- TEL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

TE Connectivity (TEL) DEF 14ADefinitive proxy

Filed: 17 Jan 25, 10:41am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| |

Filed by the Registrant ⌧ | |

| |

Filed by a Party other than the Registrant ◻ | |

| |

Check the appropriate box: | |

| |

◻ | Preliminary Proxy Statement |

| |

◻ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

⌧ | Definitive Proxy Statement |

| |

◻ | Definitive Additional Materials |

| |

◻ | Soliciting Material under §240.14a-12 |

| |||

TE CONNECTIVITY PLC | |||

(Name of Registrant as Specified In Its Charter) | |||

| |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| |||

Payment of Filing Fee (Check all boxes that apply) | |||

| | ||

⌧ | No fee required | ||

| | ||

◻ | Fee paid previously with preliminary materials | ||

| | ||

◻ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||

|

A letter to our shareholders January 17, 2025 Dear Shareholder, On behalf of the Board of Directors and our senior management team, we are pleased to invite you to attend the 2025 Annual General Meeting of Shareholders of TE Connectivity plc, to be held on Wednesday, March 12, 2025 at 2:00 p.m. GMT, at the Conrad Dublin, Earlsfort Terrace, Dublin, Ireland, subject to any adjournments or postponements. Details of the business to be presented at the meeting can be found in the accompanying Invitation to the Annual General Meeting of Shareholders and Proxy Statement. You can ensure that your shares are represented at the meeting by casting your vote either electronically at your earliest convenience or by promptly completing, signing, dating and returning your proxy card. Alternatively, you are welcome to attend the meeting and vote in person. We look forward to seeing you at the meeting. Sincerely,

Carol A. (“John”) Davidson Chairman of the Board TE Connectivity plc Parkmore Business Park West |

Table of Contents

| | |

| 1 | |

| 3 | |

| 8 | |

| 8 | |

| Security Ownership of Certain Beneficial Owners and Management | 13 |

4 | 15 | |

| 16 | |

| 32 | |

| 37 | |

| 43 | |

| 45 | |

| 63 | |

| 63 | |

| 64 | |

| 72 | |

| 73 | |

| 77 | |

| 79 | |

| 80 | |

| 81 | |

4 | Agenda Item No. 2—Appointment of Auditors and Authority to set Remuneration | 83 |

4 | Agenda Item No. 3—Advisory Vote to Approve Named Executive Officer Compensation | 85 |

4 | 87 | |

4 | Agenda Item No. 5—Determine the Price Range at which the Company can Re-allot Treasury Shares | 89 |

| 90 | |

| 91 | |

| 92 |

B-

TE CONNECTIVITY PLC

Parkmore Business Park West

Parkmore, Ballybrit

Galway, H91VN2T, Ireland

Invitation to the Annual General Meeting of Shareholders

| |

Time and Date: | 2:00 p.m., GMT, on March 12, 2025 |

Place: | The Conrad Dublin, Earlsfort Terrace, Dublin, Ireland |

Agenda Items: | 1. Election of twelve (12) director nominees proposed by the Board of Directors; |

| 2. To ratify the appointment of Deloitte & Touche LLP as the independent auditors of the Company and Deloitte Ireland LLP as our statutory auditor under Irish law and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration; |

| 3. Advisory Vote to Approve Named Executive Officer Compensation (“Say on Pay”); |

| 4. To authorize the company and/or any subsidiary of the company to make market purchases of company shares; and |

| 5. Determine the price range at which the company can re-allot treasury shares. |

| |

Persons Who Will Receive Proxy Materials: | Under rules of the Securities and Exchange Commission (“SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or the Notice, to our shareholders registered in our share register as of the close of business (Eastern Standard Time) on January 13, 2025. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or to request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. The Notice also instructs you on how you may submit your proxy over the Internet or via mail. You will not receive a printed copy of the proxy materials unless you request one in the manner set forth in the Notice or as otherwise described in the next paragraph. This permits us to conserve natural resources and reduce our printing costs, while giving shareholders a convenient and efficient way to access our proxy materials and vote their shares. |

| |

Admission to Meeting and Persons Eligible to Vote: | Shareholders who are registered with voting rights in our share register as of the close of business (Eastern Standard Time) on January 13, 2025 may grant a proxy to vote on each of the agenda items in this invitation and any other matter properly presented at the meeting for consideration. Those shareholders also have the right to attend the Annual General Meeting and vote their shares in person, or may grant a proxy to vote on each of the agenda items in this invitation and any other matter properly presented at the meeting for consideration. For information about how to attend the Annual General Meeting, please see “How do I attend the Annual General Meeting?” below. |

| |

| |

Date of Availability: | Our proxy materials are being made available on or about January 17, 2025 to each shareholder of record of TE Connectivity ordinary shares at the close of business (Eastern Standard Time) on January 13, 2025. |

| |

By order of the Board of Directors, | |

| |

Harold G. Barksdale | |

Corporate Secretary | |

| |

January 17, 2025 | |

Cautionary Note Regarding Forward-Looking Statements All statements made in this document, other than statements of historical or current facts, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking and other statements in this document address our environmental, social, governance and sustainability (“ESG”) plans and goals, among other matters. The inclusion of such statements is not an indication that this content is necessarily material to investors or required to be disclosed in our filings with the Securities and Exchange Commission. ESG related statements are also based on assumptions as well as estimates that are subject to a high level of uncertainty, and these statements should not necessarily be viewed as being representative of current or actual risk or performance, or forecasts of expected risk or performance. In addition, historical, current, and forward looking environmental and social‐related statements may be based on standards for measuring progress that are still developing, and internal controls and processes that continue to evolve. All statements contained herein that are not clearly historical in nature are forward-looking and the words “anticipate,” “believe,” “expect,” “estimate,” “plan,” “will” and similar expressions are generally intended to identify forward-looking statements but are not the exclusive means of identifying forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our Annual Report on Form 10-K for the fiscal year ended September 27, 2024. The company undertakes no obligation to update any forward-looking or other statements. | |

PROXY STATEMENT SUMMARY

This summary highlights information that is contained elsewhere in this proxy statement. It does not include all information necessary to make a voting decision, and you should read this proxy statement in its entirety before casting your vote.

In fiscal 2024, our board of directors and shareholders approved a change in our jurisdiction of incorporation from Switzerland to Ireland. In connection with the change, we entered into a merger agreement with our wholly-owned subsidiary, TE Connectivity plc, a public limited company incorporated under Irish law. Under the merger agreement, we were merged with and into TE Connectivity plc, which was the surviving entity, in order to effect our change in jurisdiction of incorporation from Switzerland to Ireland. The merger and change in jurisdiction of incorporation were completed on September 30, 2024. Effective for fiscal 2025, we are organized under the laws of Ireland. References in this proxy statement to “TE Connectivity,” the “Company,” “we,” “us,” or “our” refer to TE Connectivity Ltd. before September 30, 2024 and to TE Connectivity plc on or after September 30, 2024.

TE at a Glance

A global industrial technology leader creating a safer, sustainable, productive and connected future. Our broad range of connectivity and sensor solutions enable the distribution of power, signal and data to advance next-generation transportation, renewable energy, automated factories, data centers, medical technology and more.

|

|

|

|

|

$15.8B FY24 Annual Revenue |

| 235B Products Manufactured Annually |

| ~100 Global Manufacturing Sites |

|

|

|

|

|

~130 Countries Where We Serve Customers |

| 85,000+ Employees Including 9,000+ Engineers |

| 15,000+ Patents Worldwide Granted or Pending |

Technology & Innovation | |

| Solutions that power electric vehicles, aircraft, digital factories, and smart homes. Innovation that enables life-saving medical care, sustainable communities, efficient utility networks, and the global communications infrastructure. We partner with customers to produce highly engineered connectivity and sensing products that make a connected world possible. |

Diversification | |

| Our focus on reliability and durability, our commitment to progress, and the broad range of our product portfolio enables companies large and small to turn ideas into technology that can transform how the world works and lives tomorrow. |

Global Scale | |

| With employees, customers, engineering centers and factories around the world, and our sales coming from the Americas, Asia-Pacific and Europe/Middle East/Africa regions, we have the advantage of being a truly global industrial technology leader. |

Corporate governance summary

Director nominees

Board changes since 2017 6 of 10 independent director nominees have joined the Board |

| |

| |

| | |

| | |||

| | | | | | | ||||||

| | | | Jean-Pierre Clamadieu Former Chief Executive Officer and Chairman of the Executive Committee, Solvay S.A. Age 66 Tenure 2023 Committee: NGCC, Cyber | Terrence R. Curtin Chief Executive Officer, Age 56 Tenure 2016 | |||||||

| | Laura H. Wright Former Chief Financial Officer, Age 64 Tenure 2014 Committee: AC (Chair) (Financial Expert), Cyber Dawn C. Willoughby Former Executive Vice Age 55 Tenure 2020 Committee: MDCC |

| |||||||||

| | |||||||||||

| | | | |||||||||

| | |||||||||||

| | |||||||||||

| | | | : | | |||||||

| | | | Mark C. Trudeau Former President, Chief Executive Officer, Mallinckrodt plc Age 63 Tenure 2016 Committee: MDCC | Abhijit Y. Talwalkar Former President and Chief Executive Officer, LSI Corporation Age 60 Tenure 2017 Committee: MDCC (Chair) | |||||||

Committees: AC – Audit MDCC – Management Development & NGCC – Nominating Cyber – Joint Committee On Cybersecurity | | | | |

| | |

| | |||

| | | | | | | ||||||

|

| | |

| | | | |

| | | | | | Independence – Director Nominees ■ Independent 10 ■ Not Independent 2 | ||

Carol A. (“John”) Davidson Former Senior Vice President Age 69 Tenure 2016 Committee: AC (Financial Expert), Cyber | Lynn A. Dugle Independent Former Chief Executive Officer, President and Chairman of the Board, Engility Holdings, Inc. Age 65 Tenure 2020 Committee: AC (Financial Expert), Cyber (Co-Chair) | | | |||||

| | | ||||||

| William A. Jeffrey Retired Chief Executive Officer, SRI International Age 65 Tenure 2012 Committee: NGCC (Chair), Cyber (Co-Chair) |

| ||||||

| | | | | ||||

Sam Eldessouky Executive Vice President and Chief Financial Officer, Bausch + Lomb Corporation Age 52 Tenure 2024 Committee: AC (Financial Expert), Cyber |

| | ||||||

| | | | | ||||

Heath A. Mitts Executive Vice President and  Age 53 Tenure 2021 | Syaru Shirley Lin Research Professor, University of Virginia Age 56 Tenure 2022  Committee: NGCC, Cyber | | | | ||||

| | | | | | | ||

| |

2025 Annual General Meeting Proxy Statement | 5 |

Executive Compensation Summary

Executive Compensation Governance Highlights

We maintain a full complement of compensation governance best practices that help ensure our compensation programs remain aligned with shareholder interests.

What We Do

√ Link pay to performance with a high percentage of variable compensation | √ Include a “clawback” provision in all executive officer incentive award agreements (both annual and long-term), in addition to adopting the NYSE mandated executive “clawback” policy |

√ Perform annual say-on-pay advisory vote for shareholders | √ Maintain robust stock ownership requirements for executives (6x CEO, 3x executive officers) |

√ Design compensation programs to mitigate undue risk-taking | √ Include performance criteria in incentive plans that are consistent with annual operating budgets, strategic forecasts and investor guidance |

√ Retain a fully independent external compensation consultant whose independence is reviewed annually by the MDCC | √ Cap incentive compensation payments for individuals including our CEO |

√ Align executive compensation with shareholder returns through long-term incentives | √ Maintain an insider trading policy applicable to all executive officers and employees |

√ Review share utilization annually | √ Provide only limited non-business aircraft usage |

What We Do Not Do

x Provide tax gross ups for executives except under our relocation program | x Provide excise tax gross ups |

x Provide perquisites for named executive officers except for limited non-business aircraft usage | x Re-price underwater stock options |

x Provide tax gross ups for personal aircraft use | x Allow hedging or pledging of TE securities |

| |

6 | 2025 Annual General Meeting Proxy Statement |

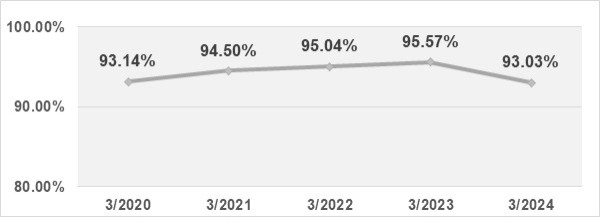

Historical “Say on Pay” votes

The Management Development and Compensation Committee believes the results of last year’s “Say on Pay” vote affirmed our shareholders’ support of our Company’s executive compensation program. This confirmed our decision to maintain a consistent overall approach in setting executive compensation for 2024.

Executive Compensation Principles

Our executive compensation philosophy calls for competitive total compensation that will reward executives for achieving individual and corporate performance objectives and will attract, motivate and retain leaders who will drive the creation of shareholder value. In setting compensation we adhere to the following core principles:

| | | | | | | | |||||||

| | | | | | | | | ||||||

| Shareholder Alignment |

| Performance Based |

| Appropriate Risk |

| Competitive with |

| ||||||

| | | | | | | | | ||||||

| | | | | | | | | ||||||

| | | | | | | ||||||||

| Focus on executive |

| Simple and Transparent |

| Fair and Equitable | | ||||||||

| | | | | | | ||||||||

Fiscal 2024 Compensation Highlights

Executive Compensation Actions

| | |

Base Salaries Increase in base salary for Mr. Stucki to maintain his competitive pay position in the marketplace. | Equity Award Values Delivered annual equity awards for the CEO and the other NEOs in order to keep pace and ensure alignment with the market and to reflect strong individual performance. | |

Target Cash Incentives No target bonus percentages were increased for fiscal 2024. | Equity Award Structure Equity incentive awards for the CEO and the other NEOs were in the form of stock options (50%) and performance stock units (50%). | |

| |

2025 Annual General Meeting Proxy Statement | 7 |

PROXY STATEMENT

FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS OF

TE CONNECTIVITY PLC

TO BE HELD ON WEDNESDAY, MARCH 12, 2025

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

Why am I receiving these materials?

TE Connectivity’s Board of Directors is soliciting your proxy to vote at the Annual General Meeting to be held at 2:00 p.m., GMT, on March 12, 2025, at the Conrad Dublin, Earlsfort Terrace, Dublin, Ireland. The information provided in this proxy statement is for your use in determining how you will vote on the agenda items described herein.

We have made available our proxy materials to each person who is registered as a holder of our shares in the register of shareholders (such owners are often referred to as “holders of record” or “record holders”) as of the close of business (Eastern Standard Time) on January 13, 2025. We also will send a copy of the proxy materials, including the proxy card, to any holder of record who requests them in the manner set forth in the Notice. Distribution to shareholders of the Notice of Internet Availability of Proxy Materials (the “Notice”), is scheduled to begin on or about January 17, 2025.

We have requested that banks, brokerage firms and other nominees who hold TE Connectivity shares on behalf of the owners of the shares (such owners are often referred to, and we refer to them below, as “beneficial owners,” “beneficial shareholders” or “street name holders”) as of the close of business (Eastern Standard Time) on January 13, 2025 forward the Notice to those beneficial shareholders. We have agreed to pay the reasonable expenses of the banks, brokerage firms and other nominees for forwarding these materials.

Are proxy materials available on the Internet?

Yes.

Important Notice regarding the Availability of Proxy Materials for the Annual General Meeting to be held on March 12, 2025.

Our proxy statement for the Annual General Meeting to be held on March 12, 2025, other proxy materials, our annual report to shareholders for fiscal year 2024 and our 2024 Irish Statutory Financial Statements are available at http://www.te.com/TEAnnualMeeting.

Under SEC rules, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our shareholders registered in our share register as of the close of business (Eastern Standard Time) on January 13, 2025. All shareholders will have the ability to access the proxy materials, including our Irish statutory financial statements, on the website referred to in the Notice or to request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. The Notice also instructs you on how you may submit your proxy over the Internet or via mail. You will not receive a printed copy of the proxy materials unless you request one in the manner set forth in the Notice. This permits us to conserve natural resources and reduce our printing costs, while giving shareholders a convenient and efficient way to access our proxy materials and vote their shares. Our proxy materials are being made available on or about January 17, 2025.

What agenda items are scheduled to be voted on at the meeting?

The five (5) agenda items scheduled for a vote are:

| ● | Agenda Item No. 1: To elect twelve (12) nominees proposed by the Board of Directors as directors to hold office until the next Annual General Meeting of shareholders; |

| ● | Agenda Item No. 2: To ratify the appointment of Deloitte & Touche LLP as the independent auditors of the Company and Deloitte Ireland LLP as our statutory auditor under Irish law and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration; |

| |

8 | 2025 Annual General Meeting Proxy Statement |

| ● | Agenda Item No. 3: Advisory Vote to Approve Named Executive Officer Compensation (“Say on Pay”); |

| ● | Agenda Item No. 4: To authorize the company and/or any subsidiary of the company to make market purchases of company shares; and |

| ● | Agenda Item No. 5: Determine the price range at which the company can re-allot treasury shares. |

What is the recommendation of the Board of Directors on each of the agenda items scheduled to be voted on at the meeting? How do the Board of Directors and executive officers intend to vote with respect to the agenda items?

TE Connectivity’s Board of Directors recommends that you vote FOR each of the agenda items listed above as recommended by our Board of Directors. Our Directors and Executive Officers have indicated that they intend to vote their shares in favor of each of the agenda items. On January 13, 2025, our Directors and Executive Officers and their affiliates beneficially owned approximately 0.1% of the outstanding shares entitled to vote.

What is the difference between being a shareholder of record and a beneficial owner?

If your shares are registered directly in your name in our share register operated by our stock transfer agent, you are considered the “shareholder of record” of those shares.

If your shares are held in a stock brokerage account or by a bank or other nominee on your behalf and the broker, bank or nominee is registered in our share register as a shareholder with voting rights, your broker, bank or other nominee is considered the shareholder of record and you are considered the “beneficial owner” or “street name holder” of those shares. In this case, the shareholder of record that is registered as a shareholder with voting rights has forwarded either the Notice or the proxy materials, as applicable, and separate voting instructions, to you. As the beneficial owner, when directing the shareholder of record how to vote your shares, you should follow the voting instructions they have provided to you.

Who is entitled to vote?

Shareholders of record

All shareholders registered in our share register at the close of business (Eastern Standard Time) on January 13, 2025 are entitled to vote on the matters set forth in this proxy statement and any other matter properly presented at the meeting for consideration, provided such shareholders become registered as shareholders with voting rights by that time. See “— I am a shareholder of record. How do I become registered as a shareholder with voting rights?”

Beneficial owners

Beneficial owners whose banks, brokers or nominees are shareholders registered in our share register with respect to the beneficial owners’ shares at the close of business (Eastern Standard Time) on January 13, 2025 are entitled to vote on the matters set forth in this proxy statement and any other matter properly presented at the meeting for consideration, provided such banks, brokers or nominees become registered as shareholders with voting rights. See “— How do I vote if a I am a beneficial shareholder?”

I am a shareholder of record. How do I become registered as a shareholder with voting rights?

If you are a shareholder of record, you have been registered as a shareholder with voting rights in our share register, unless in certain circumstances (such as failure to comply with particular disclosure requirements set forth in our Articles of Association) we have specifically advised you that you are registered as a shareholder without voting rights.

How do I vote if I am a shareholder of record?

If you are a registered shareholder, you can vote in the following ways:

By Internet: You can vote over the Internet at https://www.proxyvote.com by following the instructions in the Notice of Internet Availability of Proxy Materials previously sent to you or on the proxy card. By casting votes electronically, you will authorize the appointed proxy to vote your shares on your behalf.

By Mail: You can vote by marking, dating and signing the proxy card (which will be sent to you at your request in accordance with instructions provided in the Notice) and returning it by mail for receipt by no later

| |

2025 Annual General Meeting Proxy Statement | 9 |

than indicated below. By marking, dating, signing and mailing the proxy card as instructed, you authorize the appointed proxy to vote your shares on your behalf.

In order to assure that your votes are tabulated in time to be voted at the Annual General Meeting, you must vote electronically by 5:00 p.m., GMT on March 11, 2025, or submit your proxy card by mail so that it is received by 5:00 p.m., GMT on March 11, 2025.

If you have voted electronically or timely submitted a properly executed proxy card, your shares will be voted by the proxy as you have instructed. If any other matters are properly presented at the meeting (or any adjournment thereof), the proxy will either (i) vote the shares represented by your completed proxy in accordance with the specific instructions given by you, (ii) if selected by you in granting your proxy (as a general instruction), in accordance with the recommendation of the Company’s Board of Directors at the meeting, or (iii) if no instructions are given, abstain from voting your shares.

How do I vote if I am a beneficial shareholder?

General: If you hold your shares in street name, you should provide instructions to your bank or broker on how you wish your vote to be recorded by following the instructions on your voting instruction form supplied to you by your bank or broker with these proxy materials.

Can I vote by Internet?

Yes. If you are a shareholder of record, see the Internet voting instructions provided on the Notice or proxy card. If you are a beneficial owner, see the voting instruction card provided by your bank, broker or other nominee.

Can I vote by telephone?

If you are a shareholder of record, you cannot vote by telephone. If you are a beneficial owner, see the voting instruction card provided by your broker, bank or other nominee for telephone voting instructions.

If my shares are held in “street name” by my broker, will my broker vote my shares for me?

We recommend that you contact your broker. Your broker can give you directions on how to instruct the broker to vote your shares. If you have not provided instructions to the broker, your broker will be able to vote your shares with respect to “routine” matters but not “non-routine” matters pursuant to New York Stock Exchange (“NYSE”) rules. We believe the following agenda items will be considered non-routine under NYSE rules and therefore your broker will not be able to vote your shares with respect to these agenda items unless the broker receives appropriate instructions from you: Non-Routine Proposals: Agenda Item No. 1 (Election of Directors) and Agenda Item No. 3 (Advisory Vote to Approve Named Executive Officer Compensation).

What will happen if I don’t vote my shares?

If you are a shareholder of record and you do not vote electronically or sign and return a proxy card with votes indicated, no votes will be cast on your behalf on any of the items of business at the meeting. If you are a shareholder of record and you return a signed proxy card but make no specific direction as to how your shares are to be voted, the proxy will vote your shares in accordance with the general instruction “FOR” each of the director nominees and “FOR” each of the other agenda items (including each subpart thereof) and in accordance with the recommendation of the Board of Directors.

If you are a beneficial shareholder and you do not provide voting instructions to your bank or broker, subject to any contractual arrangements, your bank or broker may vote your shares in its discretion on all Routine agenda items but not Non-Routine Proposals. We believe that Agenda Item No. 1 (Election of Directors) and Agenda Item No. 3 (Advisory Vote to Approve Named Executive Officer Compensation) are non-routine proposals and no votes will be cast on your behalf on Agenda Items No. 1 and No. 3.

How many shares can vote at the Annual General Meeting?

Our ordinary shares are our only class of voting stock. As of January 13, 2025, there were 298,472,685 ordinary shares issued and outstanding and entitled to vote. Shares duly represented at the Annual General Meeting will be entitled to one vote per share for each matter presented at the Annual General Meeting.

| |

10 | 2025 Annual General Meeting Proxy Statement |

What quorum is required for the Annual General Meeting?

The presence, in person or by proxy, of two or more holders who together hold shares representing at least the majority of the ordinary shares entitled to vote constitutes a quorum for the conduct of business at the Annual General Meeting.

How do I attend the Annual General Meeting?

For admission to the meeting, shareholders and their authorized representatives must bring a valid

government-issued photo identification, such as a driver’s license or a passport. Shareholders of record with voting rights should bring the Notice they have received to the check-in area, where their ownership will be verified. Those who have beneficial ownership of ordinary shares held by a bank, brokerage firm or other nominee which has voting rights must bring to the check-in area a valid proxy from their banks, brokers or nominees showing that they own TE Connectivity ordinary shares as of the close of business (Eastern Standard Time) on January 13, 2025.

Registration at the meeting will begin at 1:00 p.m., GMT and close at 1:45 p.m., GMT, and the meeting will begin at 2:00 p.m., GMT. See “— How do I vote if I am a shareholder of record?” and “—How do I vote if I am a beneficial shareholder?” for a discussion of who is eligible and how to vote in person at the Annual General Meeting.

Security measures will be in place at the meeting to help ensure the safety of attendees. Cameras, sound recording devices, signs, photographs and visual displays are not permitted in the meeting without the prior permission of TE Connectivity. We reserve the right to inspect bags, backpacks, briefcases or other packages brought to the meeting. Cell phones and other sound transmitting devices must be turned off during the meeting.

What vote is required for approval of each agenda item and what is the effect of broker non-votes and abstentions?

The following agenda items require the affirmative vote of a majority of the votes cast at the Annual General Meeting, whether in person or by proxy. A majority means at least half plus one additional vote of the votes which are cast at a general meeting of shareholders.

| ● | Agenda Item No. 1: Election of twelve (12) director nominees proposed by the Board of Directors; |

| ● | Agenda Item No. 2: To ratify the appointment of Deloitte & Touche LLP as the independent auditors of the Company and Deloitte Ireland LLP as our statutory auditor under Irish law and to authorize the Audit Committee of the Board of Directors to set the auditors’ remuneration; |

| ● | Agenda Item No. 3: Advisory Vote to Approve Named Executive Officer Compensation (“Say on Pay”); and |

| ● | Agenda Item No. 4: To authorize the company and/or any subsidiary of the company to make market purchases of company shares. |

The following agenda item requires the affirmative vote of 75% of the votes cast at the Annual General Meeting, whether in person or by proxy:

| ● | Agenda Item No. 5: Determine the price range at which the company can re-allot treasury shares. |

Ordinary shares which are represented by broker non-votes (which occur when a broker holding shares for a beneficial owner does not vote on a particular agenda item because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner) and ordinary shares which are cast as abstentions on any matter, are counted towards the determination of a quorum but will not be counted as a vote cast and will be disregarded and have no effect on the proposal.

Who will count the votes and certify the results?

An independent vote tabulator will count the votes. A representative of Broadridge Financial Solutions has been appointed by the Board of Directors as the independent inspector of election and will determine the existence of a quorum, validity of proxies, and certify the results of the voting.

| |

2025 Annual General Meeting Proxy Statement | 11 |

If I vote and then want to change or revoke my vote, may I?

If you are a shareholder of record and have (i) voted via the Internet, you may change your vote and revoke your proxy by submitting subsequent voting instructions via the Internet by the deadline for Internet voting or by attending the Annual Meeting in person and submitting a new poll card during the meeting; (ii) submitted a proxy card, you may change or revoke your vote by submitting a revocation letter and new proxy card so that it is received by no later than 5:00 p.m., GMT on March 11, 2025 or attending the Annual Meeting in person and submitting a new poll card during the meeting.

If your shares are held in a stock brokerage account or by a bank or other nominee on your behalf, follow the voting instructions provided to you with these materials to determine how you may change your vote.

Can I sell my shares before the meeting if I have voted?

Yes. TE Connectivity does not block the transfer of shares before the meeting. However, unless you are a shareholder of record with voting rights at the close of business (Eastern Standard Time) on January 13, 2025, your vote will not be counted.

Whom may I contact for assistance?

You should contact D. F. King & Co., Inc., whom we have engaged as a proxy solicitor for the Annual General Meeting. The contact information for D. F. King is below:

D. F. King & Co., Inc.

(888) 887-1266 (US callers only)

+1 (212) 257-2468

Email: TEL@dfking.com (reference TE Connectivity in the subject line)

| |

12 | 2025 Annual General Meeting Proxy Statement |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of outstanding shares of TE Connectivity beneficially owned as of January 13, 2025 by each current director and nominee, each executive officer named in the Summary Compensation table and all of our executive officers, directors and nominees as a group. The address of our executive officers, directors and nominees is c/o TE Connectivity plc, Parkmore Business Park West, Parkmore, Ballybrit, Galway, H91VN2T, Ireland.

| | |

| | Number of |

| | Shares |

| | Beneficially |

Beneficial Owner |

| Owned(1) |

Directors, Nominees and Executive Officers: |

| |

Terrence R. Curtin(2)(3)(4)(5) | | 1,006,417 |

John S. Jenkins, Jr.(2)(4) | | 161,846 |

Heath A. Mitts(2)(3)(4) | | 368,803 |

Aaron K. Stucki(2)(4) |

| 135,388 |

Jean Pierre Clamadieu(3) |

| 3,763 |

Carol A. (“John”) Davidson(3) |

| 17,332 |

Lynn A. Dugle(3) |

| 6,410 |

Sam Eldessouky(3) | | 771 |

William A. Jeffrey(3) |

| 23,461 |

Syaru Shirley Lin(3) | | 3,720 |

Abhijit Y. Talwalkar(3) |

| 10,040 |

Mark C. Trudeau(3) |

| 6,688 |

Dawn C. Willoughby(3) |

| 6,410 |

Laura H. Wright(3) |

| 17,684 |

All directors, nominees and executive officers as a group (17 persons)(4)(5) |

| 2,036,670 |

| |

| (1) | The number shown reflects the number of shares owned beneficially as of January 13, 2025 based on information furnished by the persons named, public filings and TE Connectivity records. Beneficial ownership is determined in accordance with SEC rules and generally includes voting or investment power with respect to securities. Except as otherwise indicated in the notes below and subject to applicable community property laws, each owner has sole voting and sole investment power with respect to all shares beneficially owned by such person. To the extent indicated in the notes below, shares beneficially owned by a person include shares of which the person has the right to acquire beneficial ownership within 60 days after January 13, 2025. All current directors, nominees and executive officers as a group beneficially owned 0.9% of the outstanding shares as of January 13, 2025. No current director, nominee or executive officer appearing in the above table beneficially owned 1.0% or more of the outstanding shares as of January 13, 2025. |

| (2) | The named person is designated in the Summary Compensation table as a named executive officer. |

| (3) | The named person is a director and nominee for director. |

| (4) | Includes shares issuable upon the exercise of stock options presently exercisable or exercisable within 60 days after January 13, 2025 as follows: Mr. Curtin—887,475; Mr. Jenkins—136,561; Mr. Mitts—323,300; Mr. Stucki—111,798; all executive officers as a group—1,691,281. |

| (5) | Includes 40,000 shares held by a family trust. |

| |

2025 Annual General Meeting Proxy Statement | 13 |

The following table sets forth the information indicated for persons or groups known to us to be beneficial owners of more than 5% of our outstanding shares beneficially owned as of January 13, 2025.

| | | | | |

| | Number of |

| Percentage |

|

Name and Address of Beneficial Owner |

| Shares |

| of Class |

|

The Vanguard Group(1) | | 32,378,987 | | 10.8 | % |

100 Vanguard Blvd. | | | | | |

Malvern, PA 19355 | | | | | |

BlackRock Inc.(2) | | 24,039,941 | | 8.0 | % |

50 Hudson Yards | | | | | |

New York, NY 10001 | | | | | |

T. Rowe Price Associates, Inc.(3) | | 21,939,834 | | 7.3 | % |

100 E. Pratt Street | | | | | |

Baltimore, MD 21202 | | | | | |

Dodge & Cox(4) | | 15,667,374 | | 5.2 | % |

555 California Street, 40th Floor | | | | | |

San Francisco, CA 94104 | | | | | |

| (1) | This information is based on a Schedule 13G/A filed with the SEC on January 8, 2025 by The Vanguard Group, which reported sole voting power, sole dispositive power, and shared dispositive power as follows: sole voting power—0, shared voting power—314,483, sole dispositive power— 31,111,178, and shared dispositive power— 1,267,809. |

| (2) | This information is based on a Schedule 13G/A filed with the SEC on February 6, 2024 by BlackRock Inc., which reported sole voting power and sole dispositive power as follows: sole voting power— 21,727,057 and sole dispositive power— 24,039,941. |

| (3) | This information is based on a Schedule 13G/A filed with the SEC on November 14, 2024 by T. Rowe Price Associates, Inc., which reported sole voting power and sole dispositive power as follows: sole voting power— 21,211,927 and sole dispositive power— 21,927,496. |

| (4) | This information is based on a Schedule 13G/A filed with the SEC on February 13, 2024 by Dodge & Cox, which reported sole voting power and sole dispositive power as follows: sole voting power— 14,994,374 and sole dispositive power— 15,667,374. |

| |

14 | 2025 Annual General Meeting Proxy Statement |

AGENDA ITEM NO. 1—ELECTION OF DIRECTORS

Motion Proposed by the Board of Directors

At the Annual General Meeting, upon the recommendation of the Nominating, Governance and Compliance Committee, the Board of Directors proposes twelve (12) nominees for individual election as directors to hold office until the Annual General Meeting of shareholders in 2026. All twelve (12) nominees are current directors of TE Connectivity plc. All nominees are listed below with brief biographies.

Vote Requirement to Elect Directors

The approval of a majority of the votes cast at the meeting, whether in person or by proxy, is required for approval of the election of each of the twelve (12) nominees for director.

RECOMMENDATION

The Board of Directors recommends a vote “FOR” the election of each of the twelve (12) nominees for director.

The Board of Directors recommends a vote “FOR” the election of each of the twelve (12) nominees for director.

| |

2025 Annual General Meeting Proxy Statement | 15 |

NOMINEES FOR ELECTION

Qualifications of Nominees Recommended by the Board of Directors

TE promotes a high performing culture through highly engaged employees who are both inclusive and open to diverse perspectives, fostering TE’s purpose of creating a safer, sustainable, productive and connected future. The Company executes on this vision by building on three central pillars – Inclusion, Diversity and Engagement. See “Board Diversity and Self-Assessment” below for additional information.

The Company’s Board Governance Principles require that the Board as a whole is constituted to be strong in its collective knowledge of and diversity of experience in accounting and finance, management and leadership, vision and strategy, business operations, business judgment, crisis management, risk assessment, industry knowledge, corporate governance and global markets. The Nominating, Governance and Compliance Committee designs searches for candidates to fill vacancies on the board and makes recommendations for director nominations to the board. When preparing to search for a new director, the committee takes into account the experience, qualifications, skills and expertise of the board's current members. The committee seeks candidates who have a history of achievement and leadership and are experienced in areas relevant to the Company's business such as international trade, finance, technology, manufacturing processes and marketing. The committee also considers independence, as defined by applicable law, stock exchange listing standards and the categorical standards listed in the Company's Board Governance Principles, which are set forth in the "Board Organization and Independence of its Members" section of the Principles, and which can be found on the Company's website at www.te.com under About TE – Executive Team – Board Documents.

To assist with determining the needs of the board, the Nominating, Governance and Compliance Committee developed and maintains a Diversity and Skills Matrix to assist in the consideration of the appropriate balance of experience, skills and attributes required of a director and to be represented on the board of directors as a whole. The Diversity and Skills Matrix is based on the Company's strategic plan and is reviewed and updated by the Board on a regular basis. The Nominating, Governance and Compliance Committee evaluates candidates against the Diversity and Skills Matrix when determining whether to recommend candidates for initial election to the Board of Directors and when determining whether to recommend currently serving directors for re-election. In addition, our Board considers director tenure in connection with evaluating current directors for nomination for re-election. It is the general policy of the Board not to nominate directors who have reached the age of 72 for re-election, although the Board may determine to waive this policy in individual cases. See “Board Retirement Policy” below for additional information.

The professional experience, qualifications, skills and expertise of each nominee is set forth immediately below and in the director Diversity and Skills Matrix that follows the Board’s biographies. The Board and the Company believe that all nominees possess additional qualities, business knowledge and personal attributes valuable to their service on the Board and that all have demonstrated commitment to ethical and moral values and personal and professional integrity.

The Board of Directors has concluded that the experience, qualifications, skills and expertise of each director nominee qualifies each nominee to serve as a director of the Company.

| |

16 | 2025 Annual General Meeting Proxy Statement |

| | ||

Age 66 Director since 2023 Current Public Company Directorships ● Airbus SE ● Engie SA (Chair) TE Board committee ●Nominating Governance & Compliance ●Joint Committee on Cybersecurity Other Public Company Directorships within the past five years ● AXA SA | Jean-Pierre Clamadieu – Independent Chairman, ENGIE S.A. Former Chief Executive Officer and Chairman of the Executive Committee, Solvay S.A. Professional Highlights Mr. Clamadieu is Chairman of the Board of Directors of ENGIE S.A., a French multinational utility company mainly active in the power and gas sectors. He was first appointed in May 2018 and has been reelected in April 2022 for 4 years. From 2011 to 2019 Mr. Clamadieu served as Chief Executive Officer and Chairman of the Executive Committee of Solvay S.A., a Belgian multinational chemical company. In 1993, he joined the Rhône-Poulenc group where he held several management positions. Following the creation of Rhodia SA as a spin-off of the chemicals and polymers activities of Rhône-Poulenc Mr. Clamadieu held a variety of leadership roles in this organization, including Chairman and Chief Executive Officer from 2008 to 2011. In September 2011 Rhodia was acquired by the Solvay Group. Between 1981 - 1993, he held various positions in the French Public Service. Mr. Clamadieu graduated from École Nationale Supérieure des Mines de Paris with an engineering degree. He is Chief Engineer of the Corps of Mines. Nominee Qualifications Mr. Clamadieu brings a range of valuable expertise to the Board. He has held multiple global leadership positions, including as a two-time CEO of global chemicals companies, and has proven himself as an effective leader both in times of financial crisis and in growth. He has held numerous Independent Director and Chairman roles with international companies in industry relevant to TE Connectivity. Mr. Clamadieu has strong global experience. Prior to becoming CEO of Rhodia, he held numerous multijurisdictional and global leadership positions. He has served on (or currently serves on) the Board of Directors of global businesses of scale across the aerospace, financial services, utilities, chemicals and industrial sectors. Mr. Clamadieu’s international business experience and perspective make him a valuable asset for providing essential business guidance to the Board and the Company. |

| |

2025 Annual General Meeting Proxy Statement | 17 |

Age 56 Executive Director since 2016 Chief Executive Officer since 2017 Current Public Company Directorships ● DuPont de Nemours Inc. TE Board committee ● None Other Public Company Directorships within the past five years ● None | Terrence R. Curtin - Executive Director Chief Executive Officer, TE Connectivity plc Professional Highlights Mr. Curtin has served as the Chief Executive Officer of TE Connectivity since March 2017. Previously Mr. Curtin served as President of TE Connectivity from March 2015 and immediately prior to that served as Executive Vice President and President, Industrial Solutions since August 2012. Previously he served as Executive Vice President and Chief Financial Officer from October 2006 through July 2012. Mr. Curtin served on the TE Connectivity Board prior to our separation from Tyco International and was Vice President and Corporate Controller at Tyco Electronics since 2001. Prior to joining TE Connectivity, Mr. Curtin worked for Arthur Andersen LLP. Mr. Curtin has a Bachelor’s degree in Accounting from Albright College. Nominee Qualifications Mr. Curtin has extensive knowledge of our Company and executive leadership experience having served as an employee of ours since 2001 and in executive leadership positions at TE Connectivity since 2006 including having served as our Chief Executive Officer since March 2017. In his prior role as President, Mr. Curtin was responsible for all of TE’s connectivity and sensor businesses and mergers and acquisitions activities. In his prior role as President, Industrial Solutions, Mr. Curtin was responsible for the operations and strategic direction of TE’s Industrial, Energy, and Aerospace, Defense, Oil and Gas businesses. As TE’s Executive Vice President and Chief Financial Officer, Mr. Curtin was responsible for developing and implementing the financial strategy for TE and for creating the financial infrastructure necessary to drive the Company’s financial direction, vision and compliance initiatives. Mr. Curtin is also a Certified Public Accountant. |

| |

18 | 2025 Annual General Meeting Proxy Statement |

Age 69 Director since 2016 Current Public Company Directorships ●FMC Corporation ●International Flavors & Fragrances Inc. TE Chairman of the Board of Directors (since March 2024) TE Board committee ●Audit (Financial Expert) ●Joint Committee on Cybersecurity Other Public Company Directorships within the past five years ●Allergan plc ●Legg Mason, Inc | Carol A. (“John”) Davidson – Independent Former Senior Vice President, Controller and Chief Accounting Officer, Tyco International Ltd. Professional Highlights Mr. Davidson served as the Senior Vice President, Controller and Chief Accounting Officer of Tyco International Ltd., a provider of diversified industrial products and services, from January 2004 to September 2012. Between 1997 and 2004, Mr. Davidson held a variety of leadership roles at Dell Inc., a computer and technology services company, including the positions of Vice President, Audit, Risk and Compliance, and Vice President, Corporate Controller. From 1981 to 1997, Mr. Davidson held a variety of accounting and financial leadership roles at Eastman Kodak Company, a provider of imaging technology products and services. He holds a Bachelor of Science in Accounting from St. John Fisher University and an MBA from the University of Rochester. Nominee Qualifications Mr. Davidson is a Certified Public Accountant with extensive leadership experience across multiple industries and brings a strong track record of building and leading global teams and implementing governance and controls processes. From January 2013 to August 2018, he served on the Board of Governors of the Financial Industry Regulatory Authority (FINRA), an independent regulator of securities firms. In addition, until December 2015, he was a member of the Board of Trustees of the Financial Accounting Foundation which oversees financial accounting and reporting standards setting processes for the United States. Mr. Davidson’s significant experience with complex accounting and financial issues combined with his knowledge of public reporting requirements and processes bring accounting and financial management insight to the Board. Mr. Davidson brings over ten years of public company directorship experience to the Board. |

| |

2025 Annual General Meeting Proxy Statement | 19 |

● ● ● Financial Expert) | |

| |

Age 65 Director since 2020 Current Public Company Directorships ●EOG Resources, Inc. ●KBR, Inc. ●Micron Technology Inc. TE Board committee ● Audit (Financial Expert) ● Joint Committee on Cybersecurity (Co-Chair) Other Public Company Directorships within the past five years ● State Street Corporation | Lynn A. Dugle – Independent Former Chief Executive Officer, President and Chairman of the Board, Engility Holdings, Inc. Professional Highlights Ms. Dugle joined Engility in 2016 and formerly served as Engility’s (NYSE: EGL) chief executive officer, president and chairman of the board of directors before leading the sale of the company to SAIC (NYSE: SAIC) in 2019. Prior to joining Engility, Ms. Dugle spent more than a decade in senior management positions at Raytheon and retired from the company in March 2015 as a Raytheon Company vice president and President of Raytheon Intelligence, Information and Services (IIS) which housed Raytheon’s Cyber and Special Operations division. Prior to her President’s role, Ms. Dugle was vice president of engineering, technology and quality for the former Raytheon Network Centric Systems (NCS). Before joining Raytheon in April 2004, Ms. Dugle held a number of officer-level positions culminating in a general management role with ADC Telecommunications. Ms. Dugle earned a bachelor’s of science in technical management and a bachelor’s of arts in Spanish from Purdue University. She received a master’s of business administration from The University of Texas at Dallas. Nominee Qualifications Ms. Dugle has more than 30 years of executive leadership experience in defense, intelligence and high-tech industries. As the former Chief Executive Officer and Chairman of Engility Holdings, Ms. Dugle brings to the Board valuable experience in leading the development of large businesses with a focus on information, technology and security matters. Prior to her role at Engility, Ms. Dugle was responsible for advanced cyber solutions, cyber security services and information-based solutions at Raytheon. Ms. Dugle also has leadership experience with respect to strategy and global operations, including with respect to engineering, technology and quality functions. |

| |

20 | 2025 Annual General Meeting Proxy Statement |

| |

Age 52 Director since 2024 Current Public Company Directorships ● None TE Board committee ● Audit (Financial Expert) ● Joint Committee on Cybersecurity Other Public Company Directorships within the past five years ● None | Sam Eldessouky – Independent Executive Vice President and Chief Financial Officer, Bausch + Lomb Corporation Professional Highlights Sam Eldessouky has served since January 2022 as the Executive Vice President and Chief Financial Officer for Bausch & Lomb Corp. Prior to that, Mr. Eldessouky joined Bausch Health Companies Inc. in 2016 and served as Senior Vice President, Controller and Chief Accounting Officer until he was appointed Chief Financial Officer in June 2021. Previously, he served as senior vice president, controller and chief accounting officer for Tyco International plc from 2012 to 2016. During his tenure at Tyco, Mr. Eldessouky led the efforts to redesign the controller’s organization and the implementation of Enterprise Performance Management framework, and he played a significant role in the wholesale turnaround of Tyco’s business. He also played a key role in executing the spinoffs of Covidien and Tyco Electronics (now TE Connectivity) in 2007 and ADT NA and Flow Control in 2012. Prior to that, Mr. Eldessouky spent ten years at PwC, where he held several roles of increasing responsibility and served in PwC’s National Office providing technical accounting guidance on complex accounting matters. Mr. Eldessouky has a Bachelor of Science in Accountancy from Ain Shams University and a Master’s degree in Accounting and Finance from the University of Liverpool. Nominee Qualifications Mr. Eldessouky is a Certified Public Accountant and Chartered Global Management Accountant. As a current Chief Financial Officer, Mr. Eldessouky brings significant experience with complex accounting and financial issues, including implementing governance and controls processes, and public company leadership experience to the Board. Additionally, he served as a member of the Board of Trustees of Financial Executives Research Foundation and Financial Executives International. He also served as a member of the Global Preparers Forum, an external advisory body to the International Accounting Standards Board, from 2007 to 2013. Mr. Eldessouky meets the SEC’s definition of an Audit Committee financial expert. |

| |

2025 Annual General Meeting Proxy Statement | 21 |

● ●Compliance ● | |

| |

Age 65 Director since 2012 Current Public Company Directorships ●None TE Board committee ●Nominating Governance & Compliance (Chair) ●Joint Committee on Cybersecurity (Co-Chair) Other Public Company Directorships within the past five years ●None | William A. Jeffrey – Independent Retired Chief Executive Officer, SRI International Professional Highlights The Honorable Dr. William A. Jeffrey served as Chief Executive Officer of SRI International, a research and development organization serving government and industry, from September 2014 to December 2021. From September 2008 through August 2014, Dr. Jeffrey was Chief Executive Officer and President of HRL Laboratories, LLC, an automotive, aerospace and defense research and development laboratory. From 2007 through 2008, he was the Director of the Science and Technology Division of the Institute for Defense Analyses and prior to that he was Director of the National Institute of Standards and Technology from 2005. From 2002 to 2005, Dr. Jeffrey served in the White House as Senior Director of Homeland and National Security and Assistant Director of Space and Aeronautics in the Executive Office of the President, Office of Science and Technology Policy. He began his career at the Institute for Defense Analyses in 1988. Nominee Qualifications Dr. Jeffrey brings exceptional technical and scientific expertise and leadership experience to the Board as a former CEO of a private technology research organization with broad technical experience relevant to TE’s major markets as well as in innovation strategies, particularly as related to research and development. He has almost 20 years of government executive experience and experience in U.S. public policy. |

| |

22 | 2025 Annual General Meeting Proxy Statement |

Age 56 Director since 2022 Current Public Company Directorships ● Langham Hospitality Investments ● Mediatek, Inc. TE Board committee ●Nominating Governance & Compliance ●Joint Committee on Cybersecurity Other Public Company Directorships within the past five years ●Swire Pacific ●Mercuries Life Insurance | Syaru Shirley Lin – Independent Research Professor, University of Virginia Professional Highlights Professor Lin has been Research Professor since 2022 and had previously been Compton Visiting Professor of World Politics since 2019 at the Miller Center of Public Affairs at the University of Virginia. She is also a Nonresident Senior Fellow in the Foreign Policy Program at the Brookings Institution and an Adjunct Professor at the Chinese University of Hong Kong and chairs the Center for Asia-Pacific Resilience and Innovation (CAPRI). Previously, she was with The Goldman Sachs Group, Inc. holding multiple positions, including Managing Director and Partner, Principal Investment Area, based in Hong Kong from 2000 to 2003, Vice President, Principal Investment Area from 1997 to 2000, and Associate, Corporate Finance, Investment Banking from 1994 to 1997. Prof. Lin earned a doctoral degree in Politics and Public Administration in 2010 from the University of Hong Kong; a master's degree in International and Public Affairs, in 2005 from the University of Hong Kong and an A.B. degree in East Asian Studies, in 1990 from Harvard College. Nominee Qualifications Prof. Lin brings a range of valuable expertise to the Board. She has more than 10 years of instructional experience in international relations, international and comparative political economy in the United States and Asia as well as over a decade of analytical and investment experience in the investment banking industry. Prof. Lin brings vast knowledge on international matters, with a focus on the Asia Pacific environment, to the Board. Her senior leadership experience with Goldman Sachs lent her the opportunity to gain valuable experience by serving on the boards of private and publicly listed companies in the U.S., China, Japan, Taiwan and Hong Kong. She brings deep China/APAC experience across many sectors, including as an executive, board director, researcher, author and lecturer. Prof. Lin also has leadership experience with respect to strategy and global operations, gained by managing over 30 investment professionals and administrators based in Asia, including Hong Kong, Taipei, Seoul, Tokyo and Singapore, making investments in twelve countries. |

| |

2025 Annual General Meeting Proxy Statement | 23 |

Age 53 Director since 2021 Current Public Company Directorships ●Veralto Corporation TE Board committee ●None Other Public Company Directorships within the past five years ●Columbus McKinnon Corporation | Heath A. Mitts – Executive Director Executive Vice President and Chief Financial Officer, TE Connectivity plc Professional Highlights Mr. Mitts has been Executive Vice President and Chief Financial Officer at TE Connectivity since September 2016. Previously he was Senior Vice President and Chief Financial Officer at IDEX Corporation, a globally diversified company specializing in fluid, metering, health and science technologies, as well as fire, safety and other products, from March 2011 until September 2016. Mr. Mitts joined IDEX as Vice President, Corporate Finance in September 2005. Mr. Mitts holds an MBA in finance from Pennsylvania State University and a Bachelor’s degree in finance and political science from Southern Methodist University. Nominee Qualifications Mr. Mitts has extensive knowledge of our Company and executive leadership experience having served as our Chief Financial Officer since 2016. In addition, Mr. Mitts’ other qualifications to serve on our Board include his senior leadership and governance experience, his extensive finance and accounting background and his international business experience. |

| |

24 | 2025 Annual General Meeting Proxy Statement |

Age 60 Director since 2017 Current Public Company Directorships ● Advanced Micro Devices, Inc. ● iRhythm Technologies, Inc. (Chair) ● Lam Research Corporation (Chair) TE Board committee ● Management Development & Compensation (Chair) Other Public Company Directorships within the past five years ● None | Abhijit Y. Talwalkar – Independent Former President and Chief Executive Officer, LSI Corporation Professional Highlights Mr. Talwalkar is the former President and Chief Executive Officer of LSI Corporation, a leading provider of silicon, systems and software technologies for the storage and networking markets, a position he held from May 2005 until the completion of LSI’s merger with Avago Technologies in May 2014. From 1993 to 2005, Mr. Talwalkar was employed by Intel Corporation, the largest semiconductor manufacturer in the industry. At Intel, he held a number of senior management positions, including Corporate Vice President and Co-General Manager of the Digital Enterprise Group, which was comprised of Intel’s business client, server, storage and communications businesses, and as Vice President and General Manager for the Intel Enterprise Platform Group, where he focused on developing, marketing, and driving Intel business strategies for enterprise computing. Prior to joining Intel, Mr. Talwalkar held senior engineering and marketing positions at Sequent Computer Systems, a multiprocessing computer systems design and manufacturer that later became a part of IBM; Bipolar Integrated Technology, Inc., a VLSI bipolar semiconductor company; and Lattice Semiconductor Inc., a service driven developer of programmable design solutions widely used in electronic systems. Mr. Talwalkar has a Bachelor of Science degree in electrical engineering from Oregon State University. Nominee Qualifications Mr. Talwalkar brings experience as a public company executive officer and director, along with a proven record of executive leadership including nine years as a chief executive officer. Mr. Talwalkar served as a member of the board of directors of the U.S. Semiconductor Industry Association, a semiconductor industry trade association from May 2005 to May 2014. He was additionally a member of the U.S. delegation for World Semiconductor Council proceedings. His experience in marketing, mergers and acquisitions and other business and operations experience brings relevant insight to the Board |

| |

2025 Annual General Meeting Proxy Statement | 25 |

Age 63 Director since 2016 Current Public Company Directorships ● None TE Board committee ● Management Development & Compensation Other Public Company Directorships within the past five years ● Mallinckrodt plc | Mark C. Trudeau – Independent Former President, Chief Executive Officer, Mallinckrodt plc Professional Highlights Mr. Trudeau served from June 2013 until June 2022 as the President, Chief Executive Officer and a director of Mallinckrodt plc, a global business that develops, manufactures, markets and distributes specialty pharmaceuticals and therapies, which filed for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code in October 2020. Prior to that, Mr. Trudeau served as Senior Vice President and President of the Pharmaceuticals business of Covidien plc beginning in February 2012. He joined Covidien from Bayer HealthCare Pharmaceuticals LLC USA, the U.S. healthcare business of Bayer AG, where he served as Chief Executive Officer. He simultaneously served as President of Bayer HealthCare Pharmaceuticals, the U.S. organization of Bayer’s global pharmaceuticals business. In addition, he served as Interim President of the global specialty medicine business unit from January to August 2010. Prior to joining Bayer in 2009, Mr. Trudeau headed the immuno science Division at Bristol Myers Squibb. During his 10 plus years at Bristol Myers Squibb, he served in multiple senior roles, including President of the Asia/Pacific region, President and General Manager of Canada and General Manager/Managing Director in the United Kingdom. Mr. Trudeau also served in a variety of executive positions at Abbott Laboratories from 1988 to 1998. Mr. Trudeau holds a Bachelor’s degree in Chemical Engineering and an MBA, both from the University of Michigan. Nominee Qualifications Mr. Trudeau brings experience as a public company executive officer and director, along with a proven record of executive leadership and strong global business expertise including in the areas of strategy, operations and management, as well as other areas of business. Mr. Trudeau has over three decades of leadership positions at global companies which makes him well suited to provide valuable insight to our board and meets the SEC definition of an audit committee financial expert. |

| |

26 | 2025 Annual General Meeting Proxy Statement |

Age 55 Director since 2020 Current Public Company Directorships ● J. M. Smucker Company ● International Flavors & Fragrances Inc. TE Board committee ● Management Development & Compensation Other Public Company Directorships within the past five years ● None | Dawn C. Willoughby – Independent Former Executive Vice President and Chief Operating Officer of The Clorox Company Professional Highlights Ms. Willoughby was the Executive Vice President and Chief Operating Officer of The Clorox Company, a manufacturer and marketer of consumer and professional products, from September 2014 through January 2019. She also served as the company’s Senior Vice President and General Manager, Clorox Cleaning Division; Vice President and General Manager, Home Care Products; and Vice President and General Manager, Glad Products, along with several other positions since she began there in 2001. Prior to her career at The Clorox Company, Ms. Willoughby spent nine years with The Procter & Gamble Company, where she held several positions in sales management. Ms. Willoughby obtained a Bachelor of Arts in sports management from the University of Minnesota and an MBA from the University of California, Los Angeles Anderson School of Business. Nominee Qualifications Ms. Willoughby is well qualified to serve on our Board of Directors due to her prior business experience and experience serving as a public company director. Ms. Willoughby brings an extensive background leading business operations through her former roles with The Clorox Company and The Procter & Gamble Company. She also brings strong insights regarding sustainability through her former role with The Clorox Company. In addition, Ms. Willoughby’s background enables her to provide valuable insights to the Board, particularly in management, strategy, sales, marketing, and sustainability. |

| |

2025 Annual General Meeting Proxy Statement | 27 |

Age 64 Director since 2014 Current Public Company Directorships ● Spirit AeroSystems Holdings, Inc. ● CMS Energy Corporation and its subsidiary Consumers Energy Company ● Joby Aviation, Inc. TE Board committee ●Audit (Chair)(Financial Expert) ●Joint Committee on Cybersecurity Other Public Company Directorships within the past five years ● None | Laura H. Wright – Independent Former Chief Financial Officer of Southwest Airlines Professional Highlights Ms. Wright retired in 2012 as Chief Financial Officer of Southwest Airlines, a provider of air transportation in the United States. During her 25 year career at Southwest, she served in a variety of financial roles including Chief Financial Officer, Senior Vice President Finance, Treasurer and Assistant Treasurer. She began her career at Arthur Young & Co. in 1982 as a member of their tax staff, following which she became a Tax Manager from 1986 through 1988. Ms. Wright holds Bachelor and Master of Science degrees in accounting from the University of North Texas and is a Certified Public Accountant. Nominee Qualifications Ms. Wright brings extensive large public company leadership experience, including nine years as Chief Financial Officer and six years as Treasurer. As a former Chief Financial Officer and Treasurer, she brings finance experience, including corporate financial reporting, risk management, capital markets, investor relations, tax, strategy, and mergers and acquisitions to the Board. She also brings ten years of public company directorship experience to the Board and meets the SEC definition of an audit committee financial expert. |

| |

28 | 2025 Annual General Meeting Proxy Statement |

Director Diversity and Skills Matrix

TE CONNECTIVITY PLC - DIRECTOR DIVERSITY & SKILLS MATRIX | ||||||||||||||

| | | | | | BACKGROUND & EXPERTISE | ||||||||

DIRECTOR | AGE | YEAR JOINED BOARD | INDEPENDENT | GENDER | DIVERSE | PUBLIC COMPANY CEO | EXECUTIVE LEADERSHIP | TECHNOLOGY EVOLUTION & MARKET TRENDS | FINANCE & ACCOUNTING | GLOBAL PUBLIC POLICY | GLOBAL BUSINESS MANAGEMENT | OPERATIONS* | CYBERSECURITY & IT | MERGERS & ACQUISITIONS |

Clamadieu, Jean- Pierre | 66 | 2023 | YES | M | • | • | • | | | • | • | • | | • |

Curtin, Terrence R. | 56 | 2016 | NO | M | | • | • | | • | | • | • | | • |

Davidson, Carol A. "John" | 69 | 2016 | YES | M | • | • | • | • | • | |||||

Dugle, Lynn A. | 65 | 2020 | YES | F | • | • | • | • | • | • | • | |||

Eldessouky, Sam | 52 | 2024 | YES | M | • | | • | | • | | • | | | • |

Jeffrey, William A. | 65 | 2012 | YES | M | • | • | • | • | • | |||||

Syaru Shirley Lin | 56 | 2022 | YES | F | • | • | • | • | • | • | ||||

Mitts, Heath A. | 53 | 2021 | NO | M | • | • | • | • | ||||||

Talwalkar, Abhijit Y. | 60 | 2017 | YES | M | • | • | • | • | • | • | • | |||

Trudeau, Mark C. | 63 | 2016 | YES | M | • | • | • | • | • | |||||

Willoughby, Dawn C. | 55 | 2020 | YES | F | • | • | • | • | • | |||||

Wright, Laura H. | 64 | 2014 | YES | F | • | • | • | • | ||||||

9 | 5 | 12 | 4 | 6 | 4 | 8 | 3 | 4 | 11 | |||||

Ages | 50s (5) |

| YES (10) | M (8) |

|

|

|

|

|

|

|

|

|

|

Average Age | 65.82 | |||||||||||||

Average Tenure |

| 7.1 |

|

|

|

|

|

|

|

|

|

|

|

|

* Emphasis on supply chain, safety and business continuity

| |

2025 Annual General Meeting Proxy Statement | 29 |

Director Skill Set Considerations; Use of Matrix

In recruiting and selecting Board candidates, the Nominating, Governance & Compliance Committee takes into account the size of the Board and considers a skills matrix. This skills matrix helps the Committee determine whether a particular Board member or candidate possesses one or more of the skill sets, as well as whether those skills and/or other attributes qualify him or her for service on a particular committee. The Committee also considers a wide range of additional factors, including other positions the Director or candidate holds, including other boards of directors on which he or she serves; the results of the Board and Committee assessments; each Director’s and candidate’s projected retirement date; the independence of each Director and candidate; and the Company’s current and future business needs.

Commitment to Diversity

The Company is committed to a strategy of inclusiveness and to pursuing diversity in terms of viewpoints, backgrounds, and experiences, as well as diversity regarding gender, race, ethnicity, sexual orientation, national origin and underrepresented groups. The Company believes that it benefits from having directors with these traits. Of the twelve directors nominated to serve on the Board at the Annual General Meeting, four identify as women, one identifies as African American, one director identifies as LGBTQ+ and four directors identify as ethnically or geographically diverse or born outside the United States. The Board Governance Principles and the NGCC charter require candidates for the Board, among other things, to have the highest standards of individual and corporate integrity and trust and individual backgrounds that provide a portfolio of diverse experience, backgrounds and knowledge commensurate with the Company’s needs.

The Board is committed to using the refreshment process to strengthen diversity on the Board. To accomplish this, the Nominating, Governance and Compliance Committee requires in all cases that director search firms engaged by the Company include a selection of women and ethnically diverse candidates in prospective director candidate pools. In addition, the Nominating, Governance and Compliance Committee is committed to interviewing women and ethnically diverse candidates for future vacancies on the Board.

Board Self-Assessment

A self-assessment of the Board and its Committees is conducted annually.

Annual Self-Assessment

| ● | The NGCC oversees an annual self-assessment of the Board and each Committee’s performance |

| ● | The self-assessment seeks to identify specific areas, if any, in need of improvement or strengthening, including with respect to the diversity of our Board in terms of viewpoints, backgrounds and experiences |

| ● | The self-assessment is conducted with each individual director by the General Counsel and a member of the NGCC |

Self-Assessment Questions

| ● | After the September NGCC meeting, the General Counsel sends a list of questions to the Board members on the subject of the functioning of the Board and Committees to be discussed during one-on-one interviews |

One-on-One Discussions

| ● | The General Counsel meets individually with each director prior to the December meeting to discuss the self-assessment questions previously provided to Board members, including effectiveness of Board and its Committees, opportunities for improvement, current functioning of the Board and its Committees and any other topics of current interest |

| ● | The Chairman of the Board also meets individually with each director prior to the December meeting to discuss board culture, effectiveness, individual director performance and discharge of governance principles |

| ● | The General Counsel and Chairman of the Board shares comments and feedback with the Board and NGCC at the December meeting |

| |

30 | 2025 Annual General Meeting Proxy Statement |

Feedback Incorporated

| ● | As a result of this process: |

| o | The Board and its Committees identify potential areas for improvement, as well as existing practices which have contributed to high effectiveness |

| o | Items requiring follow-up are monitored on a going-forward basis by the full Board, Committees and/or Committee chairs, as applicable |

| o | The NGCC considers the skills, diversity and contributions of each director as part of its annual nomination process to ensure our directors continue to possess the necessary skills and experience to effectively oversee the Company |

Shareholder Recommendations

The NGCC will consider all shareholder recommendations for candidates for the Board, which should be sent to the Nominating, Governance and Compliance Committee, c/o Harold G. Barksdale, Secretary, TE Connectivity plc, Parkmore Business Park West, Parkmore, Ballybrit, Galway, H91VN2T, Ireland. In addition to considering candidates suggested by shareholders, the Committee considers candidates recommended by current directors, Company officers, employees and others. The Committee screens all candidates in the same manner regardless of the source of the recommendation. The Committee's review is typically based on any written materials provided with respect to the candidate. The Committee determines whether the candidate meets the Company's general qualifications and specific qualities and skills for directors (see "Qualifications of Nominees Recommended by the Board of Directors" above) and whether requesting additional information or an interview is appropriate.

| |

2025 Annual General Meeting Proxy Statement | 31 |

CORPORATE GOVERNANCE

Governance Principles