©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 2 Safe Harbor Statement This presentation contains “forward-looking” statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include information regarding our growth strategy, markets, priorities, media spend, long-term goals, expected total revenue and adjusted EBITDA, and our profitability. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements including, but not limited to, statements regarding our expectations, beliefs, including beliefs in our services and in the identity theft protection services industry, intentions, strategies, investments and expenditures for new member acquisitions and to grow our business, including investments in sales and marketing and in technology and development, future operations, future financial position, fluctuations in our financial performance from period to period, future revenue, projected expenses, our ability to fund continuing operations and plans and objectives of management and also include statements regarding the final resolution of the FTC and consumer class action matters, along with a possible settlement with certain states’ attorneys general for related claims, as well as the regulatory environment, and other legal proceedings. Forward-looking statements represent our beliefs and assumptions only as of the date of this presentation. You should read the documents that we file with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for this fiscal year ended December 31, 2015 and in our Quarterly on Form 10-Q for the period ended March 31, 2016, and the risks detailed from time to time therein, completely and with the understanding that our actual future results may be different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward- looking statements, even if new information becomes available in the future. This presentation includes certain non-GAAP financial measures as defined by SEC rules. As required by Regulation G, we have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the Appendix.

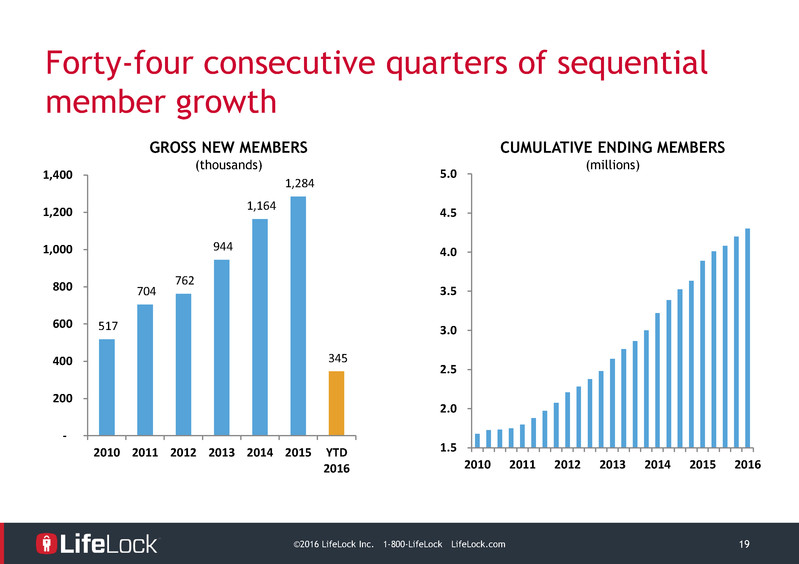

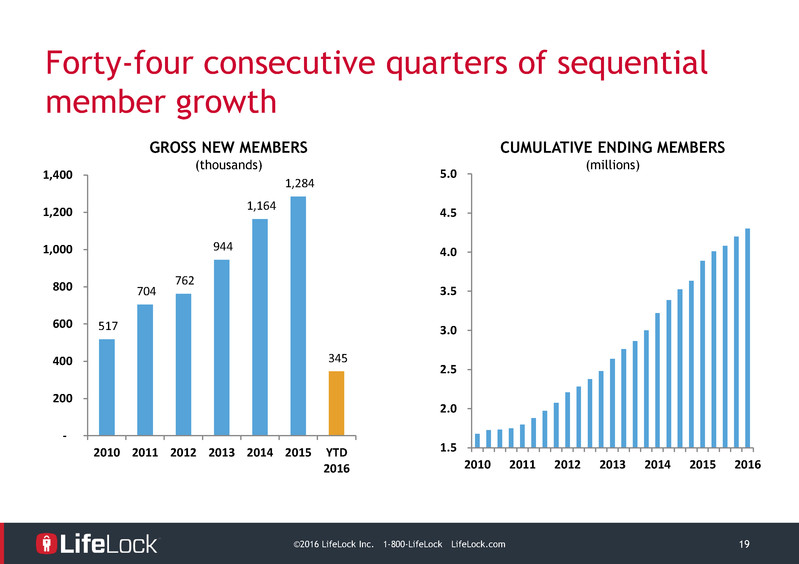

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 3 Recent Business Highlights Hilary Schneider became chief executive officer on March 1, 2016. Roy Guthrie became independent chairman of the board. Doug Jeffries became chief administrative officer, and will also succeed Chris Power as chief financial officer following Q2 earnings. Recorded the 44th consecutive quarter of sequential growth in revenue and cumulative ending members. Added approximately 345,000 gross new members in the first quarter of 2016 and ended the quarter with approximately 4.3 million members. Achieved the 2nd highest premium take rate during Q1 2016 Increased monthly average revenue per member by 5% year over year in Q1 Acquired 4.4 million shares for $51.9 million in connection with the previously announced $100 million share repurchase program.

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 4 Identity Theft is prevalent while Consumer Behavior Increases Risk * Based on sample of 4,402 respondents to monthly online consumer survey conducted by MSI International on behalf of LifeLock, Jan-Dec 2015. ** 2015 Data Protection and Breach. Online Trust Alliance. Pre-Release Draft (January 29, 2015) Based on first nine months of 2014. *** Federal Trade Commission press release, February 27, 2015. **** 2016 Identity Fraud: Fraud Hits an Inflection Point – Javelin Strategy (February 2016) ***** Identity Theft Study, a commissioned survey conducted by Forrester Consulting on behalf of LifeLock. Results are based on survey participant identity theft and life events between April 2013 and May 2014. #1 COMPLAINT In the US to the FTC from 2000-2014*** 904 MILLION Number of records exposed by data breach in 2014** $15 BILLION In losses due to identity theft in US**** 1/4 Americans have been victims of ID theft* Smartphone users are 3.5 times more likely than non-smartphone users to be an identity theft victim in the past 12 months.***** Online Shoppers are 4 times more likely to be an identity theft victim in the past 12 months.***** Social Media users are 3 times more likely than non-social media users to be an identity theft victim in the past 12 months.*****

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 5 78M ADULTS Early Innings of Large U.S. Addressable Market 40+ MILLION DOING NOTHING 30+ MILLION DOING SOMETHING CONCERNED ABOUT IDENTITY THEFT $50K PLUS INCOME 78 Million 4.3 MILLION CURRENT MARKET SHARE

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 6 Broadening Target Market Demographics BEHAVIORS Tech Savvy Active on Social Media ATTITUDES Understand Risks of Identity Theft Willing to Pay to Protect Assets 5% PENETRATION 78 Million ADULTS DEMOGRAPHICS Income Above National Average Age - 35+ Gender Neutral A majority are married with children at home

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 7 Positioned as the Premium Offering Features/ Service Level Identity Theft Protection Services (ITPS) Credit Monitoring Some companies listed are owned by Experian or Equifax

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 8 4x the Brand Awareness of the Closest ITPS Competitor 33% 7% 0% 0% 4% 1% 0% 3% 10% 3% 0% 5% 10% 15% 20% 25% 30% 35% 40% LifeLock Experian FreeCreditScore.com Protect myID Equifax Trusted ID ID Patrol TransUnion Credit Karma ID Guard % When asked what companies are you aware of that provide Identity Theft Protection/Credit Monitoring & Alerts services to consumers? A commissioned survey conducted in Oct-Dec 2015 by MSI International on behalf of LifeLock. Base: Total Respondents 1034 (aware) Q5a. (10-point scale: 10=extremely likely to consider; 1=not at all likely to consider)

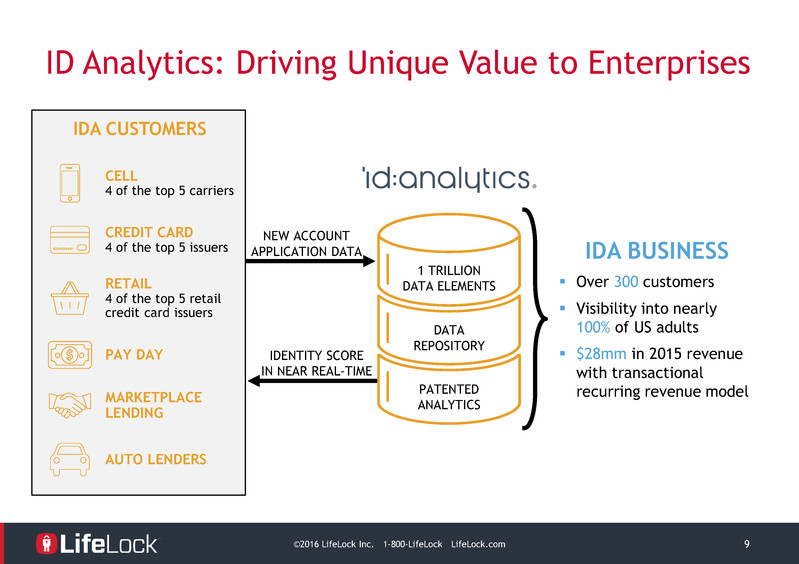

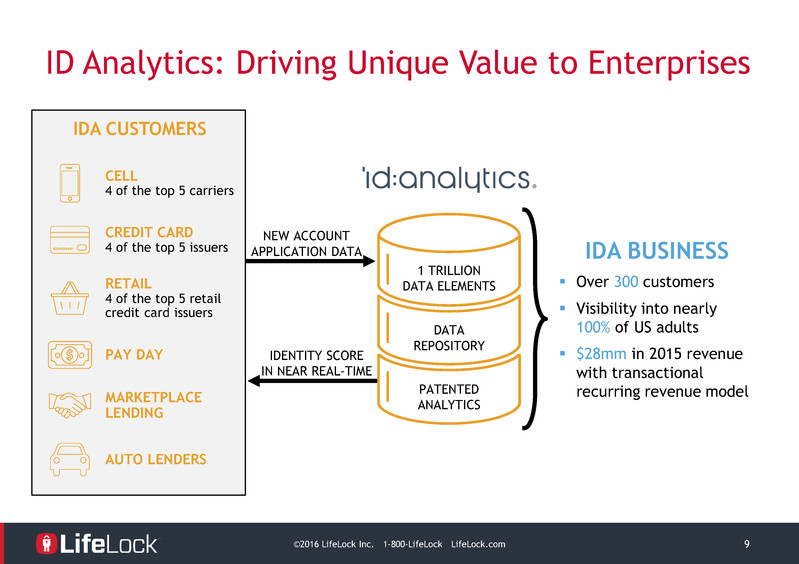

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 9 IDENTITY SCORE IN NEAR REAL-TIME NEW ACCOUNT APPLICATION DATA ID Analytics: Driving Unique Value to Enterprises IDA CUSTOMERS CELL 4 of the top 5 carriers CREDIT CARD 4 of the top 5 issuers RETAIL 4 of the top 5 retail credit card issuers PAY DAY AUTO LENDERS MARKETPLACE LENDING IDA BUSINESS Over 300 customers Visibility into nearly 100% of US adults $28mm in 2015 revenue with transactional recurring revenue model 1 TRILLION DATA ELEMENTS PATENTED ANALYTICS DATA REPOSITORY

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 10 IDA Serves a Large Addressable Market with Strong Penetration in its Core Market CORE MARKET WIRELESS BANK + STORE CARD MARKET- PLACE ADJACENT TARGET MARKET AUTO STUDENT LOANS PAY DAY MORTGAGEWIRELINE + PAID TV TAX RETURNS

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 11 IDA Gives LifeLock Members Unique Visibility and is key to high retention rate CREDIT CARD AUTO LENDERS CELL Did you open a new credit card? Yes No LifeLock Member FRAUDSTER Consumer attempts to open New Account NO YES IDA Customer

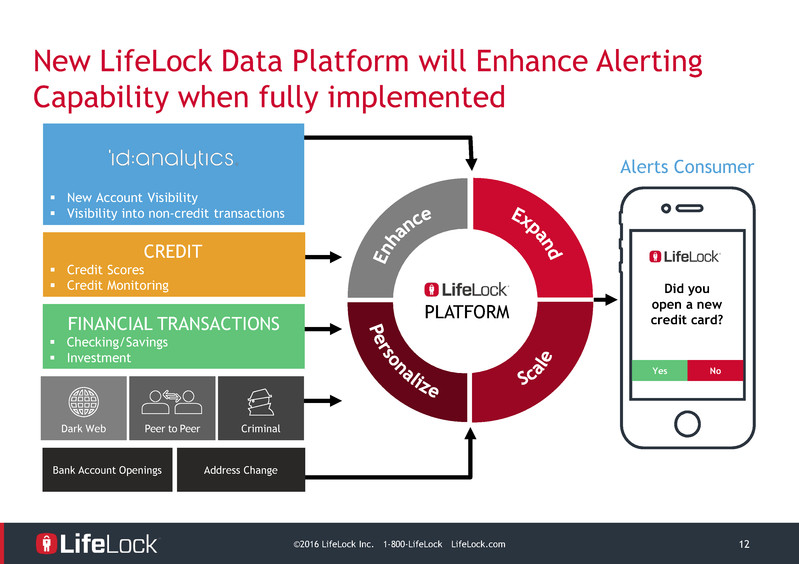

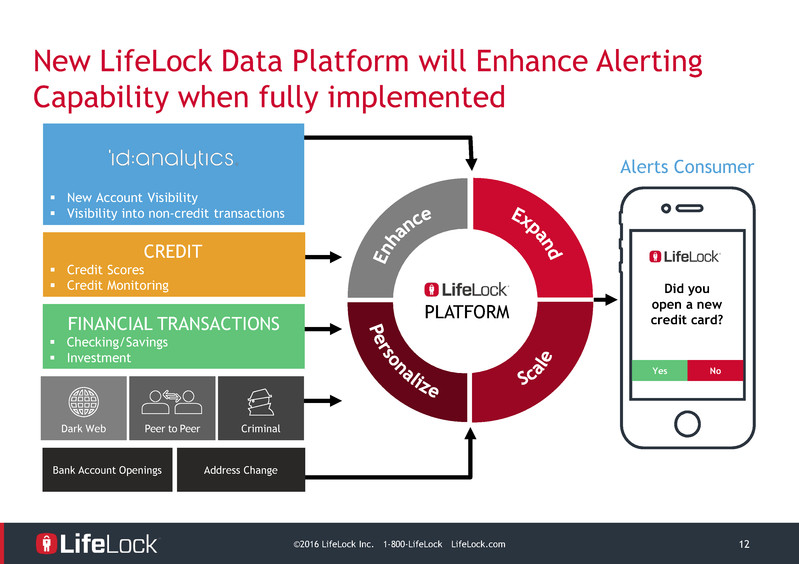

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 12 New LifeLock Data Platform will Enhance Alerting Capability when fully implemented Did you open a new credit card? Yes No Alerts Consumer z PLATFORM Checking/Savings Investment FINANCIAL TRANSACTIONS New Account Visibility Visibility into non-credit transactions Credit Scores Credit Monitoring CREDIT Dark Web Peer to Peer Criminal Bank Account Openings Address Change

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 13 Product Lineup - Good, Better, Best LIFELOCK STANDARD $9.99/mo LifeLock Identity Alert® System* $1 Million Service Guarantee** Live Member Service Support Lost Wallet Protection Address Change Verification Reduced Pre-Approved Credit Card Offers Black Market Website Surveillance LifeLock Privacy Monitor Identity Restoration Support Stolen Funds Reimbursement** $25K 1 LIFELOCK ADVANTAGE $19.99/mo All features in LifeLock Standard, plus: Credit Card Activity Alerts* Checking and Savings Account Activity Alerts* Fictitious Identity Monitoring Court Records Scanning Data Breach Notifications Online Annual Credit Report Online Annual Credit Score Stolen Funds Reimbursement** $100K 2 LIFELOCK ULTIMATE PLUS $29.99/mo All features in our LifeLock Advantage Service, plus: Investment Account Activity Alerts* Online Annual Tri-Bureau Credit Report and Scores Bank Account Takeover Alerts* Credit Inquiry Alerts* File Sharing Network Searches Sex Offender Registry Reports Monthly Credit Score Tracking Priority Live Member Service Support Stolen Funds Reimbursement** $1mn 3 * LifeLock does not monitor all transactions at all businesses. ** Lost Funds Reimbursement and Service Guarantee benefits for State of Washington members are provided under a Master Insurance Policy issued by United Specialty Insurance Company. Benefits for all other members are provided under a Master Insurance Policy underwritten by State National Insurance Company. Under the Service Guarantee LifeLock will spend up to $1 million to hire experts to help your recovery. Under the Lost Funds Reimbursement, LifeLock will reimburse lost funds up to $25,000 for Standard membership, up to $100,000 for advantage membership and up to $1 million for Ultimate Plus membership. Coverage currently limited for NY And WA. For residents of New York and Washington, currently LifeLock will reimburse up to $10,000 for Standard membership, up to $15,000 for Advantage membership and up to $25,000 for Ultimate Plus membership. Please see the policy for terms, conditions and exclusions at LifeLock.com/legal.

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 14 LifeLock’s Ultimate Plus vs. Credit Monitoring V A LU E PROTECTIONCREDIT BASED SERVICES Credit Alerts Credit Scores Credit Monitoring Broader Transaction Visibility Dedicated Remediation Team New Account Visibility $1MN Service Guarantee* Backed by Insurance* *Subject to terms and conditions

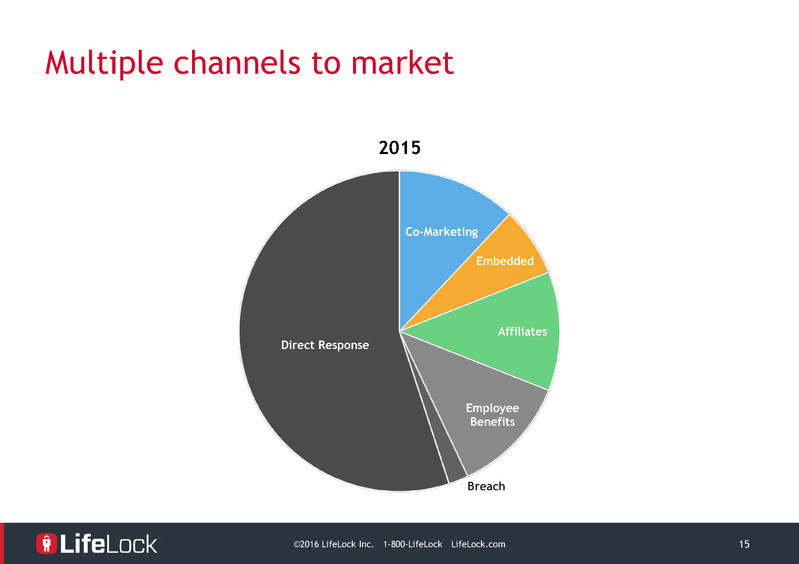

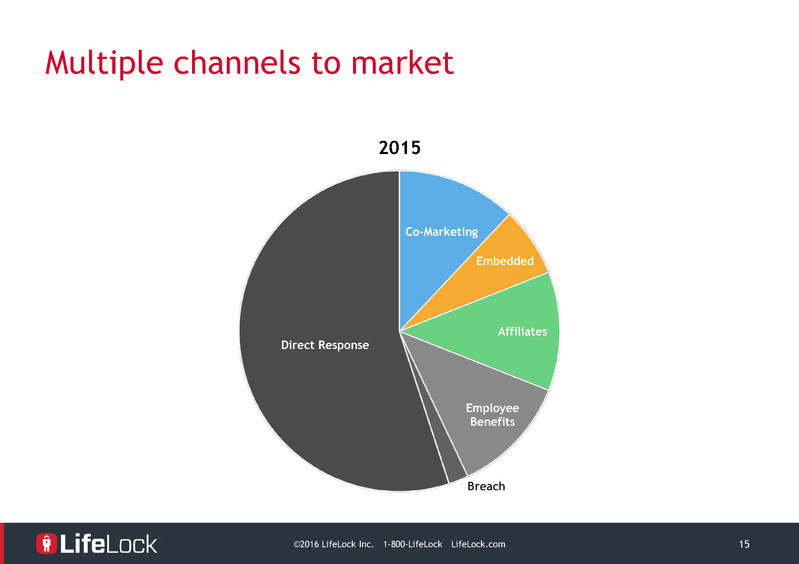

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 15 Co-Marketing Embedded Affiliates Employee Benefits Breach Direct Response Multiple channels to market 2015

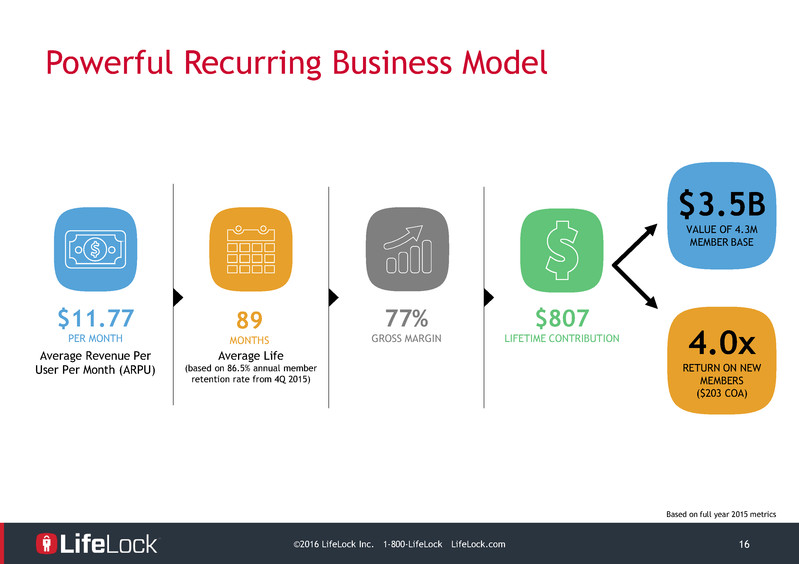

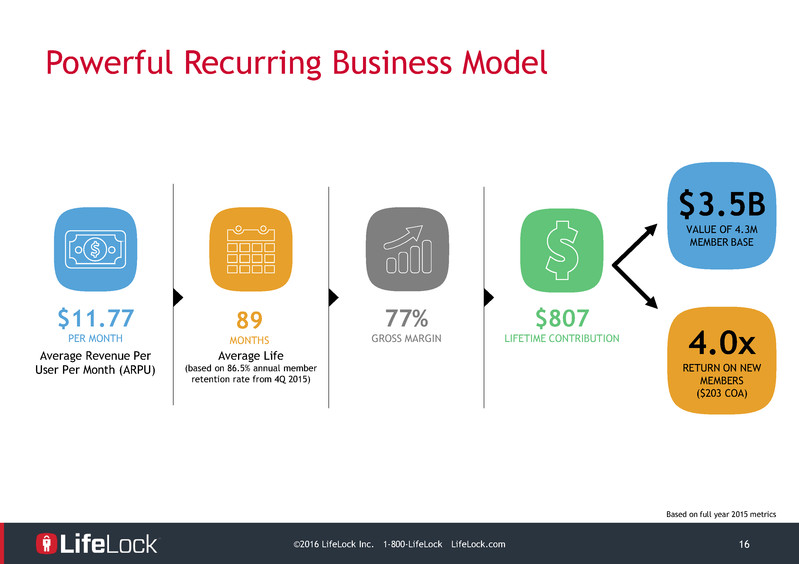

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 16 Powerful Recurring Business Model $11.77 PER MONTH Average Revenue Per User Per Month (ARPU) 89 MONTHS 77% GROSS MARGIN Average Life (based on 86.5% annual member retention rate from 4Q 2015) $807 LIFETIME CONTRIBUTION $3.5B VALUE OF 4.3M MEMBER BASE 4.0x RETURN ON NEW MEMBERS ($203 COA) Based on full year 2015 metrics

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 17 Seasoned Team with Track Record of Success Hilary Schneider Chief Executive Officer Chris Power Chief Financial Officer Douglas Jeffries Chief Administrative Officer Mike Dean Chief Strategy Officer Neil Daswani, Ph. D Chief Information Security Officer Ty Shay Chief Marketing Officer Dev Patel, Ph. D Senior Vice President, Product and Technology Sharon Segev Executive Vice President, General Counsel and Secretary Ignacio Martinez Chief Risk Officer

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 18 Consistent Revenue and Adjusted EBITDA* growth FCF Generation of $89.6m in 2015 - 175.0 350.0 525.0 700.0 Consumer Enterprise (10.0) 10.0 30.0 50.0 70.0 90.0REVENUE ($M) ADJUSTED EBITDA ($M) *Non-GAAP financial measure, see Appendix for most comparable GAAP number and reconciliation **2016 Revenue and Adjusted EBITDA figures are based on the mid-point of the guidance provided in our Earnings Results call February 10, 2016 for the full year ending December 31, 2016.

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 19 Forty-four consecutive quarters of sequential member growth 517 704 762 944 1,164 1,284 345 - 200 400 600 800 1,000 1,200 1,400 2010 2011 2012 2013 2014 2015 YTD 2016 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 2010 2011 2012 2013 2014 2015 2016 GROSS NEW MEMBERS (thousands) CUMULATIVE ENDING MEMBERS (millions)

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 20 7.00 8.00 9.00 10.00 11.00 12.00 2010 2011 2012 2013 2014 2015 Q1 2016 Consistent growth in Revenue per Member MONTHLY AVERAGE REVENUE PER MEMBER

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 21 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2010 2011 2012 2013 2014 2015 2016 GNM* LifeLock Premium Products LifeLock Command Center LifeLock Basic and Standard LifeLock for Minors/LifeLock Junior Growth in Revenue per Member driven by penetration of premium products ** * Gross new members for the Q1 2016. ** LifeLock Premium Products include LifeLock Ultimate, LifeLock Ultimate Plus & LifeLock Advantage.

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 22 Strong Cash position with no debt Dec 31, 2015 ($Millions) Mar 31, 2016 ($Millions) Cash and Marketable Securities 246.7 201.8 Goodwill & Intangible Assets 202.3 199.2 Deferred Tax Assets 77.4 84.9 Total Other Assets 66.5 67.8 Deferred Revenue 166.4 185.6 Debt - - Total Other Liabilities* 108.3 102.7 Stockholder’s Equity 318.1 265.4

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 23 Long-Term Goals* Reconciliation of Sales and Marketing Expenses to Adjusted Sales and Marketing Expenses 2011 2012 2013 2014 2015 LT GOALS1 Adj GM 68% 71% 73% 75% 77% 75% - 77% Adj S&M 47% 44% 44% 44% 46% 36% - 39% Adj T&D 9% 10% 10% 10% 10% 9% - 10% Adj G&A 8% 7% 9% 11% 10% 7% - 8% Adj EBITDA 6.4% 11.2% 11.4% 11.7% 12.3% 20% - 25% FCF 12% 15% 18% 19% 15% 18% - 23% 1 These goals are forward‐looking, are subject to significant business, economic, regulatory, competitive, and other uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section in our filings with the Securities and Exchange Commission from time to time, including our Form 10-K for the year ended December 31, 2015. Nothing in this presentation should be regarded as a representation by any person that these goals will be achieved and the Company undertakes no duty to update its goals. *All measures are non-Gaap financial measures, see appendix for most comparable Gaap number & reconciliation. LifeLock has not presented reconciliation for long term goals as such goals are forward-looking and LifeLock is unable to predict or estimate of the reconciling items between the Gaap and non-Gaap measures. This presentation includes certain non-GAAP financial measures as defined by SEC rules. As required by Regulation G, we have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the Appendix.

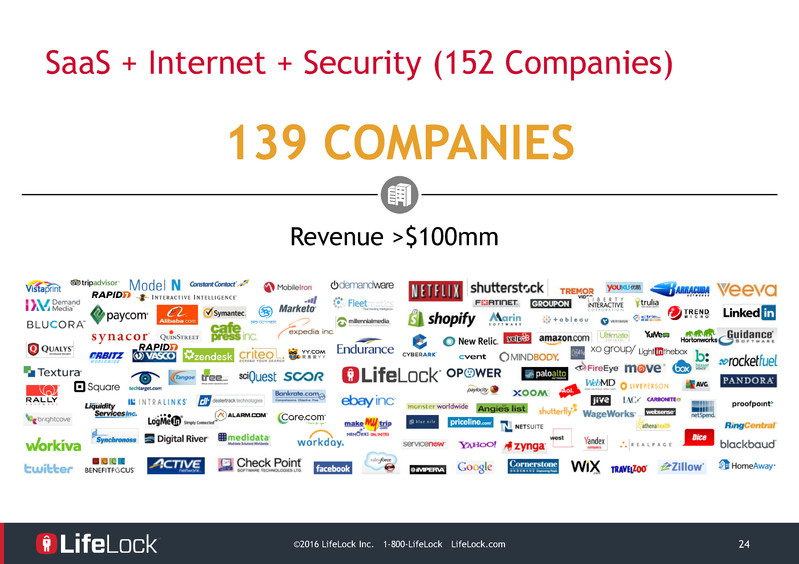

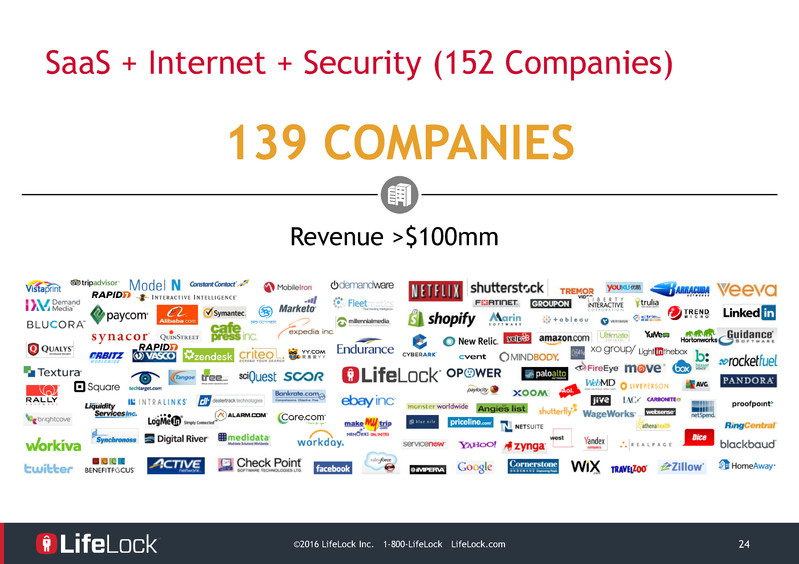

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 24 SaaS + Internet + Security (152 Companies) 139 COMPANIES Revenue >$100mm

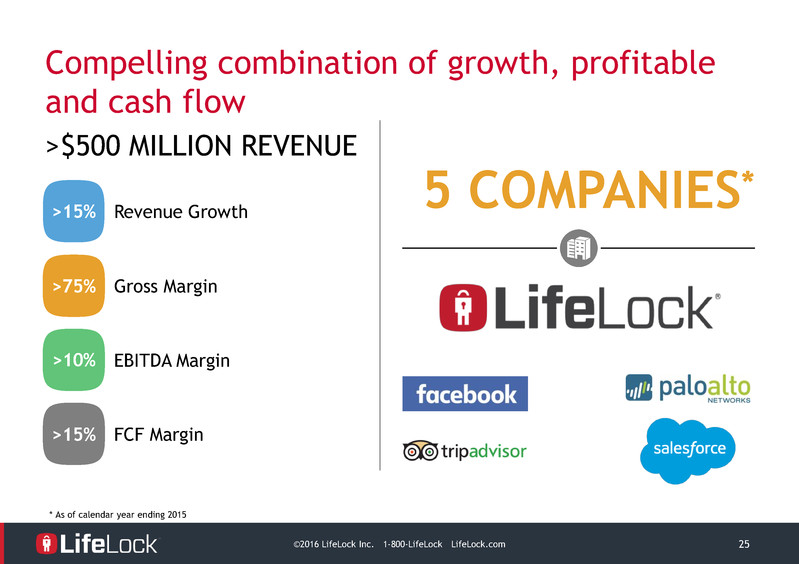

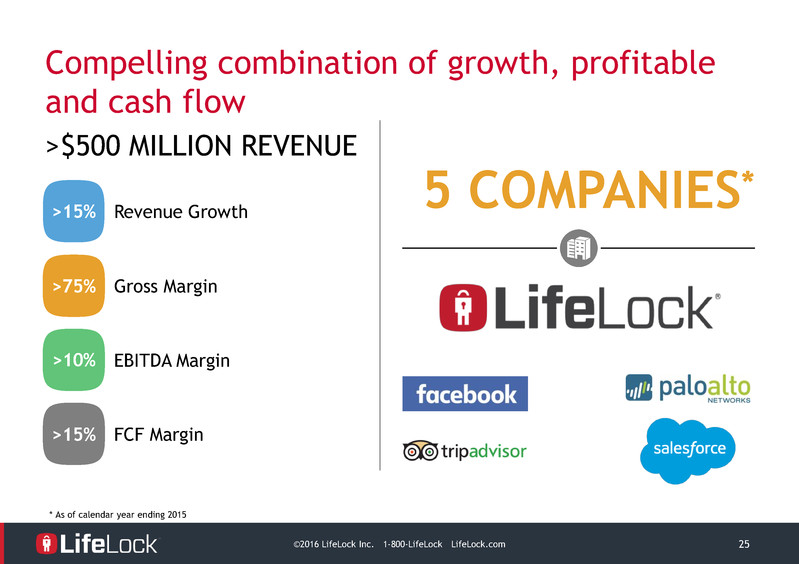

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 25 Compelling combination of growth, profitable and cash flow Revenue Growth >$500 MILLION REVENUE Gross Margin EBITDA Margin FCF Margin 5 COMPANIES* * As of calendar year ending 2015 >10% >75% >15% >15%

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 26 Key Investment Highlights Large and growing addressable market Leader in consumer identity theft and consumer risk management Industry leading service offering Strong barriers to entry: Data, analytics, technology platform, and brand Experienced management team with track record of execution Predictable subscription model Compelling combination of growth, profitability, and cash flow

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 27 Appendix

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 28 Reconciliation of Net Cash Provided by (Used In) Operating Activities to Free Cash Flow 2010 2011 2012 2013 2014 2015 Cash Flows Provided by (used in) Operations $(14.5) $24.3 $48.4 $77.4 $109.2 $(3.8) Acquisition of Property and Equipment $(1.5) $(2.0) $(7.5) $(10.4) $(14.6) $(14.2) Legal Settlement $11.0 - $(3.5) - $(5.0) $100.0 Expenses Related to FTC Litigation - - - - - $7.5 Free Cash Flow $(5.0) $22.3 $37.4 $67.0 $89.6 $89.5 Reconciliation of Net Income (Loss) to Adjusted EBITDA Net Income (Loss) $(15.4) $(4.3) $23.5 $54.5 $2.5 $(51.0) Depreciation and Amortization $4.2 $3.7 $10.4 $12.8 $16.3 $18.7 Share-based Compensation $3.3 $3.3 $6.8 $11.1 $18.1 $27.2 Interest Expense $1.4 $0.2 $3.7 $0.4 $0.4 $0.4 Interest Income - - - $(0.1) $(0.3) $(0.8) Change in Fair Value of Warrant Liabilities $1.3 $8.7 $(3.1) - - - Change In Embedded Derivatives - - $2.8 - - - Other Expenses - - - - $0.1 $0.2 Acquisition Expenses - $0.6 $0.7 $1.1 - $3.1 Legal Settlement - - $(3.6) - $15.0 $98.5 Expenses Related to FTC Litigation - - - - - $9.6 Income Tax (Benefit) Expense - $0.2 $(13.7) $(37.5) $3.4 $(33.5) Adjusted EBITDA $(5.2) $12.5 $27.5 $42.2 $55.5 $72.3 GAAP to Non-GAAP Reconciliations

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 29 Reconciliation of Cost of Services to Adjusted Cost of Services 2010 2011 2012 2013 2014 2015 Cost of Services $51.4 $62.6 $79.9 $100.1 $120.4 $137.4 Share-based Compensation $(0.3) $(0.3) $(0.6) $(0.8) $(1.3) $(1.8) Adjusted Cost of Services $51.1 $62.3 $79.3 $99.3 $119.1 $135.6 Reconciliation of Gross Profit to Adjusted Gross Profit Gross Profit $110.8 $131.3 $196.5 $269.6 $355.6 $450.1 Share-based Compensation $0.3 $0.3 $0.6 $0.8 $1.3 $1.8 Adjusted Gross Profit $111.1 $131.6 $197.1 $270.4 $356.9 $451.9 GAAP to Non-GAAP Reconciliations

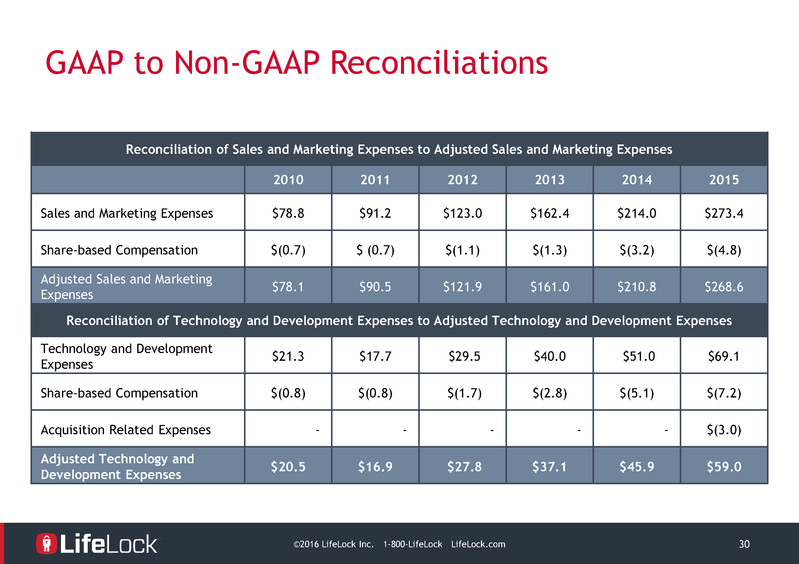

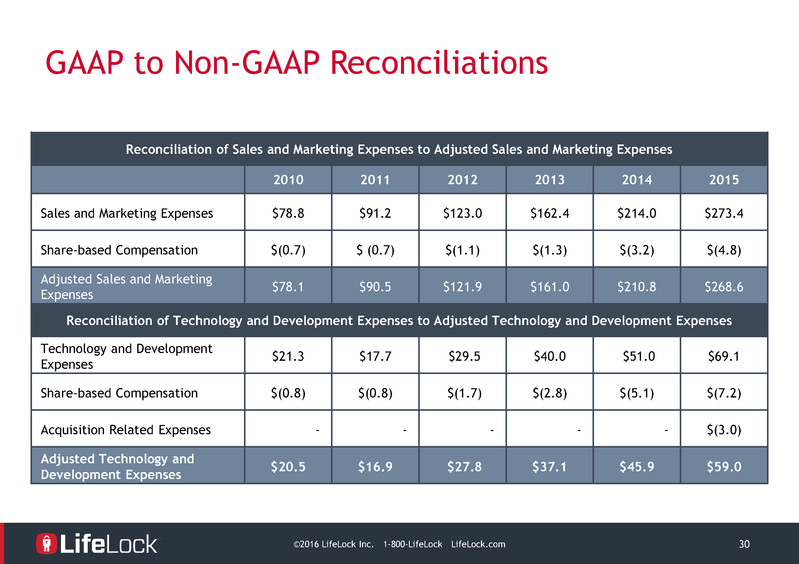

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 30 GAAP to Non-GAAP Reconciliations Reconciliation of Sales and Marketing Expenses to Adjusted Sales and Marketing Expenses 2010 2011 2012 2013 2014 2015 Sales and Marketing Expenses $78.8 $91.2 $123.0 $162.4 $214.0 $273.4 Share-based Compensation $(0.7) $ (0.7) $(1.1) $(1.3) $(3.2) $(4.8) Adjusted Sales and Marketing Expenses $78.1 $90.5 $121.9 $161.0 $210.8 $268.6 Reconciliation of Technology and Development Expenses to Adjusted Technology and Development Expenses Technology and Development Expenses $21.3 $17.7 $29.5 $40.0 $51.0 $69.1 Share-based Compensation $(0.8) $(0.8) $(1.7) $(2.8) $(5.1) $(7.2) Acquisition Related Expenses - - - - - $(3.0) Adjusted Technology and Development Expenses $20.5 $16.9 $27.8 $37.1 $45.9 $59.0

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 31 GAAP to Non-GAAP Reconciliations Reconciliation of General and Administrative Expenses to Adjusted General and Administrative Expenses 2010 2011 2012 2013 2014 2015 General and Administrative Expenses $23.3 $17.5 $24.6 $42.1 $75.7 $183.3 Share-Based Compensation $(1.5) $(1.5) $(3.3) $(6.2) $(8.7) $(13.5) Acquisition Related Expenses - $(0.6) $(0.7) $(1.0) - $(0.1) Legal Reserve - - $3.6 - $(15.0) $(98.5) Expenses Related to FTC Litigation - - - - - $(9.6) Adjusted General and Administrative Expenses $21.8 $15.4 $24.2 $34.9 $52.0 $61.5

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 32 Components of Profit and Loss Fulfillment Partners (incl Insurance) Member Services Credit Card Fees Other 2015 Actual $M % of Rev Consumer Revenue 559.5 95.2% Enterprise Revenue 28.0 4.8% Total Revenue 587.5 100.0% Adj COS 135.6 23.1% Adj GM 451.9 76.9% Adj S&M 268.6 45.7% Adj T&D 59.0 10.0% Adj G&A 61.5 10.5% Adj EBITDA 72.3 12.3% COST OF SERVICE

©2016 LifeLock Inc. 1-800-LifeLock LifeLock.com 33 Components of Profit and Loss SALES AND MARKETING Media Commissions Enterprise Production Personnel Other 2015 Actual $M % of Rev Consumer Revenue 559.5 95.2% Enterprise Revenue 28.0 4.8% Total Revenue 587.5 100.0% Adj COS 135.6 23.1% Adj GM 451.9 76.9% Adj S&M 268.6 45.7% Adj T&D 59.0 10.0% Adj G&A 61.5 10.5%