EXHIBIT 99.1 INVESTOR PRESENTATION AS OF MAY 8, 2020

Forward Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2020 Guidance” section are forward- looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 (the “Quarterly Report”) and our Annual Report on Form 10-K for the fiscal year ended June 30, 2019 (the “2019 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the Quarterly Report or the 2019 Annual Report. These risks include: • the potential impact and effects of the recent outbreak of the Covid-19 pandemic (“Covid-19”) on the business of Broadridge, Broadridge’s results of operations and financial performance, any measures Broadridge has and may take in response to Covid-19 and any expectations Broadridge may have with respect thereto; • the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; • Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; • a material security breach or cybersecurity attack affecting the information of Broadridge's clients; • changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; • declines in participation and activity in the securities markets; • the failure of Broadridge's key service providers to provide the anticipated levels of service; • a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; • overall market and economic conditions and their impact on the securities markets; • Broadridge’s failure to keep pace with changes in technology and demands of its clients; • Broadridge’s ability to attract and retain key personnel; • the impact of new acquisitions and divestitures; and • competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. © 2020 | 2

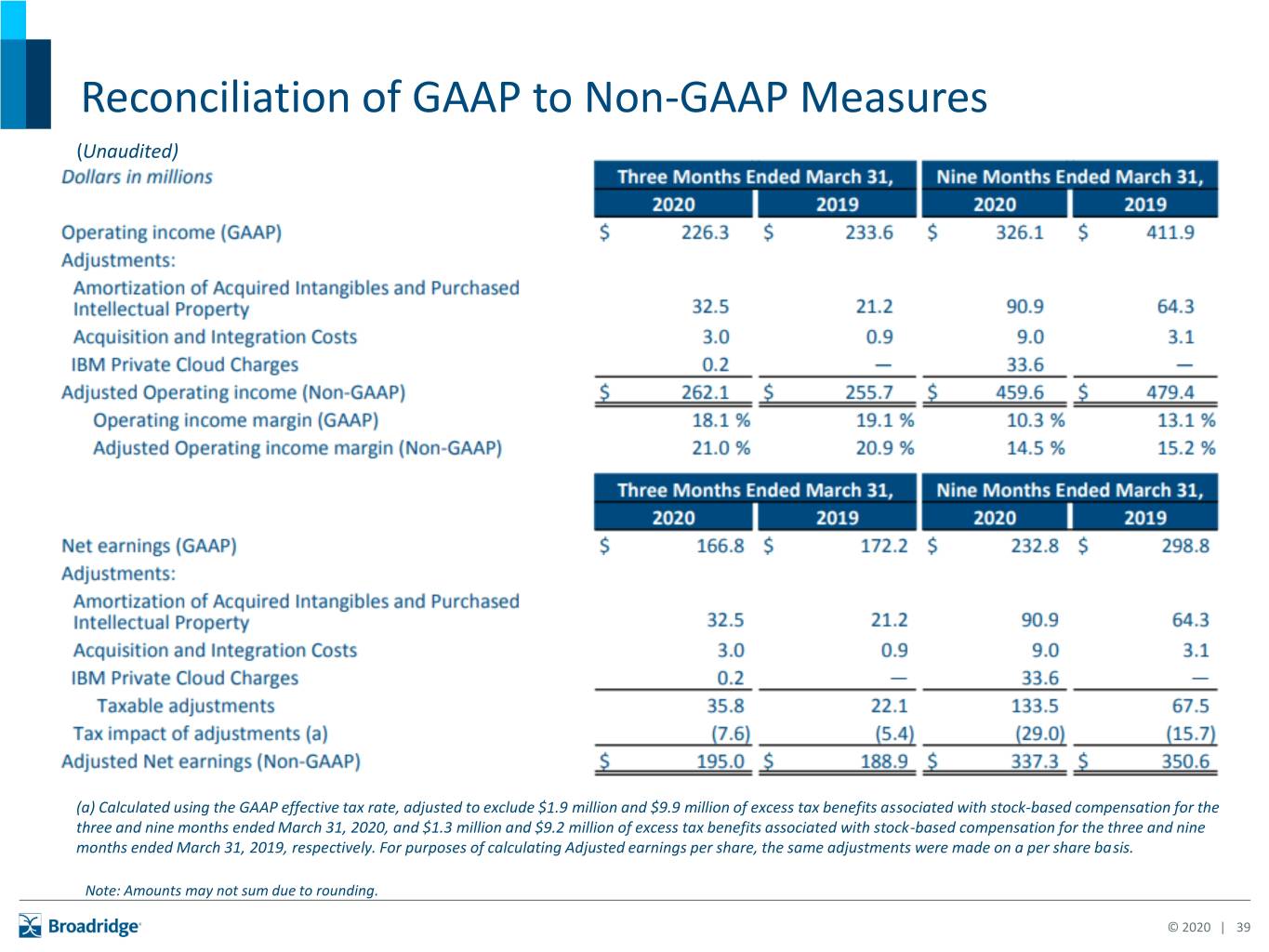

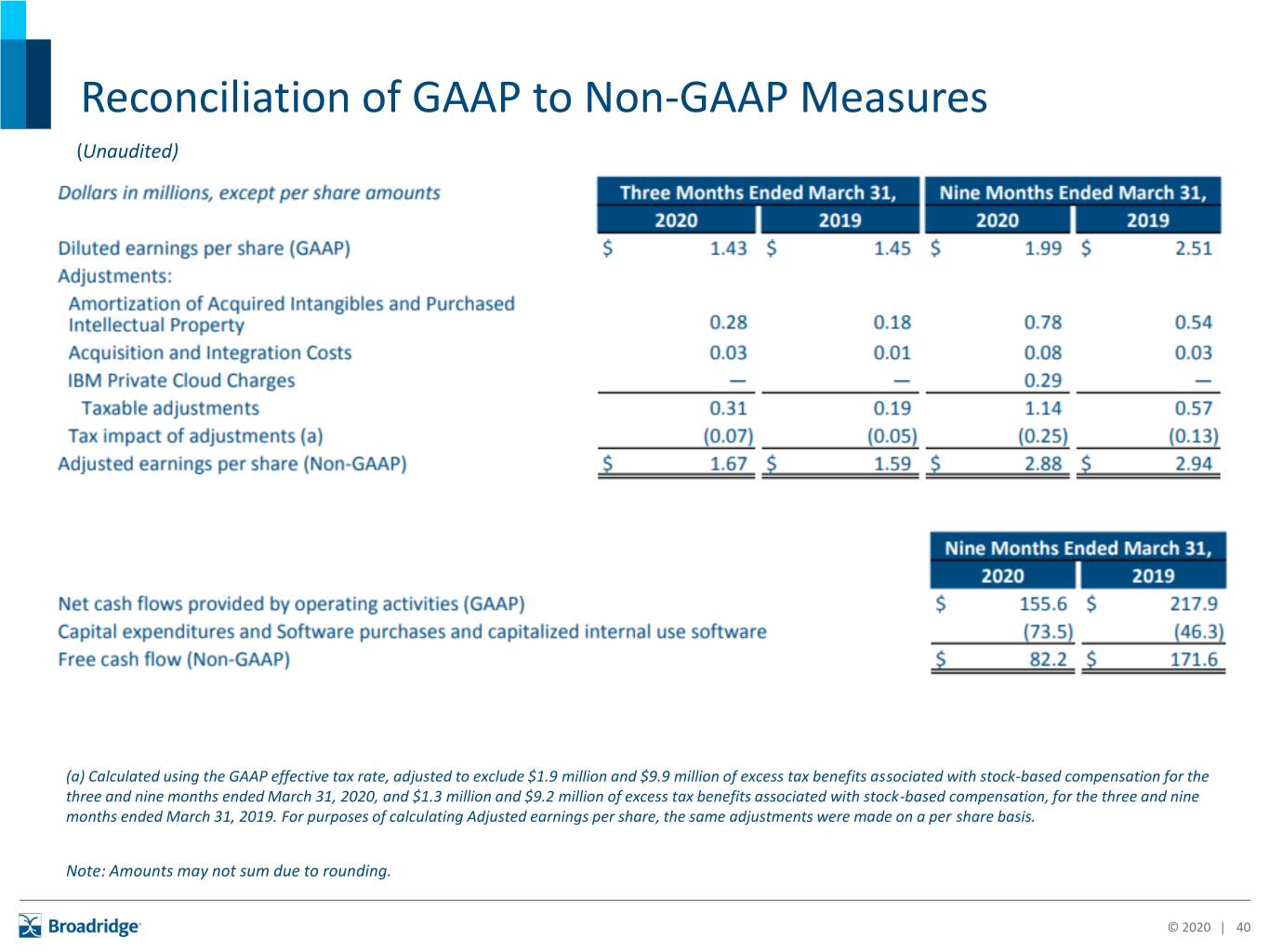

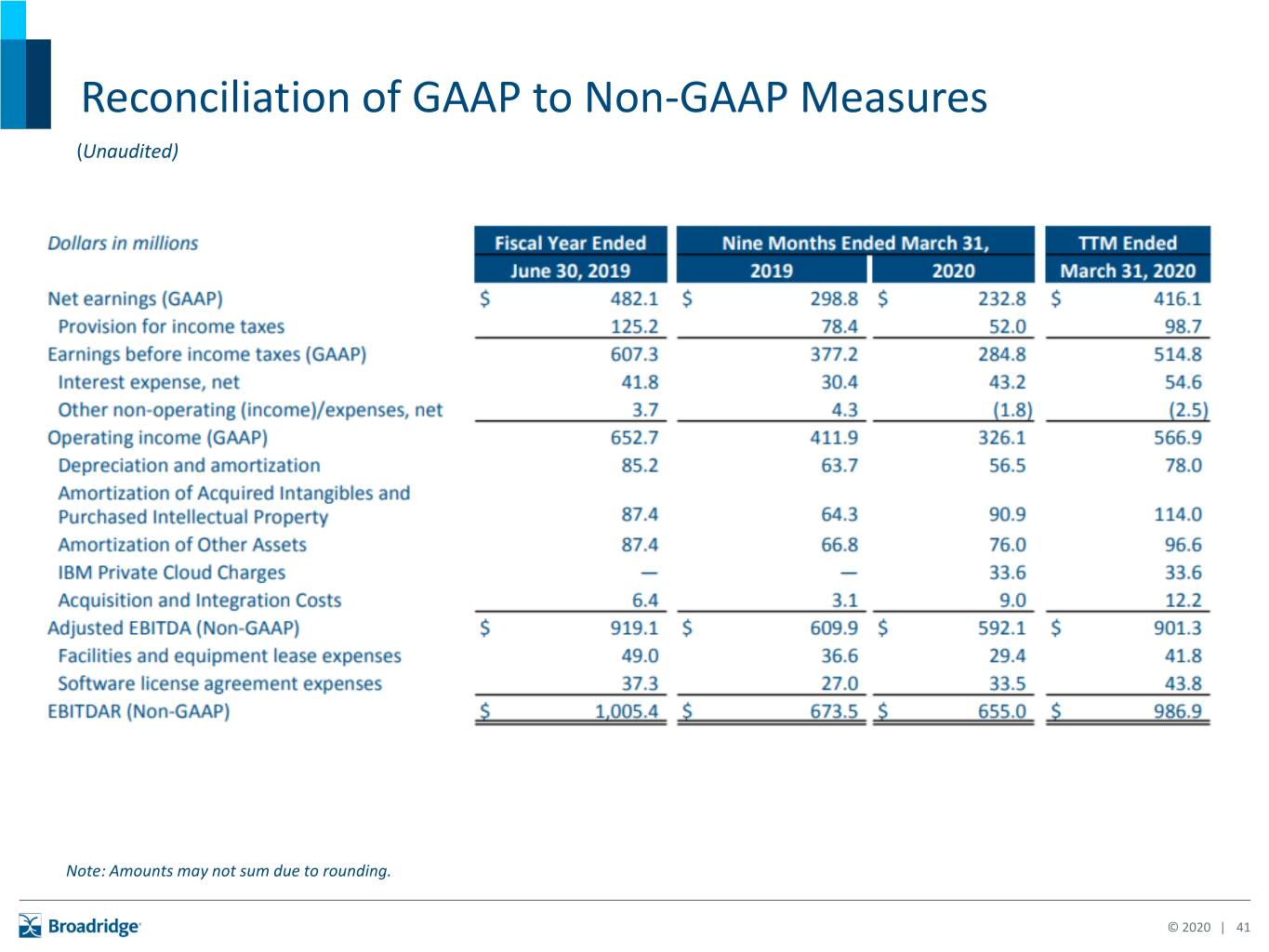

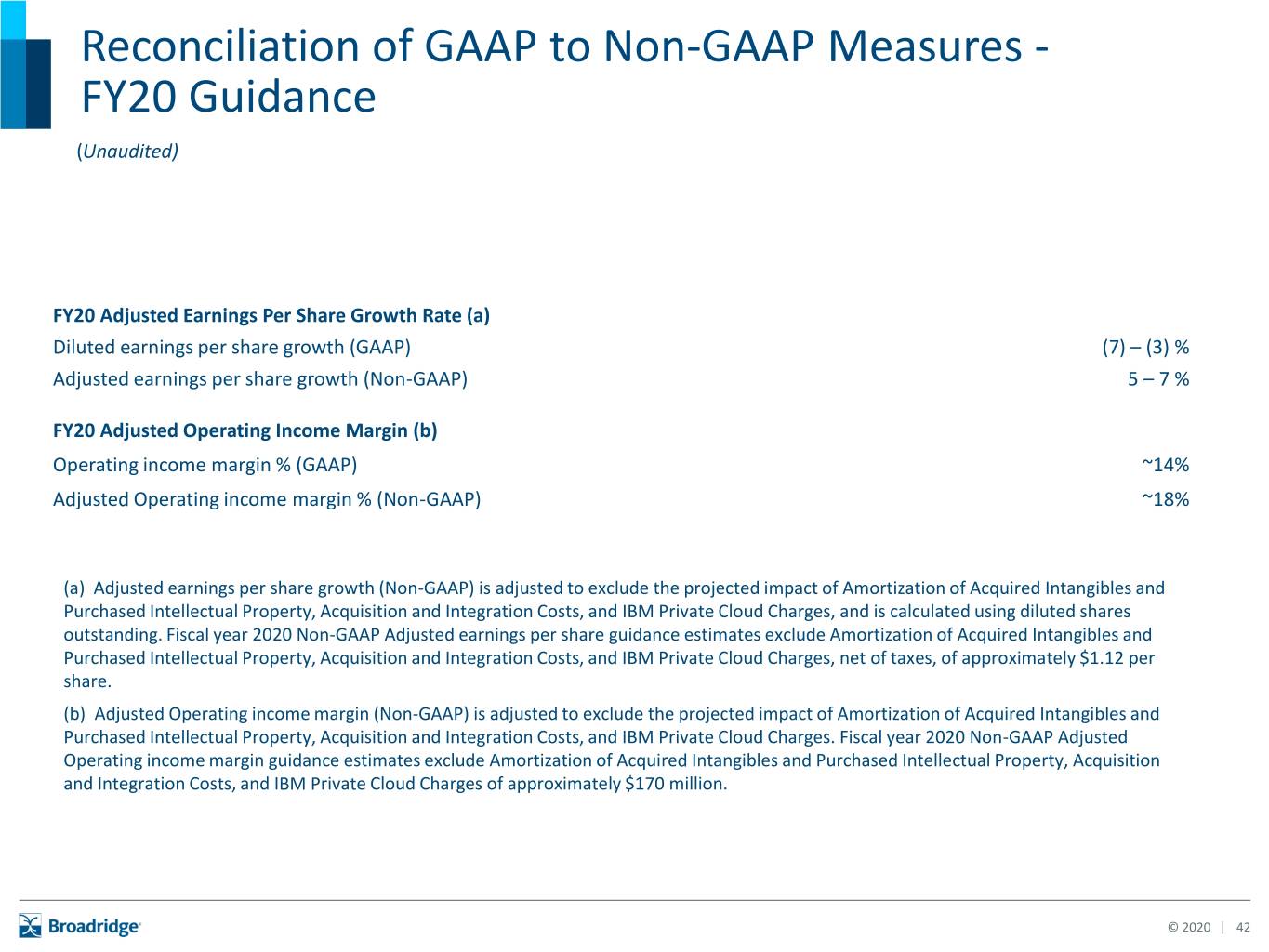

Use of Non-GAAP Financial Measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, Adjusted EBITDA, EBITDAR and Free cash flow. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, for internal planning, evaluating leverage, forecasting purposes and in the calculation of performance-based compensation. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Please see slides 37-42 for further explanation of our Non-GAAP Measures, the reasons we believe these Non-GAAP measures are helpful to our investors, and reconciliations of these Non-GAAP measures to the most directly comparable GAAP measures. © 2020 | 3

Broadridge and Covid ▪1 The Covid-19 crisis has reinforced the essential nature of Broadridge’s work – what we do matters ▪2 The health and safety of our associates is our top priority ▪3 We have delivered strong operational performance ▪4 As a result, we are seeing continued growth and solid financial results despite the crisis ▪5 Long-term impact confirms Broadridge business model and supports future growth © 2020 | 4

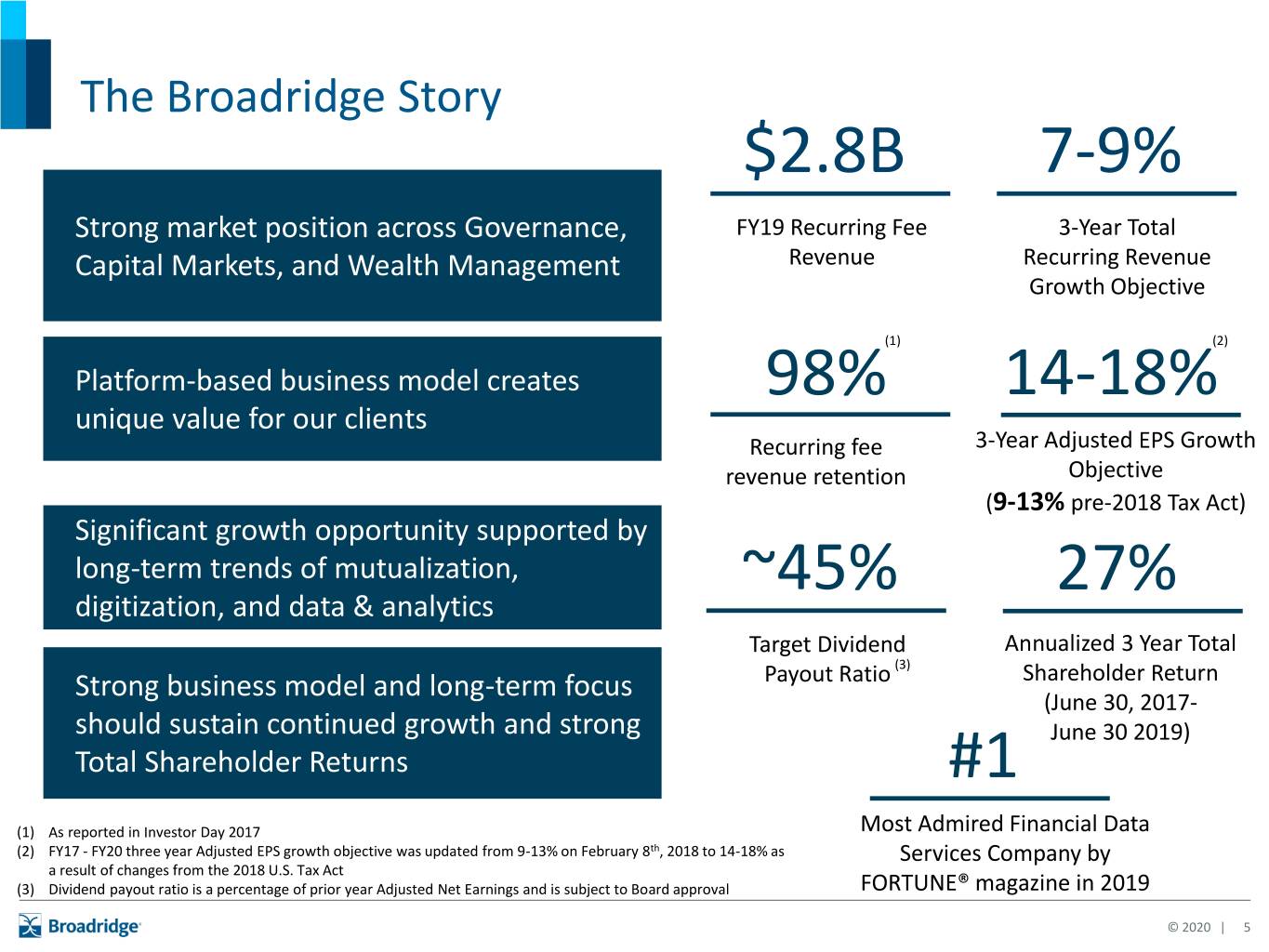

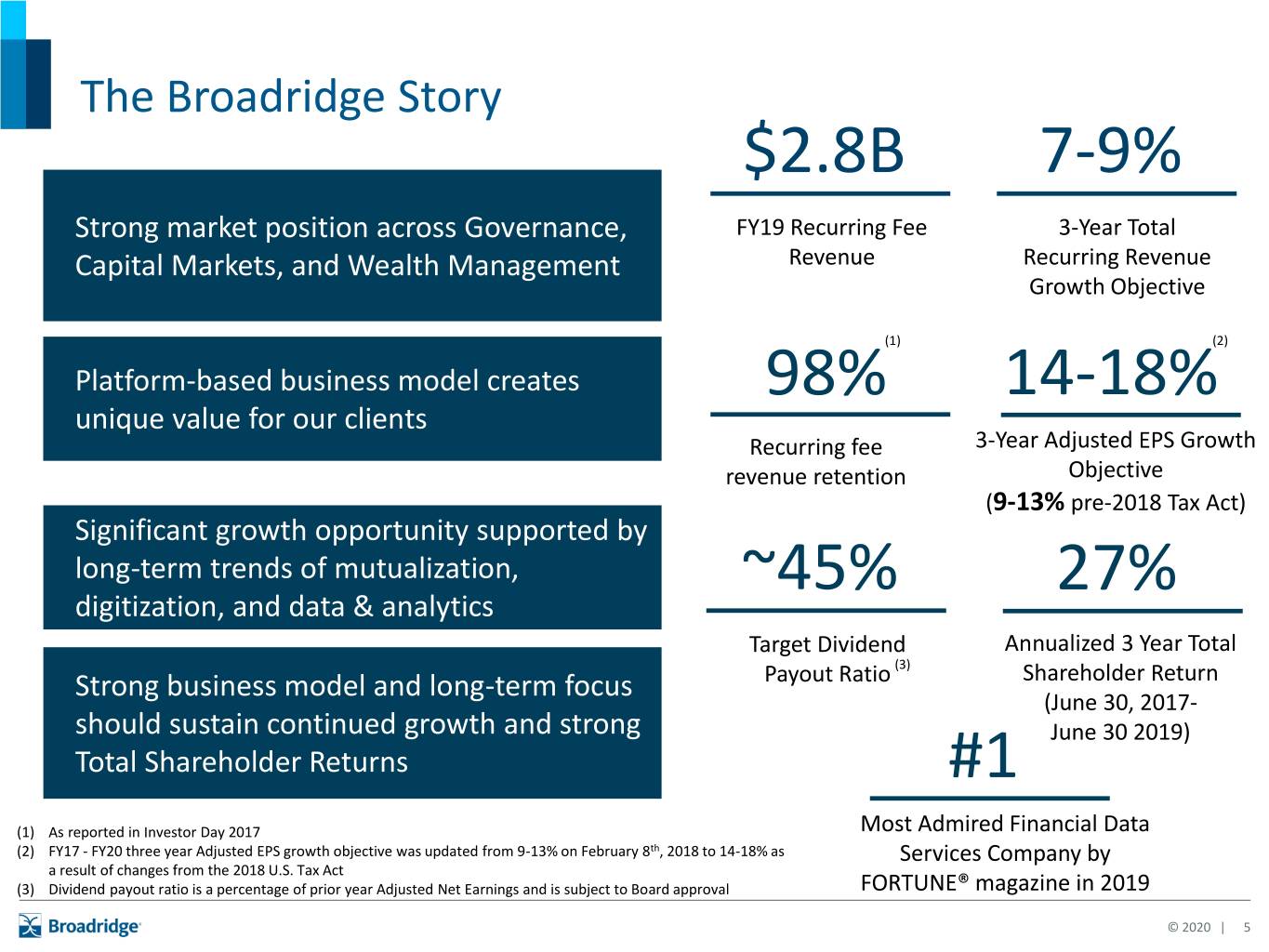

The Broadridge Story $2.8B 7-9% Strong market position across Governance, FY19 Recurring Fee 3-Year Total Capital Markets, and Wealth Management Revenue Recurring Revenue Growth Objective (1) (2) Platform-based business model creates 98% 14-18% unique value for our clients Recurring fee 3-Year Adjusted EPS Growth revenue retention Objective (9-13% pre-2018 Tax Act) Significant growth opportunity supported by long-term trends of mutualization, ~45% 27% digitization, and data & analytics Target Dividend Annualized 3 Year Total (3) Strong business model and long-term focus Payout Ratio Shareholder Return (June 30, 2017- should sustain continued growth and strong June 30 2019) Total Shareholder Returns #1 (1) As reported in Investor Day 2017 Most Admired Financial Data (2) FY17 - FY20 three year Adjusted EPS growth objective was updated from 9-13% on February 8th, 2018 to 14-18% as Services Company by a result of changes from the 2018 U.S. Tax Act (3) Dividend payout ratio is a percentage of prior year Adjusted Net Earnings and is subject to Board approval FORTUNE® magazine in 2019 © 2020 | 5

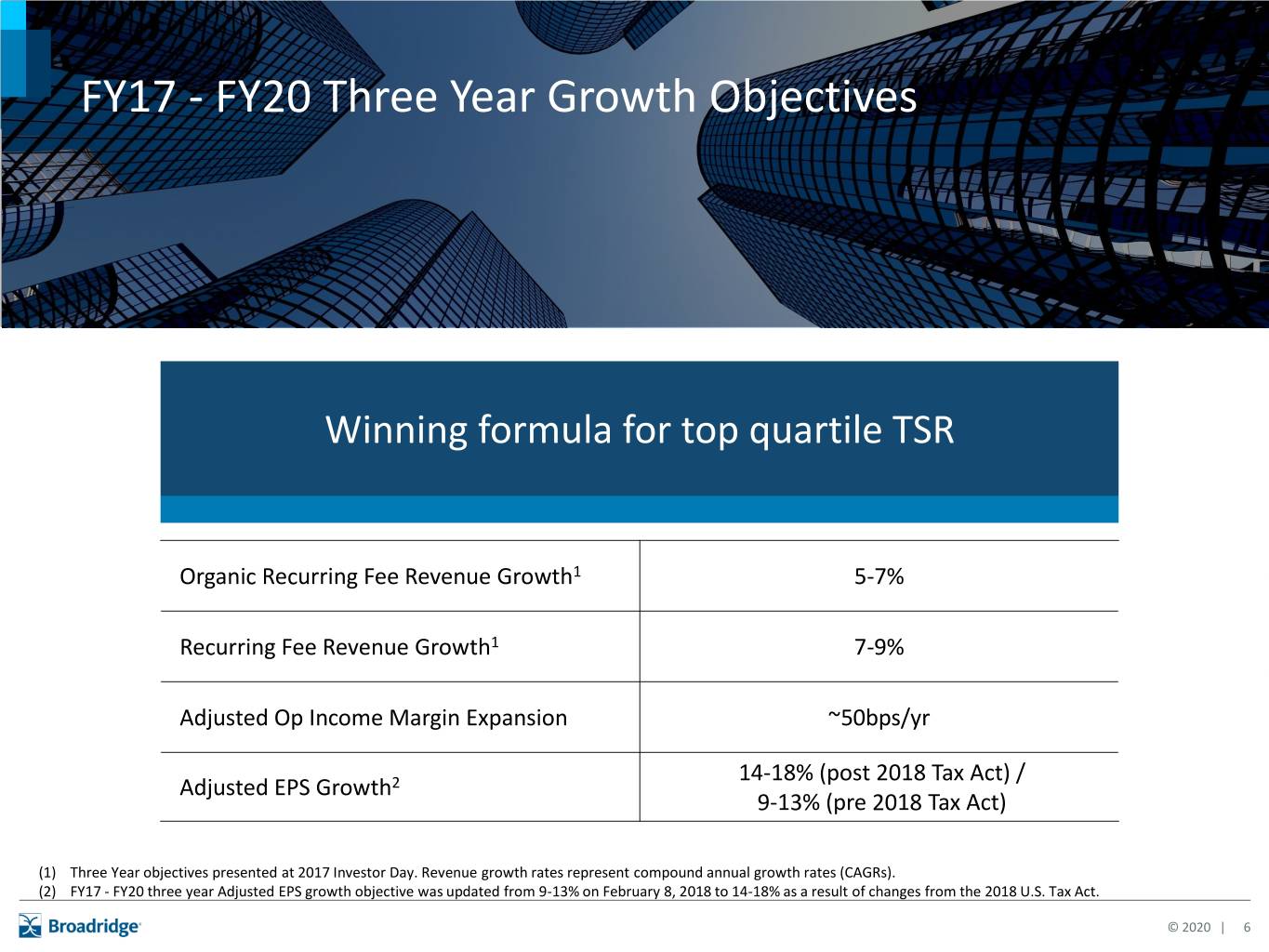

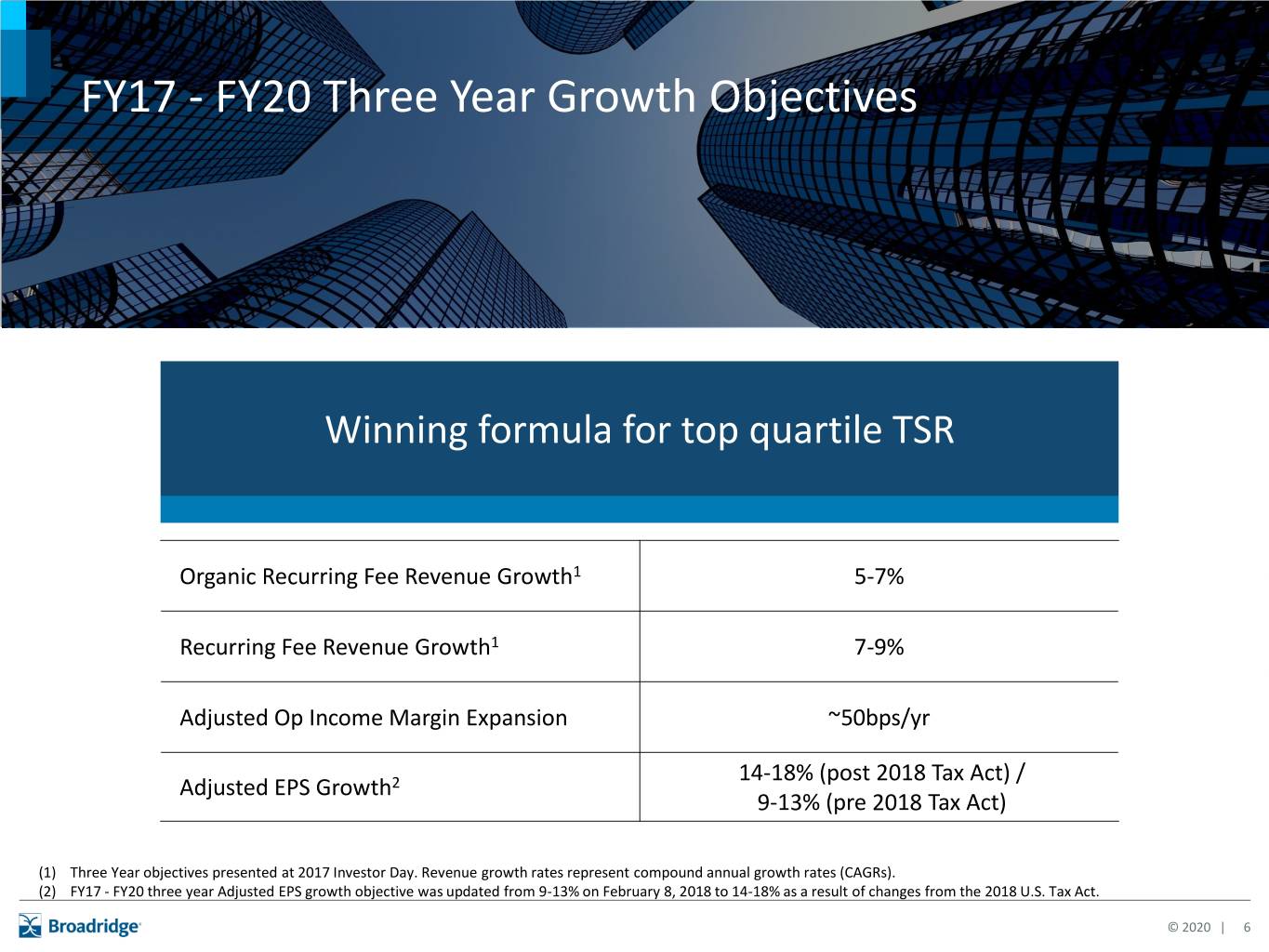

FY17 - FY20 Three Year Growth Objectives Winning formula for top quartile TSR Organic Recurring Fee Revenue Growth1 5-7% Recurring Fee Revenue Growth1 7-9% Adjusted Op Income Margin Expansion ~50bps/yr 14-18% (post 2018 Tax Act) / Adjusted EPS Growth2 9-13% (pre 2018 Tax Act) (1) Three Year objectives presented at 2017 Investor Day. Revenue growth rates represent compound annual growth rates (CAGRs). (2) FY17 - FY20 three year Adjusted EPS growth objective was updated from 9-13% on February 8, 2018 to 14-18% as a result of changes from the 2018 U.S. Tax Act. © 2020 | 6

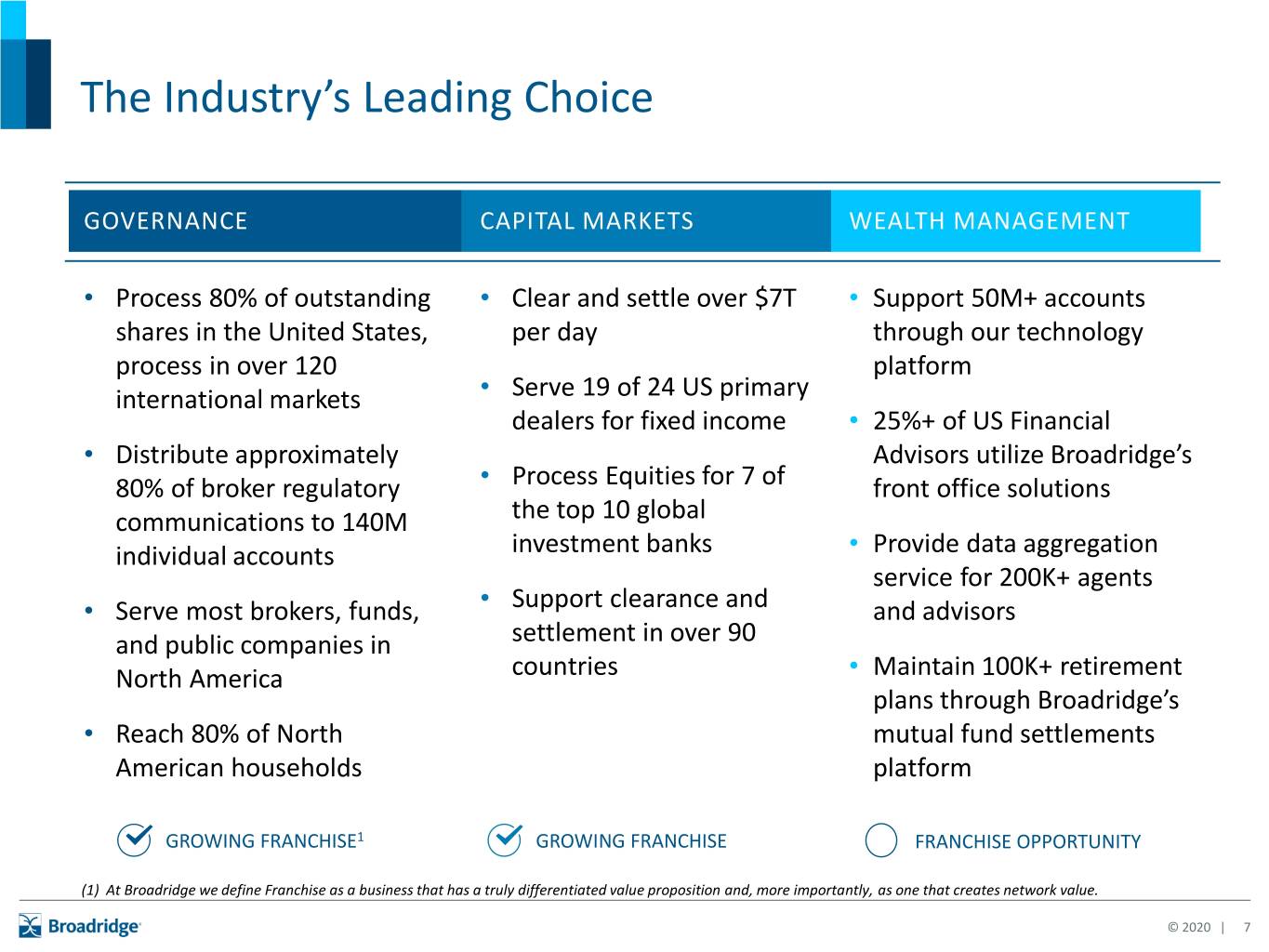

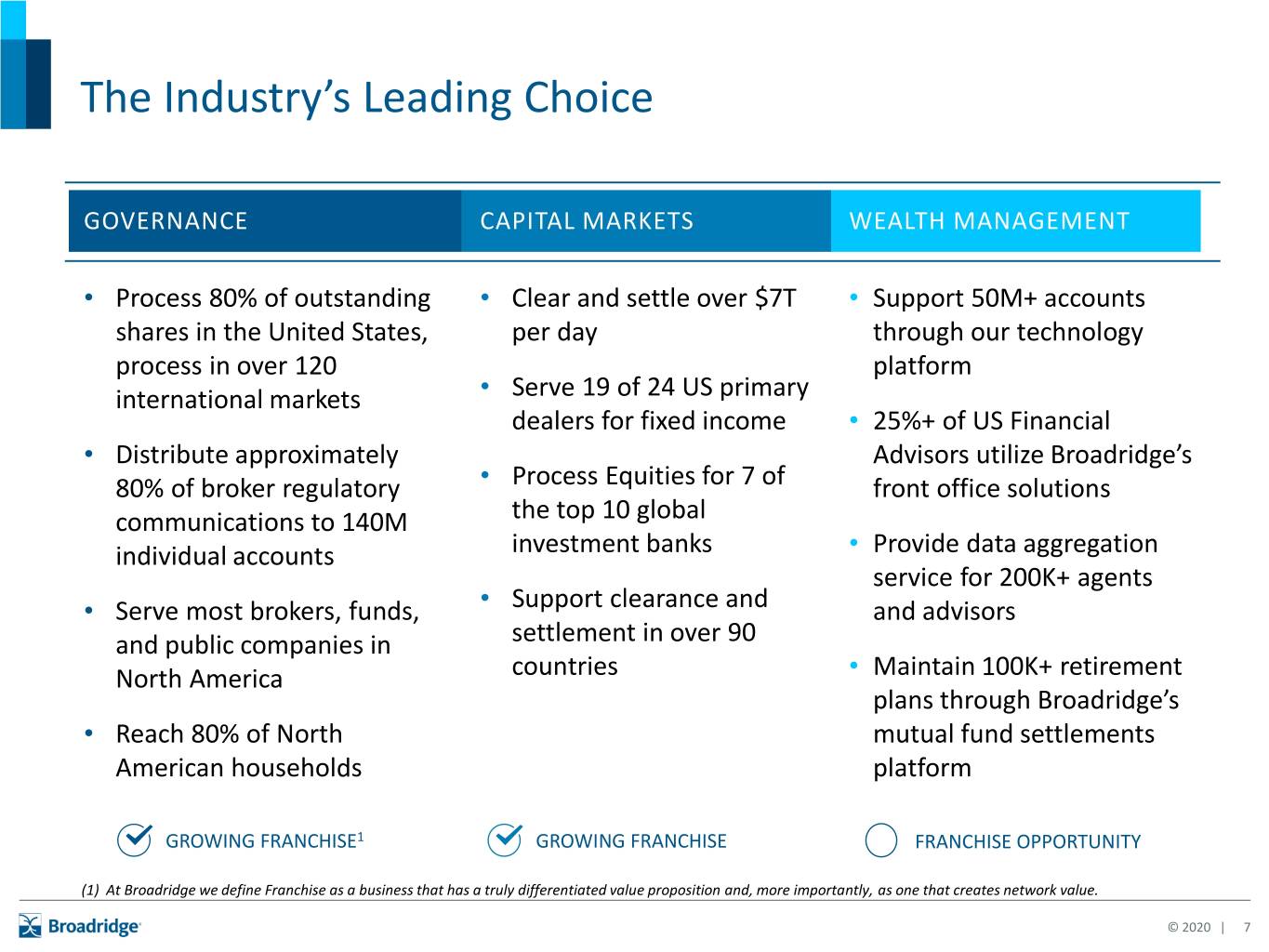

The Industry’s Leading Choice GOVERNANCE CAPITAL MARKETS WEALTH MANAGEMENT • Process 80% of outstanding • Clear and settle over $7T • Support 50M+ accounts shares in the United States, per day through our technology process in over 120 platform international markets • Serve 19 of 24 US primary dealers for fixed income • 25%+ of US Financial • Distribute approximately Advisors utilize Broadridge’s 80% of broker regulatory • Process Equities for 7 of front office solutions communications to 140M the top 10 global individual accounts investment banks • Provide data aggregation service for 200K+ agents • Serve most brokers, funds, • Support clearance and and advisors and public companies in settlement in over 90 North America countries • Maintain 100K+ retirement plans through Broadridge’s • Reach 80% of North mutual fund settlements American households platform GROWING FRANCHISE1 GROWING FRANCHISE FRANCHISE OPPORTUNITY (1) At Broadridge we define Franchise as a business that has a truly differentiated value proposition and, more importantly, as one that creates network value. © 2020 | 7

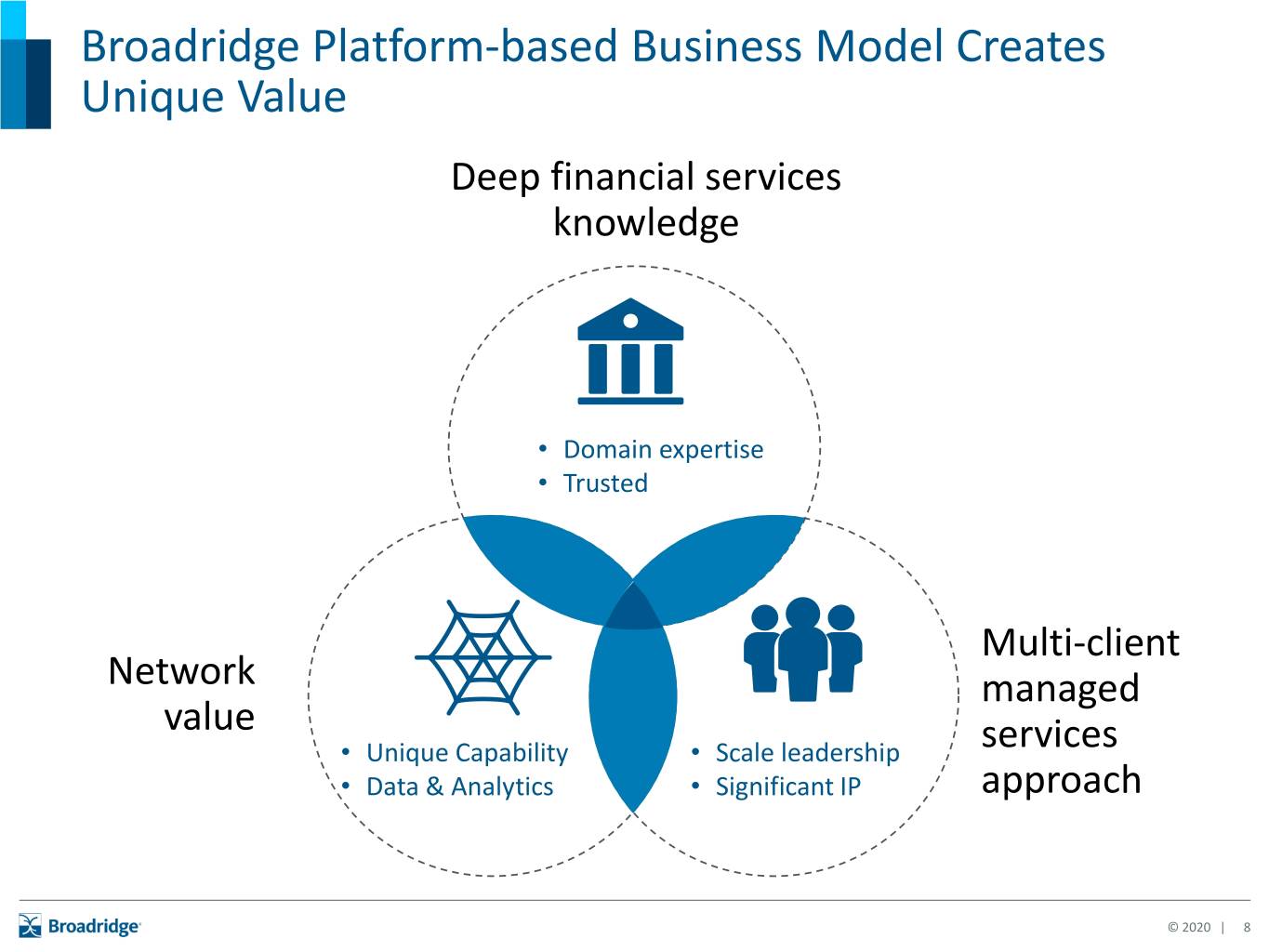

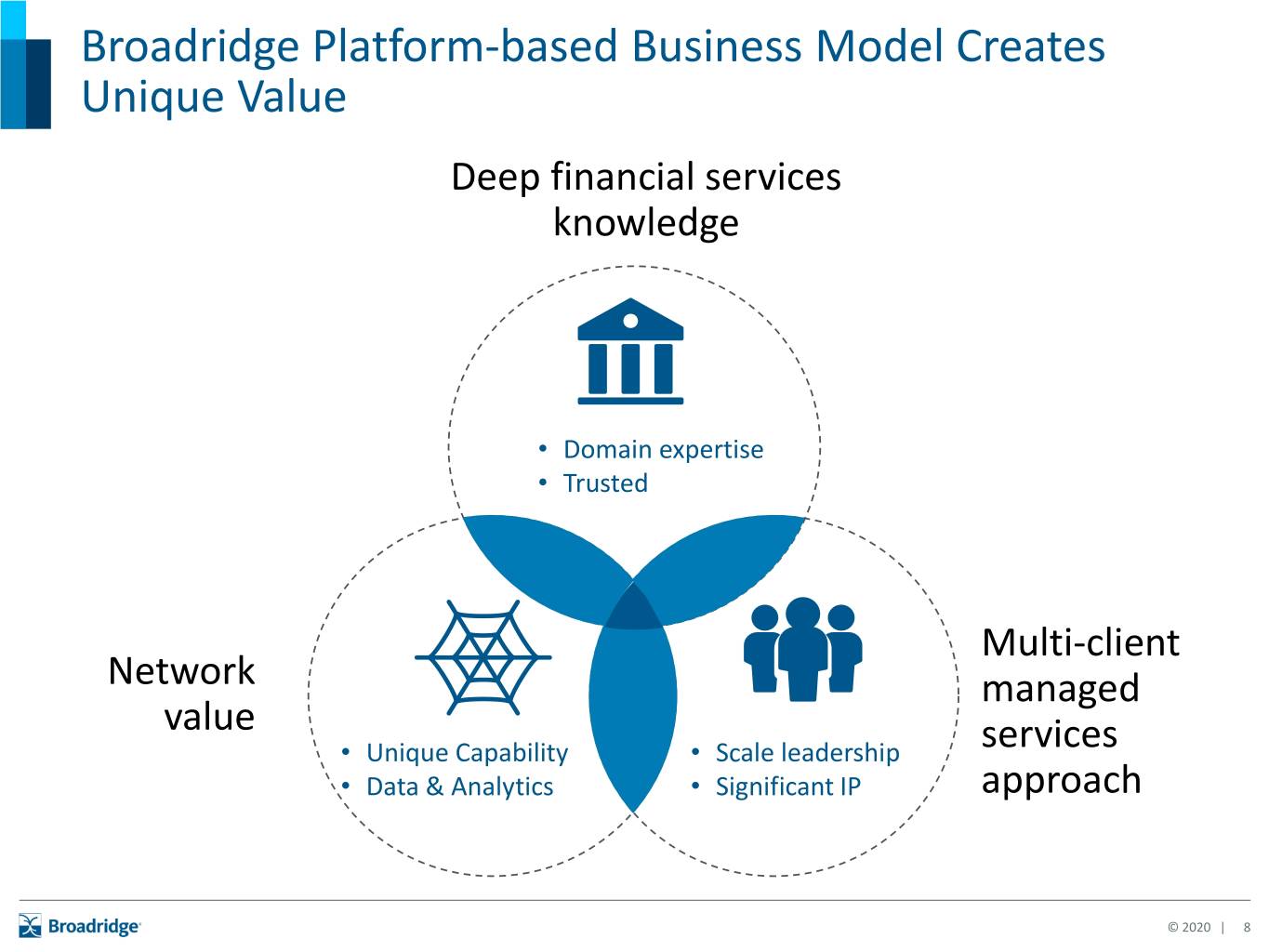

Broadridge Platform-based Business Model Creates Unique Value Deep financial services knowledge • Domain expertise • Trusted Multi-client Network managed value • Unique Capability • Scale leadership services • Data & Analytics • Significant IP approach © 2020 | 8

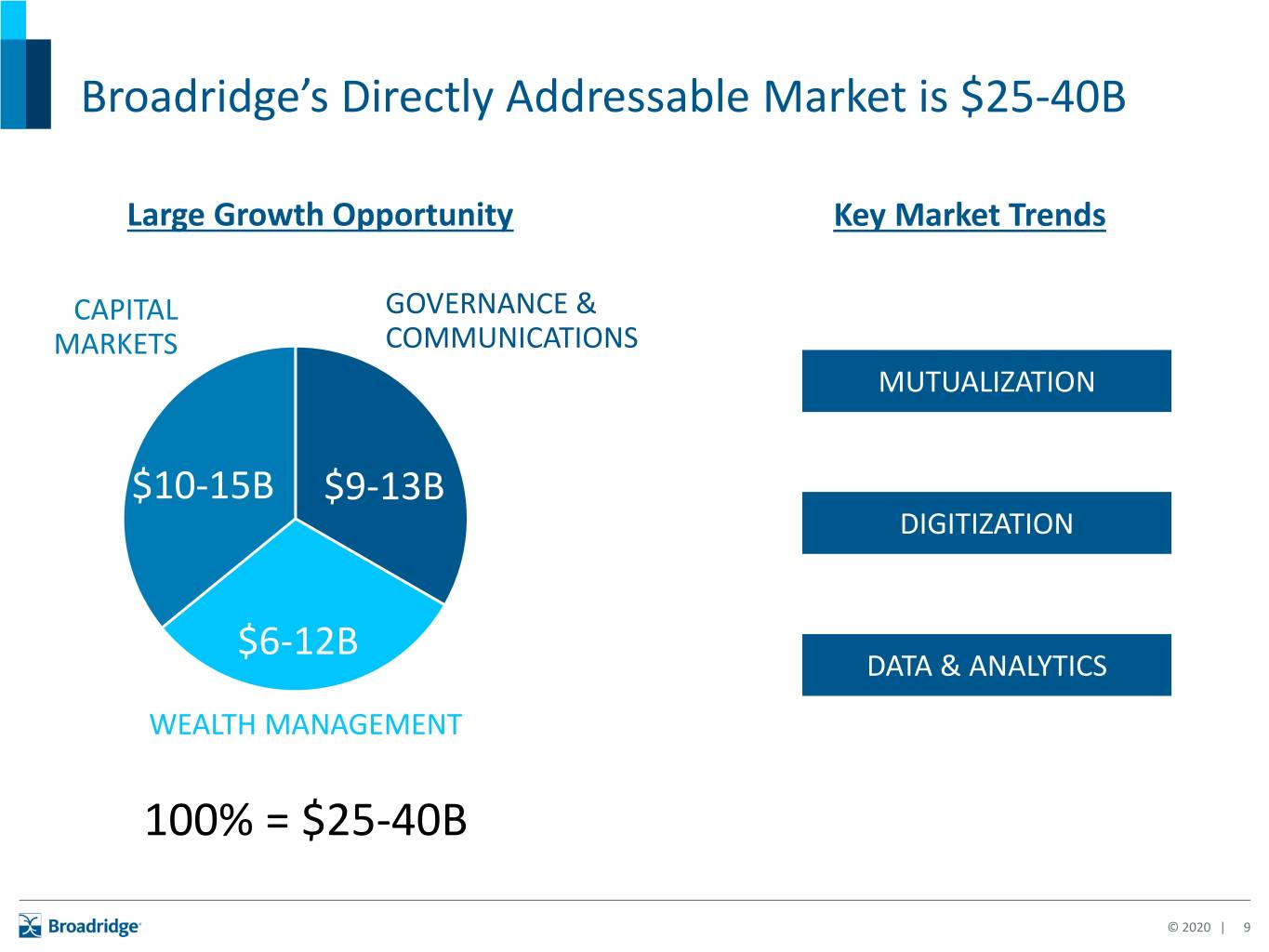

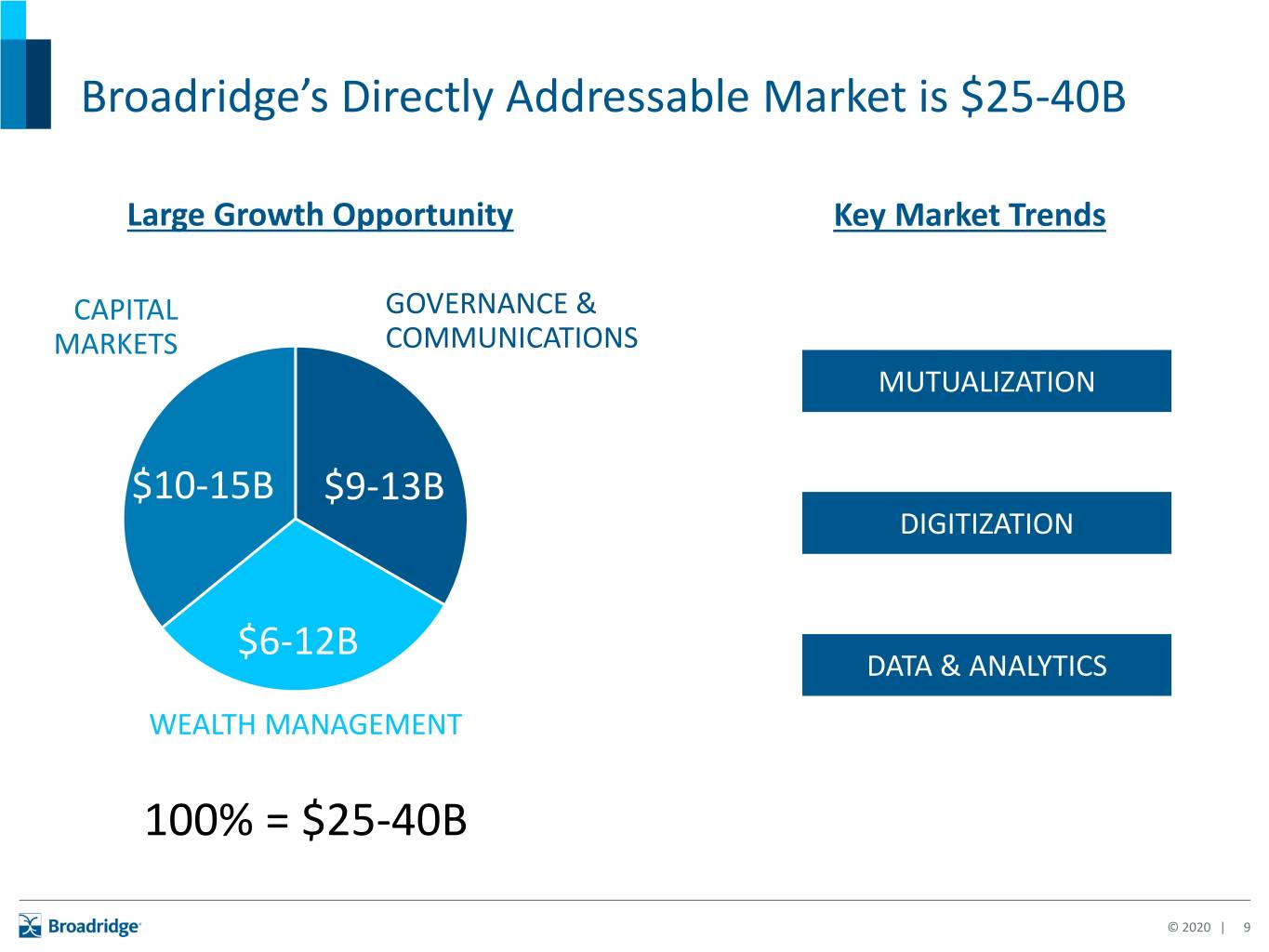

Broadridge’s Directly Addressable Market is $25-40B Large Growth Opportunity Key Market Trends CAPITAL GOVERNANCE & MARKETS COMMUNICATIONS MUTUALIZATION $10-15B $9-13B DIGITIZATION $6-12B DATA & ANALYTICS WEALTH MANAGEMENT 100% = $25-40B © 2020 | 9

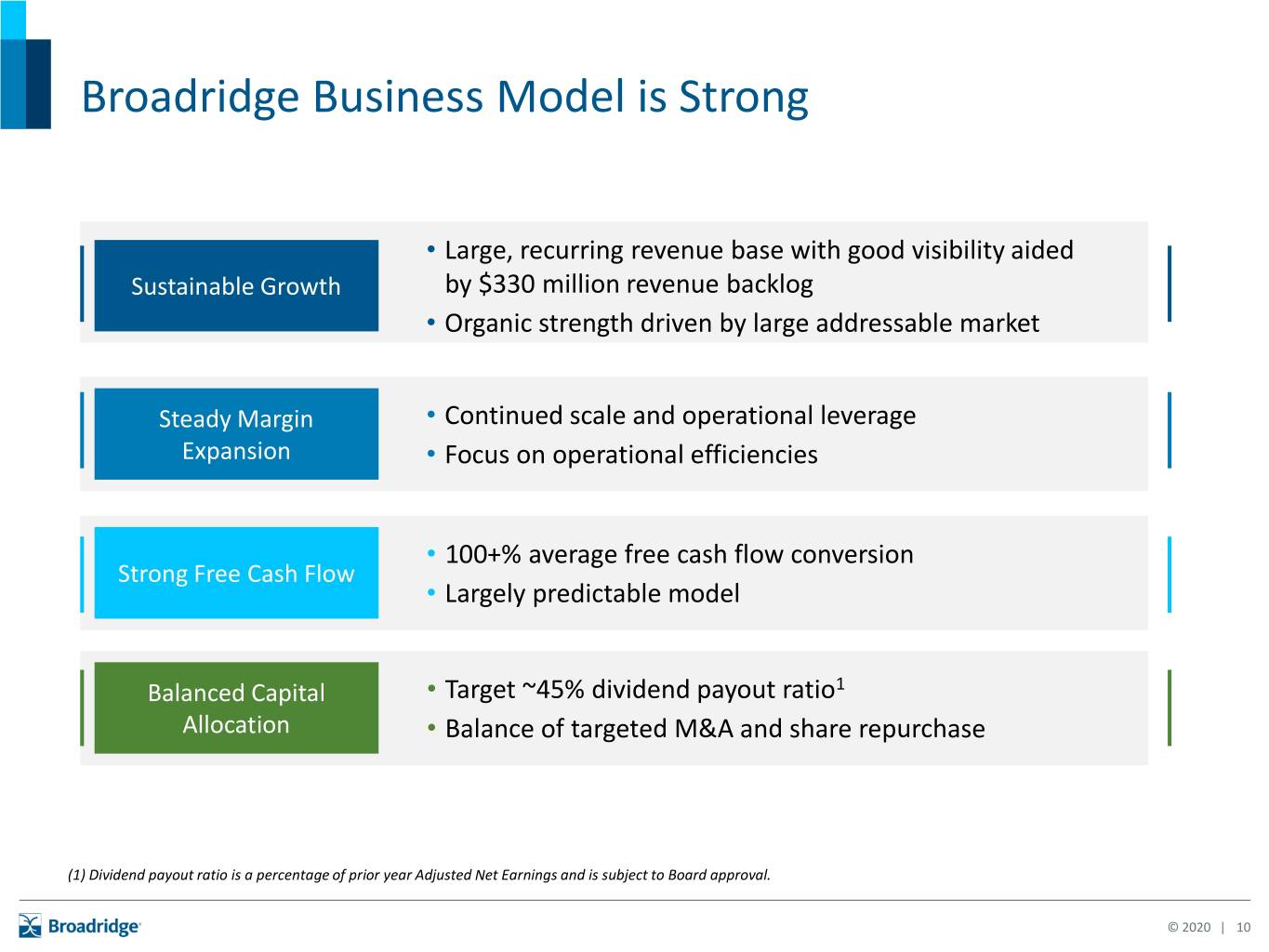

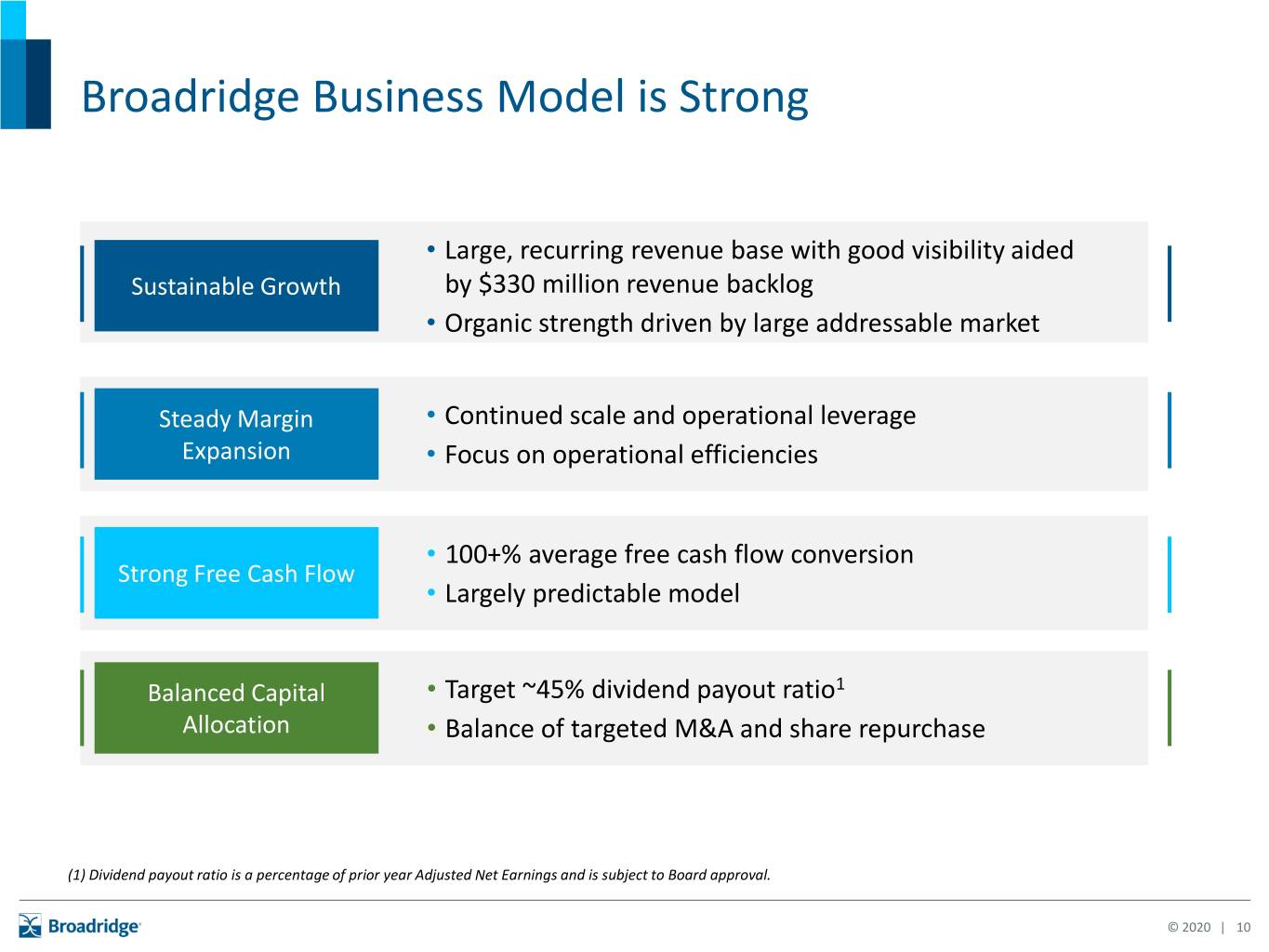

Broadridge Business Model is Strong • Large, recurring revenue base with good visibility aided Sustainable Growth by $330 million revenue backlog • Organic strength driven by large addressable market Steady Margin • Continued scale and operational leverage Expansion • Focus on operational efficiencies • 100+% average free cash flow conversion Strong Free Cash Flow • Largely predictable model Balanced Capital • Target ~45% dividend payout ratio1 Allocation • Balance of targeted M&A and share repurchase (1) Dividend payout ratio is a percentage of prior year Adjusted Net Earnings and is subject to Board approval. © 2020 | 10

Executing Against Investor Day Themes Extend Governance Drive Capital Markets Build Wealth Management • Driving next-gen regulatory • Extending global post trade • On track to deliver front to communications technology platform back wealth management ✓ Strengthening digital ✓ Continued progress platform for UBS in CY21 products to enhance onboarding major clients • Continued strong interest regulatory and other ✓ New client wins further from key clients in communications extend international reach integrated Wealth ✓ Rule 30e-3 and Enhanced platform Content opportunities • Developing new products to drive network value in • RPM, Rockall, Shadow and • Growing data & analytics fixed income market ClearStructure acquisitions suite • Developing blockchain- accelerate growth and • Broadening corporate enabled solution for repo broaden product suite issuer solution set market • Continuing penetration of • Building omni-channel existing products communications © 2020 | 11

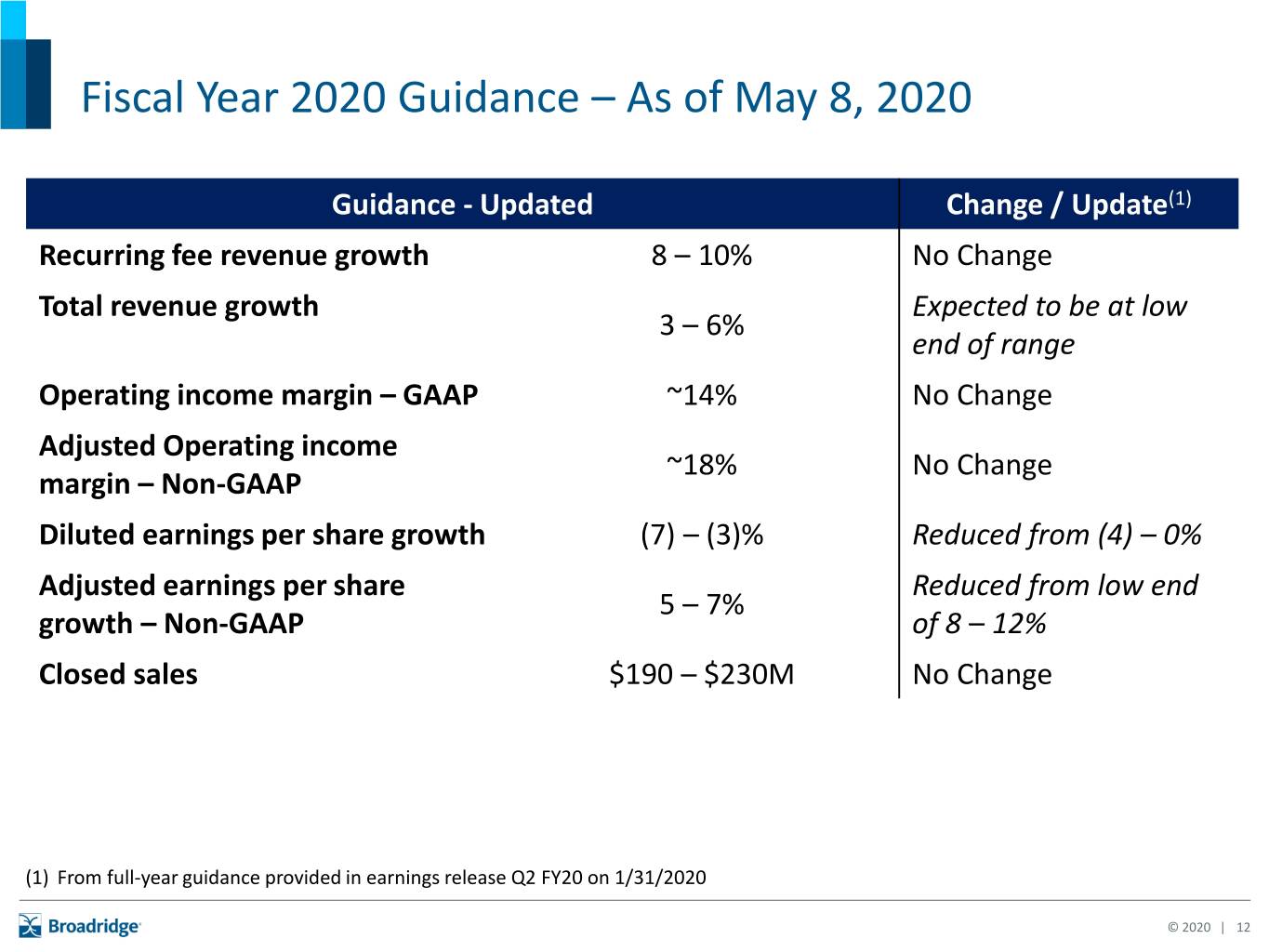

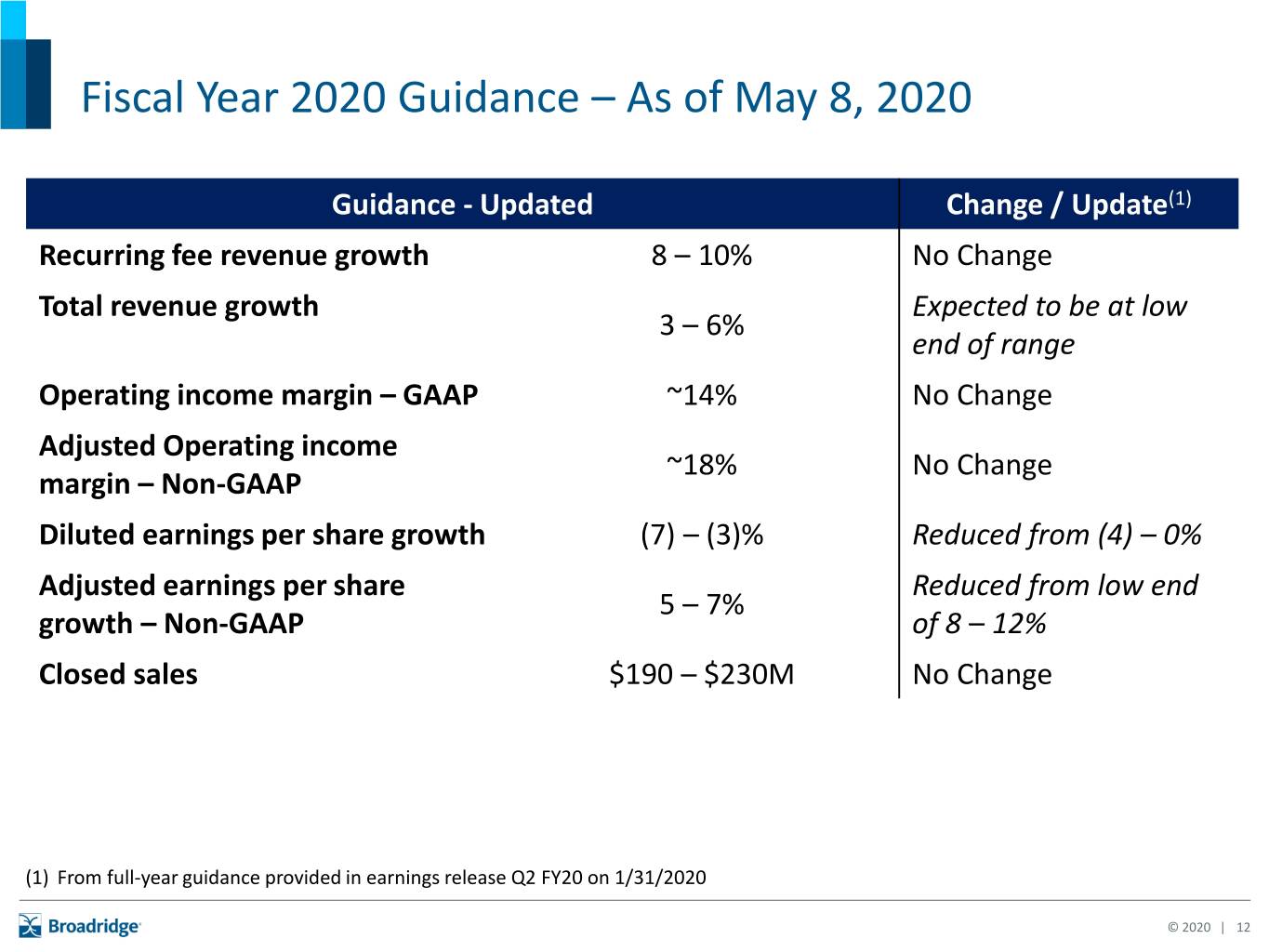

Fiscal Year 2020 Guidance – As of May 8, 2020 Guidance - Updated Change / Update(1) Recurring fee revenue growth 8 – 10% No Change Total revenue growth Expected to be at low 3 – 6% end of range Operating income margin – GAAP ~14% No Change Adjusted Operating income ~18% No Change margin – Non-GAAP Diluted earnings per share growth (7) – (3)% Reduced from (4) – 0% Adjusted earnings per share Reduced from low end 5 – 7% growth – Non-GAAP of 8 – 12% Closed sales $190 – $230M No Change (1) From full-year guidance provided in earnings release Q2 FY20 on 1/31/2020 © 2020 | 12

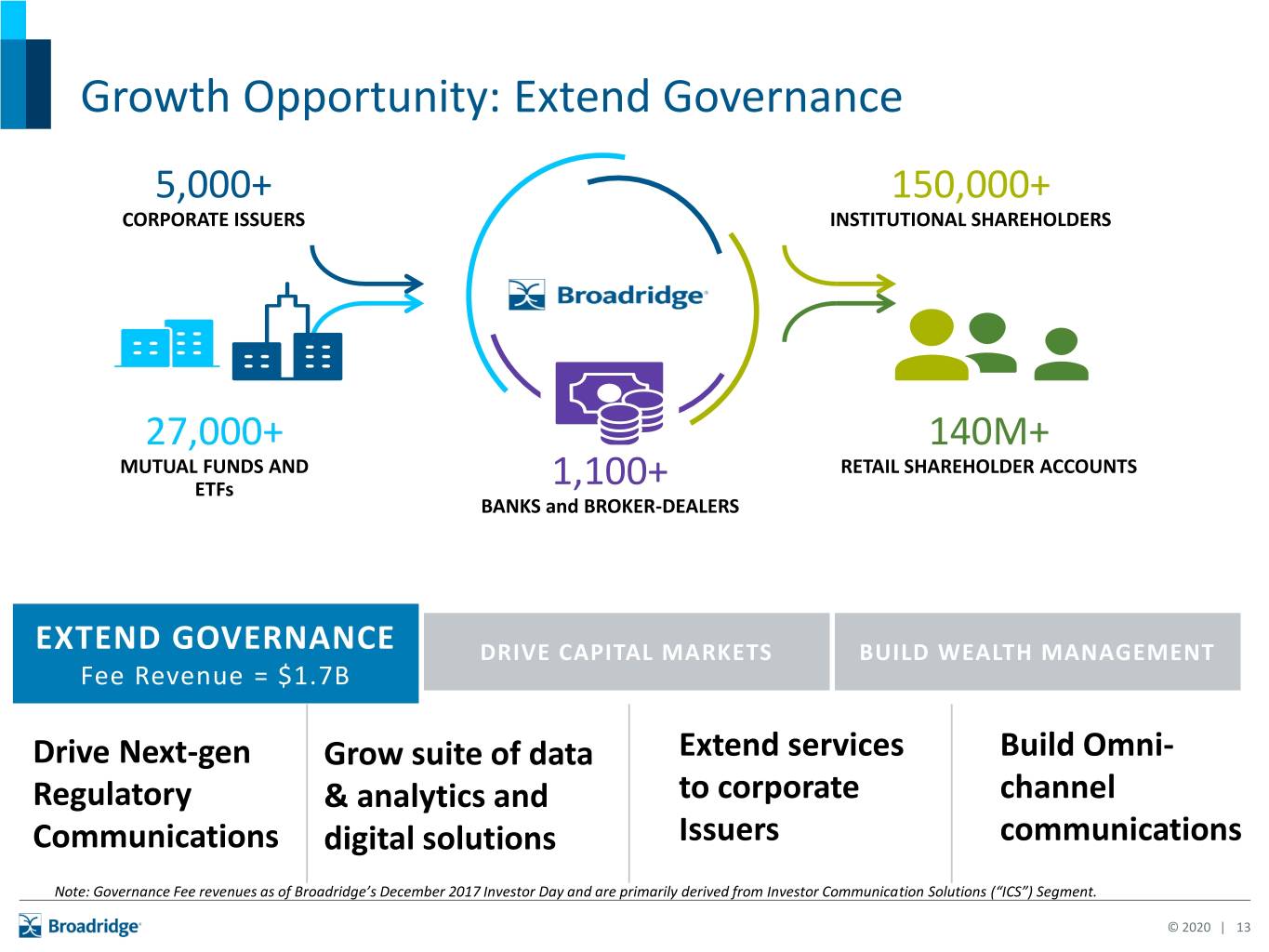

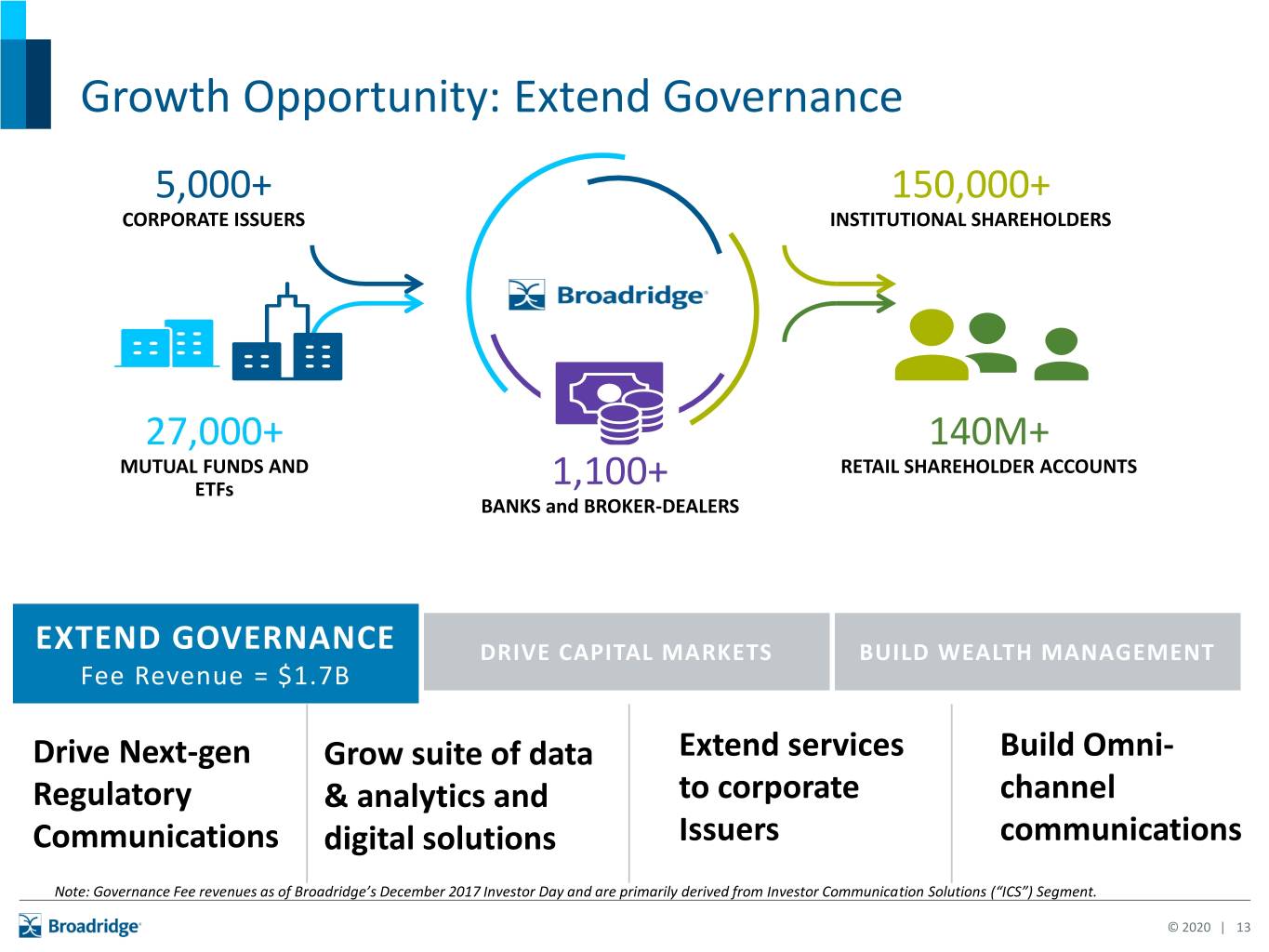

Growth Opportunity: Extend Governance 5,000+ 150,000+ CORPORATE ISSUERS INSTITUTIONAL SHAREHOLDERS 27,000+ 140M+ MUTUAL FUNDS AND RETAIL SHAREHOLDER ACCOUNTS ETFs 1,100+ BANKS and BROKER-DEALERS EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH MANAGEMENT Fee Revenue = $1.7B Drive Next-gen Grow suite of data Extend services Build Omni- Regulatory & analytics and to corporate channel Communications digital solutions Issuers communications Note: Governance Fee revenues as of Broadridge’s December 2017 Investor Day and are primarily derived from Investor Communication Solutions (“ICS”) Segment. © 2020 | 13

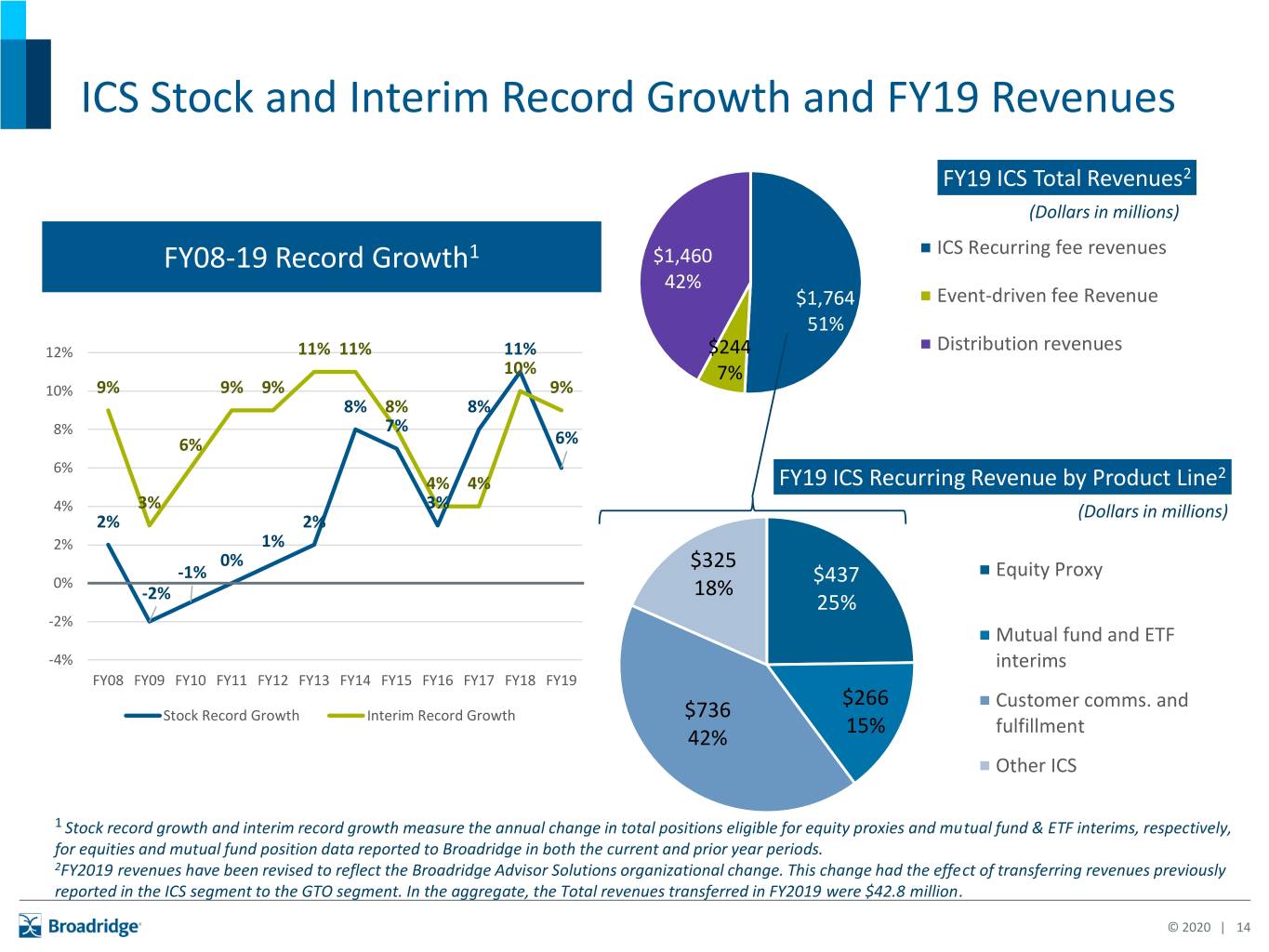

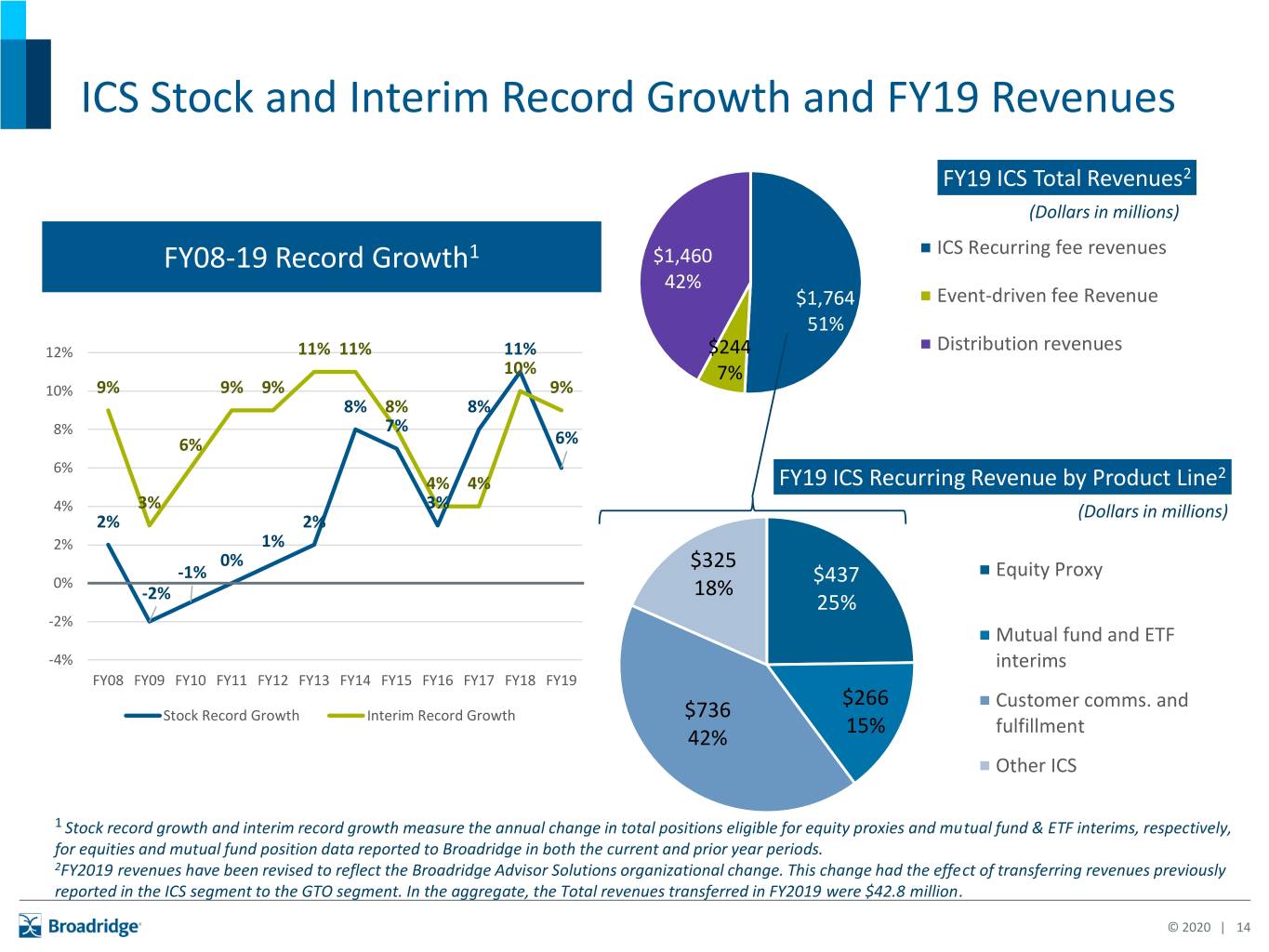

ICS Stock and Interim Record Growth and FY19 Revenues FY19 ICS Total Revenues2 (Dollars in millions) FY08-19 Record Growth1 $1,460 ICS Recurring fee revenues 42% $1,764 Event-driven fee Revenue 51% 12% 11% 11% 11% $244 Distribution revenues 10% 7% 10% 9% 9% 9% 9% 8% 8% 8% 8% 7% 6% 6% 6% 2 4% 4% FY19 ICS Recurring Revenue by Product Line 4% 3% 3% (Dollars in millions) 2% 2% 2% 1% 0% $325 -1% $437 Equity Proxy 0% 18% -2% 25% -2% Mutual fund and ETF -4% interims FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 $266 Customer comms. and Stock Record Growth Interim Record Growth $736 15% fulfillment 42% Other ICS 1 Stock record growth and interim record growth measure the annual change in total positions eligible for equity proxies and mutual fund & ETF interims, respectively, for equities and mutual fund position data reported to Broadridge in both the current and prior year periods. 2FY2019 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In the aggregate, the Total revenues transferred in FY2019 were $42.8 million. © 2020 | 14

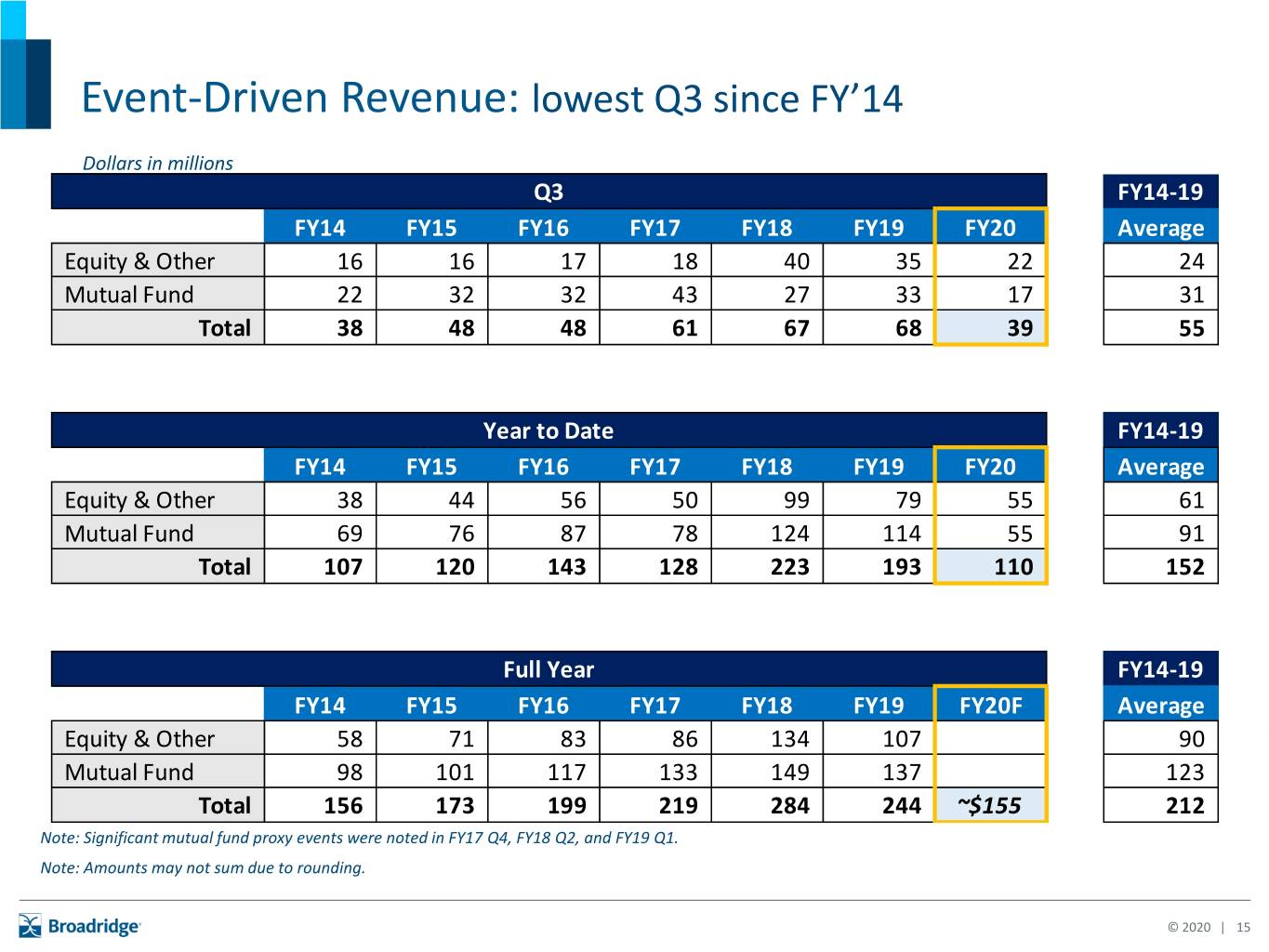

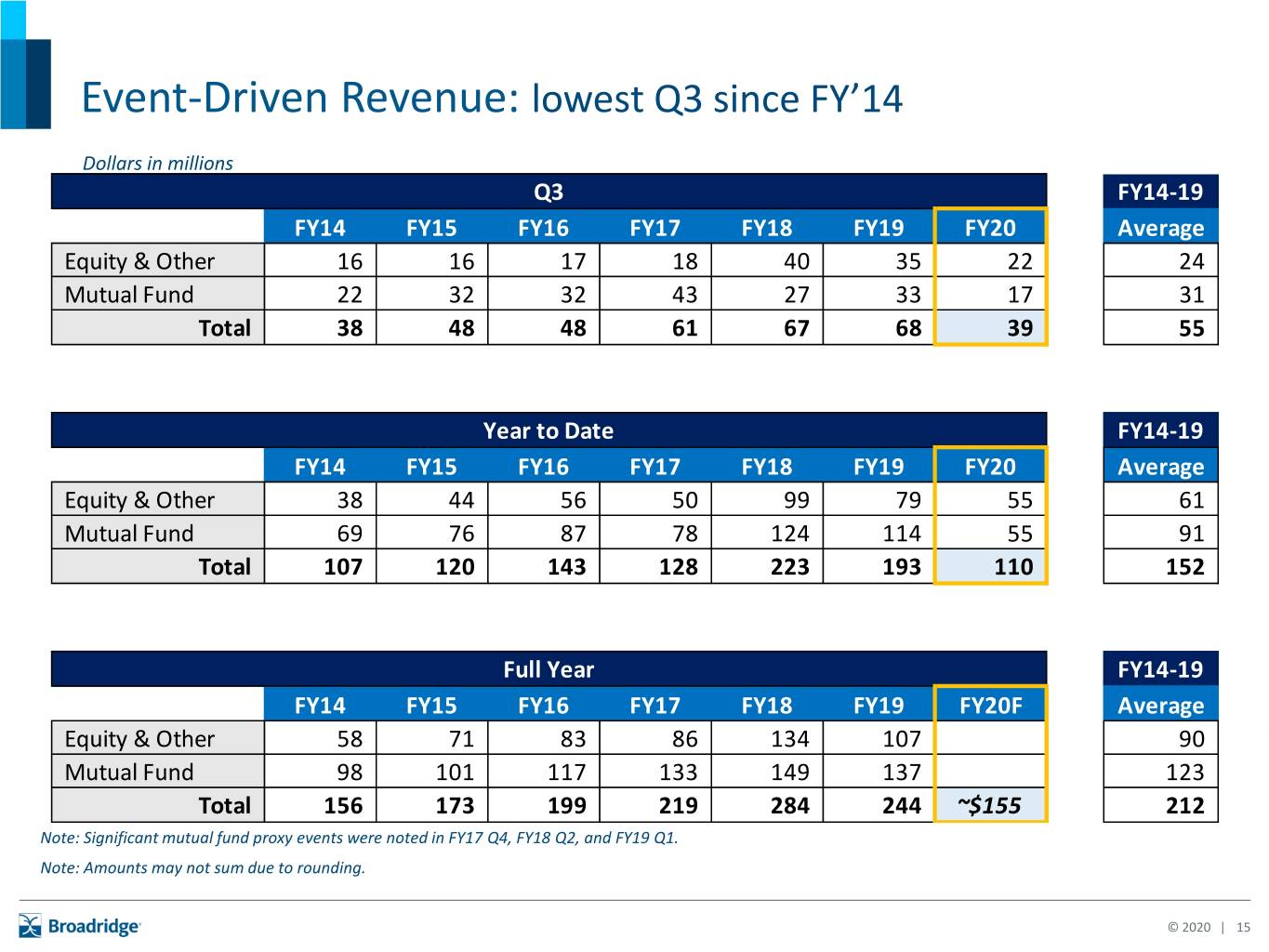

Event-Driven Revenue: lowest Q3 since FY’14 Dollars in millions Q3 FY14-19 FY14 FY15 FY16 FY17 FY18 FY19 FY20 Average Equity & Other 16 16 17 18 40 35 22 24 Mutual Fund 22 32 32 43 27 33 17 31 Total 38 48 48 61 67 68 39 55 Year to Date FY14-19 FY14 FY15 FY16 FY17 FY18 FY19 FY20 Average Equity & Other 38 44 56 50 99 79 55 61 Mutual Fund 69 76 87 78 124 114 55 91 Total 107 120 143 128 223 193 110 152 Full Year FY14-19 FY14 FY15 FY16 FY17 FY18 FY19 FY20F Average Equity & Other 58 71 83 86 134 107 90 Mutual Fund 98 101 117 133 149 137 123 Total 156 173 199 219 284 244 ~$155 212 Note: Significant mutual fund proxy events were noted in FY17 Q4, FY18 Q2, and FY19 Q1. Note: Amounts may not sum due to rounding. © 2020 | 15

Growth Opportunity: Drive Capital Markets Strong Unique managed Emerging Global market market position services model capabilities momentum • Serve 19 of the 24 US • Support 40+ clients for • Securities Financing & Fixed Income primary both technology and Collateral dealers operations including 7 Management of 24 US Fixed Income • Process Equities for 7 primary dealers • Corporate Actions of the top 10 global investment banks • Regulatory Reporting • Clear and settle in over 90 markets globally EXTEND GOVERNANCE DRIVE CAPITAL MARKETS BUILD WEALTH MANAGEMENT Fee Revenue = $0.5B Scale Global Post- Build Network Extend Additional Trade Technology Value Enterprise Capabilities Platform of the Future Note: Capital Markets Fee revenues as of Broadridge’s December 2017 Investor Day and are primarily derived from Global Technology and Operations (“GTO”) Segment © 2020 | 16

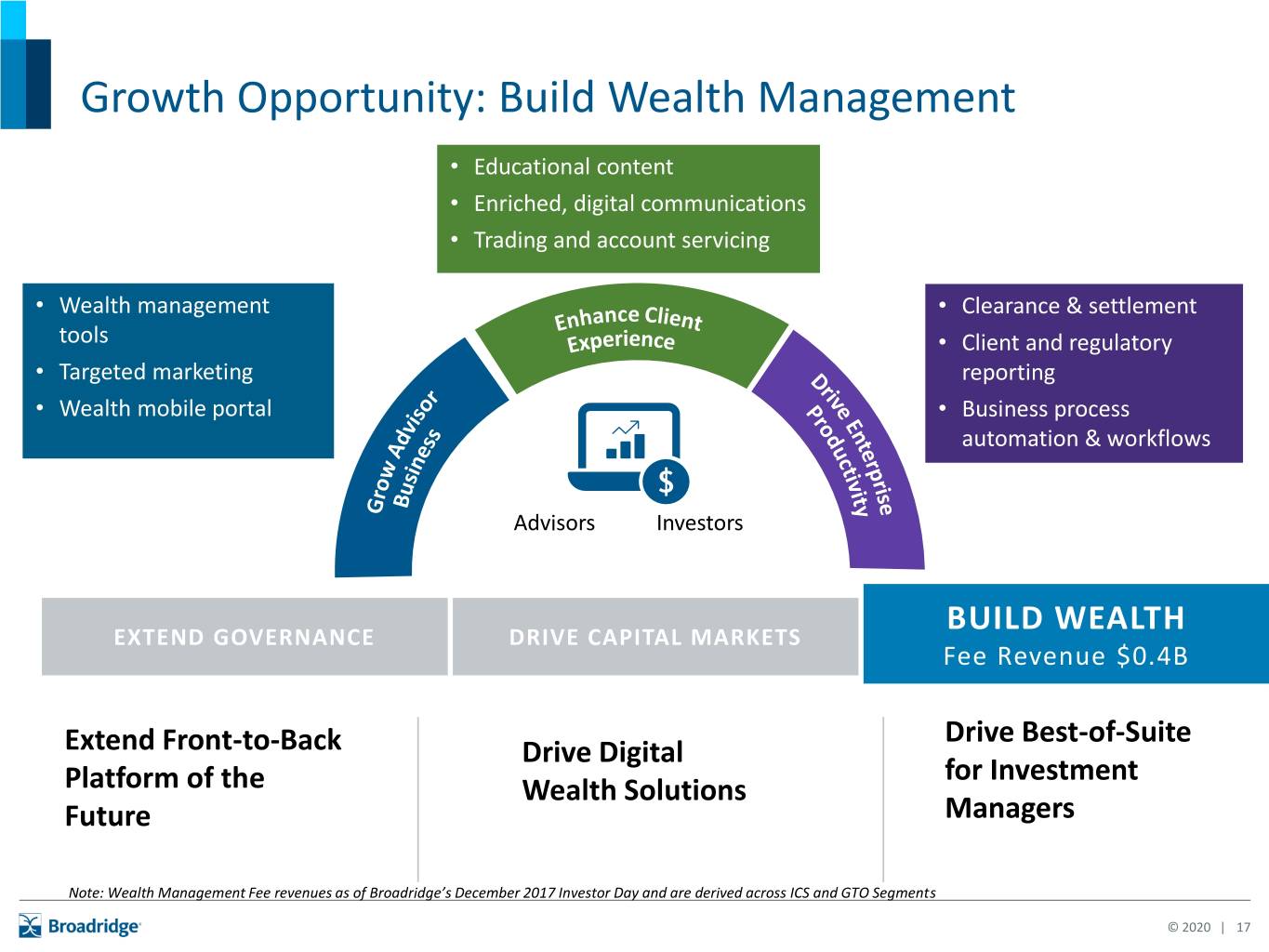

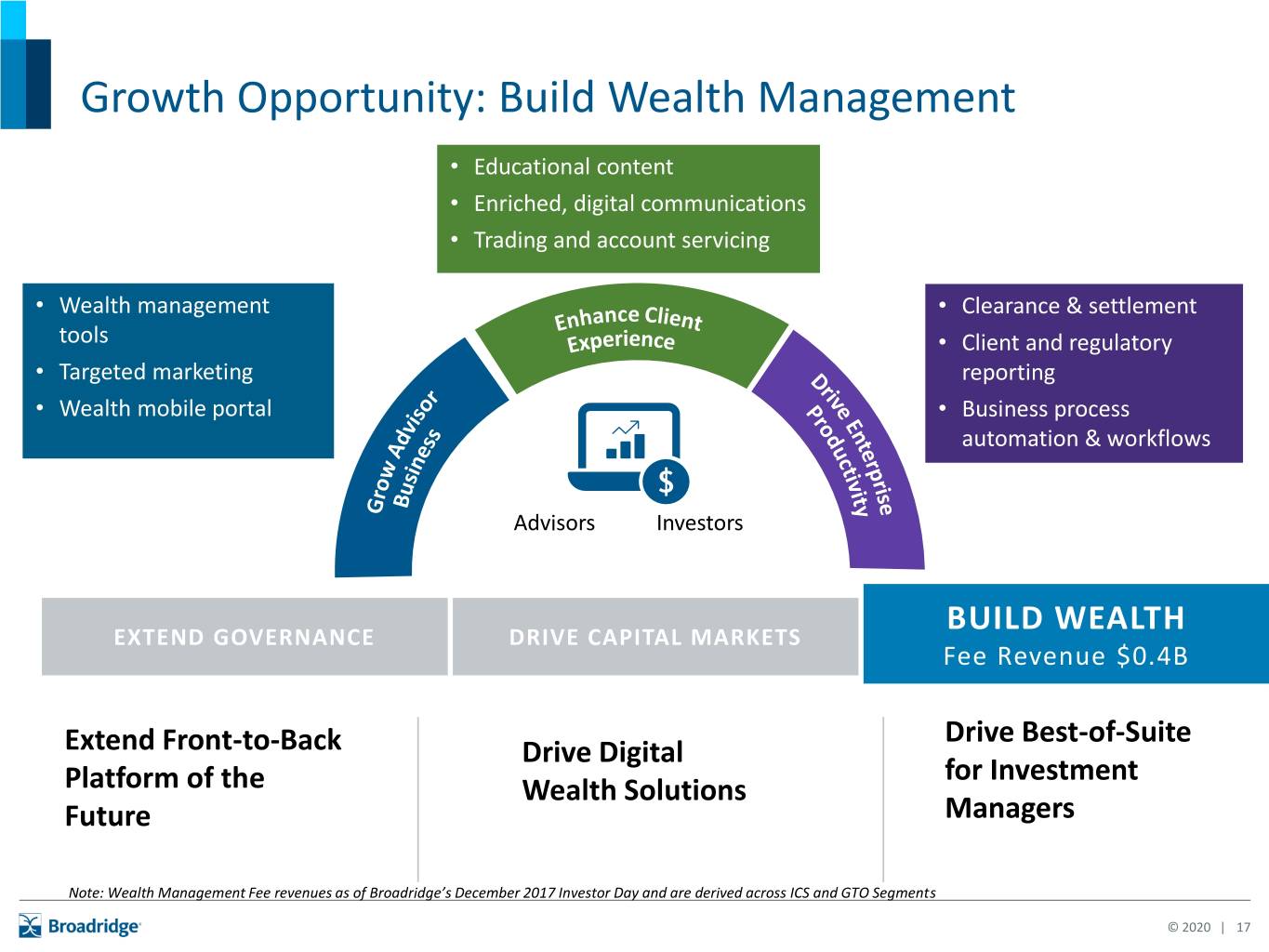

Growth Opportunity: Build Wealth Management • Educational content • Enriched, digital communications • Trading and account servicing • Wealth management • Clearance & settlement tools • Client and regulatory • Targeted marketing reporting • Wealth mobile portal • Business process automation & workflows Advisors Investors BUILD WEALTH EXTEND GOVERNANCE DRIVE CAPITAL MARKETS Fee Revenue $0.4B Drive Best-of-Suite Extend Front-to-Back Drive Digital for Investment Platform of the Wealth Solutions Future Managers Note: Wealth Management Fee revenues as of Broadridge’s December 2017 Investor Day and are derived across ICS and GTO Segments © 2020 | 17

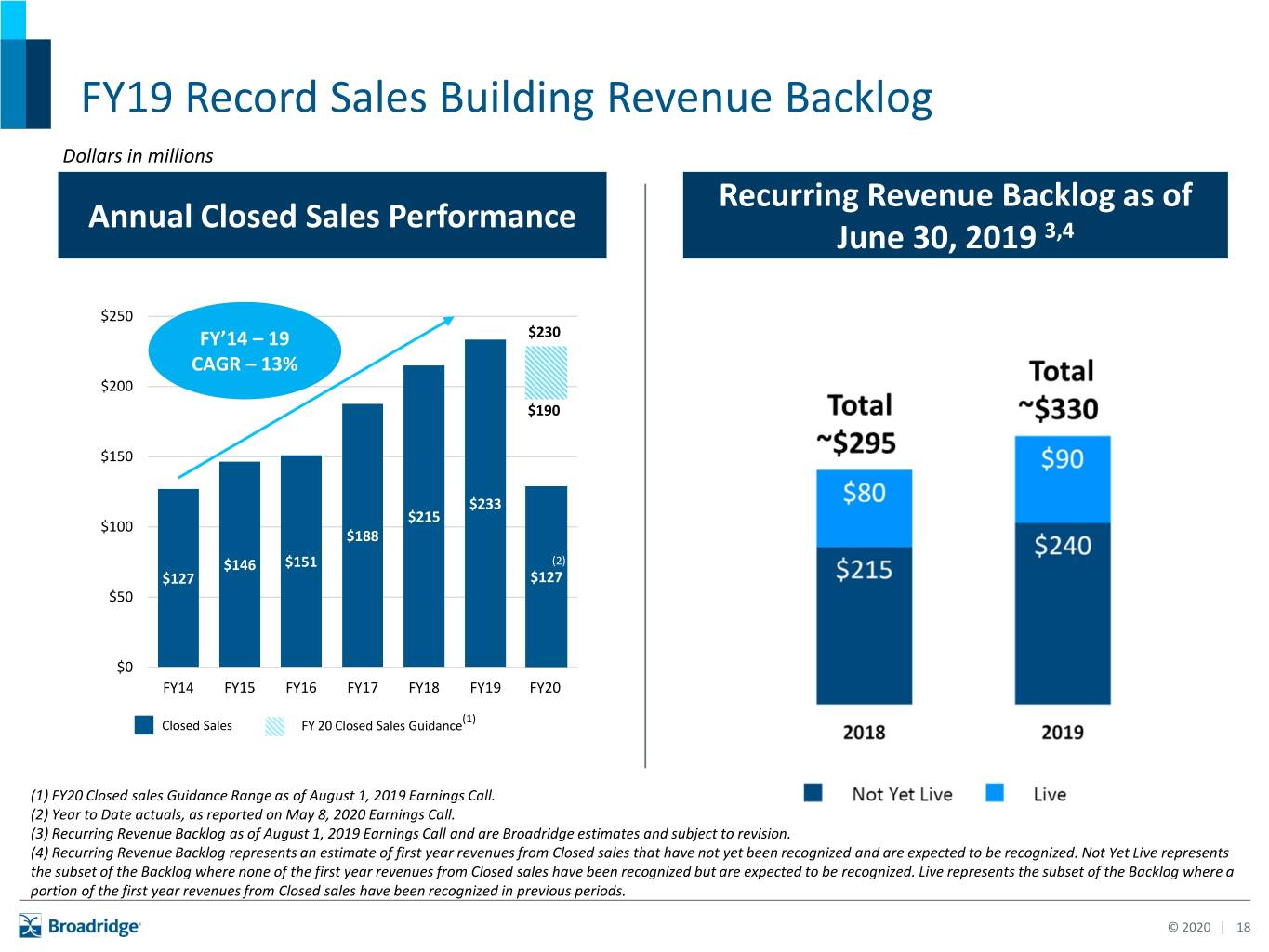

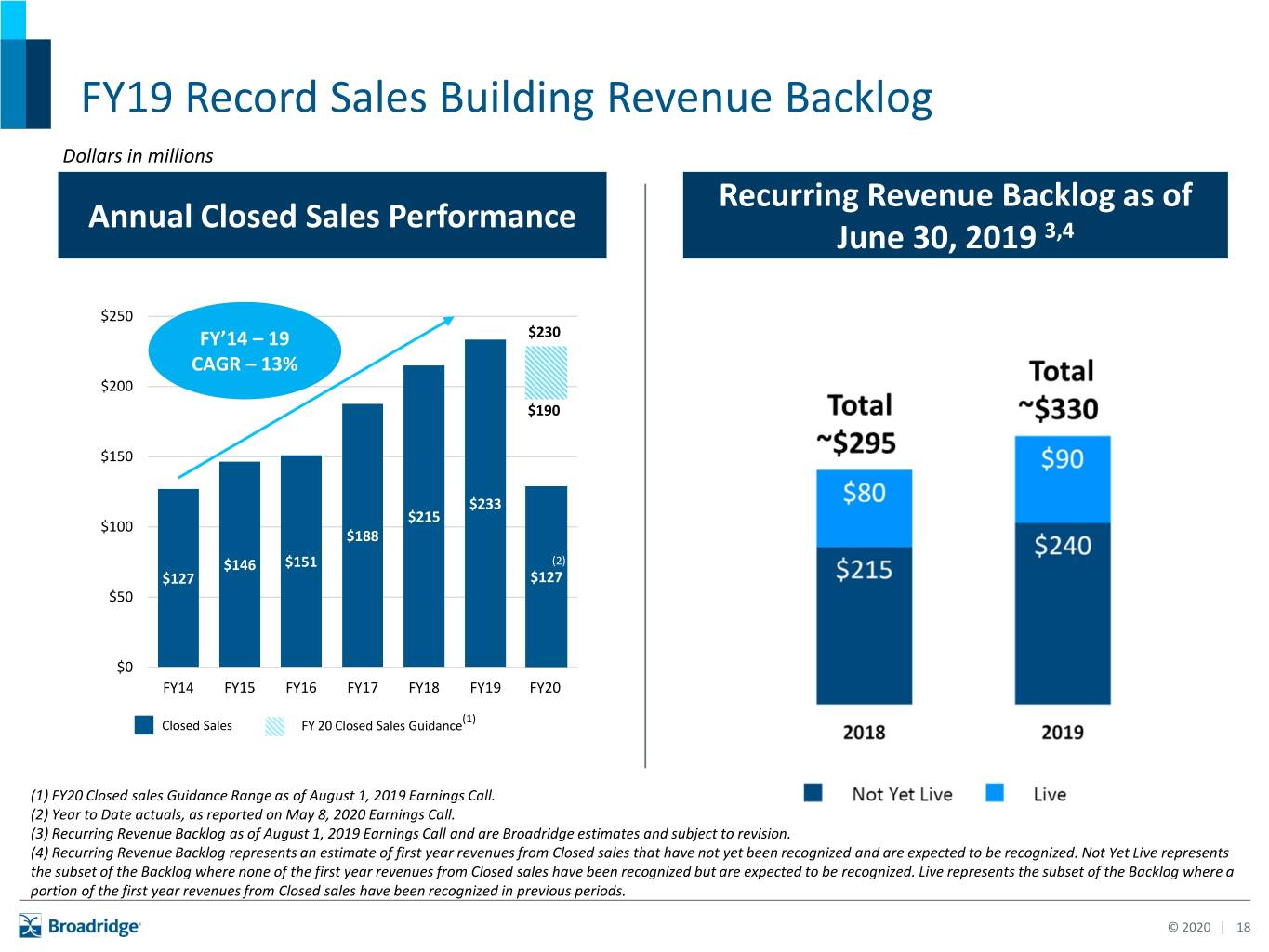

FY19 Record Sales Building Revenue Backlog Dollars in millions Recurring Revenue Backlog as of Annual Closed Sales Performance June 30, 2019 3,4 $250 FY’14 – 19 $230 CAGR – 13% $200 $190 $150 $233 $215 $100 $188 $146 $151 (2) $127 $127 $50 $83 $0 FY14 FY15 FY16 FY17 FY18 FY19 FY20 (1) Closed Sales FY 20 Closed Sales Guidance (1) FY20 Closed sales Guidance Range as of August 1, 2019 Earnings Call. (2) Year to Date actuals, as reported on May 8, 2020 Earnings Call. (3) Recurring Revenue Backlog as of August 1, 2019 Earnings Call and are Broadridge estimates and subject to revision. (4) Recurring Revenue Backlog represents an estimate of first year revenues from Closed sales that have not yet been recognized and are expected to be recognized. Not Yet Live represents the subset of the Backlog where none of the first year revenues from Closed sales have been recognized but are expected to be recognized. Live represents the subset of the Backlog where a portion of the first year revenues from Closed sales have been recognized in previous periods. © 2020 | 18

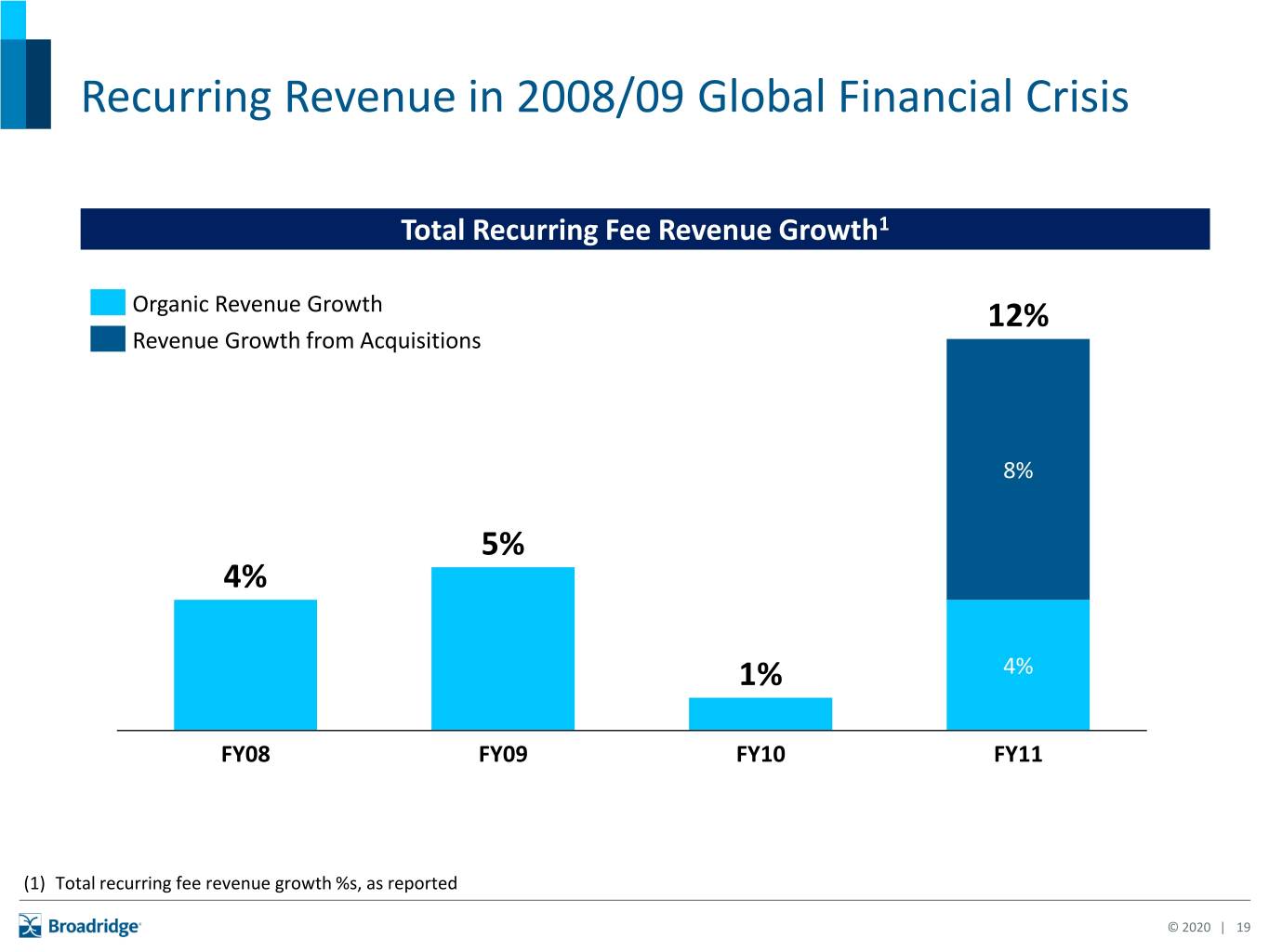

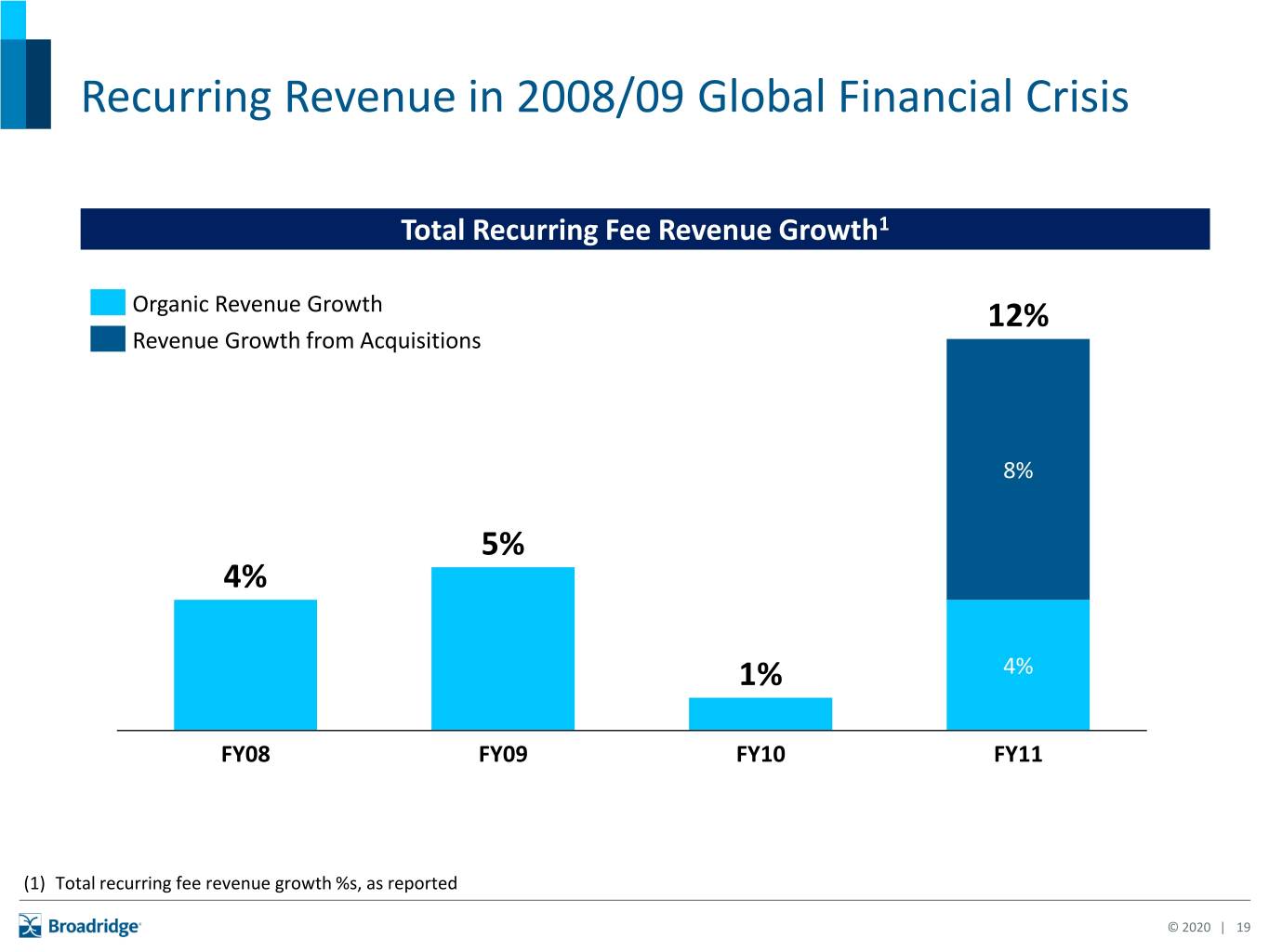

Recurring Revenue in 2008/09 Global Financial Crisis Total Recurring Fee Revenue Growth1 Organic Revenue Growth 12% Revenue Growth from Acquisitions 8% 5% 4% 1% 4% FY08 FY09 FY10 FY11 (1) Total recurring fee revenue growth %s, as reported © 2020 | 19

Early Thinking on FY’21 ▪ Our preliminary planning contemplates a prolonged recession ▪ Resilient business model supported by secular growth drivers . . . • Strong $330M+ backlog • Single digit position growth: Total equity / mutual fund position growth remained positive through Global Financial Crisis • 97+% client revenue retention rate • Mutualization not cyclical, downturn may increase outsourcing demand ▪ . . . but Covid-19 recession will impact FY’21 • Steep trading and post-sale prospectus volume comparisons in 2H FY’21 • Impact of lower assets under administration and interest rates on Mutual Fund Processing and Transfer Agent businesses • Potential client onboarding delays and lower license activity Preliminary FY’21 Outlook: Low Single Digit Recurring Revenue Growth © 2020 | 20

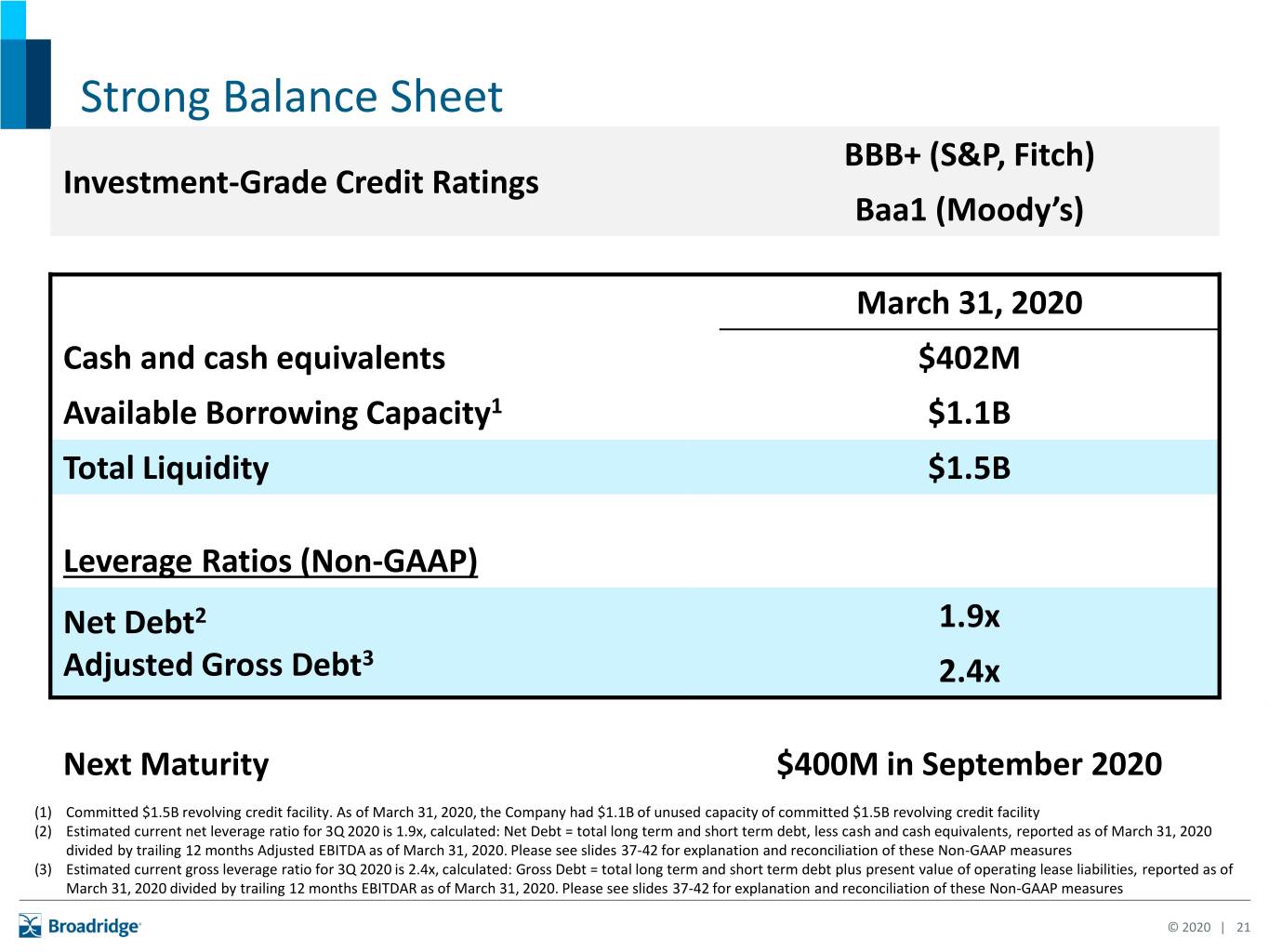

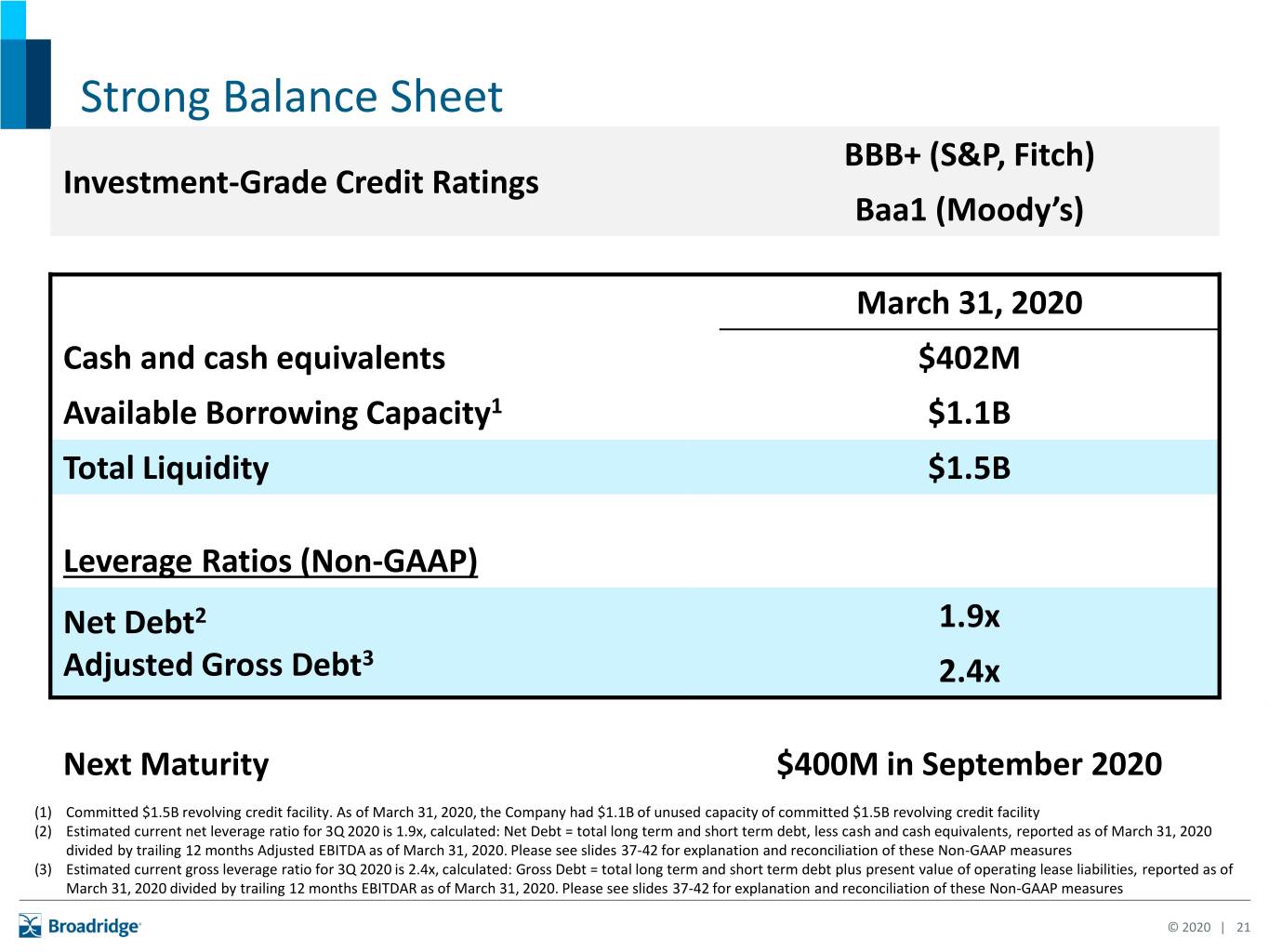

Strong Balance Sheet BBB+ (S&P, Fitch) Investment-Grade Credit Ratings Baa1 (Moody’s) March 31, 2020 Cash and cash equivalents $402M Available Borrowing Capacity1 $1.1B Total Liquidity $1.5B Leverage Ratios (Non-GAAP) Net Debt2 1.9x Adjusted Gross Debt3 2.4x Next Maturity $400M in September 2020 (1) Committed $1.5B revolving credit facility. As of March 31, 2020, the Company had $1.1B of unused capacity of committed $1.5B revolving credit facility (2) Estimated current net leverage ratio for 3Q 2020 is 1.9x, calculated: Net Debt = total long term and short term debt, less cash and cash equivalents, reported as of March 31, 2020 divided by trailing 12 months Adjusted EBITDA as of March 31, 2020. Please see slides 37-42 for explanation and reconciliation of these Non-GAAP measures (3) Estimated current gross leverage ratio for 3Q 2020 is 2.4x, calculated: Gross Debt = total long term and short term debt plus present value of operating lease liabilities, reported as of March 31, 2020 divided by trailing 12 months EBITDAR as of March 31, 2020. Please see slides 37-42 for explanation and reconciliation of these Non-GAAP measures © 2020 | 21

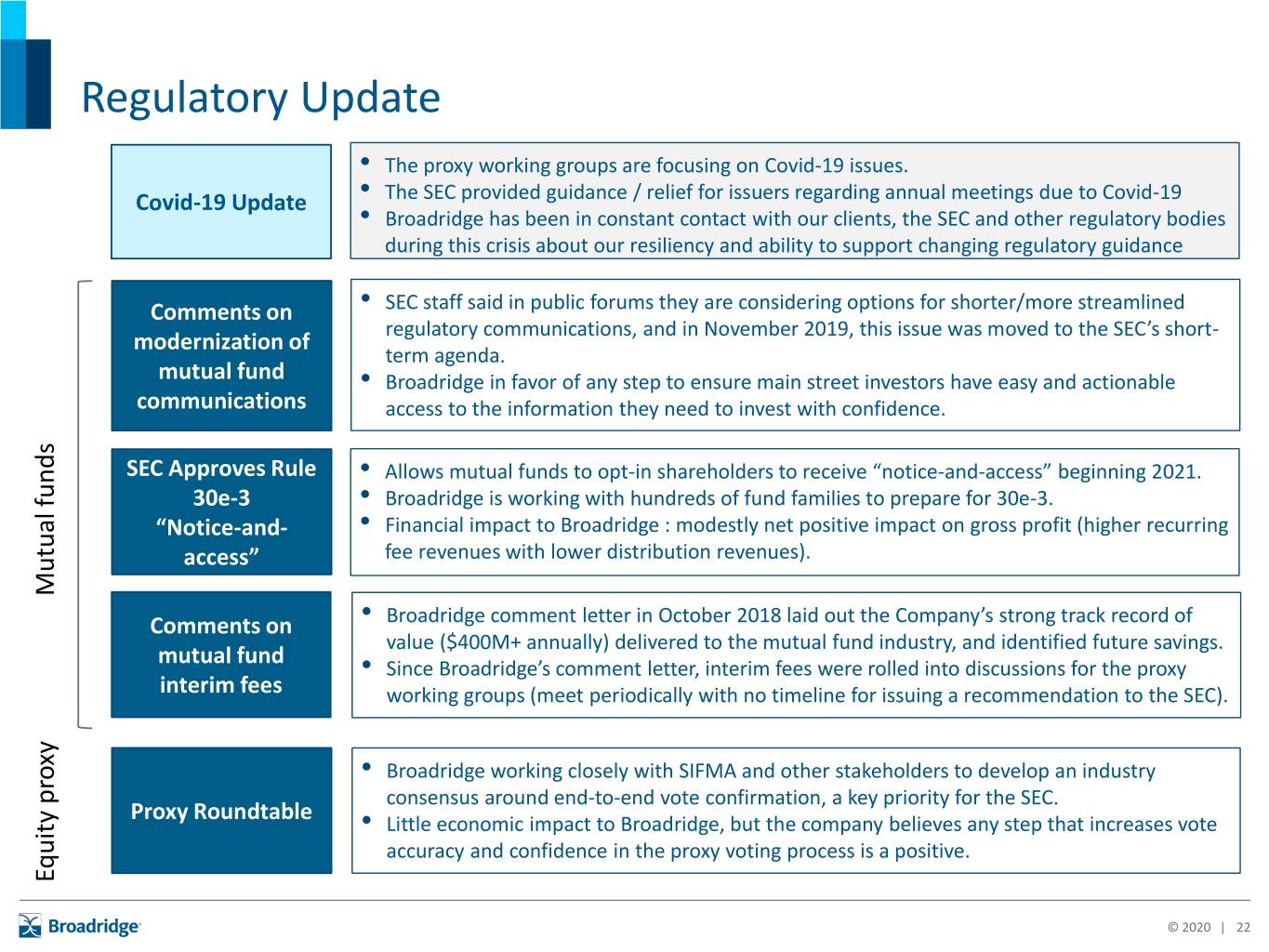

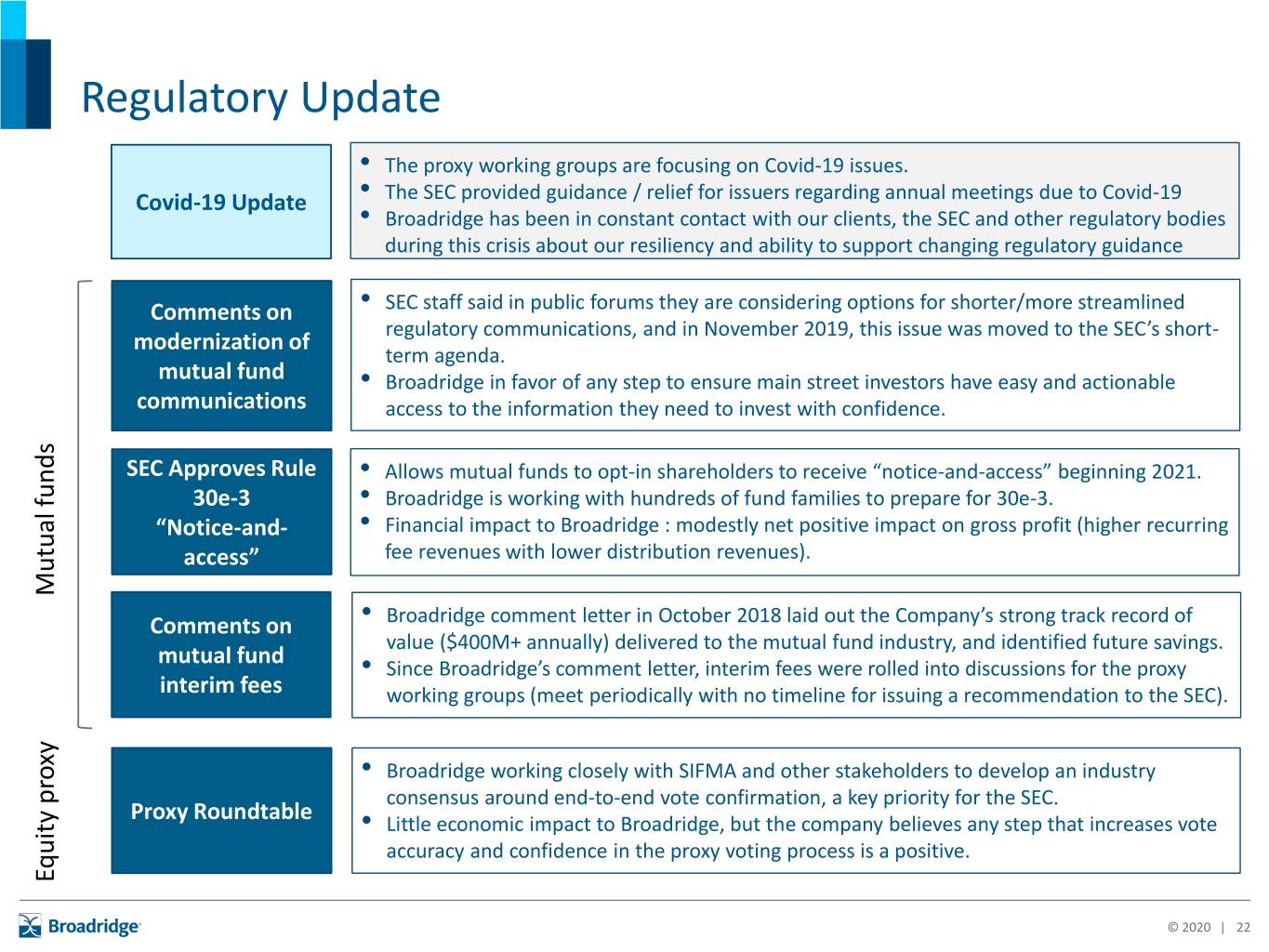

Regulatory Update • The proxy working groups are focusing on Covid-19 issues. Covid-19 Update • The SEC provided guidance / relief for issuers regarding annual meetings due to Covid-19 • Broadridge has been in constant contact with our clients, the SEC and other regulatory bodies during this crisis about our resiliency and ability to support changing regulatory guidance Comments on • SEC staff said in public forums they are considering options for shorter/more streamlined regulatory communications, and in November 2019, this issue was moved to the SEC’s short- modernization of term agenda. mutual fund • Broadridge in favor of any step to ensure main street investors have easy and actionable communications access to the information they need to invest with confidence. SEC Approves Rule • Allows mutual funds to opt-in shareholders to receive “notice-and-access” beginning 2021. 30e-3 • Broadridge is working with hundreds of fund families to prepare for 30e-3. “Notice-and- • Financial impact to Broadridge : modestly net positive impact on gross profit (higher recurring access” fee revenues with lower distribution revenues). Mutual funds Mutual Comments on • Broadridge comment letter in October 2018 laid out the Company’s strong track record of value ($400M+ annually) delivered to the mutual fund industry, and identified future savings. mutual fund • Since Broadridge’s comment letter, interim fees were rolled into discussions for the proxy interim fees working groups (meet periodically with no timeline for issuing a recommendation to the SEC). • Broadridge working closely with SIFMA and other stakeholders to develop an industry consensus around end-to-end vote confirmation, a key priority for the SEC. Proxy Roundtable • Little economic impact to Broadridge, but the company believes any step that increases vote accuracy and confidence in the proxy voting process is a positive. Equity proxy Equity © 2020 | 22

Third Quarter Fiscal 2020 Results

1 Covid-19 Has Reinforced the Essential Nature of Broadridge’s Work ▪ Supporting dynamic capital markets processing trillions of dollars of trading activity ▪ Providing investors key information about their investments in a time of high volatility and uncertainty ▪ Ensuring strong and timely corporate governance ▪ Deemed essential under federal guidelines and state orders ▪ Constant communication with regulators and clients © 2020 | 24

2 Ensuring the Health and Safety of our Associates ▪ Importance of the Service-Profit Chain ▪ Moved to 100% work-from-home for non-production associates • Began in January in Asia-Pacific • North America and Europe staff in early March • India staff starting in mid-March ▪ Strong measures to protect essential production associates • Masks, gloves, temperature checking required • Redistributed work through redundant production facilities • 50% staffing in most-impacted locations to maximize social distancing ▪ Supporting the communities in which we operate © 2020 | 25

3 Delivered Strong Operational Performance ▪ Our resilient and scalable technology successfully supported unprecedented market volumes ▪ Delivering an effective proxy season to support strong corporate governance ▪ Managed very strong spike in transactional communications driven by market volatility ▪ Scaling operations and technology to support a 4x increase in Virtual Shareholder Meetings © 2020 | 26

4 Expecting Continued Growth and Solid Financial Results ▪ Broadridge reported solid third quarter results • Recurring fee revenue growth of 9% • 20% increase in Closed sales including stronger March ▪ Fiscal Year 2020 guidance calls for continued growth • 8 – 10% Recurring fee revenue growth, including organic growth of 4% • Continued Adjusted EPS growth tempered by significantly lower event-driven revenues • Remain on track to deliver strong Closed sales ▪ Broadridge remains on-track to deliver at or above the midpoint of our three year Adjusted EPS growth objective of 14-18% © 2020 | 27

Long-Term Impact Confirms Broadridge Business Model 5 and Supports Future Growth ▪ Broadridge will continue investing to support future growth ▪ Covid-19 crisis strengthens long-term trends on mutualization, digitization and data driving Broadridge’s growth ▪ New focus on resiliency and enhanced digital capabilities will be critical in a post-pandemic world ▪ Positive long-term outlook and strong business fundamentals leave Broadridge well-positioned © 2020 | 28

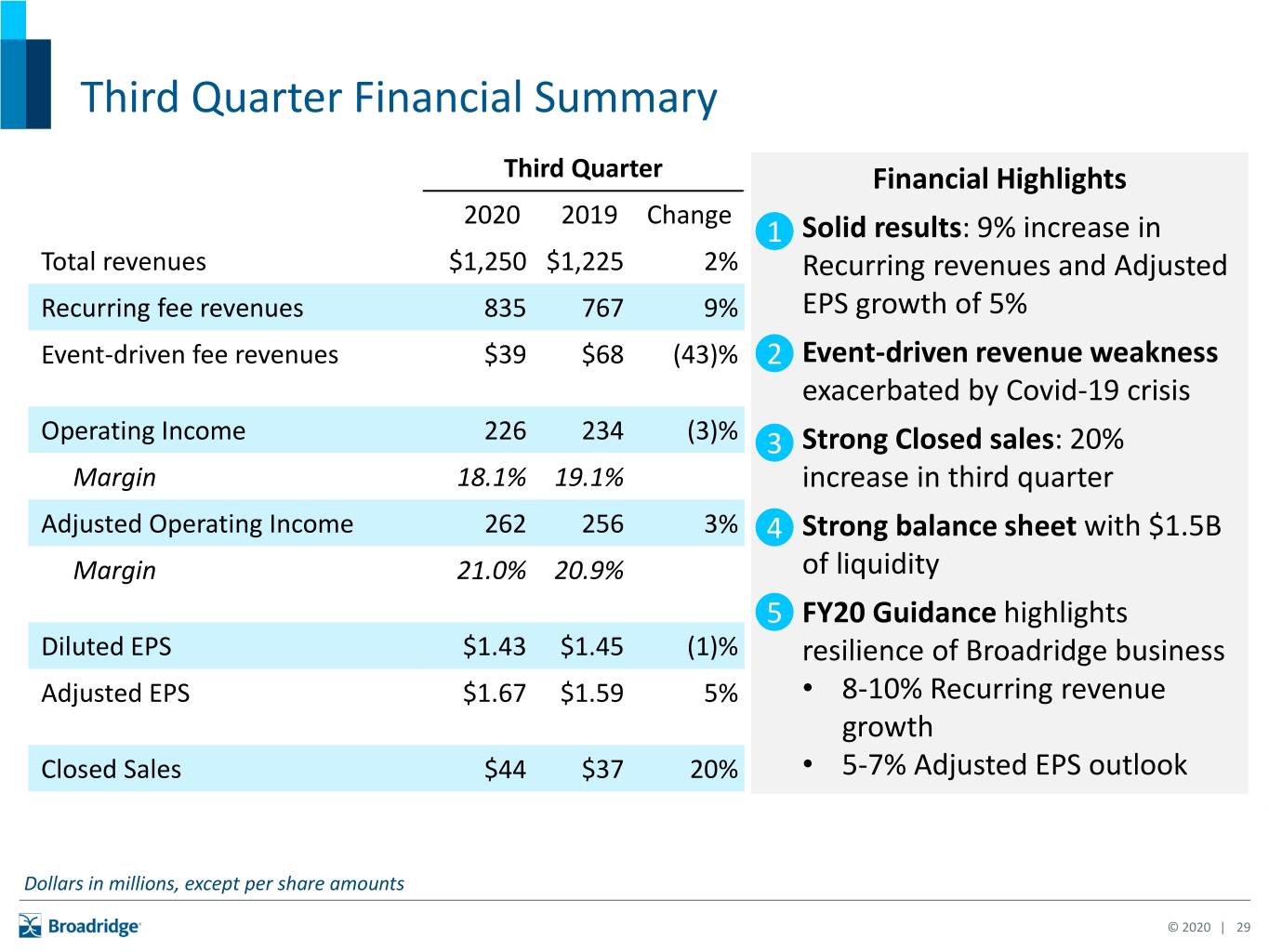

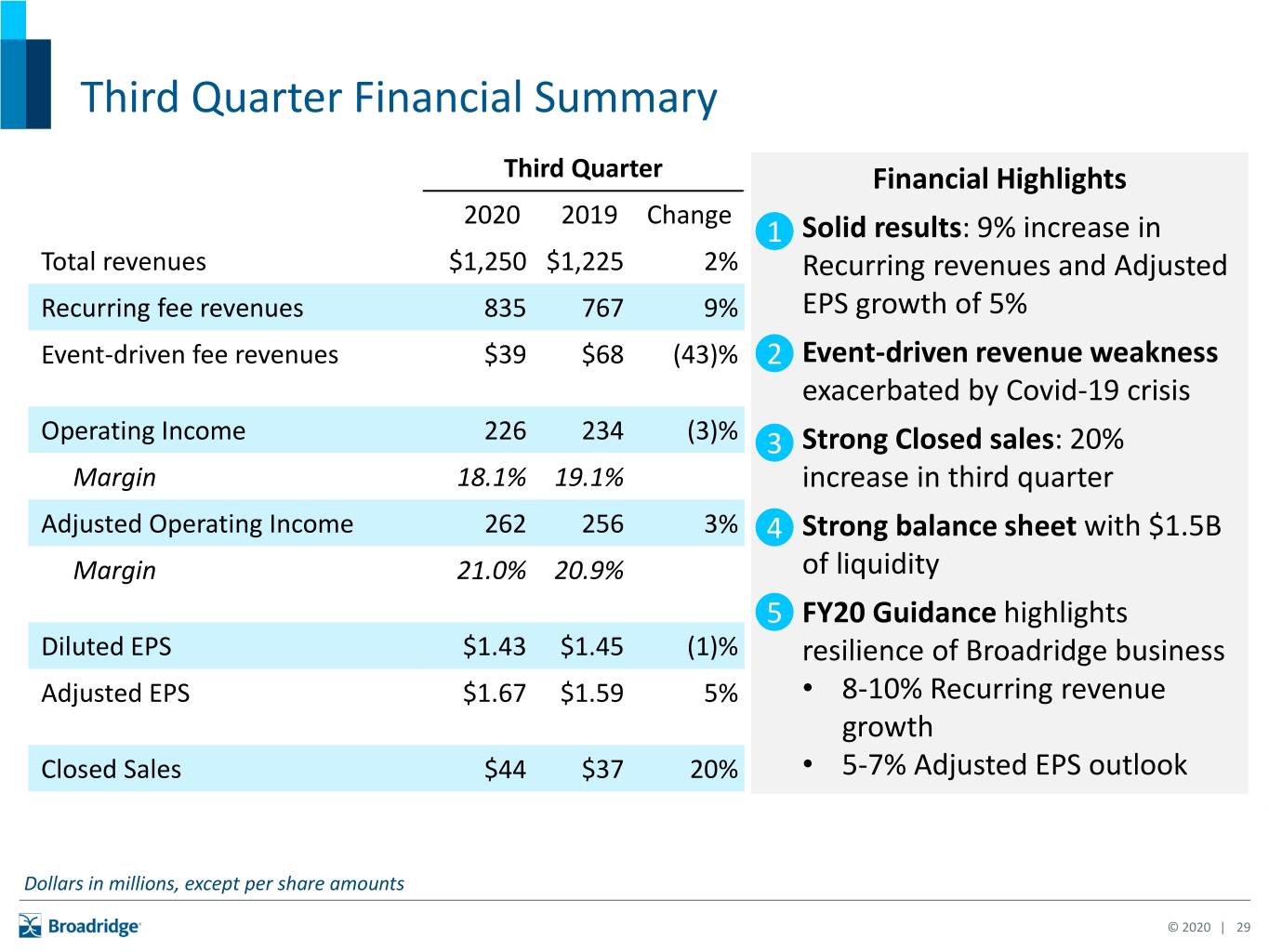

Third Quarter Financial Summary Third Quarter Financial Highlights 2020 2019 Change 1.1 Solid results: 9% increase in Total revenues $1,250 $1,225 2% Recurring revenues and Adjusted Recurring fee revenues 835 767 9% EPS growth of 5% Event-driven fee revenues $39 $68 (43)% 2.2 Event-driven revenue weakness exacerbated by Covid-19 crisis Operating Income 226 234 (3)% 3.3 Strong Closed sales: 20% Margin 18.1% 19.1% increase in third quarter Adjusted Operating Income 262 256 3% 4.4 Strong balance sheet with $1.5B Margin 21.0% 20.9% of liquidity 5.5 FY20 Guidance highlights Diluted EPS $1.43 $1.45 (1)% resilience of Broadridge business Adjusted EPS $1.67 $1.59 5% • 8-10% Recurring revenue growth Closed Sales $44 $37 20% • 5-7% Adjusted EPS outlook Dollars in millions, except per share amounts © 2020 | 29

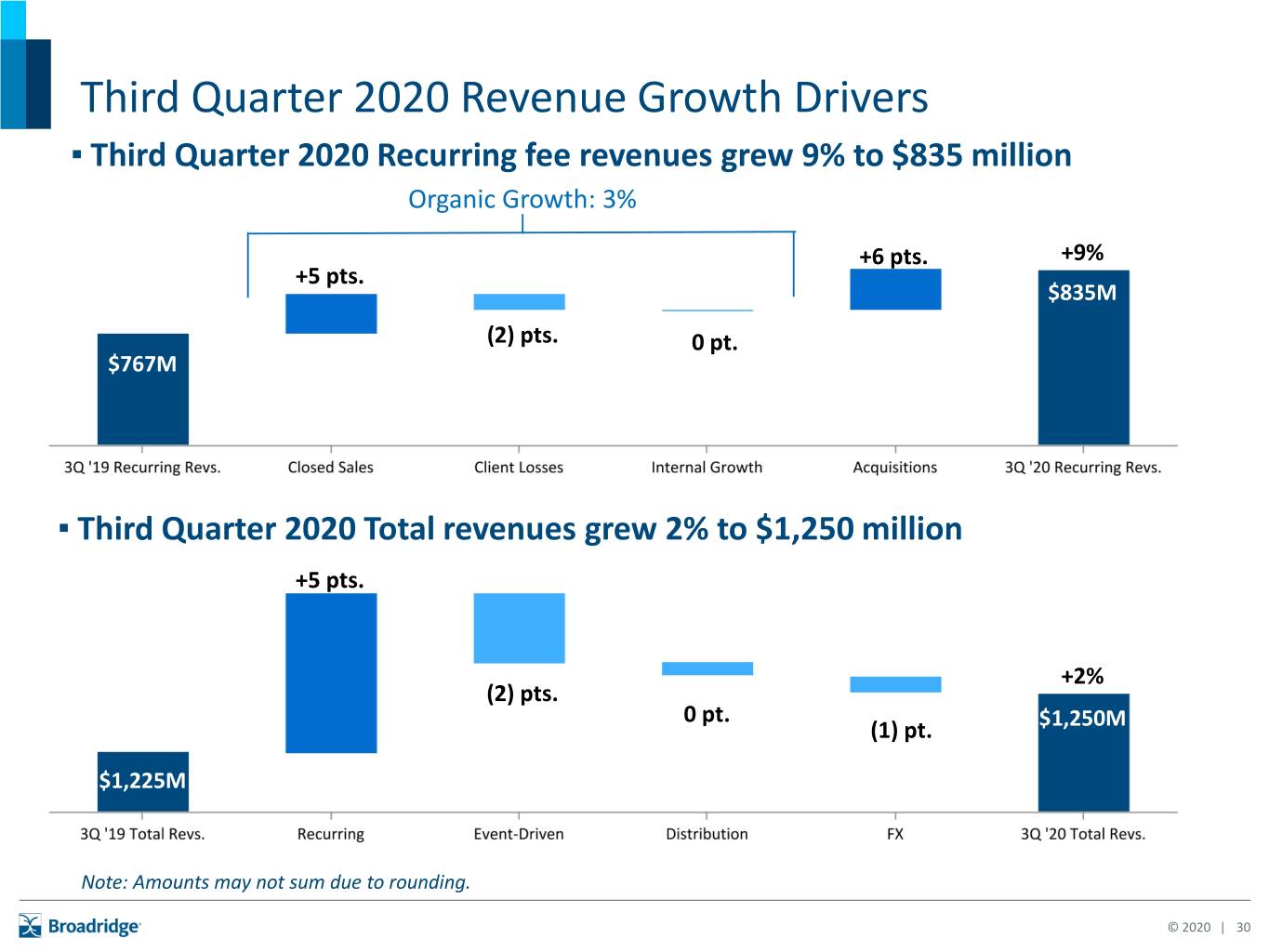

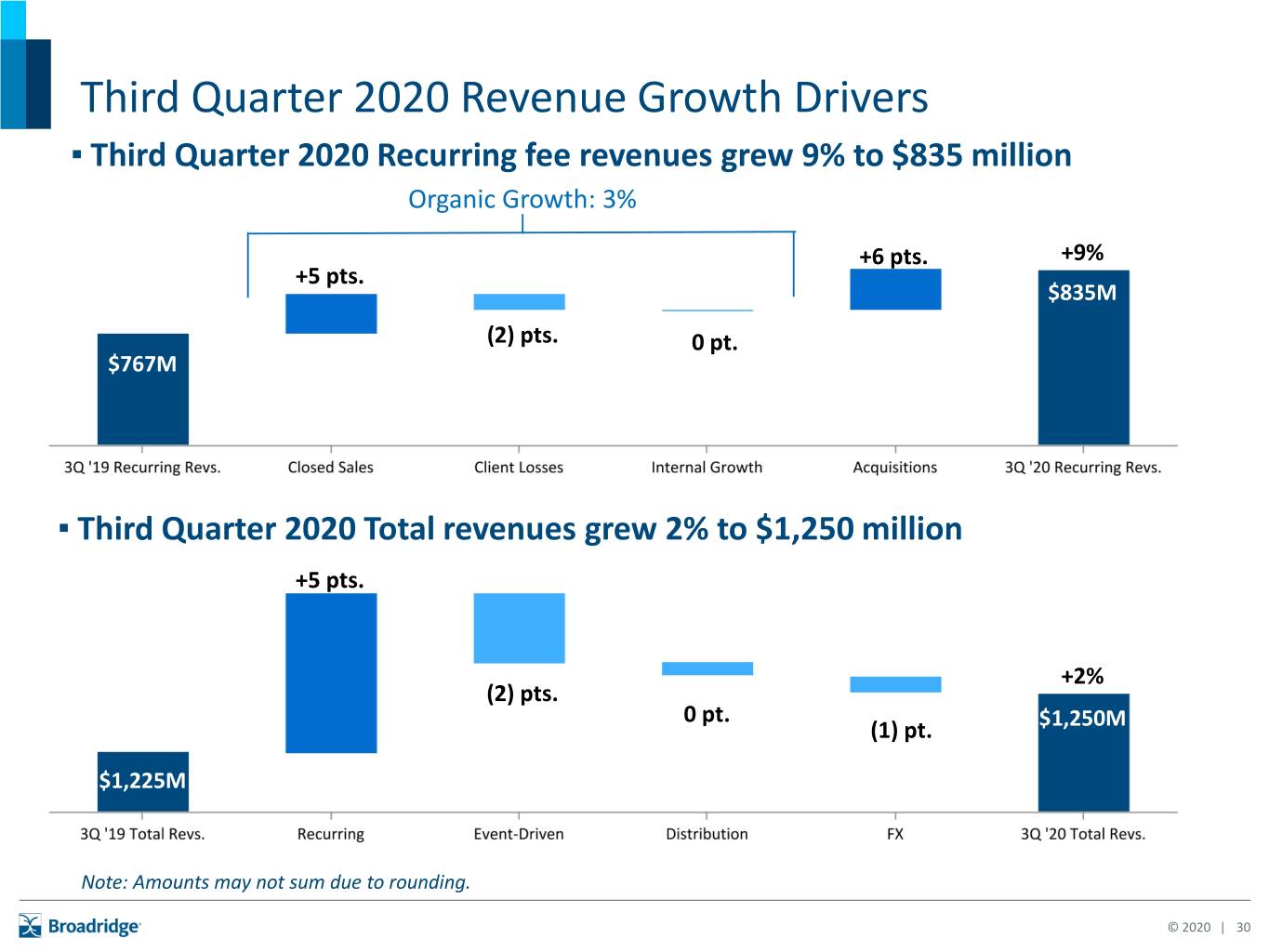

Third Quarter 2020 Revenue Growth Drivers ▪ Third Quarter 2020 Recurring fee revenues grew 9% to $835 million Organic Growth: 3% $623M +6 pts. +9% $576M +5 pts. $835M (2) pts. 0 pt. $767M ▪ Third Quarter 2020 Total revenues grew 2% to $1,250 million +5 pts. $1,225M +2% (2) pts. 0 pt. (1) pt. $1,250M $1,225M Note: Amounts may not sum due to rounding. © 2020 | 30

Third Quarter Fiscal 2020 ICS Results Total Revenues Recurring Revenues Highlights -3% +2% • Covid-19 related production shifts $1,006 $980 $520 $529 reduced Equity proxy revenues by $15- 20 million, offsetting impact of 7% stock $136 $153 record growth $520 $529 $87 $82 • Higher volumes led by post-sale prospectus drove customer $68 $39 $201 $208 communications growth $418 $412 • Continued strong growth in data & $84 $97 analytics products offset by lower interest rates and market impact on 2019 2020 2019 2020 assets under administration Recurring Revenues Equity Proxy Net New Business 3 pts Event Driven Mutual Fund and ETF interims Internal Growth (4) pts Distribution Customer Comms. & fulfillment Other ICS Organic Recurring Revenue Growth (1)% Acquisitions 3 pts Total Growth 2% Dollars in millions © 2020 | 31

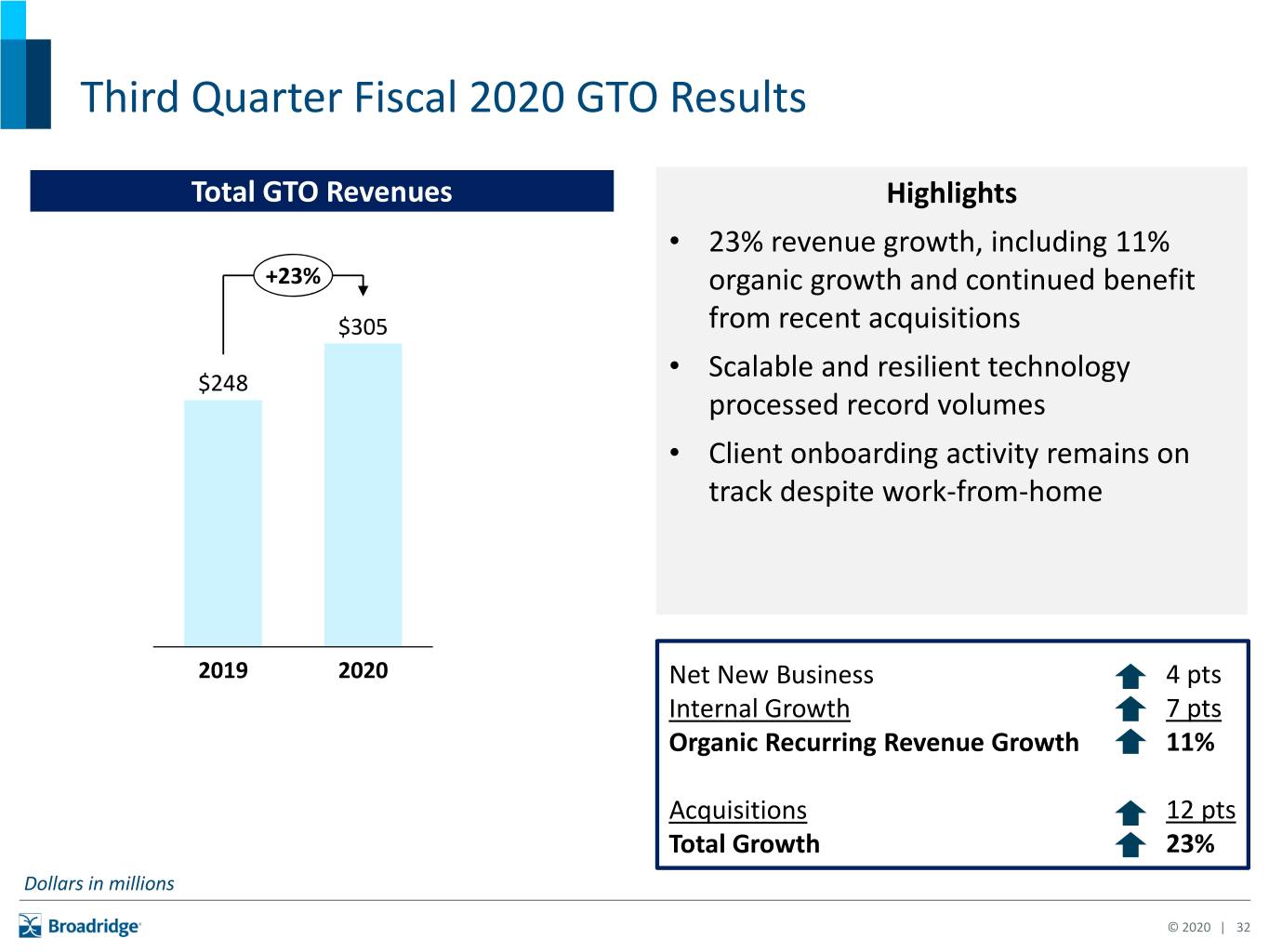

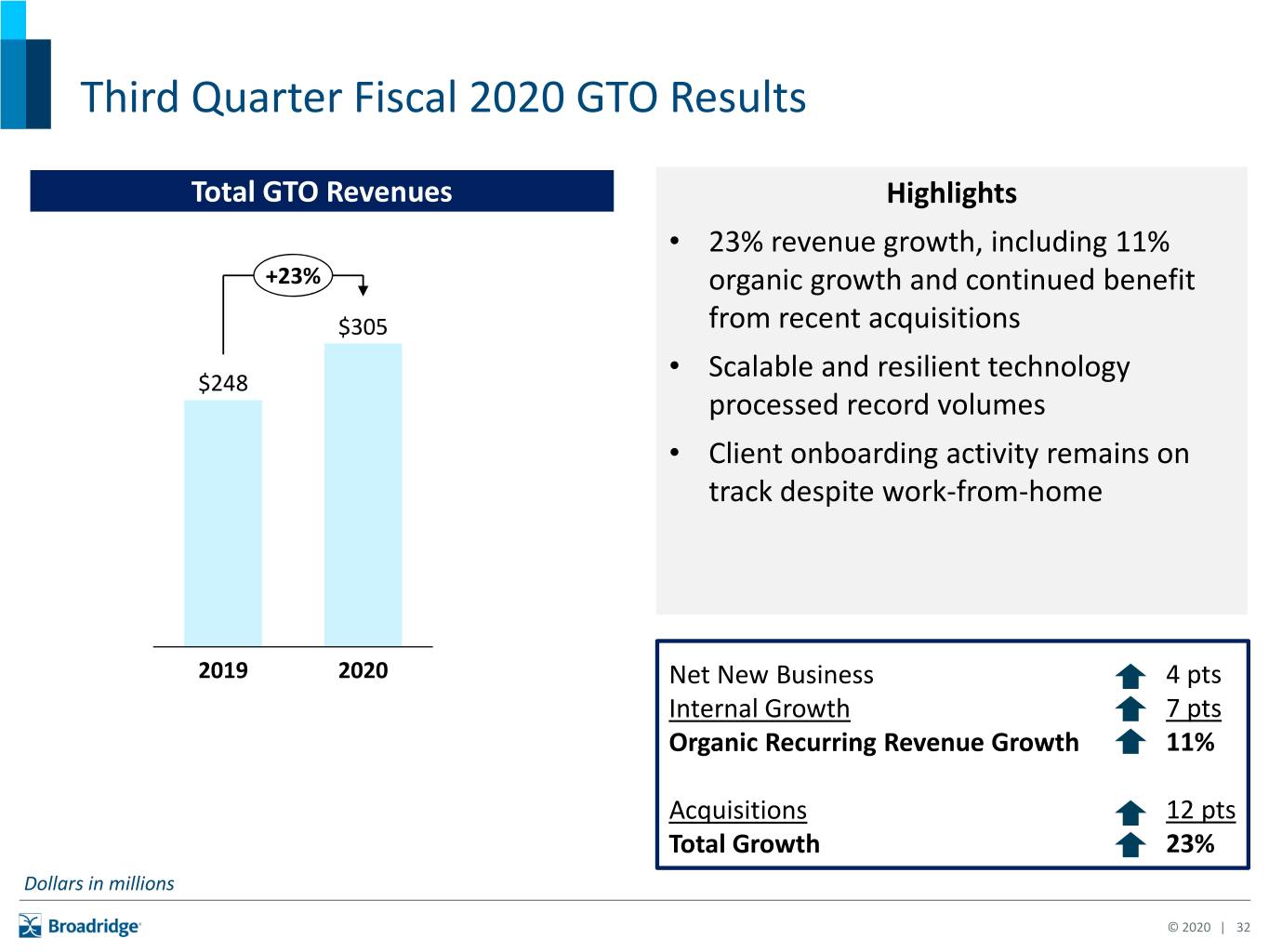

Third Quarter Fiscal 2020 GTO Results Total GTO Revenues Highlights • 23% revenue growth, including 11% +23% organic growth and continued benefit $305 from recent acquisitions • Scalable and resilient technology $248 processed record volumes • Client onboarding activity remains on track despite work-from-home 2019 2020 Net New Business 4 pts Internal Growth 7 pts Organic Recurring Revenue Growth 11% Acquisitions 12 pts Total Growth 23% Dollars in millions © 2020 | 32

Nine Months Fiscal Year 2020 vs. Nine Months Fiscal Year 2019 © 2020 | 33

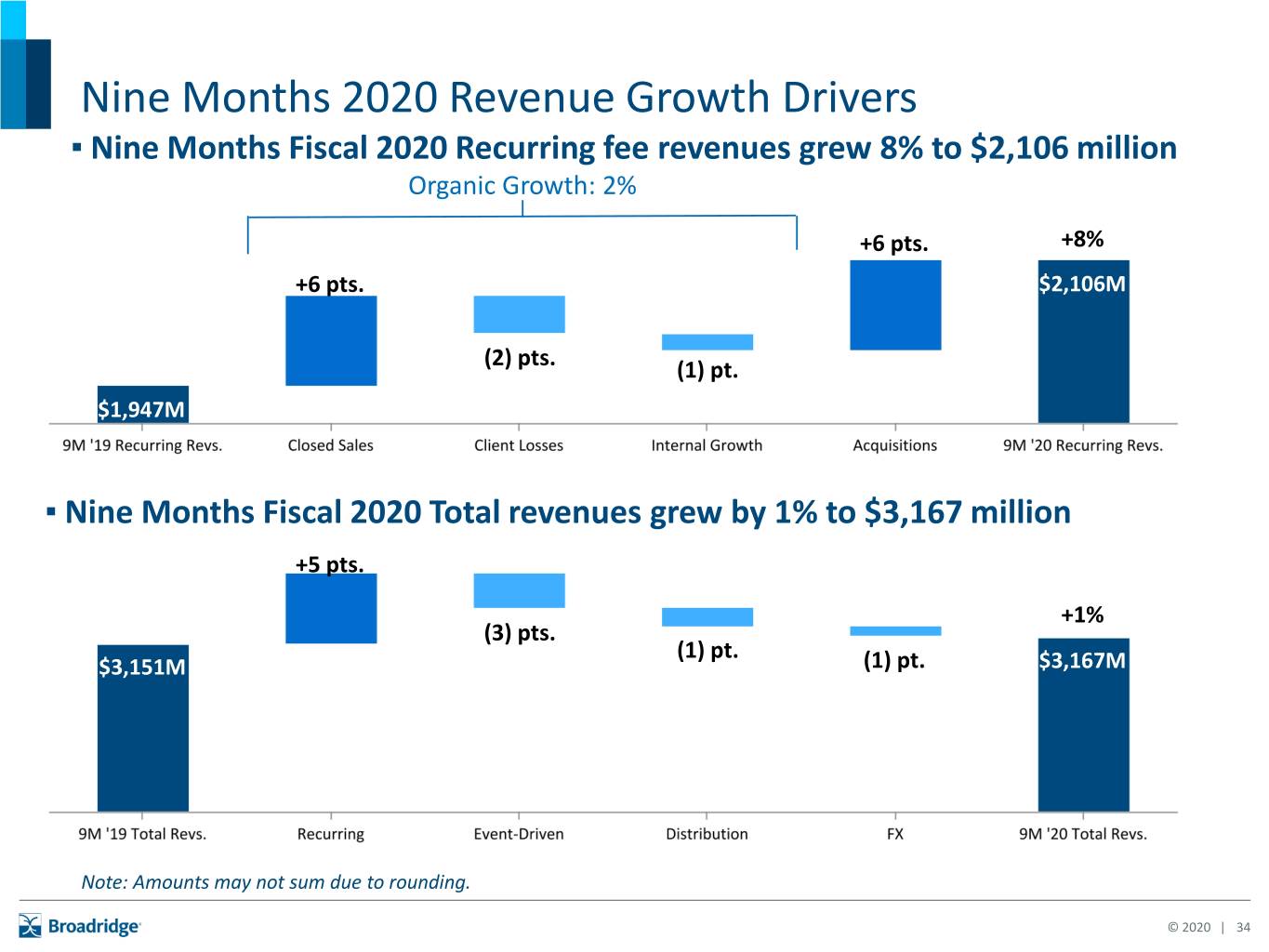

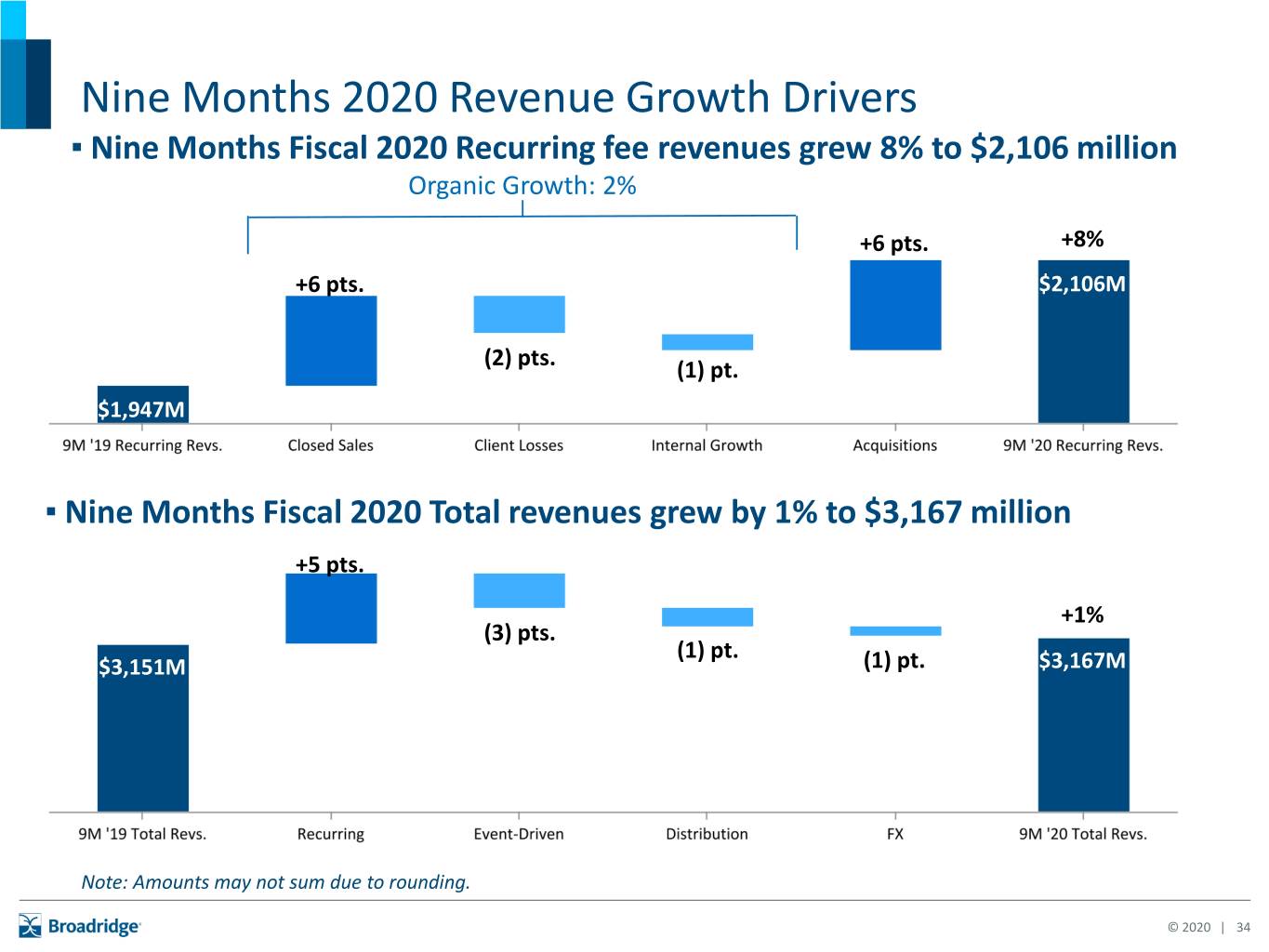

Nine Months 2020 Revenue Growth Drivers ▪ Nine Months Fiscal 2020 Recurring fee revenues grew 8% to $2,106 million Organic Growth: 2% $623M +6 pts. $1,272M+8% $576M +6 pts. $2,106M $1,179M (2) pts. (1) pt. $1,947M ▪ Nine Months Fiscal 2020 Total revenues grew by 1% to $3,167 million $576M +5 pts. +1% (3) pts. (1) pt. $3,151M (1) pt. $3,167M Note: Amounts may not sum due to rounding. © 2020 | 34

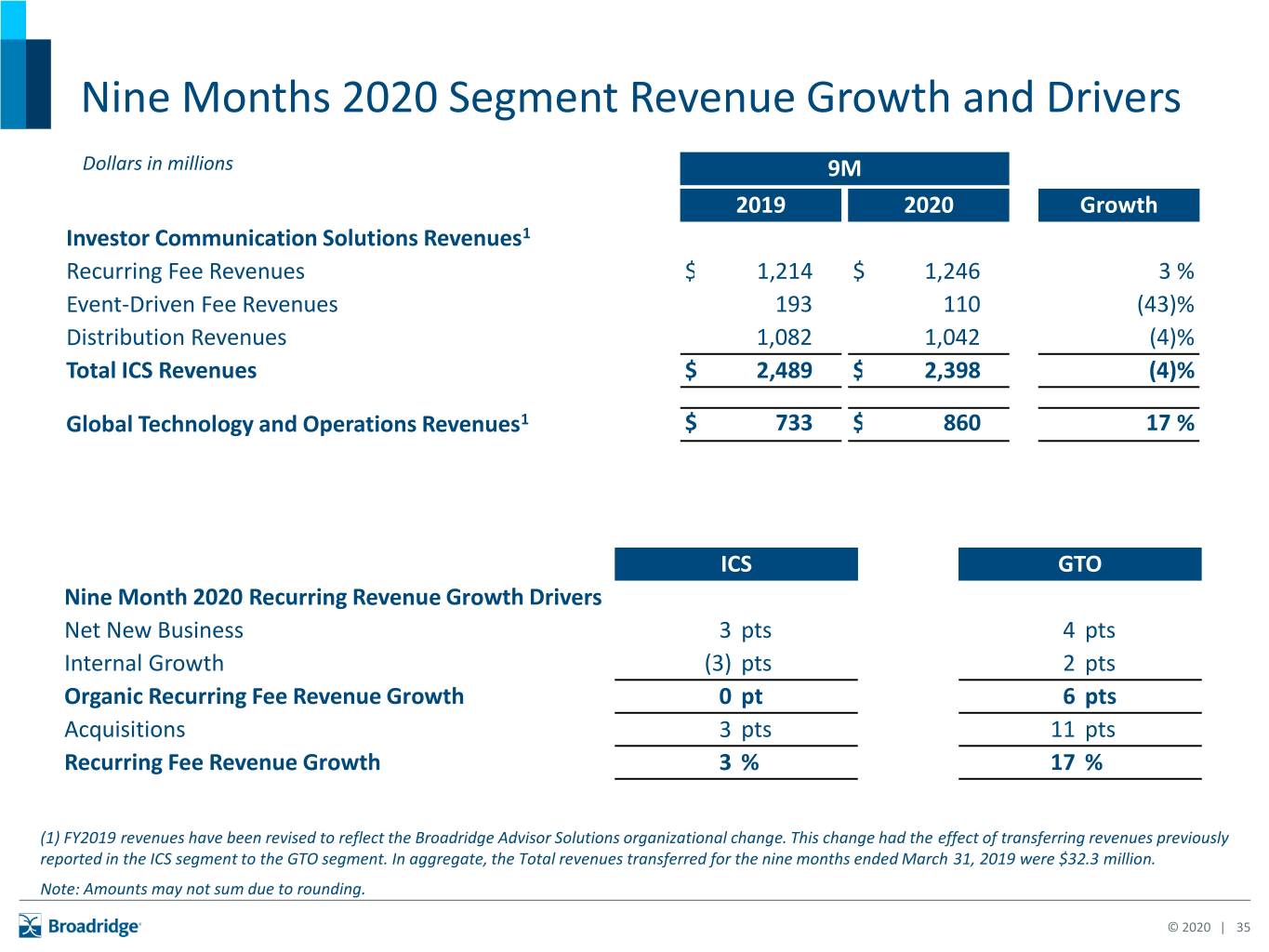

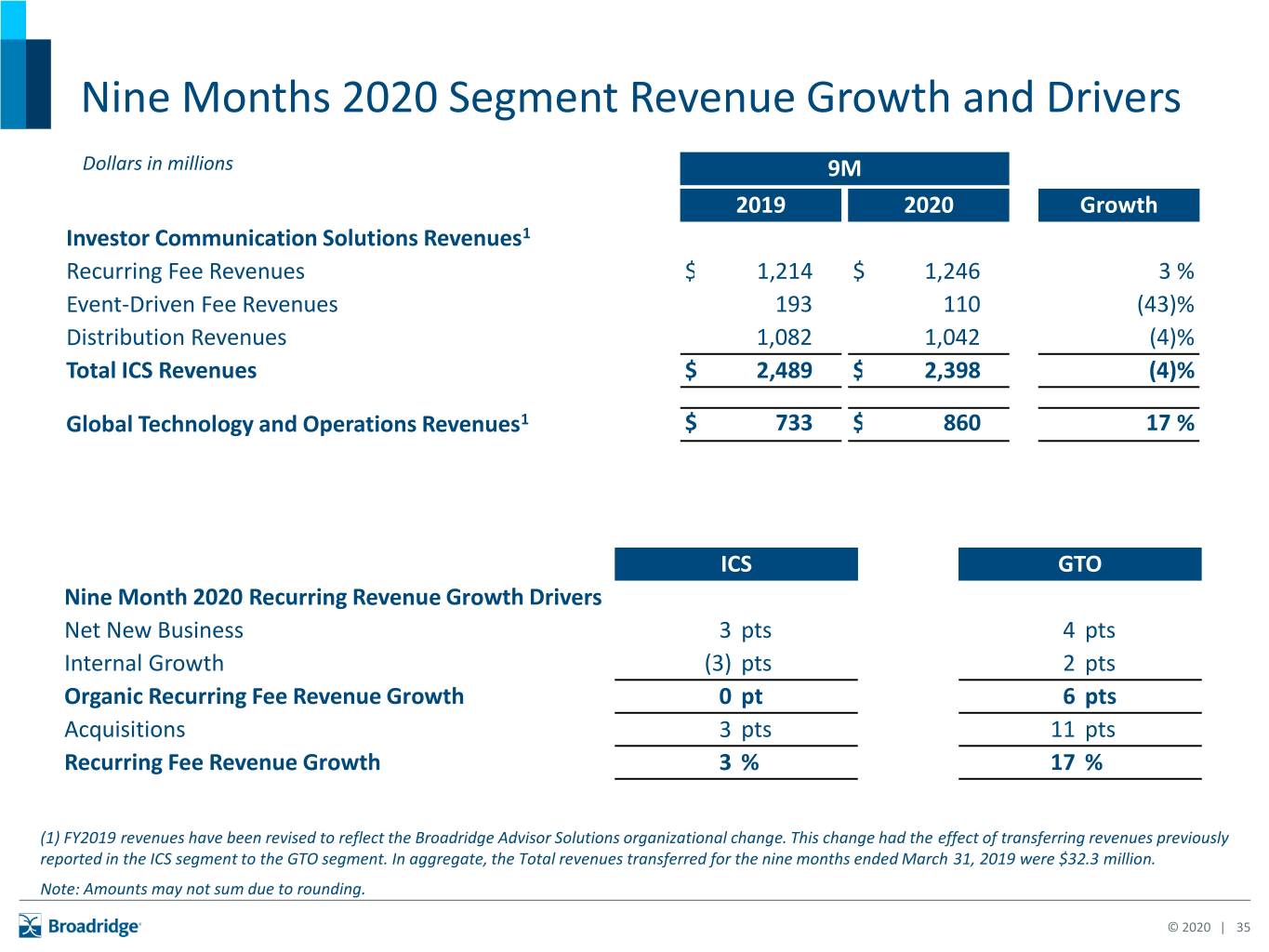

Nine Months 2020 Segment Revenue Growth and Drivers Dollars in millions 9M 2019 2020 Growth Investor Communication Solutions Revenues1 Recurring Fee Revenues $ 1,214 $ 1,246 3 % Event-Driven Fee Revenues 193 110 (43)% Distribution Revenues 1,082 1,042 (4)% Total ICS Revenues $ 2,489 $ 2,398 (4)% Global Technology and Operations Revenues1 $ 733 $ 860 17 % ICS GTO Nine Month 2020 Recurring Revenue Growth Drivers Net New Business 3 pts 4 pts Internal Growth (3) pts 2 pts Organic Recurring Fee Revenue Growth 0 pt 6 pts Acquisitions 3 pts 11 pts Recurring Fee Revenue Growth 3 % 17 % (1) FY2019 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In aggregate, the Total revenues transferred for the nine months ended March 31, 2019 were $32.3 million. Note: Amounts may not sum due to rounding. © 2020 | 35

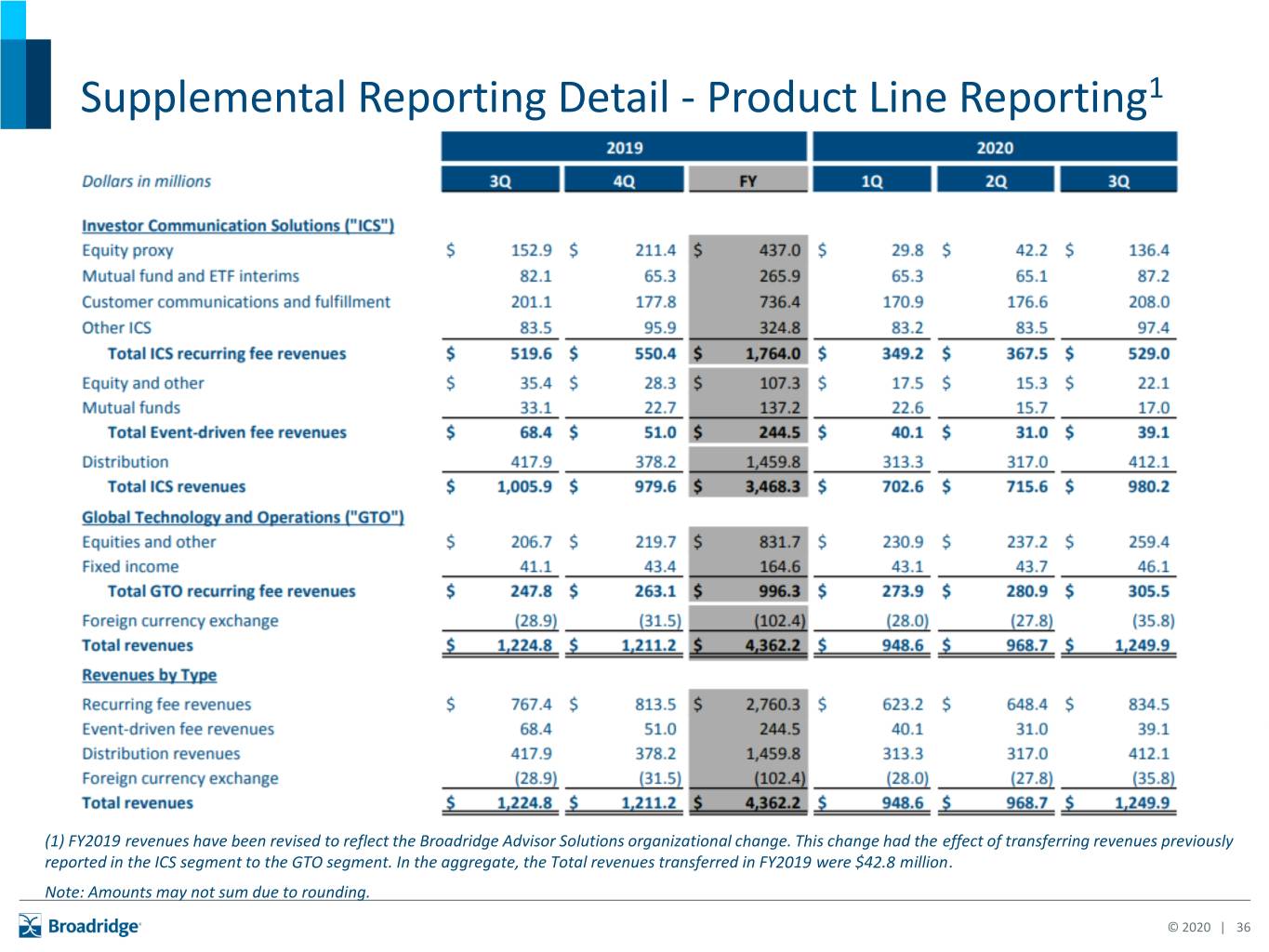

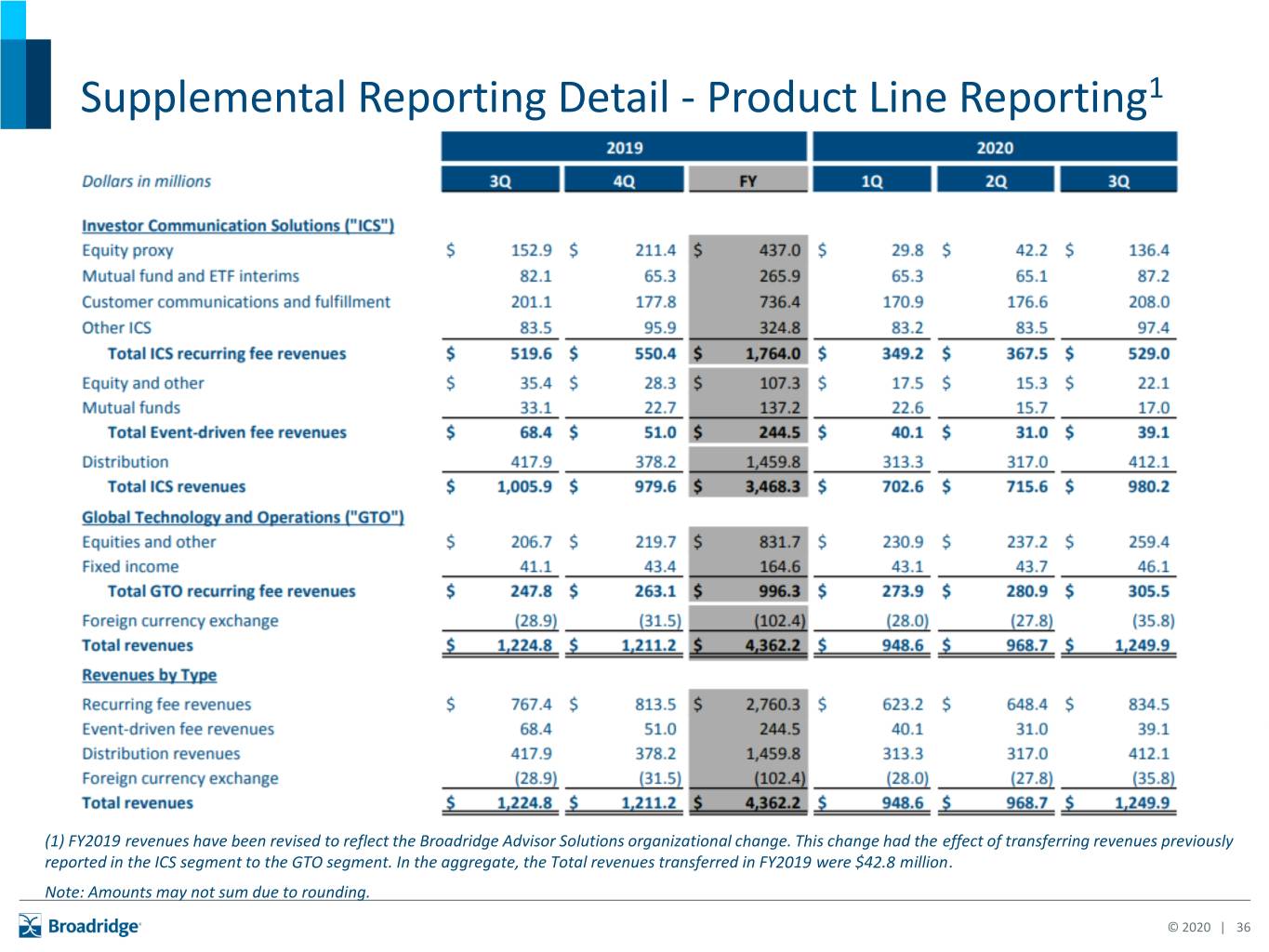

Supplemental Reporting Detail - Product Line Reporting1 (1) FY2019 revenues have been revised to reflect the Broadridge Advisor Solutions organizational change. This change had the effect of transferring revenues previously reported in the ICS segment to the GTO segment. In the aggregate, the Total revenues transferred in FY2019 were $42.8 million. Note: Amounts may not sum due to rounding. © 2020 | 36

Explanation of Non-GAAP Measures and Reconciliation of GAAP to Non- GAAP Measures © 2020 | 37

Non-GAAP Financial Measures Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings and Adjusted Earnings Per Share, Adjusted EBITDA and EBITDAR Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings and Adjusted earnings per share reflect Operating income, Operating income margin, Net earnings, and Diluted earnings per share, as adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing operating performance. These adjusted measures exclude the impact of: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, and (iii) IBM Private Cloud Charges. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. IBM Private Cloud Charges represent a charge on the hardware assets to be transferred to International Business Machines Corporation ("IBM") and other charges related to the information technology agreement for private cloud services the Company entered into with IBM. Adjusted EBITDA reflects Net earnings before interest, taxes, other non-operating (income)/expenses net, depreciation, amortization, IBM Private Cloud Charges, and Acquisition and Integration Costs. EBITDAR reflects Adjusted EBITDA before facilities and equipment lease expenses, and software license agreement expenses. Our management uses Adjusted EBITDA and EBITDAR to better understand the Company’s pre-tax cash flow, adjusted for the impact of leverage. We exclude IBM Private Cloud Charges from our Adjusted Operating income and other earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and this item does not reflect ordinary operations or earnings. We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non-cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets. Free Cash Flow In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities less Capital expenditures as well as Software purchases and capitalized internal use software. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. © 2020 | 38

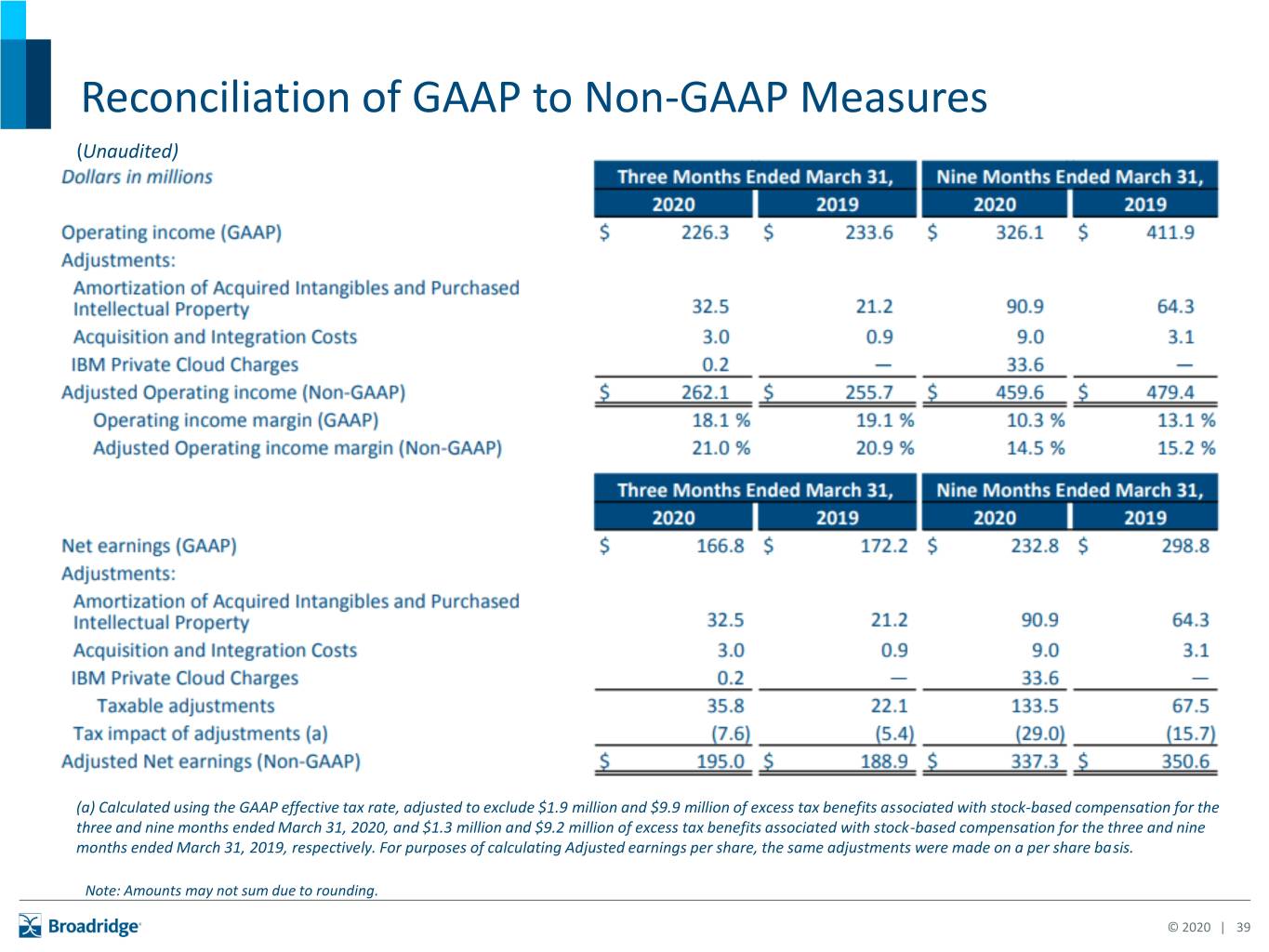

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (a) Calculated using the GAAP effective tax rate, adjusted to exclude $1.9 million and $9.9 million of excess tax benefits associated with stock-based compensation for the three and nine months ended March 31, 2020, and $1.3 million and $9.2 million of excess tax benefits associated with stock-based compensation for the three and nine months ended March 31, 2019, respectively. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. © 2020 | 39

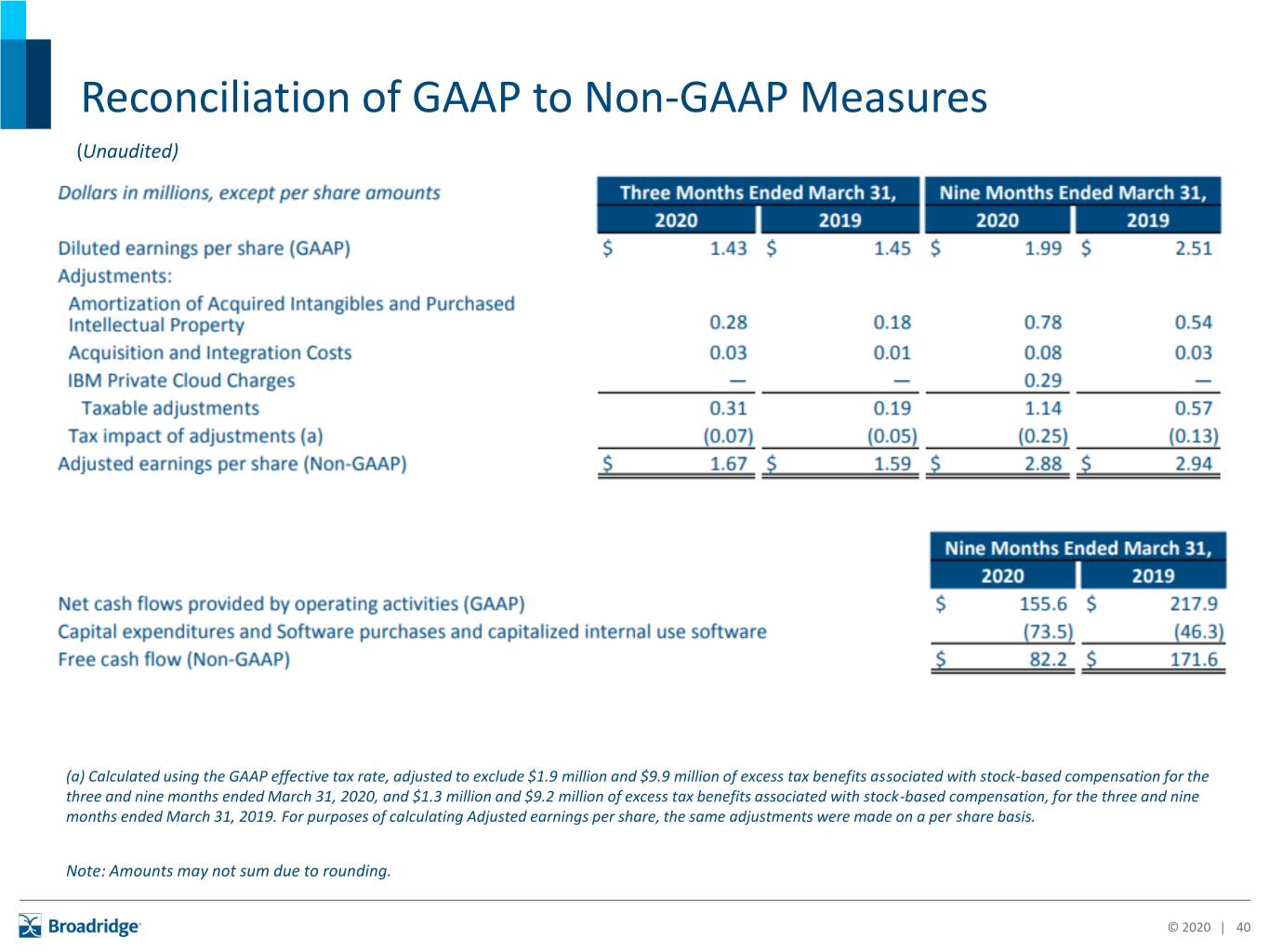

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (a) Calculated using the GAAP effective tax rate, adjusted to exclude $1.9 million and $9.9 million of excess tax benefits associated with stock-based compensation for the three and nine months ended March 31, 2020, and $1.3 million and $9.2 million of excess tax benefits associated with stock-based compensation, for the three and nine months ended March 31, 2019. For purposes of calculating Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. © 2020 | 40

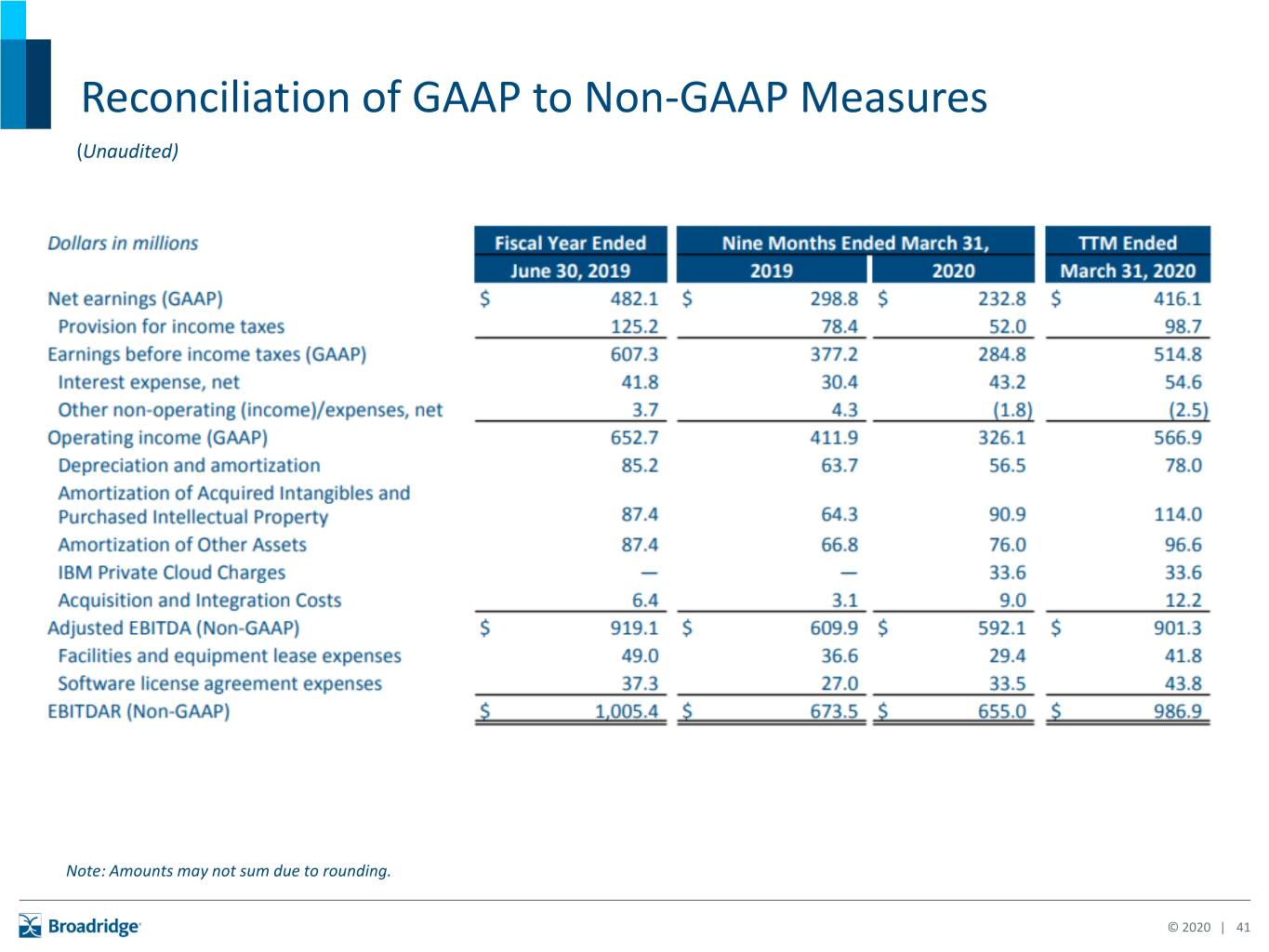

Reconciliation of GAAP to Non-GAAP Measures (Unaudited) Note: Amounts may not sum due to rounding. © 2020 | 41

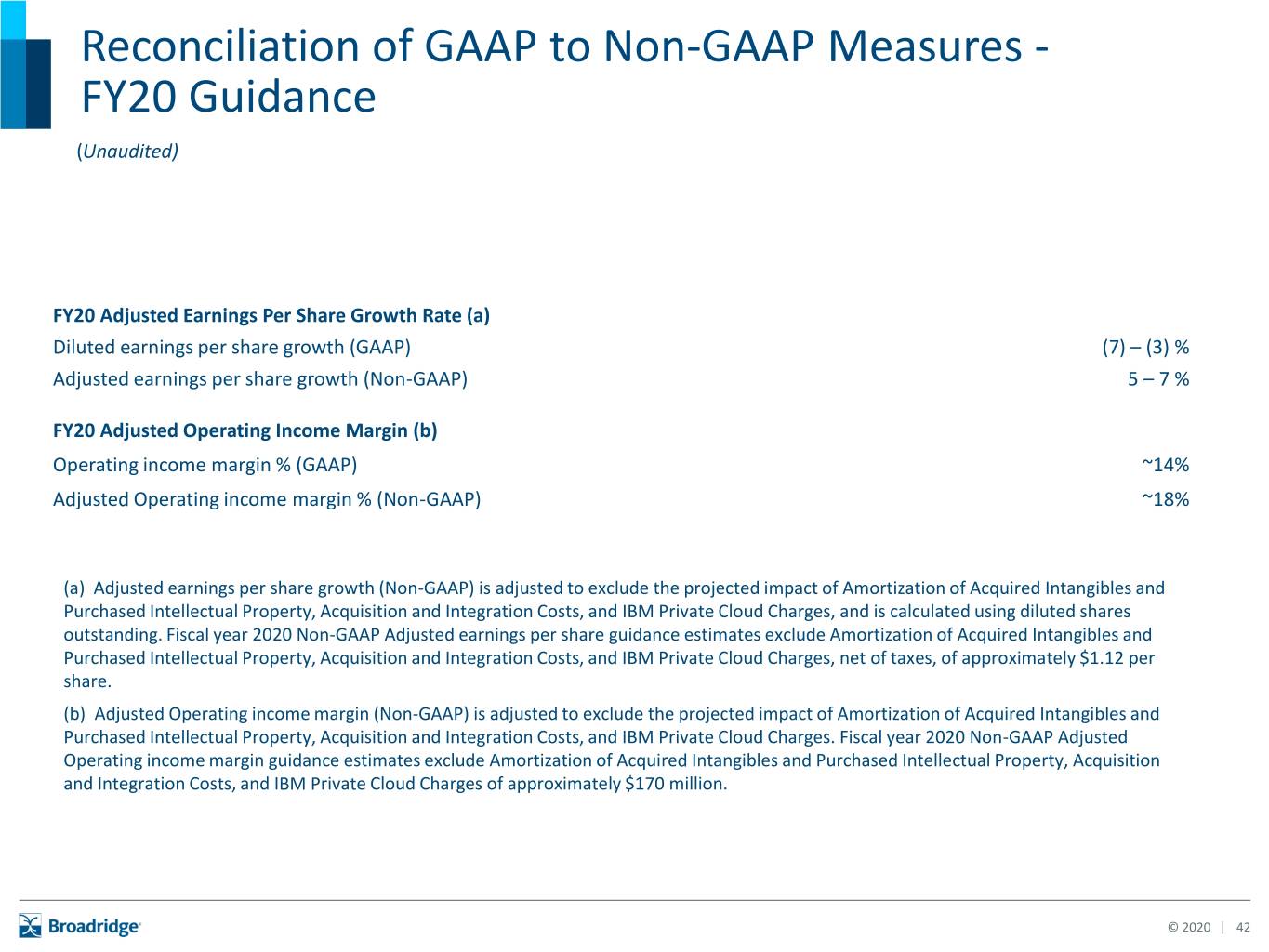

Reconciliation of GAAP to Non-GAAP Measures - FY20 Guidance (Unaudited) FY20 Adjusted Earnings Per Share Growth Rate (a) Diluted earnings per share growth (GAAP) (7) – (3) % Adjusted earnings per share growth (Non-GAAP) 5 – 7 % FY20 Adjusted Operating Income Margin (b) Operating income margin % (GAAP) ~14% Adjusted Operating income margin % (Non-GAAP) ~18% (a) Adjusted earnings per share growth (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges, and is calculated using diluted shares outstanding. Fiscal year 2020 Non-GAAP Adjusted earnings per share guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges, net of taxes, of approximately $1.12 per share. (b) Adjusted Operating income margin (Non-GAAP) is adjusted to exclude the projected impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges. Fiscal year 2020 Non-GAAP Adjusted Operating income margin guidance estimates exclude Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and IBM Private Cloud Charges of approximately $170 million. © 2020 | 42

Broadridge Investor Relations Contacts W. Edings Thibault Tel: 516-472-5129 Email: edings.thibault@broadridge.com Elsa Ballard Tel: 212-973-6197 Email: elsa.ballard@broadridge.com © 2020 | 43