0© 2023 | Scaling a Global Fintech Leader Investor Presentation March 2023 EXHIBIT 99.1

1© 2023 | This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” “on track,” and other words of similar meaning are forward-looking statements. In particular, information appearing in the “Fiscal Year 2023 Guidance” section and statements about our three-year objectives are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors described and discussed in Part I, “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the year ended June 30, 2022 (the “2022 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2022 Annual Report. These risks include: • Changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; • Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; • A material security breach or cybersecurity attack affecting the information of Broadridge's clients; • The potential impact and effects of the Covid-19 pandemic (“Covid-19”) on the business of Broadridge, Broadridge’s results of operations and financial performance, any measures Broadridge has and may take in response to Covid-19 and any expectations Broadridge may have with respect thereto; • Declines in participation and activity in the securities markets; • The failure of Broadridge's key service providers to provide the anticipated levels of service; • A disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; • Overall market, economic and geopolitical conditions and their impact on the securities markets; • The success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; • Broadridge’s failure to keep pace with changes in technology and demands of its clients; • Competitive conditions; • Broadridge’s ability to attract and retain key personnel; and • The impact of new acquisitions and divestitures. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Forward-Looking Statements

2© 2023 | Use of Non-GAAP Financial Measures This presentation includes certain Non-GAAP financial measures including Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share (“EPS”), Free cash flow, and Recurring revenue growth constant currency. Please see the “Explanation of Non-GAAP Measures and Reconciliation of GAAP to Non-GAAP Measures” section of this presentation for more information on Broadridge’s use of Non-GAAP measures and reconciliations to GAAP measures. Key Performance Indicators Management focuses on a variety of key indicators to plan, measure and evaluate the Company’s business and financial performance. These performance indicators include Revenues and Recurring revenue, as well as Non-GAAP measures of Adjusted Operating income, Adjusted Net earnings, Adjusted EPS, Free cash flow, Recurring revenue growth constant currency, and Closed sales. In addition, management focuses on select operating metrics specific to Broadridge of Record Growth, which is comprised of Stock Record Growth (also referred to as “SRG” or “equity position growth”) and Interim Record Growth (also referred to as “IRG” or “mutual fund/ETF position growth”), and Internal Trade Growth (“ITG”). Please refer to Item 2. Management’s Discussion and Analysis of Financial Condition of the Company’s Form 10-Q for a discussion of Revenues, Recurring revenue, Record Growth and Internal Trade Growth in the “Key Performance Indicators” section and the “Results of Operations” section for a description of Closed sales. Foreign Exchange Rates Beginning with the first quarter of fiscal year 2023, the Company changed reporting for segment revenues, segment earnings (loss) before income taxes, segment amortization of acquired intangibles and purchased intellectual property, and Closed sales to reflect the impact of actual foreign exchange rates applicable to the individual periods presented. The presentation of these metrics for the prior periods has been changed to conform to the current period presentation. Total consolidated revenues and earnings before income taxes were not impacted. Notes on Presentation Amounts presented in this presentation may not sum due to rounding. All FY’23 Recurring revenue dollar amounts shown in this presentation are GAAP, and FY’23 Recurring revenue growth percentages are shown as constant currency (Non-GAAP). Recurring revenue growth percentages for FY’18 through FY’22 are calculated based on constant foreign currency exchange rates used for internal management reporting as described in the Company’s segment footnote within its Form 10-K for each respective year. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. Use of Non-GAAP financial measures, KPIs and foreign exchange rates

3© 2023 | A clear path for long term growth A global Fintech leader addressing a large and growing market Three franchise businesses executing on clear growth strategies grounded in long term trends Long track record delivering consistent growth and strong total shareholder returns 2014 Invest for Growth 2017 Ready for Next 2020 A Global Fintech Leader 2023 Scaling a Global Fintech Leader

4© 2023 | Broadridge is a global Fintech leader Managing proxy voting for 750 million equity shareholder positions Powering $9T per day in fixed income and equity trades Distributing more than 7B critical communications each year 750 MILLION $9 TRILLION 7 BILLION Broadridge powers the critical infrastructure behind investing, governance, and communications $60 billion and growing market opportunity

5© 2023 | Technology and operations spend by global banks is over $190 Billion Broadridge has a $60 billion and growing market opportunity $60B CURRENT OPPORTUNITY $22B GOVERNANCE $23B CAPITAL MARKETS $16B WEALTH

6© 2023 | Capital Markets $903M Recurring Revenue 14% Average Annual Growth Wealth & Investment Management $550M Recurring Revenue 11% Average Annual Growth Governance $2.3B Recurring Revenue 8% Average Annual Growth $3.7B FY’22 RECURRING REVENUE Three strong growing franchises with $3.7 billion in Recurring revenue Note: Average Annual Growth reflects the FY’18-FY’22 time period

7© 2023 | The Broadridge financial model is focused on driving steady revenue growth and consistent earnings per share growth, generated by: Continued margin expansion from our scale and operational efficiencies Balanced capital allocation leveraging our strong free cash flow businesses Investments in our long-term growth strategy Sustainable recurring revenue growth

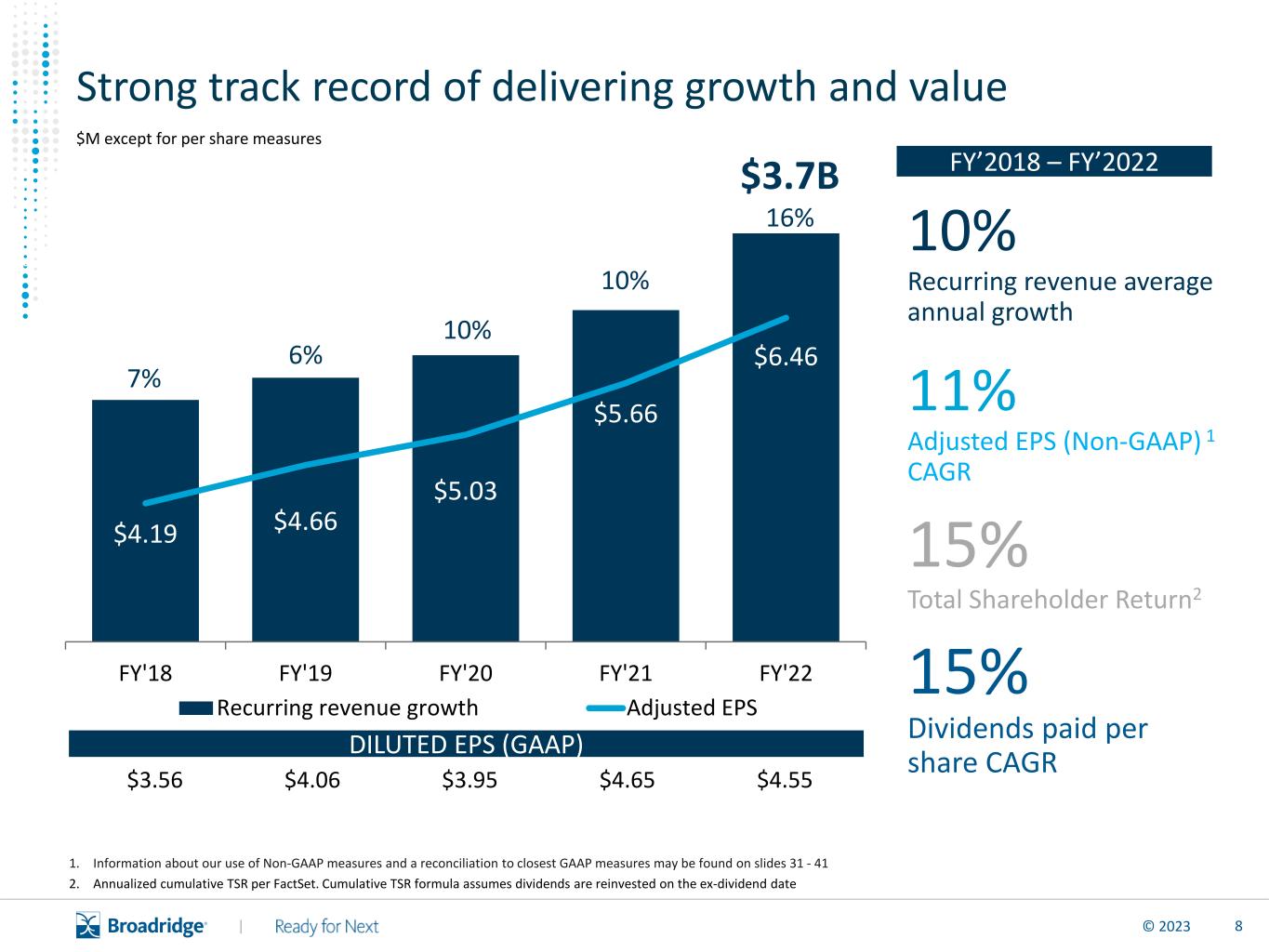

8© 2023 | $4.19 $4.66 $5.03 $5.66 $6.46 2.5 3.5 4.5 5.5 6.5 7.5 1000 1500 2000 2500 3000 3500 4000 FY'18 FY'19 FY'20 FY'21 FY'22 Recurring revenue growth Adjusted EPS Strong track record of delivering growth and value $M except for per share measures 10% Recurring revenue average annual growth 11% Adjusted EPS (Non-GAAP) 1 CAGR 15% Total Shareholder Return2 15% Dividends paid per share CAGR 1. Information about our use of Non-GAAP measures and a reconciliation to closest GAAP measures may be found on slides 31 - 41 2. Annualized cumulative TSR per FactSet. Cumulative TSR formula assumes dividends are reinvested on the ex-dividend date $3.56 $4.06 $3.95 $4.65 $4.55 DILUTED EPS (GAAP) FY’2018 – FY’2022$3.7B 16% 10% 10% 6% 7%

9© 2023 | 13.8% 15.0% 13.8% 13.6% 13.3% Consistent margin expansion Note: Information about our use of Non-GAAP measures and a reconciliation to closest GAAP measures may be found on slides 31 - 41 15.9% 17.1% 17.5% FY'18 FY'19 FY'20 FY'21 FY'22 +120 bps +40 bps +60 bps Efficiency Contributions from business reengineering and internal growth Digital Margin expansion due to mix shift toward digital M&A Primarily weighted to early-stage businesses Investment Strategic investment aligned with client demand Scale Natural OpEx leverage from a SaaS business 72 bps annual FY’18-22 average Adjusted Operating Income margin expansion ADJUSTED OPERATING INCOME MARGIN (NON-GAAP) OPERATING INCOME MARGIN (GAAP) 18.1% +80 bps 18.7% +60 bps

10© 2023 | Track record of delivering consistent growth and strong TSR FY’14 – FY’17 (CAGR) FY’17 – FY’20 (CAGR) Three-year Growth Objectives (CAGR) FY’20 – FY’23 Organic Recurring revenue growth1 5% 5% 5-7% Recurring revenue growth 7%2 7% 7-9% Adj. Operating Income Margin expansion (bps/ year) (Non-GAAP) 532 80 50+ Adj. Earnings per share growth (Non-GAAP) 12% 12%4 8-12% 1. As defined in the Form 10-K. Average Organic Recurring revenue growth per year 2. Excluding the North American Customer Communications acquisition completed in 2016 3. Information about the use of non-GAAP measures and a reconciliation to the closest GAAP figures may be found on slides 31 - 41 of this presentation 4. Excluding the impact of the U.S. Tax Act Cuts and Jobs Act (Tax Act). As reported and including the Tax Act impact, Adjusted EPS growth CAGR was 17% 5. Annualized cumulative TSR per FactSet. Cumulative TSR formula assumes dividends are reinvested on the ex-date Annualized Total Shareholder Return5 25% 21% 3 FY’14-FY’17 FY’17-FY’20

11© 2023 | Investor Communication Solutions SEGMENT OVERVIEW

12© 2023 | ICS Strategy Extend our strong and growing Governance franchise Grow End-to-End Issuer Solutions Build Data-Driven Fund Solutions Drive Next-Gen Regulatory Transform Omni-Channel Communications A leader at the heart of a powerful governance network Recurring revenues of $2.3B and average annual growth rate of 8% from FY’18-22 Strong and consistent underlying growth trends Complementary businesses built on deep relationships Track record of digital transformation

13© 2023 | Our network links investors, asset managers, and issuers across North America 170M+ Retail shareholder accounts 120,000+ Institutional shareholders 30,000+ Mutual funds and ETFs ISSUERS OF SECURITIES SHAREHOLDERS 200,000+ Financial advisors 9,000+ Corporate issuers REGULATORY BODIES & TRADE ASSOCIATIONS 1,000+ Banks and broker-dealers INTERMEDIARIES

14© 2023 | 1% 2% 8% 7% 3% 8% 11% 6% 10% 26% 18% 9% 11% 11% 8% 4% 4% 10% 9% 2% 10% 14% FY'12 FY'13 FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'21 FY'22 Equity MF/ETF ITG EQUITY & MUTUAL FUND/ETF POSITION GROWTH Key volume drivers: position and trade volume growth 1% (4)% 8% 3% 2% 3% 13% 6% 9% 12% 1%INTERNAL TRADE GROWTH (ITG) 10Y Avg. 10% 8% 5% 1. Represents the estimated change in daily trade volumes for clients whose contracts are linked to trade volumes and who were on Broadridge’s trading platforms in both the current and prior year periods 1

15© 2023 | The importance of corporate governance continues to grow Technology is driving increased participation and diversification for retail investors New technologies are lowering the cost of investing and bringing in new investors. ETFs Managed Accounts Zero commission trading Enhanced apps/digitization Broadridge is Innovating Given its position at the intersection of issuers, funds, broker dealers and investors, Broadridge is investing to make it easier than ever to vote and drive down the cost of shareholder engagement. Enabling Pass-Through Voting End-to-End Vote Confirmation Enhanced VSMs Upgraded ProxyVote app ESG continues to grow in importance to investors Environmental, social and governance considerations are continuing to grow in importance to retail and institutional investors, powering more focus on proxy voting, engagement and ESG disclosures. Support for E&S proposals grew to 40% Proposed SEC disclosure requirements 1. Per Broadridge data for 2022 proxy season 1

16© 2023 | ICS segment overview FY'18 FY'19 FY'20 FY'21 FY'22 8% ICS FISCAL YEAR RECURRING REVENUES $615 $216 $364 $1,075 FY'21 FY'22 +11% $2,270 YoY Growth +15% +6% +14% 8% Regulatory Customer Communications Data-Driven Fund Solutions Issuer Avg. Annual Growth 4% 7% 6% $2.3B11% 11%

17© 2023 | Global Technology and Operations SEGMENT OVERVIEW

18© 2023 | $701M $558M GTO FISCAL YEAR RECURRING REVENUES $550 $903 FY'21 FY'22 $1,452 +39% +5% YoY Growth FY'18 FY'19 FY'20 FY'21 FY'22 Wealth & Investment Management Capital Markets 18% 4%10% 24%13% Avg. Annual Growth $1.5B GTO Strategy: Grow Capital Markets franchise and continue building next-gen Wealth & Investment Management franchise 7% +24%

19© 2023 | Capital Markets overview 1. In equity and fixed income trades processed on average per day • A global leader in post-trade processing for cash securities • Continued growth driven by evolution of global banks • Launching AI-powered fixed income trading platform • Itiviti adds strength, scale, and attractive returns Trading Innovation Global Simplification Enterprise & Data Solutions Network Value $9T LEADING GLOBAL SaaS PLATFORM 1 FY'18 FY'19 FY'20 FY'21 FY'22 14% Recurring Revenues Avg. Annual Growth 10% 4% 10% 7% $903M 39%

20© 2023 | Itiviti (BTCS) acquisition is delivering value for Broadridge 1 Significantly strengthen Capital Markets franchise Deepening relationships at key clients Enhancing liquidity, market making, and trade processing across trade lifecycle Developing capabilities to drive front-to-back solutions suite 2 Drive additional global scale and reach 60%+ growth in FY’22 in revenues outside of North America More than $30M in FY’22 Closed sales Accelerating OEMS development for U.S. market 3 Deliver attractive returns to shareholders $256M in FY’22 revenue 30%+ Adjusted Operating income margins in FY’22 Actioned approximately $10M of revenue and cost synergies Expecting double-digit revenue growth for FY’23 Near-term: continue driving share gains in existing markets Medium-term: extend franchise across regions and asset classes Long-term: differentiate with modular solution suite across full trade lifecycle Strategic Roadmap

21© 2023 | • Leading provider of back-office capabilities • Strong set of differentiated component solutions for front- and middle-office • Launching the industry’s only unified front-to-back technology platform • Growing Integrated Investment Management Suite Wealth & Investment Management overview FY'18 FY'19 FY'20 FY'21 FY'22 11% Recurring Revenues Avg. Annual Growth 10% 4% 29% 7% $550M 5%

22© 2023 | Fiscal second quarter 2023 summary

23© 2023 | Key messages as of February 2, 2023 earnings call Broadridge delivered strong second quarter results including 8% Recurring revenue growth constant currency and 11% Adjusted EPS growth 1 2 3 4 Broadridge continues to execute on key long term growth initiatives across Governance, Capital Markets and Wealth & Investment Management Reaffirming outlook for 6-9% Recurring revenue growth constant currency and 7-11% Adjusted EPS growth. We remain on track to deliver at or above our three-year objectives Investor participation remained strong, with second quarter equity position growth of 9% and mutual fund/ETF position growth of 6% 5 Continued execution highlights strength and resilience of the Broadridge business model

24© 2023 | SECOND QUARTER SUMMARY FINANCIAL RESULTS 2023 2022 Inc./(Dec.) Recurring revenues $840 $793 6% Total revenues 1,293 1,260 3% Operating income 108 69 57% Adjusted Operating income – Non-GAAP 173 141 23% Diluted earnings per share $0.48 $0.40 20% Adjusted earnings per share – Non-GAAP $0.91 $0.82 11% Closed sales $65 $82 (20%) Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 31 – 41 Constant currency growth – Non-GAAP 8% Adjusted Operating income margin – Non-GAAP 13.4% 11.2% 220bps $ in millions, except per share data Summary financial results

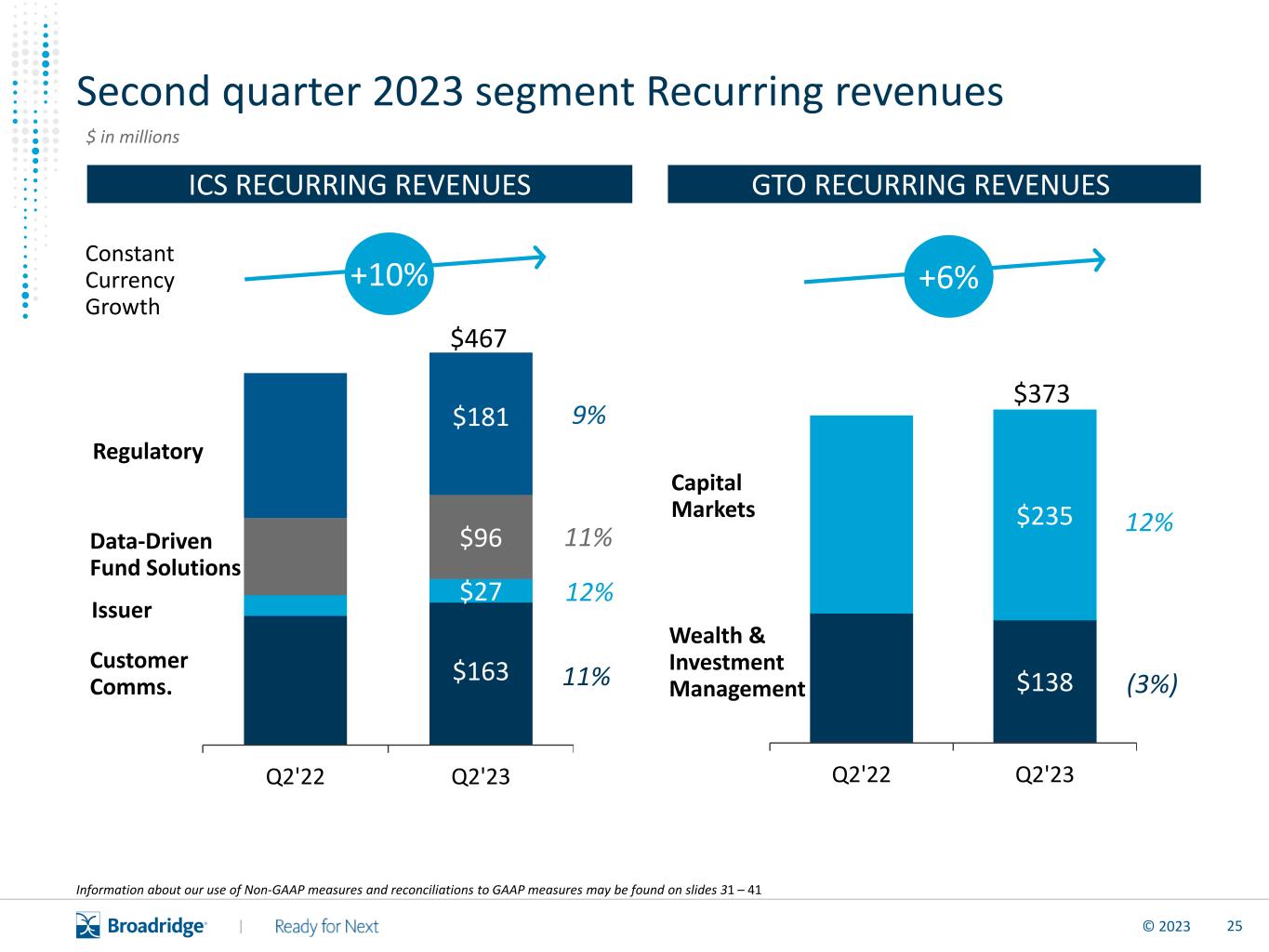

25© 2023 | $138 $235 Q2'22 Q2'23 $163 $27 $96 $181 Q2'22 Q2'23 Regulatory Customer Comms. Data-Driven Fund Solutions Issuer 12% 11% 11% 9% ICS RECURRING REVENUES GTO RECURRING REVENUES $467 Capital Markets Wealth & Investment Management $373 12% (3%) +10% Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 31 – 41 +6% $ in millions Constant Currency Growth Second quarter 2023 segment Recurring revenues

26© 2023 | $65 $59 $70 $63 $38 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q2'22 Total Revenue Recurring Event-Driven Distribution FX Q2'23 Total Revenue QUARTERLY EVENT-DRIVEN REVENUE 4 pts (2) pts 1 pt 3% SECOND QUARTER 2023 TOTAL REVENUE GROWTH DRIVERS $58M FY’16-FY’22 QUARTERLY AVERAGE $ in millions. Pts contribution to growth 0 pts $1,293 Second quarter 2023 Total revenue growth drivers

27© 2023 | FY'21 FY'22 FY'23 $231 $280 $ in millions CLOSED SALES H1'22 H1'23 $112 $94 $270 – $310 Closed sales remain on track with fiscal year 2023 guidance

28© 2023 | 1. Net investments on new client conversions, including development of platform capabilities 2. Last twelve months (LTM) Free cash flow conversion equals Free cash flow for the most recent four quarters divided by Adjusted Net earnings for the same four quarters 3. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 31 – 41 FREE CASH FLOW CONVERSION (LTM)NET CLIENT PLATFORM SPEND 1 $ in millions $154 $114 $97 $163 $78 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 56% 50% 48% 41% 51% Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 2,3 Client platform spend and FCF conversion

29© 2023 | TOTAL CAPITAL RETURNS $1.94 $2.16 $2.30 $2.56 $2.90 33% 11% 6% 11% 13% DIVIDENDS PER SHARE M&A Client Platform Investments CapEx and Software 2 1. Includes Software purchases and capitalized internal use software 2. Net investments on new client conversions, including development of platform capabilities 3. Includes acquisitions and minority investments SELECT USES OF CASH YTD’23 1 $241 FY'19 FY'20 FY'21 FY'22 FY'23 $33 $0 $ in millions, except per share data 3 6 $253$248$269 $578 4. Capital returns to shareholders through dividends and total share repurchases net of option proceeds. FY’23 annual dividend amount subject to Board declaration YOY GROWTH 4 $131 Capital allocation

30© 2023 | Fiscal Year 2023 Guidance as of February 2, 2023 FY’23 Guidance Updates/ Changes Recurring revenue growth constant currency - Non-GAAP 6 - 9% No Change Adjusted Operating income margin - Non-GAAP Increase of ~ 50 bps No Change Adjusted earnings per share growth - Non-GAAP 7 - 11% No Change Closed sales $270M - $310M No Change

31© 2023 | Explanation of Non-GAAP measures and Reconciliation of GAAP to Non-GAAP measures

32© 2023 | Non-GAAP measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, Free cash flow, and Recurring revenue growth constant currency. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non-GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, for internal planning and forecasting purposes. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Reconciliations of Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings, and Adjusted Earnings Per Share These Non-GAAP measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items the exclusion of which management believes provides insight regarding our ongoing operating performance. Depending on the period presented, these adjusted measures exclude the impact of certain of the following items: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, (iii) IBM Private Cloud Charges, (iv) Real Estate Realignment and Covid-19 Related Expenses, (v) Russia-Related Exit Costs, (vi) Investment Gains, (vii) Software Charge, (viii) Loss (Gain) on Acquisition-Related Financial Instrument, (ix) Gain on Sale of a Joint Venture Investment, (x) Tax Act items, (xi) Gain on Sale of Securities, and (xii) MAL investment gain. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. IBM Private Cloud Charges represent a charge on the hardware assets transferred to IBM and other charges related to the IBM Private Cloud Agreement. Real Estate Realignment and Covid-19 Related Expenses are comprised of two major components: Real Estate Realignment Expenses, and Covid-19 Related Expenses. Real Estate Realignment Expenses are expenses associated with the exit of certain of the Company’s leased facilities in response to the Covid-19 pandemic, which consist of the impairment of certain right of use assets, leasehold improvements and equipment, as well as other related facility exit expenses directly resulting from, and attributable to, the exit of these leased facilities. Covid-19 Related Expense are direct and incremental expenses incurred by the Company to protect the health and safety of Broadridge associates during the Covid-19 outbreak, including expenses associated with monitoring the temperatures for associates entering our facilities, enhancing the safety of our office environment in preparation for workers to return to Company facilities on a more regular basis, ensuring proper social distancing in our production facilities, personal protective equipment, enhanced cleaning measures in our facilities, and other safety related expenses. Russia-Related Exit Costs are direct and incremental costs associated with the Company’s wind down of business activities in Russia in response to Russia’s invasion of Ukraine, including relocation-related expenses of impacted associates. Investment Gains represent non- operating, non-cash gains on privately held investments. Software Charge represents a charge related to an internal use software product that is no longer expected to be used. Gain on Sale of a Joint Venture Investment represents a non-operating, cash gain on the sale of one of the Company’s joint venture investments. Loss (Gain) on Acquisition-Related Financial Instrument represents a non-operating loss (gain) on a financial instrument designed to minimize the Company's foreign exchange risk associated with the Itiviti acquisition, as well as certain other non-operating financing costs associated with the Itiviti acquisition. Tax Act items represent the net impact of a U.S. federal transition tax on earnings of certain foreign subsidiaries, foreign jurisdiction withholding taxes and certain benefits related to the remeasurement of the Company’s net U.S. federal and state deferred tax liabilities attributable to the Tax Act. The Gain on Sale of Securities represents a non-operating gain on the sale of securities associated with the Company’s retirement plan obligations. The MAL investment gain represents a non-cash, nontaxable gain on investment from the Company’s acquisition of MAL in March 2017.

33© 2023 | We exclude Acquisition and Integration Costs, IBM Private Cloud Charges, Real Estate Realignment and Covid-19 Related Expenses, the Russia-Related Exit Costs, Investment Gains, the Software Charge, the Gain on Acquisition-Related Financial Instrument and the Gain on Sale of a Joint Venture Investment from our Adjusted Operating income (as applicable) and other adjusted earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and enhances comparability across fiscal reporting periods, as these items are not reflective of our underlying operations or performance. We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non- cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets. Free cash flow and Free cash flow conversion In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as Net cash flows provided by operating activities plus Proceeds from asset sales, less Capital expenditures as well as Software purchases and capitalized internal use software. Free cash flow conversion is calculated as Free cash flow divided by Adjusted Net earnings for the given period. Recurring Revenue Growth Constant Currency As a multi-national company, we are subject to variability of our reported U.S. dollar results due to changes in foreign currency exchange rates. The exclusion of the impact of foreign currency exchange fluctuations from our Recurring revenue growth, or what we refer to as amounts expressed “on a constant currency basis”, is a Non-GAAP measure. We believe that excluding the impact of foreign currency exchange fluctuations from our Recurring revenue growth provides additional information that enables enhanced comparison to prior periods. Changes in Recurring revenue growth expressed on a constant currency basis are presented excluding the impact of foreign currency exchange fluctuations. To present this information, current period results for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the average exchange rates in effect during the corresponding period of the comparative year, rather than at the actual average exchange rates in effect during the current fiscal year. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. Non-GAAP measures

34© 2023 | 1Confidential and Proprietary | Year ended June 30, Dollars in millions 2022 2021 2020 2019 2018 2017 2016 2015 2014 Operating Income (GAAP) $759.9 $678.7 $624.9 $652.7 $598.1 $534.0 $502.3 $468.5 $418.3 Adjustments: Amortization of acquired intangibles and purchased intellectual property 250.2 153.7 122.9 87.4 81.4 72.6 31.8 25.3 22.6 Acquisition and integration costs 24.5 18.1 12.5 6.4 8.8 19.1 5.0 5.0 2.1 IBM private cloud charges — — 32.0 — — — — — — Real estate realignment and Covid-19 related expenses (a) 30.5 45.3 2.4 — — — — — — Russia-Related Exit Costs 1.4 — — — — — — — — Software charge — 6.0 — — — — — — — Adjusted operating income (Non-GAAP) $1,066.4 $901.8 $794.8 $746.5 $688.2 $625.7 $539.2 $498.8 $442.9 Operating income margin (GAAP) 13.3% 13.6% 13.8% 15.0% 13.8% 12.9% 17.3% 17.4% 16.4% Adjusted operating income margin (Non-GAAP) 18.7% 18.1% 17.5% 17.1% 15.9% 15.1% 18.6% 18.5% 17.3% (Unaudited) Reconciliation of GAAP to Non-GAAP Measures (a) Real Estate Realignment Expenses were $23.0 million, $29.6 million, and $0.0 million for the year ended June 30, 2022, 2021, and 2020, respectively. Covid-19 Related Expenses were $7.5 million, $15.7 million, and $2.4 million for the year ended June 30, 2022, 2021, and 2020, respectively.

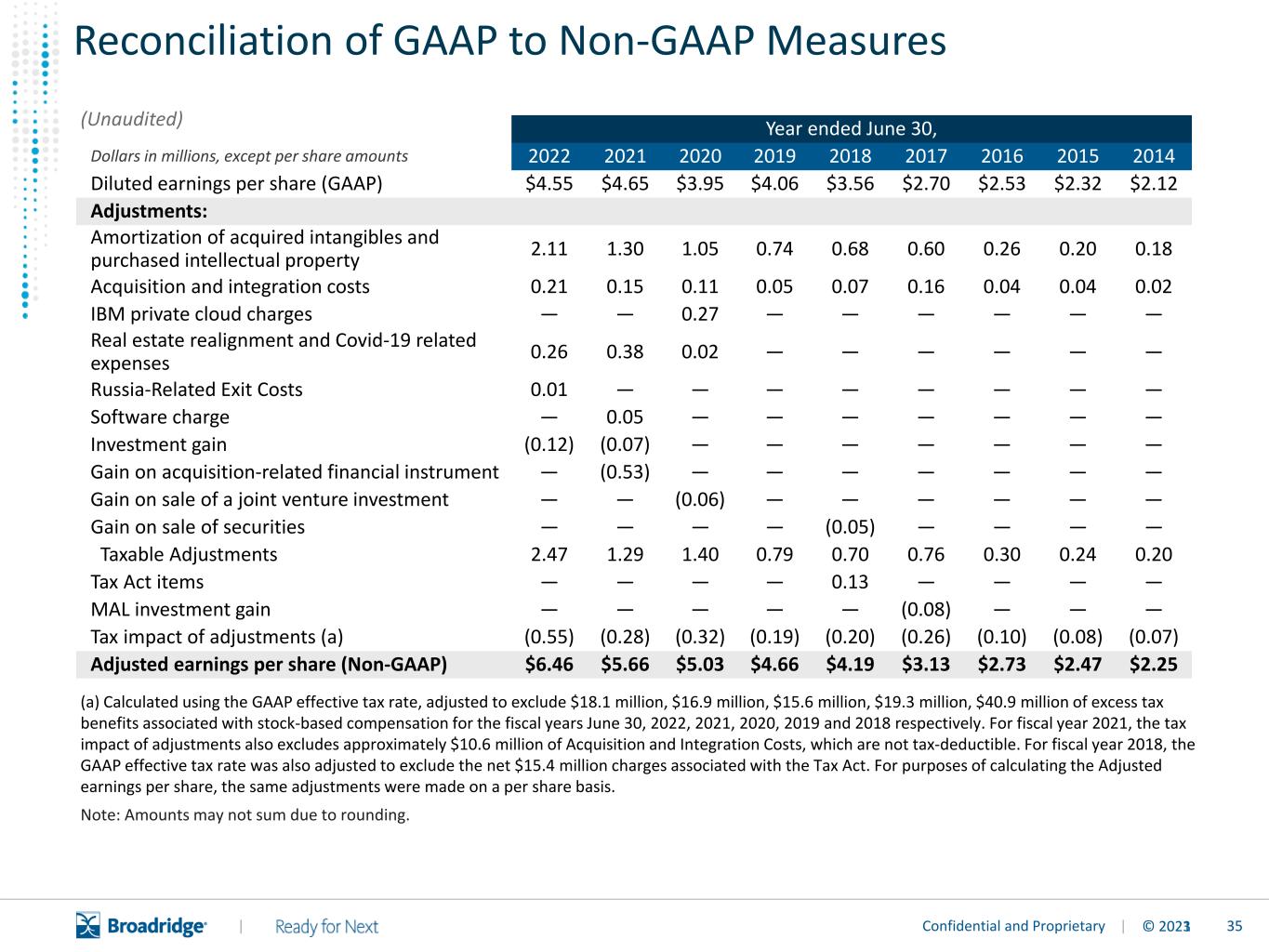

35© 2023 | 1Confidential and Proprietary | (Unaudited) Year ended June 30, Dollars in millions, except per share amounts 2022 2021 2020 2019 2018 2017 2016 2015 2014 Diluted earnings per share (GAAP) $4.55 $4.65 $3.95 $4.06 $3.56 $2.70 $2.53 $2.32 $2.12 Adjustments: Amortization of acquired intangibles and purchased intellectual property 2.11 1.30 1.05 0.74 0.68 0.60 0.26 0.20 0.18 Acquisition and integration costs 0.21 0.15 0.11 0.05 0.07 0.16 0.04 0.04 0.02 IBM private cloud charges — — 0.27 — — — — — — Real estate realignment and Covid-19 related expenses 0.26 0.38 0.02 — — — — — — Russia-Related Exit Costs 0.01 — — — — — — — — Software charge — 0.05 — — — — — — — Investment gain (0.12) (0.07) — — — — — — — Gain on acquisition-related financial instrument — (0.53) — — — — — — — Gain on sale of a joint venture investment — — (0.06) — — — — — — Gain on sale of securities — — — — (0.05) — — — — Taxable Adjustments 2.47 1.29 1.40 0.79 0.70 0.76 0.30 0.24 0.20 Tax Act items — — — — 0.13 — — — — MAL investment gain — — — — — (0.08) — — — Tax impact of adjustments (a) (0.55) (0.28) (0.32) (0.19) (0.20) (0.26) (0.10) (0.08) (0.07) Adjusted earnings per share (Non-GAAP) $6.46 $5.66 $5.03 $4.66 $4.19 $3.13 $2.73 $2.47 $2.25 (a) Calculated using the GAAP effective tax rate, adjusted to exclude $18.1 million, $16.9 million, $15.6 million, $19.3 million, $40.9 million of excess tax benefits associated with stock-based compensation for the fiscal years June 30, 2022, 2021, 2020, 2019 and 2018 respectively. For fiscal year 2021, the tax impact of adjustments also excludes approximately $10.6 million of Acquisition and Integration Costs, which are not tax-deductible. For fiscal year 2018, the GAAP effective tax rate was also adjusted to exclude the net $15.4 million charges associated with the Tax Act. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Note: Amounts may not sum due to rounding. Reconciliation of GAAP to Non-GAAP Measures

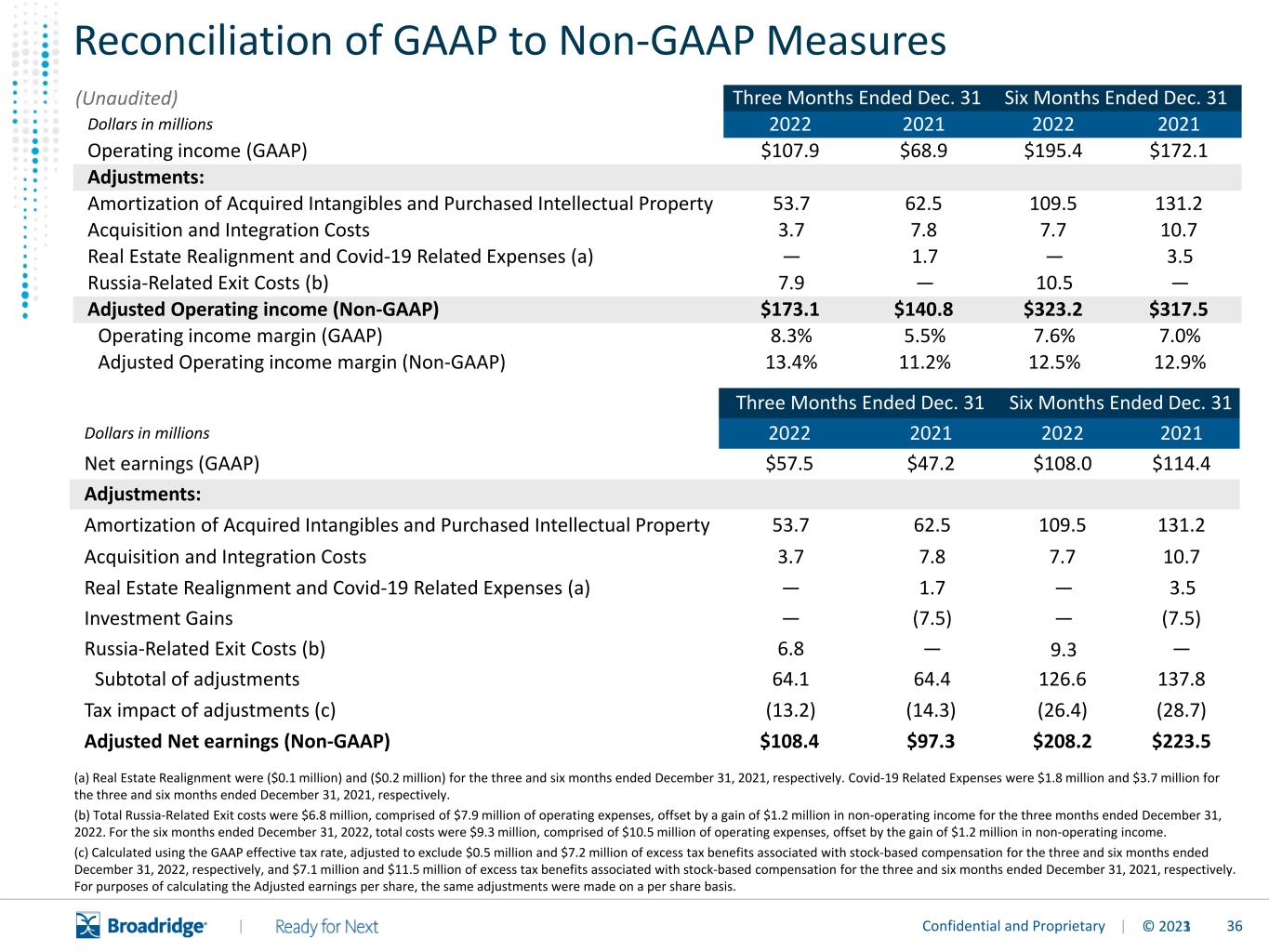

36© 2023 | 1Confidential and Proprietary | (Unaudited) Three Months Ended Dec. 31 Six Months Ended Dec. 31 Dollars in millions 2022 2021 2022 2021 Operating income (GAAP) $107.9 $68.9 $195.4 $172.1 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 53.7 62.5 109.5 131.2 Acquisition and Integration Costs 3.7 7.8 7.7 10.7 Real Estate Realignment and Covid-19 Related Expenses (a) — 1.7 — 3.5 Russia-Related Exit Costs (b) 7.9 — 10.5 — Adjusted Operating income (Non-GAAP) $173.1 $140.8 $323.2 $317.5 Operating income margin (GAAP) 8.3% 5.5% 7.6% 7.0% Adjusted Operating income margin (Non-GAAP) 13.4% 11.2% 12.5% 12.9% Three Months Ended Dec. 31 Six Months Ended Dec. 31 Dollars in millions 2022 2021 2022 2021 Net earnings (GAAP) $57.5 $47.2 $108.0 $114.4 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 53.7 62.5 109.5 131.2 Acquisition and Integration Costs 3.7 7.8 7.7 10.7 Real Estate Realignment and Covid-19 Related Expenses (a) — 1.7 — 3.5 Investment Gains — (7.5) — (7.5) Russia-Related Exit Costs (b) 6.8 — 9.3 — Subtotal of adjustments 64.1 64.4 126.6 137.8 Tax impact of adjustments (c) (13.2) (14.3) (26.4) (28.7) Adjusted Net earnings (Non-GAAP) $108.4 $97.3 $208.2 $223.5 (a) Real Estate Realignment were ($0.1 million) and ($0.2 million) for the three and six months ended December 31, 2021, respectively. Covid-19 Related Expenses were $1.8 million and $3.7 million for the three and six months ended December 31, 2021, respectively. (b) Total Russia-Related Exit costs were $6.8 million, comprised of $7.9 million of operating expenses, offset by a gain of $1.2 million in non-operating income for the three months ended December 31, 2022. For the six months ended December 31, 2022, total costs were $9.3 million, comprised of $10.5 million of operating expenses, offset by the gain of $1.2 million in non-operating income. (c) Calculated using the GAAP effective tax rate, adjusted to exclude $0.5 million and $7.2 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2022, respectively, and $7.1 million and $11.5 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2021, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Reconciliation of GAAP to Non-GAAP Measures

37© 2023 | 1Confidential and Proprietary | (Unaudited) (a) Real Estate Realignment Expenses impacted Adjusted earnings per share by $0.00 for the three and six months ended December 31, 2021. Covid-19 Related Expenses impacted Adjusted earnings per share by $0.02 and $0.03 for the three and six months ended December 31, 2021, respectively. (b) Calculated using the GAAP effective tax rate, adjusted to exclude $0.5 million and $7.2 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2022, respectively, and $7.1 million and $11.5 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2021, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Three Months Ended Dec. 31 Six Months Ended Dec. 31 Dollars in millions, except per share amounts 2022 2021 2022 2021 Diluted earnings per share (GAAP) $0.48 $0.40 $0.91 $0.97 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.45 0.53 0.92 1.11 Acquisition and Integration Costs 0.03 0.07 0.06 0.09 Real Estate Realignment and Covid-19 Related Expenses (a) — 0.01 — 0.03 Investment Gains — (0.06) — (0.06) Russia-Related Exit Costs 0.06 — 0.08 — Subtotal of adjustments 0.54 0.54 1.06 1.16 Tax impact of adjustments (b) (0.11) (0.12) (0.22) (0.24) Adjusted earnings per share (Non-GAAP) $0.91 $0.82 $1.75 $1.89 Six Months Ended Dec. 31 Dollars in millions 2022 2021 Net cash flows used in operating activities (GAAP) $(81.4) $(94.6) Capital expenditures and Software purchases and capitalized internal use software (33.1) (29.2) Free cash flow (Non-GAAP) $(114.5) $(123.8) Reconciliation of GAAP to Non-GAAP Measures

38© 2023 | 1Confidential and Proprietary | (Unaudited) Global Technology and Operations Capital Markets Wealth and Investment Management Total Recurring revenue growth (GAAP) 6% (5)% 2% Impact of foreign currency exchange 6% 3% 5% Recurring revenue growth constant currency (Non-GAAP) 12% (3)% 6% Three Months Ended December 31, 2022 Investor Communication Solutions Regulatory Data-Driven Fund Solutions Issuer Customer Comms. Total Recurring revenue growth (GAAP) 9% 9% 12% 10% 9% Impact of foreign currency exchange 1% 2% —% —% 1% Recurring revenue growth constant currency (Non-GAAP) 9% 11% 12% 11% 10% Consolidated Total Recurring revenue growth (GAAP) 6% Impact of foreign currency exchange 2% Recurring revenue growth constant currency (Non-GAAP) 8% Reconciliation of GAAP to Non-GAAP Measures

39© 2023 | 1Confidential and Proprietary | (Unaudited) Global Technology and Operations Capital Markets Wealth and Investment Management Total Recurring revenue growth (GAAP) 8% (1)% 4% Impact of foreign currency exchange 5% 2% 4% Recurring revenue growth constant currency (Non-GAAP) 13% 1% 8% Six Months Ended December 31, 2022 Investor Communication Solutions Regulatory Data-Driven Fund Solutions Issuer Customer Comms. Total Recurring revenue growth (GAAP) 6% 10% 14% 10% 9% Impact of foreign currency exchange —% 2% —% —% 1% Recurring revenue growth constant currency (Non-GAAP) 6% 12% 14% 11% 9% Consolidated Total Recurring revenue growth (GAAP) 7% Impact of foreign currency exchange 2% Recurring revenue growth constant currency (Non-GAAP) 9% Reconciliation of GAAP to Non-GAAP Measures

40© 2023 | 1Confidential and Proprietary | (Unaudited) (a) Last twelve months (LTM) sums the last four quarters of Free cash flow for the given period (b) Last twelve months (LTM) sums the last four quarters of Adjusted Net earnings for the given period (c) Free cash flow conversion is calculated as Free cash flow divided by Adjusted Net earnings for the given period FY 2021 FY 2022 FY 2023 Dollars in millions Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net earnings (GAAP) $165.0 $260.4 $67.2 $47.2 $176.6 $248.1 $50.4 $57.5 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 31.9 56.8 68.7 62.5 60.8 58.2 55.9 53.7 Acquisition and Integration Costs 9.2 6.5 2.9 7.8 3.1 10.6 4.1 3.7 Real Estate Realignment and Covid-19 Related Expenses 3.3 4.2 1.8 1.7 3.3 23.7 — — Russia-Related Exit Costs — — — — — 1.4 2.6 6.8 Investment Gains — — — (7.5) — (6.7) — — Loss (Gain) on Acquisition-Related Financial Instrument 9.6 (71.7) — — — — — — Subtotal of adjustments 54.0 (4.1) 73.4 64.4 67.2 87.2 62.5 64.1 Tax impact of adjustments (10.9) 1.8 (14.4) (14.3) (15.4) (21.6) (13.2) (13.2) Adjusted Net earnings (Non-GAAP) $208.1 $258.2 $126.3 $97.3 $228.4 $313.7 $99.7 $108.4 FY 2021 FY 2022 FY 2023 Dollars in millions Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net cash flows (used in) provided by operating activities (GAAP) $ 106.2 $ 450.5 $ (135.4) $ 40.8 $ 80.7 $ 457.4 $ (204.5) $ 123.1 Capital expenditures and Software purchases and capitalized internal use software (20.4) (29.5) (15.9) (13.3) (25.2) (18.7) (13.6) (19.5) Free cash flow (Non-GAAP) $ 85.8 $ 421.0 $ (151.4) $ 27.6 $ 55.5 $ 438.7 $ (218.1) $ 103.5 FY 2022 FY 2023 Dollars in millions Q2 Q3 Q4 Q1 Q2 LTM Free cash flow (a) 383.0 352.6 370.4 303.7 379.7 LTM Adjusted Net earnings (Non-GAAP) (b) 689.7 710.1 765.7 739.1 750.3 LTM Free cash flow conversion (Non-GAAP) (c) 56 % 50 % 48 % 41 % 51 % Reconciliation of GAAP to Non-GAAP Measures

41© 2023 | 1Confidential and Proprietary | Fiscal Year, 2023 FY23 Recurring revenue growth (a) Impact of foreign currency exchange – Recurring revenue growth constant currency – Non-GAAP 6-9% FY23 Adjusted Operating income margin (b) Operating income margin % - GAAP Increase of ~150 bps Adjusted Operating income margin % - Non-GAAP Increase of ~50 bps FY23 Adjusted earnings per share growth rate (c) Diluted earnings per share – GAAP ~13-17% growth Adjusted earnings per share – Non-GAAP 7-11% growth (Unaudited) (a) The Company is unable to reconcile its forward-looking Recurring revenue growth constant currency fiscal year 2023 guidance without unreasonable efforts because of the uncertainty in the amounts of future foreign currency exchange rates. For the same reason, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. (b) Adjusted Operating income margin guidance (Non-GAAP) is adjusted to exclude the projected $255 million impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and Russia-Related Exit Costs. (c) Adjusted earnings per share growth guidance (Non-GAAP) is adjusted to exclude the projected $1.65 per share impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Acquisition and Integration Costs, and Russia-Related Exit Costs, and is calculated using diluted shares outstanding. Reconciliation of GAAP to Non-GAAP Measures Fiscal Year 2023 guidance

42© 2023 | W. Edings Thibault Greg Faje Sean Silva broadridgeir@broadridge.com Broadridge Investor Relations Contacts