Exhibit 99.42

| Professionals in resources, mining, processing, construction and the environment | www.cam-llc.com |

TECHNICAL REPORT

GALENA MINE PROJECT

SHOSHONE COUNTY, IDAHO

Prepared for:

U.S. Silver Corporation

14 April 2011

113116

Prepared by:

Chlumsky, Armbrust & Meyer, LLC

Fred Barnard PhD., Calif. Professional Geol.

Steve Milne P.E.

12600 W. Colfax Ave., Suite A-250

Lakewood, Colorado 80215

Telephone: (303) 716-1617

Fax: (303) 716-3386

TABLE OF CONTENTS

| | Page No. |

| Section | | |

| | | | | | | |

| | 1.0 | SUMMARY | 1 | |

| | | 1.1 | Scope | 1 | |

| | | 1.2 | Property Description and Ownership | 1 | |

| | | 1.3 | Physiography and Infrastructure | 2 | |

| | | 1.4 | Geology and Mineralization | 2 | |

| | | 1.5 | Exploration and Data Compilation | 3 | |

| | | 1.6 | Reserve and Resource Estimation | 4 | |

| | | 1.7 | Development and Operations | 7 | |

| | | 1.8 | Conclusions and Recommendations | 9 | |

| | 2.0 | INTRODUCTION AND TERMS OF REFERENCE | 11 | |

| | | 2.1 | Data Gathering and Site Visit | 12 | |

| | | 2.2 | Units and Abbreviations | 12 | |

| | 3.0 | RELIANCE ON OTHER EXPERTS | 13 | |

| | 4.0 | PROPERTY DESCRIPTION AND LOCATION | 14 | |

| | | 4.1 | Property Location | 14 | |

| | | 4.2 | Ownership | 14 | |

| | | 4.3 | Property Description | 15 | |

| | | 4.4 | Property Parcels | 16 | |

| | 5.0 | ACCESSIBILITY, CLIMATE, INFRASTRUCTURE AND PHYSIOGRAPHY | 19 | |

| | | 5.1 | Accessibility | 19 | |

| | | 5.2 | Climate | 19 | |

| | | 5.3 | Infrastructure | 19 | |

| | | 5.4 | Physiography | 20 | |

| | 6.0 | HISTORY | 22 | |

| | | 6.1 | Galena Mine History | 22 | |

| | | 6.2 | Coeur Mine History | 26 | |

| | | 6.3 | Caladay Property History | 26 | |

| | 7.0 | GEOLOGICAL SETTING | 28 | |

| | | 7.1 | Regional Geology | 28 | |

| | | 7.2 | Local and Property Geology | 29 | |

| | | | 7.2.1 | Vitreous Quartzite | 30 | |

| | | | 7.2.2 | Sericitic Quartzite | 30 | |

| | | | 7.2.3 | Siltite-Argillite | 31 | |

| | | | 7.2.4 | Structure | 31 | |

| | 8.0 | DEPOSIT TYPES | 32 | |

| | 9.0 | MINERALIZATION | 33 | |

| | | 9.1 | Galena Mine | 33 | |

| | | 9.2 | Coeur Mine | 37 | |

| | 10.0 | EXPLORATION | 38 | |

| | | 10.1 | Geologic Mapping | 38 | |

| | | 10.2 | Chip Samples | 38 | |

| | | 10.3 | Exploration Program | 38 | |

| | 11.0 | DRILLING | 39 | |

| | 12.0 | SAMPLING METHOD AND APPROACH | 42 | |

| | | 12.1 | Channel Samples | 42 | |

| | | 12.2 | Diamond Drill Samples | 42 | |

| | | 12.3 | Density Determination | 43 | |

CAM 113116

Galena Mine Technical Report

14 April 2011

TABLE OF CONTENTS

| | | | Page No. |

| | | |

| Section | | |

| | 13.0 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 46 | |

| | | 13.1 | Facilities | 46 | |

| | | 13.2 | Sample Preparation | 46 | |

| | | 13.3 | Assaying | 47 | |

| | | 13.4 | Quality Assurance/Quality Control | 47 | |

| | | | 13.4.1 | Assay Standards | 47 | |

| | | | 13.4.2 | Blank Samples | 56 | |

| | | | 13.4.3 | Duplicate Samples | 57 | |

| | | 13.5 | Summary and Recommendations for Assaying | 59 | |

| | 14.0 | DATA VERIFICATION | 60 | |

| | 15.0 | ADJACENT PROPERTIES | 62 | |

| | 16.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 63 | |

| | 17.0 | MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES | 64 | |

| | | 17.1 | Basis | 64 | |

| | | 17.2 | Mineral Resource Definitions | 64 | |

| | | 17.3 | Mineral Reserve Definitions | 65 | |

| | | 17.4 | Resource Classification | 66 | |

| | | 17.5 | Geologic Interpretation | 67 | |

| | | 17.6 | Grade Estimation | 67 | |

| | | 17.7 | Tonnage Estimation | 68 | |

| | | | 17.7.1 | Block Shapes | 68 | |

| | | | 17.7.2 | Dilution and Mining Recovery | 68 | |

| | | | 17.7.3 | Tonnage Factors | 69 | |

| | | 17.8 | Cutoff Parameters | 69 | |

| | | 17.9 | Tabulation of Resources and Reserves | 72 | |

| | | 17.10 | Reconciliation of Resources and Reserves to Production | 80 | |

| | 18.0 | OTHER RELEVANT DATA AND INFORMATION | 83 | |

| | 19.0 | ADDITIONAL REQUIREMENTS FOR TECHNICAL REPORTS | | |

| | | ON DEVELOPMENT PROPERTIES AND PRODUCTION PROPERTIES | 84 | |

| | | 19.1 | Background | 84 | |

| | | 19.2 | Operating Permits | 85 | |

| | | 19.3 | Mining Methods | 86 | |

| | | 19.4 | Mine Infrastructure and Operations | 88 | |

| | | | 19.4.1 | Labor | 88 | |

| | | | 19.4.2 | Equipment | 89 | |

| | | | 19.4.3 | Utilities and Inputs | 90 | |

| | | 19.5 | Milling | 91 | |

| | | | 19.5.1 | Galena Mill | 92 | |

| | | | 19.5.2 | Coeur Mill | 94 | |

| | | | 19.5.3 | Tailings Disposal | 94 | |

| | | | 19.5.4 | Concentrate Sales Contracts | 95 | |

| | | 19.6 | Costs | 95 | |

| | | | 19.6.1 | Operating Costs | 95 | |

| | | | 19.6.2 | Capital Costs | 96 | |

| | | | 19.6.3 | Taxes | 97 | |

| | | 19.7 | Economic Analysis | 97 | |

| | | | 19.7.1 | Mine Plan | 97 | |

CAM 113116

Galena Mine Technical Report

14 April 2011

| | Page No. |

| Section | | |

| | | | | | | |

| | | | 19.7.2 | Cash Flow Calculations | 98 | |

| | | 19.8 | Exploration Potential | 100 | |

| | 20.0 | INTERPRETATION AND CONCLUSIONS | 102 | |

| | 21.0 | RECOMMENDATIONS | 103 | |

| | | 21.1 | Density | 103 | |

| | | 21.2 | Assaying | 103 | |

| | | 21.3 | Reconciliation | 103 | |

| | | 21.4 | Exploration and Development | 103 | |

| | | 21.5 | Work Program | 104 | |

| | 22.0 | REFERENCES | 105 | |

| | 23.0 | DATE AND SIGNATURE PAGE | 106 | |

| | | | | | | |

| | | | | | | |

| Tables | | |

| | | | | | | |

| | 1-1 | Proven and Probable Reserves by Ore Type - December 31, 2010 | 5 | |

| | 1-2 | Measured and Indicated Resources by Ore Type - December 31, 2010 | 6 | |

| | 1-3 | Inferred Resources by Ore Type - December 31, 2010 | 6 | |

| | 1-4 | Mine Production Schedule, 2011-2018 | 7 | |

| | 2-1 | Abbreviations used in this report | 12 | |

| | 4-1 | US Silver Land Position | 17 | |

| | 7-1 | Stratigraphy of the Belt Supergroup in North Idaho | 28 | |

| | 9-1 | Minerals of Economic Interest in the Galena Mine | 35 | |

| | 11-1 | Results of Selected Exploration Holes Drilled During 2010 | 40 | |

| | 12-1 | 2010 Samples used for Density Measurements | 43 | |

| | 12-2 | Tonnage Factors of Galena Project Rocks | 44 | |

| | 13-1 | Silver-Copper Assay Standards used 1-1-10 through 12-31-10 | 48 | |

| | 13-2 | Silver-Lead Assay Standards used 1-1-10 through 12-31-10 | 52 | |

| | 17-1 | Estimated Total Operating Costs, $/ton | 71 | |

| | 17-2 | Proven and Probable Reserves by Ore Type - December 31, 2010 | 72 | |

| | 17-3 | Reserves by Vein - December 31, 2010 | 72 | |

| | 17-4 | Measured and Indicated Resources by Ore Type - December 31, 2010 | 75 | |

| | 17-5 | Measured and Indicated Resources by Vein - December 31, 2010 | 76 | |

| | 17-6 | Inferred Resources by Ore Type - December 31, 2010 | 77 | |

| | 17-7 | Inferred Resources by Vein - December 31, 2010 | 78 | |

| | 17-8 | Galena Mine Plan-to Actual Reconciliation for 2010 | 81 | |

| | 19-1 | Operating and Environmental Permits | 85 | |

| | 19-2 | Manpower at Galena Mine Project | 88 | |

| | 19-3 | Galena Mine Major Equipment List | 89 | |

| | 19-4 | Power Consumption | 90 | |

| | 19-5 | Galena Mill Statistics | 92 | |

| | 19-6 | Coeur Mill Statistics | 94 | |

| | 19-7 | Costs per Ton | 96 | |

| | 19-8 | Estimated Capital Expenditures ($) | 96 | |

| | 19-9 | Mine Production Schedule, 2011-2018 | 98 | |

| | 19-10 | Life of Mine Financial analysis – Assumptions | 99 | |

| | 19-11 | Life-of-Mine Cash Flow and Sensitivities | 100 | |

CAM 113116

Galena Mine Technical Report

14 April 2011

| | | | Page No. |

| Figures | | |

| | | | | |

| | 4-1 | Location of Galena Mine Project in North Idaho | 14 | |

| | 4-2 | Ownership Structure | 15 | |

| | 4-3 | U.S. Silver Property Position, Galena Project | 18 | |

| | 7-1 | Generalized Cross-section, Galena Mine Looking West | 31 | |

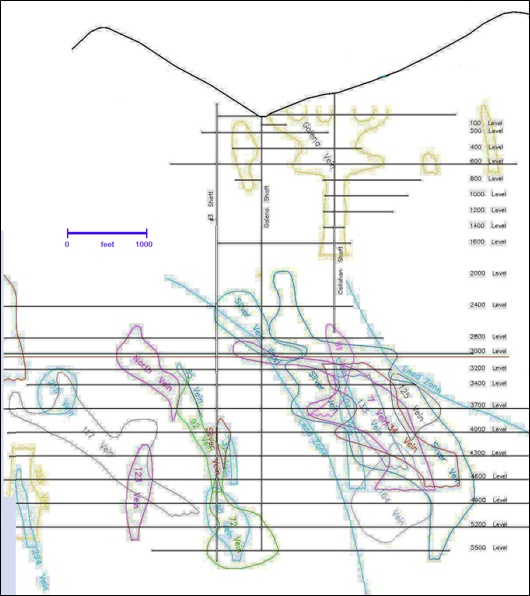

| | 9-1 | Simplified Long Section of Galena Mine with Major Orebodies, Looks Northeast | 34 | |

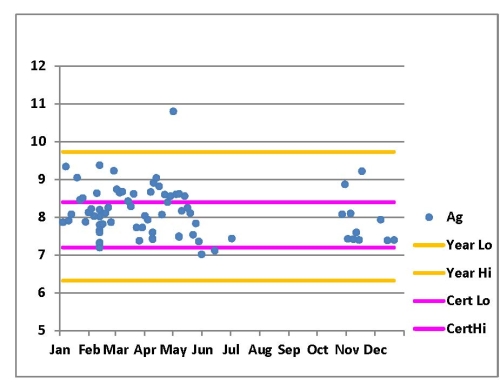

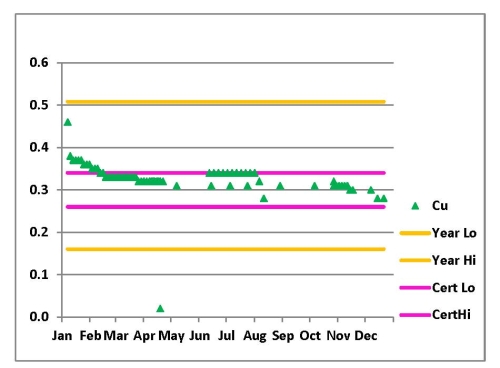

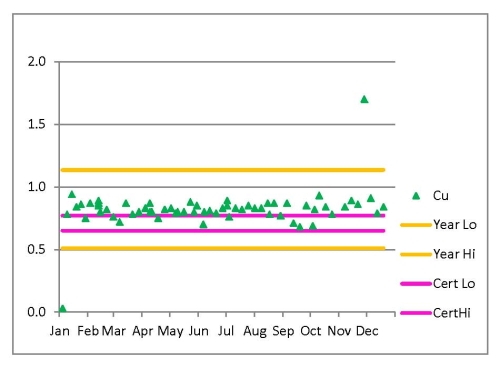

| | 13-1 | Ag-Cu: Low-Grade Standard Results for Ag in 2010 | 49 | |

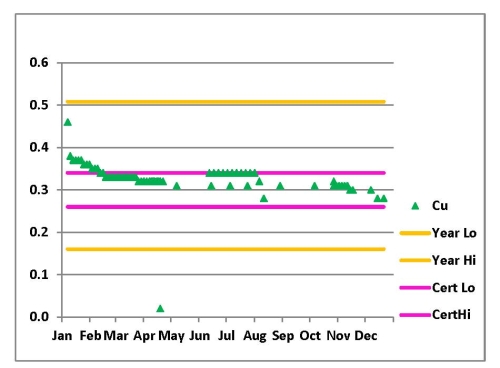

| | 13-2 | Ag-Cu Low-Grade Standard Results for Cu in 2010 | 49 | |

| | 13-3 | Ag-Cu Average-Grade Standard Results for Ag in 2010 | 50 | |

| | 13-4 | Ag-Cu Average-Grade Standard Results for Cu in 2010 | 50 | |

| | 13-5 | Ag-Cu High-Grade Standard Results for Ag in 2010 | 51 | |

| | 13-6 | Ag-Cu High-Grade Standard Results for Cu in 2010 | 51 | |

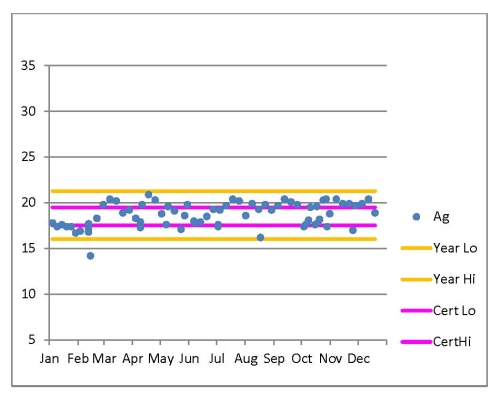

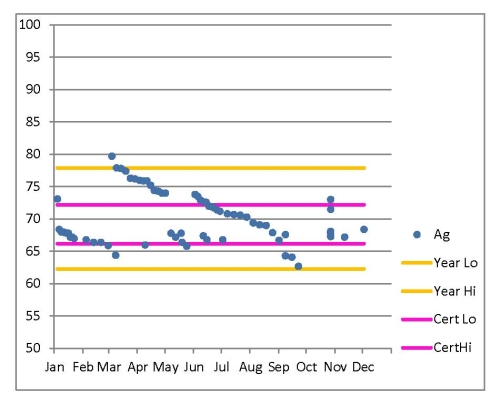

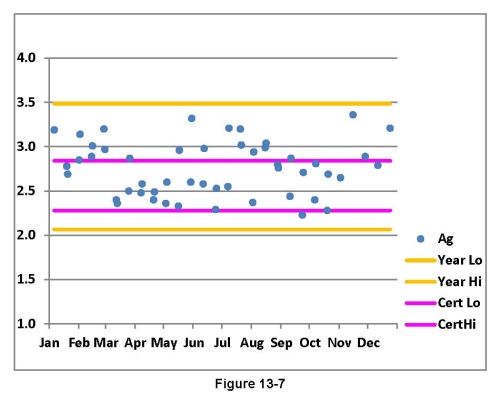

| | 13-7 | Ag-Pb Low-Grade Standard Results for Ag in 2010 | 53 | |

| | 13-8 | Ag-Pb Low-Grade Standard Results for Pb in 2010 | 53 | |

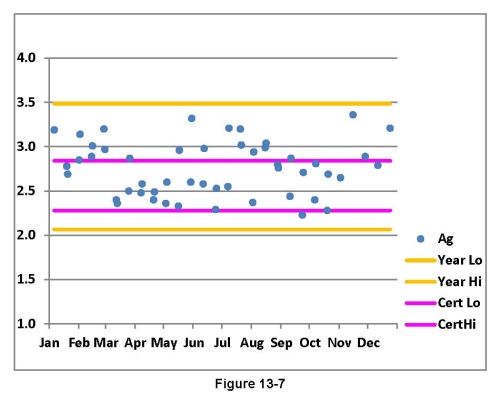

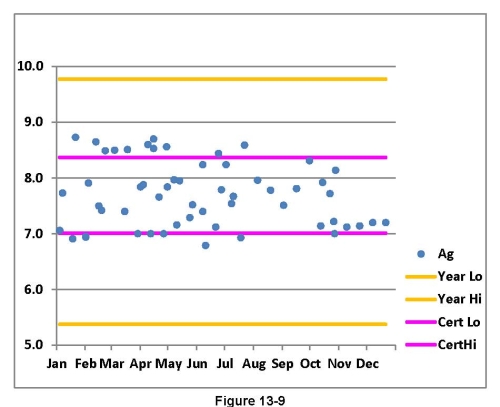

| | 13-9 | Ag-Pb Medium Grade Standard Results for Ag in 2010 | 54 | |

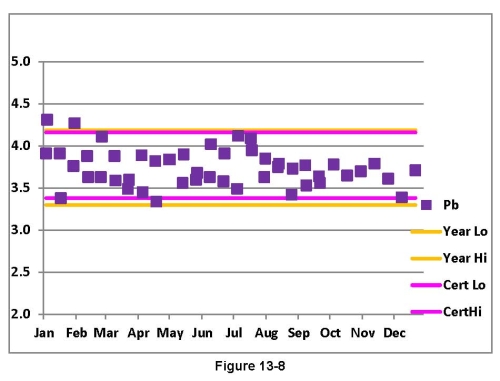

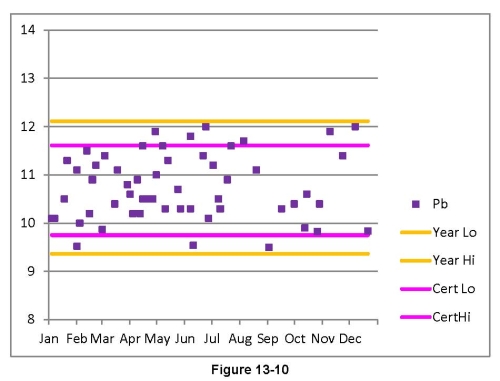

| | 13-10 | Ag-Pb Medium Grade Standard Results for Pb in 2010 | 54 | |

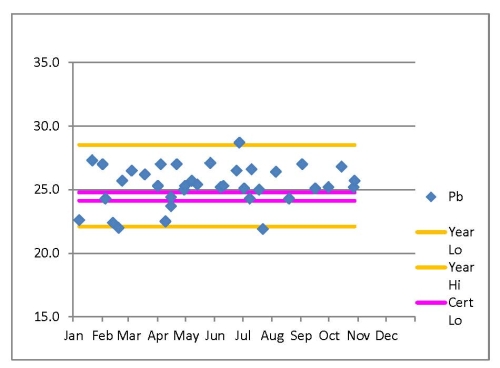

| | 13-11 | Ag-Pb High-Grade Standard Results for Ag in 2010 | 55 | |

| | 13-12 | Ag-Pb High-Grade Standard Results for Pb in 2010 | 55 | |

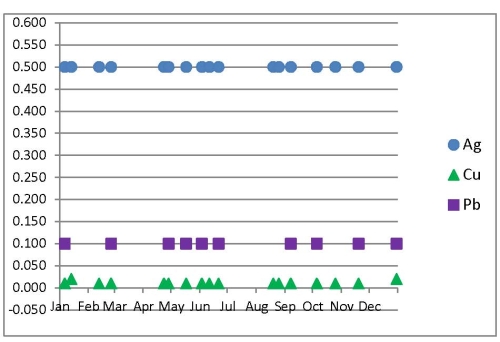

| | 13-13 | Results of Assays of Blanks in 2010 | 56 | |

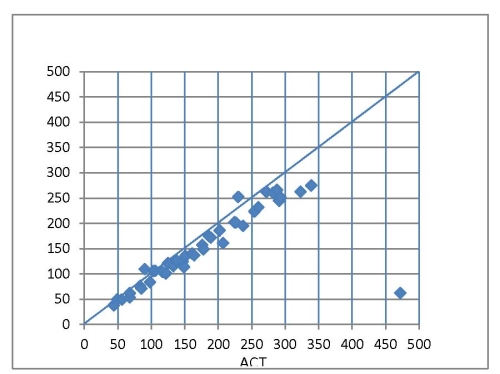

| | 13-14 | 2010 Check Assays – Fire Assay Ag (ppm) | 57 | |

| | 13-15 | 2010 Check Assays - AA Ag (ppm) | 58 | |

| | 13-16 | 2010 Check Assays - AA Cu (percent) | 58 | |

| | 13-17 | 2010 Check Assays - AA Pb (percent) | 59 | |

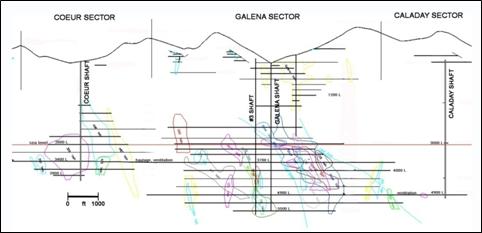

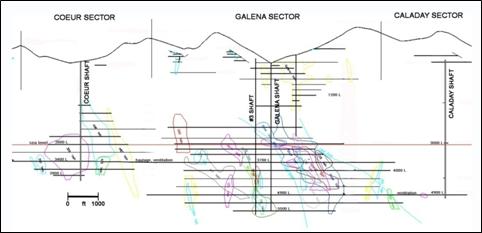

| | 19-1 | Generalized Long Section through Coeur, | | |

| | | Galena, and Caladay Shafts, Looking Northeast. | 85 | |

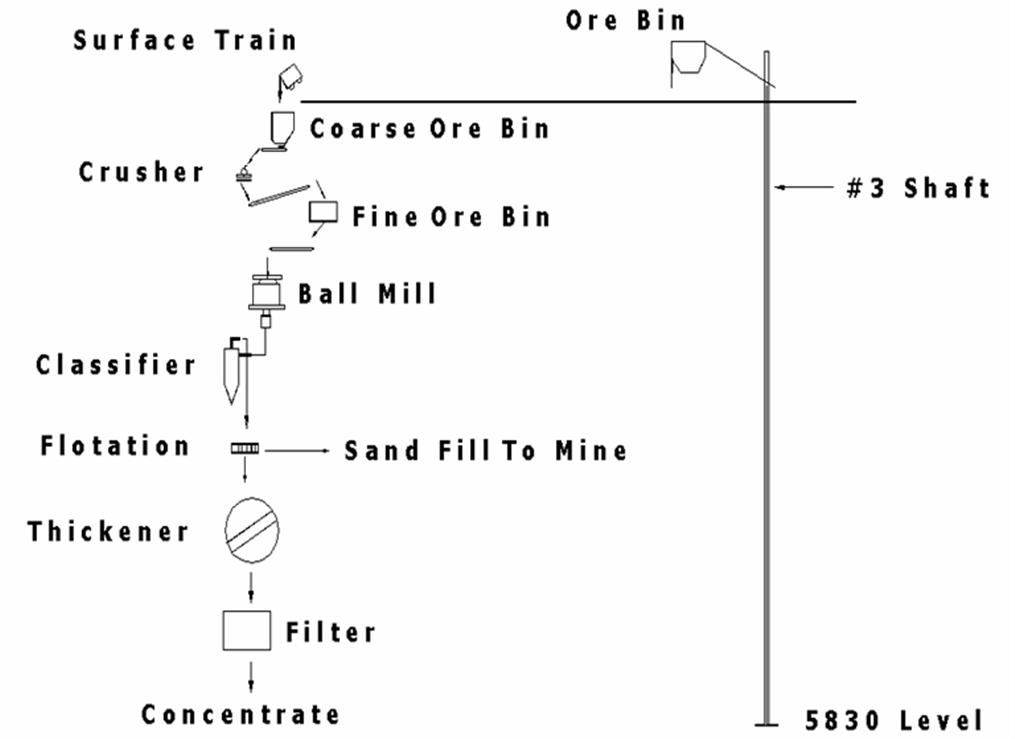

| | 19-2 | Galena Mill Flowsheet | 92 | |

CAM 113116

Galena Mine Technical Report

14 April 2011

1.0 SUMMARY

Chlumsky, Armbrust and Meyer LLC (CAM) prepared this revised Technical Report on the mineral resources and reserves at the Galena silver-copper-lead mine operation located near Wallace, Idaho. The report was prepared for, and with the cooperation of, United States Silver Corporation, a listed company in Canada. Both authors of this report visited the Galena Mine Project on March 17 and 18, 2011.

The effective date of the mineral resources and reserves is 31 December 2010. The report is in compliance with Canadian National Instrument 43-101. The purpose of the report is to provide an independent review of the mineral resources and reserves, at a time when the estimation process by US Silver has been enhanced by several significant upgrades to the estimation methodology.

| 1.2 | Property Description and Ownership |

The Galena Project is located in the Coeur d’Alene Mining District in Shoshone County, Idaho, a prolific silver-producing district of long standing. The mine project consists of the operating Galena mine with two shafts, the non-operating Coeur Mine with active haulage and hoisting, and an adjacent exploration property with one shaft, the Caladay property. Mills operate at the Galena and Coeur mines. The property covers 10,931 contiguous acres, over an area about 9 miles long east to west, and 2 miles wide north to south. The Galena Shaft is located near the center of the property and lies at 47 o28’39” N latitude and 115o58’01” W longitude, with a collar elevation of 3,042 feet above sea level.

The property is located two miles west of the town of Wallace in the heart of the Coeur d’Alene Mining district, in Northern Idaho. Spokane, Washington is about 75 miles to the west and Missoula, Montana is about 110 miles to the east. The property is about 1 mile south of Interstate Highway I-90.

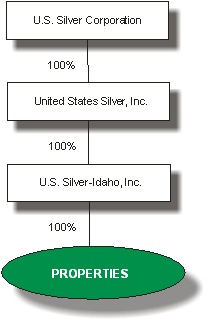

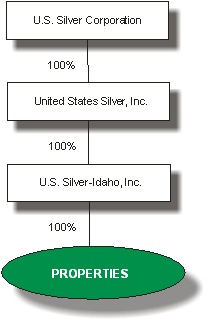

U.S. Silver Corporation, a Canadian public company, owns 100 percent of United States Silver, Inc. a Delaware corporation, which in turn owns 100 percent of U.S Silver-Idaho, an Idaho corporation which owns the subject properties. In this report, "US Silver" may refer to any or all of the three mentioned companies. US Silver purchased the Galena mine property on June 1, 2006 from Coeur d’Alene Mines Corporation, which operated the Galena Mine at that time.

US Silver’s land position is a combination of patented, unpatented and fee lands that are owned or leased by US Silver. US Silver owns 1,061 acres of fee ground, 146 patented claims totaling 2,250 acres, and 178 unpatented claims totaling 2,820 acres. All properties are in good standing with respect to title and current taxes. The leases were initiated in 1996 through 1998 and are all 20 year leases, without back-in clauses. Net smelter return royalty agreements exist on some leased properties, but no production prior to 2011 has been realized on any of the leased claims, and none is likely in the near future.

CAM 113116

Galena Mine Technical Report

14 April 2011

| 1.3 | Physiography and Infrastructure |

The Coeur d’Alene district lies in the Bitterroot Mountains, a part of the Northern Rocky Mountains. The Galena area is one of high relief and rugged terrain, with many slopes at angles of 30 percent or greater. Valley flats are restricted to the main stream and the lower reaches of some major tributaries; in only a few places do the flats exceed half a mile in width. Ridge crests range in altitude from 6,000 to 7,000 feet. Thus the maximum relief between valley floors and adjacent ridge crests and peaks ranges from 3,000 to 4,000 feet. The climate of the Coeur d’Alene district is strongly seasonal with warm summers and rigorous winters.

US Silver’s land position lies along and immediately south of the main freeway through the area, I-90. All the centers of population and US Silver’s property are accessible by main highways, hard surfaced roads or well-graded gravel roads.

US Silver has established necessary sources of water, power, waste disposal and tailings storage for current and planned operations. Personnel are sourced from nearby population centers. US Silver has the necessary processing facilities and holds sufficient surface rights to conduct operations. The Coeur Mine and Caladay shaft are connected to the Galena Mine by underground workings.

| 1.4 | Geology and Mineralization |

The Galena Project and most other ore deposits of the Coeur d’Alene Mining District are hosted by metamorphosed Precambrian sedimentary rocks of Revett Formation, part of the Belt Supergroup. The strata are composed primarily of fine-grained quartz and original clay (now metamorphosed to fine-grained white mica, or sericite). Three major rock types are generally recognized; vitreous quartzite, which is primarily metamorphosed fine-grained quartz sand, siltite-argillite, which is silt-sized quartz grains that are completely separated from each other by a large proportion of sericite, and sericitic quartzite which contains intermediate proportions of quartz and sericite.

Mineralization at the US Silver property occurs in steeply dipping fissure filling veins. The veins cut the Revett Formation, occurring on and are found along four major fracture systems and three major faults. The veins generally strike east-west and northeast-southwest, and range in thickness from a few inches to over fifteen feet. In the Galena Mine alone, tabulated mineral resources or reserves occur in more than 100 numbered or named veins, with several more in the Coeur Mine.

CAM 113116

Galena Mine Technical Report

14 April 2011

The vein mineralization is of two distinct types: silver-copper veins containing tetrahedrite and lesser chalcopyrite as the principal economic minerals; and silver-lead veins dominated by argentiferous galena. Gangues in both types are mainly siderite, with varying amounts of pyrite and quartz. Grades of the silver-copper veins range from a few ounces to over a thousand ounces of silver per ton, and since 1953 have averaged over 20 opt Ag. Copper grades range from tenths of a percent to over two percent and since 1953 have averaged 0.76% Cu. Grades of the silver-lead ores average approximately 9 opt Ag, and 10% Pb. Wallrocks are rarely mineralized, except where intersected by narrow veins or stringers.

| 1.5 | Exploration and Data Compilation |

Exploration at the Galena mine during 2010 included 49,374 feet of underground diamond drilling, and 6,546 feet of exploration and development drifting. During 2009, 13,669 feet of underground diamond drilling, and 6,851 feet of exploration and development drifting were completed.

The Galena mine had 2,092 diamond drillholes completed as of 31 December 2010. Down-hole surveys are attempted on all diamond drillholes. The primary survey tool is a REFLEX EZ-AQ electronic multi-shot down-hole survey instrument. The database contains 33,505 samples with assay values from the diamond drillholes. The database also includes 13,666 channel sample locations with 30,851 individual samples.

US Silver’s samples are analyzed by American Analytical Services, in independent laboratory in Osburn, Idaho, for silver, copper and lead by ICP (inductively-coupled plasma), and as needed for other elements. Higher-grade samples are re-assayed for silver by fire assay with gravimetric finish.

The independent laboratory (American Analytical Services) which assays most of US Silver’s exploration and production samples, became ISO-certified during 2010, and provides adequate assays.

Records of exploration at the Galena mine, dating back to the 1950’s, are on file at the mine office. Since 2000, data-handling protocols have been electronic, including an Access database, AutoCAD drafting software and Gemcom deposit modeling software.

CAM have reviewed the exploration sampling, preparation, and assaying practices at Galena, and is satisfied that the results are more than adequate for a database to be used in estimation of mineral resources and reserves.

CAM 113116

Galena Mine Technical Report

14 April 2011

| 1.6 | Reserve and Resource Estimation |

The mineral resource and reserve estimation at the Galena mine project was initially developed by the Galena mine staff, including Harry Lenhard, Senior Geologist and Daniel H. Hussey, Manager of Exploration for US Silver, who had prepared several ore-reserve updates for the Galena project (Hussey, 2007, 2008, 2009). CAM reviewed the annual resource and reserve estimates in 2006, 2010, and now in 2011. Steve Milne, P.E. of CAM, a Qualified Person, reviewed the database and methodology.

The estimates herein were calculated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on Dec 11, 2005. They incorporate assay results and geologic interpretations available through December 31, 2010, and reflect the removal of ore prior to that date.

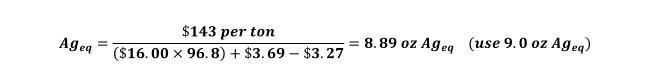

The estimates use life-of-mine average prices at $16.00 per ounce for silver, $2.90 per pound for copper, and $0.90 per pound for lead. These figures are somewhat below the 36-month historical average prices, and below the 60-month (36 months historical, plus 24 months futures) prices as of year-end 2010. No credit was taken for gold, zinc or any other metals in the cutoff grade calculation. Revenues were adjusted for recoveries. Overhead costs were proportioned against all the potential mine blocks. The cutoff grade was calculated from known costs and the NSR value of each resource block, using the cited silver and copper values in silver-copper veins, the silver and lead values in silver-lead veins, and known mill recoveries and smelter settlements.

Resources and reserves are estimated using the “accumulation” method, an accepted standard for calculating resources in narrow vein-type deposits which has been used for 50 years at the Galena mine. Kriging was formerly used on a few of the major veins, but since 2007 all veins are estimated using accumulation. The method calculates the metal content of an area by using the product of the vein thickness times the length of influence of the sample (channel or drillhole), times the corresponding diluted grade value. The quantity of metal associated with each sample is proportional to the sample thickness, length of influence, and the grade. The length of influence is generally one half the distance to adjacent samples. The volume of each ore block is determined by multiplying the average length of the block by the average height of the block by the average diluted thickness of the ore, and dividing by the tonnage factor.

During 2010, about 700 bulk-density measurements were made on new drill core and samples from active faces. Based on these bulk-density measurements, the tonnage factors were revised this year. Bulk-density measurements will continue to be made during 2011. Newly-determined tonnage factors range from 8.5 cubic feet per ton to 10.0 cubic feet per ton depending on the vein, the amount of siderite, tetrahedrite and galena present and the amount of barren dilution included. In nearly all cases the tonnage factor increased, thereby decreasing the overall tonnage by about 8%, before the application of other factors, which include depletion by mining, addition of reserves by exploration and development, and new factors for dilution during mining.

CAM 113116

Galena Mine Technical Report

14 April 2011

U.S. Silver calculates reserves on a fully-diluted basis. The channel-samples calculations are corrected to the expected as-built widths, based on the mining method, ground conditions, and miner skills. The year-end 2010 reserves and the 2011 Life-of-Mine (LOM) are based on full expected dilution.

Mineral resources are calculated on basis of the optimal mining width (i.e. not fully-diluted), since the expected full dilution will depend upon the mining method, ground conditions, miner skills, and other factors which are determined only during development and re-classification of the resources as reserves.

The mining methods applied at the Galena mine result in a very high ore recovery; therefore no ore loss is assumed or calculated.

CAM has reviewed the resources and reserves presented below in Tables 1-1, 1-2 and 1-3, and find them to have been developed using acceptable CIM standards and NI-43-101 rules, thus accurately portraying the mineral inventory at the Galena project, using the metals prices and process recoveries presented above. Further tabulation by individual veins is shown in Section 17.

Resources do not include material classified as reserves. The Coeur Mine contains some resources, but since the Coeur is not currently habilitated for mining, none of the material there is classed as reserves. No material from the Caladay deposit is included in the current resources or reserves.

Tables 1-1, 1-2, and 1-3 show the mineral reserves, measured and indicated resources, and inferred resources, respectively.

Table 1-1 Proven and Probable Reserves by Ore Type - December 31, 2010 |

| Vein Type | Short Tons | Silver | Copper | Lead |

| Ounces | Ag opt | Tons | Grade | Tons | Grade |

| Silver-Copper Veins |

Proven Reserves | 509,300 | 8,015,000 | 15.74 | 2,610 | 0.51% | -- | -- |

Probable Reserves | 556,800 | 9,836,200 | 17.67 | 2,910 | 0.52% | -- | -- |

| Total Silver-Copper Veins | 1,066,100 | 17,851,200 | 16.74 | 5,520 | 0.52% | -- | -- |

| Silver-Lead Veins |

Proven Reserves | 219,200 | 1,661,700 | 7.58 | -- | -- | 18,840 | 8.59% |

Probable Reserves | 330,400 | 2,395,500 | 7.25 | -- | -- | 23,950 | 7.25% |

| Total Silver-Lead Veins | 549,600 | 4,057,200 | 7.38 | -- | -- | 42,790 | 7.79% |

| Total Reserves | 1,615,700 | 21,908,400 | 13.56 | 5,520 | 0.52%* | 42,790 | 7.79%* |

| * Copper and lead values refer to only their respective vein types, not combined totals. |

CAM 113116

Galena Mine Technical Report

14 April 2011

Table 1-2 Measured and Indicated Resources by Ore Type - December 31, 2010 EXCLUSIVE OF RESERVES |

| Vein Type | Short Tons | Silver | Copper | Lead |

| Ounces | Ag opt | Tons | Grade | Tons | Grade |

| Silver-Copper Veins |

Measured Resources | 124,600 | 1,871,500 | 15.02 | 690 | 0.55% | -- | -- |

Indicated Resources | 364,800 | 6,148,800 | 16.85 | 1,680 | 0.46% | -- | -- |

| Total Silver-Copper Veins | 489,400 | 8,020,300 | 16.39 | 2,380 | 0.49% | -- | -- |

| Silver-Lead Veins |

Measured Resources | 27,400 | 223,400 | 8.15 | -- | -- | 2,360 | 8.61% |

Indicated Resources | 43,800 | 498,300 | 11.38 | -- | -- | 4,910 | 11.21% |

| Total Silver-Lead Veins | 71,200 | 721,700 | 10.14 | -- | -- | 7,270 | 10.21% |

| Total M&I Resource | 560,600 | 8,742,000 | 15.51 | 2,380 | 0.49%* | 7,270 | 10.21%* |

| * Copper and lead values refer to only their respective vein types, not combined totals of both vein types. |

Table 1-3 Inferred Resources by Ore Type - December 31, 2010 |

| Vein Type | Short Tons | Silver | Copper | Lead |

| Ounces | Ag opt | Tons | Grade | Tons | Grade |

| Total Silver-Copper Veins | 480,000 | 8,965,400 | 18.68 | 2,710 | 0.56% | -- | -- |

| Total Silver-Lead Veins | 546,300 | 4,743,400 | 8.68 | -- | -- | 51,600 | 9.45% |

| Total Inferred Resource | 1,026,300 | 13,708,800 | 13.36 | 2,710 | 0.56% | 51,600 | 9.45% |

| * Copper and lead values refer to only their respective vein types, not combined totals. |

Year-end 2010 is the first year since 2006 that US Silver has attempted to reconcile mill feed versus mining of reserves and resource blocks. For the year 2010, the reconciliation was not able to capture all production by stope/heading; thus it is not a true comparison of reserve/resource estimates to actual production. Reconciliations for tonnages and grade of reserve/resource blocks to mill are being initiated during 2011. The 2010 reconciliation shows that the silver-lead ore was mined nearly according to plan. Silver-copper ore yielded 14% fewer ounces Ag than programmed, due to lower tonnage and lower grade. Several sources have been identified of lower-grade material sent to the mill. CAM is of the opinion that the reconciliation derived above are a good start toward a rigorous comparison of block/shape model to actual muck. . The results show an acceptable closure, considering the nature of underground mining during periods of sharply rising prices, and the performance of other underground silver mines in the United States.

CAM 113116

Galena Mine Technical Report

14 April 2011

| 1.7 | Development and Operations |

The Galena Mine operated from 1887 to 1953 by mining galena-dominated ores. In 1953, the tetrahedrite-dominated Silver Vein was discovered on the 3000 level, and mining of silver-copper ores has been the main source of production since. The Coeur Mine was first developed in 1963, but has been inactive since 1997.

The Coeur and Galena mines are accessible by three shafts with the deepest shaft extending to 5,825 feet below the surface at the Galena mine. Level development has occurred on 10 levels at the Coeur and 13 levels at the Galena mine. Level development is spaced 200 or 300 vertical feet apart. Level development was previously conducted by track drifting and rail haulage, but since 1999 five areas were developed in the Galena Mine for rubber-tired diesel equipment. Lateral track drifts extend for thousands of feet out in an east to west direction from the shafts. The levels provide access to the over 100 veins that are producing or have produced in the past.

Mine production for the year 2011 is planned at 200,000 tons of combined silver-copper and silver-lead ore, producing as recovered metals from the mill 2,520,000 ounces of silver, 509 tons of copper and 3,345 tons of lead. Utilizing a production rate of about 2.7 million ounces per year, the current ore reserves would be depleted by the end of 2018 if no new ore is found, or upgraded from resource to reserves. Table 1-4 lists a schedule of production for 2011 through 2018 assuming a rate of about 2.7 million ounces per year. The trivial differences between totals in Tables 1-1 and 1-4 are due to rounding.

Table 1-4 Mine Production Schedule, 2011-2018 |

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | Total |

| Ag/Cu tons Ore | 150,000 | 165,000 | 125,184 | 125,184 | 125,183 | 125,183 | 125,183 | 125,183 | 1,066,100 |

| Ag grade (opt) | 14.74 | 15.07 | 17.51 | 17.51 | 17.51 | 17.51 | 17.51 | 17.51 | 16.74 |

| Cu grade (%) | 0.35 | 0.36 | 0.59 | 0.59 | 0.59 | 0.59 | 0.59 | 0.59 | 0.52 |

| Ag ounces | 2,211,000 | 2,486,550 | 2,191,972 | 2,191,972 | 2,191,954 | 2,191,954 | 2,191,954 | 2,191,954 | 1,784,931 |

| Cu Tons | 525 | 594 | 739 | 739 | 739 | 739 | 739 | 739 | 5550 |

| | | | | | | | | | |

| Ag/Pb tons Ore | 50,000 | 42,000 | 76,267 | 76,267 | 76,267 | 76,267 | 76,266 | 76,266 | 549,600 |

| Ag grade (opt) | 7.74 | 7.74 | 7.31 | 7.31 | 7.31 | 7.31 | 7.31 | 7.31 | 7.38 |

| Pb grade (%) | 7.32 | 8.47 | 7.77 | 7.77 | 7.77 | 7.77 | 7.77 | 7.77 | 7.79 |

| Ag Ounces | 387,000 | 325,080 | 557,512 | 557,512 | 557,512 | 557,512 | 557,504 | 557,504 | 4,057,136 |

CAM 113116

Galena Mine Technical Report

14 April 2011

US Silver’s underground exploration and development program is designed to systematically upgrade resources to reserves as well as to discover new resources. It is the nature of deep, narrow vein mining to carry a relatively short reserve life and to continually develop new reserves. The production schedule presented in Table 1-4 is one possible way in which the current ore reserve could be mined over the next eight years. These plans are continually revised as conditions, including metals prices, change and as new ore is discovered and developed.

The Galena mine operation has historically produced a silver-copper flotation concentrate from tetrahedrite ore, as well as a silver-lead concentrate from galena ore. Until late 2007 the mine had not produced silver-lead concentrate for several years. In September 2007 the 800 ton-per-day Coeur mill was restarted to process silver-lead ore from the Galena Mine. The main Galena mill 600 ton-per-day circuit treats silver-copper ores, while the Galena 300 ton-per-day circuit is currently idle, but could be used for either silver-copper ore or silver-lead ore.

Copper-silver concentrates are processed by Xstrata in Quebec, while silver-lead concentrates are processed at the Teck-Cominco smelter at Trail, British Columbia. Smelting contracts are typical for the North American mining industry.

Standard cash-flow calculations were run on this mine plan, using Base Case prices of $16.00 per ounce silver, $2.90 per pound for copper, and $0.90 per pound for lead. These prices are slightly below the 3-year historical averages. In addition, operating costs and metals grades were raised and lowered by 10 percent to indicate their effect on the cash flow.

The NPV (Net Present Value) for the Base Case is US$48,648,699 cash flow, discounted at 8%. The payback period is less than 2 years for the base case and slightly greater than 3 years when all metal grades, or all metal prices, are reduced by 10%.

CAM 113116

Galena Mine Technical Report

14 April 2011

| 1.8 | Conclusions and Recommendations |

U.S. Silver are well along in a program of upgrading the quality of data capture, resource/reserve estimation, and mine planning at the Galena Project, which is a continuing, profitable operation. CAM concludes that the mineral resources and reserve estimates for the Galena Project conform to NI-43-101 norms.

During 2010, the following steps were taken to refine several of the inputs to mineral estimation:

| | · | The tonnage factors (bulk densities) used to estimate tonnages were replaced with new measurements on core and hand specimens. |

| | · | The accuracy of assays at American Analytical Services has shown some improvement, and the lab has become ISO-certified. |

| | · | The mine staff have designed a new method of calculating dilution for reserve estimation, which reflects the actual mining experience during the past few years. The reserves are fully diluted, in accordance with CIM definitions. |

| | · | A first approximation has been made of a reconciliation between reserve/resource tonnages and grades, and ore delivered to the two mills. Due to the complexity of the vein system, and operational constraints, the reconciliation did not close precisely, but it is expected that with the new mineral-accounting procedures fully in place, the reconciliation will be much closer in future quarters and years. |

CAM recommends the following actions during 2011, with respect to mineral resource and reserve estimation, and mine planning:

| | · | The new system of collecting density (tonnage-factor) data should continue, with the addition of metal assays for samples in the density database. The objective is find correlations between density and metals assays, especially Cu and Pb. |

| | · | As detailed in Section 21 of this Technical Report, close attention should be paid to the continuing performance of AAS with respect to the commercial ore standards. Blanks samples should be analyzed for silver at the ppm level by ICP, as well as by fire assay, and another referee laboratory should be used in addition to ACT Labs, to resolve the source of bias in check assays. |

| | · | The reconciliation of resource/reserve blocks to mill feed should be extended to account for ore tons, and for silver, copper, and lead metal. Ideally this should be compiled on a quarterly and annual basis, and ideally with closures of less than 10%. |

| | · | The exploration and development program in the mine should be continued, to systematically discover and upgrade resources to replace mined reserves. 2011exploration program budget is for 65,000 feet of underground diamond drilling. Exploration and development should focus on silver-copper ore rather than silver-lead ore, as the silver-copper ores are more valuable on a per-ton basis. |

CAM 113116

Galena Mine Technical Report

14 April 2011

| | · | The exploration and development program in the mine should be continued, to systematically discover and upgrade resources to replace mined reserves. Additional capital needs to be expended on underground exploration and development to assure sufficient working places in the mine to allow the budgeted tonnage projections to be met. US Silver's 2011exploration program budget is for 65,000 feet of underground diamond drilling. Exploration should focus on silver-copper ore rather than silver-lead ore, as the silver-copper ores are more valuable on a per-ton basis. |

| | · | The above recommendations can readily be accommodated within the capital and operating budgets for mine operations during 2011. |

CAM 113116

Galena Mine Technical Report

14 April 2011

2.0 INTRODUCTION AND TERMS OF REFERENCE

This technical report (the “Technical Report”), conforming to Canadian National Instrument 43-101 (“NI 43-101”), was prepared by Chlumsky, Armbrust and Meyer, LLC (herein "CAM") for U.S. Silver Corporation (US Silver), a public company in Canada. The report describes the updated mineral reserve and resources estimate for the operating Galena Project, effective as of December 31, 2010.

During 2010, US Silver significantly modified and upgraded their practices relating to mineral estimation and reporting, as described herein. The changes include new determinations of mineral tonnage factors, reporting of fully-diluted reserves based on actual results of the past several years of operation by the current management, and an initial reconciliation of reserve-resource estimates to ore delivered to the mills. All of these calculations are very complex, due to the presence of scores of veins, of dissimilar types, at the Galena Project. In addition, the independent laboratory used for routine assaying became ISO certified during 2010.

Fred Barnard, California Professional Geologist, and Steve Milne, Professional Engineer in Colorado, prepared the report. As defined by NI 43-101, both are as Qualified Persons by reason of their education, professional affiliation, and relevant work experience, and both are independent of U.S. Silver. Dr. Barnard prepared Sections 2 to 16, 18, 22, and portions of Sections 1, 20, 21, and 23, and Steve Milne, P.E., prepared Sections 17, 19, and portions of Sections 1, 20, 21 and 23.

U.S. Silver Corporation, a Canadian company, owns 100 percent of United States Silver, Inc. a Delaware corporation, which in turn owns 100 percent of U.S Silver-Idaho, an Idaho corporation which owns the subject properties. In this report, "US Silver" may refer to any or all of the three mentioned companies.

All references to dollars ($) in this report are in U.S. dollars. The mine operations are conducted exclusively in Imperial units. This report exclusively refers to Imperial units for distances, areas, volumes, and masses, expressed in inches, feet, miles, acres, pounds and short tons of 2000 pounds, unless otherwise indicated. Ounces refer to troy ounces.

Information in this report is derived from:

| | · | The visits of the two authors to the Galena property on17 March, 2011, 25 and 26 February, 2010, and 26 and 27 July, 2006. |

| | · | CAM's previous (2006 and 2010) Technical Reports on the Galena Mine. |

| | · | Technical Reports by US Silver disclosing mineral resources and reserves in 2007, 2008, and 2009. |

CAM 113116

Galena Mine Technical Report

14 April 2011

| | · | Drillhole and underground sample databases compiled by US Silver technical staff and their predecessors. |

| | · | Other information gathered by CAM, or by US Silver and transmitted to CAM. |

| 2.1 | Data Gathering and Site Visit |

The authors of this report, Messrs. Barnard and Milne, visited the American Analytical Services laboratory on 16 March, and the Galena project on 17 and 18 March. On a previous visit in February 2010, they had both visited underground operations on Levels 2400 where various silver-lead and silver-copper veins were exposed in mining faces, including the 114 Vein, 146 Vein, 148 Vein, 173 Vein, 175 Vein, and 177 Vein on the 2400 Level, and the Silver Vein on the 4,000 Level. In addition, Mr. Milne visited the mills and flotation plants at both the Galena and Coeur mines. The underground and mill visits were not repeated in 2010, as there had been no fundamental changes in operating methods.

During the visit, the authors interviewed Mr. Thomas Parker (CEO of US Silver), Mr. Dan Hussey (Manager of Exploration), Mr. Greg Nickel (Chief Mine Geologist), Mr. Jeff Moe (Mine Geologist), Mr. Corey Millard (Environmental Superintendent), and Ms. Cheri Bayer (Accounting Supervisor). At the American Analytical Services laboratory, we interviewed Ms. Beth Lakin, Quality Manager.

| 2.2 | Units and Abbreviations |

All common measurements in this report are given in Imperial units. All tonnages are short tons of 2,000 pounds. Precious metal values are in troy ounces or troy ounces per short ton. Dollars are U.S. dollars.

The following abbreviations used in this report are shown in Table 2-1.

Table 2-1 Abbreviations used in this report |

| Abbreviation | Unit or Term | Abbreviation | Unit or Term |

| AAS | American Analytical Services | ounce | troy ounce |

| AA | atomic absorption analytical method | oz | troy ounce |

| Ag | Silver | QA | quality assurance |

| BLM | U.S. Bureau of Land Management | QC | quality control |

| Cu | Copper | Pb | lead |

| Ft | Feet | ton | short or Imperial ton |

| Lb | Pound | tpd | short tons per day |

| NSR | Net Smelter Return | Zn | zinc |

| opt | troy ounce per short ton | $ | U.S. dollar |

CAM 113116

Galena Mine Technical Report

14 April 2011

3.0 RELIANCE ON OTHER EXPERTS

US Silver has warranted to CAM certain information about environmental permitting, bonding, and reclamation, as verified by CAM and discussed in Section 19. US Silver also warranted US Silver’s control of property rights discussed in Section 4, which were confirmed by a letter from a law firm, as described in Section 4.2 of this report.

CAM 113116

Galena Mine Technical Report

14 April 2011

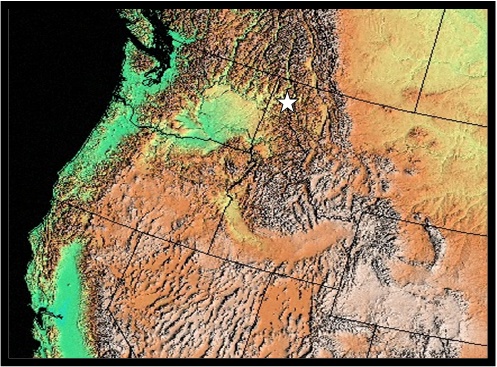

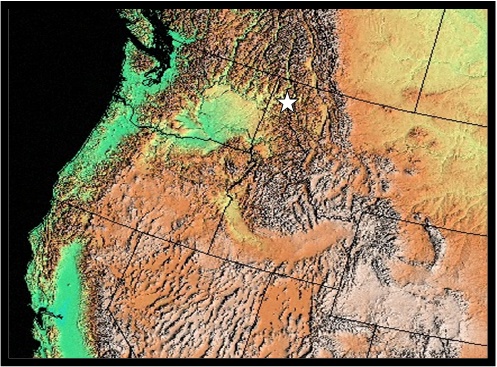

4.0 PROPERTY DESCRIPTION AND LOCATION

US Silver’s property is located in the eastern part of the Coeur d’Alene Mining district, one of the preeminent silver, lead and zinc producing areas in the world, near the base of the panhandle of northern Idaho. Spokane, Washington is about 75 miles to the west and Missoula, Montana is about 110 miles to the east. The Galena Shaft, near the center of the property, is in Section 29, Township 48 North, Range 4 East, Boise Baseline and Meridian. The Galena Shaft lies at 47.48 degrees N latitude and 115.97 W longitude. The collar of the shaft is at an elevation of 3,042 feet above mean sea level. The property lies entirely within Shoshone County, Idaho.

Figure 4-1

Location of Galena Mine Project in North Idaho

United States Silver purchased the Galena mine property on June 1, 2006 from Coeur d’Alene Mines Corporation (“Coeur”). The property includes the Galena mine, the Coeur mine, the Caladay property and leases on numerous other contiguous properties for a total of 10,931 acres (collectively the “Properties”). There are currently no underlying royalties to be paid on current production areas. The Galena mine property was formerly known as Coeur Silver Valley under Coeur’s ownership. Figure 4-2 outlines the current ownership structure of the Properties:

CAM 113116

Galena Mine Technical Report

14 April 2011

Figure 4-2

Ownership Structure

The parcel ownerships described in Section 4.4 were confirmed in a letter, dated 24 March, 2011, to CAM from Jeanine Feriancek of Holland & Hart LLP, a law firm based in Denver, Colorado. The various property-type titles were verified by Holland & Hart at dates between 29 September 2010, and 24 March 2011. US Silver’s Environmental Superintendant Corey Millard verified on 17 March 2011 that there had been no recent changes in mineral title.

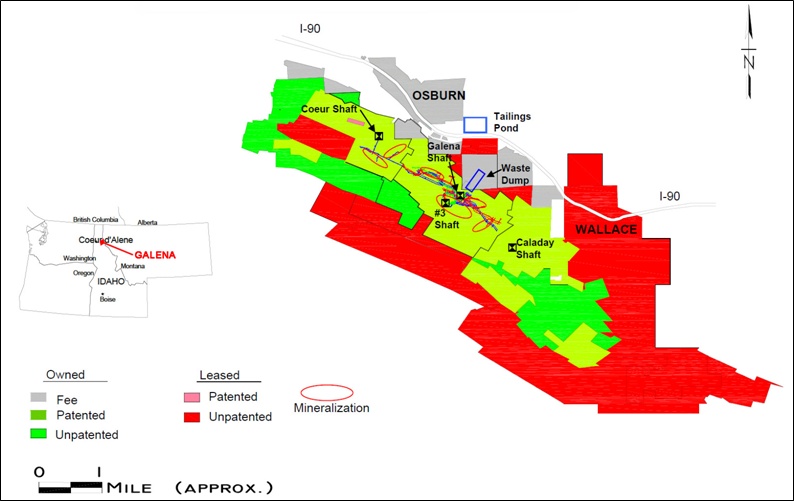

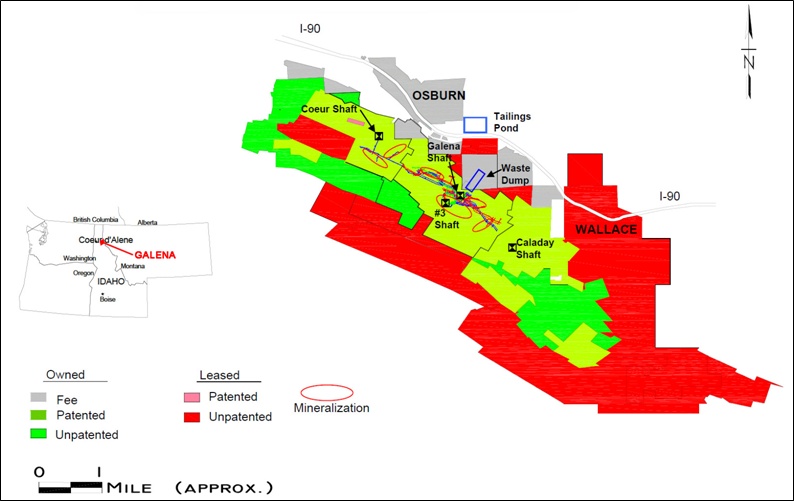

The property covers 10,931 acres over an area about 9 miles long east to west and 2 to 3 miles wide. US Silver’s property contains two mines and one exploration shaft. The operating Galena mine is located near the center of the property position, the Coeur mine which is on care and maintenance is about 1.5 miles northwest of the Galena shaft and the Caladay exploration shaft approximately 1.5 miles southeast of the Galena shaft.

CAM 113116

Galena Mine Technical Report

14 April 2011

Since 1953, the Galena and Coeur mines have combined to produce about 220 million ounces of silver, 161 million pounds of copper and 28 million pounds of lead from 10.6 million tons of combined silver-copper and silver-lead ore. More than two-thirds of the total has come from the Galena mine. Silver-copper ore grade has averaged 20.8 ounces of silver per ton and 0.76 percent copper.

The Galena mine is an operating mine and utilizes the 5,825 foot deep #3 Shaft and the Galena shaft. Both shafts access the deepest level of the mine, the 5500 level. An 800-foot section of the Galena shaft support, from above the 2400 level to the 3200 level, collapsed in about 2000. The shaft was repaired during 2008-2010, with installation of a 12 foot-diameter concrete liner. In early 2010, the shaft became operational from the collar to the 5500 level. The Galena shaft is now the designated secondary escapeway for the mine operation. The Galena mine also has an operating 800 tpd flotation mill, maintenance shop, carpenters shop, office, and dry facilities.

The Coeur mine is currently on care and maintenance. This mine is serviced by an operational three compartment shaft with a double drum hoist that goes to 4,100 feet below the surface. The Coeur mine and Galena mine are connected underground by a track haulage drift on the Galena 3700 level (same as the 3400 level in the Coeur Mine). The Coeur mine shaft serves as an exhaust ventilation shaft for the Galena mine. The Coeur mine also has an operational 500 ton per day flotation mill, maintenance shop, office, and dry facility.

The Caladay exploration shaft is serviced by a double drum hoist that goes 5,100 feet below the surface. The Caladay shaft is connected to the Galena mine workings on the 4900 level of the Galena mine. The Caladay surface facilities include a maintenance shop, warehouses, and office. The Caladay is also an exhaust shaft for the Galena mine.

US Silver’s land position is a combination of patented, unpatented and fee lands that are both owned by US Silver and leased (Table 4-1 and Figure 4-2). The claims have been legally surveyed and are in good standing with US Bureau of Land Management. US Silver owns 1,061 acres of fee ground, 146 patented claims for 2,250 acres, and 178 unpatented claims for 2,820 acres. Annual filing fees for the US Silver owned claims totals $24,920. US Silver leases 239 unpatented claims for 4,780 acres and 1 patented claim for 20 acres. The leases were initiated in 1996 through 1998 and are all 20 year leases. Monthly lease fees total $5,350 and annual BLM filing fees for leased claims totals $33,460. No back clauses are in any leases. Net smelter return royalties after all exploration, development and mining costs have been recovered exist on some leased claims but no production prior to 2009 has been realized on any of the leased claims.

CAM 113116

Galena Mine Technical Report

14 April 2011

Table 4-1 US Silver Land Position |

| Category | Acres |

| Owned or Controlled Land |

Fee land | 1,061 |

Patented mining claims | 2,250 |

Unpatented mining claims | 2,820 |

Subtotal | 6,131 |

| Leased Lands |

Patented mining claims | 20 |

Unpatented mining claims | 4,780 |

Subtotal | 4,800 |

| TOTAL ALL LANDS | 10,931 |

Since acquiring the core land package from Coeur d’Alene Mines, U.S. Silver has acquired three other past producing mines in the district. Two of these properties are held by lease agreements and one property was purchased. These properties consist of patented and unpatented claims. None of these properties are contiguous with the core land package. These properties are considered exploration projects at this time and none are currently producing. There are no plans to put them into production in the near future. In addition, U.S. Silver has staked about 300 unpatented claims in the district since acquiring the Galena mine.

CAM 113116

Galena Mine Technical Report

14 April 2011

Figure 4-3

U.S. Silver Property Position, Galena Project

CAM 113116

Galena Mine Technical Report

14 April 2011

5.0 ACCESSIBILITY, CLIMATE, INFRASTRUCTURE AND PHYSIOGRAPHY

US Silver’s land position lies immediately south of I-90, between the cities of Wallace, Idaho and Osburn, Idaho. Wallace is about 2 miles east of the Galena mine and the city of Kellogg, Idaho is about 10 miles west of the Galena mine.

All the centers of population and US Silver’s property are accessible by main highways, hard surfaced roads or well-graded gravel roads. Many miles of U.S. Forest Service and private logging roads allow access to most areas of the property.

The climate of the Coeur d’Alene district is strongly seasonal and typical of the climate of the western slope of the Northern Rocky Mountains. Precipitation ranges between 30 and 40 inches a year and is considered a net precipitation area; the largest amount falls as snow during the winter months. Rains are abundant in the early fall and spring. Warm sunny weather generally prevails from mid-June through August, although some thunder-showers occur. October and November are usually clear and cool following a mid-or late-September rainy period. Daytime temperatures in the summer are usually moderate but there are occasional short periods ranging between 90 and 100°F and temperatures in July average 86°F. Winter temperatures are generally well below freezing and below-zero temperatures have occurred. January average temperature is 22°F. Snowfall is heavy in the area and averages 49 inches. In the lower valleys toward the west end of the area, the snow may not persist through the winter but may melt away between storms; however, at higher elevations snow persists as a cover several feet thick from late fall to later spring. Snow drifts accumulate on the lee side of the high ridges, in deep swales, in densely wooded areas, and in areas protected from the sun and remain there through July or even mid-August.

The Galena Mine is located in the Coeur d’Alene Mining District which is commonly called the Silver Valley. Mining activity in the Silver Valley has been ongoing for 145 years and total historical production ranks the Silver Valley as one of the world’s most prodigious silver producing districts.

US Silver has established necessary sources of roads, water, power, waste disposal and tailings storage for current and planned operations. Personnel are sourced from nearby population centers. US Silver has established necessary processing facilities and holds sufficient surface rights to conduct operations.

CAM 113116

Galena Mine Technical Report

14 April 2011

Water is taken from wells and from a flume sourced in Lake Creek. Electrical power is obtained from the Bonneville Power Administration grid. Piped natural gas is available on the property.

The Galena Mine is located within the Lake Creek drainage. The Coeur Mine is located on the upper reach of Shields Gulch approximately two miles east of Osburn, Idaho and four miles from Wallace. The Caladay Mine is situated within Daly Gulch just outside Wallace, approximately one mile east of the Galena Mine. All three mines are connected by underground workings.

The Coeur d’Alene district lies within what is generally called the Bitterroot Mountains, a part of the Northern Rocky Mountains. At this latitude the Rocky Mountains encompass the panhandle of northern Idaho and much of western Montana, and consist of an area of poorly defined mountain ranges that are rugged and deeply dissected. In the western part they are generally separated by major drainage channels that are usually narrow floored, and in the eastern part they are north-trending elongate ranges separated by intermountain basins.

The Coeur d’Alene district lies adjacent to the South Fork of the Coeur d’Alene River. The river and its numerous tributaries drain most of the district. The Caladay Mine area is drained by Daly Creek; Galena Mine area by Lake Creek; and the Coeur Mine is located up Shields Gulch.

The area is one of high relief and generally rugged terrain. Ridge slopes are consistently steep; many are inclined at angles of about 30 percent or greater. Valley flats are restricted to the main stream and the lower reaches of some major tributaries; in only a few places do the flats exceed half a mile in width. The ridge crests are usually narrow and are similar altitudes for long distances. The ridge crests and peaks range in altitude from 6,000 to 7,000 feet. Thus the maximum relief between valley floors and adjacent ridge crests and peaks ranges from 3,000 to 4,000 feet.

Vegetation is abundant, although local differences in environment both natural and man-made effect a pronounced change in type and amount of plant cover from place to place. Only a few small areas of the original coniferous forest that once covered the district remain. The great forest fire of 1910 swept through the district and impacted much of the forest cover. Only local patches of vegetation such as timber stands in deep ravines remained after the fire. Stands of second growth and brush have replaced much of the burned-over areas. Conifers found in the area are pine, fir, hemlock, larch, cedar, and spruce. Douglas fir is the most common tree in the district.

Deciduous trees, mainly species of willow, alder, and black cottonwood, are restricted principally to the valley flats and perennial stream courses, although some willow and alder grow in thickets on ridge slopes where the moisture content of the soil is sufficient to nourish them. Some aspen flourish on high, open slopes.

CAM 113116

Galena Mine Technical Report

14 April 2011

A large variety of brushy plants and other ground cover are distributed unevenly over the district and their abundance ranges from sparse growth on the drier slopes of thin soil cover to dense thickets in moist swales.

Various grasses thrive in open areas and the more open pine forests. Bear grass is the most conspicuous growth on many open slopes and meadows in the highest terrain.

CAM 113116

Galena Mine Technical Report

14 April 2011

6.0 HISTORY

The Galena and Coeur Mines are situated in the center of the Coeur d’Alene Mining District of North Idaho. Placer gold was first discovered in the district in 1858. By 1860, the gold rush prospectors had also discovered the silver-lead veins in the district.

US Silver owns and operates the Galena mine and mill, and owns the Coeur mine and mill, and the Caladay exploration property. The Galena mine project was purchase from Coeur d’Alene Mines in June 2006. The history of each property is described below.

The Galena mine has a long history dating back to 1887, but the modern history and mining commenced in 1947 under the management of ASARCO. Since 1953 the Galena mine has primarily mined silver-copper ore with minor production of silver-lead ore. Total production since 1953 is over 172 million ounces of silver, 121.1 million pounds of copper and 28.4 million pounds of lead from 7.8 million tons of ore. Average grade of the silver-copper ore was 22.1 ounces per ton of silver and 0.82 percent copper. Average grade of the silver-lead ore was 8.2 ounces silver and 8.8 percent lead per ton of ore.

The Galena mine began with Killbuck Mining Co. in 1887. The property had six tunnels on the west side of Lake Gulch. The Number 1 tunnel was the upper most. The Number 2 tunnel was 46 feet below the Number 1 and a winze was sunk on a 2-foot wide vein down about 45 feet. The Number 3 tunnel is 80 feet below the Number 2 tunnel and some stoping was done. The Number 4 tunnel is 120 feet below the Number 3 tunnel. The adit to the Number 5 tunnel was near the new Galena boarding house.

The Tin Cup Group consisted of about 9 claims and six tunnels. The upper tunnels were opened in the early 1890's. Ore shipments are reported in May to July 1893. The Number 6 tunnel was started in February 1907. The vein in the upper three tunnels is different from the vein in tunnels 4 and 5. The vein was reported as being a quartz-siderite vein about 5 feet wide, dipping 78 degrees to the south, and striking east west. Minor stoping was done in the first 5 tunnels with a winze in the Number 2 tunnel and the Number 4 tunnel.

In 1917 the Chicago-Boston Company owned claims on the east side of Lake Gulch named Keystone (patented), Killbuck Two, Essie, Tea Cup, Adit, Lee (patented), Tin Cup, Dipper, Dike, and Butte Fraction. The Chicago-Boston Company was mining toward the old Tin Cup workings from the No.6 tunnel of the Tin Cup workings. This tunnel was situated on the east side of Lake Gulch across from the Killbuck workings. In the spring of 1916, an excessive runoff caused the Hercules flume above the Number 6 tunnel to break. Overburden was washed away exposing a silver-lead vein running east-west and just north of the adit of the Number 6 tunnel. A drift was driven to the north from the main haulage tunnel at about 50 feet from the portal exposing the vein. Eventually a second adit was started from the surface, just north of the Number 6 tunnel. In excavating for an old blacksmith shop, which lies between the two adits, a vein was exposed. In the fall of 1917 the property was leased to Eugene R. Day & Assoc. A shaft was sunk 220 feet down near the east end line of the Killbuck claim. Two levels were developed off the shaft, the 100 level and the 200 level. The vein on the 100 level averaged 4.6 feet wide with a grade of 4.0 opt silver and 6.12 percent lead. The vein on the 200 level averaged 5.5 feet wide with a grade of 2.9 opt silver and 4.14 percent lead. When the lease was up, it was not renewed. Eventually, the Chicago-Boston Co. and the Killbuck Mining Co. were consolidated, along with a few additional claims, into the Galena Mining Co.

CAM 113116

Galena Mine Technical Report

14 April 2011

1905 - AS&R buys a controlling interest in Federal Mining and Smelting.

1917-1918 - Callahan secured an option of about 1,200,000 shares of the Chicago- Boston, their option being for one year. Also they secured an option on the Killbuck Mining Co.

1920 - Callahan acquired 51 percent of Chicago-Boston Mining Co. and 80 percent of Killbuck Mining Co.

1921 - Galena Mining Co. exchanged on a share-for-share basis for Chicago-Boston and Killbuck Mining stock. Callahan obtained 62 percent of the outstanding Galena stock.

1922 - Callahan acquired all of the properties of the Galena Mining Co.

1923 - Late this year Callahan acquired 8 patented claims and 80 acres of patented homestead land of the Coeur d' Alene Vulcan Mining Co. The Galena shaft was deepened to the 600 level. The average mill grade was 3.8 percent lead and 3.9 opt silver.

1924 - A Winze was started about 1000 feet east of the Galena shaft and sunk to the 800 level.

1925 - The Galena property consisted of 84 claims comprising about 1,458 acres. The Winze was deepened to the 1400 level.

1926 - The Galena property consisted of 91 claims and about 1,533 acres. The average mill grade was 5.4 percent lead and 3.9 opt silver. The Galena mill was built.

1927 - The Galena property consisted of 96 claims and about 1,610 acres. The Galena shaft was sunk 800 feet more. The mill grade averaged 5.55 percent lead and 4.16 opt silver.

CAM 113116

Galena Mine Technical Report

14 April 2011

1928 - The Galena property consisted of 98 claims and about 1,620 acres. Mining and milling was discontinued in October. The annual grade averaged only 5.45 percent lead and 4.02 opt silver. Concentrates shipped averaged 53.3 percent lead and 39.9 opt silver. A diamond drill was set up on the 600 level about 1,880 feet east of the Galena shaft and drilled south. A vein was crossed at about 275 feet out. A crosscut was started and intercepted an 8 foot wide vein. The vein averaged 9.4 percent lead and 6.3 opt silver. This vein was labeled the South Vein or the Parallel Vein.

1929 - A raise was started on the east end of the 600 level and was up 540 feet. The top of the raise was about 400 feet from the east end of the No.6 tunnel level.

1930 - The Galena property consisted of 99 claims and about 1,620 acres. The Galena mine extracted a total of 112,988 tons from the Galena vein. It also extracted a total of 22,193 tons from the Parallel vein. The overall average mill grade was 5.2 percent lead and 4.0 opt silver.

1931 - Early in the year all mining and milling at the Galena was terminated, due to low metal prices for lead and silver during the Depression. Development work was terminated in late July except diamond drilling. Concentrates prior to the shutdown averaged 53 percent lead and 55 opt silver.

1936 - Dewatering began in the Galena shaft to the 600 level. Callahan Zinc-Lead Co. was reorganized.

1937 - Development and diamond drilling was started. The Vulcan tunnel was reopened.

1938 - All work on the Argentine property was terminated.

1939 - The mill was reopened by a lease from Silver Dollar Co. to treat silver.

1940 - The mill was leased to Zanetti Brothers who operated on leasers ore from the Callahan Zinc-Lead mining Companies mine up Nine-mile plus other leases.

1941 - Zanetti Brothers purchased the Galena mill.

1946 - Galena shaft was down to just below the 800 level.

1947 - Callahan Zinc-Lead Mining Co. deeded a two thirds interest in its Galena Mine property to a subsidiary company called the Vulcan Silver-Lead Corp.

1947 - Vulcan Silver-Lead Corp. leased the property to AS&R (future ASARCO) for 60 years.

CAM 113116

Galena Mine Technical Report

14 April 2011

1950 - During the mid 50's, Federal Mining & Smelting merged with AS&R.

1951 - Callahan Zinc-Lead Mining Co. owns 63 percent interest in the Vulcan Silver-Lead Corp. At the 2930 level (3000 level) of the Galena shaft, a mineralized zone was entered adjacent to the shaft and was termed the Vulcan vein. The average grade was 6.9 percent lead, 3.2 opt silver, and 1.6 percent zinc across an average width of 6.2 feet. Federal Mining and Smelting Co. was contemplating an option of 15 percent interest in the AS&R lease.

1953 - The Callahan Winze was dewatered from the 600 level to the 1600 level in hopes of using the winze as a manway. In February, the tetrahedrite-bearing Silver vein was cut on the 3000 level. A raise was started on the vein to the 2800 level. At this time Federal Mining and Smelting Co. had a 15 percent interest and Day Mines had a 25 percent interest. The Zanetti mill had a capacity of 135 to 150 tons per day.

1954 - The Galena mill, which had been owned and operated by Zanetti Brothers, was deeded over to ASARCO in April.

1955 - Callahan Zinc-Lead Mining Co. owns 86 percent of the Vulcan Extension. The Galena mine was put on an operating basis.

1958 - Callahan merged with Vulcan Silver-Lead Corp. The Vulcan Silver-Lead Corp was originally formed in 1946 by Callahan to take over a major portion of Callahan's old Galena mine.

1992 - In June of this year the Galena closed and was put on standby due to the price of silver, $3.62 per ounce.

1995 - ASARCO and Coeur d' Alene Mines became joint owners of the Galena and Coeur Mines. A new company called Silver Valley Resources was formed. Development work began on the lower levels.

1997 - In July of this year the Galena Mine resumed production, and the Coeur mine shut down.

1999 - In October of this year, Coeur d' Alene Mines became 100 percent owners of the Galena mine, and the name of the company changed to Coeur Silver Valley.

2006 – In June 2006, United States Silver acquired the Galena Mine, the Coeur Mine, the Caladay exploration property, and the adjoining properties, all totaling 10,931 acres. Production of silver-copper ores continued.

CAM 113116

Galena Mine Technical Report

14 April 2011

2007 - Production of silver-lead ore resumed at Galena, in addition to silver-copper ore. Lead-silver ores were milled at the refurbished Coeur mill.

2007-2009 - Various modifications were made to the milling practices, as described in Section 19.5. Exploration and production of both silver-copper and lead-ores continued.

2008-2010 - The Galena Shaft was repaired and was placed in service in early 2010, giving access from surface to the 5,500-foot level.

The Coeur Mine shaft was initiated in 1963. The mine produced continuously from 1976 through 1991, and again from 1996 through 1997. The total production was 39 million ounces of silver and 33 million pounds of copper from 2.4 million tons of ore. Average ore grades were 16.0 ounces per ton silver and 0.67 percent copper. The mine has been on care and maintenance since 1997. During the second quarter of 2007 work was begun to rehabilitate the Coeur mine 3400 level and later the Coeur Shaft. The Coeur mill was re-started in September 2007 to process silver-lead ore from the Galena mine. By early 2008 silver-lead ore was being trammed from the Galena mine 3700 level to the Coeur Shaft (Coeur 3400 level) and was being hoisted up the Coeur for processing at the Coeur mill. Mineral resources are tabulated at the Coeur mine, but no reserves, as the mine is not currently habilitated, although underground exploration and mining could resume at the Coeur sometime in the future.

| 6.3 | Caladay Property History |

The Caladay property began in the mid-1960’s as a joint venture between Callahan Mining, ASARCO and Day Mines. The joint venture sank a 5,100 foot shaft during the early 1980’s on the east end of the Coeur d’Alene Silver Belt. From the 4900 level of the Caladay shaft an exploration drift was run east and west. The western drift intersected the Galena Mine’s 4900 level.

Diamond drilling was conducted in the late 1980’s and a silver-lead deposit was located. Callahan calculated a mineral inventory in the late 1980’s, based on 71,000 feet of drilling, of 833,000 tons of silver-lead ore at an average grade of 5.96 opt Ag, and 5.76 percent lead for 4,965,000 ounces of silver and 48,000 tons of lead. The silver-copper mineralization amounted to 186,000 tons at an average grade of 13.12 opt Ag, and 0.16 percent copper for 2,436,000 ounces of silver and 297 tons of copper.

No NI 43-101-compliant resource or reserve study has been completed for the Caladay mineralization. It should be noted that the preceding estimates are historical in nature and as such are based on prior data and reports prepared by previous operators. The historical estimates should not be relied upon and there can be no assurance that any of the historical resources, in whole or in part, will ever become economically viable. U. S. Silver does not include any Caladay material in the measured, indicated or inferred resource disclosed in this Technical Report.

CAM 113116

Galena Mine Technical Report

14 April 2011

The joint venture was bought out by Coeur d'Alene Mines Corp in the 1980’s. Since then no active exploration has been conducted at the Caladay mine and no reserves or resources are reported for the Caladay property by U.S. Silver. The Caladay shaft and workings are currently used as a ventilation exhaust way. The hoist is in operable condition and the property is maintained. US Silver is currently evaluating the existing exploration data.

CAM 113116

Galena Mine Technical Report

14 April 2011

7.0 GEOLOGICAL SETTING

The Coeur d’Alene district lies within the west-central part of this area within a regional tectonic lineament known as the Lewis and Clark line that extends N 070 W from Missoula, Montana to Coeur d’Alene, Idaho. Diverse, recurrent tectonism within the Lewis and Clark line is believed to be primarily responsible for the project geologic structures that characterize the district.

The Galena mine project and the Coeur d’Alene district are hosted almost entirely within rocks of the Belt Supergroup, a sequence of sedimentary rocks of Middle Proterozoic Age, deposited 1.47 to 1.40 billion years ago, occurring primarily in western Montana, Idaho, and southeastern British Columbia. The sequence totals at least 21,000 feet in thickness in the Coeur d’Alene district.

Rocks of the Belt Supergroup are clastic sediments, with a minor component of chemical and algal dolomites. The clastic facies are dominantly clean to argillic quartzites and quartzose siltites, and argillites. These units are variously colored white, grey, purple, and black, with good lateral persistence.

The Belt Supergroup is regionally subdivided into four units, from youngest to oldest as shown in Table 7-1.

Table 7-1 Stratigraphy of the Belt Supergroup in North Idaho |

| Group | Formation | Lithology | Importance to Galena mine project |

MISSOULA | various | quartzite, siltstone, | not present on US Silver property |

| Argillite | |

| PIEGAN | Wallace | quartzite, argillite, | minor ore in old, shallow workings |

| minor carbonates | |

| St. Regis | siltite-argillite | minor ore in old, shallow workings |

| Revett | quartzite and | most of Galena mine project ore |

| RAVALLI | Burke | siltite-argillite | occurs in Revett |

| siltite with quartzite | none at Galena |

| in upper part | |

| Pre-RAVALLI or | Prichard | argillite, slate, and | not present on US Silver property |

| Lower Belt | | greywacke-quartzite | |

Belt strata have been subdivided into a number of widely mapable formations, each several hundred to thousands of feet thick. Nomenclature used to define these formations has changed slightly over the past 30 years. Descriptions of formations as redefined by Harrison and others (1986) are given as follows from oldest to youngest.

CAM 113116

Galena Mine Technical Report

14 April 2011

Burke Formation: The predominant rock type is thinly layered siltite. Vitreous and sericitic quartzites in the upper part of the formation host important ore bodies, but none have been mined in many years, and exploration of this rock type has been minimal.

Revett Formation: The Revett Formation is the most important host formation for ore in the district; 75 percent of ore production to date has come from the Revett, primarily from the upper members. Overall, the Revett Formation is composed of roughly equal proportions of siltite-argillite, sericitic quartzite, and vitreous quartzite. Both the upper and lower Revett are characterized by hard and soft subunits of relatively uniform strata that commonly range from 15 to 60 meters thick. Hard subunits are typically composed of vitreous quartzite and hard sericitic quartzite with thin seams of siltite-argillite. Soft subunits contain soft sericitic quartzite and siltite-argillite. The middle Revett is dominated by siltite-argillite.

St. Regis Formation: The St. Regis Formation is most characterized by purplish siltite-argillite. Historically, the upper portion of the upper member of the Revett Formation has locally been included as part of the St. Regis.

Wallace Formation: The Wallace Formation contains two distinct lithologies. The Middle Wallace is characterized by layers of coarse-grained sericitic quartzite 5 to 20 centimeters thick separated by thinner (5 to 10 centimeters) interbeds of black argillite. The Lower Wallace rock type typically is green argillite.

| 7.2 | Local and Property Geology |

Belt strata are composed primarily of fine-grained quartz and original clay (now metamorphosed to fine-grained white mica, or sericite). These strata vary in several sedimentological features, including grain size, grain sorting, thickness, and bed form. These features are reflected in variations in strength, hardness, and physical anisotropy. Differences in mechanical properties among strata are largely dependent on highly variable proportions of fine-grained quartz and sericite.

Although the composition of these metasediments varies widely, three major rock types are generally recognized. These rock type definitions were first applied in the district to the Revett Formation (White and Wilson, 1982) but have since been used in describing other Belt formations as well. The rock types are; vitreous quartzite, which is primarily metamorphosed fine-grained quartz sand, siltite-argillite, which is silt-sized quartz grains that are completely separated from each other by a large proportion of sericite, and sericitic quartzite which contains intermediate proportions of quartz and sericite.

CAM 113116

Galena Mine Technical Report

14 April 2011

Vitreous quartzite is a hard metasandstone with no more than 8 percent sericite. Some sericite is present at some grain boundaries but not enough to interfere materially with the fusing of quartz grains into a hard coherent rock. Such fusing is apparently responsible for the stiff, brittle nature of this rock type. The brittle nature is evident in the discrete chips or splinters created when the rock is struck with a hammer.

Vitreous quartzite beds most commonly range from 0.5 to 1.0 m thick and tend to be internally uniform in appearance. Sedimentary lamination is present within these quartzite beds, and beds sometimes separate along these laminations. Subtle variations in appearance among individual beds are believed to result from slight differences in the amount of sericite. The purest vitreous quartzite is nearly white and translucent.

Vitreous quartzite may be abundantly microfractured (particularly at the Lucky Friday Mine). In addition, short, non-persistent fractures are seen locally. These microfractures, as well as clouds of larger fractures, provide pathways for fluid flow, which is reflected in the relatively high permeability of vitreous quartzite strata compared to more sericitic strata.

Sericitic quartzite differs from vitreous quartzite primarily in being non-glassy, noticeably softer (it can be scratched with a pointed steel) and normally darker. These differences reflect the presence of a larger proportion of interstitial sericite (greater then about 8 percent). The increased amount of sericite apparently limits quartz grain intergrowth, affecting both the appearance and hardness of this rock type. The separations of grains by sericite evidently serve to buffer, but not prevent, interaction between quartz grains. The result is a softer, weaker, but still substantial rock.

Sericite in sericitic quartzite generally displays a preferred orientation, reflecting either original sedimentary layers or metamorphic foliation, depending on structural setting and history. The soft sericite promotes a plastic mode of deformation not available to vitreous quartzite.

CAM 113116

Galena Mine Technical Report

14 April 2011

As sericite content approaches 50 percent, quartz grains are sufficiently isolated from each other so as to prevent any kind of mechanical interaction between grains. At this point, the rock takes on the soft and weak plastic behavior that typifies siltite-argillite. This category includes a wide range of thinly layered (millimeters to centimeters) siltite and argillite. Argillite layers are typically interlayered with siltite layers in highly variable proportions.

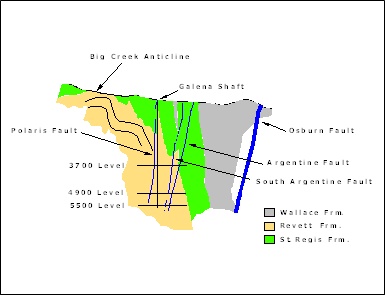

The major regional expression of the Lewis and Clark Line in the vicinity of the Galena mine project is the N75W trending Osburn Fault, which has a right-lateral offset of several miles within the Coeur d’Alene district. Other major northwesterly faults include the Polaris Fault, the Argentine, Silver Standard, Silver Summit, Big Creek, and Placer Creek faults, all of which are probably related to the Osburn Fault.

The principal fold at the Galena mine project is the Big Creek Anticline, the crest of which passes just south of the Galena Shaft. The rocks are strongly folded, and generally strike northwesterly. Bedding dips steep to the north and faults dip steep to the south (Figure 7-1).

Figure 7-1

Generalized Cross-section, Galena Mine

Looking West

CAM 113116

Galena Mine Technical Report

14 April 2011

8.0 DEPOSIT TYPES

The veins of the Coeur d’Alene district were deposited during Cretaceous or early Tertiary time. Ore forming fluids were driven by regional-scale metamorphic-hydrothermal systems associated with Cretaceous or early Tertiary deformation and plutonism that included the Idaho and Kiniksu batholiths and their precursors. These fluids scavenged metals from the Proterozoic strata of the Belt Supergroup that may include concentrations of syngenetic silver-lead-zinc deposits, with significant cooper and gold as well (Fleck et al., 2002; Hobbs, et al., 1965).

The greater Coeur d'Alene District of Idaho has produced over a billion ounces of silver and millions of tons of lead, zinc and copper since 1880 from more than a dozen major mines and many smaller mines. There is a significant variation from mine to mine, but in general the metals are hosted in metamorphosed Belt Supergroup, and are usually vein-like in morphology with relatively simple mineralogy, as at the Galena Project.

CAM 113116

Galena Mine Technical Report

14 April 2011

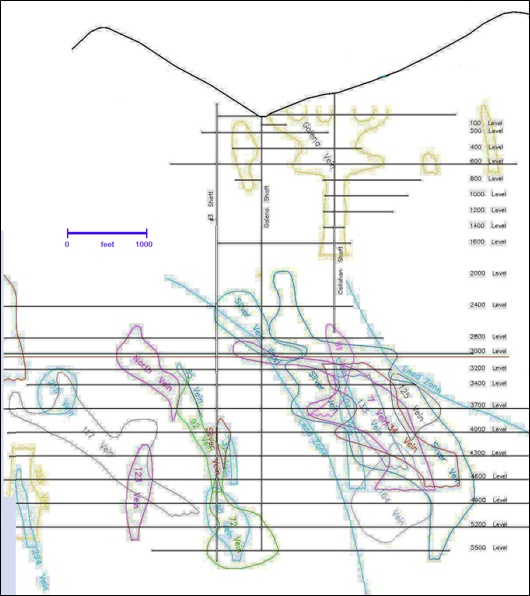

9.0 MINERALIZATION

A striking feature of the Galena Project mineralization is that two entirely distinct vein types of utterly different ore mineralogy occur within the mineralized envelope. These are: 1) silver-copper veins, dominated by tetrahedrite, and 2) silver-lead veins, dominated by galena. The two ore types require distinct milling and smelting. There are no galena-dominated veins in the Coeur Mine. As of year-end 2010, the silver-copper ores comprise 66 percent of the entire Galena Project ore reserve tons, while the silver ounces in the silver-copper ore reserve amount to 81 percent of the silver ounces in reserves. In the Galena Mine alone, tabulated mineral resources and/or reserves occur in 114 numbered or named veins, with several more in the Coeur Mine. During 2010, mining occurred on more than 30 veins within the Galena Mine.

As discussed below in Section 17, the Coeur Mine contains none of the mineral reserves, 28% of the Ag ounces in the measured and indicated mineral resources, and 15% of the Ag ounces in the inferred mineral resources. There is no current mine plan for exploiting the resources in the Coeur Mine, which has been closed since 1997, although re-opening of the Coeur has been mooted, and the infrastructure is in place. Therefore, the discussion below focuses on the Galena Mine, with a very brief description of the Coeur Mine mineralization. In both mines, workings have been below the depth of surface oxidation for several decades, and are entirely in sulfides.

Mineralization at the Galena mine project is typified by structurally controlled veins that can extend for a few thousand feet of depth and hundreds of feet of strike. The veins principally contain silver, lead, copper and zinc in relatively simple mineralogy. Silver is the primary economic metal at the Galena mine. Historically, the “silver-copper” veins, containing argentiferous tetrahedrite have been the focus of production at the Galena. The silver-copper ratio averages 25 to 30 ounces per percent copper. Typically, the silver-lead ratio of silver-lead ore at the Galena Mine is about 0.9 opt silver per percent of lead. The more important veins are shown on Figure 9-1. Due to the complex three-dimensional arrangement of the numerous veins, a two-dimensional graphic presentation is difficult.

CAM 113116

Galena Mine Technical Report

14 April 2011

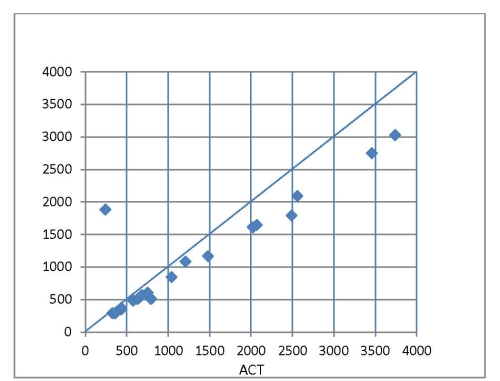

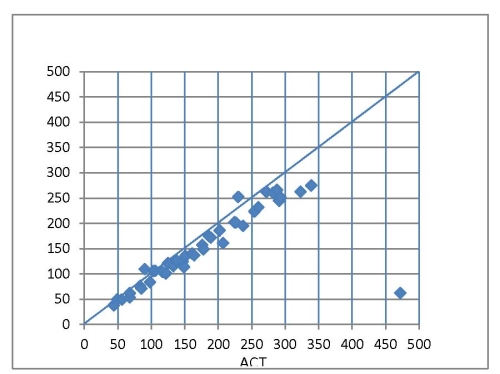

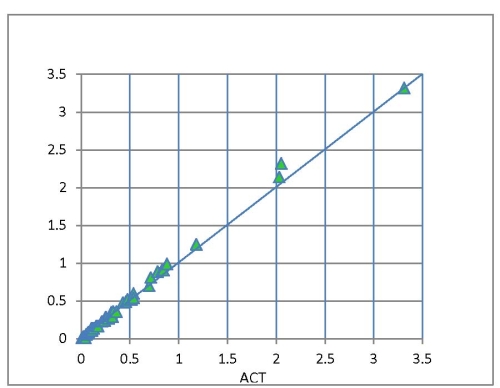

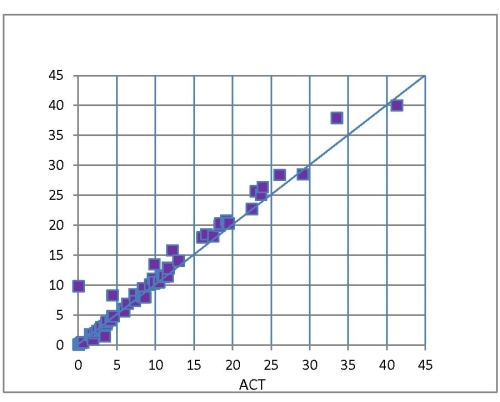

Figure 9-1