- BR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Broadridge Financial Solutions (BR) 8-KRegulation FD Disclosure

Filed: 9 Nov 11, 12:00am

November 2011 Continued Market Leadership through Execution and Innovation Investor Presentation © 2011 Broadridge Financial Solutions, Inc. Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc. Exhibit 99.1 |

1 Forward-looking statements Use of non-GAAP financial measures This presentation may include certain Non-GAAP (generally accepted accounting principles) financial measures in describing Broadridge’s performance. Management believes that such Non-GAAP measures, when presented in conjunction with comparable GAAP measures provide investors a more complete understanding of Broadridge’s underlying operational results. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between current results and prior reported results, and as a basis for planning and forecasting for future periods. These measures should be considered in addition to and not a substitute for the measures of financial performance prepared in accordance with GAAP. The reconciliations of such measures to the comparable GAAP figures are included in this presentation. This presentation and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2012 Financial Guidance” section and statements about our future financial performance are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2011 (the “2011 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward- looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2011 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s sevices with favorable pricing terms; changes in laws and regulations affecting the investor communication services provided by Broadridge; declines in participation and activity in the securities markets; overall market and economic conditions and their impact on the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; any significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Use of material contained herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. You may reproduce information contained in this presentation provided you do not alter, edit, or delete any of the content and provided you identify the source of the information as Broadridge Financial Solutions, Inc., which owns the copyright. Pre-Spin financial information Financial information presented for periods prior to the March 30, 2007 spin-off of Broadridge from Automatic Data Processing, Inc. (“ADP”) represents the operations of the brokerage services business which were operated as part of ADP. Broadridge’s financial results for periods before the spin-off from ADP may not be indicative of our future performance and do not necessarily reflect what our results would have been had Broadridge operated as a separate, stand-alone entity during the periods presented, including changes in our operations and capitalization as a result of the spin-off from ADP. |

2 Broadridge Strategy Statement Our vision is to be the leading provider of Investor Communications and Technology and Operations Solutions to Bank/Broker-Dealers, Mutual Funds, and Corporate Issuers globally – We have strong positions in large and attractive markets with opportunities to grow – We have a balanced and diverse portfolio across four related businesses: broker-dealer communications, mutual funds, issuer services, and broker- dealer technology and operations – We will grow all four businesses by leveraging our unique network, our market position, and our brand/service reputation – We will do so with a combination of organic growth and M&A – We anticipate that this approach will drive 6-9% revenue growth, low-to-mid teens earnings growth, and including a target 2-3% dividend yield and buybacks, top-quartile total shareholder returns through FY14 |

3 Broadridge is a strong, resilient business with significant growth potential History of market leadership – Proven ability to address increasingly complex customer needs through technology – Innovation and thought leader in industry for >40 years Strong position in large and attractive markets – Leader in investor communications and securities processing – Resilient through crisis due to mission-critical nature of services – Deeply respected by industry and regulators – Ample room for expansion into naturally adjacent markets Excellent team – Results-driven and deeply experienced management team aligned with shareholders – Highly engaged associates—one of the best large companies to work for in NY 1. As recognized by the NY Society of Human Resources in 2008-2011 1 |

4 Our market position is differentiated and sustainable Revenue growth Investor Communication Services $B 2.4 2.0 1.4 2011 2005 Growth through crisis and recession • Proxy services for >85% of outstanding shares in US • Processed >600 billion shares in 2011 • Used by >4,000 institutional investors globally • Eliminates >50% of physical mailings • 100K votes through mobile apps in first two months since launch New businesses Tuck-in acquisitions and partnerships within clear and strict guardrails Broadridge is well positioned to accelerate growth and continue driving significant free cash flow 5% CAGR Securities Processing Services Ranked #1 Brokerage Service Outsourcing Provider (2010) Enable clients to process in >50 countries Processes >$4 trillion in FI trades per day |

5 Investor Communication Services Securities Processing Services We are the leader in several markets Market Rank Bank/Broker-Dealer Regulatory Communications Broker-Dealer Transactional Communications Corporate Issuer Regulatory Communications Mutual Fund Proxy Mail and Tabulation Market Rank US Brokerage Processing US Fixed Income Processing Canadian Brokerage Processing #1 #1 #1 #1 #1 #1 #1 1. Rank by market share 1 1 |

6 Since spin-off, we have focused on the drivers of TSR TSR driver Key actions Portfolio Drive profitable growth Spending >$300M annually on technology Introduced >20 new products since spin-off Made several strategic acquisitions Divested Ridge and pruned underperforming products Operational excellence Improve margins by leveraging scale Migrating data center from ADP to IBM Smart-shoring – 20% of associates now in India Strict financial controls Financial strategy Generate strong cash flow for our shareholders Paid down debt to 1:1 Adjusted Debt/EBITDAR within 18 months of spin Doubled dividend in 2010, increased by further 7% in 2011 (current payout ratio 35%) Repurchased ~25M shares since spin, with additional ~7M available for repurchase at September 30, 2011 In last four years we have strengthened our position, restructured our portfolio and returned significant cash 1. Adjusted Debt-to-EBITDAR ratio calculated as (Debt + 5x Rent Expense) / (EBITDA + Rent Expense) 1 2 3 |

7 Since spin-off, we have reduced “spin debt” and returned capital Change in cash² 198 155 395 Dividends 213 392 Freed-up capital 281 FCF (Non- GAAP) 1,072 Capex 191 Cash flow from operations (GAAP) 1,263 Use of cash FY07–11, $M Focus on prudent capital stewardship 1. Gross buy-backs of $509 less proceeds from stock option exercises of $115 2. FY11 ending cash of $241 less beginning cash of $43 Buy- backs¹ Tuck-in acquisi- tions Debt reduction |

8 Mutual Fund—Core Retirement processing Data aggregation Marketing communications Proxy/solicitation Large and attractive markets – Investor Communications (ICS) is a $10B+ market BBD—Emerging products Global proxy and communications Tax reporting and outsourcing Security class actions Advisor services Bank/Broker-Dealer (BBD)—Core Regulatory communications (proxy, interims, etc.) Customer communications (transaction statements, etc.) Total addressable market $10B+ fee revenue Issuer Transfer agency Shareholder analytics Investor communications BBD—Natural adjacencies Enterprise archiving On-boarding International tax reclaim $1.3B $0.9B $2.0B $3.0B $1.8B $1.7B Mutual Fund—Natural adjacencies Transaction reporting Imaging and workflow, etc. Sources: BCG, Bain, Patpatia, Broadridge estimates |

9 Sources: Tower Group, Chartis, Aite, IM2, Broadridge internal estimates Technology and Operations (SPS) adds ~$14B to our addressable market Securities and investment firms’ overall technology and operations spend is over $100 billion and growing at 5% $1.2B $2.8B ~$5.0B Adjacent markets Middle-office Buy-side services Derivatives processing Fixed Income market data and analytics ~$5.2B North American BPO Middle- and back-office Data center services Select corporate functions US Brokerage Processing Core equities and fixed income Global Processing Core equities and fixed income Global BPO Reconciliations Total addressable market ~ $14B fee revenue |

10 Our strategy is to leverage our market role to expand our client relationships Reinforce role as the industry thought leader to lead e-transition Drive growth in adjacent markets through new organic or acquired solutions Grow core Bank/Broker-Dealer Communications Build leading data- driven Mutual Fund Solutions Provider Leverage unique data hub position and leading role in the BBD market Grow retirement trade processing, data aggregation, marketing communication and proxy/solicitation services Grow Issuer Solutions Capitalize on position in beneficial processing to expand direct relationship with issuers Expand registered proxy, transfer agency, and enhanced Issuer services Grow Global Technology and Operations Solutions Leverage market-leading global platform to expand current relationships and enter new adjacencies Grow global processing and BPO businesses; selectively pursue other adjacencies Multiple ways to win |

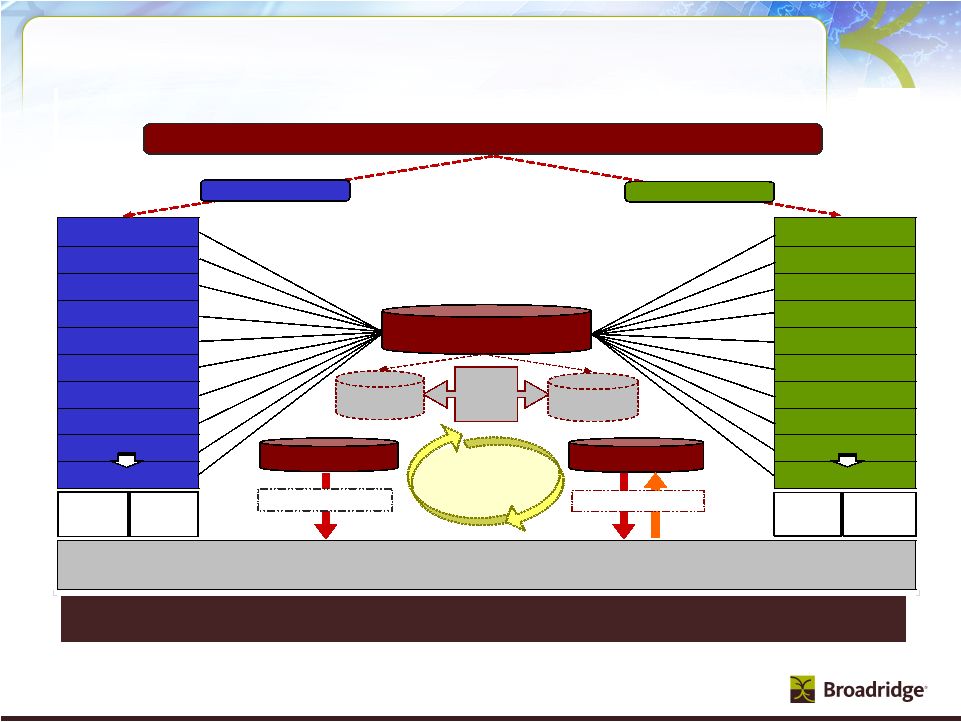

11 ICS Unique Business Systems Processing Model Proxy and Interim processing system is the “plumbing” supporting the voting process for corporate governance (1) Represents Broadridge’s estimated total number of brokerage firms and banks in the U.S. and international markets (2) Represents Broadridge’s estimated total number of positions managed by U.S. brokers and banks (3) Represents Broadridge’s estimated total number of corporate issuers in the U.S. (4) Represents total number of Fund Sponsors in the U.S. who manage over 16,000 funds including Mutual Funds, Closed-end Funds, ETFs and UITs, according to the Investment Company Institute’s 2009 Investment Company Year Book PROXY & INTERIMS PROCESSING OVERVIEW "THE PLUMBING" Broker/Bank 1 Issuer 1 / Fund 1 Broker/Bank 2 Issuer 2 / Fund 2 Broker/Bank 3 Issuer 3 / Fund 3 Broker/Bank 4 Issuer 4 / Fund 4 Broker/Bank 5 Issuer 5 / Fund 5 Broker/Bank 6 Issuer 6 / Fund 6 Broker/Bank 7 Issuer 7 / Fund 7 Broker/Bank 8 Issuer 8 / Fund 8 Broker/Bank 9 Issuer 9 / Fund 9 ˜ Brokers/Banks 800+ (1) ˜ Issuers 10,000+ (3) ˜ Funds 700+ (4) ANNUAL CORPORATE ISSUER AND MUTUAL FUND EVENTS Approximately 12,000 Events Per Year (Annual Corporate Issuer Shareholder Meetings and Mutual Fund Proxy Meetings) Proxy Distribution >40% of accounts require special processing Vote Processing Managing ~350M active positions (2) Majority of all shares are held in street-side Shareholder Preferences Database Shareholder Consent Database Equity and Mutual Fund Shareholders Broadridge manages >1,600 Corporate Issuers Broadridge processes on average 85% of U.S. shares outstanding Electronic or Physical Vote Return Data Hub and Platform Electronic or Physical Delivery Street-side Processing Registered Processing > 50% of Hard Copy Mailings Eliminated via E-Delivery and Suppressions 85% of Shares Voted Electronically BROADRIDGE Proxy Processing System Over 8 million lines of code and approximately 500,000 function points Supported by 150+ dedicated programmers |

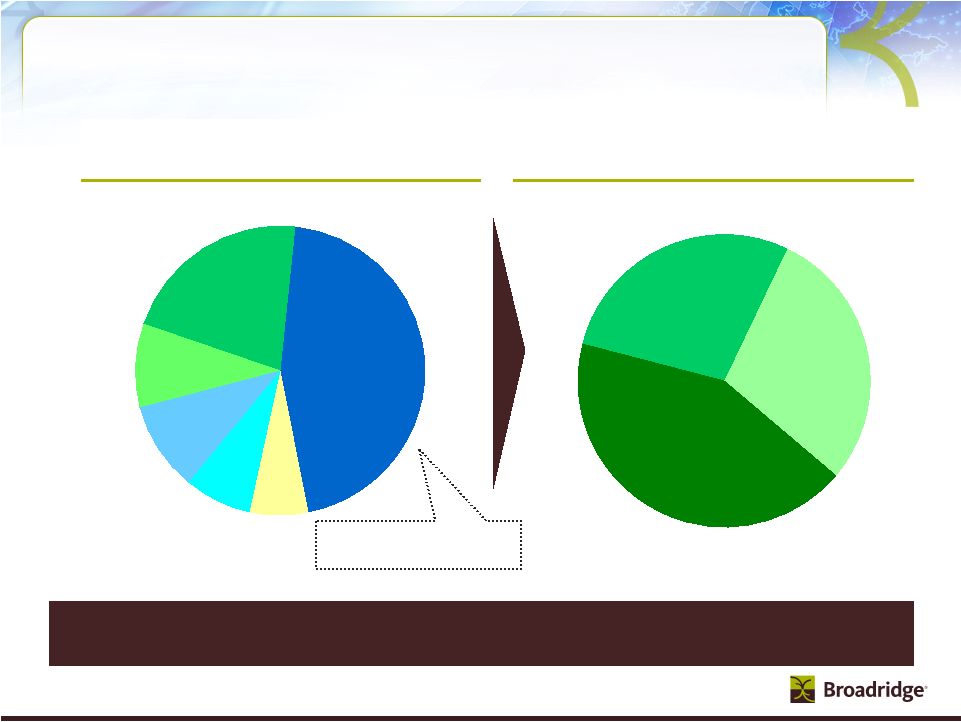

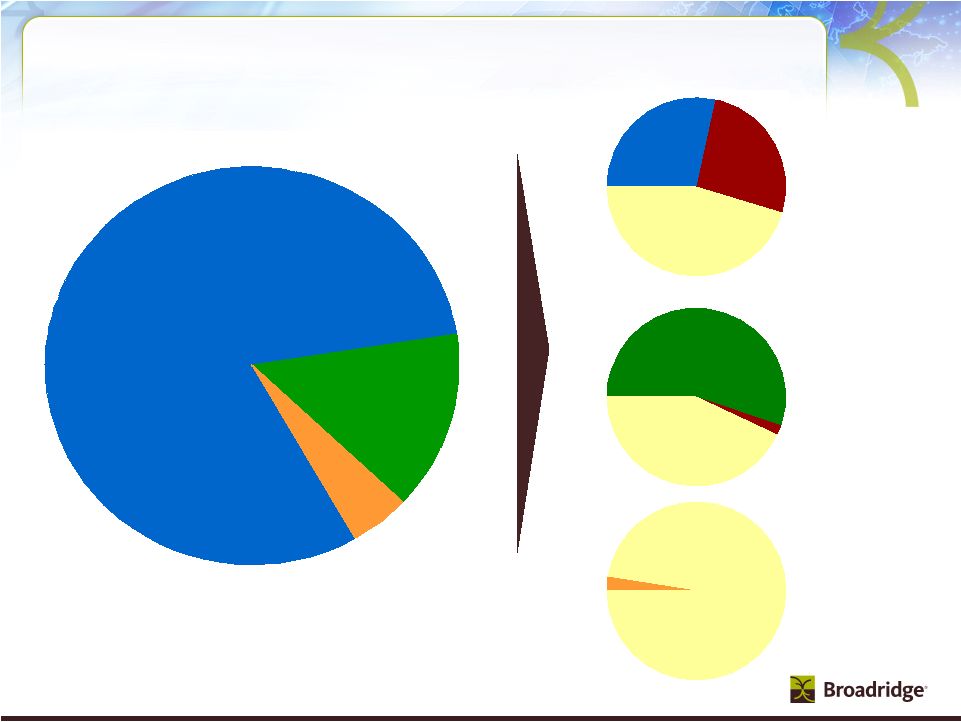

12 Bank/Broker - Dealer (43%) Mutual Fund (28%) Corporate Issuer (29%) Distribution $704M (45%) Other $103M (7%) Fulfillment $117M (8%) Transaction Reporting $156M (10%) Interims $146M (9%) Proxy $334M (21%) ICS Product and Client Revenue Overview We have a strong and diverse product offering… We have a strong and diverse product offering… ICS is highly resilient due to our deep customer relationships with our Bank/Broker-Dealer clients Primarily Postage …and we have deep and longstanding client relationships …and we have deep and longstanding client relationships Increase in electronic distribution reduces postage revenue and increases profits FY11 Product Revenues FY11 Client Revenues (Based on who pays BR as agent) |

13 ICS-Bank/Broker-Dealer What We Do: Regulatory communications – Beneficial proxy and interims for equities – Beneficial mutual fund compliance communications Customer communications – Transaction statements, trade confirmations and other reporting Global and emerging products – Advisor services – Global proxy and communications – Tax reporting and outsourcing – Securities class actions Competitive Advantages: Indispensible data hub with established relationships with majority of BBDs Strong market position and innovative leadership – First/only certified voting results – First e-delivery, phone, web and mobile voting platform Proprietary systems, network and databases – ProxyEdge® – institutional voting and record keeping platform – Preference and consent database Unmatched scale with highest level data security (ISO 27001) |

14 What We Do: Mutual Fund trade processing in the defined contribution/trust space (Matrix) Data aggregation and analytics (Access Data) Marketing/Regulatory communications including content (NewRiver) Registered proxy and solicitation Competitive Advantages: Long-standing relationships across industry Serve every mutual fund and majority of bank/broker-dealers Unique data capabilities Proprietary platform to allow mutual funds to understand their clients Innovative business applications that address unique industry issues such as compliance and distribution payments Largest electronic repository for mutual fund compliance data Industry-leading ICS products with unmatched scale Leverage to create cost-effective products for mutual funds ICS-Mutual Funds |

15 What We Do: Beneficial proxy service Registered shareholder communications – Registered proxy – Interim communications Transfer agency (TA) – Stock share registry, ownership transfers and dividend calculation Enhanced issuer solutions – Shareholder analytics – Virtual shareholder meetings – Shareholder forums – Global proxy services Competitive Advantages: Market Position – only full service provider of shareholder communications to all types of shareholders Unmatched Scale – able to leverage one billion plus shareholder communications annually as well as record-keeping, corporate actions and other shareholder account servicing Unmatched Data – unique dataset of investors and positions allows Issuers to more effectively reach their shareholders Thought Leadership – unmatched expertise to innovate the proxy process and help guide Issuers through a complex regulatory environment ICS-Issuers |

16 M A R K E T S H A R E Equity (~75%) Transactions, $239M Non-transactions, $211M Fixed Income (~15%) Transactions, $56M Non-transactions, $30M Outsourcing (~10%) $58M FY11 Product Revenues Securities Processing North America Market Share Overview¹ Equity Processing Client Volume Broadridge ~30% Competitors ~20% In-house ~50% Broadridge ~6% Untapped Market ~94% (>$1 Billion) In-house ~43% Competitors ~2% U.S. $ Fixed Income Client Volume Operations Outsourcing 1. All market share information is based on management’s estimates and is part of much larger market. No attempt has been made to size such market Broadridge ~55% |

17 What We Do: Best-of-breed processing solutions – Leading global platform – Broad asset class coverage Broad suite of add-on or point solutions – Desk top applications used by brokers and traders – Workflow and reconciliation applications – Data aggregation and warehousing tools Industry-leading global business process outsourcing (BPO) solutions Technology and Operations (SPS) |

18 Total Shareholder Return 6–9% revenue growth Financial strategy Portfolio Operational excellence Drive organic growth in current markets Exploit adjacent market opportunities Leverage economies of scale Further optimize infrastructure Generate strong FCF enabled by high ROIC Continue returning large share of FCF to shareholders Margin expansion from 13% to 17–19% We plan to deliver strong Total Shareholder Return (TSR) through FY14 35% payout that currently yields 2–3%, plus buybacks |

19 Our financial strategy is a key part of our value creation strategy 35% dividend payout, but expect no less than 64 cents per share Organic growth with limited financial risk – Avoid significant balance sheet risk – Invest in projects delivering at least 20% IRR Tuck-in acquisitions with clear growth profile and returns – Accretive to growth, margins, and earnings – >20% IRR in conservative business case Long-term investment-grade debt rating – Adjusted Debt/EBITDAR ratio target is 2:1 Excess cash used opportunistically to offset dilution and reduce share count through buybacks 1. Adjusted Debt/EBITDAR ratio calculated as (Debt + 5x Rent Expense) / (EBITDA + Rent Expense) 1 |

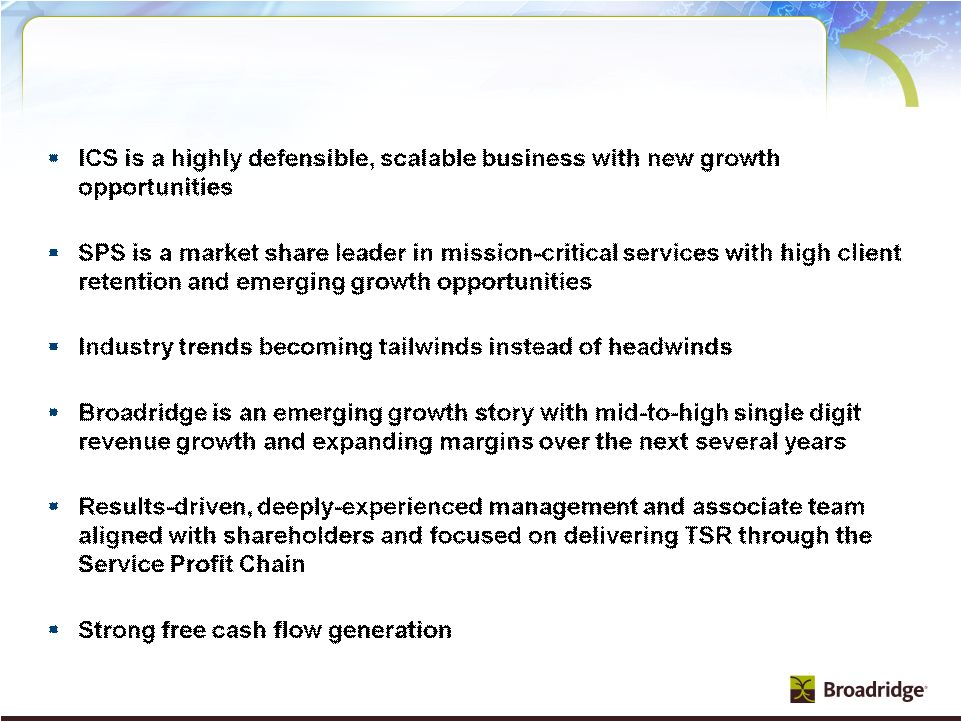

20 Broadridge's investment thesis |

21 FY07–11, $M Free Cash Flow from Operations (GAAP) 1,263 $ Capex 191 $ FCF (Non-GAAP) 1,072 $ Reconciliation of Non-GAAP to GAAP Measures |