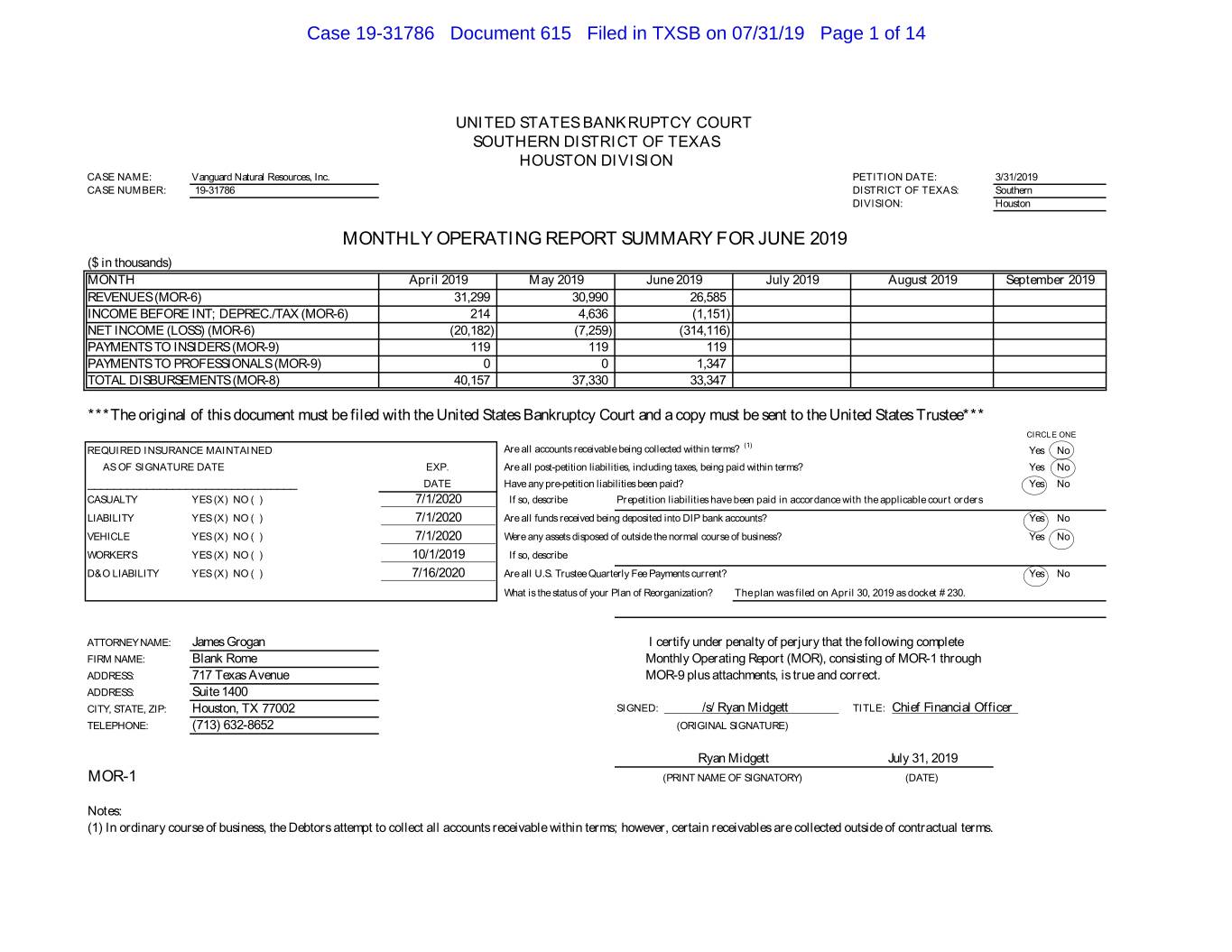

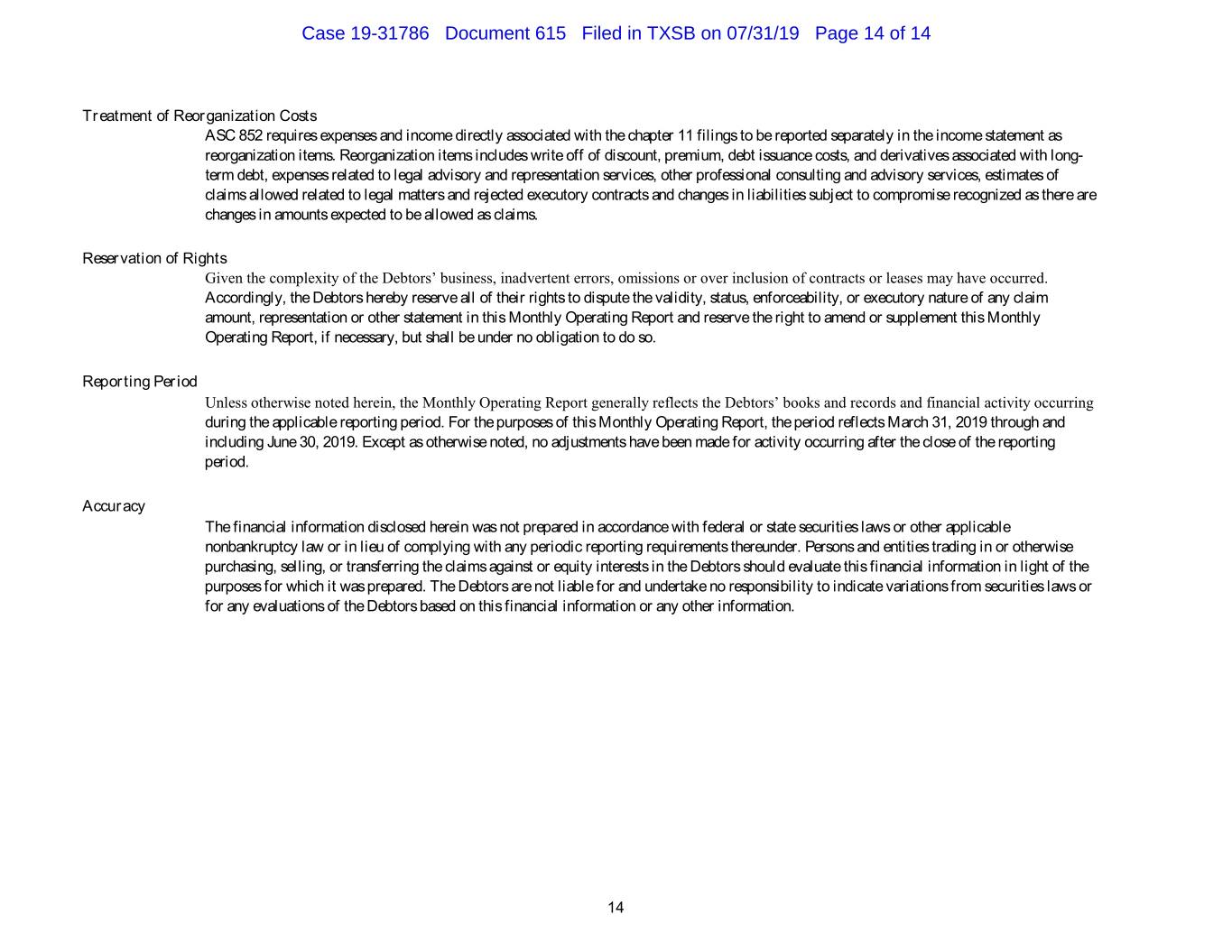

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 1 of 14 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION CASE NAME: Vanguard Natural Resources, Inc. PETITION DATE: 3/31/2019 CASE NUMBER: 19-31786 DISTRICT OF TEXAS: Southern DIVISION: Houston MONTHLY OPERATING REPORT SUMMARY FOR JUNE 2019 ($ in thousands) MONTH April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 REVENUES (MOR-6) 31,299 30,990 26,585 INCOME BEFORE INT; DEPREC./TAX (MOR-6) 214 4,636 (1,151) NET INCOME (LOSS) (MOR-6) (20,182) (7,259) (314,116) PAYMENTS TO INSIDERS (MOR-9) 119 119 119 PAYMENTS TO PROFESSIONALS (MOR-9) 0 0 1,347 TOTAL DISBURSEMENTS (MOR-8) 40,157 37,330 33,347 ***The original of this document must be filed with the United States Bankruptcy Court and a copy must be sent to the United States Trustee*** CIRCLE ONE (1) REQUIRED INSURANCE MAINTAINED Are all accounts receivable being collected within terms? Yes No AS OF SIGNATURE DATE EXP. Are all post-petition liabilities, including taxes, being paid within terms? Yes No ________________________________ DATE Have any pre-petition liabilities been paid? Yes No CASUALTY YES (X) NO ( ) 7/1/2020 If so, describe Prepetition liabilities have been paid in accordance with the applicable court orders LIABILITY YES (X) NO ( ) 7/1/2020 Are all funds received being deposited into DIP bank accounts? Yes No VEHICLE YES (X) NO ( ) 7/1/2020 Were any assets disposed of outside the normal course of business? Yes No WORKER'S YES (X) NO ( ) 10/1/2019 If so, describe D&O LIABILITY YES (X) NO ( ) 7/16/2020 Are all U.S. Trustee Quarterly Fee Payments current? Yes No What is the status of your Plan of Reorganization? The plan was filed on April 30, 2019 as docket # 230. ATTORNEY NAME: James Grogan I certify under penalty of perjury that the following complete FIRM NAME: Blank Rome Monthly Operating Report (MOR), consisting of MOR-1 through ADDRESS: 717 Texas Avenue MOR-9 plus attachments, is true and correct. ADDRESS: Suite 1400 CITY, STATE, ZIP: Houston, TX 77002 SIGNED: /s/ Ryan Midgett TITLE: Chief Financial Officer TELEPHONE: (713) 632-8652 (ORIGINAL SIGNATURE) Ryan Midgett July 31, 2019 MOR-1 (PRINT NAME OF SIGNATORY) (DATE) Notes: (1) In ordinary course of business, the Debtors attempt to collect all accounts receivable within terms; however, certain receivables are collected outside of contractual terms.

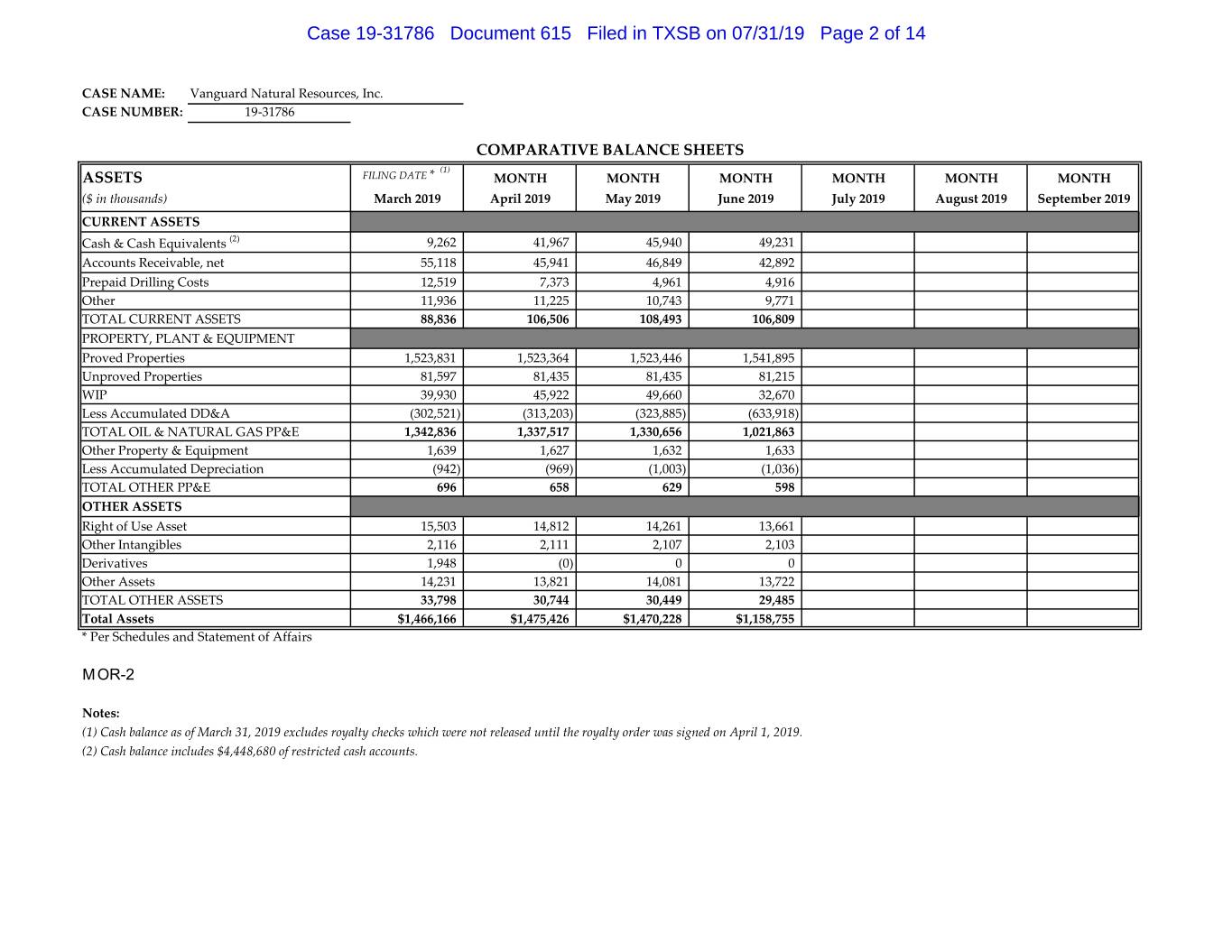

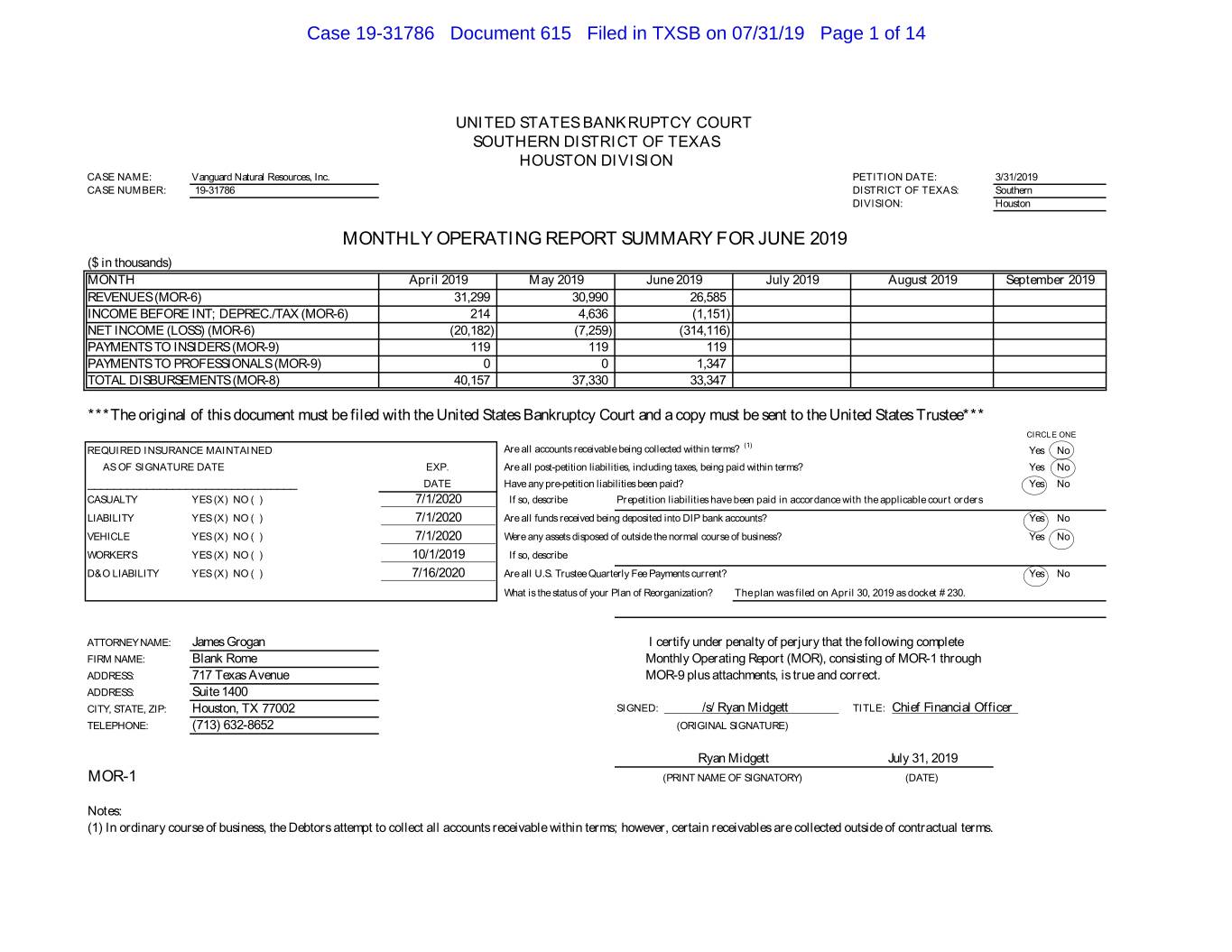

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 2 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 COMPARATIVE BALANCE SHEETS (1) ASSETS FILING DATE * MONTH MONTH MONTH MONTH MONTH MONTH ($ in thousands) March 2019 April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 CURRENT ASSETS Cash & Cash Equivalents (2) 9,262 41,967 45,940 49,231 Accounts Receivable, net 55,118 45,941 46,849 42,892 Prepaid Drilling Costs 12,519 7,373 4,961 4,916 Other 11,936 11,225 10,743 9,771 TOTAL CURRENT ASSETS 88,836 106,506 108,493 106,809 PROPERTY, PLANT & EQUIPMENT Proved Properties 1,523,831 1,523,364 1,523,446 1,541,895 Unproved Properties 81,597 81,435 81,435 81,215 WIP 39,930 45,922 49,660 32,670 Less Accumulated DD&A (302,521) (313,203) (323,885) (633,918) TOTAL OIL & NATURAL GAS PP&E 1,342,836 1,337,517 1,330,656 1,021,863 Other Property & Equipment 1,639 1,627 1,632 1,633 Less Accumulated Depreciation (942) (969) (1,003) (1,036) TOTAL OTHER PP&E 696 658 629 598 OTHER ASSETS Right of Use Asset 15,503 14,812 14,261 13,661 Other Intangibles 2,116 2,111 2,107 2,103 Derivatives 1,948 (0) 0 0 Other Assets 14,231 13,821 14,081 13,722 TOTAL OTHER ASSETS 33,798 30,744 30,449 29,485 Total Assets $1,466,166 $1,475,426 $1,470,228 $1,158,755 * Per Schedules and Statement of Affairs MOR-2 Notes: (1) Cash balance as of March 31, 2019 excludes royalty checks which were not released until the royalty order was signed on April 1, 2019. (2) Cash balance includes $4,448,680 of restricted cash accounts.

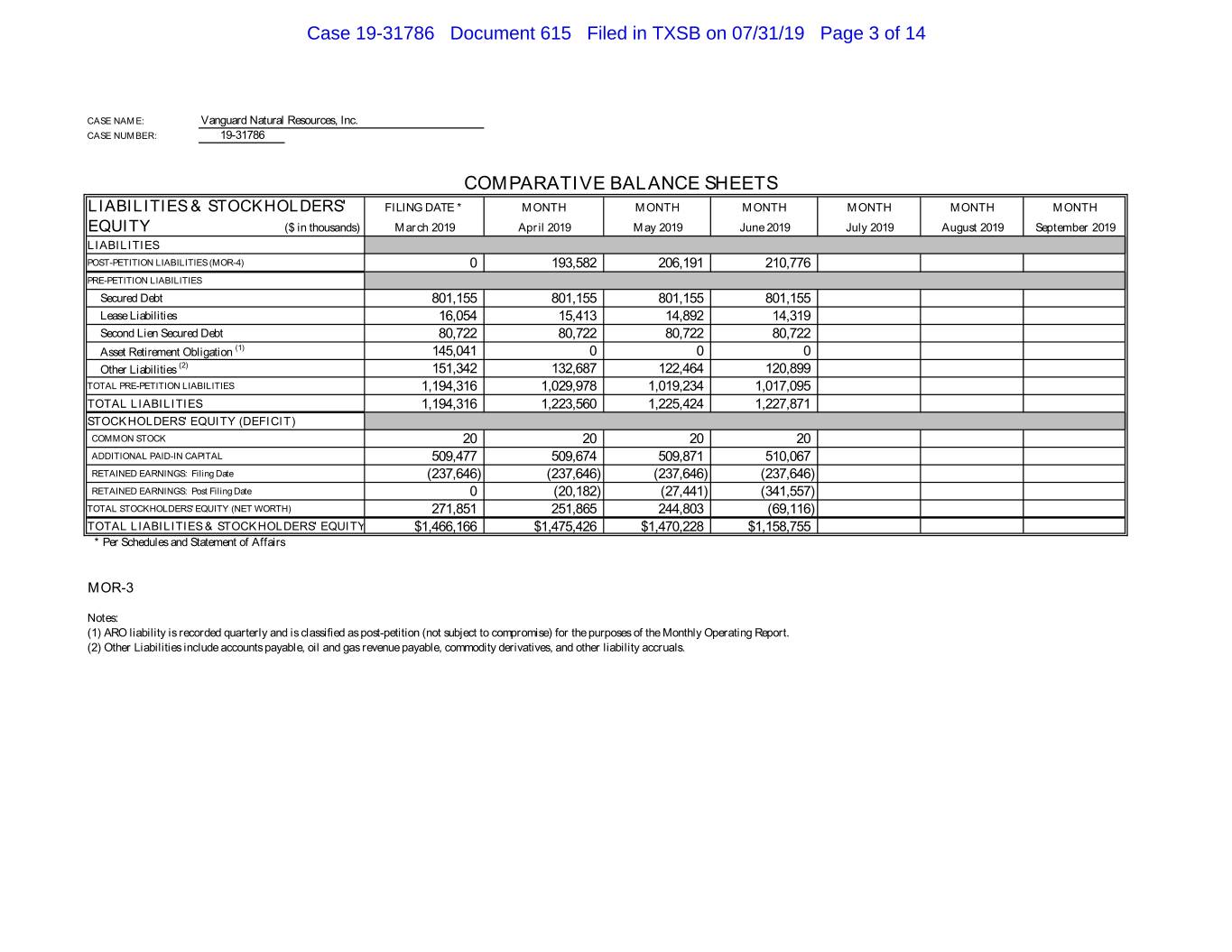

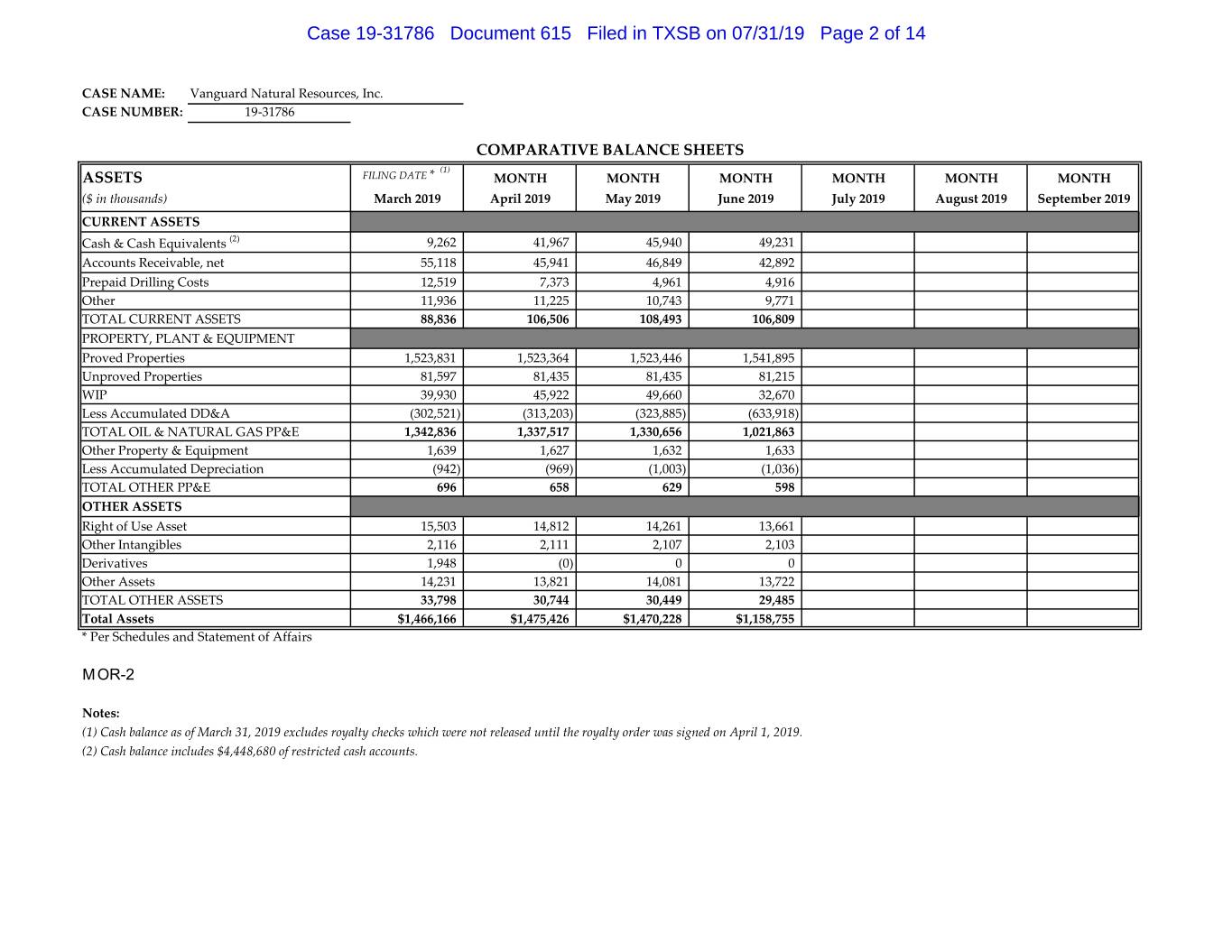

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 3 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 COMPARATIVE BALANCE SHEETS LIABILITIES & STOCKHOLDERS' FILING DATE * MONTH MONTH MONTH MONTH MONTH MONTH EQUITY ($ in thousands) March 2019 April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 LIABILITIES POST-PETITION LIABILITIES (MOR-4) 0 193,582 206,191 210,776 PRE-PETITION LIABILITIES Secured Debt 801,155 801,155 801,155 801,155 Lease Liabilities 16,054 15,413 14,892 14,319 Second Lien Secured Debt 80,722 80,722 80,722 80,722 Asset Retirement Obligation (1) 145,041 0 0 0 Other Liabilities (2) 151,342 132,687 122,464 120,899 TOTAL PRE-PETITION LIABILITIES 1,194,316 1,029,978 1,019,234 1,017,095 TOTAL LIABILITIES 1,194,316 1,223,560 1,225,424 1,227,871 STOCKHOLDERS' EQUITY (DEFICIT) COMMON STOCK 20 20 20 20 ADDITIONAL PAID-IN CAPITAL 509,477 509,674 509,871 510,067 RETAINED EARNINGS: Filing Date (237,646) (237,646) (237,646) (237,646) RETAINED EARNINGS: Post Filing Date 0 (20,182) (27,441) (341,557) TOTAL STOCKHOLDERS' EQUITY (NET WORTH) 271,851 251,865 244,803 (69,116) TOTAL LIABILITIES & STOCKHOLDERS' EQUITY $1,466,166 $1,475,426 $1,470,228 $1,158,755 * Per Schedules and Statement of Affairs MOR-3 Notes: (1) ARO liability is recorded quarterly and is classified as post-petition (not subject to compromise) for the purposes of the Monthly Operating Report. (2) Other Liabilities include accounts payable, oil and gas revenue payable, commodity derivatives, and other liability accruals.

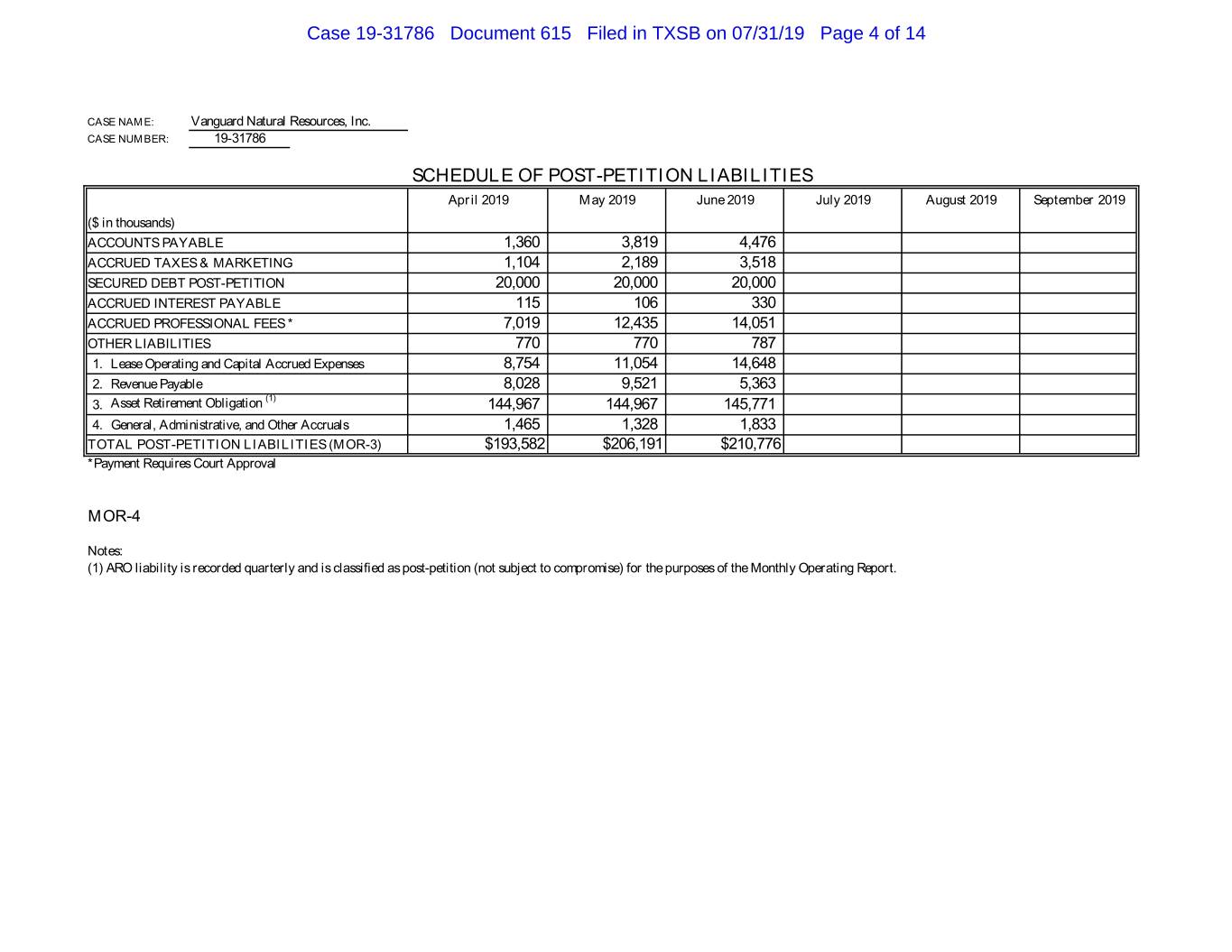

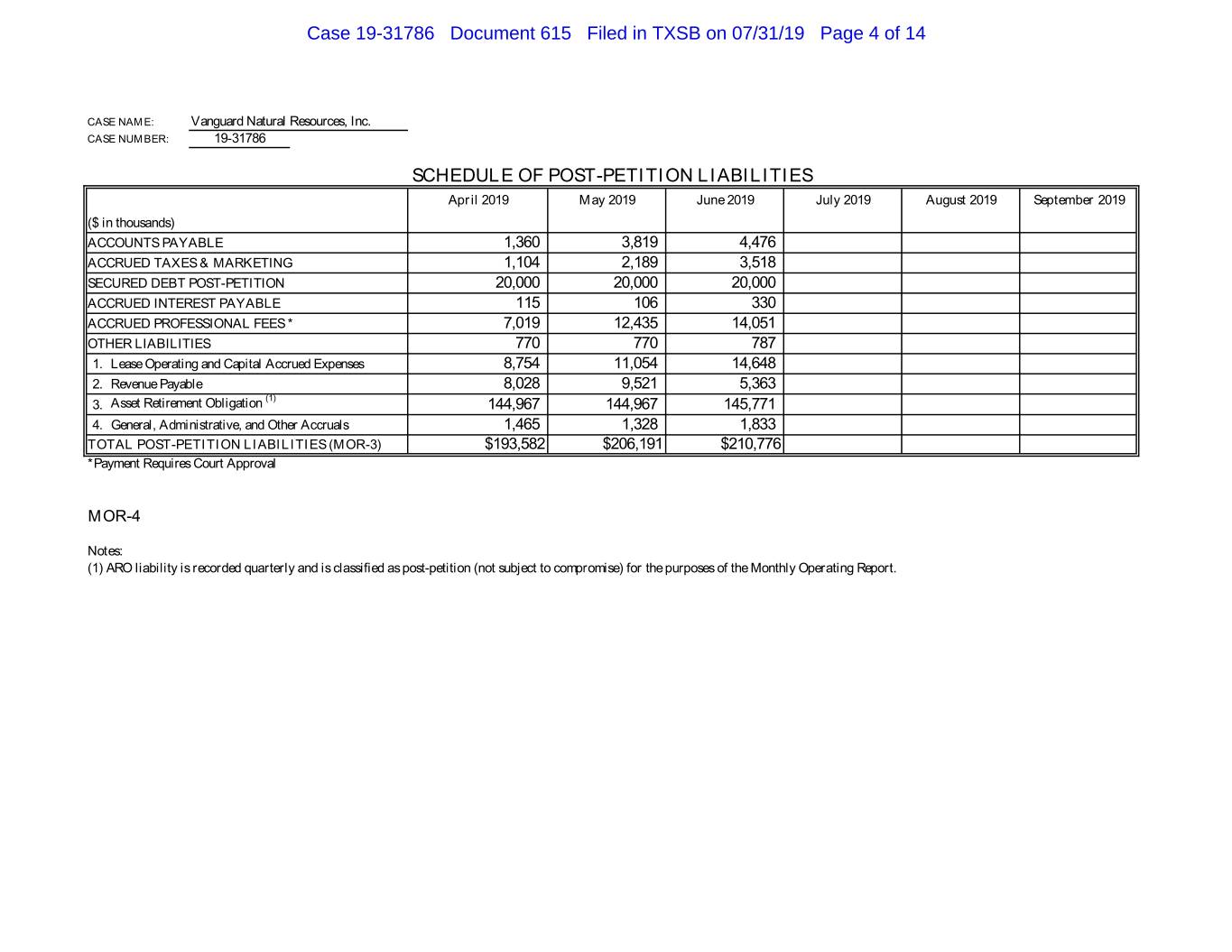

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 4 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 SCHEDULE OF POST-PETITION LIABILITIES April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 ($ in thousands) ACCOUNTS PAYABLE 1,360 3,819 4,476 ACCRUED TAXES & MARKETING 1,104 2,189 3,518 SECURED DEBT POST-PETITION 20,000 20,000 20,000 ACCRUED INTEREST PAYABLE 115 106 330 ACCRUED PROFESSIONAL FEES * 7,019 12,435 14,051 OTHER LIABILITIES 770 770 787 1. Lease Operating and Capital Accrued Expenses 8,754 11,054 14,648 2. Revenue Payable 8,028 9,521 5,363 (1) 3. Asset Retirement Obligation 144,967 144,967 145,771 4. General, Administrative, and Other Accruals 1,465 1,328 1,833 TOTAL POST-PETITION LIABILITIES (MOR-3) $193,582 $206,191 $210,776 *Payment Requires Court Approval MOR-4 Notes: (1) ARO liability is recorded quarterly and is classified as post-petition (not subject to compromise) for the purposes of the Monthly Operating Report.

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 5 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 AGING OF POST-PETITION LIABILITIES JUNE 2019 ($ in thousands) DAYS TOTAL TRADE ACCRUED TAXES LEASE OPERATING & REVENUE OTHER ACCOUNTS & MARKETING CAPITAL ACCRUAL PAYABLE 0-30 29,595 4,929 1,275 9,511 5,363 8,517 31-60 8,815 (1) 1,379 3,749 0 3,687 61-90 26,595 (451) 863 1,388 0 24,796 91+ 0 0 0 0 0 0 TOTAL (1) (2) $65,005 $4,476 $3,518 $14,648 $5,363 $37,000 AGING OF ACCOUNTS RECEIVABLE ($ in thousands) MONTH April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 0-30 DAYS 31,859 31,984 28,452 31-60 DAYS 3,316 3,460 3,093 61-90 DAYS 1,677 1,442 (998) 91+ DAYS 9,089 9,962 12,345 TOTAL (3) $45,941 $46,849 $42,892 MOR-5 Notes: (1) This may include disputed payables. (2) Due to the nature of the liabilities, Asset Retirement Obligations of approximately $146 million are excluded from the aging of post-petition liabilities. (3) Accounts Receivable includes oil and gas receivables, JIB receivables, and other miscellaneous receivables.

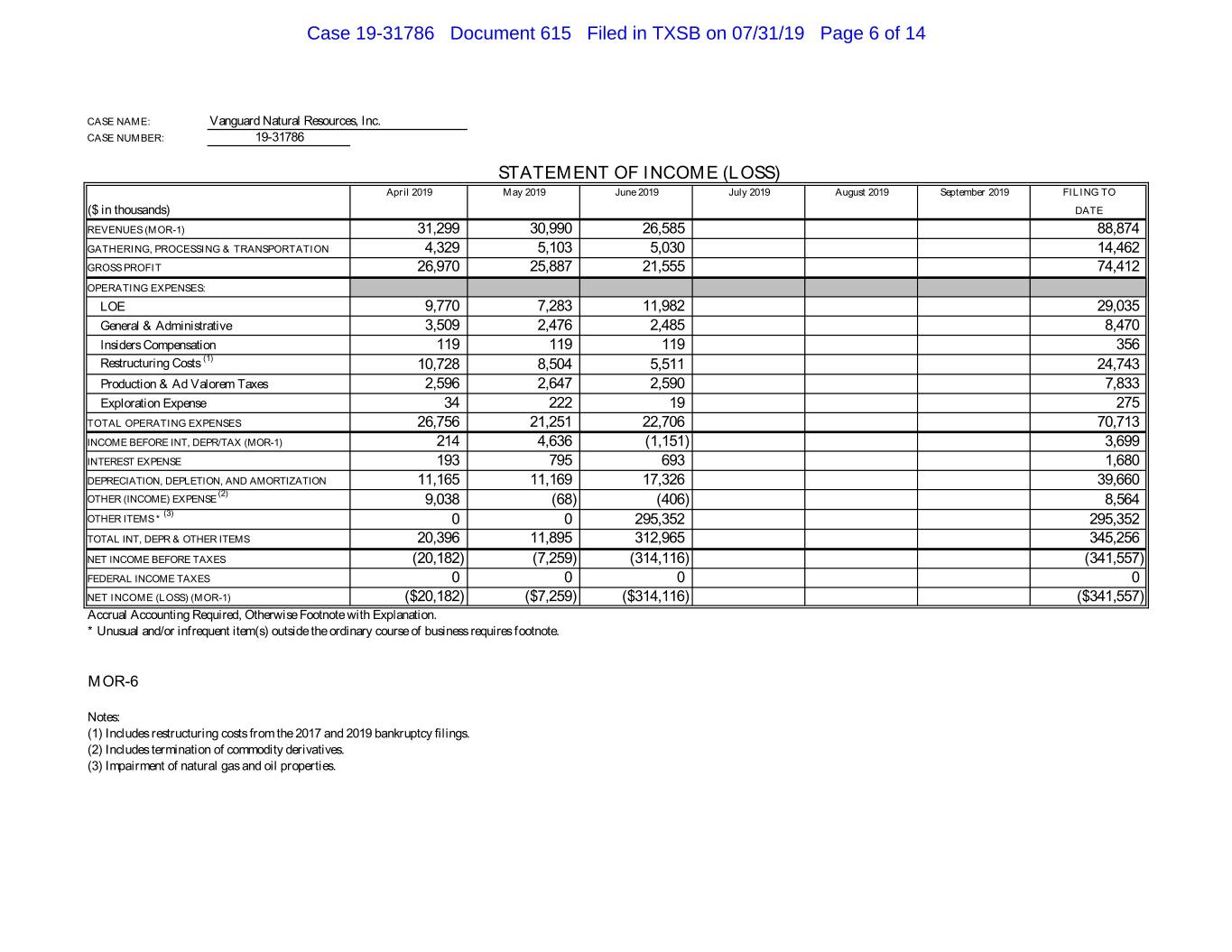

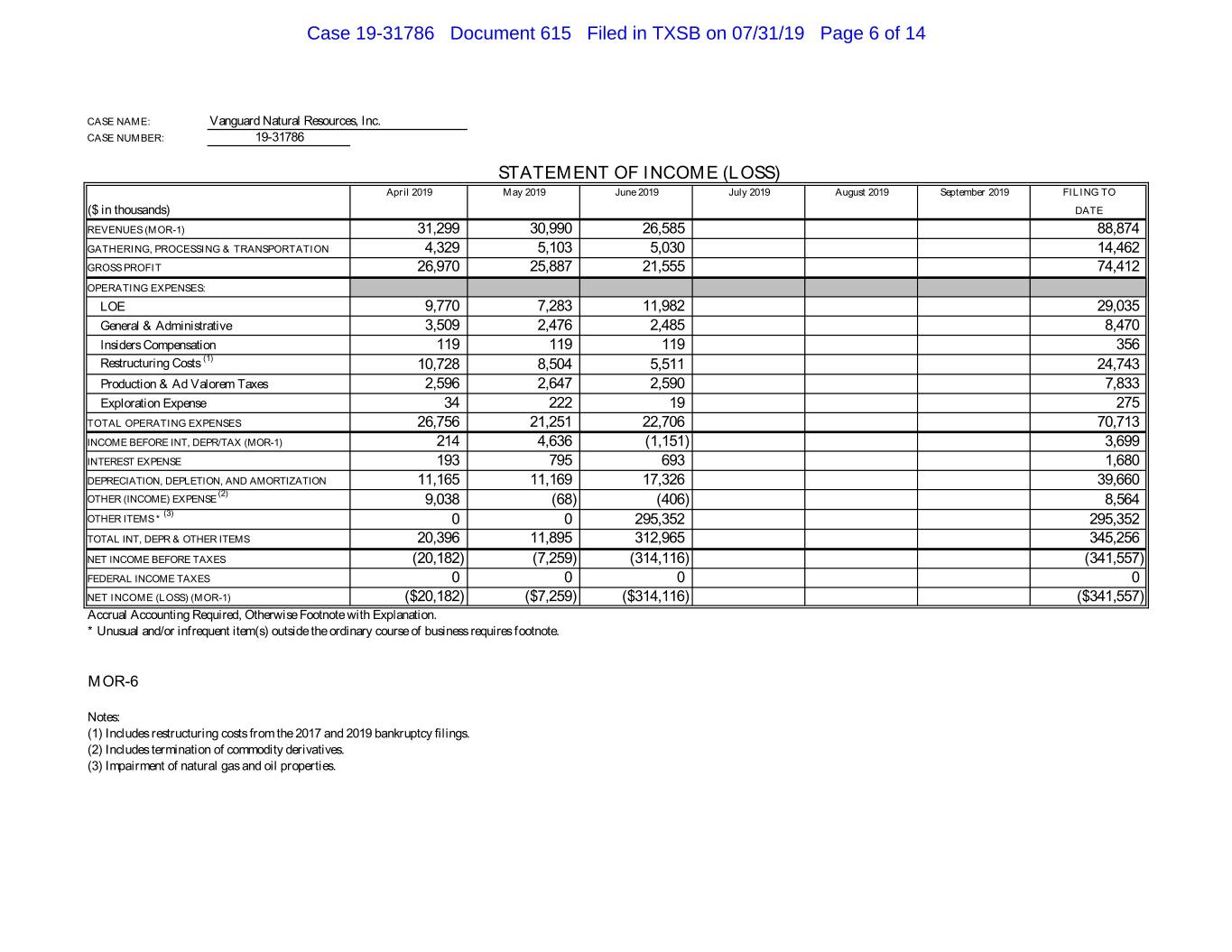

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 6 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 STATEMENT OF INCOME (LOSS) April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 FILING TO ($ in thousands) DATE REVENUES (MOR-1) 31,299 30,990 26,585 88,874 GATHERING, PROCESSING & TRANSPORTATION 4,329 5,103 5,030 14,462 GROSS PROFIT 26,970 25,887 21,555 74,412 OPERATING EXPENSES: LOE 9,770 7,283 11,982 29,035 General & Administrative 3,509 2,476 2,485 8,470 Insiders Compensation 119 119 119 356 Restructuring Costs (1) 10,728 8,504 5,511 24,743 Production & Ad Valorem Taxes 2,596 2,647 2,590 7,833 Exploration Expense 34 222 19 275 TOTAL OPERATING EXPENSES 26,756 21,251 22,706 70,713 INCOME BEFORE INT, DEPR/TAX (MOR-1) 214 4,636 (1,151) 3,699 INTEREST EXPENSE 193 795 693 1,680 DEPRECIATION, DEPLETION, AND AMORTIZATION 11,165 11,169 17,326 39,660 (2) OTHER (INCOME) EXPENSE 9,038 (68) (406) 8,564 (3) OTHER ITEMS * 0 0 295,352 295,352 TOTAL INT, DEPR & OTHER ITEMS 20,396 11,895 312,965 345,256 NET INCOME BEFORE TAXES (20,182) (7,259) (314,116) (341,557) FEDERAL INCOME TAXES 0 0 0 0 NET INCOME (LOSS) (MOR-1) ($20,182) ($7,259) ($314,116) ($341,557) Accrual Accounting Required, Otherwise Footnote with Explanation. * Unusual and/or infrequent item(s) outside the ordinary course of business requires footnote. MOR-6 Notes: (1) Includes restructuring costs from the 2017 and 2019 bankruptcy filings. (2) Includes termination of commodity derivatives. (3) Impairment of natural gas and oil properties.

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 7 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 CASH RECEIPTS AND DISBURSEMENTS April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 FILING TO (1) ($ in thousands) DATE 1. CASH-BEGINNING OF MONTH $12,532 $41,967 $45,940 $12,532 RECEIPTS: 2. CASH SALES 0 0 0 0 3. COLLECTION OF ACCOUNTS RECEIVABLE 49,140 41,303 36,637 127,080 4. LOANS & ADVANCES (attach list) 20,000 0 0 20,000 5. SALE OF ASSETS 0 0 0 0 6. OTHER (attach list) 452 0 0 452 TOTAL RECEIPTS 69,592 41,303 36,637 147,532 (Withdrawal) Contribution by Individual Debtor MFR-2 * 0 0 0 0 DISBURSEMENTS: 7. NET PAYROLL 2,880 2,929 2,794 8,603 (2) 8. PAYROLL TAXES PAID 0 0 0 0 9. SALES, USE & OTHER TAXES PAID 6,046 6,293 1,510 13,849 10. SECURED/RENTAL/LEASES 602 818 966 2,385 11. UTILITIES & TELEPHONE 120 1,457 1,380 2,958 12. INSURANCE 0 0 0 0 13. INVENTORY PURCHASES 0 0 0 0 14. VEHICLE EXPENSES 75 307 122 504 15. TRAVEL & ENTERTAINMENT 113 133 166 412 16. MARKETING & TRANSPORTATION 3,191 3,601 4,007 10,799 17. ADMINISTRATIVE & SELLING 100 409 917 1,425 18. ROYALTIES 11,079 8,427 6,293 25,799 19. LEASE OPPERATING EXPENSE & CAPITAL EXPENDITURE 12,549 8,824 11,787 33,160 20. LAND 105 432 88 625 21. OTHER (attach list) 0 0 0 (0) TOTAL DISBURSEMENTS FROM OPERATIONS 36,861 33,629 30,029 100,520 22. PROFESSIONAL FEES 988 2,964 2,892 6,843 23. U.S. TRUSTEE FEES 0 4 0 4 24. OTHER REORGANIZATION EXPENSES (attach list) 2,308 733 426 3,467 TOTAL DISBURSEMENTS 40,157 37,330 33,347 110,833 25. NET CASH FLOW 29,435 3,973 3,290 36,699 26. CASH - END OF MONTH (MOR-2) $41,967 $45,940 $49,231 $49,231 * Applies to Individual debtors only MOR-7 Notes: (1) There were no post-petition disbursements in March 2019. (2) Payroll taxes are paid to Insperity and included in net payroll.

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 8 of 14 MOR-7a Cash Receipts & Disbursements Support Loans & Advances ($ in thousands) FILING TO April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 Receipt DATE Receipt of DIP Funds 20,000 0 0 20,000 Total $20,000 $0 $0 $20,000 Other Receipts FILING TO April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 Receipt DATE Refund from JIB Partner 452 0 0 452 Total $452 $0 $0 $452 Other Reorganization Expenses Support FILING TO April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 (1) Expense DATE DIP Fees 2,308 733 426 3,467 Total $2,308 $733 $426 $3,467 MOR-7a Notes: (1) There were no post-petition disbursements in March 2019.

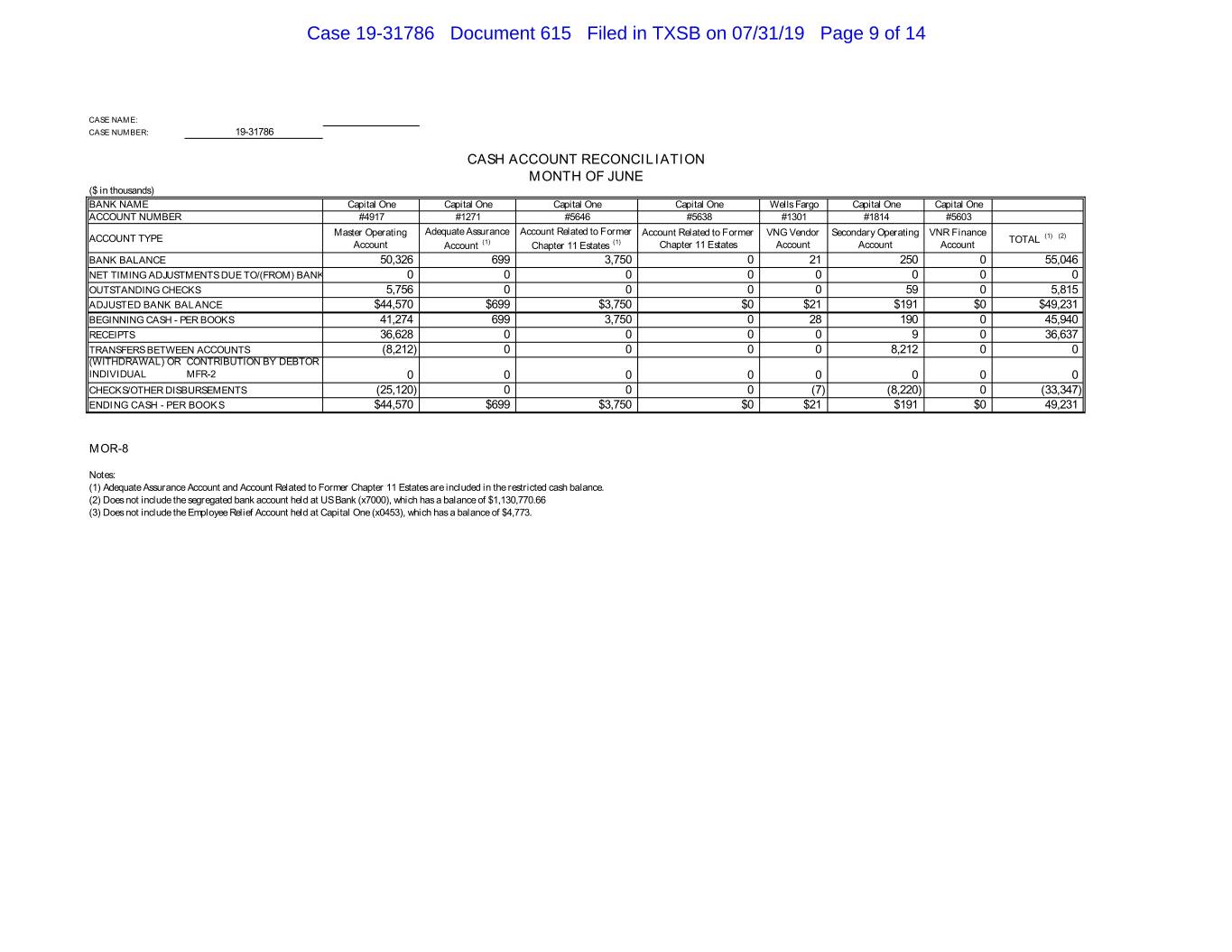

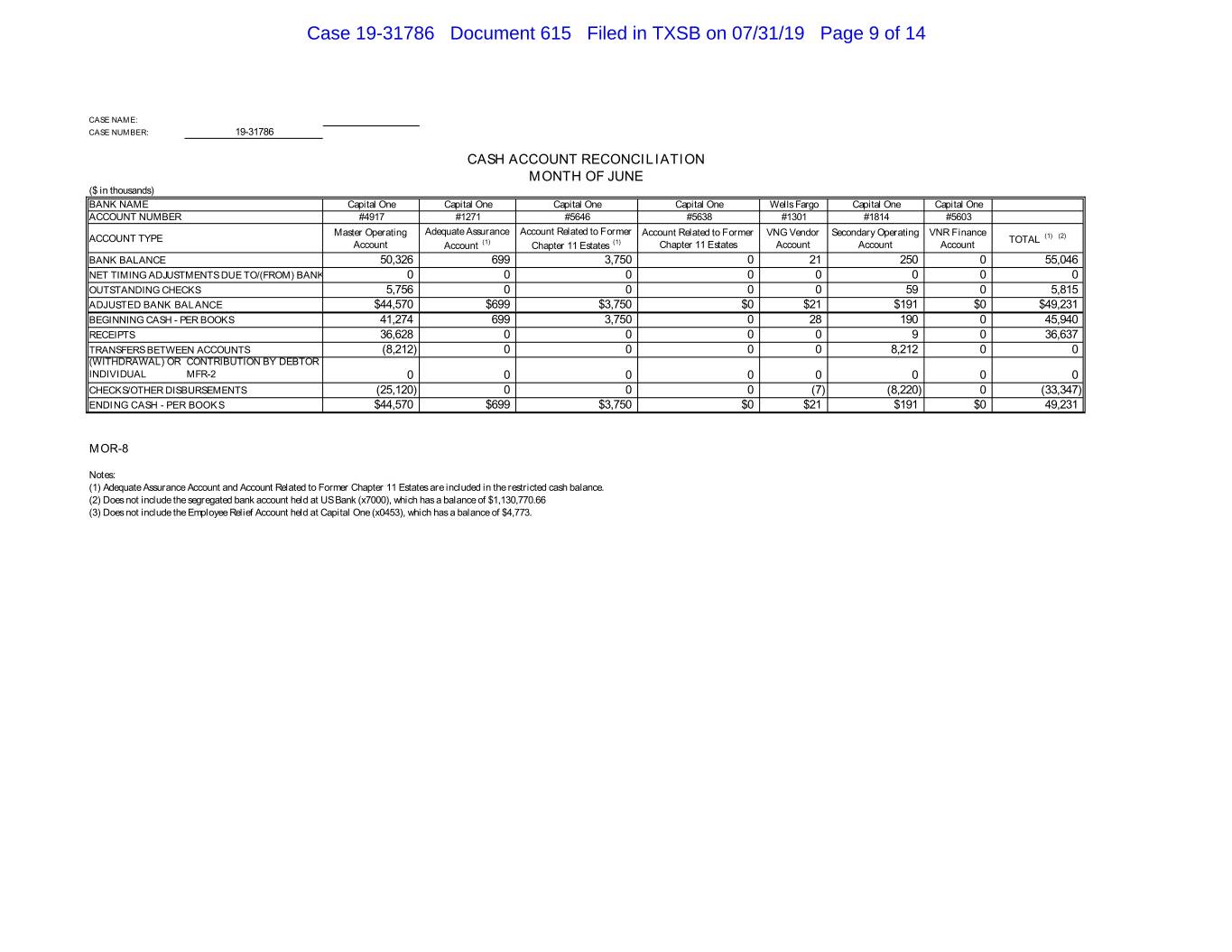

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 9 of 14 CASE NAME: CASE NUMBER: 19-31786 CASH ACCOUNT RECONCILIATION MONTH OF JUNE ($ in thousands) BANK NAME Capital One Capital One Capital One Capital One Wells Fargo Capital One Capital One ACCOUNT NUMBER #4917 #1271 #5646 #5638 #1301 #1814 #5603 Master Operating Adequate Assurance Account Related to Former Account Related to Former VNG Vendor Secondary Operating VNR Finance ACCOUNT TYPE TOTAL (1) (2) Account Account (1) Chapter 11 Estates (1) Chapter 11 Estates Account Account Account BANK BALANCE 50,326 699 3,750 0 21 250 0 55,046 NET TIMING ADJUSTMENTS DUE TO/(FROM) BANK 0 0 0 0 0 0 0 0 OUTSTANDING CHECKS 5,756 0 0 0 0 59 0 5,815 ADJUSTED BANK BALANCE $44,570 $699 $3,750 $0 $21 $191 $0 $49,231 BEGINNING CASH - PER BOOKS 41,274 699 3,750 0 28 190 0 45,940 RECEIPTS 36,628 0 0 0 0 9 0 36,637 TRANSFERS BETWEEN ACCOUNTS (8,212) 0 0 0 0 8,212 0 0 (WITHDRAWAL) OR CONTRIBUTION BY DEBTOR INDIVIDUAL MFR-2 0 0 0 0 0 0 0 0 CHECKS/OTHER DISBURSEMENTS (25,120) 0 0 0 (7) (8,220) 0 (33,347) ENDING CASH - PER BOOKS $44,570 $699 $3,750 $0 $21 $191 $0 49,231 MOR-8 Notes: (1) Adequate Assurance Account and Account Related to Former Chapter 11 Estates are included in the restricted cash balance. (2) Does not include the segregated bank account held at US Bank (x7000), which has a balance of $1,130,770.66 (3) Does not include the Employee Relief Account held at Capital One (x0453), which has a balance of $4,773.

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 10 of 14 MOR-8a Schedule of Disbursements by Debtor Entity For the Period June 1, 2019 through June 31, 2019 (Unaudited) ($ in thousands) Total Disbursements US Trustee Fee Calculation US Trustee Fees US Trustee Fees US Trustee Debtor Entity Case No. Current Period Current Quarter Accrued Paid (1) Overpayment Vanguard Natural Resources, Inc. 19-31786 $0 $30 $ 650 $ 650 $ - Eagle Rock Acquisition Partnership, L.P. 19-31787 0 0 325 325 - Eagle Rock Acquisition Partnership II, L.P. 19-31788 0 0 325 325 - Eagle Rock Energy Acquisition Co., Inc. 19-31789 0 0 325 325 - Eagle Rock Energy Acquisition Co. II, Inc. 19-31790 0 0 325 325 - Eagle Rock Upstream Development Company, Inc. 19-31791 0 0 325 325 - Eagle Rock Upstream Development Company II, Inc. 19-31792 0 0 325 325 - Escambia Asset Co. LLC 19-31793 0 0 325 325 - Escambia Operating Co. LLC 19-31794 0 0 325 325 - Vanguard Natural Gas, LLC 19-31795 8,227 24,219 242,190 250,000 7,810 Vanguard Operating, LLC 19-31796 25,120 86,584 250,000 250,000 - VNR Holdings, LLC 19-31797 0 0 325 325 - Total Disbursements for Calculating U.S. Trustee Quarterly Fees $33,347 $110,833 $ 495,765 $ 503,575 $ 7,810 MOR-8a Notes: (1) Check Number 20402 was sent to the US Trustee on July 15, 2019.

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 11 of 14 CASE NAME: Vanguard Natural Resources, Inc. CASE NUMBER: 19-31786 PAYMENTS TO INSIDERS AND PROFESSIONALS Of the total disbursements shown for the month, list the amount paid to insiders (as defined in Section 101(31)(A)-(F) of the U.S. Bankruptcy Code) and the professionals. Also, for insiders, identify the type of compensation paid (e.g., salary, commission, bonus, etc.) (Attach additional pages as necessary). ($ in thousands) April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 INSIDERS: NAME/POSITION//COMP TYPE 1. RICHARD SCOTT SLOAN CEO Salary 60 60 60 2. RYAN MIDGETT CFO Salary 27 27 27 3. JONATHAN CURTH GC Salary 32 32 32 4. 5. 6. TOTAL INSIDERS (MOR-1) $119 $119 $119 ($ in thousands) April 2019 May 2019 June 2019 July 2019 August 2019 September 2019 PROFESSIONALS: NAME/ORDER DATE 1. BLANK ROME LLP April 23, 2019 0 0 0 2. DELOITTE TAX LLP May 21, 2019 0 0 0 3. EVERCORE GROUP LLC April 23, 2019 0 0 0 4. KIRKLAND & ELLIS LLP April 23, 2019 0 0 0 5. MCCARN & WEIR, P.C. April 23, 2019 0 0 44 6. OPPORTUNE April 23, 2019 0 0 0 7. PRIME CLERK LLC April 1, 2019 0 0 1,150 8. ROGER SOAPE, INC. April 23, 2019 0 0 153 TOTAL PROFESSIONALS (MOR-1) $0 $0 $1,347 MOR-9

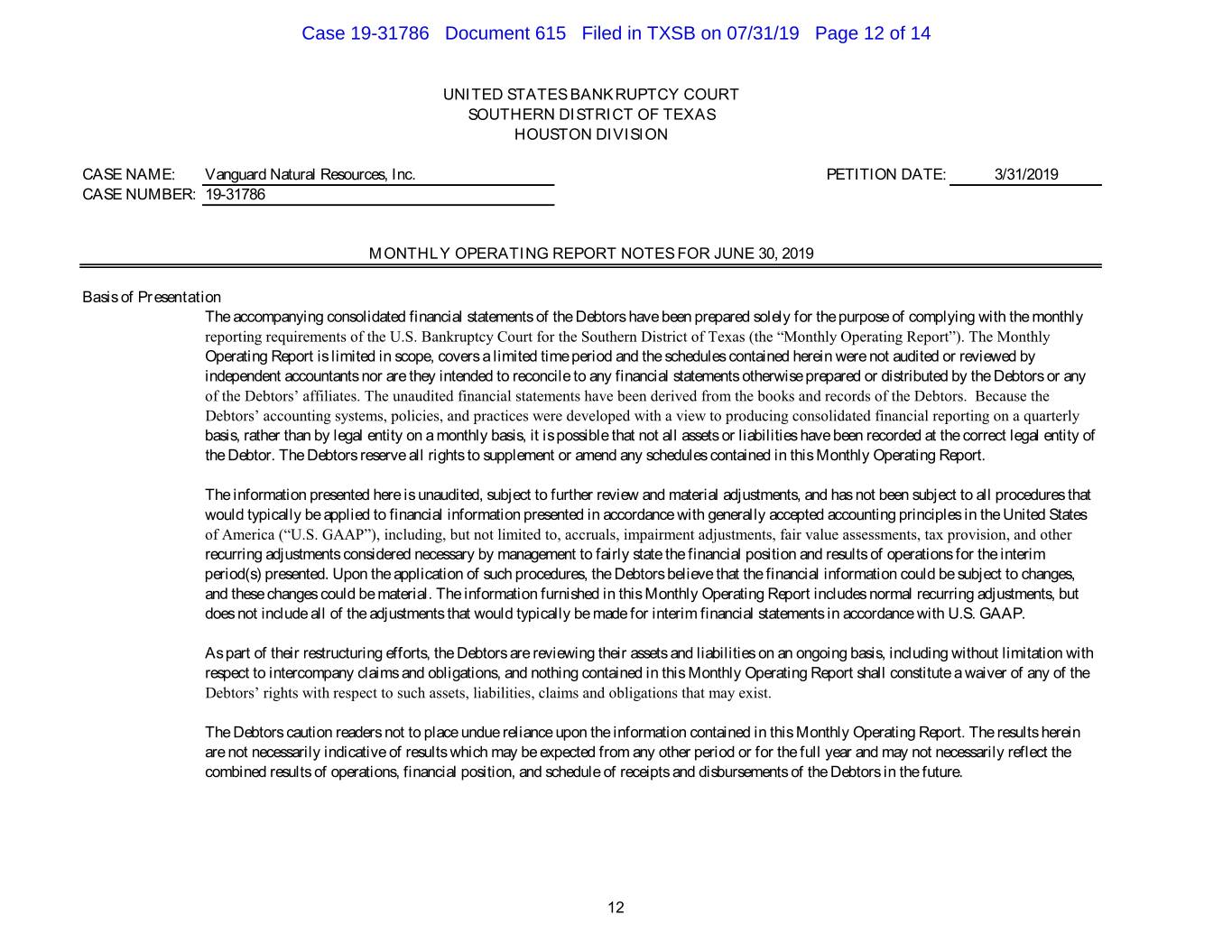

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 12 of 14 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION CASE NAME: Vanguard Natural Resources, Inc. PETITION DATE: 3/31/2019 CASE NUMBER: 19-31786 MONTHLY OPERATING REPORT NOTES FOR JUNE 30, 2019 Basis of Presentation The accompanying consolidated financial statements of the Debtors have been prepared solely for the purpose of complying with the monthly reporting requirements of the U.S. Bankruptcy Court for the Southern District of Texas (the “Monthly Operating Report”). The Monthly Operating Report is limited in scope, covers a limited time period and the schedules contained herein were not audited or reviewed by independent accountants nor are they intended to reconcile to any financial statements otherwise prepared or distributed by the Debtors or any of the Debtors’ affiliates. The unaudited financial statements have been derived from the books and records of the Debtors. Because the Debtors’ accounting systems, policies, and practices were developed with a view to producing consolidated financial reporting on a quarterly basis, rather than by legal entity on a monthly basis, it is possible that not all assets or liabilities have been recorded at the correct legal entity of the Debtor. The Debtors reserve all rights to supplement or amend any schedules contained in this Monthly Operating Report. The information presented here is unaudited, subject to further review and material adjustments, and has not been subject to all procedures that would typically be applied to financial information presented in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), including, but not limited to, accruals, impairment adjustments, fair value assessments, tax provision, and other recurring adjustments considered necessary by management to fairly state the financial position and results of operations for the interim period(s) presented. Upon the application of such procedures, the Debtors believe that the financial information could be subject to changes, and these changes could be material. The information furnished in this Monthly Operating Report includes normal recurring adjustments, but does not include all of the adjustments that would typically be made for interim financial statements in accordance with U.S. GAAP. As part of their restructuring efforts, the Debtors are reviewing their assets and liabilities on an ongoing basis, including without limitation with respect to intercompany claims and obligations, and nothing contained in this Monthly Operating Report shall constitute a waiver of any of the Debtors’ rights with respect to such assets, liabilities, claims and obligations that may exist. The Debtors caution readers not to place undue reliance upon the information contained in this Monthly Operating Report. The results herein are not necessarily indicative of results which may be expected from any other period or for the full year and may not necessarily reflect the combined results of operations, financial position, and schedule of receipts and disbursements of the Debtors in the future. 12

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 13 of 14 Treatment of Intercompany Transactions The Debtors have not made any determination that tax refunds or attributes are assets or liabilities of a particular Debtor and the Debtors reserve all of their rights on this issue. Pursuant to the Final Order (I) Authorizing the Debtors to (A) Continue to Operate Their Cash Management System and Maintain Existing Bank Accounts and (B) Continue to Perform Intercompany Transactions, and (II) Granting Related Relief [Docket No. 181], the Debtors have kept detailed information on all post-Petition Date transfers of cash among the Debtors for the period covered by the Monthly Operating Report, as described in further detail in this Report. Treatment of Certain Liabilities and GAAP Disclosures As a result of the chapter 11 filings, the payment of prepetition indebtedness is subject to compromise or other treatment under a plan of reorganization. The determination of how liabilities will ultimately be settled or treated cannot be made until the Bankruptcy Court approves a chapter 11 plan of reorganization. Accordingly, the ultimate amount of such liabilities is not determinable at this time. ASC 852 requires prepetition liabilities that are subject to compromise to be reported at the amounts expected to be allowed as claims, even if they may be settled for lesser amounts. The amounts currently classified as liabilities subject to compromise are preliminary and may be subject to future adjustments depending on Court actions, further developments with respect to disputed claims, determinations of the secured status of certain claims, the values of any collateral securing such claims, rejection of executory contracts, continued reconciliation or other events. The Monthly Operating Report does not contain all disclosures that would be required for presentation in accordance with US GAAP and there can be no assurance that, from the perspective of an investor or potential investor, the Monthly Operating Report contains information that would be typical of financial statements filed with the Securities and Exchange Commission. For instance, for the period commencing on the Petition Date and thereafter, the company stopped accrued interest on prepetition indebtedness until further review of these obligations is completed. The Debtors’ consolidated financial statements in this report have been prepared on a going concern basis, which contemplates continuity of operations, realization of assets and liquidation of liabilities in the ordinary course of business. Certain prepetition liabilities have been reclassified as liabilities subject to compromise. Liabilities subject to compromise currently include, among other things, funded debt obligations and amounts due to third parties for goods and services received prior to the Petition Date. The Debtors continue to analyze and reconcile these amounts, and, therefore, the amounts reflected herein are current estimates and subject to material change as additional analysis and decisions are completed. 13

Case 19-31786 Document 615 Filed in TXSB on 07/31/19 Page 14 of 14 Treatment of Reorganization Costs ASC 852 requires expenses and income directly associated with the chapter 11 filings to be reported separately in the income statement as reorganization items. Reorganization items includes write off of discount, premium, debt issuance costs, and derivatives associated with long- term debt, expenses related to legal advisory and representation services, other professional consulting and advisory services, estimates of claims allowed related to legal matters and rejected executory contracts and changes in liabilities subject to compromise recognized as there are changes in amounts expected to be allowed as claims. Reservation of Rights Given the complexity of the Debtors’ business, inadvertent errors, omissions or over inclusion of contracts or leases may have occurred. Accordingly, the Debtors hereby reserve all of their rights to dispute the validity, status, enforceability, or executory nature of any claim amount, representation or other statement in this Monthly Operating Report and reserve the right to amend or supplement this Monthly Operating Report, if necessary, but shall be under no obligation to do so. Reporting Period Unless otherwise noted herein, the Monthly Operating Report generally reflects the Debtors’ books and records and financial activity occurring during the applicable reporting period. For the purposes of this Monthly Operating Report, the period reflects March 31, 2019 through and including June 30, 2019. Except as otherwise noted, no adjustments have been made for activity occurring after the close of the reporting period. Accuracy The financial information disclosed herein was not prepared in accordance with federal or state securities laws or other applicable nonbankruptcy law or in lieu of complying with any periodic reporting requirements thereunder. Persons and entities trading in or otherwise purchasing, selling, or transferring the claims against or equity interests in the Debtors should evaluate this financial information in light of the purposes for which it was prepared. The Debtors are not liable for and undertake no responsibility to indicate variations from securities laws or for any evaluations of the Debtors based on this financial information or any other information. 14