Greenlight Re Investor Meeting May 12, 2016 “Rethinking Reinsurance”

• Introduction and Underwriting – Bart Hedges, CEO • Investments – David Einhorn, Chairman • Financial Overview – Tim Courtis, CFO • Q&A • Cocktail Reception – The Sky Room 2 Agenda

3 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the U.S. Federal securities laws. These statements involve risks and uncertainties that could cause actual results to differ materially from those contained in forward-looking statements made on behalf of the Company. These risks and uncertainties include the impact of general economic conditions and conditions affecting the insurance and reinsurance industry, the adequacy of our reserves, our ability to assess underwriting risk, trends in rates for property and casualty insurance and reinsurance, competition, investment market fluctuations, trends in insured and paid losses, catastrophes, regulatory and legal uncertainties and other factors described in our most recent annual report on Form 10-K and quarterly report on Form 10-Q filed subsequent thereto and other documents on file with the Securities Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Underwriting: Customer Centric Develop long-term reinsurance relationships that deliver superior value to our partners in areas of the market that present the best mutually beneficial opportunities Investing: Differentiated & Equity Focused Invest using a deep value, long-short equity strategy to maximize growth in fully diluted book value per share over the long term Our Strategy 4

5 Customer Centricity Our customer centric approach includes: • Having a transparent relationship with our partners • Shaping our partners’ behavior at the front end of the business

Customer Centric Strong Relationships Renewal Business Converting a Deal to an Annuity 6 “Sticky” Premium Flow

Converting a Deal to an Annuity 7 Underwriting Year 2011 2012 2013 2014 2015 Retention - Client 59.1% 80.0% 91.7% 78.6% 77.8% Retention - Premium 71.8% 86.0% 93.6% 69.5% 92.4% • Retention ratios for both clients and premium have been high • 2014 reflects the non-renewal of a large relationship • 62% of current premium has been with us for 4 or more years

• A real world example of our strategy being successfully executed • Windhaven is a Miami-based non-standard auto insurance writer • Portfolio focused in South Florida and expanding in Texas • We have been partners since 2011 Greenlight Re’s Partnership with Windhaven Insurance Company 8

Windhaven’s View of Our Relationship 9 Video from Jimmy Whited, President & CEO

Underwriting Vision and Focus: Adapting to the Environment 10

• Write a highly concentrated underwriting portfolio with a few sizeable relationships • Large partner deals represent 79% of total premium in underwriting year 2015 Our Initial Vision 11

Always Evolving 12 Better diversified portfolio Support one placement, then expand into others Build relationships with larger carriers who purchase reinsurance across multiple lines

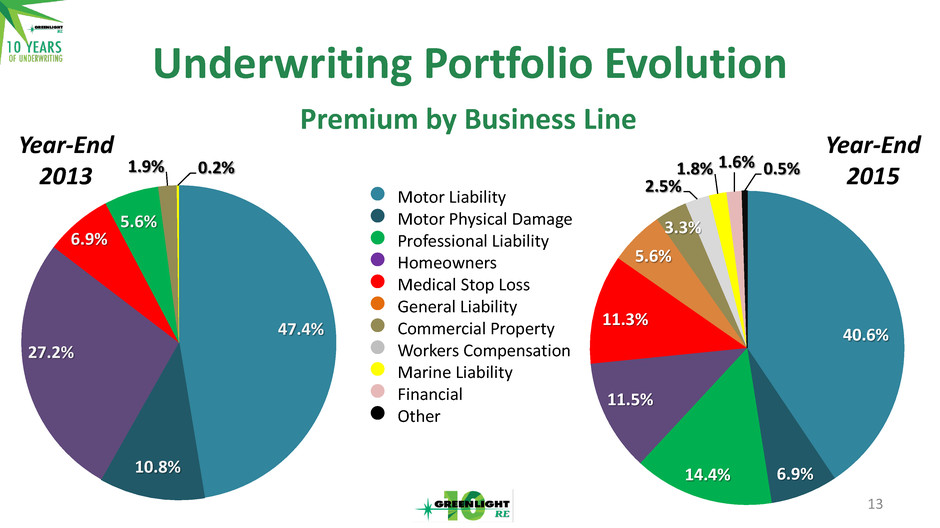

13 Underwriting Portfolio Evolution Year-End 2013 Premium by Business Line ● Motor Liability ● Motor Physical Damage ● Professional Liability ● Homeowners ● Medical Stop Loss ● General Liability ● Commercial Property ● Workers Compensation ● Marine Liability ● Financial ● Other Year-End 2015 40.6% 6.9% 14.4% 11.5% 11.3% 5.6% 3.3% 2.5% 1.8% 1.6% 0.5% 47.4% 10.8% 27.2% 6.9% 5.6% 1.9% 0.2%

Underwriting Results: A Deeper Dive 14

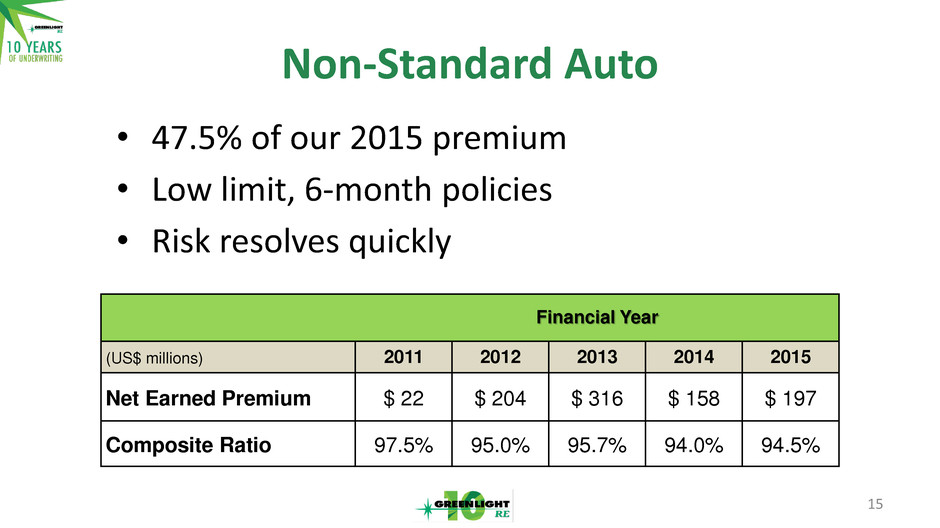

Non-Standard Auto 15 Financial Year (US$ millions) 2011 2012 2013 2014 2015 Net Earned Premium $ 22 $ 204 $ 316 $ 158 $ 197 Composite Ratio 97.5% 95.0% 95.7% 94.0% 94.5% • 47.5% of our 2015 premium • Low limit, 6-month policies • Risk resolves quickly

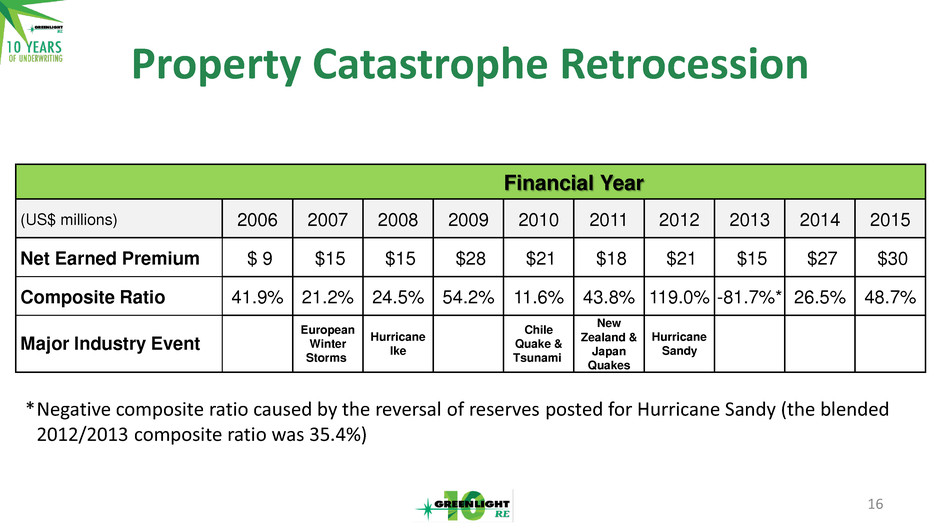

Property Catastrophe Retrocession 16 Financial Year (US$ millions) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Net Earned Premium $ 9 $15 $15 $28 $21 $18 $21 $15 $27 $30 Composite Ratio 41.9% 21.2% 24.5% 54.2% 11.6% 43.8% 119.0% -81.7%* 26.5% 48.7% Major Industry Event European Winter Storms Hurricane Ike Chile Quake & Tsunami New Zealand & Japan Quakes Hurricane Sandy * Negative composite ratio caused by the reversal of reserves posted for Hurricane Sandy (the blended 2012/2013 composite ratio was 35.4%)

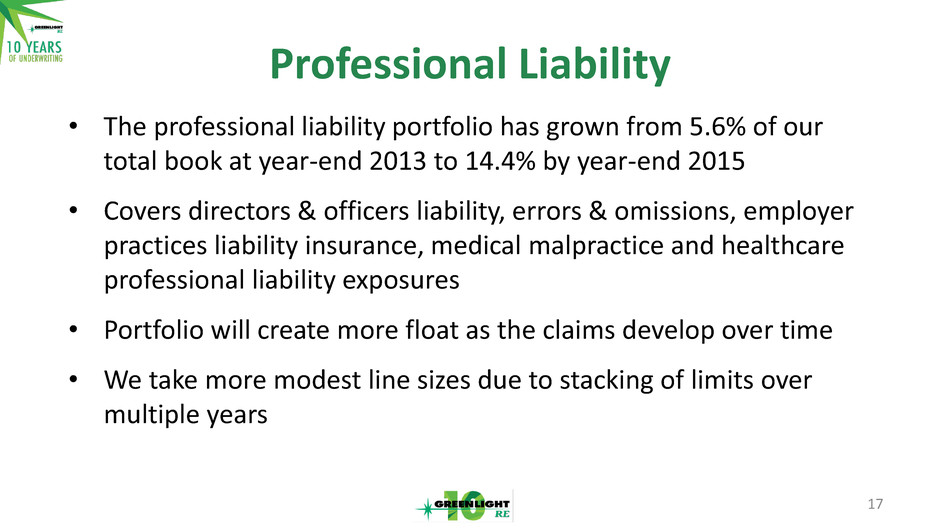

• The professional liability portfolio has grown from 5.6% of our total book at year-end 2013 to 14.4% by year-end 2015 • Covers directors & officers liability, errors & omissions, employer practices liability insurance, medical malpractice and healthcare professional liability exposures • Portfolio will create more float as the claims develop over time • We take more modest line sizes due to stacking of limits over multiple years Professional Liability 17

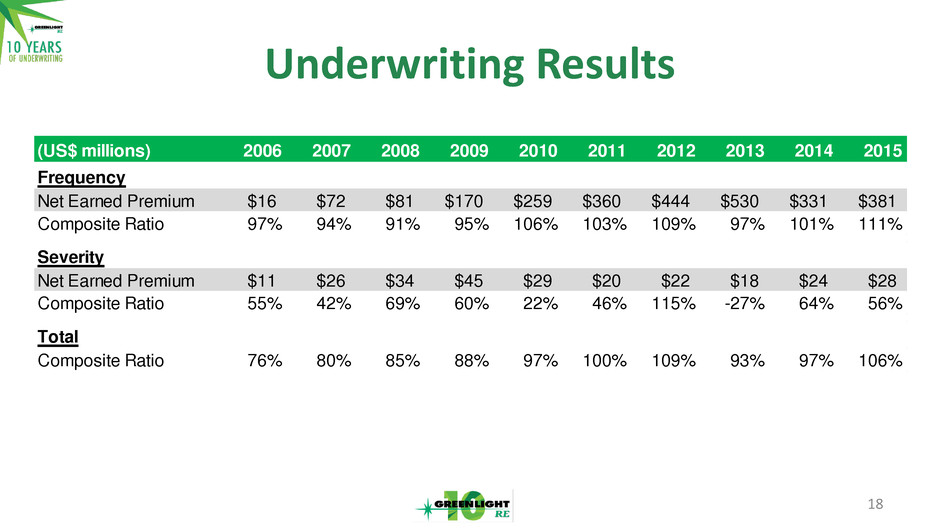

Underwriting Results 18 (US$ millions) 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Frequency Net Earned Premium $16 $72 $81 $170 $259 $360 $444 $530 $331 $381 Composite Ratio 97% 94% 91% 95% 106% 103% 109% 97% 101% 111% Severity Net Earned Premium $11 $26 $34 $45 $29 $20 $22 $18 $24 $28 Composite Ratio 55% 42% 69% 60% 22% 46% 115% -27% 64% 56% Total Composite Ratio 76% 80% 85% 88% 97% 100% 109% 93% 97% 106%

Greenlight Re Team 19

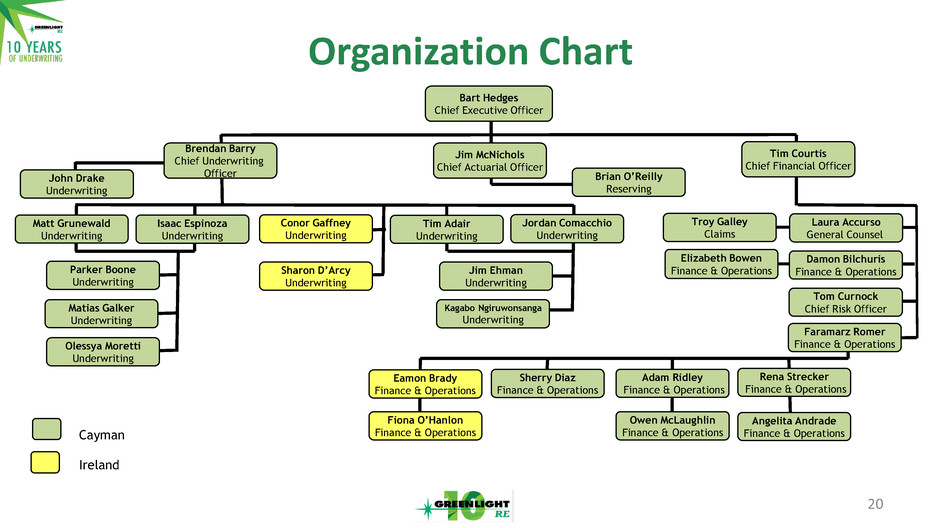

Tom Curnock Chief Risk Officer Bart Hedges Chief Executive Officer Brendan Barry Chief Underwriting Officer Jim McNichols Chief Actuarial Officer Jordan Comacchio Underwriting Kagabo Ngiruwonsanga Underwriting Tim Courtis Chief Financial Officer Sherry Diaz Finance & Operations Faramarz Romer Finance & Operations Adam Ridley Finance & Operations Laura Accurso General Counsel Jim Ehman Underwriting Matt Grunewald Underwriting Rena Strecker Finance & Operations Parker Boone Underwriting Sharon D’Arcy Underwriting Conor Gaffney Underwriting Matias Galker Underwriting John Drake Underwriting Elizabeth Bowen Finance & Operations Owen McLaughlin Finance & Operations Damon Bilchuris Finance & Operations Brian O’Reilly Reserving Angelita Andrade Finance & Operations Eamon Brady Finance & Operations Ireland Cayman Organization Chart Isaac Espinoza Underwriting Tim Adair Underwriting Troy Galley Claims Fiona O’Hanlon Finance & Operations Olessya Moretti Underwriting 20

Outlook 21

• Continue to evolve our largest customer relationships into annuities • Diversify but continue to focus on large deals – Concentration in non-standard automobile will continue – Grow the Healthcare/Employer Stop Loss portfolio – Target more geographic diversification particularly in the U.K. Looking Forward 22

David Einhorn Chairman of the Board 23

Investments held in a separate account that is managed by DME Advisors, an affiliate of Greenlight Capital Value-focused, long/short investment program Maximize total risk-adjusted return with a focus on capital preservation Average gross long exposure of 95% long and 59% short since formation of GLRE Annualized net return of 7.0% since formation of GLRE in August 2004 * Investment Approach 24 * As of April 30, 2016; past performance not necessarily indicative of future results; additional information available at the end of the presentation.

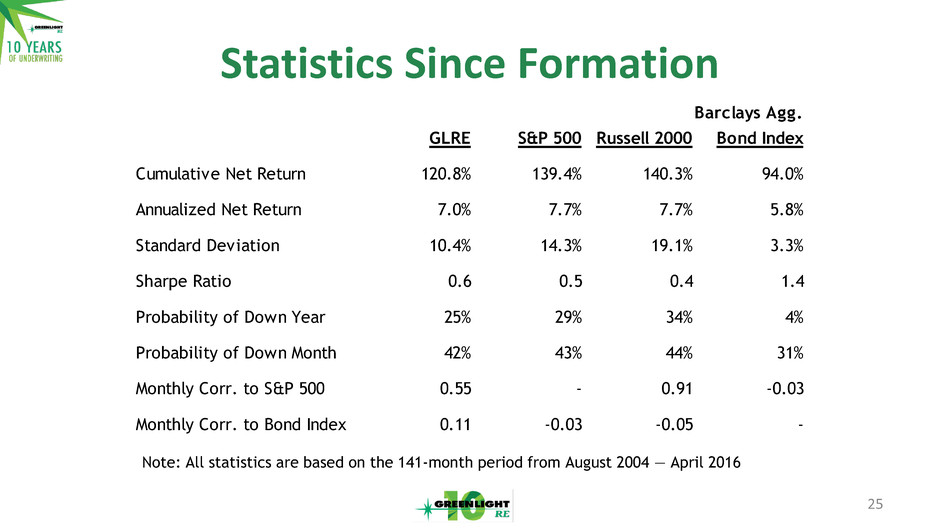

Statistics Since Formation 25 Note: All statistics are based on the 141-month period from August 2004 — April 2016 Barclays Agg. GLRE S&P 500 Russell 2000 Bond Index Cumulative Net Return 120.8% 139.4% 140.3% 94.0% Annualized Net Return 7.0% 7.7% 7.7% 5.8% Standard Deviation 10.4% 14.3% 19.1% 3.3% Sharpe Ratio 0.6 0.5 0.4 1.4 Probability of Down Year 25% 29% 34% 4% Probability of Down Month 42% 43% 44% 31% Monthly Corr. to S&P 500 0.55 - 0.91 -0.03 Monthly Corr. to Bond Index 0.11 -0.03 -0.05 -

Winners and Losers 26 19% -35% -80% -60% -40% -20% 0% 20% 40% 60% 80% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Winners Gross Contribution Losers Gross Contribution Average: 41% Average: -29%

Portfolio currently 93% long and 77% short Largest disclosed longs are Apple, CONSOL Energy, General Motors, gold, and Time Warner Long cash-rich companies trading at low multiples that are fundamentally executing Shorts include companies that are not only challenged but also pricing in too much hope for the future — “bubble” stocks, oil frackers, and high multiple cyclicals Macro positions focused on opportunities arising from unconventional monetary policies Current Investment Portfolio 27

The investment manager is subject to a modified high water mark Reduced fees until the loss plus 150% of the loss is recovered This equates to a reduced fee on approximately the next 60% of the return from DME Advisors The reinsurance team is compensated for generating underwriting profits Underwriting losses are carried forward to future underwriting years and recouped against underwriting profits Alignment with Shareholders 28

Tim Courtis Chief Financial Officer 29

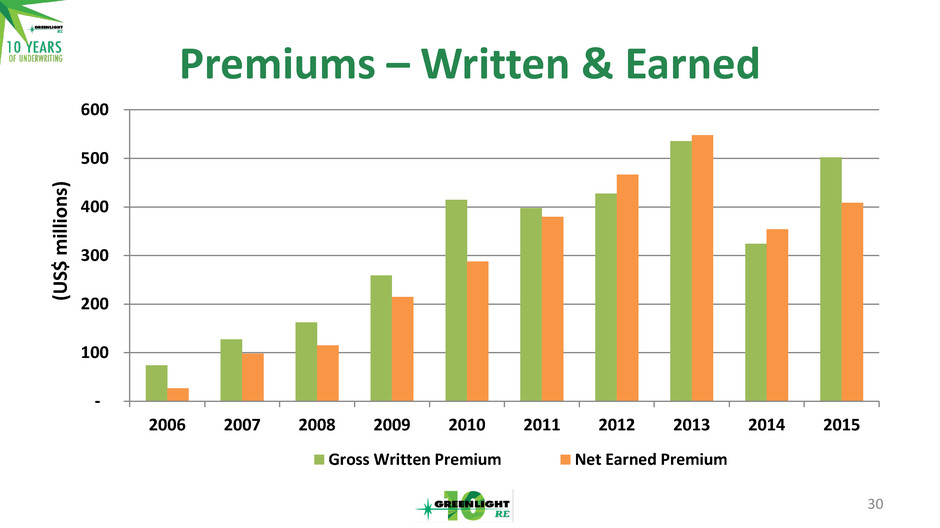

Premiums – Written & Earned 30 - 100 200 300 400 500 600 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 (US$ mi lli o n s) Gross Written Premium Net Earned Premium

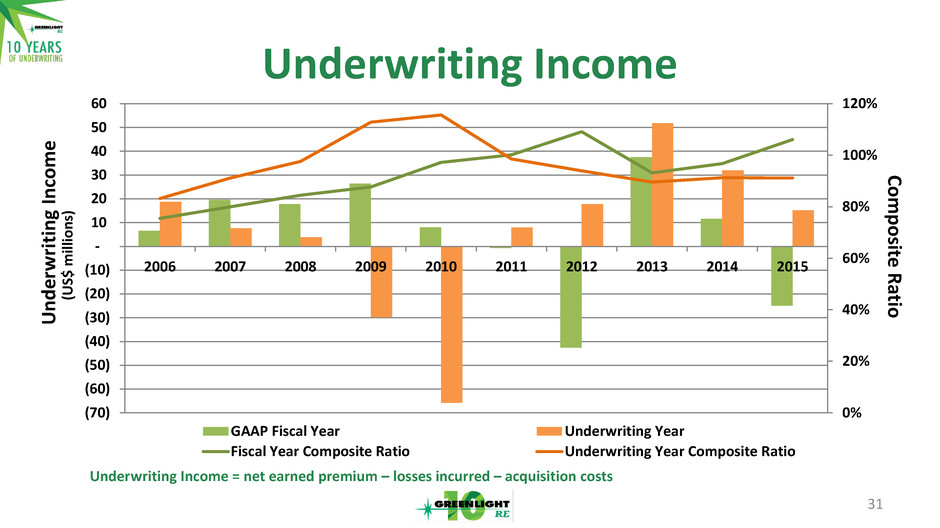

Underwriting Income 31 Underwriting Income = net earned premium – losses incurred – acquisition costs 0% 20% 40% 60% 80% 100% 120% (70) (60) (50) (40) (30) (20) (10) - 10 20 30 40 50 60 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 (U S$ m ill io n s) GAAP Fiscal Year Underwriting Year Fiscal Year Composite Ratio Underwriting Year Composite Ratio Com p o sit e R ati o Underwr it ing I n co m e

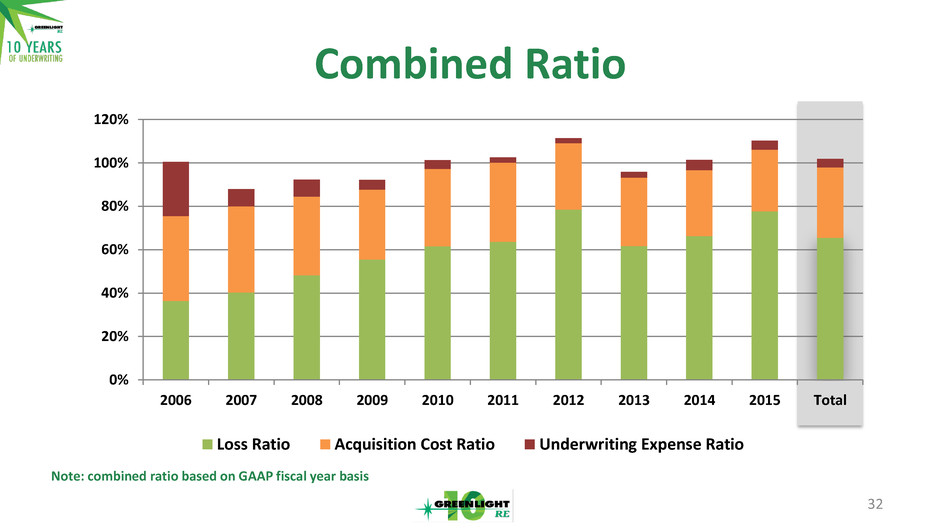

0% 20% 40% 60% 80% 100% 120% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Total Loss Ratio Acquisition Cost Ratio Underwriting Expense Ratio Combined Ratio 32 Note: combined ratio based on GAAP fiscal year basis

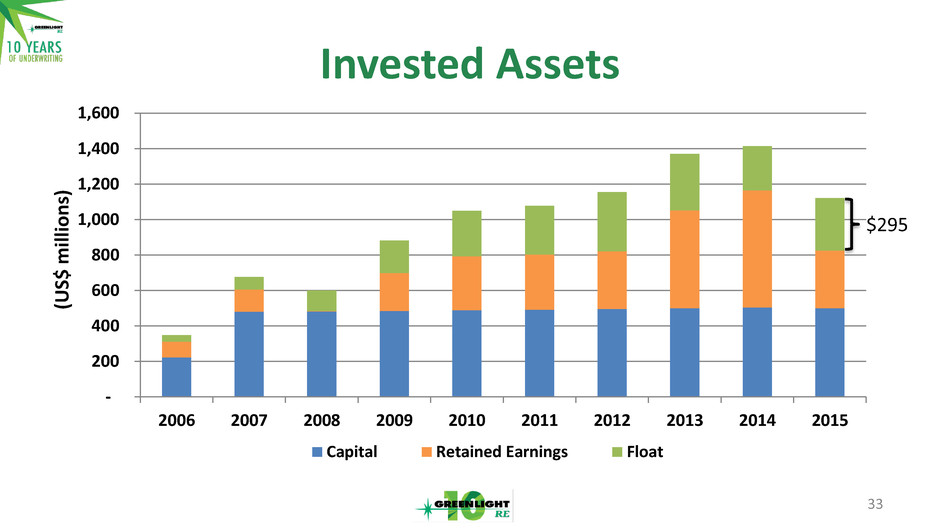

- 200 400 600 800 1,000 1,200 1,400 1,600 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 (US$ mi lli o n s) Capital Retained Earnings Float Invested Assets 33 $295

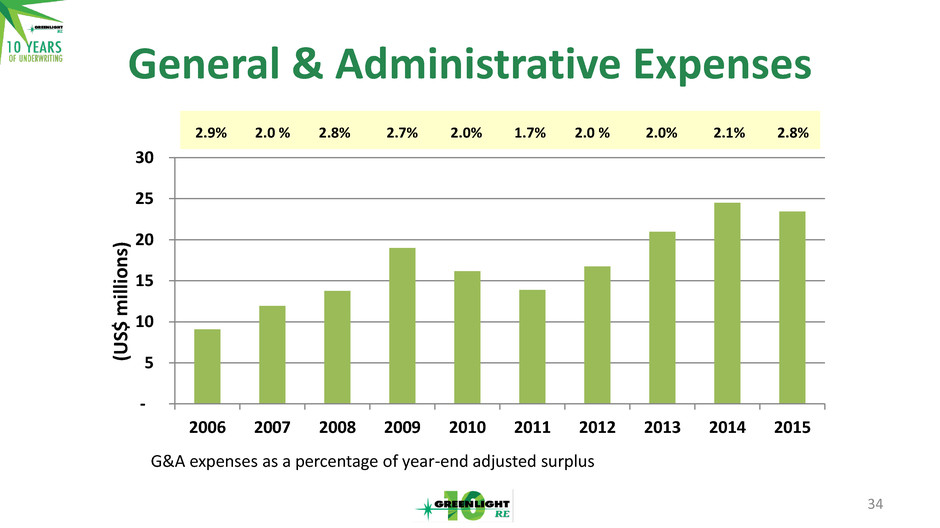

General & Administrative Expenses 34 2.9% 2.0 % 2.8% 2.7% 2.0% 1.7% 2.0 % 2.0% 2.1% 2.8% G&A expenses as a percentage of year-end adjusted surplus - 5 10 15 20 25 30 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 (US$ mi lli o n s)

Compensation Structure 35 • Align management with shareholders • Compensate for increase in economic value • Variable quantitative bonus for all employees is deferred until the ultimate underwriting result is better known

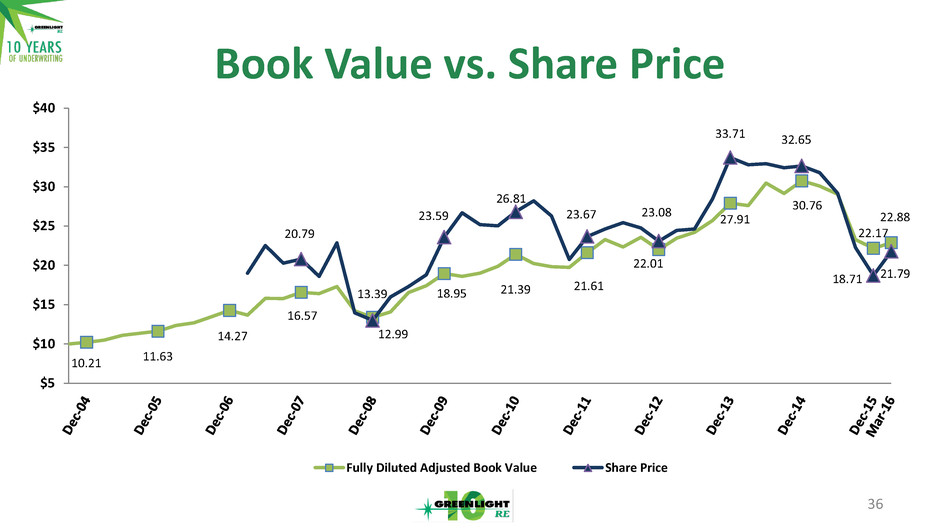

Book Value vs. Share Price 36 10.21 11.63 14.27 16.57 13.39 18.95 21.39 21.61 22.01 27.91 30.76 22.17 22.88 20.79 12.99 23.59 26.81 23.67 23.08 33.71 32.65 18.71 21.79 $5 $10 $15 $20 $25 $30 $35 $40 Fully Diluted Adjusted Book Value Share Price

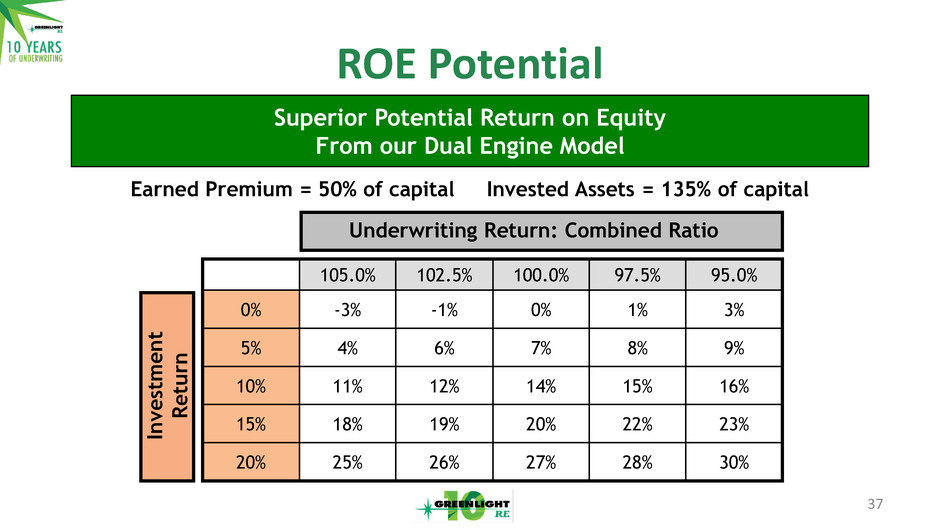

ROE Potential 37 Superior Potential Return on Equity From our Dual Engine Model Earned Premium = 50% of capital Invested Assets = 135% of capital In v e stm e n t R e tu rn 105.0% 102.5% 100.0% 97.5% 95.0% 0% -3% -1% 0% 1% 3% 5% 4% 6% 7% 8% 9% 10% 11% 12% 14% 15% 16% 15% 18% 19% 20% 22% 23% 20% 25% 26% 27% 28% 30% Underwriting Return: Combined Ratio

38 Investment Portfolio Disclosure • All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. • Performance returns of the managed account reflect the time weighted rate of return of the Net Assets, as defined in the agreement dated January 1, 2014, and are net of either the modified high-water mark incentive allocation of 10% or the standard 20% incentive allocation applied on a monthly basis pursuant to the agreement. Performance returns are estimated pending the year-end audit. Past performance is not indicative of future results. Actual returns may differ from the returns presented. • Positions reflected in this presentation do not represent all the positions held, purchased, or sold, and in the aggregate, the information may represent a small percentage of activity. The information presented is intended to provide insight into the noteworthy events, in the sole opinion of the presenter, affecting the portfolio. • Unless otherwise indicated, all exposure information is calculated on a delta adjusted basis and excludes credit default swaps, interest rate swaps, sovereign debt, currencies, commodities, volatility indexes and derivatives on any of these instruments. • Winners gross contribution are the sum of returns for each position with a positive gross return during the year. Losers gross contribution are the sum of returns for each position with a negative gross return during the year. Average reflects the numerical average of the annual positive or negative gross return. Figures for partial years are excluded. • Reference to an index does not imply that the managed account will achieve returns, volatility or other results similar to the index. The total returns for the index do not reflect the deduction of any fees or expenses which would reduce returns.