Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-228404

333-228404-01

333-228404-02

333-228404-03

333-228404-04

333-228404-05

INVESCO DB MULTI-SECTOR COMMODITY TRUST

| | | | | | |

Invesco DB Energy Fund | | 21,400,000 | | | Common Units of Beneficial Interest | |

Invesco DB Oil Fund | | 79,000,000 | | | Common Units of Beneficial Interest | |

Invesco DB Precious Metals Fund | | 21,600,000 | | | Common Units of Beneficial Interest | |

Invesco DB Gold Fund | | 14,200,000 | | | Common Units of Beneficial Interest | |

Invesco DB Base Metals Fund | | 24,600,000 | | | Common Units of Beneficial Interest | |

Invesco DB Multi-Sector Commodity Trust (the “Trust”) is organized in seven separate series as a Delaware statutory trust. Each series of the Trust (each a “Fund”) issues common units of beneficial interest (“Shares”), which represent units of fractional undivided beneficial interest in and ownership of such series only. Unless the context otherwise requires, references in this Prospectus to a “Fund” or the “Funds” are to the series of the Trust that is or are being offered pursuant to this Prospectus. Shares in each Fund are being separately offered. Shares may be purchased from each Fund only by certain eligible financial institutions, called Authorized Participants, and only in one or more blocks of 200,000 Shares (“Baskets”). Baskets are issued on the creation order settlement date as of 2:45 p.m., Eastern time, on the business day immediately following the creation order date at the applicable net asset value (“NAV”) per Share as of the closing time if the NYSE Arca, Inc. (“NYSE Arca”) or the last to close of the exchanges on which a Fund’s futures contracts are traded, whichever is later, on the creation order date. Upon submission of a creation order, the Authorized Participant may request the Managing Owner to agree to a creation order settlement date up to two business days after the creation order date.

The Shares of each Fund trade on the NYSE Arca under the following symbols: Invesco DB Energy Fund – DBE; Invesco DB Oil Fund – DBO; Invesco DB Precious Metals Fund – DBP; Invesco DB Gold Fund – DGL and Invesco DB Base Metals Fund – DBB.

Invesco Capital Management LLC serves as each Fund’s managing owner (the “Managing Owner”), commodity pool operator and commodity trading advisor.

Each Fund trades exchange-traded futures contracts on the commodities comprising a particular commodities index, with a view to tracking the index over time. Each Fund also earns interest income (“Treasury Income”) from United States Treasury securities (“Treasury Securities”) and dividends from its holdings in money

market mutual funds (affiliated or otherwise) (“Money Market Income”). Each Fund also gains an exposure to Treasury Securities through an investment in exchange-traded funds (affiliated or otherwise) (“ETFs”) that track indexes that measure the performance of U.S. Treasury Obligations with a maximum remaining maturity of up to twelve months(“T-Bill ETFs”), and each Fund may receive dividends or distributions of capital gains from those investments(“T-Bill ETF Income”). Additionally, each Fund’s performance reflects the appreciation or depreciation of its investments in Treasury Securities, money market mutual funds andT-Bill ETFs.

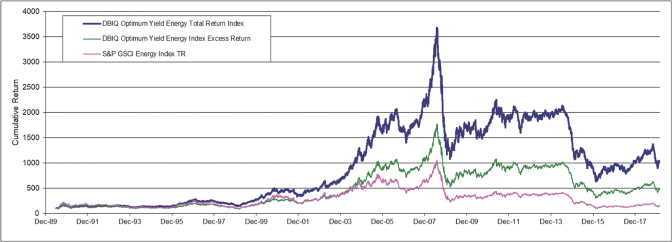

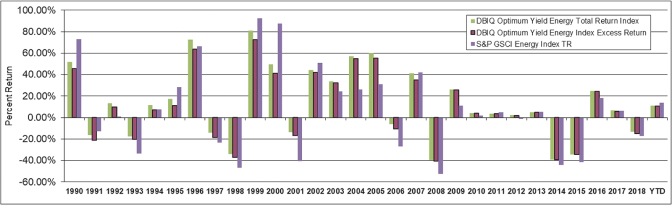

| | • | | Invesco DB Energy Fund is designed to track the DBIQ Optimum Yield Energy Index Excess Return™(“DBIQ-OY Energy ER™”), which is intended to reflect the changes in market value of the energy sector. |

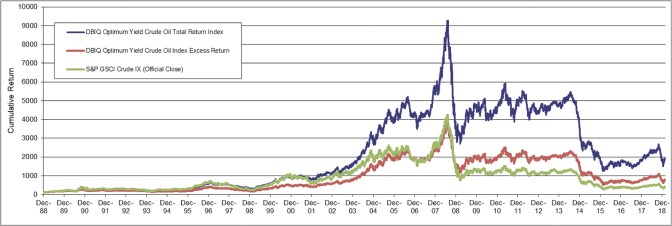

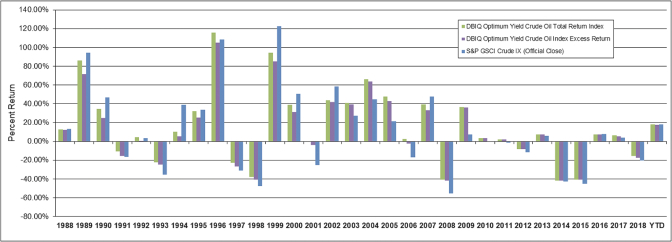

| | • | | Invesco DB Oil Fund is designed to track the DBIQ Optimum Yield Crude Oil Index Excess Return™(“DBIQ-OY CL ER™”), which is intended to reflect the changes in market value of crude oil. |

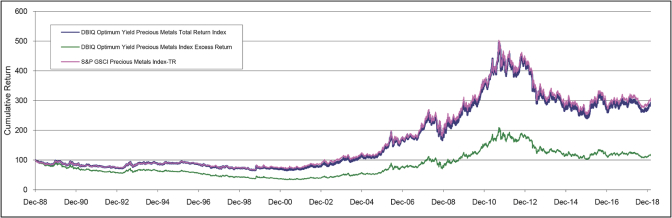

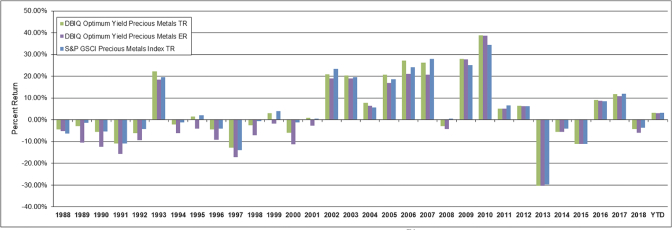

| | • | | Invesco DB Precious Metals Fund is designed to track the DBIQ Optimum Yield Precious Metals Index Excess Return™(“DBIQ-OY Precious Metals ER™”), which is intended to reflect the changes in market value of the precious metals sector. |

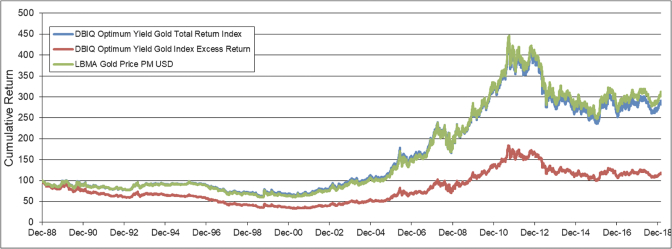

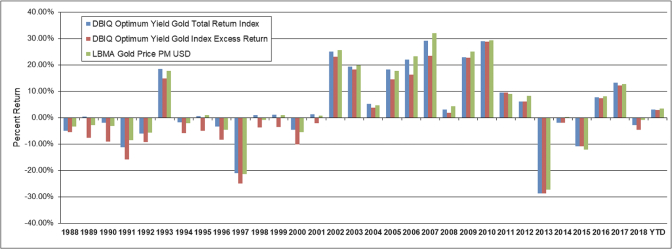

| | • | | Invesco DB Gold Fund is designed to track the DBIQ Optimum Yield Gold Index Excess Return™(“DBIQ-OY GC ER™”), which is intended to reflect the changes in market value of gold. |

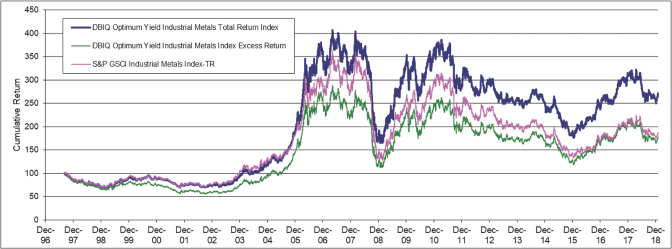

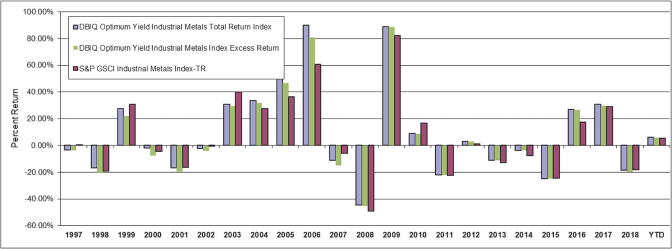

| | • | | Invesco DB Base Metals Fund is designed to track the DBIQ Optimum Yield Industrial Metals Index Excess Return™(“DBIQ-OY Industrial Metals ER™”), which is intended to reflect the changes in market value of the base metals sector. |

We refer to each of the indexes as an “Index” and we refer to them collectively as the “Indexes”.

INVESTING IN THE SHARES INVOLVES SIGNIFICANT RISKS.

PLEASE REFER TO “RISK FACTORS” BEGINNING ON PAGE 15.

| | • | | Futures trading is volatile and even a small movement in market prices could cause large losses. |

| | • | | The success of each Fund’s trading program depends upon the skill of the Managing Owner and its trading principals. |

| | • | | You could lose all or substantially all of your investment. |

| | • | | Each of the Indexes is concentrated in a small number of commodities and some are highly concentrated in a single commodity. Concentration may result in greater volatility. |

| | • | | Investors in each Fund pay fees in connection with their investment in the Shares, including asset-based fees of 0.75% per annum. Additional charges include brokerage fees of approximately 0.03% with respect to Invesco DB Energy Fund, Invesco DB Oil Fund, Invesco DB Precious Metals Fund and Invesco DB Gold Fund and 0.05% with respect to Invesco DB Base Metals Fund per annum in the aggregate. |

Authorized Participants may offer to the public, from time to time, Shares from any Baskets they create. Shares offered to the public by Authorized Participants will be offered at aper-Share offering price that will vary depending on, among other factors, the trading price of the Shares of each Fund on the NYSE Arca, the NAV per Share and the supply of and demand for the Shares at the time of sale. Because the Shares will trade at market prices, rather than the NAV of each Fund, Shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount). Authorized Participants will not receive from any Fund, the Managing Owner or any of their affiliates, any fee or other compensation in connection with their sale of Shares to the public.

An Authorized Participant may receive commissions or fees from investors who purchase Shares through their commission orfee-based brokerage accounts. In addition, the Managing Owner pays a distribution services fee to Invesco Distributors, Inc. and pays a marketing services fee to Deutsche Investment Management Americas Inc. (“DIMA”) without reimbursement from the Trust or any Fund. For more information regarding items of compensation paid to Financial Industry Regulatory Authority, Inc. (“FINRA”) members, please see the “Plan of Distribution” section on page 127.

These securities have not been approved or disapproved by the U.S. Securities and Exchange Commission (“SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense. None of the Funds is a mutual fund or any other type of investment company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THESE POOLS NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

April 25, 2019