Kavinoky Cook LLP

726 Exchange Street

Suite 800

Buffalo, New York 14210

Tel: 716-845-6000

Fax: 716-845-6474

May 5, 2010

Via EDGAR

Mark C. Shannon

Branch Chief

Mark Wojciechowski

Staff Accountant

John Coleman

Mining Engineer

United States Securities and Exchange Commission

Division of Corporation Finance

100 F. Street N.E.

Washington, D.C. 20549

Re: Infrastructure Materials Corp.

Form 10-K for the Fiscal Year Ended June 30, 2009

Filed September 28, 2009

Form 10-Q for the Quarterly Period Ended December 31, 2009

Filed February 12, 2010

File No. 0-52641

Gentlemen:

We are responding your letter dated March 26, 2010, concerning the Form 10-K for the Fiscal Year Ended June 30, 2009 and Form 10-Q for the Quarterly Period Ended December 31, 2009 filed by Infrastructure Materials Corp. (“Infrastructure” or the “Company”). For ease of your review, we have included a reference to your original comments and restated your comment before each of our responses.

Form 10-K for the Fiscal Year Ended June 30, 2009

Notes to the Consolidated Financial Statements

Note 5 Issuance of Common Shares and Warrants, page 64

| Comment #1: | We note several instances discussed in Notes 5 and 6 to your financial statements in which the terms of your outstanding warrants and/or stock options were modified, or cancelled and re-issued. Please tell us what, if any expenses was recorded related to the modification/cancellation and re-issuance of the warrants and options. As part of your response, please provide a table showing all occurrences where the terms of your warrants or options were modified or cancelled and re-issued. Please include the date of the modification, the number of warrants/shares, the terms before modification, the terms after modification, and the amount of expense, if any, recorded as a result of the modification/cancellation. |

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 2

| Response #1 | The following is the table showing all occurrences where the terms of warrants or options were modified/cancelled and re-issued. |

Warrants/ options | Date of modification | Number of warrant/options | Terms before modification | Terms after modification | | Compensation expense recorded | |

| | | | | | | | |

| Warrants | 11-Dec-08 | 11,516,348 (See Note 1) | These warrants were issued during the period 2006-2009. Refer to Note 1 below. | Reduction in exercise price of warrants to $0.25 per common share, only if the warrants were exercised prior to February 28, 2009. If not exercised by February 28, 2009, the warrants’ exercise price would remain the same as originally granted for the balance of the term. | | $ | nil | |

| | | | | | | | | |

| Options | 19-Dec-08 | 1,950,000 (See Note 2) | These options were issued during the period April 2007 to January 2008. Refer to Note 2 below. | Reduction in exercise price of 1,950,000 options to $0.30 per common share, being the closing price of the Company's stock traded on December 19, 2008.All other terms of the original grant remain the same. | | $ | 509,217 | |

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 3

Note 1:

The following details relate to the original issuance of 11,516,348 warrants:

| Period granted | | Number of warrants issued | | | Original exercise price | | Expiry date of warrants | | Reference | |

| | | | | | | | | | | |

| 2006-2007 | | | 700,214 | | | $ | 0.50 | | 31-Dec-09 | | | A | |

| 2007-2008 | | | 7,002,134 | | | $ | 0.75 | | 31-Dec-09 | | | B | |

| 2008-2009 | | | 3,520,000 | | | $ | 0.75 | | 1-Sep-10 | | | C | |

| 2008-2009 | | | 294,000 | | | $ | 0.50 | | 1-Sep-10 | | | D | |

| | | | | | | | | | | | | | |

| Total | | | 11,516,348 | | | | | | | | | | |

A. During the year ended June 30, 2007, the Company issued 700,214 broker warrants at an exercise price of $0.50 to purchase convertible debentures as part of the commission due the agents who placed the offering of common shares and convertible debentures. These warrants represented an amount equal to 10% of the convertible debentures placed.

B. During the year ended June 30, 2008, all holders of the Company’s convertible debentures exercised their conversion rights. Under the terms of the convertible debentures, the holders converted the principal amount of their convertible debentures into “Units” at $0.50 per Unit, where each Unit consisted of a Share and a warrant to purchase a Share at a purchase price of $0.75 per Share. An aggregate of 7,002,134 Shares and an aggregate of 7,002,134 share purchase warrants were issued upon conversion of the principal amount.

C. During the year ended June 30, 2009, the Company completed the private placement of 7,040,000 “Units” at $0.50 per Unit with accredited investors. Each one Unit consists of one Share and one half of a Share purchase warrant (a “Warrant”). Each full Warrant entitles the holder to purchase one share at $0.75 on or before September 1, 2010.

D. The Company issued 294,000 broker warrants to purchase Units at $0.50 per Unit (as per “C" above) in connection with the private placement. The Units have the same terms as those sold to investors.

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 4

Note 2:

The following details relate to the original issuance of 1,950,000 options:

On December 19, 2008, the Company approved the reduction to a new exercise price of $0.30 per share for 1,950,000 outstanding options which had earlier been issued at $0.50 to the holders of 1,900,000 options and at $0.60 to the holder of 50,000 options, with all other terms of the original grant remaining the same. This reduction in exercise price relates to (i) 250,000 options, each issued to six directors on April 10, 2007; (ii) 250,000 options issued to a consultant on April 10, 2007; (iii) 50,000 options each issued to two consultants on April 10, 2007; (iv) 50,000 options issued to one consultant on April 17, 2007 and (v) 50,000 options issued to one consultant on January 24, 2008.

Note 6 Stock Based Compensation, page 69

| Comment #2: | We note your statement at the bottom of page 70, that “The expected forfeiture rate of 0% is based on the vesting of stock options in a short period of time.” Given your historical experience of options being cancelled or forfeited, as shown on pages 71 and 72, please tell us why you believe a forfeiture rate of 0% is appropriate. |

| Response #2 | The Company issued 7,160,000 options since inception. Of this issuance, the option-holders have forfeited 320,417 options. On December 11, 2008, the Company cancelled 250,000 options which had earlier been issued to a director at $0.52 per common share. On December 11, 2008, the said director was issued 400,000 new options to purchase common shares at $0.15 per common share. On December 19, 2008, the Company modified and re-issued 1,950,000 options. As such, the net forfeiture has been for 320,417 options which equates to less than 5% of total issuance since inception. |

Form 10-Q for the Quarterly Period Ended December 31, 2009

Note 9 Commitments and Contingencies, page 17

| Comment #3: | We note your disclosure on page 21 regarding your acquisition of all outstanding shares of Canadian Infrastructure Corp. which closed in February 2010. Please tell us the accounting literature you intend to follow regarding your valuation and recording of this transaction. If you intend to account for this transaction as a business combination to be accounted for under the acquisition method as discussed in FASB ASC Topic 805, please provide us with the preliminary purchase price allocation. |

| Response #3 | The Company is accounting for the acquisition of all outstanding common shares of Canadian Infrastructure Corp. (“CIC”), which closed on February 9, 2010, as a business combination, and which is accounted for under the acquisition method as discussed in FASB ASC Topic 805. |

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 5

| | ASC 805 requires acquisition-date fair value measurement of identifiable assets, liabilities assumed and non-controlling interests in the acquiree. There were no liabilities in the books of CIC as of February 9, 2010, the date of acquisition. Further, all the issued and outstanding shares of CIC were acquired on February 9, 2010, resulting in the absence of non-controlling interests in the acquiree. The only assets acquired were the ‘quarry leases’ in the province of Manitoba, Canada, for which an independent valuation valued the quarry leases at $514,525 (CAD $550,000) and this amount has been recorded as a capital asset in the books of the Company as of the date of acquisition. The stock of the Company traded at $0.27 on February 9, 2010, and the Company issued 1,021,777 common shares in exchange for all issued and outstanding shares of CIC. The total increase in shareholders’ equity in the books of the Company from the issuance of these common shares is recorded at $275,880 (1,021,777 *$0.27), resulting in a bargain purchase price of $238,645 which has been credited to the Company’s Income Statement. |

Item 1.01 Form 8-K Filed on February 12, 2010

| Comment #4: | Notwithstanding your response to the above comment, please confirm, if true, that you were not required to report the transaction with Canadian Infrastructure Corp. under Item 2.01 and Item 9.01 of Form 8-K as a significant acquisition, or otherwise advise. |

| Response #4 | Given the size of the Company and the fact that it has no revenue from operations, the Company does not disagree that the transaction could have been reported as significant acquisition. The Company reported the acquisition of Canadian Infrastructure Corp. (“CIC”) as a material agreement, as opposed to a significant acquisition, largely because the Company has not determined that the assets of CIC are themselves material. The price paid by the Company was below their appraised value, as determined by a third party appraiser, and approximately equaled the cost to CIC of assembling the leased properties and carrying out preliminary exploration to confirm certain drilling results carried out by a prior operator. The Company’s interest in CIC was motivated, in part, by material infrastructure budget items in proposed Canadian federal government budgets and the proximity of the CIC claims to possible projects. While the Company believes the claims have merit, their economic viability will increase if the Canadian government projects go forward. Hence, the Company’s emphasis was to disclose the terms of the deal, including the related party disclosure, but not to characterize the properties as material at this time. The Company needs to carry out further exploration and the value of the property will be affected by the future demand for cement. |

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 6

Form 10-K for the Fiscal Year Ended June 30, 2009

Property Location and Description page 11

| Comment #5: | Please disclose the following information for each of your properties: |

| | • | The nature of your ownership or interest in the property. |

| | • | A description of all interests in your properties, including the terms of all underlying agreements and royalties. |

| | • | Describe the process by which mineral rights are acquired at this location and the basis and duration of your mineral rights, surface rights, mining claims or concessions. |

| | • | An indication of the type of claim or concession such as placer or lode, exploration or exploitation, whether the mining claims are State or Federal mining claims, patented or unpatented claims, mining leases, or mining concessions. |

| | • | Please include certain identifying information, such as the property names, claim numbers, grant numbers, mining concession name or number, and dates of recording and expiration that is sufficient to enable the claims to be distinguished from other claims that may exist in the area or your properties. |

| | • | The conditions that must be met to retain your claims or leases, including quantification and timing of all necessary payments, annual maintenance fees, and disclose who is responsible for paying these fees. |

| | • | The area of your claims, either in hectares or in acres. |

Please ensure that you fully discuss the material terms of the land or mineral rights securing agreements, as required under paragraph (b)(2) of Industry Guide 7.

| Response #5 | Attached to this letter as Exhibit A is a proposed updated and substantially more comprehensive description of the respective properties held by the Company’s three subsidiaries. With your permission, the Company proposes to include this revised property description in its next report on form 10-K for the period ended June 30, 2010. This format would be updated and used in future filings by the Company. We believe this revised disclosure addresses the comments. |

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 7

| Comment #6: | In the description of each exploration property, please provide a clear statement that the property is without known reserves and the proposed program is exploratory in nature to comply with the guidance in paragraph (b)(4)(i) of Industry Guide 7. |

| Response #6 | We have included the recommended disclaimer in each claim group and property description in the attached Exhibit A. |

| Comment #7: | We note you disclose several tonnage and grade estimates from “public record” reports in your filing. Please clarify if these tonnage and grade estimates are reserves or mineralized material pursuant to the definitions defined in Section (A) of Industry Guide 7. Additionally, comment on the reliability of these “public record” reports. Please revise your disclosure accordingly. |

| Response #7 | The Company has removed tonnage estimates and statements about grade based upon public records. The Company believes that its revised description in the attached Exhibit A does not contain such statements. |

Silver Queen Claim Group, page 11

| Comment #8: | Regulation S-K, Item 102, specifically prohibits the use of terms other than “proven” and “probable” when referring to reserve estimates in documents filed with the Commission. Please remove all resource and reserve estimates other than “proven” and “probable” throughout your entire filing. |

| Response #8 | The Company has removed all references to “proven” or “probable” reserve estimates in the description of the Silver Queen Claim Group. We refer to the proposed revised disclosure in Exhibit A. |

The Company has authorized to confirm to you on its behalf that the Company understands that:

| | (i) | the Company is responsible for the adequacy and accuracy of the disclosure in its filings; |

| | (ii) | staff comments or Company changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | (iii) | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities of the United States. |

Mark C. Shannon

Mark Wojciechowski

John Colman

Securities and Exchange Commission

May 5, 2010

Page 8

We are happy to answer any additional questions or respond to further comments.

| | Very truly yours, | |

| | | |

| | /s/ Jonathan H. Gardner | |

| | Jonathan H. Gardner | |

cc: Mason Douglas

Rakesh Malhotra

Cliff Low

EXHIBIT A

Item 1 Description of Business

Our name is Infrastructure Materials Corp. and we sometimes refer to ourselves in this report as “Infrastructure Materials” or “Infrastructure”, the “Company” or as “we,” “our,” or “us.” We are engaged in the exploration and development of cement grade limestone properties located in the states of Nevada, Idaho and Arizona and the Canadian Province of Manitoba. We have identified and recorded 1,941 claims on land owned or controlled by the Department of Interior Bureau of Land Management (“BLM”). Our claims cover 26 projects in Nevada and one project in Idaho. We have several exploration permits in effect with the State of Arizona covering two additional projects located near the municipalities of Benson and Seligman, Arizona. The Company also holds 95 quarry leases in south-central Manitoba, Canada. Our efforts going forward through our current fiscal year ending June 30, 2010, will be concentrated on development of our Blue Nose Project located in Lincoln County, Nevada and further exploration for other limestone deposits in strategic locations that can serve areas with a shortage of cement production.

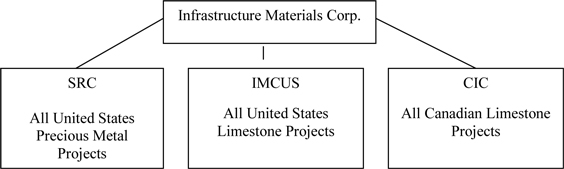

Infrastructure has three wholly-owned subsidiaries. They are (a) Infrastructure Materials Corp US, a Nevada corporation (“IMCUS”) that holds title to our limestone related claims and leases in the United States, (b) Silver Reserve Corp., a Delaware corporation (“Silver Reserve” or “SRC”) that holds title to our precious metal claims and leases, and (c) Canadian Infrastructure Corp, an Ontario, Canada corporation (“CIC”). As of November, 2008, the Company re-focused its attention and resources on the acquisition and exploration of limestone mineral claims. Prior to that date, the Company was principally focused on the precious metal properties now held by Silver Reserve. As of the period covered by this report, the Company’s principal focus is on the limestone properties held by IMCUS and CIC. The following diagram illustrates our corporate structure.

Our head office is at 1135 Terminal Way, Suite 207B, Reno, Nevada 89502 and our administration office is also at this address. Our telephone number is 775-322-4448.

PROPERTIES

Properties held by IMCUS, a wholly-owned subsidiary of Infrastructure Materials Corp.

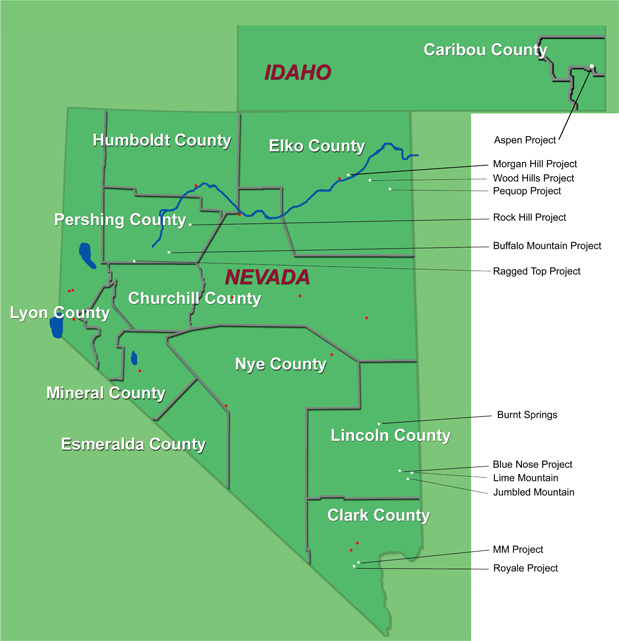

The following claim groups and leased mineral rights are described below: The Morgan Hill Claim Group, the Rock Hill Claim Group, the Buffalo Mountain Claim Group, the MM Claim Group, the Royale Claim Group, the Blue Nose Claim Group, the Wood Hills Claim Group, the Pequop Claim Group, the Burnt Springs Claim Group, the Jumbled Mountain Claim Group, the Lime Mountain Claim Group, the Ragged Top claim Group, the Blye Canyon Lease, the Tres Alamos Lease and the Aspen Claim Group.

The following is a map highlighting the counties in the States of Nevada and Idaho where the properties held by IMCUS are located.

The Morgan Hill Claim Group (other than the leased properties identified below), the Rock Hill Claim Group, the Aspen Claim Group and the Buffalo Mountain Claim Group were acquired as of November 7, 2008 when the Company purchased its now wholly –owned subsidiary, IMCUS.

Morgan Hill Claim Group

The Morgan Hill Claim Group consists of 208 unpatented, lode mineral claims located in Elko County, Nevada, approximately 20 miles west of the town of Wells, Nevada. The claims are situated about five miles north of Interstate 80 and the Union-Pacific rail line. The property is accessed via the I80 River Ranch Exit. The Morgan Hill claims cover approximately 4,297 acres of land managed by the BLM. The Morgan Hill claims cover a northeast trending package of sediments which include a block of favorable massive limestone that has a 2.5 mile strike length. This limestone exceeds 250 feet in thickness. The claim area contains very significant amounts of fine grained limestone within the Devonian Devil’s Gate and Nevada Formations. The unit thickness appears to range up to 500 feet and has varying amounts of interbedded magnesium oxide. There is adjacent sandstone for a silica supply required for cement. Morgan Hill has topography conducive to open pit mining. Preliminary tonnage estimates are positive with little to no initial strip ratio. Area topography allows access to drill areas with a track mounted drill rig. The property lies within 5 miles of the railhead. It is believed to be situated to competitively reach markets in Salt Lake City, Reno, Southern Idaho and Northern California. We have completed a 24-hole drill program on the project identifying three separate cement grade limestone zones of indeterminate thickness. Further drilling will be required to verify the thickness and continuity of the cement and high grade zones.

The 208 Morgan Hill lode mining claims are identified by number as Nevada Mining Claims (“NMC”) in the BLM records as follows:

NMC 989047 through 989130,

NMC 997410 through 997438, and

NMC 1006464 through 1006558.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the Morgan Hill claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. Currently, a claim holder is required to pay an annual fee to the BLM of $140 per claim on or before September 1 of each year. Under legislation enacted in Nevada in March of 2010, claims owners are required to pay the State of Nevada an annual fee based upon a tiered system that requires fees ranging from $70 to $189 per claim, depending upon the total number of claims in Nevada that an owner holds. The Company estimates, based upon its anticipated total number of claims to be held in Nevada as of the next calculation date, that its annual fee will be $85 per claim with the first such annual fee payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

Included in the Morgan Hill Claim Group are three groups of mineral rights known as: (a) the Perdriau Mineral Rights, (b) the Hammond Mineral and Surface Rights and (c) the Earl Edgar Mineral Trust Mineral Rights.

The Perdriau Mineral Rights

On November 30, 2009 IMCUS entered into a Mineral Rights Agreement with Perdriau Investment Corp. (“Perdriau”) to purchase 50% of the mineral rights, including all easements, rights of way and appurtenant rights of any type that run with the mineral rights located in the section of Elko County, Nevada identified below (the “Perdriau Property”). The purchase price was $10 per net acre. IMCUS purchased 340 net acres for a total purchase price of $3,400. Perdriau will be entitled to receive a royalty of $0.25 per ton for material mined and removed from the Perdriau Property. Material mined and stored on the Perdriau Property or adjacent property for reclamation purposes will not be subject to any royalty. Material removed from the Perdriau Property for the purposes of testing or bulk sampling, provided it does not exceed 50,000 tons, will also not be subject to any royalty. The royalty will be calculated and paid within 45 days after the end of each calendar quarter.

The following description of the Perdriau Property is based upon reference points used in the Public Land Survey System (the “PLSS”) that is maintained by the BLM. The Perdriau Property is located on The National Map at T37N, R58E Elko County, Nevada in the following sections:

| Section 9 | SW ¼ | 80 acres |

| Section 15 | W1/2 W1/2 | 80 acres |

| Section 19 | SE ¼ | 80 acres |

| Section 21 | N1/2 NE1/4 | 20 acres |

| Section 21 | SW ¼ | 80 acres |

| Total Net acres | 340 acres |

Hammond Surface Rights Lease and Mineral Rights Agreement

As of January 15, 2010, the Company entered into a Property Lease Agreement with Eugene M. Hammond (the “Hammond Lease”) for surface rights in Elko County, Nevada described below (the “Hammond Surface Rights”). The term of the Hammond Lease is five years and the annual rent is $500. The lessee is responsible for the payment of all real estate taxes on the Hammond Surface Rights. During the term of the Hammond Lease, the lessee has the exclusive right to conduct exploration and development work on the Hammond Surface Rights. The results of all drilling and exploration are of the property of the lessee. The lessee is responsible for any environmental damage caused by the lessee and any reclamation costs required as a result of drilling and testing. The lessee has an option to purchase the property covered by the Hammond Lease for $15,000, less the amount paid in rent during the term of the Hammond Lease. The Hammond Surface Rights are located at the following PLSS coordinates: T37N, R58E, Section 17, S ½ SE ¼, Elko County, Nevada.

Also as of January 15, 2010, IMCUS entered into a Mineral Rights Agreement with Eugene M. Hammond (the “Hammond Mineral Rights Agreement”) pursuant to which the Company purchased a 25% interest in any and all minerals extracted from the 160 acres covered by the Hammond Mineral Rights Agreement, as described below (the “Hammond Mineral Rights Property”). The purchase price was $400. In addition, the seller is entitled to receive a royalty of $0.125 per ton on material mined and removed from the Hammond Mineral Rights Property. The Hammond Mineral Rights Agreement does not cover petroleum. The Hammond Mineral Rights Property is located at the following PLSS coordinates: T37N, R58E, Section 17, SE ¼, Elko County, Nevada.

Earl Edgar Mineral Trust Mineral Rights

On December 8, 2008 IMCUS entered into a Mineral Rights Lease Agreement (the “Edgar Lease Agreement”) with the Earl Edgar Mineral Trust (the “Edgar”) to lease certain mineral rights in Elko County, Nevada described below (the “Edgar Property”). The term of the Edgar Lease Agreement is ten years and will automatically renew on the same terms and conditions for additional ten-year periods, provided the lessee is conducting exploration, development or mining either on the surface or underground at the property. The rent is to be paid each year on January 1st. $1.00 per net acre was paid upon execution of the Edgar Lease Agreement. On January 1 of each year commencing in 2010 and extending for so long as the Edgar Lease Agreement is in effect, the lessee is obligated to make the following payments:

| 2010 | $1.00 per net acre |

| 2011 | $2.00 per net acre |

| 2012 | $2.00 per net acre |

| 2013 | $3.00 per net acre |

| 2014 | $3.00 per net acre |

| 2015 | $4.00 per net acre |

| 2016 | $4.00 per net acre |

| 2017 | $5.00 per net acre in each year for the duration of the Edgar Lease Agreement. |

The Edgar Lease Agreement covers 100% of the mineral rights on 1,120 acres of the Edgar Property (“Property A”) and 50% of the mineral rights on 6,740 acres of the Edgar Property (“Property B”). Edgar is entitled to receive a royalty of $0.50 per ton for material mined and removed from Property A and $0.25 per ton for material mined and removed from Property B during the term of the Edgar Lease Agreement and any renewal thereof.

On April 9, 2009 the Company and Edgar entered into an Amendment to the Edgar Lease Agreement (the “Amendment”), effective as of December 8, 2008. The Amendment provides for Standard Steam LLC to carry out exploration for geothermal energy sources on the Edgar Property after obtaining the written consent of the Company. The Amendment also provides for other cooperation with Standard Steam LLC regarding mineral rights on the Edgar Property.

Property A of the Edgar Property is located at the following PLSS coordinates: T37N, R58E Elko County, NV in the following sections:

| Section 3 | W ¼ | 320 acres |

| Section 9 | SE ¼ | 160 acres |

| Section 15 | E ½ W ½ | 160 acres |

| Section 21 | NW ¼ | |

| | S ½ NE ¼ | 240 acres |

| Section 23 | S ½ NW ¼ | |

| | SW ¼ | 240 acres |

| Total Net acres | | 1120 acres |

Property B of the Edgar Property is located at the following PLSS coordinates in Elko County, NV in the following townships, ranges and sections:

| T37N, R58E | | |

| Section 3 | E ½ | 320 acres |

| Section 9 | SW ¼ | 160 acres |

| Section 15 | W ½ W ½ | |

| | E ½ | 480 acres |

| Section 17 | all | 640 acres |

| Section 19 | SE ¼ | 160 acres |

| Section 21 | S ½ | |

| | N ½ NE ¼ | 400 acres |

| Section 23 | N ½ NW ¼ | |

| | E ½ | 400 acres |

| Section 27 | All | 640 acres |

| Section 29 | All | 640 acres |

| Section 31 | All | 640 acres |

| Section 33 | All | 640 acres |

| Section 35 | All | 640 acres |

| T 36 N, R 58 E | | |

| Section 1 | All | 640 acres |

| | | |

| T 37 N, R 59 E | | |

| Section 31 | All | 640 acres |

| Total Net Acres | | 3360 acres |

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Rock Hill Claim Group

The Rock Hill Claim Group consists of 12 unpatented, lode mineral claims located in Pershing County, Nevada, approximately 12 miles southeast of Mill City, Nevada. Access is along unpaved roads about 25 miles southwest of Winnemucca, Nevada. The Rock Hill claims cover approximately 248 acres. The property geology indicates two basic units most likely in the rocks of the Natchez Pass Formation. Each of the two limestone units is up to 300-400 feet thick with siltstone/sandstone interbeds of variable thickness. The property is approximately 12-14 miles from the current railhead in the Dunn Glenn area. Due to the topography, access to this project would be difficult.

The 12 Rock Hill lode mining claims are identified by Nevada Mining Claim number in the BLM records as follows:

NMC 1003539 through 1003545, and

NMC 1003575 through 1003579

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Aspen Claim Group

The Aspen Claim Group consists of 63 unpatented, lode mineral claims located in Caribou and Bear Lake Counties in Aspen, Idaho, north of Montpelier and east of Soda Springs. The claim group covers approximately 1,302 acres. The Aspen claims are accessible from the southeast corner of Idaho. These lands are managed by the U.S. Forest Service. The dominant rock type at Aspen is the Aspen Range Formation and the Birdseye limestone member which is approximately 400 feet thick. Adjacent sandstones of the Wells Formation provide a ready supply of silica for cement. Geochemical results of samples taken from the property indicate cement grade limestone ranging between 94% and 95%+ calcium carbonate with minimal magnesium.

The 63 Aspen lode mining claims are identified in the BLM records by Idaho Mining Claim numbers: IMC196421 through 196438, 196448 through 196456, 196466 through196474 and 196493 through 196419.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Buffalo Mountain Claim Group

The Buffalo Mountain Claim Group consists of 9 unpatented, lode mineral claims located in Pershing County, Nevada, approximately 20 miles northeast of the town of Lovelock, Nevada. The Buffalo Mountain claims cover approximately 186 acres. Access is along unpaved roads after leaving the interstate 4 miles north of Lovelock. The geology indicates limestone within the Natchez Pass Formation. Due to the topography, access to this area would be difficult.

The 9 Buffalo Mountain lode mining claims are identified in the BLM records by Nevada Mining Claim numbers NMC 1003510 through 1003518.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

MM Claim Group

The MM Claim Group consists of 68 unpatented, lode mineral claims located in Clark County, Nevada, approximately 10 miles south of Las Vegas, Nevada. The claim group covers approximately 1,405 acres. This claim group was acquired as a result of IMCUS locating and staking the claims. Work has been conducted to define the potential of the claim group. Samples have been taken with 10% running an acceptable cement grade which may define a specific rock unit. Surface mapping is completed and on file. Access is by paved and unpaved roads south from Las Vegas.

The 68 MM lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1002566, 1002567, 1002575, 1002576, 1002584, 1002585 and 1002593 through 1002654.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Royale Claim Group

The Royale Claim Group consists of 21 unpatented, lode mineral claims located in Clark County, Nevada, approximately 15 miles south of Las Vegas, Nevada. The claim group covers approximately 434 acres. This claim group was acquired as a result of IMCUS locating and staking the claims. Reconnaissance exploration indicates good quality carbonates on the surface by visual inspection of hand samples and geochemistry. Large areas on this group are accessible by track mounted drilling equipment. Mapping and sampling is completed and on file. Access is by a paved road located 18 miles south from Las Vegas and by an unpaved road located 6 miles to the northwest.

The 21 Royale lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1002680, 1002681, 1002689, 1002690, 1003242 through 1003245, 1003322, 1003323, 1003330 through 1003335, 10033344 and 1003357 through 1003360.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Blue Nose Claim Group

The Blue Nose Claim Group consists of 301 unpatented, lode mineral claims located in Lincoln County, Nevada, west of Tule Desert, along the south edge of the Clover Mountains. The claim group covers approximately 6,219 acres. This claim group was acquired as a result of IMCUS locating and staking the claims. The property was surface mapped in November of 2008 to define favorable rock horizons. Results from this sampling indicate 60% of samples are of cement grade material. The Claim group is 8 miles east of the Union Pacific rail line in the Meadow Valley Wash. Access is via the graded Carp and Bunker Peak roads. Our Phase 1 drilling consisted of 10 holes. Eight of the 10 holes drilled in the first phase of drilling encountered cement grade limestone assay between 88% and 100% calcium carbonate with holes 8 and 10 failing to intercept any significant cement grade thicknesses or values within 300 feet of the surface due to their position being higher in the rock section. Based upon an analysis of the first phase of drilling it appears that the limestone beds are dipping to the west. Strip ratios in the area of the drill holes are considered acceptable. Areas of elevated magnesium were encountered but do not appear to affect the overall value of the cement grade zone. The Company has completed a total of 35 drill holes on the property to date. Further drilling will be required to define the full mineralized zone. An infill drilling program is in review by the BLM and we expect the program to start in May of 2010 and will add an additional 32 drill holes to evaluate the property.

The 301 Blue Nose lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1002031 through 1002327 and 1014085 through 1014088.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Wood Hills Claim Group

The Wood Hills Claim Group consists of 129 unpatented lode mineral claims located in Eastern Elko County, Nevada near Wells, Nevada. This claim group was acquired as a result of IMCUS locating and staking the claims. The claims are about 5 miles southeast of the town. The claim group covers approximately 2665 acres. Access is along unpaved roads to the project. Rail lines and Interstate Highway 80 run through Wells. Limestone beds of the Devils Gate Formation and the Ely Formation are exposed in gently dipping beds near the top and the southern extent of the Wood Hills claims. Over 50 surface samples have been taken that show good cement grade limestone.

The 129 Wood Hills lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1020023 through 1020151.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Pequop Claim Group

The Pequop Claim Group consists of 71 unpatented, lode mineral claims. This claim group was acquired as a result IMCUS locating and staking the claims. The Pequop claims are located approximately 35 miles southeast of Wells, Nevada in Elko County. They are reached by traveling south on Highway 93 about 12 miles and then 20 miles to the east and south along a gravel road to the central portion of the Pequop Range. The claim group covers approximately 1467 acres. Railroad tracks are within a half mile of the southern portion of the claims. East dipping and northeast striking beds of the Ely Formation are exposed here. They stretch for over 2 miles to the north from the railroad tunnel in the Southern Pequops. A number of the samples show good cement grade limestone with some chert (fine grained silica rich sediments) beds and silicic limestone beds. These silicic rocks could be used for a silica source in a limestone operation to make cement.

The 71 Pequop lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1020152 through 1020222.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Ragged Top Claim Group

The Ragged Top Claim Group consists of 76 unpatented, lode mineral claims located in both Pershing and Churchill Counties. This claim group was acquired as a result IMCUS locating and staking the claims. The claim group covers approximately 1570 acres and is located 23 miles southwest of Lovelock, Nevada and 8 miles northwest of Interstate Highway 80, along an unpaved road from the Union Pacific Rail corridor. Access is via the unpaved road. These claims cover 14 exposures of limestone seen in the gently rolling hillsides. The claims have been mapped and a number of surface samples have been taken.

The 76 Ragged Top lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1014006 through 1014029, 1014031 through 1014037, 1014040 through 1014049 and 1014050 through 1014084.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Lime Mountain Claim Group

The Lime Mountain Claim Group consists of 139 unpatented, lode mineral claims located in eastern Lincoln County, Nevada, about 35 miles southeast of Caliente, Nevada and about 90 miles northeast of Las Vegas, Nevada. This claim group was acquired as a result IMCUS locating and staking the claims. Access is south from Caliente along state highway 317 to Elgin and then another 15 miles south on the dirt road to Lyman Crossing where the road goes east for 15 miles to Lime Mountain. The claim group covers approximately 2872 acres. A railroad line runs north-south along Meadow Valley Wash through Lyman Crossing and Elgin. The limestone crops out in a north-south line that is 2 miles long and is approximately 1 mile wide. The project has been mapped and over 40 surface samples have been taken. Many of the samples show cement grade limestone.

The 139 Lime Mountain lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1014089 through 1014226, and 1014469.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Jumbled Mountain Claim Group

The Jumbled Mountain Claim Group consists of 242 unpatented, lode mineral claims that are located in eastern Lincoln County, Nevada, about 90 miles northeast of Las Vegas, Nevada. This claim group was acquired as a result IMCUS locating and staking the claims. Access is from Mesquite, Nevada along 20 miles of highway and 35 miles of unpaved roads. The claims are located over three isolated outcroppings of limestone covering approximately 5000 acres. These areas have been mapped and sampled. There have been 283 surface rock chip samples taken.

The 242 Jumbled Mountain lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1014227 through 1014282, and 1014283 through 1014468.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Burnt Springs Claim Group

The Burnt Springs Claim Group consists of 51 unpatented, lode mineral claims located in the Burnt Springs Range 6 to 10 miles west and northwest of the Union Pacific railway at Caliente, Nevada. This claim group was acquired as a result IMCUS locating and staking the claims. Access is along a paved highway for 7 miles then 6 miles over unpaved roads. The claims are in three separate blocks in the central part of Lincoln County, Nevada and cover approximately 1054 acres. The Burnt Springs claims are located on thick bedded limestone sequences of the lower Highland Peak Formation which are thinly covered by other rocks. A total of 76 rock chips samples have been taken from the Highland Peak Formation in the area of the claims.

The 51 Burnt Springs lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 1017566 through 1017616.

IMCUS is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to the above claims. IMCUS will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Arizona Properties

The following is a map highlighting the counties in the State of Arizona and the areas where IMCUS holds mineral exploration permits.

The interests of IMCUS in Arizona consist of mineral exploration permits that have a duration of one year from the date of issuance. The permits can be renewed for up to four additional one-year terms for a total of five years and provide the holder of the permit with an exclusive right to explore for minerals within the state land covered by the permit and to apply for mineral leases to such land. The holder of a permit may remove from the land only the amount of material required for sampling and testing and is responsible for any damage or destruction caused by the holder’s exploration activities. The holder of a permit is entitled to ingress and egress to the covered site along routes approved by the Arizona State Land Department. IMCUS has posted a bond required by the State of Arizona to back any reclamation required as a result of work performed. The permit is renewable if the holder has expended not less than $10.00 per acre during each of the first two year-long periods and $20.00 per acre during each of the next three year-long periods. The permit fee is $2.00 per acre for the first two years and $1.00 per acre per year for the following three years. Upon termination of a mineral exploration permit, the State of Arizona is entitled to information collected by the permit holder. In the event that a permit holder discovers a valuable mineral deposit, the permit holder may apply to the Arizona State Land Department for a mineral lease having a term of 20 years and renewable for an additional 20 years. A permit holder shall be the preferred recipient of the mineral lease, provided that all applicable requirements are met. A mineral lease entitles the lessee to develop and establish a mine on the leased premises, provided that a mine plan and all necessary approvals are obtained.

Blye Canyon Project

The Blye Canyon Project consists of four State of Arizona mineral exploration permits numbered 08-114298 through 08-114301.

The Blye Canyon Project area is about 23 miles west of Seligman in northwest Arizona. Access is west from Seligman, 25 miles on Highway 66 and then south of Highway 66 about 8 miles on unpaved roads to the border of Yavapai and Mohave Counties. IMCUS holds mineral exploration permits issued by the State of Arizona on 3.5 sections of land totaling 2,227 acres. The basal unit in the rocks in this area is a 300 feet-thick high magnesium carbonate sediment with minor chert (high silica sediment) and limestone beds. Overlying this is a clean gray white limestone that may be 100 to 150 feet thick. The gently north to northeast dipping rocks have little relief in the low rolling hills. The project area has been mapped and over a hundred samples have been taken. Many cement grade values were found in the samples.

THERE ARE NO KNOWN “RESERVES” IN THIS LEASE GROUP. OUR OPERATIONS WITH RESPECT TO THIS LEASED GROUP ARE ENTIRELY EXPLORATORY.

Tres Alamos Project

The Tres Alamos Project consists of 14 State of Arizona mineral exploration permits numbered 08-114302 through 08-114304 and 08-114314 through 08-114324.

The Tres Alamos Project is located 65 miles east of Tucson and 18 miles northeast of Benson, Arizona. Access is along paved and unpaved roads north and east of Benson. IMCUS has leased 14 sections of State of Arizona land in the Little Dragoon Mountains and the area just north of them in Cochise County. These permits cover about 7911 acres. Railroad lines are approximately 12 miles to the southeast of the project area. Tres Alamos Wash and the Palomas Ridge to the north are the areas with limestone outcrops. The limestone beds have a moderate east dip and northwest strike in the area of Palomas Ridge. The exposures of the limestone sediments stretch over 8000 feet in the NW-SE direction on Palomas Ridge and for about 2000 feet in the SW-NE direction. In Tres Alamos Wash, the beds dip to the southeast and strike generally northeast. Over 300 surface rock chip samples have been taken and indicate good cement grade limestone. The area has been mapped by a consulting geologist.

Description of Property held by Canadian Infrastructure Corp., a wholly owned subsidiary of Infrastructure Materials Corp.

Property Location and Description

In December of 2009, the Company expanded its area of exploration to include areas with a potential for cement stone located in south-central Manitoba, Canada. The Company purchased Canadian Infrastructure Corp. (“CIC”), a Canadian corporation, pursuant to a Share Exchange Agreement (the “Agreement”) between the Company, CIC and Todd D. Montgomery dated as of December 15, 2009. See Management’s Discussion and Analysis or Results of Operations – Material Agreements and RELATED PARTY TRANSACTIONS herein. CIC holds 95 quarry leases granted by the Province of Manitoba on three properties known as the Dauphin property, the Winnipegosis property and the Spence property. These leases cover 6,090 hectares or 15,049 acres. Exploration had been done on all three properties in the past.

The following is a map highlighting the properties held by CIC in Manitoba, Canada.

SMD Mining Ltd., which merged with Eldorado Mining to become Cameco, carried out drilling and sampling on the Dauphin property in 1988 – 89. In 1991, Cameco carried out compilation geology, sampling and drilling on the Winnipegosis property. In 1992 Continental Lime Ltd. carried out outcrop sampling and drilling on the Spence property. The Dauphin property covers an area of high calcium shale known as the White Speckled Shale unit of Cretaceous age. This unit is from 2 to 8 meters in thickness. The Winnipegosis and Spence properties cover an area of high calcium limestone, part of the Dawson Bay Formation of Devonian age. CIC drilled the Dauphin property in 2009. The drilling was done to verify the original Cameco drilling and also to extend the zone.

Dauphin Group - The Dauphin Property, the Winnipegosis Property and the Spence Property

The Dauphin Property consists of 35 quarry mineral leases. The 35 quarry mineral leases are identified by Quarry Lease number in the Manitoba Innovation, Energy and Mines, Mines Branch records as follows: QL-1958 through 1981 and 2055 through 2065.

The Winnipegosis Property consists of 25 quarry mineral leases identified by Quarry Lease number in the Manitoba Innovation, Energy and Mines, Mines Branch records as follows: QL-1983 through 2004 and 2050 through 2052.

The Spence Property consists of 35 quarry mineral leases identified by Quarry Lease number in the Manitoba Innovation, Energy and Mines, Mines Branch records as follows: QL-2005 through 2011, 2013, 2015 through 2033, 2037, and 2039 through 2045.

CIC is the registered lessee of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. CIC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. Currently, a claim holder is required to pay annual rent of CDN$24 per hectare of fraction thereof per lease.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

THERE ARE NO KNOWN “RESERVES” IN THIS LEASED GROUP. OUR OPERATIONS WITH RESPECT TO THIS LEASED GROUP ARE ENTIRELY EXPLORATORY.

Description of Property held by Silver Reserve Corp. (“SRC”), a wholly owned subsidiary of Infrastructure Materials Corp.

Property Location and Description

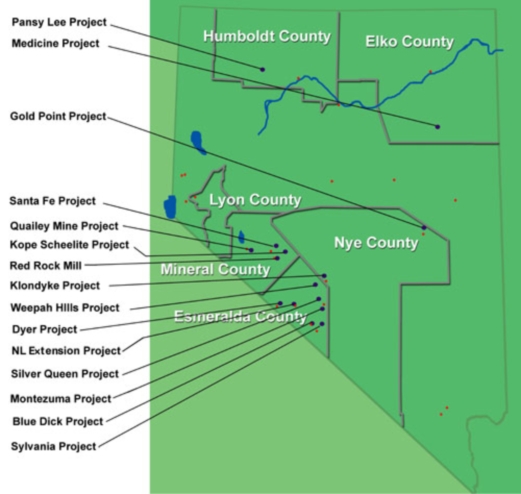

The following is a map highlighting the counties in the State of Nevada where the properties held by SRC are located.

The following claim groups are described below: the Medicine Claim Group, Klondyke Claim Group, Dyer Claim Group, Montezuma Claim Group, Nivloc Claim Group (now identified as NL Extension Projects Claim Group), Sylvania Claim Group, Santa Fe Claim Group, Silver Queen Claim Group, Blue Dick Claim Group, Weepah Hills Claim Group, Kope Scheelite Group, Quailey Patented Claims and Quailey Unpatented Claims, Pansy Lee Claim Group, Gold Point Claim Group and Red Rock Mill. These claims were originally acquired by the Company and assigned to SRC.

Medicine Claim Group

The Medicine Claims are located in Elko County, Nevada, approximately 50 miles southeast of the town of Elko, Nevada. The claims can be accessed by a secondary dirt road off the Butte Valley road. The Medicine Claim Group consists of 25 unpatented, lode mineral claims and an additional 124 contiguous unpatented, lode mineral claims staked by Silver Reserve covering the extension of the mineralized zone. The claim area covers approximately 3,078 acres. Mineralization consists of silver-lead-zinc and barite. The mineralized zone appears to continue to the north and south as well as to depth offering potential for substantial expansion of the drill indicated mineralization. Numerous small prospect pits and tunnels are located on the property. Previous operators on the Medicine Claims were Cominco, USAX and USMX. They completed 110 drill holes to various depths in the mineralized zone. In August of 2008, SRC completed a drilling of 5,470 vertical feet in the mineralized zone.

The Company obtained the original 25 Medicine Claims (the “Option Claims”) pursuant to an option agreement (the “Option Agreement”) dated as of May 1, 2008 (the “Date of Closing”) with Nevada Eagle Resources, LLC and Steve Sutherland (together, the “Optionees”). During the term of the Option Agreement, the Company has the exclusive right to explore and develop, if warranted, the Option Claims. The Company paid $10,000 to the Optionees upon execution of the Option Agreement. The Option Agreement requires the Company to make additional payments as follows: $15,000 on the first anniversary of the Date of Closing, $30,000 on the second anniversary of the Date of Closing, $60,000 on the third anniversary of the Date of Closing and $80,000 on each anniversary of the Date of Closing thereafter until the tenth anniversary of the Date of Closing. The Optionees may elect to receive payment in cash or in shares of the Company’s common stock. Upon making the final payment on the tenth anniversary of the Date of Closing, the Company will have earned a 100% undivided interest in the Option Claims. Pursuant to the Option Agreement, the Option Claims are subject to a 3% net smelter return (“NSR”) royalty payable to the Optionees. The payments made during the term of the Option Agreement are to be applied as advance NSR royalty payments. Beginning on the eleventh anniversary of the Date of Closing, the Company is required to make annual advance royalty payments of $80,000. At such time as the Option Claims are in production, if ever, the Company shall make annual royalty payments equal to the greater of the actual 3% NSR or $80,000. The Company may terminate the Option Agreement at any time before the option is fully exercised upon 60 days notice to the Optionees. The Company does not consider the Option Claims to be material assets at this time; however this assessment may change upon further exploration.

On April 7, 2009, the Company amended the Option Agreement. This amendment reduced the option payment due on May 1, 2009 from $15,000 to $10,000 and increased the payment due May 1, 2010 from $30,000 to $35,000.

Other than the deferred option payments and the NSR granted to the Optionees pursuant to the Option Agreement, as described above, which covers the 25 Option Claims of the 149 claims in this group, there are no underlying agreements or royalty interests of third parties that pertain to these claims. We will remain as the record holder of the claims as long as it continues to make all payments required by the Option Agreement and by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 149 Medicine Claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 979237 through 979259, 979258 through 987408 and 781252 through 781253.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Mohave Property Purchase Agreement

On August 1, 2006, the Company entered into a property purchase agreement (the “Mojave Property Purchase Agreement”) with the Mojave Silver Company, Inc. (the “Mojave Silver Property”) to acquire a 100% interest in claims located in Esmeralda County and Mineral County, Nevada (as further described below) and known as the Klondyke Claim Group, Dyer Claim Group, Montezuma Claim Group, Nivloc Claim Group (now identified as NL Extension Projects Claim Group), Sylvania Claim Group, Santa Fe Claim Group, Silver Queen Claim Group, Blue Dick Claim Group, Weepah Hills Claim Groups, Kope Sheelite Group, Quailey Patented Claims and Quailey Unpatented Claims (collectively the “Mojave Claims”). The Mojave Claims were conveyed in exchange for 3,540,600 shares of the Company’s common stock, then valued at $885,150. All of the Mojave Claims were subsequently assigned to our wholly-owned subsidiary, SRC.

Silver Queen Claim Group

The Silver Queen Claim Group consists of 147 unpatented, lode mineral claims located in Esmeralda County, Nevada, approximately nine miles west of Silver Peak, Nevada on Highway 47. The claim area covers approximately 3,037 acres. The property is accessed by dirt roadways.

The claims are located in the Red Mountain District. The Silver Queen Claim Group covers a northwest trending group of silver deposits that include the Silver Queen and Mohawk mines. In 1920 a producing mine was constructed and production continued through the late 1950's at the Mohawk location.

In June 2008 four drill holes were completed to depths of 400 to 500 feet vertically in the Silver Queen area on surface anomalies noted during grid sampling. In July 2008 five holes were drilled to intercept unmined mineralized zones noted by a previous operator within the Mohawk workings.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 147 Silver Queen lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 969847 through 969850, 870453 through 870535, 966963 through 967017, 986543, 969852 through 969853, 737071 and 737072.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

NL Extension Projects Claim Group

The NL Extension Projects Claim Group consists of 18 unpatented, lode mineral claims located in Esmeralda County, Nevada, approximately 6 miles southwest of Silver Peak, Nevada on Highway 47. The claim group covers approximately 372 acres. In previous reports filed by the Company, this claim group was sometimes referred to as the “Nivloc Claim Group.”

The NL Extension Projects Claims are located approximately 8.5 miles southwest of Silver Peak, Nevada and are accessible along a dirt road 7 miles west of Silver Peak. Elevations on the property range from 5900 feet to 6400 feet. The NL Extension Projects Claims lie on the eastern flank of Red Mountain and, with the Sixteen-to-One and Mohawk deposits, form a mineralized zone which trends northwesterly. The veins trend northeasterly across the zone. The Nivloc Mine operated from 1937 to 1943. The Nivloc Mine is adjacent but not within the claim group held by the Company. The Nivloc mine encountered non-mineralized carbonates at around 900 feet and we assume that the reserves here are exhausted.

A 5-hole exploratory reverse circulation drill program was completed by SRC in January of, 2008. Hole NL5 intersected 30 feet with an average grade of 2.5 ounce silver and 0.033 ounce gold per ton. The hole also intersected a second 15-foot zone with five feet grading 21 ounces silver and an average grade of 8.5 ounce silver per ton but no gold. These intersections appear to be extension of the Nivloc veins 2800 feet east of the old mine workings. Hole NL3 also appeared to intercept the vein but was abandoned due to up-hole collapse. Two additional core holes were drilled to target the veins intersection in NL5 from different angles to verify if the original intercepts went through the vein.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 18 NL Extension lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 867511 through 867525 and 964719 through 964721.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Klondyke Claim Group

The Klondyke Claim Group consists of 104 unpatented, lode mineral claims located in Esmeralda County, Nevada. The Klondyke Claim Group is accessible by road from Tonopah, Nevada. The property lies at elevations ranging from 5,400 feet to 5,908 feet. The claim group covers approximately 2,149 acres and is accessed by Nevada Route 93 and dirt road access. Fifty-six claims were acquired pursuant to the Mojave Purchase Agreement. SRC staked an additional forty-eight claims.

The Klondyke district, which was discovered in 1899, lies about 10 miles south of Tonopah, Nevada. Most of the deposits occur in veins within limestone carrying both silver and gold. The claim area hosts numerous prospects and mine shafts. The property geology was mapped at a scale of 1:12000 in 2007 and 5 separate sample grids were laid out and sampled to cover what appeared to be anomalous zones outlined during the mapping program.

Mapping and grid sampling to date indicate strong NE/SW bearing anomalous zones to the south of the old mine working where the structure runs NW/SE. Surface sampling in this zone carried grades as high as 42.3 oz silver and 0.1 oz gold per ton.

Grid sampling has identified a large gold-only anomalous zone in the southern portion of the property. A trenching program is recommended to expand this anomaly.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 104 Klondyke lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 867448 through 867503, 936129 through 936136, 964630 through 964635, 964637 through 964656, 964662 through 964667, 944675, 964682, 964689, and 964696 through 964700.

In addition, we lease two patented claims from Ovidia Harting (“Harting”) pursuant to a Lease Agreement dated May 30, 2008. The Lease Agreement has a renewable term of 10 years and permits SRC to explore the area covered by the patented claims. The Lease Agreement provides for annual payments of $1,000 per claim to Harting. These two patented claims are subject to a 3% net smelter return royalty to be calculated and paid to Harting within 45 days after the end of each calendar quarter. These claims are known as the President and Annex claims, survey No. 4141 in Section 30T IN, R43E of Esmeralda County. The Company may terminate this Lease Agreement at any time by giving 60 days notice in writing to Harting.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Dyer Claim Group

The Dyer Claim Group consists of 8 unpatented, lode mineral claims located in Esmeralda County, Nevada, approximately 5 miles east of the town of Dyer, Nevada on Highway 3A. The Dyer group of claims is accessible from the town of Dyer, Esmeralda County and cover approximately 165 acres. The Dyer district consists of several prospects and a few small mines that were operated by unknown operators. Phelps Dodge Corp briefly held claims in the area in the 1990’s. Mineralization consists of copper-gold in quartz veins within limestone rocks.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 8 Dyer lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 871091 through 871094 and 871099 through 871102.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Sylvania Claim Group

The Sylvania Claim Group consists of 2 unpatented, lode mineral claims located in Esmeralda County, Nevada. The Sylvania claims are accessible from the town of Lida, Nevada. This claim group covers approximately 41 acres.

The Sylvania District consists of a number of prospects, the Sylvania Mine and three small open pit mines. Production has occurred in the past. The deposits occur in a mile-wide northwest-trending belt or zone. Based upon publicly available records, the deposits are mainly silver-lead but some gold and tungsten also occurs. Most of the silver-lead deposits are veins in limestone. SRC held a larger group of claims at this location but felt that further work was not warranted and allowed all but two claims covering the old workings to lapse.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 2 Sylvania lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 871136 and 871137

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Montezuma Claim Group

The Montezuma Claim Group consists of 10 unpatented, lode mineral claims located in Esmeralda County, Nevada approximately 12 miles southwest of the town of Goldfield, Nevada on Highway 95. Access to the property is along Highway 95, 6 miles south of Goldfield and then approximately 14 miles west along a dirt road. The property lies at elevations ranging from 6400 feet to 6895 feet. This claim group covers approximately 207 acres. The Montezuma District consists of a number of prospects, some shafts and tunnels and one small mine. Based upon publicly available records, the district is predominantly a silver-lead district although small amounts of copper, gold and bismuth were found in some of the producers. The deposits consist of quartz veins in limestone and shale. Mapping done in the spring of 2008 indicates the property lies on the southern edge of a caldera, warranting further exploration work. A "caldera" is cauldron-like volcanic feature formed by the collapse of land following a volcanic eruption.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 10 Montezuma lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 871181 through 871186 and 870091 through 870094.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Blue Dick Claim Group

The Blue Dick Claim Group consists of 19 unpatented, lode mineral claims located in Esmeralda County, Nevada, approximately 2.5 miles west of the town of Lida, Nevada on Highway 3. Access is by dirt road. This claim group covers approximately 393 acres.

The Blue Dick claims are located in the SE part of the Palmetto Mining District. Production occurred prior to 1960 and the deposits contained silver, gold and lead and occur in veins, according to available public records. Most of these veins trend west or northwest. The claim area contains numerous prospects, tunnels, shafts and two small open pit mines. The Blue Dick mine has two shafts and two tunnels but no data is available.

Geologic mapping and sampling indicates complex low angle faulting traced from the historic underground mine workings along strike for a length of at least 3000 feet. Rock chip sampling underground carried grades of gold 1.3 opt and silver 69 opt.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to these claims. SRC will remain as the record holder of the claims as long as it continues to make all payments required by law to maintain the claims. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The 19 Blue Dick lode mining claims are identified in the BLM records by Nevada Mining Claim numbers: NMC 868274 through 868278 and 868284 through 868297.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Weepah Hills Claim Group

The Weepah Hills claim is located in Esmeralda County, Nevada, approximately 15.5 miles southwest of Tonopah, Nevada on Highways 95/6. Access to this claim is via a dirt road leading off Highways 95/6. After the initial examination of this claim group, the Company decided further work was not warranted and all but one unpatented, lode mineral claim covering the old workings were allowed to lapse. This claim covers approximately 21 acres. There are mine workings and a large head frame on the claim, which was operated in the early 1960’s, according to public records.

SRC is the registered holder of this claim group. There are no underlying agreements or royalty interests of third parties that pertain to this claim. SRC will remain as the record holder of the claim as long as it continues to make all payments required by law to maintain the claim. These payments include an annual fee of $140 per claim to the BLM and an annual fee estimated to be $85 per claim to the State of Nevada payable no later than June 1, 2011. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

The single Weepah Hills lode mining claim is identified in the BLM records by Nevada Mining Claim number: NMC 868319.

THERE ARE NO KNOWN “RESERVES” IN THIS CLAIM GROUP. OUR OPERATIONS WITH RESPECT TO THIS CLAIM GROUP ARE ENTIRELY EXPLORATORY.

Kope Scheelite Claim Group

The Kope Scheelite Claim Group consists of 26 unpatented, lode mineral claims located in Mineral County, Nevada, approximately 12 miles east of Mina, Nevada. Access is by dirt road. The elevations on the claim area range from 6800 feet to 7000 feet. The Kope Scheelite claims are located on the southernmost part of the Gabbs Valley Range. The workings on the property consist of numerous shafts and prospects. This claim group covers approximately 537 acres.