Investor Meeting May 20, 2014 “Rethinking Reinsurance”

Page 2 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. Federal securities laws. These statements involve risks and uncertainties that could cause actual results to differ materially from those contained in forward-looking statements made on behalf of the Company. These risks and uncertainties include the impact of general economic conditions and conditions affecting the insurance and reinsurance industry, the adequacy of our reserves, our ability to assess underwriting risk, trends in rates for property and casualty insurance and reinsurance, competition, investment market fluctuations, trends in insured and paid losses, catastrophes, regulatory and legal uncertainties and other factors described in our most recent annual report on Form 10-K and quarterly report on Form 10-Q filed subsequent thereto and other documents on file with the Securities Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Page 3 Today’s Agenda Overview Bart Hedges, Chief Executive Officer Investments David Einhorn, Chairman of the Board Financials Tim Courtis, Chief Financial Officer Summary Bart Hedges, Chief Executive Officer Q&A Cocktails

Page 4 Who We Are Specialist property and casualty reinsurer with operations in the Cayman Islands and Dublin, Ireland Cayman operating company is rated “A” by A.M. Best and Irish operating subsidiary is rated “A-” Our “dual-engine” reinsurance and investment strategy is fundamentally different We employ a customer centric approach Our compensation structure aligns our employees with our shareholders We measure our progress by growth in fully diluted adjusted book value per share

Our History We have had consistent surplus growth Company founded in 2004 with $212M in capital Identified Senior Management Team Raised additional $258M in Initial Public Offering (Listed on NASDAQ ticker: GLRE) Market tested our business model Achieved A- (Excellent) rating from A.M. Best Underwriting initiated 2004 2005 2006 2007 2008 2010 2009 Written Premium $74M $127M $162M $259M $415M $398M 2011 Upgraded to A (Excellent) rating from A.M. Best Page 5 $428M 2012 2013 $536M Launched Irish operations

Page 6 Underwriting Approach DELIVER SUPERIOR LONG-TERM GROWTH IN BOOK VALUE A fundamentally different approach to the reinsurance business Focus on downside on a deal-by-deal basis Fewer, bigger deals that are important to our clients and to us Focus on deal economics Bottom-up approach to underwriting portfolio Portfolio is sum total of good opportunities Small team of highly skilled generalists

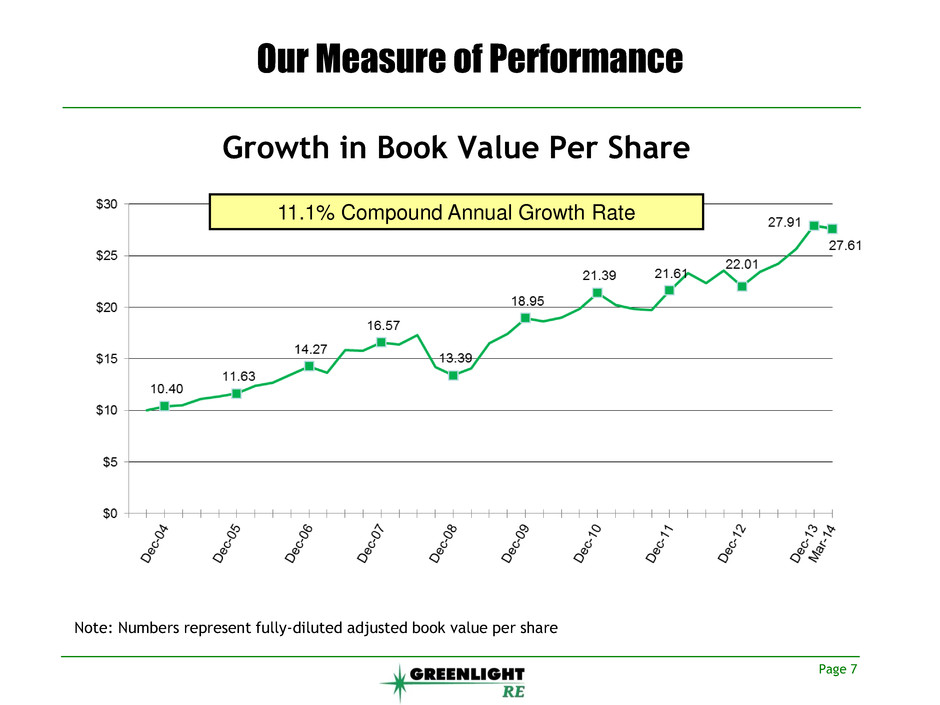

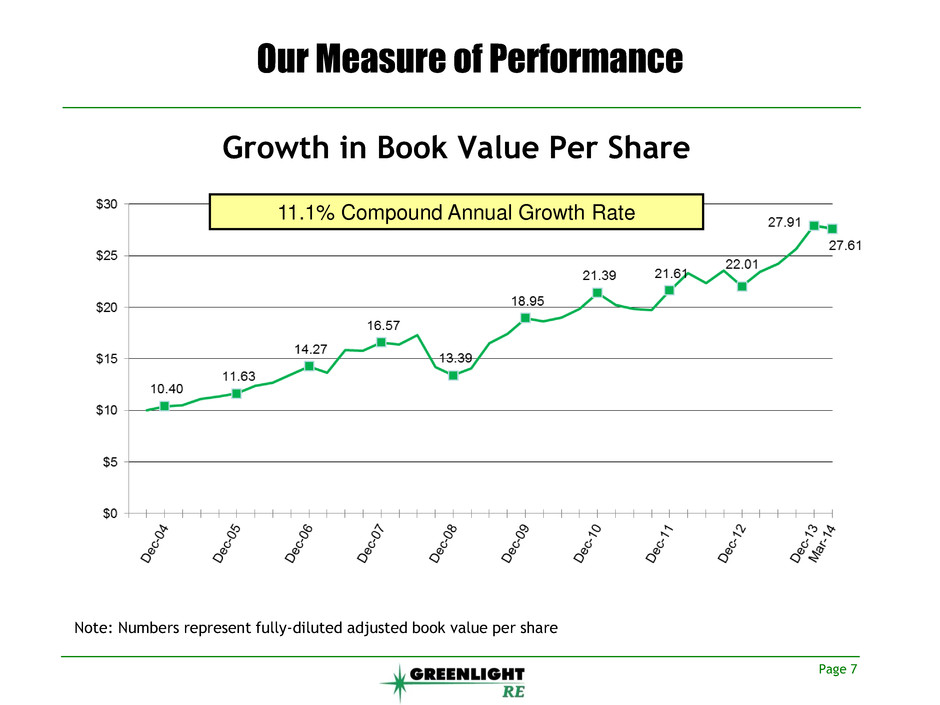

Page 7 Our Measure of Performance 11.1% Compound Annual Growth Rate Note: Numbers represent fully-diluted adjusted book value per share Growth in Book Value Per Share

Bart Hedges CEO Brendan Barry Chief Underwriting Officer Claude Wagner Chief Actuary Jordan Comacchio Underwriting Kagabo Ngiruwonsanga Underwriting Bruno Landry Underwriting Tim Courtis CFO Sherry Diaz Finance & Operations Faramarz Romer Finance & Operations Adam Ridley Finance & Operations Laura Accurso Counsel Tom Curnock Risk Management Jim Ehman Underwriting Caryl Traynor General Manager Matt Grunewald Underwriting Rena Strecker Finance & Operations Parker Boone Underwriting Sharon D’Arcy Underwriting Conor Gaffney Underwriting Matias Galker Underwriting John Drake Underwriting Elizabeth Bowen Finance & Operations Bernadette Cheung Finance & Operations Damon Bilchuris Finance & Operations Suzanne Fetter Claims Brian O’Reilly Underwriting Jessica Lopez Finance & Operations Eamon Brady Finance & Operations Ireland Cayman Organization Chart Page 8 Fiona O’Hanlon Finance & Operations Isaac Espinoza Underwriting

Page 9 How Do We Compare? Sources: Company 10k, SNL data, 2013 Figures Net E a rn e d P re mium /S urplu s

Page 10 Our Historical Underwriting Results Combined Frequency & Severity 2007 2008 2009 2010 2011 2012 2013 Net Earned Premium ($ millions) 98.0 114.9 214.7 287.7 379.7 466.7 547.9 Loss Ratio 40.3% 48.3% 55.4% 61.5% 63.6% 78.5% 61.8% Acquisition Cost & Other Ratio 39.7% 36.2% 32.3% 35.7% 36.5% 30.6% 31.4% Composite Ratio 80.0% 84.5% 87.7% 97.2% 100.1% 109.1% 93.2% Internal Expense Ratio 9.8% 9.4% 7.4% 4.4% 2.8% 2.8% 3.2% Corporate Expense Ratio 2.4% 2.6% 1.4% 1.2% 0.9% 1.0% 0.7% Total Expense Ratio 12.2% 12.0% 8.8% 5.6% 3.7% 3.8% 3.9% Combined Ratio 92.2% 96.5% 96.5% 102.8% 103.8% 112.9% 97.1% Frequency Only 2007 2008 2009 2010 2011 2012 2013 Net Earned Premium ($ millions) 71.6 81.1 169.5 258.9 360.2 444.5 529.8 Composite Ratio 94.2% 91.2% 95.2% 105.6% 103.1% 108.8% 97.2% Severity Only 2007 2008 2009 2010 2011 2012 2013 Net Earned Premium ($ millions) 26.4 33.8 45.2 28.8 19.5 22.2 18.1 Composite Ratio 41.7% 68.5% 59.5% 22.0% 46.3% 115.2% -27.3% Calendar Year Calendar Year Calendar Year

Page 11 Underwriting Results By Area of Focus Calendar Year Composite Ratio Area of Concentration 2007 2008 2009 2010 Florida Homeowners (Limited Wind) 95.0% 71.9% 84.2% 92.0% Non-Standard Auto 0.0% 0.0% 0.0% 0.0% Health (Employer Stop Loss) 97.0% 87.7% 95.3% 94.4% Catastrophe Retro 21.2% 24.5% 54.2% 14.3% Other 69.9% 98.1% 93.0% 115.4% Total 80.0% 84.5% 87.7% 97.2% Calendar Year Composite Ratio Area of Concentration 2011 2012 2013 Florida Homeowners (Limited Wind) 93.4% 97.3% 90.9% Non-Standard Auto 98.0% 96.0% 95.7% Health (Employer Stop Loss) 103.6% 93.5% 98.1% Catastrophe Retro 43.8% 119.0% -81.7% Other 113.9% 158.0% 136.8% Total 100.1% 109.1% 93.2%

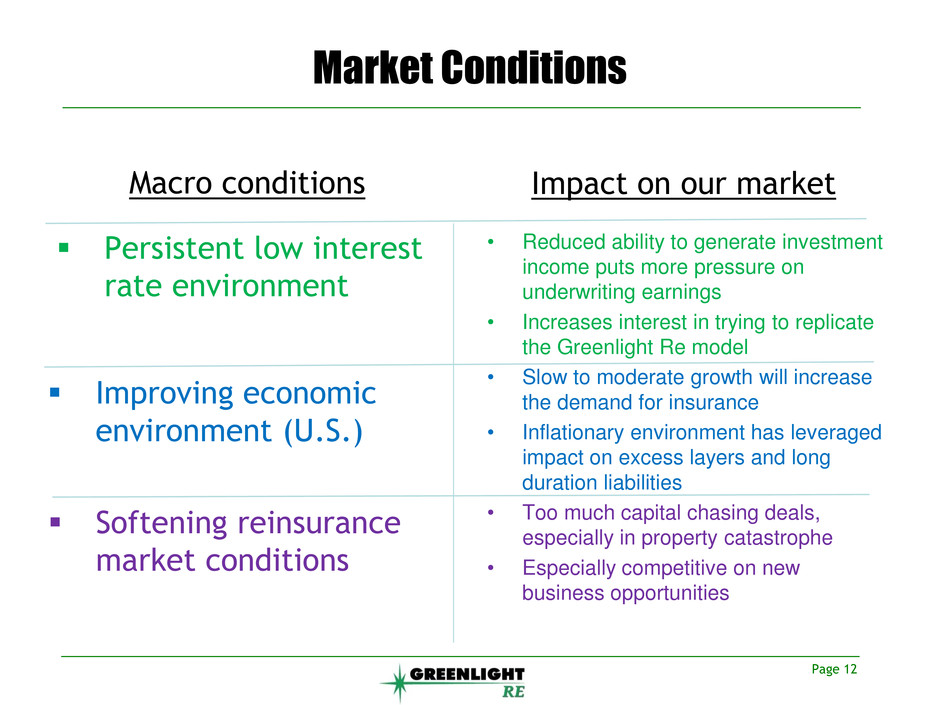

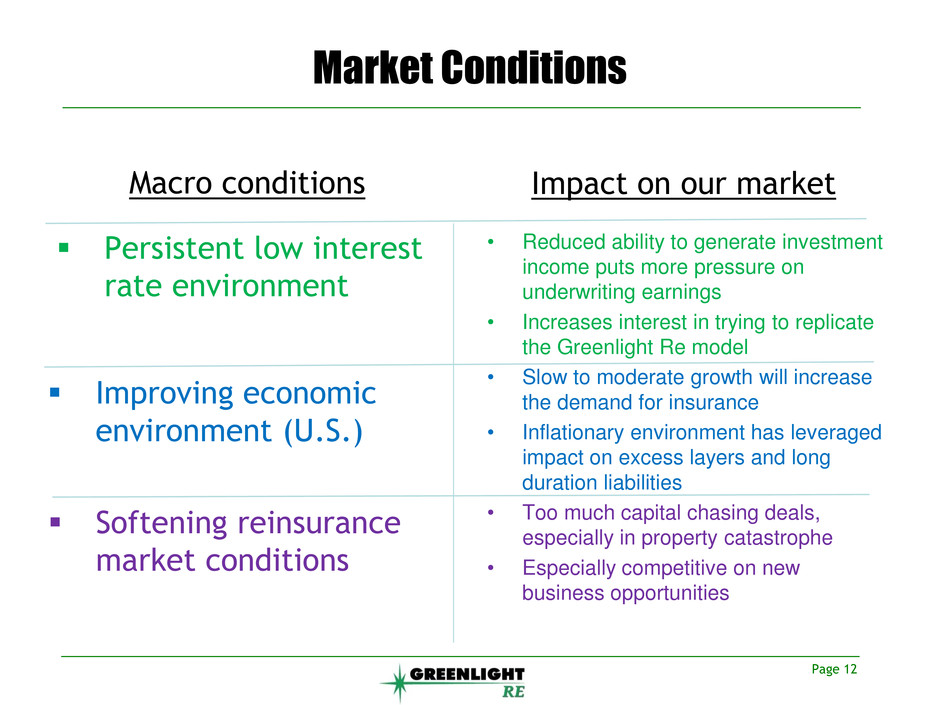

Market Conditions Macro conditions Persistent low interest rate environment Impact on our market • Reduced ability to generate investment income puts more pressure on underwriting earnings • Increases interest in trying to replicate the Greenlight Re model • Slow to moderate growth will increase the demand for insurance • Inflationary environment has leveraged impact on excess layers and long duration liabilities • Too much capital chasing deals, especially in property catastrophe • Especially competitive on new business opportunities Page 12 Improving economic environment (U.S.) Softening reinsurance market conditions

Page 13 Where are the opportunities going forward? Remain in relatively short duration lines with exposure to primary and low excess layers We expect to continue to have concentrations in: Florida Homeowners (limited wind) Employer Stop Loss Non-standard Automobile Health, including employer stop loss, may grow as a result of opportunities from full implementation of ACA Rate changes in U.S. commercial lines and workers’ compensation may make these areas more attractive U.K. market opportunities are expected to increase as a result of our efforts in Ireland

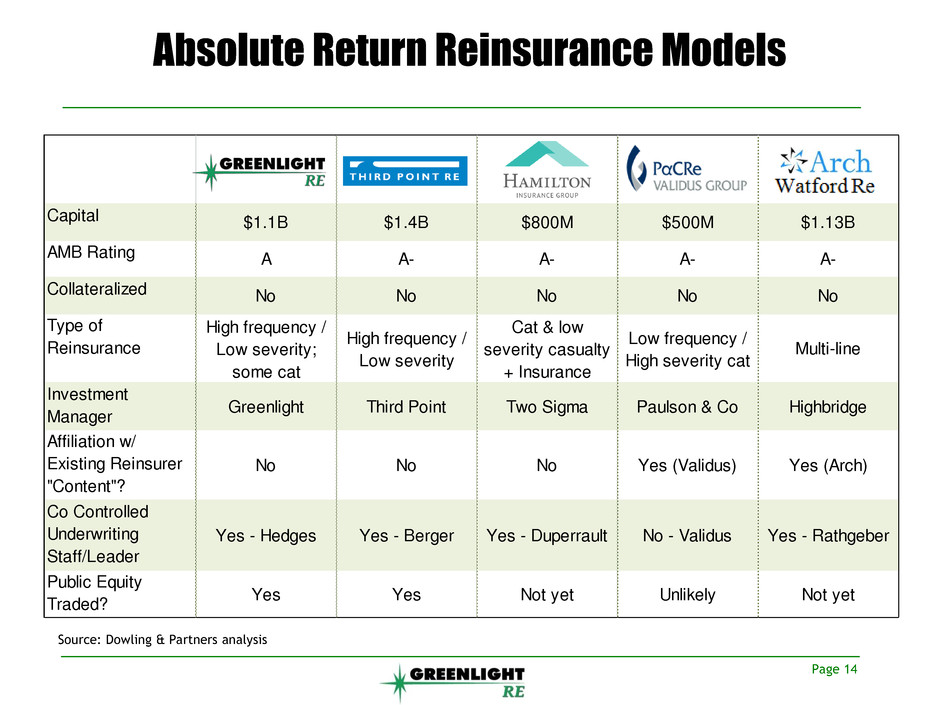

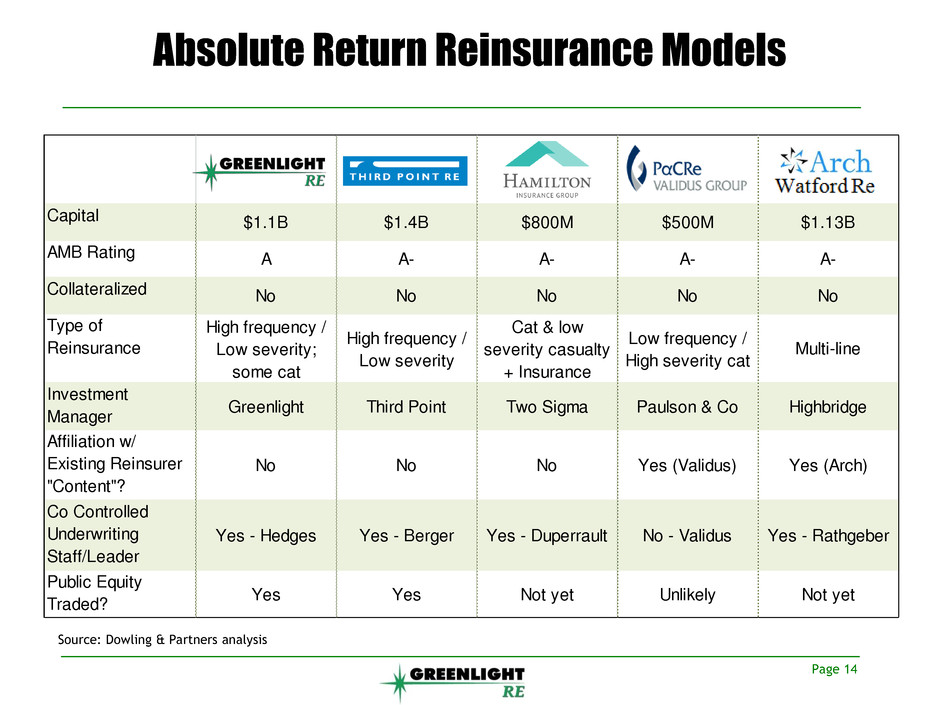

Absolute Return Reinsurance Models Page 14 Source: Dowling & Partners analysis Capital $1.1B $1.4B $800M $500M $1.13B AMB Rating A A- A- A- A- Collateralized No No No No No Type of Reinsurance High frequency / Low severity; some cat High frequency / Low severity Cat & low severity casualty + Insurance Low frequency / High severity cat Multi-line Investment Manager Greenlight Third Point Two Sigma Paulson & Co Highbridge Affiliation w/ Existing Reinsurer "Content"? No No No Yes (Validus) Yes (Arch) Co Controlled Underwriting Staff/Leader Yes - Hedges Yes - Berger Yes - Duperrault No - Validus Yes - Rathgeber Public Equity Traded? Yes Yes Not yet Unlikely Not yet Greenlight Third Point Re Hamilton Re (formerly S.A.C. Re) Pine River Re PαCRe Watford Re Capital $1.1B $1.4B $800M up to $750M $500M $1.13B AMB Rating A A- A- Assume A- A- A- Collateralized No No No No No No Type of Reinsurance High frequency / Low severity, some cat High frequency / Low severity Cat & low severity casualty + Insurance Multi-line? Low frequency / High severity cat Multi-line Investment Mgmt Style Hedge Fund Greenlight (Einhorn) Hedge Fund Third Point (Loeb) Hedge Fund Two Sigma Hedge Fund Fixed Income Pine River Hedge Fund Paulson & Co Multi-Strategy Fixed Income Highbridge Affiliation w/ Existing Reinsurer "Content"? No No No No Yes Yes Co Controlled Underwriting Staff / Leader Yes - Hedges Yes - Berger Yes – Duperrault Yes - Jewett No – Validus Yes - Rathgeber Public Equity Traded? Yes Yes Not yet Not yet Unlikely ("Family Re") Not yet S rce: D&P Analysis, Company reports RATED HEDGE FUND REINSURANCE MODELS "HEDGE FUND 1.0" "HEDGE FUND 2.0" "HEDGE FUND 3.0" ? Xreenlight Third Point Re Hamilton Re (formerly S.A.C. Re) Pine River Re PαCRe Watford Re Capital $1.1B $1.4B $800M up to $750M $500M $1.13B AMB Rating A A- A- Assume A- A- A- Collateraliz No No No No No No Type of Reinsuranc i h frequency / ow severit , some cat High frequency / Low s verity Cat & low severity casualty + Insurance Multi-line? Low frequency / High severity ca Multi-line Investment Mgmt Style edge Fund re nlight (Einhorn) Hedge Fund Third Point (L eb) H dge Fund Two Sigma Hedge Fund Fixed Income Pine River He ge Fund Paulson & Co Multi-Strategy Fixed Income Highbridge Affil ation / Existing Rein urer "Content"? No No No No Yes Yes Co Control e Underwritin Staff / Lead s - Hedges Yes - B rger Yes – Duperrault Yes - Jewett No – Validus Y s - Rathgeber Public Equit raded? Yes Yes Not yet Not yet Unlike ("Family Re") Not yet Sou c : D&P i , ompany reports RATED HEDGE FUND REINSURANCE MODELS "HEDGE FUND 1.0" "HEDGE FUND 2.0" "HEDGE FUND 3.0" ? X

Page 15 David Einhorn, Chairman of the Board

Investment Approach Investments managed by DME Advisors Value oriented, long-short investment program Focus on capital preservation Average gross long exposure of 91% long and 55% short since formation of GLRE Annualized return of 10.2% since formation of GLRE in July 2004 * Page 16 * As of April 30, 2014; past performance not necessarily indicative of future results

Investment Performance Since Formation Page 17 Note: from formation to April 30, 2014

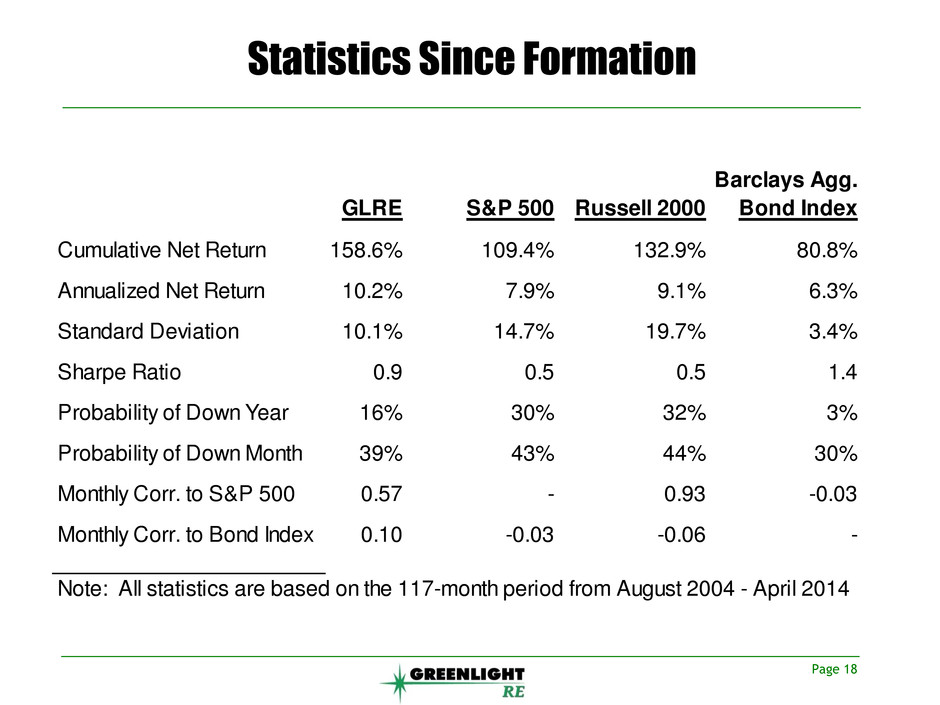

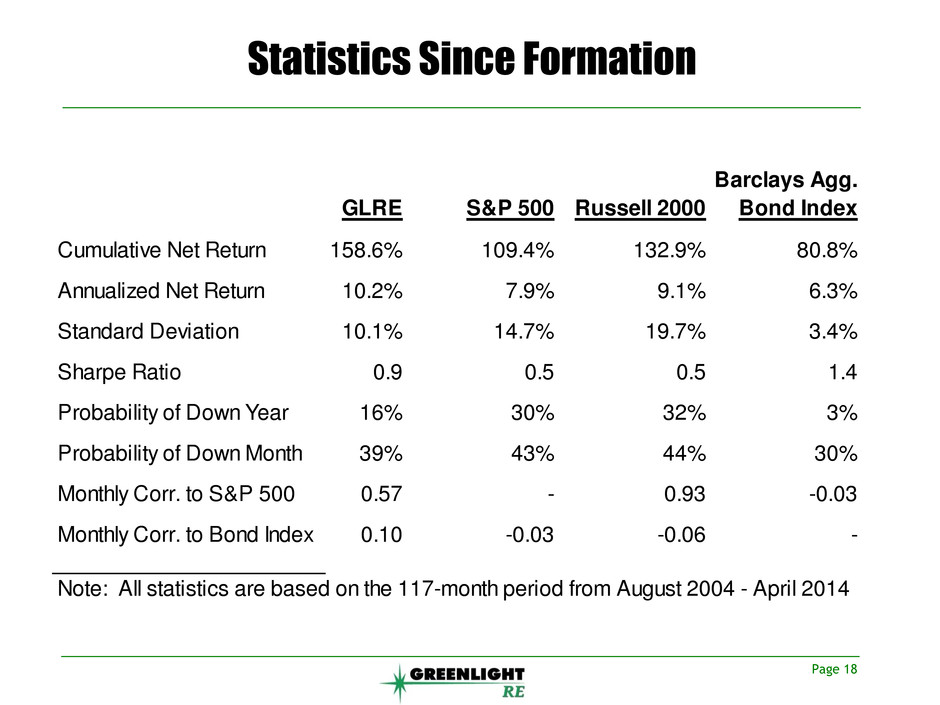

Statistics Since Formation Barclays Agg. GLRE S&P 500 Russell 2000 Bond Index Cumulative Net Return 158.6% 109.4% 132.9% 80.8% Annualized Net Return 10.2% 7.9% 9.1% 6.3% Standard Deviation 10.1% 14.7% 19.7% 3.4% Sharpe Ratio 0.9 0.5 0.5 1.4 Probability of Down Year 16% 30% 32% 3% Probability of Down Month 39% 43% 44% 30% Monthly Corr. to S&P 500 0.57 - 0.93 -0.03 Monthly Corr. to Bond Index 0.10 -0.03 -0.06 - Note: All statistics are based on the 117-month period from August 2004 - April 2014 Page 18

Current Investment Environment U.S. economy and corporate earnings continue to grow Corporate earnings expectations are high New Fed leadership and policies Wide range of possible outcomes Page 19

Current Investment Portfolio Portfolio currently 114% long and 66% short * Largest disclosed long positions are Alpha Bank, Apple, gold, Marvell, Micron and Oil States International * Long cash-rich technology companies and businesses benefitting from structural changes Shorts include secular decliners, momentum stocks and iron ore related companies Macro overlay due to monetary policy and unresolved imbalances Page 20 * as of April 30, 2014

Page 21 Compensation Structure Align management with shareholders Compensate for increase in economic value Variable quantitative bonus component for all employees based on underwriting results u/w years 2007-2008 = bonus above target u/w years 2009-2010 = no bonus u/w year 2011 = bonus above target u/w years 2012-2013 = estimated above target

Page 22 Where We Are Today Established company with fully-staffed operations in Cayman and Ireland Proven 10-year track record through a full cycle and a financial crisis “A” rating from A.M. Best provides a competitive advantage versus new players Balanced approach allows us to stay disciplined during soft reinsurance market

Page 23 Tim Courtis, Chief Financial Officer

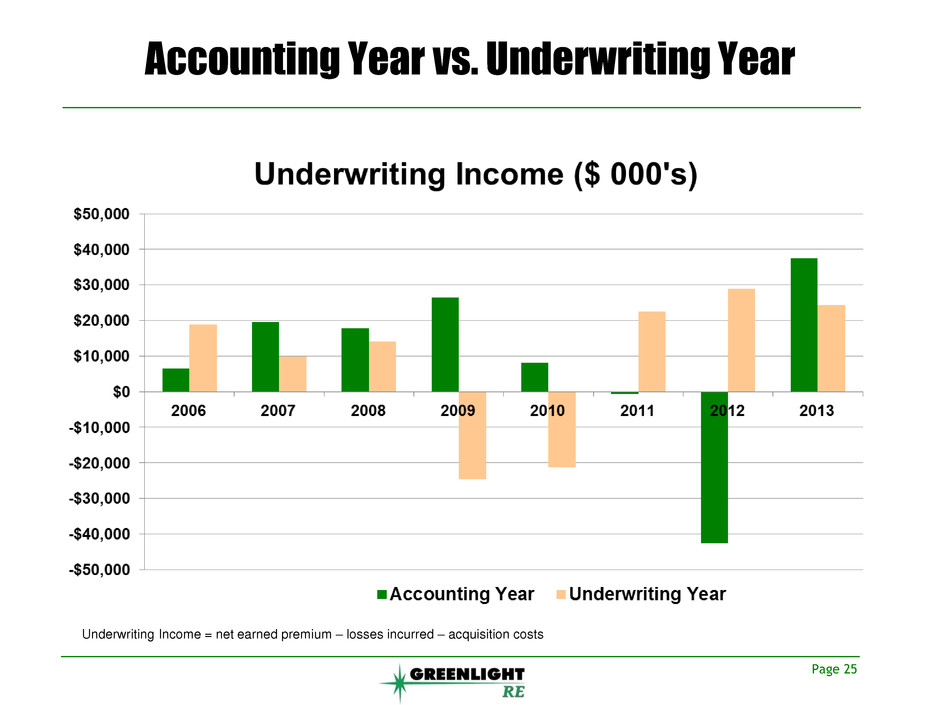

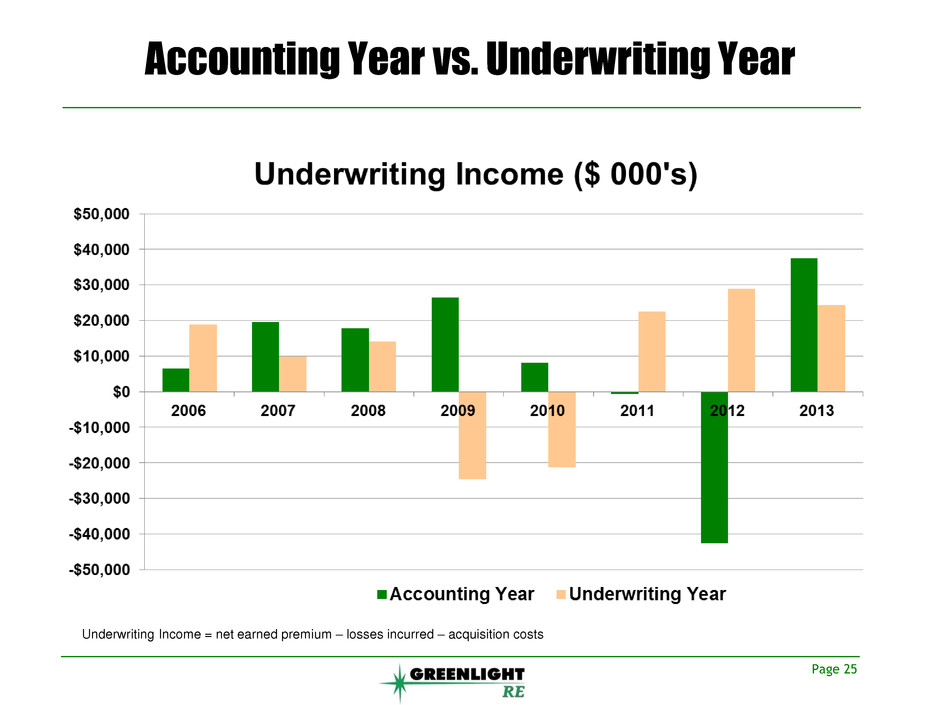

Page 24 Accounting Year vs. Underwriting Year GAAP quarterly/annual results report the accounting impact of all underwriting years Reinsurance contracts often take years to be resolved before actual profitability is known Underwriting decisions made in prior years affect current results Economics of underwriting flow into future accounting years

Page 25 Accounting Year vs. Underwriting Year Underwriting Income = net earned premium – losses incurred – acquisition costs

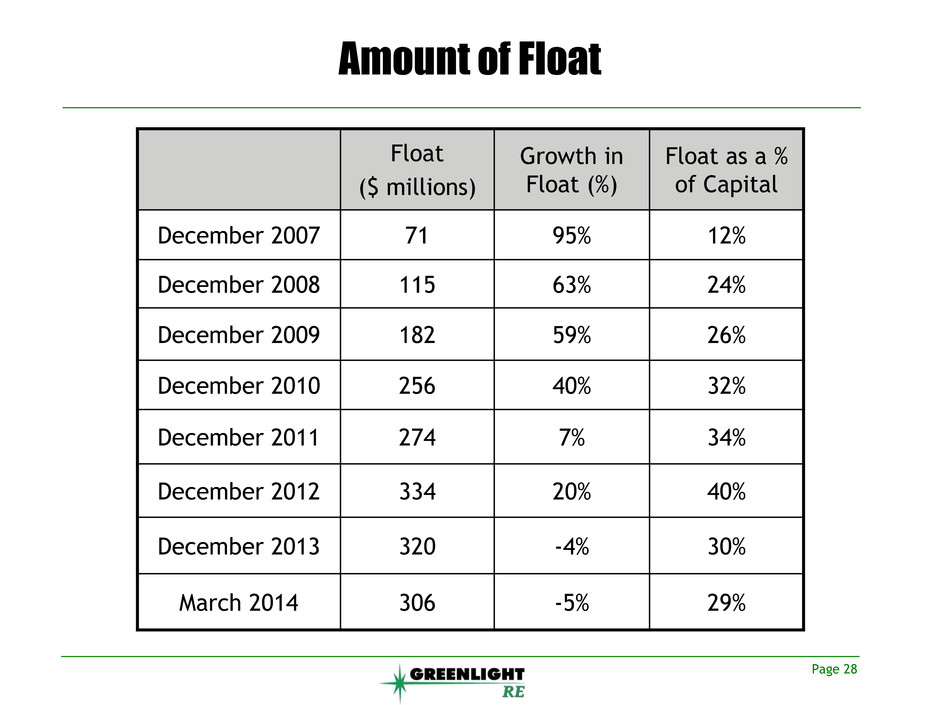

Page 26 Float We only write transactions that we believe create positive standalone economics As a consequence of writing these contracts, we generate investable funds or “float” Premium is usually collected before claims are paid The claim payment duration for our current portfolio averages between 1 – 3 years We invest our entire capital base plus our float (less a reserve for ongoing expenses) in a portfolio managed by DME Advisors

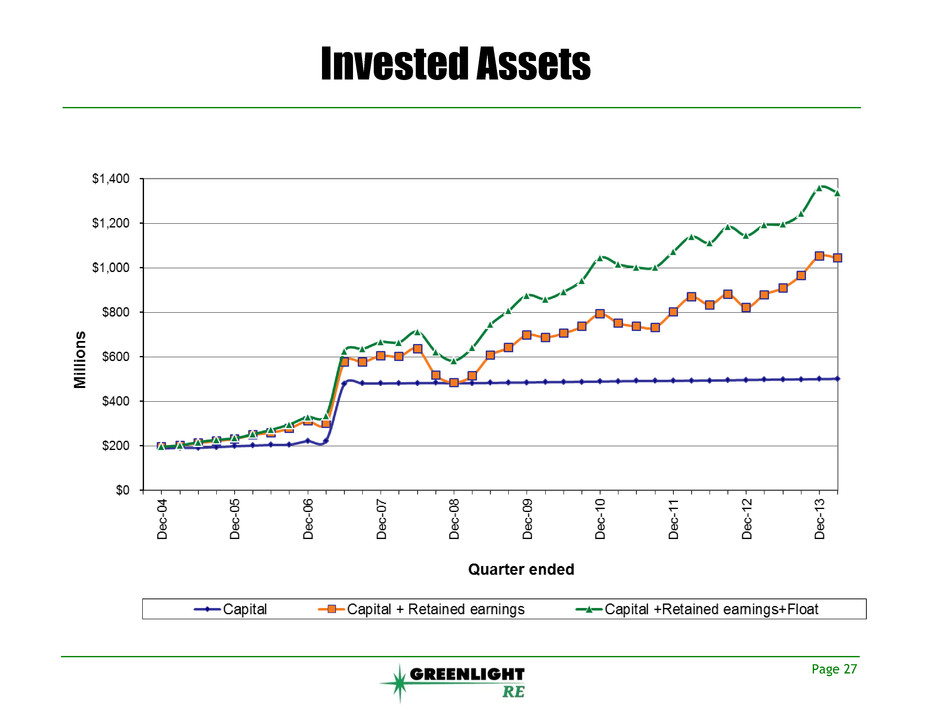

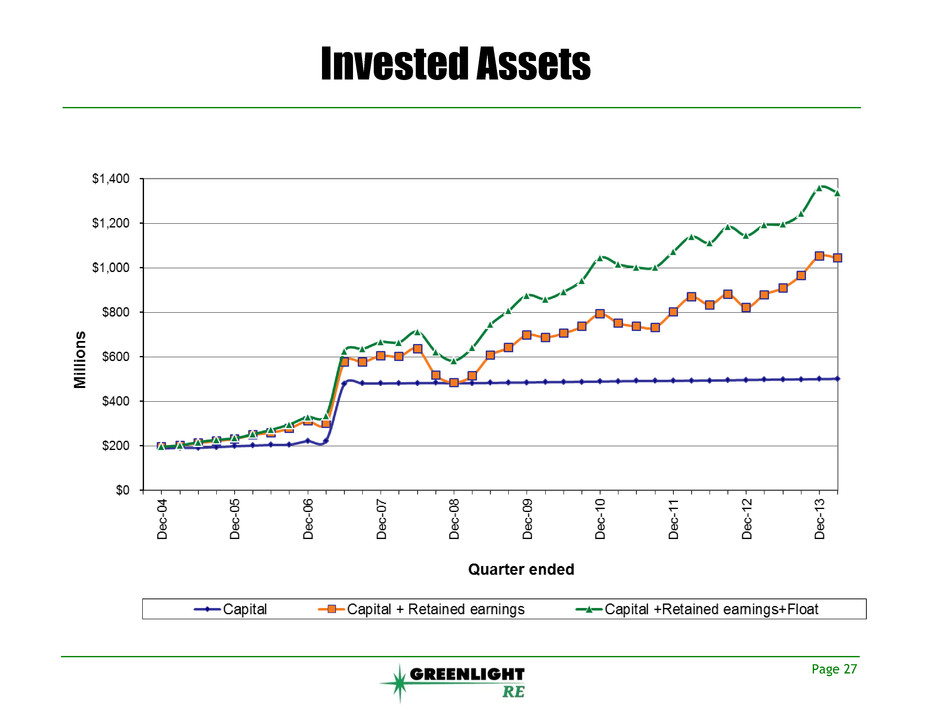

Page 27 Invested Assets

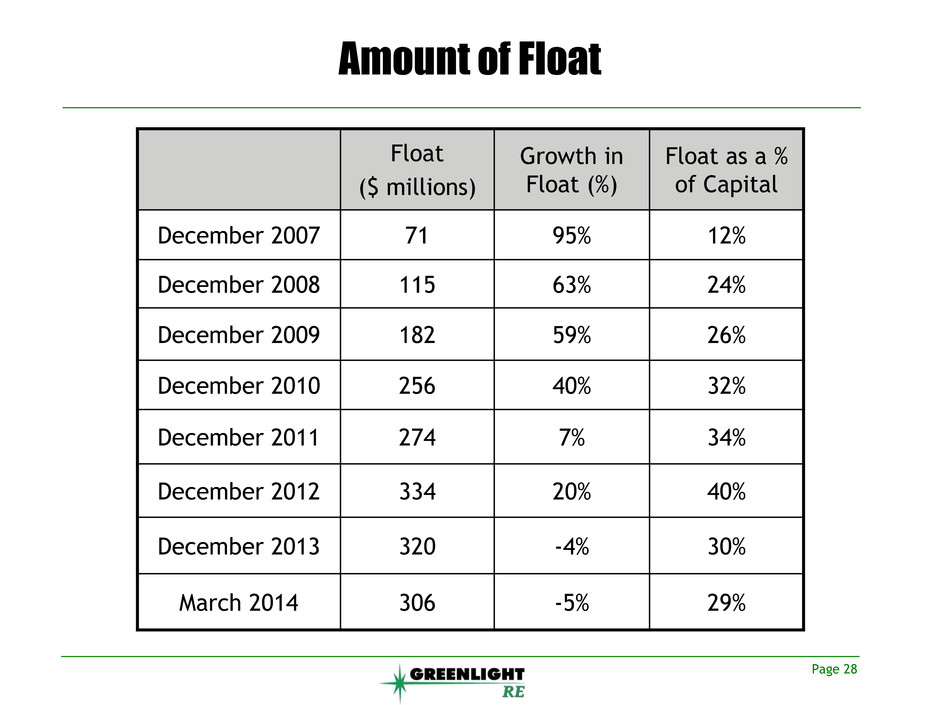

Page 28 Amount of Float Float ($ millions) Growth in Float (%) Float as a % of Capital December 2007 71 95% 12% December 2008 115 63% 24% December 2009 182 59% 26% December 2010 256 40% 32% December 2011 274 7% 34% December 2012 334 20% 40% December 2013 320 -4% 30% March 2014 306 -5% 29%

Page 29 Calculation of Float Note: as of March 31, 2014 (US$ millions) Total investments 1,343 Cash and cash equivalents 4 Restricted cash and cash equivalents 1,229 Financial contracts receivable 83 Notes receivable 16 Securities sold, not yet purchased (986) Financial contracts payable (24) Due to prime brokers (286) Performance compensation payable - Minority interest (30) Total invested assets 1,349 Shareholders' equity attributable to shareholders 1,044 Float 306

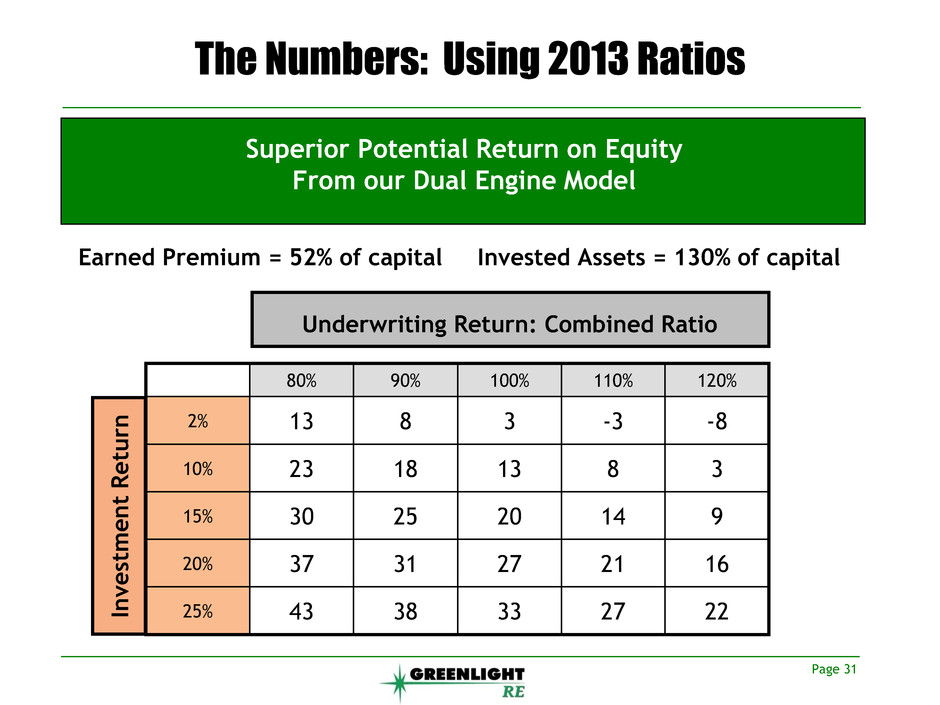

The change in fully diluted adjusted book value can be broken down as follows: Page 30 Return on Equity 2009 2010 2011 2012 2013 Investment Return on Capital 29.8% 10.8% 2.4% 6.9% 17.5% Investment Return on Float 9.5% 3.4% 0.9% 2.7% 7.6% Underwriting Net Income (Loss) 6.0% 1.0% -0.1% -5.5% 4.3% G&A Expenses + Taxes -3.8% -2.3% -2.2% -2.2% -2.6% Total ROE 41.5% 12.9% 1.0% 1.9% 26.8%

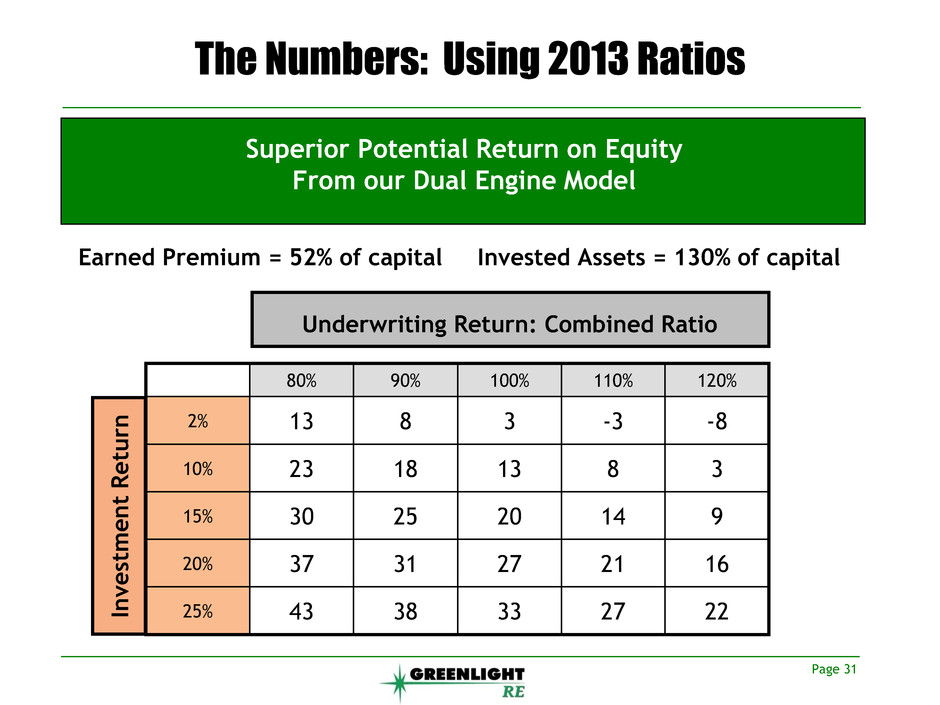

Page 31 Earned Premium = 52% of capital Invested Assets = 130% of capital Superior Potential Return on Equity From our Dual Engine Model 80% 90% 100% 110% 120% 2% 13 8 3 -3 -8 10% 23 18 13 8 3 15% 30 25 20 14 9 20% 37 31 27 21 16 25% 43 38 33 27 22 The Numbers: Using 2013 Ratios In vestm e n t Retur n Underwriting Return: Combined Ratio

Page 32 Growth in Book Value vs. Share Price Note: numbers represent fully diluted adjusted book value per share 10.40 11.63 14.27 16.57 13.39 18.95 21.39 21.61 22.01 27.91 27.61 20.79 12.99 23.59 26.81 23.67 23.08 33.71 32.80 $5 $10 $15 $20 $25 $30 $35 $40 Fully Diluted Adjusted Book Value Share Price

Page 33 Bart Hedges, Chief Executive Officer

Page 34 Summary We set out in 2004 to create a reinsurance company with a superior business model Our vision then is exactly what you see now We continue to find ways to create value in a difficult market We are eager to see what we can do in a favorable market Goals for 2014 and beyond: Continue to grow fully diluted book value per share Remain disciplined and opportunistic

Page 35 Q & A