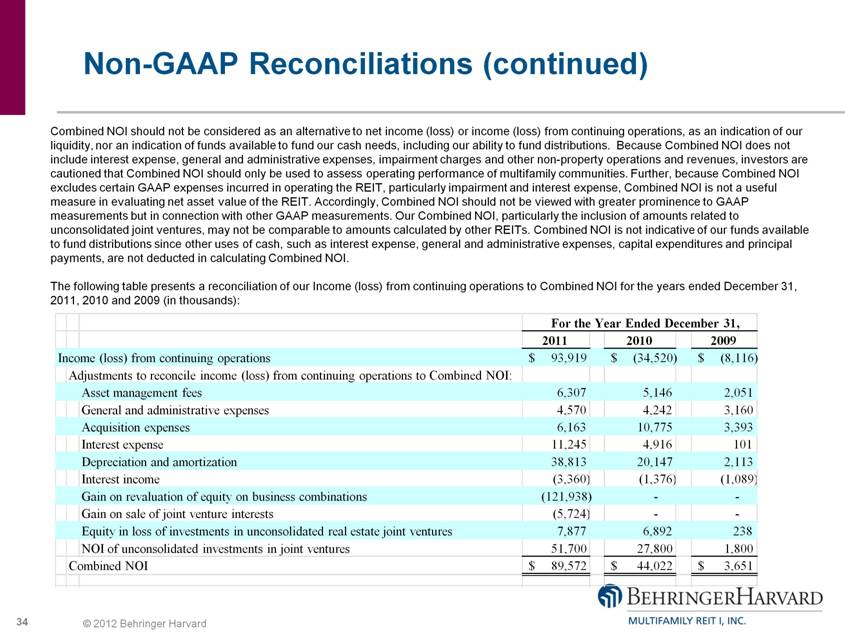

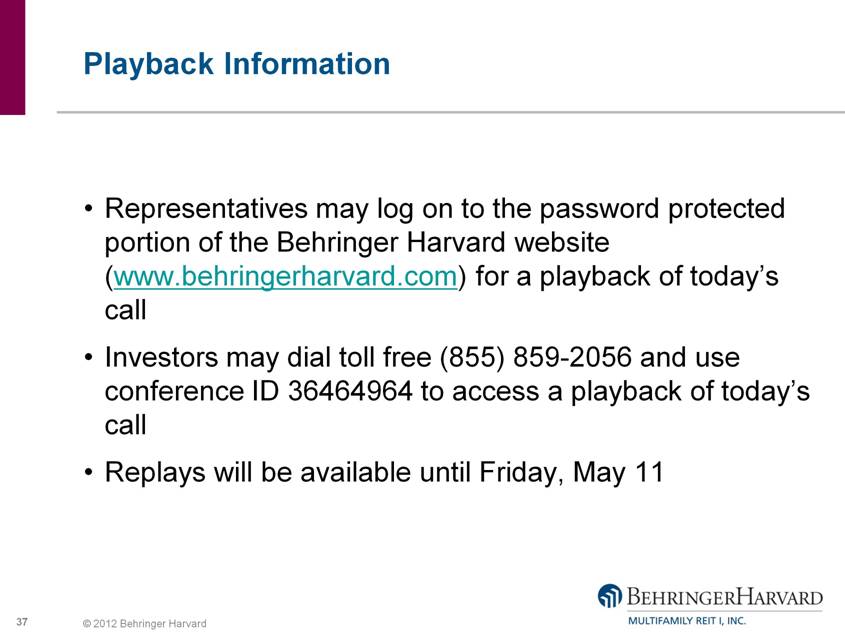

| © 2012 Behringer Harvard 34 Non-GAAP Reconciliations (continued) Combined NOI should not be considered as an alternative to net income (loss) or income (loss) from continuing operations, as an indication of our liquidity, nor an indication of funds available to fund our cash needs, including our ability to fund distributions. Because Combined NOI does not include interest expense, general and administrative expenses, impairment charges and other non-property operations and revenues, investors are cautioned that Combined NOI should only be used to assess operating performance of multifamily communities. Further, because Combined NOI excludes certain GAAP expenses incurred in operating the REIT, particularly impairment and interest expense, Combined NOI is not a useful measure in evaluating net asset value of the REIT. Accordingly, Combined NOI should not be viewed with greater prominence to GAAP measurements but in connection with other GAAP measurements. Our Combined NOI, particularly the inclusion of amounts related to unconsolidated joint ventures, may not be comparable to amounts calculated by other REITs. Combined NOI is not indicative of our funds available to fund distributions since other uses of cash, such as interest expense, general and administrative expenses, capital expenditures and principal payments, are not deducted in calculating Combined NOI. The following table presents a reconciliation of our Income (loss) from continuing operations to Combined NOI for the years ended December 31, 2011, 2010 and 2009 (in thousands): 2011 2010 2009 Income (loss) from continuing operations 93,919 $ (34,520) $ (8,116) $ Adjustments to reconcile income (loss) from continuing operations to Combined NOI: Asset management fees 6,307 5,146 2,051 General and administrative expenses 4,570 4,242 3,160 Acquisition expenses 6,163 10,775 3,393 Interest expense 11,245 4,916 101 Depreciation and amortization 38,813 20,147 2,113 Interest income (3,360) (1,376) (1,089) Gain on revaluation of equity on business combinations (121,938) - - Gain on sale of joint venture interests (5,724) - - Equity in loss of investments in unconsolidated real estate joint ventures 7,877 6,892 238 NOI of unconsolidated investments in joint ventures 51,700 27,800 1,800 Combined NOI 89,572 $ 44,022 $ 3,651 $ For the Year Ended December 31, |