Exhibit 4.2.2

AMENDMENT NO. 2 TO THE

AMENDED AND RESTATED

DECLARATION OF TRUST AND TRUST AGREEMENT

OF

DB MULTI-SECTOR COMMODITY MASTER TRUST

This Amendment No. 2 (“Amendment No. 2”) to the Amended and Restated Declaration of Trust and Trust Agreement dated as of November 21, 2006 (the “Declaration of Trust”) of DB Multi-Sector Commodity Master Trust (the “Master Trust”) by and among DB Commodity Services LLC (the “Managing Owner”), Wilmington Trust Company and PowerShares DB Multi-Sector Commodity Trust.

WHEREAS, the Managing Owner has determined that the DB Agriculture Master Fund will (i) replace its current index, Deutsche Bank Liquid Commodity Index–Optimum Yield Agriculture Excess Return™ with Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™ (the “Index”) and (ii) commence tracking the Index on October 19, 2009;

WHEREAS, the Managing Owner wishes to amend the Declaration of Trust pursuant to Section 11.1(b)(iii) thereof to give effect to the replacement of Exhibit B as provided below, effective as of October 19, 2009.

NOW, THEREFORE, in consideration of the premises and of other good and valuable consideration, the receipt and sufficiency of all of which are hereby acknowledged, the Declaration of Trust is amended as follows:

| 1. | Exhibit B to the Declaration of Trust shall be amended and replaced in its entirety withExhibit A attached hereto. |

| 2. | This Amendment No. 2 to the Declaration of Trust shall be governed by, and construed in accordance with, the laws of the State of Delaware. |

| 3. | Terms used but not otherwise defined herein shall have the meaning ascribed to such term in the Declaration of Trust, as amended. |

Remainder of page left blank intentionally.

IN WITNESS WHEREOF, this Amendment No. 2 has been executed for and on behalf of the undersigned as of the 30th day of September, 2009.

| DB COMMODITY SERVICES LLC, as Managing Owner | ||||

| By: | /s/ Martin Kremenstein | |||

| Name: | Martin Kremenstein | |||

| Title: | Chief Operating Officer | |||

| By: | /s/ Michael Gilligan | |||

| Name: | Michael Gilligan | |||

| Title: | Principal Financial Officer | |||

| Acknowledged: | ||||

WILMINGTON TRUST COMPANY, not in its individual capacity but solely as Trustee of the Master Trust | ||||

| By: | /s/ Joseph B Feil | |||

| Name: | Joseph B. Feil | |||

| Title: | Vice President | |||

2

Exhibit A

3

Exhibit B

AMENDED AND RESTATED

DESCRIPTION OF THE

DEUTSCHE BANK LIQUID COMMODITY INDEX–OPTIMUM YIELD EXCESS RETURN™

SECTOR INDEXES

DBLCI™ and Deutsche Bank Liquid Commodity Index™ are trade marks of Deutsche Bank AG and are the subject of Community Trade Mark Nos. 3055043 and 3054996. Trade Mark applications in the United States are pending. Any use of these marks must be with the consent of or under license from Deutsche Bank AG.

INTRODUCTION

Pursuant to paragraph 6 of the Description of the Deutsche Bank Liquid Commodity Index–Optimum Yield Excess Return™ Sector Indexes (the “Description”), which is Exhibit B to the Amended and Restated Declaration of Trust and Trust Agreement of DB Multi-Sector Commodity Master Trust, dated as of November 21, 2006, the Index Sponsor has made the determination that changes in regulatory circumstances affecting certain of the Index Commodities (the “Changes”) with respect to the Deutsche Bank Liquid Commodity Index–Optimum Yield Agriculture Excess Return™ (“DBLCI-OY Agriculture ER™”) have arisen, and, in the view of the Index Sponsor, such Changes necessitate the replacement of the DBLCI-OY Agriculture ER™.

Because of the Changes, the Index Sponsor has determined that the replacement index should include additional Index Commodities that are not currently part of the DBLCI-OY Agriculture ER™ in order to permit the replacement index to reflect the performance of the agricultural sector in light of the Changes. Therefore, the Index Sponsor is amending and restating the Description in full (the “Amended and Restated Description”) in order to replace the DBLCI-OY Agriculture ER™ with the Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™ (the “DBLCI Diversified Agriculture ER™”). The Amended and Restated Description includes the historical closing levels of Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™ and incorporates herein the historical closing levels of all other Sector Indexes (as defined below) as published and amended from time-to-time.

| 1. | GENERAL |

Each of the Deutsche Bank Liquid Commodity Index–Optimum Yield Excess Return™ (the “DBLCI-OYER™”) and the Deutsche Bank Liquid Commodity Index Excess Return™ (the “DBLCI ER™”) (“DBLCI-OYER™” and “DBLCI ER™,” collectively, “DBLCI™” or“DBLCI ER™”) is intended to reflect the performance of certain sectors of commodities (each, a “Sector Index”). Each Sector Index is calculated on an excess return, or unfunded basis. All Sector Indexes, excluding portions of the Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™, are rolled in a manner which are aimed at potentially maximizing the roll benefits in backwardated markets and minimizing the losses from rolling in contangoed markets (“Optimum Yield”) with respect to each Sector Index. Only Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™ is rolled both on an Optimum Yield basis and non-Optimum Yield basis as provided under “Contract Selection (Non-OY Single Commodity Indexes only)” in paragraph 2 herein. Each Sector Index is comprised of one or more

underlying commodities (the “Index Commodities”). The composition of Index Commodities with respect to each Sector Index varies according to each specific sector that such Sector Index intends to reflect. Each Index Commodity is represented in the Sector Index as an index with respect to that specific Index Commodity (“Single Commodity Index”). Each Index Commodity is assigned a weight (the “Index Base Weight”) which is intended to reflect the proportion of such Index Commodity relative to each Sector Index.

The Sector Indexes include:

| • | Deutsche Bank Liquid Commodity Index–Optimum Yield Energy Excess Return™ (“DBLCI-OY Energy ER™”) is intended to reflect the performance of the energy sector. |

| • | Deutsche Bank Liquid Commodity Index–Optimum Yield Crude Oil Excess Return™ (“DBLCI-OY CL ER™”) is intended to reflect the performance of the crude oil sector. |

| • | Deutsche Bank Liquid Commodity Index–Optimum Yield Precious Metals Excess Return™ (“DBLCI-OY Precious Metals ER™”) is intended to reflect the performance of the precious metals sector. |

| • | Deutsche Bank Liquid Commodity Index–Optimum Yield Gold Excess Return™ (“DBLCI-OY GC ER™”) is intended to reflect the performance of the gold sector. |

| • | Deutsche Bank Liquid Commodity Index–Optimum Yield Silver Excess Return™ (“DBLCI-OY SI ER™”) is intended to reflect the performance of the silver sector. |

| • | Deutsche Bank Liquid Commodity Index–Optimum Yield Industrial Metals Excess Return™ (“DBLCI-OY Industrial Metals ER™”) is intended to reflect the performance of the base metals sector. |

| • | Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™ (“DBLCI Diversified Agriculture ER™”) is intended to reflect the performance of the agricultural sector. |

DBLCI-OY CL ER™, DBLCI-OY GC ER™, or DBLCI-OY SI ER™ are Sector Indexes with a single Index Commodity, or Single Commodity Sector Indexes.

Each Sector Index has been calculated back to a base date (the “Base Date”). On the Base Date the closing level of each Sector Index, or Closing Level, was 100.

The sponsor of the each Sector Index is Deutsche Bank AG London (the “Index Sponsor”).

2

SECTOR INDEXES OVERVIEW

Sector Index | Single Commodity Index | Exchange (Contract Symbol)1 | Base Date | Index Base Weight | |||||

| DBLCI-OY Energy ER™ | Sweet Light Crude Oil (WTI) | NYMEX (CL) | June 4, 1990 | 22.50 | % | ||||

| Heating Oil | NYMEX (HO) | 22.50 | % | ||||||

| Brent Crude Oil | ICE-UK (LCO) | 22.50 | % | ||||||

| RBOB Gasoline | NYMEX (XB) | 22.50 | % | ||||||

| Natural Gas | NYMEX (NG) | 10.00 | % | ||||||

| DBLCI-OY CL ER™2 | Sweet Light Crude Oil (WTI) | NYMEX (CL) | December 2, 1988 | 100.00 | % | ||||

| DBLCI-OY Precious Metals ER™ | Gold | COMEX (GC) | December 2, 1988 | 80.00 | % | ||||

| Silver | COMEX (SI) | 20.00 | % | ||||||

| DBLCI-OY GC ER™2 | Gold | COMEX (GC) | December 2, 1988 | 100.00 | % | ||||

| DBLCI-OY SI ER™2 | Silver | COMEX (SI) | December 2, 1988 | 100.00 | % | ||||

| DBLCI-OY Industrial Metals ER™ | Aluminum | LME (MAL) | September 3, 1997 | 33.33 | % | ||||

| Zinc | LME (MZN) | 33.33 | % | ||||||

| Copper - Grade A | LME (MCU) | 33.33 | % | ||||||

| DBLCI Diversified Agriculture ER™ | Corn3 | CBOT (C) | January 18, 1989 | 12.50 | % | ||||

| Soybeans3 | CBOT (S) | 12.50 | % | ||||||

| Wheat3 | CBOT (W) | 6.25 | % | ||||||

| Kansas Wheat3 | KCB (KW) | 6.25 | % | ||||||

| Sugar3 | ICE-US (SB) | 12.50 | % | ||||||

| Cocoa4 | ICE-US (CC) | 11.11 | % | ||||||

| Coffee4 | ICE-US (KC) | 11.11 | % | ||||||

| Cotton4 | ICE-US (CT) | 2.78 | % | ||||||

| Live Cattle4 | CME (LC) | 12.50 | % | ||||||

| Feeder Cattle4 | CME (FC) | 4.17 | % | ||||||

| Lean Hogs4 | CME (LH) | 8.33 | % |

| 1 | Connotes the exchanges on which the underlying futures contracts are traded with respect to each Single Commodity Index. |

| 2 | DBLCI-OY CL ER™, DBLCI-OY GC ER™, or DBLCI-OY SI ER™ are Sector Indexes with a single Index Commodity, or Single Commodity Sector Indexes. |

| 3 | Connotes Single Commodity Index rolled on Optimum Yield basis. |

| 4 | Connotes non-OY Single Commodity Index. |

Legend:

“CBOT” means the Board of Trade of the City of Chicago Inc., or its successor.

“CME” means the Chicago Mercantile Exchange, Inc., or its successor.

“COMEX” means the Commodity Exchange Inc., New York, or its successor.

“ICE-UK” means ICE Futures Europe, or its successor.

“ICE-US” means ICE Futures U.S., Inc., or its successor.

“KCB” means the Board of Trade of Kansas City, Missouri, Inc., or its successor.

“LME” means The London Metal Exchange Limited, or its successor.

“NYMEX” means the New York Mercantile Exchange, or its successor.

3

Each Single Commodity Index employs a rule-based approach when it ‘rolls’ from one futures contract to another for each Index Commodity. Rather than select a new futures contract based on a predetermined schedule (e.g., monthly), each futures contract underlying a Single Commodity Index (excluding the following Single Commodity Indexes of the DBLCI Diversified Agriculture ER™: Cocoa, Coffee, Cotton, Live Cattle, Feeder Cattle and Live Hogs (the “non-OY Single Commodity Indexes”)) rolls to the futures contract which generates the maximum ‘implied roll yield’ (the “OY Single Commodity Indexes”). The futures contract having a delivery month within the next thirteen months which generates the highest implied roll yield will be included in each OY Single Commodity Index. As a result, each OY Single Commodity Index is able to potentially maximize the roll benefits in backwardated markets and minimize the losses from rolling in contangoed markets.

In general, as a futures contract approaches its expiration date, its price will move towards the spot price in a contango market. Assuming the spot price does not change, this would result in the futures contract price decreasing. The opposite is true in a backwardated market. A contango market will tend to cause a drag on each OY Single Commodity Index while a backwardated market will tend to cause a push on an OY Single Commodity Index.

Each of the non-OY Single Commodity Indexes rolls only to the next to expire futures contract as provided under “Contract Selection (Non-OY Single Commodity Indexes only)” in paragraph 2 below.

DBLCI™ is calculated in USD on both an excess return (unfunded) and total return (funded) index levels.

The futures contract price of the underlying futures contracts of each Single Commodity Index (and, in turn, each Index Commodity) will be the exchange closing prices for the underlying futures contract of each such Single Commodity Index on each weekday when banks in New York, New York are open (“Index Business Days”). If a weekday is not an Exchange Business Day but is an Index Business Day, the exchange closing price from the previous Index Business Day will be used for the underlying futures contract of each Single Commodity Index. “Exchange Business Day” means, in respect of the underlying futures contract of each Single Commodity Index, a day that is (or, but for the occurrence of an Index Disruption Event, as provided in paragraph 3, or Force Majeure Event, as provided in paragraph 4, would have been) a trading day for such underlying futures contract of each Single Commodity Index on the relevant Exchange, as defined in paragraph 3.

| 2. | INDEX CALCULATION AND RULES |

The excess return calculation of each Sector Index is equal to the percentage change of the market values of the underlying Single Commodity Indexes with respect to each Index Commodity. The excess return calculation of each Single Commodity Sector Index is equal to the percentage change of the market values of the underlying Single Commodity Index with respect to the applicable Index Commodity. Each Single Commodity Index will have two futures contracts on each Index Commodity throughout roll periods and one futures contracts on all other days.

4

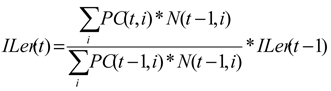

Excess Return Calculation of DBLCI ER™

The excess return calculation of the DBLCI ER™ in USD is expressed as:

Where:

| ILer(t) | = Excess Return Index level on day t | |

| ILer(t-1) | = Excess Return Index level on index calculation day t-1 | |

| PC(t,i) | = Close price of commodity future i on day t | |

| PC(t-1,i) | = Close price of commodity future i on index calculation day t-1 | |

| N(t-1,i) | = Notional holding of commodity future i on index calculation day t-1 |

Contract Selection (All Sector Indexes, excluding non-OY Single Commodity Indexes)

On the first New York business day of each month (the “Verification Date”) each futures contract currently in each OY Single Commodity Index is tested for continued inclusion in the OY Single Commodity Index based on the month in which the futures contract underlying the OY Single Commodity Index requires delivery of the underlying Index Commodity (the “Delivery Month”). If, on the Verification Date, the Delivery Month is the next month, a new futures contract is selected for the OY Single Commodity Index. For example, if the first New York business day is May 1, 2006, and the Delivery Month of a futures contract currently in the OY Single Commodity Index is June 2006, a new futures contract with a later Delivery Month will be selected for the OY Single Commodity Index.

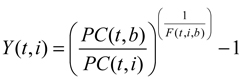

For each futures contract selected for an OY Single Commodity Index, the new futures contract selected for inclusion in the OY Single Commodity Index will be the futures contract with the maximum “implied roll yield” based on the closing price for each eligible futures contract (“Eligible Futures Contract”). Eligible Futures Contracts are any futures contracts having a Delivery Month (i) no sooner than the month after the Delivery Month of the futures contract currently in the OY Single Commodity Index, and (ii) no later than the 13th month after the Verification Date. For example, if the first New York business day is May 1, 2006 and the Delivery Month of a futures contract currently in the OY Single Commodity Index is therefore June 2006, the Delivery Month of an Eligible Futures Contract must be between July 2006 and June 2007. The implied roll yield is expressed as:

5

Where:

| Y(t,i) | = On any day t, the implied roll yield for entering into the commodity futures contract on an Index Commodity with exchange Delivery Month i | |

| PC(t,b) | = Close price of the base commodity future b | |

| PC(t,i) | = Close price of any Eligible Futures Contract with exchange Delivery Month i | |

| F(t,i,b) | = Fraction of year between the base futures contract on b and the futures contract with exchange Delivery Month i. Calculated as number of calendar days between dates divided by 365. | |

| b | = Base commodity futures contract is the Index Commodity futures contract currently in the OY Single Commodity Index. |

The futures contract with the maximum implied roll yield is then selected for inclusion in a OY Single Commodity Index. If two futures contracts have the same implied roll yield, the futures contract with the minimum number of months prior to the exchange expiry month is selected for the OY Single Commodity Index.

Contract Selection (Non-OY Single Commodity Indexes only) and Recomposition Periods

On the first Index Business Day of each month, each non-OY Single Commodity Index will select a new futures contract to replace the old futures contract as provided in the following schedule. After selection of the replacement futures contract, each non-OY Single Commodity Index will roll such replacement futures contract as provided in the sub-paragraph “Monthly Index Roll Period.”

Schedule of Rolling each Non-OY Index Commodity of DBLCI Diversified Agriculture ER™

Contract | Exchange | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||

Cocoa | ICE-US (CC) | H | H | K | K | N | N | U | U | Z | Z | Z | H | |||||||||||||

Coffee | ICE-US (KC) | H | H | K | K | N | N | U | U | Z | Z | Z | H | |||||||||||||

Cotton | ICE-US (CT) | H | H | K | K | N | N | Z | Z | Z | Z | Z | H | |||||||||||||

Live Cattle | CME (LC) | G | J | J | M | M | Q | Q | V | V | Z | Z | G | |||||||||||||

Feeder Cattle | CME (FC) | H | H | J | K | Q | Q | Q | U | V | X | F | F | |||||||||||||

Lean Hogs | CME (LH) | G | J | J | M | M | N | Q | V | V | Z | Z | G |

Month Letter Codes | ||

Month | Letter Code | |

January | F | |

February | G | |

March | H | |

April | J | |

May | K | |

June | M | |

July | N | |

August | Q | |

September | U | |

October | V | |

November | X | |

December | Z | |

6

Monthly Index Roll Period

For purposes of this sub-paragraph, the term “Single Commodity Index” also includes the term “non-OY Single Commodity Index.”

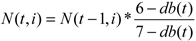

After the futures contract selection, the monthly Single Commodity Index roll unwinds the old futures contract and enters a position in the new futures contract. This takes place between the 2nd and 6th Index Business Day of the month.

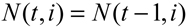

If the old futures contract and the new futures contract are the same, then the contract will not be rolled and the notional holding is kept constant as follows:

On each day during the roll period, new notional holdings are calculated. The calculations for the old futures contracts comprising a Single Commodity Index that are leaving the Sector Index and the new futures contracts comprising a Single Commodity Index that are entering the Sector Index are different.

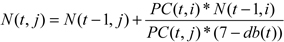

The notional holdings of the old futures contracts comprising a Single Commodity Index i is expressed as:

The notional holdings of the new futures contracts comprising a Single Commodity Index j is expressed as:

Where:

| N(t-1,i) | = Notional holding of old commodity future i on index calculation day t-1 | |

| N(t,i) | = Notional holding of old commodity future i on index calculation day t | |

| N(t-1,j) | = Notional holding of new commodity future j on index calculation day t-1 | |

| N(t,j) | = Notional holding of new commodity future j on index calculation day t | |

| db(t) | = Number of index business days in the month up to and including day t |

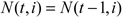

On all days that are not monthly index roll days, the notional holdings of each future contract comprising a Single Commodity Index remains constant as follows:

[Remainder of page left blank intentionally.]

7

DBLCI ER™ Re-weighting Calculation

For purposes of this sub-paragraph, the term “Single Commodity Index” also includes the term “non-OY Single Commodity Index.”

The DBLCI ER™ is re-weighted on an annual basis on the 6th Index Business Day of each November.

The DBLCI ER™ calculation is expressed as the weighted average return of each underlying Single Commodity Index.

Where:

| IL(t,c,rt) | = Index level on day t in currency c with return type rt | |

| IL(d,c,rt) | = Index level on last rebalancing day d in currency c with return type rt | |

| CIL(t,c,rt) | = Component Single Currency Index level for commodity cf on day t in currency c with return type rt | |

| CIL(d,c,rt) | = Component Single Currency Index level for commodity cf on last rebalancing day d in currency c with return type rt | |

| w(d,cf) | = Weight of commodity cf on last rebalancing day d |

| 3. | INDEX DISRUPTION EVENT |

If an Index Disruption Event in relation to a futures contract underlying a Single Commodity Index continues for a period of five successive Exchange Business Days, the Index Sponsor will, in its discretion, either (i) continue to calculate the relevant Closing Price of each futures contract underlying a Single Commodity Index by reference to the Closing Price of the relevant Exchange Traded Instrument with respect to such futures contract underlying a Single Commodity Index on the immediately preceding Valid Date (as provided in the definition of the relevant Closing Price) for a further period of five successive Exchange Business Days or (ii) select:

| (a) | an Exchange Traded Instrument relating to the relevant Index Commodity or in the determination of the Index Sponsor a commodity substantially similar to the relevant Index Commodity published in U.S. Dollars; or |

| (b) | if no Exchange Traded Instrument as described in (a) above is available or the Index Sponsor determines that for any reason (including, without limitation, the liquidity or volatility of such Exchange Traded Instrument at the relevant time) the inclusion of such Exchange Traded Instrument in a Single Commodity Index would not be appropriate, an Exchange Traded Instrument relating to the relevant Index Commodity or in the determination of the Index Sponsor a commodity substantially similar to the relevant Index Commodity published in a currency other than U.S. Dollars; or |

8

| (c) | if no such Exchange Traded Instrument as described in (a) or (b) above is available or the Index Sponsor determines that for any reason (including, without limitation, the liquidity or volatility of such Exchange Traded Instrument at the relevant time) the inclusion of such Exchange Traded Instrument would not be appropriate, an Exchange Traded Instrument relating to any commodity in the same Group of Commodities as the relevant Index Commodity which is published in U.S. Dollars, |

in each case to replace the exchange instrument relating to the relevant Index Commodity, all as determined by the Index Sponsor.

In the case of (i) above, if an Index Disruption Event in relation to the relevant Index Commodity continues for the further period of five successive Exchange Business Days referred to therein, on the expiry of such period the provisions of (ii) above shall apply.

In the case of a replacement of an Exchange Traded Instrument as described in (ii) above, the Index Sponsor will make such adjustments to the methodology and calculation of the Sector Index (or Single Commodity Sector Index, as applicable) as it determines to be appropriate to account for the relevant replacement and will publish such adjustments in accordance with paragraph 7 (Publication of Closing Levels and Adjustments) below.

For the purposes of this Description:

“Closing Price” means, in respect of an Index Business Day, the closing price on the appropriate Exchange of the relevant Index Commodity.

“Exchange” means:

| (a) | in respect of Aluminum, LME; |

| (b) | in respect of Brent Crude Oil, ICE-UK; |

| (c) | in respect of Cocoa, ICE-US; |

| (d) | in respect of Coffee, ICE-US; |

| (e) | in respect of Copper - Grade A, LME; |

| (f) | in respect of Corn, CBOT; |

| (g) | in respect of Cotton, ICE-US; |

| (h) | in respect of Feeder Cattle, CME; |

| (i) | in respect of Gold, COMEX; |

| (j) | in respect of Heating Oil, NYMEX; |

| (k) | in respect of Kansas Wheat, KCB; |

| (l) | in respect of Live Cattle, CME; |

| (m) | in respect of Lean Hogs, CME; |

| (n) | in respect of Natural Gas, NYMEX; |

| (o) | in respect of RBOB Gasoline, NYMEX; |

| (p) | in respect of Silver, COMEX; |

| (q) | in respect of Soybeans, CBOT; |

| (r) | in respect of Sugar, ICE-US; |

| (s) | in respect of Sweet Light Crude Oil (WTI), NYMEX; |

| (t) | in respect of Wheat, CBOT; and |

| (u) | in respect of Zinc, LME. |

9

“Exchange Business Day” means, in respect of an Index Commodity, a day that is (or, but for the occurrence of an Index Disruption Event or Force Majeure Event would have been) a trading day for such Index Commodity on the relevant Exchange.

“Exchange Traded Instrument” means, in respect of an Index Commodity, an instrument for future delivery of that Index Commodity on a specified delivery date traded on the relevant Exchange.

“Group of Commodities” means each of (i) energy and oils, (ii) precious metals, (iii) industrial metals and (iv) agricultural products. For the avoidance of doubt, (i) Brent Crude Oil, Heating Oil, Natural Gas, RBOB Gasoline, and Sweet Light Crude Oil (WTI) are energy and oils, (ii) Gold and Silver are precious metals, (iii) Aluminum, Copper - Grade A and Zinc are industrial metals and (iv) Cocoa, Coffee, Corn, Cotton, Feeder Cattle, Kansas Wheat, Lean Hogs, Live Cattle, Soybeans, Sugar and Wheat are agricultural products.

“Index Disruption Event” means, in respect of an Index Commodity or a related Exchange Instrument, an event (other than a Force Majeure Event) that would require the Index Sponsor to calculate the Closing Price in respect of the relevant Index Commodity on an alternative basis were such event to occur or exist on a day that is an Exchange Business Day (or, if different, the day on which the Closing Price for such Exchange Instrument for the relevant Index Business Day would, in the ordinary course, be published or announced by the relevant Exchange).

“Valid Date” means, in respect of an Index Commodity, a day which is an Exchange Business Day in respect of such Index Commodity and a day on which an Index Disruption Event in respect of such Index Commodity does not occur.

| 4. | FORCE MAJEURE |

If a Force Majeure Event occurs on an Index Business Day, the Index Sponsor may in its discretion:

| (i) | make such determinations and/or adjustments to the terms of this Description as it considers appropriate to determine any Closing Level on any such Index Business Day; and/or |

| (ii) | defer publication of the information relating to the applicable Sector Index (or applicable Single Commodity Sector Index) until the next Index Business Day on which it determines that no Force Majeure Event exists; and/or |

| (iii) | permanently cancel publication of the information relating to the applicable Sector Index. |

For the purposes of this Description:

“Force Majeure Event” means an event or circumstance (including, without limitation, a systems failure, natural or man-made disaster, act of God, armed conflict, act of terrorism, riot or labour disruption or any similar intervening circumstance) that is beyond the reasonable control of the Index Sponsor and that the Index Sponsor determines affects the applicable Sector Index (or applicable Single Commodity Sector Index), any Index Commodity or any Exchange Instrument.

10

| 5. | INDEX SPONSOR |

All determinations made by the Index Sponsor will be made by it in good faith and in a commercially reasonable manner by reference to such factors as the Index Sponsor deems appropriate and will be final, conclusive and binding in the absence of manifest error.

| 6. | CHANGE IN THE METHODOLOGY OF THE DBLCI™ |

The Index Sponsor will, subject as provided below, employ the methodology described above and its application of such methodology shall be conclusive and binding. While the Index Sponsor currently employs the above described methodology to calculate the Sector Indexes (including the Single Commodity Sector Indexes), no assurance can be given that fiscal, market, regulatory, juridical or financial circumstances (including, but not limited to, any changes to or any suspension or termination of or any other events affecting any Index Commodity or a futures contract) will not arise that would, in the view of the Index Sponsor, necessitate a modification of or change to such methodology and in such circumstances the Index Sponsor may make any such modification or change as it determines appropriate. The Index Sponsor may also make modifications to the terms of either the DBLCI™ or Sector Indexes (including the Single Commodity Sector Indexes) in any manner that it may deem necessary or desirable, including (without limitation) to correct any manifest or proven error or to cure, correct or supplement any defective provision contained in this Description. The Index Sponsor will publish notice of any such modification or change and the effective date thereof in accordance with paragraph 7 (Publication of Closing Levels and Adjustments) below.

| 7. | PUBLICATION OF CLOSING LEVELS AND ADJUSTMENTS |

The Index Sponsor will publish the Closing Levels of the Sector Indexes (including the Single Commodity Sector Indexes) and the intra-day indicative Index level once every fifteen seconds throughout each trading day (NYSE Arca symbols: DBLCI-OY Energy ER: DBENIX; DBLCI-OY CL ER: DBOLIX; DBLCI-OY Precious Metals ER: DBPMIX; DBLCI-OY GC ER: DGLDIX; DBLCI-OY SI ER: DBSLIX; DBLCI-OY Industrial Metals ER: DBBMIX; DBLCI-Diversified Agriculture ER: DBAGIX) (quoted in U.S. dollars) on the consolidated tape, Reuters and/or Bloomberg and on the Managing Owner’s website athttp://www.dbfunds.db.com andhttps://index.db.com, or any successor thereto.

The Index Sponsor will publish any adjustments made to the Sector Indexes on the Managing Owner’s website athttp://www.dbfunds.db.com andhttps://index.db.com or any successor thereto.

[Remainder of page left blank intentionally.]

11

| 8. | HISTORICAL CLOSING LEVELS |

This Amended and Restated Description incorporates the historical closing levels as published and amended from time-to-time of all Sector Indexes other than DBLCI Diversified Agriculture ER™.

Set out below are the closing levels and related data with respect to the DBLCI Diversified Agriculture ER™ as of August 31, 2009.

With respect to this paragraph 8 only, the DBLCI Diversified Agriculture ER™ shall hereinafter be referred to as the “Index” and PowerShares DB Agriculture Fund shall hereinafter be referred to as the “Fund.”

With respect to the Closing Levels Tables, historic daily Index Closing Levels have been calculated with respect to the Index since its Base Date.

The Base Date for the Index is January 18, 1989.

The Base Date was selected by the Index Sponsor based on the availability of price data with respect to the relevant underlying futures contracts on the Index Commodities of the Index.

Since June 2006, the historic data with respect to the closing prices of futures contracts on Feeder Cattle (FC), Cotton #2 (CT), Coffee (KC), Cocoa (CC), Live Cattle (LC), Lean Hogs (LH), Corn (C), Wheat (W), Soybeans (S), Sugar #11 (SB) and Kansas Wheat (KW) originated from Reuters. Prior to June 2006, the closing prices of futures contracts on Feeder Cattle (FC), Cotton #2 (CT), Coffee (KC), Cocoa (CC), Live Cattle (LC), Lean Hogs (LH), Corn (C), Wheat (W), Soybeans (S), Sugar #11 (SB) and Kansas Wheat (KW) were obtained from publicly available information from Logical Information Machines (http://www.lim.com), Bloomberg, and Reuters. The Index Sponsor has not independently verified the information extracted from these sources. The Index calculation methodology and commodity future selection are the same prior to and following June 2006.

Complete price histories regarding certain futures contracts on the Index Commodities were not available (e.g., due to lack of trading on specific days). In the event that prices on such futures contracts on the Index Commodities were unavailable during a contract selection day, such futures contract was excluded from the futures contract selection process. The Index Sponsor believes that the incomplete price histories should not have a material impact on the calculation of the Index.

The Index Closing Level is equal to the weighted sum of the market value of the commodity futures contracts of all the respective Index Commodities that comprise the Index. The market value of the commodity futures contracts of an Index Commodity is equal to the number of commodity futures contracts of an Index Commodity held multiplied by the commodity futures contracts closing price of an Index Commodity.

The weight of each Index Commodity of the Index is linked to the number of commodity futures contracts held of such Index Commodity and the price of commodity futures contracts of the Index Commodity. The weight of an Index Commodity is defined as the market value of the commodity futures contracts of the Index Commodity divided by the sum of all market values of all commodity futures contracts of the Index Commodities that comprise and Index multiplied by 100%.

The Index Commodities Weights Tables reflect the range of the weightings with respect to each of the Index Commodities used to calculate the Index.

The Index rules stipulate the holding in each Index Commodity futures contract. Holdings in each Index Commodity change during the Index rebalancing periods as determined by the optimum yield roll rules.

12

Cautionary Statement–Statistical Information

Various statistical information is presented on the following pages, relating to the Closing Levels of the Index, on an annual and cumulative basis, including certain comparisons of the Index to other commodities indices. In reviewing such information, prospective investors should consider that:

| • | Changes in Closing Levels of the Index during any particular period or market cycle may be volatile. |

Index | Worst Peak-to-Valley Drawdown and Time Period | Worst Monthly Drawdown and Month and Year | ||

DBLCI Diversified Agriculture ER™ | (53.40)%, 4/97 – 4/02 | (14.37)%, 10/08 |

For example, the “Worst Peak-to-Valley Drawdown” of the Index, represents the greatest percentage decline from any month-end Closing Level, without such Closing Level being equaled or exceeded as of a subsequent month-end, which occurred during the above-listed time period.

The “Worst Monthly Drawdown” of the Index occurred during the above-listed month and year.

| • | Neither the fees charged by the Fund nor the execution costs associated with establishing futures positions in the Index Commodities are incorporated into the Closing Levels of the Index. Accordingly, such Index Levels have not been reduced by the costs associated with an actual investment, such as the Fund, with an investment objective of tracking the Index. |

| • | The Index is independently calculated by Deutsche Bank AG London, the Index Sponsor. The DBLCI Diversified Agriculture ER™ index was established on September 18, 2009. The Index calculation methodology and commodity futures contracts selection are the same before and after September 18, 2009 with respect to the DBLCI Diversified Agriculture ER™, as described above. Accordingly, the Closing Levels of the Index, terms of the Index methodology and Index Commodities, reflect an element of hindsight at the time the Index was established. See the Fund’s prospectus within the currently effective registration statement - “Risk Factors— “You May Not Rely on Past Performance or Index Results in Deciding Whether to Buy Shares” and “— “Fewer Representative Commodities May Result In Greater Index Volatility.” |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE DBLCI DIVERSIFIED AGRICULTURE ER™ INDEX WAS ESTABLISHED IN SEPTEMBER 18, 2009, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD SINCE INCEPTION WITH RESPECT TO THE DBLCI DIVERSIFIED AGRICULTURE ER™ THROUGH SEPTEMBER 18, 2009, THE INDEX’S CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

13

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED SEE THE PROSPECTUS WITHIN THE FUND’S CURRENTLY EFFECTIVE REGISTRATION STATEMENT UNDER “RISK FACTORS”, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF THE INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUND AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

14

VOLATILITY OF DBLCI DIVERSIFIED AGRICULTURE ER™

The following table1 reflects various measures of volatility2 of the history of each Index as calculated on an excess return basis:

Volatility Type | DBLCI Diversified Agriculture ER™3 | |

Daily volatility over full history | 10.32% | |

Average rolling 3 month daily volatility | 9.57% | |

Monthly return volatility | 12.09% | |

Average annual volatility | 9.95% |

The following table reflects the daily volatility on an annual basis of each Index:

Year | DBLCI Diversified Agriculture ER™3 | |

1989 | 8.35% | |

1990 | 7.92% | |

1991 | 7.85% | |

1992 | 6.93% | |

1993 | 8.24% | |

1994 | 12.80% | |

1995 | 6.78% | |

1996 | 7.80% | |

1997 | 11.19% | |

1998 | 8.06% | |

1999 | 10.74% | |

2000 | 8.87% | |

2001 | 8.38% | |

2002 | 9.51% | |

2003 | 8.37% | |

2004 | 11.01% | |

2005 | 9.40% | |

2006 | 9.57% | |

2007 | 9.36% | |

2008 | 21.09% | |

20091 | 16.74% |

| 1 | As of August 31, 2009. Past Index levels are not necessarily indicative of future Index levels. |

| 2 | Volatility, for these purposes, means the following: |

Daily Volatility: The relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the daily change in price.

Monthly Return Volatility: The relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the monthly change in price.

Average Annual Volatility: The average of yearly volatilities for a given sample period. The yearly volatility is the relative rate at which the price of the Index moves up and down, found by calculating the annualized standard deviation of the daily change in price for each business day in the given year.

| 3 | As of January 18, 1989. Past Index levels are not necessarily indicative of future Index levels. |

15

AGRICULTURE SECTOR DATA

RELATING TO

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™

(DBLCI DIVERSIFIED AGRICULTURE ER™)

16

CLOSING LEVELS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™

| CLOSING LEVEL | CHANGES | ||||||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | ||||||||

| 1989 | 5 | 106.21 | 93.13 | -3.76 | % | -3.76 | % | ||||

| 1990 | 109.76 | 93.55 | -2.79 | % | -6.45 | % | |||||

| 1991 | 98.56 | 87.18 | -1.67 | % | -8.01 | % | |||||

| 1992 | 93.91 | 84.75 | -4.28 | % | -11.95 | % | |||||

| 1993 | 94.15 | 84.61 | 5.93 | % | -6.73 | % | |||||

| 1994 | 112.01 | 90.78 | 12.43 | % | 4.86 | % | |||||

| 1995 | 111.80 | 99.83 | 5.05 | % | 10.16 | % | |||||

| 1996 | 127.26 | 108.40 | 6.19 | % | 16.98 | % | |||||

| 1997 | 146.63 | 116.98 | 10.46 | % | 29.22 | % | |||||

| 1998 | 130.61 | 94.76 | -25.65 | % | -3.92 | % | |||||

| 1999 | 99.66 | 77.22 | -13.58 | % | -16.97 | % | |||||

| 2000 | 85.25 | 75.94 | -6.33 | % | -22.22 | % | |||||

| 2001 | 80.19 | 66.48 | -11.33 | % | -31.04 | % | |||||

| 2002 | 80.12 | 64.94 | 9.63 | % | -24.40 | % | |||||

| 2003 | 84.27 | 72.22 | 5.72 | % | -20.08 | % | |||||

| 2004 | 92.94 | 79.92 | 7.93 | % | -13.74 | % | |||||

| 2005 | 95.26 | 81.72 | 3.68 | % | -10.56 | % | |||||

| 2006 | 93.91 | 82.42 | 3.47 | % | -7.45 | % | |||||

| 2007 | 102.50 | 88.80 | 10.46 | % | 2.23 | % | |||||

| 2008 | 123.53 | 71.21 | -19.22 | % | -17.42 | % | |||||

| 2009 | 6 | 87.40 | 72.91 | -2.59 | % | -19.56 | % | ||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™

| CLOSING LEVEL | CHANGES | ||||||||||

| High1 | Low2 | Annual Index Changes3 | Index Changes Since Inception4 | ||||||||

| 1989 | 5 | 107.66 | 98.26 | 4.13 | % | 4.13 | % | ||||

| 1990 | 122.64 | 103.97 | 4.94 | % | 9.27 | % | |||||

| 1991 | 116.41 | 105.67 | 3.86 | % | 13.49 | % | |||||

| 1992 | 116.36 | 107.38 | -0.87 | % | 12.50 | % | |||||

| 1993 | 123.83 | 108.46 | 9.21 | % | 22.86 | % | |||||

| 1994 | 150.59 | 120.79 | 17.40 | % | 44.24 | % | |||||

| 1995 | 161.94 | 140.22 | 11.11 | % | 60.26 | % | |||||

| 1996 | 189.53 | 158.05 | 11.77 | % | 79.12 | % | |||||

| 1997 | 229.29 | 179.14 | 16.30 | % | 108.31 | % | |||||

| 1998 | 211.30 | 160.18 | -21.94 | % | 62.61 | % | |||||

| 1999 | 168.89 | 133.88 | -9.40 | % | 47.32 | % | |||||

| 2000 | 154.70 | 141.66 | -0.59 | % | 46.45 | % | |||||

| 2001 | 152.05 | 129.07 | -8.20 | % | 34.44 | % | |||||

| 2002 | 158.33 | 127.33 | 11.44 | % | 49.82 | % | |||||

| 2003 | 168.63 | 143.96 | 6.81 | % | 60.02 | % | |||||

| 2004 | 186.83 | 160.03 | 9.43 | % | 75.12 | % | |||||

| 2005 | 194.37 | 169.54 | 7.04 | % | 87.45 | % | |||||

| 2006 | 203.52 | 178.87 | 8.57 | % | 103.52 | % | |||||

| 2007 | 235.57 | 196.35 | 15.48 | % | 135.02 | % | |||||

| 2008 | 285.15 | 166.00 | -18.09 | % | 92.50 | % | |||||

| 2009 | 6 | 198.62 | 177.70 | -2.19 | % | 88.29 | % | ||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Please refer to notes and legends that follow on page 27.

17

INDEX COMMODITIES WEIGHTS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™

| C7 | S7 | W7 | KCW7 | ||||||||||||||||||||||

| High1 | Low2 | High1 | Low2 | High1 | Low2 | High1 | Low2 | ||||||||||||||||||

| 1989 | 5 | 12.0 | % | 11.7 | % | 12.1 | % | 10.7 | % | 6.1 | % | 6.3 | % | 6.3 | % | 6.5 | % | ||||||||

| 1990 | 12.8 | % | 12.7 | % | 11.7 | % | 12.6 | % | 5.0 | % | 5.9 | % | 5.1 | % | 5.9 | % | |||||||||

| 1991 | 12.8 | % | 12.9 | % | 12.4 | % | 12.1 | % | 5.9 | % | 6.2 | % | 6.0 | % | 6.5 | % | |||||||||

| 1992 | 13.1 | % | 11.3 | % | 12.9 | % | 12.7 | % | 8.2 | % | 7.1 | % | 8.0 | % | 7.0 | % | |||||||||

| 1993 | 12.7 | % | 12.8 | % | 12.4 | % | 12.9 | % | 6.3 | % | 6.3 | % | 6.4 | % | 6.3 | % | |||||||||

| 1994 | 9.0 | % | 12.3 | % | 9.4 | % | 12.4 | % | 5.3 | % | 6.3 | % | 5.5 | % | 6.4 | % | |||||||||

| 1995 | 15.3 | % | 13.7 | % | 12.8 | % | 12.5 | % | 7.2 | % | 6.3 | % | 8.0 | % | 6.8 | % | |||||||||

| 1996 | 14.1 | % | 13.1 | % | 12.8 | % | 13.6 | % | 7.4 | % | 6.2 | % | 8.3 | % | 6.4 | % | |||||||||

| 1997 | 9.2 | % | 11.8 | % | 10.2 | % | 12.3 | % | 5.0 | % | 6.3 | % | 5.5 | % | 6.2 | % | |||||||||

| 1998 | 12.5 | % | 13.1 | % | 12.0 | % | 12.9 | % | 5.9 | % | 6.1 | % | 6.0 | % | 6.5 | % | |||||||||

| 1999 | 12.5 | % | 12.9 | % | 12.2 | % | 11.7 | % | 6.0 | % | 6.0 | % | 6.2 | % | 6.3 | % | |||||||||

| 2000 | 13.2 | % | 12.5 | % | 13.6 | % | 12.5 | % | 6.0 | % | 6.2 | % | 6.0 | % | 6.2 | % | |||||||||

| 2001 | 11.8 | % | 11.7 | % | 11.4 | % | 12.2 | % | 6.2 | % | 6.2 | % | 6.0 | % | 5.5 | % | |||||||||

| 2002 | 11.1 | % | 11.7 | % | 12.7 | % | 13.2 | % | 5.9 | % | 5.8 | % | 6.3 | % | 5.9 | % | |||||||||

| 2003 | 12.4 | % | 11.7 | % | 12.9 | % | 13.8 | % | 6.3 | % | 6.6 | % | 6.3 | % | 5.8 | % | |||||||||

| 2004 | 14.6 | % | 13.1 | % | 13.9 | % | 14.0 | % | 6.0 | % | 6.6 | % | 6.1 | % | 6.5 | % | |||||||||

| 2005 | 11.3 | % | 10.9 | % | 13.2 | % | 13.6 | % | 6.2 | % | 6.2 | % | 5.8 | % | 6.1 | % | |||||||||

| 2006 | 12.0 | % | 13.4 | % | 11.6 | % | 11.4 | % | 6.2 | % | 7.1 | % | 6.5 | % | 8.2 | % | |||||||||

| 2007 | 12.7 | % | 12.1 | % | 13.5 | % | 14.7 | % | 6.8 | % | 7.4 | % | 6.9 | % | 7.1 | % | |||||||||

| 2008 | 12.3 | % | 10.9 | % | 14.0 | % | 11.5 | % | 8.1 | % | 6.1 | % | 8.3 | % | 6.1 | % | |||||||||

| 2009 | 6 | 11.8 | % | 11.5 | % | 12.6 | % | 11.1 | % | 6.7 | % | 6.2 | % | 6.9 | % | 6.3 | % | ||||||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

LEGEND:

Symbol | Index Commodity | Symbol | Index Commodity | |||

C | Corn | KC | Coffee | |||

S | Soybeans | CT | Cotton | |||

W | Wheat | LC | Live Cattle | |||

KCW | Kansas Wheat | FC | Feeder Cattle | |||

SB | Sugar | LH | Lean Hogs | |||

CC | Cocoa |

Please refer to notes and legends that follow on page 27.

18

INDEX COMMODITIES WEIGHTS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™

| SB7 | CC7 | KC7 | CT7 | ||||||||||||||||||||||

| High1 | Low2 | High1 | Low2 | High1 | Low2 | High1 | Low2 | ||||||||||||||||||

| 1989 | 5 | 14.8 | % | 17.4 | % | 12.2 | % | 10.0 | % | 10.2 | % | 7.7 | % | 2.6 | % | 3.5 | % | ||||||||

| 1990 | 11.5 | % | 12.2 | % | 14.1 | % | 10.6 | % | 11.6 | % | 11.1 | % | 2.5 | % | 3.0 | % | |||||||||

| 1991 | 11.7 | % | 12.3 | % | 10.3 | % | 8.7 | % | 11.1 | % | 9.8 | % | 3.1 | % | 3.3 | % | |||||||||

| 1992 | 11.5 | % | 15.1 | % | 9.7 | % | 7.9 | % | 9.1 | % | 7.0 | % | 2.4 | % | 2.5 | % | |||||||||

| 1993 | 12.4 | % | 11.7 | % | 12.0 | % | 9.7 | % | 11.0 | % | 10.1 | % | 2.9 | % | 3.1 | % | |||||||||

| 1994 | 11.2 | % | 12.6 | % | 11.1 | % | 10.6 | % | 27.4 | % | 11.4 | % | 2.9 | % | 3.8 | % | |||||||||

| 1995 | 12.4 | % | 11.7 | % | 9.6 | % | 10.5 | % | 6.4 | % | 9.8 | % | 4.4 | % | 4.2 | % | |||||||||

| 1996 | 13.4 | % | 13.0 | % | 9.5 | % | 10.6 | % | 10.3 | % | 9.6 | % | 2.3 | % | 2.8 | % | |||||||||

| 1997 | 10.5 | % | 12.9 | % | 9.1 | % | 11.0 | % | 27.9 | % | 11.5 | % | 2.1 | % | 2.8 | % | |||||||||

| 1998 | 11.7 | % | 12.9 | % | 10.8 | % | 11.2 | % | 13.9 | % | 12.3 | % | 2.6 | % | 2.7 | % | |||||||||

| 1999 | 13.5 | % | 10.9 | % | 10.7 | % | 8.8 | % | 12.1 | % | 11.7 | % | 2.5 | % | 2.7 | % | |||||||||

| 2000 | 13.4 | % | 12.2 | % | 9.9 | % | 10.8 | % | 9.4 | % | 10.8 | % | 3.1 | % | 2.8 | % | |||||||||

| 2001 | 13.4 | % | 12.3 | % | 14.0 | % | 16.8 | % | 9.5 | % | 5.7 | % | 2.3 | % | 1.3 | % | |||||||||

| 2002 | 11.9 | % | 10.8 | % | 19.8 | % | 15.8 | % | 10.9 | % | 11.2 | % | 2.6 | % | 2.7 | % | |||||||||

| 2003 | 12.4 | % | 13.5 | % | 13.1 | % | 10.1 | % | 11.4 | % | 9.2 | % | 2.4 | % | 3.1 | % | |||||||||

| 2004 | 12.7 | % | 12.0 | % | 9.7 | % | 12.1 | % | 12.2 | % | 11.8 | % | 1.7 | % | 2.7 | % | |||||||||

| 2005 | 12.0 | % | 15.6 | % | 9.8 | % | 8.0 | % | 15.8 | % | 10.7 | % | 2.9 | % | 2.9 | % | |||||||||

| 2006 | 18.8 | % | 12.4 | % | 10.8 | % | 11.5 | % | 10.6 | % | 9.7 | % | 2.6 | % | 2.3 | % | |||||||||

| 2007 | 12.8 | % | 8.9 | % | 10.9 | % | 12.2 | % | 10.9 | % | 9.8 | % | 2.5 | % | 2.6 | % | |||||||||

| 2008 | 13.8 | % | 12.7 | % | 11.8 | % | 13.5 | % | 11.0 | % | 10.9 | % | 2.4 | % | 2.9 | % | |||||||||

| 2009 | 6 | 14.4 | % | 14.2 | % | 13.5 | % | 13.6 | % | 11.8 | % | 10.7 | % | 3.2 | % | 2.8 | % | ||||||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

LEGEND:

Symbol | Index Commodity | Symbol | Index Commodity | |||

C | Corn | KC | Coffee | |||

S | Soybeans | CT | Cotton | |||

W | Wheat | LC | Live Cattle | |||

KCW | Kansas Wheat | FC | Feeder Cattle | |||

SB | Sugar | LH | Lean Hogs | |||

CC | Cocoa |

Please refer to notes and legends that follow on page 27.

19

INDEX COMMODITIES WEIGHTS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™

| LC7 | FC7 | LH7 | |||||||||||||||||

| High1 | Low2 | High1 | Low2 | High1 | Low2 | ||||||||||||||

| 1989 | 5 | 11.9 | % | 13.4 | % | 3.8 | % | 4.4 | % | 7.8 | % | 8.3 | % | ||||||

| 1990 | 12.1 | %�� | 13.3 | % | 3.8 | % | 4.4 | % | 9.7 | % | 8.3 | % | |||||||

| 1991 | 13.4 | % | 14.0 | % | 4.4 | % | 4.9 | % | 9.0 | % | 9.4 | % | |||||||

| 1992 | 12.7 | % | 14.6 | % | 4.1 | % | 5.1 | % | 8.3 | % | 9.7 | % | |||||||

| 1993 | 12.0 | % | 14.2 | % | 4.0 | % | 4.5 | % | 7.8 | % | 8.5 | % | |||||||

| 1994 | 9.3 | % | 12.2 | % | 3.3 | % | 4.2 | % | 5.4 | % | 7.9 | % | |||||||

| 1995 | 12.2 | % | 12.3 | % | 3.5 | % | 3.9 | % | 8.2 | % | 8.2 | % | |||||||

| 1996 | 9.8 | % | 12.5 | % | 3.1 | % | 4.0 | % | 9.0 | % | 8.3 | % | |||||||

| 1997 | 10.5 | % | 12.6 | % | 3.6 | % | 4.2 | % | 6.4 | % | 8.5 | % | |||||||

| 1998 | 12.3 | % | 12.1 | % | 4.2 | % | 4.1 | % | 8.3 | % | 6.0 | % | |||||||

| 1999 | 12.3 | % | 15.8 | % | 4.3 | % | 5.6 | % | 7.7 | % | 7.5 | % | |||||||

| 2000 | 12.1 | % | 12.9 | % | 4.0 | % | 4.3 | % | 9.3 | % | 8.8 | % | |||||||

| 2001 | 12.7 | % | 13.3 | % | 4.1 | % | 4.6 | % | 8.5 | % | 10.4 | % | |||||||

| 2002 | 10.5 | % | 12.2 | % | 3.4 | % | 3.9 | % | 4.9 | % | 6.7 | % | |||||||

| 2003 | 11.7 | % | 14.3 | % | 4.0 | % | 4.4 | % | 7.1 | % | 7.6 | % | |||||||

| 2004 | 11.0 | % | 10.0 | % | 4.0 | % | 3.6 | % | 8.0 | % | 7.7 | % | |||||||

| 2005 | 11.7 | % | 13.0 | % | 4.0 | % | 5.0 | % | 7.4 | % | 8.1 | % | |||||||

| 2006 | 10.9 | % | 12.3 | % | 3.6 | % | 4.1 | % | 6.5 | % | 7.5 | % | |||||||

| 2007 | 11.4 | % | 13.0 | % | 3.8 | % | 4.9 | % | 7.9 | % | 7.3 | % | |||||||

| 2008 | 9.1 | % | 12.0 | % | 3.1 | % | 4.0 | % | 6.1 | % | 9.5 | % | |||||||

| 2009 | 6 | 9.6 | % | 11.7 | % | 3.7 | % | 4.2 | % | 5.8 | % | 7.9 | % | ||||||

THE FUND WILL TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE EXCESS RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

LEGEND:

Symbol | Index Commodity | Symbol | Index Commodity | |||

C | Corn | KC | Coffee | |||

S | Soybeans | CT | Cotton | |||

W | Wheat | LC | Live Cattle | |||

KCW | Kansas Wheat | FC | Feeder Cattle | |||

SB | Sugar | LH | Lean Hogs | |||

CC | Cocoa |

Please refer to notes and legends that follow on page 27.

20

INDEX COMMODITIES WEIGHTS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™

| C7 | S7 | W7 | KCW7 | ||||||||||||||||||||||

| High1 | Low2 | High1 | Low2 | High1 | Low2 | High1 | Low2 | ||||||||||||||||||

| 1989 | 5 | 12.0 | % | 11.7 | % | 12.1 | % | 10.7 | % | 6.1 | % | 6.3 | % | 6.3 | % | 6.5 | % | ||||||||

| 1990 | 12.8 | % | 13.0 | % | 11.7 | % | 13.0 | % | 5.0 | % | 6.3 | % | 5.1 | % | 6.5 | % | |||||||||

| 1991 | 12.8 | % | 12.9 | % | 12.4 | % | 12.1 | % | 5.9 | % | 6.2 | % | 6.0 | % | 6.5 | % | |||||||||

| 1992 | 13.1 | % | 11.3 | % | 12.9 | % | 12.7 | % | 8.2 | % | 7.1 | % | 8.0 | % | 7.0 | % | |||||||||

| 1993 | 12.7 | % | 12.8 | % | 12.4 | % | 12.9 | % | 6.3 | % | 6.3 | % | 6.4 | % | 6.3 | % | |||||||||

| 1994 | 9.0 | % | 12.3 | % | 9.4 | % | 12.4 | % | 5.3 | % | 6.3 | % | 5.5 | % | 6.4 | % | |||||||||

| 1995 | 12.8 | % | 13.7 | % | 13.1 | % | 12.5 | % | 6.2 | % | 6.3 | % | 6.3 | % | 6.8 | % | |||||||||

| 1996 | 15.0 | % | 13.1 | % | 13.3 | % | 13.6 | % | 6.1 | % | 6.2 | % | 7.2 | % | 6.4 | % | |||||||||

| 1997 | 9.2 | % | 11.8 | % | 10.2 | % | 12.3 | % | 5.0 | % | 6.3 | % | 5.5 | % | 6.2 | % | |||||||||

| 1998 | 12.5 | % | 13.1 | % | 12.0 | % | 12.9 | % | 5.9 | % | 6.1 | % | 6.0 | % | 6.5 | % | |||||||||

| 1999 | 12.5 | % | 12.9 | % | 12.2 | % | 11.7 | % | 6.0 | % | 6.0 | % | 6.2 | % | 6.3 | % | |||||||||

| 2000 | 13.2 | % | 13.5 | % | 13.6 | % | 13.6 | % | 6.0 | % | 6.2 | % | 6.0 | % | 6.2 | % | |||||||||

| 2001 | 11.8 | % | 11.7 | % | 11.0 | % | 12.2 | % | 6.0 | % | 6.2 | % | 5.8 | % | 5.5 | % | |||||||||

| 2002 | 11.1 | % | 11.7 | % | 12.7 | % | 13.2 | % | 5.9 | % | 5.8 | % | 6.3 | % | 5.9 | % | |||||||||

| 2003 | 12.4 | % | 11.7 | % | 12.9 | % | 13.8 | % | 6.3 | % | 6.6 | % | 6.3 | % | 5.8 | % | |||||||||

| 2004 | 14.6 | % | 13.1 | % | 13.9 | % | 14.0 | % | 6.0 | % | 6.6 | % | 6.1 | % | 6.5 | % | |||||||||

| 2005 | 11.3 | % | 10.9 | % | 13.2 | % | 13.6 | % | 6.2 | % | 6.2 | % | 5.8 | % | 6.1 | % | |||||||||

| 2006 | 12.8 | % | 13.4 | % | 12.8 | % | 11.4 | % | 6.3 | % | 7.1 | % | 6.3 | % | 8.2 | % | |||||||||

| 2007 | 12.7 | % | 12.7 | % | 13.5 | % | 12.9 | % | 6.8 | % | 6.2 | % | 6.9 | % | 6.2 | % | |||||||||

| 2008 | 12.3 | % | 10.9 | % | 14.0 | % | 11.5 | % | 8.1 | % | 6.1 | % | 8.3 | % | 6.1 | % | |||||||||

| 2009 | 6 | 11.8 | % | 11.5 | % | 12.6 | % | 12.0 | % | 6.7 | % | 5.9 | % | 6.9 | % | 6.2 | % | ||||||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

LEGEND:

Symbol | Index Commodity | Symbol | Index Commodity | |||

C | Corn | KC | Coffee | |||

S | Soybeans | CT | Cotton | |||

W | Wheat | LC | Live Cattle | |||

KCW | Kansas Wheat | FC | Feeder Cattle | |||

SB | Sugar | LH | Lean Hogs | |||

CC | Cocoa |

Please refer to notes and legends that follow on page 27.

21

INDEX COMMODITIES WEIGHTS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™

| SB7 | CC7 | KC7 | CT7 | ||||||||||||||||||||||

| High1 | Low2 | High1 | Low2 | High1 | Low2 | High1 | Low2 | ||||||||||||||||||

| 1989 | 5 | 14.8 | % | 17.4 | % | 12.2 | % | 10.0 | % | 10.2 | % | 7.7 | % | 2.6 | % | 3.5 | % | ||||||||

| 1990 | 11.5 | % | 11.1 | % | 14.1 | % | 10.4 | % | 11.6 | % | 11.4 | % | 2.5 | % | 2.5 | % | |||||||||

| 1991 | 11.7 | % | 12.3 | % | 10.3 | % | 8.7 | % | 11.1 | % | 9.8 | % | 3.1 | % | 3.3 | % | |||||||||

| 1992 | 11.5 | % | 15.1 | % | 9.7 | % | 7.9 | % | 9.1 | % | 7.0 | % | 2.4 | % | 2.5 | % | |||||||||

| 1993 | 12.4 | % | 11.7 | % | 12.0 | % | 9.7 | % | 11.0 | % | 10.1 | % | 2.9 | % | 3.1 | % | |||||||||

| 1994 | 11.2 | % | 12.6 | % | 11.1 | % | 10.6 | % | 27.4 | % | 11.4 | % | 2.9 | % | 3.8 | % | |||||||||

| 1995 | 13.3 | % | 11.7 | % | 10.4 | % | 10.5 | % | 9.5 | % | 9.8 | % | 2.8 | % | 4.2 | % | |||||||||

| 1996 | 14.8 | % | 13.0 | % | 9.3 | % | 10.6 | % | 9.1 | % | 9.6 | % | 2.2 | % | 2.8 | % | |||||||||

| 1997 | 10.5 | % | 12.9 | % | 9.1 | % | 11.0 | % | 27.9 | % | 11.5 | % | 2.1 | % | 2.8 | % | |||||||||

| 1998 | 11.7 | % | 12.9 | % | 10.8 | % | 11.2 | % | 13.9 | % | 12.3 | % | 2.6 | % | 2.7 | % | |||||||||

| 1999 | 13.5 | % | 10.9 | % | 10.7 | % | 8.8 | % | 12.1 | % | 11.7 | % | 2.5 | % | 2.7 | % | |||||||||

| 2000 | 13.4 | % | 10.2 | % | 9.9 | % | 10.1 | % | 9.4 | % | 10.0 | % | 3.1 | % | 3.2 | % | |||||||||

| 2001 | 12.8 | % | 12.3 | % | 15.7 | % | 16.8 | % | 8.4 | % | 5.7 | % | 2.2 | % | 1.3 | % | |||||||||

| 2002 | 11.9 | % | 10.8 | % | 19.8 | % | 15.8 | % | 10.9 | % | 11.2 | % | 2.6 | % | 2.7 | % | |||||||||

| 2003 | 12.4 | % | 13.5 | % | 13.1 | % | 10.1 | % | 11.4 | % | 9.2 | % | 2.4 | % | 3.1 | % | |||||||||

| 2004 | 12.7 | % | 12.0 | % | 9.7 | % | 12.1 | % | 12.2 | % | 11.8 | % | 1.7 | % | 2.7 | % | |||||||||

| 2005 | 12.0 | % | 15.6 | % | 9.8 | % | 8.0 | % | 15.8 | % | 10.7 | % | 2.9 | % | 2.9 | % | |||||||||

| 2006 | 11.6 | % | 12.4 | % | 11.4 | % | 11.5 | % | 11.5 | % | 9.7 | % | 2.9 | % | 2.3 | % | |||||||||

| 2007 | 12.8 | % | 11.7 | % | 10.9 | % | 11.5 | % | 10.9 | % | 11.2 | % | 2.5 | % | 2.9 | % | |||||||||

| 2008 | 13.8 | % | 12.7 | % | 11.8 | % | 13.5 | % | 11.0 | % | 10.9 | % | 2.4 | % | 2.9 | % | |||||||||

| 2009 | 6 | 14.4 | % | 13.8 | % | 13.5 | % | 13.9 | % | 11.8 | % | 10.7 | % | 3.2 | % | 3.0 | % | ||||||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

LEGEND:

Symbol | Index Commodity | Symbol | Index Commodity | |||

C | Corn | KC | Coffee | |||

S | Soybeans | CT | Cotton | |||

W | Wheat | LC | Live Cattle | |||

KCW | Kansas Wheat | FC | Feeder Cattle | |||

SB | Sugar | LH | Lean Hogs | |||

CC | Cocoa |

Please refer to notes and legends that follow on page 27.

22

INDEX COMMODITIES WEIGHTS TABLES

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™

| LC7 | FC7 | LH7 | |||||||||||||||||

| High1 | Low2 | High1 | Low2 | High1 | Low2 | ||||||||||||||

| 1989 | 5 | 11.9 | % | 13.4 | % | 3.8 | % | 4.4 | % | 7.8 | % | 8.3 | % | ||||||

| 1990 | 12.1 | % | 13.1 | % | 3.8 | % | 4.3 | % | 9.7 | % | 8.6 | % | |||||||

| 1991 | 13.4 | % | 14.0 | % | 4.4 | % | 4.9 | % | 9.0 | % | 9.4 | % | |||||||

| 1992 | 12.7 | % | 14.6 | % | 4.1 | % | 5.1 | % | 8.3 | % | 9.7 | % | |||||||

| 1993 | 12.0 | % | 14.2 | % | 4.0 | % | 4.5 | % | 7.8 | % | 8.5 | % | |||||||

| 1994 | 9.3 | % | 12.2 | % | 3.3 | % | 4.2 | % | 5.4 | % | 7.9 | % | |||||||

| 1995 | 12.5 | % | 12.3 | % | 4.1 | % | 3.9 | % | 8.9 | % | 8.2 | % | |||||||

| 1996 | 10.7 | % | 12.5 | % | 3.4 | % | 4.0 | % | 9.0 | % | 8.3 | % | |||||||

| 1997 | 10.5 | % | 12.6 | % | 3.6 | % | 4.2 | % | 6.4 | % | 8.5 | % | |||||||

| 1998 | 12.3 | % | 12.1 | % | 4.2 | % | 4.1 | % | 8.3 | % | 6.0 | % | |||||||

| 1999 | 12.3 | % | 15.8 | % | 4.3 | % | 5.6 | % | 7.7 | % | 7.5 | % | |||||||

| 2000 | 12.1 | % | 13.1 | % | 4.0 | % | 4.4 | % | 9.3 | % | 9.5 | % | |||||||

| 2001 | 13.1 | % | 13.3 | % | 4.1 | % | 4.6 | % | 9.3 | % | 10.4 | % | |||||||

| 2002 | 10.5 | % | 12.2 | % | 3.4 | % | 3.9 | % | 4.9 | % | 6.7 | % | |||||||

| 2003 | 11.7 | % | 14.3 | % | 4.0 | % | 4.4 | % | 7.1 | % | 7.6 | % | |||||||

| 2004 | 11.0 | % | 10.0 | % | 4.0 | % | 3.6 | % | 8.0 | % | 7.7 | % | |||||||

| 2005 | 11.7 | % | 13.0 | % | 4.0 | % | 5.0 | % | 7.4 | % | 8.1 | % | |||||||

| 2006 | 12.7 | % | 12.3 | % | 4.3 | % | 4.1 | % | 7.4 | % | 7.5 | % | |||||||

| 2007 | 11.4 | % | 13.2 | % | 3.8 | % | 4.4 | % | 7.9 | % | 7.3 | % | |||||||

| 2008 | 9.1 | % | 12.0 | % | 3.1 | % | 4.0 | % | 6.1 | % | 9.5 | % | |||||||

| 2009 | 6 | 9.6 | % | 11.1 | % | 3.7 | % | 4.2 | % | 5.8 | % | 7.6 | % | ||||||

THE FUND WILL NOT TRADE WITH A VIEW TO TRACKING THE

DEUTSCHE BANK LIQUID COMMODITY INDEX DIVERSIFIED AGRICULTURE TOTAL RETURN™ OVER TIME.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND

NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

LEGEND:

Symbol | Index Commodity | Symbol | Index Commodity | |||

C | Corn | KC | Coffee | |||

S | Soybeans | CT | Cotton | |||

W | Wheat | LC | Live Cattle | |||

KCW | Kansas Wheat | FC | Feeder Cattle | |||

SB | Sugar | LH | Lean Hogs | |||

CC | Cocoa |

Please refer to notes and legends that follow on page 27.

23

All statistics based on data from January 18, 1989 to August 31, 2009.

VARIOUS STATISTICAL MEASURES | DBLCI Diversified Agriculture ER™8 | DBLCI Diversified Agriculture TR™9 | Goldman Sachs US Agriculture Total Return10 | ||||||

Annualized Changes to Index Level11 | -1.0 | % | 3.1 | % | -1.8 | % | |||

Average rolling 3 month daily volatility12 | 9.6 | % | 9.4 | % | 13.1 | % | |||

Sharpe Ratio13 | -0.53 | -0.10 | -0.44 | ||||||

% of months with positive change14 | 47 | % | 52 | % | 48 | % | |||

Average monthly positive change15 | 2.7 | % | 2.7 | % | 3.8 | % | |||

Average monthly negative change16 | -2.5 | % | -2.4 | % | -3.5 | % | |||

ANNUALIZED INDEX LEVELS17 | DBLCI Diversified Agriculture ER™8 | DBLCI Diversified Agriculture TR™9 | Goldman Sachs US Agriculture Total Return10 | ||||||

1 year | -24.8 | % | -24.3 | % | -31.5 | % | |||

3 year | -2.1 | % | 0.5 | % | 0.9 | % | |||

5 year | -1.3 | % | 1.7 | % | -1.6 | % | |||

7 year | 1.2 | % | 3.7 | % | -2.8 | % | |||

10 year | -0.4 | % | 2.6 | % | -3.8 | % | |||

15 year | -1.9 | % | 1.8 | % | -3.2 | % | |||

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN SEPTEMBER 2009, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JANUARY 1989 THROUGH SEPTEMBER 2009, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED IN THE FUND’S PROSPECTUS WITHIN THE CURRENTLY EFFECTIVE REGISTRATION STATEMENT UNDER “RISK FACTORS”, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUND AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

Please refer to notes and legends that follow on page 27.

24

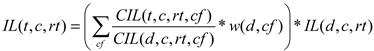

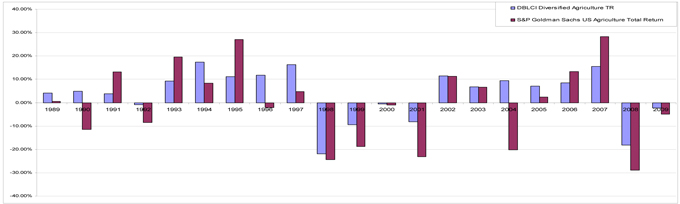

DBLCI DIVERSIFIED AGRICULTURE ER, DBLCI DIVERSIFIED BROAD AGRICULTURE TR AND GOLDMAN SACHS US AGRICULTURE TOTAL RETURN INDEX

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

Each of DBLCI Diversified Agriculture ER, DBLCI Diversified Agriculture TR and Goldman Sachs US Agriculture Total Return Index are indices and do not reflect actual trading. DBLCI Diversified Agriculture TR and Goldman Sachs US Agriculture Total Return Index are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN SEPTEMBER 2009, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JANUARY 1989 THROUGH SEPTEMBER 2009, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED IN THE FUND’S PROSPECTUS WITHIN THE CURRENTLY EFFECTIVE REGISTRATION STATEMENT UNDER “RISK FACTORS”, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUND AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

Please refer to notes and legends that follow on page 27.

25

COMPARISON OF DBLCI DIVERSIFIED AGRICULTURE TR AND GOLDMAN SACHS US AGRICULTURE TOTAL RETURN INDEX

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE AND NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

DBLCI Diversified Agriculture TR and Goldman Sachs US Agriculture Total Return Index are indices and do not reflect actual trading. DBLCI Diversified Agriculture TR and Goldman Sachs US Agriculture Total Return Index are calculated on a total return basis and do not reflect any fees or expenses.

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN SEPTEMBER 2006, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JANUARY 1989 THROUGH SEPTEMBER 2009, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED IN THE FUND’S PROSPECTUS WITHIN THE CURRENTLY EFFECTIVE REGISTRATION STATEMENT UNDER “RISK FACTORS”, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.

THE MANAGING OWNER COMMENCED OPERATIONS IN JANUARY 2006. AS MANAGING OWNER, THE MANAGING OWNER AND ITS TRADING PRINCIPALS HAVE BEEN MANAGING THE DAY-TO-DAY OPERATIONS FOR THE FUND AND MANAGING FUTURES TRADING ACCOUNTS. BECAUSE THERE ARE LIMITED ACTUAL TRADING RESULTS TO COMPARE TO THE INDEX CLOSING LEVELS SET FORTH HEREIN, PROSPECTIVE INVESTORS SHOULD BE PARTICULARLY WARY OF PLACING UNDUE RELIANCE ON THE ANNUAL OR CUMULATIVE INDEX RESULTS.

Please refer to notes and legends that follow on page 27.

26

NOTES AND LEGENDS:

| 1. | “High” reflects the highest closing level of the Index during the applicable year. |

| 2. | “Low” reflects the lowest closing level of the Index during the applicable year. |

| 3. | “Annual Index Changes” reflect the change to the Index level on an annual basis as of December 31 of each applicable year. |

| 4. | “Index Changes Since Inception” reflects the change of the Index level since inception on a compounded annual basis as of December 31 of each applicable year. |

| 5. | Closing levels as of inception on January 18, 1989. |

| 6. | Closing levels as of August 31, 2009. |

| 7. | The Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™ and Deutsche Bank Liquid Commodity Index Diversified Agriculture Total Return™ reflect the change in market value of C (Corn), S (Soybeans), W (Wheat), KW (Kansas Wheat), SB (Sugar) and CT (Cotton), on an optimum yield basis, and CC (Cocoa), KC (Coffee), LC (Live Cattle), FC (Feeder Cattle), and LH (Lean Hogs) on a non-optimum yield basis. |

| 8. | “DBLCI Diversified Agriculture ER™” is Deutsche Bank Liquid Commodity Index Diversified Agriculture Excess Return™. |

| 9. | “DBLCI Diversified Agriculture TR™” is Deutsche Bank Liquid Commodity Index Diversified Agriculture Total Return™. |

| 10. | “Goldman Sachs US Agriculture Total Return” is S&P Goldman Sachs US Agriculture Total Return. |

| 11. | “Annualized Changes to Index Level” reflect the change to the applicable index level on an annual basis as of December 31 of each applicable year. |

| 12. | “Average rolling 3 month daily volatility.” The daily volatility reflects the relative rate at which the price of the applicable index moves up and down, which is found by calculating the annualized standard deviation of the daily change in price. In turn, an average of this value is calculated on a 3 month rolling basis. |

| 13. | “Sharpe Ratio” compares the annualized rate of return minus the annualized risk-free rate of return to the annualized variability — often referred to as the “standard deviation” — of the monthly rates of return. A Sharpe Ratio of 1:1 or higher indicates that, according to the measures used in calculating the ratio, the rate of return achieved by a particular strategy has equaled or exceeded the risks assumed by such strategy. The risk-free rate of return that was used in these calculations was assumed to be 4.03%. |

| 14. | “% of months with positive change” during the period from inception to August 31, 2009. |

| 15. | “Average monthly positive change” during the period from inception to August 31, 2009. |

| 16. | “Average monthly negative change” during the period from inception to August 31, 2009. |

| 17. | “Annualized Index Levels” reflect the change to the level of the applicable index on an annual basis as of December 31 of each the applicable time period (e.g., 1 year, 3, 5 or 7, 10 or 15 years, as applicable). |

WHILE THE FUND’S OBJECTIVE IS NOT TO GENERATE PROFIT THROUGH ACTIVE PORTFOLIO MANAGEMENT, BUT IS TO TRACK THE INDEX, BECAUSE THE INDEX WAS ESTABLISHED IN SEPTEMBER 2006, CERTAIN INFORMATION RELATING TO INDEX CLOSING LEVELS MAY BE CONSIDERED TO BE “HYPOTHETICAL.” HYPOTHETICAL INFORMATION MAY HAVE CERTAIN INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW.

NO REPRESENTATION IS BEING MADE THAT THE INDEX WILL OR IS LIKELY TO ACHIEVE ANNUAL OR CUMULATIVE CLOSING LEVELS CONSISTENT WITH OR SIMILAR TO THOSE SET FORTH HEREIN. SIMILARLY, NO REPRESENTATION IS BEING MADE THAT THE FUND WILL GENERATE PROFITS OR LOSSES SIMILAR TO THE FUND’S PAST PERFORMANCE, WHEN AVAILABLE, OR THE HISTORICAL ANNUAL OR CUMULATIVE CHANGES IN THE INDEX CLOSING LEVELS. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY INVESTMENT METHODOLOGIES, WHETHER ACTIVE OR PASSIVE.

27

ONE OF THE LIMITATIONS OF HYPOTHETICAL INFORMATION IS THAT IT IS GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. TO THE EXTENT THAT INFORMATION PRESENTED HEREIN RELATES TO THE PERIOD JANUARY 1989 THROUGH SEPTEMBER 2009, THE INDEX CLOSING LEVELS REFLECT THE APPLICATION OF THE INDEX’S METHODOLOGY, AND SELECTION OF INDEX COMMODITIES, IN HINDSIGHT.

NO HYPOTHETICAL RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THERE ARE NUMEROUS FACTORS, INCLUDING THOSE DESCRIBED IN THE FUND’S PROSPECTUS WITHIN THE CURRENTLY EFFECTIVE REGISTRATION STATEMENT UNDER “RISK FACTORS”, RELATED TO THE COMMODITIES MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF THE FUND’S EFFORTS TO TRACK ITS INDEX OVER TIME WHICH CANNOT BE, AND HAVE NOT BEEN, ACCOUNTED FOR IN THE PREPARATION OF SUCH INDEX INFORMATION SET FORTH ON THE FOLLOWING PAGES, ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL PERFORMANCE RESULTS FOR THE FUND. FURTHERMORE, THE INDEX INFORMATION DOES NOT INVOLVE FINANCIAL RISK OR ACCOUNT FOR THE IMPACT OF FEES AND COSTS ASSOCIATED WITH THE FUND.