UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark one)

| x | Annual report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year ended June 30, 2009, or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

000-52641

Commission File Number

INFRASTRUCTURE MATERIALS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | | 98-0492752 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

1135 Terminal Way, Suite 207B

Reno, NV 89502 USA

(Address of Principal Executive Offices) (Zip Code)

866-448-1073

(Registrant’s telephone number, including area code)

With a copy to:

Jonathan H. Gardner

Kavinoky Cook LLP

726 Exchange St., Suite 800

Buffalo, NY 14210

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer as defined by Rule 405 of the Securities Act Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Rule 13 or Section 15(d) of the Act Yes ¨ No x

Indicate by check mark whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant Rule 405 of Regulation S-T (s 220.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes ¨ No x

Check if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer or a smaller reporter.

Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yesx No

The issuer had no revenue during the year ended June 30, 2009.

The aggregate market value of the Common Stock held by non-affiliates of the issuer, as of June 30, 2009 was approximately $16,775,679 based upon a share valuation of $0.44 per share. This share valuation is based upon the closing price of the Company’s shares as of June 30, 2009. For purposes of this disclosure, shares of Common Stock held by persons who the issuer believes beneficially own more than 5% of the outstanding shares of Common Stock and shares held by officers and directors of the issuer have been excluded because such persons may be deemed to be affiliates of the issuer.

As of June 30, 2009, 60,198,500 shares of the issuer’s Common Stock were outstanding. No other classes of stock have been issued by the issuer.

Transitional Small Business Disclosure Yes ¨ No x

EXPLANATORY NOTE

This Report on Form 10-K/A of Infrastructure Materials Corp. (the “Company”) amends and restates the report on Form 10-K filed by the Company on September 28, 2009 for the fiscal year ended June 30, 2009, (the “Original Report”) in the following respects.

The Company’s financial statements for the fiscal years ended June 30, 2008 and June 30, 2009 are revised to incorporate additional general and administrative expenses relating to warrant modification expense of $844,423 and $346,673, respectively.

An analysis of the modification of warrants in fiscal year 2008 determined that the modification increased the value of the warrants by $844,423. This amount, attributable to the extension of the expiry of the warrants, is included as an expense in general and administrative expenses in the Company’s restated financial statements for the year ended June 30, 2008. Please refer to Note 15 to the Company’s financial statements filed with this report for more detailed information.

An analysis of the modification of warrants in fiscal year 2009 determined that the modification increased the value of the warrants by $346,673. This amount, attributable to the reduction in the exercise price of the warrants, is included as an expense in the general and administrative expenses in the restated financial statements for the year ended June 30, 2009. Please refer to Note 15 to the Company’s financial statements filed with this report for more detailed information.

Other than the revisions described above, we have not included in this Amendment No 1. any events that occurred or information that became available subsequent to the date of filing of the Original Report.

TABLE OF CONTENTS

| | | Page |

| | Part I | |

| | | |

| Item 1. | Description of Business and Risk Factors | 4 |

| | | |

| Item 1A. | Risk Factors | 5 |

| | | |

| Item 2. | Properties | 8 |

| | | |

| Item 3. | Legal Proceedings | 19 |

| | | |

| Item 4. | Submission of Matters to a Vote of Securities Holders | 19 |

| | | |

| | Part II | |

| | | |

| Item 5. | Market For Common Equity, Related Stockholder Matters and Small Business Issuer Purchase of Equity Securities | 20 |

| | | |

| Item 6. | Selected Financial Data | 26 |

| | | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 26 |

| | | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 35 |

| | | |

| Item 8. | Financial Statements and Supplementary Data | 36 |

| | | |

| Item 9. | Change in and Disagreements With Accountants on Accounting and Financial Disclosure | 36 |

| | | |

| Item 9A. | Controls and Procedures | 36 |

| | | |

| Item 9A(T) | Controls and Procedures | 36 |

| | | |

| Item 9B. | Other Information | 37 |

| | | |

| | Part III | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 38 |

| | | |

| Item 11. | Executive Compensation | 40 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 44 |

| | | |

| Item 13. | Certain Relationships and Related Transactions | 46 |

| | | |

| Item 14. | Principal Accountant Fees and Services | 46 |

| | | |

| | PART IV | |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules | 46 |

PART I

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which include, without limitation, statements about our explorations, development, efforts to raise capital, expected financial performance and other aspects of our business identified in this Annual Report, as well as other reports that we file from time to time with the Securities and Exchange Commission. Any statements about our business, financial results, financial condition and operations contained in this Annual Report that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “expects,” “intends,” “projects,” or similar expressions are intended to identify forward-looking statements. Our actual results could differ materially from those expressed or implied by these forward-looking statements as a result of various factors, including the risk factors described in the section entitled, RISK FACTORS and elsewhere in this report. We undertake no obligation to update publicly any forward-looking statements for any reason, except as required by law, even as new information becomes available or other events occur in the future.

Item 1. Description of Business.

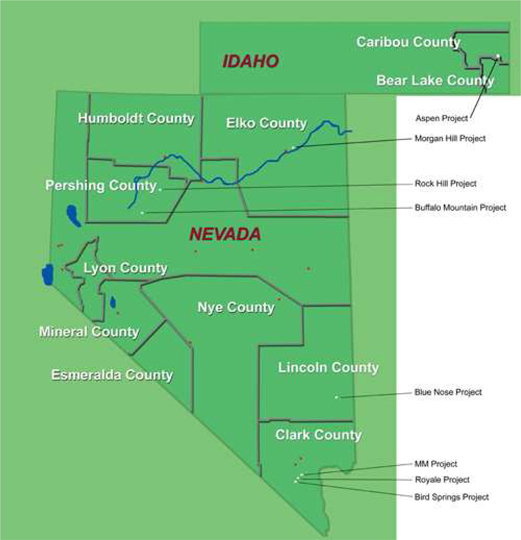

Our name is Infrastructure Materials Corp. and we sometimes refer to ourselves in this annual report as “Infrastructure Materials”, the “Company”, or as “we,” “our,” or “us.” We are an exploration stage mining company. Our objective is to explore and, if warranted, develop our limestone, precious and base metal mineral claims located in Clark County, Elko County, Esmeralda County, Humboldt County, Lincoln County, Mineral County, Nye County and Pershing County, in the State of Nevada, and Caribou County in the State of Idaho, as more fully described herein. In addition to our mineral claims, we own a milling facility, buildings and relating milling equipment located in Mina, Nevada. The Company continues to look for opportunities to locate and develop other mineral deposits of materials in high demand or anticipated high demand. We believe that the federal government of the United States will embark on major infrastructure expenditures over the next ten years, creating a demand for cement that exceeds the current sources of supply in certain areas of the United States. Cement is made from limestone and we believe acquisitions and development of exploration stage limestone claims and concessions have significant potential.

In November of 2008, the Company substantially changed its business focus to the exploration and, if warranted development of cement grade limestone properties, located in the States of Nevada and Idaho. The Company acquired Infrastructure Materials Corp US (“IMC US”), a Nevada Corporation, pursuant to a Share Exchange Agreement (the “Agreement”) between the Company, IMC US and Todd D. Montgomery dated as of November 7, 2008. Mr. Montgomery was the sole shareholder of IMC US in addition to serving as the Company’s Chief Executive Officer and as a member of its Board of Directors. IMC US held five limestone properties at the time of purchase, covering a total of 402 mineral claims. These claim groups were; the Morgan Hill Group, LM Group, Rock Hill Group, Blue Mountain Group and the Aspen Group. Subsequent to the date of this report, the Company abandoned the LM Group. The Agreement was approved by the disinterested members of the Company’s Board of Directors on November 6, 2008. Under the terms of the Agreement, the Company acquired all of the issued and outstanding stock of IMC US in exchange for 397,024 shares of the Company’s common stock at the agreed price of $0.50 per share or $198,512. That amount represents Mr. Montgomery’s out-of-pocket expenditures for the incorporation of IMC US and the cost of assembling the five limestone properties owned by IMC US. For accounting purposes the transaction is measured at the fair value, being the market value of the equity instruments delivered on the transaction date. The fair value of the 397,024 shares of the Company’s stock issued was valued at $31,762. As of the date of this report, the Company does not consider the mineral claims acquired pursuant to the Agreement to be material. Our assessment may change after exploration of the claims.

On December 1, 2008, Infrastructure Materials Corp. (the “Company”) amended its Certificate of Incorporation to change its name to from “Silver Reserve Corp.” to “Infrastructure Materials Corp.” The name change was effected pursuant to Section 253 of the Delaware General Corporation Law by merging a wholly-owned subsidiary (formed for the purpose of implementing the name change) into the Company. The Company was the surviving corporation and, in connection with the merger, it has amended its Certificate of Incorporation to change its name to “Infrastructure Materials Corp.” pursuant to the Certificate of Ownership and Merger filed with the Secretary of State of the State of Delaware on December 1, 2008.

On December 18, 2008, the Company incorporated a second wholly owned subsidiary in the State of Delaware under its former name “Silver Reserve Corp.”, sometimes referred to as “Silver Reserve” or “SRC”. The Company assigned all of its silver/base metal projects to this subsidiary.

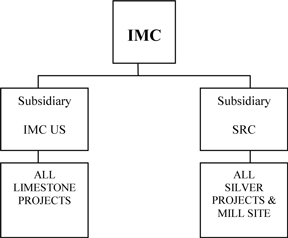

On March 27, 2009, the Company assigned the milling facility at Mina Nevada to Silver Reserve Corp. The following chart illustrates the corporate structure of the Company.

Our head office is at 1135 Terminal Way, Suite 207B, Reno, Nevada 89502 and our administration office is also at this address. We have a branch office at 1226 White Oaks Blvd. Suite 10A, Oakville, Ontario, Canada L6H 2B9. Our toll free telephone number is 866-448-1073 and our toll free fax number is 866-786-6415.

Item 1A. Risk Factors

RISK FACTORS

| 1. | THE COMPANY HAS NO SOURCE OF OPERATING REVENUE AND EXPECTS TO INCUR SIGNIFICANT EXPENSES BEFORE ESTABLISHING AN OPERATING COMPANY, IF IT IS ABLE TO ESTABLISH AN OPERATING COMPANY AT ALL. |

Currently, the Company has no source of revenue, limited working capital and no commitments to obtain additional financing. The Company will require additional working capital to carry out its exploration programs. The Company has no operating history upon which an evaluation of its future success or failure can be made. The ability to achieve and maintain profitability and positive cash flow is dependent upon:

| - | further exploration of our properties and the results of that exploration. |

| - | raising the capital necessary to conduct this exploration and preserve the Company’s Properties. |

| - | raising capital to develop our properties, establish a mining operation, and operate this mine in a profitable manner if any of these activities are warranted by the results of our exploration programs and a feasibility study. |

Because the Company has no operating revenue, it expects to incur operating losses in future periods as it continues to spend funds to explore its properties. Failure to raise the necessary capital to continue exploration could cause the Company to go out of business.

| 2. | BECAUSE OF THE UNIQUE DIFFICULTIES AND UNCERTAINTIES INHERENT IN MINERAL EXPLORATION VENTURES AND CURRENT DETERIORATION IN EQUITY MARKETS, WE FACE A HIGH RISK OF BUSINESS FAILURE. |

Investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. Our prospects are further complicated by a pronounced deterioration in equity markets and constriction in equity capital available to finance and maintain our exploration activities. Our likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake and the difficult economy and market volatility that we are experiencing. Moreover, most exploration projects do not result in the discovery of commercial mineable deposits.

| 3. | OUR BUSINESS IS AFFECTED BY CHANGES IN COMMODITY PRICES. |

Our ability to develop our properties and the future profitability of those operations is directly related to the market price of certain minerals. The Company is negatively affected by the current decline in commodity prices

| 4. | THE COMPANY COULD ENCOUNTER REGULATORY AND PERMITTING DELAYS. |

The Company could face delays in obtaining permits to operate on the property covered by the claims. Such delays could jeopardize financing, if any is available, which could result in having to delay or abandon work on some or all of the properties.

| 5. | THERE ARE PENNY STOCK SECURITIES LAW CONSIDERATIONS THAT COULD LIMIT YOUR ABILITY TO SELL YOUR SHARES. |

Our common stock is considered a "penny stock" and the sale of our stock by you will be subject to the "penny stock rules" of the Securities and Exchange Commission. The penny stock rules require broker-dealers to take steps before making any penny stock trades in customer accounts. As a result, the market for our shares could be illiquid and there could be delays in the trading of our stock which would negatively affect your ability to sell your shares and could negatively affect the trading price of your shares.

| 6. | CURRENT LEVELS OF MARKET VOLATILITY COULD HAVE ADVERSE IMPACTS |

The capital and credit markets have been experiencing volatility and disruption. If the current levels of market disruption and volatility continue or worsen, there can be no assurance that the Company will not experience adverse effects, which may be material. These effects may include, but are not limited to, difficulties in raising additional capital or debt and a smaller pool of investors and funding sources. There is thus no assurance the Company will have access to the equity capital markets to obtain financing when necessary or desirable.

| 7. | MINING OPERATIONS IN GENERAL INVOLVE A HIGH DEGREE OF RISK, WHICH WE MAY BE UNABLE, OR MAY NOT CHOOSE TO INSURE AGAINST, MAKING EXPLORATION AND/OR DEVELOPMENT ACTIVITIES WE MAY PURSUE SUBJECT TO POTENTIAL LEGAL LIABILITY FOR CERTAIN CLAIMS. |

Our operations are subject to all of the hazards and risks normally encountered in the exploration, development and production of minerals. These include unusual and unexpected geological formations, rock falls, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although we plan to take adequate precautions to minimize these risks, and risks associated with equipment failure or failure of retaining dams which may result in environmental pollution, there can be no assurance that even with our precautions, damage or loss will not occur and that we will not be subject to liability which will have a material adverse effect on our business, results of operation and financial condition.

| 8. | BECAUSE OF THE UNIQUE DIFFICULTIES AND UNCERTAINTIES INHERENT IN MINERAL EXPLORATION VENTURES, WE FACE A HIGH RISK OF BUSINESS FAILURE. |

Stockholders should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Most exploration projects do not result in the discovery of commercially mineable deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

| 9 | WE DO NOT INTEND TO PAY DIVIDENDS IN THE FORESEEABLE FUTURE. |

We have never declared or paid a dividend on our common stock. We intend to retain earnings, if any, for use in the operation and expansion of our business and, therefore, do not anticipate paying any dividends in the foreseeable future.

Item 2(a). Description of Limestone Properties held by Infrastructure Materials Corp. US., a wholly owned subsidiary of Infrastructure Materials Corp.

Property Location and Description

The following is a map highlighting the counties in the States of Nevada and Idaho where the properties are located.

The claim groups described below are owned by the Company’s two wholly-owned subsidiaries, Silver Reserve and IMC US. The Klondyke Claim Group, Dyer Claim Group, Montezuma Claim Group, Nivloc Claim Group (now identified as NL Extension Projects Claim Group), Sylvania Claim Group, Santa Fe Claim Group, Silver Queen Claim Group, Blue Dick Claim Group, Weepah Hills Claim Group, Kope Sheelite Group, Quailey Patented Claims and Quailey Unpatented Claims (collectively the “Mojave Claims”). were originally acquired by the Company and assigned to Silver Reserve. The Morgan Hill Claim Group, the Rock Hill Claim Group, the Buffalo Mountain Claim Group, the MM Claim Group, the Royale Claim Group and the Aspen Claim Group are owned by the Company’s wholly owned subsidiary IMC US.

Morgan Hill Claim Group

The Morgan Hill Claim Group consists of 212 mineral claims located in Elko County, Nevada, approximately 20 miles west of the town of Wells, Nevada. The claims are situated about five miles north of Interstate 80 and the Union-Pacific rail line. The property is accessed via the I80 River Ranch Exit. The Morgan Hill claims cover BLM lands within the private land “checkerboard” found within a 20 mile radius on each side of the transcontinental railroad. The Morgan Hill claims cover a NE trending package of Paleozoic sediments which include a block of favorable massive limestone that has a 2.5 mile strike length. This limestone exceeds 250 feet in thickness. The claim area contains very significant amounts of micritic limestone within the Devonian Devil’s Gate and Nevada Formations. The unit thickness appears to range up to 500 feet and range varying amounts of interbedded MgO. There is adjacent sandstone for a silica supply required for cement. Morgan Hill has topography conducive to open pit mining. Preliminary tonnage estimates are positive with little to no initial strip ratio. Area topography allows access to drill areas with a track mounted drill rig. The property lies within 5 miles of the railhead. It is believed to be situated to competitively reach markets in Salt Lake, Reno, South Idaho and Northern California. Subsequent to the date of this report a 24 hole drill program has been completed on the project identifying three separate cement grade limestone zones of indeterminate thickness. Angle drilling will be required to verify the thickness and continuity of the cement and high grade zones.

Rock Hill Claim Group

The Rock Hill Claim Group consists of 63 mineral claims located in Pershing County, Nevada, approximately 12 miles southeast of Mill City, , Nevada. The Rock Hill claims are accessible from the town of Lovelock, Nevada. The property geology indicates two basic units most likely in the Natchez Pass Formation. Each limestone unit is up to 300-400 feet thick with Siltstone/Sandstone interbeds of variable thickness, noted during the mapping. The property is approximately 12-14 miles from the current railhead in the Dunn Glenn area. Due to the topography, access to this project would be difficult. Subsequent to the period covered by this report, the Company elected to abandon 51 of the 63 claims.

Buffalo Mountain Claim Group

The Buffalo Mountain Claim Group consists of 36 mineral claims located in Pershing County, Nevada, approximately 20 miles northeast of the town of Lovelock, Nevada. The geology indicates limestone within the Triassic Natchez Pass Formation. (Based on mapped geology and geochemistry, the outcrops have probable dolomite interbeds) Due to the topography, access to this area would be difficult. Subsequent to the period covered by this report, the Company elected to abandon 27 of the 36 claims.

MM Claim Group

The MM Claim Group consists of 94 mineral claims located in Clark County, Nevada, approximately 15 miles south of Las Vegas, Nevada. Work has been conducted to define the potential of the claim group. Samples have been taken with 10% running an acceptable cement grade which may define a specific stratigraphic unit. Surface mapping is completed and on file. Subsequent to the period covered by this report, the Company elected to abandon 26 of the 94 claims.

Royale Claim Group

The Royale Claim Group consists of 281 mineral claims located in Clark County, Nevada, approximately 10 miles south of Las Vegas, Nevada. Reconnaissance exploration indicates good quality carbonates on the surface by visual inspection of hand samples and geochemistry. Large areas on this group are accessible by track mounted drilling equipment. Mapping and sampling is completed and on file. Subsequent to the period covered by this report, the Company elected to abandon 253 of the 281 claims.

Blue Nose Claim Group

The Blue Nose Claim Group consists of 297 mineral claims located in Lincoln County, Nevada, west of Tule Desert, along the south edge of the Clover Mountains. The property was surface mapped in November of 2008 to define favorable stratigraphic horizons. Results from this sampling indicate 60% of samples are of cement grade material which is clustered to the northwest portion of the Group. The Claim group is 8 miles east of the Union Pacific rail line in the meadow valley wash. Access is via the graded Carp and Bunker Peak roads. Phase 1 drilling consisted of 10 holes. Eight of the 10 holes drilled in the first phase of drilling encountered cement grade limestone assay between 88% and 100% calcium carbonate (CaCO3) with holes 8 and 10 failing to intercept any significant cement grade thicknesses or values within 300 feet of the surface due to their position being higher in the stratigraphic section. Based upon an analysis of the first phase of drilling it appears that the limestone beds are dipping to the west. Strip ratios in the area of the drill holes are considered acceptable. Areas of elevated magnesium were encountered but do not appear to affect the overall value of the cement grade zone. Further drilling will be required to define the full mineralized zone.

Aspen Claim Group

The Aspen Claim Group consists of 138 mineral claims located in Caribou and Bear Lake Counties in Aspen, Idaho, north of Montplier and east of Soda Springs. The Aspen claims are accessible from the southeast corner of Idaho north of Montplier and east of Soda Springs in the Caribou and Bear Lake Counties in Idaho. These lands are managed by the U.S. Forest Service. The dominant lithology at Aspen is the Aspen Range Formation and the Birdseye limestone member which is approximately 400 feet thick. Adjacent sandstones of the Wells Formation provide a ready supply of silica for cement. Geochemical results of samples taken from the property indicate cement grade limestone ranging between 94% and 95%+ calcium carbonateCaCo3 with minimal Magnesium. Preliminary tonnage estimates are positive with no strip ratio. Subsequent to the period covered by this report, the Company elected to abandon 75 of the 138 claims.

LM Claim Group and Bird Springs Claim Group

After a field visit to the site of each of these claim groups, the Company decided to abandon both groups in their entirety. The abandonment of the LM Claim Group, one of the claim groups acquired in the purchase of IMC US, and the Bird Springs Claim group were each effectuated following the period covered by this report.

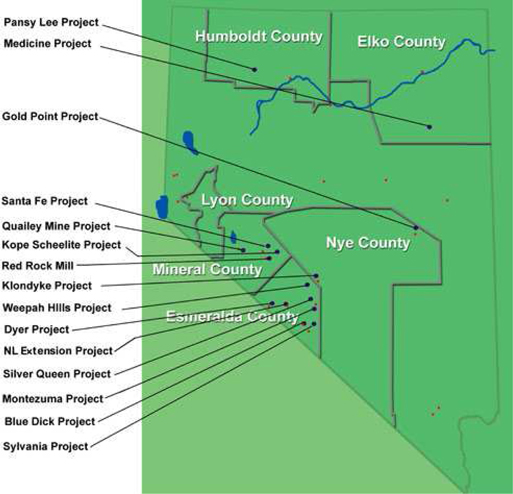

Item 2(b). Description of Property held by Silver Reserve Corp., a wholly owned subsidiary of Infrastructure Materials Corp.

Property Location and Description

The following is a map highlighting the counties in the State of Nevada where the properties are located.

On May 20, 2008, the Company entered into an option agreement (the “Option Agreement”) with Nevada Eagle Resources, LLC and Steve Sutherland (together, the “Optionees”) effective as of May 1, 2008 (the “Date of Closing”), to acquire 25 mineral claims located in Elko County, Nevada and known as the “Medicine Claims.” During the term of the Option Agreement, the Company has the exclusive right to explore and develop, if warranted, the Medicine Claims. The Company paid $10,000 to the Optionees upon execution of the Option Agreement. The Option Agreement requires the Company to make additional payments as follows: $15,000 on the first anniversary of the Date of Closing, $30,000 on the second anniversary of the Date of Closing, $60,000 on the third anniversary of the Date of Closing and $80,000 on each anniversary of the Date of Closing thereafter until the tenth anniversary of the Date of Closing. The Optionees may elect to receive payment in cash or in shares of the Company’s common stock. Upon making the final payment on the tenth anniversary of the Date of Closing, the Company will have earned a 100% undivided interest in the Medicine Claims. Pursuant to the Option Agreement, the Medicine Claims are subject to a 3% net smelter return (“NSR”) royalty payable to the Optionees. The payments made during the term of the Option Agreement are to be applied as advance NSR royalty payments. Beginning on the eleventh anniversary of the Date of Closing, the Company is required to make annual advance royalty payments of $80,000. At such time as the Medicine Claims are in production, if ever, the Company shall make annual royalty payments equal to the greater of the actual 3% NSR or $80,000. The Company may terminate the Option Agreement at any time before the option is fully exercised upon 60 days notice to the Optionees. The Company does not consider the Medicine Claims to be material assets at this time; however this assessment may change upon further exploration.

On April 7, 2009, the Company amended the Option Agreement. This amendment reduced the option payment due on May 1, 2009 from $15,000 to $10,000 and increased the payment due May 1, 2010 from $30,000 to $35,000.

The Medicine Claim Group consists of 25 unpatented claims and the company has staked an additional 124 contiguous claims located in Elko County, Nevada, covering the extension of the mineralized zone not covered by previous operation.

The mineralized zone appears to continue to the north and south as well as to depth offering potential for substantial expansion of the drill indicated mineralization. As mineralization comes to the surface, there is potential for open pit mining.

Silver Queen Claim Group

The Silver Queen Claim Group consists of 147 mineral claims located in Esmeralda County, Nevada, approximately nine miles west of Silver Peak, Nevada on Highway 47.

The claims lie at elevations ranging from 7,800 feet to 9,012 feet and are located in the Red Mountain District. The Silver Queen Claim Group covers a north west trending group of silver deposits that include the Silver Queen and Mohawk mines. The deposits located in the Red Mountain district were first discovered in 1907. In 1920 a producing mine was constructed and production continued through the late 1950's. Based upon publicly available records, the ore produced from this mine averaged 20-25 ounces of silver per ton.

Based upon public records, there may be as much as 52,167 tons of probably and possible mineralized material grading an average of 13.4 ounces per ton of silver (699,000 ounces silver) remains unmined in the mine workings. The report estimates extraction, after mining losses, there may be as much as 40,071 tons of probably and possible mineralized material grading 13.3 ounces per ton silver (532,900 ounces silver). The Company believes there is good potential for finding additional tons of mineralized material. Four major exploration targets with good potential within the claim group and separate from the Mohawk vein occurrence are documented in the public records. Recent work by the Company has traced the vein structures in the Mohawk Mine to the Silver Queen mine, for a total of 1.8 miles offering large exploration potential for this project. Surface exploration has also identified a large silver/lead/zinc anomaly 1000 feet long and 600 feet wide away from the vein structures encompassing the known mines on the property that appears to have had very little previous exploration.

A limited drill program was completed on this new surface anomalies discovered during grid sampling. Four reverse circulation holes were drilled to depth of 400 to 500 feet vertically. Further surface sampling indicates that the anomaly is much larger than initially indicated and further drilling to the west is warranted on what appears to be a new and separate vein structure.

On August 1, 2006, the Company acquired the Pansy Lee Claims from Anglo Gold Mining Inc. in exchange for 1,850,000 shares of the Company’s common stock. In December 2008, the certificates representing these shares were re-issued to reflect the change of the Company’s name from “Silver Reserve Corp.” to “Infrastructure Materials Corp.” Our interest was acquired pursuant to an Asset Purchase Agreement dated August 1, 2006 (the “Pansy Lee Purchase Agreement”). Pursuant to the Pansy Lee Purchase Agreement, in the event that any one or more claims becomes a producing claim, our revenue is subject to a 2% net smelter return royalty where net smelter returns are based upon gross revenue. Gross revenue would be calculated after commercial production commences and includes the aggregate of the following amounts: revenue received by the Company from arm’s length purchasers of all mineral products produced from the property, the fair market value of all products sold by the Company to persons not dealing with the Company at arms length and the Company’s share of the proceeds of insurance on products. From such revenue, the Company would be permitted to deduct: sales charges levied by any sales agent on the sale of products; transportation costs for products; all costs, expenses and charges of any nature whatsoever which are either paid or incurred by the Company in connection with the refinement and beneficiation of products after leaving the property and all insurance costs and taxes. On August 15, 2006, Anglo Gold Mining Inc. assigned the Pansy Lee Purchase Agreement to the shareholders of Anglo Gold Mining, Inc. with the consent of the Company.

The Pansy Lee Claim Group consists of 30 mineral claims located in Humboldt County, Nevada, approximately eight miles north west of Winnemucca, Nevada.

The Pansy Lee claims are accessible by road from Winnemucca, Nevada. A graded dirt road runs northwesterly for a distance of 12 miles to the property which lies at elevations ranging from 4600 feet to 5200 feet.

A substantial amount of underground work has been done on the Pansy Lee Claims, as much as 910 feet below surface with over 6000 feet of horizontal tunneling on several levels. A mine was operated at the Pansy Lee claim site from 1937 to 1942. Further production occurred in 1964 and 1974. Work was undertaken again in 1981 and 1982. Much of our information about the Pansy Lee Claim Group was obtained from publicly available reports and articles concerning prior exploration of the site by other parties. A public report prepared in 1986, estimated that approximately 73,800 tons of average grades of 0.218 ounces gold per ton and 17.48 ounces silver per ton for recoverable ounces of 14,480 gold and 1,159,700 silver remained in the mine.

The Nevada Bureau of Mines Bulletin 59 (1964) reported the following production figures:

| Date | | Action | | Tons | | Au | | Ag |

| 1936-37 | | Shipped | | 205 | | - | | - |

| 1939-40 | | Shipped | | 1,677 | | - | | - |

| 1939-42 | | Milled | | 39,598 | | 0.134 | | 11.5 |

| 1941 | | Shipped | | 407 | | 0.385 | | 32.5 |

| Total | | | | 41,887 | | | | |

Three core holes were drilled and completed to depths of 800 feet on angle below the existing workings. It appears the 'Swede' vein was encountered in all three holes. Work to date indicates the mineralized zone should extend to depth and along strike on the 2 main veins in the mine. Further drilling of these extensions is warranted.

The NL Extension Projects Claim Group consists of 18 mineral claims located in Esmeralda County, Nevada, approximately 6 miles southwest of Silver Peak, Nevada on Highway 47.

The NL Extension Projects Claims are accessible from the town of Silver Peak, Nevada. Elevations on the property range from 5900 feet to 6400 feet. The NL Extension Projects Claims lie on the eastern flank of Red Mountain and, with the Sixteen-to-One and Mohawk deposits, form a mineralized zone which trends northwesterly. The veins trend northeasterly across the zone. The Nivloc Mine operated from 1937 to 1943 with ore grading 0.05 ounces of gold and 11.0 ounces of silver per ton, according to public records. The Nivloc Mine is adjacent but not within the claim group held by the Company. The Nivloc mine encountered non-mineralized Paleozoic carbonates at around 900 feet and we assume that the reserves here are exhausted.

The Red Mountain District also hosts the Mohawk and Silver Queen mines controlled by the Company. A 5-hole exploratory reverse circulation drill program has been completed. Hole NL5 intersected 30 feet with an average grade of 2.5 ounce silver and 0.033 ounce gold per ton. The hole also intersected a second 15-foot zone with five feet grading 21 ounces silver and an average grade of 8.5 ounce silver per ton but no gold. These intersections appear to be extension of the Nivloc veins 2800 feet east of the old mine workings. Hole NL3 also appeared to hit the vein but was abandoned due to up-hole collapse. Two additional core holes were drilled to target the veins intersection in NL5 from different angles to verify if the original intercepts went through the vein.

Klondyke Claim Group

The Klondyke Claim Group consists of 63 mineral claims located in Esmeralda County, Nevada. We staked an additional 103 claims contiguous to the purchased group. The Klondyke Claim Group is accessible by road from Tonopah, Nevada. The property lies at elevations ranging from 5,400 feet to 5,908 feet.

The Klondyke district, which was discovered in 1899, lies about 10 miles south of Tonopah, Nevada. Most of the deposits occur in veins within limestone carrying both silver and gold. Production up to 1960 was 2,758 tons, according to public records. The claim area hosts numerous prospects and mine shafts. The property geology was mapped at a scale of 1:12000 in 2007 and 5 separate sample grids were laid out and sampled to cover what appeared to be anomalous zones outlined during the mapping program. A limited drill program has been proposed but not submitted to the BLM to follow up surface and geologic anomalies.

Mapping and grid sampling to date indicate strong NE/SW bearing anomalous zones to the south of the old mine working where the structure runs NW/SE. Surface sampling in this zone carried grades as high as 42.3 oz silver and 0.1 oz gold per ton.

Grid sampling has identified a large gold-only anomalous zone in the southern portion of the property. A trenching program is recommended.

Subsequent to the period covered by this report, the Company elected to retain only 104 of the 166 mineral claims and 62 mineral claims were abandoned.

The Dyer Claim Group consists of 19 mineral claims located in Esmeralda County, Nevada, approximately 5 miles east of the town of Dyer, Nevada on Highway 3A. The Dyer group of claims are accessible from the town of Dyer, Esmeralda County. The property lies at elevations ranging from 4,800 feet to 5,600 feet. The Dyer district consists of several prospects and a few small mines. The deposits consist of black copper-silver sulfide in quartz veins in crushed and decomposed limestone. Surface oxidation has led to the formation of copper carbonate, iron oxide and silver chloride. Mineralization consists of copper-gold sulfides in quartz veins within limestone country rocks.

Subsequent to the period covered by this report, the Company elected to retain only 8 of the 19 mineral claims and 11 mineral claims were abandoned.

Sylvania Claim Group

The Sylvania Claim Group consists of 2 mineral claims located in Esmeralda County, Nevada. The Sylvania claims are accessible from the town of Lida, Nevada. The property lies at elevations ranging from 7,320 feet to 7,800 feet.

The Sylvania District consists of a number of prospects, the Sylvania Mine and three small open pit mines. Production has occurred in the past and a steel head frame in good condition remains on the property. Based upon publicly available records, the deposits occur in a mile-wide northwest-trending belt or zone. Based upon publicly available records, the deposits are mainly silver-lead but some gold and tungsten also occurs. Most of the silver-lead deposits are veins in limestone. The Company held a larger group of claims at this location but felt that further work was not warranted and allowed all but two claims covering the old workings to lapse.

Montezuma Claim Group

The Montezuma Claim Group consists of 19 mineral claims located in Esmeralda County, Nevada approximately 5.5 miles west of the town of Goldfield, Nevada on Highway 95. The property lies at elevations ranging from 6400 feet to 6895 feet. The Montezuma District consists of a number of prospects, some shafts and tunnels and one small mine. Based upon publicly available records, the district is predominantly a silver-lead district although small amounts of copper, gold and bismuth were found in some of the producers. The deposits consist of quartz veins in limestone and shale and also replacements in limestone. Mapping done in the spring of 2008 indicates the property lies on the southern edge of a caldera, warranting further exploration work. A "caldera" is cauldron-like volcanic feature formed by the collapse of land following a volcanic eruption. Some calderas are known to support rich mineralogy.

Subsequent to year end only 10 of the 19 mineral claims were retained and 9 mineral claims were abandoned.

Blue Dick Claim Group

The Blue Dick Claim Group consists of 32 mineral claims located in Esmeralda County, Nevada, approximately 2.5 miles west of the town of Lida, Nevada on Highway 3.

The claims lie at elevations ranging from 6920 feet 8440 feet. The Blue Dick claims are located in the SE part of the Palmetto District. Production occurred prior to 1960 and the deposits contained silver, gold and lead and occur in veins, according to public records. Most of these veins trend west or northwest. The claim area contains numerous prospects, adits, shafts and two small open pit mines. The Blue Dick mine, has two shafts and two adits but no data is available.

Geologic mapping and sampling indicates complex thrust faulting traced from the historic underground mine workings along strike for a length of at least 3000 feet. Rock chip sampling underground carried grades of gold 1.3 opt and silver 69 opt.

Geochemical anomalies have also been located south of the mine workings and grid samples have provided an additional target area. Surface rock chip sampling yielded values up to 25% copper, 1.30 opt gold, 68 opt silver and 7 % lead. There are 5 drill targets currently identified on the property.

Subsequent to year end only 19 of the 32 mineral claims were retained and 9 mineral claims were abandoned.

Weepah Hills Claim Group

The Weepah Hills claims are located in Esmeralda County, Nevada, approximately 15.5 miles southwest of Tonopah, Nevada on Highway 95. After the initial examination of this claim group, the Company decided further work was not warranted and all but one claim covering the old workings were allowed to lapse. There are mine workings and a large head frame on the claim which was operated in the early 1960’s, according to public records.

Kope Scheelite Claims Group

The Kope Scheelite Claims Group consists of 44 mineral claims located in Mineral County, Nevada, approximately 2 miles east of Luning. Nevada. The elevations on the claim area range from 6800 feet to 7000 feet. The Kope Scheelite claims are located on the southernmost part of the Gabbs Valley Range. The workings on the property consist of numerous shafts and prospects.

Geologic mapping completed in 2007 indicates strong NW/SE bearing mineralized trends running across the property. Recent mapping indicated new strong gold, silver and copper mineralization along NW/SE bearing structures.

Subsequent to year end only 26 of the 44 mineral claims were retained and 18 mineral claims were abandoned.

Subsequent to year end only 16 of the 27 mineral claims were retained and 11 mineral claims were abandoned.

Quailey Claim Group

The Quailey Mine Claim Group consists of 35 staked claims and 9 patented claims (for a total of 44 claims) located in Mineral County, Nevada approximately 16 miles southeast of Hawthorne, Nevada on the northwest side of Excelsior Mountains. The Company purchased 15 staked claims and 9 patented claims. Following the closing of the purchase the Company staked an additional 20 claims contiguous to the staked claims purchased.

In the past the Federal government permitted private parties to obtain title to a claim known as a “patent claim” if certain conditions were met. Patents for claims are no longer issued. Staked claims are created by physically inserting a stake in the ground at each corner of the claim and filing the location of the claim as so demarcated with a government BLM recording office.

The Quailey Mine claims are accessible from the city of Hawthorne, Nevada. A number of dirt roads provide accesses to the main workings of the former mine. Most of the information for the Quailey Mine Project was obtained from a 1975 report by J. McLaren Forbes. The early work on the property was done in 1882 when copper ores with silver and gold values were mined and smelted on the property. Later, between 1907 and 1914, Excelsior Enterprises Inc. was active on the property. Just prior to this activity, a number of the claims were surveyed and patented. During the period 1975-76 the mine was rehabilitated. This work was done by Ladd Enterprises Inc, of Reno, Nevada. This property appears to be a skarn type deposit. A “skarn” is a metamorphic zone developed in the contact area around igneous rock intrusions when carbonate sedimentary rocks are invaded by and replaced with chemical elements that original from the igneous rock mass nearby. Many skarns also include ore minerals.

Historical records indicate copper, gold and silver ores were mined from 4000 feet of developed mine workings.

During the year the Company filed a quiet title suit and received clear title to all the patented claims.

Subsequent to year end only 7 of the 35 staked claims were retained and the 9 patented claims were retained and 28 of the staked claims were abandoned.

Gold Point Claim Group

On February 15, 2008, the Company entered into an agreement with Roger Hall, an officer and director of the Company, to acquire 14 mineral claims referred to as the Gold Point Claim Group in consideration of the sum of $5,000 dollars payable in cash and 175,000 common shares in the capital of the Company.

The Gold Point Claim Group now consists of 8 mineral claims located in Nye County in the Gold Point District, about 10 miles north east of Current, Nevada.

Mineralization from 0.5 to 10 ppm gold was noted in shaley rocks adjacent to substantial jasperoids on the property. The “jasperoids” found in Nevada are hard, dense purple-black rocks with considerable content of pyrite.

Red Rock Mill

On August 1, 2006, the Company entered into an agreement with International Energy Resources, Inc. to purchase a mill building and related milling equipment located on 28 mill site claims at Mina in Mineral County, Nevada. The mill building is a corrugated steel structure. The assets were conveyed in exchange for 6,975,000 common shares of the Company valued at $1,743,750 pursuant to a Property Purchase Agreement with International Energy Resources, Inc. (the “International Energy Resources Purchase Agreement”).

On August 1, 2006 the Company purchased a 100% interest in refinery equipment from Nevada Refinery Inc. in exchange for 88,500 shares of common stock of the Company, valued at $22,125. The Company intends to install this equipment in its mill building located near Mina, Nevada. The refinery equipment will be used to refine “dore” bars or smelt concentrate produced from the milling process. “Doré” bars are bars of precious metal, in this case silver and gold, poured from molten material recovered in the final processing of the mill.

On August 15, 2006, International Energy Resources Inc. assigned the International Energy Resources Purchase Agreement to its shareholders with the consent of the Company. The milling facility is a custom mill installation located near the town of Mina, Nevada, approximately 185 miles south east of Reno, Nevada on US 95. The mill has operated under various configurations to meet specific requirements of prior operators. Ore from various sources has been custom milled and processed for the production of concentrate or doré bars.

The mill is nominally designed to process 200 tons of ore per day. Depending on the ore hardness, the crushing circuit will be able to process up to about 250 tons of ore per day. The flotation and leach sections are also capable of running at the 200 tons per day rate. However, other areas of the processing section do not appear to have sufficient capacity to sustain the mill’s nominal design rate and some additions may be required.

Subsequent to year end only 6 of the 28 Mill Site claims were retained and 22 mineral claims were abandoned.

Property Purchases

The following paragraph describes the acquisition of the Claim Groups. All of the following Claim Groups have been assigned to the Company’s wholly-owned subsidiary, Silver Reserve Corp.

On August 1, 2006, the Company entered into a property purchase agreement (the “Mojave Silver Property Purchase Agreement”) with the Mojave Silver Company, Inc. (the “Mojave Silver Property”) to acquire a 100% interest in claims located in Esmeralda County and Mineral County, Nevada (as further described below) and known as the Klondyke Claim Group, Dyer Claim Group, Montezuma Claim Group, Nivloc Claim Group (now identified as NL Extension Claim Group), Sylvania Claim Group, Santa Fe Claim Group, Silver Queen Claim Group, Blue Dick Claim Group, Weepah Hills Claim Groups, Kope Sheelite Group, Quailey Patented Claims and Quailey Unpatented Claims (collectively the “Mojave Claims”). The Mojave Claims were conveyed in exchange for 3,540,600 shares of the Company’s common stock, valued at $885,150. On August 15, 2006 Mojave Silver Company Inc. assigned the Mojave Silver Property Purchase Agreement to the shareholders of Mojave Silver Company with the consent of the Company Since the purchase, the Company has added claims to some of the groups and abandoned claims in other groups.

Regulations Governing Mining in Nevada

All exploration and mining in Nevada is carried out under regulation established by the Federal Bureau of Land Management (the “BLM”) and the Nevada Bureau of Mining and Geology, and in some circumstances the local county or municipality where the claims are located. These regulations cover exploration work where the surface is disturbed, all types of underground mining, air and water quality, use of ground water from wells, rivers, ponds and lakes, waste management, protection of the environment wildlife and historical sites, road building, discharge and disposal of all materials from mining operations plus other matters.

Government Requirements for Maintenance of Claims

A claim holder is required to pay an annual fee of $140.00 per claim to the BLM on or before August 31 of each year. In addition, a claim holder is required to pay annual County filing fees in most counties within Nevada and Idaho.

Government Permitting

The BLM and the Nevada Bureau of Mining and Geology issue permits required for exploration and mining in the State of Nevada. The Company is required to post bonds with the BLM to cover reclamation cost related to the work carried out on any claim group.

Item 3. Legal Proceedings.

There is no legal proceeding pending or, to the best of our knowledge, threatened against the Company.

Item 4. Submission of Matters to a Vote of Security Holders.

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

As of June 30, 2009, there were 60,198,500 shares of common stock of the Company (a “Share” or “Shares”) outstanding, held by 591 shareholders of record.

Private Placements of Securities issued during the Year Ended June 30, 2007

The Company completed private placements of Shares at $0.25 per share from accredited investors for the number of shares and on the dates set out below.

| Shares | | Date Issued |

| | | |

| 1,087,500 | | July 4, 2006 |

| 112,500 | | July 5, 2006 |

| 914,888 | | July 26, 2006 |

| 1,200,000 | | August 3, 2006 |

| 280,851 | | August 10, 2006 |

| 3,595,739 | | |

The Company registered the resale of the shares listed above in a registration statement on Form SB-2 which was made effective by the SEC on April 24, 2007.

The foregoing private placements were exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”) pursuant to an exemption afforded by Regulation S promulgated thereunder (“Regulation S”). Each of the investors that participated in the foregoing private placement was a non “U.S. Person” as that term is defined in Rule 902 of Regulation S.

The Company issued Convertible Debentures in the amounts and on the dates set out below.

Issue Date | | Amount | |

| | | | |

| 7/4/2006 | | $ | 729,137.50 | |

| 7/26/2006 | | $ | 671,280.00 | |

| 7/10/2006 | | $ | 875,000.00 | |

| 8/2/2006 | | $ | 204,787.25 | |

Each Convertible Debenture had a term maturing on December 31, 2007 and bore interest at the rate of 2% per annum. Interest is payable on conversion or maturity and may be payable by delivery of cash or Shares. The Convertible Debentures were ranked equal with each other.

The Convertible Debentures were convertible into “Units” where each Unit consists of one Share and Share purchase warrant (a “Warrant”) at the rate of one Unit for each $0.50 of principal under the Convertible Debenture at the time of conversion. The Company reserved the right to pay interest in cash or Shares at its option. Each Warrant entitled the holder to purchase one Share at $0.75 per Share for a term of 12 months following issuance of the Warrant. The Convertible Debentures were convertible at any time before maturity of the Convertible Debentures. The Convertible Debentures were converted as described below in “Securities issued during the Year Ended June 30, 2008.”

The Company registered the Shares and the Shares to be issued upon exercise of the warrants issuable upon conversion of the Convertible Debentures on a registration statement on Form SB-2 that was made effective on April 24, 2007.

The foregoing private placement of Convertible Debentures was exempt from registration under the Securities Act pursuant to an exemption afforded by Regulation S. Each of the investors in the foregoing private placement is a non “U.S. Person” as that term is defined in Rule 902 of Regulation S.

Broker Purchase Warrants to purchase Convertible Debentures

During the year ended June 30, 2007, the Company issued broker warrants to purchase convertible debentures as part of the commission due the agents who placed the offering of common shares and convertible debentures. These warrants listed below represented an amount equal to 10% of the convertible debentures placed.

The Company issued 700,214 warrants at an exercise price of $0.50. The expiry dates of the above listed broker warrants was originally June 30, 2007 and was extended to December 31, 2007 and was further extended to December 31, 2008 from December 31, 2007 by resolution of the Board of Directors on November 21, 2007. Further the Board of Directors by a resolution on June 18, 2008, extended the expiry of these warrants until December 31, 2009.

| Date Issued | | Expiration Date | | Exercise Price | |

| | | | | | |

| | | | | | |

| July 6, 2006 | | December 31, 2009 | | $ | 175,000 | |

| July 26, 2006 | | December 31, 2009 | | | 67,128 | |

| August 2, 2006 | | December 31, 2009 | | | 107,979 | |

| | | | | $ | 350,107 | |

Securities issued during the Year Ended June 30, 2008

The Convertible Debentures issued in the year ended June 30,2007 as well as Convertible Debentures of similar terms issued in the year ended June 30, 2006, were converted into shares and warrants between October 3, 2007 and November 5, 2007. The interest was paid in common shares of the Company. This resulted in the issuance of the following Shares and warrants on the dates set out below.

Conversion Date | Shares | Shares Issued for Interest | Warrants Issued |

| | | | |

| Oct 8/07 | 446,812 | 10,967 | 446,812 |

| | | | |

| Oct 9/07 | 1,935,394 | 52,663 | 1,935,394 |

| | | | |

| Oct 10/07 | 300,000 | 7,397 | 300,000 |

| | | | |

| Oct 12/07 | 446,812 | 11,067 | 446,812 |

| | | | |

| Oct 16/07 | 2,159,574 | 55,673 | 2,159,574 |

| | | | |

| Oct 25/07 | 127,604 | 3,460 | 127,604 |

| | | | |

| Oct 30/07 | 127,663 | 3,498 | 127,663 |

| | | | |

| Nov 5/07 | 1,458,275 | 39,871 | 1,458,275 |

The interest shares were issued as “restricted” and may not be re-sold unless an exemption from registration is available such as the exemption afforded by Rule 144 promulgated under the Securities Act.

The expiry dates of these warrants were extended to December 31, 2009 by a resolution of the Board of Directors on June 18, 2008.

Effective as of September 1, 2007, the Company entered into an agreement with Brehnam Trading Corp. (“Brehnam”) for a term of 24 months to provide consulting services on financial matters, business growth and development, and general business matters. The Company paid Brehnam 1,500,000 restricted Shares earned in equal installments of 375,000 shares on December 1, 2007, June 1, 2008, December 1, 2008 and June 1, 2009. The said 1,500,000 Shares were tendered in one certificate upon execution of the agreement and were deemed to be in Brenham’s possession. On July 6, 2009, the consulting period was extended to August 30, 2011 without further compensation.

Effective as of September 1, 2007, the Company entered into an agreement with Costa View Inc. (“Costa”) for a term of 24 months to provide consulting services on financial public relations, business promotion, business growth and development, including mergers and acquisitions, and general business matters. The Company paid Costa 1,500,000 restricted Shares earned in equal installments of 375,000 shares on December 1, 2007, June 1, 2008, December 1, 2008 and June 1, 2009. The said 1,500,000 Shares were tendered in one certificate upon execution of the agreement and were deemed to be in Costa View’s possession. On July 6, 2009 the consulting period was amended and extended to August 30, 2011 without further compensation.

On February 15, 2008 the Company entered into an agreement with Roger Hall, an officer and director of the Company, to acquire 15 mineral claims referred to as the Gold Point Claim Group in consideration of the sum of $5,000 payable in cash and 175,000common shares in the capital of the Company, valued at $105,000.Shares.

The Company issued 25,000 Shares to Endeavor Holdings, Inc. on March 3, March 28, April 28, May 28, June 26, July 20 and September 3 of 2008 for a total of 175,000 common shares valued at $85,250 in accordance with the terms of the contract dated March 3, 2008. The contract was terminated on October 1, 2008.

Securities issued during the Year Ended June 30, 2009

On August 22, 2008, the Company completed private placements of “Units” at $0.50 per Unit from accredited investors for 7,040,000 Units. Each Unit consists of one Share and one half a Share purchase warrant. Each full warrant entitles the holder to purchase Share at $0.75 on or before September 1, 2010. This private placement was exempt from registration under the Securities Act pursuant to an exemption afforded by Regulation S. All of the investors were non-U.S. Persons. The Company paid a commission of $147,000 and issued 294,000 broker warrants to purchase Units at $0.50 per Unit in connection with the private placement as listed below. The Units have the same terms as those sold to investors.

| Date | | $'s | | | Shares | | | Warrants | |

| | | | | | | | | | |

| Jul 6’08 | | $ | 50,000 | | | | 100,000 | | | | 50,000 | |

| | | | | | | | | | | | | |

| Jul 7'08 | | $ | 250,000 | | | | 500,000 | | | | 250,000 | |

| | | | | | | | | | | | | |

| Jul 8'08 | | $ | 500,000 | | | | 1,000,000 | | | | 500,000 | |

| | | | | | | | | | | | | |

| Jul 21'08 | | $ | 100,000 | | | | 200,000 | | | | 100,000 | |

| | | | | | | | | | | | | |

| Jul 24'08 | | $ | 20,000 | | | | 40,000 | | | | 20,000 | |

| | | | | | | | | | | | | |

| Jul 29'08 | | $ | 100,000 | | | | 200,000 | | | | 100,000 | |

| | | | | | | | | | | | | |

| Aug 1'08 | | $ | 200,000 | | | | 400,000 | | | | 200,000 | |

| | | | | | | | | | | | | |

| Aug 5'08 | | $ | 350,000 | | | | 700,000 | | | | 350,000 | |

| | | | | | | | | | | | | |

| Aug 13'08 | | $ | 500,000 | | | | 1,000,000 | | | | 500,000 | |

| | | | | | | | | | | | | |

| Aug 14/08 | | $ | 200,000 | | | | 400,000 | | | | 200,000 | |

| | | | | | | | | | | | | |

| Aug 15/08 | | $ | 1,000,000 | | | | 2,000,000 | | | | 1,000,000 | |

| | | | | | | | | | | | | |

| Aug 22/08 | | $ | 250,000 | | | | 500,000 | | | | 250,000 | |

| | | | | | | | | | | | | |

| | | $ | 3,520,000 | | | | 7,040,000 | | | | 3,520,000 | |

Broker Warrants:

| Issued | | Expiration Date | | Units | | | Amount | |

| | | | | | | | | |

| August 15, 2008 | | September 1, 2010 | | | 245,000 | | | $ | 122,500 | |

| | | | | | | | | | | |

| August 13, 2008 | | September 1, 2010 | | | 49,000 | | | $ | 24,500 | |

Between February and March 2009, the Company received an election to purchase 8,900,907 Shares under the exercise of warrants at $0.25 per Share. This exercise price of $0.25 per Share was part of a one time offer to all warrant holders approved by the Board of Directors on December 11, 2008 that provided that the exercise price be reduced from $0.75 per Share to $0.25 per share if the warrants were exercised prior to February 28, 2009. The Company received $2,225,227 and issued 8,900,907 shares.

Our common stock is traded on the Over the Counter Bulletin Board sponsored by the National Association of Securities Dealers, Inc. under the symbol “IFAM” (formerly “SLVV”). The Over the Counter Bulletin Board does not have any quantitative or qualitative standards such as those required for companies listed on the Nasdaq Small Cap Market or National Market System. Our high and low sales prices of our common stock during the fiscal year ended June 30, 2009 is as follows:

| Quarter ended | | High | | | Low | |

| | | | | | | |

| September 30, 2008 | | $ | 0.69 | | | $ | 0.30 | |

| | | | | | | | | |

| December 31, 2008 | | $ | 0.35 | | | $ | 0.08 | |

| | | | | | | | | |

| March 31, 2009 | | $ | 0.37 | | | $ | 0.15 | |

| | | | | | | | | |

| June 30, 2009 | | $ | 0.52 | | | $ | 0.18 | |

Stock Option Plan

On April 20, 2006, we adopted the 2006 Stock Option Plan (the "Plan") under which our officers, directors, consultants, advisors and employees may receive stock options. The aggregate number of shares of common stock that may be issued under the plan is 5,000,000. The purpose of the Plan is to assist us in attracting and retaining selected individuals to serve as directors, officers, consultants, advisors, and employees of Infrastructure Materials Corp. who contribute to our success, and to achieve long-term objectives that will inure to the benefit of all shareholders through the additional incentive inherent in the ownership of our common stock. Options granted under the plan will be either "incentive stock options", intended to qualify as such under the provisions of section 422 of the Internal Revenue Code of 1986, as from time to time amended (the "Code") or "unqualified stock options". For the purposes of the Plan, the term "subsidiary" shall mean “Subsidiary Corporation,” as such term is defined in section 424(f) of the Code, and "affiliate" shall have the meaning set forth in Rule 12b-2 of the Exchange Act.

The following table summarizes the options outstanding as at June 30, 2009:

| | | Option Price | | | Weighted average remaining contractual life | | | Weighted average remaining contractual life | | | Number of options | |

| Expiry Date | | Per Share | | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Aug 30, 2009 | | | 0.25 | | | | 0.17 | | | | | | | 20,833 | | | | | |

| Aug 30, 2009 | | | 0.15 | | | | 0.17 | | | | | | | 10,417 | | | | | |

| Dec 31, 2009 | | | 0.30 | | | | 0.51 | | | | | | | 50,000 | | | | | |

| Dec 31, 2009 | | | 0.35 | | | | 0.51 | | | | | | | 133,333 | | | | | |

| April 9, 2012 | | | 0.30 | | | | 2.82 | | | | 3.75 | | | | 1,800,000 | | | | 1,850,000 | |

| April 16, 2012 | | | 0.50 | | | | 2.84 | | | | 3.75 | | | | 50,000 | | | | 50,000 | |

| May 16, 2012 | | | 0.50 | | | | 2.92 | | | | | | | | - | | | | - | |

| Jan 23, 2013 | | | 0.60 | | | | 3.62 | | | | 4.58 | | | | 50,000 | | | | 50,000 | |

| April 1, 2013 | | | 0.35 | | | | 3.81 | | | | 4.75 | | | | 50,000 | | | | 400,000 | |

| June 22, 2013 | | | 0.52 | | | | 4.04 | | | | 4.95 | | | | - | | | | 250,000 | |

| Dec 10, 2013 | | | 0.15 | | | | 4.51 | | | | | | | | 1,925,000 | | | | - | |

| Dec 10, 2013 | | | 0.25 | | | | 4.51 | | | | | | | | 50,000 | | | | - | |

| Jan 1, 2014 | | | 0.15 | | | | 4.57 | | | | | | | | 300,000 | | | | | |

| Feb 2, 2014 | | | 0.31 | | | | 4.66 | | | | | | | | 150,000 | | | | | |

| June 4, 2014 | | | 0.47 | | | | 5.00 | | | | | | | | 50,000 | | | | | |

| Options outstanding at end of year | | | | | | | | | | | | 4,639,583 | | | | 2,600,000 | |

| Weighted average exercise price at end of year | | | | | | | | | | | | 0.24 | | | | 0.49 | |

| Weighted average remaining contractual life | | | | 3.65 | | | | 4.03 | | | | | | | | | |

| | | Number of Shares | |

| | | 2009 | | | 2008 | |

| | | | | | | |

| Outstanding, beginning of year | | | 2,600,000 | | | | 1,910,000 | |

| Granted | | | 4,550,000 | | | | 700,000 | |

| Expired | | | - | | | | - | |

| Exercised | | | - | | | | - | |

| Forfeited | | | (2,510,417 | ) | | | (10,000 | ) |

| Cancelled | | - | | | - | |

| Outstanding, end of year | | | 4,639,583 | | | | 2,600,000 | |

| Exercisable, end of year | | | 3,524,750 | | | | 2,045,833 | |

Item 6. Selected Financial Data

Not applicable

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This section should be read in conjunction with the accompanying financial statements and notes included in this report.

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

PLAN OF OPERATIONS

Discussion of Operations & Financial Condition

Twelve months ended June 30, 2009

The Company has no source of revenue and we continue to operate at a loss. We expect our operating losses to continue for so long as we remain in an exploration stage and perhaps thereafter. As at June 30, 2009, we had accumulated losses of $13,620,745 (June 30, 2008 - $7,575,268). Our ability to emerge from the exploration stage and conduct mining operations is dependent, in large part, upon our raising additional equity financing.

As described in greater detail below, the Company’s major endeavor over the years has been its effort to raise additional capital to pursue its exploration activities.

In November of 2008, we substantially changed our business focus to the exploration and development of cement grade limestone properties, also located in the States of Nevada and Idaho. We acquired Infrastructure Materials Corp US (“IMC US”), a Nevada Corporation, pursuant to a Share Exchange Agreement between the Company, IMC US and Todd D. Montgomery dated as of November 7, 2008. Mr. Montgomery was the sole shareholder of IMC US in addition to serving as the Company’s Chief Executive Officer and as a member of its Board of Directors. IMC US held five limestone properties at the time of purchase, covering a total of 402 mineral claims. These claim groups were; the Morgan Hill Group, LM Group, Rock Hill Group, Blue Mountain Group and the Aspen Group. Subsequent to the date of this report, the Company abandoned the LM Group.

The Company continues to look for opportunities to develop other mineral deposits of commodities in high demand or anticipated high demand. We believe that the federal governments in the United States will embark on major infrastructure expenditures in the next 10 years creating a demand for cement that exceeds the current sources of supply in certain areas of the United States. Cement is made from limestone and we believe our acquisitions in this area have significant potential.

On December 1, 2008, the Company amended its Certificate of Incorporation to change its name from “Silver Reserve Corp.” to “Infrastructure Materials Corp.”

On December 18, 2008, the Company incorporated a second wholly owned subsidiary in the State of Delaware under its former name “Silver Reserve Corp.”, sometimes referred to as “Silver Reserve”. The Company assigned all of its silver/base metal projects to this subsidiary.

We have continued to raise capital and are moving forward with exploration on our Projects. We have completed the evaluation of 9 of our Limestone Projects and determined that the Blue Nose and Morgan Hill Projects provide the best opportunity for development of resources that could go to production. We have completed the evaluation of all of our Silver Reserve Projects and determined that the Medicine and Silver Queen, Pansy Lee and NL Extension Projects provide the best opportunities for development. We have decided to discontinue exploration of the silver projects and we are concentrating our efforts on the limestone Projects. As of the date of this report the Company is seeking a buyer to purchase the assets of our wholly-owned subsidiary, Silver Reserve Corp.

The consolidated financial statements include the accounts of the Company and its subsidiaries, Infrastructure Materials Corp US and Silver Reserve Corp. All material inter-company accounts and transactions have been eliminated.

SELECTED ANNUAL INFORMATION

| | | June 30, 2009 | | | June 30, 2008 | |

| | | | | | | |

| Revenues | | Nil | | | Nil | |

| Net Loss | | $ | 6,045,477 | | | $ | 4,635,465 | |

| Loss per share-basic and diluted | | $ | (0.11 | ) | | $ | (0.11 | ) |

| Total Assets | | $ | 4,884,471 | | | $ | 3,050,237 | |

| Total Liabilities | | $ | 270,901 | | | $ | 350,402 | |

| Cash dividends declared per share | | Nil | | | Nil | |

Our total assets for the year ended June 30, 2009 includes cash and cash equivalents of $420,266, short-term investments of $3,116,803, prepaid expenses of $205,482 and capital assets of $1,141,920. Our total assets for the year ended June 30, 2008 includes cash and cash equivalents of $1,553,855, prepaid expenses of $155,546 and capital assets of $1,340,836. The total assets increased from $3,050,237 on June 30, 2008 to $4,884,471 on June 30, 2009. This increase is the result of capital financing in July 2008 and August 2008 as well as the exercise of warrants in February 2009 and March 2009.

Revenues

No revenue was generated by the Company’s operations during the years ended June 30, 2009 and June 30, 2008.

Net Loss

The Company’s expenses are reflected in the Statements of Operation under the category of Operating Expenses. To meet the criteria of United States generally accepted accounting principles (“GAAP”), all mineral property acquisition and exploration costs are expensed as incurred. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property are capitalized. For the purpose of preparing financial information, all costs associated with a property that has the potential to add to the Company's proven and probable reserves are expensed until a final feasibility study demonstrating the existence of proven and probable reserve is completed. No costs have been capitalized in the periods covered by these financial statements. Once capitalized, such costs will be amortized using the units-of-production method over the estimated life of the probable reserve.

The significant components of expense that have contributed to the total operating expense are discussed as follows:

(a) General and Administrative Expense

Included in Operating Expenses for the year ended June 30, 2009 is general and administrative expense of $3,472,024, as compared with $2,627,129 for the year ended June 30, 2008. General and administrative expense represents approximately 57% of the total operating expense for the year ended June 30, 2009 and 56% of the total Operating Expense for the year ended June 30, 2008. General and administrative expense increased by $844,895 in the current year, compared to the prior year. Most of the increase is from higher consulting fees ($277,857), due diligence costs on limestone projects ($175,720), stock based compensation ($674,778), wages ($166,953) and foreign currency losses ($51,921) offset in part by a decrease in warrant modification expense of $497,750.

(b) Project Expense

Included in operating expenses for the year ended June 30, 2009 is project expenses for $2,409,468 as compared with $1,836,077 for the year ended June 30, 2008. Project expense represents approximately 40% of the total operating expense for the year ended June 30, 2009 and approximately 39% of the total operating expense for the year ended June 30, 2008. The majority of project expenses for the years ended June 30, 2009 and June 30, 2008 related to exploration on the limestone, precious and base metal claims.

Liquidity and Capital Resources

The following table summarizes the company’s cash flows and cash in hand:

| | | Year ended | | | Year ended | |

| | | June 30, 2009 | | | June 30, 2008 | |

| | | | | | | |

| Cash and cash equivalent | | $ | 420,266 | | | $ | 1,553,855 | |

| Working capital | | $ | 3,471,649 | | | $ | 1,358,999 | |

| Cash used in operating activities | | $ | (3,599,725 | ) | | $ | (2,173,006 | ) |

| Cash used/provided in investing activities | | $ | (3,132,091 | ) | | $ | 1,087,605 | |

| Cash provided by financing activities | | $ | 5,598,227 | | | $ | nil | |

As at June 30, 2009, the Company had working capital of $3,471,650 as compared to $1,358,999 as of June 30, 2008. Working capital increased as a result of capital financing in July 2008 and August 2008 as well as warrant exercises in February 2009 and March 2009 which was not expended on drilling and exploration projects during the year. The Company did not raise any capital during the year ended June 30, 2008.

Off-Balance Sheet Arrangement

The Company had no off- balance sheet arrangements as of June 30, 2009 and June 30, 2008.

Contractual Obligations and Commercial Commitments

On August 1, 2006, the Company acquired the Pansy Lee Claims from Anglo Gold Mining Inc. in exchange for 1,850,000 shares of the Company’s common stock. The Company’s interest was acquired pursuant to an Asset Purchase Agreement dated August 1, 2006 (the “Pansy Lee Purchase Agreement”). Pursuant to the Pansy Lee Purchase Agreement, in the event that any one or more claims becomes a producing claim, the Company’s revenue is subject to a 2% net smelter return royalty where net smelter returns are based upon gross revenue. Gross revenue would be calculated after commercial production commences and includes the aggregate of the following amounts: revenue received by the Company from arm’s length purchasers of all mineral products produced from the property, the fair market value of all products sold by the Company to persons not dealing with the Company at arms length and the Company’s share of the proceeds of insurance on products. From such revenue, the Company would be permitted to deduct: sales charges levied by any sales agent on the sale of products; transportation costs for products; all costs, expenses and charges of any nature whatsoever which are either paid or incurred by the Company in connection with the refinement and beneficiation of products after leaving the property and all insurance costs and taxes.

Effective as of September 1, 2007, the Company entered into an agreement with Brehnam Trading Corp. (“Brehnam”) for a term of 24 months to provide consulting services on financial matters, business growth and development, and general business matters. The Company paid Brehnam 1,500,000 Shares earned in equal installments of 375,000 shares on December 1, 2007, June 1, 2008, December 1, 2008 and June 1, 2009. The said 1,500,000 Shares were tendered in one certificate upon execution of the agreement and are deemed to be in Brenham’s possession and were issued as “restricted” and may not be re-sold unless an exemption from registration is available such as the exemption afforded by Rule 144 promulgated under the Securities Act. On July 6, 2009 the consulting period was amended and extended to August 30, 2011 without further compensation. Brenham is required to return any unearned Shares if the agreement is terminated early.