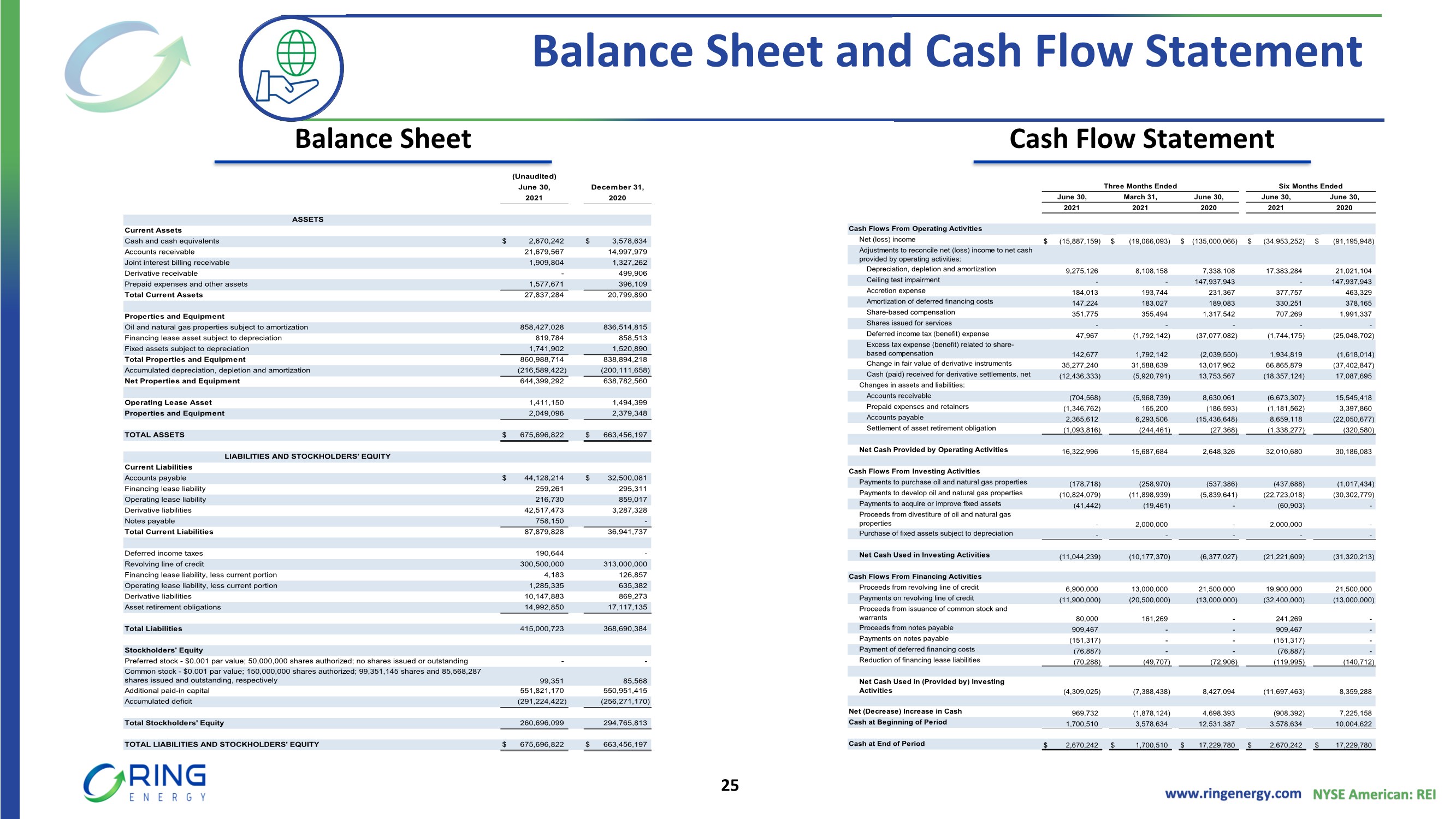

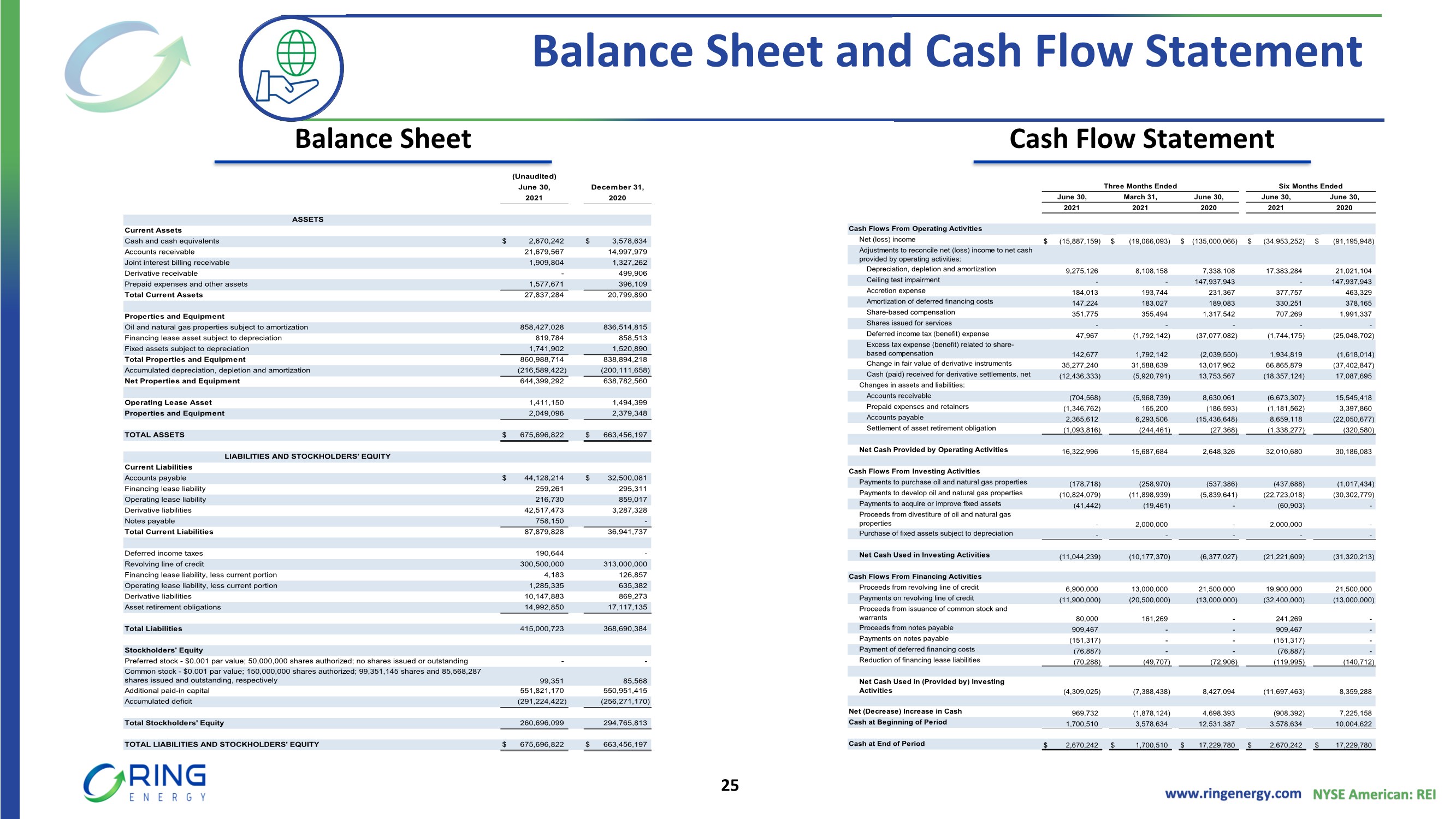

| www.ringenergy.com NYSE American: REI Balance Sheet and Cash Flow Statement 25 Balance Sheet Cash Flow Statement ASSETS Current Assets Cash and cash equivalents $ 2,670,242 $ 3,578,634 Accounts receivable 21,679,567 14,997,979 Joint interest billing receivable 1,909,804 1,327,262 Derivative receivable - 499,906 Prepaid expenses and other assets 1,577,671 396,109 Total Current Assets 27,837,284 20,799,890 Properties and Equipment Oil and natural gas properties subject to amortization 858,427,028 836,514,815 Financing lease asset subject to depreciation 819,784 858,513 Fixed assets subject to depreciation 1,741,902 1,520,890 Total Properties and Equipment 860,988,714 838,894,218 Accumulated depreciation, depletion and amortization (216,589,422) (200,111,658) Net Properties and Equipment 644,399,292 638,782,560 Operating Lease Asset 1,411,150 1,494,399 Properties and Equipment 2,049,096 2,379,348 TOTAL ASSETS $ 675,696,822 $ 663,456,197 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Accounts payable $ 44,128,214 $ 32,500,081 Financing lease liability 259,261 295,311 Operating lease liability 216,730 859,017 Derivative liabilities 42,517,473 3,287,328 Notes payable 758,150 - Total Current Liabilities 87,879,828 36,941,737 Deferred income taxes 190,644 - Revolving line of credit 300,500,000 313,000,000 Financing lease liability, less current portion 4,183 126,857 Operating lease liability, less current portion 1,285,335 635,382 Derivative liabilities 10,147,883 869,273 Asset retirement obligations 14,992,850 17,117,135 Total Liabilities 415,000,723 368,690,384 Stockholders' Equity Preferred stock - $0.001 par value; 50,000,000 shares authorized; no shares issued or outstanding - - Common stock - $0.001 par value; 150,000,000 shares authorized; 99,351,145 shares and 85,568,287 shares issued and outstanding, respectively 99,351 85,568 Additional paid-in capital 551,821,170 550,951,415 Accumulated deficit (291,224,422) (256,271,170) Total Stockholders' Equity 260,696,099 294,765,813 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 675,696,822 $ 663,456,197 RING ENERGY, INC. Condenced Balance Sheets June 30, December 31, (Unaudited) 2021 2020 Cash Flows From Operating Activities Net (loss) income $ (15,887,159) $ (19,066,093) $ (135,000,066) $ (34,953,252) $ (91,195,948) Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation, depletion and amortization 9,275,126 8,108,158 7,338,108 17,383,284 21,021,104 Ceiling test impairment - - 147,937,943 - 147,937,943 Accretion expense 184,013 193,744 231,367 377,757 463,329 Amortization of deferred financing costs 147,224 183,027 189,083 330,251 378,165 Share-based compensation 351,775 355,494 1,317,542 707,269 1,991,337 Shares issued for services - - - - - Deferred income tax (benefit) expense 47,967 (1,792,142) (37,077,082) (1,744,175) (25,048,702) Excess tax expense (benefit) related to share- based compensation 142,677 1,792,142 (2,039,550) 1,934,819 (1,618,014) Change in fair value of derivative instruments 35,277,240 31,588,639 13,017,962 66,865,879 (37,402,847) Cash (paid) received for derivative settlements, net (12,436,333) (5,920,791) 13,753,567 (18,357,124) 17,087,695 Changes in assets and liabilities: Accounts receivable (704,568) (5,968,739) 8,630,061 (6,673,307) 15,545,418 Prepaid expenses and retainers (1,346,762) 165,200 (186,593) (1,181,562) 3,397,860 Accounts payable 2,365,612 6,293,506 (15,436,648) 8,659,118 (22,050,677) Settlement of asset retirement obligation (1,093,816) (244,461) (27,368) (1,338,277) (320,580) Net Cash Provided by Operating Activities 16,322,996 15,687,684 2,648,326 32,010,680 30,186,083 Cash Flows From Investing Activities Payments to purchase oil and natural gas properties (178,718) (258,970) (537,386) (437,688) (1,017,434) Payments to develop oil and natural gas properties (10,824,079) (11,898,939) (5,839,641) (22,723,018) (30,302,779) Payments to acquire or improve fixed assets (41,442) (19,461) - (60,903) - Proceeds from divestiture of oil and natural gas properties - 2,000,000 - 2,000,000 - Purchase of fixed assets subject to depreciation - - - - - Net Cash Used in Investing Activities (11,044,239) (10,177,370) (6,377,027) (21,221,609) (31,320,213) Cash Flows From Financing Activities Proceeds from revolving line of credit 6,900,000 13,000,000 21,500,000 19,900,000 21,500,000 Payments on revolving line of credit (11,900,000) (20,500,000) (13,000,000) (32,400,000) (13,000,000) Proceeds from issuance of common stock and warrants 80,000 161,269 - 241,269 - Proceeds from notes payable 909,467 - - 909,467 - Payments on notes payable (151,317) - - (151,317) - Payment of deferred financing costs (76,887) - - (76,887) - Reduction of financing lease liabilities (70,288) (49,707) (72,906) (119,995) (140,712) Net Cash Used in (Provided by) Investing Activities (4,309,025) (7,388,438) 8,427,094 (11,697,463) 8,359,288 Net (Decrease) Increase in Cash 969,732 (1,878,124) 4,698,393 (908,392) 7,225,158 Cash at Beginning of Period 1,700,510 3,578,634 12,531,387 3,578,634 10,004,622 Cash at End of Period $ 2,670,242 $ 1,700,510 $ 17,229,780 $ 2,670,242 $ 17,229,780 Three Months Ended June 30, June 30, June 30, 2021 2020 Six Months Ended RING ENERGY, INC. Condensed Statements of Cash Flows (Unaudited) 2021 March 31, 2021 June 30, 2020 |