,814 | | | | 5,488,549 | | | | 12,738,418 | | | | 11,049,055 | | | | 3,750,729 | |

| Net assets value, offering and redemption price per share | | $ | 11.78 | | | $ | 11.56 | | | $ | 12.17 | | | $ | 12.75 | | | $ | 14.80 | |

See Notes to Financial Statements.

| Morningstar ETF Asset Allocation Series |

| Statements of Operations | For the Six Months Ended June 30, 2021 (Unaudited) |

| | | Morningstar Conservative ETF Asset Allocation Portfolio | | | Morningstar Income and Growth ETF Asset Allocation Portfolio | | | Morningstar Balanced ETF Asset Allocation Portfolio | | | Morningstar Growth ETF Asset Allocation Portfolio | | | Morningstar Aggressive Growth ETF Asset Allocation Portfolio | |

| | | | | | | | | | | | | | | | |

| INVESTMENT INCOME: | | | | | | | | | | | | | | | |

| Dividends | | $ | 325,409 | | | $ | 602,640 | | | $ | 1,641,682 | | | $ | 2,115,435 | | | $ | 1,203,058 | |

| Total Investment Income | | | 325,409 | | | | 602,640 | | | | 1,641,682 | | | | 2,115,435 | | | | 1,203,058 | |

| | | | | | | | | | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | | | | | | | | | |

| Investment advisor fee | | | 83,843 | | | | 154,820 | | | | 413,113 | | | | 550,020 | | | | 312,150 | |

| Recoupment of previously waived fees | | | – | | | | – | | | | 1,160 | | | | 2,996 | | | | – | |

| 12b-1 fees: | | | | | | | | | | | | | | | | | | | | |

| Class II | | | 41,027 | | | | 77,818 | | | | 189,811 | | | | 170,946 | | | | 68,243 | |

| Custodian fees | | | 6,146 | | | | 2,747 | | | | 4,632 | | | | 9,111 | | | | 5,115 | |

| Administration fees | | | 4,078 | | | | 4,078 | | | | 4,078 | | | | 4,078 | | | | 4,078 | |

| Legal fees | | | 2,178 | | | | 3,872 | | | | 9,924 | | | | 13,135 | | | | 7,325 | |

| Audit fees | | | 8,805 | | | | 8,812 | | | | 8,832 | | | | 8,842 | | | | 8,819 | |

| Trustees' fees and expenses | | | 5,511 | | | | 9,751 | | | | 24,846 | | | | 32,813 | | | | 18,246 | |

| Report to shareholder fees | | | 1,551 | | | | 2,767 | | | | 6,763 | | | | 11,134 | | | | 7,527 | |

| Other expenses | | | 6,143 | | | | 7,950 | | | | 13,685 | | | | 16,418 | | | | 10,572 | |

| Total expenses before waiver/reimbursements | | | 159,282 | | | | 272,615 | | | | 676,844 | | | | 819,493 | | | | 442,075 | |

| Less fees waived/reimbursed by investment advisor | | | | | | | | | | | | | | | | | | | | |

| Class I | | | (2,338 | ) | | | (1,177 | ) | | | (1 | ) | | | – | | | | (3,467 | ) |

| Class II | | | (17,151 | ) | | | (11,152 | ) | | | (72 | ) | | | – | | | | (2,187 | ) |

| Total Net Expenses | | | 139,793 | | | | 260,286 | | | | 676,771 | | | | 819,493 | | | | 436,421 | |

| Net Investment Income | | | 185,616 | | | | 342,354 | | | | 964,911 | | | | 1,295,942 | | | | 766,637 | |

| | | | | | | | | | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | | | | | | | | | | | | | |

| Net realized gain on investments | | | 581,041 | | | | 1,149,851 | | | | 1,477,598 | | | | 2,433,954 | | | | 2,467,055 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (151,678 | ) | | | 1,846,965 | | | | 12,275,809 | | | | 22,461,745 | | | | 14,976,599 | |

| Net Realized and Unrealized Gain on Investments | | | 429,363 | | | | 2,996,816 | | | | 13,753,407 | | | | 24,895,699 | | | | 17,443,654 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 614,979 | | | $ | 3,339,170 | | | $ | 14,718,318 | | | $ | 26,191,641 | | | $ | 18,210,291 | |

See Notes to Financial Statements.

| Morningstar Conservative ETF Asset Allocation Portfolio |

| Statements of Changes in Net Assets |

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| | | | | | | |

| Net investment income | | $ | 185,616 | | | $ | 524,012 | |

| Net realized gain | | | 581,041 | | | | 675,242 | |

| Long-term capital gain distributions from other investment companies | | | – | | | | 58,845 | |

| Net change in unrealized appreciation/(depreciation) | | | (151,678 | ) | | | 1,218,494 | |

| Net increase in net assets resulting from operations | | | 614,979 | | | | 2,476,593 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Class I | | | – | | | | (102,256 | ) |

| Class II | | | – | | | | (757,895 | ) |

| Total distributions | | | – | | | | (860,151 | ) |

| | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sale of shares | | | 742,156 | | | | 645,876 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 102,256 | |

| Cost of shares redeemed | | | (376,046 | ) | | | (954,884 | ) |

| Net increase/(decrease) from share transactions | | | 366,110 | | | | (206,752 | ) |

| Class II | | | | | | | | |

| Proceeds from sale of shares | | | 4,001,897 | | | | 18,818,243 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 757,895 | |

| Cost of shares redeemed | | | (5,324,554 | ) | | | (18,123,816 | ) |

| Net increase/(decrease) from share transactions | | | (1,322,657 | ) | | | 1,452,322 | |

| | | | | | | | | |

| Net increase/(decrease) in net assets | | | (341,568 | ) | | | 2,862,012 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of period | | | 37,569,848 | | | | 34,707,836 | |

| End of period | | $ | 37,228,280 | | | $ | 37,569,848 | |

| | | | | | | | | |

| OTHER INFORMATION - SHARES: | | | | | | | | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 63,314 | | | | 57,004 | |

| Reinvested | | | – | | | | 8,846 | |

| Redeemed | | | (32,057 | ) | | | (83,933 | ) |

| Net increase/(decrease) in shares outstanding | | | 31,257 | | | | (18,083 | ) |

| | | | | | | | | |

| Class II | | | | | | | | |

| Sold | | | 344,902 | | | | 1,688,966 | |

| Reinvested | | | – | | | | 65,846 | |

| Redeemed | | | (458,292 | ) | | | (1,614,343 | ) |

| Net increase/(decrease) in shares outstanding | | | (113,390 | ) | | | 140,469 | |

See Notes to Financial Statements.

| Morningstar Income and Growth ETF Asset Allocation Portfolio |

| Statements of Changes in Net Assets |

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| | | | | | | |

| Net investment income | | $ | 342,354 | | | $ | 982,032 | |

| Net realized gain | | | 1,149,851 | | | | 1,880,698 | |

| Long-term capital gain distributions from other investment companies | | | – | | | | 80,152 | |

| Net change in unrealized appreciation | | | 1,846,965 | | | | 2,356,915 | |

| Net increase in net assets resulting from operations | | | 3,339,170 | | | | 5,299,797 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Class I | | | – | | | | (222,482 | ) |

| Class II | | | – | | | | (1,973,856 | ) |

| Total distributions | | | – | | | | (2,196,338 | ) |

| | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sale of shares | | | 554,012 | | | | 909,590 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 222,482 | |

| Cost of shares redeemed | | | (404,838 | ) | | | (720,943 | ) |

| Net increase from share transactions | | | 149,174 | | | | 411,129 | |

| Class II | | | | | | | | |

| Proceeds from sale of shares | | | 2,861,379 | | | | 5,688,539 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 1,973,856 | |

| Cost of shares redeemed | | | (5,403,386 | ) | | | (13,855,660 | ) |

| Net decrease from share transactions | | | (2,542,007 | ) | | | (6,193,265 | ) |

| | | | | | | | | |

| Net increase/(decrease) in net assets | | | 946,337 | | | | (2,678,677 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of period | | | 69,299,955 | | | | 71,978,632 | |

| End of period | | $ | 70,246,292 | | | $ | 69,299,955 | |

| | | | | | | | | |

| OTHER INFORMATION - SHARES: | | | | | | | | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 52,209 | | | | 92,241 | |

| Reinvested | | | – | | | | 21,663 | |

| Redeemed | | | (37,870 | ) | | | (73,110 | ) |

| Net increase in shares outstanding | | | 14,339 | | | | 40,794 | |

| | | | | | | | | |

| Class II | | | | | | | | |

| Sold | | | 253,288 | | | | 549,296 | |

| Reinvested | | | – | | | | 180,922 | |

| Redeemed | | | (480,177 | ) | | | (1,338,434 | ) |

| Net decrease in shares outstanding | | | (226,889 | ) | | | (608,216 | ) |

See Notes to Financial Statements.

| Morningstar Balanced ETF Asset Allocation Portfolio |

| Statements of Changes in Net Assets |

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| | | | | | | |

| Net investment income | | $ | 964,911 | | | $ | 2,484,027 | |

| Net realized gain | | | 1,477,598 | | | | 6,333,488 | |

| Long-term capital gain distributions from other investment companies | | | – | | | | 155,115 | |

| Net change in unrealized appreciation | | | 12,275,809 | | | | 4,756,345 | |

| Net increase in net assets resulting from operations | | | 14,718,318 | | | | 13,728,975 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Class I | | | – | | | | (993,719 | ) |

| Class II | | | – | | | | (4,588,072 | ) |

| Total distributions | | | – | | | | (5,581,791 | ) |

| | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sale of shares | | | 2,249,255 | | | | 3,175,861 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 993,719 | |

| Cost of shares redeemed | | | (1,164,502 | ) | | | (3,062,996 | ) |

| Net increase from share transactions | | | 1,084,753 | | | | 1,106,584 | |

| Class II | | | | | | | | |

| Proceeds from sale of shares | | | 6,201,911 | | | | 17,455,053 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 4,588,072 | |

| Cost of shares redeemed | | | (12,486,735 | ) | | | (23,575,084 | ) |

| Net decrease from share transactions | | | (6,284,824 | ) | | | (1,531,959 | ) |

| | | | | | | | | |

| Net increase in net assets | | | 9,518,247 | | | | 7,721,809 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of period | | | 179,451,981 | | | | 171,730,172 | |

| End of period | | $ | 188,970,228 | | | $ | 179,451,981 | |

| | | | | | | | | |

| OTHER INFORMATION - SHARES: | | | | | | | | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 191,688 | | | | 308,748 | |

| Reinvested | | | – | | | | 90,585 | |

| Redeemed | | | (100,461 | ) | | | (308,932 | ) |

| Net increase in shares outstanding | | | 91,227 | | | | 90,401 | |

| | | | | | | | | |

| Class II | | | | | | | | |

| Sold | | | 525,516 | | | | 1,637,954 | |

| Reinvested | | | – | | | | 412,968 | |

| Redeemed | | | (1,059,236 | ) | | | (2,321,293 | ) |

| Net decrease in shares outstanding | | | (533,720 | ) | | | (270,371 | ) |

See Notes to Financial Statements.

| Morningstar Growth ETF Asset Allocation Portfolio |

| Statements of Changes in Net Assets |

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| | | | | | | |

| Net investment income | | $ | 1,295,942 | | | $ | 3,291,937 | |

| Net realized gain | | | 2,433,954 | | | | 8,431,282 | |

| Long-term capital gain distributions from other investment companies | | | – | | | | 63,520 | |

| Net change in unrealized appreciation | | | 22,461,745 | | | | 8,873,338 | |

| Net increase in net assets resulting from operations | | | 26,191,641 | | | | 20,660,077 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Class I | | | – | | | | (4,679,798 | ) |

| Class II | | | – | | | | (5,956,158 | ) |

| Total distributions | | | – | | | | (10,635,956 | ) |

| | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sale of shares | | | 3,921,172 | | | | 7,403,181 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 4,679,798 | |

| Cost of shares redeemed | | | (4,263,552 | ) | | | (6,353,295 | ) |

| Net increase/(decrease) from share transactions | | | (342,380 | ) | | | 5,729,684 | |

| Class II | | | | | | | | |

| Proceeds from sale of shares | | | 3,845,228 | | | | 12,055,432 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 5,956,158 | |

| Cost of shares redeemed | | | (9,402,918 | ) | | | (27,271,241 | ) |

| Net decrease from share transactions | | | (5,557,690 | ) | | | (9,259,651 | ) |

| | | | | | | | | |

| Net increase in net assets | | | 20,291,571 | | | | 6,494,154 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of period | | | 233,668,934 | | | | 227,174,780 | |

| End of period | | $ | 253,960,505 | | | $ | 233,668,934 | |

| | | | | | | | | |

| OTHER INFORMATION - SHARES: | | | | | | | | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 312,393 | | | | 701,893 | |

| Reinvested | | | – | | | | 405,528 | |

| Redeemed | | | (340,652 | ) | | | (606,866 | ) |

| Net increase/(decrease) in shares outstanding | | | (28,259 | ) | | | 500,555 | |

| | | | | | | | | |

| Class II | | | | | | | | |

| Sold | | | 312,099 | | | | 1,165,916 | |

| Reinvested | | | – | | | | 526,628 | |

| Redeemed | | | (766,081 | ) | | | (2,645,497 | ) |

| Net decrease in shares outstanding | | | (453,982 | ) | | | (952,953 | ) |

See Notes to Financial Statements.

| Morningstar Aggressive Growth ETF Asset Allocation Portfolio |

| Statements of Changes in Net Assets |

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | |

| | | | | | | |

| OPERATIONS: | | | | | | |

| | | | | | | |

| Net investment income | | $ | 766,637 | | | $ | 1,800,184 | |

| Net realized gain | | | 2,467,055 | | | | 2,716,921 | |

| Long-term capital gain distributions from other investment companies | | | – | | | | 7,466 | |

| Net change in unrealized appreciation | | | 14,976,599 | | | | 7,732,936 | |

| Net increase in net assets resulting from operations | | | 18,210,291 | | | | 12,257,507 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Class I | | | – | | | | (2,734,191 | ) |

| Class II | | | – | | | | (1,851,426 | ) |

| Total distributions | | | – | | | | (4,585,617 | ) |

| | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sale of shares | | | 4,856,859 | | | | 8,571,638 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 2,734,191 | |

| Cost of shares redeemed | | | (2,179,521 | ) | | | (4,561,933 | ) |

| Net increase from share transactions | | | 2,677,338 | | | | 6,743,896 | |

| Class II | | | | | | | | |

| Proceeds from sale of shares | | | 2,175,780 | | | | 8,782,518 | |

| Issued to shareholders in reinvestment of distributions | | | – | | | | 1,851,426 | |

| Cost of shares redeemed | | | (7,116,970 | ) | | | (12,163,352 | ) |

| Net decrease from share transactions | | | (4,941,190 | ) | | | (1,529,408 | ) |

| | | | | | | | | |

| Net increase in net assets | | | 15,946,439 | | | | 12,886,378 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of period | | | 129,652,794 | | | | 116,766,416 | |

| End of period | | $ | 145,599,233 | | | $ | 129,652,794 | |

| | | | | | | | | |

| OTHER INFORMATION - SHARES: | | | | | | | | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 338,791 | | | | 745,782 | |

| Reinvested | | | – | | | | 211,789 | |

| Redeemed | | | (149,710 | ) | | | (388,591 | ) |

| Net increase in shares outstanding | | | 189,081 | | | | 568,980 | |

| | | | | | | | | |

| Class II | | | | | | | | |

| Sold | | | 154,993 | | | | 772,378 | |

| Reinvested | | | – | | | | 144,982 | |

| Redeemed | | | (506,088 | ) | | | (1,058,048 | ) |

| Net decrease in shares outstanding | | | (351,095 | ) | | | (140,688 | ) |

See Notes to Financial Statements.

| Morningstar Conservative ETF Asset Allocation Portfolio – Class I |

| Financial Highlights |

The financial highlights table is intended to help you understand the Portfolio’s financial performance for the years presented. Certain information reflects financial results for a single Portfolio share. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Portfolio (assuming reinvestment of all dividends and distributions).

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | | | For the Year Ended December 31, 2019 | | | For the Year Ended December 31, 2018 | | | For the Year Ended December 31, 2017 | | | For the Year Ended December 31, 2016(1) | |

| PER COMMON SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net asset value - beginning of year | | $ | 11.65 | | | $ | 11.18 | | | $ | 10.50 | | | $ | 11.16 | | | $ | 10.75 | | | $ | 10.72 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income after waiver/reimbursements(2) | | | 0.07 | | | | 0.19 | | | | 0.24 | | | | 0.25 | | | | 0.25 | | | | 0.22 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.13 | | | | 0.56 | | | | 0.78 | | | | (0.48 | ) | | | 0.44 | | | | 0.30 | |

| Total income/(loss) from investment operations | | | 0.20 | | | | 0.75 | | | | 1.02 | | | | (0.23 | ) | | | 0.69 | | | | 0.52 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income after waiver/reimbursements | | | – | | | | (0.22 | ) | | | (0.25 | ) | | | (0.27 | ) | | | (0.23 | ) | | | (0.20 | ) |

| From net realized gain | | | – | | | | (0.06 | ) | | | (0.09 | ) | | | (0.16 | ) | | | (0.05 | ) | | | (0.29 | ) |

| Total distributions | | | – | | | | (0.28 | ) | | | (0.34 | ) | | | (0.43 | ) | | | (0.28 | ) | | | (0.49 | ) |

| Net increase/(decrease) in net asset value | | | 0.20 | | | | 0.47 | | | | 0.68 | | | | (0.66 | ) | | | 0.41 | | | | 0.03 | |

| Net asset value - end of year | | $ | 11.85 | | | $ | 11.65 | | | $ | 11.18 | | | $ | 10.50 | | | $ | 11.16 | | | $ | 10.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return* | | | 1.72 | %(3) | | | 6.80 | % | | | 9.75 | % | | | (2.09 | )% | | | 6.45 | % | | | 4.88 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000) | | $ | 4,782 | | | $ | 4,334 | | | $ | 4,362 | | | $ | 3,891 | | | $ | 3,888 | | | $ | 3,714 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total expenses before waiver/reimbursements | | | 0.63 | %(4) | | | 0.62 | % | | | 0.62 | % | | | 0.59 | % | | | 0.57 | % | | | 0.58 | % |

| Net expenses after waiver/reimbursements | | | 0.53 | %(4) | | | 0.53 | % | | | 0.53 | % | | | 0.53 | % | | | 0.53 | % | | | 0.53 | % |

| Net investment income after waiver/reimbursements | | | 1.22 | %(4) | | | 1.65 | % | | | 2.17 | % | | | 2.24 | % | | | 2.27 | % | | | 1.97 | % |

| Portfolio turnover rate | | | 9 | %(3) | | | 73 | % | | | 17 | % | | | 47 | % | | | 35 | % | | | 55 | % |

| * | Assumes reinvestment of any dividends and distributions. The performance does not include the fees and expenses incurred by investing through a separate account or qualified plan and does not reflect the variable annuity or life insurance contract charges. If they did the Portfolio’s performance would be lower. |

| (1) | Prior to April 30, 2016, the Morningstar Conservative ETF Asset Allocation Portfolio was known as Ibbotson Conservative ETF Asset Allocation Portfolio. |

| (2) | Per share numbers have been calculated using the average shares method. |

See Notes to Financial Statements.

| Morningstar Conservative ETF Asset Allocation Portfolio – Class II |

| Financial Highlights |

The financial highlights table is intended to help you understand the Portfolio’s financial performance for the years presented. Certain information reflects financial results for a single Portfolio share. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Portfolio (assuming reinvestment of all dividends and distributions).

| | | For the Six Months Ended June 30, 2021 (Unaudited) | | | For the Year Ended December 31, 2020 | | | For the Year Ended December 31, 2019 | | | For the Year Ended December 31, 2018 | | | For the Year Ended December 31, 2017 | | | For the Year Ended December 31, 2016(1) | |

| PER COMMON SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net asset value - beginning of year | | $ | 11.59 | | | $ | 11.13 | | | $ | 10.45 | | | $ | 11.11 | | | $ | 10.70 | | | $ | 10.67 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income after waiver/reimbursements(2) | | | 0.06 | | | | 0.16 | | | | 0.21 | | | | 0.22 | | | | 0.22 | | | | 0.18 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.13 | | | | 0.56 | | | | 0.78 | | | | (0.48 | ) | | | 0.44 | | | | 0.31 | |

| Total income/(loss) from investment operations | | | 0.19 | | | | 0.72 | | | | 0.99 | | | | (0.26 | ) | | | 0.66 | | | | 0.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income after waiver/reimbursements | | | – | | | | (0.20 | ) | | | (0.22 | ) | | | (0.24 | ) | | | (0.20 | ) | | | (0.17 | ) |

| From net realized gain | | | – | | | | (0.06 | ) | | | (0.09 | ) | | | (0.16 | ) | | | (0.05 | ) | | | (0.29 | ) |

| Total distributions | | | – | | | | (0.26 | ) | | | (0.31 | ) | | | (0.40 | ) | | | (0.25 | ) | | | (0.46 | ) |

| Net increase/(decrease) in net asset value | | | 0.19 | | | | 0.46 | | | | 0.68 | | | | (0.66 | ) | | | 0.41 | | | | 0.03 | |

| Net asset value - end of year | | $ | 11.78 | | | $ | 11.59 | | | $ | 11.13 | | | $ | 10.45 | | | $ | 11.11 | | | $ | 10.70 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Return* | | | 1.64 | %(3) | | | 6.49 | % | | | 9.53 | % | | | (2.37 | )% | | | 6.20 | % | | | 4.61 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000) | | $ | 32,447 | | | $ | 33,236 | | | $ | 30,346 | | | $ | 29,536 | | | $ | 31,368 | | | $ | 31,705 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total expenses before waiver/reimbursements | | | 0.88 | %(4) | | | 0.87 | % | | | 0.87 | % | | | 0.84 | % | | | 0.82 | % | | | 0.83 | % |

| Net expenses after waiver/reimbursements | | | 0.78 | %(4) | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

| Net investment income after waiver/reimbursements | | | 0.97 | %(4) | | | 1.42 | % | | | 1.90 | % | | | 1.98 | % | | | 2.00 | % | | | 1.66 | % |

| Portfolio turnover rate | | | 9 | %(3) | | | 73 | % | | | 17 | % | | | 47 | % | | | 35 | % | | | 55 | % |

| * | Assumes reinvestment of any dividends and distributions. The performance does not include the fees and expenses incurred by investing through a separate account or qualified plan and does not reflect the variable annuity or life insurance contract charges. If they did the Portfolio’s performance would be lower. |

| (1) | Prior to April 30, 2016, the Morningstar Conservative ETF Asset Allocation Portfolio was known as Ibbotson Conservative ETF Asset Allocation Portfolio. |

| (2) | Per share numbers have been calculated using the average shares method. |

| (3) | Not annualized. |

| (4) | Annualized. |

See Notes to Financial Statements.

| Morningstar Income and Growth ETF Asset Allocation Portfolio – Class I |

| Financial Highlights |

The financial highlights table is intended to help you understand the Portfolio’s financial performance for the years presented. Certain information reflects financial results for a single Portfolio share. The total returns in the table represent the rate that an investor would have earned or lost on an investment in the Portfolio (assuming reinvestment of all dividends and distributions).