Exhibit 99.1

June 2013

This presentation contains “forward-looking” statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities and the effects of competition.

Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates “ “believes “ “could “ “seeks “ “estimates “ “intends “ “may “ “plans “ “potential “ “predicts “ “projects “ “should “ “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results performance or achievements expressed or implied by the forward-looking statements Forward-looking statements represent our beliefs and assumptions only as of the date of this presentation. You should read the documents that we file with the Securities and Exchange Commission (SEC), including the risks detailed from time to time therein, completely and with the understanding that our actual future results may be different from what we expect. Except as required by law we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

This presentation includes certain non-GAAP financial measures as defined by SEC rules. As required by Regulation G, we have provided a reconciliation of those measures to the most directly comparable GAAP measures which is available in the Appendix

TODD DAVIS

CO-FOUNDER CHARIMAN

& CHIEF EXECUTIVE OFFICER

VISION STATEMENT

Absolute knowledge of identities and convenient protection for cunsumers

And enterprises anytime anyhere.

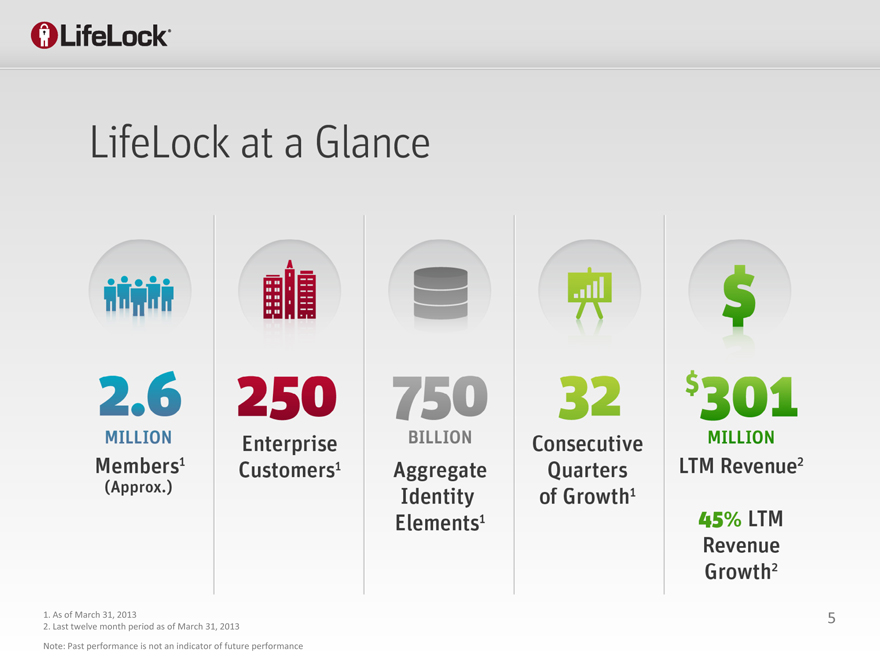

2.6 million

250 enterprises customers

750 billion aggregate identity Elements1

32 Consecutive Quarters of growth1

$301 Million LTM Revenue2

456% LTM Revenue Growth2

2. Last twelve month period as of March 31, 2013

Note: Past performance is not an indicator of future performance

Key Investment Highlights

Broad releveance of identity theft protection provides large and growing addressable market

Leader in consumer identity theft and enterprise fraud protection

Strong Barriers to entry: data, analytics, technology platform and brand

6

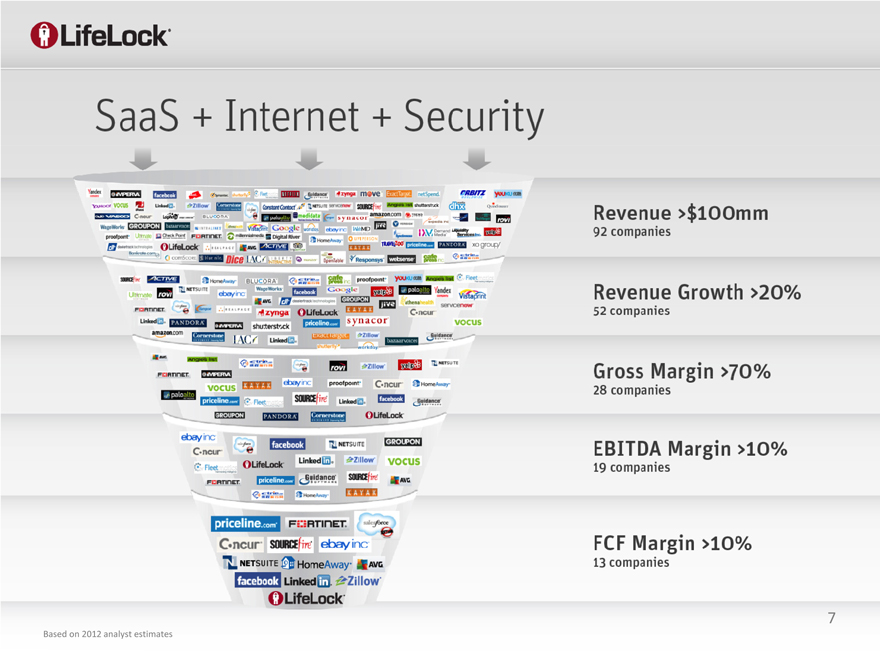

Revenue >100 million

Revenue Growth >20% 52 companies

92 companies

Gross Margin >70%

28 companies

EBITDA Margin >10%

19 companies

FCF margin >10%

13 companies

Based on 2012 analyst estimates

Note: Past performance is not an indicator of future performance

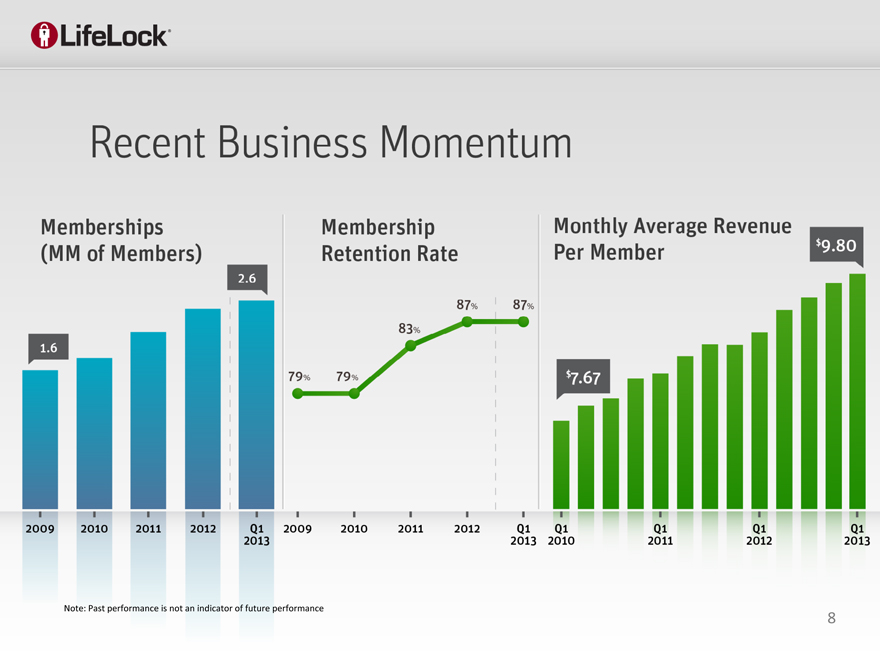

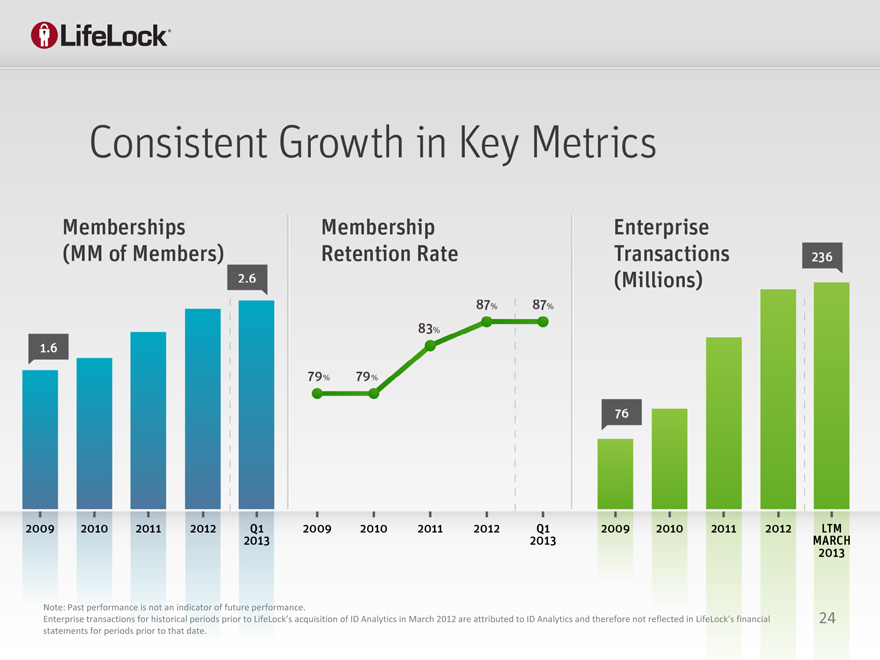

Memberships (MM of Members) 1.6

2.6

79%

2009

2010

2011

2012

Q12013

Q12012

Q12011

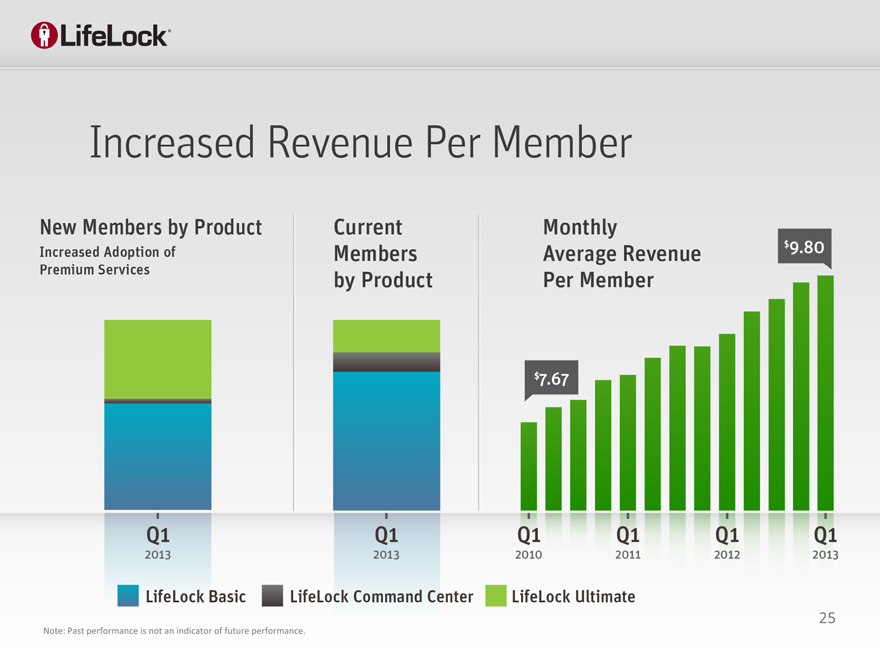

$7.67

$9.80

2009

2010

2011

2012

Membership Retention Rate

Monthly Average Revenue

Per Member

LifeLock Ultimate name a Best in Class Overall “ identity Theft Protection Solution

Announced May Launch of LifeLock Junior

Reported Strong Q1 2013 results

Named finalist for Better Business Bureau Ethics Award

9

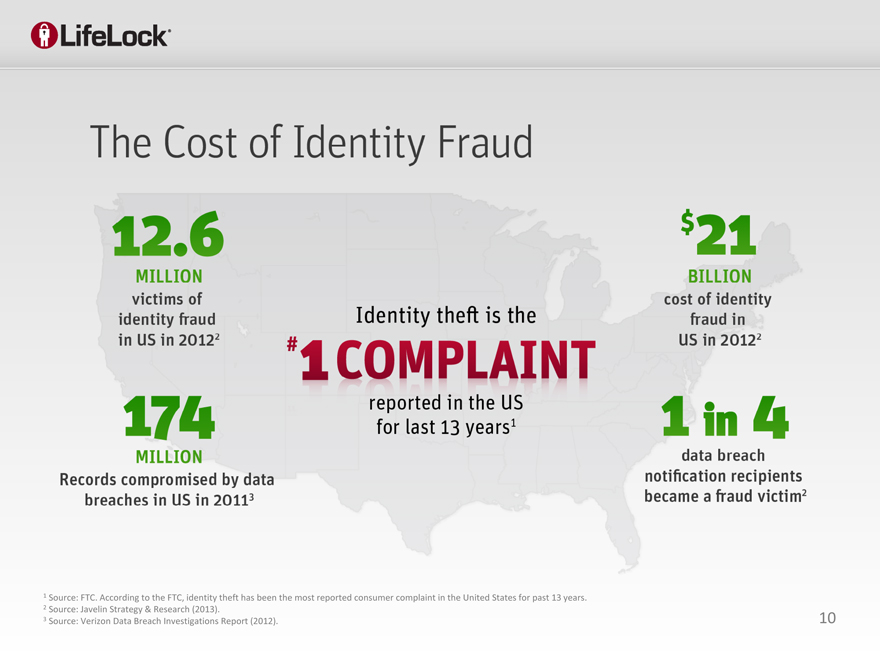

1 Source: FTC According to the FTC identity theft has been the most reported consumer complaint in the United States for past 13 years

2 | | Source: Javelin Strategy & Research (2013). |

3 | | Source: Verizon Data Breach Investigations Report (2012). |

10

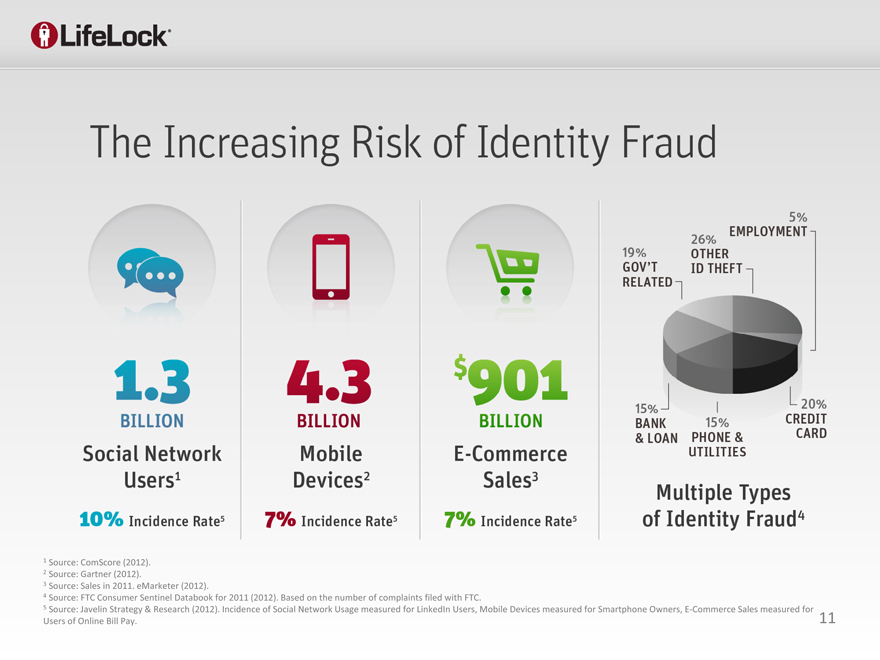

1 | | Source: ComScore (2012). |

2 | | Source: Gartner (2012). |

3 | | Source: Sales in 2011. eMarketer (2012). |

4 | | Source: FTC Consumer Sentinel Databook for 2011 (2012) Based on the number of complaints filed with FTC |

5 Source: Javelin Strategy & Research (2012). Incidence of Social Network Usage measured for LinkedIn Users, Mobile Devices measured for Smartphone Owners, E-Commerce Sales measured for Users of Online Bill Pay.

11

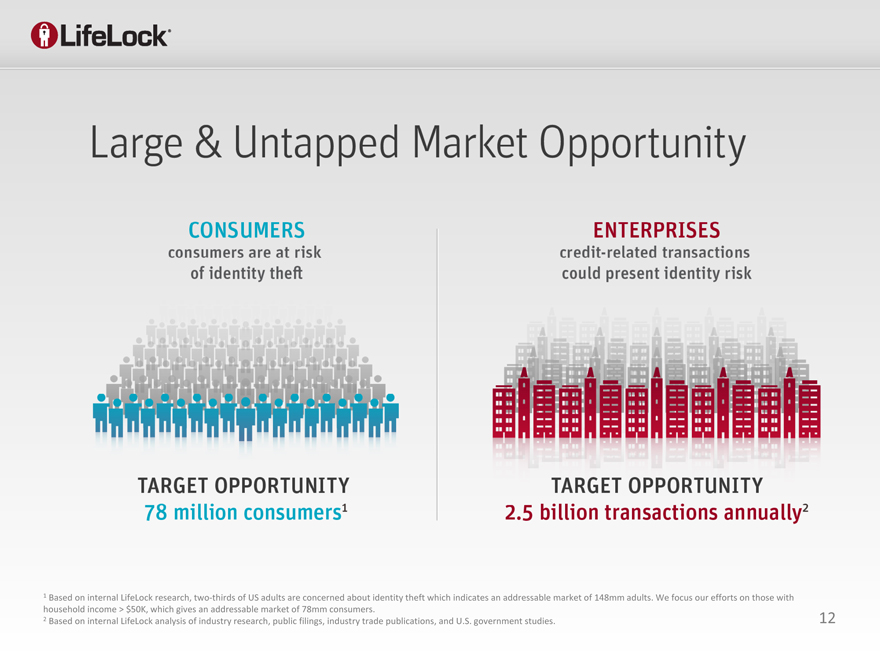

1 Based on internal LifeLock research two-thirds of US adults are concerned about identity theft which indicates an addressable market of 148mm adults We focus our efforts on those with household income > $50K, which gives an addressable market of 78mm consumers.

2 Based on internal LifeLock analysis of industry research, public filings, industry trade publications, and U.S. government studies.

12

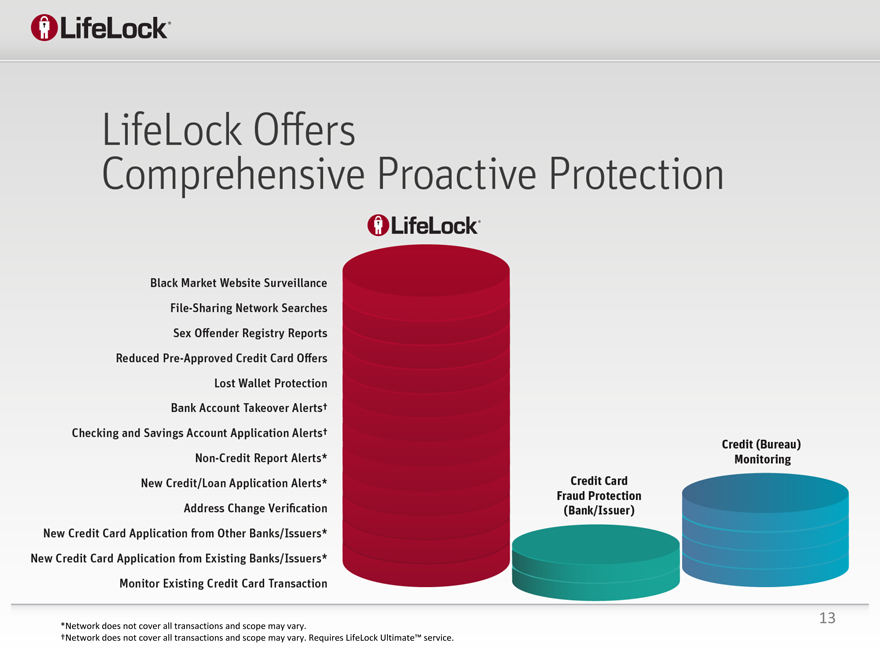

13

*Network does not cover all transactions and scope may vary.

†Network does not cover all transactions and scope may vary. Requires LifeLock Ultimate™ service.

LifeLocK Offers comprehensive Proactive Protection

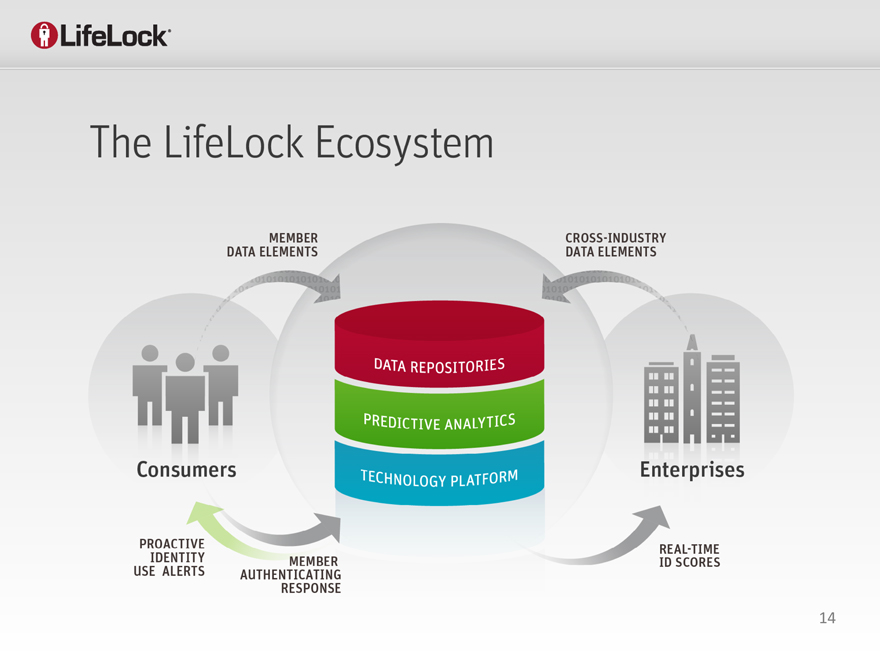

The LifeLock Ecosystem

Member DATA ELEMENTS

CROSS-INDUSTRY DATA-ELEMENTS

CONSUMERS

PROACTIVE IDENTITY USE ALERTS

ENTERPRISES

DATA REPOSITORIES

PREDICTDIVE ANALYTICS

TECHNOLOGY PLATFORM

14

15

OUR UNIQUE DATA REPOSITORIES

750 BILLION IDENTITY ELEMENTS

45 MILLION IDENTITY ELEMENTS

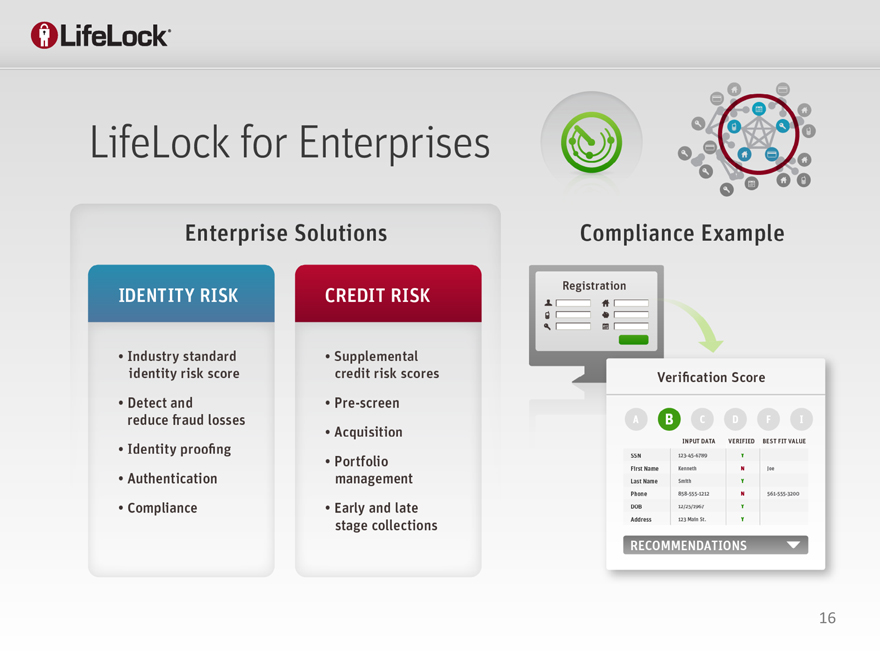

LIFELOCK FOR ENTERPRISES

COMPLIANCE EXAMPLE

IDENTITY RISK

CREDIT RISK

VERIFICATION SCROE

16

LIFELOCK FOR CONSUMERS

17

MULTI-CHANNEL GO TO MARKET STRATEGY

DIRECT TO CONSUMER MARKETING

PARTNERS DISTRIBUTION CHANNELS

DIRECT SALES

STRATEGIC PARTNERS

18

OUR GROWTH STRATEGY

CORE EXECTUTION

NEW PRODUCTS

CHANNEL EXPANSION

LEVERAGE THE LIFELOCK ECOSYSTEM

19

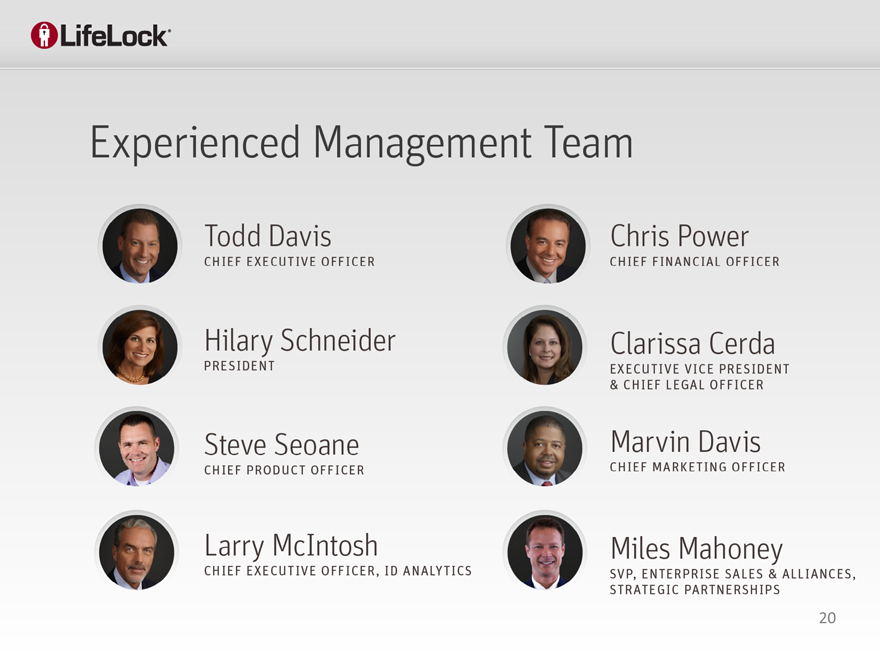

EXPERIENCED MANAGEMENT TEAM

20

CHRIS POWER

CHIEF FINANCIAL OFFICER

21

KEY FINANCIAL HIGHLIGHTS

22

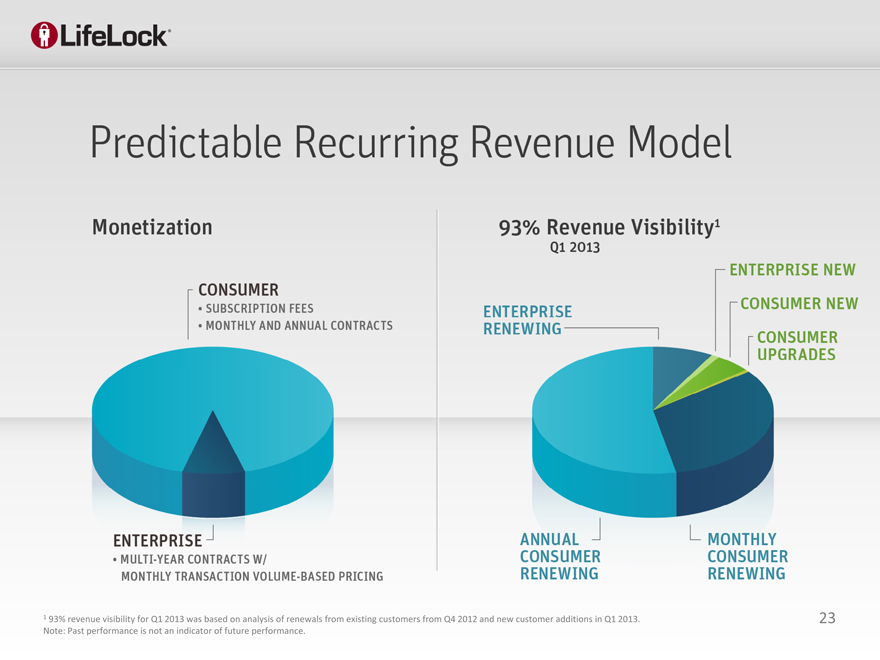

PREDICATABLE RECURRING REVENUE MODEL

1 93% revenue visibility for Q1 2013 was based on analysis of renewals from existing customers from Q4 2012 and new customer additions in Q1 2013.

23

Note: Past performance is not an indicator of future performance.

Note: Past performance is not an indicator of future performance

Enterprise transactions for historical periods prior to LifeLock’s acquisition of ID Analytics in March 2012 are attributed to ID Analytics and therefore not reflected in LifeLock’s financial 24 statements for periods prior to that date.

24

INCREASED REVENUE PER MEMBER

25

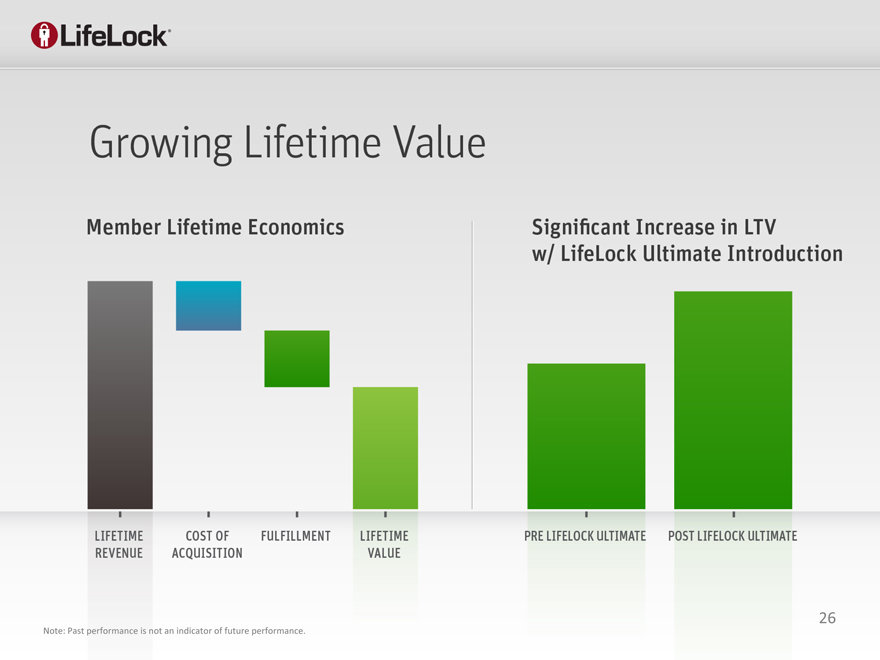

GROWING LIFETIME VALUE

Note: Past performance is not an indicator of future performance.

26

Note: Past performance is not an indicator of future performance.

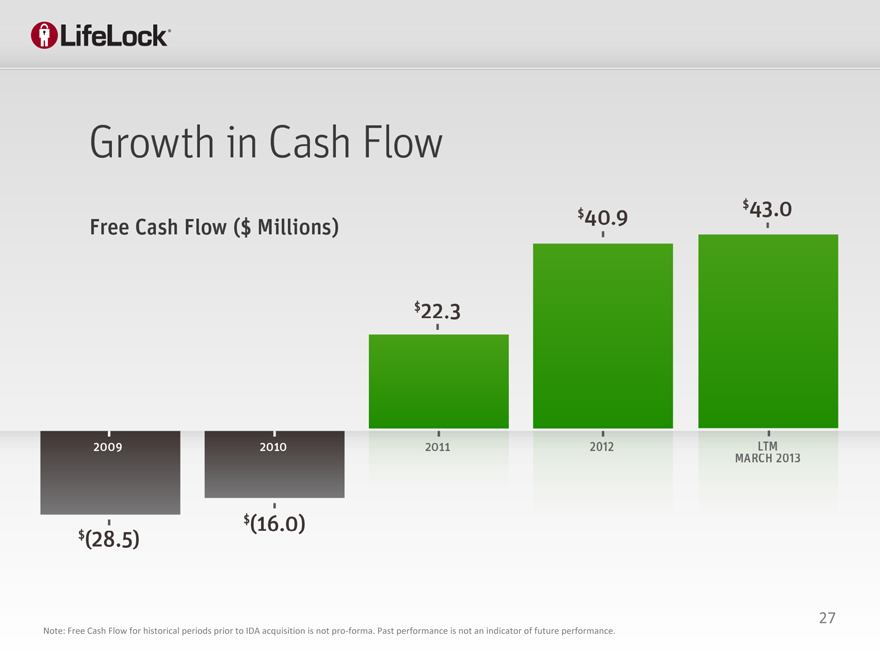

GROWTH IN CASH FLOW

FREE CASH FLOW ($ IN MILLIONS

27

Note: Free Cash Flow for historical periods prior to IDA acquisition is not pro-forma. Past performance is not an indicator of future performance.

Long term

28

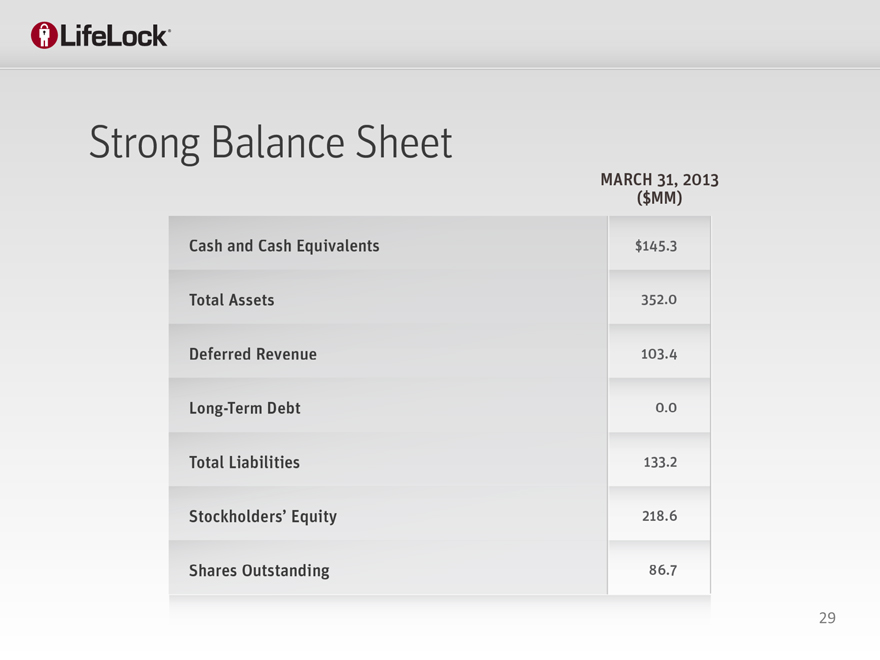

Strong balance sheet

29

Key investment highlights

30

Appendix

31

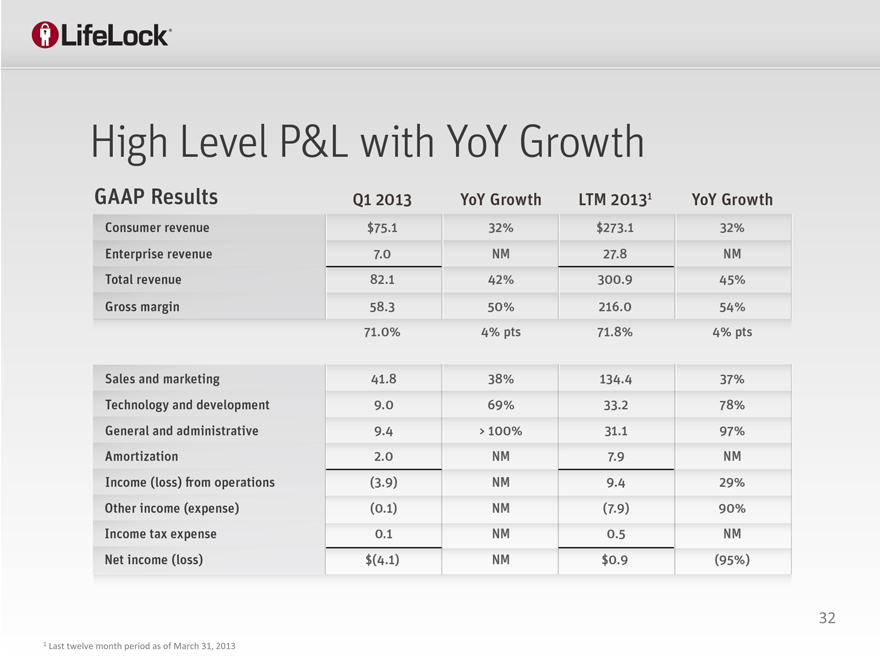

High level P&L with YoY Growth

32

1 | | Last twelve month period as of March 31, 2013 |

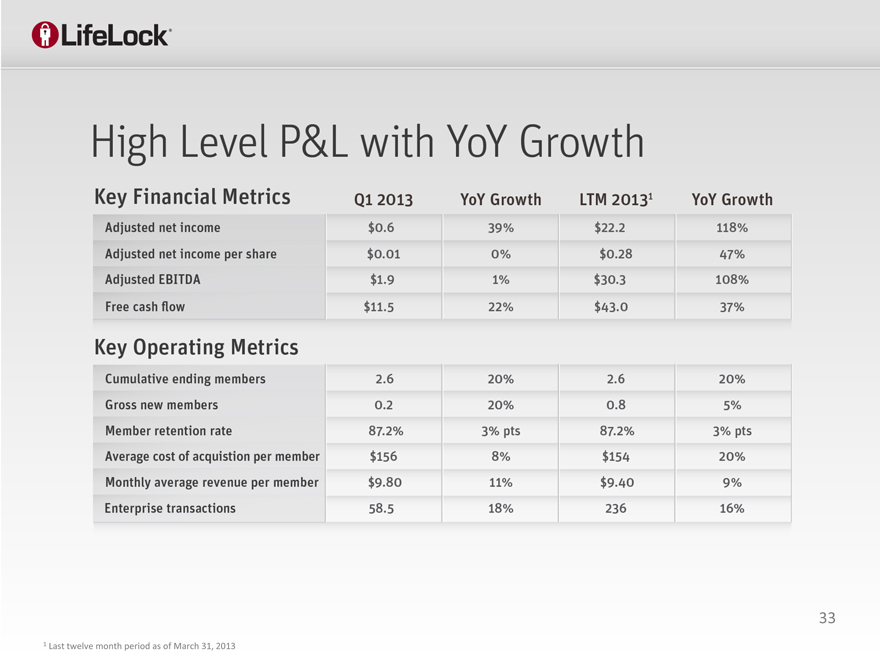

High level P&L with YoY Growth

33

1 | | Last twelve month period as of March 31, 2013 |

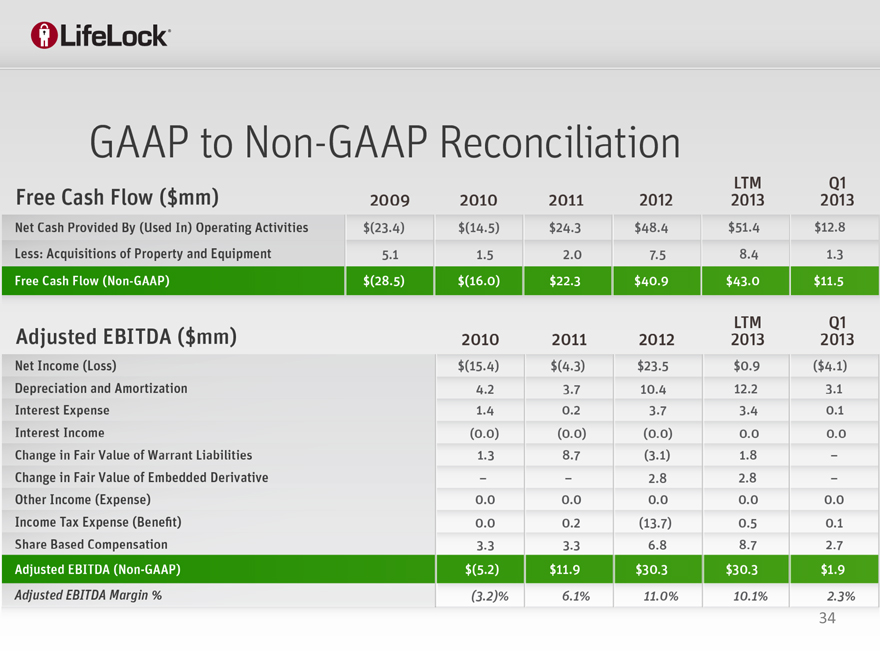

GAAP to Non-GAAP reconciliation

34

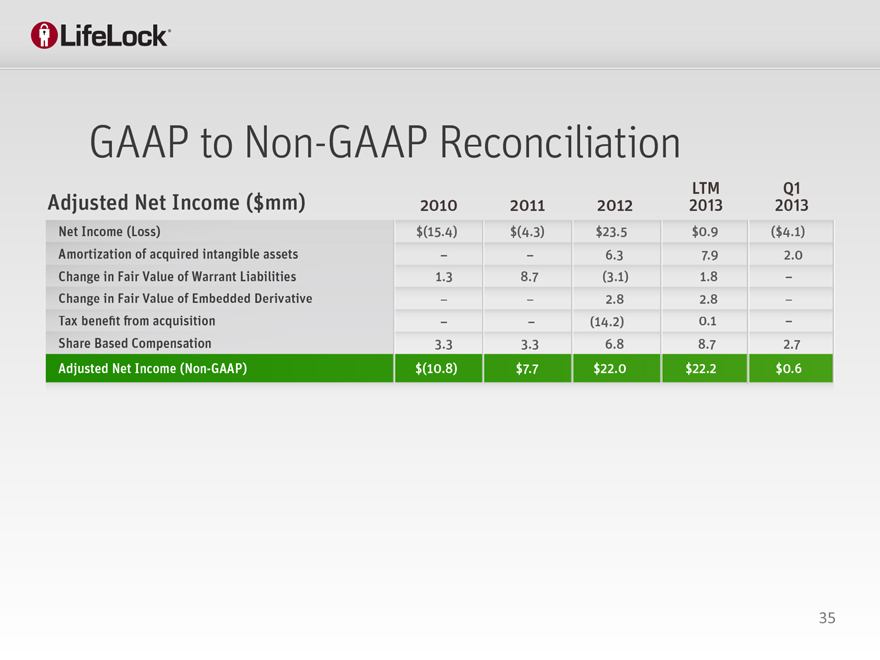

GAAP to Non-GAAP reconciliation

35

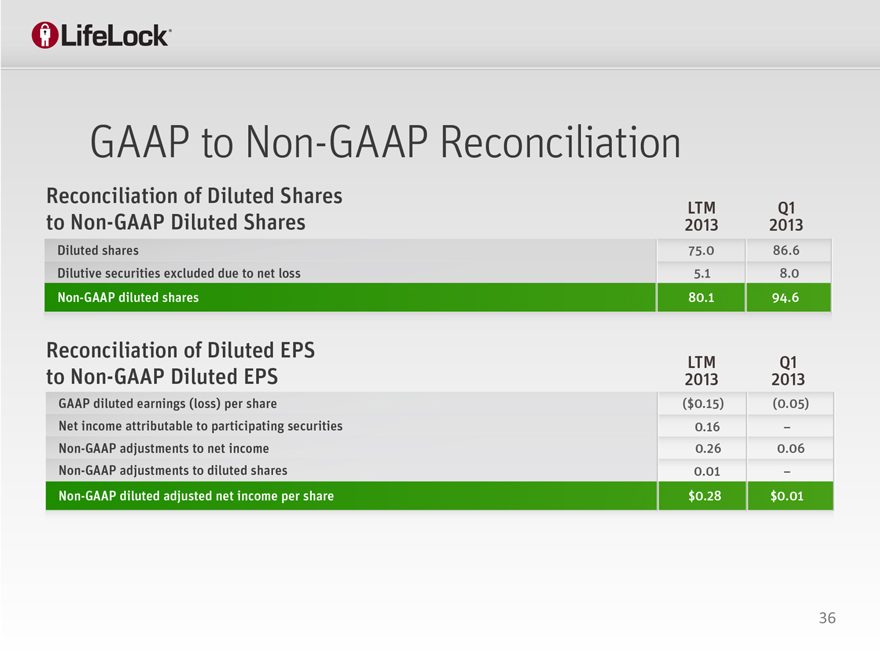

GAAP to Non-GAAP reconciliation

36