UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB

x | QUARTERLY REPORT UNDER SECTION 13 0R 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2007

o | TRANSITION REPORT UNDER SECTION 13 0R 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

ROCK CITY ENERGY CORP. |

| (Exact name of small business issuer as specified in its charter) |

Nevada | | 20-5503984 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3388 - Via Lido, 4th Floor, Newport Beach, California, 92663 |

| (Address of principal executive offices) |

1-866-472-7987 |

| (Issuer’s telephone number) |

| |

| (Former name, former address and former fiscal year, if changed since last report) |

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

oYes xNo

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

oYes xNo

Indicate the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.

Class | | Outstanding at November 13, 2007 |

| | | |

Shares of common stock - $0.001 par value | | 8,000,000 |

Transitional Small Business Disclosure Format: oYes xNo

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | September 30, | | December 31, | |

| | | 2007 | | 2006 | |

| | | (Unaudited) | | | |

| Assets | | | | | |

| | | | | | |

| Current assets | | | | | |

| Cash | | $ | 694,516 | | $ | 100,291 | |

| | | | | | | | |

| Total current assets | | | 694,516 | | | 100,291 | |

| | | | | | | | |

| Unproved oil and gas properties | | | 100 | | | 100 | |

| | | | | | | | |

| Total assets | | $ | 694,616 | | $ | 100,391 | |

| | | | | | | | |

| | | | | | | | |

| Liabilities and Stockholders' Equity | | | | | | | |

| | | | | | | | |

| Current liabilities | | | | | | | |

| Accounts payable | | $ | 1,479 | | $ | 4,075 | |

| Accrued liabilities | | | - | | | 8,500 | |

| Due to related party | | | 165,516 | | | 13,911 | |

| | | | | | | | |

| Total current liabilities | | | 166,995 | | | 26,486 | |

| | | | | | | | |

| Commitments and contingencies | | | | | | | |

| | | | | | | | |

| Minority interest | | | 38,995 | | | 39,954 | |

| | | | | | | | |

| | | | | | | | |

| Stockholders' equity | | | | | | | |

Preferred stock, 25,000,000 shares authorized; $0.001 par value, 0 shares issued and outstanding | | | - | | | - | |

Common stock, 200,000,000 shares authorized; $0.001 par value, 8,000,000 and 4,000,000 shares issued and outstanding at September 30, 2007 and December 31, 2006 | | | 8,000 | | | 4,000 | |

| Additional paid-in capital | | | 633,430 | | | 37,430 | |

| Accumulated deficit | | | (152,804 | ) | | (7,479 | ) |

| | | | | | | | |

| Total stockholders' equity | | | 488,626 | | | 33,951 | |

| | | | | | | | |

| Total liabilities and stockholders' equity | | $ | 694,616 | | $ | 100,391 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| | | Three Months | | Nine Months | | August 10, 2006 | | August 10, 2006 | |

| | | Ended | | Ended | | (Inception) to | | (Inception) to | |

| | | September 30, 2007 | | September 30, 2007 | | September 30, 2006 | | September 30, 2007 | |

| | | | | | | | | | |

| Expenses | | | | | | | | | |

| General & Administrative | | $ | - | | $ | 84 | | $ | - | | $ | 84 | |

| Professional fees | | | 142,940 | | | 145,672 | | | 1,487 | | | 153,195 | |

| Regulatory costs | | | - | | | 528 | | | - | | | 653 | |

| | | | | | | | | | | | | | |

| Total expenses | | | 142,940 | | | 146,284 | | | 1,487 | | | 153,932 | |

| | | | | | | | | | | | | | |

| Other income | | | | | | | | | | | | | |

| Interest income | | | - | | | - | | | 1,216 | | | 2,268 | |

| | | | | | | | | | | | | | |

| Net loss before franchise tax and minority interest | | | (142,940 | ) | | (146,284 | ) | | (271 | ) | | (151,664 | ) |

| | | | | | | | | | | | | | |

| Franchise tax | | | - | | | - | | | - | | | (1,021 | ) |

| | | | | | | | | | | | | | |

| Net loss before minority interest | | | (142,940 | ) | | (146,284 | ) | | (271 | ) | | (152,685 | ) |

| | | | | | | | | | | | | | |

| Minority interest | | | 116 | | | 959 | | | 71 | | | (119 | ) |

| | | | | | | | | | | | | | |

| Net loss for the period | | $ | (142,824 | ) | $ | (145,325 | ) | $ | (200 | ) | $ | (152,804 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Basic and diluted loss per share | | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | | | |

| | | | | | | | | | | | | | |

| Basic and diluted weighted average shares outstanding | | | 4,508,287 | | | 5,010,989 | | | 4,000,000 | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2007

AND FOR THE PERIOD FROM INCEPTION (AUGUST 10, 2006) THROUGH SEPTEMBER 30, 2006

(UNAUDITED)

| | | Common Stock Issued | | Additional | | | | | |

| | | Number of | | | | Paid-In | | Accumulated | | | |

| | | Shares | | Amount | | Capital | | Deficit | | Total | |

| | | | | | | | | | | | |

| Balance at inception (August 10, 2006) | | | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | | | | | | | | |

| Issuance of common stock | | | 4,000,000 | | | 4,000 | | | 37,430 | | | - | | | 41,430 | |

| | | | | | | | | | | | | | | | | |

| Net loss for the period ended September 30, 2006 | | | - | | | - | | | - | | | (200 | ) | | (200 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, September 30, 2006 | | | 4,000,000 | | | 4,000 | | | 37,430 | | | (200 | ) | | 41,230 | |

| | | | | | | | | | | | | | | | | |

| Net loss for the three months ended December 31, 2006 | | | - | | | - | | | - | | | (7,279 | ) | | (7,279 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance December 31, 2006 | | | 4,000,000 | | | 4,000 | | | 37,430 | | | (7,479 | ) | | 33,951 | |

| | | | | | | | | | | | | | | | | |

| Issuance of common stock | | | 4,000,000 | | | 4,000 | | | 596,000 | | | - | | | 600,000 | |

| | | | | | | | | | | | | | | | | |

| Net loss for the nine months ended September 30, 2007 | | | - | | | - | | | - | | | (145,325 | ) | | (145,325 | ) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, September 30, 2007 | | | 8,000,000 | | $ | 8,000 | | $ | 633,430 | | $ | (152,804 | ) | $ | 488,626 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | Nine Months | | August 10, 2006 | | August 10, 2006 | |

| | | Ended | | (Inception) to | | (Inception) to | |

| | | September 30, 2007 | | September 30, 2006 | | September 30, 2007 | |

| | | | | | | | |

| Cash flows from operating activities: | | | | | | | |

| Net loss | | $ | (145,325 | ) | $ | (200 | ) | $ | (152,804 | ) |

| | | | | | | | | | | |

| Adjustments to reconcile net loss to net cash (used in) | | | | | | | | | | |

| provided by operating activities: | | | | | | | | | | |

| Cash acquired on acquisition of subsidiary | | | - | | | 294 | | | 294 | |

| Minority interest | | | (959 | ) | | (71 | ) | | 119 | |

| | | | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | | |

| Accounts payable | | | (2,596 | ) | | 453 | | | (69,943 | ) |

| Accrued liabilities | | | (8,500 | ) | | 310 | | | - | |

| Due to related party | | | 151,605 | | | (494 | ) | | 156,302 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net cash (used in) provided by operating activities | | | (5,775 | ) | | 292 | | | (66,032 | ) |

| | | | | | | | | | | |

| Cash flows from investment activities: | | | | | | | | | | |

| Repayment of note payable from related party | | | - | | | - | | | 160,548 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net cash provided by investment activities | | | - | | | - | | | 160,548 | |

| | | | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | | | |

| Common stock issued | | | 600,000 | | | - | | | 600,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net cash provided by financing activities | | | 600,000 | | | - | | | 600,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net increase in cash | | | 594,225 | | | 292 | | | 694,516 | |

| | | | | | | | | | | |

| Cash, beginning of period | | | 100,291 | | | - | | | - | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Cash, end of period | | $ | 694,516 | | $ | 292 | | $ | 694,516 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Supplemental cash flow information: | | | | | | | | | | |

| Cash paid during the period for: | | | | | | | | | | |

| Franchise taxes | | $ | - | | $ | - | | $ | 1,021 | |

| Interest | | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | | |

| Non-cash items: | | | | | | | | | | |

| Common shares issued on acquisition of subsidiary | | $ | - | | $ | 41,430 | | $ | 41,430 | |

| Net assets acquired on acquisition of subsidiaries (net of cash) | | $ | - | | $ | (80,012 | ) | $ | (80,012 | ) |

| Minority interest | | $ | - | | $ | 38,876 | | $ | 38,876 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

ROCK CITY ENERGY CORP.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

1. ORGANIZATION AND BASIS OF PRESENTATION

Organization

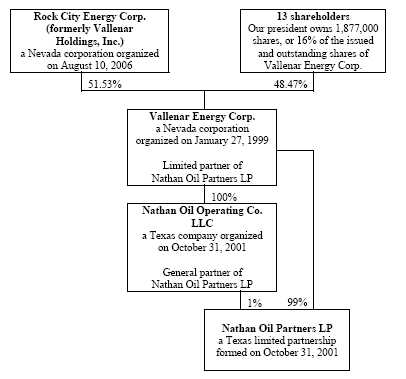

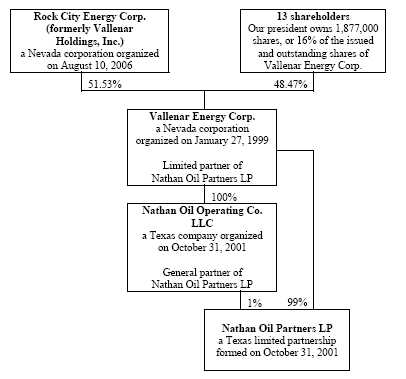

Rock City Energy Corp. was incorporated in the State of Nevada on August 10, 2006 as Vallenar Holdings, Inc. and changed its name to Rock City Energy Corp. on January 26, 2007. On August 24, 2006, Rock City acquired a 51.53% interest in Vallenar Energy Corp., a company incorporated in the State of Nevada on January 27, 1999. Vallenar owns all of Nathan Oil Operating Co. LLC, a limited liability company organized in the State of Texas on October 31, 2001. Vallenar has a 99% interest in Nathan Oil Partners LP, a limited partnership formed in the State of Texas on October 31, 2001. Nathan Oil Operating Co. LLC has a 1% interest in Nathan Oil Partners LP.

Rock City is involved in the oil and gas exploration business. Through Vallenar’s subsidiary, Nathan Oil Partners LP, Rock City has an interest in several oil and gas leases in the state of Texas. In these notes, the terms “Company”, “we”, “us” or “our” mean Rock City Energy Corp. and its subsidiary whose operations are included in these condensed consolidated financial statements.

Basis of Presentation

The unaudited condensed consolidated financial statements included herein have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions to Form 10-QSB and Item 310(b) of Regulation S-B. They do not include all information and notes required by generally accepted accounting principles for complete financial statements. However, except as disclosed herein, there have been no material changes in the information disclosed in the notes to the audited consolidated financial statements included in the registration statement on Form SB-2/A of Rock City Energy Corp. dated August 30, 2007, for the period from August 10, 2006 (inception) to December 31, 2006. In the opinion of management, all adjustments (including normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three and nine months ended September 30, 2007, are not necessarily indicative of the results that may be expected for any other interim period or the entire year. For further information, these unaudited condensed consolidated financial statements and the related notes should be read in conjunction with the Company’s audited consolidated financial statements for the period from August 10, 2006 (inception) to December 31, 2006, included in the Company’s registration statement on Form SB-2/A dated August 30, 2007.

Exploration Stage

These condensed consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States of America, and are expressed in United States dollars. The Company has not produced significant revenue from its principal business and is an exploration stage company as defined by Statement of Financial Accounting Standards No. 7.

The Company is in the early exploration stage. In an exploration stage company, management devotes most of its time to conducting exploratory work and developing its business. These condensed consolidated financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has never paid any dividends and is unlikely to pay dividends or generate earnings in the immediate or foreseeable future. The Company’s continuation as a going concern and its ability to emerge from the exploration stage with any planned principal business activity is dependent upon the continued financial support of its shareholders and its ability to obtain the necessary equity financing and attain profitable operations.

ROCK CITY ENERGY CORP.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A summary of the Company’s significant accounting policies is included in the Company’s SB-2/A dated August 30, 2007. Additional significant accounting policies that affect the Company or that have been developed since December 31, 2006, are summarized below.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentration of credit risk consist principally of cash deposits. At September 30, 2007, and December 31, 2006, the Company had approximately $694,000 and $100,000, respectively in cash that was not insured. This cash is on deposit with a major chartered Canadian bank. The Company has not experienced any losses in cash balances and does not believe it is exposed to any significant credit risk on cash and cash equivalents.

3. GOING CONCERN

The Company has accumulated a deficit of $152,804 since inception and will require additional financing to fund and support its operations until it achieves positive cash flow from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The Company’s ability to achieve and maintain profitability and positive cash flow is dependent upon its ability to locate profitable oil and gas properties, generate revenue from oil and gas production, and control its drilling, production and operating costs. The Company plans to mitigate its losses in the future through an agreement with a Texas oil and gas company (“operator”) whereby the operator has agreed to initiate drilling operations on the oil and gas properties and pay the exploration, drilling, completing, equipping and operating costs associated with developing the oil and gas properties. Based upon its current plans, the Company expects to incur operating losses in the future and cannot assure that it will be able to obtain additional financing, locate profitable oil and gas properties, generate revenue from oil and gas production, or control its drilling, production or operating costs; or that the operator will initiate drilling operations or pay for the exploration, drilling, completing, equipping or operating costs associated with developing the oil and gas properties. These condensed consolidated financial statements do not include any adjustments that might result from the realization of these uncertainties.

4. UNPROVED OIL AND GAS PROPERTIES

The Company has an interest in the following nine leases located in Edwards County in Texas:

Deep Allar Lease

The Deep Allar Lease covers the rights to develop and extract hydrocarbons from depths below 1,500 feet from approximately 7,750 acres.

Shallow Allar Lease

The Shallow Allar Lease covers the rights to develop and extract hydrocarbons from depths above 1,500 feet from approximately 7,750 acres.

Baggett Leases

The Baggett leases refer to six leases covering the rights to develop and extract hydrocarbons at any depth from approximately 651 acres.

ROCK CITY ENERGY CORP.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

4. UNPROVED OIL AND GAS PROPERTIES (continued)

Driver Lease

The Driver Lease refers to one lease covering the rights to develop and extract hydrocarbons at any depth from approximately 790 acres.

The Deep Allar Lease, the Shallow Allar Lease, the Baggett Leases and the Driver Lease all include provisions that allow their primary terms to be extended for so long as operations are conducted on the land with no cessation for more than 180 consecutive days in the case of the Deep Allar Lease and the Shallow Allar Lease, 90 consecutive days in the case of the Baggett Leases, and 60 consecutive days in the case of the Driver Lease. Operations are defined as drilling, testing, completing, marketing, recompleting, deepening, plugging back or repairing of a well in search for or in an endeavor to obtain production of oil, gas, sulphur or other minerals, or the production of oil, gas, sulphur or other mineral, whether or not in paying quantities.

On May 8, 2006, Vallenar entered into a letter agreement dated April 3, 2006, with an operator for the development of the Company’s oil and gas properties. Under the agreement, the operator can earn a 100% leasehold interest in the leases to depths below 1,500 feet in exchange for drilling until it has completed a well capable of producing hydrocarbons in commercial quantities. When the operator has completed the first ten wells and recovered 100% of the costs to drill the wells (“payout”), the Company can back in for a 25% working interest in the wells. On future wells, the Company can either participate from the outset to earn a 25% working interest, or back in after payout to earn a 6.25% working interest.

Pursuant to an assignment of oil and gas leases agreement, dated June 9, 2006, the Company assigned all of its oil and gas leases, so far as they cover depths below 1,500 feet, to the operator in exchange for the operator’s initiating drilling operations on the land covered by the leases before the primary terms of the leases expire. If the operator successfully completes a well capable of producing hydrocarbons in commercial quantities, this assignment of oil and gas leases will become permanent.

Overriding royalty interests in the oil and gas leases totaling between 5% and 8.33% of all oil, gas and other minerals produced, were assigned to three parties between October 4, 2002 and April 21, 2006. (Note 5)

At September 30, 2007 the Deep and Shallow Allar and Baggett Leases were in good standing because the Company’s operator had performed sufficient work on these oil and gas leases to extend and maintain them. The Driver Lease, comprising 790 gross and net acres, expired in February 2007. The Company’s operator obtained a new lease covering the same acreage and has an undivided 68.75% interest in the mineral rights. The Company’s proportionate interest in this ninth lease is 25% of the operator’s interest in the deep rights, or a net interest of 17.19%, and 100% interest in the shallow rights, or a net interest of 68.75%. (Notes 5 and 8)

The following table presents information regarding the Company’s unproved property leasehold acquisition costs in the following area:

| | | September 30, 2007 | | December 31, 2006 | |

| | | | | | |

| | | | | | |

| Texas | | $ | 100 | | $ | 100 | |

The Company’s unproven properties are evaluated quarterly for the possibility of potential impairment. During the nine months ended September 30, 2007 and the year ended December 31, 2006, no impairment charges were recorded against the unproven oil and gas properties.

ROCK CITY ENERGY CORP.

(An Exploration Stage Company)

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(UNAUDITED)

5. RELATED-PARTY TRANSACTIONS

Due to Related Party

At September 30, 2007 and December 31, 2006, we had fees and advances payable to our parent company, Brek Energy Corporation in the amounts of, $165,516 and $13,911, respectively. These advances are non-interest-bearing, unsecured and have no fixed terms of repayment. During the nine months ended September 30, 2007 the Company paid or accrued $150,000 in management and administrative fees to Brek.

Overriding Royalty Interest

The president of the Company has overriding royalty interests in all oil, gas and other minerals produced of 3.17% in seven of the oil and gas leases, and 1.5% in one of the oil and gas leases. (Note 4)

6. COMMON STOCK

On August 24, 2006, the Company issued 4,000,000 common shares to Brek in exchange for 5,312,500 shares of common stock and 733,333 shares of preferred stock in Vallenar Energy Corp.

On June 7, 2007, the Company issued 4,000,000 unregistered and restricted common shares at $0.15 per share to Brek for $600,000 cash.

7. COMMITMENTS

Oil and Gas Commitments

As is customary in the oil and gas industry, the Company may at times have commitments to preserve or earn certain acreage positions or wells. If the Company does not pay such commitments, it may lose the acreage positions or wells.

Lease Commitments

The Company had no lease commitments at September 30, 2007.

8. SUBSEQUENT EVENT

Subsequent to September 30, 2007, the Company’s operator paid a shut in royalty to extend the terms of the Baggett leases. (Note 4)

Item 2. Management’s Discussion and Analysis or Plan of Operation

Certain information included in this Form 10-QSB and other materials filed or to be filed by us with the Securities and Exchange Commission (as well as information included in oral or written statements made by us or on our behalf), may contain forward-looking statements about our current and expected performance trends, growth plans, business goals and other matters. These statements may be contained in our filings with the Securities and Exchange Commission, in our press releases, in other written communications, and in oral statements made by or with the approval of one of our authorized officers. Words or phrases such as “believe,” “plan,” “will likely result,” “expect,” “intend,” “will continue,” “is anticipated,” “estimate,” “project,” “may,” “could,” “would,” “should,” and similar expressions are intended to identify forward-looking statements. These statements, and any other statements that are not historical facts, are forward-looking statements.

We have identified and filed important factors, risks and uncertainties that could cause our actual results to differ materially from those projected in forward-looking statements made by us, or on our behalf (see “Risk Factors” included in the registration statement filed on Form SB-2 and declared effective by the Securities and Exchange Commission on September 17, 2007). These cautionary statements are to be used as a reference in connection with any forward-looking statements. Because of these factors, risks and uncertainties, we caution against placing undue reliance on forward-looking statements. Although we believe that the assumptions underlying forward-looking statements are reasonable, any of the assumptions could be incorrect, and there can be no assurance that forward-looking statements will prove to be accurate. Forward-looking statements speak only as of the date on which they are made. We do not undertake any obligation to modify or revise any forward-looking statement to take into account or otherwise reflect subsequent events or circumstances arising after the date that the forward-looking statement was made.

General

This discussion and analysis should be read in conjunction with our interim unaudited condensed consolidated financial statements and related notes included in this Form 10-QSB and the audited consolidated financial statements and related notes included in the registration statement on Form SB-2, file number 333-139312, that was declared effective by the Securities and Exchange Commission on September 17, 2007. The inclusion of supplementary analytical and related information in this report may require us to make appropriate estimates and assumptions to enable us to fairly present, in all material respects, our analysis of trends and expectations with respect to our results of operations and financial position taken as a whole.

We are involved in the oil and gas exploration business. Through our subsidiary we have an interest in several oil and gas leases in the state of Texas.

We are in the early exploration stage. In an exploration stage company, management devotes most of its time to conducting exploratory work and developing its business. Our continuation as a going concern and ability to emerge from the exploration stage with any planned principal business activity is dependent upon our continued financial support, ability to attain profitable operations and ability to raise equity financing.

“We”, “us” or “our” where used throughout this document mean Rock City Energy Corp. and its subsidiaries.

Our Objectives and Areas of Focus

We were incorporated on August 10, 2006 as Vallenar Holdings, Inc. and changed our name to Rock City Energy Corp. on January 26, 2007. We did not have any operations between August 10 and August 24, 2006. Between August 10, 2006, and September 30, 2007, we had no revenue and accumulated a deficit of $152,804.

On August 24, 2006, we acquired a 51.53% interest in Vallenar Energy Corp., a corporation organized in the State of Nevada on January 27, 1999. Vallenar owns all of Nathan Oil Operating Co. LLC, a limited liability company organized in the State of Texas on October 31, 2001. Nathan Oil Operating Co. LLC is the general partner of Nathan Oil Partners LP, a limited partnership formed in the State of Texas on October 31, 2001. Vallenar is the only limited partner. This structure is illustrated in the following diagram.

We are a holding company based in Newport Beach, California, and a wholly owned subsidiary of Brek Energy Corp. Brek is an oil and gas company whose properties consist of the oil and gas leases in Texas in which Rock City has an interest, and an undivided 25% working interest in oil and gas properties in Utah, Wyoming and California. Gasco Energy Inc. owns the remaining undivided 75% working interest. On September 20, 2006, Brek disclosed that it had entered into an Agreement and Plan of Merger with Gasco and Gasco Acquisition, Inc. One of the purposes of the merger is to consolidate Gasco’s ownership of the Utah, Wyoming and California oil and gas properties. Once the merger is completed, Brek will be a wholly owned subsidiary of Gasco. As a condition to the merger, Brek must spin off all of its shares of our capital stock to its shareholders. Brek intends to complete the spin-off before November 30, 2007.

Through Vallenar, we have interests in nine oil and gas leases located in the Rocksprings Prospect in the Val Verde Basin of Edwards County, Texas. The nine leases are designated, for purposes of this discussion, as follows:

| · | The “deep Allar lease” refers to one lease covering the rights to develop and extract hydrocarbons from depths below 1,500 feet on approximately 7,749.644 acres. |

| · | The “shallow Allar lease” refers to one lease covering the rights to develop and extract hydrocarbons from depths above 1,500 feet on approximately 7,749.644 acres. |

| · | The “Baggett leases” refer to six leases covering the rights to develop and extract hydrocarbons at any depth from approximately 650.9 acres. |

| · | The “Driver lease” refers to one lease covering the rights to develop and extract hydrocarbons at any depth from approximately 790.2 acres. |

The leases all include provisions that allow the lease term to be extended for so long as operations are conducted on the land with no cessation for more than 180 consecutive days in the case of the deep and shallow Allar leases, for more than 90 consecutive days in the case of the Baggett leases, and for more than 60 consecutive days in the case of the Driver lease. “Operations” are defined as drilling, testing, completing, marketing, recompleting, deepening, plugging back or repairing of a well in search for or in an endeavor to obtain production of oil, gas, sulphur or other minerals, or the production of oil, gas, sulphur or other minerals, whether or not in paying quantities

In this discussion, when we discuss “the deep rights”, we mean the rights to develop and extract hydrocarbons from depths below 1,500 feet. When we discuss “the shallow rights”, we mean the rights to develop and extract hydrocarbons from the surface to 1,500 feet.

Our goal is to develop our properties to fully exploit all of their resources, but we have not been able to do this to date because we lack working capital. Our plan is to earn revenue by assigning our rights to develop the properties covered by our leases, rather than by undertaking the expense and the risk of the exploration and development. On May 8, 2006, we entered into a letter agreement with Chesapeake Exploration Limited Partnership for the deep rights associated with the deep Allar lease, the Baggett leases and the Driver lease. In conjunction with the letter agreement, we executed an assignment of the deep rights included in the deep Allar lease, the Baggett leases and the Driver lease (collectively, the “assigned leases”) to Chesapeake on June 9, 2006. The assignment is subject to all the applicable terms and provisions of the letter agreement. We retained the shallow rights in the assigned leases and, because the letter agreement only covers deep rights, we did not assign the shallow Allar lease.

In the letter agreement, Chesapeake agreed to initiate drilling operations on the land covered by the assigned leases before the end of their primary terms in February 2007. If Chesapeake successfully completes a well capable of producing hydrocarbons in commercial quantities, the assignment of oil and gas leases to Chesapeake will become permanent. No other specific provisions in the assignment govern expiration or termination. We cannot guarantee that Chesapeake will successfully develop the oil and gas reserves on the properties covered by the assigned leases.

If Chesapeake successfully develops the properties in accordance with the terms of the letter agreement, Chesapeake will be entitled to recover all of the costs of drilling, completing, equipping and operating the first 10 wells. Thereafter, we will be entitled to a 25% working interest in Chesapeake’s interest in the wells. We also have the right to participate in any wells that Chesapeake drills after the first 10, with a 25% working interest if we elect to participate from the outset and pay our proportionate share of the costs, or a 6.25% working interest after Chesapeake recovers its costs if we elect not to participate and pay our proportionate share.

The letter agreement also permits us to propose a well if Chesapeake fails to begin drilling a well on acreage covered by the assigned leases at least sixty days before the expiration of the terms of the assigned leases. Chesapeake may participate in any proposed well, so long as it consents within fifteen days of our proposal.

While we retained the shallow rights to all of the leases and have, under the terms of the letter agreement, the right to drill wells on the undeveloped portion of the leased properties, we do not have the funds to develop these rights.

Under the terms of the letter agreement, aside from initiating drilling operations, Chesapeake is required to

| · | obtain a 3-D seismic survey over the area covered by the assigned leases at its own expense, |

| · | provide interpretive data relating to the acreage covered by the assigned leases, and, in the initial well, |

| · | provide an array of logs, including a magnetic imaging log and sidewall cores in the shallow zone of the assigned lease, |

| · | assign to us our proportionate interest in wellbores according to the level of participation that we have elected, |

| · | transport our gas for $0.50/mcf (mcf means 1,000 cubic feet), which includes processing fees and costs, and market our gas for $0.03/mcf, and |

| · | immediately begin the process of building, or procuring, a pipeline to transport the gas to market once it has successfully completed a well capable of producing natural gas in commercial quantities. |

Chesapeake has drilled four wells—two on the acreage covered by the Baggett leases and two on the acreage covered by the deep Allar lease—and has paid shut in royalties to extend the terms of the Baggett and the deep Allar leases. One of the wells on the Allar acreage was completed as a dry hole. The remaining three wells are waiting on a pipeline.

Chesapeake did not initiate drilling on the property covered by the Driver lease that we assigned to it. Instead, Chesapeake, through a partner, top-leased the acreage covered by the Driver lease to February 2010 but obtained only an undivided 68.75% interest in the oil, gas and all other mineral rights. Our proportionate interest in the Driver lease is 25% of Chesapeake’s interest in the deep rights and 100% of Chesapeake’s interest in the shallow rights. We are entitled to our proportionate share of any additional interest that Chesapeake acquires in the Driver lease. Chesapeake has informed us that it acquired an additional 11.25% interest in the Driver lease, for a total of 80%, which increases our interest in the deep rights to 20% and in the shallow rights to 80%. We have not seen the agreement under which Chesapeake takes its interest in the Driver lease and are relying entirely on Chesapeake’s representations that we have an interest in the Driver lease.

Critical accounting estimates

An appreciation of our critical accounting estimates is necessary to understand our financial results. These policies may require that we make difficult and subjective judgments regarding uncertainties, and, as a result, our estimates may significantly impact our financial results. The precision of these estimates and the likelihood of future changes depend on a number of underlying variables and a range of possible outcomes. Other than our accounting for our oil and gas properties, our critical accounting policies do not involve a choice between alternative methods of accounting. We have applied our critical accounting policies and estimation methods consistently.

Oil and gas reserves

We follow the full cost method of accounting whereby all costs related to the acquisition and development of oil and gas properties are capitalized into a single cost center referred to as a full cost pool. Depletion of exploration and development costs will be computed using the units of production method based upon estimated proved oil and gas reserves. Under the full cost method of accounting, capitalized oil and gas property costs less accumulated depletion cannot exceed a ceiling of an amount equal to the present value, discounted at 10%, of estimated future net revenue from proved oil and gas reserves plus the cost, or the estimated fair value if lower, of unproved properties. If capitalized costs exceed this ceiling, we would recognize the impairment.

Estimated reserve quantities and future net cash flows have the most significant impact on the results of operations because these reserve estimates are used in providing a measure of the overall value of our oil and gas properties.

Estimating accumulations of gas and oil is complex and is not exact because of the numerous uncertainties inherent in the process. The process relies on interpretations of available geological, geophysical, engineering and production data. The extent, quality and reliability of these technical data can vary. The process also requires certain economic assumptions, some of which are mandated by the Securities and Exchange Commission, such as gas and oil prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. The accuracy of a reserve estimate is a function of the quality and quantity of available data, the interpretation of that data, the accuracy of various mandated economic assumptions, and the judgment of the persons preparing the estimate.

We have not conducted a reserves estimate on our properties because our oil and gas properties are not in production.

The most accurate method of determining proved reserve estimates is based upon a decline analysis method, which consists of extrapolating future reservoir pressure and production from historical pressure decline and production data. The accuracy of the decline analysis method generally increases with the length of the production history. Once we have producing wells, their production history will be relatively short, so we will have to use other (generally less accurate) methods such as volumetric analysis and analogy to the production history of wells of other operators in the same reservoir in conjunction with the decline analysis method to determine our estimates of proved reserves, including developed producing, developed non-producing and undeveloped. As the wells produce over time and more data become available, we will re-determine the estimated proved reserves on an annual basis and may adjust them based on that data.

Once the wells are actually producing gas and oil, gas and oil prices, revenue, taxes, development expenditures, operating expenses and reserves of recoverable gas and oil most likely will vary from our estimates, and any significant variance could materially affect the quantity and present value of our reserves. We may adjust estimates of proved reserves to reflect production history, acquisitions, divestitures, ownership interest revisions, results of exploration and development and prevailing gas and oil prices. Our reserves may be susceptible to drainage by operators on adjacent properties.

Our unproven properties are evaluated quarterly for the possibility of potential impairment. During the nine months ended September 30, 2007 we did not record any impairment charges against the unproven oil and gas properties.

Concentration of Credit Risk

Financial instruments that potentially subject us to concentration of credit risk consist principally of cash deposits. At September 30, 2007, and December 31, 2006, we had approximately $694,000 and $100,000, respectively in cash that was not insured. This cash is on deposit with a major chartered Canadian bank. We have not experienced any losses in cash balances and do not believe we are exposed to any significant credit risk on cash and cash equivalents.

Recent accounting pronouncements

Refer to Note 2 of our Notes to Consolidated Financial Statements as of December 31, 2006, filed in our registration statement on Form SB-2 which was declared effective by the Securities and Exchange Commission on September 17, 2007, for a discussion of recent accounting standards and pronouncements.

We had a net loss of $145,325 during the nine months ended September 30, 2007. At September 30, 2007, we had a cash balance of $694,516. When our cash balance is offset against our current obligations of $1,479 in accounts payable and $165,516 due to a related party, we are left with working capital of $527,521 at September 30, 2007.

We believe that our cash and cash equivalents as of the date of this filing are adequate to satisfy our working capital needs for the next twelve months.

Our independent registered public accounting firm has added an explanatory paragraph to their audit opinion issued in connection with our consolidated financial statements for the year ended December 31, 2006, which states that our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to locate profitable oil and gas properties, generate revenue from oil and gas production and control our drilling, production and operating costs. We plan to mitigate our losses in the future through an agreement with Chesapeake whereby Chesapeake has agreed to initiate drilling operations on the oil and gas properties and pay the exploration, drilling, completing, equipping and operating costs associated with developing the oil and gas properties. Based upon our current plans, we expect to incur operating losses in the future and cannot assure that we will be able to obtain additional financing, locate profitable oil and gas properties, generate revenue from oil and gas production or control drilling, production or operating costs, or that Chesapeake will initiate drilling operations or pay for the exploration, drilling, completing, equipping or operating costs associated with developing the oil and gas properties. The accompanying unaudited condensed consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Related-party transactions

At September 30, 2007 we were indebted to Brek in the amount of $165,516, which includes $150,000 in management and administrative fees billed to us by Brek. This payable bears no interest, is unsecured, and has no fixed repayment terms.

Our president has overriding royalty interests in all oil, gas and other minerals produced of 3.17%, in seven of our oil and gas leases and 1.5% in one of our oil and gas leases.

Comparison of the three and nine months ended September 30, 2007

Overall results of operations

During the nine months ended September 30, 2007, we had a net loss of $145,325, primarily due to professional fees.

Expenses

During the three months ended September 30, 2007, we incurred $142,940 in expenses, all of which we spent on professional fees for management and administration.

During the nine months ended September 30, 2007, we incurred $146,284 in expenses, approximately $146,000 of which was spent on professional fees for legal, accounting, management and administrative services.

We expect our expenses to increase following the spin-off because Brek will no longer be required to pay our legal, accounting and regulatory costs.

During the three and nine months ended September 30, 2007, we did not earn any interest income because the note receivable from Brek was repaid during the fourth quarter of 2006. We earned interest income of $1,216 for the period from inception (August 10, 2006) to September 30, 2006, on the note receivable from Brek.

Liquidity and Capital Resources; Plan of Operation

Liquidity and Capital Resources

In the notes to our condensed consolidated financial statements as of September 30, 2007, we caution that our ability to continue as a going concern is uncertain. We have not generated any revenue to cover our expenses and we have accumulated a deficit of $152,804. As of September 30, 2007, we had $166,995 in current liabilities. When these liabilities are offset against our current assets of $694,516 cash, we are left with working capital of $527,521. On June 7, 2007, we issued 4,000,000 shares of our common stock at $0.15 per share to Brek for $600,000 cash. The funds we raised in this offering should be adequate to support our operations for the next 12 months. We are in the early stage of exploration and we have not produced any revenue from our oil and gas properties. Thus far, management has devoted most of its time to conducting exploratory work and developing our business. Our plans over the next twelve months include ceasing to be a subsidiary of Brek, raising equity capital, and exploring and developing our properties through our agreement with Chesapeake

We are not certain that Chesapeake will be able to develop our properties, profitably or at all. Since May 8, 2006, the date of the Letter Agreement with Chesapeake, Chesapeake has begun drilling operations on the properties covered by eight leases, designing a pipeline, and negotiating with various landowners for permission to cross their lands to build the pipeline. If Chesapeake successfully obtains the appropriate easements and builds the pipeline, we expect that Chesapeake can sell the gas produced. If Chesapeake can develop the properties, the fluctuation of gas prices will impact the amount of revenue earned from the leases. If the resources required to develop the wells are in high demand, the development costs will increase, which will likely delay our earning any revenue. We are dependent on Chesapeake to both produce the gas and buy the gas produced. We cannot be certain that we will ever receive revenue from our agreement with Chesapeake.

The following table summarizes our sources and uses of cash for the following periods:

| Sources and uses of cash | |

| | | | |

| | | Nine Months Ended September 30, 2007 | | August 10, 2006 (Inception) to September 30, 2006 | |

| | | | | | |

| Net cash (used in) provided by operating activities | | $ | (5,775 | ) | $ | 292 | |

| Net cash provided by financing activities | | | 600,000 | | | - | |

| Net increase in cash | | $ | 594,225 | | $ | 202 | |

Net cash used in operating activities

We used $5,775 of cash in operations during the nine months ended September 30, 2007 to pay accounts payable of $2,596 and to fund our net loss of $146,284, which was our net loss before our minority interest allocation of $959. Our net loss includes the reversal of accrued liabilities of $8,500 and was offset by an increase in the amount due to our parent company Brek of $151,615.

Net cash used in investment activities

During the nine months ended September 30, 2007, we did not have any investment activities.

Net cash provided by financing activities

During the nine months ended September 30, 2007, we sold 4 million shares of our common stock at $0.15 per share for total proceeds of $600,000.

Plan of Operation

On October 4, 2007 Chesapeake paid a shut in royalty to extend the terms of the Baggett leases. Chesapeake expects to start drilling again on the Baggett leases at the beginning of 2008. As a result of Chesapeake’s actions, all of the acreage covered by the assigned leases has been secured beyond the original termination dates of the leases. However, as noted under “Our Objectives and Areas of Focus” above, in order to continue the terms of the assigned leases beyond the original termination dates, operations cannot cease for the periods of time specified in the leases. Chesapeake began operations on a second well on the Baggett acreage on June 2, 2007, and on the Allar acreage on August 8, 2007. The primary term of the new Driver lease expires in 2010, so no operations are required on the Driver acreage until then. We sent the data from the wells drilled on the Allar acreage for a professional review to determine the potential in the shallow zone. The results were not encouraging. We do not intend to conduct operations of our own to extend the term of the shallow Allar lease, so the lease will expire unless the operations that Chesapeake conducts into the deep zone qualify to extend the term of the shallow Allar lease.

We plan to seek other oil and gas projects as our financial condition permits, and to find experienced operators to develop the properties in exchange for a working interest on terms similar to the agreement we have with Chesapeake.

We have no other operations. If our oil and gas leases are not successfully developed, we will earn no revenue.

In March 2007, we sold 4,000,000 shares of our common stock to Brek at a price of $0.15 per share for gross proceeds of $600,000. We estimate that our annual operating costs will be about $240,000, which does not include the costs of acquiring future oil and gas leases or properties. These costs are made up of our administrative, legal and accounting costs. Nathan’s operating costs are paid by Vallenar. If Vallenar’s working capital is insufficient to meet its own and Nathan’s operating costs, then Vallenar will be required to raise the funds necessary to continue its and Nathan’s operations. If that were the case, we would likely provide additional capital to Vallenar, either in the form of a loan or through an investment in additional shares of Vallenar’s common stock. However, we cannot guarantee that we will have the cash available if Vallenar or Nathan needs money, or that we would be able obtain funding from a third party.

We cannot guarantee that Chesapeake will successfully develop the oil and gas reserves on the properties covered by the leases or that we will be able to rely on any other source for cash to cover our cash requirements if we were unable to do so.

We do not expect to purchase a plant or any significant equipment or to have any significant changes in the number of employees over the next twelve months.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenue or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors. We do not have any non-consolidated, special-purpose entities.

Contingencies and commitments

We had no contingencies or long-term commitments at September 30, 2007, and have none as of the date of this filing.

As is customary in the oil and gas industry, we may at times have agreements to preserve or earn acreage or wells. If we do not perform as required by the agreements, which might require that we pay money or engage in operations such as drilling wells, we could lose the acreage or wells.

Contractual obligations

We did not have any contractual obligations at September 30, 2007, and do not have any as of the date of this filing.

Internal and external sources of liquidity

We have funded our operations solely through subscriptions for common shares. We have no commitments for financing.

Inflation

We do not believe that inflation will have a material impact on our future operations.

Item 3. Controls and Procedures.

Disclosure Controls and Procedures

Richard N. Jeffs, our chief executive officer and chief financial officer, has evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15 and 15d-15 under the Securities Exchange Act of 1934 (the “Exchange Act”)) as of the end of the period covered by this quarterly report (the “Evaluation Date”). Based on such evaluation, Mr. Jeffs has concluded that, as of the Evaluation Date, our disclosure controls and procedures are effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

Changes in Internal Controls

During the quarter of the fiscal year covered by this report, there were no changes in our internal controls or, to our knowledge, in other factors that have materially affected, or are reasonably likely to materially affect, these controls and procedures subsequent to the date we carried out this evaluation.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

Not applicable

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

Not applicable

Item 3. Defaults Upon Senior Securities.

Not applicable

Item 4. Submission of Matters to a Vote of Security Holders.

Not applicable

Item 5. Other Information

Not applicable

Item 6. Exhibits

| Exhibit No. | | | Title | |

| 3.1 | | | Articles of Incorporation(1) | |

| 3.2 | | | Bylaws(1) | |

| 31.1 | | | Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* | |

| 31.2 | | | Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* | |

| 32 | | | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002* | |

(1) Incorporated by reference from the registrant’s registration statement on Form SB-2, SEC File No. 333-139312, filed with the Securities and Exchange Commission on December 13, 2006.

*Filed herewith.

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of 1934, Rock City Energy Corp. has caused this report to be signed on its behalf by the undersigned duly authorized person.

| | ROCK CITY ENERGY CORP. | |

| | | | |

| Date: November 13, 2007 | By: | /s/ Richard N. Jeffs | |

| | | Richard N. Jeffs | |

| | | Director, President and Chief Financial Officer (Principal Executive Officer and Principal Financial Officer) | |