Exhibit 4.1.1

SECOND AMENDED AND RESTATED

DECLARATION OF TRUST

AND

TRUST AGREEMENT

OF

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

Dated as of December 31, 2010

By and Among

DB COMMODITY SERVICES LLC

WILMINGTON TRUST COMPANY

and

THE UNITHOLDERS

from time to time hereunder

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I DEFINITIONS; THE TRUST | ||||||

SECTION 1.1. | Definitions | 1 | ||||

SECTION 1.2. | Name | 9 | ||||

SECTION 1.3. | Delaware Trustee; Business Offices | 9 | ||||

SECTION 1.4. | Declaration of Trust | 9 | ||||

SECTION 1.5. | Purposes and Powers | 10 | ||||

SECTION 1.6. | Tax Treatment | 10 | ||||

SECTION 1.7. | General Liability of the Managing Owner | 11 | ||||

SECTION 1.8. | Legal Title | 11 | ||||

SECTION 1.9. | Series Trust | 11 | ||||

| ARTICLE II THE TRUSTEE | ||||||

SECTION 2.1. | Term; Resignation | 11 | ||||

SECTION 2.2. | Powers | 12 | ||||

SECTION 2.3. | Compensation and Expenses of the Trustee | 12 | ||||

SECTION 2.4. | Indemnification | 12 | ||||

SECTION 2.5. | Successor Trustee | 13 | ||||

SECTION 2.6. | Liability of Trustee | 13 | ||||

SECTION 2.7. | Reliance; Advice of Counsel | 14 | ||||

SECTION 2.8. | Payments to the Trustee | 15 | ||||

| ARTICLE III CAPITAL CONTRIBUTIONS; CREATIONS AND ISSUANCE OF CREATION BASKETS | ||||||

SECTION 3.1. | General | 15 | ||||

SECTION 3.2. | Establishment of Series, or Funds, of the Trust | 16 | ||||

SECTION 3.3. | Establishment of Classes and Sub-Classes | 17 | ||||

SECTION 3.4. | Offer of Limited Units, Procedures for Creation and Issuance of Creation Baskets | 17 | ||||

SECTION 3.5. | Book-Entry-Only System, Fund Global Securities | 19 | ||||

SECTION 3.6. | Assets | 22 | ||||

SECTION 3.7. | Liabilities of Funds | 22 | ||||

SECTION 3.8. | Distributions | 24 | ||||

SECTION 3.9. | Voting Rights | 24 | ||||

SECTION 3.10. | Equality | 24 | ||||

i

| ARTICLE IV THE MANAGING OWNER | ||||||

SECTION 4.1. | Management of the Trust | 25 | ||||

SECTION 4.2. | Authority of Managing Owner | 25 | ||||

SECTION 4.3. | Obligations of the Managing Owner | 26 | ||||

SECTION 4.4. | General Prohibitions | 28 | ||||

SECTION 4.5. | Liability of Covered Persons | 29 | ||||

SECTION 4.6. | Fiduciary Duty | 29 | ||||

SECTION 4.7. | Indemnification of the Managing Owner | 30 | ||||

SECTION 4.8. | Expenses and Limitations Thereon | 32 | ||||

SECTION 4.9. | Compensation to the Managing Owner | 33 | ||||

SECTION 4.10. | Other Business of Unitholders | 33 | ||||

SECTION 4.11. | Voluntary Withdrawal of the Managing Owner | 33 | ||||

SECTION 4.12. | Authorization of Registration Statements | 33 | ||||

SECTION 4.13. | Litigation | 34 | ||||

| ARTICLE V TRANSFERS OF UNITS | ||||||

SECTION 5.1. | General Prohibition | 34 | ||||

SECTION 5.2. | Transfer of Managing Owner’s General Units | 34 | ||||

SECTION 5.3. | Transfer of Limited Units | 35 | ||||

| ARTICLE VI CAPITAL ACCOUNTS; ALLOCATIONS | ||||||

SECTION 6.1. | Capital Accounts | 35 | ||||

SECTION 6.2. | Periodic Closing of Books | 36 | ||||

SECTION 6.3. | Periodic Allocations | 36 | ||||

SECTION 6.4. | Code Section 754 Adjustments | 37 | ||||

SECTION 6.5. | Allocation of Profit and Loss for U.S. Federal Income Tax Purposes | 37 | ||||

SECTION 6.6. | Effect of Section 754 Election | 38 | ||||

SECTION 6.7. | Admissions of Unitholders; Transfers | 38 | ||||

SECTION 6.8. | Allocation of Distributions | 38 | ||||

SECTION 6.9. | Liability for State and Local and Other Taxes | 39 | ||||

SECTION 6.10. | Consent to Methods | 39 | ||||

| ARTICLE VII REDEMPTIONS | ||||||

SECTION 7.1. | Redemption of Redemption Baskets | 39 | ||||

ii

SECTION 7.2. | Other Redemption Procedures | 41 | ||||

| ARTICLE VIII THE LIMITED OWNERS | ||||||

SECTION 8.1. | No Management or Control; Limited Liability; Exercise of Rights through DTC | 41 | ||||

SECTION 8.2. | Rights and Duties | 41 | ||||

SECTION 8.3. | Limitation on Liability | 42 | ||||

| ARTICLE IX BOOKS OF ACCOUNT AND REPORTS | ||||||

SECTION 9.1. | Books of Account | 43 | ||||

SECTION 9.2. | Annual Reports and Monthly Statements | 44 | ||||

SECTION 9.3. | Tax Information | 44 | ||||

SECTION 9.4. | Calculation of Net Asset Value | 44 | ||||

SECTION 9.5. | Maintenance of Records | 44 | ||||

SECTION 9.6. | Certificate of Trust | 44 | ||||

| ARTICLE X FISCAL YEAR | ||||||

SECTION 10.1. | Fiscal Year | 45 | ||||

| ARTICLE XI AMENDMENT OF TRUST AGREEMENT; MEETINGS | ||||||

SECTION 11.1. | Amendments to this Trust Agreement | 45 | ||||

SECTION 11.2. | Meetings of the Trust or the Funds | 47 | ||||

SECTION 11.3. | Action Without a Meeting | 47 | ||||

| ARTICLE XII TERM | ||||||

SECTION 12.1. | Term | 47 | ||||

| ARTICLE XIII TERMINATION | ||||||

SECTION 13.1. | Events Requiring Dissolution of the Trust or any Fund | 48 | ||||

SECTION 13.2. | Distributions on Dissolution | 49 | ||||

iii

SECTION 13.3. | Termination; Certificate of Cancellation | 50 | ||||

| ARTICLE XIV POWER OF ATTORNEY | ||||||

SECTION 14.1. | Power of Attorney Executed Concurrently | 50 | ||||

SECTION 14.2. | Effect of Executing and Submitting the Purchase Order Subscription Agreement | 51 | ||||

SECTION 14.3. | Limitation on Power of Attorney | 51 | ||||

| ARTICLE XV MISCELLANEOUS | ||||||

SECTION 15.1. | Governing Law | 51 | ||||

SECTION 15.2. | Provisions In Conflict With Law or Regulations | 52 | ||||

SECTION 15.3. | Construction | 52 | ||||

SECTION 15.4. | Notices | 52 | ||||

SECTION 15.5. | Counterparts | 53 | ||||

SECTION 15.6. | Binding Nature of Trust Agreement | 53 | ||||

SECTION 15.7. | No Legal Title to Trust Estate | 53 | ||||

SECTION 15.8. | Creditors | 53 | ||||

SECTION 15.9. | Integration | 53 | ||||

SECTION 15.10. | Goodwill; Use of Name | 53 | ||||

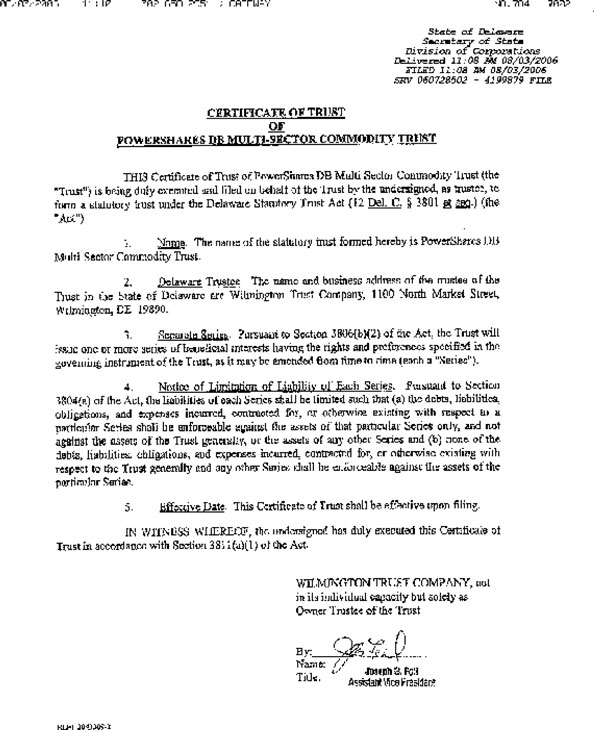

EXHIBIT A | ||||

Certificate of Trust | A-1 | |||

EXHIBIT B | ||||

Description of the Indexes | B-1 | |||

EXHIBIT C | ||||

Form of Global Certificate | C-1 | |||

EXHIBIT D | ||||

Form of Participant Agreement | D-1 |

iv

POWERSHARES DB MULTI-SECTOR COMMODITY TRUST

SECOND AMENDED AND RESTATED

DECLARATION OF TRUST

AND TRUST AGREEMENT

This SECOND AMENDED AND RESTATED DECLARATION OF TRUST AND TRUST AGREEMENT ofPOWERSHARES DB MULTI-SECTOR COMMODITY TRUST is made and entered into as promptly as reasonably practicable and after the determination of the net asset value of each series of DB Multi-Sector Commodity Master Trust on the 31st day of December, 2010, by and amongDB COMMODITY SERVICES LLC, a Delaware limited liability company,WILMINGTON TRUST COMPANY, a Delaware banking corporation, as trustee, and theUNITHOLDERS from time to time hereunder.

* * *

RECITALS

WHEREAS, the Trust was formed on August 3, 2006 pursuant to the execution and filing by the Trustee of the Certificate of Trust on August 3, 2006 and the execution and delivery by each of the Trustee and the Managing Owner of a Declaration of Trust and Trust Agreement dated as of August 3, 2006 (the “Original Agreement”);

WHEREAS, the Managing Owner and the Trustee entered into an Amended and Restated Declaration of Trust and Trust Agreement dated as of November 21, 2006 (as amended from time to time, the “Existing Agreement”) to amend and restate the Original Agreement; and

WHEREAS, the Trustee and the Managing Owner desire to amend the Existing Agreement pursuant to Section 11.1(b)(iii) thereof to make the amendments effectuated hereby.

NOW, THEREFORE, pursuant to Section 11.1(b)(iii) of the Existing Agreement, the Trustee and the Managing Owner hereby amend and restate the Existing Agreement in its entirety as set forth below.

ARTICLE I

DEFINITIONS; THE TRUST

SECTION 1.1.Definitions. As used in this Trust Agreement, the following terms shall have the following meanings unless the context otherwise requires:

“Adjusted Capital Account” means, for each Fund, as of the last day of a taxable period, a Unitholder’s Capital Account as maintained pursuant to Section 6.1, increased by any amounts which such Unitholder is obligated to restore pursuant to any provision of this Trust Agreement or is deemed to be obligated to restore pursuant to Treasury Regulation section 1.704-2 and decreased by the amount of all losses and deductions that, as of the end of the taxable period, are reasonably expected to be allocated to such Unitholder in subsequent years under sections

1

704(e)(2) and 706(d) of the Code and the amount of all distributions that, as of the end of such taxable period, are reasonably expected to be made to such Unitholder in subsequent years in accordance with the terms of this Trust Agreement or otherwise to the extent they exceed offsetting increases to such Capital Account that are reasonably expected to occur during or prior to the year in which such distributions are reasonably expected to be made. The foregoing definition of Adjusted Capital Account is intended to comply with the provisions of Treasury Regulation section 1.704-1(b)(2)(ii)(d) and shall be interpreted consistently therewith.

“Adjusted Property” means any property the adjusted basis of which has been adjusted pursuant to Sections 6.1(a) and (b).

“Administrator” means any Person from time to time engaged to perform administrative services for the Trust pursuant to authority delegated by the Managing Owner.

“Affiliate” – An “Affiliate” of a “Person” means (i) any Person directly or indirectly owning, controlling or holding with power to vote 10% or more of the outstanding voting securities of such Person, (ii) any Person 10% or more of whose outstanding voting securities are directly or indirectly owned, controlled or held with power to vote by such Person, (iii) any Person, directly or indirectly, controlling, controlled by or under common control with such Person, (iv) any employee, officer, director, member, manager or partner of such Person, or (v) if such Person is an employee, officer, director, member, manager or partner, any Person for which such Person acts in any such capacity.

“Basket” means a Creation Basket or a Redemption Basket, as the context may require.

“Beneficial Owners” shall have the meaning assigned to such term in Section 3.5(d).

“Book-Tax Disparity” means with respect to any item of Adjusted Property, as of the date of any determination, the difference between the adjusted value of such property and the adjusted basis thereof for U.S. federal income tax purposes as of such date. For each Fund, a Unitholder’s portion of such Fund’s Book-Tax Disparities in all of its Adjusted Property will be reflected by the difference between such Unitholder’s Capital Account balance as maintained pursuant to Section 6.1 and the hypothetical balance of such Unitholder’s Capital Account computed as if it had been maintained strictly in accordance with U.S. federal income tax accounting principles.

“Business Day” means any day other than a day when banks in New York City are required or permitted to be closed.

“Capital Account” means the capital account maintained for a Unitholder pursuant to Section 6.1.

“Capital Contributions” means the amounts of cash contributed and agreed to be contributed to the Trust by any Participant or by the Managing Owner, as applicable, in accordance with Article III hereof.

“CE Act” means the Commodity Exchange Act, as amended.

2

“Certificate of Trust” means the Certificate of Trust of the Trust, including all amendments thereto, if any, in the form attached hereto as Exhibit A, filed with the Secretary of State of the State of Delaware pursuant to Section 3810 of the Delaware Trust Statute.

“CFTC” means the Commodity Futures Trading Commission.

“Code” means the Internal Revenue Code of 1986, as amended.

“Commodities” means positions in Commodity Contracts, forward contracts, foreign exchange positions and traded physical commodities, as well as cash commodities resulting from any of the foregoing positions.

“Commodity Broker” means any person who engages in the business of effecting transactions in Commodity Contracts for the account of others or for his or her own account.

“Commodity Contract” means any futures contract or option thereon providing for the delivery or receipt at a future date of a specified amount and grade of a traded commodity at a specified price and delivery point, or any other futures contract or option thereon approved for trading for U.S. persons.

“Continuous Offering” means the continuous offering during which additional Limited Units may be sold in Baskets pursuant to this Trust Agreement.

“Conflicting Provisions” shall have the meaning assigned thereto in Section 15.2(a).

“Corporate Trust Office” means the principal office at which at any particular time the corporate trust business of the Trustee is administered, which office at the date hereof is located at Rodney Square North, 1100 North Market Street, Wilmington, Delaware 19890, Attention: Corporate Trust Administration.

“Covered Person” means the Managing Owner and their respective Affiliates.

“Creation Basket” means the minimum number of Limited Units of a Fund that may be created at any one time, which shall be 200,000 or such greater or lesser number as the Managing Owner may determine from time to time for each Fund.

“Creation Basket Capital Contribution” of a Fund means a Capital Contribution made by a Participant in connection with a Purchase Order Subscription Agreement and the creation of a Creation Basket in an amount equal to the product obtained by multiplying (i) the number of Creation Baskets set forth in the relevant Purchase Order Subscription Agreement by (ii) the Net Asset Value per Basket of a Fund as of closing time of the Exchange or the last to close of the exchanges on which any one of the Index Commodities are traded, whichever is later, on the Purchase Order Subscription Date.

“Delaware Trust Statute” means the Delaware Statutory Trust Act, Chapter 38 of Title 12 of the Delaware Code, 12 Del. C. § 3801et seq., as the same may be amended from time to time.

3

“Depository” means The Depository Trust Company, New York, New York, or such other depository of Limited Units as may be selected by the Managing Owner as specified herein.

“Depository Agreement” means the Letter of Representations relating to each Fund from the Managing Owner to the Depository, dated as of November 21, 2006 as the same may be amended or supplemented from time to time.

“Distributor” means any Person from time to time engaged to provide distribution services or related services to the Trust pursuant to authority delegated by the Managing Owner.

“DTC” shall have the meaning assigned to such term in Section 3.5(b).

“DTC Participants” shall have the meaning assigned to such term in Section 3.5(c).

“DTCC” shall have the meaning assigned to such term in Section 3.5(c).

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Event of Withdrawal” shall have the meaning set forth in Section 13.1(a) hereof.

“Exchange” means NYSE Arca or, if the Limited Units of any Fund shall cease to be listed on NYSE Arca and are listed on one or more other exchanges, the exchange on which the Units of such Fund are principally traded, as determined by the Managing Owner.

“Expenses” shall have the meaning assigned to such term in Section 2.4.

“Fiscal Quarter” shall mean each period ending on the last day of each March, June, September and December of each Fiscal Year, or, if the Trust is required by law to have a Fiscal Year other than a calendar year, such other applicable quarterly period.

“Fiscal Year” shall have the meaning set forth in Article X hereof.

“Fund” means a Fund established and designated as a series of the Trust as provided in Section 3.2(a).

“Global Security” means the global certificate or certificates for each Fund issued to the Depository as provided in the Depository Agreement, each of which shall be in substantially the form attached hereto as Exhibit C.

“Indemnified Parties” shall have the meaning assigned to such term in Section 2.4.

“Index” or “Indexes” means the Index that each Fund is designed to track (or, collectively, the Indexes) as more fully described in Exhibit B hereto, as it may be amended from time to time.

“Index Commodities” means the underlying Commodities that comprise each applicable Index, from time to time, as described in the Prospectus.

4

“Indirect Participants” shall have the meaning assigned to such term in Section 3.5(c).

“Internal Revenue Service” or “IRS” means the U.S. Internal Revenue Service or any successor thereto.

“Limited Owner” means any person or entity who is or becomes a Beneficial Owner of Limited Units of a Fund.

“Liquidating Trustee” shall have the meaning assigned thereto in Section 13.2.

“Losses” means, in respect of each Fiscal Year of a Fund, losses of such Fund as determined for U.S. federal income tax purposes, and each item of income, gain, loss or deduction entering into the computation thereof.

“Management Fee” means the management fee set forth in Section 4.9.

“Managing Owner” means DB Commodity Services LLC, or any substitute therefor as provided herein, or any successor thereto by merger or operation of law.

“Margin Call” means a demand for additional funds after the initial good faith deposit required to maintain a customer’s account in compliance with the requirements of a particular commodity exchange or of a commodity broker.

“Net Asset Value of a Fund” means the total assets of the Trust Estate of a Fund including, but not limited to, all cash and cash equivalents or other securities less total liabilities of such Fund, each determined on the basis of generally accepted accounting principles in the United States, consistently applied under the accrual method of accounting, including, but not limited to, the extent specifically set forth below:

(a) Net Asset Value of a Fund shall include any unrealized profit or loss on open Commodities positions and any other credit or debit accruing to such Fund but unpaid or not received by the Fund.

(b) All open commodity futures contracts and options traded on a United States exchange are calculated at their then current market value, which shall be based upon the settlement price for that particular commodity futures contract and options traded on the applicable United States exchange on the date with respect to which net asset value is being determined; provided, that if a commodity futures contract and options traded on a United States exchange could not be liquidated on such day, due to the operation of daily limits or other rules of the exchange upon which that position is traded or otherwise, the Managing Owner may value such commodity futures contract or option pursuant to policies the Managing Owner has adopted, which are consistent with normal industry standards. The current market value of all open commodity futures contracts and options traded on a non-United States exchange shall be based upon the settlement price for that particular commodity futures contract or option traded on the applicable non-United States exchange on the date with respect to which net asset value of a Fund is being determined; provided further, that if a commodity futures contract or option traded on a non-United States exchange could not be liquidated on such day, due to the operation of daily limits (if applicable) or other rules of the exchange upon which that position is traded or

5

otherwise, the Managing Owner may value such commodity futures contract pursuant to policies the Managing Owner has adopted, which are consistent with normal industry standards. The current market value of all open forward contracts entered into by a Fund shall be the mean between the last bid and last asked prices quoted by the bank or financial institution which is a party to the contract on the date with respect to which Net Asset Value of a Fund being determined; provided, that if such quotations are not available on such date, the mean between the last bid and asked prices on the first subsequent day on which such quotations are available shall be the basis for determining the market value of such forward contract for such day. The Managing Owner may in its discretion value any of the Trust Estate (and under circumstances, including, but not limited to, periods during which a settlement price of a futures contract is not available due to exchange limit orders or force majeure type events such as systems failure, natural or man-made disaster, act of God, armed conflict, act of terrorism, riot or labor disruption or any similar intervening circumstance) value any asset of a Fund pursuant to such other principles as the Managing Owner deems fair and equitable so long as such principles are consistent with normal industry standards.

(c) Interest earned on a Fund’s commodity brokerage account shall be accrued at least monthly.

(d) The amount of any distribution made pursuant to Article VI hereof shall be a liability of a Fund from the day when the distribution is declared until it is paid.

“Net Asset Value Per Basket of a Fund” means the product obtained by multiplying the Net Asset Value Per Unit of a Fund by the number of Limited Units comprising a Basket of such Fund at such time.

“Net Asset Value Per Unit of a Fund” means the Net Asset Value of a Fund divided by the number of Units of such Fund outstanding on the date of calculation.

“NFA” means the National Futures Association.

“NYSE Arca” means NYSE Arca, Inc.

“Order Cut-Off Time” means 10:00 a.m., New York time, on a Business Day.

“Organization and Offering Expenses” shall have the meaning assigned thereto in Section 4.8(a)(ii).

“Participant” means a Person that is a (1) a registered broker dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker dealer to engage in securities transactions, (2) a DTC Participant, and (3) has entered into a Participant Agreement which, at the relevant time, is in full force and effect.

“Participant Agreement” means an agreement among a Fund, the Managing Owner and a Participant, substantially in the form of Exhibit D hereto, as it may be amended or supplemented from time to time in accordance with its terms.

6

“Percentage Interest” shall be a fraction, the numerator of which is the number of the Unitholder’s Units and the denominator of which is the total number of Units of such Fund outstanding as of the date of determination.

“Person” means any natural person, partnership, limited liability company, statutory trust, corporation, association, trust or other legal entity.

“Pit Brokerage Fee” shall include floor brokerage, clearing fees, NFA fees and exchange fees.

“Power of Attorney” shall have the meaning assigned thereto in Section 14.2.

“Profits” means, for each Fiscal Year of a Fund, profits of such Fund as determined for U.S. federal income tax purposes, and each item of income, gain, loss or deduction entering into the computation thereof.

“Prospectus” means the final prospectus and disclosure document of the Trust, constituting a part of a Registration Statement, as filed with the SEC and declared effective thereby, or becoming automatically effective, as applicable, as the same may at any time and from time to time be amended or supplemented.

“Purchase Order Subscription Agreement” shall have the meaning assigned thereto in Section 3.4(a)(i).

“Purchase Order Subscription Date” shall have the meaning assigned thereto in Section 3.4(a)(i).

“Pyramiding” means the use of unrealized profits on existing Commodities to provide margin for additional Commodities positions of the same or related Commodities.

“Reconstituted Trust” shall have the meaning assigned thereto in Section 13.1(a).

“Redemption Basket” means the minimum number of Limited Units of a Fund that may be redeemed pursuant to Section 7.1, which shall be the number of Limited Units of such Fund constituting a Creation Basket on the relevant Redemption Order Date.

“Redemption Distribution” means the cash delivered in satisfaction of a redemption of a Redemption Basket as specified in Section 7.1(c).

“Redemption Order” shall have the meaning assigned thereto in Section 7.1(a).

“Redemption Order Date” shall have the meaning assigned thereto in Section 7.1(b).

“Redemption Settlement Time” shall have the meaning assigned thereto in Section 7.1(d).

“Registration Statement” means a registration statement on Form S-1, or any other form, as applicable, as it may be amended from time to time, filed with the SEC pursuant to which the Trust registered the Units, as the same may at any time and from time to time be further amended or supplemented.

7

“SEC” means the Securities and Exchange Commission.

“Subscribing Participant” means a Participant who has submitted a Purchase Order Subscription Agreement to create one or more Units that has not yet been filled or accepted by the Managing Owner.

“Suspended Redemption Order” shall have the meaning assigned thereto in Section 7.1(d).

“Tax Matters Partner” shall have the meaning assigned thereto in Section 1.6(b).

“Transaction Fee” shall have the meaning assigned thereto in Section 3.4(d).

“Treasury Regulations” means regulations, including proposed or temporary regulations, promulgated under the Code. References herein to specific provisions of proposed or temporary regulations shall include analogous provisions of final Treasury Regulations or other successor Treasury Regulations.

“Trust” means PowerShares DB Multi-Sector Commodity Trust, a Delaware statutory trust formed in separate series pursuant to the Certificate of Trust, the business and affairs of which are governed by this Trust Agreement.

“Trust Agreement” means this Second Amended and Restated Declaration of Trust and Trust Agreement, as it may at any time or from time to time be amended.

“Trust Estate” means, with respect to a Fund, all any cash, futures, forward and option contracts, all funds on deposit in the Fund’s accounts, and any other property held by the Fund, and all proceeds therefrom, including any rights of the Fund pursuant to any other agreements to which the Fund is a party.

“Trustee” means Wilmington Trust Company or any substitute therefor as provided herein, acting not in its individual capacity but solely as trustee of the Trust.

“Unitholders” means the Managing Owner and all Limited Owners, as holders of Units of a Fund, where no distinction is required by the context in which the term is used.

“Units” means the common units of fractional undivided beneficial interest in the profits, losses, distributions, capital and assets of, and ownership of, a Fund. The Managing Owner’s Capital Contributions shall be represented by “General” Units and a Limited Owner’s Capital Contributions shall be represented by “Limited” Units.

“Unrealized Gain” attributable to Fund property means, as of any date of determination, the excess, if any, of the fair market value of such property as of such date over the property’s adjusted basis for U.S. federal income tax purposes as of the date of determination.

8

“Unrealized Loss” attributable to Fund property means, as of any date of determination, the excess, if any, of the property’s adjusted basis for U.S. federal income tax purposes as of the date of determination over the fair market value of such property as of such date of determination.

SECTION 1.2.Name.

(a) The name of the Trust is “PowerShares DB Multi-Sector Commodity Trust” in which name the Trustee and the Managing Owner may engage in the business of the Trust, make and execute contracts and other instruments on behalf of the Trust and sue and be sued on behalf of the Trust.

SECTION 1.3.Delaware Trustee; Business Offices.

(a) The sole Trustee of the Trust is Wilmington Trust Company, which is located at the Corporate Trust Office or at such other address in the State of Delaware as the Trustee may designate in writing to the Unitholders. The Trustee shall receive service of process on the Trust in the State of Delaware at the foregoing address. In the event Wilmington Trust Company resigns or is removed as the Trustee, the Trustee of the Trust in the State of Delaware shall be the successor Trustee, subject to Section 2.5.

(b) The principal office of the Trust, and such additional offices as the Managing Owner may establish, shall be located at such place or places inside or outside the State of Delaware as the Managing Owner may designate from time to time in writing to the Trustee and the Unitholders. Initially, the principal office of the Trust shall be at c/o DB Commodity Services LLC, 60 Wall Street, New York, New York 10005.

SECTION 1.4.Declaration of Trust. The Trust has received the sum of $1,000 for each Fund in bank accounts in the name of each Fund controlled by the Managing Owner, which funds shall be held in trust, upon and subject to the conditions set forth herein for the use and benefit of the Unitholders of each Fund. It is the intention of the parties hereto that the Trust shall be a statutory trust organized in series, or Funds, under the Delaware Trust Statute and that this Trust Agreement shall constitute the governing instrument of the Trust. It is not the intention of the parties hereto to create a general partnership, limited partnership, limited liability company, joint stock association, corporation, bailment or any form of legal relationship other than a Delaware statutory trust except to the extent that each Fund is deemed to constitute a partnership under the Code and applicable state and local tax laws. Nothing in this Trust Agreement shall be construed to make the Unitholders partners or members of a joint stock association except to the extent such Unitholders are deemed to be partners under the Code and applicable state and local tax laws. Notwithstanding the foregoing, it is the intention of the parties hereto to create a partnership among the Unitholders for purposes of taxation under the Code and applicable state and local tax laws. Effective as of the date hereof, the Trustee and the Managing Owner shall have all of the rights, powers and duties set forth herein and in the Delaware Trust Statute with respect to accomplishing the purposes of the Trust. The Trustee has filed the certificate of trust required by Section 3810 of the Delaware Trust Statute in connection with the formation of the Trust under the Delaware Trust Statute.

9

SECTION 1.5.Purposes and Powers. The purposes of the Trust and each Fund shall be: (a) directly or indirectly to trade, buy, sell, spread or otherwise acquire, hold or dispose of Commodities, including but not limited to, exchange-traded futures on the applicable Commodities or Index Commodities with a view to tracking the performance of the applicable Indexes over time; (b) to enter into forward contracts referencing the applicable Indexes or one or more of the applicable Commodities or Index Commodities with a view to tracking the performance of the applicable Indexes over time; (c) to enter into any lawful transaction and engage in any lawful activities in furtherance of or incidental to the foregoing purposes; and (d) as determined from time to time by the Managing Owner, to engage in any other lawful business or activity for which a statutory trust may be organized under the Delaware Trust Statute. The Trust shall have all of the powers specified in Section 15.1 hereof, including, without limitation, all of the powers which may be exercised by a Managing Owner on behalf of the Trust under this Trust Agreement.

SECTION 1.6.Tax Treatment.

(a) Each of the parties hereto, by entering into this Trust Agreement, (i) expresses its intention that the Units of each Fund will qualify under applicable tax law as interests in a partnership which holds the Trust Estate of each Fund, (ii) agrees that it will file its own U.S. federal, state and local income, franchise and other tax returns in a manner that is consistent with the classification of each Fund as a partnership in which each of the Unitholders thereof is a partner and (iii) agrees to use reasonable efforts to notify the Managing Owner promptly upon a receipt of any notice from any taxing authority having jurisdiction over such holders of Units of each Fund with respect to the treatment of the Units of such Fund as anything other than interests in a partnership.

(b) The Tax Matters Partner (as defined in Section 6231 of the Code and any corresponding state and local tax law) of each Fund initially shall be the Managing Owner. The Tax Matters Partner, at the expense of each Fund, (i) shall prepare or cause to be prepared and filed each Fund’s tax returns as a partnership for U.S. federal, state and local tax purposes and (ii) shall be authorized to perform all duties imposed by Section 6221 et seq. of the Code, including, without limitation, (A) the power to conduct all audits and other administrative proceedings with respect to each Fund’s tax items; (B) the power to extend the statute of limitations for all Unitholders with respect to each Fund’s tax items; (C) the power to file a petition with an appropriate U.S. federal court for review of a final administrative adjustment of any Fund; and (D) the power to enter into a settlement with the IRS on behalf of, and binding upon, those Limited Owners having less than 1% interest in any Fund, unless a Limited Owner shall have notified the IRS and the Managing Owner that the Managing Owner shall not act on such Limited Owner’s behalf. The designation made by each Unitholder of a Fund in this Section 1.6(b) is hereby approved by each Unitholder of such Fund as an express condition to becoming a Unitholder. Each Unitholder agrees to take any further action as may be required by regulation or otherwise to effectuate such designation. Subject to Section 4.7, each Fund hereby indemnifies, to the full extent permitted by law, the Managing Owner from and against any damages or losses (including attorneys’ fees) arising out of or incurred in connection with any action taken or omitted to be taken by it in carrying out its responsibilities as Tax Matters Partner, provided such action taken or omitted to be taken does not constitute fraud, negligence or misconduct.

10

SECTION 1.7.General Liability of the Managing Owner.

(a) The Managing Owner shall be liable for the acts, omissions, obligations and expenses of each Fund, to the extent not paid out of the assets of each Fund, to the same extent the Managing Owner would be so liable as if each Fund were a partnership under the Delaware Revised Uniform Limited Partnership Act and the Managing Owner were a general partner of such partnership. The foregoing provision shall not, however, limit the ability of the Managing Owner to limit its liability by contract. The obligations of the Managing Owner under this Section 1.7 shall be evidenced by its ownership of the General Units which, solely for purposes of the Delaware Trust Statute, will be deemed to be a separate class of Units of each Fund. Without limiting or affecting the liability of the Managing Owner as set forth in this Section 1.7, notwithstanding anything in this Trust Agreement to the contrary, Persons having any claim against the Trust or any Fund by reason of the transactions contemplated by this Trust Agreement and any other agreement, instrument, obligation or other undertaking to which the Trust or any Fund is a party, shall look only to the appropriate Fund Trust Estate for payment or satisfaction thereof.

(b) Subject to Sections 8.1 and 8.3 hereof, no Unitholder, other than the Managing Owner, to the extent set forth above, shall have any personal liability for any liability or obligation of the Trust or any Fund.

SECTION 1.8.Legal Title. Legal title to all of the Trust Estate of each Fund shall be vested in the Trust as a separate legal entity;provided,however, that where applicable law in any jurisdiction requires any part of the Trust Estate to be vested otherwise, the Managing Owner may cause legal title to the Trust Estate or any portion thereof to be held by or in the name of the Managing Owner or any other Person (other than a Unitholder) as nominee.

SECTION 1.9.Series Trust. The Units of the Trust shall be divided into series, each a Fund, as provided in Section 3806(b)(2) of the Delaware Trust Statute. Accordingly, it is the intent of the parties hereto that Articles IV, V, VII, VIII, IX and X of this Trust Agreement shall apply also with respect to each such Fund as if each such Fund were a separate statutory trust under the Delaware Trust Statute, and each reference to the term “Trust” in such Articles shall be deemed to be a reference to each Fund separately to the extent necessary to give effect to the foregoing intent, as the context may require. The use of the terms “Trust”, “Fund” or “series” in this Trust Agreement shall in no event alter the intent of the parties hereto that the Trust receive the full benefit of the limitation on interseries liability as set forth in Section 3804 of the Delaware Trust Statute.

ARTICLE II

THE TRUSTEE

SECTION 2.1.Term; Resignation.

(a) Wilmington Trust Company has been appointed and hereby agrees to serve as the Trustee of the Trust. The Trust shall have only one Trustee unless otherwise determined by the Managing Owner. The Trustee shall serve until such time as the Managing Owner removes the Trustee or the Trustee resigns and a successor Trustee is appointed by the Managing Owner in accordance with the terms of Section 2.5 hereof.

11

(b) The Trustee may resign at any time upon the giving of at least sixty (60) days’ advance written notice to the Trust; provided, that such resignation shall not become effective unless and until a successor Trustee shall have been appointed by the Managing Owner in accordance with Section 2.5 hereof. If the Managing Owner does not act within such sixty (60) day period, the Trustee may apply, at the expense of the Trust, to the Court of Chancery of the State of Delaware for the appointment of a successor Trustee.

SECTION 2.2.Powers. The Trustee shall have only the rights, duties, obligations and liabilities specifically provided for herein and shall have no implied rights, duties, obligations and liabilities with respect to the business and affairs of the Trust or any Fund. The Trustee shall have the power and authority to execute and file certificates as required by the Delaware Trust Statute and to accept service of process on the Trust in the State of Delaware. The Trustee shall provide prompt notice to the Managing Owner of its performance of any of the foregoing. The Managing Owner shall reasonably keep the Trustee informed of any actions taken by the Managing Owner with respect to the Trust that would reasonably be expected to affect the rights, obligations or liabilities of the Trustee hereunder or under the Delaware Trust Statute.

SECTION 2.3.Compensation and Expenses of the Trustee. The Trustee shall be entitled to receive from the Managing Owner or an Affiliate of the Managing Owner (including the Trust) reasonable compensation for its services hereunder as set forth in a separate fee agreement and shall be entitled to be reimbursed by the Managing Owner or an Affiliate of the Managing Owner (including the Trust) for reasonable out-of-pocket expenses incurred by it in the performance of its duties hereunder, including without limitation, the reasonable compensation, out-of-pocket expenses and disbursements of counsel and such other agents as the Trustee may employ in connection with the exercise and performance of its rights and duties hereunder.

SECTION 2.4.Indemnification. The Trust (or if the Trust has insufficient assets, the Managing Owner) shall be liable for, and does hereby indemnify, protect, save and keep harmless the Trustee (in its capacity as Trustee and individually) and its successors, assigns, legal representatives, officers, directors, employees, agents and servants (the “Indemnified Parties”) from and against any and all liabilities, obligations, losses, damages, penalties, taxes (excluding any taxes payable by the Trustee on or measured by any compensation received by the Trustee for its services hereunder or any indemnity payments received by the Trustee pursuant to this Section 2.4), claims, actions, suits, costs, expenses or disbursements (including legal fees and expenses) of any kind and nature whatsoever (collectively, “Expenses”), which may be imposed on, incurred by or asserted against the Indemnified Parties in any way relating to or arising out of the formation, operation or termination of the Trust, the execution, delivery and performance of any other agreements to which the Trust is a party or the action or inaction of the Trustee hereunder or thereunder, except for Expenses resulting from the gross negligence or willful misconduct of the Indemnified Parties. The indemnities contained in this Section 2.4 shall survive the termination of the Trust Agreement or the removal or resignation of the Trustee.

12

SECTION 2.5.Successor Trustee. Upon the resignation or removal of the Trustee, the Managing Owner shall appoint a successor Trustee by delivering a written instrument to the outgoing Trustee. Any successor Trustee must satisfy the requirements of Section 3807 of the Delaware Trust Statute. Any resignation or removal of the Trustee and appointment of a successor Trustee shall not become effective until a written acceptance of appointment is delivered by the successor Trustee to the outgoing Trustee and the Managing Owner and any fees and expenses due to the outgoing Trustee are paid. Following compliance with the preceding sentence, the successor Trustee shall become fully vested with all of the rights, powers, duties and obligations of the outgoing Trustee under this Trust Agreement, with like effect as if originally named as Trustee, and the outgoing Trustee shall be discharged of its duties and obligations under this Trust Agreement.

SECTION 2.6.Liability of Trustee. Except as otherwise provided in this Article II, in accepting the trust created hereby, Wilmington Trust Company acts solely as Trustee hereunder and not in its individual capacity, and all Persons having any claim against Wilmington Trust Company by reason of the transactions contemplated by this Trust Agreement and any other agreement to which the Trust or any Fund is a party shall look only to the appropriate Fund Trust Estate for payment or satisfaction thereto;provided,however, that in no event is the foregoing intended to affect or limit the liability of the Managing Owner as set forth in Section 1.7 hereof. The Trustee shall not be liable or accountable hereunder to the Trust or to any other Person or under any other agreement to which the Trust or any Fund is a party, except for the Trustee’s own gross negligence or willful misconduct. In particular, but not by way of limitation:

(a) The Trustee shall have no liability or responsibility for the validity or sufficiency of this Trust Agreement or for the form, character, genuineness, sufficiency, value or validity of any Trust Estate;

(b) The Trustee shall not be liable for any actions taken or omitted to be taken by it in accordance with the instructions of the Managing Owner or the Liquidating Trustee;

(c) The Trustee shall not have any liability for the acts or omissions of the Managing Owner or its delegatees;

(d) The Trustee shall not be liable for its failure to supervise the performance of any obligations of the Managing Owner or its delegatees or any Participant or Commodity Broker;

(e) No provision of this Trust Agreement shall require the Trustee to act or expend or risk its own funds or otherwise incur any financial liability in the performance of any of its rights or powers hereunder if the Trustee shall have reasonable grounds for believing that such action, repayments of such funds or adequate indemnity against such risk or liability is not reasonably assured or provided to it;

13

(f) Under no circumstances shall the Trustee be liable for indebtedness evidenced by or other obligations of the Trust or any Fund arising under this Trust Agreement or any other agreements to which the Trust or any Fund is a party;

(g) The Trustee shall be under no obligation to exercise any of the rights or powers vested in it by this Trust Agreement, or to institute, conduct or defend any litigation under this Trust Agreement or any other agreements to which the Trust or any Fund is a party, at the request, order or direction of the Managing Owner or any Unitholders unless the Managing Owner or such Unitholders have offered to Wilmington Trust Company (in its capacity as Trustee and individually) security or indemnity satisfactory to it against the costs, expenses and liabilities that may be incurred by Wilmington Trust Company (including, without limitation, the reasonable fees and expenses of its counsel) therein or thereby;

(h) Notwithstanding anything contained herein to the contrary, the Trustee shall not be required to take any action in any jurisdiction other than in the State of Delaware if the taking of such action will (i) require the consent or approval or authorization or order of or the giving of notice to, or the registration with or taking of any action in respect of, any state or other governmental authority or agency of any jurisdiction other than the State of Delaware, (ii) result in any fee, tax or other governmental charge under the laws of any jurisdiction or any political subdivision thereof in existence as of the date hereof other than the State of Delaware becoming payable by the Trustee or (iii) subject the Trustee to personal jurisdiction, other than in the State of Delaware, for causes of action arising from personal acts unrelated to the consummation of the transactions by the Trustee, as the case may be, contemplated hereby; and

(i) To the extent that, at law or in equity, the Trustee has duties (including fiduciary duties) and liabilities relating thereto to the Trust, the Unitholders or to any other Person, the Trustee acting under this Trust Agreement shall not be liable to the Trust, the Unitholders or to any other Person for its good faith reliance on the provisions of this Trust Agreement. The provisions of this Trust Agreement, to the extent that they restrict the duties and liabilities of the Trustee otherwise existing at law or in equity are agreed by the parties hereto to replace such other duties and liabilities of the Trustee.

SECTION 2.7.Reliance; Advice of Counsel.

(a) In the absence of bad faith, the Trustee may conclusively rely upon certificates or opinions furnished to the Trustee and conforming to the requirements of this Trust Agreement in determining the truth of the statements and the correctness of the opinions contained therein, and shall incur no liability to anyone in acting on any signature, instrument, notice, resolutions, request, consent, order, certificate, report, opinion, bond or other document or paper believed by it to be genuine and believed by it to be signed by the proper party or parties and need not investigate any fact or matter pertaining to or in any such document;provided,however, that the Trustee shall have examined any certificates or opinions so as to reasonably determine compliance of the same with the requirements of this Trust Agreement. The Trustee may accept a certified copy of a resolution of the board of directors or other governing body of any corporate party as conclusive evidence that such resolution has been duly adopted by such body and that the same is in full force and effect. As to any fact or matter the method of the determination of which is not specifically prescribed herein, the Trustee may for all purposes

14

hereof rely on a certificate, signed by the president or any vice president or by the treasurer or other authorized officers of the relevant party, as to such fact or matter, and such certificate shall constitute full protection to the Trustee for any action taken or omitted to be taken by it in good faith in reliance thereon.

(b) In the exercise or administration of the Trust hereunder and in the performance of its duties and obligations under this Trust Agreement, the Trustee, at the expense of the Managing Owner or an Affiliate of the Managing Owner (including the Trust) (i) may act directly or through its agents, attorneys, custodians or nominees pursuant to agreements entered into with any of them, and the Trustee shall not be liable for the conduct or misconduct of such agents, attorneys, custodians or nominees if such agents, attorneys, custodians or nominees shall have been selected by the Trustee with reasonable care and (ii) may consult with counsel, accountants and other skilled professionals to be selected with reasonable care by it. The Trustee shall not be liable for anything done, suffered or omitted in good faith by it in accordance with the opinion or advice of any such counsel, accountant or other such Persons.

SECTION 2.8.Payments to the Trustee. Any amounts paid to the Trustee pursuant to this Article shall be deemed not to be a part of any Trust Estate immediately after such payment. Any amounts owing to the Trustee under this Trust Agreement shall constitute a claim against the applicable Trust Estate.

ARTICLE III

CAPITAL CONTRIBUTIONS; CREATIONS AND ISSUANCE OF CREATION BASKETS

SECTION 3.1.General.

(a) The Managing Owner shall have the power and authority, without Limited Owner approval, to issue Units in one or more series, or Funds, from time to time as it deems necessary or desirable. Each Fund shall be separate from all other Funds created as series of the Trust in respect of the assets and liabilities allocated to that Fund and shall represent a separate investment portfolio of the Trust. The Managing Owner shall have exclusive power without the requirement of Limited Owner approval to establish and designate such separate and distinct series, as set forth in Section 3.2, and to fix and determine the relative rights and preferences as between the Units of the Funds as to right of redemption, special and relative rights as to dividends and other distributions and on liquidation, conversion rights, and conditions under which the Funds shall have separate voting rights or no voting rights.

(b) The Managing Owner may, without Limited Owner approval, divide or subdivide Units of any Fund into two or more classes or sub-classes, Units of each such class or sub-class having such preferences and special or relative rights and privileges as the Managing Owner may determine as provided in Section 3.3. The fact that a Fund shall have been initially established and designated without any specific establishment or designation of classes or sub-classes, shall not limit the authority of the Managing Owner to divide a Fund and establish and designate separate classes or sub-classes thereof.

15

(c) The number of Fund Units authorized shall be unlimited, and the Units so authorized may be represented in part by fractional Units, calculated to four decimal places. From time to time, the Managing Owner may divide or combine the Units of any Fund or class thereof into a greater or lesser number without thereby changing the proportionate beneficial interests in the Fund or class thereof. The Managing Owner may issue Units of any Fund or class thereof for such consideration and on such terms as it may determine (or for no consideration if pursuant to a Unit dividend or split-up), all without action or approval of the Limited Owners thereof. All Units when so issued on the terms determined by the Managing Owner shall be fully paid and non-assessable. The Managing Owner may classify or reclassify any unissued Units or any Units previously issued and reacquired of any Fund or class thereof into one or more series or classes thereof that may be established and designated from time to time. The Managing Owner may hold as treasury Units, reissue for such consideration and on such terms as it may determine, or cancel, at its discretion from time to time, any Units of any Fund or class thereof reacquired by the Trust. Unless otherwise determined by the Managing Owner, treasury Units shall not be deemed cancelled. The Units of each Fund shall initially be divided into two classes: General Units and Limited Units.

(d) The Managing Owner and/or its Affiliates has made an investment of $1,000 in each Fund.

(e) Other than contemplated by Section 3.5, no certificates or other evidence of beneficial ownership of the Units will be issued.

(f) Every Unitholder, by virtue of having purchased or otherwise acquired a Unit, shall be deemed to have expressly consented and agreed to be bound by the terms of this Trust Agreement.

SECTION 3.2.Establishment of Series, or Funds, of the Trust.

(a) Without limiting the authority of the Managing Owner set forth in Section 3.2(b) to establish and designate any further series, the Managing Owner has heretofore established and designated seven initial series, or Funds, as follows:

PowerShares DB Energy Fund;

PowerShares DB Oil Fund;

PowerShares DB Precious Metals Fund;

PowerShares DB Gold Fund;

PowerShares DB Silver Fund;

PowerShares DB Base Metals Fund; and

PowerShares DB Agriculture Fund.

The provisions of this Article III shall be applicable to the above-designated Funds and any further Fund that may from time to time be established and designated by the Managing Owner as provided in Section 3.2(b);provided,however, that such provisions may be amended, varied or abrogated by the Managing Owner with respect to any Fund created after the initial formation of the Trust in the written instrument creating such Fund.

16

(b) The establishment and designation of any series, or Funds, other than those set forth above shall be effective upon the execution by the Managing Owner of an instrument setting forth such establishment and designation and the relative rights and preferences of such series, or Funds, or as otherwise provided in such instrument. At any time that there are no Units outstanding of any particular series previously established and designated, the Managing Owner may by an instrument executed by it abolish that series and the establishment and designation thereof. Each instrument referred to in this Section shall have the status of an amendment to this Trust Agreement.

SECTION 3.3.Establishment of Classes and Sub-Classes. The division of any series, or Funds, into two or more classes or sub-classes and the establishment and designation of such classes or sub-classes shall be effective upon the execution by the Managing Owner of an instrument setting forth such division, and the establishment, designation, and relative rights and preferences of such classes, or as otherwise provided in such instrument. The relative rights and preferences of the classes or sub-classes of any series may differ in such respects as the Managing Owner may determine to be appropriate, provided that such differences are set forth in the aforementioned instrument. At any time that there are no Units outstanding of any particular class or sub-class previously established and designated, the Managing Owner may by an instrument executed by it abolish that class or sub-class and the establishment and designation thereof. Each instrument referred to in this paragraph shall have the status of an amendment to this Trust Agreement.

SECTION 3.4.Offer of Limited Units, Procedures for Creation and Issuance of Creation Baskets.

(a)General. The following procedures, as supplemented by the more detailed procedures specified in the Exhibits, annexes, attachments and procedures, as applicable to the Participant Agreement for each Fund, which may be amended from time to time in accordance with the provisions of the Participant Agreement (and any such amendment will not constitute an amendment of this Trust Agreement), will govern the Trust with respect to the creation and issuance of Creation Baskets. Subject to the limitations upon and requirements for issuance of Creation Baskets stated herein and in such procedures, the number of Creation Baskets which may be issued by each Fund is unlimited.

(i) On any Business Day, each Participant may submit to the Managing Owner a purchase order and subscription agreement to subscribe for and agree to purchase one or more Creation Baskets for the applicable Fund (such request by a Participant, a “Purchase Order Subscription Agreement”) in the manner provided in the Participant Agreement. Purchase Order Subscription Agreements must be received by the Order Cut-Off Time on a Business Day (the “Purchase Order Subscription Date”). The Managing Owner will process Purchase Order Subscription Agreements only from Participants with respect to which a Participant Agreement for the Fund is in full force and effect. The Managing Owner will maintain and make available at the Trust’s principal offices during normal business hours a current list of the Participants for each Fund with respect to which a Participant Agreement is in full force and effect. The Managing Owner will deliver (or cause to be delivered) a copy of the Prospectus to each Fund Participant prior to its execution and delivery of the applicable Participant Agreement and prior to accepting any Purchase Order Subscription Agreement.

17

(ii) Any Purchase Order Subscription Agreement is subject to rejection by the Managing Owner pursuant to Section 3.4(c).

(iii) After accepting a Fund Participant’s Purchase Order Subscription Agreement, the Managing Owner will issue and deliver Creation Baskets to fill such Fund Participant’s Purchase Order Subscription Agreement as of noon New York time on the Business Day immediately following the Purchase Order Subscription Date, but only if by such time the Managing Owner has received (A) for its own account, the Transaction Fee, and (B) for the account of the applicable Fund the Creation Basket Capital Contribution due from the Fund Participant submitting the Purchase Order Subscription Agreement for the Fund.

(b)Deposit with the Depository. Upon issuing a Creation Basket for any Fund pursuant to a Purchase Order Subscription Agreement, the Managing Owner will cause the Trust to deposit the Creation Basket with the Depository in accordance with the Depository’s customary procedures, for credit to the account of the Fund Participant that submitted the Purchase Order Subscription Agreement.

(c)Rejection. For each Fund, the Managing Owner shall have the absolute right, but shall have no obligation, to reject any Purchase Order Subscription Agreement or Creation Basket Capital Contribution: (i) determined by the Managing Owner not to be in proper form; (ii) that the Managing Owner has determined would have adverse tax consequences to the Trust, any Fund or to any Limited Owners; (iii) the acceptance or receipt of which would, in the opinion of counsel to the Managing Owner, be unlawful; or (iv) if circumstances outside the control of the Managing Owner make it for all practical purposes not feasible to process creations of Creation Baskets. The Managing Owner shall not be liable to any person by reason of the rejection of any Purchase Order Subscription Agreement or Creation Basket Capital Contribution.

(d)Transaction Fee. For each Fund, a non-refundable transaction fee will be payable by a Fund Participant to the Managing Owner for its own account in connection with each Purchase Order Subscription Agreement pursuant to this Section and in connection with each Redemption Order of such Participant pursuant to Section 7.1 (each a “Transaction Fee”). The Transaction Fee charged in connection with each such creation and redemption shall be initially $500, but may be changed as provided below. Even though a single Purchase Order Subscription Agreement or Redemption Order may relate to multiple Creation Baskets, only a single Transaction Fee will be due for each Purchase Order or Redemption Order for a Fund. The Transaction Fee may subsequently be waived, modified, reduced, increased or otherwise changed by the Managing Owner, but will not in any event exceed 0.10 % of the Net Asset Value Per Basket of a Fund at the time of creation of a Creation Basket or redemption of a Redemption Basket, as the case may be. The Managing Owner shall notify the Depository of any agreement to change the Transaction Fee and shall not implement any increase for redemptions of outstanding Units until 30 days after the date of that notice. The amount of the Transaction Fee in effect at any given time shall be made available by the Trustee upon request.

18

(e)Global Certificate Only. Certificates for Creation Baskets will not be issued, other than the applicable Global Security issued to the Depository. So long as the Depository Agreement is in effect, Creation Baskets will be issued and redeemed and Limited Units will be transferable solely through the book-entry systems of the Depository and the DTC Participants and their Indirect Participants as more fully described in Section 3.5. The Depository may determine to discontinue providing its service with respect to Creation Baskets and Limited Units by giving notice to the Managing Owner pursuant to and in conformity with the provisions of the Depository Agreement and discharging its responsibilities with respect thereto under applicable law. Under such circumstances, the Managing Owner shall take action either to find a replacement for the Depository to perform its functions at a comparable cost and on terms acceptable to the Managing Owner or, if such a replacement is unavailable, to terminate the Trust or the Funds, as applicable.

SECTION 3.5.Book-Entry-Only System, Fund Global Securities.

(a)Global Security. The Trust and the Managing Owner will enter into the Depository Agreement pursuant to which the Depository will act as securities depository for Limited Units of each Fund. Limited Units of each Fund will be represented by a Global Security (which may consist of one or more certificates as required by the Depository), which will be registered, as the Depository shall direct, in the name of Cede & Co., as nominee for the Depository and deposited with, or on behalf of, the Depository. No other certificates evidencing Limited Units will be issued. The Global Security for each Fund shall be in the form attached hereto as Exhibit C or described therein and shall represent such Limited Units as shall be specified therein, and may provide that it shall represent the aggregate amount of outstanding Limited Units of a Fund from time to time endorsed thereon and that the aggregate amount of outstanding Limited Units represented thereby may from time to time be increased or decreased to reflect creations or redemptions of Baskets. Any endorsement of a Global Security to reflect the amount, or any increase or decrease in the amount, of outstanding Limited Units represented thereby shall be made in such manner and upon instructions given by the Managing Owner on behalf of the Trust as specified in the Depository Agreement.

(b)Legend. Any Global Security issued to The Depository Trust Company or its nominee shall bear a legend substantially to the following effect: “Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (“DTC”), to the Trust or its agent for registration of transfer, exchange, or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as is requested by an authorized representative of DTC (and any payment is made to Cede & Co. or to such other entity as is required by an authorized representative of DTC), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.”

(c)The Depository. The Depository has advised the Trust and the Managing Owner as follows: The Depository is a limited-purpose trust company organized under New York Banking Law, a “banking organization” within the meaning of the New York Banking Law, a member of the U.S. Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing agency” registered pursuant to the

19

provisions of Section 17A of the Securities Exchange Act of 1934, as amended. DTC holds and provides asset servicing for DTC’s participants (the “DTC Participants”). DTC also facilitates the post-trade settlement among DTC Participants of sales and other securities transactions among the DTC Participants in deposited securities, through electronic computerized book-entry transfers and pledges between DTC Participants’ accounts. This eliminates the need for physical movement of securities certificates. DTC Participants include both U.S. and non-U.S. securities brokers and dealers, banks, trust companies, clearing corporations, and certain other organizations. DTC is a wholly-owned subsidiary of The Depository Trust & Clearing Corporation (“DTCC”). DTCC is the holding company for DTC, National Securities Clearing Corporation and Fixed Income Clearing Corporation, all of which are registered clearing agencies. DTCC is owned by the users of its regulated subsidiaries. Access to the DTC system is also available to others such as both U.S. and non-U.S. securities, brokers and dealers, banks, trust companies, and clearing corporations that clear through or maintain a custodial relationship with a DTC Participant, either directly or indirectly (“Indirect Participants”).

(d)Beneficial Owners. As provided in the Depository Agreement, upon the settlement date of any creation, transfer or redemption of Limited Units of a Fund, the Depository will credit or debit, on its book-entry registration and transfer system, the number of Limited Units so created, transferred or redeemed to the accounts of the appropriate DTC Participants. The accounts to be credited and charged shall be designated by the Managing Owner on behalf of each Fund and each Participant, in the case of a creation or redemption of Baskets. Ownership of beneficial interest in Limited Units will be limited to DTC Participants, Indirect Participants and persons holding interests through DTC Participants and Indirect Participants. Owners of beneficial interests in Limited Units (“Beneficial Owners”) will be shown on, and the transfer of beneficial ownership by Beneficial Owners will be effected only through, in the case of DTC Participants, records maintained by the Depository and, in the case of Indirect Participants and Beneficial Owners holding through a DTC Participant or an Indirect Participant, through those records or the records of the relevant DTC Participants. Beneficial Owners are expected to receive from or through the broker or bank that maintains the account through which the Beneficial Owner has purchased or sold Limited Units a written confirmation relating to their purchase or sale of Limited Units.

(e)Reliance on Procedures. So long as Cede & Co., as nominee of the Depository, is the registered owner of Limited Units, references herein to the registered or record owners of Limited Units shall mean Cede & Co. and shall not mean the Beneficial Owners of Limited Units. Beneficial Owners of Limited Units will not be entitled to have Limited Units registered in their names, will not receive or be entitled to receive physical delivery of certificates in definitive form and will not be considered the record or registered holder of Limited Units under this Trust Agreement. Accordingly, to exercise any rights of a holder of Limited Units under this Trust Agreement, a Beneficial Owner must rely on the procedures of the Depository and, if such Beneficial Owner is not a DTC Participant, on the procedures of each DTC Participant or Indirect Participant through which such Beneficial Owner holds its interests. The Trust and the Managing Owner understand that under existing industry practice, if the Trust or any Fund requests any action of a Beneficial Owner, or a Beneficial Owner desires to take any action that the Depository, as the record owner of all outstanding Limited Units of such Fund, is entitled to take, in the case of a Trustee request, the Depository will notify the DTC Participants regarding such request, such DTC Participants will in turn notify each Indirect Participant

20

holding Limited Units through it, with each successive Indirect Participant continuing to notify each person holding Limited Units through it until the request has reached the Beneficial Owner, and in the case of a request or authorization to act being sought or given by a Beneficial Owner, such request or authorization is given by the Beneficial Owner and relayed back to the Trust or such Fund through each Indirect Participant and DTC Participant through which the Beneficial Owner’s interest in the Limited Units is held.

(f)Communication between the Trust and the Beneficial Owners. As described above, the Trust and the Funds will recognize the Depository or its nominee as the owner of all Limited Units for all purposes except as expressly set forth in this Trust Agreement. Conveyance of all notices, statements and other communications to Beneficial Owners will be effected as follows. Pursuant to the Depository Agreement, the Depository is required to make available to the Funds upon request and for a fee to be charged to the Funds a listing of the Limited Unit holdings of each DTC Participant. The Trust or the Funds shall inquire of each such DTC Participant as to the number of Beneficial Owners holding Limited Units, directly or indirectly, through such DTC Participant. The Trust or the Funds shall provide each such DTC Participant with sufficient copies of such notice, statement or other communication, in such form, number and at such place as such DTC Participant may reasonably request, in order that such notice, statement or communication may be transmitted by such DTC Participant, directly or indirectly, to such Beneficial Owners. In addition, the Funds shall pay to each such DTC Participant an amount as reimbursement for the expenses attendant to such transmittal, all subject to applicable statutory and regulatory requirements.

(g)Distributions. Distributions on Limited Units pursuant to Section 3.8 shall be made to the Depository or its nominee, Cede & Co., as the registered owner of all Limited Units. The Trust and the Managing Owner expect that the Depository or its nominee, upon receipt of any payment of distributions in respect of Limited Units, shall credit immediately DTC Participants’ accounts with payments in amounts proportionate to their respective beneficial interests in Limited Units as shown on the records of the Depository or its nominee. The Trust and the Managing Owner also expect that payments by DTC Participants to Indirect Participants and Beneficial Owners held through such DTC Participants and Indirect Participants will be governed by standing instructions and customary practices, as is now the case with securities held for the accounts of customers in bearer form or registered in a “street name,” and will be the responsibility of such DTC Participants and Indirect Participants. None of the Trust, the Funds, the Trustee or the Managing Owner will have any responsibility or liability for any aspects of the records relating to or notices to Beneficial Owners, or payments made on account of beneficial ownership interests in Limited Units, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests or for any other aspect of the relationship between the Depository and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants or Indirect Participants or between or among the Depository, any Beneficial Owner and any person by or through which such Beneficial Owner is considered to own Limited Units.

(h)Limitation of Liability. Each Global Security to be issued hereunder is executed and delivered solely on behalf of the applicable Fund by the Managing Owner, as Managing Owner, in the exercise of the powers and authority conferred and vested in it by this Trust Agreement. The representations, undertakings and agreements made on the part of the

21

Fund in each Global Security are made and intended not as personal representations, undertakings and agreements by the Managing Owner or the Trustee, but are made and intended for the purpose of binding only the Fund. Nothing in the Global Security shall be construed as creating any liability on the Managing Owner or the Trustee, individually or personally, to fulfill any representation, undertaking or agreement other than as provided in this Trust Agreement.

(i)Successor Depository. If a successor to The Depository Trust Company shall be employed as Depository hereunder, the Trust and the Managing Owner shall establish procedures acceptable to such successor with respect to the matters addressed in this Section 3.5.

SECTION 3.6.Assets. All consideration received by a Fund for the issue or sale of Units together with all of the applicable Trust Estate in which such consideration is invested or reinvested, all income, earnings, profits, and proceeds thereof, including any proceeds derived from the sale, exchange or liquidation of such assets and any funds or payments derived from any reinvestment of such proceeds in whatever form the same may be, shall irrevocably belong to that Fund for all purposes, subject only to the rights of creditors of such Fund and except as may otherwise be required by applicable tax laws, and shall be so recorded upon the books of account of the Trust. Separate and distinct records shall be maintained for each Fund and the assets associated with a Fund shall be held and accounted for in such separate and distinct records (directly or indirectly, including through a nominee or otherwise) separately from the other assets of the Trust, or any other Fund. In the event that there is any Trust Estate, or any income, earnings, profits, and proceeds thereof, funds, or payments which are not readily identifiable as belonging to any particular Fund, the Managing Owner shall allocate them among any one or more of the Funds established and designated from time to time in such manner and on such basis as the Managing Owner, in its sole discretion, deems fair and equitable. Each such allocation by the Managing Owner shall be conclusive and binding upon all Unitholders for all purposes.

SECTION 3.7.Liabilities of Funds.

(a) The Trust Estate belonging to each particular Fund shall be charged with the liabilities of the Trust in respect of that series and only that series; and all expenses, costs, charges, indemnities and reserves attributable to that Fund, and any general liabilities, expenses, costs, charges, indemnities or reserves of the Trust which are not readily identifiable as belonging to any particular Fund, shall be allocated and charged by the Managing Owner to and among any one or more of the series established and designated from time to time in such manner and on such basis as the Managing Owner in its sole discretion deems fair and equitable. Each allocation of liabilities, expenses, costs, charges and reserves by the Managing Owner shall be conclusive and binding upon all Unitholders for all purposes. The Managing Owner shall have full discretion, to the extent not inconsistent with applicable law, to determine which items shall be treated as income and which items as capital, and each such determination and allocation shall be conclusive and binding upon the Unitholders. Every written agreement, instrument or other undertaking made or issued by or on behalf of a particular series shall include a recitation limiting the obligation or claim represented thereby to that series and its assets.

22

(b) Without limitation of the foregoing provisions of this Section, but subject to the right of the Managing Owner in its discretion to allocate general liabilities, expenses, costs, charges or reserves as herein provided, the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to a particular series shall be enforceable against the assets of such series only and against the Managing Owner, and not against the assets of the Trust generally or of any other series. Notice of this limitation on interseries liabilities shall be set forth in the Certificate of Trust of the Trust (whether originally or by amendment) as filed or to be filed in the Office of the Secretary of State of the State of Delaware pursuant to the Delaware Trust Statute, and upon the giving of such notice in the Certificate of Trust, the statutory provisions of Section 3804 of the Delaware Trust Statute relating to limitations on interseries liabilities (and the statutory effect under Section 3804 of setting forth such notice in the Certificate of Trust) shall become applicable to the Trust and each Fund. Every Unit, note, bond, contract, instrument, certificate or other undertaking made or issued by or on behalf of a particular series shall include a recitation limiting the obligation on Units represented thereby to that series and its assets.