Exhibit 4.4

Execution Copy

SHARE SUBSCRIPTION AGREEMENT

THIS SHARE SUBSCRIPTION AGREEMENT (this “Agreement”) is made and entered into as of August 9, 2006 by and among:

| (1) | JA Development Co., Ltd., a company incorporated under the laws of the British Virgin Islands (the “Company”); |

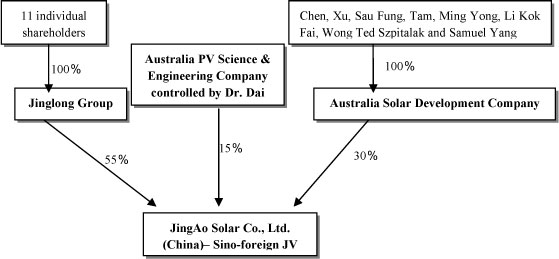

| (2) | JingAo Solar Co., Ltd. , currently an equity joint venture established under the laws of the PRC (“JingAo China”); , currently an equity joint venture established under the laws of the PRC (“JingAo China”); |

(parties (1) and (2) and all other direct or indirect subsidiaries of the foregoing are hereinafter referred to collectively as “Group Companies” and each individually as a “Group Company”); and

| (3) | Leeway Asia L.P., a Cayman Islands limited partnership (the“Investor”). |

RECITALS

WHEREAS, the Company desires to issue and allot to the Investor and the Investor desires to subscribe for up to 582 Series A Preferred Shares of the Company, with no par value (“Series A Shares”) at an aggregate subscription price of US$10,000,000, subject to the terms and conditions set forth in this Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing recitals, the mutual promises hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1.DEFINITIONS. For purposes of this Agreement the following terms shall have the following meanings:

1.1. “Affiliates” shall mean any individual, partnership, corporation, trust or other entity that directly or indirectly controls, or is controlled by, or is under common control with, such person, where control means the direct or indirect ownership of more than 50% of the outstanding shares or other ownership interests having ordinary voting power to elect directors or the equivalent and, in the case of any shareholder that is an investment fund or account (or a subsidiary of any such investment fund or account), the term “Affiliates” shall include any other investment fund or account (or a subsidiary of any such investment fund or account) managed by the manager of such shareholder (or, if such shareholder is a subsidiary of an investment fund or account, the investment fund or account of which such shareholder is a subsidiary) and any person who succeeds such manager as the manager of such investment fund or account, as applicable.

1.2. “Board” shall mean the board of directors of the Company.

1.3. “Business Day” shall mean any day (excluding Saturdays, Sundays and public holidays in the PRC) on which banks generally are open for business in the PRC.

1.4. “Controlled Account” shall mean a bank account to be opened in the name of the Company at a bank to be agreed by the parties, with one signatory appointed by the Company and one signatory appointed by the Investor, and any payment out of which shall require the signature of both signatories;

1.5. “Intellectual Property” shall mean all intellectual property, including, without limitation, patents, trademarks, trade names, copyrights, proprietary information and rights, service marks, domain names, mask works, trade secrets, know-how, business processes, all computer software including the codes, inventions, information, processes, formulas, applications, design, drawings, technical data, and all documentation related to any of the foregoing.

1.6. “Key Shareholders” shall have the meaning given to it inExhibit C hereto.

1.7. “Material Adverse Effect” shall mean any change, event or effect (“Effect”) that may be materially adverse to the general affairs, business, operations, assets, condition (financial or otherwise), or results of operations of the Group Companies taken as a whole;provided,however, that in no event shall any of the following be deemed, either alone or in combination, to constitute, nor shall any of the following be taken into account in determining whether there has been, a Material Adverse Effect: (i) any Effect that results from changes in general economic conditions or as a result of war or an act of terrorism, (ii) any Effect that results from any action taken pursuant to or in accordance with this Agreement or at the request of the Investor provided that in carrying out such action which was requested by the Investor, any of the relevant Group Companies was not negligent, fraudulent or in willful default, or (iii) any issue or condition which the Company may reasonably demonstrate was known to the Investor prior to the date of this Agreement or has been disclosed in the Disclosure Schedule.

1.8. “Plan of Restructuring” shall mean the Plan of Restructuring attached hereto asExhibit E.

1.9. “PRC” shall mean the People’s Republic of China.

1.10. “Share Option Plan” shall mean the share option plan attached hereto asExhibit D.

1.11. “US GAAP” shall mean the generally accepted accounting principles in the United States.

1.12. “US$” shall mean United States dollars.

2

2.AGREEMENT TO SUBSCRIBE FOR AND ALLOT SHARES.

2.1.Authorization. As of the Closing (as defined below), the Company will have authorized the issuance, pursuant to the terms and conditions of this Agreement, of 582 Series A Shares having the rights, preferences, privileges and restrictions as set forth in the Amended and Restated Memorandum and Articles of Association of the Company attached hereto asExhibit A (the “Restated Articles”).

2.2.Agreement to Subscribe for and Allot Series A Shares. Subject to the terms and conditions hereof, the Company hereby agrees to issue and allot to the Investor, and the Investor hereby agrees to subscribe for from the Company, on the Closing Date (as defined below), 582 Series A Shares for an aggregate subscription price of US$10,000,000 (the “Subscription Amount”).

2.3.Closing and Delivery. Subject to the fulfillment or valid waiver of the conditions set forth in Section 6, the closing of the subscription for Series A Shares by the Investor (the “Closing”) shall be held at the offices of Skadden, Arps, Slate, Meagher & Flom LLP, in Beijing, the PRC, on August 21, 2006. If the Closing does not occur on August 21, 2006, this Agreement shall expire. At the Closing, the Investor will deliver the Subscription Amount to the Controlled Account, the operation of which shall be separately agreed upon by the parties hereto. Upon the payment of the Subscription Amount, the Company shall, forthwith, issue a share certificate representing the Series A Shares subscribed for by the Investor, enter such subscription in its Register of Members and deliver to the Investor a certified copy of the Register of Members reflecting the issuance of the Series A Shares.

3.REPRESENTATIONS AND WARRANTIES OF THE GROUP COMPANIES.

The Group Companies (collectively, the “Covenantors”), jointly and severally, hereby represent and warrant to the Investor, except as set forth in the Disclosure Schedule (the “Disclosure Schedule”) attached to this Agreement asExhibit B, and as limited below, as of the date hereof and as of the date of the Closing, as set forth in this Section 3. The Investor acknowledges that the Disclosure Schedule may be revised and delivered to the Investor prior to Closing, provided that any such amendment shall not relate to any fact or matter having a Material Adverse Effect. In this Agreement, any reference to a party’s “knowledge” means such party’s actual current knowledge after due and diligent inquiries of officers, directors and other employees of such party reasonably believed to have knowledge of the matter in question.

3.l.Organization, Standing and Qualification. Each Group Company is duly organized, validly existing and in good standing (or equivalent status in the relevant jurisdiction) under, and by virtue of, the laws of the place of its incorporation or establishment and has all requisite power and authority to own its properties and assets and to carry on its business as now conducted and as proposed to be conducted, and to perform each of its obligations hereunder and under any agreement contemplated hereunder to which it is a party. Each Group Company is qualified to do business and is in good standing (or equivalent status in the relevant jurisdiction) in each jurisdiction where failure to be so qualified would have a Material Adverse Effect.

3

3.2.Capitalization.

(a) Immediately prior to the Closing, (A) the authorized share capital of the Company consists of a total of (i) ordinary shares of no par value (the “Common Shares”), of which 10,000 shares are issued and outstanding; and (ii) 582 authorized Series A Shares, of which none are issued and outstanding, and (B) the issued share capital of the Company and the holders thereof are as set out in the Disclosure Schedule.

Except for the Share Option Plan attached hereto as Exhibit D, there are no options, warrants, conversion privileges or other rights, or agreements with respect to the issuance thereof, presently outstanding to purchase any of the shares of the Company. Any options granted outside of the Share Option Plan shall be deducted from the number of shares reserved for issuance under the Share Option Plan. Except as provided in the Restated Articles, no shares of the Company’s outstanding share capital, or shares issuable by the Company, are subject to any preemptive rights, rights of first refusal or other rights to purchase such shares (whether in favor of the Company or any other person).

(b) Immediately prior to the Closing, JingAo China’s registered capital is RMB¥120,000,000, which has been paid in full. At the completion of the restructuring as set forth in the Plan of Restructuring, the Company which will be the sole shareholder of JingAo China. The registered capital is not subject to any encumbrance.

JingAo China is not a party to or bound by any contract, agreement or arrangement to allot or issue or sell or create any lien on any of its registered capital or any other security convertible into any registered capital or other security of JingAo China, other than the Transaction Agreements (as defined below). Except as provided for in the Transaction Agreements, there are no outstanding rights of first refusal or other rights, options, warrants, conversion privileges, subscriptions or other rights or agreements to purchase or otherwise acquire or issue any registered capital of JingAo China, or obligating JingAo China to issue, transfer, grant or sell any registered capital in JingAo China. Except for the Shareholders Agreement (as defined below), there are no shareholders agreements in respect of the Company or JingAo China.

3.3.Subsidiaries. Except for the Company’s ownership of JingAo China and as set forth in the Disclosure Schedule, no Group Company presently owns or controls, directly or indirectly, any interest in any other corporation, partnership, trust, joint venture, association or other entity.

3.4.Due Authorization. All corporate action on the part of the Group Companies and, as applicable, their respective officers, directors and shareholders necessary for the authorization, execution and delivery of this Agreement and the Shareholders Agreement in substantially the form attached hereto asExhibit C (the “Shareholders Agreement”) (this Agreement and the Shareholders Agreement collectively the “Transaction Agreements”), and the performance of all obligations of the Group Companies hereunder and thereunder, the authorization, issuance, reservation for issuance, allotment and delivery of (i) all Series A Shares being sold hereunder, and (ii) the Common Shares issuable upon conversion of such Series A Shares, has been or will be taken prior to the Closing. Each of the Transaction Agreements is a valid and binding obligation of the Group Companies, enforceable in accordance with their respective terms, subject, as to enforcement of remedies, to applicable bankruptcy, insolvency, moratorium, reorganization and similar laws affecting creditors’ rights generally and to general equitable principles.

4

3.5.Financial Statements. The Company has delivered to the Investor the unaudited consolidated financial statements for the period from its inception to December 31, 2005 and for the six months ended June 30, 2006 (collectively, the“Financial Statements”). The Financial Statements are accurate and complete in all material respects and present fairly the financial position of the Group Companies based on the Company’s best knowledge as of the respective dates thereof and the results of operations of the Group Companies for the periods covered thereby.

3.6.Valid Issuance of Series A Shares and Common Shares.

(a) The Series A Shares, when issued, sold and delivered in accordance with the terms of this Agreement and following receipt of any subscription monies owing to the Company, will be duly and validly authorized and issued, credited as fully paid and nonassessable.

(b) The Common Shares when issued upon conversion of the Series A Shares will be duly and validly authorized and issued, credited as fully paid and nonassessable.

(c) The outstanding capital shares of the Company are duly and validly authorized and issued, credited as fully paid and nonassessable, have been issued in accordance with all applicable laws, the Company’s Memorandum and Articles of Association and any relevant securities laws or pursuant to valid exemptions therefrom.

3.7.Compliance with Laws; Consents and Permits. None of the Group Companies is in violation of any applicable statute, rule, regulation, order or restriction of any domestic or foreign government or any instrumentality or agency thereof in respect of the conduct of its business or the ownership of its properties. All consents, permits, approvals, orders, authorizations or registrations, qualifications, designations, declarations or filings by or with any governmental authority and any third party which are required to be obtained or made by each Group Company in connection with the consummation of the transactions contemplated hereunder shall have been obtained or made prior to and be effective as of the Closing, the absence of which would prevent or materially delay the consummation of the transactions contemplated hereunder. Each Group Company has all franchises, permits, licenses, registrations and any similar authority necessary for the conduct of its business as currently conducted and as proposed to be conducted, the absence of which would be reasonably likely to have a Material Adverse Effect. None of the Group Companies is in default under any of such franchises, permits, licenses, registrations or other similar authority.

3.8.Title to Properties and Assets. Each Group Company has good and marketable title to its properties and assets held free and clear of any mortgage, pledge, lien, encumbrance, security interest or charge of any kind except such encumbrances or liens that arise in the ordinary course of business that do not materially impair such Group Company’s ownership or use of such property or assets. With respect to the property and assets it leases, each Group Company is in compliance with such leases and, to the best of its knowledge, such Group Company holds valid leasehold interests in such assets free of any liens, encumbrances, security interests or claims of any party other than the lessors of such property and assets.

5

3.9.Intellectual Property.

(a) Each Group Company has sufficient title and ownership of or licenses to the Intellectual Property necessary for its business as now conducted or proposed to be conducted without any conflict with or infringement of the rights of others, except for such items as have yet to be conceived or developed or that are expected to be available for licensing on reasonable terms from third parties.

(b) There are no outstanding options, licenses or agreements of any kind relating to the Intellectual Property used by the Group Companies, nor is any of the Group Companies bound by or a party to any options, licenses or agreements of any kind with respect to any Intellectual Property rights of any other person or entity, except, in either case, for end-user, object code, internal-use software license and support/maintenance agreements, and non-disclosure agreements.

(c) Each Group Company has taken all commercially reasonable security measures to protect the secrecy, confidentiality, and value of all the Intellectual Property required to conduct its business.

(d) None of the Group Companies has received any written communications alleging that any of the Group Companies has violated or, by conducting its business (including as proposed to be conducted by such Group Companies), would violate any of the Intellectual Property rights of any other person or entity.

(e) To the knowledge of the Covenantors, none of the Group Companies’ employees or consultants is obligated under any contract (including licenses, covenants or commitments of any nature) or other agreement, or subject to any judgment, decree or order of any court or administrative agency, that would interfere with the use of his or her best efforts to promote the interests of the Group Companies or that would conflict with the business of the Group Companies as proposed to be conducted.

(f) To the knowledge of the Covenantors, neither the execution nor delivery of any of the Transaction Agreements, nor the carrying on of the Group Companies’ business by the employees of the Group Companies, nor the conduct of the Group Companies’ business as proposed, will conflict with or result in a breach of the terms, conditions or provisions of, or constitute a default under, any contract, covenant or instrument under which any of such employees or consultants is now obligated. The Group Companies do not believe it is or will be necessary to utilize any inventions of any of their employees or consultants (or people it currently intends to hire) made prior to or outside the scope of their relationship with the Group Companies. All of the Group Companies’ registered patents, copyrights, trademarks and service marks are in full force and effect, are not subject to any taxes, and the Group Companies are current on all the maintenance fees with respect thereto.

3.10.Material Contracts and Obligations. All material agreements, contracts, leases, licenses, instruments, commitments, indebtedness, liabilities and other obligations to which each Group Company is a party or by which it is bound and which (i) are material to the conduct and operations of its business and properties, (ii) involve any of the officers, consultants, directors, employees or shareholders of the Group Company; or (iii) obligate such Group Company to share, license or develop any product or technology

6

(except licenses granted in the ordinary course of business), are listed in the Disclosure Schedule attached hereto asExhibit B and have been made available for inspection by the Investor and its counsel. For purposes of this Section 3.10, “material” shall mean (i) reasonably likely to result in consideration to any Group Company, or imposing liability or contingent liability on any Group Company, in excess of US$5,000,000 in the current fiscal year, (ii) which cannot be performed within its terms within 12 months after the date on which it was entered into or cannot be terminated on less than 12 months’ notice, (iii) containing exclusivity, non-competition, or similar clauses that impair, restrict or impose conditions on any Group Company’s right to offer or sell products or services in specified areas, during specified periods, or otherwise, (iv) transferring or licensing any Intellectual Property to or from any Group Company (other than licenses granted in the ordinary course of business or licenses for commercially readily available “off the shelf” computer software), (v) entered into not in the ordinary course of business or not on arm’s length terms or (vi) an agreement the termination of which would be reasonably likely to have a Material Adverse Effect.

3.11.Litigation. Except as set forth in the Disclosure Schedule, there is no action, suit, proceeding, claim, arbitration or investigation (“Action”) pending (or, to the knowledge of the Covenantors, currently threatened) against any of the Group Companies, any Group Company’s activities, properties or assets or, to the best of the Covenantors’ knowledge, against any officer, director or employee of each Group Company in connection with such officer’s, director’s or employee’s relationship with, or actions taken on behalf of, the Company, or otherwise that is likely to result, individually or in the aggregate, in any Material Adverse Effect on the business, properties, assets, financial condition, affairs of any Group Company. By way of example, but not by way of limitation, there are no Actions pending against any of the Group Companies or, to the knowledge of the Covenantors, threatened against any of the Group Companies, relating to the use by any employee of any Group Company of any information, technology or techniques allegedly proprietary to any of their former employers, clients or other parties. None of the Group Companies is a party to or subject to the provisions of any order, writ, injunction, judgment or decree of any court or government agency or instrumentality and there is no Action by any Group Company currently pending or which it intends to initiate.

3.12.Compliance with Other Instruments and Agreements. None of the Group Companies is in, nor shall the conduct of its business as currently or proposed to be conducted result in, violation, breach or default of any term of its constitutional documents (the “Constitutional Documents”), or in any material respect of any term or provision of any mortgage, indenture, contract, agreement or instrument to which the Group Company is a party or by which it may be bound, (the “Group Company Contracts”) or of any provision of any judgment, decree, order, statute, rule or regulation applicable to or binding upon the Group Company, and where the occurrence of such violation, breach or default would be reasonably likely to have a Material Adverse Effect. None of the activities, agreements, commitments or rights of any Group Company is ultra vires or unauthorized. The execution, delivery and performance of and compliance with the Transaction Agreements and the consummation of the transactions contemplated hereby and thereby will not result in any such violation, breach or default, or be in conflict with or constitute, with or without the passage of time or the giving of notice or both, either a default under any Group Company’s Constitutional Documents or any Group Company Contract, or, to the knowledge of the Covenantors, a violation of any statutes, laws, regulations or orders, or an event which results

7

in the creation of any lien, charge or encumbrance upon any asset of any Group Company and where the occurrence of such violation, breach of default would be reasonably likely to have a Material Adverse Effect, or prevent or materially delay the consummation of the transactions contemplated thereon.

3.13.Disclosure. Each of the Covenantors has provided the Investor with all the information that the Investor has reasonably requested in deciding whether to subscribe for Series A Shares and all such information is accurate in all material respects and not misleading in any material respect. No representation or warranty by the Covenantors in this Agreement contains any untrue statement of a material fact, or omits to state any material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances in which they are made, not materially misleading.

3.14.Registration Rights. Except as provided in the Shareholders Agreement, neither the Company nor any other Group Company has granted or agreed to grant any person or entity any registration rights (including piggyback registration rights) with respect to, nor is the Company obliged to list, any of the Company’s shares on any securities exchange. Except as contemplated under the Transaction Agreements, there are no voting or similar agreements that relate to the Company’s securities.

3.15.Material Liabilities. The Group Companies, taken as a whole, do not have any material liability or obligation, absolute or contingent (individually or in the aggregate), except (i) obligations and liabilities reflected on the Financial Statements, (ii) obligations incurred in the ordinary course of business that would not be required to be reflected in financial statements prepared in accordance with US GAAP, and (iii) obligations and liabilities disclosed in the Disclosure Schedule attached hereto asExhibit B.

3.16.Changes in Condition. Except as specifically set forth in this Agreement or in the Disclosure Schedule, since June 30, 2006, there has not been, other than those transactions and matters contemplated or implemented in accordance with the Transaction Agreements:

(a) any material adverse change in the assets, liabilities, financial condition or operating results of the Group Companies, taken as a whole, from that reflected in the most recent Financial Statements, if applicable, except changes in the ordinary course of business that have not been, individually or in the aggregate, materially adverse to the Group Companies, taken as a whole;

(b) any material change in the contingent obligations of the Group Companies, taken as a whole, by way of guarantee, endorsement, indemnity, warranty or otherwise;

(c) any damage, destruction or loss, whether or not covered by insurance, materially and adversely affecting the assets, properties, financial condition, operating results or business of the Group Companies, taken as a whole (as presently conducted and as presently proposed to be conducted), which is in excess of US$1,000,000;

(d) any waiver by any Group Company of a valuable right or of a material debt;

8

(e) any satisfaction or discharge of any lien, claim or encumbrance or payment of any obligation by any Group Company which is in excess of US$1,000,000, except such satisfaction, discharge or payment made in the ordinary course of business to the assets, properties, financial condition, operating results or business of such Group Company;

(f) any material change or amendment to a material contract or arrangement by which any Group Company or any of its assets or properties is bound or subject which is valued in excess of US$1,000,000, except for changes or amendments which are expressly provided for or disclosed in this Agreement;

(g) any material change in any compensation arrangement or agreement with any present or prospective employee, contractor or director;

(h) any sale, assignment or transfer of any material Intellectual Property or other material intangible assets of any Group Company which is valued in excess of US$1,000,000;

(i) any resignation or termination of any member of the Group Companies’ senior management;

(j) any mortgage, pledge, transfer of a security interest in, or lien created by any Group Company with respect to, any of such Group Company’s properties or assets, except liens for taxes not yet due or payable and except created in the normal course of business;

(k) any debt, obligation, or liability incurred, assumed or guaranteed by any Group Company individually in excess of US$500,000 or in excess of US$1,000,000 in the aggregate except where it is incurred, assumed or guaranteed pursuant to the then current business plan or budget;

(l) any declaration, setting aside or payment or other distribution in respect of any Group Company’s share capital, or any direct or indirect redemption, purchase or other acquisition of any of such share capital by any Group Company;

(m) any failure to conduct business in the ordinary course in any material respect;

(n) any other event or condition of any character which could reasonably be expected to have a Material Adverse Effect; or

(o) any agreement or commitment by a Group Company to do any of the things described in this Section 3.16.

3.17.Tax Matters. Except as set forth in the Disclosure Schedule, the provisions for taxes in the respective Financial Statements are sufficient for the payment of all accrued and unpaid applicable taxes of each Group Company. There have been no examinations or audits of any tax returns or reports by any applicable governmental agency. Each Group Company has duly filed all tax returns required to have been filed by it and paid all taxes shown to be due on such returns. Further, each Group Company has

9

duly withheld individual income taxes and adequately paid mandatory contributions to the statutory welfare or social security funds on behalf of all its employees in material compliance with the applicable regulations in each respective jurisdiction such that there shall be no material default or underpayment in respect of individual income taxes and mandatory contributions to the statutory social security funds. No Group Company is subject to any waivers of applicable statutes of limitations with respect to the taxes for any year. Since incorporation, none of the Group Companies has incurred any taxes or similar assessments other than in the ordinary course of business.

3.18.Related Party Transactions. Except as set forth in the Disclosure Schedule, no officer or director of a Group Company or any “Affiliate” or “Associate” (as those terms are defined in Rule 405 promulgated under the United States Securities Act of 1933, as amended (the “Securities Act”)) of any such person has any agreement, understanding, proposed transaction with, or is indebted to, any Group Company, nor is any Group Company indebted (or committed to make loans or extend or guarantee credit) to any of such persons (other than for accrued salaries, reimbursable expenses or other standard employee benefits). Except as set forth in the Disclosure Schedule, no officer or director of a Group Company has any direct or indirect ownership interest in any firm or corporation with which a Group Company is affiliated or with which a Group Company has a business relationship, or any firm or corporation that competes with a Group Company. Except as set forth in the Disclosure Schedule, no Affiliate or Associate of any officer or director of a Group Company is directly or indirectly interested in any material contract with a Group Company. Except as set forth in the Disclosure Schedule, no officer or director of a Group Company or any Affiliate or Associate of any such person has had, either directly or indirectly, a material interest in: (i) any person or entity which purchases from or sells, licenses or furnishes to a Group Company any goods, property, intellectual or other property rights or services; or (ii) any contract or agreement to which a Group Company is a party or by which it may be bound or affected.

3.19.Employee Matters. Except as set forth in the Disclosure Schedule, each Group Company has complied in all material aspects with all applicable employment and labor laws. To the knowledge of the Covenantors, none of the Group Companies’ officers or key employees intends to terminate their employment with any Group Company, nor does any Group Company have a present intention to terminate the employment of any officer or key employee.

3.20.Financial Advisor Fees. There exists no agreement or understanding between any Group Company or any of its Affiliates and any investment bank or other financial advisor under which such Group Company may owe any brokerage, placement or other fees relating to the subscription of Series A Shares.

4.REPRESENTATIONS AND WARRANTIES OF THE INVESTOR.

The Investor represents and warrants to the Company as follows:

4.1.Authorization. The Investor has all requisite power, authority and capacity to enter into the Transaction Agreements, and to perform its obligations under the Transaction Agreements. This Agreement has been duly authorized, executed and delivered

10

by the Investor. The Transaction Agreements, when executed and delivered by the Investor, will constitute valid and legally binding obligations of the Investor, subject, as to enforcement of remedies, to applicable bankruptcy, insolvency, moratorium, reorganization and similar laws affecting creditors’ rights generally and to general equitable principles.

4.2.Accredited Investor. The Investor is an Accredited Investor within the definition set forth in Rule 501(a) under Regulation D of the Securities Act.

4.3.Purchase for Own Account. Series A Shares and Common Shares issuable upon conversion of Series A Shares will be acquired for the Investor’s own account, not as a nominee or agent, and not with a view to or in connection with the sale or distribution of any part thereof.

4.4.Exempt from Registration; Restricted Securities. The Investor understands that Series A Shares and Common Shares issuable upon conversion of Series A Shares will not, when issued, be registered under the Securities Act or registered or listed publicly pursuant to any other applicable securities laws and regulations, on the ground that the sale provided for in this Agreement is exempt from registration under the Securities Act or the registration or listing requirements of any other applicable securities laws and regulations, and that the reliance of the Company on such exemption is predicated in part on the Investor’s representations set forth in this Agreement. The Investor understands that Series A Shares and Common Shares issuable upon conversion of Series A Shares are restricted securities within the meaning of Rule 144 under the Securities Act and that Series A Shares and Common Shares issuable upon conversion of Series A Shares are not registered or listed publicly and must be held indefinitely unless they are subsequently registered or listed publicly or an exemption from such registration or listing is available.

5.COVENANTS OF THE GROUP COMPANIES.

The Group Companies jointly and severally covenant to the Investor as follows:

5.1.Use of Proceeds from the Subscription for Series A Shares. The proceeds from the subscription for Series A Shares (the “Proceeds”) shall be used by the Company in the following manner: (i) US$8,250,000 to finance the acquisition by the Company of JingAo China pursuant to the Plan of Restructuring (the “Acquisition”); and (ii) US$1,750,000 intended to fund the registered capital of a Sino-foreign joint venture to be established by the Company in Shanghai.

5.2.Restructuring of the Company.The Group Companies shall use all commercially reasonable efforts to take, or cause to be taken, all actions, and to do, or cause to be done, all things necessary, proper or advisable under applicable laws and regulations to consummate and make effective the Plan of Restructuring and the other transactions contemplated by this Agreement. The Group Companies shall use all commercially reasonable efforts to comply as promptly as practicable with any Laws of any Governmental Authority that are applicable to the Plan of Restructuring or any of the other transactions contemplated hereby or by the Subscription Agreement and pursuant to which any consent, approval, order or authorization of, or registration, declaration or filing with, any Governmental Authority or any other Person in connection with such transactions is necessary. The Group Companies shall use all

11

commercially reasonable efforts to keep the Investor apprised of the status of any communications with, and any inquiries or requests for additional information from, any Governmental Authority (or other Person regarding the Plan of Restructuring of any of the other transactions contemplated by this Agreement or the Transaction Agreements) in respect of any such filing, registration or declaration and shall comply promptly with any such inquiry or request (and, unless precluded by law, provide copies of any such communications that are in writing).

5.3.Confidentiality and Employment Agreement. The Group Companies shall cause all of their present and future officers and employees to enter into a standard form confidentiality and employment contract with the Company or JingAo China, as the case may be in form and substance approved by the Board.

5.4.Additional Covenants. If at any time prior to the Closing, the Group Companies come to know of any fact or event which is in any way materially inconsistent with any of the representations and warranties given by the Group Companies or which would render any of the representations and warranties, if given at that time, untrue or inaccurate, then the Group Companies shall give immediate written notice thereof to the Investor in which event the Investor may within ten (10) Business Days of receiving such notice terminate this Agreement by written notice without any penalty whatsoever.

5.5.Fulfillment of Closing Conditions. The Group Companies shall use their best efforts to fulfill all conditions contained in Section 6 of this Agreement.

5.6.Qualified Public Offering. Subject to applicable Laws, each of the Group Companies shall use commercially reasonable best efforts to effectuate the closing of a Qualified Public Offering (as defined inExhibitC) prior to the second (2nd) anniversary of the Closing Date.

5.7Key Management. The Group Companies shall procure that the Key Management as set forth in the Disclosure Schedules listed each undertakes and covenants that (a) during his employment he will not directly or indirectly engage in any activity which the Board reasonably considers may be, or become, harmful to the interests of any Group Company or which might reasonably be considered to interfere with the performance of his duties; and (b) he shall not, whether directly or indirectly, on his own behalf or on behalf of or in conjunction with any other person, firm, company or other entity for the period of 1 year following the termination of his employment with the relevant Group Company, carry on, set up, be employed, engaged or interested in a business anywhere in the PRC which is in competition with the business of any Group Company.

5.7Conduct Post-Closing. The Company shall ensure that the affairs of each Group Company and their respective subsidiaries are conducted in the ordinary and usual course of business, and that all reasonable steps are taken to preserve and protect the assets of each Group Company and their respective subsidiaries and to preserve and retain their goodwill.

12

6.CONDITIONS TO INVESTOR’S OBLIGATIONS AT THE CLOSING.

The obligation of the Investor to subscribe for Series A Shares at the Closing is subject to the fulfillment or valid written waiver signed by the Investor, on or prior to such Closing, of the following conditions:

6.1.Representations and Warranties True and Correct. The representations and warranties made by the Group Companies in Section 3 hereof shall be true and correct in all material respects when made, and shall be true and correct in all material respects as of the date of the Closing with the same force and effect as if they had been made on and as of such date, subject to changes contemplated by this Agreement, except for those representations and warranties (a) that contain any materiality qualification or otherwise make reference to a Material Adverse Effect, which representations and warranties, to the extent so qualified, shall instead be true and correct in all respects as of such respective dates and (b) that address matters only as of a particular date, which representations will have been true and correct in all material respects (subject to clause (a)) as of such particular date.

6.2.Performance of Obligations. Each of the Group Companies shall have performed and complied with all agreements, obligations and conditions contained in the Transaction Agreements that are required to be performed or complied with by it on or before the Closing.

6.3.Proceedings and Documents. All corporate approvals and other proceedings in connection with the transactions contemplated by the Transaction Agreements and all documents and instruments incidental to such transactions shall be completed and reasonably satisfactory in substance and form to the Investor, and the Investor shall have received all such counterpart originals or certified or other copies of such documents as it may reasonably request.

6.4.Approvals, Consents and Waivers. Each Group Company shall have obtained any and all approvals, consents and waivers necessary for consummation of the transactions contemplated by the Transaction Agreements, including, but not limited to, (i) all permits, authorizations, approvals, consents or permits of any governmental authority or regulatory body, unless otherwise agreed by the parties, and (ii) the waiver by the existing shareholders of the Company of any anti-dilution rights, rights of first refusal, preemptive rights and all similar rights that may exist in connection with the issuance of the Series A Shares.

6.5.Compliance Certificate. The Group Companies shall have delivered to the Investor certificates, dated the Closing Date, signed by a Company director and the legal representative JingAo China certifying that the conditions specified in Sections 6.1, 6.2, 6.4, 6.6 and 6.8 have been fulfilled and stating that there has been no Material Adverse Effect.

6.6.Amendment to Constitutional Documents. The Restated Articles shall have been duly adopted by the Company by all necessary corporate action of its Board and its shareholders.

6.7.Execution of Shareholders Agreement. The Group Companies, the Investor and the Key Shareholders (as defined inExhibit C) shall have executed and delivered the Shareholders Agreement, in substantially the form attached hereto asExhibit C.

13

6.8.No Material Adverse Effect. There shall have been no Material Adverse Effect since the date of this Agreement.

6.9Legal Opinions. The Group Companies shall have delivered to the Investor legal opinions from: (a) Conyers Dill & Pearman and (b) Tian Yuan Law Firm in forms reasonably satisfactory to the Investor.

7.CONDITIONS TO COMPANY’S OBLIGATIONS AT THE CLOSING.

The obligations of the Company under this Agreement with respect to the Investor are subject to the fulfillment or valid written waiver by the Company at or before the Closing of the following conditions:

7.1.Representations and Warranties. The representations and warranties of the Investor contained in Section 4 hereof shall be true and correct as of the Closing.

7.2.Securities Exemptions. The allotment and issuance of Series A Shares and issuance of Common Shares upon conversion of Series A Shares shall be exempt from the registration and/or qualification requirements of all applicable securities laws.

7.3.Execution of Shareholders Agreement. The Group Companies, the Investor and the Key Shareholders shall have executed and delivered the Shareholders Agreement, in substantially the form attached hereto asExhibit C.

8.INDEMNIFICATION.

8.1.Survival of Representations and Warranties. The representations and warranties made herein shall survive for a period of eighteen (18) months after the Closing Date.

8.2.Indemnification.

(a) To the fullest extent permitted by applicable law, the Covenantors shall, jointly and severally, indemnify, defend and hold harmless the Investor, from and against any and all Losses arising out of, relating to, connected with or incidental to: (i) any breach of any representation or warranty made by any of the Covenantors in the Transaction Agreements, or (ii) any failure by the Covenantors to comply with any covenant or term of the agreement contained in the Transaction Agreements or in any other documents or agreements contemplated hereby.

(b) The maximum amount of aggregate Losses that shall be payable by the Covenantors pursuant to this Section 8.2 shall be capped at the Subscription Amount.

8.3.Definition of Losses. As used in this Agreement, “Losses” means all losses, liabilities, damages, deficiencies, suits or claims (whether brought by shareholders of the Group Companies or other third parties), debts, obligations, interest, penalties, expenses, judgments or settlements of any nature or kind, including all costs and expenses related thereto, including without limitation reasonable attorneys’ fees and disbursements, court costs, amounts paid in settlement and expenses of investigation, whether at law or in equity, whether known or unknown, foreseen or unforeseen, of any kind or nature.

14

9.MISCELLANEOUS.

9.1.Governing Law. Except with respect to the references in this Agreement to the Securities Act, this Agreement shall be governed by and construed exclusively in accordance with the laws of the State of New York without giving effect to any choice of law rule that would cause the application of the laws of any jurisdiction other than the laws of New York to the rights and duties of the parties hereunder.

9.2.Successors and Assigns. Except as otherwise expressly provided herein, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto whose rights or obligations hereunder are affected by such amendments. This Agreement and the rights and obligations therein may not be assigned by the Investor without the written consent of the Company except to a parent corporation, a subsidiary or an Affiliate. This Agreement and the rights and obligations therein may not be assigned by the parties hereto without the written consent of the Investor.

9.3.Entire Agreement. This Agreement, the Shareholders Agreement, and the schedules and exhibits hereto and thereto, which are hereby expressly incorporated herein by this reference constitute the entire understanding and agreement between the parties with regard to the subject matter hereof and thereof; provided, however, that nothing in this Agreement or related agreements shall be deemed to terminate or supersede the provisions of any confidentiality and nondisclosure agreements executed by the parties hereto prior to the date hereof, which agreements shall continue in full force and effect until terminated in accordance with their respective terms.

9.4.Notices. Except as may be otherwise provided herein, all notices, requests, waivers and other communications made pursuant to this Agreement shall be in writing and shall be conclusively deemed to have been duly given (i) when hand delivered to the other party, upon delivery; (ii) when sent by facsimile, upon receipt of confirmation of error-free transmission; (iii) seven (7) Business Days after deposit in the mail as air mail or certified mail, receipt requested, postage prepaid and addressed to the other party as set forth on the signature page hereto; or (iv) three (3) Business Days after deposit with an overnight delivery service, postage prepaid, with next business-day delivery guaranteed, provided that the sending party receives a confirmation of delivery from the delivery service provider. Each person making a communication hereunder by facsimile shall promptly confirm by telephone to the person to whom such communication was addressed each communication made by it by facsimile pursuant hereto but the absence of such confirmation shall not affect the validity of any such communication. The initial address and facsimile number of each party are as shown below the signature of such party on the signature page of this Agreement. A party may change or supplement the addresses given above, or designate additional addresses, for purposes of this Section 9.4 by giving the other party written notice of the new address in the manner set forth above.

9.5.Amendments and Waivers. Any term of this Agreement may be amended only with the written consent of all of the parties hereto. Any amendment or waiver effected in accordance with this Section 9.5 shall be binding upon all of the parties hereto, and their respective assigns.

15

9.6.Delays or Omissions. No delay or omission in exercising any right, power or remedy accruing to any party hereto, upon any breach or default of any party hereto under this Agreement, shall impair any such right, power or remedy of such party nor shall it be construed to be a waiver of any such breach or default, or an acquiescence therein, or of any similar breach of default thereafter occurring; nor shall it be construed to be a waiver of any other breach or default theretofore or thereafter occurring. Any waiver, permit, consent or approval of any kind or character on the part of any party hereto of any breach of default under this Agreement or any waiver on the part of any party hereto of any provisions or conditions of this Agreement, must be in writing and shall be effective only to the extent specifically set forth in such writing. All remedies, either under this Agreement, or by law or otherwise afforded to the parties hereto shall be cumulative and not alternative.

9.7.Interpretation; Titles and Subtitles. This Agreement shall be construed according to its fair language. The rule of construction to the effect that ambiguities are to be resolved against the drafting party shall not be employed in interpreting this Agreement. The titles of the sections and subsections of this Agreement are for convenience of reference only and are not to be considered in construing this Agreement. Unless otherwise expressly provided herein, all references to Sections and Exhibits herein are to Sections and Exhibits of this Agreement.

9.8.Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which together shall constitute one instrument.

9.9.Severability. If any provision of this Agreement is found to be invalid or unenforceable, then such provision shall be construed, to the extent feasible, so as to render the provision enforceable and to provide for the consummation of the transactions contemplated hereby on substantially the same terms as originally set forth herein, and if no feasible interpretation would save such provision, it shall be severed from the remainder of this Agreement, which shall remain in full force and effect unless the severed provision is essential to the rights or benefits intended by the parties. In such event, the parties shall use best efforts to negotiate, in good faith, a substitute, valid and enforceable provision or agreement that most nearly effects the parties’ intent in entering into this Agreement.

9.10.Confidentiality and Non-Disclosure. The parties hereto agree to be bound by the confidentiality and non-disclosure provisions of Section 6 of the Shareholders Agreement.

9.11.Further Assurances. Each party shall from time to time and at all times hereafter make, do, execute, or cause or procure to be made, done and executed such further acts, deeds, conveyances, consents and assurances without further consideration, which may reasonably be required to effect the transactions contemplated by this Agreement.

16

9.12.Dispute Resolution.

(a)Negotiation Between Parties. The parties agree to negotiate in good faith to resolve any dispute between them regarding this Agreement. If the negotiations do not resolve the dispute to the reasonable satisfaction of all parties within thirty (30) days, Section 9.12(b) shall apply.

(b)Arbitration. In the event the parties are unable to settle a dispute between them regarding this Agreement in accordance with subsection (a) above, such dispute shall he referred to and finally settled by arbitration at the Hong Kong International Arbitration Centre in accordance with the UNCITRAL Arbitration Rules (the “UNCITRAL Rules”) in effect, which rules are deemed to be incorporated by reference into this subsection (b). The arbitration tribunal shall consist of three arbitrators to be appointed according to the UNCITRAL Rules. The language of the arbitration shall be English. The parties understand and agree that this provision regarding arbitration shall not prevent any party from pursuing equitable or injunctive relief in a judicial forum to compel another party to comply with this provision, to preserve the status quo prior to the invocation of arbitration under this provision, or to prevent or halt actions that may result in irreparable harm. A request for such equitable or injunctive relief shall not waive this arbitration provision.

9.13.Expenses. The Company and the Investor will bear their respective legal and accountants’ fees and expenses with respect to this Agreement and the transactions contemplated hereby; provided however, if the transaction proceeds to Closing, then the Company shall reimburse the Investor for its reasonable fees and expenses related to this transaction, which amount shall be deducted from the Subscription Amount to be delivered at Closing.

9.14.Termination. This Agreement may be terminated by any party hereto by written notice to the other parties. Such termination under this Section 9.14, as well as the expiry of this Agreement shall be without prejudice to any claims for damages or other remedies that the parties may have under this Agreement or applicable law.

— REMAINDER OF THIS PAGE LEFT INTENTIONALLY BLANK —

17

IN WITNESS WHEREOF, the parties hereto have caused their respective duly authorized representatives to execute this Agreement as of the date and year first above written.

| COMPANY | ||

| JA Development Co., Ltd. | ||

| By: | /s/ Yang Huaijin | |

| Name: | Yang Huaijin | |

| Title: | Attorney-in-fact | |

| Address: | Romasco Place, Wickhams Cay 1, | |

| P.O. Box 3140, Road Town, | ||

| Tortola, British Virgin Islands | ||

| Facsimile: | (86-319) 5800754 | |

| JingAo Solar Co., Ltd. | ||

| ||

| By: | /s/ Yang Huaijin | |

| Name: | Yang Huaijin | |

| Title: | Chief Executive Officer | |

| Address: | Jinglong Industrial Park, | |

| Jinglong Street, Ningjin County, | ||

| Hebei Province, 055550, PRC | ||

| Facsimile: | ||

18

IN WITNESS WHEREOF, the parties hereto have caused their respective duly authorized representatives to execute this Agreement as of the date and year first above written.

| Leeway Asia Ltd. | ||

| For and on behalf of Leeway Asia L.P. | ||

| By: | /s/ Sheldon Liu | |

| Name: | Sheldon Liu | |

| Title: | Director | |

| Address: | PO Box 908 GT | |

| George Town, | ||

| Grand Cayman | ||

| Cayman Islands | ||

| Facsimile: | +8610 8486 8563 | |

19

LIST OF EXHIBITS

| Exhibit A | Restated Articles | |

| Exhibit B | Disclosure Schedule | |

| Exhibit C | Shareholders Agreement | |

| Exhibit D | Employee Share Option Plan | |

| Exhibit E | Plan of Restructuring | |

20

EXHIBIT A

RESTATED ARTICLES

A - 1

TERRITORY OF THE BRITISH VIRGIN ISLANDS

THE BVI BUSINESS COMPANIES ACT 2004

AMENDED AND RESTATED MEMORANDUM OF ASSOCIATION

OF

JA Development Co., Ltd.

A COMPANY LIMITED BY SHARES

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | In this Memorandum of Association and the attached Articles of Association, if not inconsistent with the subject or context: |

“Act” means the BVI Business Companies Act, 2004 (No. 16 of 2004) and includes the regulations made under the Act.

“Additional Ordinary Shares” means all Ordinary Shares issued by the Company;provided that the term “Additional Ordinary Shares” does not include (i) Employee Compensation Shares; (ii) Ordinary Shares issued or issuable in connection with any share split, share dividend, combination, recapitalization or other similar transaction of the Company; (iii) Ordinary Shares issued or issuable upon conversion or exercise of the Series A Preference Shares or upon conversion or exercise of any convertible notes, warrants or options outstanding on the Original Series A Issue Date; (iv) Ordinary Shares issued in connection with a bona fide business acquisition by the Company of another business, whether by merger, consolidation, sale of assets, sale or exchange of stock or otherwise; or (v) Ordinary Shares issued in connection with a Qualified Public Offering.

“Applicable Conversion Price” has the meaning specified inSection 4 ofSchedule A hereto.

“Articles” means the attached Articles of Association of the Company.

“Auditors” means the Persons for the time being performing the duties of auditors of the Company.

“Board” means the board of directors of the Company.

“Chairman of the Board” has the meaning specified inArticle 16.8 of the Articles.

“Company” means JA Development Co., Ltd., a company organized and existing under the laws of the British Virgin Islands.

“Control” means, when used with respect to any Person, power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

A - 2

“Conversion Share” has the meaning specified inSection 4(c) ofSchedule A hereto.

“Debenture” means debenture stock, mortgages, bonds and any other such securities of the Company whether constituting a charge on the assets of the Company or not.

“Director” means a member of the Board.

“Distribution” in relation to a distribution by the Company to a Shareholder means the direct or indirect transfer of an asset, other than Shares, to or for the benefit of the Shareholder, or the incurring of a debt to or for the benefit of a Shareholder, in relation to Shares held by a Shareholder, and whether by means of a purchase of an asset, the purchase, redemption or other acquisition of Shares, a distribution of indebtedness or otherwise, and includes a dividend.

“Eligible Person” means individuals, corporations, trusts, the estates of deceased individuals, partnerships and unincorporated associations of persons.

“Employee Compensation Share” means up to 1082 Ordinary Shares (as adjusted for share splits, subdivision, consolidation, recapitalizations, reclassifications, and similar transactions prior to such date) issued or issuable to employees, consultants or directors of the Company either in connection with the provision of services to the Company or on exercise of any options to purchase Employee Compensation Shares granted under a share incentive plan or other arrangement approved by the Company’s Board, including without limitation in connection with a restricted stock or other equity compensation plan or arrangement approved by the Company’s Board.

“Equity Securities” means any Ordinary Shares or Ordinary Share Equivalents of the Company.

“Future Issuance Price” has the meaning specified inSection 4(e)(5) ofSchedule A hereto.

“Liquidation Event” has the meaning specified inSection 2(b) ofSchedule A hereto.

“Memorandum” means this Memorandum of Association of the Company to be adopted by resolution in writing of all Shareholders.

“Ordinary Shares” has the meaning specified inSection 6.1 of the Memorandum.

“Ordinary Share Equivalents” means warrants, options and rights exercisable for Ordinary Shares or securities convertible into or exchangeable for Ordinary Shares, including, without limitation, the Series A Preference Shares.

“Original Series A Issue Date” means the date of issuance by the Company of its first Series A Preference Share pursuant to the Subscription Agreement.

“Original Series A Issue Price” means US$17,177.914 per share.

“paid-up” means paid-up and/or credited as paid-up.

“Person” or “person” means any individual, sole proprietorship, partnership, firm, joint venture, estate, trust, unincorporated organization, association, corporation, institution, public benefit corporation, entity or governmental or regulatory authority or other entity of any kind or nature.

A - 3

“Qualified Public Offering” means a firm commitment underwritten registered public offering by the Company of its Ordinary Shares, equal to at least fifteen percent (15%) of the Company’s total issued shared capital post-offering on a fully-diluted basis and listing, on a reputable international stock exchange (including without limitation stock exchanges in the United States, Hong Kong and Singapore, or any other stock exchange that is approved by the Board) with a total market capitalization of the Company following completion of the public offering of not less than US$540,000,000.

“Redemption Amount” has the meaning specified inSection 4(c)(i) ofSchedule A hereto.

“Redemption Closing” has the meaning specified inSection 5(a)(iii)(3) ofSchedule A hereto.

“Redemption Price” has the meaning specified inSection 5(a)(iii)(2) ofSchedule A hereto.

“Redemption Notice” has the meaning specified inSection 5(a)(iii)(1) ofSchedule A hereto.

“Registered office” means the registered office for the time being of the Company.

“Registrar” means the Registrar of Corporate Affairs appointed under section 229 of the Act.

“Related Party Transaction” means any transaction, contract, agreement or arrangement between the Company, on the one hand, and any Director, officer or Shareholder, or an entity Controlled by any Director, officer or Shareholder, on the other hand.

“Resolution of Directors” means either:

| (a) | a resolution approved at a duly convened and constituted meeting of directors of the Company or of a committee of directors of the Company by the affirmative vote of a majority of the directors present at the meeting who voted except that where a director is given more than one vote, he shall be counted by the number of votes he casts for the purpose of establishing a majority; or |

| (b) | a resolution consented to in writing by all directors or by all members of a committee of directors of the Company, as the case may be. |

“Resolution of Shareholders” means either:

| (a) | a resolution approved at a duly convened and constituted meeting of the Shareholders of the Company by the affirmative vote of a majority of in excess of fifty percent (50%) of the votes of the Shares entitled to vote thereon which were present at the meeting and were voted; or |

| (b) | a resolution consented to in writing by a majority of in excess of fifty percent (50%) of the votes of Shares entitled to vote thereon. |

“Schedule A” meansSchedule A to the Memorandum.

“Seal” means any seal which has been duly adopted as the common seal of the Company.

“Securities” means Shares and debt obligations of every kind of the Company, and including without limitation options, warrants and rights to acquire shares or debt obligations.

A - 4

“Secretary” includes an Assistant Secretary and any person appointed to perform the duties of Secretary of the Company.

“Series A Conversion Price” has the meaning specified inSection 4(d) ofSchedule A hereto.

“Series A Preference Shares” has the meaning specified inSection 6.1 of the Memorandum.

“Subscription Agreement” means that certain Share Subscription Agreement entered into by and among the Company, Leeway Asia L.P. and the other parties thereto, dated on or about August 9, 2006, regarding the issuance of Series A Preference Shares.

“Subsidiary” means, with respect to any specified Eligible Person, any Eligible Person of which the specified Eligible Person, directly or indirectly, owns more than fifty percent (50%) of the issued and outstanding authorized capital, share capital, voting interests or registered capital.

“Share” has the meaning specified inSection 6.1 of this Memorandum and may also be referenced as “share” and includes any fraction of a share.

“Shareholder” means an Eligible Person whose name is entered in the register of members of the Company as the holder of one or more Shares or fractional Shares.

| 1.2 | In the Memorandum and the Articles, unless the context otherwise requires a reference to: |

| (a) | a “Regulation” is a reference to a regulation of the Articles; |

| (b) | a “Clause” is a reference to a clause of the Memorandum; |

| (c) | “Written” or any term of like import includes information generated, sent, received or stored by electronic, electrical, digital, magnetic, optical, electromagnetic, biometric or photonic means, including electronic data interchange, electronic mail, telegram, telex or telecopy, and “in writing” shall be construed accordingly; |

| (d) | The term “day” means “calendar day”; |

| (e) | voting by Shareholders is a reference to the casting of the votes attached to the Shares held by the Shareholder voting; |

| (f) | the Act, the Memorandum or the Articles is a reference to the Act or those documents as amended or, in the case of the Act, any re-enactment thereof; |

| (g) | importing the masculine gender also include the feminine gender and vice-versa; and |

| (h) | the singular includes the plural and vice versa. |

| 1.3 | Any words or expressions defined in the Act unless the context otherwise requires bear the same meaning in the Memorandum and the Articles unless otherwise defined herein. |

| 1.4 | Headings are inserted for convenience only and shall be disregarded in interpreting the Memorandum and the Articles. |

A - 5

| 2. | NAME |

The name of the Company is JA Development Co., Ltd.

| 3. | STATUS |

The Company is a company limited by shares.

| 4. | REGISTERED OFFICE AND REGISTERED AGENT |

| 4.1 | The first registered office of the Company is Romasco Place, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British Virgin Islands or at such other place as the Directors may from time to time decide. |

| 4.2 | The first registered agent of the Company is Codan Trust Company (B.V.I.) Ltd. Of Romasco Place, Wickhams Cay 1, P.O.Box 3140, Road Town, Tortola, British Virgin Islands. |

| 4.3 | The Company may by Resolution of Shareholders or by Resolution of Directors change the location of its registered office or change its registered agent. |

| 4.4 | Any change of registered office or registered agent will take effect on the registration by the Registrar of a notice of the change filed by the existing registered agent or a legal practitioner in the British Virgin Islands acting on behalf of the Company. |

| 5. | CAPACITY AND POWERS |

| 5.1 | Subject to the Act and any other British Virgin Islands legislation, the Company has, irrespective of corporate benefit: |

| (a) | full capacity to carry on or undertake any business or activity, do any act or enter into any transaction, including but not limited to the following: |

| (i) | To carry on the business of an investment company and to act as promoters and entrepreneurs and to carry on business as financiers, capitalists, concessionaires, merchants, brokers, traders, dealers, agents, importers and exporters and to undertake and carry on and execute all kinds of investment, financial, commercial, mercantile, trading and other operations. |

| (ii) | To carry on whether as principals, agents or otherwise howsoever the business of realtors, developers, consultants, estate agents or managers, builders, contractors, engineers, manufacturers, dealers in or vendors of all types of property including services. |

| (iii) | To exercise and enforce all rights and powers conferred by or incidental to the ownership of any shares, stock, obligations or other securities including but without prejudice to the generality of the foregoing all such powers of veto or control as may be conferred by virtue of the holding by the Company of some special proportion of the issued or nominal amount thereof, to provide managerial and other executive, supervisory and consultant services for or in relation to any company in which the Company is interested upon such terms as may be thought fit. |

| (iv) | To purchase or otherwise acquire, to sell, exchange, surrender, lease, mortgage, charge, convert, turn to account, dispose of and deal with real and personal property and rights of all kinds and, in particular, mortgages, |

A - 6

debentures, produce, concessions, options, contracts, patents, annuities, licenses, stocks, shares, bonds, policies, book debts, business concerns, undertakings, claims, privileges and choses in action of all kinds. |

| (v) | To subscribe for, conditionally or unconditionally, to underwrite, issue on commission or otherwise, take, hold, deal in and convert stocks, shares and securities of all kinds and to enter into partnership or into any arrangement for sharing profits, reciprocal concessions or cooperation with any person or company and to promote and aid in promoting, to constitute, form or organize any company, syndicate or partnership of any kind, for the purpose of acquiring and undertaking any property and liabilities of the Company or of advancing, directly or indirectly, the objects of the Company or for any other purpose which the Company may think expedient. |

| (vi) | To stand surety for or to guarantee, support or secure the performance of all or any of the obligations of any person, firm or company whether or not related or affiliated to the Company in any manner and whether by personal covenant or by mortgage, charge or lien upon the whole or any part of the undertaking, property and assets of the Company, both present and future, including its uncalled capital or by any such method and whether or not the Company shall receive valuable consideration therefor. |

| (vii) | To engage in or carry on any other lawful trade, business or enterprise which may at any time appear to the Directors of the Company capable of being conveniently carried on in conjunction with any of the aforementioned businesses or activities or which may appear to the Directors of the Company likely to be profitable to the Company. |

| In the interpretation of this Memorandum of Association in general and of this Article in particular no object, business or power specified or mentioned shall be limited or restricted by reference to or inference from any other object, business or power, or the name of the Company, or by the juxtaposition of two or more objects, businesses or powers and that, in the event of any ambiguity in this Article or elsewhere in this Memorandum of Association, the same shall be resolved by such interpretation and construction as will widen and enlarge and not restrict the objects, businesses and powers of and exercisable by the Company. |

| (b) | for the purposes of paragraph (a), full rights, powers and privileges. |

| 5.2 | For the purposes of section 9(4) of the Act, there are no limitations on the business that the Company may carry on. Except as prohibited or limited by the Act, the Company shall have full power and authority to carry out any object and shall have and be capable of from time to time and at all times exercising any and all of the powers at any time or from time to time exercisable by a natural person or body corporate in doing in any part of the world whether as principal, agent, contractor or otherwise whatever may be considered by it necessary for the attainment of its objects and whatever else may be considered by it as incidental or conducive thereto or consequential thereon, including, but without in any way restricting the generality of the foregoing, the power to make any alterations or amendments to this Memorandum of Association and the Articles of Association of the Company considered necessary or convenient in the manner set out in the Articles of Association of the Company, and the power to do any of the following acts or things, viz: |

A - 7

to pay all expenses of and incidental to the promotion, formation and incorporation of the Company; to register the Company to do business in any other jurisdiction; to sell, lease or dispose of any property of the Company; to draw, make, accept, endorse, discount, execute and issue promissory notes, debentures, bills of exchange, bills of lading, warrants and other negotiable or transferable instruments; to lend money or other assets and to act as guarantors; to borrow or raise money on the security of the undertaking or on all or any of the assets of the Company including uncalled capital or without security; to invest money of the Company in such manner as the Directors determine; to promote other companies; to sell the undertaking of the Company for cash or any other consideration; to distribute assets in specie to Shareholders of the Company; to make charitable or benevolent donations; to pay pensions or gratuities or provide other benefits in cash or kind to Directors, officers, employees, past or present and their families; to purchase Directors and officers liability insurance and to carry on any trade or business and generally to do all acts and things which, in the opinion of the Company or the Directors, may be conveniently or profitably or usefully acquired and dealt with, carried on, executed or done by the Company in connection with the aforesaid businessprovided that the Company shall only carry on the businesses for which a license is required under the laws of the British Virgin Islands when so licensed under the terms of such laws.

| 5.3 | The liability of each Shareholder is limited to the amount from time to time unpaid on such Shareholder’s shares. |

| 6. | AUTHORISED SHARES |

| 6.1 | The Company is authorised to issue a maximum of 50,000 Shares comprising of 49,185 Ordinary Shares without par value (the “Ordinary Shares”) and 815 Series A Preference Shares without par value (the “Series A Preference Shares”), with power for the Company insofar as is permitted by applicable law, this Memorandum (includingSchedule A) and the Articles to redeem or purchase any of its shares and to increase or reduce the said capital and to issue any part of its capital, whether original, redeemed or increased with or without any preference, priority or special privilege or subject to any postponement of rights or to any conditions or restrictions and so that unless the conditions of issue shall otherwise expressly declare every issue of shares whether declared to be preference or otherwise shall be subject to the powers hereinbefore contained. The Ordinary Shares and the Series A Preference Shares are collectively referred to herein as the “Shares.” |

| 6.2 | The Shares in the Company shall be issued in the currency of the United States of America. |

| 6.3 | Subject to the provisions ofSchedule A and the other rights attaching to the Series A Preference Shares in these Memorandum and Articles of Association, each Ordinary Share in the Company confers on the holder: |

| (a) | the right to one vote at a meeting of the members of the Company or on any resolution of the members of the Company; |

| (b) | the right to an equal share in any dividend paid by the Company in accordance with the Act; and |

| (c) | the right to an equal share in the distribution of the surplus assets of the Company. |

| 6.4 | In addition to any other rights attaching to the Series A Preference Shares, each Series A Preference Share in the Company confers on the holder the rights set out inSchedule A attached hereto. For the sake of clarity,Schedule A forms part of the Memorandum. In the event of any conflict between the conditions in the Memorandum andSchedule A,Schedule A shall prevail. |

A - 8

| 6.5 | Subject to the provisions of the Act, the Memorandum and the Articles, shares may be issued on the terms that they are, or at the option of the Company or the holder are, to be redeemed on such terms and in such manner as the Company, before the issue of the shares, may by resolution determine. |

| 6.6 | Subject to the provisions of the Act, the Memorandum and the Articles, the Company may purchase its own shares (including fractions of a share), including any redeemable shares, provided that the manner of purchase has first been authorized by the Company in general meeting and may make payment therefore in any manner authorized by the Act, including out of capital. |

| 7. | VARIATION OF RIGHTS |

Subject toSchedule A,if at any time the share capital of the Company is divided into different classes or series of shares, the rights attached to any class or series (unless otherwise provided by the terms of issue of the shares of that class or series) may not, whether or not the Company is being wound-up, be varied without the consent in writing of the holders of at least a majority of the issued shares of that class or series, or without the sanction of a Resolution of Shareholders passed at a general meeting of the holders of the shares of that class or series.

The provisions of this Memorandum and the Articles relating to general meetings shall apply to every such general meeting of the holders of one class of shares except that the necessary quorum shall be one (1) person holding or representing by proxy at least one-third of the issued shares of the class and that any holder of shares of the class present in person or by proxy may demand a poll.

| 8. | RIGHTS NOT VARIED BY THE ISSUE OF SHARES PARI PASSU |

Subject toSchedule A, the rights conferred upon the holders of the shares of any class issued with preferred or other rights shall not, unless otherwise expressly provided by the terms of issue of the shares of that class, be deemed to be varied by the creation or issue of further shares ranking pari passu therewith.

| 9. | REGISTERED SHARES |

| 9.1 | Subject to the provisions, if any, in that behalf in this Memorandum (including but not limited toSchedule A) and in the Articles and to any direction that may be given by the Company in a general meeting and without prejudice to any special rights previously conferred on the holders of existing shares, the Directors may allot, issue, grant options over or otherwise dispose of shares of the Company (including fractions of a share) with or without preferred, deferred or other special rights or restrictions, whether in regard to dividend, voting, return of capital or otherwise and to such persons, at such times and on such other terms as they think proper. The Company shall not issue shares in bearer form. The Company shall issue registered shares only. |

| 9.2 | The Company is not authorised to issue bearer shares, convert registered shares to bearer shares or exchange registered shares for bearer shares. |

A - 9

| 10. | TRANSFER OF SHARES |