UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22001 |

|

TDAX Funds, Inc. |

(Exact name of registrant as specified in charter) |

|

420 Lexington Avenue, Suite 2550 New York, New York | | 10170 |

(Address of principal executive offices) | | (Zip code) |

|

David M. Kelley TDAX Funds, Inc. 420 Lexington Avenue Suite 2550 New York, New York 10170 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 867-7400 | |

|

Date of fiscal year end: | May 31, 2008 | |

|

Date of reporting period: | November 30, 2007 | |

| | | | | | | | |

Item 1. Report to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

SEMI-ANNUAL REPORT

November 30, 2007

(Unaudited)

TDAX Funds, Inc.

TDAX Independence 2010 Exchange-Traded Fund

TDAX Independence 2020 Exchange-Traded Fund

TDAX Independence 2030 Exchange-Traded Fund

TDAX Independence 2040 Exchange-Traded Fund

TDAX Independence In-Target Exchange-Traded Fund

TDAX Funds, Inc.

TABLE OF CONTENTS

| | | Page | |

| Shareholder Letter | | | 1 | | |

|

| Fund Performance Overview | |

|

| TDAX Independence 2010 Exchange-Traded Fund | | | 2 | | |

|

| TDAX Independence 2020 Exchange-Traded Fund | | | 3 | | |

|

| TDAX Independence 2030 Exchange-Traded Fund | | | 4 | | |

|

| TDAX Independence 2040 Exchange-Traded Fund | | | 5 | | |

|

| TDAX Independence In-Target Exchange-Traded Fund | | | 6 | | |

|

| Fees and Expenses | | | 7 | | |

|

| Schedule of Investments | |

|

| TDAX Independence 2010 Exchange-Traded Fund | | | 8 | | |

|

| TDAX Independence 2020 Exchange-Traded Fund | | | 13 | | |

|

| TDAX Independence 2030 Exchange-Traded Fund | | | 18 | | |

|

| TDAX Independence 2040 Exchange-Traded Fund | | | 23 | | |

|

| TDAX Independence In-Target Exchange-Traded Fund | | | 28 | | |

|

| Statements of Assets and Liabilities | | | 32 | | |

|

| Statements of Operations | | | 34 | | |

|

| Statements of Changes in Net Assets | | | 36 | | |

|

| Financial Highlights | | | 38 | | |

|

| Notes to Financial Statements | | | 40 | | |

|

| Information About Advisory Agreement | | | 45 | | |

|

| Additional Information | | | 47 | | |

|

TO OUR SHAREHOLDERS:

We are pleased to present the first shareholder report on the TDAX Independence family of target-date exchange-traded funds (ETFs). This report covers the period from the launch of the five funds on NYSE Arca, Inc. on October 1, 2007 through the end of the funds' semi-annual period on November 30, 2007.

Even though the TDAX Independence ETFs have been trading for a short period, they have achieved some significant milestones and accumulated a number of firsts. The TDAX Independence ETFs are:

• The first lifecycle ETFs to enter the market. Other target-date products are either funds of mutual funds or funds of ETFs. Historically, first-to-market ETFs have garnered attention and assets. At the end of November, the TDAX Independence ETFs collectively held $111 million in assets.

• The first ETFs to hold a blended portfolio of both fixed income and equity securities. And, like all ETFs, TDAX Independence ETFs are easy-to-access, transparent, and lower-cost products. Where open-end target-date mutual funds have expense ratios averaging 1.27%*, TDAX Independence ETFs are estimated to have an expense ratio of 0.73%, which will be reduced to 0.65% as a result of a contractual waiver**.

• ETFs that are intended to fulfill the requirements to be deemed Qualified Default Investment Alternatives (QDIA), a new retirement investment category resulting from the Pension Protection Act of 2006. QDIAs may be adopted by plan sponsors to serve as 401(k) default options. The TDAX Independence ETFs provide investors with a retirement option that reallocates and rebalances automatically.

We are also pleased to report the initial dividend distributions for the TDAX Independence ETFs. The following dividends per share were paid to shareholders of record as of December 21, 2007, on December 31, 2007:

TDAX Independence 2010 $0.20929

TDAX Independence 2020 $0.11064

TDAX Independence 2030 $0.08937

TDAX Independence 2040 $0.06457

TDAX Independence In-Target $0.14932

Lifecycle funds continue to be one of the fastest growing products for investors saving for retirement. In 2006, lifecycle funds increased assets by 50% to $303 billion, after rising 57% in 2005. According to the Investment Company Institute, this trend is expected to continue and assets may grow to $465 billion by 2010.

In addition, ETFs are one of the fastest growing investment products ever. ETF assets are collectively expected to grow to $2 trillion by 2010 from their mid-November 2007 $580 billion total, according to Morgan Stanley research. The study also noted that over 37% of the 601 ETFs trading in the U.S. today have been issued this year. Needless to say, we believe, the TDAX Independence ETFs are well positioned to capture these two surging trends of investor interest.

We look forward to concluding TDAX Funds, Inc.'s first full year of operations in 2008 and thank you for your support.

Very truly yours,

| |  | |

|

| Anthony F. Dudzinski | | David M. Kelley | |

|

| Chairman & | | President & | |

|

| Chief Operating Officer | | Chief Executive Officer | |

|

* Source: Morningstar Database October 2007.

** The total expense ratio in the most recent prospectus is estimated at 0.73%. Amerivest Investment Management, LLC ("Amerivest") has contractually agreed to pay Fund operating expenses (excluding, among other things, acquired fund fees and expenses, interest, taxes, brokerage commissions and extraordinary expenses) in order to limit Net Annual Operating Expenses for shares of each Fund to 0.65% of the Fund's average net assets (the "Expense Cap"). The Expense Cap will remain in effect until at least September 30, 2008. Amerivest is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. This reimbursement may be requested by Amerivest if the aggregate amount actually paid by the Fund toward operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the Expense Cap. Normal brokerage commissions apply.

1

TDAX Funds, Inc.

PERFORMANCE SUMMARY

TDAX Independence 2010 Exchange-Traded Fund (TDD)

The TDAX Independence 2010 Exchange-Traded Fund commenced investment operations and began trading on NYSE Arca, Inc. ("NYSE Arca") on October 1, 2007, and seeks to track the performance, before fees and expenses, of the Zacks 2010 Lifecycle Index.

The Zacks 2010 Lifecycle Index is an index consisting of securities from three broad asset classes: international equities, domestic equities, and fixed income that is designed to represent a diversified portfolio of securities. The Underlying Index automatically rebalances annually, or quarterly when necessary, along a "glidepath" designed to prudently maximize capital appreciation at its target date. "Glidepath" refers to the Underlying Index's asset allocation strategy over time. Gradually, the Underlying Index's allocation among the different classes of securities will adjust from a more aggressive allocation (emphasizing greater equity exposure) to a more conservative allocation (emphasizing greater fixed income exposure) as the target date approaches. After the target date, allocations shift from conservative to more moderately conservative allocations, allowing for a larger exposure to equities than at the target date.

Performance as of 11/30/07

| Cumulative Total Return | |

| | | Net Asset Value | | Market Price | | Zacks 2010

Lifecycle

Index | | Dow Jones

Target 2010

Index | |

| Since Inception1 | | | 0.16 | % | | | 0.06 | % | | | 1.45 | % | | | 1.82 | % | |

1 Total returns are calculated based on the commencement of trading, 10/1/07. The Zacks 2010 Lifecycle Index return is a price return and does not include dividend or interest payments. The Fund is new and has only a very short performance history. The returns shown may not be illustrative of longer-term performance.

The preceding performance chart is provided for comparative purposes and represents the period noted. The Fund's net asset value per share ("NAV") is calculated by dividing the value of the Fund's total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on NYSE Arca of a share of the Fund from inception through November 30, 2007. The price used to calculate market price returns is the mid-point of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. Each index in the series allocates among U.S. stock, bond and cash subindexes on a monthly basis to measure predefined relative risk levels.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Total returns for a period less than one year have not been annualized.

Performance quoted represents past performance and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.tdaxshares.com. Investment in the Fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The total expense ratio in the most recent prospectus is estimated at 0.73%. Amerivest has agreed to cap the expense ratio at 0.65% until at least 9/30/08.

Top Ten Holdings2 as of 11/30/07

| Top Ten Equity Holdings | |

| Description | | Shares | | Market Value | | % of Net Assets | |

| Sun Microsystems, Inc. | | | 5,748 | | | $ | 119,442 | | | | 0.8 | % | |

| Exxon Mobil Corp. | | | 1,047 | | | | 93,350 | | | | 0.6 | % | |

| Procter & Gamble Co. (The) | | | 1,193 | | | | 88,281 | | | | 0.6 | % | |

| American Express Co. | | | 1,340 | | | | 79,032 | | | | 0.5 | % | |

| Pfizer, Inc. | | | 3,186 | | | | 75,700 | | | | 0.5 | % | |

| United Technologies Corp. | | | 947 | | | | 70,806 | | | | 0.5 | % | |

| Johnson & Johnson | | | 1,044 | | | | 70,721 | | | | 0.5 | % | |

| Motorola, Inc. | | | 4,426 | | | | 70,682 | | | | 0.5 | % | |

| Microsoft Corp. | | | 1,993 | | | | 66,964 | | | | 0.4 | % | |

| Altria Group, Inc. | | | 800 | | | | 62,048 | | | | 0.4 | % | |

| Top Ten Fixed Income Holdings | |

| Description | | Principal Amount | | Market Value | | % of Net Assets | |

| U.S. Treasury Note, 6.00, 8/15/09 | | | 1,374,000 | | | $ | 1,440,017 | | | | 9.4 | % | |

| Fed. Home Loan Mort. Corp., 4.50, 1/15/13 | | | 756,000 | | | | 771,887 | | | | 5.1 | % | |

| Fed. Natl. Mort. Assoc., 5.00, 9/15/08 | | | 541,000 | | | | 545,379 | | | | 3.6 | % | |

| U.S. Treasury Note, 4.75, 11/15/08 | | | 425,000 | | | | 430,910 | | | | 2.8 | % | |

| U.S. Treasury Note, 3.50, 2/15/10 | | | 405,000 | | | | 408,892 | | | | 2.7 | % | |

| Citigroup, Inc., 6.00, 2/21/12 | | | 362,000 | | | | 374,843 | | | | 2.5 | % | |

| Fed. Natl. Mort. Assoc., 5.00, 4/15/15 | | | 350,000 | | | | 364,982 | | | | 2.4 | % | |

| Merrill Lynch & Co., Inc., 5.00, 1/15/15 | | | 242,000 | | | | 228,253 | | | | 1.5 | % | |

| Goldman Sachs Grp. L.P., 5.00, 10/01/14 | | | 212,000 | | | | 207,190 | | | | 1.4 | % | |

| Wachovia Corp., 5.25, 8/01/14 | | | 212,000 | | | | 206,697 | | | | 1.4 | % | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.tdaxshares.com.

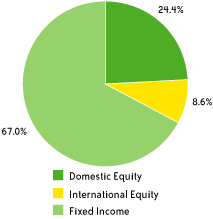

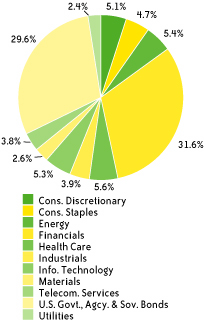

Asset Class Breakdown

as of 11/30/07*

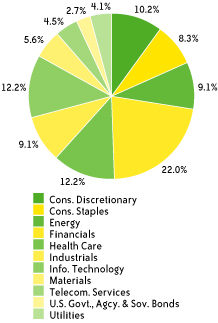

Sector Breakdown as of 11/30/07*

*Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Global Industry Classification Standards (GICS).

2

TDAX Funds, Inc.

PERFORMANCE SUMMARY

TDAX Independence 2020 Exchange-Traded Fund (TDH)

The TDAX Independence 2020 Exchange-Traded Fund commenced investment operations and began trading on NYSE Arca, Inc. ("NYSE Arca") on October 1, 2007, and seeks to track the performance, before fees and expenses, of the Zacks 2020 Lifecycle Index.

The Zacks 2020 Lifecycle Index is an index consisting of securities from three broad asset classes: international equities, domestic equities, and fixed income that is designed to represent a diversified portfolio of securities. The Underlying Index automatically rebalances annually, or quarterly when necessary, along a "glidepath" designed to prudently maximize capital appreciation at its target date. "Glidepath" refers to the Underlying Index's asset allocation strategy over time. Gradually, the Underlying Index's allocation among the different classes of securities will adjust from a more aggressive allocation (emphasizing greater equity exposure) to a more conservative allocation (emphasizing greater fixed income exposure) as the target date approaches. After the target date, allocations shift from conservative to more moderately conservative allocations, allowing for a larger exposure to equities than at the target date.

Performance as of 11/30/07

| Cumulative Total Return | |

| | | Net Asset Value | | Market Price | | Zacks 2020

Lifecycle

Index | | Dow Jones

Target 2020

Index | |

| Since Inception1 | | | -1.14 | % | | | -0.96 | % | | | 1.64 | % | | | -0.03 | % | |

1 Total returns are calculated based on the commencement of trading, 10/1/07. The Zacks 2020 Lifecycle Index return is a price return and does not include dividend or interest payments. The Fund is new and has only a very short performance history. The returns shown may not be illustrative of longer-term performance.

The preceding performance chart is provided for comparative purposes and represents the period noted. The Fund's net asset value per share ("NAV") is calculated by dividing the value of the Fund's total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on NYSE Arca of a share of the Fund from inception through November 30, 2007. The price used to calculate market price returns is the mid-point of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. Each index in the series allocates among U.S. stock, bond and cash subindexes on a monthly basis to measure predefined relative risk levels.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Total returns for a period less than one year have not been annualized.

Performance quoted represents past performance and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.tdaxshares.com. Investment in the Fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The total expense ratio in the most recent prospectus is estimated at 0.73%. Amerivest has agreed to cap the expense ratio at 0.65% until at least 9/30/08.

Top Ten Holdings2 as of 11/30/07

| Top Ten Equity Holdings | |

| Description | | Shares | | Market Value | | % of Net Assets | |

| Sun Microsystems, Inc. | | | 22,122 | | | $ | 459,694 | | | | 1.5 | % | |

| Exxon Mobil Corp. | | | 4,053 | | | | 361,364 | | | | 1.2 | % | |

| Procter & Gamble Co. | | | 4,628 | | | | 342,471 | | | | 1.1 | % | |

| American Express Co. | | | 5,472 | | | | 322,738 | | | | 1.1 | % | |

| Pfizer, Inc. | | | 12,562 | | | | 298,472 | | | | 1.0 | % | |

| Motorola, Inc. | | | 17,775 | | | | 283,866 | | | | 0.9 | % | |

| United Technologies Corp. | | | 3,749 | | | | 280,312 | | | | 0.9 | % | |

| Johnson & Johnson | | | 3,987 | | | | 270,079 | | | | 0.9 | % | |

| Microsoft Corp. | | | 7,745 | | | | 260,232 | | | | 0.9 | % | |

| Exelon Corp. | | | 3,003 | | | | 243,453 | | | | 0.8 | % | |

| Top Ten Fixed Income Holdings | |

| Description | | Principal Amount | | Market Value | | % of Net Assets | |

| Fed. Home Loan Mort. Corp., 4.50, 1/15/13 | | | 483,000 | | | $ | 493,150 | | | | 1.6 | % | |

| U.S. Treasury Bond, 7.625, 2/15/25 | | | 351,000 | | | | 485,285 | | | | 1.6 | % | |

| U.S. Treasury Bond, 8.125, 8/15/19 | | | 357,000 | | | | 484,851 | | | | 1.6 | % | |

| Citigroup, Inc., 6.00, 2/21/12 | | | 402,000 | | | | 416,262 | | | | 1.4 | % | |

| Fed. Home Loan Mort. Corp., 6.25, 7/15/32 | | | 342,000 | | | | 404,024 | | | | 1.3 | % | |

| U.S. Treasury Bond, 6.25, 5/15/30 | | | 235,000 | | | | 295,843 | | | | 1.0 | % | |

| HSBC Finance Corp., 6.375, 11/27/12 | | | 271,000 | | | | 283,191 | | | | 0.9 | % | |

| Morgan Stanley, 5.30, 3/01/13 | | | 277,000 | | | | 274,752 | | | | 0.9 | % | |

| US Treasury Note, 4.75, 5/15/14 | | | 255,000 | | | | 271,336 | | | | 0.9 | % | |

| Goldman Sachs Grp. L.P., 5.00, 10/01/14 | | | 271,000 | | | | 264,852 | | | | 0.9 | % | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.tdaxshares.com.

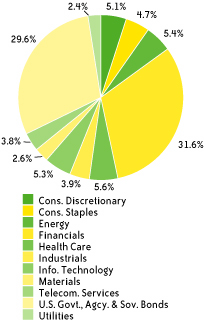

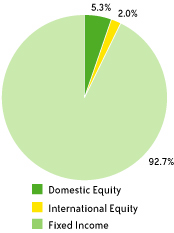

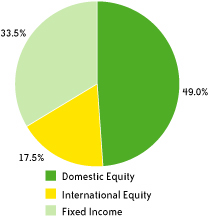

Asset Class Breakdown

as of 11/30/07*

Sector Breakdown as of 11/30/07*

*Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Global Industry Classification Standards (GICS).

3

TDAX Funds, Inc.

PERFORMANCE SUMMARY

TDAX Independence 2030 Exchange-Traded Fund (TDN)

The TDAX Independence 2030 Exchange-Traded Fund commenced investment operations and began trading on NYSE Arca, Inc. ("NYSE Arca") on October 1, 2007, and seeks to track the performance, before fees and expenses, of the Zacks 2030 Lifecycle Index.

The Zacks 2030 Lifecycle Index is an index consisting of securities from three broad asset classes: international equities, domestic equities, and fixed income that is designed to represent a diversified portfolio of securities. The Underlying Index automatically rebalances annually, or quarterly when necessary, along a "glidepath" designed to prudently maximize capital appreciation at its target date. "Glidepath" refers to the Underlying Index's asset allocation strategy over time. Gradually, the Underlying Index's allocation among the different classes of securities will adjust from a more aggressive allocation (emphasizing greater equity exposure) to a more conservative allocation (emphasizing greater fixed income exposure) as the target date approaches. After the target date, allocations shift from conservative to more moderately conservative allocations, allowing for a larger exposure to equities than at the target date.

Performance as of 11/30/07

| Cumulative Total Return | |

| | | Net Asset Value | | Market Price | | Zacks 2030

Lifecycle

Index | | Dow Jones

Target 2030

Index | |

| Since Inception1 | | | -2.27 | % | | | -2.18 | % | | | -0.09 | % | | | -1.45 | % | |

1 Total returns are calculated based on the commencement of trading, 10/1/07. The Zacks 2030 Lifecycle Index return is a price return and does not include dividend or interest payments. The Fund is new and has only a very short performance history. The returns shown may not be illustrative of longer-term performance.

The preceding performance chart is provided for comparative purposes and represents the period noted. The Fund's net asset value per share ("NAV") is calculated by dividing the value of the Fund's total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on NYSE Arca of a share of the Fund from inception through November 30, 2007. The price used to calculate market price returns is the mid-point of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. Each index in the series allocates among U.S. stock, bond and cash subindexes on a monthly basis to measure predefined relative risk levels.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Total returns for a period less than one year have not been annualized.

Performance quoted represents past performance and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.tdaxshares.com. Investment in the Fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The total expense ratio in the most recent prospectus is estimated at 0.73%. Amerivest has agreed to cap the expense ratio at 0.65% until at least 9/30/08.

Top Ten Holdings2 as of 11/30/07

| Top Ten Equity Holdings | |

| Description | | Shares | | Market Value | | % of Net Assets | |

| Sun Microsystems, Inc. | | | 24,606 | | | $ | 511,313 | | | | 2.0 | % | |

| Exxon Mobil Corp. | | | 4,496 | | | | 400,863 | | | | 1.6 | % | |

| Procter & Gamble Co. (The) | | | 5,148 | | | | 380,953 | | | | 1.5 | % | |

| American Express Co. | | | 6,338 | | | | 373,814 | | | | 1.5 | % | |

| Pfizer, Inc. | | | 14,098 | | | | 334,969 | | | | 1.3 | % | |

| Motorola, Inc. | | | 19,681 | | | | 314,306 | | | | 1.3 | % | |

| Johnson & Johnson | | | 4,606 | | | | 312,011 | | | | 1.2 | % | |

| United Technologies Corp. | | | 4,161 | | | | 311,117 | | | | 1.2 | % | |

| Chevron Corp. | | | 3,271 | | | | 287,096 | | | | 1.1 | % | |

| Microsoft Corp. | | | 8,172 | | | | 274,579 | | | | 1.1 | % | |

| Top Ten Fixed Income Holdings | |

| Description | | Principal Amount | | Market Value | | % of Net Assets | |

| U.S. Treasury Note, 4.75, 5/15/14 | | | 127,000 | | | $ | 135,136 | | | | 0.5 | % | |

| U.S. Treasury Bond, 6.25, 5/15/30 | | | 103,000 | | | | 129,667 | | | | 0.5 | % | |

| Fed. Home Loan Mort. Corp., 6.25, 7/15/32 | | | 109,000 | | | | 128,768 | | | | 0.5 | % | |

| Lincoln National Corp., 7.00, 5/17/66 | | | 109,000 | | | | 109,042 | | | | 0.4 | % | |

| Travelers Cos., Inc. (The), 6.25, 3/15/37 | | | 104,000 | | | | 98,776 | | | | 0.4 | % | |

| U.S. Treasury Bond, 8.125, 8/15/19 | | | 70,000 | | | | 95,069 | | | | 0.4 | % | |

| U.S. Treasury Note, 3.50, 2/15/10 | | | 84,000 | | | | 84,807 | | | | 0.3 | % | |

| American Gen. Fin. Corp., 5.375, 10/01/12 | | | 84,000 | | | | 83,920 | | | | 0.3 | % | |

| Procter & Gamble Co. (The), 5.55, 3/05/37 | | | 79,000 | | | | 79,163 | | | | 0.3 | % | |

| American Express Co., 6.80, 9/01/66 | | | 68,000 | | | | 70,052 | | | | 0.3 | % | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.tdaxshares.com.

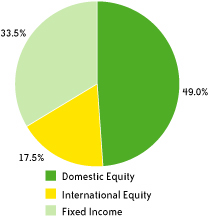

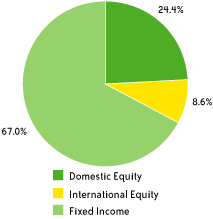

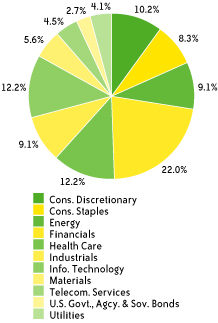

Asset Class Breakdown

as of 11/30/07*

Sector Breakdown as of 11/30/07*

*Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Global Industry Classification Standards (GICS).

4

TDAX Funds, Inc.

PERFORMANCE SUMMARY

TDAX Independence 2040 Exchange-Traded Fund (TDV)

The TDAX Independence 2040 Exchange-Traded Fund commenced investment operations and began trading on NYSE Arca, Inc. ("NYSE Arca") on October 1, 2007, and seeks to track the performance, before fees and expenses, of the Zacks 2040 Lifecycle Index.

The Zacks 2040 Lifecycle Index is an index consisting of securities from three broad asset classes: international equities, domestic equities, and fixed income that is designed to represent a diversified portfolio of securities. The Underlying Index automatically rebalances annually, or quarterly when necessary, along a "glidepath" designed to prudently maximize capital appreciation at its target date. "Glidepath" refers to the Underlying Index's asset allocation strategy over time. Gradually, the Underlying Index's allocation among the different classes of securities will adjust from a more aggressive allocation (emphasizing greater equity exposure) to a more conservative allocation (emphasizing greater fixed income exposure) as the target date approaches. After the target date, allocations shift from conservative to more moderately conservative allocations, allowing for a larger exposure to equities than at the target date.

Performance as of 11/30/07

| Cumulative Total Return | |

| | | Net Asset Value | | Market Price | | Zacks 2040

Lifecycle

Index | | Dow Jones

Target 2040

Index | |

| Since Inception1 | | | -2.61 | % | | | -2.43 | % | | | -1.85 | % | | | -2.14 | % | |

1 Total returns are calculated based on the commencement of trading, 10/1/07. The Zacks 2040 Lifecycle Index return is a price return and does not include dividend or interest payments. The Fund is new and has only a very short performance history. The returns shown may not be illustrative of longer-term performance.

The preceding performance chart is provided for comparative purposes and represents the period noted. The Fund's net asset value per share ("NAV") is calculated by dividing the value of the Fund's total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on NYSE Arca of a share of the Fund from inception through November 30, 2007. The price used to calculate market price returns is the mid-point of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. Each index in the series allocates among U.S. stock, bond and cash subindexes on a monthly basis to measure predefined relative risk levels.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Total returns for a period less than one year have not been annualized.

Performance quoted represents past performance and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.tdaxshares.com. Investment in the Fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The total expense ratio in the most recent prospectus is estimated at 0.73%. Amerivest has agreed to cap the expense ratio at 0.65% until at least 9/30/08.

Top Ten Holdings2 as of 11/30/07

| Top Ten Equity Holdings | |

| Description | | Shares | | Market Value | | % of Net Assets | |

| Sun Microsystems, Inc. | | | 26,624 | | | $ | 553,247 | | | | 2.2 | % | |

| Exxon Mobil Corp. | | | 4,844 | | | | 431,890 | | | | 1.7 | % | |

| Procter & Gamble Co. (The) | | | 5,566 | | | | 411,883 | | | | 1.6 | % | |

| American Express Co. | | | 6,837 | | | | 403,246 | | | | 1.6 | % | |

| Pfizer, Inc. | | | 15,226 | | | | 361,771 | | | | 1.4 | % | |

| Motorola, Inc. | | | 21,516 | | | | 343,611 | | | | 1.4 | % | |

| United Technologies Corp. | | | 4,518 | | | | 337,811 | | | | 1.4 | % | |

| Johnson & Johnson | | | 4,718 | | | | 319,597 | | | | 1.3 | % | |

| General Electric Co. | | | 7,863 | | | | 301,074 | | | | 1.2 | % | |

| Exelon Corp. | | | 3,672 | | | | 297,688 | | | | 1.2 | % | |

| Top Ten Fixed Income Holdings | |

| Description | | Principal Amount | | Market Value | | % of Net Assets | |

| U.S. Treasury Bond, 7.50, 11/15/16 | | | 44,000 | | | $ | 55,478 | | | | 0.2 | % | |

| Fed. Home Loan Mort. Corp., 6.25, 7/15/32 | | | 45,000 | | | | 53,161 | | | | 0.2 | % | |

| American Express Co., 6.80, 9/01/66 | | | 40,000 | | | | 41,206 | | | | 0.2 | % | |

| Bristol-Myers Squibb Co., 5.875, 11/15/36 | | | 28,000 | | | | 27,883 | | | | 0.1 | % | |

| Procter & Gamble Co. (The), 5.55, 3/05/37 | | | 26,000 | | | | 26,053 | | | | 0.1 | % | |

| Eli Lilly & Co., 5.55, 3/15/37 | | | 26,000 | | | | 25,417 | | | | 0.1 | % | |

| U.S. Treasury Note, 3.50, 2/15/10 | | | 25,000 | | | | 25,240 | | | | 0.1 | % | |

| Lincoln National Corp., 7.00, 5/17/66 | | | 25,000 | | | | 25,009 | | | | 0.1 | % | |

| Travelers Cos., Inc. (The), 6.25, 3/15/37 | | | 26,000 | | | | 24,694 | | | | 0.1 | % | |

| Burlington Northern Santa Fe Corp., 6.15, 5/01/37 | | | 25,000 | | | | 24,680 | | | | 0.1 | % | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.tdaxshares.com.

Asset Class Breakdown

as of 11/30/07*

Sector Breakdown as of 11/30/07*

*Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Global Industry Classification Standards (GICS).

5

TDAX Funds, Inc.

PERFORMANCE SUMMARY

TDAX Independence In-Target Exchange-Traded Fund (TDX)

The TDAX Independence In-Target Exchange-Traded Fund commenced investment operations and began trading on NYSE Arca, Inc. ("NYSE Arca") on October 1, 2007, and seeks to track the performance, before fees and expenses, of the Zacks In-Target Lifecycle Index.

The Zacks In-Target Lifecycle Index is an index consisting of securities from three broad asset classes: international equities, domestic equities, and fixed income that is designed to represent a diversified portfolio of securities. The Zacks In-Target Lifecycle Index is designed for persons who are at or near their target date and therefore has a conservative allocation (emphasis on greater fixed income exposure). Allocations will now begin to shift from conservative to more moderately conservative allocations, allowing for a larger exposure to equities than at inception.

Performance as of 11/30/07

| Cumulative Total Return | |

| | | Net Asset Value | | Market Price | | Zacks In-Target

Lifecycle

Index | | Dow Jones

Target Today

Index | |

| Since Inception1 | | | 1.08 | % | | | 0.26 | % | | | -0.02 | % | | | 1.52 | % | |

1 Total returns are calculated based on the commencement of trading, 10/1/07. The Zacks In-Target Lifecycle Index return is a price return and does not include dividend or interest payments. The Fund is new and has only a very short performance history. The returns shown may not be illustrative of longer-term performance.

The preceding performance chart is provided for comparative purposes and represents the period noted. The Fund's net asset value per share ("NAV") is calculated by dividing the value of the Fund's total assets less total liabilities by the number of shares outstanding. The market price return is based on the change in the market price on NYSE Arca of a share of the Fund from inception through November 30, 2007. The price used to calculate market price returns is the mid-point of the bid/ask spread for Fund shares at 4 p.m. Eastern Time on NYSE Arca. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. The Dow Jones Target Date Indexes are indexes whose allocations are automatically adjusted to reduce potential risk over time. Each index in the series allocates among U.S stock, bond and cash subindexes on a monthly basis to measure predefined relative risk levels.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Total returns for a period less than one year have not been annualized.

Performance quoted represents past performance and does not guarantee future results. Current performance may be higher or lower than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.tdaxshares.com. Investment in the Fund poses investment risk including possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The total expense ratio in the most recent prospectus is estimated at 0.73%. Amerivest has agreed to cap the expense ratio at 0.65% until at least 9/30/08.

Top Ten Holdings2 as of 11/30/07

| Top Ten Equity Holdings | |

| Description | | Shares | | Market Value | | % of Net Assets | |

| Exxon Mobil Corp. | | | 334 | | | $ | 29,780 | | | | 0.2 | % | |

| Sun Microsystems, Inc. | | | 1,206 | | | | 25,060 | | | | 0.2 | % | |

| Procter & Gamble Co. (The) | | | 331 | | | | 24,494 | | | | 0.2 | % | |

| Johnson & Johnson | | | 334 | | | | 22,626 | | | | 0.1 | % | |

| American Express Co. | | | 361 | | | | 21,292 | | | | 0.1 | % | |

| Wal-Mart Stores, Inc. | | | 361 | | | | 17,292 | | | | 0.1 | % | |

| Pfizer, Inc. | | | 719 | | | | 17,083 | | | | 0.1 | % | |

| Motorola, Inc. | | | 1,049 | | | | 16,753 | | | | 0.1 | % | |

| Chevron Corp. | | | 184 | | | | 16,150 | | | | 0.1 | % | |

| Bank of America Corp. | | | 334 | | | | 15,407 | | | | 0.1 | % | |

| Top Ten Fixed Income Holdings | |

| Description | | Principal Amount | | Market Value | | % of Net Assets | |

| U.S. Treasury Note, 4.375, 12/31/07 | | | 1,676,000 | | | $ | 1,677,310 | | | | 11.0 | % | |

| U.S. Treasury Note, 4.875, 8/15/09 | | | 1,365,000 | | | | 1,404,671 | | | | 9.2 | % | |

| U.S. Treasury Note, 3.125, 9/15/08 | | | 1,350,000 | | | | 1,348,946 | | | | 8.9 | % | |

| U.S. Treasury Note, 4.625, 9/15/08 | | | 1,320,000 | | | | 1,324,435 | | | | 8.7 | % | |

| U.S. Treasury Note, 4.75, 11/15/08 | | | 1,138,000 | | | | 1,153,826 | | | | 7.6 | % | |

| U.S. Treasury Note, 3.75, 5/15/08 | | | 1,139,000 | | | | 1,141,670 | | | | 7.5 | % | |

| U.S. Treasury Note, 3.50, 2/15/10 | | | 870,000 | | | | 878,361 | | | | 5.8 | % | |

| U.S. Treasury Note, 2.625, 3/15/09 | | | 616,000 | | | | 612,246 | | | | 4.0 | % | |

| U.S. Treasury Note, 3.875, 7/15/10 | | | 496,000 | | | | 506,657 | | | | 3.3 | % | |

| U.S. Treasury Note, 4.50, 5/15/10 | | | 466,000 | | | | 482,383 | | | | 3.2 | % | |

2 Holdings are subject to change without notice and there is no guarantee that the Fund will remain invested in any particular security. For a complete list of holdings go to www.tdaxshares.com.

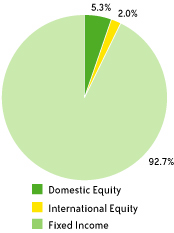

Asset Class Breakdown

as of 11/30/07*

Sector Breakdown as of 11/30/07*

*Weightings are expressed as a percentage of total investments and may change over time. The sector classifications used above are based on company classifications under Global Industry Classification Standards (GICS). Sectors representing less than 1% of total investments are included in Other.

6

TDAX Funds, Inc.

FEES AND EXPENSES (UNAUDITED)

As a shareholder of one or more of the various TDAX Independence ETFs (each, a "Fund"), you incur advisory fees and other Fund expenses. The expense examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 invested at the beginning of the period (in this case, since inception) and held through the period ended November 30, 2007.

ACTUAL EXPENSES

The first line in the following tables provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the following tables provides information about hypothetical account values and hypothetical expenses based on the Funds' actual expense ratio and an assumed rate of return of 5% per year before expenses (which is not the Funds' actual return). The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

October 1, 2007

(Commencement of

Investment Operations) | | Ending

Account Value

November 30, 2007 | | Annualized

Expense Ratio(1)

based on the number of

days in the period | | Expenses Paid

During the Period(2)

October 1, 2007

(Commencement of

Investment Operations) to

November 30, 2007 | |

TDAX Independence 2010

Exchange Traded-Fund | |

| Actual | | $ | 1,000.00 | | | $ | 1,001.60 | | | | 0.66 | % | | $ | 1.10 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.72 | | | | 0.66 | % | | $ | 3.32 | | |

TDAX Independence 2020

Exchange Traded-Fund | |

| Actual | | $ | 1,000.00 | | | $ | 988.60 | | | | 0.65 | % | | $ | 1.08 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.73 | | | | 0.65 | % | | $ | 3.31 | | |

TDAX Independence 2030

Exchange Traded-Fund | |

| Actual | | $ | 1,000.00 | | | $ | 977.30 | | | | 0.65 | % | | $ | 1.08 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.73 | | | | 0.65 | % | | $ | 3.31 | | |

TDAX Independence 2040

Exchange Traded-Fund | |

| Actual | | $ | 1,000.00 | | | $ | 973.90 | | | | 0.65 | % | | $ | 1.08 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.73 | | | | 0.65 | % | | $ | 3.31 | | |

TDAX Independence In-Target

Exchange Traded-Fund | |

| Actual | | $ | 1,000.00 | | | $ | 1,010.80 | | | | 0.66 | % | | $ | 1.10 | | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.71 | | | | 0.66 | % | | $ | 3.33 | | |

(1) Amerivest Investment Management, LLC ("Amerivest"), a sub-advisor to the Funds, has contractually agreed to pay Fund operating expenses (excluding, among other things, acquired fund fees and expenses, interest, taxes, brokerage commissions and extraordinary expenses) in order to limit the Net Annual Operating Expenses for shares of each Fund to 0.65% of the Fund's average net assets (the "Expense Cap"). The Expense Cap will remain in effect until at least September 30, 2008. Amerivest is permitted to be reimbursed for fee reductions and/or expense payments made in the prior three fiscal years. This reimbursement may be requested by Amerivest if the aggregate amount actually paid by the Fund toward operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the Expense Cap. Ratios would have been higher if fees were not reduced by Amerivest.

(2) Expenses are calculated using the annualized expense ratio, which represents the ongoing expenses as a percentage of net assets for the period October 1, 2007 (commencement of investment operations) to November 30, 2007. Expenses are calculated by multiplying the Fund's annualized expense ratio by the average account value for the period; then multiplying the result by 61 days and then dividing the result by 366.

7

TDAX Funds, Inc.

SCHEDULE OF INVESTMENTS

TDAX INDEPENDENCE 2010 EXCHANGE-TRADED FUND

November 30, 2007 (Unaudited)

| | | Number

of Shares | | Market

Value | |

| COMMON STOCKS—32.5% | |

| CONSUMER DISCRETIONARY—3.1% | |

| Aeropostale, Inc.* | | | 149 | | | $ | 3,807 | | |

| ArvinMeritor, Inc. | | | 449 | | | | 4,539 | | |

| Brookfield Homes Corp. | | | 449 | | | | 7,570 | | |

| Cabela's, Inc., Class A* | | | 149 | | | | 2,464 | | |

| Coach, Inc.* | | | 598 | | | | 22,210 | | |

| Collective Brands, Inc.* | | | 449 | | | | 6,883 | | |

| Comcast Corp., Class A* | | | 1,395 | | | | 28,653 | | |

Compagnie Financiere Richemont SA,

Class A (China) | | | 87 | | | | 5,987 | | |

| Daimler AG (Germany) | | | 48 | | | | 4,900 | | |

| DeVry, Inc. | | | 349 | | | | 19,188 | | |

| DIRECTV Group (The), Inc.* | | | 1,495 | | | | 37,181 | | |

| Fleetwood Enterprises, Inc.* | | | 1,349 | | | | 7,379 | | |

| Gemstar-TV Guide International, Inc.* | | | 745 | | | | 4,396 | | |

| Home Depot (The), Inc. | | | 449 | | | | 12,823 | | |

| HONDA MOTOR Co. Ltd. (Japan) | | | 300 | | | | 10,169 | | |

| J. Crew Group, Inc.* | | | 129 | | | | 6,198 | | |

| Jo-Ann Stores, Inc.* | | | 260 | | | | 4,280 | | |

| Jos. A. Bank Clothiers, Inc.* | | | 149 | | | | 3,858 | | |

| Lear Corp.* | | | 176 | | | | 5,181 | | |

| Liberty Global, Inc., Class A* | | | 490 | | | | 19,904 | | |

| Live Nation, Inc.* | | | 248 | | | | 3,328 | | |

| McDonald's Corp. | | | 598 | | | | 34,965 | | |

| Men's Wearhouse (The), Inc. | | | 149 | | | | 5,143 | | |

| New York & Co., Inc.* | | | 745 | | | | 5,491 | | |

| Omnicom Group, Inc. | | | 100 | | | | 4,875 | | |

| Sony Corp. (Japan) | | | 300 | | | | 16,254 | | |

| Sotheby's | | | 149 | | | | 5,580 | | |

| Steven Madden Ltd.* | | | 149 | | | | 3,387 | | |

| Target Corp. | | | 449 | | | | 26,967 | | |

| Tempur-Pedic International, Inc. | | | 349 | | | | 10,362 | | |

| Time Warner, Inc. | | | 1,193 | | | | 20,591 | | |

| Toyota Motor Corp. (Japan) | | | 900 | | | | 50,630 | | |

| Under Armour, Inc., Class A* | | | 69 | | | | 3,428 | | |

| Universal Technical Institute, Inc.* | | | 449 | | | | 7,916 | | |

| Viacom, Inc., Class B* | | | 837 | | | | 35,171 | | |

| Yum! Brands, Inc. | | | 745 | | | | 27,677 | | |

| | | | | | | | 479,335 | | |

| CONSUMER STAPLES—2.9% | |

| Altria Group, Inc. | | | 800 | | | | 62,048 | | |

| British American Tobacco PLC (United Kingdom) | | | 82 | | | | 3,182 | | |

| Carrefour SA (France) | | | 51 | | | | 3,961 | | |

| Coca-Cola (The) Co. | | | 900 | | | | 55,890 | | |

| ConAgra Foods, Inc. | | | 1,044 | | | | 26,121 | | |

| CVS Caremark Corp. | | | 449 | | | | 18,000 | | |

| Diageo PLC (United Kingdom) | | | 383 | | | | 8,607 | | |

| Groupe DANONE (France) | | | 9 | | | | 796 | | |

| Kraft Foods, Inc., Class A | | | 800 | | | | 27,640 | | |

| Longs Drug Stores Corp. | | | 149 | | | | 7,885 | | |

| Nestle SA (China) | | | 96 | | | | 46,170 | | |

| Pilgrim's Pride Corp. | | | 149 | | | | 3,886 | | |

| Procter & Gamble (The) Co. | | | 1,193 | | | | 88,281 | | |

| Reckitt Benckiser Group PLC (United Kingdom) | | | 51 | | | | 3,031 | | |

| Seaboard Corp. | | | 3 | | | | 4,527 | | |

| Tesco PLC (United Kingdom) | | | 1,262 | | | | 12,429 | | |

| | | Number

of Shares | | Market

Value | |

| CONSUMER STAPLES (Continued) | |

| Unilever NV (Netherlands) | | | 296 | | | $ | 10,493 | | |

| Wal-Mart Stores, Inc. | | | 1,193 | | | | 57,145 | | |

| | | | | | | | 440,092 | | |

| ENERGY—3.1% | |

| Alon USA Energy, Inc. | | | 149 | | | | 4,145 | | |

| BG Group PLC (United Kingdom) | | | 547 | | | | 11,450 | | |

| BP PLC (United Kingdom) | | | 3,879 | | | | 47,057 | | |

| Chevron Corp. | | | 598 | | | | 52,485 | | |

| ConocoPhillips | | | 598 | | | | 47,864 | | |

| Dril-Quip, Inc.* | | | 149 | | | | 8,407 | | |

| ENI S.p.A (Italy) | | | 281 | | | | 10,052 | | |

| EOG Resources, Inc. | | | 598 | | | | 49,501 | | |

| Exxon Mobil Corp. | | | 1,047 | | | | 93,350 | | |

| International Coal Group, Inc.* | | | 1,793 | | | | 8,983 | | |

| Newpark Resources, Inc.* | | | 891 | | | | 4,794 | | |

| Occidental Petroleum Corp. | | | 149 | | | | 10,396 | | |

| Oil States International, Inc.* | | | 149 | | | | 4,725 | | |

| Oilsands Quest, Inc.* | | | 1,145 | | | | 5,153 | | |

| PetroHawk Energy Corp.* | | | 296 | | | | 4,825 | | |

| Petroleum Development Corp.* | | | 149 | | | | 7,550 | | |

| Repsol YPF, S.A. (Spain) | | | 93 | | | | 3,437 | | |

Royal Dutch Shell PLC, Class A

(United Kingdom) | | | 712 | | | | 28,782 | | |

Royal Dutch Shell PLC, Class B

(United Kingdom) | | | 523 | | | | 20,991 | | |

| Schlumberger Ltd. (Netherlands Antilles) | | | 233 | | | | 21,774 | | |

| Total SA (France) | | | 224 | | | | 18,160 | | |

| W-H Energy Services, Inc.* | | | 149 | | | | 7,525 | | |

| | | | | | | | 471,406 | | |

| FINANCIALS—7.0% | |

| ABN AMRO Holding NV (Netherlands) | | | 221 | | | | 11,678 | | |

| Allianz SE (Germany) | | | 66 | | | | 13,660 | | |

| American Express Co. | | | 1,340 | | | | 79,032 | | |

| American International Group, Inc. | | | 249 | | | | 14,474 | | |

| Aspen Insurance Holdings Ltd. (Bermuda) | | | 146 | | | | 4,205 | | |

| Assicurazioni Generali S.p.A (Italy) | | | 30 | | | | 1,381 | | |

| Aviva PLC (United Kingdom) | | | 466 | | | | 6,535 | | |

| AXA (France) | | | 242 | | | | 9,921 | | |

| Banco Bilbao Vizcaya Argentaria, S.A. (Spain) | | | 149 | | | | 3,720 | | |

| Banco Santander S.A. (Spain) | | | 2,350 | | | | 50,499 | | |

| Bank of America Corp. | | | 745 | | | | 34,367 | | |

| Barclays PLC (United Kingdom) | | | 1,959 | | | | 22,678 | | |

| BNP Paribas (France) | | | 126 | | | | 14,269 | | |

| Charles Schwab (The) Corp. | | | 1,691 | | | | 41,108 | | |

| Citigroup, Inc. | | | 1,044 | | | | 34,765 | | |

| Commonwealth Bank of Australia (Australia) | | | 6 | | | | 317 | | |

| Credit Suisse Group (China) | | | 422 | | | | 25,472 | | |

| Deerfield Triarc Capital Corp. REIT | | | 1,909 | | | | 14,337 | | |

| Delphi Financial Group, Inc., Class A | | | 149 | | | | 5,728 | | |

| Deutsche Bank AG (Germany) | | | 12 | | | | 1,582 | | |

| Digital Realty Trust, Inc. REIT | | | 351 | | | | 13,394 | | |

| Dollar Financial Corp.* | | | 149 | | | | 4,452 | | |

| Fortis (Belgium) | | | 44 | | | | 1,183 | | |

| Franklin Resources, Inc. | | | 351 | | | | 43,235 | | |

| GFI Group, Inc.* | | | 149 | | | | 14,510 | | |

See Notes to Financial Statements.

8

TDAX Funds, Inc.

SCHEDULE OF INVESTMENTS (CONTINUED)

TDAX INDEPENDENCE 2010 EXCHANGE-TRADED FUND

November 30, 2007 (Unaudited)

| | | Number

of Shares | | Market

Value | |

| FINANCIALS (Continued) | |

| Goldman Sachs Group (The), Inc. | | | 100 | | | $ | 22,664 | | |

| HBOS PLC (United Kingdom) | | | 831 | | | | 13,635 | | |

| Highwoods Properties, Inc. REIT | | | 349 | | | | 11,074 | | |

| HSBC Holdings PLC (United Kingdom) | | | 2,276 | | | | 38,842 | | |

| ING Groep N.V. (Netherlands) | | | 413 | | | | 16,083 | | |

| International Securities Exchange Holdings, Inc. | | | 149 | | | | 10,011 | | |

| Intesa Sanpaolo S.p.A (Italy) | | | 368 | | | | 2,944 | | |

| JPMorgan Chase & Co. | | | 598 | | | | 27,281 | | |

| Lincoln National Corp. | | | 598 | | | | 36,819 | | |

| Lloyds TSB Group PLC (United Kingdom) | | | 1,773 | | | | 18,045 | | |

| Mizuho Financial Group, Inc. (Japan) | | | 1 | | | | 5,364 | | |

| Morgan Stanley | | | 100 | | | | 5,272 | | |

Muenchener Rueckversicherungs-Gesellschaft AG

(Germany) | | | 30 | | | | 5,483 | | |

| National City Corp. | | | 1,193 | | | | 23,574 | | |

| Nomura Holdings, Inc. (Japan) | | | 900 | | | | 16,130 | | |

| Nordea Bank AB (Sweden) | | | 1,200 | | | | 20,137 | | |

| Northern Trust Corp. | | | 349 | | | | 28,266 | | |

| NYSE Euronext | | | 380 | | | | 32,908 | | |

| Odyssey Re Holdings Corp. | | | 349 | | | | 13,450 | | |

| optionsXpress Holdings, Inc. | | | 449 | | | | 13,654 | | |

| Platinum Underwriters Holdings Ltd. (Bermuda) | | | 102 | | | | 3,705 | | |

| Post Properties, Inc. REIT | | | 149 | | | | 5,410 | | |

| Prudential PLC (United Kingdom) | | | 440 | | | | 6,143 | | |

| Realty Income Corp. REIT | | | 449 | | | | 12,797 | | |

Royal Bank of Scotland Group PLC

(United Kingdom) | | | 2,411 | | | | 22,754 | | |

| Simon Property Group, Inc. REIT | | | 249 | | | | 24,514 | | |

| SLM Corp.* | | | 598 | | | | 22,772 | | |

| Societe Generale (France) | | | 36 | | | | 5,579 | | |

| Sumitomo Mitsui Financial Group, Inc. (Japan) | | | 1 | | | | 8,573 | | |

| Swiss Re (China) | | | 72 | | | | 5,354 | | |

| UBS AG (China) | | | 616 | | | | 31,208 | | |

| UniCredito Italiano S.p.A (Italy) | | | 1,944 | | | | 16,622 | | |

| Vornado Realty Trust REIT | | | 149 | | | | 13,410 | | |

| Wachovia Corp. | | | 451 | | | | 19,393 | | |

| Waddell & Reed Financial, Inc., Class A | | | 149 | | | | 5,093 | | |

| Wells Fargo & Co. | | | 598 | | | | 19,393 | | |

| Westpac Banking Corp. (Australia) | | | 145 | | | | 3,633 | | |

| Zurich Financial Services AG (China) | | | 36 | | | | 10,498 | | |

| | | | | | | | 1,064,989 | | |

| HEALTH CARE—4.2% | |

| Abbott Laboratories | | | 598 | | | | 34,391 | | |

| Alexion Pharmaceuticals, Inc.* | | | 81 | | | | 5,890 | | |

| AMERIGROUP Corp.* | | | 351 | | | | 12,064 | | |

| AstraZeneca PLC (United Kingdom) | | | 212 | | | | 10,069 | | |

| Auxilium Pharmaceuticals, Inc.* | | | 269 | | | | 7,545 | | |

| Becton, Dickinson & Co. | | | 498 | | | | 41,200 | | |

| CIGNA Corp. | | | 498 | | | | 26,698 | | |

| Dendreon Corp.* | | | 703 | | | | 3,515 | | |

| Genzyme Corp.* | | | 598 | | | | 44,808 | | |

| GlaxoSmithKline PLC (United Kingdom) | | | 910 | | | | 24,100 | | |

| Hologic, Inc.* | | | 149 | | | | 9,892 | | |

| Illumina, Inc.* | | | 149 | | | | 8,611 | | |

| Johnson & Johnson | | | 1,044 | | | | 70,721 | | |

| Magellan Health Services, Inc.* | | | 149 | | | | 6,772 | | |

| Matria Healthcare, Inc.* | | | 449 | | | | 10,201 | | |

| | | Number

of Shares | | Market

Value | |

| HEALTH CARE (Continued) | |

| McKesson Corp. | | | 498 | | | $ | 33,232 | | |

| Merck & Co., Inc. | | | 745 | | | | 44,223 | | |

| Novartis AG (China) | | | 550 | | | | 31,347 | | |

| Pfizer, Inc. | | | 3,186 | | | | 75,700 | | |

| Roche Holding AG (China) | | | 194 | | | | 37,028 | | |

| Sanofi-Aventis SA (France) | | | 54 | | | | 5,153 | | |

| STERIS Corp. | | | 149 | | | | 4,166 | | |

| Takeda Pharmaceutical Co. Ltd. (Japan) | | | 100 | | | | 6,401 | | |

| Thermo Fisher Scientific, Inc.* | | | 745 | | | | 42,942 | | |

| UnitedHealth Group, Inc. | | | 449 | | | | 24,695 | | |

| Ventana Medical Systems, Inc.* | | | 149 | | | | 13,234 | | |

| WellPoint, Inc.* | | | 149 | | | | 12,547 | | |

| | | | | | | | 647,145 | | |

| INDUSTRIALS—3.3% | |

| ABB Ltd. (China) | | | 487 | | | | 14,312 | | |

| Aecom Technology Corp.* | | | 311 | | | | 8,269 | | |

| Allegiant Travel Co.* | | | 378 | | | | 13,381 | | |

| Boeing Co. | | | 351 | | | | 32,482 | | |

| Brady Corp., Class A | | | 349 | | | | 13,970 | | |

| Caterpillar, Inc. | | | 349 | | | | 25,093 | | |

| CDI Corp. | | | 449 | | | | 11,975 | | |

| Compagnie de Saint-Gobain (France) | | | 50 | | | | 4,936 | | |

| Danaher Corp. | | | 100 | | | | 8,682 | | |

| Emerson Electric Co. | | | 449 | | | | 25,602 | | |

| FedEx Corp. | | | 100 | | | | 9,847 | | |

| Fuel Tech, Inc.* | | | 675 | | | | 16,477 | | |

| General Electric Co. | | | 1,242 | | | | 47,555 | | |

| Granite Construction, Inc. | | | 149 | | | | 6,112 | | |

| IKON Office Solutions, Inc. | | | 149 | | | | 1,882 | | |

| Illinois Tool Works, Inc. | | | 149 | | | | 8,270 | | |

| Ingersoll-Rand Co., Ltd., Class A (Bermuda) | | | 90 | | | | 4,648 | | |

| JetBlue Airways Corp.* | | | 1,379 | | | | 9,653 | | |

Koninklijke (Royal) Philips Electronics N.V.

(Netherlands) | | | 203 | | | | 8,540 | | |

| Manpower, Inc. | | | 149 | | | | 9,104 | | |

| Mitsubishi Corp. (Japan) | | | 300 | | | | 8,600 | | |

| Northrop Grumman Corp. | | | 451 | | | | 35,534 | | |

| PHH Corp.* | | | 149 | | | | 3,302 | | |

| Raven Industries, Inc. | | | 349 | | | | 12,121 | | |

| Schneider Electric SA (France) | | | 9 | | | | 1,260 | | |

| Siemens AG (Germany) | | | 84 | | | | 12,789 | | |

| Simpson Manufacturing Co., Inc. | | | 449 | | | | 11,948 | | |

| Trane, Inc. | | | 598 | | | | 21,953 | | |

| Union Pacific Corp. | | | 100 | | | | 12,614 | | |

| United Parcel Service, Inc., Class B | | | 351 | | | | 25,862 | | |

| United Technologies Corp. | | | 947 | | | | 70,806 | | |

| | | | | | | | 497,579 | | |

| INFORMATION TECHNOLOGY—4.3% | |

| Accenture Ltd., Class A (Bermuda) | | | 239 | | | | 8,260 | | |

| Agilysys, Inc. | | | 149 | | | | 2,070 | | |

| Amkor Technology, Inc.* | | | 598 | | | | 4,928 | | |

| Ansoft Corp.* | | | 351 | | | | 10,183 | | |

| Benchmark Electronics, Inc.* | | | 149 | | | | 2,675 | | |

| CANON, Inc. (Japan) | | | 300 | | | | 15,713 | | |

| Cisco Systems, Inc.* | | | 1,044 | | | | 29,253 | | |

| eBay, Inc.* | | | 800 | | | | 26,824 | | |

See Notes to Financial Statements.

9

TDAX Funds, Inc.

SCHEDULE OF INVESTMENTS (CONTINUED)

TDAX INDEPENDENCE 2010 EXCHANGE-TRADED FUND

November 30, 2007 (Unaudited)

| | | Number

of Shares | | Market

Value | |

| INFORMATION TECHNOLOGY (Continued) | |

| Entegris, Inc.* | | | 296 | | | $ | 2,563 | | |

| FLIR Systems, Inc.* | | | 149 | | | | 10,241 | | |

| Foundry Networks, Inc.* | | | 449 | | | | 7,916 | | |

| Hewlett-Packard Co. | | | 449 | | | | 22,971 | | |

| Intel Corp. | | | 1,146 | | | | 29,888 | | |

| International Business Machines Corp. | | | 149 | | | | 15,672 | | |

| Ixia* | | | 900 | | | | 9,297 | | |

| Jack Henry & Associates, Inc. | | | 149 | | | | 3,987 | | |

| Juniper Networks, Inc.* | | | 598 | | | | 17,773 | | |

| Lawson Software, Inc.* | | | 628 | | | | 6,104 | | |

| Microsoft Corp. | | | 1,993 | | | | 66,964 | | |

| Motorola, Inc. | | | 4,426 | | | | 70,682 | | |

| MPS Group, Inc.* | | | 149 | | | | 1,654 | | |

| Nintendo Co. Ltd. (Japan) | | | 4 | | | | 2,434 | | |

| Nokia Oyj (Finland) | | | 775 | | | | 31,022 | | |

| Nuance Communications, Inc.* | | | 658 | | | | 13,278 | | |

| ON Semiconductor Corp.* | | | 598 | | | | 5,496 | | |

| Orbcomm, Inc.* | | | 1,548 | | | | 12,059 | | |

| Perficient, Inc.* | | | 449 | | | | 7,530 | | |

| Perot Systems Corp., Class A* | | | 451 | | | | 5,931 | | |

| SAIC, Inc.* | | | 568 | | | | 11,326 | | |

| SAP AG (Germany) | | | 127 | | | | 6,513 | | |

| SAVVIS, Inc.* | | | 143 | | | | 4,582 | | |

| Sonus Networks, Inc.* | | | 721 | | | | 4,744 | | |

| Sun Microsystems, Inc.* | | | 5,748 | | | | 119,442 | | |

| Sybase, Inc.* | | | 149 | | | | 3,820 | | |

| Symantec Corp.* | | | 1,047 | | | | 18,637 | | |

| Telefonaktiebolaget LM Ericsson (Sweden) | | | 6,000 | | | | 14,652 | | |

| ValueClick, Inc.* | | | 449 | | | | 10,614 | | |

| Veeco Instruments, Inc.* | | | 449 | | | | 7,534 | | |

| Xerox Corp. | | | 745 | | | | 12,576 | | |

| | | | | | | | 657,808 | | |

| MATERIALS—1.9% | |

| A. Schulman, Inc. | | | 149 | | | | 3,212 | | |

| Alcoa, Inc. | | | 449 | | | | 16,330 | | |

| Anglo American PLC (United Kingdom) | | | 403 | | | | 27,229 | | |

| ArcelorMittal (Luxembourg) | | | 75 | | | | 5,550 | | |

| BASF AG (Germany) | | | 30 | | | | 4,173 | | |

| Bayer AG (Germany) | | | 48 | | | | 3,970 | | |

| BHP Billiton Ltd. (Australia) | | | 416 | | | | 15,813 | | |

| BHP Billiton PLC (United Kingdom) | | | 604 | | | | 19,958 | | |

| CF Industries Holdings, Inc. | | | 149 | | | | 13,556 | | |

| Dow Chemical (The) Co. | | | 349 | | | | 14,637 | | |

| E.I. du Pont de Nemours & Co. | | | 449 | | | | 20,721 | | |

| Headwaters, Inc.* | | | 149 | | | | 1,788 | | |

| JFE Holdings, Inc. (Japan) | | | 302 | | | | 16,471 | | |

| NIPPON STEEL Corp. (Japan) | | | 3,000 | | | | 17,985 | | |

| Quanex Corp. | | | 149 | | | | 7,456 | | |

| Rio Tinto PLC (United Kingdom) | | | 218 | | | | 25,281 | | |

| Southern Copper Corp. | | | 249 | | | | 27,551 | | |

| Terra Industries, Inc.* | | | 319 | | | | 12,052 | | |

| Weyerhaeuser Co. | | | 349 | | | | 25,540 | | |

| Xstrata PLC (United Kingdom) | | | 140 | | | | 9,842 | | |

| | | | | | | | 289,115 | | |

| | | Number

of Shares | | Market

Value | |

| TELECOMMUNICATION SERVICES—1.4% | |

| AT&T, Inc. | | | 1,495 | | | $ | 57,124 | | |

| BT Group PLC (United Kingdom) | | | 1,441 | | | | 8,496 | | |

| Golden Telecom, Inc.* | | | 149 | | | | 15,118 | | |

| Koninklijke (Royal) KPN N.V. (Netherlands) | | | 260 | | | | 4,793 | | |

| Qwest Communications International, Inc.* | | | 5,994 | | | | 39,740 | | |

| Telefonica S.A. (Spain) | | | 670 | | | | 22,531 | | |

| Time Warner Telecom, Inc., Class A* | | | 254 | | | | 5,697 | | |

| Verizon Communications, Inc. | | | 598 | | | | 25,840 | | |

| Vodafone Group PLC (United Kingdom) | | | 10,768 | | | | 40,340 | | |

| | | | | | | | 219,679 | | |

| UTILITIES—1.3% | |

| American Electric Power Co., Inc. | | | 449 | | | | 21,404 | | |

| Constellation Energy Group, Inc. | | | 351 | | | | 35,174 | | |

| E.ON AG (Germany) | | | 36 | | | | 7,362 | | |

| Endesa S.A. (Spain) | | | 337 | | | | 18,590 | | |

| Enel S.p.A (Italy) | | | 484 | | | | 5,818 | | |

| Exelon Corp. | | | 745 | | | | 60,396 | | |

| National Grid PLC (United Kingdom) | | | 547 | | | | 9,240 | | |

| PNM Resources, Inc. | | | 149 | | | | 3,305 | | |

| RWE AG (Germany) | | | 33 | | | | 4,523 | | |

| Suez SA (France) | | | 66 | | | | 4,406 | | |

| Tokyo Electric Power (The) Co., Inc. (Japan) | | | 600 | | | | 16,389 | | |

| Westar Energy, Inc. | | | 149 | | | | 3,861 | | |

| | | | | | | | 190,468 | | |

Total Common Stocks

(Cost $5,069,724) | | | | | | | 4,957,616 | | |

| | | Principal

Amount | | Market

Value | |

| CORPORATE BONDS—36.7% | |

| CONSUMER DISCRETIONARY—1.9% | |

Comcast Cable Communications Holdings, Inc.

8.375%, 3/15/13 | | $ | 112,000 | | | | 126,056 | | |

Daimler Finance North America LLC

7.30%, 1/15/12 | | | 60,000 | | | | 64,939 | | |

Home Depot (The), Inc.

5.40%, 3/01/16 | | | 105,000 | | | | 99,666 | | |

| | | | | | | | 290,661 | | |

| CONSUMER STAPLES—1.7% | |

Diageo Finance BV (Netherlands)

5.30%, 10/28/15 | | | 75,000 | | | | 74,819 | | |

Kroger (The) Co.

5.50%, 2/01/13 | | | 45,000 | | | | 46,112 | | |

Wal-Mart Stores, Inc.

4.55%, 5/01/13 | | | 137,000 | | | | 136,492 | | |

| | | | | | | | 257,423 | | |

| ENERGY—2.2% | |

Apache Corp.

5.25%, 4/15/13 | | | 62,000 | | | | 63,633 | | |

Enterprise Products Operating LP, Series B

5.60%, 10/15/14 | | | 59,000 | | | | 59,758 | | |

Hess Corp.

6.65%, 8/15/11 | | | 80,000 | | | | 85,136 | | |

See Notes to Financial Statements.

10

TDAX Funds, Inc.

SCHEDULE OF INVESTMENTS (CONTINUED)

TDAX INDEPENDENCE 2010 EXCHANGE-TRADED FUND

November 30, 2007 (Unaudited)

| | | Principal

Amount | | Market

Value | |

| ENERGY (Continued) | |

Kinder Morgan Energy Partners L.P.

6.75%, 3/15/11 | | $ | 35,000 | | | $ | 36,833 | | |

Spectra Energy Capital LLC

6.25%, 2/15/13 | | | 90,000 | | | | 94,846 | | |

| | | | | | | | 340,206 | | |

| FINANCIALS—24.0% | |

American General Finance Corp., Series H MTN

5.375%, 10/01/12 | | | 120,000 | | | | 119,885 | | |

Ameriprise Financial, Inc.

5.35%, 11/15/10 | | | 81,000 | | | | 83,221 | | |

Bank of America Corp.

4.50%, 8/01/10 | | | 180,000 | | | | 180,415 | | |

Bank of America Corp.

4.875%, 1/15/13 | | | 15,000 | | | | 15,005 | | |

Boeing Capital Corp. Ltd.

5.80%, 1/15/13 | | | 60,000 | | | | 63,729 | | |

Boston Properties LP

6.25%, 1/15/13 | | | 109,000 | | | | 113,086 | | |

Capital One Financial Corp.

6.15%, 9/01/16 | | | 90,000 | | | | 83,848 | | |

Citigroup, Inc.

6.00%, 2/21/12 | | | 362,000 | | | | 374,843 | | |

Countrywide Home Loans, Inc., Series L MTN

4.00%, 3/22/11 | | | 33,000 | | | | 25,116 | | |

European Investment Bank (Supranational)

4.625%, 5/15/14 | | | 122,000 | | | | 125,085 | | |

General Electric Capital Corp., Series A MTN

5.875%, 2/15/12 | | | 111,000 | | | | 116,526 | | |

Genworth Financial, Inc.

5.75%, 6/15/14 | | | 60,000 | | | | 61,278 | | |

Goldman Sachs Group, L.P.

5.00%, 10/01/14 | | | 212,000 | | | | 207,190 | | |

Goldman Sachs Group (The), Inc.

3.875%, 1/15/09 | | | 75,000 | | | | 74,187 | | |

HSBC Finance Corp.

6.375%, 11/27/12 | | | 152,000 | | | | 158,837 | | |

| 5.50%, 1/19/16 | | | 100,000 | | | | 99,029 | | |

International Lease Finance Corp., Series Q MTN

5.75%, 6/15/11 | | | 152,000 | | | | 154,841 | | |

iStar Financial, Inc., Series 1

5.875%, 3/15/16 | | | 55,000 | | | | 45,067 | | |

John Deere Capital Corp.

7.00%, 3/15/12 | | | 60,000 | | | | 65,693 | | |

JPMorgan Chase & Co.

5.75%, 1/02/13 | | | 75,000 | | | | 76,866 | | |

Kreditanstalt fuer Wiederaufbau (Germany)

4.25%, 6/15/10 | | | 111,000 | | | | 113,464 | | |

Lehman Brothers Holdings, Inc. MTN

5.50%, 4/04/16 | | | 90,000 | | | | 86,506 | | |

Marsh & McLennan Cos., Inc.

5.75%, 9/15/15 | | | 88,000 | | | | 88,346 | | |

Merrill Lynch & Co., Inc., Series C MTN

5.00%, 1/15/15 | | | 242,000 | | | | 228,253 | | |

MetLife, Inc.

5.00%, 6/15/15 | | | 60,000 | | | | 57,840 | | |

Morgan Stanley

5.05%, 1/21/11 | | | 100,000 | | | | 100,151 | | |

| 5.30%, 3/01/13 | | | 162,000 | | | | 160,685 | | |

| | | Principal

Amount | | Market

Value | |

| FINANCIALS (Continued) | |

National Rural Utilities Cooperative

Finance Corp., Series C MTN

7.25%, 3/01/12 | | $ | 66,000 | | | $ | 71,891 | | |

Residential Capital LLC

6.375%, 6/30/10 | | | 10,000 | | | | 6,700 | | |

Royal Bank of Scotland Group PLC

(United Kingdom)

5.00%, 10/01/14 | | | 85,000 | | | | 85,313 | | |

SLM Corp., Series A MTN

5.375%, 5/15/14 | | | 40,000 | | | | 35,355 | | |

Wachovia Corp.

5.25%, 8/01/14 | | | 212,000 | | | | 206,697 | | |

Wells Fargo & Co.

5.00%, 11/15/14 | | | 188,000 | | | | 185,567 | | |

| | | | | | | | 3,670,515 | | |

| HEALTH CARE—1.3% | |

AmerisourceBergen Corp.

5.875%, 9/15/15 | | | 60,000 | | | | 60,879 | | |

UnitedHealth Group, Inc.

4.875%, 3/15/15 | | | 87,000 | | | | 83,847 | | |

WellPoint, Inc.

5.25%, 1/15/16 | | | 56,000 | | | | 54,325 | | |

| | | | | | | | 199,051 | | |

| INDUSTRIALS—0.6% | |

United Technologies Corp.

4.375%, 5/01/10 | | | 90,000 | | | | 90,330 | | |

| INFORMATION TECHNOLOGY—0.9% | |

International Business Machines Corp.

4.25%, 9/15/09 | | | 66,000 | | | | 66,460 | | |

Oracle Corp.

5.25%, 1/15/16 | | | 66,000 | | | | 66,061 | | |

| | | | | | | | 132,521 | | |

| MATERIALS—0.6% | |

Alcoa, Inc.

6.00%, 1/15/12 | | | 95,000 | | | | 98,896 | | |

| TELECOMMUNICATION SERVICES—2.3% | |

Embarq Corp.

7.082%, 6/01/16 | | | 48,000 | | | | 50,140 | | |

New Cingular Wireless Services, Inc.

7.875%, 3/01/11 | | | 175,000 | | | | 189,907 | | |

Sprint Capital Corp.

8.375%, 3/15/12 | | | 97,000 | | | | 104,093 | | |

| | | | | | | | 344,140 | | |

| UTILITIES—1.2% | |

Constellation Energy Group, Inc.

4.55%, 6/15/15 | | | 50,000 | | | | 46,395 | | |

Dominion Resources, Inc., Series C

5.15%, 7/15/15 | | | 99,000 | | | | 96,008 | | |

Exelon Generation Co. LLC

5.35%, 1/15/14 | | | 35,000 | | | | 34,385 | | |

| | | | | | | | 176,788 | | |

Total Corporate Bonds

(Amortized Cost $5,538,541) | | | | | | | 5,600,531 | | |

See Notes to Financial Statements.

11

TDAX Funds, Inc.

SCHEDULE OF INVESTMENTS (CONTINUED)

TDAX INDEPENDENCE 2010 EXCHANGE-TRADED FUND

November 30, 2007 (Unaudited)

| | | Principal

Amount | | Market

Value | |

UNITED STATES GOVERNMENT & AGENCIES

OBLIGATIONS—27.7% | |

| FEDERAL HOME LOAN MORTGAGE CORP.—5.0% | |

| 4.50%, 1/15/13 | | $ | 756,000 | | | $ | 771,887 | | |

| FEDERAL NATIONAL MORTGAGE ASSOCIATION—6.0% | |

| 5.00%, 9/15/08 | | | 541,000 | | | | 545,379 | | |

| 5.00%, 4/15/15 | | | 350,000 | | | | 364,982 | | |

| | | | | | | | 910,361 | | |

| UNITED STATES TREASURY BONDS/NOTES—16.7% | |

| 5.125%, 6/30/08 | | | 75,000 | | | | 75,773 | | |

| 4.75%, 11/15/08 | | | 425,000 | | | | 430,910 | | |

| 6.00%, 8/15/09 | | | 1,374,000 | | | | 1,440,447 | | |

| 3.50%, 2/15/10 | | | 405,000 | | | | 408,892 | | |

| 4.75%, 5/15/14 | | | 188,000 | | | | 200,044 | | |

| | | | | | | | 2,556,066 | | |

Total United States Government &

Agencies Obligations

(Amortized Cost $4,154,648) | | | | | | | 4,238,314 | | |

| SOVEREIGN BONDS—1.3% | |

| SOVEREIGN—1.3% | |

Italy Government International Bond (Italy)

6.00%, 2/22/11 | | | 131,000 | | | | 140,338 | | |

United Mexican States, Series A MTN (Mexico)

6.375%, 1/16/13 | | | 58,000 | | | | 61,741 | | |

Total Sovereign Bonds

(Amortized Cost $197,044) | | | | | | | 202,079 | | |

Total Investments—98.2%

(Amortized Cost $14,959,957) | | | | | | $ | 14,998,540 | | |

| Other assets less liabilities—1.8% | | | | | | | 279,149 | | |

| Net Assets—100.0% | | | | | | $ | 15,277,689 | | |

MTN - Medium Term Note.

REIT - Real Estate Investment Trust.

* Non-income producing security.

See Notes to Financial Statements.

12

TDAX Funds, Inc.

SCHEDULE OF INVESTMENTS

TDAX INDEPENDENCE 2020 EXCHANGE-TRADED FUND

November 30, 2007 (Unaudited)

| | | Number

of Shares | | Market

Value | |

| COMMON STOCKS—65.8% | |

| CONSUMER DISCRETIONARY—6.7% | |

| Aeropostale, Inc.* | | | 1,491 | | | $ | 38,095 | | |

| ArvinMeritor, Inc. | | | 2,226 | | | | 22,505 | | |

| Brookfield Homes Corp. | | | 1,485 | | | | 25,037 | | |

| Cabela's, Inc., Class A* | | | 138 | | | | 2,283 | | |

| Coach, Inc.* | | | 2,226 | | | | 82,674 | | |

| Comcast Corp., Class A* | | | 5,817 | | | | 119,481 | | |

Compagnie Financiere Richemont SA,

Class A (China) | | | 282 | | | | 19,407 | | |

| Daimler AG (Germany) | | | 279 | | | | 28,483 | | |

| DeVry, Inc. | | | 746 | | | | 41,015 | | |

| DIRECTV Group (The), Inc.* | | | 5,955 | | | | 148,100 | | |

| Fleetwood Enterprises, Inc.* | | | 3,711 | | | | 20,299 | | |

| Gemstar-TV Guide International, Inc.* | | | 3,384 | | | | 19,966 | | |

| Home Depot (The), Inc. | | | 1,623 | | | | 46,353 | | |

| HONDA MOTOR Co. Ltd. (Japan) | | | 1,800 | | | | 61,014 | | |

| J. Crew Group, Inc.* | | | 528 | | | | 25,370 | | |

| Jo-Ann Stores, Inc.* | | | 1,035 | | | | 17,036 | | |

| Jos. A. Bank Clothiers, Inc.* | | | 746 | | | | 19,314 | | |

| Lear Corp.* | | | 702 | | | | 20,667 | | |

| Liberty Global, Inc., Class A* | | | 1,605 | | | | 65,195 | | |

| Live Nation, Inc.* | | | 999 | | | | 13,407 | | |

| Matsushita Electric Industrial Co. Ltd. (Japan) | | | 1,000 | | | | 20,149 | | |

| McDonald's Corp. | | | 2,850 | | | | 166,639 | | |

| Men's Wearhouse (The), Inc. | | | 746 | | | | 25,752 | | |

| New York & Co., Inc.* | | | 3,987 | | | | 29,384 | | |

| Omnicom Group, Inc. | | | 885 | | | | 43,144 | | |

| Priceline.com, Inc.* | | | 138 | | | | 15,704 | | |

| Regis Corp. | | | 138 | | | | 4,056 | | |

| Sony Corp. (Japan) | | | 1,600 | | | | 86,689 | | |

| Sotheby's | | | 746 | | | | 27,938 | | |

| Speedway Motorsports, Inc. | | | 138 | | | | 4,658 | | |

| Steven Madden Ltd.* | | | 879 | | | | 19,980 | | |

| Target Corp. | | | 2,226 | | | | 133,694 | | |

| Tempur-Pedic International, Inc. | | | 1,491 | | | | 44,268 | | |

| Time Warner, Inc. | | | 4,728 | | | | 81,605 | | |

| Toyota Motor Corp. (Japan) | | | 3,608 | | | | 202,964 | | |

| Universal Technical Institute, Inc.* | | | 1,485 | | | | 26,181 | | |

| Viacom, Inc., Class B* | | | 3,292 | | | | 138,330 | | |

| Yum! Brands, Inc. | | | 3,103 | | | | 115,276 | | |

| | | | | | | | 2,022,112 | | |

| CONSUMER STAPLES—5.8% | |

| Altria Group, Inc. | | | 3,103 | | | | 240,669 | | |

British American Tobacco PLC

(United Kingdom) | | | 558 | | | | 21,650 | | |

| Carrefour SA (France) | | | 313 | | | | 24,309 | | |

| Coca-Cola (The) Co. | | | 3,491 | | | | 216,791 | | |

| ConAgra Foods, Inc. | | | 4,455 | | | | 111,464 | | |

| CVS Caremark Corp. | | | 746 | | | | 29,907 | | |

| Diageo PLC (United Kingdom) | | | 1,095 | | | | 24,609 | | |

| Groupe DANONE (France) | | | 42 | | | | 3,715 | | |

| Kraft Foods, Inc., Class A | | | 2,970 | | | | 102,614 | | |

| Longs Drug Stores Corp. | | | 746 | | | | 39,478 | | |

| Nestle SA (China) | | | 385 | | | | 185,160 | | |

| Pilgrim's Pride Corp. | | | 746 | | | | 19,456 | | |

| Procter & Gamble (The) Co. | | | 4,628 | | | | 342,471 | | |

| Seaboard Corp. | | | 12 | | | | 18,108 | | |

| | | Number

of Shares | | Market

Value | |

| CONSUMER STAPLES (Continued) | |

| Tesco PLC (United Kingdom) | | | 8,690 | | | $ | 85,587 | | |

| Unilever NV (Netherlands) | | | 1,767 | | | | 62,638 | | |

| Unilever PLC (United Kingdom) | | | 102 | | | | 3,742 | | |

| Wal-Mart Stores, Inc. | | | 4,728 | | | | 226,471 | | |

| | | | | | | | 1,758,839 | | |

| ENERGY—6.3% | |

| Alon USA Energy, Inc. | | | 746 | | | | 20,754 | | |

| BG Group PLC (United Kingdom) | | | 1,599 | | | | 33,470 | | |

| BP PLC (United Kingdom) | | | 16,561 | | | | 200,906 | | |

| Chevron Corp. | | | 2,489 | | | | 218,460 | | |

| ConocoPhillips | | | 2,369 | | | | 189,615 | | |

| Dril-Quip, Inc.* | | | 746 | | | | 42,089 | | |

| ENI S.p.A (Italy) | | | 476 | | | | 17,027 | | |

| EOG Resources, Inc. | | | 2,126 | | | | 175,990 | | |

| Exxon Mobil Corp. | | | 4,053 | | | | 361,364 | | |

| International Coal Group, Inc.* | | | 5,406 | | | | 27,084 | | |

| Newpark Resources, Inc.* | | | 4,119 | | | | 22,160 | | |

| Occidental Petroleum Corp. | | | 879 | | | | 61,328 | | |

| Oil States International, Inc.* | | | 746 | | | | 23,656 | | |

| Oilsands Quest, Inc.* | | | 4,583 | | | | 20,624 | | |

| PetroHawk Energy Corp.* | | | 1,623 | | | | 26,455 | | |

| Petroleum Development Corp.* | | | 746 | | | | 37,800 | | |

Royal Dutch Shell PLC, Class A

(United Kingdom) | | | 3,366 | | | | 136,067 | | |

Royal Dutch Shell PLC, Class B

(United Kingdom) | | | 2,507 | | | | 100,621 | | |

| Schlumberger Ltd. (Netherlands Antilles) | | | 1,047 | | | | 97,842 | | |

| Total SA (France) | | | 857 | | | | 69,476 | | |

| W-H Energy Services, Inc.* | | | 746 | | | | 37,673 | | |

| | | | | | | | 1,920,461 | | |

| FINANCIALS—14.0% | |

| ABN AMRO Holding NV (Netherlands) | | | 902 | | | | 47,664 | | |

| Allianz SE (Germany) | | | 301 | | | | 62,297 | | |

| American Express Co. | | | 5,472 | | | | 322,738 | | |

| American International Group, Inc. | | | 1,541 | | | | 89,578 | | |

| Aspen Insurance Holdings Ltd. (Bermuda) | | | 1,023 | | | | 29,462 | | |

| Assicurazioni Generali S.p.A (Italy) | | | 180 | | | | 8,283 | | |

Australia & New Zealand Banking

Group Ltd. (Australia) | | | 139 | | | | 3,462 | | |

| Aviva PLC (United Kingdom) | | | 1,473 | | | | 20,656 | | |

| AXA (France) | | | 879 | | | | 36,036 | | |

| Banco Bilbao Vizcaya Argentaria, S.A. (Spain) | | | 480 | | | | 11,985 | | |

| Banco Santander S.A. (Spain) | | | 9,542 | | | | 205,050 | | |

| Bank of America Corp. | | | 3,103 | | | | 143,141 | | |

| Barclays PLC (United Kingdom) | | | 6,705 | | | | 77,618 | | |

| BNP Paribas (France) | | | 291 | | | | 32,954 | | |

| Calamos Asset Management, Inc., Class A | | | 1,485 | | | | 43,971 | | |

| Cascade Bancorp | | | 1,485 | | | | 25,750 | | |

| Charles Schwab (The) Corp. | | | 6,350 | | | | 154,369 | | |

| Citigroup, Inc. | | | 3,987 | | | | 132,767 | | |