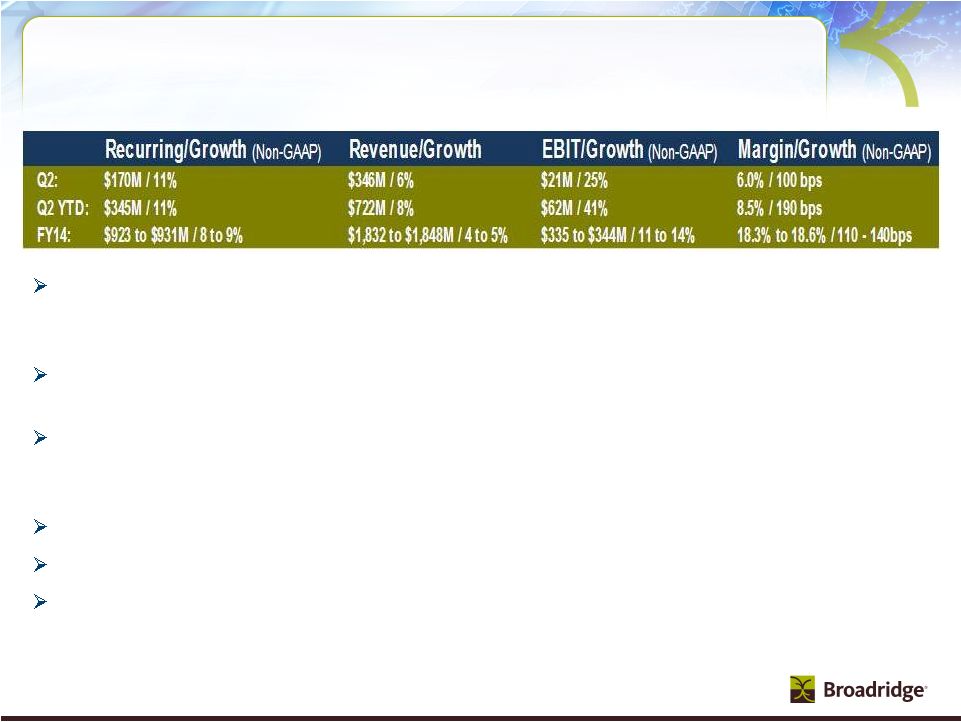

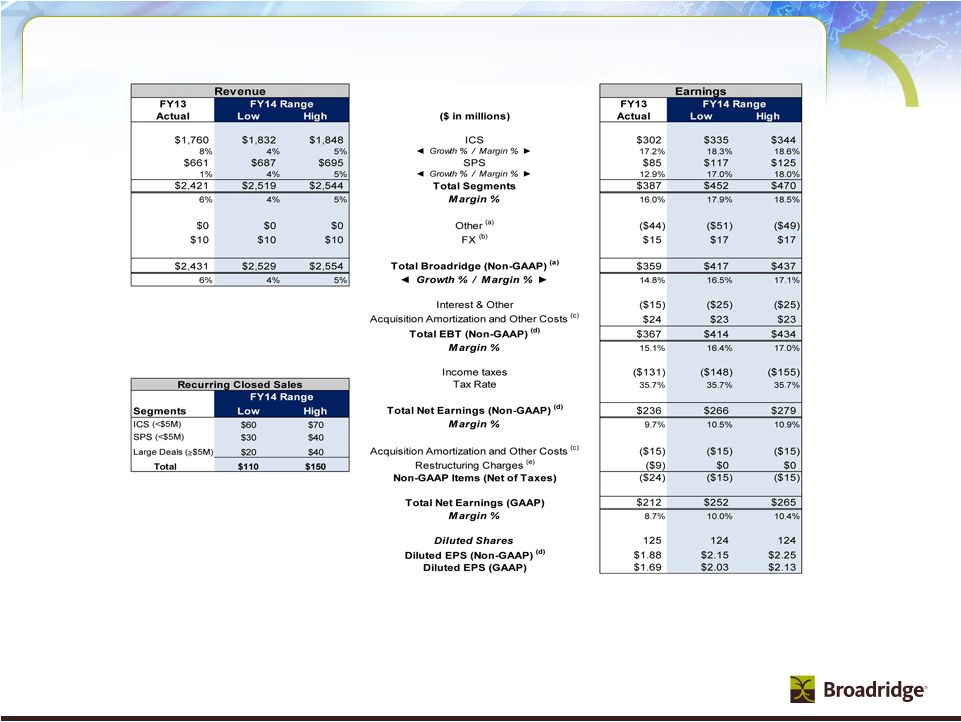

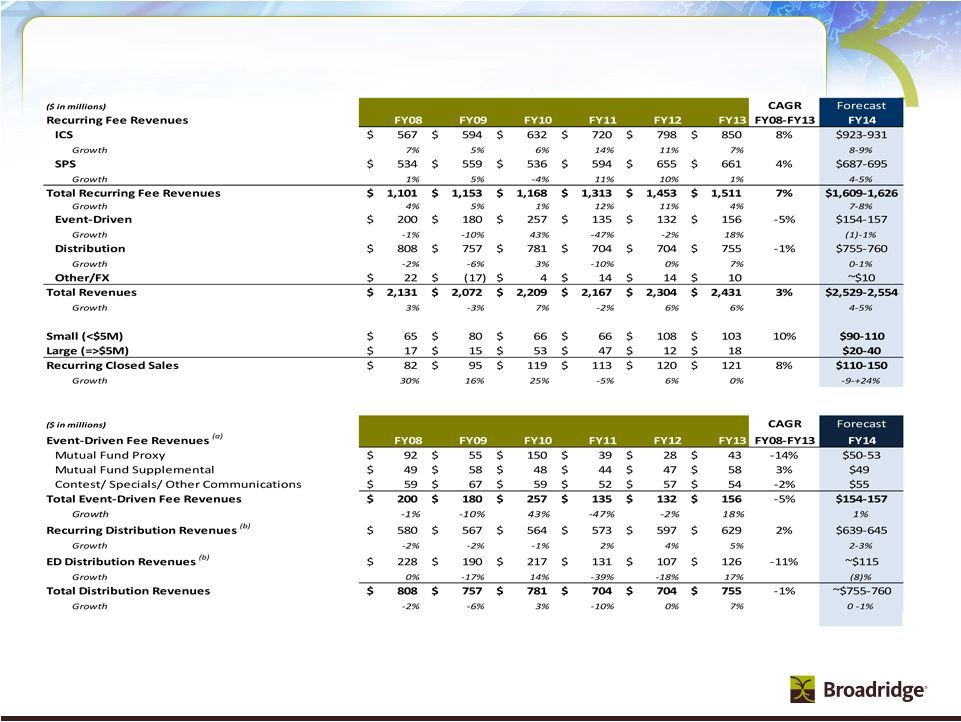

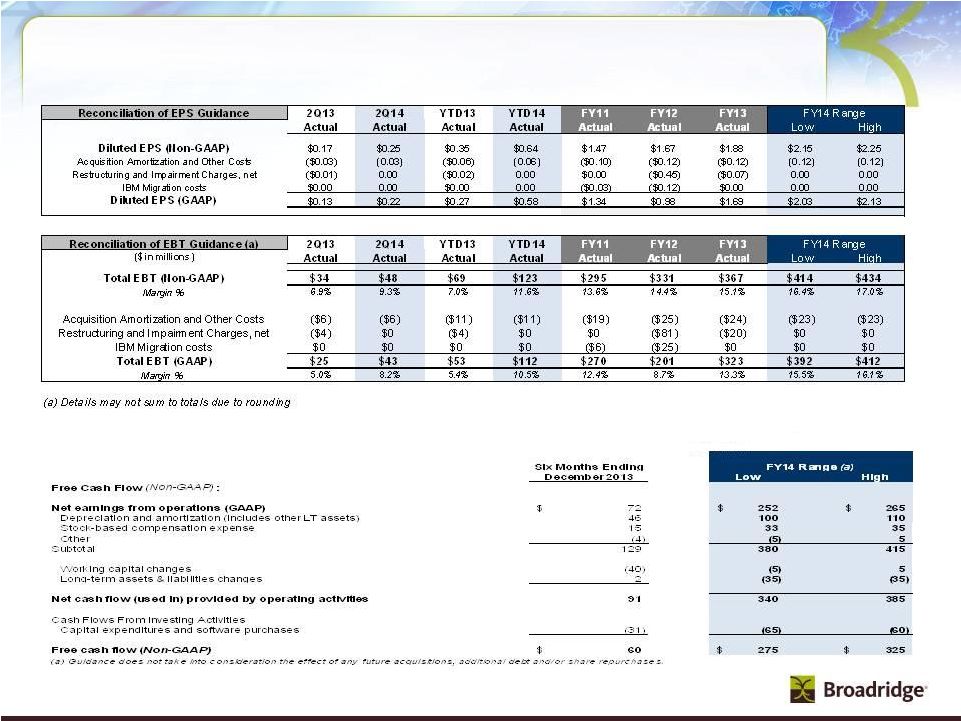

9 Summary Record first half diluted EPS with both segments contributing Recurring revenue continues to be strong led by Net New Business Recurring closed sales pipeline is very strong and growing Positive impact from favorable market-based activities Strong client revenue retention rate of 98% Raising fiscal year 2014 guidance 7-8% recurring revenue growth (4-5% total revenue growth) $2.15-2.25 Non-GAAP diluted EPS ($2.03-2.13 GAAP diluted EPS) Free cash flow of $300M (at mid-point of range) Strong business model includes stable recurring revenue with slight internal growth, consistent closed sales results, plus E&A execution driving top quartile performance Well known and highly respected brand in providing investor communications and securities processing solutions Both segments contributing to top and bottom line results Stable recurring revenue and slight internal growth Strong and reliable free cash flows Best suited to benefit from three strategic disruptive macro-trends Proven ability to create diversity of growth opportunities in all markets through our E&A product portfolio Ongoing journey to sustainable top quartile performance with momentum Paying meaningful dividend currently targeting 40% payout ratio Reinvesting in our business with a focus on 3 key macro-trends and strategic tuck-in acquisitions Opportunistic share repurchases to offset dilution and reduce share count All of the above while maintaining investment grade credit rating Highly engaged associates aligned to service profit chain Recognized as one of the Best Companies to Work for in New York State for the seventh consecutive year |