As filed with the Securities and Exchange Commission on July 24, 2007

Registration No. 333-139312

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

PRE-EFFECTIVE AMENDMENT NO. 2

TO

FORM SB-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________

ROCK CITY ENERGY CORP.

(formerly Vallenar Holdings, Inc.)

(Name of Small Business Issuer in Its Charter)

Nevada (State or Other Jurisdiction of Incorporation or Organization) | 1311 (Primary Standard Industrial Classification Code Number) | 20-5503984 (I.R.S. Employer Identification No.) |

3388 Via Lido, Fourth Floor

Newport Beach, California 92663

Telephone: (866) 472-7987

(Address and telephone number

of principal executive offices)

Richard N. Jeffs

President

3388 Via Lido, Fourth Floor

Newport Beach, California 92663

Telephone: (866) 472-7987

(Name, address and telephone number of agent for service)

Copies of communications to:

Mary Ann Sapone, Esq. Richardson & Patel LLP 10900 Wilshire Boulevard, Suite 500 Los Angeles, California 90024 Telephone: (310) 208-1182 Facsimile (310) 208-1154 |

_________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | | Amount to be Registered | | Proposed maximum offering price per unit | | Proposed maximum aggregate offering price | | Amount of registration fee(1) | |

| Common stock, $0.001 par value(2) | | | 4,000,000 | | $ | 0.0103575 | | $ | 41,430 | | $ | 1.27(3 | ) |

| Common stock, $0.001 par value(2) | | | 4,000,000 | | $ | 0.15 | | $ | 600,000 | | $ | 184.50 | |

| TOTAL | | | 8,000,000 | | $ | 0.080178(4 | ) | $ | 641,430 | | $ | 185.77 | |

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended, based on the book value of the shares.

(2) The shares being registered are owned by Brek Energy Corporation and are being registered for a spin-off distribution to the Brek Energy Corporation shareholders.

(3) A fee of $80.84 was paid on December 13, 2006.

(4) Based on the average book value of the shares issued.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Dated July 24, 2007

PRELIMINARY PROSPECTUS

ROCK CITY ENERGY CORP.

(formerly Vallenar Holdings, Inc.)

8,000,000 Shares of Common Stock

This prospectus covers 8,000,000 shares of our common stock which are owned by our parent corporation, Brek Energy Corporation (“Brek”). These shares will be distributed to the shareholders of Brek in a spin-off. Shareholders of Brek on the record date will receive approximately one share of our common stock in exchange for approximately ten shares of Brek common stock that they hold as of the record date for the distribution. No fractional shares will be issued and no shares will be issued to holders of fewer than 1,000 shares of Brek common stock. Instead, any holder of Brek common stock who would receive a fractional share due to the spin-off will have the fractional share rounded up to the next whole share, and any holder of Brek common stock who holds fewer than 1,000 shares will receive cash in lieu of these securities. The cash payment will be equal to the product of the number of shares of Rock City’s common stock to which the shareholder would be entitled but for the 1,000 share limit times the average of the high and low trading prices for Brek’s common stock over the five trading days immediately prior to the effective date of the spin-off. Distribution of our common stock to Brek’s shareholders will be made within 30 days of the date of this prospectus.

We are distributing our common stock to the shareholders of Brek at our book value of $0.08 per share. Brek shareholders will not be required to pay for the shares of our common stock that they receive in the spin-off, nor will they be required to surrender or exchange their shares of Brek common stock.

Brek is an “underwriter” within the meaning of the Securities Act of 1933 in connection with the distribution of these shares to its shareholders.

There is currently no public market for our common stock and it is possible that no trading market will begin for a substantial period of time after we close this offering. Our common stock is not quoted on any national exchange or on the Nasdaq Stock Market. When trading begins we believe that our common stock will be traded on the OTC Bulletin Board however, there is no assurance that this will occur.

An investment in our securities involves a high degree of risk. You should purchase our securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning at page 3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________, 2007.

Inside Front Cover

We have not authorized anyone to provide you with information different from that contained in this prospectus. These securities may be sold only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the effective date of this offering, regardless of the time of delivery of this prospectus or of any sale of the securities. You must not consider that the delivery of this prospectus or any sale of the securities covered by this prospectus implies that there has been no change in our affairs since the effective date of this offering or that the information contained in this prospectus is current or complete as of any time after the effective date of this offering.

We are not making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. No action is being taken in any jurisdiction outside of the United States to permit a public offering of our securities or the possession or distribution of this prospectus in any such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside of the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable in that jurisdiction.

TABLE OF CONTENTS

| Prospectus Summary | 1 |

| | |

| Risk Factors | 3 |

| | |

| Cautionary Statement Regarding Forward-Looking Statements | 8 |

| | |

| Use of Proceeds | 9 |

| | |

| Determination of Offering Price | 9 |

| | |

| Market for Common Equity | 9 |

| | |

| Management’s Discussion and Analysis or Plan of Operation | 10 |

| | |

| Business | 19 |

| | |

| Management | 23 |

| | |

| Certain Relationships and Related Party Transactions | 26 |

| | |

| Security Ownership of Certain Beneficial Owners and Management | 27 |

| | |

| Description of Our Securities | 27 |

| | |

| Plan of Distribution | 28 |

| | |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 28 |

| | |

| Where You Can Find Further Information About Us | 31 |

| | |

| Experts | 31 |

| | |

| Legal Matters | 31 |

| | |

| Index to Financial Statements (Vallenar Energy Corp.) | F-1 |

| | |

| Index to Financial Statements (Rock Citiy Energy Corp.) | F-19 |

PROSPECTUS SUMMARY

This summary highlights information from this prospectus. However, for a more complete understanding of this offering, we encourage you to read this entire prospectus, including our consolidated financial statements and the notes to those statements. All references in this prospectus to “Rock City”, “we”, “us” or “our” refer to Rock City Energy Corp. and its subsidiary, Vallenar Energy Corp., unless the context otherwise indicates.

Information Related to the Spin-off

On September 20, 2006, Brek Energy Corporation (“Brek”) disclosed that it entered into an Agreement and Plan of Merger with Gasco Energy, Inc. and Gasco Acquisition, Inc. We are a wholly owned subsidiary of Brek. As a condition to the consummation of the merger, Brek must spin off all of the shares of our common stock that it owns to its shareholders. Brek expects the merger to be consummated by December 31, 2007. Once the merger is consummated, Brek will be a wholly owned subsidiary of Gasco Energy, Inc.

Each holder of Brek common stock will receive approximately one share of our common stock in exchange for every approximately ten shares of Brek common stock that they hold as of the record date for the distribution. No fractional shares will be issued and no shares will be issued to holders of fewer than 1,000 shares of Brek common stock. Instead, any holder of Brek common stock who would receive a fractional share due to the spin-off will have the fractional share rounded up to the next whole share, and any holder of Brek common stock who holds fewer than 1,000 shares of Brek common stock will receive cash in lieu of Rock City securities. The cash payment will be equal to the product of the number of Rock City shares to which the Brek shareholder would be entitled but for the 1,000-share limit, times the average of the high and low trading prices for Brek’s common stock over the five trading days immediately prior to the effective date of the spin-off.

The exact number of shares to be issued will be computed by dividing the number of shares of Brek common stock outstanding on the record date, deducting all the shares held by those with fewer than 1,000 shares, and dividing the difference by 8,000,000. The record date for the distribution will be set after the registration statement of which this prospectus is a part is declared effective by the Securities and Exchange Commission. Brek plans to distribute our common stock to its shareholders within 30 days of the date of this prospectus. Brek shareholders will not be required to pay for the shares of our common stock that they receive in the spin-off, nor will they be required to surrender or exchange their shares of Brek common stock.

As a result of the spin-off, our common stock may be publicly traded however, we can offer no assurance that an active trading market for our securities will develop.

Nevada Agency & Trust Company, Brek’s stock transfer agent, located in Reno, Nevada, will act as our distribution agent for the spin-off. Brek will pay all costs associated with the distribution of the shares of our common stock.

Rock City Energy Corp.

We were incorporated on August 10, 2006 in the state of Nevada. We are a newly-formed exploration stage company. We were formed to acquire all of Brek’s shares in Vallenar Energy Corp., an oil and gas company. As a condition to the consummation of the merger with Gasco Acquisition Inc., Brek is required to dispose of all of the outstanding capital stock of Rock City. On August 24, 2006 we issued 4,000,000 shares of common stock to Brek in exchange for 5,312,500 shares of Vallenar Energy Corp. common stock and 733,333 shares of Vallenar Energy Corp. preferred stock. On March 7, 2007, we issued an additional 4,000,000 shares of common stock at $0.15 per share to Brek in exchange for $600,000. Other than our interest in Vallenar Energy Corp., we have no operations.

Vallenar Energy Corp. was incorporated on January 27, 1999 in the state of Nevada and does business through its subsidiary, Nathan Oil Partners LP. Through Vallenar Energy Corp., we hold interests in leases covering approximately 9,191 gross and approximately 8,618 net acres in the Rocksprings Prospect in the Val Verde Basin of Edwards County, Texas. Aside from the leases, which are being developed by an unrelated third party, Vallenar Energy Corp. has no operations.

Corporate Information

We maintain our principal offices at 3388 Via Lido, Fourth Floor, Newport Beach, California 92663. Our telephone number is (866) 472-7987.

Exploration Stage Company and Going Concern

We are an exploration stage company. Our consolidated financial statements have been prepared on a going concern basis which contemplates the realization of assets and the liquidation of liabilities in the ordinary course of business. At March 31, 2007 we had an accumulated deficit of $7,518. Additional financing will be required to support development of our oil and gas properties until we achieve positive cash flow from operations. These factors raise doubt about our ability to continue as a going concern. Our ability to emerge from the exploration stage with respect to our principal business activity is dependent upon the continued financial support of our shareholders, our ability to obtain necessary equity financing to continue our operations and the attainment of profitable operations.

RISK FACTORS

This offering involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus, including our consolidated financial statements and the notes to those statements, before you purchase our common stock. The risks and uncertainties described below are those that we currently believe may materially adversely affect our company. Additional risks and uncertainties may also impair our business operations. If the following risks actually occur, our business, financial condition and results of operations could be seriously harmed, the trading price of our common stock could decline and you could lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS OPERATIONS

Vallenar Energy Corp., through its subsidiary, Nathan Oil Partners LP, holds interests in oil and gas leases but these leases may never be successfully developed. Therefore, the common stock you receive in the spin-off may never have any value.

Nathan Oil Partners LP, Vallenar Energy Corp.’s subsidiary, holds interests in oil and gas leases however it does not have the funds to develop these leases. It has entered into an agreement with an operator for drilling, completing, equipping and operating wells on its properties, but there is no guarantee that these activities will be successful. If these activities are unsuccessful, we will have no operations and earn no revenues and the common stock you receive in the spin-off will never have any value.

Our auditor has expressed doubt about our ability to continue as a going concern. If we are unable to continue our business due to a lack of money, the common stock you receive in the spin-off may never have any value.

Our consolidated financial statements have been prepared on a going concern basis which contemplates the realization of assets and the liquidation of liabilities in the ordinary course of business. At March 31, 2007 we had an accumulated deficit of $7,518. Additional financing will be required to locate and purchase the rights to profitable oil and gas properties and to support the development of those properties until we achieve positive cash flow from operations. These factors raise doubt about our ability to continue as a going concern. Our ability to emerge from the exploration stage with respect to our principal business activity is dependent upon the continued financial support of our shareholders, our ability to obtain necessary debt or equity financing to continue our operations, and the attainment of profitable operations. If we are unable to accomplish these objectives, the common stock that you receive in the spin-off may never have any value.

In order to extend the terms of our leases beyond the primary term, we need to conduct operations on the properties. We lost a portion of the acreage covered by one of our leases. We could suffer such losses again in the future. A loss of acreage could have a material adverse affect on our business and results of operations.

While our leases had varying terms, all of the primary terms were due to expire between January 31, 2007 and February 8, 2007. In order to extend the primary term of each lease, we were required to conduct operations on the properties covered by the leases. We assigned all of our leases to Chesapeake Exploration Limited Partnership in exchange for Chesapeake’s agreement to initiate drilling operations on the land covered by the leases before the end of the primary term. Chesapeake initiated the drilling of two wells during January and February 2007 in order to extend the terms of eight of the leases. Chesapeake did not initiate drilling on the ninth lease covering approximately 790 acres. Instead, Chesapeake, through a partner, top-leased the acreage covered by the ninth lease to February 2010 but obtained only an undivided 68.75% interest in the mineral rights. Our proportionate interest in the ninth lease is 25% of Chesapeake’s interest in the deep rights, or a net interest of 17.1875%, and 100% of Chesapeake’s interest in the shallow rights, or a net interest of 68.75%. Therefore, we lost a portion of the acreage by failing to drill a well that would extend the term. We may lose some or all of our rights in the leases if we do not have the resources to continue to conduct operations as required by the leases. If we lose additional acreage our business and results of operations could be materially adversely affected.

In some instances members of the board of directors may be liable for losses incurred by holders of our common stock. If a shareholder were to prevail in such an action in the U.S., it may be difficult for the shareholder to enforce the judgment against any of our three board members who are not U.S. residents.

In certain instances, such as trading securities based on material non-public information, a director may incur liability to shareholders for losses sustained by the shareholders as a result of the director’s illegal or negligent activity. However, three of our directors, Messrs. Richard N. Jeffs, Gregory Pek and Ian Robinson, reside outside the U. S. and maintain a substantial portion of their assets outside the U.S. As a result it may be difficult or impossible to effect service of process within the U.S. upon such persons or to enforce in the U.S. courts any judgment obtained here against such persons predicated upon any civil liability provisions of the U.S. federal securities laws.

Foreign courts may not entertain original actions predicated solely upon U.S. federal securities laws against these directors. Furthermore, judgments predicated upon any civil liability provisions of the U.S. federal securities laws may not be directly enforceable in foreign countries.

As a result of the foregoing, it may be difficult or impossible for a shareholder to recover from any of these directors if, in fact, the shareholder is damaged as a result of the director’s negligent or illegal activity.

RISKS RELATED TO THE SPIN-OFF

Vallenar Energy Corp., our operating subsidiary, has no recent operating history as an independent company. If we are unable to provide financial and administrative support for Vallenar Energy Corp.’s day-to-day operations, our business could suffer.

Until we became its parent on August 24, 2006, Vallenar Energy Corp. was operated as a subsidiary of Brek. After the spin-off, we will be an independent public company. Our ability to satisfy our obligations and achieve or maintain profitability will be solely dependent upon the future performance of our business, and we will not be able to rely upon the financial and other resources of Brek. As of the date of this prospectus, we have approximately $600,000 in cash, which should be adequate to support our operations for the next 12 months.

During the period of its ownership of Vallenar Energy Corp.’s business, Brek performed certain significant corporate functions for it, including providing legal and accounting services and day-to-day operational functions, such as support staff. In connection with the spin-off, we will be required to create our own, or to engage third parties to provide, corporate business functions that will replace those provided by Brek. As an independent public company, we will be required to bear the cost of obtaining these services. We may not be able to perform, or engage third parties to provide, these functions with the same level of expertise and on the same or as favorable terms as they have been provided by Brek. In that event, our business and operations could suffer.

If the spin-off is determined to be a taxable transaction, you could be required to pay tax on the common stock you receive.

Neither we nor Brek have requested a ruling from the Internal Revenue Service or any other tax authority with respect to the tax implications of the spin-off, and no independent legal opinion will be obtained. Brek has attempted to structure the spin-off in a manner designed to assure that the transaction is tax-free to Brek’s U.S. shareholders. If the spin-off failed to meet all of the requirements that must be satisfied in order to be accorded tax-free treatment under the Internal Revenue Code, then the spin-off could be taxable as a dividend by Brek to its shareholders. If that were to happen, Brek’s shareholders could be liable for the payment of a tax to the extent that the fair value of our common stock exceeds Brek’s adjusted tax basis in our common stock at the time of the distribution.

If the spin-off is not a legal dividend, it could be held invalid by a court and harm our financial condition and results of operations.

The spin-off is subject to the provisions of Section 78.288 of the Nevada Revised Statutes, which requires that distributions be made only if, after making the distribution, the corporation is able to pay its debts as they become due. If a shareholder were to challenge the distribution, a court could later determine that the spin-off was invalid under Nevada law and void the transaction. The resulting complications, costs and expenses could harm our financial condition and results of operations.

Brek’s creditors at the time of the spin-off may challenge the spin-off as a fraudulent conveyance or transfer that could lead a court to void the spin-off. If that were to happen, you may be required to return the shares you receive.

Brek’s creditors could file a legal action challenging the spin-off as a fraudulent conveyance or transfer. If a court determined that Brek was insolvent at the time of the spin-off or was rendered insolvent by reason of the spin-off, the court could be asked to void the spin-off (in whole or in part). If a court voided the spin-off, it could require that our shareholders return to Brek some or all of the shares of our common stock issued in the spin-off.

INVESTMENT RISKS

There is no trading market for our shares. You may not be able to sell your shares if you need money.

Prior to this offering there has been no public market for our common stock. It is not likely that an active market for our common stock will develop or be sustained after this offering or in the foreseeable future. You may not be able to sell the shares you own.

If we are successful in having our stock quoted on the OTC Bulletin Board, we will be subject to the penny stock rules. The application of the “penny stock” rules to our common stock could limit the trading and liquidity of the common stock, adversely affect the market price of our common stock and increase your transaction costs to sell those shares.

If we are successful in having our stock quoted on the OTC Bulletin Board, it will be a “low-priced” security under rules promulgated under the Securities Exchange Act of 1934. In accordance with these rules, broker-dealers participating in transactions in low-priced securities must first deliver a risk disclosure document which describes the risks associated with such stocks, the broker-dealer’s duties in selling the stock, the customer’s rights and remedies and certain market and other information. Furthermore, the broker-dealer must make a suitability determination approving the customer for low-priced stock transactions based on the customer’s financial situation, investment experience and objectives. Broker-dealers must also disclose these restrictions in writing to the customer, obtain specific written consent from the customer, and provide monthly account statements to the customer. The effect of these restrictions probably decreases the willingness of broker-dealers to make a market in our common stock, decreases liquidity of our common stock and increases transaction costs for sales and purchases of our common stock as compared to other securities.

Substantial sales of our common stock following the spin-off could depress the market price of our common stock.

All of the shares of our common stock issued in the spin-off, other than shares distributed to our “affiliates” (as that term is defined in applicable securities laws) will be eligible for immediate resale in the public market. It is likely that some Brek shareholders will sell the shares of our common stock that they receive in the spin-off. Any sales of substantial amounts of our common stock in the public market, or the perception that such sales might occur, could depress the market price of our common stock. We are unable to predict whether substantial amounts of our common stock will be sold in the public market following the spin-off.

We have not paid cash dividends and we are unlikely to pay cash dividends in the foreseeable future.

We plan to use all of our earnings, to the extent we have earnings, to fund our operations. We do not plan to pay any cash dividends in the foreseeable future. We cannot guarantee that we will, at any time, generate sufficient surplus cash that would be available for distribution as a dividend to the holders of our common stock. You should not expect to receive cash dividends on our common stock. Accordingly, shareholders must be prepared to rely on sales of their common stock after price appreciation, which might never occur, to earn an investment return. If our common stock does not appreciate in value, or if our common stock loses value, our shareholders may lose some or all of their investment in our shares.

We have the ability to issue additional shares of our common stock and to issue preferred stock without asking for shareholder approval, which could cause your investment to be diluted.

Our articles of incorporation authorize the board of directors to issue up to 200,000,000 shares of common stock and 25,000,000 shares of preferred stock. The power of the board of directors to issue shares of common or preferred stock is generally not subject to shareholder approval. Accordingly, any additional issuance of our common or preferred stock may have the effect of diluting your investment.

Our articles of incorporation permit us to issue shares of preferred stock. By issuing preferred stock, we may be able to delay, defer or prevent a change of control.

Our articles of incorporation permit us to issue 25,000,000 shares of preferred stock. Our articles of incorporation also permit our board of directors to determine the rights, preferences, privileges and restrictions granted to, or imposed upon, the preferred stock and to fix the number of shares constituting any series and the designation of such series without further action by our shareholders.

Depending on the rights, preferences and privileges granted when the preferred stock is issued, holders of our preferred stock may delay, defer or prevent a change in control, may discourage bids for our common stock at a premium over the market price of the common stock and may adversely affect the market price of and the voting and other rights of the holders of our common stock.

After the spin-off, the price of our common stock may be volatile and the common stock you receive may lose all or part of its value.

The price of our common stock after the spin-off may fluctuate widely, depending upon a number of factors, many of which are beyond our control. For instance, our future results of operations could be below the expectations of investors and, to the extent our company is followed by securities analysts, the expectations of these analysts. If this occurs, our stock price could decline. Other factors that could affect our stock price include the following:

| | · | changes in analysts’ recommendations or projections, if any |

| | · | changes in market valuations of similar companies |

| | · | actions or announcements by our competitors |

| | · | actual or anticipated fluctuations in our operating results |

| | · | changes in general economic or market conditions or other economic factors unrelated to our performance |

In addition, the stock markets have experienced significant price and trading volume fluctuations, and the market prices of oil and gas producing companies generally have been extremely volatile and have recently experienced sharp share price and trading volume changes. These broad market fluctuations may adversely affect the trading price of our common stock.

CAUTIONARY STATEMENT REGARDING

FORWARD LOOKING STATEMENTS

This prospectus contains forward-looking statements. These statements are not historical facts, but rather are based on our current expectations, estimates and projections about our industry and our beliefs and assumptions. Words including “may,” “could,” “would,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “seeks,” “estimates” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which remain beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. These risks and uncertainties include general economic conditions, particularly as they affect our ability to raise sufficient working capital, our reliance on Chesapeake Exploration Limited Partnership to successfully develop our oil and gas properties, our ability to raise enough to cover our operating expenses and other factors that are described in the sections of this prospectus titled “Risk Factors,” “Management’s Discussion and Analysis or Plan of Operation,” “Business” and elsewhere. We caution you not to place undue reliance on these forward-looking statements, which reflect our management’s view only as of the date of this prospectus. We are not obligated to update these statements or publicly release the results of any revisions to them to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

We will not receive any proceeds from Brek’s spin-off distribution of our common stock or from subsequent sales of the shares of common stock by our shareholders.

DETERMINATION OF OFFERING PRICE

The spin-off distribution described in this prospectus is a spin-off dividend distribution of Rock City common stock owned by Brek. Brek will distribute its 8,000,000 shares of Rock City common stock to its shareholders within 30 days of the date of this prospectus. There is currently no public market for our common stock. Additionally, the price of the shares is not indicative of current market value of the assets owned by us and no valuation or appraisal has been prepared for our business and potential business expansion. For purposes of calculating the value of the shares of common stock included in this prospectus, we have used the price of $0.08 per share, which represents the book value of a share of our common stock as of the date of this prospectus.

MARKET FOR COMMON EQUITY

There is presently no public market for our common stock. We plan to apply for the quotation of our common stock on the OTC Bulletin Board upon the completion of the spin-off and the effectiveness of the registration statement of which this prospectus is a part; however, we can provide no assurance that our shares will be quoted on the OTC Bulletin Board or, if quoted, that a public market will develop.

None of our common stock is subject to outstanding options or warrants to purchase, or securities convertible into, common stock. None of our common stock may be sold pursuant to Rule 144 under the Securities Act of 1933. All of our common stock will be freely tradable once the Securities and Exchange Commission declares effective the registration statement of which this prospectus is a part.

We have not paid cash dividends since our inception and we do not contemplate paying dividends in the foreseeable future. We intend to retain any future earnings to finance the growth and development of our business. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, results of operation, capital requirements, contractual restrictions, general business conditions and other factors that our board of directors may deem relevant.

According to section 78.288 of the Nevada Revised Statutes, no distribution to shareholders may be made if, after giving it effect, the corporation would not be able to pay its debts as they become due in the usual course of business or, except as otherwise specifically allowed by the articles of incorporation, the corporation’s total assets would be less than the sum of its total liabilities plus the amount that would be needed, if the corporation were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of shareholders whose preferential rights are superior to those receiving the distribution.

We have no compensation plans pursuant to which our equity securities could be distributed.

After the spin-off distribution, we anticipate that we will have approximately 1,500 shareholders.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OR PLAN OF OPERATION

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated financial statements and related footnotes included elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of a number of factors including, but not limited to, those set forth under “Risk Factors” and elsewhere in this prospectus.

Results of Operations

We were incorporated on August 10, 2006 and did not have any operations between August 10 and August 24, 2006. Between August 24 and March 31, 2007 we had no revenue and our loss from operations and accumulated deficit was $7,518.

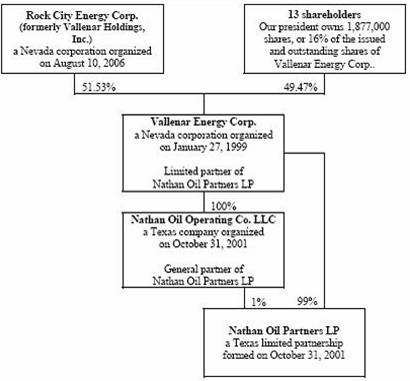

On August 24, 2006, we acquired a 51.53% interest in Vallenar Energy Corp. (“Energy”), a corporation organized in the State of Nevada on January 27, 1999. Energy owns all of Nathan Oil Operating Co. LLC, a limited liability company organized in the State of Texas on October 31, 2001. Nathan Oil Operating Co. LLC is the general partner of Nathan Oil Partners LP, a limited partnership formed in the State of Texas on October 31, 2001. Energy is the only limited partner. This structure is illustrated in the following diagram.

Acquisition of Energy

On August 24, 2006, we issued 4,000,000 shares of our common stock to Brek, a corporation sharing common directors with us, in exchange for 5,312,500 common shares and 733,333 convertible preferred shares of Energy or 51.53% of Energy’s issued and outstanding shares. We allocated the purchase price of Energy based on the historical cost of the assets we acquired and liabilities we assumed because Energy and Rock City are under common control. Energy’s net assets on August 24, 2006 were $41,430 and are summarized in Table 1.

Table 1

| Net Assets | | | | |

| Current assets assumed | | $ | 160,842 | |

| Oil and gas leases | | | 100 | |

| Liabilities assumed | | | (80,636 | ) |

| Minority interest | | | (38,876 | ) |

| | | $ | 41,430 | |

Our unaudited pro forma operating results on August 24, 2006 (the date of acquisition) are the same as the results shown on our consolidated statement of operations included in our March 31, 2007 audited consolidated financial statements, which are filed with this document.

Overall Results of Operations

During the three months ended March 31, 2007, we had a net loss of $39 primarily due to bank and regulatory charges. For the period from inception (August 10, 2006) to March 31, 2007, we had a net loss of $7,518 or $0.00 per share. Our net loss was primarily due to professional fees, franchise tax and minority interest offset by interest revenue.

Expenses

During the three months ended March 31, 2007, we spent $75 on bank charges and regulatory fees. These expenses were offset by the minority interest portion of these expenses of $36. For the period from inception (August 10, 2006) to March 31, 2007, we spent $7,518 on professional and regulatory fees in connection with our incorporation and changing our name. Once the spin-off occurs, we expect our expenses to increase because our parent, Brek will not be required to pay our professional and regulatory costs.

Interest Income

During the three months ended March 31, 2007, we did not have any interest income because the note receivable from Brek was repaid during the fourth quarter of 2006. We received interest income of $2,268 for the period from inception (August 10, 2006) to March 31, 2007 on the note receivable from Brek Energy Corporation.

Franchise Tax

During the three months ended March 31, 2007, we did not incur any franchise tax expense. We have filed all of our corporate income tax returns, which resulted in our paying franchise tax of approximately $1,021 during the period from inception (August 10, 2006) to March 31, 2007.

Liquidity and Capital Resources; Plan of Operation

In the notes to our condensed consolidated financial statements as of March 31, 2006, we caution that our ability to continue as a going concern is uncertain. We have not generated any revenues to cover our expenses and we have an accumulated deficit of $7,518. As of March 31, 2007, we had $26,490 in current liabilities. When these liabilities are offset against our current assets of $700,320, we are left with a working capital of $673,830, which includes cash of $700,220. On March 7, 2007, we sold 4,000,000 shares of our common stock to Brek. The funds we raised in this offering should be adequate to support our operations for the next 12 months. We are in the early stage of exploration and we have not produced any revenues from our oil and gas properties. Thus far, management has devoted most of its time to conducting exploratory work and developing our business. Our plans over the next twelve months include ceasing to be a subsidiary of Brek, raising equity capital, exploring and developing our properties through our joint operating agreement with Chesapeake Exploration Limited Partnership (“Chesapeake”), which is more fully disclosed in the section of this prospectus titled “Business”, and considering other oil and gas projects.

We are not certain that Chesapeake will be able to develop our properties, profitably or at all. Since May 8, 2006, the date that we entered into the joint operating agreement with Chesapeake, Chesapeake has begun drilling operations on the property covered by eight leases, designing a pipeline and negotiating with various landowners for permission to cross their lands to build the pipeline. If Chesapeake is successful in obtaining the appropriate easements and building the pipeline, we expect that the gas produced will be sold. If Chesapeake can develop the properties, the fluctuation of gas prices will impact the amount of revenues earned from the leases. Furthermore, if the resources required to develop the wells are in high demand, the development costs will increase, which will likely result in a delay of the receipt of the revenue to which we would be entitled. We are dependent on Chesapeake to both produce the gas and purchase the gas produced. We cannot be certain that we will ever receive revenues from our agreement with Chesapeake.

PLAN OF OPERATION

We are a holding company based in Newport Beach, California, and a wholly owned subsidiary of Brek. Brek’s properties consist of oil and gas leases in Texas in which Rock City has an interest and an undivided 25% working interest in oil and gas properties in Utah, Wyoming and California. Gasco Energy Inc. (“Gasco”) owns the remaining undivided 75% working interest. On September 20, 2006, Brek disclosed that it had entered into an Agreement and Plan of Merger with Gasco and Gasco Acquisition, Inc. One of the purposes of the merger is to consolidate Gasco’s ownership of the Utah, Wyoming and California oil and gas properties. Once the merger is consummated, Brek will be a wholly owned subsidiary of Gasco. As a condition to the merger, Brek must spin off all of the shares of our capital stock to the Brek shareholders.

Through Energy, we have interests in nine oil and gas leases located in the Rocksprings Prospect in the Val Verde Basin of Edwards County, Texas. These oil and gas leases are more fully described in the section of this prospectus titled “Business”. The nine leases are designated, for purposes of this discussion, as follows:

The “Deep Allar Lease” covers the rights to develop and extract hydrocarbons from depths below 1,500 feet on approximately 7,749.644 acres.

The “Shallow Allar Lease” covers the rights to develop and extract hydrocarbons from depths above 1,500 feet on approximately 7,749.644 acres.

The “Baggett Leases” refer to six leases covering the rights to develop and extract hydrocarbons at any depth from approximately 650.9 acres.

The “Driver Lease” refers to one lease covering the rights to develop and extract hydrocarbons at any depth from approximately 790.2 acres.

The Deep Allar Lease, the Shallow Allar Lease, the Baggett Leases and the Driver Lease all include provisions that allow the lease term to be extended for so long as operations are conducted on the land with no cessation for more than 180 consecutive days, in the case of the Deep Allar Lease and the Shallow Allar Lease, 90 consecutive days in the case of the Baggett Leases and 60 consecutive days in the case of the Driver Lease. “Operations” are defined as drilling, testing, completing, marketing, recompleting, deepening, plugging back or repairing of a well in search for or in an endeavor to obtain production of oil, gas, sulphur or other minerals, or the production of oil, gas, sulphur or other minerals, whether or not in paying quantities.

In this discussion, when we discuss “the deep rights”, we mean the rights to develop and extract hydrocarbons from depths below 1,500 feet. When we discuss “the shallow rights”, we mean the rights to develop and extract hydrocarbons from the surface to 1,500 feet.

Our goal is to develop our properties to fully exploit all of their resources, but we have not been able to do this to date because of a lack of working capital. Our plan is to earn revenues by assigning our rights to develop the properties covered by our leases, rather than by undertaking the expense and the risk of the exploration and development. On May 8, 2006, therefore, we entered into an agreement with Chesapeake for the deep rights associated with the Deep Allar Lease, the Baggett Leases and the Driver Lease (the “Letter Agreement”). In conjunction with the Letter Agreement, we executed an assignment of the deep rights included in the Deep Allar Lease, the Baggett Leases and the Driver Lease (collectively, the “Assigned Leases”) to Chesapeake on June 9, 2006. The assignment is subject to all the applicable terms and provisions of the Letter Agreement. We retained the shallow rights and, because the Letter Agreement only covers deep rights, the Shallow Allar Lease was not included in the leases we assigned.

In the Letter Agreement, Chesapeake agreed to initiate drilling operations on the land covered by the Assigned Leases before the end of their primary terms in February 2007. If Chesapeake successfully completes a well capable of producing hydrocarbons in commercial quantities, the assignment of oil and gas leases will become permanent. There are no other specific provisions in the assignment governing expiration or termination. We cannot guarantee that Chesapeake will successfully develop the oil and gas reserves on the properties covered by the leases.

If the property is successfully developed in accordance with the terms of the Letter Agreement, Chesapeake will be entitled to recover all of the costs of drilling, completing, equipping and operating the first 10 wells. Thereafter, we will be entitled to a 25% working interest in Chesapeake’s interest in the wells. We also have the right to participate in any wells that Chesapeake drills after the first 10, with a 25% working interest if we elect to participate from the outset and pay our proportionate share of the costs, or a 6.25% working interest after Chesapeake recovers its costs if we elect not to participate and pay our proportionate share.

The Letter Agreement also permits us to propose a well if Chesapeake fails to begin drilling a well on acreage covered by the Assigned Leases at least sixty days before the expiration of the terms of the Assigned Leases. Chesapeake may participate in any proposed well, so long as it does so within fifteen days of our proposal. A more complete discussion of the Letter Agreement is included in the section of this prospectus titled “Business”.

While we retained the shallow rights to all of the leases, and, pursuant to the terms of the Letter Agreement we have the right to drill wells on the undeveloped portion of the leased properties, we do not currently have the funds to develop these rights.

Under the terms of the Letter Agreement, aside from initiating drilling operations, Chesapeake is also required to

| | · | obtain a 3-D seismic survey over the area covered by the Assigned Leases at its own expense, |

| | · | provide interpretive data relating to the acreage covered by the Assigned Leases, and, in the initial well, provide an array of logs, including a magnetic imaging log and sidewall cores in the shallow zone of the Assigned Lease, |

| | · | assign to us our proportionate interest in wellbores according to the level of participation that we have elected, |

| | · | transport our gas for $0.50/mcf (1,000 cubic feet), which includes processing fees and costs, and market our gas for $0.03/mcf, and |

| | · | once it has successfully completed a well capable of producing natural gas in commercial quantities, to immediately begin the process of building, or procuring, a pipeline to transport the gas to market. |

Chesapeake initiated the drilling of two wells during January and February 2007. The first well extended the terms of the Baggett Leases. This well has been waiting on a pipeline hookup since April 3, 2007. The second well, because it was drilled on the property covered by the Shallow Allar Lease and the Deep Allar Lease, extended the terms of both leases. This well was competed as a dry hole.

Chesapeake did not initiate drilling on the property covered by the Driver Lease. Instead, Chesapeake, through a partner, top-leased the acreage covered by the Driver Lease to February 2010 but obtained only an undivided 68.75% interest in the oil, gas and all other mineral rights. Our proportionate interest in the Driver Lease is 25% of Chesapeake’s interest in the deep rights, or a net interest of 17.1875%, and 100% of Chesapeake’s interest in the shallow rights, or a net interest of 68.75%.

As a result of Chesapeake’s actions, all of the acreage covered by the Assigned Leases has been secured beyond the original termination dates of the leases. However, as noted above, in order to continue the terms of the Assigned Leases beyond the original termination dates, there must be no cessation of operations for the period of time specified in the lease. Therefore, Chesapeake began drilling a second well on the property covered by the Baggett Leases on June 7, 2007 and we expect that it will begin drilling a second well on the property covered by the Deep Allar Lease in a timely manner. Once we receive the results of a professional review of the data from the first well drilled on the properties covered by the Deep Allar Lease and the Shallow Allar Lease, we will determine whether to initiate drilling operations under the Shallow Allar Lease. If we decide to initiate drilling operations, we will be required to raise funds in order to do so.

We plan to seek other oil and gas projects as our financial condition permits and to find experienced operators to develop the properties in exchange for a working interest, similar to the agreement we have with Chesapeake.

We have no other operations. If our oil and gas leases are not successfully developed, we will earn no revenues.

In March 2007 we sold 4,000,000 shares of our common stock to Brek at a price of $0.15 per share for gross proceeds of $600,000. We estimate that our annual operating costs will be about $240,000, which does not include the costs of acquiring future oil and gas leases or properties. These costs are made up of our administrative, legal and accounting costs. Nathan’s operating costs are paid by Energy. If Energy’s working capital is insufficient to meet Nathan’s operating costs, then Energy will be required to raise the funds necessary to continue Nathan’s operations. If that were the case, we would likely provide additional capital to Energy, either in the form of a loan or through an investment in additional shares of its common stock. However, we cannot guarantee you that we will have the cash available if Nathan needs money, or that we would be able obtain funding from a third party.

We cannot guarantee that Chesapeake will successfully develop the oil and gas reserves on the properties covered by the leases or that we will be able to rely on any other source for cash to cover our cash requirements if we were unable to do so.

Over the next twelve months we do not expect to purchase a plant or any significant equipment.

Over the next twelve months we do not expect any significant changes in the number of employees.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenue or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors. We do not have any non-consolidated, special-purpose entities.

Going Concern

At March 31, 2007 we had accumulated a deficit of $7,518 since inception. We will require additional debt or equity financing to fund and support our operations until we achieve positive cash flows from operations. At this time, we have no commitments for future financing. These factors raise substantial doubt about our ability to continue as a going concern.

Our ability to achieve and maintain profitability and positive cash flows is dependent upon our ability to locate and obtain the rights to profitable oil and gas properties and to find third parties who will develop the properties on terms acceptable to us. We have retained certain rights to explore and extract hydrocarbons from the surface of the property covered by our leases to a dept of 1,500 feet. In order to develop these rights we will need to obtain financing.

While we entered into a joint operating agreement with Chesapeake under which Chesapeake is to develop the properties covered by our leases, we cannot assure you that Chesapeake will succeed in developing the properties. We expect to incur operating losses in future periods because we do not yet receive any revenues from our oil and gas properties and we are not sure when we will receive revenues, if ever.

Our financial statements do not include any adjustments that might result from the realization of these uncertainties.

Contingencies and commitments

We had no contingencies or long-term commitments at March 31, 2007 and have none as of the date of this prospectus.

As is customary in the oil and gas industry, we may at times have agreements to preserve or earn acreage or wells. If we do not perform as required by the agreements, which might require that we pay money or engage in operations such as drilling wells, we could lose the acreage or wells.

Critical accounting estimates

An appreciation of our critical accounting estimates is necessary to understand our financial results. These policies may require that we make difficult and subjective judgments regarding uncertainties, and, as a result, our estimates may significantly impact our financial results. The precision of these estimates and the likelihood of future changes depend on a number of underlying variables and a range of possible outcomes. Other than our accounting for our oil and gas properties, our critical accounting policies do not involve a choice between alternative methods of accounting. We have applied our critical accounting policies and estimation methods consistently.

Oil and gas reserves

We follow the full cost method of accounting whereby all costs related to the acquisition and development of oil and gas properties are capitalized into a single cost center referred to as a full cost pool. Depletion of exploration and development costs will be computed using the units of production method based upon estimated proved oil and gas reserves. Under the full cost method of accounting, capitalized oil and gas property costs less accumulated depletion cannot exceed a ceiling of an amount equal to the present value, discounted at 10%, of estimated future net revenues from proved oil and gas reserves plus the cost, or the estimated fair value if lower, of unproved properties. If capitalized costs exceed this ceiling, we would recognize the impairment.

Estimated reserve quantities and future net cash flows have the most significant impact on the results of operations because these reserve estimates are used in providing a measure of the overall value of our oil and gas properties.

Estimating accumulations of gas and oil is complex and is not exact because of the numerous uncertainties inherent in the process. The process relies on interpretations of available geological, geophysical, engineering and production data. The extent, quality and reliability of these technical data can vary. The process also requires certain economic assumptions, some of which are mandated by the Securities and Exchange Commission, such as gas and oil prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. The accuracy of a reserve estimate is a function of the quality and quantity of available data, the interpretation of that data, the accuracy of various mandated economic assumptions, and the judgment of the persons preparing the estimate.

We have not conducted a reserves estimate on our properties because our oil and gas properties are not in production.

The most accurate method of determining proved reserve estimates is based upon a decline analysis method, which consists of extrapolating future reservoir pressure and production from historical pressure decline and production data. The accuracy of the decline analysis method generally increases with the length of the production history. Once we have producing wells, their production history will be relatively short, so we will have to use other (generally less accurate) methods such as volumetric analysis and analogy to the production history of wells of other operators in the same reservoir in conjunction with the decline analysis method to determine our estimates of proved reserves, including developed producing, developed non-producing and undeveloped. As the wells produce over time and more data become available, we will re-determine the estimated proved reserves on an annual basis and may adjust them based on that data.

Once the wells are actually producing gas and oil, gas and oil prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable gas and oil reserves most likely will vary from our estimates. Any significant variance could materially affect the quantities and present value of our reserves. In addition, we may adjust estimates of proved reserves to reflect production history, acquisitions, divestitures, ownership interest revisions, results of exploration and development and prevailing gas and oil prices. Our reserves may also be susceptible to drainage by operators on adjacent properties.

Impairment of long-lived assets

The cost of our unproved properties will be withheld from our depletion base as described above until the properties are either developed or abandoned. We review these properties periodically, and at least annually, for possible impairment.

Although a reserves study has not been conducted on our properties, we believe the value of our unproved properties is not impaired because of nearby producing natural gas wells, our agreement with Chesapeake, and our belief that our properties could contain commercial deposits of natural gas.

Recent accounting pronouncements

In December 2004, the FASB issued SFAS No. 153, Exchanges of Nonmonetary Assets, which changes the guidance in APB 29, Accounting for Nonmonetary Transactions. This statement amends APB 29 to eliminate the exception for nonmonetary exchanges of similar productive assets and replaces it with a general exception for exchanges of nonmonetary assets that do not have commercial substance. A nonmonetary exchange has commercial substance if the future cash flows of the entity are expected to change significantly as a result of the exchange. The provisions of SFAS 153 are to be applied prospectively and are effective for fiscal years beginning after June 15, 2005. Adoption of SFAS 153 did not have a material impact on our financial position or results of operations.

In May 2005, the FASB issued SFAS No. 154, Accounting Changes and Error Corrections. This statement, which replaces APB Opinion No. 20, Accounting Changes, and FASB Statement No. 3, Reporting Accounting Changes in Interim Financial Statements, requires that a voluntary change in accounting principle be applied retrospectively to all prior period financial statements presented, unless it is impracticable to do so. SFAS 154 also provides that a change in method of depreciating or amortizing a long-lived non-financial asset be accounted for as a change in estimate effected by a change in accounting principle, and also provides that a correction of errors in previously issued financial statements should be termed a “restatement”. SFAS 154 is effective for fiscal years beginning after December 15, 2005. Adoption of SFAS 154 did not have a material impact on our financial position or results of operations.

In February 2006, the FASB issued SFAS No. 155 Accounting for Certain Hybrid Financial Instruments - an amendment of FASB Statements No. 133 and 140. This statement amends FASB Statements No. 133, Accounting for Derivative Instruments and Hedging Activities, and No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. This statement resolves issues addressed in Statement 133 Implementation Issue No. D1, Application of Statement 133 to Beneficial Interests in Securitized Financial Assets. This statement is effective for all financial instruments acquired or issued after the beginning of an entity’s first fiscal year that begins after September 15, 2006. Adoption of SFAS 155 did not have a material impact on our condensed consolidated financial statements.

In March 2006, the FASB issued SFAS No. 156, Accounting for Servicing of Financial Assets - an amendment of FASB Statement No. 140. SFAS No. 156 amends SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities, with respect to accounting for separately recognized servicing assets and servicing liabilities. SFAS No. 156 is effective for fiscal years that begin after September 15, 2006, with early adoption permitted as of the beginning of an entity’s fiscal year. We do not have any servicing assets or servicing liabilities and, accordingly, the adoption of SFAS No. 156 did not have a material impact on our condensed consolidated financial statements.

In June 2006, the FASB issued FASB Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes, and Interpretation of FASB Statement No. 109. FIN 48 clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements and prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in an income tax return. FIN 48 also provides guidance on recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective beginning in fiscal 2008. We adopted the provisions of FIN 48 on January 1, 2007. FIN 48 provides detailed guidance for the financial statement recognition, measurement and disclosure of uncertain tax positions recognized in the financial statements in accordance with SFAS 109. Tax positions must meet a “more-likely-than-not” recognition threshold at the effective date to be recognized upon the adoption of FIN 48 and in subsequent periods. The adoption of FIN 48 had an immaterial impact on our condensed consolidated financial position and did not result in unrecognized tax benefits being recorded. Accordingly, no corresponding interest and penalties have been accrued. We file income tax returns in the U.S. federal jurisdiction and various states. There are currently no federal or state income tax examinations underway for these jurisdictions. We had net operating losses for the period from August 10, 2006 (inception) to December 31, 2006, which remain open for examination by the Internal Revenue Service.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosure requirements about fair-value measurements required under the accounting pronouncements, but does not change existing guidance as to whether or not an instrument is carried at fair value. SFAS 157 will be effective for our fiscal year beginning on January 1, 2008. Our adoption of SFAS 157 is not expected to have a material impact on our condensed consolidated financial statements.

In September 2006, the Securities and Exchange Commission staff published Staff Accounting Bulletin SAB No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements. SAB 108 addresses quantifying the financial statement effects of misstatements, specifically, how the effects of prior year uncorrected errors must be considered in quantifying misstatements in the current year financial statements. SAB 108 is effective for fiscal years ending after November 15, 2006. We adopted SAB 108 in the fourth quarter of 2006. Adoption did not have a material impact on our consolidated financial statements.

In September 2006, the FASB issued SFAS 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R). This statement requires an employer to recognize the over funded or under funded status of a defined benefit postretirement plan as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through comprehensive income of a business entity. This statement also requires an employer to measure the funded status of a plan as of the date of its year end statement of financial position, with limited exceptions. We will be required to initially recognize the funded status of a defined benefit postretirement plan and to provide the required disclosures as of the end of the fiscal year ending after December 15, 2006. The requirement to measure plan assets and benefit obligations as of the date of the employer’s fiscal year end statement of financial position is effective for fiscal years ending after December 15, 2008, or fiscal 2009 for us. Adoption of SFAS 158 is not expected to have a material impact on our condensed consolidated financial statements.

��

In December 2006, the FASB issued FASB Staff Position (“FSP”) EITF 00-19-2, Accounting for Registration Payment Arrangements. This FSP specifies that the contingent obligation to make future payments or otherwise transfer consideration under a registration payment arrangement should be separately recognized and measured in accordance with FASB Statement No. 5, Accounting for Contingencies. This FSP is effective immediately for registration payment arrangements and the financial instruments subject to those arrangements that are entered into or modified subsequent to December 21, 2006. For registration payment arrangements and financial instruments subject to those arrangements that were entered into prior to December 21, 2006, the guidance in the FSP was effective for us on January 1, 2006. The adoption of this FSP had no impact on our consolidated financial position or results from operations.

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards (SFAS) No. 159, The Fair Value Option for Financial Assets and Financial Liabilities - including an amendment of SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities, which applies to all entities with available-for-sale and trading securities. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. The objective is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. This statement is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provisions of FASB Statement No. 157, Fair Value Measurements. We plan to adopt SFAS No. 159 effective January 1, 2008. We are in the process of determining the effect, if any, the adoption of SFAS No. 159 will have on our condensed consolidated financial statements.

Contractual obligations

We did not have any contractual obligations at March 31, 2007, and do not have any as of the date of this prospectus.

Internal and external sources of liquidity

We have funded our operations solely through subscriptions for common shares. We have no commitments for financing.

Inflation

We do not believe that inflation will have a material impact on our future operations.

BUSINESS

We are a holding company. Through our subsidiary, Vallenar Energy Corp., we have interests in oil and gas leases which have been assigned to a third party for exploration and development. Our plan is to earn revenues by assigning our rights to develop the properties covered by our leases, rather than by undertaking the expense and the risk of the exploration and development.

We hold a 51.53% interest in our subsidiary, Vallenar Energy Corp., a company formed in Nevada on January 27, 1999. Vallenar Energy Corp. operates through its subsidiary, Nathan Oil Partners LP, or “Nathan”, which was formed on October 31, 2001. In February 2002, Nathan acquired nine leases covering approximately 9,191 gross and 8,865 net acres in the Rocksprings Prospect in the Val Verde Basin of Edwards County, Texas. The leases were originally acquired with the intention of developing any heavy crude oil reserves on the properties covered by the leases, although no studies have been done to determine whether heavy crude oil reserves are present. In 2005 natural gas wells were discovered nearby. We believe that these properties may have significant deposits of natural gas and that extracting the natural gas will be less costly than extracting heavy oil. In furtherance of this objective, on May 8, 2006, Nathan entered into an agreement with Chesapeake Exploration Limited Partnership (referred to in this discussion as “Chesapeake”). The agreement is dated April 3, 2006.

In exchange for Chesapeake’s promise to bear the costs of drilling the first 10 wells, to operate the wells and to market, transport and sell our share of the production from the wells, Nathan assigned the Deep Allar Lease and the deep rights in the Baggett Leases and the Driver Lease to Chesapeake. Nathan did this because it did not have the professional expertise or other resources to be a producer and it did not have the professional or financial means to identify drill targets and initiate the drilling of wells in order to extend the terms of the Assigned Leases before they expired.

Chesapeake and Nathan signed a joint operating agreement in which Chesapeake agreed to initiate drilling operations on the land covered by the Assigned Leases before the expiration of the primary terms. Chesapeake extended the terms of the Deep Allar Lease (along with the Shallow Allar Lease) and the Bagget Leases but it did not initiate drilling operations on the land covered by the Driver Lease before it expired on February 4, 2007. Instead, Chesapeake obtained an agreement with the entity holding the top lease on the properties covered by the Driver Lease. A top lease is a lease that becomes effective upon the termination of a prior lease. As a result of its agreement with the entity holding the top lease, upon the expiration of the Driver Lease, Chesapeake obtained an interest of 68.75% in the deep rights included in the top lease. The top lease is referred to in this discussion as the “Driver Bergstein Lease”. This resulted in a reduction of the net acreage covered by the Assigned Leases from 8,865 acres to 8,618 acres.

If Chesapeake successfully completes a well capable of producing hydrocarbons in commercial quantities, the assignment of the Assigned Leases will become permanent. In that case, in accordance with the terms of the Letter Agreement and assuming that Chesapeake has drilled at least 10 wells, and that it has recovered from the revenue produced by those wells (net of taxes and royalties) all of its costs in drilling, completing, equipping and operating the wells, Nathan will eventually have an interest in 25% of the production from the wells. Chesapeake has not yet informed us that they have completed a well capable of producing hydrocarbons in commercial quantities, although it has drilled two wells on the leased acres as of the date of this prospectus and it began drilling a third well on June 7, 2007. We are relying entirely on information that we receive informally from Chesapeake for the status of our leases and we have not yet independently confirmed it. The assignment of the leases was executed on June 9, 2006. Nathan retained all of the rights from the surface to 1,500 feet.

As we noted above, once Chesapeake has recovered all of the costs of drilling, completing, equipping and operating the first 10 wells, commonly said to have “paid out”, Nathan will be entitled to a 25% working interest in Chesapeake’s interest in the wells. Our working interests would include 25% in wells drilled on approximately 7,750 acres covered by the Deep Allar Lease, 12.5% in wells drilled on approximately 651 acres covered by the Baggett Leases, and 17.1875% in wells drilled on approximately 790 acres covered by the Driver Bergstein Lease. Alternatively, Nathan may, at any time before the first ten wells have paid out, elect to pay 25% of the drilling, completing and operating costs, less any revenue earned from the wells, to the date of the election, to earn an immediate 25% working interest in the wells drilled as of the date of the election. In all subsequently drilled wells, Nathan may participate by paying 25% of the costs of drilling, completing, equipping and operating the wells to earn a 25% working interest in the wells, or it may elect to pay nothing toward these costs and earn a 6.25% working interest in these wells after Chesapeake has recovered 100% of its costs. Chesapeake has made no representation that it will be successful in drilling, completing, equipping and operating any wells in accordance with the agreement.

If Chesapeake has not commenced operations for drilling a well within 60 days from the expiration of a lease’s primary term, or from the expiration of the term provided for in the lease’s continuous development provision, then Nathan will have the right to drill a well under the terms of the joint operating agreement. Chesapeake will have a period of 15 days from the receipt of Nathan’s drilling proposal to elect to participate. As we described above, Chesapeake has drilled two wells and is in the process of drilling a third well. The first well was drilled on the property covered by the Baggett Leases and has been waiting on a pipeline hookup since April 3, 2007. The second well, which was dry, was drilled on the property covered by the Shallow Allar Lease and the Deep Allar Lease. Chesapeake is currently drilling a third well on the property covered by the Baggett Leases.

Chesapeake will charge a transportation fee of $0.50 per Mcf (thousand cubic feet) and a marketing fee of $0.03 per Mcf for natural gas produced and transported from the property covered by the leases. Upon successful completion of a well capable of producing natural gas in commercial quantities, Chesapeake has agreed to immediately begin the building or procuring of a pipeline to transport the natural gas to the market.

As is customary in the oil and gas industry, only a preliminary title review was conducted at the time Chesapeake entered into the agreement. Before it started its drilling operations, Chesapeake was responsible for examining the title of the drill site tract and performing any curative work, if necessary, with respect to significant defects, if any, before proceeding with the operations.

Our leasehold properties are subject to royalty, overriding royalty and other outstanding interests customary in the industry. The properties may also be subject to burdens such as liens incident to operating agreements and current taxes, development obligations under oil and gas leases and other encumbrances, easements and restrictions. We do not believe that any of these burdens will materially interfere with our use of these properties.

Operations

Our property has eleven wellbores, which Getty Oil drilled between 1975 and 1981, for which we have no information, and one bore hole which we drilled in 2002, the results of which were inconclusive. During the three most recent fiscal years, we had no drilling activity and no oil and gas production from our property and, therefore, no costs that would be associated with such production. We have not retained the services of an engineer to determine if there are oil or gas reserves on our property and we are unable to assure you that any such reserves exist.

We have no oil and gas reserves or production subject to long-term supply, delivery or similar agreements. Estimates of our total proved oil and gas reserves have not been filed with or included in reports to any federal authority or agency other than the Securities and Exchange Commission.

Table 2 illustrates the gross and net acres of developed and undeveloped gas and oil leases held by Nathan.

Table 2

Acreage

| | | Developed Acres | | Undeveloped Acres | |

Area | | Gross | | Net | | Gross | | Net | |

| Texas | | | 0 | | | 0 | | | 9,191 | | | 8,618 | |

| Total | | | 0 | | | 0 | | | 9,191 | | | 8,618 | |

Competition