August 14, 2008 Earnings Webcast & Conference Call Fourth Quarter and Fiscal Year 2008 Broadridge Financial Solutions, Inc. Exhibit 99.2 |

1 Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, such as our fiscal year 2009 financial guidance, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2008 (the “2008 Annual Report”). Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the 2008 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; the pricing of Broadridge’s products and services; changes in laws affecting the investor communication services provided by Broadridge; changes in laws regulating registered securities clearing firms and broker- dealers; declines in trading volume, market prices, or the liquidity of the securities markets; any material breach of Broadridge security affecting its clients’ customer information; Broadridge’s ability to continue to obtain data center services from its former parent company, Automatic Data Processing, Inc. (“ADP”); any significant slowdown or failure of Broadridge’s systems; changes in technology; availability of skilled technical employees; the impact of new acquisitions and divestitures; competitive conditions; overall market and economic conditions; and any adverse consequences from Broadridge’s spin-off from ADP. Broadridge disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. |

2 Today’s Agenda Opening Remarks Rich Daly, CEO Full Year & Fourth Quarter 2008 Results Dan Sheldon, CFO Fiscal Year 2009 Guidance Summary Dan Sheldon, CFO Summary Rich Daly, CEO Q&A Rich Daly, CEO Dan Sheldon, CFO Marvin Sims, VP Investor Relations Closing Remarks Rich Daly, CEO Note: For a reconciliation of Non-GAAP to GAAP measures used in this presentation, please see the attached Appendix |

3 Opening Remarks Key Topics: Full Year & Fourth Quarter 2008 Financial Results • Revenues and earnings for the quarter and fiscal year were in line with expectations • Full year diluted earnings per share (EPS) within latest 2008 EPS guidance • Exceeded original financial guidance for Pre-tax Earnings and EPS, as full year EPS was $0.21 per share higher than the mid-point of original guidance • Full year EPS benefited by $0.10 from one-time items in non-core areas • Business units performing well in a tough market, led by ICS segment • Solid proxy season highlighted by the successful implementation of Notice & Access, equity stock record growth and higher suppression rates • Exiting year as expected in securities processing business segments • 19% growth in full year closed sales and pipeline remains strong and very active |

4 Opening Remarks Key Topics: Fiscal Year 2009 Guidance overview: • Sales Plan of $160M to $180M, or 7% to 21% growth over fiscal year 2008 • Operating units projected to continue to perform well in light of challenging markets, as we expect revenue improvement in core segments • Revenue growth of 2% to 4% (Fee only growth of 3% to 7%) with growth in each quarter • GAAP EPS in the range of $1.45 to $1.55 GAAP EPS growth of 7% to 14% Non-GAAP EPS growth of 2% to 9%, excluding transition expenses Despite revenue growth each quarter, EPS performance is weighted towards second half of fiscal year 2009 due to one-time grow-over in first half Another strong fourth quarter expected from the core investor communication business |

5 Opening Remarks Key Topics: Investor Communication business overview: • ICS segment represents over 70% of Broadridge’s revenues and earnings • Fiscal year 2009 revenue growth in the range of 2% to 4%, and fee only revenue growth of 5% to 9% • Sales Plan range of $100M to $110M • Continued industry leadership in Notice & Access, as issuers realized an estimated $140M in savings • Event-driven revenue net flat to slightly down for fiscal year 2009 • Pending regulatory change moving from full prospectus to summary prospectus should be neutral to positive • Product opportunities for Investor Mailbox and Investor Network • ICS positioned as the investor communication solutions provider |

6 Opening Remarks Key Topics: Securities Processing and Clearing and Outsourcing businesses overview: • Fiscal year 2009 revenue growth in the range of 2% to 4% for Securities Processing segment and 8% to 16% for Clearing and Outsourcing segment • Sales Plan range of $60M to $70M and includes $25M to $35M related to Outsourcing • We expect to generate $100M of additional Broadridge revenue through Outsourcing over the next three years • Investigo acquisition further expands wealth management capability • Current market continues to present both opportunities and challenges • With Outsourcing offering, we believe Securities Processing and Clearing and Outsourcing segments are well-positioned and prospects are good |

7 Opening Remarks Key Topics: Free Cash Flow & Policy Update • Free cash flow in the range of $180M to $250M • Continued to pay down long-term debt to maintain our Debt-to-EBITDA goal of 1:1 ratio • Returning cash to stockholders: Raising dividend to $0.28 per year, an increase of approximately 17% over FY 2008, subject to the discretion of the Board of Directors Implementing share repurchase program, up to two million shares, to offset dilution resulting from equity compensation plans • Anticipating to be more acquisitive, which includes an international focus Credit Rating Agency Update • Received Fitch credit rating of BBB with stable outlook |

8 FY08 Key Highlights: Q4 represents over 35% of our full year revenues and over 50% of our full year earnings Q4 - Revenue 2% (fee only 7%) to $792M and Full Year 3% (fee only 6%) to $2.2B • Sales contributed 3% (Full Year = 2%) • Losses reduced growth by 2% (Full Year = 3%) • Internal Growth contributed 3% (Full Year = 3%) • Event-driven reduced growth by 1% (Full Year = flat) • Distribution Fees reduced growth by 2% (Full Year = -1%) • Other/FX contributed 1% (Full Year = 2%) Q4 - Pre-tax Margin before transition and interest expenses 100 bps to 22.7% and Full Year 60 bps to 16.8%- Non-GAAP (Q4 -Pre-tax Margin 110 bps and Full Year Pre-tax Margin 20 bps – GAAP ) • Q4- Solid ICS performance offset by SPS R&D expenses • Full Year- Positive impact from ICS, SPS first half trade volumes and timing in build of public company infrastructure & investment ramp-up Q4 - Diluted EPS 8% to $0.71 and Full Year - Diluted EPS 4% to $1.42 – Non-GAAP (1) (Q4 - Diluted EPS 3% to $0.69 and Full Year Diluted EPS 4% to $1.36 – GAAP ) • Full year interest expense vs. one quarter in prior year • Higher tax rate due to final adjustments related to spin-off from ADP • Fully diluted shares 2M to 141M Note: (1) Excludes one-time transition expense only Broadridge Results – Q4 & FY 2008 |

9 Segment Results – Investor Communication Solutions FY08 Key Highlights: Revenues (Q4 Fee Revenues 9% and Full Year 5%) • Q4 - Net New Business $8M driven by registered proxy and transaction reporting • Full Year - Net New Business $2M (sales $18M offset primarily by previously announced client losses) • Q4 - Internal Growth $17M driven by Notice and Access, Equity Proxy and Interim position growth as well as fulfillment volumes – Mutual Fund Interims stock record growth 6% and Equity Proxy stock record growth 2% Margin • Q4 Margin 140 bps due to Notice & Access and operating leverage • Full Year Margin 160 bps due to operating leverage, favorable mix of distribution fees, Notice & Access and one-time items FY09 Key Drivers: • Recurring Fee revenue Net New Business contributes 3% to 4% • Recurring Fee revenue Internal Growth contributes 3% to 4% • Event-driven Fee revenue contributes -1% to 1% • Distribution Fee revenue flat due to the adoption of Notice and Access, offset by new business and postal rate increases 4Q FY08 FY09 Range ($ in millions) Actual Actual Low High Revenues $630 $1,575 $1,612 $1,644 Growth Rate 2% 1% 2% 4% Fee Revenues $322 $767 $803 $837 Growth Rate 9% 5% 5% 9% Recurring (RC) 10% 5% 6% 8% Event-driven (ED) -1% 0% -1% 1% Distribution Revenues $308 $808 $809 $807 Growth Rate -5% -2% 0% 0% Margin 26.3% 16.2% 16.6% 17.0% Margin Basis Points (bps) Improvement 140 bps 160 bps 40 bps 80 bps |

10 10 Segment Results – Securities Processing Solutions FY08 Key Highlights: Revenues - Q4 and Full Year 2% • Q4 - Net New Business contributed -2% (sales of 5% offset by losses of 7% – impact of previously announced client loss) • Full Year - Net New Business contributed -3% (sales of 4% offset by losses of 7%) • Q4 - Internal Growth contributed 4% (Equity TPD 1% slightly above 2.4M and Fixed Income TPD 26% to 266K TPD) • Full Year - Internal Growth contributed 5% (Equity TPD 13% and Fixed Income TPD 22%) Margins • Q4 610 bps and Full Year (Non-GAAP) 190 bps margins driven by previously announced client loss, higher investments and RBC conversion related resources no longer capitalized and “returning” to expense run rate FY09 Key Drivers: • Net New Business contributes 1% to 2% • Internal Growth flat to 1% 4Q FY08 FY09 Range ($ in millions) Actual Actual Low High Revenues $133 $514 $526 $535 Growth Rate 2% 2% 2% 4% Margin 20.8% 26.7% 25.3% 26.0% Margin Basis Points (bps) Changes 610 bps 190 bps 140 bps 70 bps |

11 Segment Results – Clearing and Outsourcing Solutions FY08 Key Highlights: Revenues (Q4 8% and Full Year 2%) • Q4 - Net New Business contributed -2% (Sales of 10% offset by losses of 12%, primarily by previously announced fiscal year 2007 client loss) • Full Year - Net New Business contributed 1% (sales of 13% offset by losses of 12%) • Q4 - Internal Growth 6% (TPD and clearance fees up, and net interest income down 10%) • Full Year - Internal Growth 1% (lower net interest related to federal funds rate reduction contributed -5%) • Federal Funds impact $8M annualized - $4M FY’08 second half ($4M FY’09 impact first half) Pre-tax Margin • Q4 - Operating losses at $1M; operating leverage offset by impact of interest rate reductions • Full Year - Operating losses reduced by 28% from ($6.9M) to ($5.0M) – Non-GAAP FY09 Key Drivers: • Net New Business contributes 14% to 19% • Internal Growth contributes -6% to -3% (federal funds rate reductions impact Internal Growth and Margin) 4Q FY08 FY09 Range ($ in millions) Actual Actual Low High Revenues $24 $96 $104 $111 Growth Rate -8% 2% 8% 16% Margin -4% -5% -5% -2% Pre-tax Loss -$1 -$5 -$5 -$2 |

12 Segment Results – Other & Foreign Exchange (FX) FY08 Key Highlights: Revenues • Q4 and Full Year Other Revenues of $1M and $9M, respectively, related to termination fees • Q4 and Full Year FX Revenues increased to $5M from ($3M) and to $14M from ($13M) respectively, contributing $27M to revenue year- over-year due to weakening of U.S. dollar Pre-tax Margin • Q4 Net Other Expense of $25M is made up of: – Interest expense ($5M) and one-time transition expenses of ($4M) – Investments and corporate expenses of ($16M) • Full Year Net Other Expense of $77M – Interest expense ($31M) and one-time transition expenses of ($14M) – Investments and corporate expenses of ($32M) FY09 Key Drivers: • No material termination fees • Interest expense of approximately $19M • No transition expenses in fiscal year 2009 • Full year run rate in corporate expenses and investments (first half grow-over - $17M) • FX – U.S. dollar remains unchanged in relation to foreign currencies or improves 4Q FY08 FY09 Range ($ in millions) Actual Actual Low High Revenues Other (termination fees) $1 $9 $0 $1 FX $5 $14 $7 $14 Pre-tax Margin Other Termination Fees $1 $9 $0 $1 Transition Expense -$4 -$14 $0 $0 Corporate & Investments -$16 -$32 -$41 -$39 Interest Expense -$5 -$31 -$19 -$19 FX $2 $6 $3 $5 |

13 Fiscal Year 2009 Grow-Over Discussion First half of FY’09 tough EPS compare given one-time items in FY’08 Positive impact to FY’08 for Other – corporate/investments of $0.10 per share and equal negative EPS impact to FY’09 Q4 will always be largest quarter in any given year Quarters: Q1 – Q3 Event-driven revenues will not repeat in same quarters each year and therefore can be quite “lumpy” FY'08 Grow Overs ($ in millions) Q1 Q2 Q3 Q4 FY09 Other- Corp/Investments Termination Fees (2) (5) 0 (1) (8) Corporate Build (6) (2) 0 0 (8) Investments (4) (5) 0 0 (9) Founders Grants 0 (5) 0 5 0 Sub-total (12) (17) 0 4 (25) Segments SPS- Non-Deferred S&P (5) (3) (2) 0 (10) ($17) ($20) ($2) $4 ($35) = $17M discussed on page 12 |

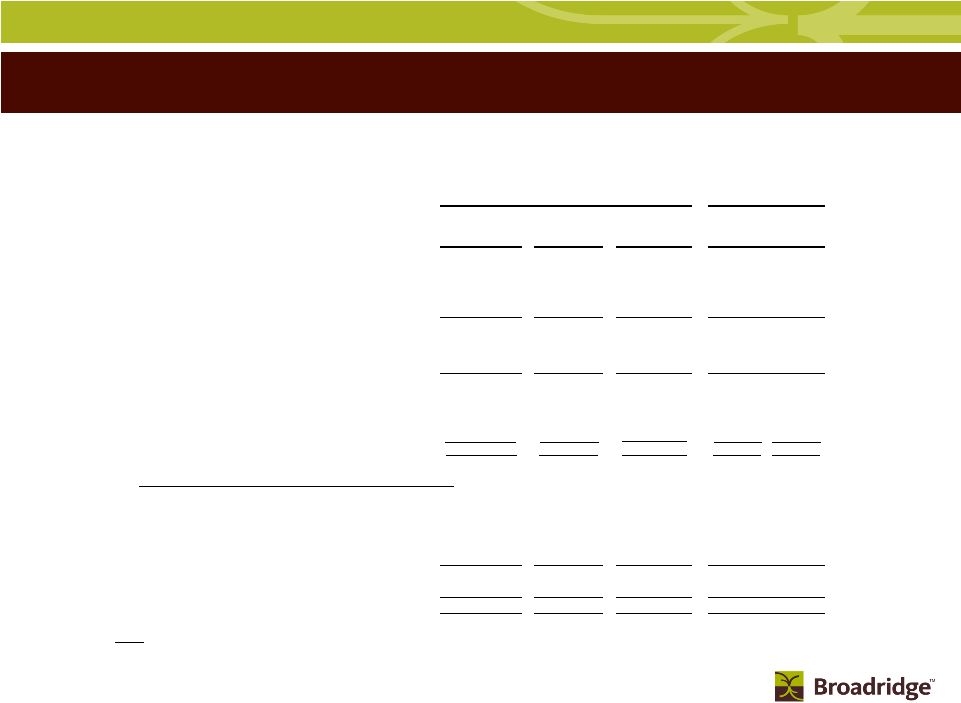

14 Broadridge Cash Flow – FY 2008 and FY 2009 Forecast Note The FY09 forecast does not take into consideration any share repurchases Broadridge Financial Solutions, Inc. Calculation of Free Cash Flow - Non-GAAP Unaudited (In millions) FY09 Range Low High Ridge Clearing All Other All Other Financing Processing Broadridge Processing Calculation of Free Cash Flow (Non-GAAP): Activities Activities Total Activities Earnings - $ 192 $ 192 $ 207 $ 222 $ Depreciation and amortization - 52 52 55 65 Deferred taxes - (15) (15) (15) (10) Stock-based compensation expense - 35 35 35 40 Other - 7 7 5 5 Subtotal - 271 271 287 322 Working capital changes - 79 79 (20) (10) Securities Clearing Activities 146 - 146 - - Long-term assets & liabilities changes - (14) (14) (20) (15) Net cash flow provided by (used in) operating activities 146 336 482 247 297 Cash Flows From Investing Activities Capital expenditures - (41) (41) (55) (45) Intangibles - (5) (5) (7) (5) Free Cash Flow 146 $ 290 $ 436 $ 185 $ 247 $ Acquisitions - (6) (6) not currently in guidance Long-term debt payment - (170) (170) (150) (100) Dividend - (34) (34) (39) (39) Proceeds from exercise of stock options - 20 20 Short-term borrowings (overnight bank loans) (109) - (109) (40) (30) Short-term borrowings (bank overdrafts) (27) - (27) - - Net change in cash and cash equivalents 10 $ 100 $ 110 $ (44) $ 78 $ Cash and cash equivalents, at the beginning of year 16 72 88 172 172 Cash and cash equivalents, at the end of year 26 $ 172 $ 198 $ 128 $ 250 $ Twelve Months Ended June 30, 2008 Cash Flows From Other Investing and Financing Activities |

15 Broadridge - FY 2009 Financial Guidance Summary Revenue growth is cyclical: In up markets expect high single digit to low double digit growth In down markets expect negative to single digit growth Revenue growth of 2% - 4% (3% to 7% fee only) Sales Plan for year of $160M - $180M Earnings before interest and taxes margin 15.9% - 16.6% Diluted Earnings Per Share of $1.45 - $1.55 Interest expense of approximately $19M Effective Tax Rate of approximately 39% No additional one-time transition expenses Free cash flow in the range of $180M to $250M Recently completed Investigo acquisition is contemplated in guidance Diluted Weighted-Average Shares of approximately 143 million |

16 Summary Solid fiscal year 2008 and exceeded original guidance despite challenging market conditions Notice & Access successfully implemented as a result of our industry leadership and has generated meaningful industry savings Use strong free cash flows to pay increased dividend, and execute share repurchase program to offset share dilution from equity compensation plans Anticipating to be more acquisitive in fiscal year 2009 Revenue growth anticipated in each quarter of fiscal year 2009 Fiscal year 2009 projected to be a solid year with operating segments continuing to perform well in challenging market conditions The second half of fiscal year 2009 anticipated to be stronger than the first half We believe the business is well-positioned for fiscal year 2009 |

17 Q&A There are no slides during this portion of the presentation |

18 Closing Comments There are no slides during this portion of the presentation |

19 Appendix Appendix |

20 Segments – FY 2009 Financial Guidance Summary Investor Communication: Revenues 2% - 4% Margins 16.6% - 17.0% Sales Plan $100M - $110M Securities Processing: Revenues 2% - 4% Margins 25.3% - 26.0% Clearing and Outsourcing: Revenues 8% - 16% Operating losses at $2M - $5M Sales Plan $60M - $70M for the combined Securities Processing and Clearing and Outsourcing business segments |

21 GAAP to Non-GAAP Earnings Reconciliation Note: Management believes that certain Non-GAAP (generally accepted accounting principles) measures, when presented in conjunction with comparable GAAP measures provide investors a more complete understanding of Broadridge’s underlying operational results. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between current results and prior reported results, and as a basis for planning and forecasting for future periods. These measures should be considered in addition to and not a substitute for the measures of financial performance prepared in accordance with GAAP. Broadridge Financial Solutions, Inc. Reconciliation of GAAP to Non-GAAP Measures Earnings, Margins and Per Share Reconciliation (In millions except per share and margin data) (unaudited) Three Months Ended June 30, 2008 Three Months Ended June 30, 2007 Earnings Before Income Taxes Pre-tax Margins Net Earnings Net Earnings Per Share Earnings Before Income Taxes Pre-tax Margins Net Earnings Net Earnings Per Share GAAP basis measures 171.1 $ 21.6% 97.8 $ 0.69 $ 158.5 $ 20.5% 98.7 $ 0.71 $ Non-GAAP adjustments: One-time transition expenses 3.9 0.5% 2.2 0.02 14.0 1.8% 8.7 0.06 Interest on new debt & other 5.2 0.6% 3.0 0.02 10.5 1.4% 6.6 0.05 Total Non-GAAP adjustments 9.1 1.1% 5.2 0.04 24.5 3.2% 15.3 0.11 Non-GAAP measures 180.2 $ 22.7% 103.0 $ 0.73 $ 183.0 $ 23.7% 114.0 $ 0.82 $ Twelve Months Ended June 30, 2008 Twelve Months Ended June 30, 2007 Earnings Before Income Taxes Pre-tax Margins Net Earnings Net Earnings Per Share Earnings Before Income Taxes Pre-tax Margins Net Earnings Net Earnings Per Share GAAP basis measures 325.9 $ 14.8% 192.2 $ 1.36 $ 320.8 $ 15.0% 197.1 $ 1.42 $ Non-GAAP adjustments: One-time transition expenses 13.7 0.6% 8.1 0.06 14.0 0.7% 8.6 0.06 Interest on new debt & other 30.9 1.4% 18.2 0.13 12.3 0.5% 7.6 0.05 Total Non-GAAP adjustments 44.6 2.0% 26.3 0.19 26.3 1.2% 16.2 0.11 Non-GAAP measures 370.5 $ 16.8% 218.5 $ 1.55 $ 347.1 $ 16.2% 213.3 $ 1.53 $ |

22 EPS Impact from One-time Items and Termination Fees Reconciliation Note: Management believes that certain Non-GAAP (generally accepted accounting principles) measures, when presented in conjunction with comparable GAAP measures provide investors a more complete understanding of Broadridge’s underlying operational results. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between current results and prior reported results, and as a basis for planning and forecasting for future periods. These measures should be considered in addition to and not a substitute for the measures of financial performance prepared in accordance with GAAP. Broadridge Financial Solutions, Inc. Reconciliation of GAAP to Non-GAAP Measures Impact of One-time on Earnings Per Share Reconciliation (In millions except per share) (unaudited) Fiscal Year 2008 Earnings Per Share 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Full Year Fiscal 2008 EPS - GAAP basis measures 0.26 $ 0.21 $ 0.21 $ 0.69 $ 1.36 $ One-time transition expenses 0.01 0.01 0.02 0.01 0.06 EPS - Excluding transition expenses - Non-GAAP 0.27 $ 0.22 $ 0.23 $ 0.70 $ 1.42 $ Termination Fees 0.01 0.02 - - 0.03 Timing in Public Company Corporate Build 0.03 0.01 - - 0.03 Timing of Investments 0.02 0.02 - - 0.04 0.05 0.05 - - 0.10 EPS - Non-GAAP 0.22 $ 0.17 $ 0.23 $ 0.70 $ 1.32 $ Fiscal Year 2008 Pre-tax Earnings 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Full Year Fiscal 2008 Pre-tax Earnings - GAAP 59.1 $ 47.3 $ 48.4 $ 171.1 $ 325.9 $ One-time transition expenses 2.1 3.5 4.2 3.9 13.7 Pre-tax Earnings - Excluding transition expenses - Non-GAAP 61.2 $ 50.8 $ 52.6 $ 175.0 $ 339.6 $ Termination Fees 2.0 5.0 - 0.7 7.7 Timing in Public Company Corporate Build 6.0 2.0 - - 8.0 Timing of Investments 4.0 5.0 - - 9.0 12.0 12.0 - 0.7 24.7 Pre-tax Earnings - Non-GAAP 49.2 $ 38.8 $ 52.6 $ 174.3 $ 314.9 $ Less One-time items: Non-GAAP adjustments: Non-GAAP adjustments: Less One-time items: |

23 Intersegment Transfer Pricing Reconciliation 2008 2007 2008 2007 Investor Communication Solutions Net revenue as reported 630.0 $ 619.4 $ 1,575.2 $ 1,554.2 $ Transfer pricing adjustment - - - (2.0) Net revenue as Adjusted - Non-GAAP 630.0 $ 619.4 $ 1,575.2 $ 1,552.2 $ EBT as reported 165.9 $ 154.2 $ 255.3 $ 226.8 $ Transfer pricing adjustment - - - (0.7) EBT as adjusted - Non-GAAP 165.9 $ 154.2 $ 255.3 $ 226.1 $ Margin % as reported 26.3% 24.9% 16.2% 14.6% Margin % as adjusted - Non-GAAP 26.3% 24.9% 16.2% 14.6% Securities Processing Solutions Net revenue as reported 133.4 $ 130.9 $ 514.4 $ 509.9 $ Transfer pricing adjustment - - - (6.0) Net revenue as adjusted - Non-GAAP 133.4 $ 130.9 $ 514.4 $ 503.9 $ EBT as reported 27.7 $ 35.2 $ 137.5 $ 148.4 $ Transfer pricing adjustment - - - (4.3) EBT as adjusted - Non GAAP 27.7 $ 35.2 $ 137.5 $ 144.1 $ Margin % as reported 20.8% 26.9% 26.7% 29.1% Margin % as adjusted - Non-GAAP 20.8% 26.9% 26.7% 28.6% Clearing and Outsourcing Solutions Net revenue as reported 23.5 $ 25.6 $ 95.8 $ 93.8 $ Transfer pricing adjustment - - - - Net revenue as adjusted - Non-GAAP 23.5 $ 25.6 $ 95.8 $ 93.8 $ EBT as reported (0.9) $ (0.6) $ (5.0) $ (11.9) $ Transfer pricing adjustment - - - 5.0 EBT as adjusted - Non-GAAP (0.9) $ (0.6) $ (5.0) $ (6.9) $ Margin % as reported -3.8% -2.3% -5.2% -12.7% Margin % as adjusted - Non-GAAP -3.8% -2.3% -5.2% -7.4% Twelve months ended June 30, Broadridge Financial Solutions, Inc. Intersegment Transfer Price Reconciliation ($ In millions except margin data) (Unaudited) Three months ended June 30, |

24 Use of Materials Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. You may reproduce information contained in this presentation provided you do not alter, edit, or delete any of the content and provided you identify the source of the information as Broadridge Financial Solutions, Inc., which owns the copyright. |