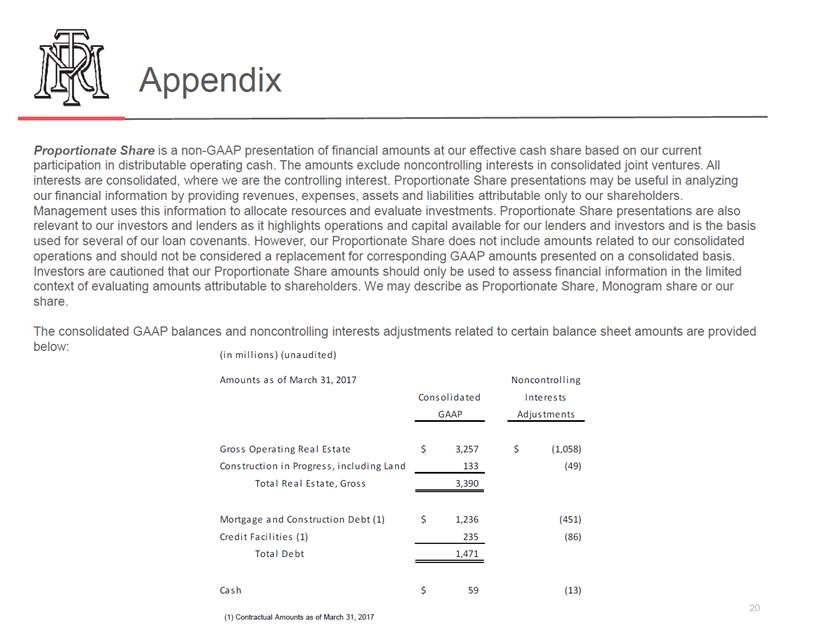

Appendix Adjusted EBITDA Adjusted EBITDA is a non-GAAP performance measurement of earnings before interest, taxes, depreciation, amortization, and other non-recurring items. Its purpose is to highlight earnings without finance, depreciation and certain amortization expenses and its use is limited to specialized analysis. Similar to other non-GAAP measurements, Adjusted EBITDA is presented on our Proportionate Share. Our presentation may be different than other companies. Reconciliation of net incom e (los s ) available to the Com pany to Adjus ted Proportionate EBITDA: (in thous ands ) (unaudited) March 31, 2017 March 31, 2016 Total Debt per Cons olidated Balance Sheet Les s : Unam ortized adjus tm ents from bus ines s com binations Plus : Deferred financing cos ts , net Les s : noncontrolling interes ts s hare of adjus tm ents Proportionate Share of Contractual Debt Les s : Proportionate s hare of cas h and cas h equivalents Net Proportionate Share of Contractual Debt $ 1,459,057 (1) 11,849 (536,643) $ 1,518,658 (2,076) 13,724 (513,259) 934,262 (45,601) 1,017,047 (53,439) $ 888,661 $ 963,608 Total Cas h and cas h equivalents per Cons olidated Balance Sheet Les s : noncontrolling interes ts s hare of adjus tm ents Proportionate s hare of cas h and cas h equivalents $ 59,150 (13,549) $ 67,847 (14,408) $ 45,601 $ 53,439 For the Three Months Ended March 31, 2017 2016 Net incom e (los s ) available to the Com pany Les s : Gains on s ales of real es tate Depreciation and am ortization Interes t expens e Los s on early extinguis hm ent of debt Other, net Les s : noncontrolling interes ts s hare of adjus tm ents Adjus ted Proportionate EBITDA $ 75,985 (86,723) 33,652 11,228 3,901 188 (14,668) $ (8,305) - 31,836 9,774 - 210 (12,818) $ 23,563 $ 20,697 Annualized Adjus ted Proportionate EBITDA Net Proportionate Share of Contractual Debt to Annualized Adjus ted Proportionate EBITDA $ 94,252 $ 82,788 11.6x 9.4x 19