UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21989 | |||||||

| ||||||||

AllianzGI Equity & Convertible Income Fund | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

1633 Broadway, New York, New York |

| 10019 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Scott Whisten — 1633 Broadway, New York, New York 10019 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 212-739-3367 |

| ||||||

| ||||||||

Date of fiscal year end: | January 31 |

| ||||||

| ||||||||

Date of reporting period: | July 31, 2019 |

| ||||||

ITEM 1. REPORT TO SHAREHOLDERS

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (us.allianzgi.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at us.allianzgi.com/edelivery.

If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform a Fund at any time. If you invest through a financial intermediary, you should contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with a Fund or all funds held in your account if you invest through your financial intermediary.

Table of Contents

2–3 |

| Letter from the President |

4–8 |

| Fund Insights |

9–11 |

| Performance & Statistics |

12–50 |

| Schedules of Investments |

51 |

| Statements of Assets and Liabilities |

52 |

| Statements of Operations |

53–54 |

| Statements of Changes in Net Assets |

55 |

| Statement of Cash Flows |

56–58 |

| Financial Highlights |

59–74 |

| Notes to Financial Statements |

75 |

| Annual Shareholder Meeting Results |

76 |

| Proxy Voting Policies & Procedures |

77–84 |

| Matters Relating to the Trustees’ Consideration of the Investment Management Agreements |

85–88 |

| Privacy Policy |

July 31, 2019 | Semi-Annual Report 1

Letter from the President

Dear Shareholder:

The US economic expansion continued during the six-month fiscal reporting period ended July 31, 2019, although the pace moderated. Meanwhile, economic growth overseas also weakened. Over this period, global equities generated solid results. Elsewhere, the overall US bond market moved higher during the period.

For the six-month reporting period ended July 31, 2019 ¡ AllianzGI Diversified Income & Convertible Fund returned 12.72% on net asset value (“NAV”) and returned 15.15% on market price.

¡ AllianzGI Equity & Convertible Income Fund returned 9.20% on NAV and returned 12.35% on market price.

¡ AllianzGI NFJ Dividend, Interest & Premium Strategy Fund returned 7.00% on NAV and returned 9.29% on market price. |

|

Thomas J. Fuccillo President & Chief |

During the six-month period ended July 31, 2019, the Russell 3000 Index, a broad measure of US stock market performance, returned 10.95%; the Russell 1000 Value Index, a measure of large-cap value-style stocks, returned 8.74%; and the Russell 1000 Growth Index, a measure of growth style stocks, gained 13.99%. Convertible securities, as reflected by the ICE BofA Merrill Lynch All Convertibles All Qualities Index, gained 8.88%.

Turning to the US economy, gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 1.1% annual pace during the fourth quarter of 2018. The US economy then grew at a 3.1% annual pace during the first quarter of 2019. Finally, the Commerce Department’s revised reading showed that the economy expanded at a 2.0% annual pace in the second quarter of the year.

Looking back, the US Federal Reserve (the “Fed”) raised rates four times in 2018, with the last hike pushing the federal funds rate to a range between 2.25% and 2.50%. However, at its January 2019 meeting, the Fed indicated that it expected to pause from tightening monetary policy as it monitored incoming economic data. Then, at its June 2019 meeting, the Federal Open Market Committee (the “Committee”) communicated that it “continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes, but uncertainties about this outlook have increased.” In his press conference after the meeting, Fed Chair Jerome Powell stated, “The case for somewhat more accommodative policy has strengthened.” Finally, at its meeting that concluded on July 31, 2019, the Fed lowered the federal funds rate to a range between 2.00% and 2.25%. This was the Fed’s first rate cut since 2008.

2 Semi-Annual Report | July 31, 2019

Outlook In our opinion, the global economy looks increasingly fragmented, and our outlook calls for more unease over trade tensions and politics. |

|

Receive this report electronically and eliminate paper mailings.

To enroll, visit: us.allianzgi.com/edelivery. |

The outcome of US-China trade negotiations seems uncertain and we currently see only slightly better-than-even odds of the two countries signing a much-needed agreement. Without a deal, US tariffs could expand into consumer-oriented areas, increasing the prices of imported goods. The Fed will watch inflation closely, especially if more trade tariffs are implemented. In our opinion, the Fed may be less inclined to keep rates low if inflation moves higher, which could undermine support for high stock prices. Still, while the US economy remains late-cycle, we believe it is not yet facing a recession.

The second half of 2019 will be important for the European Union as it appoints new members to its leadership team. Support for mainstream pro-European parties held up in recent European Parliamentary elections, but the legislative body will likely end up more fragmented and decision-making could slow. Meanwhile, in the UK, economic and corporate uncertainty is being prolonged by the extension of the Brexit deadline until October 31, 2019. The election of a new Prime Minister raises additional questions about the future path of Brexit and policymaking overall.

With political uncertainty high, investors might consider pivoting towards income-generating investments – but with low to negative yields on many bonds and cash, we believe that the biggest risk is still to take no risk. In our view, it will be important to take an active approach to investing. This approach could involve watching out for high-priced assets and taking contrarian positions when attractive valuations can be found.

On behalf of Allianz Global Investors U.S. LLC, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com/closedendfunds, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

Thomas J. Fuccillo

President & Chief Executive Officer

July 31, 2019 | Semi-Annual Report 3

Fund Insights

AllianzGI Diversified Income & Convertible Fund/AllianzGI Equity & Convertible Income Fund/AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

July 31, 2019 (unaudited)

AllianzGI Diversified Income & Convertible Fund

For the period of February 1, 2019 through July 31, 2019, as provided by Douglas G. Forsyth, CFA, Portfolio Manager.

For the six-month period ended July 31, 2019, the AllianzGI Diversified Income & Convertible Fund (the “Fund”) returned 12.72% on net asset value (“NAV”) and 15.15% on market price.

During the reporting period, the Russell 1000 Growth Index, a measure of growth style stocks, returned 13.99%; convertible securities, as reflected by the ICE BofA Merrill Lynch All Convertibles All Qualities Index, returned 8.88%; and high yield bonds, as reflected by the ICE BofA Merrill Lynch High Yield Master II Index, returned 5.86%.

Market Overview

The equity, convertible and high-yield bond markets produced positive returns over the reporting period. Stocks recorded fresh all-time highs and led risk assets. Convertible bonds were positively impacted by underlying equity strength. The high-yield bond market was supported by a strong technical backdrop, continuing to benefit from steady demand as yield-seeking investors faced fewer options with negative-yielding debt globally continuing to grow.

Globally, central banks announced stimulus measures or suggested future accommodation. The US Federal Reserve (the “Fed”) cut interest rates and ended quantitative tightening, citing global developments and muted inflation pressures. Coordinated easing efforts and dovish outlooks pressured global yields.

The first-quarter earnings season was the first period without the tax reform tailwind. Although high yield financials revealed lower year-over-year comparisons for revenue and earnings before interest, taxes, depreciation, and amortization growth, most issuers reported better-than-expected results. Most convertible bond issuers exceeded first-quarter expectations and reported higher year-over-year comparisons for revenue and earnings growth. Correspondingly, three-quarters of the S&P 500 Index’s constituents surpassed first-quarter earnings estimates.

Economic reports indicated that the growth rate of activity was moderate. While the labor market remained strong and consumer spending picked up, business investment was soft and overall inflation was muted.

Trade tensions persisted throughout the period. The US raised tariffs on Chinese imports and China retaliated with tariffs on US imports. Planned tariffs on Mexico were cancelled, and at the G20 summit, the US and

4 Semi-Annual Report | July 31, 2019

Fund Insights

AllianzGI Diversified Income & Convertible Fund/AllianzGI Equity & Convertible Income Fund/AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

July 31, 2019 (unaudited) (continued)

China temporarily agreed to pause tariff hikes and restart bilateral trade negotiations.

Against this back drop, equity volatility spiked in May 2019 on escalating tensions and then again in late July 2019 heading into the Federal Open Market Committee meeting.

Portfolio Specifics

The Fund benefited from exposure to equities, convertibles and high-yield bonds. In addition to providing a positive total return and relative outperformance compared to the S&P 500 Index, the Fund also delivered a high level of income over the reporting period.

In the equity sleeve of the Fund’s portfolio, exposure to information technology, consumer discretionary and communication services helped performance. Conversely, the health care, energy and materials sectors hindered performance.

In the convertible sleeve of the Fund’s portfolio, sectors that contributed positively to performance included technology, health care and financials. On the other hand, consumer staples and energy sectors pressured performance.

In the high yield sleeve of the Fund’s portfolio, industries that aided performance included health care, retail and gaming. Only the telecommunications industry detracted from performance.

For the Fund’s covered call strategy, many option positions expired below strike and the Fund was able to retain the set premiums.

Outlook

In our opinion, synchronized central bank easing and progress on trade could help to support economic and earnings growth in the future.

AllianzGI Equity & Convertible Income Fund

For the period of February 1, 2019 through July 31, 2019, as provided by Douglas G. Forsyth, CFA, Portfolio Manager.

For the six-month period ended July 31, 2019, the AllianzGI Equity & Convertible Income Fund (the “Fund”) returned 9.20% on net asset value (“NAV”) and 12.35% on market price.

Market Overview

The equity and convertible markets produced positive returns over the reporting period. Stocks recorded fresh all-time highs and led risk assets. Convertible bonds were positively impacted by underlying equity strength.

Globally, central banks announced stimulus measures or suggested future accommodation. The US Federal Reserve (the “Fed”) cut interest rates and ended quantitative tightening, citing global developments and muted inflation pressures.

July 31, 2019 | Semi-Annual Report 5

Fund Insights

AllianzGI Diversified Income & Convertible Fund/AllianzGI Equity & Convertible Income Fund/AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

July 31, 2019 (unaudited) (continued)

Coordinated easing efforts and dovish outlooks pressured global yields.

The first-quarter earnings season was the first period without the tax reform tailwind. Most convertible bond issuers exceeded first-quarter expectations and reported higher year-over-year comparisons for revenue and earnings growth. Correspondingly, three-quarters of the S&P 500 Index’s constituents surpassed first-quarter earnings estimates.

Economic reports indicated that the growth rate of activity was moderate. While the labor market remained strong and consumer spending picked up, business investment was soft and overall inflation was muted.

Trade tensions persisted throughout the period. The US raised tariffs on Chinese imports and China retaliated with tariffs on US imports. Planned tariffs on Mexico were cancelled, and at the G20 summit, the US and China temporarily agreed to pause tariff hikes and restart bilateral trade negotiations.

Against this back drop, equity volatility spiked in May on escalating tensions and then again in late July heading into the Federal Open Market Committee meeting.

Portfolio Specifics

The Fund benefited from exposure to both convertible bonds and equities. In addition to providing a positive total return and relative outperformance compared to the S&P 500

Index, the Fund also delivered a high level of income over the reporting period.

In the equity sleeve of the Fund’s portfolio, exposure to information technology, consumer discretionary and communication services helped performance. Conversely, the health care, energy and materials sectors hindered performance.

In the convertible sleeve of the Fund’s portfolio, sectors that contributed positively to performance included technology, health care and financials. On the other hand, consumer staples, energy and transportation pressured performance.

For the Fund’s covered call strategy, many option positions expired below strike and the Fund was able to retain the set premiums.

Outlook

In our opinion, synchronized central bank easing and progress on trade could help to support economic and earnings growth in the future.

AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

For the period of February 1, 2019 through July 31, 2019, as provided by the Value Equity, US team.

For the six-month period ended July 31, 2019, the AllianzGI NFJ Dividend, Interest & Premium

6 Semi-Annual Report | July 31, 2019

Fund Insights

AllianzGI Diversified Income & Convertible Fund/AllianzGI Equity & Convertible Income Fund/AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

July 31, 2019 (unaudited) (continued)

Strategy Fund (the “Fund”) returned 7.00% on net asset value (“NAV”) and 9.29% on market price.

During the reporting period, the Russell 1000 Value Index, a measure of large-cap value style stocks, returned 8.74%; convertible securities, as reflected by the ICE BofA Merrill Lynch All Convertibles All Qualities Index, returned 8.88%.

Market Overview

The equity and convertible markets produced positive returns over the reporting period. Stocks recorded fresh all-time highs and convertible bonds were positively impacted by underlying equity strength.

Globally, central banks announced stimulus measures or suggested future accommodation. The US Federal Reserve (the “Fed”) cut interest rates and ended quantitative tightening, citing global developments and muted inflation pressures. Coordinated easing efforts and dovish outlooks pressured global yields.

The first-quarter earnings season was the first period without the tax reform tailwind, and three-quarters of the S&P 500 Index’s constituents surpassed first-quarter earnings estimates. Most convertible bond issuers exceeded first-quarter expectations and reported higher year-over-year comparisons for revenue and earnings growth.

The US economy expanded by 2.0% on an annualized basis in the second quarter, with growth driven by consumer spending. While this was slower than the 3.1% rate of expansion recorded in the first quarter, it reinforced the picture of moderating growth, rather than a notable slowdown. The labor market remained strong and consumer spending picked up, while business investment was soft and overall inflation was muted.

Trade tensions persisted throughout the period. The US raised tariffs on Chinese imports and China retaliated with tariffs on US imports. Planned tariffs on Mexico were cancelled, and at the G20 summit, the US and China temporarily agreed to pause tariff hikes and restart bilateral trade negotiations.

Against this back drop, equity volatility spiked in May 2019 on escalating tensions and then again in late July 2019 heading into the Federal Open Market Committee (“FOMC”) meeting, when the Fed cut interest rates by 25 basis points, marking the first such reduction since 2008.

Portfolio Specifics

In the equities sleeve of the Fund’s portfolio, selection across the information technology and utilities sectors detracted while holdings in the industrials and communications services sectors contributed to performance. From an allocation perspective, an overweight in energy hurt relative results while an

July 31, 2019 | Semi-Annual Report 7

Fund Insights

AllianzGI Diversified Income & Convertible Fund/AllianzGI Equity & Convertible Income Fund/AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

July 31, 2019 (unaudited) (continued)

overweight in information technology benefited returns.

In the convertible sleeve of the Fund’s portfolio, sectors that contributed positively to performance included technology, financials and media. On the other hand, energy, consumer staples and transportation pressured performance.

In the covered call sleeve of the Fund’s portfolio, many option positions expired below strike and the Fund was able to retain the set premiums.

Outlook

In our opinion, synchronized central bank easing and progress on trade could help to support economic and earnings growth in the future.

8 Semi-Annual Report | July 31, 2019

Performance & Statistics

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited)

Total Return(1) |

| Market Price |

| NAV |

Six Months |

| 15.15% |

| 12.72% |

1 Year |

| 6.46% |

| 10.70% |

Commencement of Operations (5/27/15) to 7/31/19 |

| 8.34% |

| 9.26% |

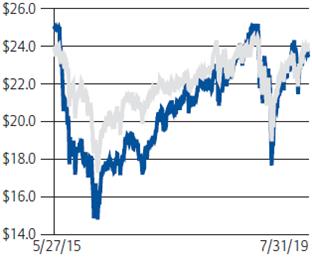

Market Price/NAV Performance |

| Market Price/NAV |

|

|

Commencement of Operations (5/27/15) to 7/31/19 |

| Market Price |

| $23.47 |

|

| NAV(2) |

| $23.79 |

|

| Discount to NAV |

| -1.35% |

|

| Market Price Yield(3) |

| 8.54% |

|

| Leverage Ratio(4) |

| 29.94% |

|

|

|

| |

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares and includes the effect of any expense reductions, if any. Total return for a period of more than one year represents the average annual total return. Total return for a period of less than one year is not annualized.

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends.

An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) The NAV disclosed in the Fund’s financial statements may differ due to accounting principles generally accepted in the United States of America.

(3) Market Price Yield is determined by dividing the annualized current (declared August 1, 2019) monthly dividend per common share (comprised of net investment income and net capital gains, if any) by the market price per common share at July 31, 2019.

(4) Represents Mandatory Redeemable Preferred Shares, Senior Secured Notes and amounts drawn under the short-term margin loan facility (“Leverage”) outstanding, as a percentage of total managed assets as of July 31, 2019. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

July 31, 2019 | Semi-Annual Report 9

Performance & Statistics

AllianzGI Equity & Convertible Income Fund

July 31, 2019 (unaudited)

Total Return(1) |

| Market Price |

| NAV |

Six Months |

| 12.35% |

| 9.20% |

1 Year |

| 3.60% |

| 5.68% |

5 Year |

| 10.39% |

| 7.94% |

10 Year |

| 11.77% |

| 10.75% |

Commencement of Operations (2/27/07) to 7/31/19 |

| 7.02% |

| 7.23% |

Market Price/NAV Performance |

| Market Price/NAV |

|

|

Commencement of Operations (2/27/07) to 7/31/19 |

| Market Price |

| $22.26 |

|

| NAV(2) |

| $23.80 |

|

| Discount to NAV |

| -6.47% |

|

| Market Price Yield(3) |

| 6.83% |

|

|

|

|

|

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares and includes the effect of any expense reductions, if any. Total return for a period of more than one year represents the average annual total return. Total return for a period of less than one year is not annualized.

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends.

An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily.

(2) The NAV disclosed in the Fund’s financial statements may differ due to accounting principles generally accepted in the United States of America.

(3) Market Price Yield is determined by dividing the annualized current quarterly dividend per share (comprised of net investment income and net capital gains, if any) by the market price per share at July 31, 2019.

10 Semi-Annual Report | July 31, 2019

Performance & Statistics

AllianzGI NFJ Dividend, Interest & Premium Strategy Fund

July 31, 2019 (unaudited)

Total Return(1) |

| Market Price |

| NAV |

Six Months |

| 9.29% |

| 7.00% |

1 Year |

| 4.92% |

| 1.68% |

5 Year |

| 1.44% |

| 2.60% |

10 Year |

| 9.23% |

| 7.35% |

Commencement of Operations (2/28/05) to 7/31/19 |

| 4.12% |

| 4.62% |

Market Price/NAV Performance |

| Market Price/NAV |

|

|

Commencement of Operations (2/28/05) to 7/31/19 |

| Market Price |

| $12.54 |

|

| NAV(2) |

| $14.00 |

|

| Discount to NAV |

| -10.43% |

|

| Market Price Yield(3) |

| 5.20% |

|

|

|

|

|

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares and includes the effect of any expense reductions, if any. Total return for a period of more than one year represents the average annual total return. Total return for a period of less than one year is not annualized.

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends.

An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the number of shares outstanding. Holdings are subject to change daily.

(2) The NAV disclosed in the Fund’s financial statements may differ due to accounting principles generally accepted in the United States of America.

(3) Market Price Yield is determined by dividing the annualized current quarterly dividend per share (comprised of net investment income and net capital gains, if any) by the market price per share at July 31, 2019.

July 31, 2019 | Semi-Annual Report 11

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

Convertible Bonds & Notes – 66.0% |

|

|

| ||

|

| Aerospace & Defense – 0.8% |

|

|

|

$755 |

| Aerojet Rocketdyne Holdings, Inc., 2.25%, 12/15/23 (g) |

| $1,301,362 |

|

695 |

| Arconic, Inc., 1.625%, 10/15/19 |

| 698,854 |

|

|

|

|

| 2,000,216 |

|

|

| Apparel & Textiles – 0.1% |

|

|

|

595 |

| Iconix Brand Group, Inc., 5.75%, 8/15/23 (g) |

| 188,913 |

|

|

| Auto Components – 0.6% |

|

|

|

1,320 |

| Meritor, Inc., 3.25%, 10/15/37 |

| 1,406,358 |

|

|

| Auto Manufacturers – 0.8% |

|

|

|

2,000 |

| Tesla, Inc., 2.375%, 3/15/22 (g) |

| 2,034,824 |

|

|

| Biotechnology – 4.4% |

|

|

|

1,635 |

| BioMarin Pharmaceutical, Inc., 0.599%, 8/1/24 (g) |

| 1,666,282 |

|

1,710 |

| Exact Sciences Corp., 0.375%, 3/15/27 (g) |

| 2,114,085 |

|

|

| Illumina, Inc., |

|

|

|

1,170 |

| zero coupon, 8/15/23 (a)(b)(g) |

| 1,265,894 |

|

340 |

| 0.50%, 6/15/21 |

| 453,368 |

|

1,115 |

| Insmed, Inc., 1.75%, 1/15/25 (g) |

| 1,015,757 |

|

690 |

| Ionis Pharmaceuticals, Inc., 1.00%, 11/15/21 |

| 831,927 |

|

|

| Medicines Co., |

|

|

|

1,300 |

| 2.75%, 7/15/23 (g) |

| 1,295,217 |

|

450 |

| 3.50%, 1/15/24 (a)(b) |

| 730,687 |

|

1,245 |

| PTC Therapeutics, Inc., 3.00%, 8/15/22 (g) |

| 1,417,848 |

|

|

|

|

| 10,791,065 |

|

|

| Commercial Services – 3.3% |

|

|

|

2,530 |

| Chegg, Inc., 0.125%, 3/15/25 (a)(b)(g) |

| 2,819,769 |

|

1,580 |

| Euronet Worldwide, Inc., 0.75%, 3/15/49 (a)(b)(g) |

| 1,865,072 |

|

1,330 |

| FTI Consulting, Inc., 2.00%, 8/15/23 (a)(b)(g) |

| 1,609,884 |

|

1,390 |

| Square, Inc., 0.50%, 5/15/23 |

| 1,773,547 |

|

|

|

|

| 8,068,272 |

|

|

| Computers – 0.9% |

|

|

|

810 |

| Lumentum Holdings, Inc., 0.25%, 3/15/24 (g) |

| 973,960 |

|

695 |

| Rapid7, Inc., 1.25%, 8/1/23 (a)(b)(g) |

| 1,106,210 |

|

|

|

|

| 2,080,170 |

|

|

| Diversified Financial Services – 1.2% |

|

|

|

650 |

| LendingTree, Inc., 0.625%, 6/1/22 (g) |

| 1,073,719 |

|

675 |

| PRA Group, Inc., 3.00%, 8/1/20 (g) |

| 668,140 |

|

980 |

| Qudian, Inc., 1.00%, 7/1/26 (a)(b) |

| 1,128,256 |

|

|

|

|

| 2,870,115 |

|

|

| Electric Utilities – 0.4% |

|

|

|

845 |

| NRG Energy, Inc., 2.75%, 6/1/48 |

| 894,030 |

|

|

| Electronic Equipment, Instruments & Components – 0.8% |

|

|

|

|

| SunPower Corp. (g), |

|

|

|

1,115 |

| 0.875%, 6/1/21 |

| 1,030,785 |

|

1,035 |

| 4.00%, 1/15/23 |

| 928,965 |

|

|

|

|

| 1,959,750 |

|

12 Semi-Annual Report | July 31, 2019

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Electronics – 1.1% |

|

|

|

$1,600 |

| Fortive Corp., 0.875%, 2/15/22 (a)(b)(g) |

| $1,648,075 |

|

940 |

| OSI Systems, Inc., 1.25%, 9/1/22 (g) |

| 1,124,812 |

|

|

|

|

| 2,772,887 |

|

|

| Energy-Alternate Sources – 0.5% |

|

|

|

790 |

| Enphase Energy, Inc., 1.00%, 6/1/24 (a)(b)(g) |

| 1,236,414 |

|

3,615 |

| SunEdison, Inc., 3.375%, 6/1/25 (a)(b)(c) |

| 81,337 |

|

|

|

|

| 1,317,751 |

|

|

| Engineering & Construction – 0.9% |

|

|

|

1,830 |

| KBR, Inc., 2.50%, 11/1/23 (a)(b) |

| 2,221,002 |

|

|

| Entertainment – 0.7% |

|

|

|

1,425 |

| Live Nation Entertainment, Inc., 2.50%, 3/15/23 |

| 1,772,274 |

|

|

| Equity Real Estate Investment Trusts (REITs) – 1.5% |

|

|

|

1,880 |

| Blackstone Mortgage Trust, Inc., 4.375%, 5/5/22 (g) |

| 1,960,036 |

|

790 |

| Extra Space Storage L.P., 3.125%, 10/1/35 (a)(b)(g) |

| 984,070 |

|

460 |

| IIP Operating Partnership L.P., 3.75%, 2/21/24 (a)(b) |

| 743,196 |

|

|

|

|

| 3,687,302 |

|

|

| Healthcare-Products – 2.8% |

|

|

|

1,330 |

| CONMED Corp., 2.625%, 2/1/24 (a)(b)(g) |

| 1,560,896 |

|

1,610 |

| Insulet Corp., 1.375%, 11/15/24 (g) |

| 2,340,675 |

|

1,420 |

| Repligen Corp., 0.375%, 7/15/24 |

| 1,533,281 |

|

1,314 |

| Wright Medical Group, Inc., 1.625%, 6/15/23 |

| 1,429,382 |

|

|

|

|

| 6,864,234 |

|

|

| Healthcare-Services – 1.4% |

|

|

|

435 |

| Anthem, Inc., 2.75%, 10/15/42 (g) |

| 1,780,166 |

|

1,015 |

| Teladoc Health, Inc., 1.375%, 5/15/25 |

| 1,527,596 |

|

|

|

|

| 3,307,762 |

|

|

| Internet – 10.3% |

|

|

|

1,015 |

| Boingo Wireless, Inc., 1.00%, 10/1/23 (a)(b)(g) |

| 873,675 |

|

|

| Booking Holdings, Inc. (g), |

|

|

|

1,025 |

| 0.35%, 6/15/20 |

| 1,482,808 |

|

1,325 |

| 0.90%, 9/15/21 |

| 1,528,835 |

|

1,560 |

| Ctrip.com International Ltd., 1.99%, 7/1/25 (g) |

| 1,730,066 |

|

655 |

| Etsy, Inc., zero coupon, 3/1/23 (g) |

| 1,276,718 |

|

2,420 |

| IAC Financeco 2, Inc., 0.875%, 6/15/26 (a)(b)(g) |

| 2,544,458 |

|

625 |

| MercadoLibre, Inc., 2.00%, 8/15/28 (a)(b) |

| 995,759 |

|

555 |

| Okta, Inc., 0.25%, 2/15/23 |

| 1,520,855 |

|

1,935 |

| Palo Alto Networks, Inc., 0.75%, 7/1/23 (a)(b)(g) |

| 2,135,224 |

|

1,530 |

| Q2 Holdings, Inc., 0.75%, 6/1/26 (a)(b) |

| 1,696,845 |

|

935 |

| RingCentral, Inc., zero coupon, 3/15/23 (g) |

| 1,665,127 |

|

2,395 |

| Twitter, Inc., 0.25%, 6/15/24 |

| 2,553,319 |

|

805 |

| Wayfair, Inc., 1.125%, 11/1/24 (a)(b)(g) |

| 1,099,386 |

|

1,185 |

| Wix.com Ltd., zero coupon, 7/1/23 |

| 1,503,207 |

|

780 |

| Zendesk, Inc., 0.25%, 3/15/23 (g) |

| 1,146,054 |

|

1,290 |

| Zillow Group, Inc., 2.00%, 12/1/21 (g) |

| 1,510,773 |

|

|

|

|

| 25,263,109 |

|

July 31, 2019 | Semi-Annual Report 13

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Iron/Steel – 0.5% |

|

|

|

$890 |

| Cleveland-Cliffs, Inc., 1.50%, 1/15/25 |

| $1,281,636 |

|

|

| Lodging – 0.6% |

|

|

|

850 |

| Caesars Entertainment Corp., 5.00%, 10/1/24 |

| 1,466,781 |

|

|

| Machinery-Diversified – 0.6% |

|

|

|

1,100 |

| Chart Industries, Inc., 1.00%, 11/15/24 (a)(b)(g) |

| 1,552,938 |

|

|

| Media – 4.1% |

|

|

|

|

| DISH Network Corp. (g), |

|

|

|

1,330 |

| 2.375%, 3/15/24 |

| 1,187,424 |

|

2,760 |

| 3.375%, 8/15/26 |

| 2,535,993 |

|

|

| Liberty Media Corp., |

|

|

|

1,335 |

| 1.00%, 1/30/23 (g) |

| 1,613,522 |

|

855 |

| 1.375%, 10/15/23 |

| 1,024,464 |

|

1,705 |

| 2.125%, 3/31/48 (a)(b)(g) |

| 1,751,801 |

|

735 |

| 2.25%, 12/1/48 (a)(b)(g) |

| 886,858 |

|

390 |

| World Wrestling Entertainment, Inc., 3.375%, 12/15/23 (g) |

| 1,170,599 |

|

|

|

|

| 10,170,661 |

|

|

| Mining – 0.6% |

|

|

|

1,340 |

| SSR Mining, Inc., 2.50%, 4/1/39 (a)(b) |

| 1,536,813 |

|

|

| Oil, Gas & Consumable Fuels – 2.3% |

|

|

|

1,310 |

| Chesapeake Energy Corp., 5.50%, 9/15/26 (g) |

| 937,670 |

|

1,065 |

| Ensco Jersey Finance Ltd., 3.00%, 1/31/24 (g) |

| 801,412 |

|

820 |

| Helix Energy Solutions Group, Inc., 4.125%, 9/15/23 |

| 1,011,755 |

|

2,620 |

| Nabors Industries, Inc., 0.75%, 1/15/24 (g) |

| 1,851,297 |

|

1,160 |

| Transocean, Inc., 0.50%, 1/30/23 (g) |

| 1,123,992 |

|

|

|

|

| 5,726,126 |

|

|

| Pharmaceuticals – 3.2% |

|

|

|

1,725 |

| DexCom, Inc., 0.75%, 12/1/23 (a)(b)(g) |

| 2,075,391 |

|

1,455 |

| Horizon Pharma Investment Ltd., 2.50%, 3/15/22 (g) |

| 1,638,746 |

|

620 |

| Neurocrine Biosciences, Inc., 2.25%, 5/15/24 |

| 893,782 |

|

1,055 |

| Sarepta Therapeutics, Inc., 1.50%, 11/15/24 (g) |

| 2,303,867 |

|

960 |

| Teva Pharmaceutical Finance Co. LLC, 0.25%, 2/1/26, Ser. C (g) |

| 884,996 |

|

|

|

|

| 7,796,782 |

|

|

| Pipelines – 0.9% |

|

|

|

2,820 |

| Cheniere Energy, Inc., 4.25%, 3/15/45 (g) |

| 2,234,850 |

|

|

| Semiconductors – 7.4% |

|

|

|

520 |

| Advanced Micro Devices, Inc., 2.125%, 9/1/26 (g) |

| 2,021,800 |

|

1,680 |

| Cree, Inc., 0.875%, 9/1/23 (a)(b)(g) |

| 2,073,571 |

|

|

| Inphi Corp. (g), |

|

|

|

870 |

| 0.75%, 9/1/21 |

| 1,081,936 |

|

480 |

| 1.125%, 12/1/20 |

| 744,398 |

|

225 |

| Intel Corp., 3.25%, 8/1/39 (g) |

| 558,616 |

|

3,355 |

| Microchip Technology, Inc., 1.625%, 2/15/27 (g) |

| 4,283,664 |

|

300 |

| Micron Technology, Inc., 3.125%, 5/1/32, Ser. D |

| 1,354,601 |

|

170 |

| Novellus Systems, Inc., 2.625%, 5/15/41 |

| 1,095,270 |

|

14 Semi-Annual Report | July 31, 2019

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Semiconductors (continued) |

|

|

|

$1,040 |

| NXP Semiconductors NV, 1.00%, 12/1/19 |

| $1,112,238 |

|

1,320 |

| ON Semiconductor Corp., 1.625%, 10/15/23 |

| 1,678,779 |

|

930 |

| Silicon Laboratories, Inc., 1.375%, 3/1/22 (g) |

| 1,233,262 |

|

515 |

| Teradyne, Inc., 1.25%, 12/15/23 (g) |

| 944,860 |

|

|

|

|

| 18,182,995 |

|

|

| Software – 10.0% |

|

|

|

2,375 |

| Akamai Technologies, Inc., 0.125%, 5/1/25 (g) |

| 2,681,864 |

|

445 |

| Alteryx, Inc., 0.50%, 6/1/23 (g) |

| 1,198,532 |

|

1,205 |

| Atlassian, Inc., 0.625%, 5/1/23 (g) |

| 2,174,794 |

|

1,950 |

| Coupa Software, Inc., 0.125%, 6/15/25 (a)(b)(g) |

| 2,193,452 |

|

1,320 |

| Envestnet, Inc., 1.75%, 6/1/23 (g) |

| 1,621,667 |

|

880 |

| Five9, Inc., 0.125%, 5/1/23 (g) |

| 1,201,070 |

|

1,000 |

| j2 Global, Inc., 3.25%, 6/15/29 |

| 1,402,963 |

|

1,720 |

| LivePerson, Inc., 0.75%, 3/1/24 (a)(b) |

| 1,930,820 |

|

495 |

| MongoDB, Inc., 0.75%, 6/15/24 |

| 1,075,424 |

|

1,710 |

| Pluralsight, Inc., 0.375%, 3/1/24 (a)(b) |

| 1,863,014 |

|

805 |

| ServiceNow, Inc., zero coupon, 6/1/22 (g) |

| 1,677,516 |

|

1,800 |

| Splunk, Inc., 1.125%, 9/15/25 (a)(b)(g) |

| 2,087,625 |

|

715 |

| Twilio, Inc., 0.25%, 6/1/23 |

| 1,462,305 |

|

1,350 |

| Workday, Inc., 0.25%, 10/1/22 (g) |

| 1,981,181 |

|

|

|

|

| 24,552,227 |

|

|

| Telecommunications – 2.4% |

|

|

|

1,725 |

| GCI Liberty, Inc., 1.75%, 9/30/46 (a)(b)(g) |

| 2,021,846 |

|

1,680 |

| Viavi Solutions, Inc., 1.00%, 3/1/24 (g) |

| 2,109,569 |

|

1,715 |

| Vonage Holdings Corp., 1.75%, 6/1/24 (a)(b) |

| 1,829,459 |

|

|

|

|

| 5,960,874 |

|

|

| Transportation – 0.9% |

|

|

|

2,305 |

| Air Transport Services Group, Inc., 1.125%, 10/15/24 (g) |

| 2,301,686 |

|

Total Convertible Bonds & Notes (cost-$155,140,206) |

| 162,264,403 |

| ||

|

|

|

|

|

|

Shares |

|

|

|

|

|

Common Stock – 33.3% |

|

|

| ||

|

| Aerospace & Defense – 0.7% |

|

|

|

3,400 |

| Boeing Co. (g) |

| 1,160,012 |

|

2,600 |

| Raytheon Co. (g) |

| 473,954 |

|

|

|

|

| 1,633,966 |

|

|

| Automobiles – 0.3% |

|

|

|

72,600 |

| Ford Motor Co. (g) |

| 691,878 |

|

|

| Banks – 1.1% |

|

|

|

42,300 |

| Bank of America Corp. (g) |

| 1,297,764 |

|

4,911 |

| CCF Holdings LLC, Class A (cost-$0; purchased 12/18/18) (d)(f)(h)(i) |

| – | † |

5,357 |

| CCF Holdings LLC, Class B (cost-$0; purchased 12/12/18) (d)(f)(h)(i) |

| 1 |

|

12,900 |

| JPMorgan Chase & Co. |

| 1,496,400 |

|

|

|

|

| 2,794,165 |

|

July 31, 2019 | Semi-Annual Report 15

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

| ||||

|

|

|

|

|

| ||||

Shares |

|

|

| Value |

| ||||

|

| Beverages – 0.5% |

|

|

|

| |||

9,000 |

| PepsiCo, Inc. |

| $1,150,290 |

|

| |||

|

| Biotechnology – 1.4% |

|

|

|

| |||

13,200 |

| AbbVie, Inc. |

| 879,384 |

|

| |||

1,900 |

| Biogen, Inc. (i) |

| 451,858 |

|

| |||

15,200 |

| Gilead Sciences, Inc. (g) |

| 995,904 |

|

| |||

7,100 |

| Vertex Pharmaceuticals, Inc. (i) |

| 1,183,002 |

|

| |||

|

|

|

| 3,510,148 |

|

| |||

|

| Building Products – 0.3% |

|

|

|

| |||

17,452 |

| Johnson Controls International PLC |

| 740,663 |

|

| |||

|

| Capital Markets – 0.3% |

|

|

|

| |||

3,300 |

| S&P Global, Inc. |

| 808,335 |

|

| |||

|

| Chemicals – 0.4% |

|

|

|

| |||

16,600 |

| Chemours Co. |

| 316,562 |

|

| |||

3,800 |

| Corteva, Inc. (i) |

| 112,100 |

|

| |||

3,800 |

| DOW, Inc. (i) |

| 184,072 |

|

| |||

3,800 |

| DuPont de Nemours, Inc. |

| 274,208 |

|

| |||

|

|

|

| 886,942 |

|

| |||

|

| Communications Equipment – 0.6% |

|

|

|

| |||

25,100 |

| Cisco Systems, Inc. |

| 1,390,540 |

|

| |||

|

| Construction & Engineering – 0.2% |

|

|

|

| |||

15,300 |

| Fluor Corp. (g) |

| 497,403 |

|

| |||

|

| Diversified Telecommunication Services – 0.0% |

|

|

|

| |||

32,499 |

| Frontier Communications Corp. (i) |

| 42,899 |

|

| |||

|

| Energy Equipment & Services – 0.3% |

|

|

|

| |||

9,200 |

| National Oilwell Varco, Inc. |

| 219,144 |

|

| |||

12,800 |

| Schlumberger Ltd. (g) |

| 511,616 |

|

| |||

|

|

|

| 730,760 |

|

| |||

|

| Entertainment – 1.4% |

|

|

|

| |||

4,600 |

| Netflix, Inc. (g)(i) |

| 1,485,754 |

|

| |||

8,900 |

| Take-Two Interactive Software, Inc. (i) |

| 1,090,428 |

|

| |||

5,900 |

| Walt Disney Co. (g) |

| 843,759 |

|

| |||

|

|

|

| 3,419,941 |

|

| |||

|

| Food & Staples Retailing – 1.4% |

|

|

|

| |||

6,800 |

| Costco Wholesale Corp. |

| 1,874,284 |

|

| |||

32,900 |

| Kroger Co. (g) |

| 696,164 |

|

| |||

16,700 |

| Walgreens Boots Alliance, Inc. (g) |

| 909,983 |

|

| |||

|

|

|

| 3,480,431 |

|

| |||

|

| Healthcare Equipment & Supplies – 1.2% |

|

|

|

| |||

4,000 |

| Align Technology, Inc. (g)(i) |

| 836,320 |

|

| |||

22,500 |

| Boston Scientific Corp. (i) |

| 955,350 |

|

| |||

2,400 |

| Intuitive Surgical, Inc. (g)(i) |

| 1,246,824 |

|

| |||

|

|

|

| 3,038,494 |

|

| |||

16 Semi-Annual Report | July 31, 2019

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

| Value |

|

|

| Healthcare Providers & Services – 1.4% |

|

|

|

3,500 |

| Laboratory Corp. of America Holdings (i) |

| $586,320 |

|

9,300 |

| McKesson Corp. (g) |

| 1,292,235 |

|

6,600 |

| UnitedHealth Group, Inc. |

| 1,643,466 |

|

|

|

|

| 3,522,021 |

|

|

| Hotels, Restaurants & Leisure – 1.2% |

|

|

|

5,900 |

| McDonald’s Corp. (g) |

| 1,243,248 |

|

11,500 |

| Starbucks Corp. (g) |

| 1,088,935 |

|

4,200 |

| Wynn Resorts Ltd. |

| 546,294 |

|

|

|

|

| 2,878,477 |

|

|

| Household Durables – 0.1% |

|

|

|

5,900 |

| DR Horton, Inc. |

| 270,987 |

|

|

| Industrial Conglomerates – 0.8% |

|

|

|

3,500 |

| 3M Co. |

| 611,520 |

|

7,300 |

| Honeywell International, Inc. |

| 1,258,958 |

|

|

|

|

| 1,870,478 |

|

|

| Insurance – 0.3% |

|

|

|

9,900 |

| Progressive Corp. |

| 801,702 |

|

|

| Interactive Media & Services – 2.0% |

|

|

|

2,200 |

| Alphabet, Inc., Class A (g)(i) |

| 2,680,040 |

|

11,800 |

| Facebook, Inc., Class A (g)(i) |

| 2,291,914 |

|

|

|

|

| 4,971,954 |

|

|

| Internet & Direct Marketing Retail – 1.5% |

|

|

|

6,800 |

| Alibaba Group Holding Ltd., ADR (i) |

| 1,177,148 |

|

1,400 |

| Amazon.com, Inc. (g)(i) |

| 2,613,492 |

|

|

|

|

| 3,790,640 |

|

|

| IT Services – 2.8% |

|

|

|

12,000 |

| Fiserv, Inc. (g)(i) |

| 1,265,160 |

|

6,000 |

| International Business Machines Corp. (g) |

| 889,440 |

|

3,600 |

| Mastercard, Inc., Class A (g) |

| 980,172 |

|

10,700 |

| PayPal Holdings, Inc. (g)(i) |

| 1,181,280 |

|

14,200 |

| Visa, Inc., Class A (g) |

| 2,527,600 |

|

|

|

|

| 6,843,652 |

|

|

| Machinery – 1.1% |

|

|

|

13,300 |

| Caterpillar, Inc. |

| 1,751,211 |

|

5,000 |

| Deere & Co. (g) |

| 828,250 |

|

|

|

|

| 2,579,461 |

|

|

| Media – 0.4% |

|

|

|

24,200 |

| Comcast Corp., Class A (g) |

| 1,044,714 |

|

13,574 |

| LiveStyle, Inc. (d)(f)(i)(j) |

| 1 |

|

|

|

|

| 1,044,715 |

|

|

| Multi-Line Retail – 0.3% |

|

|

|

9,000 |

| Target Corp. (g) |

| 777,600 |

|

|

| Oil, Gas & Consumable Fuels – 0.7% |

|

|

|

14,900 |

| Occidental Petroleum Corp. |

| 765,264 |

|

July 31, 2019 | Semi-Annual Report 17

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

| Value |

|

|

| Oil, Gas & Consumable Fuels (continued) |

|

|

|

60,184 |

| Southwestern Energy Co. (i) |

| $132,405 |

|

9,500 |

| Valero Energy Corp. (g) |

| 809,875 |

|

|

|

|

| 1,707,544 |

|

|

| Pharmaceuticals – 1.5% |

|

|

|

10,000 |

| Allergan PLC |

| 1,605,000 |

|

16,200 |

| Bristol-Myers Squibb Co. |

| 719,442 |

|

13,100 |

| Merck & Co., Inc. (g) |

| 1,087,169 | �� |

43,950 |

| Teva Pharmaceutical Industries Ltd., ADR (i) |

| 348,523 |

|

|

|

|

| 3,760,134 |

|

|

| Road & Rail – 0.4% |

|

|

|

4,800 |

| Union Pacific Corp. |

| 863,760 |

|

|

| Semiconductors & Semiconductor Equipment – 2.6% |

|

|

|

4,000 |

| Advanced Micro Devices, Inc. (i) |

| 121,800 |

|

4,100 |

| Broadcom, Inc. |

| 1,188,959 |

|

35,500 |

| Marvell Technology Group Ltd. (g) |

| 932,230 |

|

25,300 |

| Micron Technology, Inc. (i) |

| 1,135,717 |

|

6,400 |

| NVIDIA Corp. |

| 1,079,808 |

|

9,700 |

| QUALCOMM, Inc. (g) |

| 709,652 |

|

9,700 |

| Texas Instruments, Inc. (g) |

| 1,212,597 |

|

|

|

|

| 6,380,763 |

|

|

| Software – 3.7% |

|

|

|

7,200 |

| Adobe, Inc. (g)(i) |

| 2,151,792 |

|

1,100 |

| Atlassian Corp. PLC, Class A (i) |

| 154,132 |

|

3,200 |

| Intuit, Inc. (g) |

| 887,392 |

|

20,200 |

| Microsoft Corp. |

| 2,752,654 |

|

8,000 |

| Salesforce.com, Inc. (g)(i) |

| 1,236,000 |

|

4,700 |

| ServiceNow, Inc. (g)(i) |

| 1,303,733 |

|

3,100 |

| Workday, Inc., Class A (i) |

| 619,938 |

|

|

|

|

| 9,105,641 |

|

|

| Specialty Retail – 0.8% |

|

|

|

9,400 |

| Home Depot, Inc. |

| 2,008,686 |

|

|

| Technology Hardware, Storage & Peripherals – 1.3% |

|

|

|

12,000 |

| Apple, Inc. (g) |

| 2,556,480 |

|

12,700 |

| NetApp, Inc. |

| 742,823 |

|

|

|

|

| 3,299,303 |

|

|

| Textiles, Apparel & Luxury Goods – 0.3% |

|

|

|

7,600 |

| NIKE, Inc., Class B (g) |

| 653,828 |

|

Total Common Stock (cost-$98,436,013) |

| 81,948,201 |

| ||

18 Semi-Annual Report | July 31, 2019

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

Corporate Bonds & Notes – 26.3% |

|

|

| ||

|

| Aerospace & Defense – 0.6% |

|

|

|

$1,000 |

| TransDigm, Inc., 6.50%, 5/15/25 (g) |

| $1,033,750 |

|

350 |

| Triumph Group, Inc., 7.75%, 8/15/25 (g) |

| 351,750 |

|

|

|

|

| 1,385,500 |

|

|

| Auto Components – 0.7% |

|

|

|

360 |

| Adient U.S. LLC, 7.00%, 5/15/26 (a)(b)(g) |

| 365,400 |

|

1,000 |

| Goodyear Tire & Rubber Co., 5.00%, 5/31/26 (g) |

| 1,001,400 |

|

475 |

| Panther BF Aggregator 2 L.P., 8.50%, 5/15/27 (a)(b) |

| 483,906 |

|

|

|

|

| 1,850,706 |

|

|

| Auto Manufacturers – 0.4% |

|

|

|

535 |

| Navistar International Corp., 6.625%, 11/1/25 (a)(b)(g) |

| 553,725 |

|

535 |

| Tesla, Inc., 5.30%, 8/15/25 (a)(b)(g) |

| 469,463 |

|

|

|

|

| 1,023,188 |

|

|

| Building Materials – 0.1% |

|

|

|

161 |

| Builders FirstSource, Inc., 5.625%, 9/1/24 (a)(b) |

| 167,239 |

|

|

| Chemicals – 0.5% |

|

|

|

305 |

| Kraton Polymers LLC, 7.00%, 4/15/25 (a)(b)(g) |

| 311,100 |

|

85 |

| Trinseo Materials Operating SCA, 5.375%, 9/1/25 (a)(b)(g) |

| 80,856 |

|

875 |

| Tronox, Inc., 6.50%, 4/15/26 (a)(b)(g) |

| 841,181 |

|

|

|

|

| 1,233,137 |

|

|

| Commercial Services – 1.9% |

|

|

|

190 |

| Cardtronics, Inc., 5.50%, 5/1/25 (a)(b)(g) |

| 188,813 |

|

350 |

| Cenveo Corp., 6.00%, 5/15/24 (cost-$418,546: purchased 12/14/15) (a)(b)(c)(d)(f)(h) |

| 19,250 |

|

300 |

| Gartner, Inc., 5.125%, 4/1/25 (a)(b)(g) |

| 309,375 |

|

475 |

| Herc Holdings, Inc., 5.50%, 7/15/27 (a)(b) |

| 476,781 |

|

|

| Hertz Corp. (a)(b), |

|

|

|

355 |

| 7.125%, 8/1/26 |

| 363,227 |

|

295 |

| 7.625%, 6/1/22 |

| 306,172 |

|

475 |

| Laureate Education, Inc., 8.25%, 5/1/25 (a)(b)(g) |

| 518,937 |

|

915 |

| RR Donnelley & Sons Co., 6.00%, 4/1/24 (g) |

| 902,419 |

|

|

| United Rentals North America, Inc. (g), |

|

|

|

505 |

| 5.25%, 1/15/30 |

| 517,842 |

|

1,000 |

| 5.50%, 7/15/25 |

| 1,042,500 |

|

|

|

|

| 4,645,316 |

|

|

| Computers – 0.4% |

|

|

|

520 |

| Dell International LLC, 7.125%, 6/15/24 (a)(b)(g) |

| 549,907 |

|

345 |

| Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) |

| 332,925 |

|

|

|

|

| 882,832 |

|

|

| Containers & Packaging – 0.4% |

|

|

|

455 |

| Berry Global, Inc., 5.625%, 7/15/27 (a)(b)(g) |

| 478,888 |

|

450 |

| Trivium Packaging Finance BV, 8.50%, 8/15/27 (a)(b) |

| 474,750 |

|

|

|

|

| 953,638 |

|

July 31, 2019 | Semi-Annual Report 19

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Distribution/Wholesale – 0.2% |

|

|

|

$495 |

| H&E Equipment Services, Inc., 5.625%, 9/1/25 (g) |

| $510,469 |

|

|

| Diversified Financial Services – 1.8% |

|

|

|

1,688 |

| CCF Holdings LLC, PIK 10.75%, 10.75%, 12/15/23 (a)(b)(c)(d)(f) |

| 688,473 |

|

1,500 |

| Community Choice Financial Issuer LLC, 9.00%, 6/15/23 (cost-$1,500,000; purchased 9/6/18) (a)(b)(g)(h) |

| 1,503,750 |

|

495 |

| Navient Corp., 6.75%, 6/15/26 |

| 516,656 |

|

|

| Springleaf Finance Corp. (g), |

|

|

|

460 |

| 6.625%, 1/15/28 |

| 496,800 |

|

1,000 |

| 8.25%, 10/1/23 |

| 1,160,000 |

|

|

|

|

| 4,365,679 |

|

|

| Electric Utilities – 0.3% |

|

|

|

1,000 |

| Talen Energy Supply LLC, 6.50%, 6/1/25 (g) |

| 810,000 |

|

|

| Electrical Equipment – 0.3% |

|

|

|

750 |

| Energizer Holdings, Inc., 7.75%, 1/15/27 (a)(b)(g) |

| 817,500 |

|

|

| Engineering & Construction – 0.4% |

|

|

|

500 |

| AECOM, 5.875%, 10/15/24 (g) |

| 541,875 |

|

435 |

| Tutor Perini Corp., 6.875%, 5/1/25 (a)(b)(g) |

| 427,931 |

|

|

|

|

| 969,806 |

|

|

| Entertainment – 1.1% |

|

|

|

885 |

| AMC Entertainment Holdings, Inc., 6.125%, 5/15/27 (g) |

| 797,053 |

|

250 |

| Cedar Fair L.P., 5.375%, 6/1/24 (g) |

| 258,125 |

|

1,000 |

| Scientific Games International, Inc., 5.00%, 10/15/25 (a)(b)(g) |

| 1,025,000 |

|

515 |

| Stars Group Holdings BV, 7.00%, 7/15/26 (a)(b) |

| 543,969 |

|

|

|

|

| 2,624,147 |

|

|

| Equity Real Estate Investment Trusts (REITs) – 0.0% |

|

|

|

60 |

| CyrusOne L.P., 5.375%, 3/15/27 (g) |

| 63,825 |

|

|

| Food & Beverage – 0.3% |

|

|

|

310 |

| Albertsons Cos. LLC, 7.50%, 3/15/26 (a)(b)(g) |

| 343,131 |

|

495 |

| Post Holdings, Inc., 5.75%, 3/1/27 (a)(b)(g) |

| 515,419 |

|

|

|

|

| 858,550 |

|

|

| Food Service – 0.2% |

|

|

|

390 |

| Aramark Services, Inc., 5.00%, 2/1/28 (a)(b)(g) |

| 407,550 |

|

|

| Healthcare-Products – 0.4% |

|

|

|

590 |

| Avantor, Inc., 9.00%, 10/1/25 (a)(b)(g) |

| 655,272 |

|

260 |

| Hill-Rom Holdings, Inc., 5.00%, 2/15/25 (a)(b)(g) |

| 270,075 |

|

|

|

|

| 925,347 |

|

|

| Healthcare-Services – 1.6% |

|

|

|

1,000 |

| Community Health Systems, Inc., 6.875%, 2/1/22 (g) |

| 690,000 |

|

800 |

| DaVita, Inc., 5.125%, 7/15/24 (g) |

| 805,000 |

|

413 |

| Encompass Health Corp., 5.75%, 11/1/24 (g) |

| 419,203 |

|

500 |

| HCA, Inc., 7.50%, 2/15/22 |

| 554,850 |

|

475 |

| Select Medical Corp., 6.25%, 8/15/26 (a)(b) |

| 483,313 |

|

1,000 |

| Tenet Healthcare Corp., 8.125%, 4/1/22 (g) |

| 1,071,250 |

|

|

|

|

| 4,023,616 |

|

20 Semi-Annual Report | July 31, 2019

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Home Builders – 0.6% |

|

|

|

$365 |

| Brookfield Residential Properties, Inc., 6.50%, 12/15/20 (a)(b)(g) |

| $365,456 |

|

1,000 |

| KB Home, 8.00%, 3/15/20 (g) |

| 1,030,000 |

|

|

|

|

| 1,395,456 |

|

|

| Internet – 0.7% |

|

|

|

460 |

| Go Daddy Operating Co. LLC, 5.25%, 12/1/27 (a)(b)(g) |

| 480,700 |

|

505 |

| Netflix, Inc., 5.375%, 11/15/29 (a)(b) |

| 532,775 |

|

305 |

| Symantec Corp., 5.00%, 4/15/25 (a)(b)(g) |

| 311,421 |

|

350 |

| Zayo Group LLC, 5.75%, 1/15/27 (a)(b)(g) |

| 356,125 |

|

|

|

|

| 1,681,021 |

|

|

| Lodging – 0.6% |

|

|

|

355 |

| MGM Resorts International, 5.50%, 4/15/27 |

| 377,290 |

|

1,000 |

| Wynn Las Vegas LLC, 5.50%, 3/1/25 (a)(b)(g) |

| 1,051,250 |

|

|

|

|

| 1,428,540 |

|

|

| Machinery-Construction & Mining – 0.1% |

|

|

|

360 |

| Terex Corp., 5.625%, 2/1/25 (a)(b)(g) |

| 361,800 |

|

|

| Media – 2.7% |

|

|

|

1,000 |

| Cablevision Systems Corp., 8.00%, 4/15/20 (g) |

| 1,033,750 |

|

|

| CCO Holdings LLC (a)(b)(g), |

|

|

|

125 |

| 5.125%, 5/1/27 |

| 129,219 |

|

300 |

| 5.50%, 5/1/26 |

| 313,875 |

|

490 |

| Clear Channel Worldwide Holdings, Inc., 9.25%, 2/15/24 (a)(b) |

| 532,875 |

|

|

| CSC Holdings LLC (a)(b)(g), |

|

|

|

460 |

| 7.50%, 4/1/28 |

| 508,875 |

|

1,000 |

| 7.75%, 7/15/25 |

| 1,077,500 |

|

|

| Diamond Sports Group LLC (a)(b), |

|

|

|

170 |

| 5.375%, 8/15/26 |

| 173,188 |

|

455 |

| 6.625%, 8/15/27 |

| 467,512 |

|

220 |

| DISH DBS Corp., 5.875%, 7/15/22 (g) |

| 223,194 |

|

1,000 |

| Gray Television, Inc., 5.875%, 7/15/26 (a)(b)(g) |

| 1,040,000 |

|

440 |

| Meredith Corp., 6.875%, 2/1/26 |

| 467,500 |

|

475 |

| Nexstar Escrow, Inc., 5.625%, 7/15/27 (a)(b) |

| 493,406 |

|

310 |

| Virgin Media Secured Finance PLC, 5.50%, 5/15/29 (a)(b)(g) |

| 318,370 |

|

|

|

|

| 6,779,264 |

|

|

| Metal Fabricate/Hardware – 0.2% |

|

|

|

470 |

| Park-Ohio Industries, Inc., 6.625%, 4/15/27 (g) |

| 471,175 |

|

|

| Mining – 0.6% |

|

|

|

480 |

| Alcoa Nederland Holding BV, 6.75%, 9/30/24 (a)(b)(g) |

| 505,200 |

|

695 |

| Constellium SE, 6.625%, 3/1/25 (a)(b)(g) |

| 729,750 |

|

170 |

| Hudbay Minerals, Inc., 7.625%, 1/15/25 (a)(b) |

| 177,016 |

|

|

|

|

| 1,411,966 |

|

|

| Miscellaneous Manufacturing – 0.1% |

|

|

|

285 |

| Koppers, Inc., 6.00%, 2/15/25 (a)(b)(g) |

| 270,750 |

|

|

| Oil, Gas & Consumable Fuels – 2.2% |

|

|

|

235 |

| AmeriGas Partners L.P., 5.875%, 8/20/26 (g) |

| 250,275 |

|

July 31, 2019 | Semi-Annual Report 21

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Oil, Gas & Consumable Fuels (continued) |

|

|

|

$250 |

| Callon Petroleum Co., 6.125%, 10/1/24 (g) |

| $245,630 |

|

1,000 |

| Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 (g) |

| 987,000 |

|

1,040 |

| Chesapeake Energy Corp., 8.00%, 3/15/26 (a)(b)(g) |

| 837,200 |

|

1,000 |

| CVR Refining LLC, 6.50%, 11/1/22 (g) |

| 1,013,750 |

|

|

| Sunoco L.P. (g), |

|

|

|

300 |

| 5.50%, 2/15/26 |

| 311,250 |

|

170 |

| 5.875%, 3/15/28 |

| 176,375 |

|

495 |

| Transocean, Inc., 7.50%, 1/15/26 (a)(b)(g) |

| 467,775 |

|

465 |

| USA Compression Partners L.P., 6.875%, 9/1/27 (a)(b)(g) |

| 485,883 |

|

1,000 |

| Valaris PLC, 7.75%, 2/1/26 |

| 735,000 |

|

|

|

|

| 5,510,138 |

|

|

| Paper & Forest Products – 0.1% |

|

|

|

365 |

| Mercer International, Inc., 7.375%, 1/15/25 |

| 378,615 |

|

|

| Pharmaceuticals – 0.8% |

|

|

|

295 |

| Bausch Health Americas, Inc., 8.50%, 1/31/27 (a)(b)(g) |

| 325,636 |

|

|

| Bausch Health Cos., Inc. (a)(b)(g), |

|

|

|

330 |

| 6.125%, 4/15/25 |

| 338,563 |

|

345 |

| 7.25%, 5/30/29 |

| 359,449 |

|

615 |

| Endo Finance LLC, 5.375%, 1/15/23 (a)(b)(g) |

| 393,600 |

|

465 |

| Horizon Pharma USA, Inc., 5.50%, 8/1/27 (a)(b) |

| 478,229 |

|

|

|

|

| 1,895,477 |

|

|

| Pipelines – 0.6% |

|

|

|

465 |

| DCP Midstream Operating L.P., 5.125%, 5/15/29 (g) |

| 479,531 |

|

325 |

| NGL Energy Partners L.P., 7.50%, 4/15/26 (a)(b) |

| 338,000 |

|

|

| Targa Resources Partners L.P. (a)(b)(g), |

|

|

|

335 |

| 6.50%, 7/15/27 |

| 365,576 |

|

230 |

| 6.875%, 1/15/29 |

| 254,196 |

|

|

|

|

| 1,437,303 |

|

|

| Real Estate – 0.3% |

|

|

|

700 |

| Kennedy-Wilson, Inc., 5.875%, 4/1/24 (g) |

| 718,214 |

|

|

| Retail – 1.0% |

|

|

|

1,000 |

| Conn’s, Inc., 7.25%, 7/15/22 (g) |

| 1,000,000 |

|

300 |

| L Brands, Inc., 6.875%, 11/1/35 (g) |

| 268,500 |

|

1,000 |

| Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (a)(b)(g) |

| 695,000 |

|

480 |

| Party City Holdings, Inc., 6.625%, 8/1/26 (a)(b) |

| 463,200 |

|

|

|

|

| 2,426,700 |

|

|

| Semiconductors – 0.2% |

|

|

|

475 |

| Amkor Technology, Inc., 6.625%, 9/15/27 (a)(b)(g) |

| 499,938 |

|

|

| Software – 1.3% |

|

|

|

800 |

| Camelot Finance S.A., 7.875%, 10/15/24 (a)(b)(g) |

| 838,000 |

|

480 |

| IQVIA, Inc., 5.00%, 5/15/27 (a)(b)(g) |

| 501,543 |

|

1,000 |

| j2 Cloud Services LLC, 6.00%, 7/15/25 (a)(b) |

| 1,059,250 |

|

115 |

| MSCI, Inc., 5.375%, 5/15/27 (a)(b) |

| 122,369 |

|

22 Semi-Annual Report | July 31, 2019

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Principal |

|

|

| Value |

|

|

| Software (continued) |

|

|

|

$230 |

| Rackspace Hosting, Inc., 8.625%, 11/15/24 (a)(b)(g) |

| $211,600 |

|

480 |

| SS&C Technologies, Inc., 5.50%, 9/30/27 (a)(b)(g) |

| 500,100 |

|

|

|

|

| 3,232,862 |

|

|

| Telecommunications – 2.5% |

|

|

|

600 |

| CenturyLink, Inc., 7.50%, 4/1/24, Ser. Y (g) |

| 658,314 |

|

800 |

| Cincinnati Bell, Inc., 7.00%, 7/15/24 (a)(b)(g) |

| 688,000 |

|

1,000 |

| Consolidated Communications, Inc., 6.50%, 10/1/22 (g) |

| 911,617 |

|

385 |

| GTT Communications, Inc., 7.875%, 12/31/24 (a)(b)(g) |

| 301,263 |

|

1,000 |

| Hughes Satellite Systems Corp., 7.625%, 6/15/21 (g) |

| 1,076,120 |

|

500 |

| Intelsat Jackson Holdings S.A., 5.50%, 8/1/23 (g) |

| 463,125 |

|

500 |

| Level 3 Financing, Inc., 5.375%, 5/1/25 (g) |

| 516,250 |

|

365 |

| Sprint Corp., 7.625%, 3/1/26 (g) |

| 408,811 |

|

1,000 |

| T-Mobile USA, Inc., 4.75%, 2/1/28 (g) |

| 1,031,250 |

|

|

|

|

| 6,054,750 |

|

|

| Transportation – 0.1% |

|

|

|

150 |

| XPO Logistics, Inc., 6.50%, 6/15/22 (a)(b)(g) |

| 152,757 |

|

Total Corporate Bonds & Notes (cost-$66,330,537) |

| 64,624,771 |

| ||

|

|

|

|

|

|

Shares |

|

|

|

|

|

Convertible Preferred Stock – 12.4% |

|

|

| ||

|

| Banks – 4.0% |

|

|

|

3,690 |

| Bank of America Corp., 7.25%, Ser. L (e)(g) |

| 5,230,354 |

|

3,255 |

| Wells Fargo & Co., 7.50%, Ser. L (e)(g) |

| 4,526,273 |

|

|

|

|

| 9,756,627 |

|

|

| Chemicals – 0.5% |

|

|

|

21,910 |

| International Flavors & Fragrances, Inc., 6.00%, 9/15/21 (g) |

| 1,178,101 |

|

|

| Electric Utilities – 2.4% |

|

|

|

24,690 |

| American Electric Power Co., Inc., 6.125%, 3/15/22 (g) |

| 1,345,111 |

|

30,110 |

| NextEra Energy, Inc., 6.123%, 9/1/19 (g) |

| 1,989,368 |

|

22,170 |

| Sempra Energy, 6.00%, 1/15/21, Ser. A |

| 2,464,417 |

|

|

|

|

| 5,798,896 |

|

|

| Electronics – 0.5% |

|

|

|

1,320 |

| Fortive Corp., 5.00%, 7/1/21, Ser. A (g) |

| 1,290,215 |

|

|

| Equity Real Estate Investment Trusts (REITs) – 0.7% |

|

|

|

1,425 |

| Crown Castle International Corp., 6.875%, 8/1/20, Ser. A (g) |

| 1,717,766 |

|

|

| Hand/Machine Tools – 0.9% |

|

|

|

5,710 |

| Colfax Corp., 5.75%, 1/15/22 (g) |

| 712,437 |

|

14,225 |

| Stanley Black & Decker, Inc., 5.375%, 5/15/20 (g) |

| 1,449,954 |

|

|

|

|

| 2,162,391 |

|

|

| Healthcare-Products – 2.5% |

|

|

|

37,575 |

| Avantor, Inc., 6.25%, 5/15/22, Ser. A (g) |

| 2,302,596 |

|

25,585 |

| Becton Dickinson and Co., 6.125%, 5/1/20, Ser. A (g) |

| 1,578,723 |

|

2,090 |

| Danaher Corp., 4.75%, 4/15/22, Ser. A (g) |

| 2,371,941 |

|

|

|

|

| 6,253,260 |

|

July 31, 2019 | Semi-Annual Report 23

Schedule of Investments

AllianzGI Diversified Income & Convertible Fund

July 31, 2019 (unaudited) (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

| Value |

|

|

| Insurance – 0.9% |

|

|

|

19,120 |

| Assurant, Inc., 6.50%, 3/15/21, Ser. D (g) |

| $2,233,598 |

|

Total Convertible Preferred Stock (cost-$28,541,600) |

| 30,390,854 |

| ||

Preferred Stock (a)(d)(f)(i)(j) – 0.5% |

|

|

| ||

|

| Media – 0.5% |

|

|

|

532 |

| LiveStyle, Inc., Ser. A |

| 72,379 |

|

11,500 |

| LiveStyle, Inc., Ser. B |

| 1,150,000 |

|

1,250 |

| LiveStyle, Inc., Ser. B |

| 12 |

|

Total Preferred Stock (cost-$2,429,842) |

| 1,222,391 |

| ||

|

|

|

|

|

|

Units |

|

|

|

|

|

Warrants (a)(d)(f)(i)(j) – 0.0% |

|

|

| ||

|

| Media – 0.0% |

|

|

|

3,000 |

| LiveStyle, Inc., expires 11/30/21, Ser. C (cost-$0) |

| – | † |

|

|

|

|

|

|

Principal |

|

|

|

|

|

Repurchase Agreements – 4.8% |

|

|

| ||

$11,744 |

| State Street Bank and Trust Co., dated 7/31/19, 0.50%, due 8/1/19, proceeds $11,744,163; collateralized by U.S. Treasury Notes, 1.375%, due 5/31/21, valued at $11,981,052 including accrued interest (cost-$11,744,000) |

| 11,744,000 |

|

Total Investments, before options written |

| 352,194,620 |

| ||

Total Options Written – (0.0)% (premiums received-$65,336) (i)(k)(l) |

| (33,575 | ) | ||

Total Investments, net of options written |

| 352,161,045 |

| ||

Other liabilities in excess of other assets – (43.3)% |

| (106,426,611 | ) | ||

Net Assets – 100.0% |

| $245,734,434 |

| ||

Notes to Schedule of Investments:

† Actual amount rounds to less than $1.

(a) Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $87,219,556, representing 35.5% of net assets.

(b) 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $85,997,165, representing 35.0% of net assets.

(c) In default.