3 To our stockholders INTRODUCTION Fiscal 2018 was an exceptional year for Broadridge. We reported strong financial results and increased the level of investment in our business by spending on new technologies, new products and investing in our associates. These achievements were recognized in the marketplace as Broadridge generated total shareholder return of 55%, putting us well into the top quartile of S&P 500 companies. Speaking of the S&P 500, Broadridge shares were added to that index in June 2018, recognition of our strong track record of execution and value creation as a Fintech leader since becoming a public company 11 years ago. Broadridge enters fiscal 2019 better positioned than ever for future growth. As CEO, I keep a mental scorecard of where we stand on culture, strategy, products, investments, client satisfaction, pipeline, and backlog to help me assess the outlook for our company. Culture is the most important element, and Broadridge has built a strong and unique client-focused corporate culture, based on the Service-Profit Chain. Strategy is next. We have the right strategy and the right products to take advantage of the large and growing demand for our services by extending our strong franchises in governance and capital markets and by targeting new opportunities in wealth management and in international markets. Further, we are making the investments we need in new products and new technologies to drive long-term growth. Critical to my CEO scorecard is that each of those investments is tied to a tangible market opportunity, with real dollars behind it and clear senior executive sponsorship. Finally, we are winning in the marketplace. The combination of our focus on clients and broad product set drives strong client satisfaction, which, in turn, results in a 97% client revenue retention rate. Looking forward, our sales pipeline is strong and includes multiple discussions with clients about potentially transformative transactions for our technology and communications solutions. Our backlog, aided by another year of record closed sales, rose 18% to a very healthy $295 million. When I look at my scorecard, I am more bullish than ever. Given that strong position, my tenure and age, the time is right for Broadridge to transition to new leadership. I am extremely pleased that Tim Gokey, our current President and Chief Operating Officer, and my long-time partner in managing our business, will become Broadridge’s next CEO on January 2, 2019, and I will become the Executive Chairman of the Broadridge Board of Directors. There is no more committed and capable executive in Fintech than Tim. Since joining Broadridge in 2010, Tim has served in a variety of leadership positions. As the architect of the turnaround in our GTO segment and author 2018 Annual Report Broadridge enters fiscal 2019 better positioned than ever for future growth There is no more committed and capable executive in Fintech than Tim

4 of our current growth strategy, Tim has played a key role in helping us transform Broadridge into a Fintech leader. He will bring to his new role a deep knowledge of the financial services industry honed as a Partner at McKinsey and executive at H&R Block, a keen understanding of the importance of innovation to our future success, and a proven track record of delivering sustained growth at Broadridge. I am confident that our company will be in strong hands. In my new role as Executive Chairman, I will manage the Board and will continue to work on regulatory matters, including digital adoption and raising retail investor engagement. Les Brun, our current Chairman, will continue to serve on our Board as Broadridge’s Lead Independent Director. STRONG FISCAL 2018 PERFORMANCE Broadridge delivered very strong financial results in fiscal 2018, including record closed sales up 14%, total revenues up 5% to $4.3 billion, 10% growth in Adjusted operating income and Adjusted EPS growth of 34%. Just as importantly, we were able to balance strong bottom-line performance with making the important investments that will sustain our market leadership and deliver long-term growth. ARTIFICIAL INTELLIGENCE We are bringing to market innovative solutions that help our clients harness the transformational power of AI. We continue to recognize the potential of artificial intelligence to help our clients streamline operations, make better decisions and enhance customer engagement. We are exploring ways to apply AI, including machine learning and robotic process automation, in innovative ways across segments and functions, from trade allocation and securities financing to investment accounting.

5 I will start my review of those results with my favorite topic: closed sales, or, to be more specific, record closed sales! Broadridge reported a record $215 million in closed sales, up 14% from fiscal 2017. What is really exciting about this performance is not just the growth, but the breadth and quality of the mandates we’ve won, which touch all aspects of our business, worldwide. This remarkable performance reflects our strong value proposition as we help our clients get ahead of today’s challenges to capitalize on what’s next and drive the transformation of their businesses. For example, our Governance business signed a fast-growing new client and an extension with a major existing client that included a significant expansion of services. In Capital Markets, we added the North American operations of a major Asian bank and won two new clients in the Japanese market. And, in Wealth Management, we grew our business with a significant retail brokerage client, further expanded our reach in the Canadian market, and recorded notable wins in our front-office advisory solutions products. Both of our operating segments performed well in fiscal 2018. The Investor Communication Solutions (ICS) segment delivered revenue growth of 3% in fiscal 2018 to $3.5 billion. ICS recurring fee revenues, which exclude distribution revenues and event-driven revenues, grew a solid 5%. 2018 Annual Report BLOCKCHAIN DIGITAL CLOUD Our cognitive marketing tool combines AI with advanced analytics and deep learning technology to help advisors identify prospects and make personal connections. Smart Insights™ What is really exciting is the breadth and quality of the mandates we’ve won

6 The biggest contributors to this growth were our core proxy and mutual fund governance products, which benefited from the continued demand for stocks, mutual funds, and exchange traded funds (ETFs). As I’ve said in the past, the popularity of these investments has consistently trended upward over time, creating increased demand for our governance and proxy services, and fiscal 2018 was no exception. We also benefited from strong demand for our data and analytics products and for our wealth management products, which target front-office financial advisors. Customer communications revenues were flat for the year, in part because of subscriber losses at some of our larger clients. More encouraging is that our clients are increasingly recognizing the value that Broadridge can bring to them as a result of our investments in digital distribution. Our customer communications pipeline is strong and we are building the digital capabilities that will drive continued market leadership. Event-driven activity was another important contributor to the growth in ICS revenues. By definition, event-driven activity does not reoccur on a predictable annual cycle. In fiscal 2018, Broadridge benefited from a proxy vote at a very large mutual fund complex as well as several large equity proxy contests. The activity behind these revenues is very much a part of the corporate governance process in which Broadridge plays such a critical role. When mutual fund complexes go out for a proxy vote every five or so years, they are able to do so because Broadridge built and maintains an infrastructure that enables them to communicate with millions of investors and accurately count tens of millions of votes to get them the approvals they need on governance matters. Another driver of event-driven revenues is a proxy contest, where in addition to management, activists also send a proxy, with both sides using our infrastructure to make multiple distributions in an effort to persuade shareholders to vote one way or the other. Regardless of whether the meeting is routine or contested, Broadridge is the honest broker in this process and we prove it every day through transparency and independent verification. Our Global Technology and Operations (GTO) segment keeps getting stronger, with revenue growth of 10% to $912 million. The biggest growth driver continues to be the addition of new clients onto our platforms. Our clients continue to face pressure to reduce both the cost and complexity of their operations and they see Broadridge as a partner who can help them achieve that goal. Our Global Technology and Operations segment keeps getting stronger

7 An added benefit to our growth in fiscal 2018 was an increase in trading volume across both equity and fixed income markets. A third growth driver was the increasing demand for non-trade services, including professional services, where clients are turning to us to help them implement new technology and streamline their operations. As in the past, we converted Broadridge’s revenue growth into even stronger earnings growth while continuing to invest in our business. We strengthened our existing product suite by investing in new technologies like blockchain, cloud, and AI. We increased investment in products that will drive growth over the next three to five years, like fixed income, tax, advisor tools, data and digital. And we invested in our associates by increasing benefits and raising our minimum hourly wage as part of our focus on the Service-Profit Chain. Even with these investments, we delivered strong 10% growth in Adjusted operating income. Combined with the benefits of tax reform, this resulted in a 33% increase in Adjusted net earnings to $504 million and a 34% increase in Adjusted earnings per share to $4.19. I am very pleased with our strong financial results. BALANCED CAPITAL ALLOCATION STRATEGY We generate a significant amount of cash flow every year. What we do with that cash —your cash—to grow our business and create value for our stockholders is one of the most important decisions we make. At Broadridge our focus remains on using that cash in a balanced way to invest in our business and reward our stockholders through dividends and share repurchases. We view acquisitions as an integral part of the investments we are making in broadening our product lineup. Broadridge invested $148 million in M&A in fiscal 2018, completing six tuck-in acquisitions to strengthen our data capabilities and expand the range of services we offer to funds and corporate issuers. We also invested $98 million in capital expenditures and software investments, including the upgrade of our GTO center of operations, where we moved into a modern facility in the Gateway complex in downtown Newark, New Jersey. We returned a total of $391 million to stockholders. Broadridge’s commitment to a strong dividend is an important component of our strategy to create long-term shareholder value. This year, we returned $166 million through the dividend, and, consistent with our commitment to a target payout ratio of 45% of our Adjusted net earnings, the Board approved a 33% annual dividend increase to $1.94 per share for fiscal 2019. Broadridge has 2018 Annual Report

8 ARTIFICIAL INTELLIGENCE increased its dividend every year since becoming a public company. That’s 11 consecutive years, including seven years in a row of double digit increases, of delivering higher returns to our shareholders. Share repurchases are the final aspect of our balanced capital allocation strategy. In fiscal 2018, we repurchased 2 million shares, returning $225 million to stockholders in the process. A LARGE AND GROWING MARKET An important reason I am so confident in the outlook for Broadridge is our large and growing addressable market. We have estimated the size of the market to be $40 billion. From my seat, I see Broadridge’s market opportunity as unlimited for all practical purposes. Client focus is a core principle of our Service-Profit Chain culture and I spend at least 50% of my time—more when my other responsibilities allow it—focused on client issues. So I hear firsthand in meeting after meeting about both the challenges and opportunities that our clients face. I know corporate issuers and mutual funds are looking for the most efficient and effective means of communicating with shareholders, and that their needs here have only increased given cost pressures and the rise of activism as an asset class. Our patented blockchain technology solution, successfully piloted with leading global banks, will transform proxy voting and repo agreement processes through distributed ledger technology. Patent secured I see Broadridge’s market opportunity as unlimited for all practical purposes

9 DIGITAL BLOCKCHAIN CLOUD I hear regularly how financial institutions face pressure to cut operating costs, optimize capital and liquidity, meet increasingly complex regulatory requirements across multiple geographies, and adapt to evolving technologies. And I understand that wealth managers are seeking ways to remain relevant and profitable and differentiate themselves in the face of the rapid growth of alternative brokerage options, the growth of ETFs/passive products, and ever-changing regulations, among other challenges. The good news is that Broadridge brings solutions to bear on each one of those problems and more. As a Fintech leader, our breadth and depth of knowledge and hands-on delivery, together with our powerful technology platforms, empower our clients to navigate the needs of today and tomorrow for their own clients. A CLEAR STRATEGY TO DELIVER NETWORK VALUE AND LONG-TERM GROWTH Another reason I am confident in our future is that we have the right strategy to go after that large and growing market opportunity. It’s a clear strategy, because if there is a lesson I have learned in four decades of developing and executing business plans, it is that there is a direct relationship between a plan’s clarity and its execution. So there are only three primary elements to the Broadridge growth strategy. First, we will extend our Governance 2018 Annual Report We are applying innovation to real-world challenges for measurable results. Broadridge is a blockchain leader. As our clients face increasing cost pressure, transitioning technologies and other challenges, we continue to invest both organically and strategically in blockchain innovation. We have successfully partnered with leading global banks on proofs of concept and live pilots, including a global proxy pilot with Banco Santander, JP Morgan and Northern Trust to test practical uses for blockchain in investor voting.

10 The concept of network value is critical to our plans Alone you’re a company. Together, we’re an industry. franchise. Second, we will drive growth in our Capital Markets franchise. And third, we intend to build our next franchise business in Wealth Management. We see compelling opportunities across all three fronts in North America and globally. A key word in that strategy is franchise. At Broadridge, we define franchise as a business having a truly differentiated value proposition and, more importantly, as one that creates network value. The concept of network value is critical to our plans and important in understanding how we think about our business. The basic concept of network value is that the value for our services increases as we add more clients to our platform and greatly exceeds that of any point-to-point solution. How does Broadridge deliver network value to our clients? Five ways: 1. Our mutualized platform enables economic efficiencies for all parties across mission critical functions. That is the power of scale. 2. Our visibility across the ecosystem allows us to enhance all clients’ compliance, risk management and other capabilities. That “halo effect” comes from the breadth of our client base, which gives us the ability to address issues emerging at one client and apply a solution that serves all. 3. Our ability to harness data from the network to deliver critical and real-time insights to all participating clients beyond just their firm, providing a broader and more accurate market perspective. 4. Our scale and deep focus allow us more rapidly to transition our clients to next-gen technologies, including what we are calling the Broadridge ABCDs of innovation: AI, Blockchain, Cloud and Digital. 5. Our platforms enable clients to take advantage of our industry-leading cybersecurity capabilities, which require significant and sustained levels of investment. Our clients need to know that their data is secure as it passes through our platforms and we are among only a handful of firms who have the scale to make those investments and to earn that level of trust. At the end of the day, it’s really quite simple. Our aim is to make sure clients understand the benefits that being in Broadridge’s network, along with hundreds of other clients, can provide in the form of lower cost, reduced complexity, and increased effectiveness. Alone you’re a company. Together, we’re an industry. The last part of our strategy is about ensuring that we keep our focus on the long-term growth of our business. That means having the fortitude to invest in new products and

11 new technologies that will be critical to the next phase of our growth. All too often, and especially for publicly-traded companies, the pressure to generate near-term profits can crowd out medium-term investments. At Broadridge, we are committed to sustaining our leadership position by making sure that we deliver value to our clients today...and even more value tomorrow. All of our activities are underpinned by a long-term commitment to exceptional client service aligned with the Service-Profit Chain. Our growth strategy is clear. EXTENDING OUR GOVERNANCE FRANCHISE So how are we doing on the execution? I will start with governance, where we are driving four broad opportunities to extend our Governance franchise. The first large opportunity is to drive the next-generation of regulatory communications. Recent actions by the Securities and Exchange Commission (SEC) have only increased my excitement about how Broadridge can apply our technology to transform how funds and issuers communicate with their shareholders. The SEC appears to have clear goals: utilize technology to increase shareholder engagement, further drive down costs, and strengthen our system of corporate governance. From my perspective of 40 years of experience in engaging with the SEC on these issues, I have never seen greater alignment between its goals and Broadridge’s unique ability to facilitate those goals through the creation of enhanced content, delivered digitally in a personalized format, compounded by our long-term history of driving down costs. We’re not aware of another company that can match our capabilities. We are working with clients and with the SEC to create enhanced content for ETF and mutual fund investors and, potentially, for equity investors. That means interim and annual reports that deliver more relevant information to shareholders in a format that is easy to read and digest, and works both on paper and in an interactive digital format that costs less to deliver. This capability is unique to Broadridge. We continue to drive conventional and next-generation digital delivery. We invested further in our digital capabilities with the acquisition of ActivePath, and we have realigned our customer communications organization to focus more intensely on growing our digital revenues. Our clients are taking notice and increasingly see this as a key differentiator for Broadridge. 2018 Annual Report

12 ARTIFICIAL INTELLIGENCE Finally, Broadridge is making blockchain a reality in proxy voting. After running a non-U.S. shareholder meeting on blockchain for each of the past two years, we now have an end-to-end solution built on distributed ledger technology for the U.S. proxy market, and in fiscal 2018 we conducted the first annual meetings on blockchain for North American issuers. Broadridge will join that list this fall, as our 2018 Annual Meeting will also be conducted on blockchain. We also successfully completed pilots in partnership with our Capital Markets clients to test the effectiveness of blockchain in bilateral repurchase agreements, demonstrating the power of this technology to improve these processes as well. More and more, Broadridge is a blockchain leader. Data is the second broad opportunity and focus area for us to extend our Governance franchise. We are integrating the data from our governance products with other data sources to deliver insight to our clients, especially our investment management clients. Over the past year we have made several acquisitions to extend our data capabilities for global asset managers, including Spence Johnson, the Morningstar fund advisory product, and MackayWilliams. We expect these acquisitions to both broaden and deepen our available data sets and help sustain the momentum we are seeing in the marketplace. CLOUD We are accelerating adoption of cloud technology by enabling a streamlined, secure and cost-effective migration path for clients. The cloud continues to open up new opportunities for firms to optimize operations, reduce costs and grow profitably. Broadridge is uniquely positioned to help our clients capitalize on these opportunities. Our standardized processes and technology, built on a leading cloud platform and supported by a dedicated team, help mutualize costs and reduce risks. Broadridge is making blockchain a reality in proxy voting. More and more, Broadridge is a blockchain leader.

13 A third and critical element of our strategy is to build a leading omni-channel, cloud-enabled communications hub for high value customer communications. As I have shared with you in the past, our clients are frustrated that 20 years since email access has become ubiquitous, the vast majority of bills and statements continue to be delivered on paper to a physical mailbox. Having already saved our clients billions of dollars over the past decade by successfully digitizing 64% of regulatory and proxy communications, we see this as a significant opportunity. Broadridge aims to play a key role in helping the industry transform from the two-dimensional world of email and physical mail into a more multi-dimensional world that incorporates an ability to deliver communications directly to a consumer’s chosen cloud drive. To make this vision a reality, we have created a dedicated digital sales team and invested in digital technology that enhances the consumer experience around consumer statements, bills, and regulatory communications, furthering our capacity to deliver enhanced digital content for our clients. We are also testing our ability to deliver statements directly to a widely-used cloud drive. Our clients are paying attention. They know that they need to transform their digital delivery capabilities to be ready for this evolution. Broadridge’s work in building out our next-gen communications hub is a critical selling point with key strategic clients and we are seeing a growing pipeline of opportunities. BLOCKCHAIN DIGITAL 2018 Annual Report Cloud first Our “cloud first” approach to development lets us offer more solutions as a service to our clients each day and ensure that all new products are cloud-optimized.

14 We continue to make strong progress in bringing new clients onto our global post-trade technology platform The last element of our governance strategy is an increased focus on serving corporate issuers. Almost every public company around the globe relies on Broadridge in varying degrees in their annual meeting process. We see an opportunity to continue to build on these relationships to offer a broader array of services. In fiscal 2018, we expanded our range of issuer services through the acquisition of Summit Financial, adding document management capabilities to our product portfolio. In addition, we are ramping up our efforts to encourage sustained engagement with retail shareholders by corporate issuers. Too often, it takes a proxy contest for corporate managements to reach out to retail shareholders to get their message out and encourage them to vote. This is a missed opportunity. We are working to persuade companies to communicate regularly, keeping their retail shareholders up to date on key strategic matters and on their performance. Making an effort to drive retail shareholder engagement on a regular basis seems to me to be an inexpensive form of insurance. That is especially true when Broadridge can help them do it for a tiny fraction of what they might spend in the event of a contest. We are extending our Governance franchise. DRIVING OUR CAPITAL MARKETS FRANCHISE The second pillar of our growth strategy is to drive our Capital Markets franchise by helping our clients simplify and transform their complex technology and operations eco-systems. We continue to make strong progress in bringing new clients onto our global post-trade technology platform. For example, we now have a major client up and running across Europe, Asia and the Americas on a truly global platform. Earlier in the year we won a new contract with a Tier 1 bank in which we will bring six separate corporate actions systems into a single global platform managed by Broadridge. Demand for mutualization remains strong, and our recent wins in Japan and elsewhere point to the strength and breadth of this opportunity and validate our efforts to further build our business outside North America. We are also working to create additional network value for our capital markets clients. One important effort we are making is in the fixed income market. Today, approximately $5 trillion of fixed income transactions take place on our post-trade processing platform used by 18 of the 23 primary dealers. We see an opportunity to apply AI capabilities to the unique transaction data on our platform in order to bring additional liquidity to the very illiquid corporate bond market. We are in early days on this effort but have

15 committed real resources and I am excited about the long-term potential to deliver huge value to our clients. We are driving our Capital Markets franchise. BUILDING A WEALTH MANAGEMENT FRANCHISE Third, we see a significant opportunity to create value for our clients and stockholders by building a franchise business in wealth management. Wealth managers are faced with critical and conflicting mandates to reduce cost, integrate new technologies and deliver enhanced services to their clients, all while meeting ever increasing regulatory requirements. It’s an enormous challenge and they are asking Broadridge to help them reduce the cost and complexity of their operations to accomplish their goals. Broadridge already has a big footprint in wealth management, as we service the top 20 North American wealth providers in some capacity, and we have a set of strong products aimed at wealth management clients in both our GTO and ICS segments. The next step in creating a franchise is to develop an integrated platform that will create a seamless network that brings together our proprietary solutions across the front–, middle–, and back-office operations with other best-in-class capabilities. Client interest in this product is very high. In the meantime, we continue to see strong demand across both GTO and ICS for our wealth management point solutions. In GTO, we have won some significant new back-office business from retail wealth players in both the U.S. and Canada. In ICS, as I noted earlier, our front-office solutions for financial advisors contributed nicely to our overall growth in fiscal 2018. We are making good progress in building the next Broadridge franchise in wealth management. Finally, the drivers of demand across our markets are global so we are also working to expand the use of our solutions in markets outside North America. We notched several significant international sales wins in 2018, which is evidence that our efforts are paying dividends. We estimate a multi-billion dollar market opportunity exists internationally, and we are seeing clients expand their use of our services across new regions as new clients onboard to our platforms. Across governance, capital markets, wealth management and international, our strategy is working. 2018 Annual Report Broadridge already has a big footprint in wealth management

16 CLOUD READY FOR NEXT At Broadridge, we use “Ready for Next” as our tagline to remind clients that we will help them navigate risk, enrich client engagement, optimize efficiency and grow their business. To me, as the CEO, it is a commitment made to both our clients and associates that the work we do today is important and valuable and that we intend to ensure that the work we do tomorrow is more important and even more valuable. To you as an investor, it is a clear signal that we are spending real dollars today on new products and new technologies that are tied to real opportunities to drive our growth in the future. Our long-term focus paid off in fiscal 2018. Much of the recurring revenue growth we saw last year was a direct result of the initiatives we have been driving the past three years. Investments in growing our data capabilities, extending our product line in wealth management and in enhancing our global post-trade technology platform all contributed to our revenues and should continue to sustain our growth over the next several years. Going forward, we will continue to invest in new products and technologies that will drive our innovation roadmap and develop new products and services and prepare our clients for next generation challenges. Increasingly, our investment focus is on new Communications digitized 64% Driving the “print-to-digital” transformation, Broadridge has successfully digitized 64 percent of regulatory and proxy communications and 30 percent of customer communications for our clients. We are spending real dollars today on new products and new technologies that are tied to real opportunities

17 ARTIFICIAL INTELLIGENCE BLOCKCHAIN technologies, especially the Broadridge ABCDs of AI, Blockchain, Cloud, and Digital. We believe these offer compelling opportunities for Broadridge to utilize its experience and unique market perspective to build-out solutions that allow clients to turn disruption into opportunity for growth, and uncertainty into confidence. BROADRIDGE CULTURE AND THE SERVICE-PROFIT CHAIN One of the great lessons of my career is the importance of corporate culture to our success as a company and it is an area about which Tim and I are both passionate. Broadridge is committed to creating value for all stakeholders through the Service-Profit Chain, through which highly-engaged associates deliver superior service, generate strong business performance, and create shareholder value. We independently measure both associate and client satisfaction. We view every client as a 100-year client, and client satisfaction is the only common metric on which every one of our more than 10,000 associates is compensated. That foundation of partnership bolsters the work we do and earns our clients’ trust every day. As a result, we are consistently rated by our clients as a top vendor, which in turn creates greater loyalty and willingness to work more with Broadridge. 2018 Annual Report DIGITAL Building on our heritage of innovation, we continue to drive digital transformation. We see digitization as not just a center of efficiency and cost savings for our clients— but as an essential component for growth. That’s why we are committed to driving digital transformation. Our track record speaks for itself: Our investments have saved our clients billions of dollars over the past decade. And we are still extending our technology, data and channel partnerships to transform and accelerate the pace of digital adoption. Our recent acquisition of an Israeli-based digital technology company, ActivePath, helps our clients enhance the experience associated with statements, bills, and regulatory communications for their customers. One of the great lessons of my career is the importance of corporate culture

18 It takes engaged, dedicated and knowledgeable associates to serve clients well and create real and sustainable competitive advantage and value. Broadridge understands this, and we are committed to a culture of service and performance. This year, we took important steps to further enhance our employee pay and benefit programs, and to bolster the depth and talent of our management team across the organization. We increased hourly wages, expanded parental leave and vacation days, and raised our charitable giving match. We strive to be an employer of choice and are passionate about creating an environment in which every associate can thrive, build their knowledge and skills, and be rewarded for doing so. We are also pursuing Corporate Social Responsibility efforts designed to elevate the communities we touch around the world. The Broadridge Foundation is at the heart of our Company’s community efforts, and partners with organizations focused on providing educational opportunities in underserved areas. These programs have an impact on the lives of thousands of children around the world, and Broadridge is proud to play its part. We are also dedicated to reducing our environmental impact. This includes a focus on reducing paper waste, an issue that is aligned with the goals of our business to drive digital communications. Every client that converts to paperless delivery of shareholder materials contributes to fewer trees cut down, less carbon dioxide in our environment and

19 a reduction in the emissions stream that physical communications require. We’re proud of the positive impact we are having on the environment by driving digital adoption. THE BEST IS YET TO COME This is my last stockholder letter as CEO. After four decades of building and leading businesses, including nearly a dozen years as CEO, it’s hard for me to imagine what my life will be like after I leave Broadridge. The good news for me is that time has not come yet. I am delighted that Tim has encouraged me to stay and our independent Board members have appointed me Executive Chairman. In my new role I will manage the Board and work with Tim on specific regulatory matters for which I have an incredible passion, including digital adoption and working to better engage retail investors. My new activities will in many ways take me back to my entrepreneurial roots, when I focused less on the day-to-day management of the company and more on value propositions to evolve the Everything we do helps clients get ahead of today’s challenges to capitalize on what’s next. 2018 Annual Report

20 Rich Daly Chief Executive Officer governance marketplace to create opportunities for our business and to improve the effectiveness and efficiency of the process for brokers, issuers, funds and regulators. I am more excited about the future of our company today than when I sat down in my extra bedroom 30 odd years ago to write the first business plan for our communications business. The opportunities for Broadridge are bigger than ever. We have the right strategy, the right products and the right investments to ensure that we can deliver value to our clients today, more value tomorrow, and even more value in five years. We also have in Tim Gokey the right next CEO and a strong and deep management team to lead our company to that next level of growth. I want to thank all of our stockholders for their confidence in our management team and me. I also want to thank our Board of Directors for their independent guidance and insights that are so important to effective governance. Lastly, and most importantly, I want to thank my fellow Broadridge associates. At work, as in other areas of our lives, it is the people we surround ourselves with that make the difference. At Broadridge, the hard work and dedication of our associates have enabled us to build the great Fintech company that it has been my privilege to lead. The best is yet to come. Sincerely, The opportunities for Broadridge are bigger than ever

21 Results are presented in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”) except where otherwise noted. Please see our Explanation and Reconciliation of the Company’s Use of Non- GAAP Financial Measures on pages 24 and 25 of this Annual Report for a discussion of the Company’s use of Non-GAAP measures. (1) Adjusted Operating income and Adjusted Net earnings are Non-GAAP financial measures. (2) Free cash flow is a Non-GAAP financial measure defined by the Company as Net cash flows provided by operating activities less Capital expenditures and Software purchases and capitalized internal use software. (3) The computation of Adjusted earnings per share is a Non-GAAP financial measure defined as the Company’s Adjusted Net earnings divided by the Diluted weighted-average shares outstanding. FISCAL YEARS ENDED JUNE 30, 2018 2017 2016 (Dollars in millions, except per share amounts) Revenues $4,330 $4,143 $2,897 Operating income 595 532 500 Adjusted Operating income(1) 685 623 537 Earnings before income taxes 561 488 469 Net earnings 428 327 307 Adjusted Net earnings(1) 504 378 332 Free cash flow(2) 596 402 362 Diluted earnings per share 3.56 2.70 2.53 Adjusted earnings per share(3) 4.19 3.13 2.73 Cash dividends declared per common share 1.46 1.32 1.20 2018 Financial Highlights REVENUES (dollars in millions) 2018 $4,330 2016 $2,897 2017 $4,143 OPERATIN G INCOME (dollars in millions) 2018 $595 2016 $500 2017 $532 0 1000 2000 3000 4000 5000 2018 Annual Report

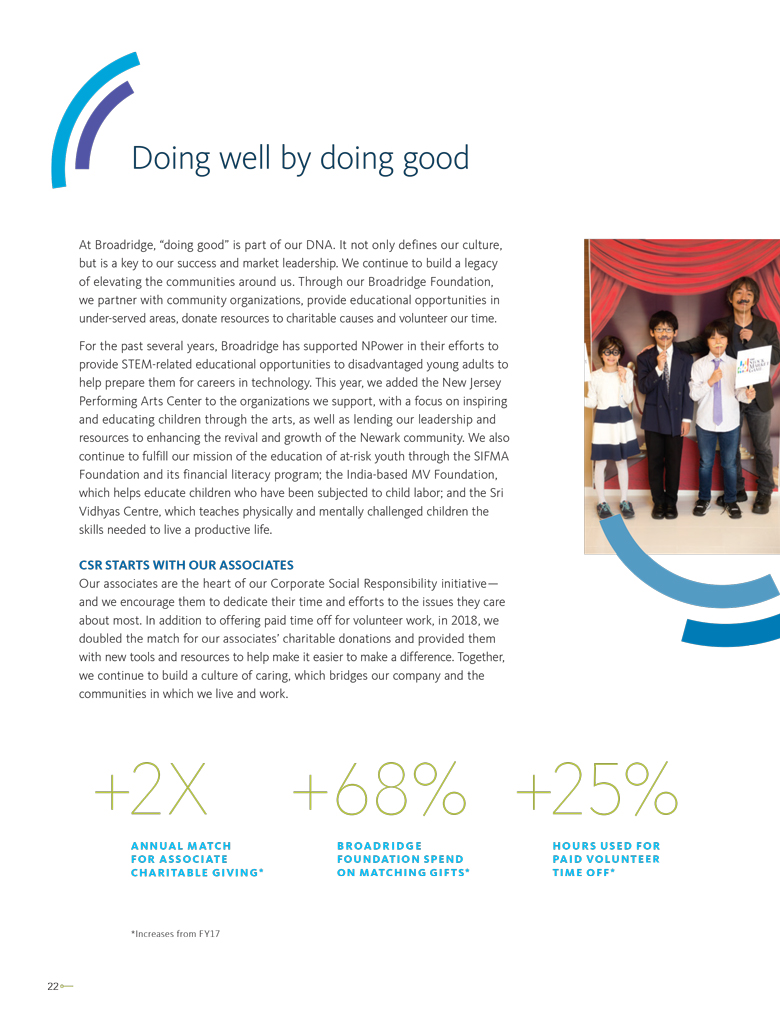

22 At Broadridge, “doing good” is part of our DNA. It not only defines our culture, but is a key to our success and market leadership. We continue to build a legacy of elevating the communities around us. Through our Broadridge Foundation, we partner with community organizations, provide educational opportunities in under-served areas, donate resources to charitable causes and volunteer our time. For the past several years, Broadridge has supported NPower in their efforts to provide STEM-related educational opportunities to disadvantaged young adults to help prepare them for careers in technology. This year, we added the New Jersey Performing Arts Center to the organizations we support, with a focus on inspiring and educating children through the arts, as well as lending our leadership and resources to enhancing the revival and growth of the Newark community. We also continue to fulfill our mission of the education of at-risk youth through the SIFMA Foundation and its financial literacy program; the India-based MV Foundation, which helps educate children who have been subjected to child labor; and the Sri Vidhyas Centre, which teaches physically and mentally challenged children the skills needed to live a productive life. CSR STARTS WITH OUR ASSOCIATES Our associates are the heart of our Corporate Social Responsibility initiative— and we encourage them to dedicate their time and efforts to the issues they care about most. In addition to offering paid time off for volunteer work, in 2018, we doubled the match for our associates’ charitable donations and provided them with new tools and resources to help make it easier to make a difference. Together, we continue to build a culture of caring, which bridges our company and the communities in which we live and work. Doing well by doing good +2X ANNUAL MATCH FOR ASSOCIATE CHARITABLE GIVING* *Increases from FY17 +68% BROADRIDGE FOUNDATION SPEND ON MATCHING GIFTS* +25% HOURS USED FOR PAID VOLUNTEER TIME OFF*

23 2018 Annual Report Doing well in business… ... by doing good for our associates and our communities. Winner 2018 best outsourcing provider to the sell side Waters Sell Side Technology Awards Winner 2018 best managed support services provider Risk Technology Awards Winner 2018 best global data visualization software provider Hedgeweek Global Awards Winner 2018 best blockchain initiative of the year FTF News Technology Innovation Awards Winner 2018 diversity champion InvestmentNews Diversity & Inclusion Awards Winner 2015–2018 world’s most admired companies, financial data services FORTUNE® Magazine World’s Most Admired Companies Winner 2008–2018 best companies to work for in New York New York State Society for Human Resource Management Winner 2013–2018 best place to work for LGBTQ equality Human Rights Campaign Foundation

24 The Company’s results in this Annual Report to Stockholders are presented in accordance with U.S. GAAP except where otherwise noted. In certain circumstances, results have been presented in this Annual Report including the Letter to Stockholders (the “Letter to Stockholders”) that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitate investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, for internal planning and forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non- GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings Per Share These Non-GAAP measures reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, (iii) Tax Act items, (iv) the Gain on Sale of Securities and (v) the Message Automation Limited (“MAL”) investment gain. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company’s acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. Tax Act items represent the net impact of a U.S. federal transition tax on earnings of certain foreign subsidiaries, foreign jurisdiction withholding taxes and certain benefits related to the remeasurement of the Company’s net U.S. federal and state deferred tax liabilities attributable to the U.S. Tax Cuts and Jobs Act. The Gain on Sale of Securities represents a non-operating gain on the sale of securities associated with the Company’s retirement plan obligations. The MAL investment gain represents a non-cash, nontaxable gain on investment from the Company’s acquisition of MAL in March 2017. We exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, Tax Act items, Gain on Sale of Securities and the MAL investment gain from our earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and these items do not reflect ordinary operations or earnings. Management believes these adjusted measures may be useful to an investor in evaluating the underlying operating performance of our business. Free Cash Flows In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures and Software purchases and capitalized internal use software. Set forth on the next page is a reconciliation of such Non-GAAP measures to the most directly comparable GAAP measures (unaudited). Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures