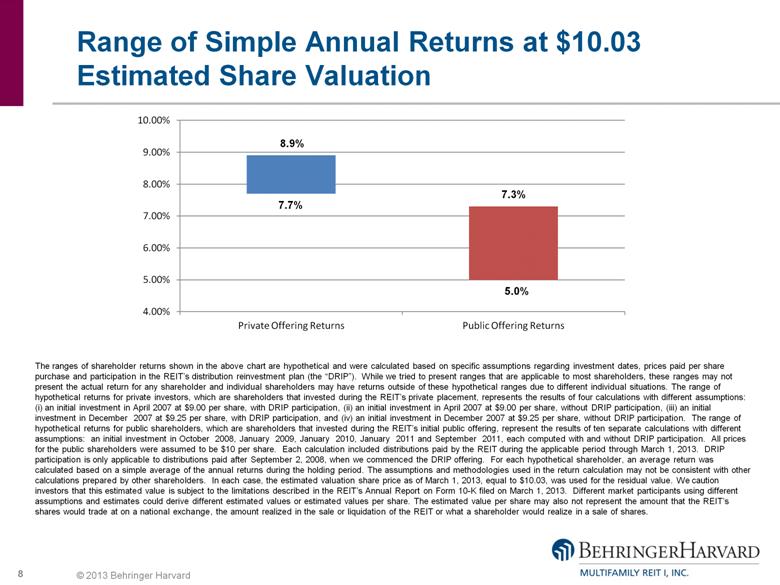

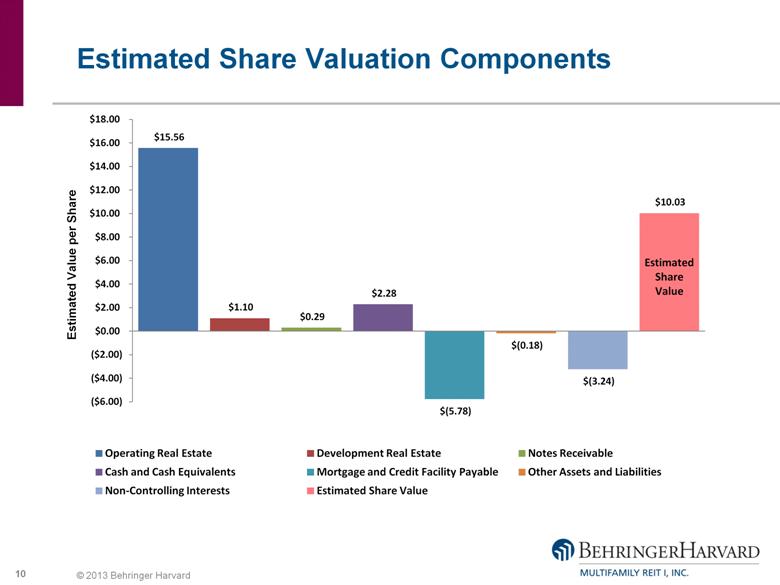

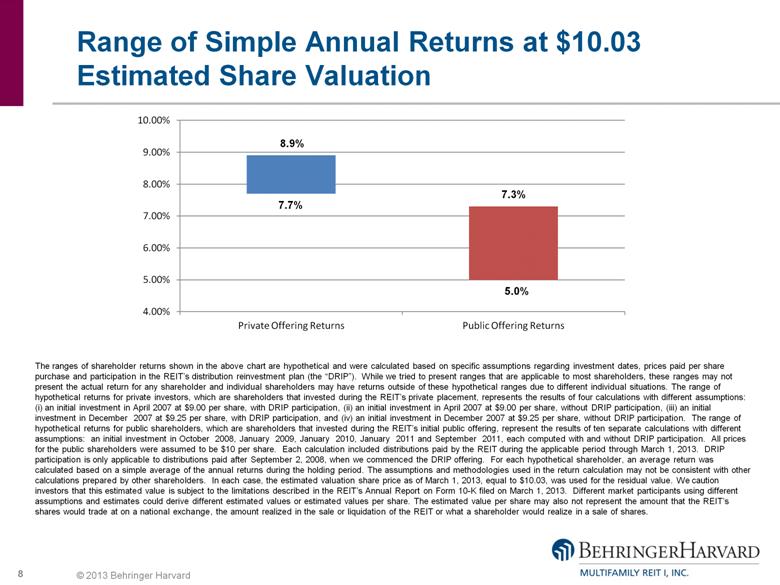

| Range of Simple Annual Returns at $10.03 Estimated Share Valuation 8.9% 7.7% 7.3% 5.0% The ranges of shareholder returns shown in the above chart are hypothetical and were calculated based on specific assumptions regarding investment dates, prices paid per share purchase and participation in the REIT’s distribution reinvestment plan (the “DRIP”). While we tried to present ranges that are applicable to most shareholders, these ranges may not present the actual return for any shareholder and individual shareholders may have returns outside of these hypothetical ranges due to different individual situations. The range of hypothetical returns for private investors, which are shareholders that invested during the REIT’s private placement, represents the results of four calculations with different assumptions: (i) an initial investment in April 2007 at $9.00 per share, with DRIP participation, (ii) an initial investment in April 2007 at $9.00 per share, without DRIP participation, (iii) an initial investment in December 2007 at $9.25 per share, with DRIP participation, and (iv) an initial investment in December 2007 at $9.25 per share, without DRIP participation. The range of hypothetical returns for public shareholders, which are shareholders that invested during the REIT’s initial public offering, represent the results of ten separate calculations with different assumptions: an initial investment in October 2008, January 2009, January 2010, January 2011 and September 2011, each computed with and without DRIP participation. All prices for the public shareholders were assumed to be $10 per share. Each calculation included distributions paid by the REIT during the applicable period through March 1, 2013. DRIP participation is only applicable to distributions paid after September 2, 2008, when we commenced the DRIP offering. For each hypothetical shareholder, an average return was calculated based on a simple average of the annual returns during the holding period. The assumptions and methodologies used in the return calculation may not be consistent with other calculations prepared by other shareholders. In each case, the estimated valuation share price as of March 1, 2013, equal to $10.03, was used for the residual value. We caution investors that this estimated value is subject to the limitations described in the REIT’s Annual Report on Form 10-K filed on March 1, 2013. Different market participants using different assumptions and estimates could derive different estimated values or estimated values per share. The estimated value per share may also not represent the amount that the REIT’s shares would trade at on a national exchange, the amount realized in the sale or liquidation of the REIT or what a shareholder would realize in a sale of shares. |