Powering and transforming financial markets Investor Presentation February 2024 EXHIBIT 99.1

2 Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge Financial Solutions, Inc. ("Broadridge" or the "Company") contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” “on track,” and other words of similar meaning are forward-looking statements. In particular, information appearing in the “Fiscal Year 2024 Guidance” section and statements about our three-year objectives are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors described and discussed in Part I, “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the year ended June 30, 2023 (the “2023 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2023 Annual Report. These risks include: • Changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; • Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; • A material security breach or cybersecurity attack affecting the information of Broadridge's clients; • Declines in participation and activity in the securities markets; • The failure of Broadridge's key service providers to provide the anticipated levels of service; • A disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; • Overall market, economic and geopolitical conditions and their impact on the securities markets; • The success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; • Broadridge’s failure to keep pace with changes in technology and demands of its clients; • Competitive conditions; • Broadridge’s ability to attract and retain key personnel; and • The impact of new acquisitions and divestitures. There may be other factors that may cause our actual results to differ materially from the forward-looking statements. Our actual results, performance or achievements could differ materially from those expressed in, or implied by, the forward-looking statements. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

3 Use of Non-GAAP financial measures, KPIs and foreign exchange rates Use of Non-GAAP Financial Measures This presentation includes certain Non-GAAP financial measures including Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share (“EPS”), Free cash flow, Free cash flow conversion, and Recurring revenue growth constant currency. Please see the “Explanation of Non-GAAP Measures and Reconciliation of GAAP to Non-GAAP Measures” section of this presentation for more information on Broadridge’s use of Non-GAAP measures and reconciliations to GAAP measures. Key Performance Indicators Management focuses on a variety of key indicators to plan, measure and evaluate the Company’s business and financial performance. These performance indicators include Revenues and Recurring revenue, as well as Non-GAAP measures of Adjusted Operating income, Adjusted Net earnings, Adjusted EPS, Free cash flow, Recurring revenue growth constant currency, and Closed sales. In addition, management focuses on select operating metrics specific to Broadridge of Record Growth, which is comprised of Stock Record Growth (also referred to as “SRG” or “equity position growth”) and Interim Record Growth (also referred to as “IRG” or “mutual fund/ETF position growth”), and Internal Trade Growth (“ITG”). Please refer to Item 2. Management’s Discussion and Analysis of Financial Condition of the 2023 Annual Report for a discussion of Revenues, Recurring revenue, Record Growth and Internal Trade Growth in the “Key Performance Indicators” section and the “Results of Operations” section for a description of Closed sales. Foreign Exchange Rates Beginning with the first quarter of fiscal year 2023, the Company changed reporting for segment revenues, segment earnings (loss) before income taxes, segment amortization of acquired intangibles and purchased intellectual property, and Closed sales to reflect the impact of actual foreign exchange rates applicable to the individual periods presented. The presentation of these metrics for the prior periods has been changed to conform to the current period presentation. Total consolidated revenues and earnings before income taxes were not impacted. Notes on Presentation Amounts presented in this presentation may not sum due to rounding. All FY’23 and FY’24 Recurring revenue dollar amounts shown in this presentation are GAAP, and FY’23 and FY’24 Recurring revenue growth percentages are shown as constant currency (Non-GAAP). Recurring revenue growth percentages for FY’14 through FY’22 are calculated based on constant foreign currency exchange rates used for internal management reporting as described in the Company’s segment footnote within its Form 10-K for each respective year. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation.

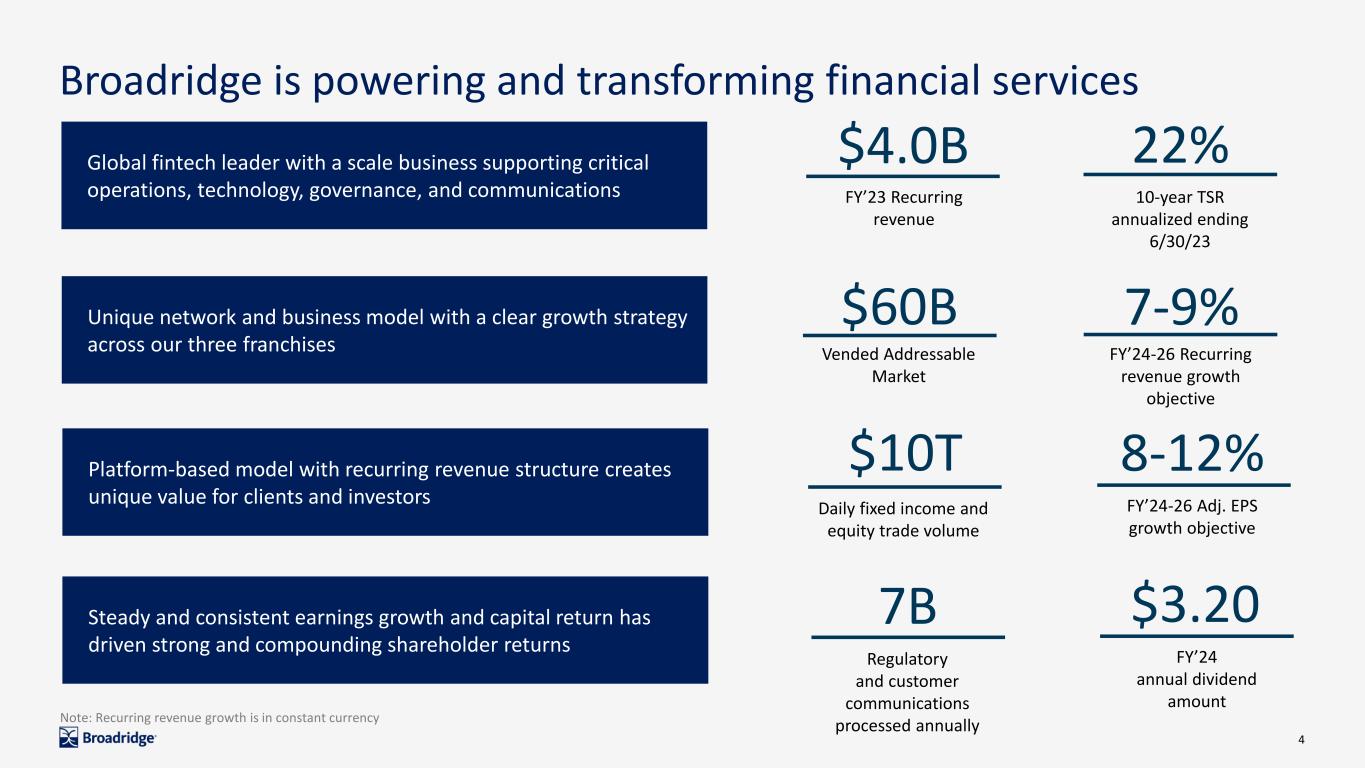

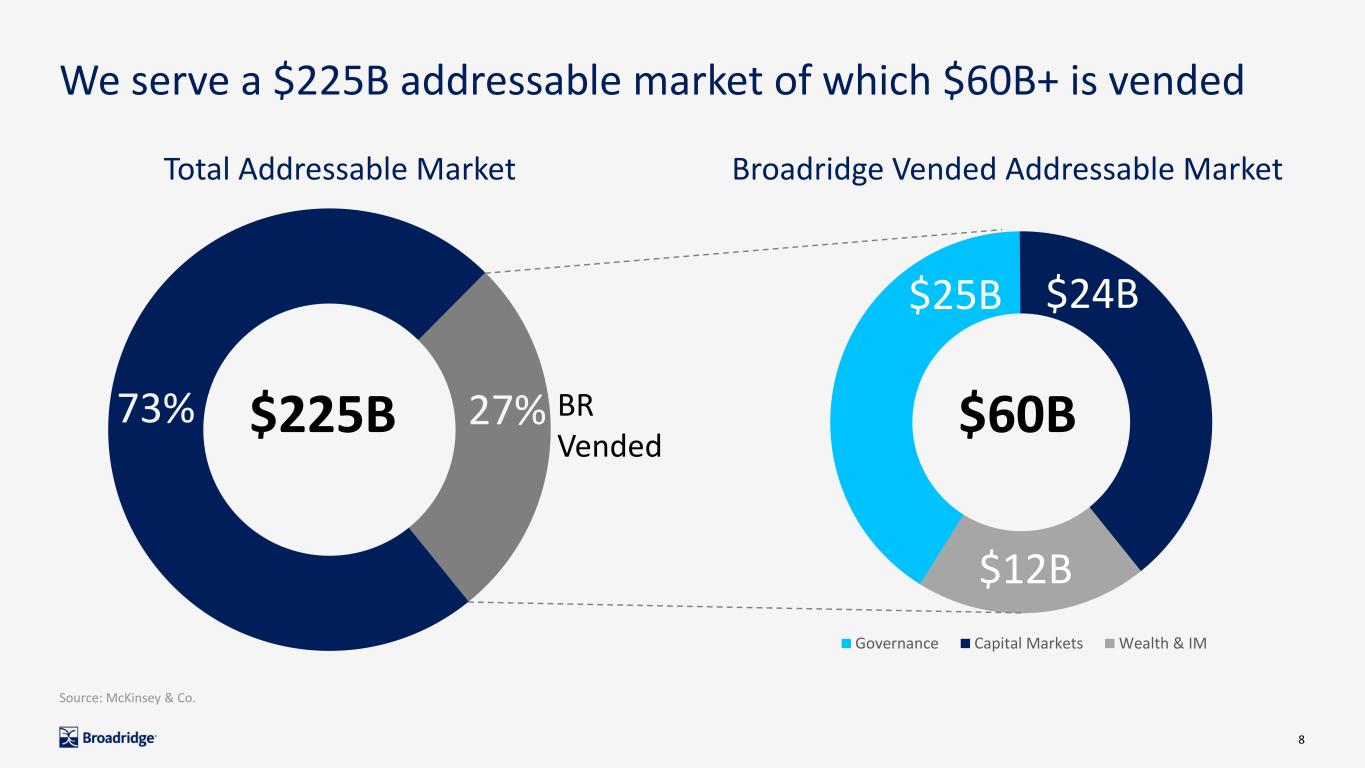

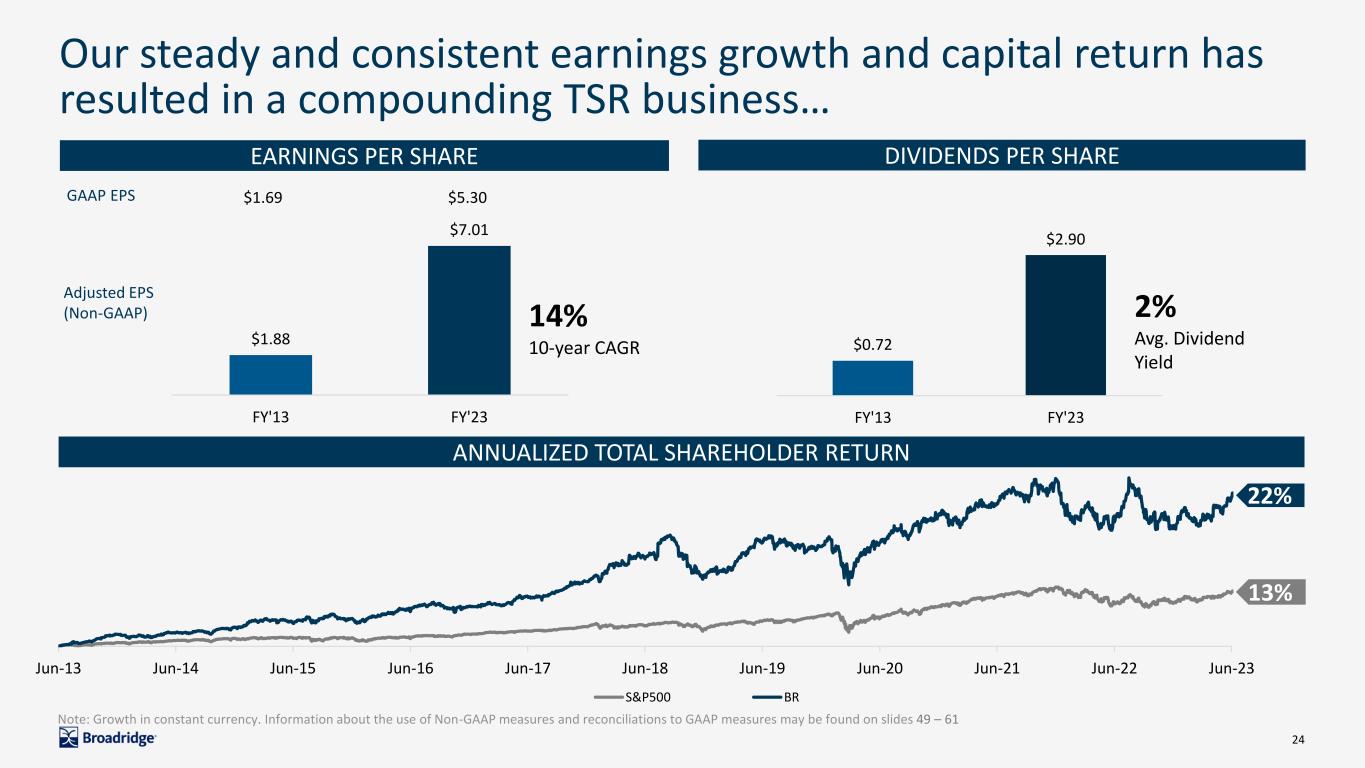

4 Broadridge is powering and transforming financial services Unique network and business model with a clear growth strategy across our three franchises Platform-based model with recurring revenue structure creates unique value for clients and investors Steady and consistent earnings growth and capital return has driven strong and compounding shareholder returns $4.0B FY’23 Recurring revenue 7-9% FY’24-26 Recurring revenue growth objective $60B Vended Addressable Market Global fintech leader with a scale business supporting critical operations, technology, governance, and communications $10T Daily fixed income and equity trade volume 8-12% FY’24-26 Adj. EPS growth objective 22% 10-year TSR annualized ending 6/30/23 $3.20 FY’24 annual dividend amount 7B Regulatory and customer communications processed annuallyNote: Recurring revenue growth is in constant currency

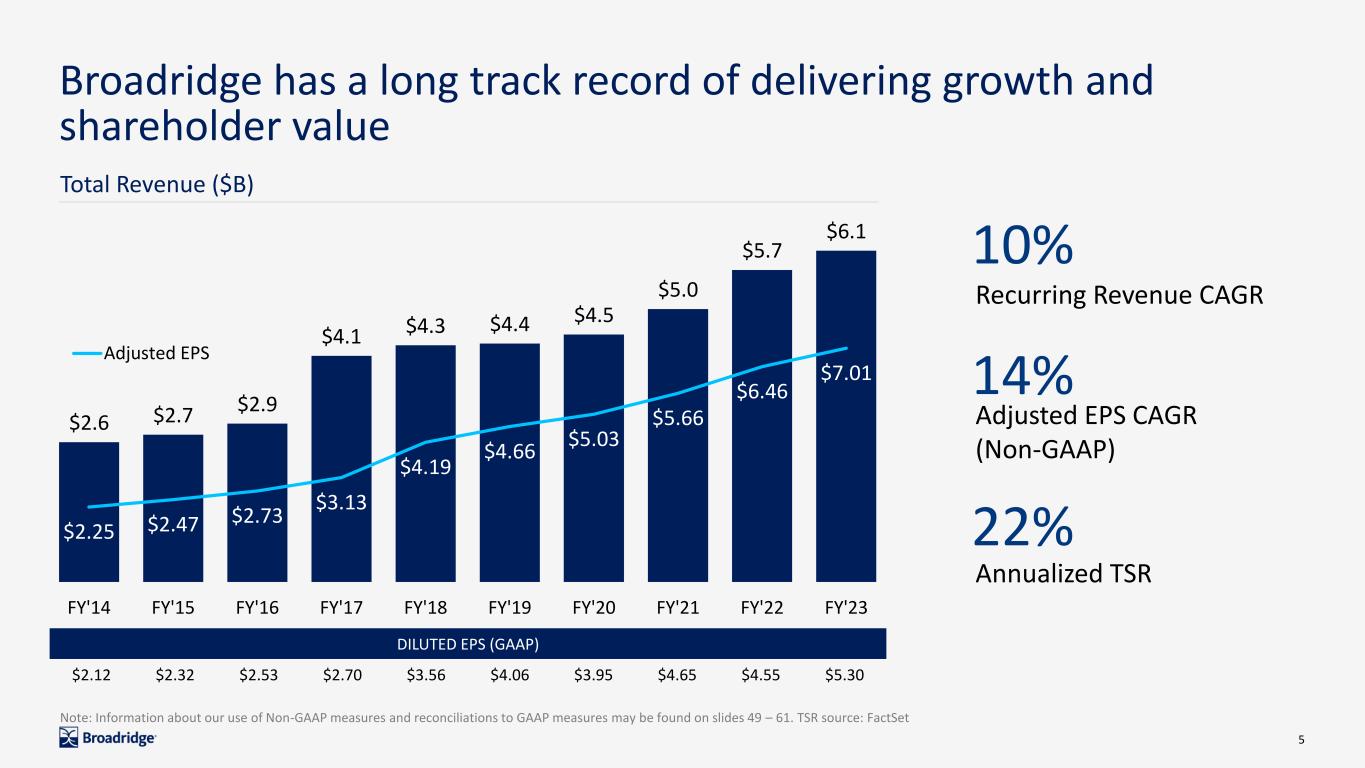

5 Broadridge has a long track record of delivering growth and shareholder value $2.6 $2.7 $2.9 $4.1 $4.3 $4.4 $4.5 $5.0 $5.7 $6.1 $2.25 $2.47 $2.73 $3.13 $4.19 $4.66 $5.03 $5.66 $6.46 $7.01 FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'21 FY'22 FY'23 Adjusted EPS Total Revenue ($B) 10% Recurring Revenue CAGR 14% Adjusted EPS CAGR (Non-GAAP) 22% Annualized TSR Note: Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61. TSR source: FactSet DILUTED EPS (GAAP) $2.12 $2.32 $2.53 $2.70 $3.56 $4.06 $3.95 $4.65 $4.55 $5.30

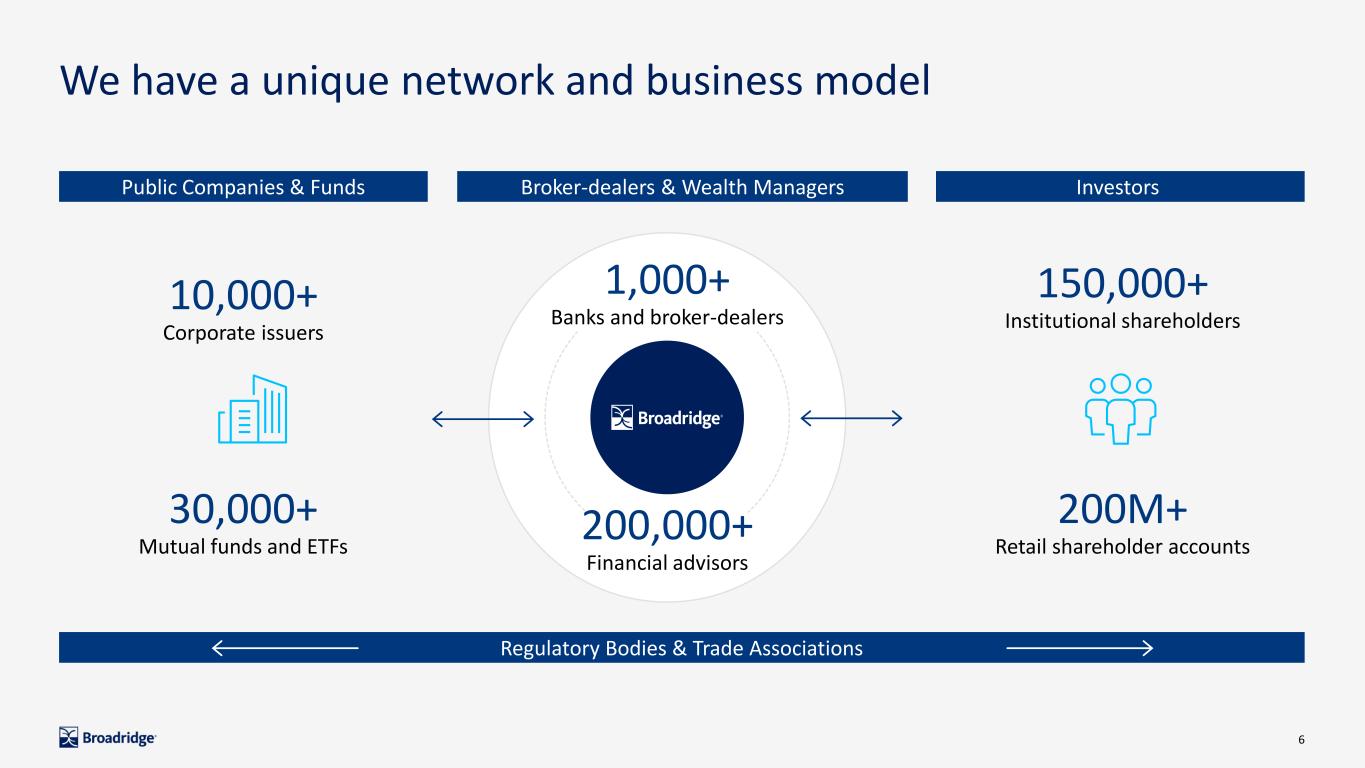

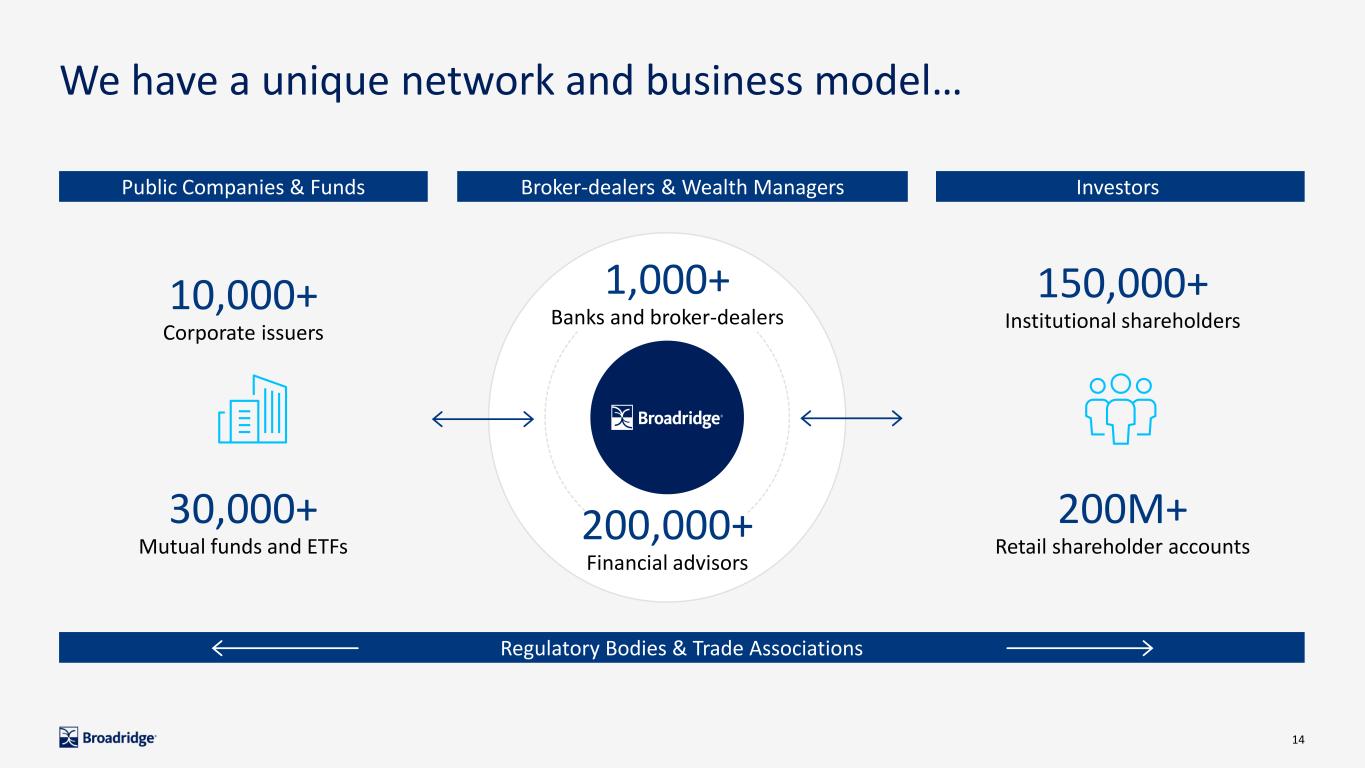

6 We have a unique network and business model Regulatory Bodies & Trade Associations Broker-dealers & Wealth Managers Investors Public Companies & Funds 10,000+ Corporate issuers 1,000+ Banks and broker-dealers 30,000+ Mutual funds and ETFs 200,000+ Financial advisors 150,000+ Institutional shareholders 200M+ Retail shareholder accounts

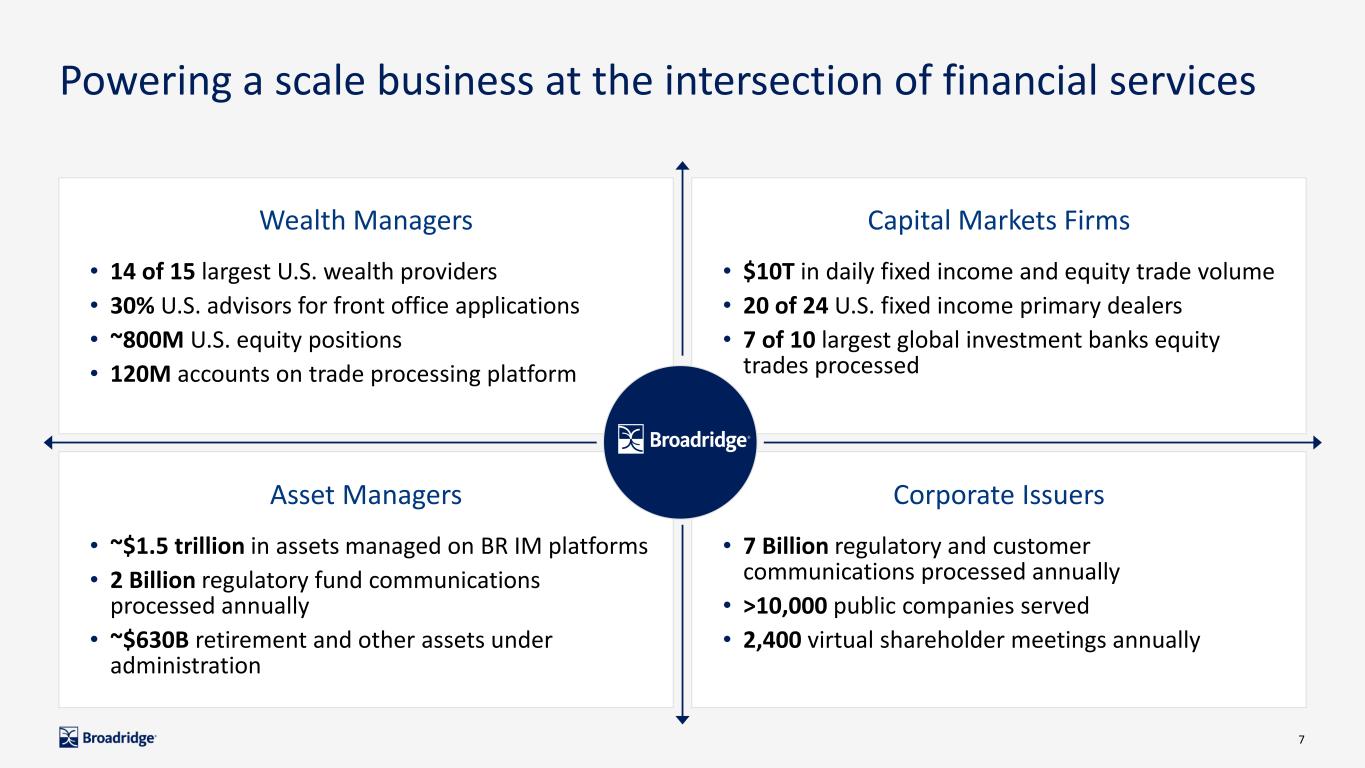

7 Powering a scale business at the intersection of financial services Wealth Managers 30,000+ Mutual funds and ETFs 120,000+ Institutional shareholders 170M+ Retail shareholder accounts Capital Markets Firms Asset Managers Corporate Issuers • 14 of 15 largest U.S. wealth providers • 30% U.S. advisors for front office applications • ~800M U.S. equity positions • 120M accounts on trade processing platform • $10T in daily fixed income and equity trade volume • 20 of 24 U.S. fixed income primary dealers • 7 of 10 largest global investment banks equity trades processed • ~$1.5 trillion in assets managed on BR IM platforms • 2 Billion regulatory fund communications processed annually • ~$630B retirement and other assets under administration • 7 Billion regulatory and customer communications processed annually • >10,000 public companies served • 2,400 virtual shareholder meetings annually

8 We serve a $225B addressable market of which $60B+ is vended Source: McKinsey & Co. Governance Capital Markets Wealth & IM $25B $24B Broadridge Vended Addressable Market 27%73% Total Addressable Market $12B $225B $60BBR Vended

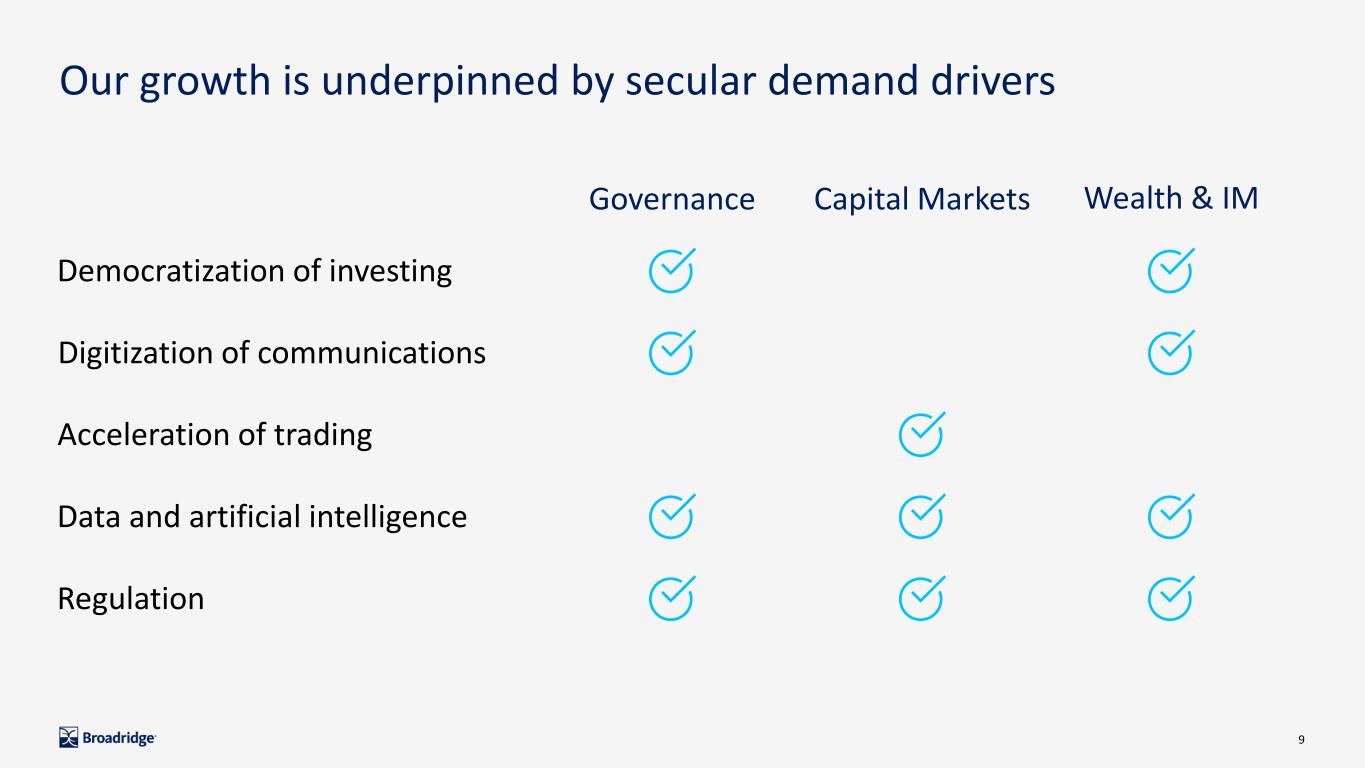

9 Our growth is underpinned by secular demand drivers Digitization of communications Acceleration of trading Democratization of investing Data and artificial intelligence Regulation Governance Capital Markets Wealth & IM

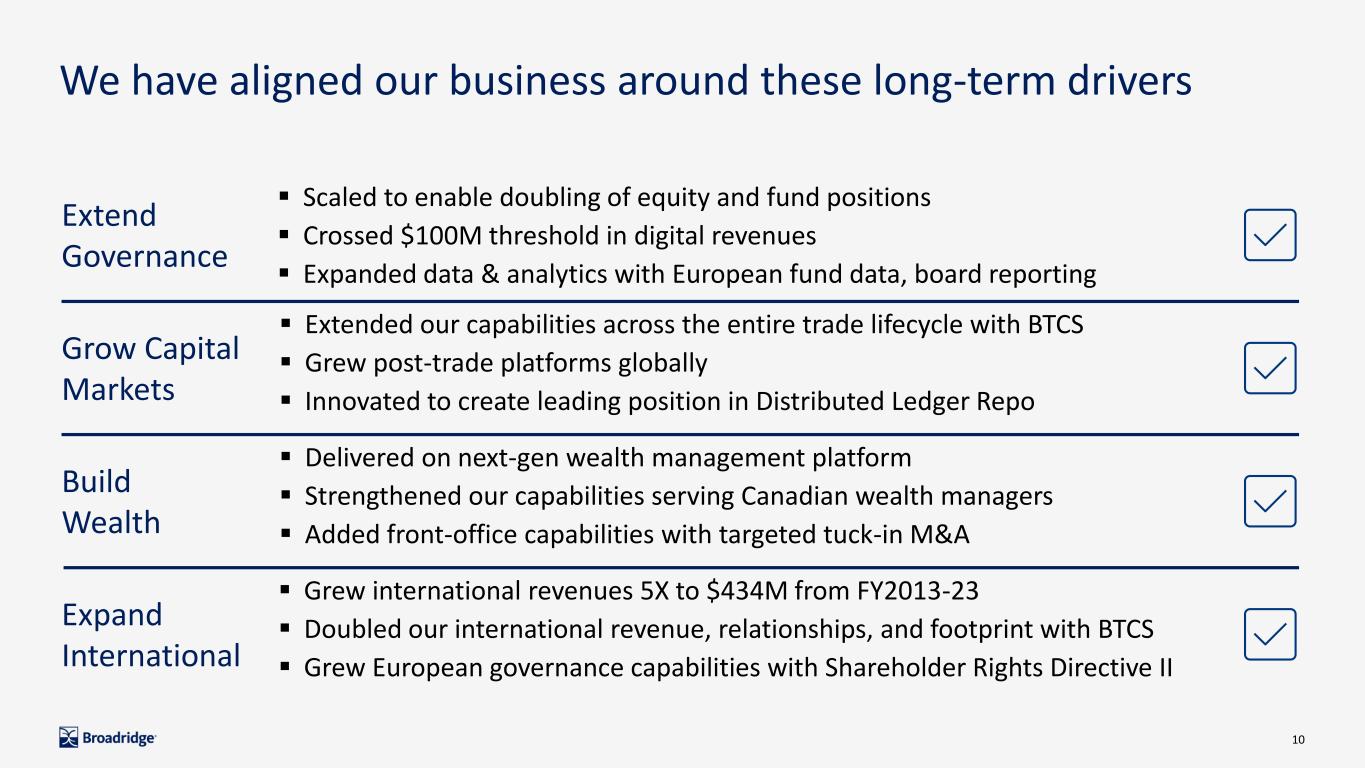

10 We have aligned our business around these long-term drivers Extend Governance ▪ Scaled to enable doubling of equity and fund positions ▪ Crossed $100M threshold in digital revenues ▪ Expanded data & analytics with European fund data, board reporting ▪ Extended our capabilities across the entire trade lifecycle with BTCS ▪ Grew post-trade platforms globally ▪ Innovated to create leading position in Distributed Ledger Repo ▪ Delivered on next-gen wealth management platform ▪ Strengthened our capabilities serving Canadian wealth managers ▪ Added front-office capabilities with targeted tuck-in M&A ▪ Grew international revenues 5X to $434M from FY2013-23 ▪ Doubled our international revenue, relationships, and footprint with BTCS ▪ Grew European governance capabilities with Shareholder Rights Directive II Grow Capital Markets Build Wealth Expand International

11 Driving Democratization and Digitization in Governance ✓ Drive democratization in regulatory communications ✓ Digitize communications ✓ Leverage data for asset management ✓ Simplify corporate governance Simplifying Trading in Capital Markets ✓ Optimize trading and connectivity ✓ Simplify post-trade ✓ Deliver transformation and innovation Modernizing Wealth Management ✓ Execute go-to market plan across multiple channels ✓ Enhance and integrate component solutions ✓ Deliver selective transformation opportunities We have a clear plan for long-term growth

Investor Communication Solutions (“ICS”)

13 We continue to extend our strong and growing Governance franchise $0.7B $0.2B $0.4B $1.1B FY'19 FY'20 FY'21 FY'22 FY'23 $2.5B ICS Recurring Revenue Avg. annual growth 9% 12% Regulatory Data-Driven Fund Solutions Issuer Customer Communications 10% 16% 03% Note: Growth in constant currency. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

14 We have a unique network and business model… Regulatory Bodies & Trade Associations Broker-dealers & Wealth Managers Investors Public Companies & Funds 10,000+ Corporate issuers 1,000+ Banks and broker-dealers 30,000+ Mutual funds and ETFs 200,000+ Financial advisors 150,000+ Institutional shareholders 200M+ Retail shareholder accounts

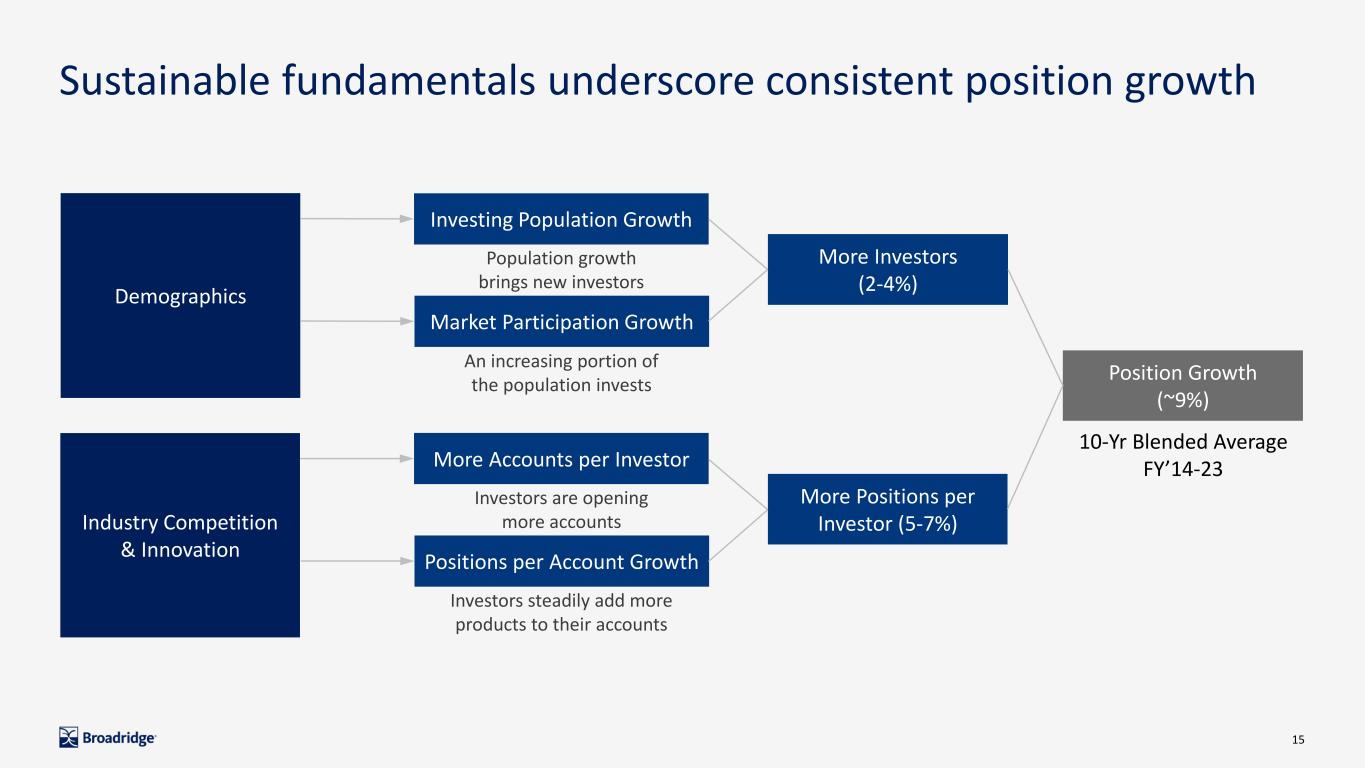

15 Sustainable fundamentals underscore consistent position growth Position Growth (~9%) More Positions per Investor (5-7%) More Investors (2-4%) Investing Population Growth Market Participation Growth Population growth brings new investors An increasing portion of the population invests Demographics Industry Competition & Innovation 10-Yr Blended Average FY’14-23More Accounts per Investor Positions per Account Growth Investors are opening more accounts Investors steadily add more products to their accounts

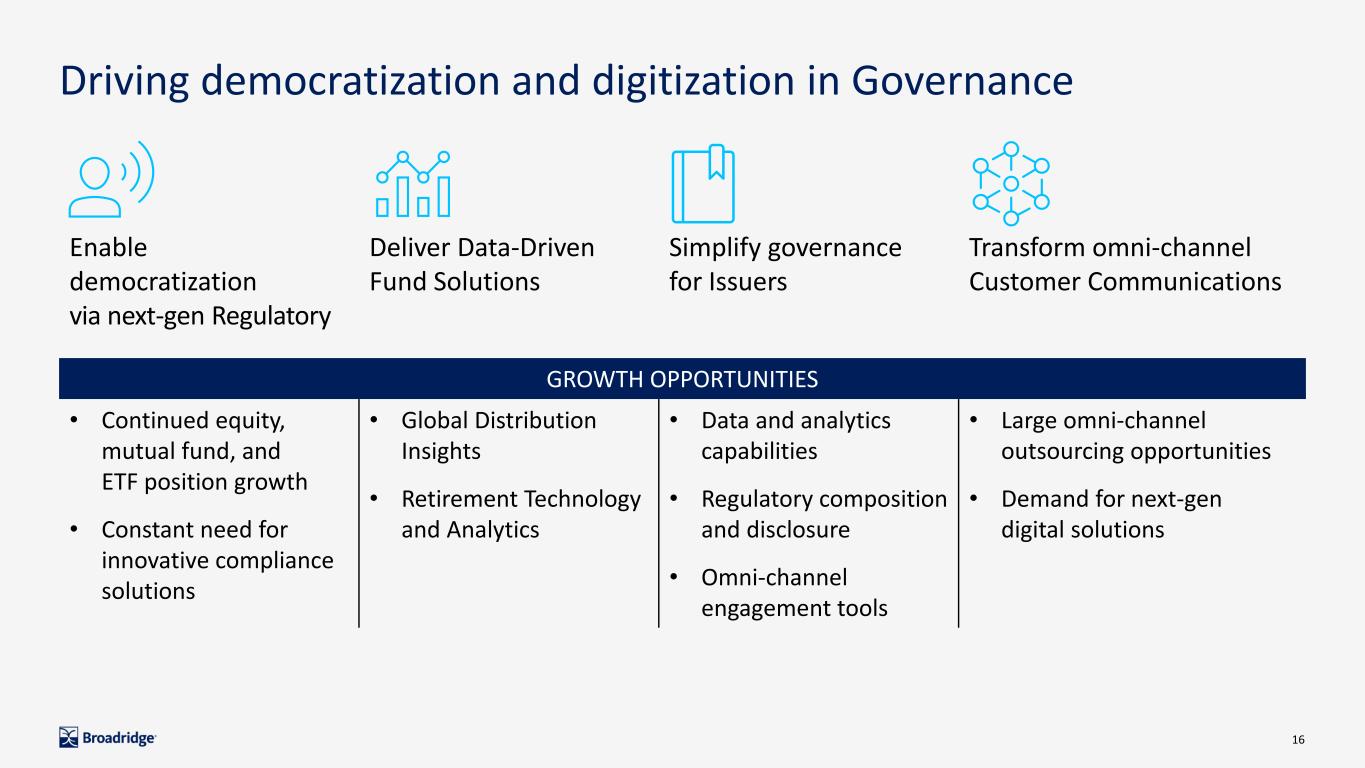

16 Enable democratization via next-gen Regulatory Deliver Data-Driven Fund Solutions Simplify governance for Issuers Transform omni-channel Customer Communications GROWTH OPPORTUNITIES • Continued equity, mutual fund, and ETF position growth • Constant need for innovative compliance solutions • Global Distribution Insights • Retirement Technology and Analytics • Data and analytics capabilities • Regulatory composition and disclosure • Omni-channel engagement tools • Large omni-channel outsourcing opportunities • Demand for next-gen digital solutions Driving democratization and digitization in Governance

Global Technology & Operations (“GTO”)

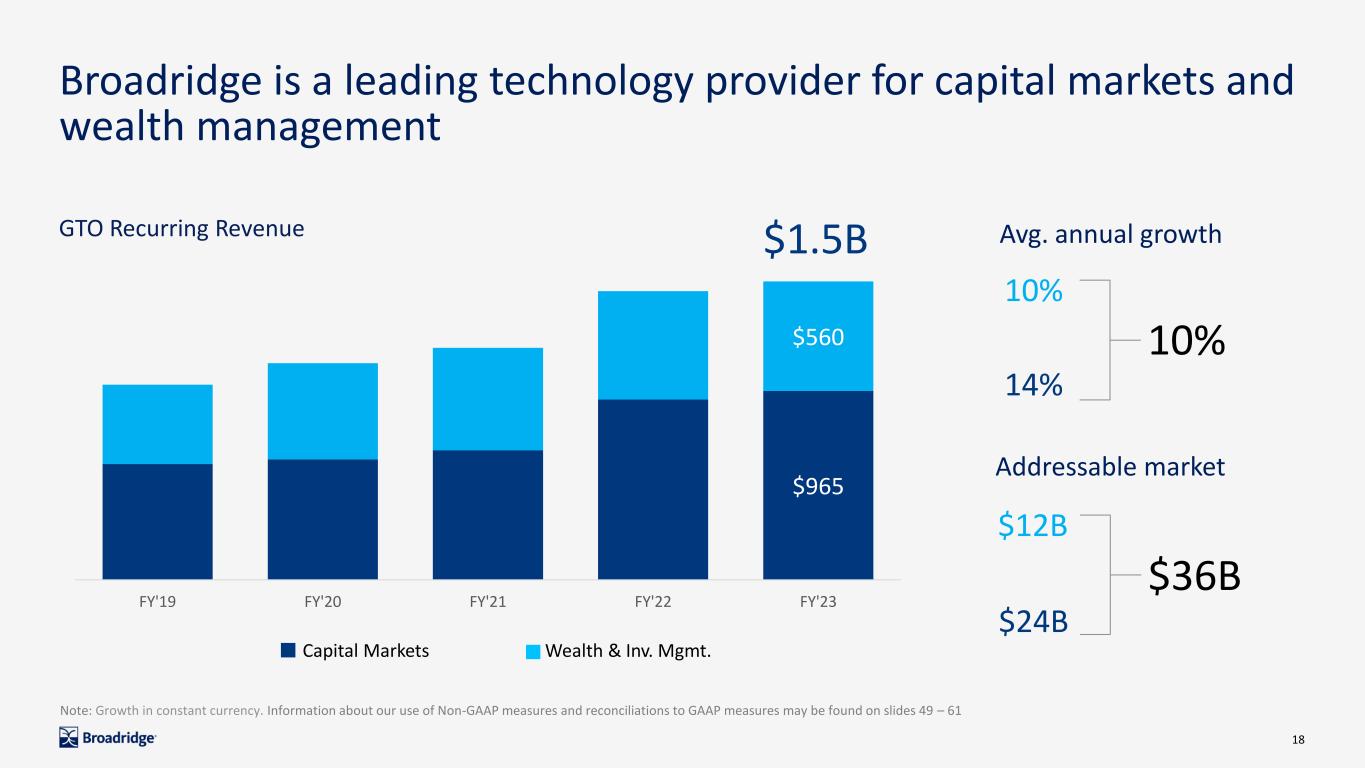

18 $965 $560 FY'19 FY'20 FY'21 FY'22 FY'23 Broadridge is a leading technology provider for capital markets and wealth management $1.5BGTO Recurring Revenue Avg. annual growth 10% 10% Capital Markets Wealth & Inv. Mgmt. 14% Note: Growth in constant currency. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61 Addressable market $12B $24B $36B

19 Capital Markets: Broadridge technology powers the entire trade lifecycle Initiate order Buy-side Sell-side Middle-office Lifecycle Events • Trade Confirmation • Allocation of Trade to Sub-accounts • Trade Validation Middle-office Matching and Allocation Market Participants Back-office Lifecycle Events • Trade Clearing and Settlement • Trade Booking • Confirmations and Statements Sent • Ongoing Asset Servicing Back-office Clearing, Settlement, Finance and AccountingMarket Participants Front-office Trading and Execution Front-office Lifecycle Events • Order Capture and Trade Matching • Order Routing to Exchange or OTC Party • Trade Execution • Notice of Execution Market Participants

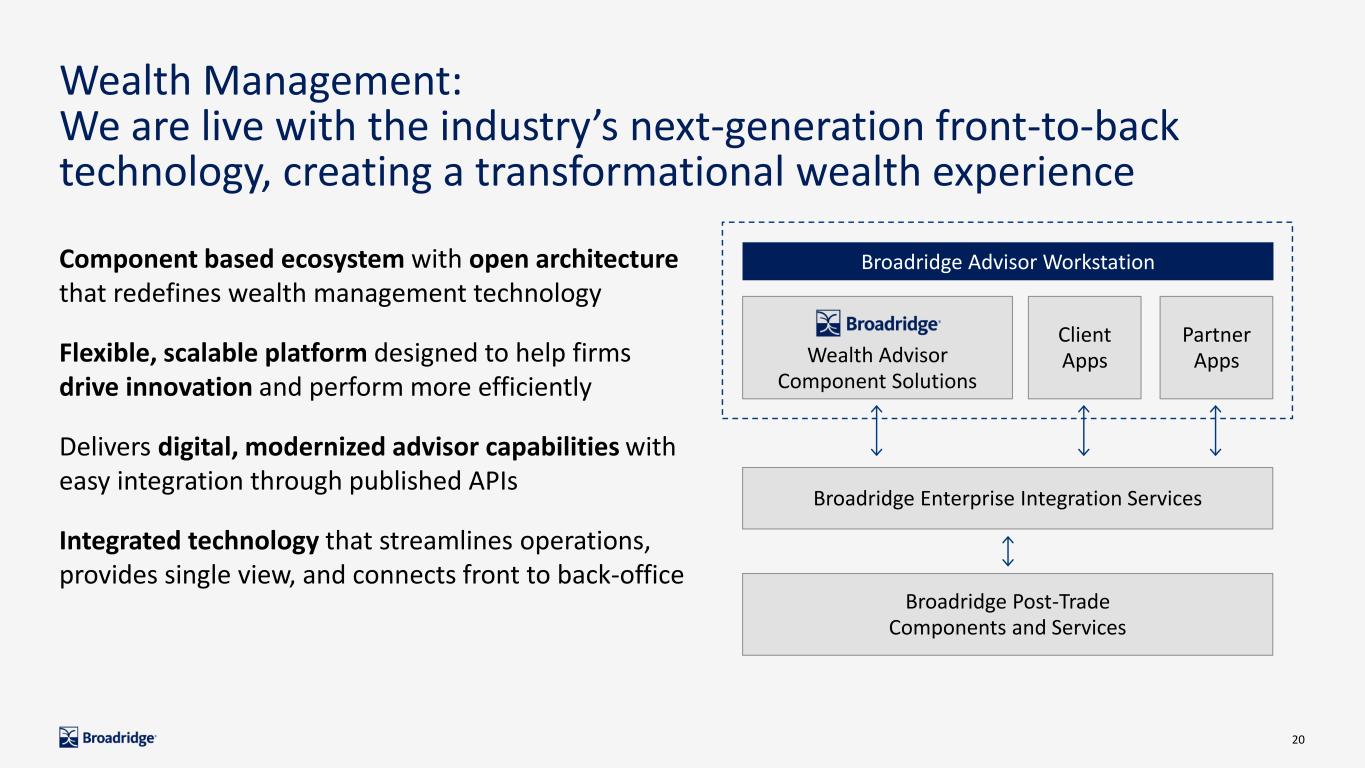

20 Component based ecosystem with open architecture that redefines wealth management technology Flexible, scalable platform designed to help firms drive innovation and perform more efficiently Delivers digital, modernized advisor capabilities with easy integration through published APIs Integrated technology that streamlines operations, provides single view, and connects front to back-office Broadridge Enterprise Integration Services Broadridge Post-Trade Components and Services Broadridge Advisor Workstation Wealth Advisor Component Solutions Client Apps Partner Apps Wealth Management: We are live with the industry’s next-generation front-to-back technology, creating a transformational wealth experience

21 GROWTH OPPORTUNITIES We are executing a clear growth strategy across Capital Markets and Wealth Management • Personalizing the investor experience • Optimizing advisor productivity • Digitizing operations • Optimizing trading and connectivity • Simplifying post-trade • Delivering transformation and innovation Modernizing Wealth Management Simplifying and innovating trading in Capital Markets

A financial model powering sustainable long-term growth with high returns

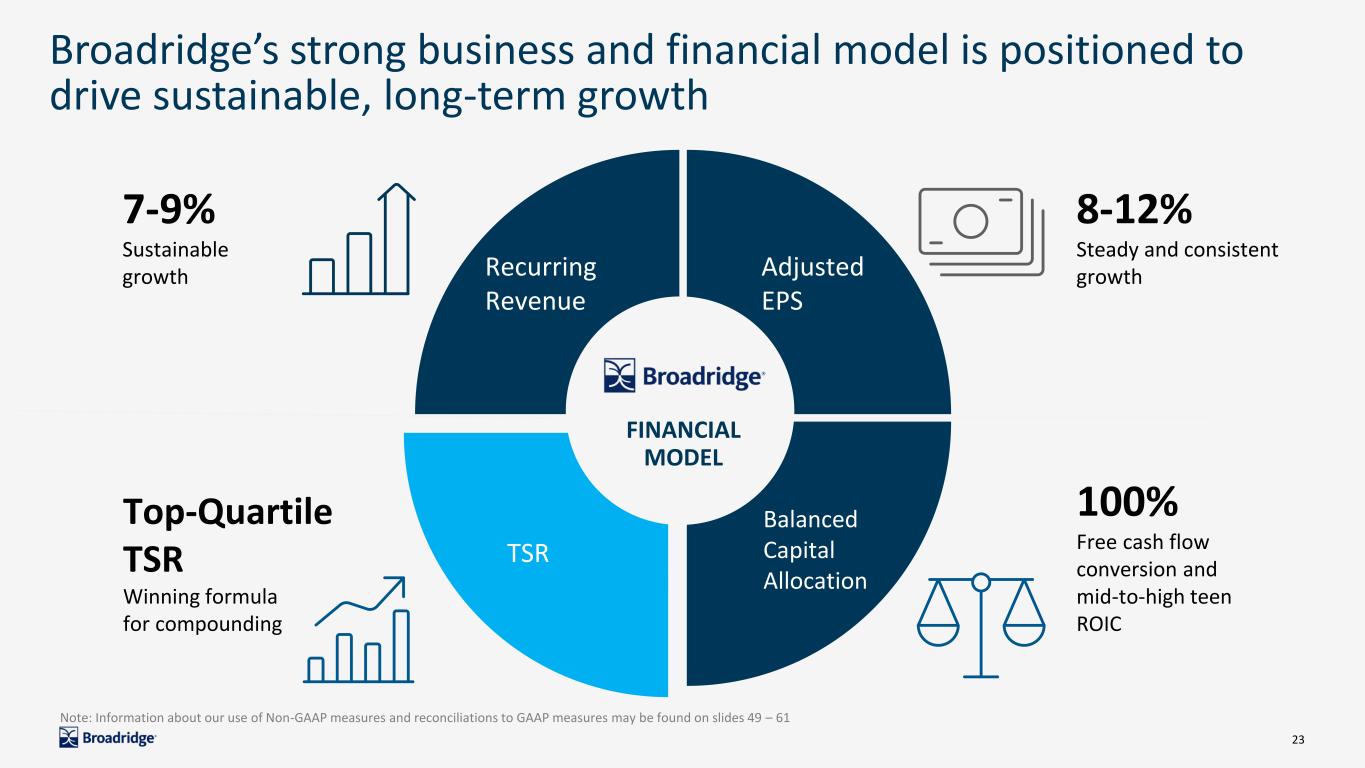

23 Broadridge’s strong business and financial model is positioned to drive sustainable, long-term growth Recurring Revenue Balanced Capital Allocation TSR Adjusted EPS 100% Free cash flow conversion and mid-to-high teen ROIC 7-9% Sustainable growth 8-12% Steady and consistent growth Top-Quartile TSR Winning formula for compounding FINANCIAL MODEL Note: Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

24 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Jun-20 Jun-21 Jun-22 Jun-23 S&P500 BR Our steady and consistent earnings growth and capital return has resulted in a compounding TSR business… $0.72 $2.90 FY'13 FY'23 $1.88 $7.01 FY'13 FY'23 14% 10-year CAGR EARNINGS PER SHARE DIVIDENDS PER SHARE ANNUALIZED TOTAL SHAREHOLDER RETURN 2% Avg. Dividend Yield 22% 13% GAAP EPS $1.69 $5.30 Adjusted EPS (Non-GAAP) Note: Growth in constant currency. Information about the use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

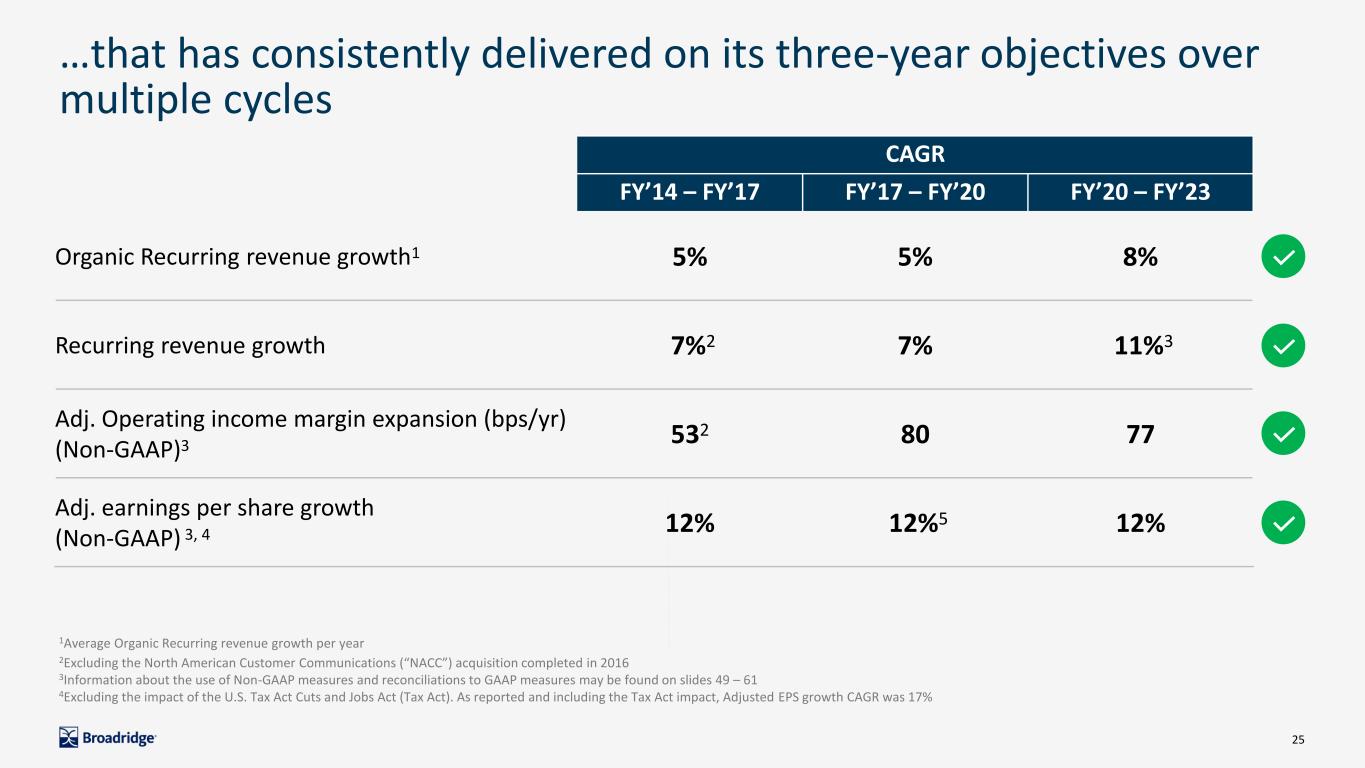

25 …that has consistently delivered on its three-year objectives over multiple cycles CAGR FY’14 – FY’17 FY’17 – FY’20 FY’20 – FY’23 Organic Recurring revenue growth1 5% 5% 8% Recurring revenue growth 7%2 7% 11%3 Adj. Operating income margin expansion (bps/yr) (Non-GAAP)3 532 80 77 Adj. earnings per share growth (Non-GAAP) 3, 4 12% 12%5 12% 1Average Organic Recurring revenue growth per year 2Excluding the North American Customer Communications (“NACC”) acquisition completed in 2016 3Information about the use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61 4Excluding the impact of the U.S. Tax Act Cuts and Jobs Act (Tax Act). As reported and including the Tax Act impact, Adjusted EPS growth CAGR was 17%

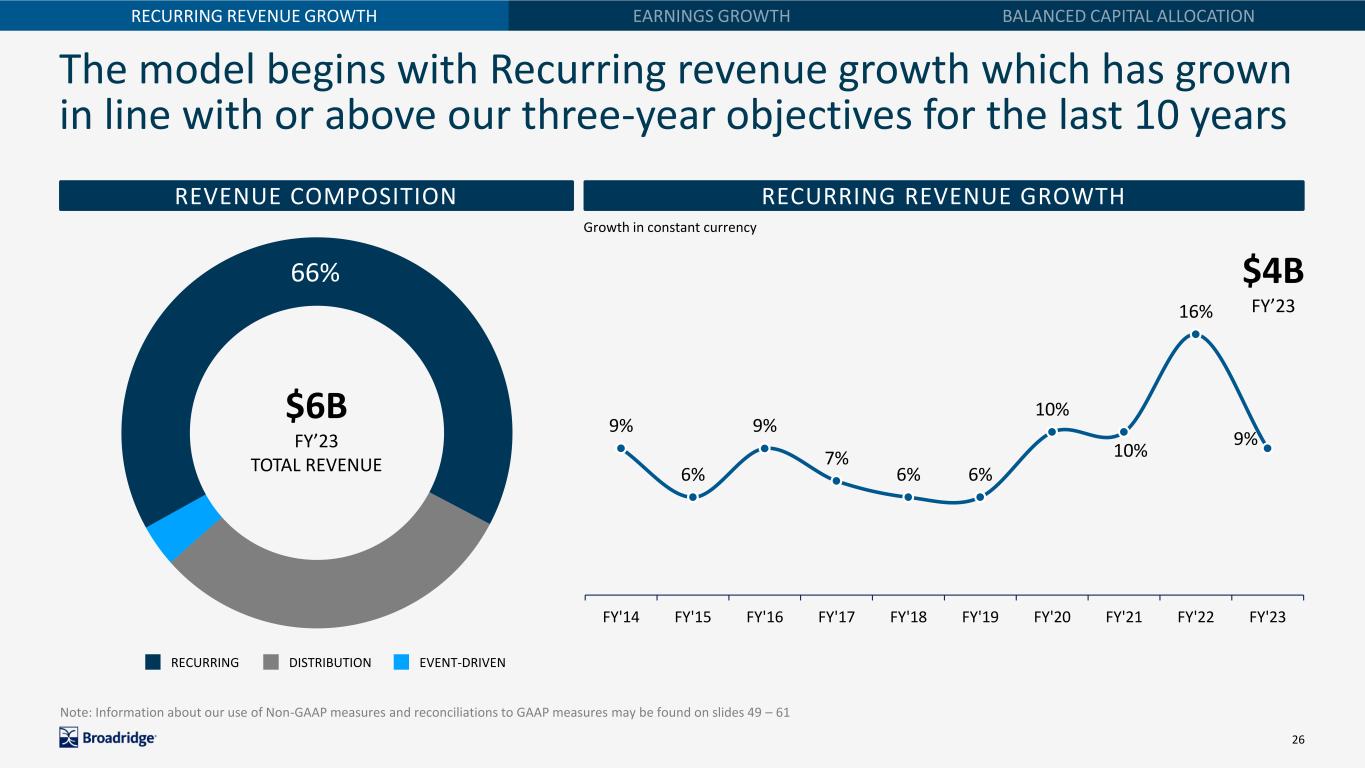

26 The model begins with Recurring revenue growth which has grown in line with or above our three-year objectives for the last 10 years RECURRING REVENUE GROWTH 66% 9% 6% 9% 7% 6% 6% 10% 10% 16% 9% FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'21 FY'22 FY'23 RECURRING DISTRIBUTION EVENT-DRIVEN $6B FY’23 TOTAL REVENUE REVENUE COMPOSITION RECURRING REVENUE GROWTH Growth in constant currency $4B FY’23 Note: Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

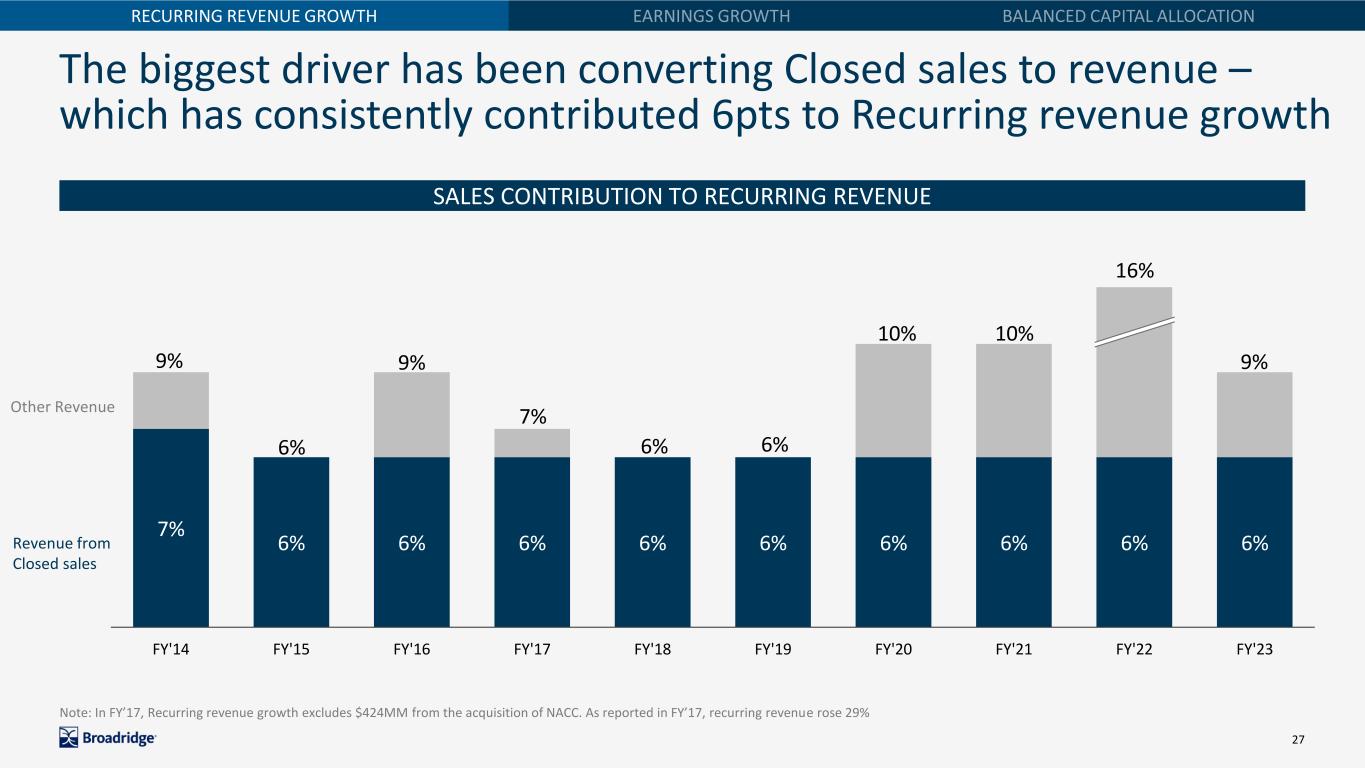

27 The biggest driver has been converting Closed sales to revenue – which has consistently contributed 6pts to Recurring revenue growth Note: In FY’17, Recurring revenue growth excludes $424MM from the acquisition of NACC. As reported in FY’17, recurring revenue rose 29% SALES CONTRIBUTION TO RECURRING REVENUE 7% 6% 6% 6% 6% 6% 6% 6% 6% 6% FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'21 FY'22 FY'23 9% 16% 10%10% 6%6% 7% 9%9% 6% Revenue from Closed sales Other Revenue RECURRING REVENUE GROWTH

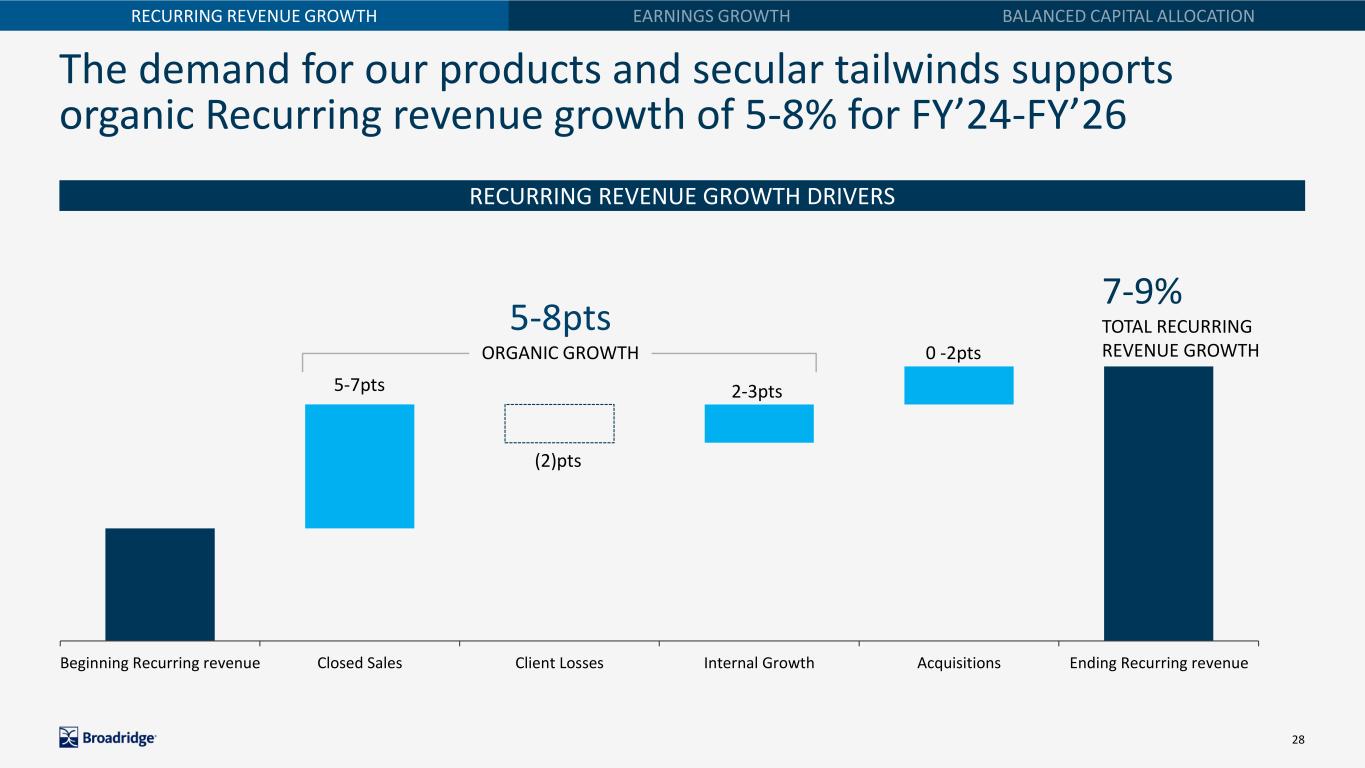

28 The demand for our products and secular tailwinds supports organic Recurring revenue growth of 5-8% for FY’24-FY’26 RECURRING REVENUE GROWTH RECURRING REVENUE GROWTH DRIVERS Beginning Recurring revenue Closed Sales Client Losses Internal Growth Acquisitions Ending Recurring revenue 5-7pts (2)pts 2-3pts 0 -2pts 7-9% TOTAL RECURRING REVENUE GROWTH 5-8pts ORGANIC GROWTH

29 Investments are a key part of our financial model. We invest in high return opportunities that enable us to sustain a high level of Recurring revenue growth RECURRING REVENUE GROWTH CAPEX Client Platform Investment OPEX Medium Term Long Term Product Enhancement Digital (e.g. InFocus) DLR Sales & Marketing Gen AI Client Retention GPTM (e.g. ETD) Tailored Shareholder Reports Storage Hosting/Cloud Migration C A P IT A L Short Term Wealth Management Modules Bond GPT InfrastructureRevenue Generating / Quantifiable Return PAYOUT PERIOD

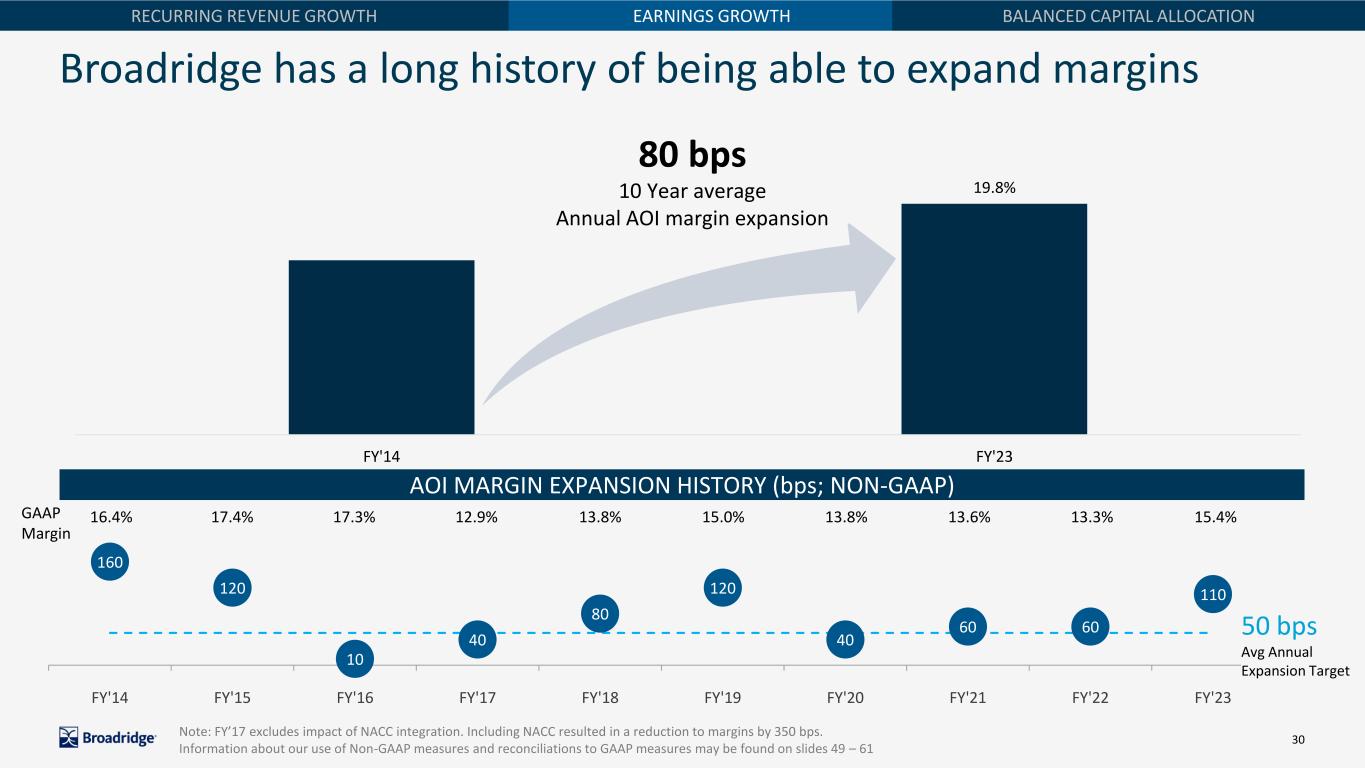

30 160 120 10 40 80 120 40 60 60 110 FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'21 FY'22 FY'23 19.8% FY'14 FY'23 AOI MARGIN EXPANSION HISTORY (bps; NON-GAAP) 50 bps Avg Annual Expansion Target 10 Year average Annual AOI margin expansion 80 bps Broadridge has a long history of being able to expand margins RECURRING REVENUE GROWTH EARNINGS GROWTH BALANCED CAPITAL ALLOCATION Note: FY’17 excludes impact of NACC integration. Including NACC resulted in a reduction to margins by 350 bps. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61 16.4% 17.4% 17.3% 12.9% 13.8% 15.0% 13.8% 13.6% 13.3% 15.4%GAAP Margin

31 Broadridge generates operating leverage through scale, higher- margin digital growth and cost efficiency, allowing us to fund growth investments while delivering margin expansion RECURRING REVENUE GROWTH EARNINGS GROWTH BALANCED CAPITAL ALLOCATION Scale Digital Expense Mgt & Efficiency Investment Margin Expansion 50-70bps 20-30bps 10-20bps (40-60bps) 40-60bps

32 We are committed to strong and balanced capital stewardship… M&A Internal Investment Dividend Share repurchase Maintain investment grade Drive ~100% FCF conversion, monetize recent investments, return ROIC to mid-high teens Capital Allocation Priorities ✓ Fund high return internal investments ✓ Grow dividend in line with earnings ✓ Pursue attractive, tuck-in M&A ✓ Return excess cash through share buybacks RECURRING REVENUE GROWTH EARNINGS GROWTH BALANCED CAPITAL ALLOCATION

33 …and are committed to a strong dividend growing in line with earnings… RECURRING REVENUE GROWTH EARNINGS GROWTH BALANCED CAPITAL ALLOCATION 17% 29% 11% 10% 11% 33% 11% 6% 11% 13% 10% GROWTH IN ANNUAL DIVIDEND 45% Target dividend payout ratio 11 Out of 12 years with double-digit dividend increase 43% 46% 46% 47% 45% 45% 45% 45% 45% 45% 45% FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'21 FY'22 FY'23 FY'24 FY’14 – FY’24 ANNUAL DIVIDEND $0.84 $1.08 $1.32 $1.20 $1.46 $1.94 $2.16 $2.30 $2.56 $2.90 $3.20 Est. Note: Dividend payout ratio is calculated as total dividends paid as a percentage of the prior year’s Adjusted Net earnings. Dividend declaration subject to Board of Directors approval

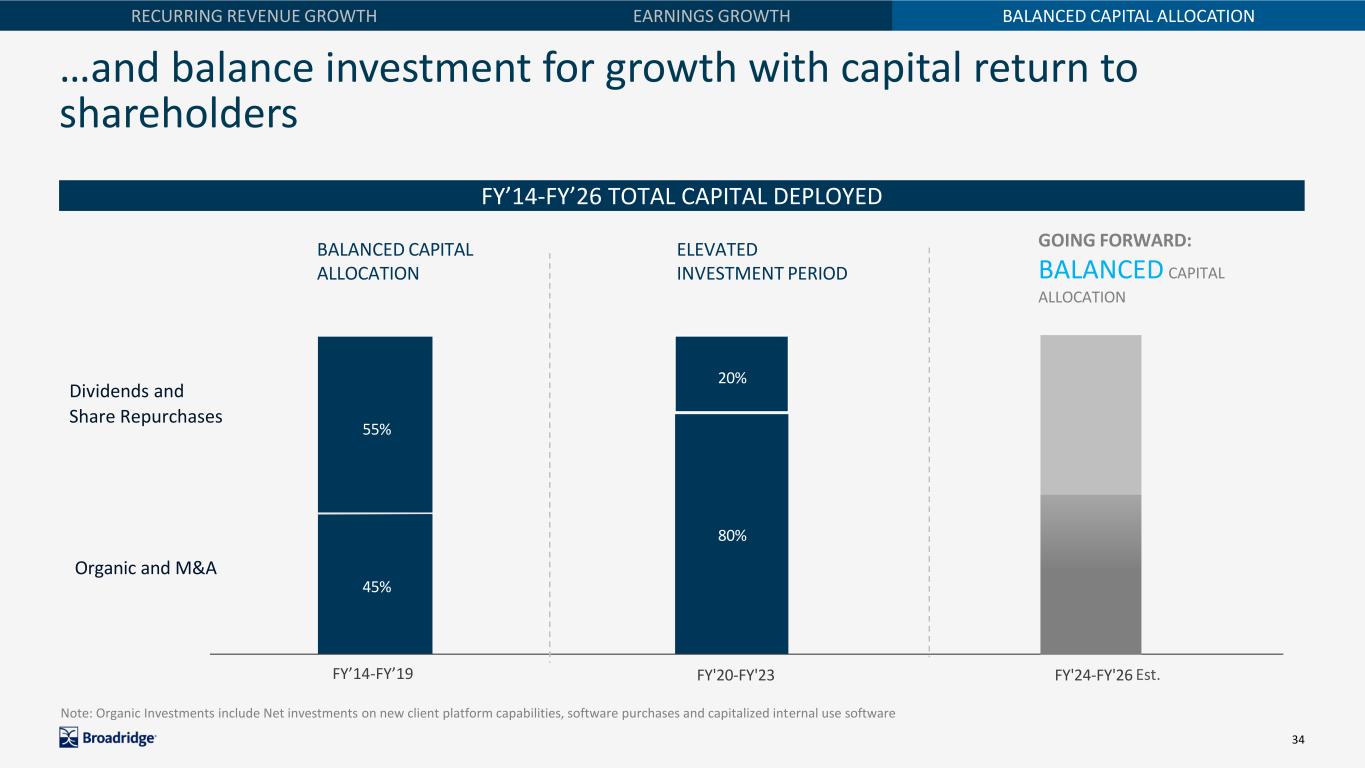

34 …and balance investment for growth with capital return to shareholders RECURRING REVENUE GROWTH EARNINGS GROWTH BALANCED CAPITAL ALLOCATION 55% 45% 20% 80% FY'09-FY'19 FY'20-FY'23 FY'24-FY'26 Dividends and Share Repurchases Organic and M&A BALANCED CAPITAL ALLOCATION ELEVATED INVESTMENT PERIOD GOING FORWARD: BALANCED CAPITAL ALLOCATION FY’14-FY’26 TOTAL CAPITAL DEPLOYED FY’14 ’19 Est. Note: Organic Investments include Net investments on new client platform capabilities, software purchases and capitalized internal use software

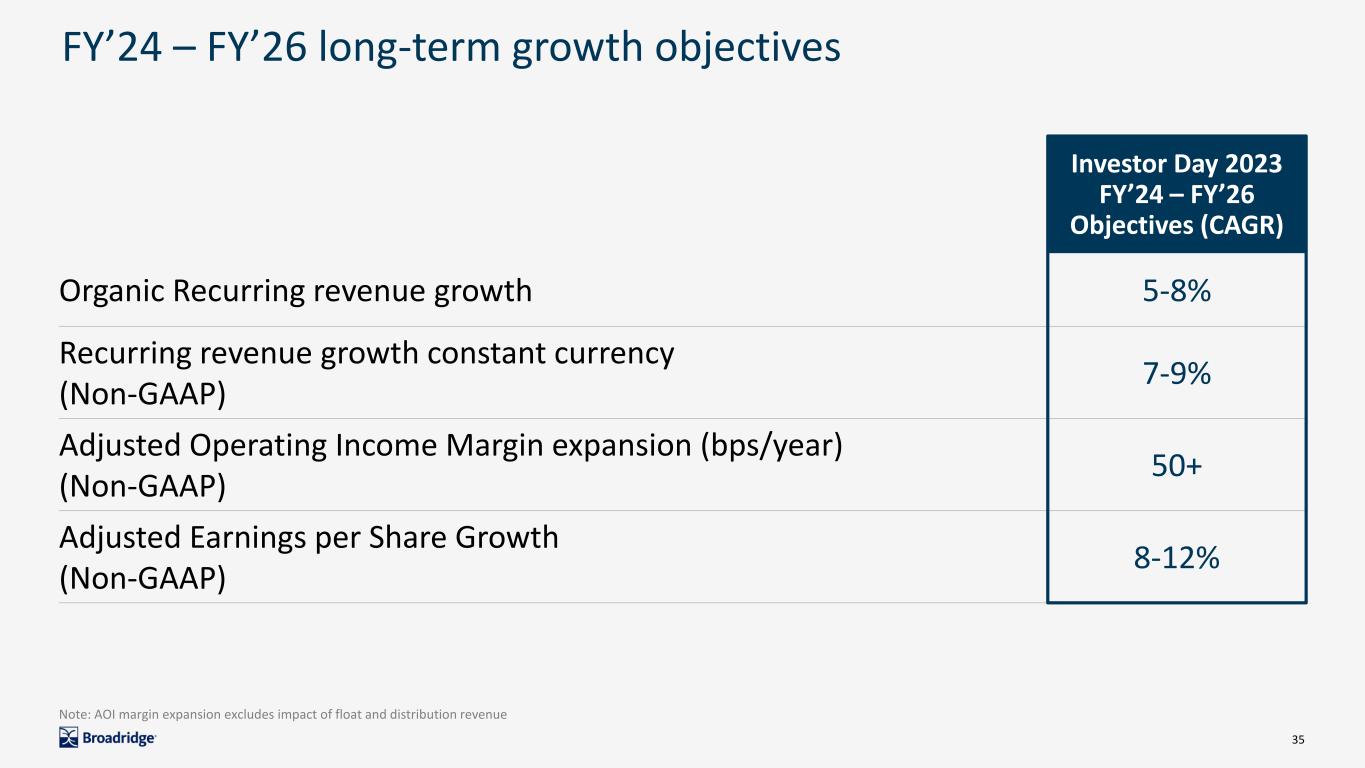

35 FY’24 – FY’26 long-term growth objectives Investor Day 2023 FY’24 – FY’26 Objectives (CAGR) Organic Recurring revenue growth 5-8% Recurring revenue growth constant currency (Non-GAAP) 7-9% Adjusted Operating Income Margin expansion (bps/year) (Non-GAAP) 50+ Adjusted Earnings per Share Growth (Non-GAAP) 8-12% Note: AOI margin expansion excludes impact of float and distribution revenue

Q2’24 results

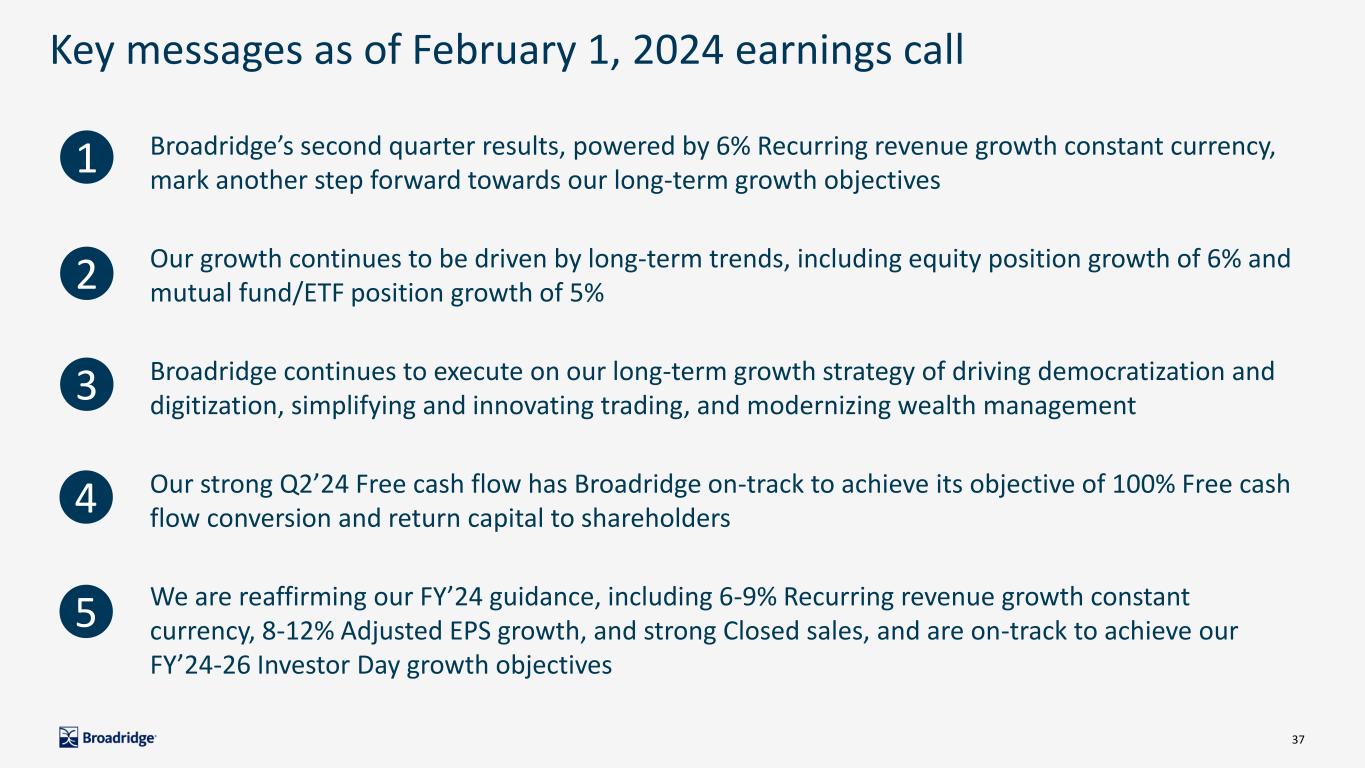

37 Key messages as of February 1, 2024 earnings call Broadridge’s second quarter results, powered by 6% Recurring revenue growth constant currency, mark another step forward towards our long-term growth objectives Our growth continues to be driven by long-term trends, including equity position growth of 6% and mutual fund/ETF position growth of 5% Broadridge continues to execute on our long-term growth strategy of driving democratization and digitization, simplifying and innovating trading, and modernizing wealth management Our strong Q2’24 Free cash flow has Broadridge on-track to achieve its objective of 100% Free cash flow conversion and return capital to shareholders We are reaffirming our FY’24 guidance, including 6-9% Recurring revenue growth constant currency, 8-12% Adjusted EPS growth, and strong Closed sales, and are on-track to achieve our FY’24-26 Investor Day growth objectives 1 2 3 4 5

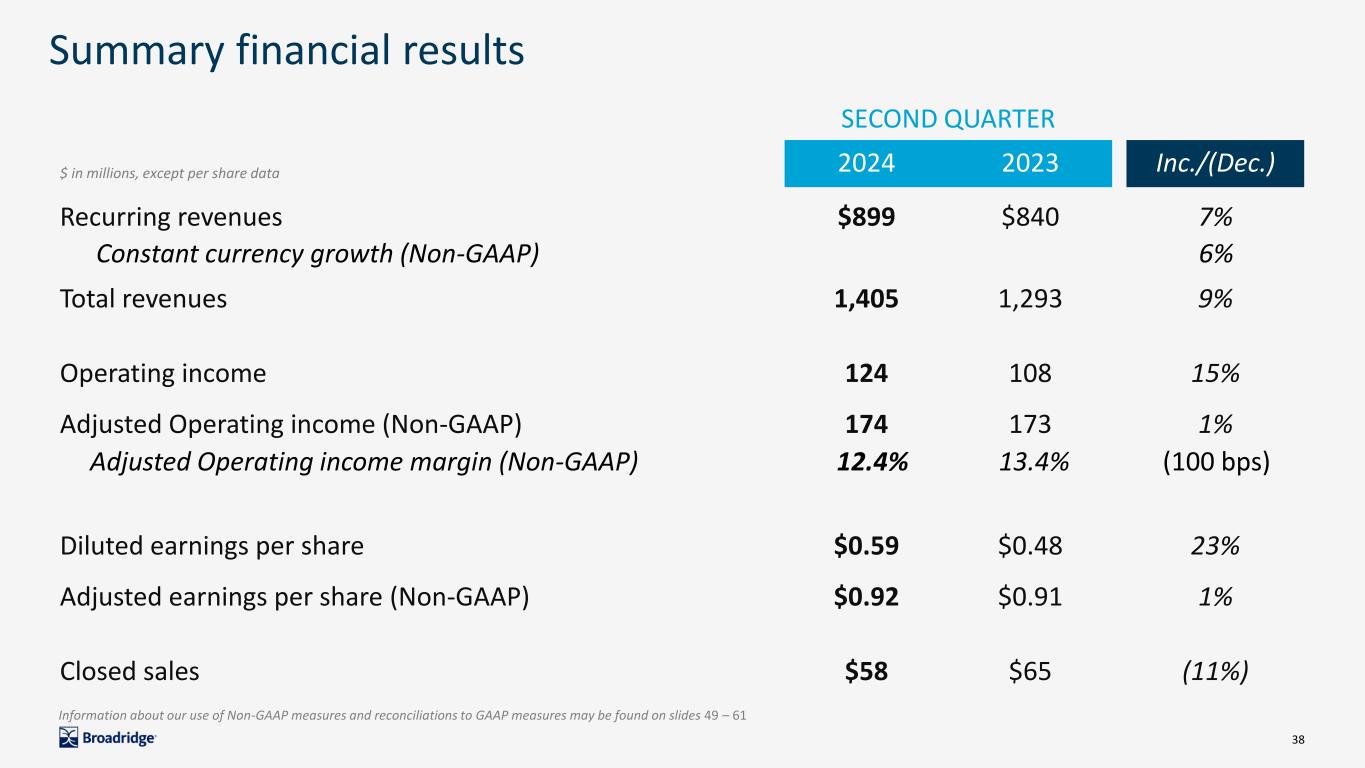

38 Summary financial results SECOND QUARTER $ in millions, except per share data 2024 2023 Inc./(Dec.) Recurring revenues $899 $840 7% Total revenues 1,405 1,293 9% Operating income 124 108 15% Adjusted Operating income (Non-GAAP) 174 173 1% Diluted earnings per share $0.59 $0.48 23% Adjusted earnings per share (Non-GAAP) $0.92 $0.91 1% Closed sales $58 $65 (11%) Constant currency growth (Non-GAAP) 6% Adjusted Operating income margin (Non-GAAP) 12.4% 13.4% (100 bps) Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

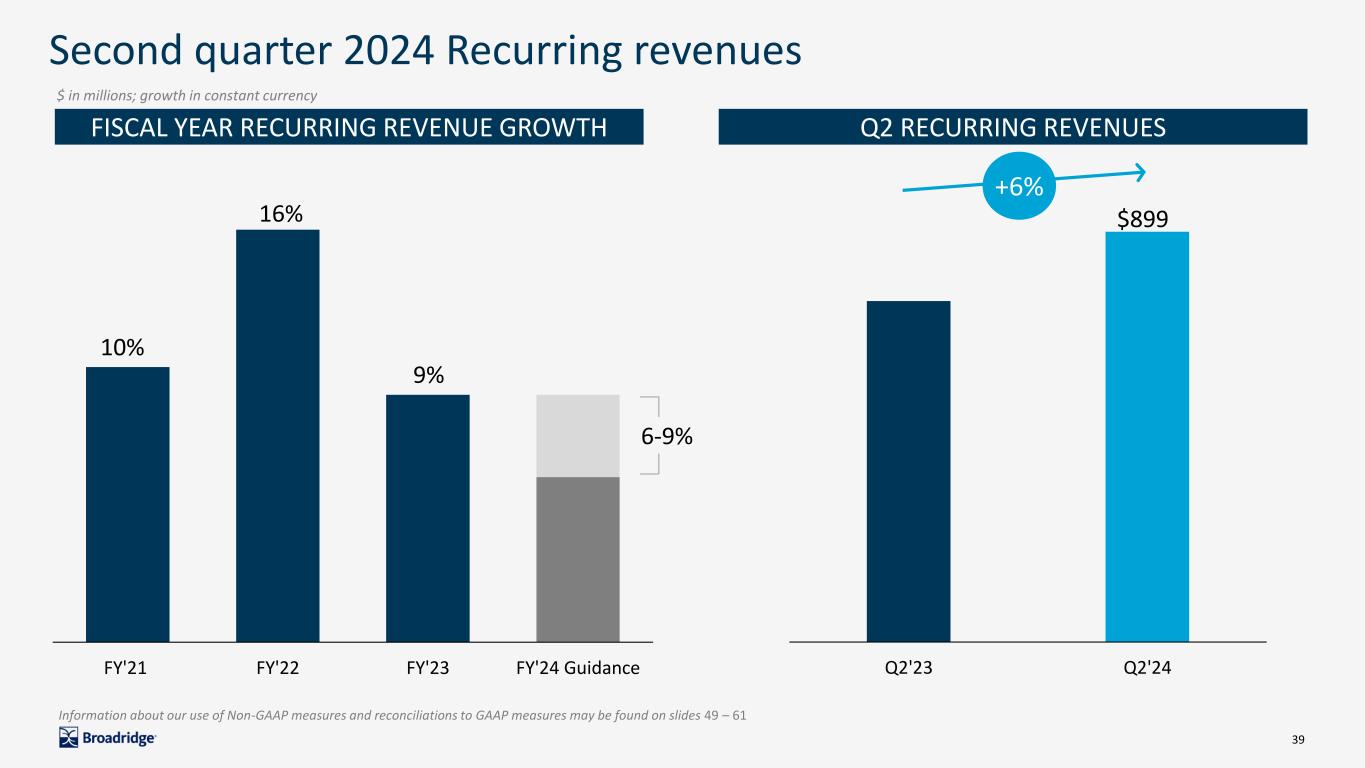

39 FY'21 FY'22 FY'23 FY'24 Guidance Second quarter 2024 Recurring revenues Q2'23 Q2'24 $89916% 10% 9% FISCAL YEAR RECURRING REVENUE GROWTH Q2 RECURRING REVENUES 6-9% +6% $ in millions; growth in constant currency Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

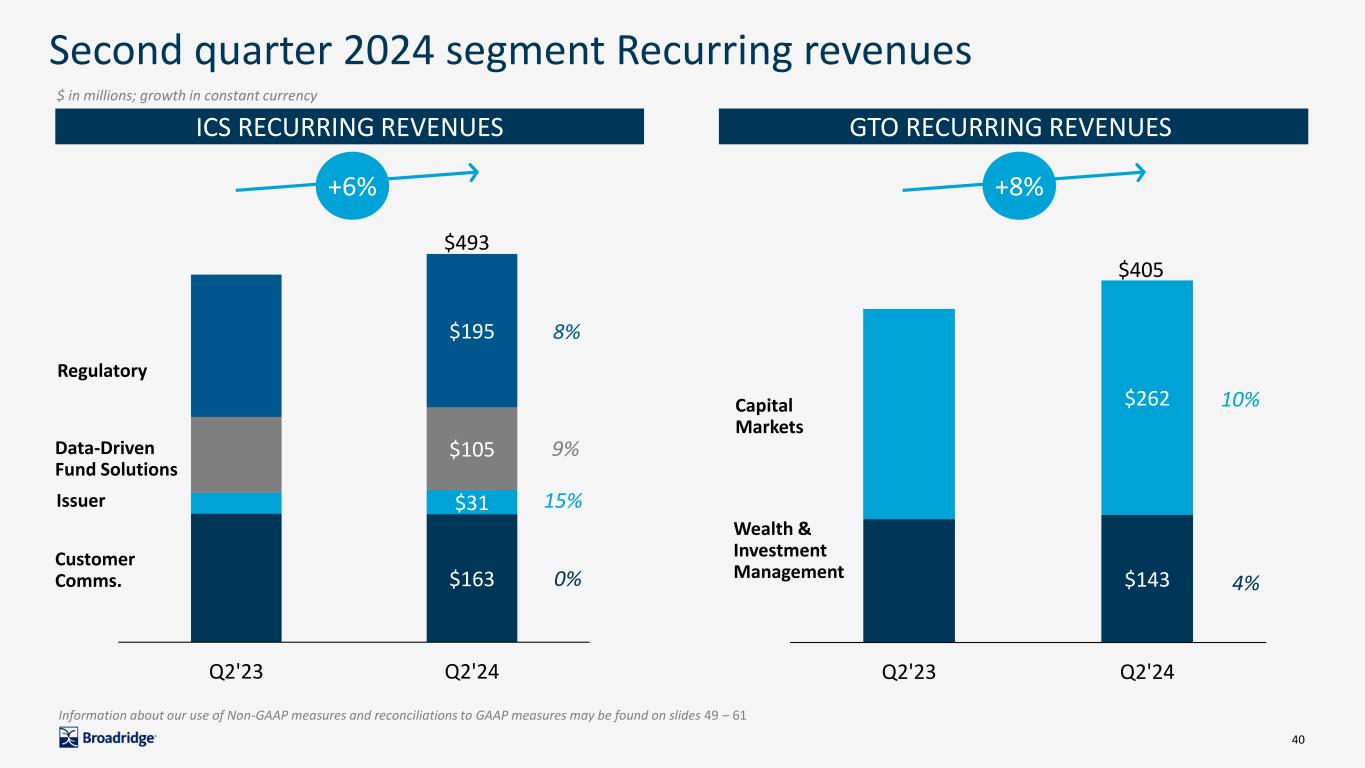

40 Second quarter 2024 segment Recurring revenues $163 $31 $105 $195 Q2'23 Q2'24 Regulatory Customer Comms. Data-Driven Fund Solutions Issuer 15% 0% 9% 8% ICS RECURRING REVENUES GTO RECURRING REVENUES $493 $143 $262 Q2'23 Q2'24 Capital Markets Wealth & Investment Management 10% 4% $405 $ in millions; growth in constant currency +6% +8% Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

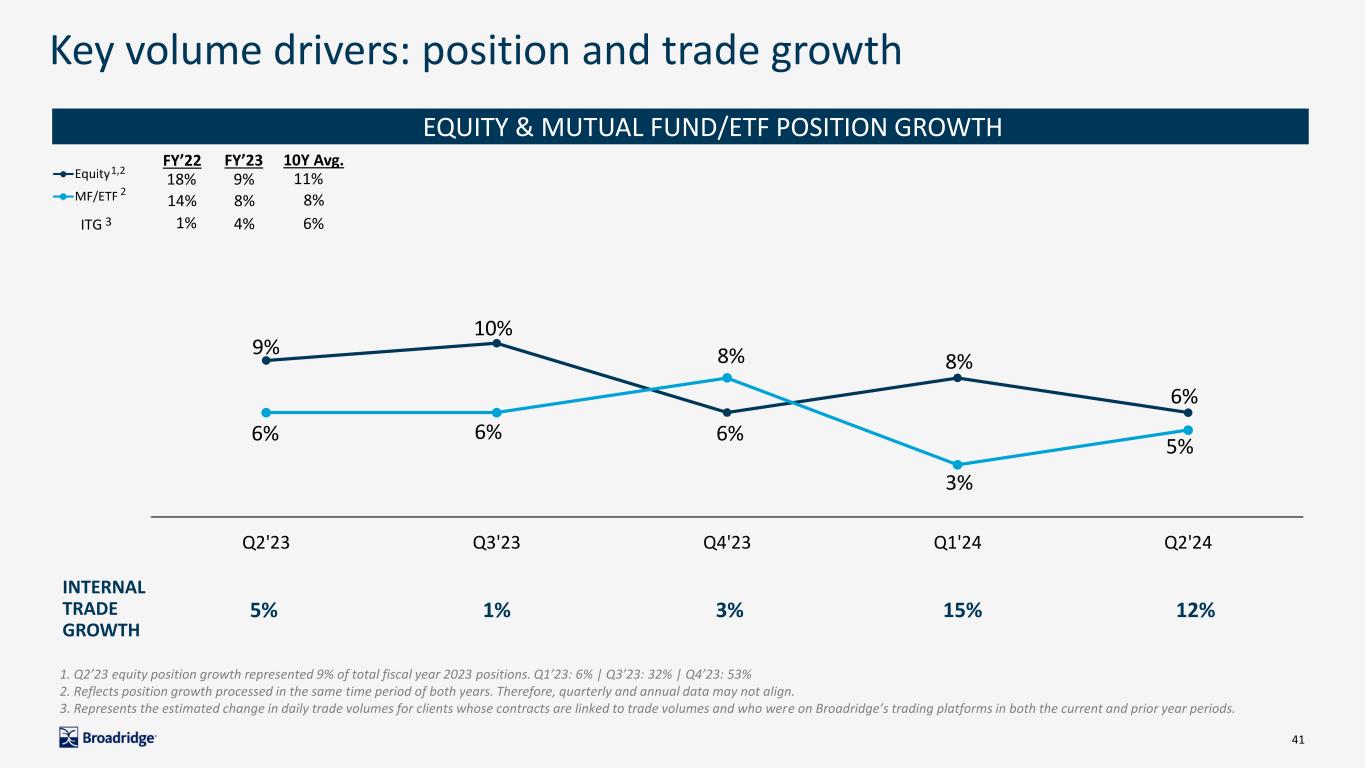

41 9% 10% 6% 8% 6% 6% 6% 8% 3% 5% Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Key volume drivers: position and trade growth 5% 1% 3% 15% 12% INTERNAL TRADE GROWTH EQUITY & MUTUAL FUND/ETF POSITION GROWTH 1. Q2’23 equity position growth represented 9% of total fiscal year 2023 positions. Q1’23: 6% | Q3’23: 32% | Q4’23: 53% 2. Reflects position growth processed in the same time period of both years. Therefore, quarterly and annual data may not align. 3. Represents the estimated change in daily trade volumes for clients whose contracts are linked to trade volumes and who were on Broadridge’s trading platforms in both the current and prior year periods. ITG 3 FY’22 FY’23 9% 8% 18% 14% 4%1% 11% 10Y Avg. 8% 6% 2 1,2

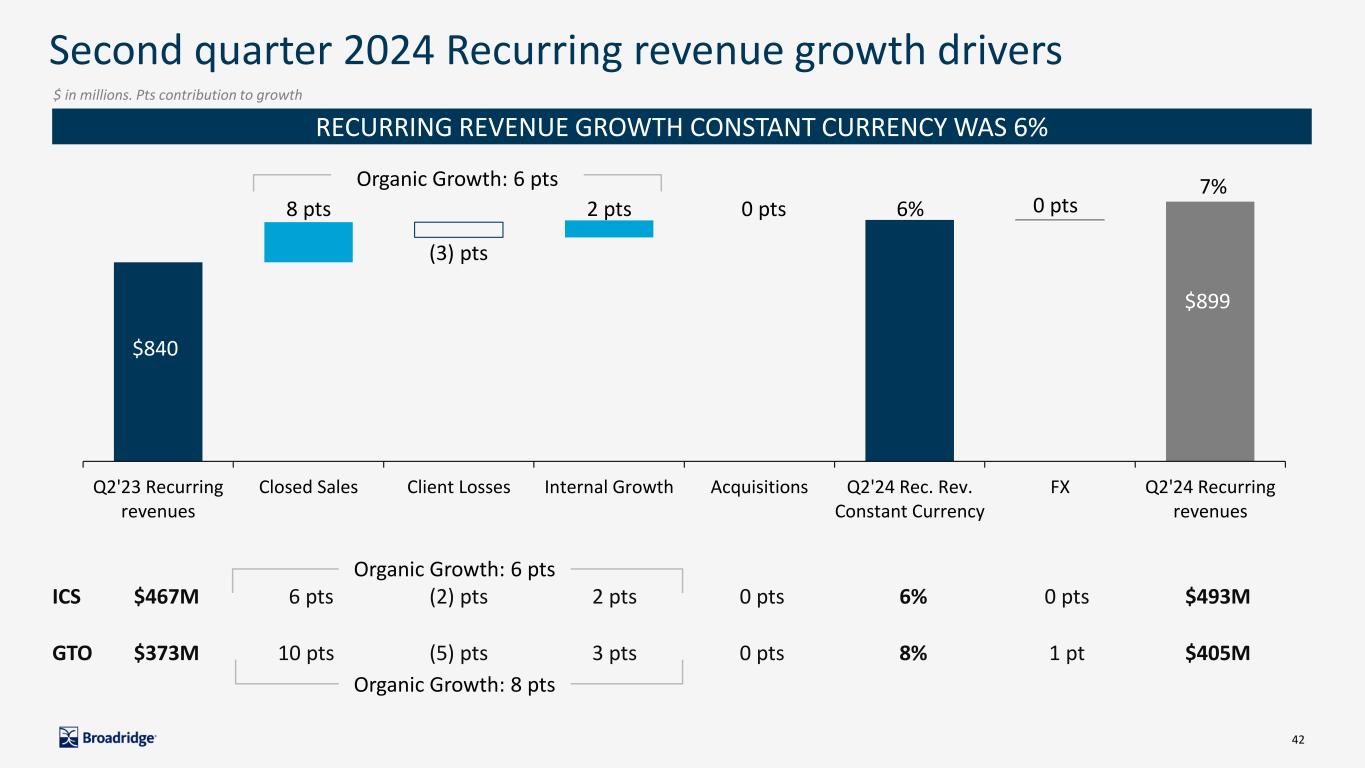

42 Q2'23 Recurring revenues Closed Sales Client Losses Internal Growth Acquisitions Q2'24 Rec. Rev. Constant Currency FX Q2'24 Recurring revenues RECURRING REVENUE GROWTH CONSTANT CURRENCY WAS 6% Second quarter 2024 Recurring revenue growth drivers ICS $467M 6 pts (2) pts 2 pts 0 pts 6% 0 pts $493M GTO $373M 10 pts (5) pts 3 pts 0 pts 8% 1 pt $405M 8 pts (3) pts 2 pts 0 pts 7% 0 pts6% Organic Growth: 6 pts $899 $ in millions. Pts contribution to growth Organic Growth: 8 pts Organic Growth: 6 pts $840

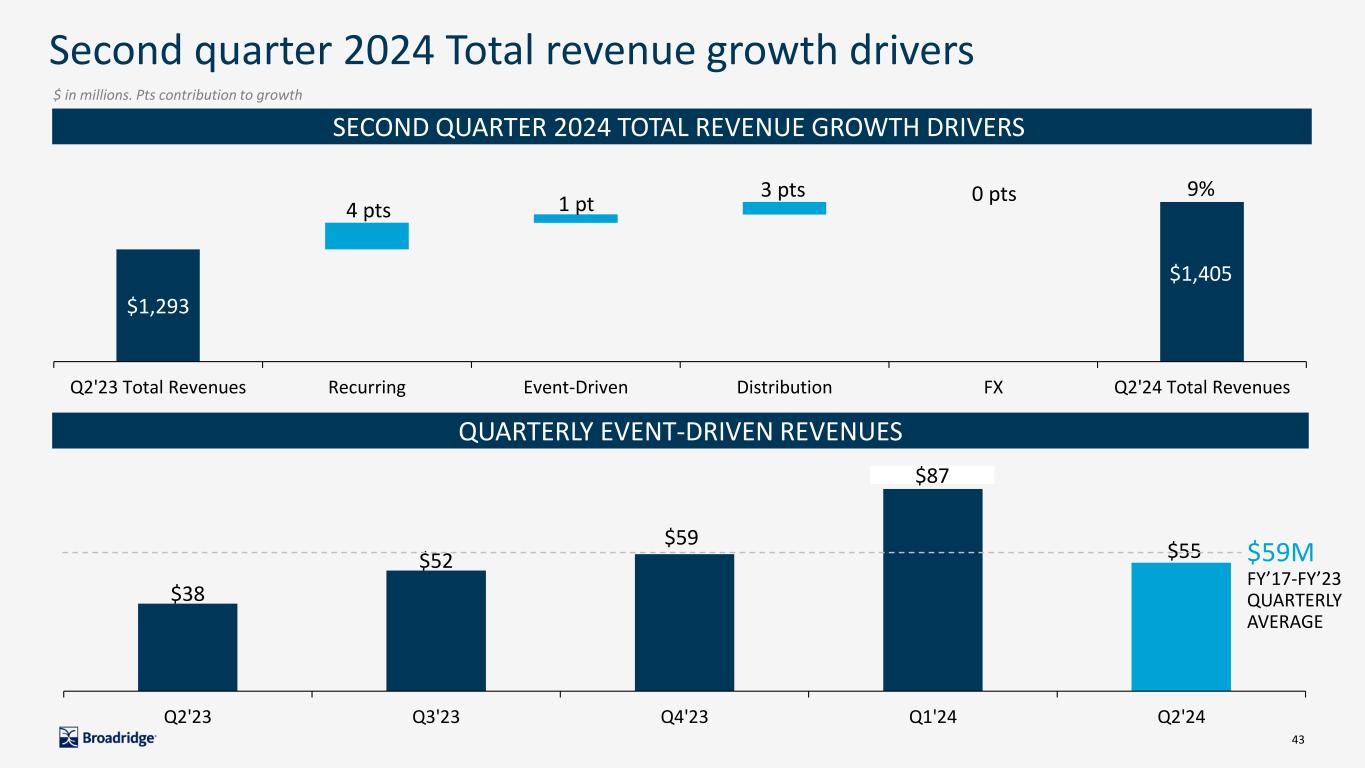

43 SECOND QUARTER 2024 TOTAL REVENUE GROWTH DRIVERS $38 $52 $59 $55 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 $59M FY’17-FY’23 QUARTERLY AVERAGE Second quarter 2024 Total revenue growth drivers $1,293 Q2'23 Total Revenues Recurring Event-Driven Distribution FX Q2'24 Total Revenues QUARTERLY EVENT-DRIVEN REVENUES 4 pts 1 pt 3 pts 9%0 pts $1,405 $87 $ in millions. Pts contribution to growth

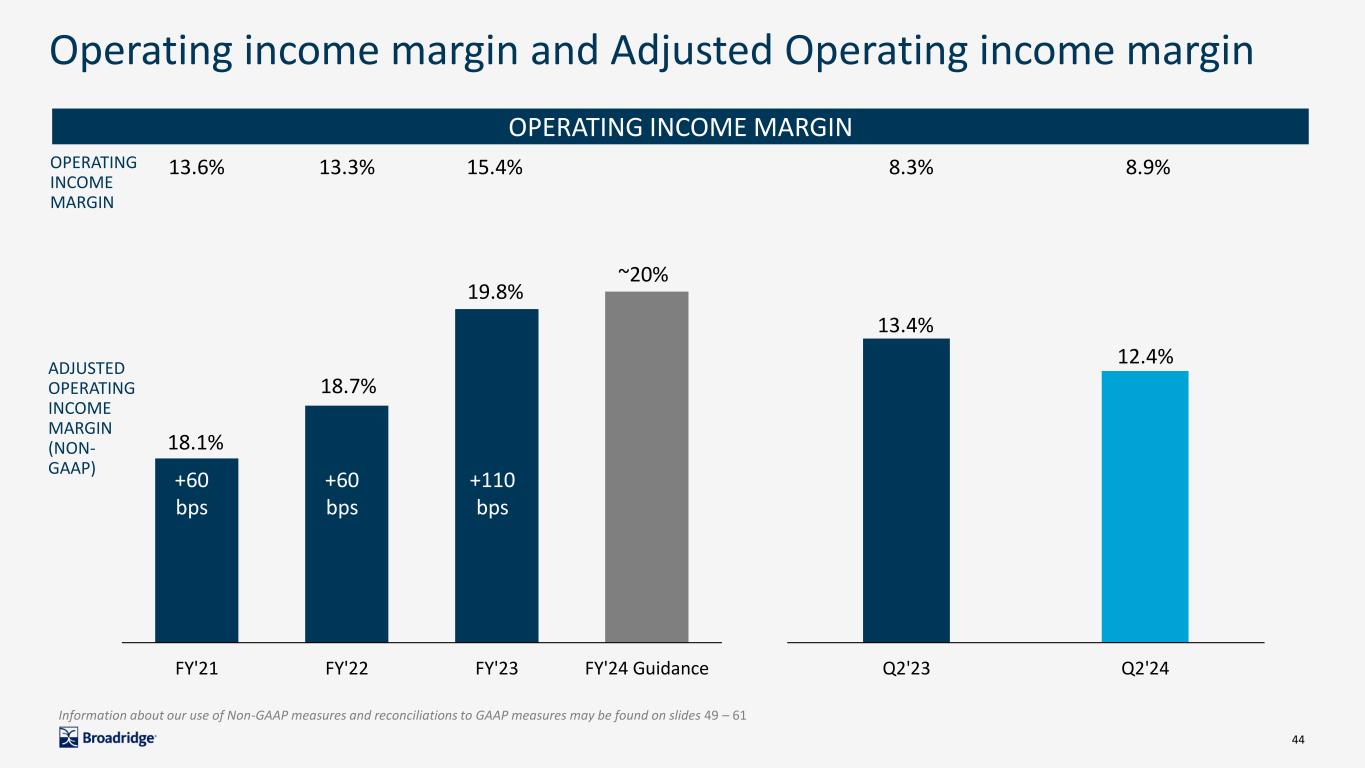

44 Operating income margin and Adjusted Operating income margin OPERATING INCOME MARGIN 18.1% 18.7% 19.8% FY'21 FY'22 FY'23 FY'24 Guidance 13.6% 13.3% 15.4% 8.9%8.3% Q2'23 Q2'24 +60 bps +60 bps OPERATING INCOME MARGIN ADJUSTED OPERATING INCOME MARGIN (NON- GAAP) 12.4% +110 bps ~20% 13.4% Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61

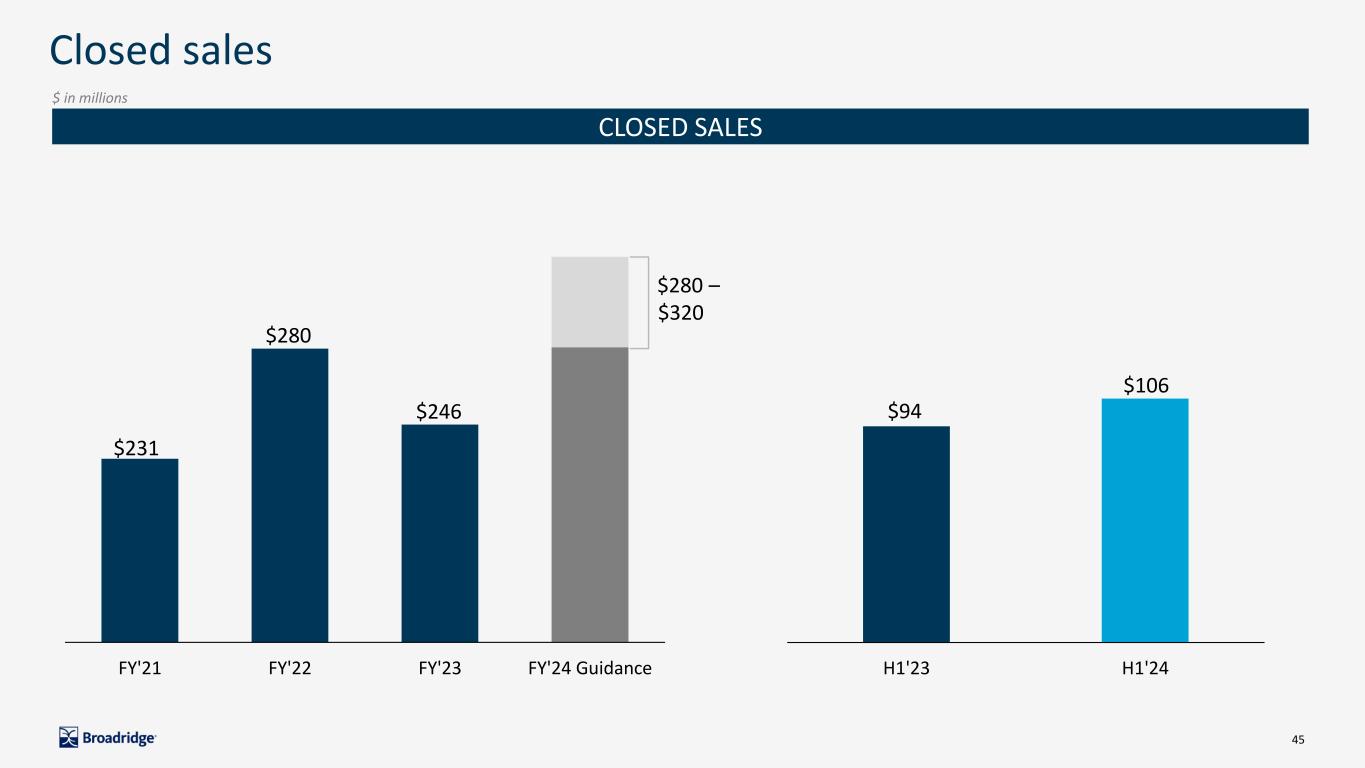

45 FY'21 FY'22 FY'23 FY'24 Guidance Closed sales CLOSED SALES $ in millions $280 H1'23 H1'24 $94 $106 $280 – $320 $246 $231

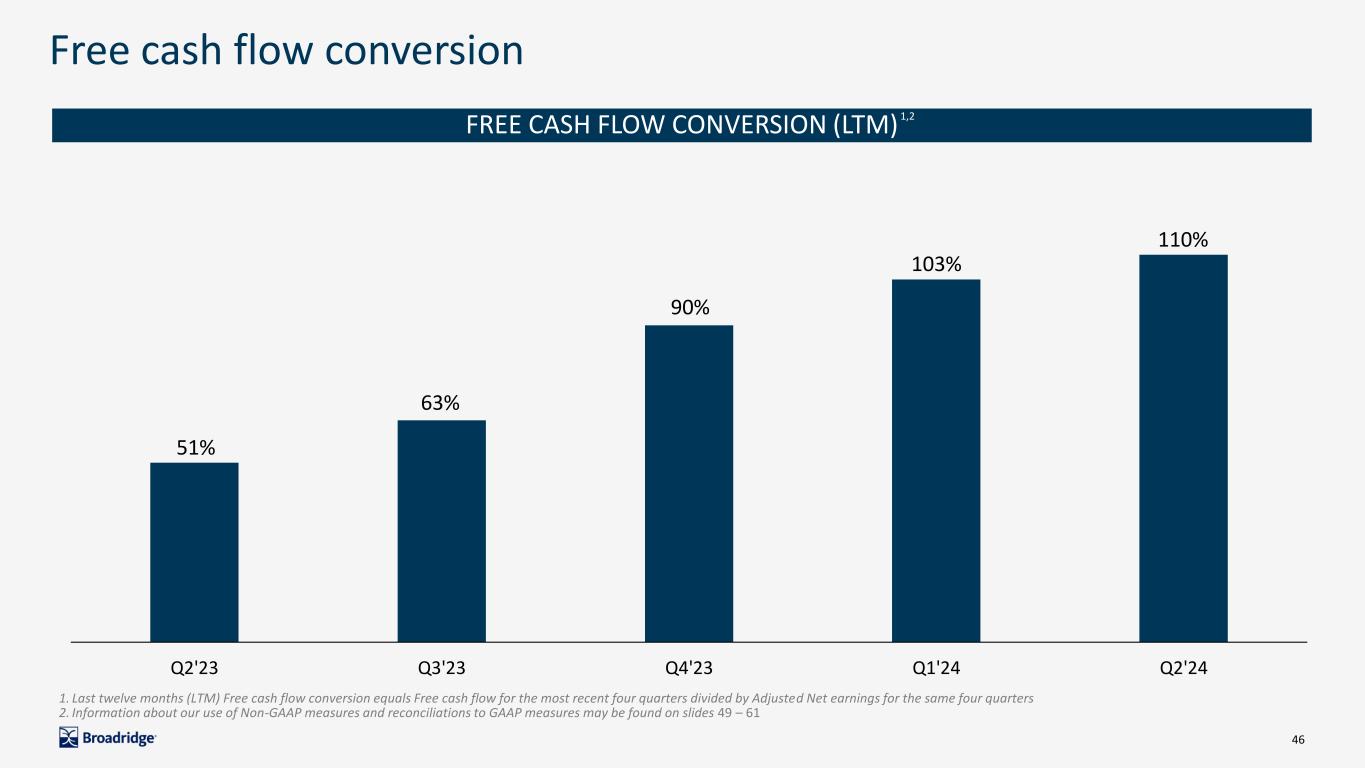

46 Free cash flow conversion FREE CASH FLOW CONVERSION (LTM) 1,2 1. Last twelve months (LTM) Free cash flow conversion equals Free cash flow for the most recent four quarters divided by Adjusted Net earnings for the same four quarters 2. Information about our use of Non-GAAP measures and reconciliations to GAAP measures may be found on slides 49 – 61 51% 63% 90% 103% 110% Q2'23 Q3'23 Q4'23 Q1'24 Q2'24

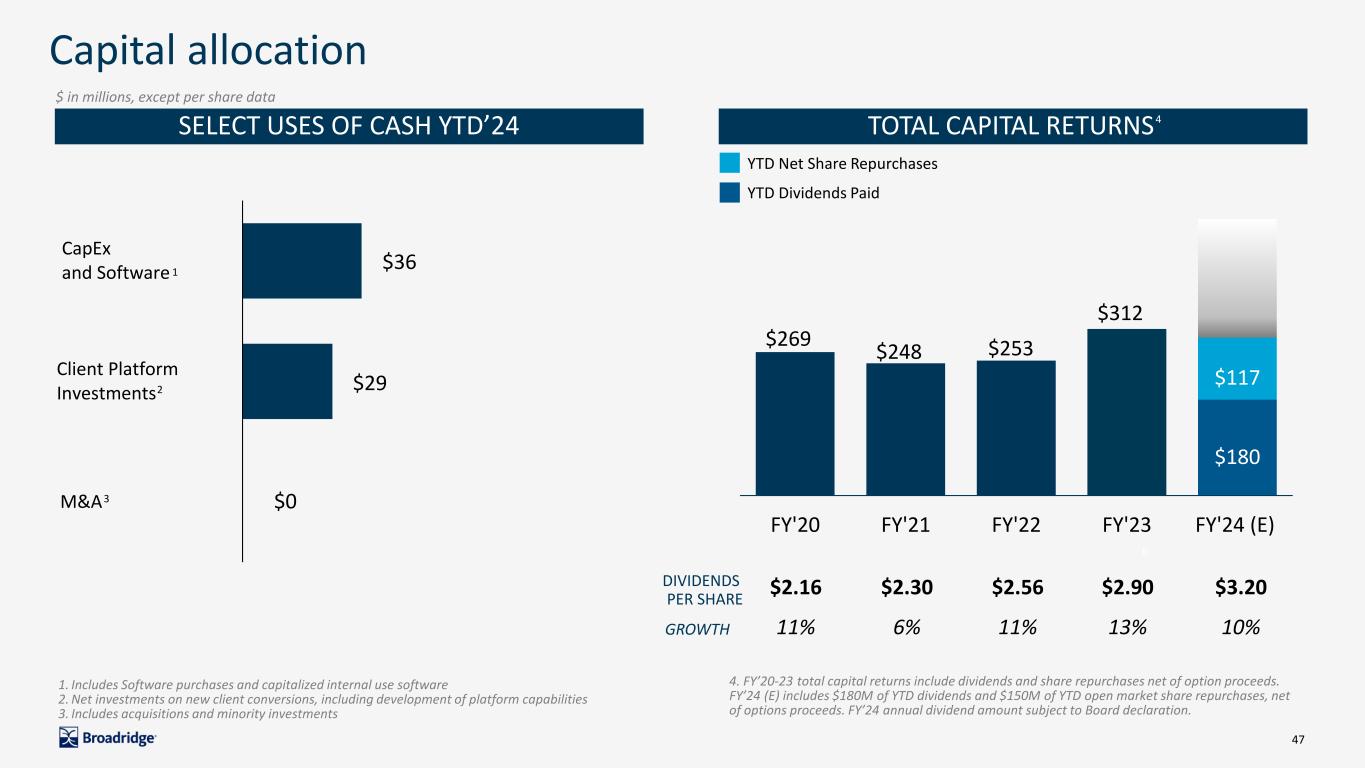

47 SELECT USES OF CASH YTD’24 TOTAL CAPITAL RETURNS Capital allocation $ in millions, except per share data $2.16 $2.30 $2.56 $2.90 $3.20 11% 6% 11% 13% 10% DIVIDENDS PER SHARE M&A Client Platform Investments CapEx and Software 2 1. Includes Software purchases and capitalized internal use software 2. Net investments on new client conversions, including development of platform capabilities 3. Includes acquisitions and minority investments 1 $29 $36 $03 6 4. FY’20-23 total capital returns include dividends and share repurchases net of option proceeds. FY’24 (E) includes $180M of YTD dividends and $150M of YTD open market share repurchases, net of options proceeds. FY’24 annual dividend amount subject to Board declaration. GROWTH $236 FY'20 FY'21 FY'22 FY'23 FY'24 (E) $253$248 $269 $312 $180 $117 YTD Net Share Repurchases YTD Dividends Paid 4

Explanation of non-GAAP measures and reconciliation of GAAP to non-GAAP measures

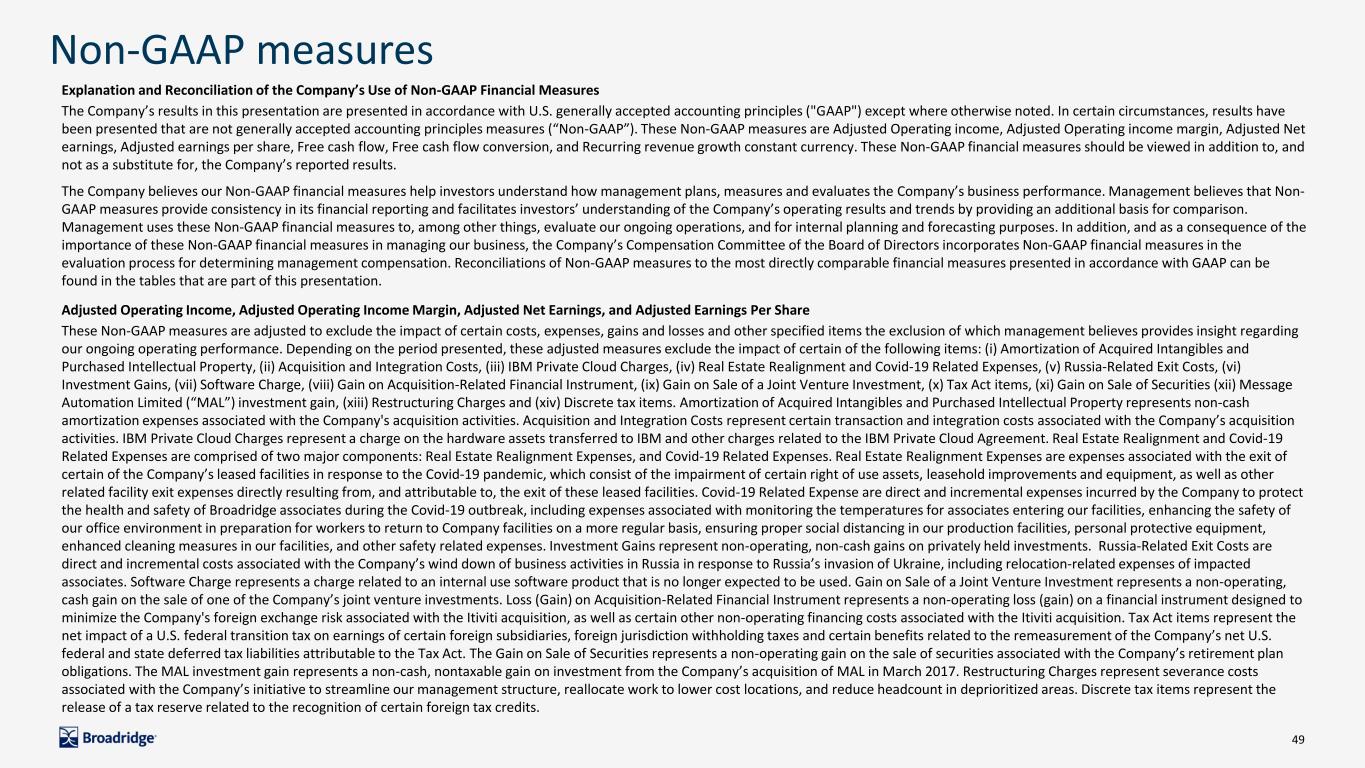

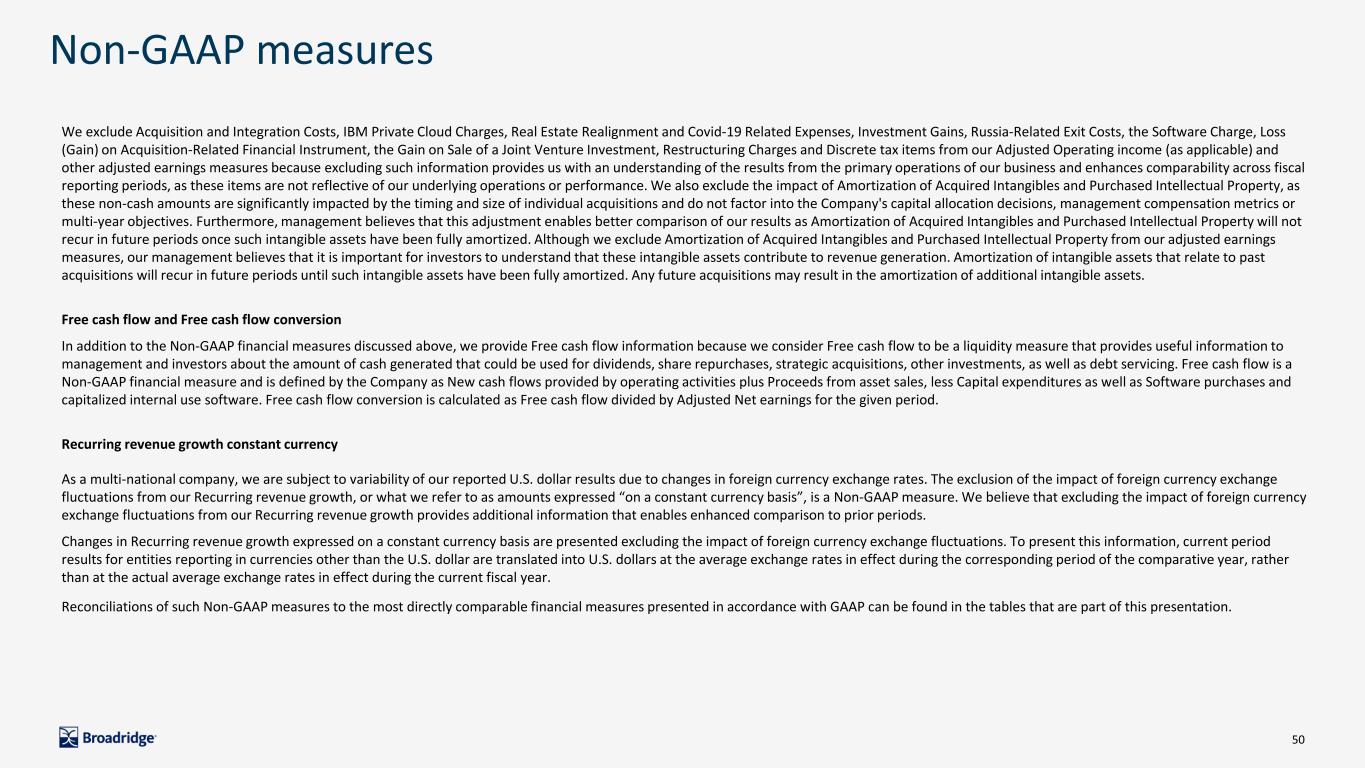

49 Non-GAAP measures Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company’s results in this presentation are presented in accordance with U.S. generally accepted accounting principles ("GAAP") except where otherwise noted. In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP measures are Adjusted Operating income, Adjusted Operating income margin, Adjusted Net earnings, Adjusted earnings per share, Free cash flow, Free cash flow conversion, and Recurring revenue growth constant currency. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results. The Company believes our Non-GAAP financial measures help investors understand how management plans, measures and evaluates the Company’s business performance. Management believes that Non- GAAP measures provide consistency in its financial reporting and facilitates investors’ understanding of the Company’s operating results and trends by providing an additional basis for comparison. Management uses these Non-GAAP financial measures to, among other things, evaluate our ongoing operations, and for internal planning and forecasting purposes. In addition, and as a consequence of the importance of these Non-GAAP financial measures in managing our business, the Company’s Compensation Committee of the Board of Directors incorporates Non-GAAP financial measures in the evaluation process for determining management compensation. Reconciliations of Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation. Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Earnings, and Adjusted Earnings Per Share These Non-GAAP measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items the exclusion of which management believes provides insight regarding our ongoing operating performance. Depending on the period presented, these adjusted measures exclude the impact of certain of the following items: (i) Amortization of Acquired Intangibles and Purchased Intellectual Property, (ii) Acquisition and Integration Costs, (iii) IBM Private Cloud Charges, (iv) Real Estate Realignment and Covid-19 Related Expenses, (v) Russia-Related Exit Costs, (vi) Investment Gains, (vii) Software Charge, (viii) Gain on Acquisition-Related Financial Instrument, (ix) Gain on Sale of a Joint Venture Investment, (x) Tax Act items, (xi) Gain on Sale of Securities (xii) Message Automation Limited (“MAL”) investment gain, (xiii) Restructuring Charges and (xiv) Discrete tax items. Amortization of Acquired Intangibles and Purchased Intellectual Property represents non-cash amortization expenses associated with the Company's acquisition activities. Acquisition and Integration Costs represent certain transaction and integration costs associated with the Company’s acquisition activities. IBM Private Cloud Charges represent a charge on the hardware assets transferred to IBM and other charges related to the IBM Private Cloud Agreement. Real Estate Realignment and Covid-19 Related Expenses are comprised of two major components: Real Estate Realignment Expenses, and Covid-19 Related Expenses. Real Estate Realignment Expenses are expenses associated with the exit of certain of the Company’s leased facilities in response to the Covid-19 pandemic, which consist of the impairment of certain right of use assets, leasehold improvements and equipment, as well as other related facility exit expenses directly resulting from, and attributable to, the exit of these leased facilities. Covid-19 Related Expense are direct and incremental expenses incurred by the Company to protect the health and safety of Broadridge associates during the Covid-19 outbreak, including expenses associated with monitoring the temperatures for associates entering our facilities, enhancing the safety of our office environment in preparation for workers to return to Company facilities on a more regular basis, ensuring proper social distancing in our production facilities, personal protective equipment, enhanced cleaning measures in our facilities, and other safety related expenses. Investment Gains represent non-operating, non-cash gains on privately held investments. Russia-Related Exit Costs are direct and incremental costs associated with the Company’s wind down of business activities in Russia in response to Russia’s invasion of Ukraine, including relocation-related expenses of impacted associates. Software Charge represents a charge related to an internal use software product that is no longer expected to be used. Gain on Sale of a Joint Venture Investment represents a non-operating, cash gain on the sale of one of the Company’s joint venture investments. Loss (Gain) on Acquisition-Related Financial Instrument represents a non-operating loss (gain) on a financial instrument designed to minimize the Company's foreign exchange risk associated with the Itiviti acquisition, as well as certain other non-operating financing costs associated with the Itiviti acquisition. Tax Act items represent the net impact of a U.S. federal transition tax on earnings of certain foreign subsidiaries, foreign jurisdiction withholding taxes and certain benefits related to the remeasurement of the Company’s net U.S. federal and state deferred tax liabilities attributable to the Tax Act. The Gain on Sale of Securities represents a non-operating gain on the sale of securities associated with the Company’s retirement plan obligations. The MAL investment gain represents a non-cash, nontaxable gain on investment from the Company’s acquisition of MAL in March 2017. Restructuring Charges represent severance costs associated with the Company’s initiative to streamline our management structure, reallocate work to lower cost locations, and reduce headcount in deprioritized areas. Discrete tax items represent the release of a tax reserve related to the recognition of certain foreign tax credits.

50 Non-GAAP measures We exclude Acquisition and Integration Costs, IBM Private Cloud Charges, Real Estate Realignment and Covid-19 Related Expenses, Investment Gains, Russia-Related Exit Costs, the Software Charge, Loss (Gain) on Acquisition-Related Financial Instrument, the Gain on Sale of a Joint Venture Investment, Restructuring Charges and Discrete tax items from our Adjusted Operating income (as applicable) and other adjusted earnings measures because excluding such information provides us with an understanding of the results from the primary operations of our business and enhances comparability across fiscal reporting periods, as these items are not reflective of our underlying operations or performance. We also exclude the impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, as these non-cash amounts are significantly impacted by the timing and size of individual acquisitions and do not factor into the Company's capital allocation decisions, management compensation metrics or multi-year objectives. Furthermore, management believes that this adjustment enables better comparison of our results as Amortization of Acquired Intangibles and Purchased Intellectual Property will not recur in future periods once such intangible assets have been fully amortized. Although we exclude Amortization of Acquired Intangibles and Purchased Intellectual Property from our adjusted earnings measures, our management believes that it is important for investors to understand that these intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets. Free cash flow and Free cash flow conversion In addition to the Non-GAAP financial measures discussed above, we provide Free cash flow information because we consider Free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated that could be used for dividends, share repurchases, strategic acquisitions, other investments, as well as debt servicing. Free cash flow is a Non-GAAP financial measure and is defined by the Company as New cash flows provided by operating activities plus Proceeds from asset sales, less Capital expenditures as well as Software purchases and capitalized internal use software. Free cash flow conversion is calculated as Free cash flow divided by Adjusted Net earnings for the given period. Recurring revenue growth constant currency As a multi-national company, we are subject to variability of our reported U.S. dollar results due to changes in foreign currency exchange rates. The exclusion of the impact of foreign currency exchange fluctuations from our Recurring revenue growth, or what we refer to as amounts expressed “on a constant currency basis”, is a Non-GAAP measure. We believe that excluding the impact of foreign currency exchange fluctuations from our Recurring revenue growth provides additional information that enables enhanced comparison to prior periods. Changes in Recurring revenue growth expressed on a constant currency basis are presented excluding the impact of foreign currency exchange fluctuations. To present this information, current period results for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the average exchange rates in effect during the corresponding period of the comparative year, rather than at the actual average exchange rates in effect during the current fiscal year. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this presentation.

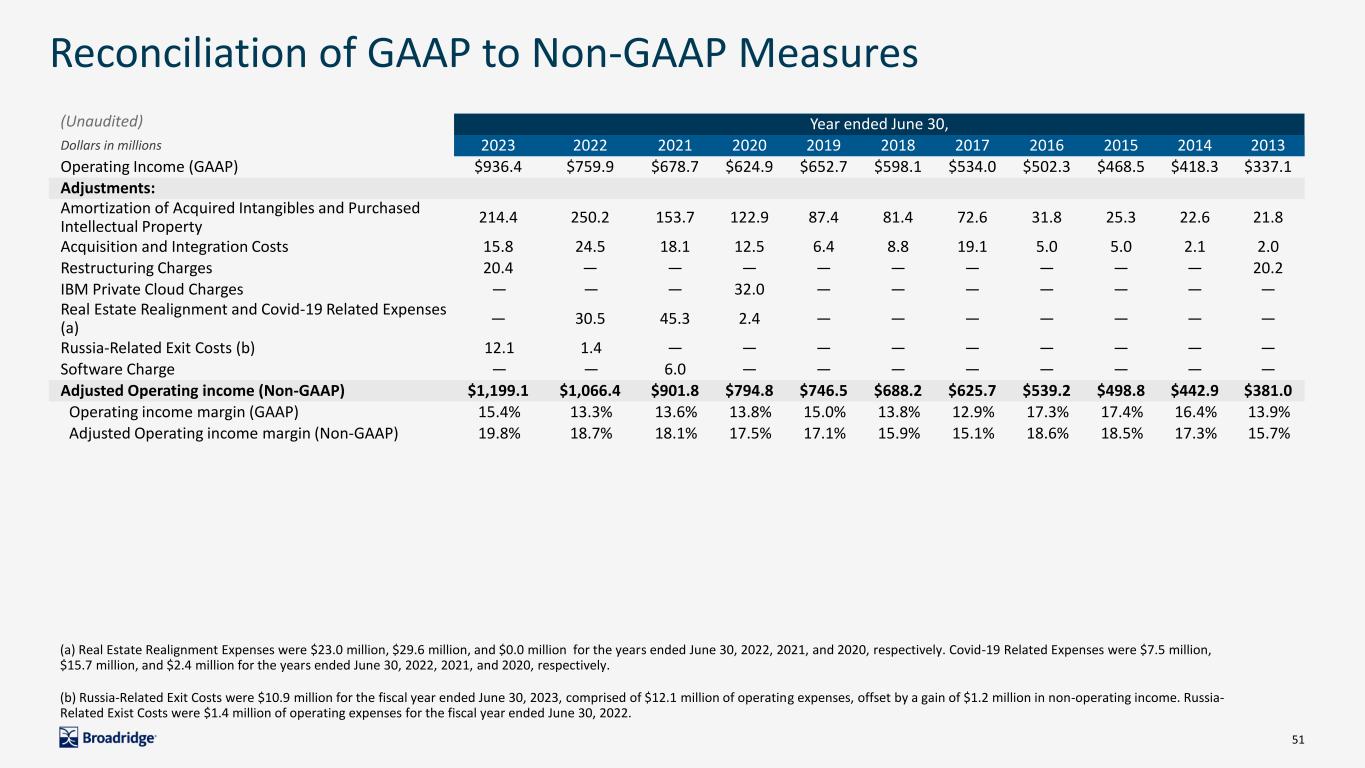

51 Reconciliation of GAAP to Non-GAAP Measures Year ended June 30, Dollars in millions 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 Operating Income (GAAP) $936.4 $759.9 $678.7 $624.9 $652.7 $598.1 $534.0 $502.3 $468.5 $418.3 $337.1 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 214.4 250.2 153.7 122.9 87.4 81.4 72.6 31.8 25.3 22.6 21.8 Acquisition and Integration Costs 15.8 24.5 18.1 12.5 6.4 8.8 19.1 5.0 5.0 2.1 2.0 Restructuring Charges 20.4 — — — �� — — — — — 20.2 IBM Private Cloud Charges — — — 32.0 — — — — — — — Real Estate Realignment and Covid-19 Related Expenses (a) — 30.5 45.3 2.4 — — — — — — — Russia-Related Exit Costs (b) 12.1 1.4 — — — — — — — — — Software Charge — — 6.0 — — — — — — — — Adjusted Operating income (Non-GAAP) $1,199.1 $1,066.4 $901.8 $794.8 $746.5 $688.2 $625.7 $539.2 $498.8 $442.9 $381.0 Operating income margin (GAAP) 15.4% 13.3% 13.6% 13.8% 15.0% 13.8% 12.9% 17.3% 17.4% 16.4% 13.9% Adjusted Operating income margin (Non-GAAP) 19.8% 18.7% 18.1% 17.5% 17.1% 15.9% 15.1% 18.6% 18.5% 17.3% 15.7% (Unaudited) (a) Real Estate Realignment Expenses were $23.0 million, $29.6 million, and $0.0 million for the years ended June 30, 2022, 2021, and 2020, respectively. Covid-19 Related Expenses were $7.5 million, $15.7 million, and $2.4 million for the years ended June 30, 2022, 2021, and 2020, respectively. (b) Russia-Related Exit Costs were $10.9 million for the fiscal year ended June 30, 2023, comprised of $12.1 million of operating expenses, offset by a gain of $1.2 million in non-operating income. Russia- Related Exist Costs were $1.4 million of operating expenses for the fiscal year ended June 30, 2022.

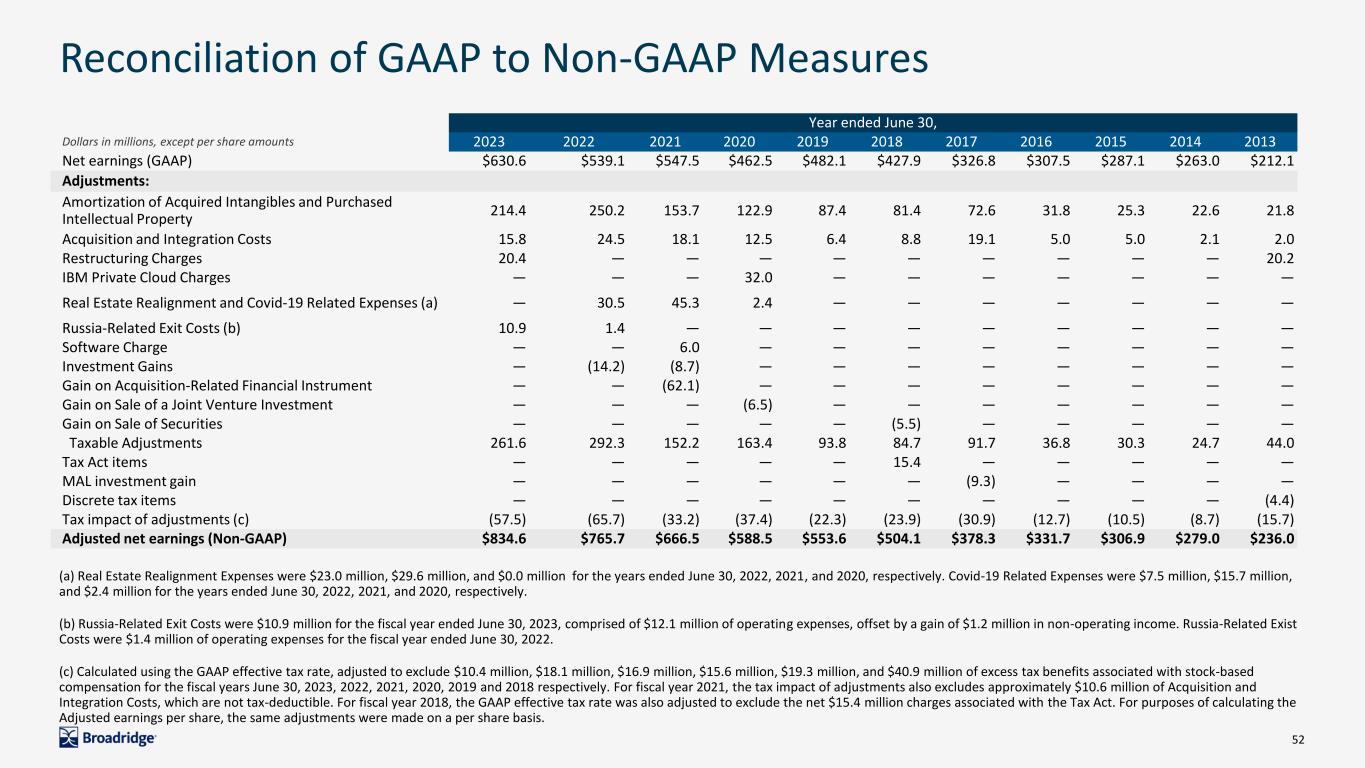

52 Reconciliation of GAAP to Non-GAAP Measures (a) Real Estate Realignment Expenses were $23.0 million, $29.6 million, and $0.0 million for the years ended June 30, 2022, 2021, and 2020, respectively. Covid-19 Related Expenses were $7.5 million, $15.7 million, and $2.4 million for the years ended June 30, 2022, 2021, and 2020, respectively. (b) Russia-Related Exit Costs were $10.9 million for the fiscal year ended June 30, 2023, comprised of $12.1 million of operating expenses, offset by a gain of $1.2 million in non-operating income. Russia-Related Exist Costs were $1.4 million of operating expenses for the fiscal year ended June 30, 2022. (c) Calculated using the GAAP effective tax rate, adjusted to exclude $10.4 million, $18.1 million, $16.9 million, $15.6 million, $19.3 million, and $40.9 million of excess tax benefits associated with stock-based compensation for the fiscal years June 30, 2023, 2022, 2021, 2020, 2019 and 2018 respectively. For fiscal year 2021, the tax impact of adjustments also excludes approximately $10.6 million of Acquisition and Integration Costs, which are not tax-deductible. For fiscal year 2018, the GAAP effective tax rate was also adjusted to exclude the net $15.4 million charges associated with the Tax Act. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Year ended June 30, Dollars in millions, except per share amounts 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 Net earnings (GAAP) $630.6 $539.1 $547.5 $462.5 $482.1 $427.9 $326.8 $307.5 $287.1 $263.0 $212.1 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 214.4 250.2 153.7 122.9 87.4 81.4 72.6 31.8 25.3 22.6 21.8 Acquisition and Integration Costs 15.8 24.5 18.1 12.5 6.4 8.8 19.1 5.0 5.0 2.1 2.0 Restructuring Charges 20.4 — — — — — — — — — 20.2 IBM Private Cloud Charges — — — 32.0 — — — — — — — Real Estate Realignment and Covid-19 Related Expenses (a) — 30.5 45.3 2.4 — — — — — — — Russia-Related Exit Costs (b) 10.9 1.4 — — — — — — — — — Software Charge — — 6.0 — — — — — — — — Investment Gains — (14.2) (8.7) — — — — — — — — Gain on Acquisition-Related Financial Instrument — — (62.1) — — — — — — — — Gain on Sale of a Joint Venture Investment — — — (6.5) — — — — — — — Gain on Sale of Securities — — — — — (5.5) — — — — — Taxable Adjustments 261.6 292.3 152.2 163.4 93.8 84.7 91.7 36.8 30.3 24.7 44.0 Tax Act items — — — — — 15.4 — — — — — MAL investment gain — — — — — — (9.3) — — — — Discrete tax items — — — — — — — — — — (4.4) Tax impact of adjustments (c) (57.5) (65.7) (33.2) (37.4) (22.3) (23.9) (30.9) (12.7) (10.5) (8.7) (15.7) Adjusted net earnings (Non-GAAP) $834.6 $765.7 $666.5 $588.5 $553.6 $504.1 $378.3 $331.7 $306.9 $279.0 $236.0

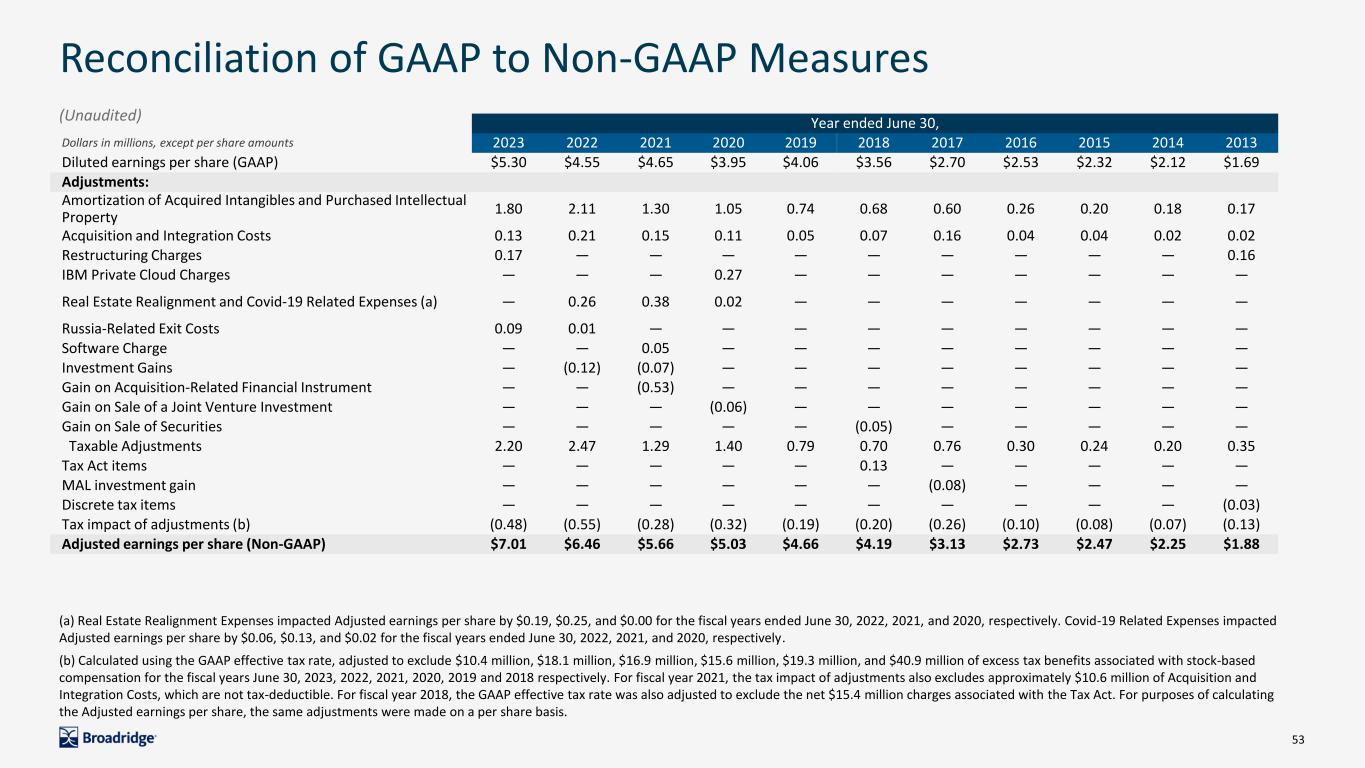

53 Year ended June 30, Dollars in millions, except per share amounts 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 Diluted earnings per share (GAAP) $5.30 $4.55 $4.65 $3.95 $4.06 $3.56 $2.70 $2.53 $2.32 $2.12 $1.69 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 1.80 2.11 1.30 1.05 0.74 0.68 0.60 0.26 0.20 0.18 0.17 Acquisition and Integration Costs 0.13 0.21 0.15 0.11 0.05 0.07 0.16 0.04 0.04 0.02 0.02 Restructuring Charges 0.17 — — — — — — — — — 0.16 IBM Private Cloud Charges — — — 0.27 — — — — — — — Real Estate Realignment and Covid-19 Related Expenses (a) — 0.26 0.38 0.02 — — — — — — — Russia-Related Exit Costs 0.09 0.01 — — — — — — — — — Software Charge — — 0.05 — — — — — — — — Investment Gains — (0.12) (0.07) — — — — — — — — Gain on Acquisition-Related Financial Instrument — — (0.53) — — — — — — — — Gain on Sale of a Joint Venture Investment — — — (0.06) — — — — — — — Gain on Sale of Securities — — — — — (0.05) — — — — — Taxable Adjustments 2.20 2.47 1.29 1.40 0.79 0.70 0.76 0.30 0.24 0.20 0.35 Tax Act items — — — — — 0.13 — — — — — MAL investment gain — — — — — — (0.08) — — — — Discrete tax items — — — — — — — — — — (0.03) Tax impact of adjustments (b) (0.48) (0.55) (0.28) (0.32) (0.19) (0.20) (0.26) (0.10) (0.08) (0.07) (0.13) Adjusted earnings per share (Non-GAAP) $7.01 $6.46 $5.66 $5.03 $4.66 $4.19 $3.13 $2.73 $2.47 $2.25 $1.88 Reconciliation of GAAP to Non-GAAP Measures (Unaudited) (a) Real Estate Realignment Expenses impacted Adjusted earnings per share by $0.19, $0.25, and $0.00 for the fiscal years ended June 30, 2022, 2021, and 2020, respectively. Covid-19 Related Expenses impacted Adjusted earnings per share by $0.06, $0.13, and $0.02 for the fiscal years ended June 30, 2022, 2021, and 2020, respectively. (b) Calculated using the GAAP effective tax rate, adjusted to exclude $10.4 million, $18.1 million, $16.9 million, $15.6 million, $19.3 million, and $40.9 million of excess tax benefits associated with stock-based compensation for the fiscal years June 30, 2023, 2022, 2021, 2020, 2019 and 2018 respectively. For fiscal year 2021, the tax impact of adjustments also excludes approximately $10.6 million of Acquisition and Integration Costs, which are not tax-deductible. For fiscal year 2018, the GAAP effective tax rate was also adjusted to exclude the net $15.4 million charges associated with the Tax Act. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

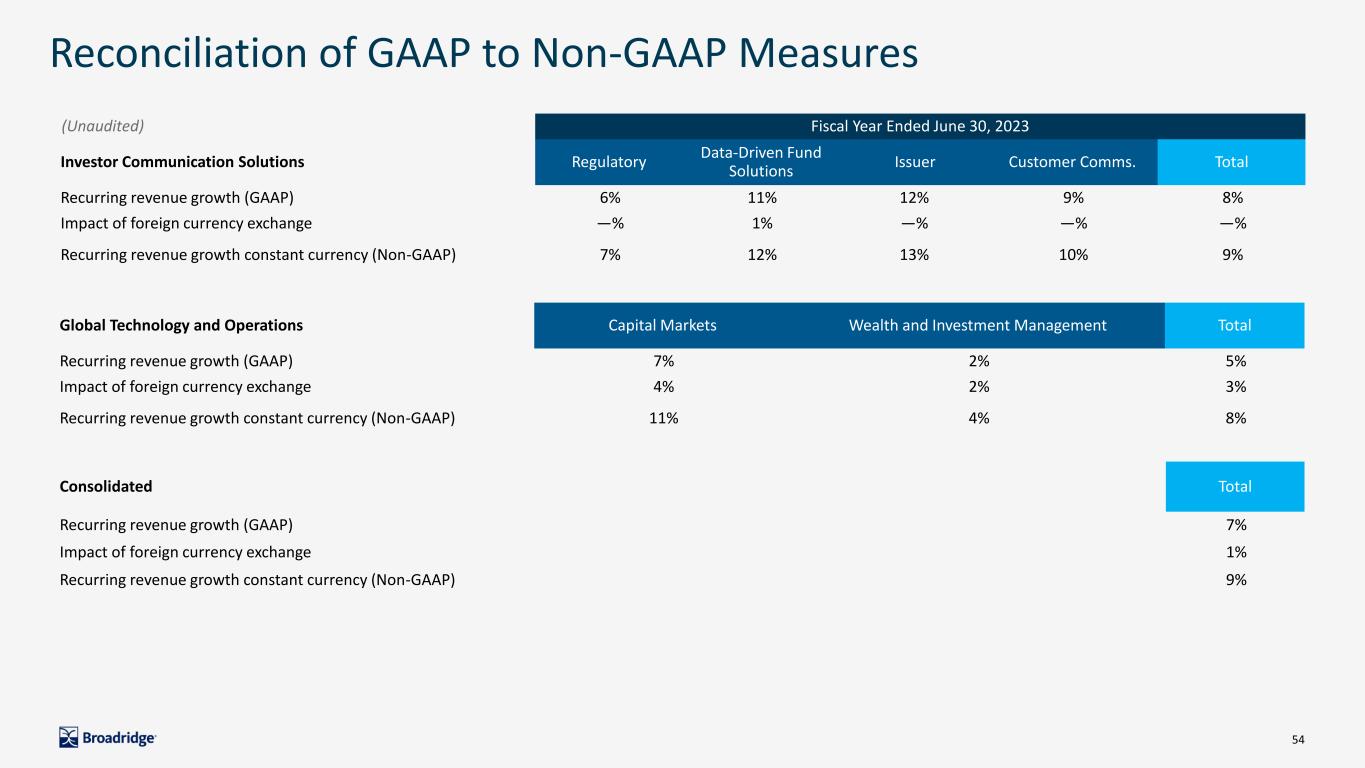

54 Fiscal Year Ended June 30, 2023 Investor Communication Solutions Regulatory Data-Driven Fund Solutions Issuer Customer Comms. Total Recurring revenue growth (GAAP) 6% 11% 12% 9% 8% Impact of foreign currency exchange —% 1% —% —% —% Recurring revenue growth constant currency (Non-GAAP) 7% 12% 13% 10% 9% Reconciliation of GAAP to Non-GAAP Measures Global Technology and Operations Capital Markets Wealth and Investment Management Total Recurring revenue growth (GAAP) 7% 2% 5% Impact of foreign currency exchange 4% 2% 3% Recurring revenue growth constant currency (Non-GAAP) 11% 4% 8% Consolidated Total Recurring revenue growth (GAAP) 7% Impact of foreign currency exchange 1% Recurring revenue growth constant currency (Non-GAAP) 9% (Unaudited)

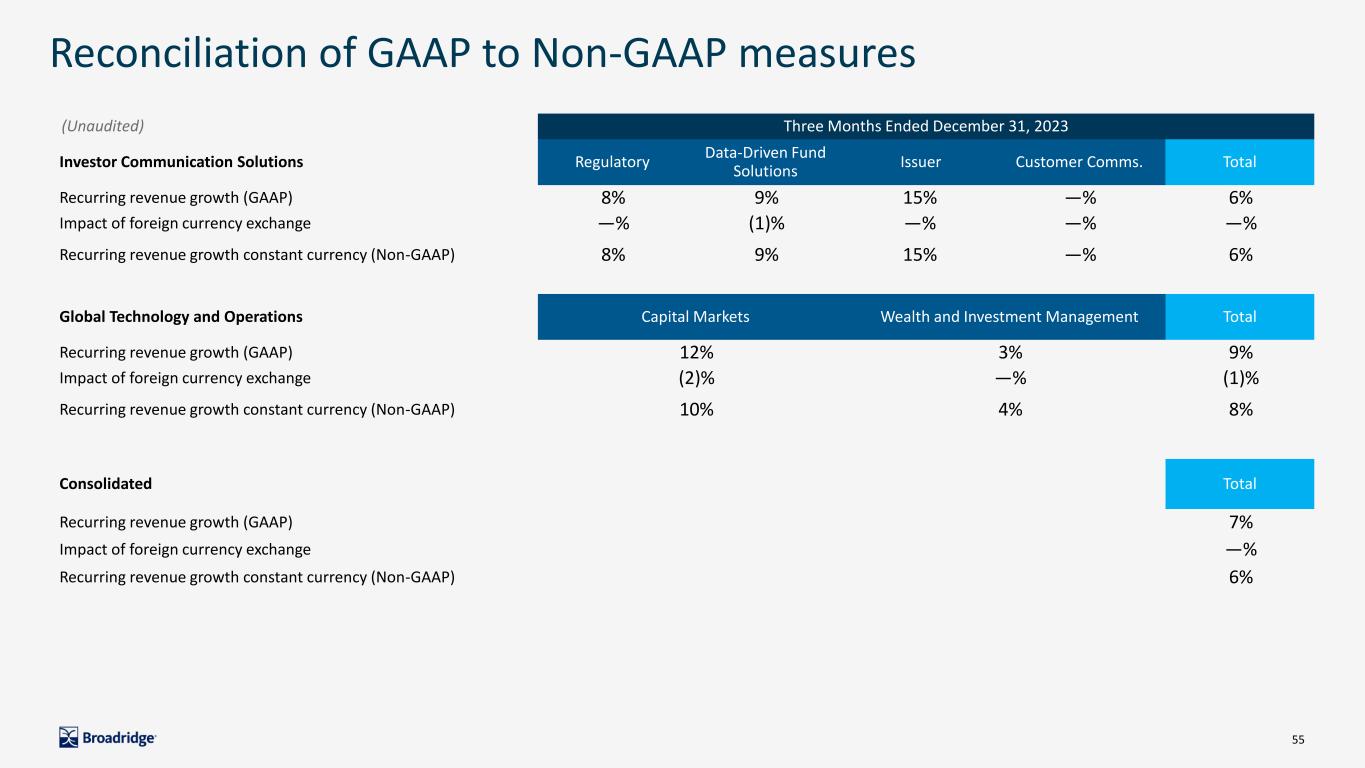

55 Three Months Ended December 31, 2023 Investor Communication Solutions Regulatory Data-Driven Fund Solutions Issuer Customer Comms. Total Recurring revenue growth (GAAP) 8% 9% 15% —% 6% Impact of foreign currency exchange —% (1)% —% —% —% Recurring revenue growth constant currency (Non-GAAP) 8% 9% 15% —% 6% Reconciliation of GAAP to Non-GAAP measures (Unaudited) Global Technology and Operations Capital Markets Wealth and Investment Management Total Recurring revenue growth (GAAP) 12% 3% 9% Impact of foreign currency exchange (2)% —% (1)% Recurring revenue growth constant currency (Non-GAAP) 10% 4% 8% Consolidated Total Recurring revenue growth (GAAP) 7% Impact of foreign currency exchange —% Recurring revenue growth constant currency (Non-GAAP) 6%

56 Year ended June 30, Dollars in millions 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Net cash flows from operating activities (GAAP) $823.3 $443.5 $640.1 $598.2 $617.0 $693.6 $515.9 $437.7 $431.4 $387.7 Capital expenditures and Software purchases and capitalized internal use software (75.2) (73.1) (100.7) (98.7) (72.6) (97.9) (113.7) (75.5) (66.0) (53.4) Proceeds from asset sales — — 18.0 — — — — — — — Free cash flow (Non-GAAP) $748.2 $370.4 $557.3 $499.5 $544.4 $595.7 $402.2 $362.2 $365.4 $334.3 Adjusted Net earnings (Non-GAAP) (a) $834.6 $765.7 $666.5 $588.5 $553.6 $504.1 $378.3 $331.7 $306.9 $279.0 Free cash flow conversion (Non-GAAP) (b) 90 % 48 % 84 % 85 % 98 % 118 % 106 % 109 % 119 % 120 % Reconciliation of GAAP to Non-GAAP Measures (a) Refer to slide 137 for a reconciliation of the Non-GAAP measure to the GAAP measure (b) Free cash flow conversion is calculated as free cash flow divided by adjusted net earnings for the given period (Unaudited)

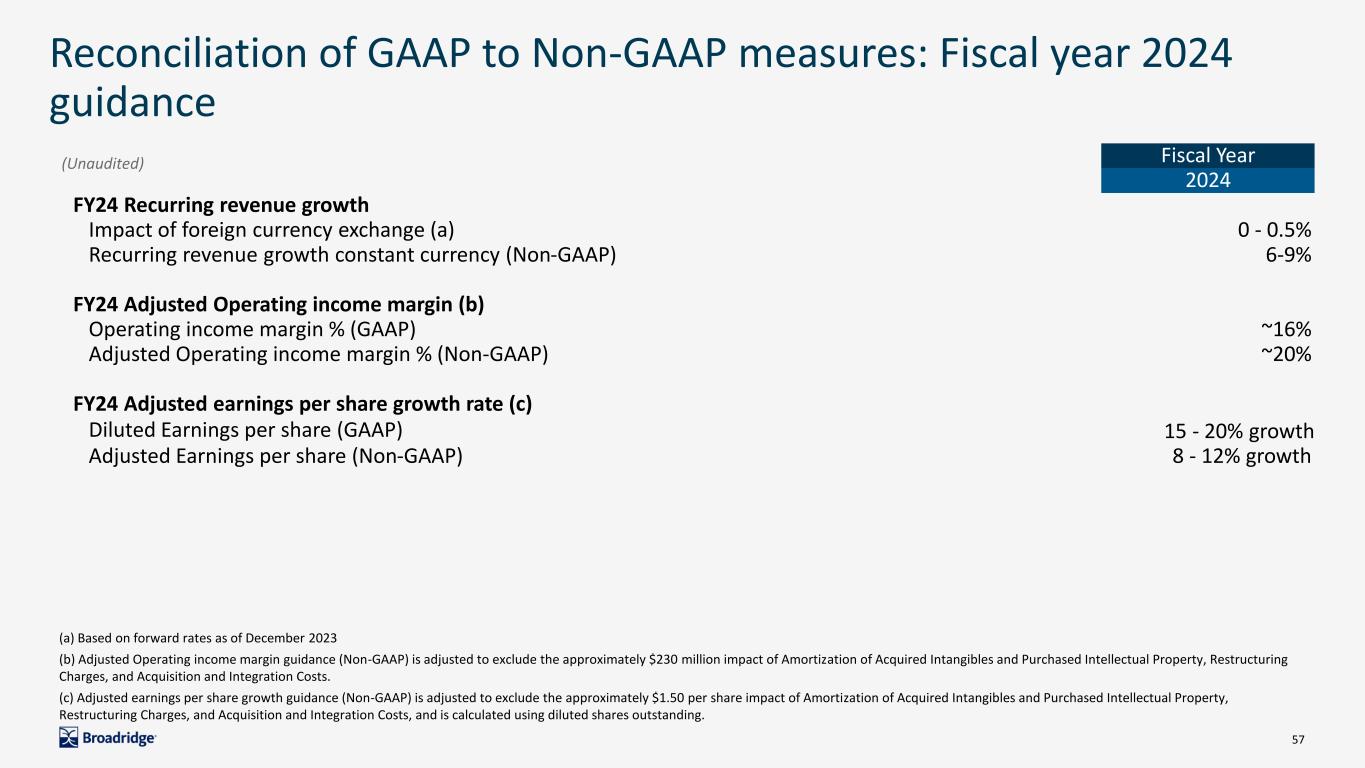

57 Reconciliation of GAAP to Non-GAAP measures: Fiscal year 2024 guidance Fiscal Year 2024 FY24 Recurring revenue growth Impact of foreign currency exchange (a) 0 - 0.5% Recurring revenue growth constant currency (Non-GAAP) 6-9% FY24 Adjusted Operating income margin (b) Operating income margin % (GAAP) ~16% Adjusted Operating income margin % (Non-GAAP) ~20% FY24 Adjusted earnings per share growth rate (c) Diluted Earnings per share (GAAP) 15 - 20% growth Adjusted Earnings per share (Non-GAAP) 8 - 12% growth (Unaudited) (a) Based on forward rates as of December 2023 (b) Adjusted Operating income margin guidance (Non-GAAP) is adjusted to exclude the approximately $230 million impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Restructuring Charges, and Acquisition and Integration Costs. (c) Adjusted earnings per share growth guidance (Non-GAAP) is adjusted to exclude the approximately $1.50 per share impact of Amortization of Acquired Intangibles and Purchased Intellectual Property, Restructuring Charges, and Acquisition and Integration Costs, and is calculated using diluted shares outstanding.

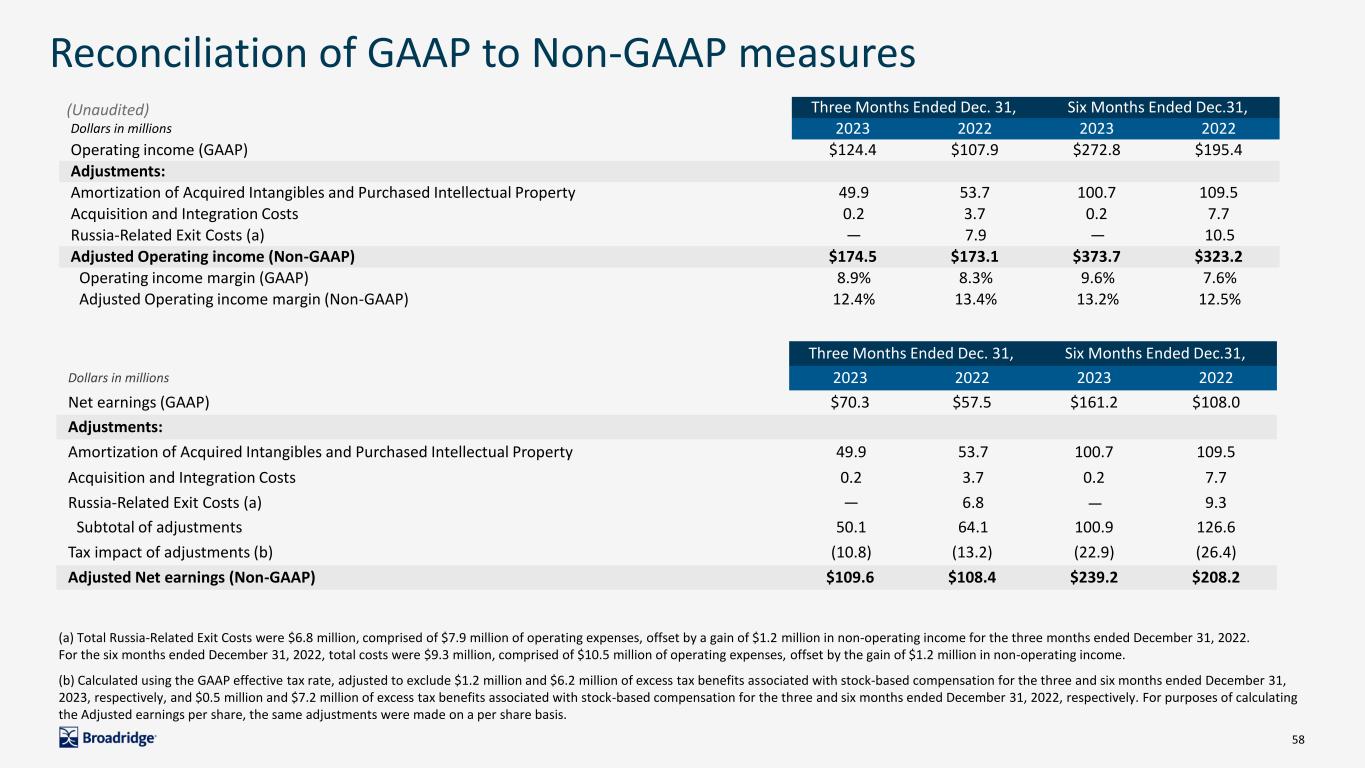

58 Reconciliation of GAAP to Non-GAAP measures (Unaudited) Three Months Ended Dec. 31, Six Months Ended Dec.31, Dollars in millions 2023 2022 2023 2022 Operating income (GAAP) $124.4 $107.9 $272.8 $195.4 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 49.9 53.7 100.7 109.5 Acquisition and Integration Costs 0.2 3.7 0.2 7.7 Russia-Related Exit Costs (a) — 7.9 — 10.5 Adjusted Operating income (Non-GAAP) $174.5 $173.1 $373.7 $323.2 Operating income margin (GAAP) 8.9% 8.3% 9.6% 7.6% Adjusted Operating income margin (Non-GAAP) 12.4% 13.4% 13.2% 12.5% Three Months Ended Dec. 31, Six Months Ended Dec.31, Dollars in millions 2023 2022 2023 2022 Net earnings (GAAP) $70.3 $57.5 $161.2 $108.0 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 49.9 53.7 100.7 109.5 Acquisition and Integration Costs 0.2 3.7 0.2 7.7 Russia-Related Exit Costs (a) — 6.8 — 9.3 Subtotal of adjustments 50.1 64.1 100.9 126.6 Tax impact of adjustments (b) (10.8) (13.2) (22.9) (26.4) Adjusted Net earnings (Non-GAAP) $109.6 $108.4 $239.2 $208.2 (a) Total Russia-Related Exit Costs were $6.8 million, comprised of $7.9 million of operating expenses, offset by a gain of $1.2 million in non-operating income for the three months ended December 31, 2022. For the six months ended December 31, 2022, total costs were $9.3 million, comprised of $10.5 million of operating expenses, offset by the gain of $1.2 million in non-operating income. (b) Calculated using the GAAP effective tax rate, adjusted to exclude $1.2 million and $6.2 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2023, respectively, and $0.5 million and $7.2 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2022, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis.

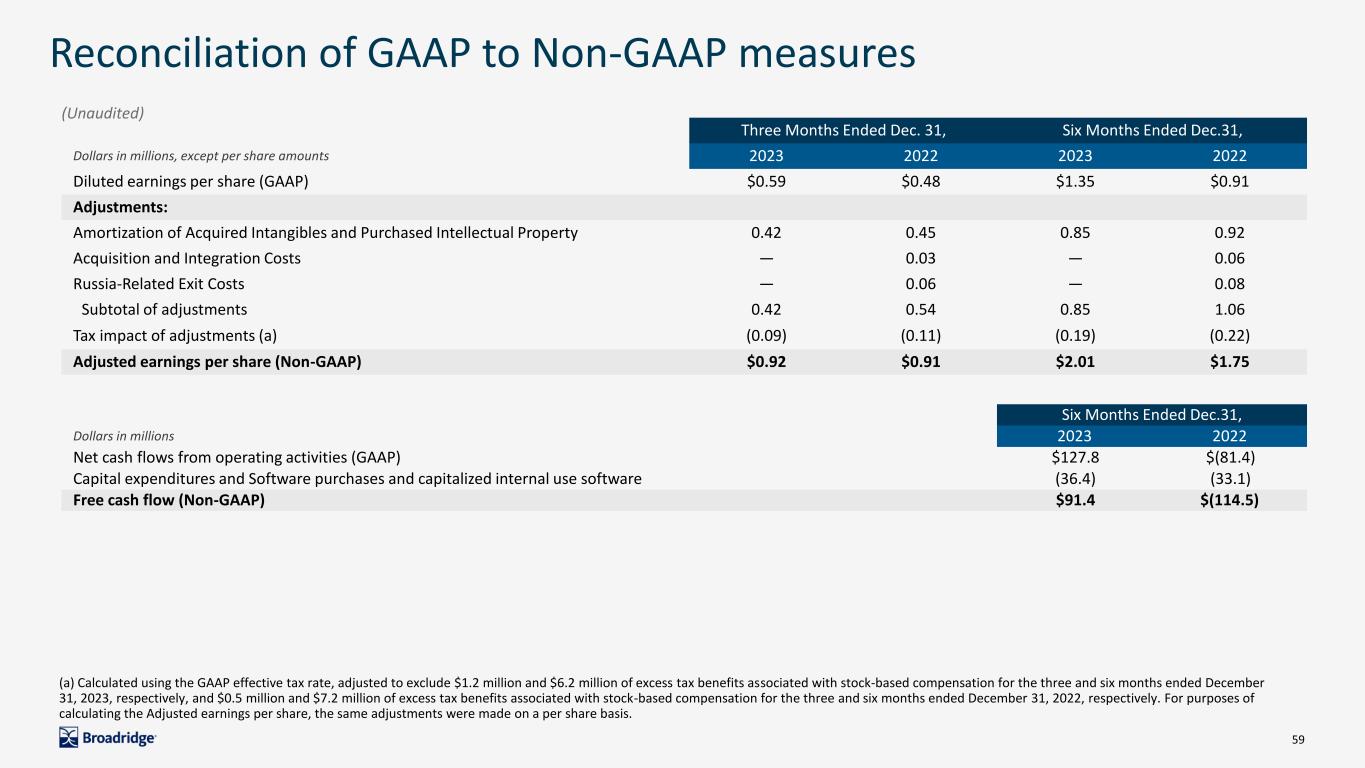

59 Reconciliation of GAAP to Non-GAAP measures (Unaudited) (a) Calculated using the GAAP effective tax rate, adjusted to exclude $1.2 million and $6.2 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2023, respectively, and $0.5 million and $7.2 million of excess tax benefits associated with stock-based compensation for the three and six months ended December 31, 2022, respectively. For purposes of calculating the Adjusted earnings per share, the same adjustments were made on a per share basis. Three Months Ended Dec. 31, Six Months Ended Dec.31, Dollars in millions, except per share amounts 2023 2022 2023 2022 Diluted earnings per share (GAAP) $0.59 $0.48 $1.35 $0.91 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 0.42 0.45 0.85 0.92 Acquisition and Integration Costs — 0.03 — 0.06 Russia-Related Exit Costs — 0.06 — 0.08 Subtotal of adjustments 0.42 0.54 0.85 1.06 Tax impact of adjustments (a) (0.09) (0.11) (0.19) (0.22) Adjusted earnings per share (Non-GAAP) $0.92 $0.91 $2.01 $1.75 Six Months Ended Dec.31, Dollars in millions 2023 2022 Net cash flows from operating activities (GAAP) $127.8 $(81.4) Capital expenditures and Software purchases and capitalized internal use software (36.4) (33.1) Free cash flow (Non-GAAP) $91.4 $(114.5)

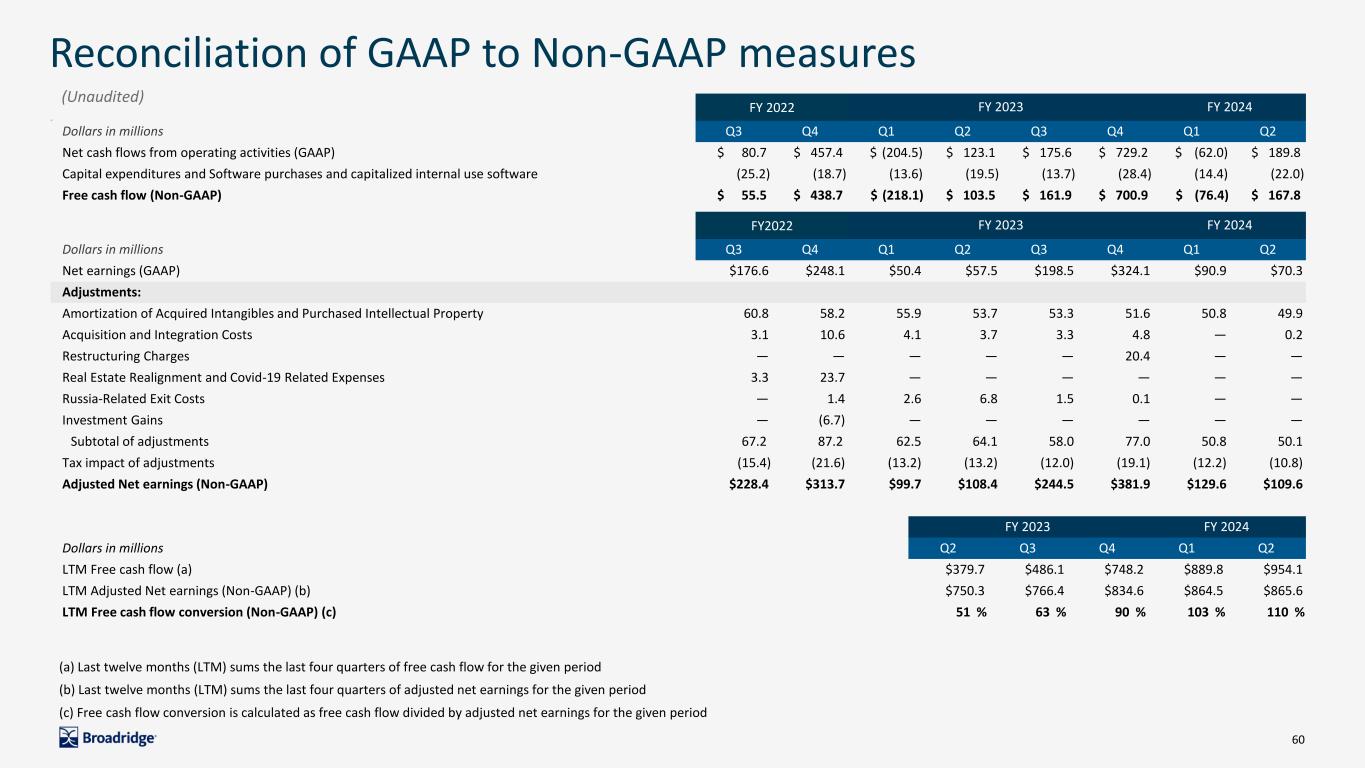

60 QQ FY 2022 FY 2023 FY 2024 Dollars in millions Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net cash flows from operating activities (GAAP) $ 80.7 $ 457.4 $ (204.5) $ 123.1 $ 175.6 $ 729.2 $ (62.0) $ 189.8 Capital expenditures and Software purchases and capitalized internal use software (25.2) (18.7) (13.6) (19.5) (13.7) (28.4) (14.4) (22.0) Free cash flow (Non-GAAP) $ 55.5 $ 438.7 $ (218.1) $ 103.5 $ 161.9 $ 700.9 $ (76.4) $ 167.8 Reconciliation of GAAP to Non-GAAP measures (Unaudited) (a) Last twelve months (LTM) sums the last four quarters of free cash flow for the given period (b) Last twelve months (LTM) sums the last four quarters of adjusted net earnings for the given period (c) Free cash flow conversion is calculated as free cash flow divided by adjusted net earnings for the given period FY2022 FY 2023 FY 2024 Dollars in millions Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Net earnings (GAAP) $176.6 $248.1 $50.4 $57.5 $198.5 $324.1 $90.9 $70.3 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 60.8 58.2 55.9 53.7 53.3 51.6 50.8 49.9 Acquisition and Integration Costs 3.1 10.6 4.1 3.7 3.3 4.8 — 0.2 Restructuring Charges — — — — — 20.4 — — Real Estate Realignment and Covid-19 Related Expenses 3.3 23.7 — — — — — — Russia-Related Exit Costs — 1.4 2.6 6.8 1.5 0.1 — — Investment Gains — (6.7) — — — — — — Subtotal of adjustments 67.2 87.2 62.5 64.1 58.0 77.0 50.8 50.1 Tax impact of adjustments (15.4) (21.6) (13.2) (13.2) (12.0) (19.1) (12.2) (10.8) Adjusted Net earnings (Non-GAAP) $228.4 $313.7 $99.7 $108.4 $244.5 $381.9 $129.6 $109.6 FY 2023 FY 2024 Dollars in millions Q2 Q3 Q4 Q1 Q2 LTM Free cash flow (a) $379.7 $486.1 $748.2 $889.8 $954.1 LTM Adjusted Net earnings (Non-GAAP) (b) $750.3 $766.4 $834.6 $864.5 $865.6 LTM Free cash flow conversion (Non-GAAP) (c) 51 % 63 % 90 % 103 % 110 %

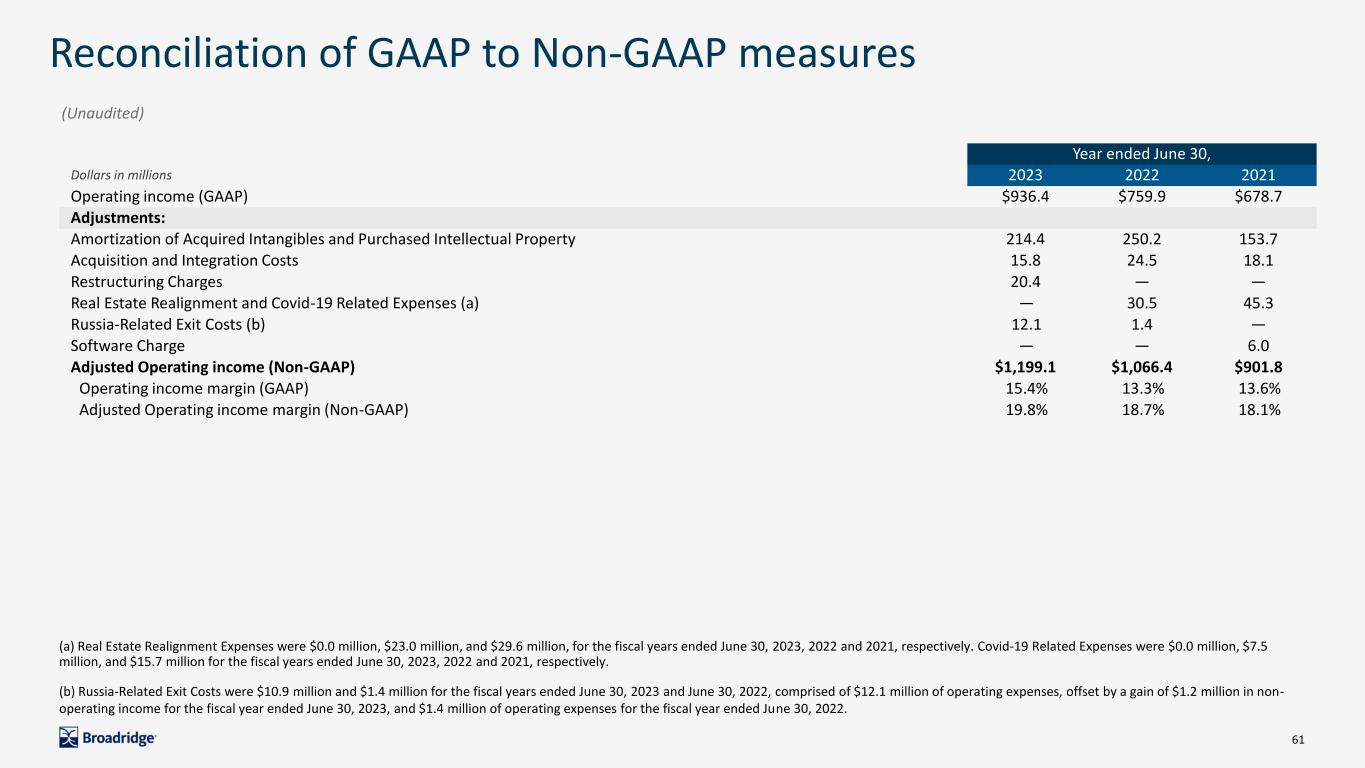

61 Reconciliation of GAAP to Non-GAAP measures (Unaudited) (a) Real Estate Realignment Expenses were $0.0 million, $23.0 million, and $29.6 million, for the fiscal years ended June 30, 2023, 2022 and 2021, respectively. Covid-19 Related Expenses were $0.0 million, $7.5 million, and $15.7 million for the fiscal years ended June 30, 2023, 2022 and 2021, respectively. (b) Russia-Related Exit Costs were $10.9 million and $1.4 million for the fiscal years ended June 30, 2023 and June 30, 2022, comprised of $12.1 million of operating expenses, offset by a gain of $1.2 million in non- operating income for the fiscal year ended June 30, 2023, and $1.4 million of operating expenses for the fiscal year ended June 30, 2022. Year ended June 30, Dollars in millions 2023 2022 2021 Operating income (GAAP) $936.4 $759.9 $678.7 Adjustments: Amortization of Acquired Intangibles and Purchased Intellectual Property 214.4 250.2 153.7 Acquisition and Integration Costs 15.8 24.5 18.1 Restructuring Charges 20.4 — — Real Estate Realignment and Covid-19 Related Expenses (a) — 30.5 45.3 Russia-Related Exit Costs (b) 12.1 1.4 — Software Charge — — 6.0 Adjusted Operating income (Non-GAAP) $1,199.1 $1,066.4 $901.8 Operating income margin (GAAP) 15.4% 13.3% 13.6% Adjusted Operating income margin (Non-GAAP) 19.8% 18.7% 18.1%

Contact Investor Relations broadridgeir@broadridge.com