UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-22003 |

Nuveen Core Equity Alpha Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

31 December 2019

Nuveen

Closed-End Funds

| | |

| JCE | | Nuveen Core Equity Alpha Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, (i) by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences.” Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Annual Report

IMPORTANT DISTRIBUTION NOTICE

for Shareholders of the Nuveen Core Equity Alpha Fund (JCE)

Annual Shareholder Report for the period ending December 31, 2019

The Nuveen Core Equity Alpha Fund (JCE) seeks to offer attractive cash flow to its shareholders, by converting the expected long-term total return potential of the Fund’s portfolio of investments into regular quarterly distributions. Following is a discussion of the Managed Distribution Policy the Fund uses to achieve this.

The Fund pays quarterly common share distributions that seek to convert the Fund’s expected long-term total return potential into regular cash flow. As a result, the Fund’s regular common share distributions (presently $0.2500 per share, respectively) may be derived from a variety of sources, including:

| | • | | net investment income consisting of regular interest and dividends, |

| | • | | realized capital gains or, |

| | • | | possibly, returns of capital representing in certain cases unrealized capital appreciation. |

Such distributions are sometimes referred to as “managed distributions.” The Fund seeks to establish a distribution rate that roughly corresponds to the Adviser’s projections of the total return that could reasonably be expected to be generated by the Fund over an extended period of time. The Adviser may consider many factors when making such projections, including, but not limited to, long-term historical returns for the asset classes in which the Fund invests. As portfolio and market conditions change, the distribution amount and distribution rate on the Common Shares under the Fund’s Managed Distribution Policy could change.

When it pays a distribution, the Fund provides holders of its Common Shares a notice of the estimated sources of the Fund’s distributions (i.e., what percentage of the distributions is estimated to constitute ordinary income, short-term capital gains, long-term capital gains, and/or a non-taxable return of capital) on a year-to-date basis. It does this by posting the notice on its website (www.nuveen.com/cef), and by sending it in written form.

You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s Managed Distribution Policy. The Fund’s actual financial performance will likely vary from month-to-month and from year-to-year, and there may be extended periods when the distribution rate will exceed the Fund’s actual total returns. The Managed Distribution Policy provides that the Board may amend or terminate the Policy at any time without prior notice to Fund shareholders. There are presently no reasonably foreseeable circumstances that might cause the Fund to terminate its Managed Distribution Policy.

Table of Contents

3

Chair’s Letter to Shareholders

Dear Shareholders,

Financial markets finished 2019 on a high note, despite the challenges of a weak start to the year, a slower global economy and heightened geopolitical risks. While global manufacturing languished, consumers remained resilient amid tight labor markets, growing wages and tame inflation. Global business sentiment, however, was less optimistic due to trade frictions and weaker global demand. Across advanced economies growth in corporate profits and earnings was subdued in 2019. Nevertheless, the Federal Reserve’s (Fed) pivot to easing monetary conditions, along with liquidity provided by other central banks around the world, provided confidence that the economic cycle could be extended. Additionally, the year ended with a reduction in trade tensions and Brexit uncertainty, although the next phase of U.S.-China trade negotiations are expected to be more challenging and the U.K. has a relatively short transition window in which to redefine its relationship with the European Union.

We continue to anticipate muted economic growth and increased market volatility this year. The U.S. economy held steady in the second half of 2019, although growth for the year overall moderated from 2018’s pace. Consumer confidence remains underpinned by low unemployment and modest wage growth. Looser financial conditions, in part driven by the Fed’s three interest rate cuts in 2019, have revived momentum in the housing market and should continue to encourage borrowing by consumers and businesses. Although consumer spending in Europe and Japan, like in the U.S., has remained supported by jobs growth and rising wages, economic growth there appears more fragile. The COVID-19 coronavirus outbreak poses a new downside risk to the global economy, as disruptions to both demand and production ripple through global supply chains. We are closely monitoring the situation.

At Nuveen, we still see investment opportunities in the maturing economic environment, but we are taking a selective approach. If you’re concerned about where the markets are headed from here, we encourage you to work with your financial advisor to review your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

February 21, 2020

4

Portfolio Managers’ Comments

Nuveen Core Equity Alpha Fund (JCE)

The equity portion of the Fund is managed by Intech Investment Management LLC (Intech), an independently managed subsidiary of Janus Henderson Group plc. The portfolio management team is composed of Dr. Adrian Banner, CEO/CIO, and Vassilios Papathanakos, PhD.

The Fund also employs a call option strategy managed by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Fund’s investment adviser. David A. Friar and Jody I. Hrazanek oversee this program.

Effective February 28, 2019, Joseph W. Runnels, CFA is no longer a portfolio manager of the Fund.

Here the Intech team members, along with the NAM team, discuss economic and financial markets, their management strategies and the performance of the Fund for the twelve-month reporting period ended December 31, 2019.

What factors affected the U.S. economy and financial markets during the twelve-month reporting period ended December 31, 2019?

The U.S. economy reached the tenth year of expansion since the previous recession ended in June 2009, marking the longest expansion in U.S. history. In the fourth quarter of 2019, gross domestic product (GDP) grew at an annualized rate of 2.1%, according to the “advance” estimate by the Bureau of Economic Analysis. GDP measures the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. In the final months of the year, the economy was boosted by moderate consumer spending, along with positive contributions from government spending and trade, which offset weakness in business investment. For 2019 as a whole, U.S. GDP grew 2.3%, a decline from 2.9% in 2018 and the slowest pace since 2016.

Consumer spending, the largest driver of the economy, remained well supported by low unemployment, wage gains and tax cuts. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 3.5% in December 2019 from 3.9% in December 2018 and job gains averaged around 176,000 per month for the past twelve months. As the jobs market has tightened, average hourly earnings grew at an annualized rate of 2.9% in December 2019. However, inflation remained subdued. The Bureau of Labor Statistics said the Consumer Price Index (CPI) increased 2.3% over the twelve-month reporting period ended December 31, 2019 before seasonal adjustment.

Low mortgage rates and low inventory drove home prices moderately higher in this reporting period, despite declining new home sales and housing starts. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, was up 3.5% year-over-year in November 2019 (most recent data available at the time this report was prepared). The10-City and20-City Composites reported year-over-year increases of 2.0% and 2.6%, respectively.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Refer to the Glossary of Terms Used in this report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments(continued)

As data pointed to slower momentum in the overall economy, the Federal Reserve (Fed) notably shifted its stance. Although the Fed had indicated in December 2018 that there could be two more rate hikes in 2019, global growth concerns kept the central bank on the sidelines. As expected by the markets, the Fed left rates unchanged throughout the first half of 2019 while speculation increased that the Fed’s next move would be a rate cut. At the July 2019, September 2019 and October 2019 policy committee meetings, the Fed announced a 0.25% cut to its main policy rate. Markets registered disappointment with the Fed’s explanation that the rate cuts were a“mid-cycle adjustment,” rather than a prolonged easing period, and its signal that there would be no additional rate cuts in 2019. Also in the latter half of 2019, the Fed announced it would stop shrinking its bond portfolio sooner than scheduled, as well as began buying short-term Treasury bills to help money markets operate smoothly and maintain short-term borrowing rates at low levels. Fed Chairman Powell emphasized that the Treasury bill purchases were not a form of quantitative easing.

During the twelve-month reporting period, geopolitical news remained a prominent market driver. Tariff and trade policy topped the list of concerns, most prominently the U.S.-China relations. After several rounds of talks, escalating rhetoric from both sides and a series of tariff increases, tensions appeared to ease in the later months of 2019. The U.S. and China signaled their agreement on a partial trade deal, which included rolling back some tariffs, increasing China’s purchases of U.S. agriculture products and the consideration of intellectual property, technology and financial services rights. (Subsequent to the close of the reporting period, the “phase one” deal was signed on January 15, 2020.) While much of the focus remained on the U.S.-China relationship, trade spats between the U.S. and Mexico, the European Union, Brazil and Argentina also arose throughout the period. More than a year after the three countries signed onto the U.S., Mexico and Canada Agreement (USMCA) trade deal, which replaces the North American Free Trade Agreement, the U.S. House of Representatives approved the deal in December 2019 (and, subsequent to the close of the reporting period, the Senate voted in January 2020 to approve it). Global manufacturing and export data continued to show evidence of trade-related slumps, which increased worries that the slowdown would spread into other segments of the global economy.

The Brexit saga also appeared to make a breakthrough by the end of 2019. After former Prime Minister Theresa May was unable to secure a Brexit deal by the original March 29, 2019 deadline, she resigned as of June 7, 2019. When her successor, Boris Johnson, failed to meet the EU’s first deadline extension of October 31, 2019, the EU approved a “flextension” to January 31, 2020. A U.K. general election was scheduled for December 2019, wherein the Conservative Party won a large majority and bolstered Prime Minister Johnson’s mandate to get Brexit done. A few days later, the British Parliament passed the Brexit Bill. In Italy, investors worried about another potential budget clash between the eurosceptic coalition government and the EU. However, following the unexpected resignation of the prime minister in August 2019, the newly formed coalition government appeared to take a less antagonistic stance. Europe also contended with the “yellow vest” protests in France, immigration policy concerns, Russian sanctions and political risk in Turkey.

Elsewhere, anti-government protests erupted across Latin America, Hong Kong and Lebanon during 2019, and Venezuela’s economic and political crisis deepened. In Argentina, markets were shocked by the defeat of incumbent President Macri, prompting concerns about the economic policies favored by the incoming Fernandez administration. Brazil’s Bolsonaro administration achieved a legislative win on pension reform and kept the economy on a path of modest growth. Europe’s traditional centrist parties lost seats in the May 2019 Parliamentary elections and populist parties saw marginal gains. The ruling parties in India and South Africa maintained their majorities, where slower economic growth could complicate their respective reform mandates.

The S&P 500® Index returned 31.49% in 2019, as strong returns in the first and fourth quarters helped deliver its best annual return since 2013 and an annual return of over 30% for just the fifth time in the last three decades.

6

How did the Fund perform during this twelve-month reporting period ended December 31, 2019?

The table in the Performance Overview and Holding Summaries section of this report provides total returns for theone-year, five-year andten-year periods ended December 31, 2109. The Fund’s total returns at net asset value (NAV) are compared with the performance of a corresponding market index. For the twelve-month reporting period ended December 31, 2019 the Fund underperformed the S&P 500® Index, but outperformed the Blended Index.

What key strategies were used to manage the Fund during this twelve-month reporting period ended December 31, 2019?

The investment objective of the Fund is to provide an attractive level of total return, primarily through long-term capital appreciation and secondarily through income and gains. The Fund invests in a portfolio of common stocks selected from the stocks comprising the S&P 500® Index, using a proprietary mathematical process designed by Intech and also employs risk reduction techniques. Typically, the Fund’s equity portfolio will hold 150 – 450 stocks included in the S&P 500® Index.

The Fund also employs an option strategy that seeks to enhance the Fund’s risk-adjusted performance over time by means of attempting to reduce volatility of the Fund’s returns relative to the returns of the S&P 500® Index. The Fund expects to write (sell) call options on a custom basket of equities with a notional value of up to 50% of the value of the equity portfolio. The goal of the Fund’s equity portfolio is to produce long-term returns in excess of the S&P 500® Index with an equal or lesser amount of risk.

Intech uses a purely portfolio-theoretic methodology, and does not specifically select stocks or overweight sectors in response to market conditions or expectations. Instead, they modify the Fund’s equity holdings in an attempt to construct a portfolio that is slightly more efficient than the S&P 500® Index, by using an optimization program that analyzes a stock’s relative volatility and its return correlation with other equities. Effectively, the investment process tends to favor stocks with higher relative volatility and lower correlation as they offer more potential to capture volatility through regular rebalancing. Intech’s investment process doesn’t select stocks based on their potential for future performance, but combines securities based on how their stock prices move relative to the index in order to increase the potential for trading profits at time of rebalancing.

The strategy generated a positive trading profit during the year and benefited from a favorable positioning within the energy sector. From a stock specific standpoint, an overweight to TransDigm Group Inc, Intuitive Surgical Inc and Advanced Micro Devices Inc, which performed strongly, were among the positive contributors during the reporting period.

The portfolio faced headwinds from its positioning in the smaller names and adverse sector positioning relative to the S&P 500® Index during the reporting period. Specifically, average underweights to some strong performing mega cap technology-oriented names, including Apple Inc, Microsoft Corp, Amazon.com, Facebook and Alphabet, were among the biggest detractors during the reporting period. Additionally, an underweight to a few strongly performingmega-cap banks also detracted from performance, including JPMorgan Chase & Co. and Bank of America. The portfolio has eliminated its holdings in Amazon, Facebook, Alphabet, JPMorgan Chase & Co. and Bank of America.

As mentioned previously, the Fund also wrote call options with average expirations between 30 and 90 days. This was done in an effort to enhance returns, although it meant the Fund did relinquish some of the upside potential of its equity portfolio. During the reporting period, stock market volatility as measured by the Chicago Board Options Exchange (Cboe) Volatility Index® (the ”VIX®”) ended the reporting period at 13.78. The VIX®’s year-over- year decline was one of largest in history. As a result, the Fund maintained an overwrite percentage during most of the reporting period averaging around 34%. NAM utilized Russell 2000® Index options. Unlike other indexes, the Russell 2000® Index had periods of flat performance throughout the reporting period. While, NAM was able to collect more premium income as it was a favorable environment for writing options on the Russell 2000® Index, the strategy detracted from performance.

7

Common Share Information

DISTRIBUTION INFORMATION

The following 19(a) Notice presents the Fund’s most current distribution information as of November 30, 2019 as required by certain exempted regulatory relief the Fund has received.

Because the ultimate tax character of your distributions depends on the Fund’s performance for its entire fiscal year (which is the calendar year for the Fund) as well as certain fiscal year-end (FYE) tax adjustments, estimated distribution source information you receive with each distribution may differ from the tax information reported to you on your Fund’s IRS Form 1099 statement.

DISTRIBUTION INFORMATION – AS OF NOVEMBER 30, 2019

This notice provides shareholders with information regarding fund distributions, as required by current securities laws. You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s Managed Distribution Policy.

The Fund may in certain periods distribute more than its income and net realized capital gains, and the Fund currently estimates that it has done so for the fiscal year-to-date period. In such instances, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

The amounts and sources of distributions set forth below are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. More details about the Fund’s distributions and the basis for these estimates are available on www.nuveen.com/cef.

The following table provides estimates of the Fund’s distribution sources, reflecting year-to-date cumulative experience through the latest month-end. The Fund attributes these estimates equally to each regular distribution throughout the year. Consequently, the estimated information shown below is for the current distribution, and also represents an updated estimate for all prior months in the year.

8

Data as of November 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Estimated Per Share Sources of Distribution1 | | | Estimated Percentage of the Distribution1 | |

| JCE (FYE 12/31) | | Per Share

Distribution | | | Net

Investment

Income | | | Long-Term

Gains | | | Short-Term

Gains | | | Return of

Capital | | | Net

Investment

Income | | | Long-Term

Gains | | | Short-Term

Gains | | | Return of

Capital | |

Current Quarter | | $ | 0.2500 | | | $ | 0.0218 | | | $ | 0.0365 | | | $ | 0.0000 | | | $ | 0.1917 | | | | 8.70 | % | | | 14.60 | % | | | 0.00 | % | | | 76.70 | % |

Fiscal YTD | | $ | 1.0000 | | | $ | 0.0872 | | | $ | 0.1459 | | | $ | 0.0000 | | | $ | 0.7669 | | | | 8.70 | % | | | 14.60 | % | | | 0.00 | % | | | 76.70 | % |

| 1 | Net investment income (NII) is a projection through the end of the current calendar quarter using actual data through the stated month-end date above. Capital gain amounts are as of the stated date above. The estimated per share sources above include an allocation of the NII based on prior year attributions which can be expected to differ from the actual final attributions for the current year. |

The following table provides information regarding JCE’s distributions and total return performance over various time periods. This information is intended to help you better understand whether returns for the specified time periods were sufficient to meet distributions.

Data as of November 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Annualized | | | Cumulative | |

JCE (FYE 12/31) Inception Date | | Quarterly

Distribution | | | Fiscal YTD Distribution | | | Net Asset Value (NAV) | | | 5-Year Return on NAV | | | Fiscal YTD Dist Rate on NAV1 | | | Fiscal YTD Return on NAV | | | Fiscal YTD Dist Rate on NAV1 | |

Mar 2007 | | $ | 0.2500 | | | $ | 1.0000 | | | $ | 14.99 | | | | 8.10 | % | | | 6.67 | % | | | 24.47 | % | | | 6.67 | % |

| 1 | As a percentage of 11/29/19 NAV. |

DISTRIBUTION INFORMATION – AS OF DECEMBER 31, 2019

The following tables provide information regarding the Fund’s common share distributions and total return performance for the fiscal year ended December 31, 2019. This information is intended to help you better understand whether the Fund’s returns for the specified time period were sufficient to meet its distributions.

Data as of December 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per Share Sources of Distribution | | | Percentage of the Distribution | |

| JCE (FYE 12/31) | | Per Share

Distribution | | | Net

Investment

Income | | | Long-Term

Gains | | | Short-Term

Gains | | | Return of

Capital1 | | | Net

Investment

Income | | | Long-Term

Gains | | | Short-Term

Gains | | | Return of

Capital1 | |

Fiscal YTD | | $ | 1.0000 | | | $ | 0.0973 | | | $ | 0.5489 | | | $ | 0.0000 | | | $ | 0.3538 | | | | 9.73 | % | | | 54.89 | % | | | 0.00 | % | | | 35.38 | % |

| | | | | | | | | | | | | | | | |

| | | | | | Annualized | |

| JCE (FYE 12/31) Inception Date | | Net Asset

Value (NAV) | | | 1-Year

Return on NAV | | | 5-Year

Return on NAV | | | Fiscal YTD Dist Rate on NAV | |

Mar 2007 | | $ | 15.04 | | | | 26.96 | % | | | 8.53 | % | | | 6.65 | % |

| 1 | Return of Capital may represent unrealized gains, return of shareholder’s principal, or both. In certain circumstances, all or a portion of the return of capital may be characterized as ordinary income under federal tax law. The actual tax characterization will be provided to shareholders on Form 1099-DIV shortly after calendar year-end. |

CHANGE IN METHOD OF PUBLISHING NUVEENCLOSED-END FUND DISTRIBUTION AMOUNTS

During November 2019, the NuveenClosed-End Funds discontinued the practice of announcing Fund distribution amounts and timing via press release. Instead, information about the NuveenClosed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted and can be found on Nuveen’sClosed-End Fund resource page, which is atwww.nuveen.com/closed-end-fund-distributions, along with other Nuveenclosed-end fund product updates. Shareholders can expect regular distribution information to be posted on www.nuveen.com on the first business day of each month. To ensure that our shareholders have timely access to the latest information, a subscribe function can be activated at this link here, or at this web page(www.nuveen.com/en-us/people/about-nuveen/for-the-media).

9

Common Share Information(continued)

COMMON SHARE EQUITY SHELF PROGRAM

During the current reporting period, the Fund was authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (“Shelf Offering”). Under this program the Fund, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above the Fund’s NAV per common share. Under the Shelf Offering, the Fund was authorized to issue additional shares as shown in the accompanying table.

| | | | |

| | | JCE | |

Additional authorized common shares | | | 1,600,000 | * |

| * | Represents additional authorized common shares for the period February 25, 2019 through December 31, 2019. |

During the current reporting period, the Fund did not sell common shares through its shelf program.

Refer to the Notes to Financial Statements, Note 5 – Fund Shares, Common Shares Equity Shelf Programs and Offering Costs for further details of Shelf Offering and the Fund’s transactions.

COMMON SHARE REPURCHASES

During August 2019, the Fund’s Board of Trustees reauthorized an open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of December 31, 2019, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

| | | | |

| | | JCE | |

Common Shares cumulatively repurchased and retired | | | 449,800 | |

Common Shares authorized for repurchase | | | 1,605,000 | |

During the current reporting period, the Fund did not repurchase any of its outstanding common shares.

OTHER COMMON SHARE INFORMATION

As of December 31, 2019, and during the current reporting period, the Fund’s common share price was trading at a premium/(discount) to its common share NAV as shown in the accompanying table.

| | | | |

| | | JCE | |

Common Share NAV | | $ | 15.04 | |

Common Share price | | $ | 14.62 | |

Premium/(Discount) to NAV | | | (2.79 | )% |

12-month average premium/(discount) to NAV | | | (2.83 | )% |

10

Risk Considerations and Investment Policy Updates

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Core Equity Alpha Fund (JCE)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Common stock returns often have experienced significant volatility. The Fund may not participate in any appreciation of its equity portfolio as fully as it would if the Fund did not sellcall options. In addition, the Fund will continue to bear the risk of declines in the value of the equity portfolio. Becauseindex options are settled in cash, sellers of index call options, such as the Fund, cannot provide in advance for their potential settlement obligations by acquiring and holding the underlying securities. For these and other risks, includingtax risk, please see the Fund’s webpage at www.nuveen.com/JCE.

Investment Policy Updates

Change in Investment Policy

The Fund has recently adopted the following policy regarding limits to investments in illiquid securities:

While there are no such limits imposed by applicable regulations, certain NuveenClosed-End Funds formerly had investment policies that placed limits on a Fund’s ability to invest in illiquid securities. All exchange-listed Nuveen Closed-End Funds now have no formal limit on their ability to invest in such illiquid securities, but the Fund’s portfolio management team will monitor such investments in the regular, overall management of the Fund’s portfolio securities.

11

| | |

| JCE | | Nuveen Core Equity Alpha Fund Performance Overview and Holding Summaries as of December 31, 2019 |

Refer to Glossary of Terms Used in this Report for further definition of terms used within this section.

Average Annual Total Returns as of December 31, 2019

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

| JCE at Common Share NAV | | | 26.96% | | | | 8.53% | | | | 12.14% | |

| JCE at Common Share Price | | | 30.26% | | | | 8.46% | | | | 13.20% | |

| Blended Index1 | | | 23.38% | | | | 9.37% | | | | 10.31% | |

| S&P 500® Index | | | 31.49% | | | | 11.70% | | | | 13.56% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

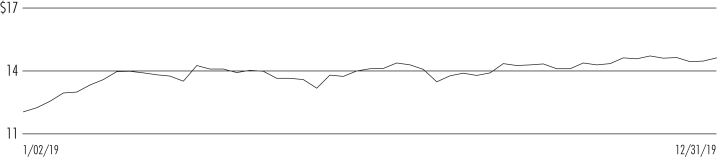

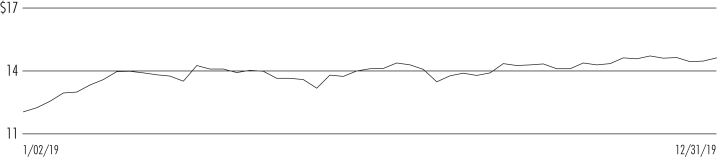

Common Share Price Performance —Weekly Closing Price

| 1 | The Blended Index consists of: 1) 50% of the S&P 500® Index and 2) 50% of the CBOE S&P 500® Buy/write Index(BXM). |

12

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 99.8% | |

| Repurchase Agreements | | | 0.5% | |

| Other Assets Less Liabilities | | | (0.3)% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Health Care Equipment & Supplies | | | 7.4% | |

| IT Services | | | 6.9% | |

| Equity Real Estate Investment Trust | | | 5.9% | |

| Specialty Retail | | | 5.2% | |

| Oil, Gas & Consumable Fuels | | | 5.0% | |

| Software | | | 4.9% | |

| Capital Markets | | | 4.9% | |

| Insurance | | | 4.0% | |

| Health Care Providers & Services | | | 3.9% | |

| Pharmaceuticals | | | 2.8% | |

| Electric Utilities | | | 2.7% | |

| Road & Rail | | | 2.5% | |

| Multiline Retail | | | 2.5% | |

| Semiconductors & Semiconductor Equipment | | | 2.4% | |

| Media | | | 2.4% | |

| Aerospace & Defense | | | 2.2% | |

| Commercial Services & Supplies | | | 2.1% | |

| Technology Hardware, Storage & Peripherals | | | 2.0% | |

| Banks | | | 1.9% | |

| Chemicals | | | 1.8% | |

| Food Products | | | 1.8% | |

| Electronic Equipment, Instruments & Components | | | 1.8% | |

| Food & Staples Retailing | | | 1.7% | |

| Communications Equipment | | | 1.6% | |

| Other | | | 19.2% | |

| Repurchase Agreements | | | 0.5% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)

| | | | |

| Intuitive Surgical Inc | | | 2.4% | |

| CSX Corp | | | 1.8% | |

| Progressive Corp | | | 1.7% | |

| HCA Inc | | | 1.6% | |

| NextEra Energy Inc | | | 1.5% | |

13

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nuveen Core Equity Alpha Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Nuveen Core Equity Alpha Fund (the “Fund”) as of December 31, 2019, the related statement of operations for the year ended December 31, 2019, the statement of changes in net assets for each of the two years in the period ended December 31, 2019, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2019 and the financial highlights for each of the five years in the period ended December 31, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Chicago, Illinois

February 27, 2020

We have served as the auditor of one or more investment companies in Nuveen Funds since 2002.

14

| | |

| JCE | | Nuveen Core Equity Alpha Fund Portfolio of Investments December 31, 2019 |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | LONG-TERM INVESTMENTS – 99.8% | | | | | | | | | | | | |

| | |

| | | | COMMON STOCKS – 99.8% | | | | | |

| |

| | | | Aerospace & Defense – 2.2% | |

| | | | |

| | 4,490 | | | Arconic Inc | | | | | | | | | | $ | 138,157 | |

| | 9,585 | | | Boeing Co, (2) | | | | | | | | | | | 3,122,410 | |

| | 10,800 | | | Textron Inc | | | | | | | | | | | 481,680 | |

| | 2,846 | | | TransDigm Group Inc, (3) | | | | | | | | | | | 1,593,760 | |

| | | | Total Aerospace & Defense | | | | | | | | | | | 5,336,007 | |

| | | | |

| | | | Air Freight & Logistics – 0.6% | | | | | | | | | |

| | | | |

| | 15,000 | | | CH Robinson Worldwide Inc | | | | | | | | | | | 1,173,000 | |

| | 2,893 | | | Expeditors International of Washington Inc | | | | | | | | | | | 225,712 | |

| | 294 | | | FedEx Corp | | | | | | | | | | | 44,456 | |

| | | | Total Air Freight & Logistics | | | | | | | | | | | 1,443,168 | |

| | | | |

| | | | Airlines – 0.4% | | | | | | | | | |

| | | | |

| | 689 | | | Alaska Air Group Inc | | | | | | | | | | | 46,680 | |

| | 10,900 | | | United Airlines Holdings Inc, (3) | | | | | | | | | | | 960,181 | |

| | | | Total Airlines | | | | | | | | | | | 1,006,861 | |

| | | | |

| | | | Auto Components – 0.0% | | | | | | | | | |

| | | | |

| | 502 | | | Aptiv PLC | | | | | | | | | | | 47,675 | |

| | | | |

| | | | Automobiles – 0.1% | | | | | | | | | |

| | | | |

| | 4,405 | | | General Motors Co | | | | | | | | | | | 161,223 | |

| | 1,007 | | | Harley-Davidson Inc | | | | | | | | | | | 37,450 | |

| | | | Total Automobiles | | | | | | | | | | | 198,673 | |

| | | | |

| | | | Banks – 1.9% | | | | | | | | | |

| | | | |

| | 3,199 | | | Citizens Financial Group Inc | | | | | | | | | | | 129,911 | |

| | 3,824 | | | Comerica Inc | | | | | | | | | | | 274,372 | |

| | 16,536 | | | Fifth Third Bancorp | | | | | | | | | | | 508,316 | |

| | 762 | | | First Republic Bank | | | | | | | | | | | 89,497 | |

| | 55,500 | | | Huntington Bancshares Inc, (2) | | | | | | | | | | | 836,940 | |

| | 8,538 | | | KeyCorp | | | | | | | | | | | 172,809 | |

| | 361 | | | M&T Bank Corp | | | | | | | | | | | 61,280 | |

| | 17,760 | | | People’s United Financial Inc | | | | | | | | | | | 300,144 | |

| | 3,101 | | | PNC Financial Services Group Inc | | | | | | | | | | | 495,012 | |

| | 59,374 | | | Regions Financial Corp, (2) | | | | | | | | | | | 1,018,858 | |

| | 1,441 | | | SVB Financial Group, (3) | | | | | | | | | | | 361,749 | |

| | 1,752 | | | Truist Financial Corp | | | | | | | | | | | 98,673 | |

| | 3,115 | | | Zions Bancorp NA | | | | | | | | | | | 161,731 | |

| | | | Total Banks | | | | | | | | | | | 4,509,292 | |

| | | | |

| | | | Beverages – 0.1% | | | | | | | | | |

| | | | |

| | 1,415 | | | Brown-Forman Corp, Class B | | | | | | | | | | | 95,654 | |

| | 1,321 | | | Constellation Brands Inc, Class A | | | | | | | | | | | 250,660 | |

| | | | Total Beverages | | | | | | | | | | | 346,314 | |

| | | | |

| | | | Biotechnology – 0.6% | | | | | | | | | |

| | | | |

| | 1,057 | | | Alexion Pharmaceuticals Inc, (3) | | | | | | | | | | | 114,315 | |

| | 1,310 | | | Amgen Inc | | | | | | | | | | | 315,802 | |

| | 325 | | | Biogen Inc, (3) | | | | | | | | | | | 96,437 | |

| | 2,864 | | | Incyte Corp, (3) | | | | | | | | | | | 250,084 | |

| | 1,799 | | | Regeneron Pharmaceuticals Inc, (3) | | | | | | | | | | | 675,489 | |

| | | | Total Biotechnology | | | | | | | | | | | 1,452,127 | |

| | | | |

| | | | Building Products – 0.4% | | | | | | | | | |

| | | | |

| | 3,666 | | | Allegion PLC | | | | | | | | | | | 456,564 | |

| | 2,774 | | | AO Smith Corp | | | | | | | | | | | 132,153 | |

15

| | |

| |

| JCE | | Nuveen Core Equity Alpha Fund(continued) |

| | Portfolio of Investments December 31, 2019 |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Building Products(continued) | | | | | | | | | |

| | | | |

| | 1,619 | | | Fortune Brands Home & Security Inc | | | | | | | | | | $ | 105,786 | |

| | 6,092 | | | Masco Corp | | | | | | | | | | | 292,355 | |

| | | | Total Building Products | | | | | | | | | | | 986,858 | |

| | | | |

| | | | Capital Markets – 4.9% | | | | | | | | | |

| | | | |

| | 2,874 | | | Bank of New York Mellon Corp | | | | | | | | | | | 144,648 | |

| | 127 | | | BlackRock Inc | | | | | | | | | | | 63,843 | |

| | 14,537 | | | CME Group Inc | | | | | | | | | | | 2,917,867 | |

| | 10,147 | | | E*TRADE Financial Corp | | | | | | | | | | | 460,369 | |

| | 17,447 | | | Franklin Resources Inc | | | | | | | | | | | 453,273 | |

| | 427 | | | Intercontinental Exchange Inc | | | | | | | | | | | 39,519 | |

| | 13,158 | | | Invesco Ltd | | | | | | | | | | | 236,581 | |

| | 7,925 | | | Moody’s Corp | | | | | | | | | | | 1,881,474 | |

| | 7,198 | | | Morgan Stanley | | | | | | | | | | | 367,962 | |

| | 5,000 | | | MSCI Inc | | | | | | | | | | | 1,290,900 | |

| | 2,020 | | | Nasdaq Inc | | | | | | | | | | | 216,342 | |

| | 1,928 | | | Northern Trust Corp | | | | | | | | | | | 204,831 | |

| | 1,147 | | | Raymond James Financial Inc | | | | | | | | | | | 102,610 | |

| | 7,835 | | | S&P Global Inc | | | | | | | | | | | 2,139,347 | |

| | 10,937 | | | T Rowe Price Group Inc | | | | | | | | | | | 1,332,564 | |

| | | | Total Capital Markets | | | | | | | | | | | 11,852,130 | |

| | | | |

| | | | Chemicals – 1.8% | | | | | | | | | |

| | | | |

| | 2,690 | | | Celanese Corp | | | | | | | | | | | 331,193 | |

| | 8,245 | | | CF Industries Holdings Inc | | | | | | | | | | | 393,616 | |

| | 543 | | | Eastman Chemical Co | | | | | | | | | | | 43,038 | |

| | 197 | | | Ecolab Inc | | | | | | | | | | | 38,019 | |

| | 2,726 | | | FMC Corp | | | | | | | | | | | 272,109 | |

| | 3,433 | | | International Flavors & Fragrances Inc | | | | | | | | | | | 442,926 | |

| | 678 | | | LyondellBasell Industries NV, Class A | | | | | | | | | | | 64,057 | |

| | 34,644 | | | Mosaic Co, (2) | | | | | | | | | | | 749,696 | |

| | 1,452 | | | PPG Industries Inc | | | | | | | | | | | 193,828 | |

| | 3,305 | | | Sherwin-Williams Co | | | | | | | | | | | 1,928,600 | |

| | | | Total Chemicals | | | | | | | | | | | 4,457,082 | |

| | | | |

| | | | Commercial Services & Supplies – 2.1% | | | | | | | | | |

| | | | |

| | 4,400 | | | Cintas Corp | | | | | | | | | | | 1,183,952 | |

| | 9,916 | | | Copart Inc, (3) | | | | | | | | | | | 901,761 | |

| | 25,900 | | | Republic Services Inc | | | | | | | | | | | 2,321,417 | |

| | 20,700 | | | Rollins Inc | | | | | | | | | | | 686,412 | |

| | | | Total Commercial Services & Supplies | | | | | | | | | | | 5,093,542 | |

| | | | |

| | | | Communications Equipment – 1.6% | | | | | | | | | |

| | | | |

| | 9,137 | | | Cisco Systems Inc | | | | | | | | | | | 438,211 | |

| | 5,500 | | | F5 Networks Inc, (3) | | | | | | | | | | | 768,075 | |

| | 29,620 | | | Juniper Networks Inc | | | | | | | | | | | 729,541 | |

| | 11,967 | | | Motorola Solutions Inc | | | | | | | | | | | 1,928,362 | |

| | | | Total Communications Equipment | | | | | | | | | | | 3,864,189 | |

| | | | |

| | | | Construction & Engineering – 0.1% | | | | | | | | | |

| | | | |

| | 1,517 | | | Jacobs Engineering Group Inc | | | | | | | | | | | 136,272 | |

| | 2,131 | | | Quanta Services Inc | | | | | | | | | | | 86,753 | |

| | | | Total Construction & Engineering | | | | | | | | | | | 223,025 | |

| | | | |

| | | | Consumer Finance – 0.8% | | | | | | | | | |

| | | | |

| | 3,238 | | | American Express Co | | | | | | | | | | | 403,099 | |

| | 420 | | | Capital One Financial Corp | | | | | | | | | | | 43,222 | |

| | 14,700 | | | Discover Financial Services | | | | | | | | | | | 1,246,854 | |

| | 7,720 | | | Synchrony Financial | | | | | | | | | | | 277,997 | |

| | | | Total Consumer Finance | | | | | | | | | | | 1,971,172 | |

16

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Containers & Packaging – 0.8% | | | | | | | | | |

| | | | |

| | 2,185 | | | Avery Dennison Corp | | | | | | | | | | $ | 285,842 | |

| | 20,035 | | | Ball Corp | | | | | | | | | | | 1,295,663 | |

| | 8,814 | | | Sealed Air Corp | | | | | | | | | | | 351,062 | |

| | | | Total Containers & Packaging | | | | | | | | | | | 1,932,567 | |

| | | | |

| | | | Distributors – 0.1% | | | | | | | | | |

| | | | |

| | 6,626 | | | LKQ Corp, (3) | | | | | | | | | | | 236,548 | |

| | | | |

| | | | Diversified Consumer Services – 0.1% | | | | | | | | | |

| | | | |

| | 9,003 | | | H&R Block Inc | | | | | | | | | | | 211,390 | |

| | | | |

| | | | Diversified Telecommunication Services – 0.1% | | | | | | | | | |

| | | | |

| | 10,543 | | | CenturyLink Inc | | | | | | | | | | | 139,273 | |

| | | | |

| | | | Electric Utilities – 2.7% | | | | | | | | | |

| | | | |

| | 4,432 | | | Entergy Corp | | | | | | | | | | | 530,954 | |

| | 3,467 | | | Evergy Inc | | | | | | | | | | | 225,667 | |

| | 3,858 | | | Eversource Energy | | | | | | | | | | | 328,200 | |

| | 21,300 | | | Exelon Corp | | | | | | | | | | | 971,067 | |

| | 9,700 | | | FirstEnergy Corp | | | | | | | | | | | 471,420 | |

| | 14,544 | | | NextEra Energy Inc | | | | | | | | | | | 3,521,975 | |

| | 4,365 | | | Pinnacle West Capital Corp | | | | | | | | | | | 392,544 | |

| | 2,797 | | | Xcel Energy Inc | | | | | | | | | | | 177,582 | |

| | | | Total Electric Utilities | | | | | | | | | | | 6,619,409 | |

| | | | |

| | | | Electrical Equipment – 0.5% | | | | | | | | | |

| | | | |

| | 9,607 | | | AMETEK Inc | | | | | | | | | | | 958,202 | |

| | 1,434 | | | Eaton Corp PLC | | | | | | | | | | | 135,828 | |

| | 262 | | | Rockwell Automation Inc | | | | | | | | | | | 53,100 | |

| | | | Total Electrical Equipment | | | | | | | | | | | 1,147,130 | |

| | | | |

| | | | Electronic Equipment, Instruments & Components – 1.8% | | | | | | | | | |

| | | | |

| | 21,705 | | | Amphenol Corp, Class A | | | | | | | | | | | 2,349,132 | |

| | 19,723 | | | Corning Inc | | | | | | | | | | | 574,137 | |

| | 2,186 | | | IPG Photonics Corp, (3) | | | | | | | | | | | 316,795 | |

| | 9,775 | | | Keysight Technologies Inc, (3) | | | | | | | | | | | 1,003,208 | |

| | 1,278 | | | TE Connectivity Ltd | | | | | | | | | | | 122,484 | |

| | | | Total Electronic Equipment, Instruments & Components | | | | | | | | | | | 4,365,756 | |

| | | | |

| | | | Energy Equipment & Services – 0.2% | | | | | | | | | |

| | | | |

| | 6,299 | | | Halliburton Co | | | | | | | | | | | 154,136 | |

| | 7,133 | | | National Oilwell Varco Inc | | | | | | | | | | | 178,682 | |

| | 10,393 | | | TechnipFMC PLC | | | | | | | | | | | 222,826 | |

| | | | Total Energy Equipment & Services | | | | | | | | | | | 555,644 | |

| | | | |

| | | | Entertainment – 0.5% | | | | | | | | | |

| | | | |

| | 6,574 | | | Activision Blizzard Inc | | | | | | | | | | | 390,627 | |

| | 2,487 | | | Netflix Inc, (3) | | | | | | | | | | | 804,719 | |

| | 836 | | | Take-Two Interactive Software Inc, (3) | | | | | | | | | | | 102,351 | |

| | | | Total Entertainment | | | | | | | | | | | 1,297,697 | |

| | | | |

| | | | Equity Real Estate Investment Trust – 5.9% | | | | | | | | | |

| | | | |

| | 4,075 | | | American Tower Corp | | | | | | | | | | | 936,517 | |

| | 14,643 | | | Apartment Investment & Management Co, Class A | | | | | | | | | | | 756,311 | |

| | 5,115 | | | AvalonBay Communities Inc | | | | | | | | | | | 1,072,615 | |

| | 4,145 | | | Crown Castle International Corp | | | | | | | | | | | 589,212 | |

| | 13,463 | | | Digital Realty Trust Inc | | | | | | | | | | | 1,612,060 | |

| | 4,412 | | | Duke Realty Corp | | | | | | | | | | | 152,964 | |

| | 10,300 | | | Equity Residential | | | | | | | | | | | 833,476 | |

| | 3,033 | | | Extra Space Storage Inc | | | | | | | | | | | 320,345 | |

| | 12,900 | | | Healthpeak Properties Inc | | | | | | | | | | | 444,663 | |

| | 8,256 | | | Host Hotels & Resorts Inc | | | | | | | | | | | 153,149 | |

| | 1,470 | | | Iron Mountain Inc | | | | | | | | | | | 46,849 | |

17

| | |

| |

| JCE | | Nuveen Core Equity Alpha Fund(continued) |

| | Portfolio of Investments December 31, 2019 |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Equity Real Estate Investment Trust(continued) | | | | | | | | | |

| | | | |

| | 4,837 | | | Kimco Realty Corp | | | | | | | | | | $ | 100,174 | |

| | 6,700 | | | Mid-America Apartment Communities Inc | | | | | | | | | | | 883,462 | |

| | 15,206 | | | Prologis Inc, (2) | | | | | | | | | | | 1,355,463 | |

| | 14,946 | | | Realty Income Corp | | | | | | | | | | | 1,100,474 | |

| | 2,800 | | | Simon Property Group Inc | | | | | | | | | | | 417,088 | |

| | 27,875 | | | UDR Inc | | | | | | | | | | | 1,301,762 | |

| | 25,100 | | | Welltower Inc | | | | | | | | | | | 2,052,678 | |

| | 1,893 | | | Weyerhaeuser Co | | | | | | | | | | | 57,169 | |

| | | | Total Equity Real Estate Investment Trust | | | | | | | | | | | 14,186,431 | |

| | | | |

| | | | Food & Staples Retailing – 1.7% | | | | | | | | | |

| | | | |

| | 10,055 | | | Costco Wholesale Corp | | | | | | | | | | | 2,955,365 | |

| | 8,900 | | | Sysco Corp | | | | | | | | | | | 761,306 | |

| | 6,260 | | | Walgreens Boots Alliance Inc | | | | | | | | | | | 369,090 | |

| | | | Total Food & Staples Retailing | | | | | | | | | | | 4,085,761 | |

| | | | |

| | | | Food Products – 1.8% | | | | | | | | | |

| | | | |

| | 31,700 | | | Archer-Daniels-Midland Co, (2) | | | | | | | | | | | 1,469,295 | |

| | 18,900 | | | Hormel Foods Corp | | | | | | | | | | | 852,579 | |

| | 2,286 | | | Kellogg Co | | | | | | | | | | | 158,100 | |

| | 3,019 | | | Kraft Heinz Co | | | | | | | | | | | 97,001 | |

| | 1,741 | | | Lamb Weston Holdings Inc | | | | | | | | | | | 149,778 | |

| | 9,364 | | | McCormick & Co Inc | | | | | | | | | | | 1,589,352 | |

| | 933 | | | Tyson Foods Inc, Class A | | | | | | | | | | | 84,940 | |

| | | | Total Food Products | | | | | | | | | | | 4,401,045 | |

| | |

| | | | Health Care Equipment & Supplies – 7.4% | | | | |

| | | | |

| | 27,416 | | | Abbott Laboratories | | | | | | | | | | | 2,381,354 | |

| | 701 | | | ABIOMED Inc, (3) | | | | | | | | | | | 119,584 | |

| | 149 | | | Align Technology Inc, (3) | | | | | | | | | | | 41,577 | |

| | 34,300 | | | Baxter International Inc, (2) | | | | | | | | | | | 2,868,166 | |

| | 4,870 | | | Becton Dickinson and Co, (2) | | | | | | | | | | | 1,324,494 | |

| | 1,394 | | | Boston Scientific Corp, (3) | | | | | | | | | | | 63,037 | |

| | 2,671 | | | Cooper Cos Inc | | | | | | | | | | | 858,165 | |

| | 12,597 | | | DENTSPLY SIRONA Inc | | | | | | | | | | | 712,864 | |

| | 2,380 | | | Edwards Lifesciences Corp, (3) | | | | | | | | | | | 555,230 | |

| | 24,215 | | | Hologic Inc, (3) | | | | | | | | | | | 1,264,265 | |

| | 4,600 | | | IDEXX Laboratories Inc, (3) | | | | | | | | | | | 1,201,198 | |

| | 9,636 | | | Intuitive Surgical Inc, (3) | | | | | | | | | | | 5,696,321 | |

| | 4,600 | | | ResMed Inc | | | | | | | | | | | 712,862 | |

| | | | Total Health Care Equipment & Supplies | | | | | | | | | | | 17,799,117 | |

| |

| | | | Health Care Providers & Services – 3.9% | |

| | | | |

| | 5,370 | | | Anthem Inc | | | | | | | | | | | 1,621,901 | |

| | 1,196 | | | Cardinal Health Inc | | | | | | | | | | | 60,494 | |

| | 30,928 | | | Centene Corp, (2), (3) | | | | | | | | | | | 1,944,443 | |

| | 1,625 | | | Cigna Corp | | | | | | | | | | | 332,296 | |

| | 2,492 | | | DaVita Inc, (3) | | | | | | | | | | | 186,975 | |

| | 26,993 | | | HCA Inc, (2) | | | | | | | | | | | 3,989,835 | |

| | 13,200 | | | Henry Schein Inc, (3) | | | | | | | | | | | 880,704 | |

| | 1,053 | | | Humana Inc | | | | | | | | | | | 385,946 | |

| | 594 | | | Universal Health Services Inc, Class A | | | | | | | | | | | 85,215 | |

| | | | Total Health Care Providers & Services | | | | | | | | | | | 9,487,809 | |

| |

| | | | Hotels, Restaurants & Leisure – 1.3% | |

| | | | |

| | 4,949 | | | Carnival Corp | | | | | | | | | | | 251,558 | |

| | 388 | | | Chipotle Mexican Grill Inc, (3) | | | | | | | | | | | 324,799 | |

| | 2,714 | | | Hilton Worldwide Holdings Inc | | | | | | | | | | | 301,010 | |

| | 1,264 | | | Marriott International Inc, Class A | | | | | | | | | | | 191,407 | |

| | 12,439 | | | MGM Resorts International | | | | | | | | | | | 413,845 | |

| | 4,045 | | | Norwegian Cruise Line Holdings Ltd, (3) | | | | | | | | | | | 236,268 | |

| | 3,077 | | | Royal Caribbean Cruises Ltd | | | | | | | | | | | 410,810 | |

| | 2,815 | | | Wynn Resorts Ltd | | | | | | | | | | | 390,919 | |

18

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| |

| | | | Hotels, Restaurants & Leisure(continued) | |

| | | | |

| | 6,109 | | | Yum! Brands Inc | | | | | | | | | | $ | 615,360 | |

| | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | 3,135,976 | |

| |

| | | | Household Durables – 0.3% | |

| | | | |

| | 1,009 | | | Leggett & Platt Inc | | | | | | | | | | | 51,287 | |

| | 840 | | | Lennar Corp, Class A | | | | | | | | | | | 46,864 | |

| | 4,482 | | | PulteGroup Inc | | | | | | | | | | | 173,902 | |

| | 2,784 | | | Whirlpool Corp | | | | | | | | | | | 410,723 | |

| | | | Total Household Durables | | | | | | | | | | | 682,776 | |

| |

| | | | Household Products – 1.2% | |

| | | | |

| | 30,672 | | | Church & Dwight Co Inc, (2) | | | | | | | | | | | 2,157,468 | |

| | 5,055 | | | Clorox Co | | | | | | | | | | | 776,145 | |

| | | | Total Household Products | | | | | | | | | | | 2,933,613 | |

| |

| | | | Independent Power & Renewable Electricity Producers – 1.6% | |

| | | | |

| | 104,498 | | | AES Corp, (2) | | | | | | | | | | | 2,079,510 | |

| | 42,400 | | | NRG Energy Inc, (2) | | | | | | | | | | | 1,685,400 | |

| | | | Total Independent Power & Renewable Electricity Producers | | | | | | | | | | | 3,764,910 | |

| | | | |

| | | | Insurance – 4.0% | | | | | | | | | |

| | | | |

| | 14,600 | | | Aflac Inc | | | | | | | | | | | 772,340 | |

| | 9,673 | | | Allstate Corp | | | | | | | | | | | 1,087,729 | |

| | 9,987 | | | Arthur J Gallagher & Co | | | | | | | | | | | 951,062 | |

| | 2,243 | | | Assurant Inc | | | | | | | | | | | 294,013 | |

| | 7,781 | | | Cincinnati Financial Corp | | | | | | | | | | | 818,172 | |

| | 544 | | | Everest Re Group Ltd | | | | | | | | | | | 150,601 | |

| | 495 | | | Globe Life Inc | | | | | | | | | | | 52,099 | |

| | 2,190 | | | Lincoln National Corp | | | | | | | | | | | 129,232 | |

| | 1,356 | | | Loews Corp | | | | | | | | | | | 71,176 | |

| | 7,754 | | | MetLife Inc | | | | | | | | | | | 395,221 | |

| | 6,805 | | | Principal Financial Group Inc | | | | | | | | | | | 374,275 | |

| | 55,200 | | | Progressive Corp, (2) | | | | | | | | | | | 3,995,928 | |

| | 4,697 | | | Prudential Financial Inc | | | | | | | | | | | 440,297 | |

| | 6,771 | | | Unum Group | | | | | | | | | | | 197,442 | |

| | | | Total Insurance | | | | | | | | | | | 9,729,587 | |

| |

| | | | Interactive Media & Services – 0.1% | |

| | | | |

| | 6,167 | | | Twitter Inc, (3) | | | | | | | | | | | 197,652 | |

| |

| | | | Internet & Direct Marketing Retail – 0.1% | |

| | | | |

| | 3,622 | | | eBay Inc | | | | | | | | | | | 130,790 | |

| | | | |

| | | | IT Services – 6.9% | | | | | | | | | |

| | | | |

| | 1,302 | | | Accenture PLC, Class A | | | | | | | | | | | 274,162 | |

| | 1,497 | | | Akamai Technologies Inc, (3) | | | | | | | | | | | 129,311 | |

| | 17,905 | | | Automatic Data Processing Inc | | | | | | | | | | | 3,052,803 | |

| | 378 | | | Broadridge Financial Solutions Inc | | | | | | | | | | | 46,698 | |

| | 9,053 | | | DXC Technology Co | | | | | | | | | | | 340,302 | |

| | 6,500 | | | Fiserv Inc, (3) | | | | | | | | | | | 751,595 | |

| | 599 | | | FleetCor Technologies Inc, (3) | | | | | | | | | | | 172,344 | |

| | 7,000 | | | Gartner Inc, (3) | | | | | | | | | | | 1,078,700 | |

| | 9,345 | | | Global Payments Inc | | | | | | | | | | | 1,706,023 | |

| | 11,343 | | | Mastercard Inc, Class A | | | | | | | | | | | 3,386,906 | |

| | 15,000 | | | Paychex Inc | | | | | | | | | | | 1,275,900 | |

| | 13,788 | | | PayPal Holdings Inc, (2), (3) | | | | | | | | | | | 1,491,448 | |

| | 13,200 | | | VeriSign Inc, (3) | | | | | | | | | | | 2,543,376 | |

| | 1,575 | | | Visa Inc | | | | | | | | | | | 295,943 | |

| | 6,765 | | | Western Union Co | | | | | | | | | | | 181,167 | |

| | | | Total IT Services | | | | | | | | | | | 16,726,678 | |

| |

| | | | Leisure Products – 0.1% | |

| | | | |

| | 1,505 | | | Hasbro Inc | | | | | | | | | | | 158,943 | |

19

| | |

| |

| JCE | | Nuveen Core Equity Alpha Fund(continued) |

| | Portfolio of Investments December 31, 2019 |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| |

| | | | Life Sciences Tools & Services – 1.4% | |

| | | | |

| | 4,110 | | | Agilent Technologies Inc | | | | | | | | | | $ | 350,624 | |

| | 6,315 | | | Illumina Inc, (3) | | | | | | | | | | | 2,094,938 | |

| | 4,505 | | | IQVIA Holdings Inc, (3) | | | | | | | | | | | 696,068 | |

| | 214 | | | Mettler-Toledo International Inc, (3) | | | | | | | | | | | 169,762 | |

| | | | Total Life Sciences Tools & Services | | | | | | | | | | | 3,311,392 | |

| |

| | | | Machinery – 1.5% | |

| | | | |

| | 1,155 | | | Caterpillar Inc | | | | | | | | | | | 170,570 | |

| | 3,938 | | | Cummins Inc | | | | | | | | | | | 704,744 | |

| | 6,538 | | | Deere & Co | | | | | | | | | | | 1,132,774 | |

| | 1,043 | | | Flowserve Corp | | | | | | | | | | | 51,910 | |

| | 785 | | | Illinois Tool Works Inc | | | | | | | | | | | 141,010 | |

| | 2,400 | | | Ingersoll-Rand PLC | | | | | | | | | | | 319,008 | |

| | 3,237 | | | PACCAR Inc | | | | | | | | | | | 256,047 | |

| | 679 | | | Parker-Hannifin Corp | | | | | | | | | | | 139,752 | |

| | 2,795 | | | Snap-on Inc | | | | | | | | | | | 473,473 | |

| | 817 | | | Stanley Black & Decker Inc | | | | | | | | | | | 135,410 | |

| | 826 | | | Xylem Inc | | | | | | | | | | | 65,080 | |

| | | | Total Machinery | | | | | | | | | | | 3,589,778 | |

| |

| | | | Media – 2.4% | |

| | | | |

| | 1,919 | | | Charter Communications Inc, Class A, (3) | | | | | | | | | | | 930,869 | |

| | 8,800 | | | Discovery Inc, Class A, (3) | | | | | | | | | | | 288,112 | |

| | 47,648 | | | Discovery Inc, (2), (3) | | | | | | | | | | | 1,452,787 | |

| | 3,715 | | | DISH Network Corp, Class A, (3) | | | | | | | | | | | 131,771 | |

| | 18,288 | | | Fox Corp, Class A | | | | | | | | | | | 677,936 | |

| | 21,521 | | | Fox Corp, Class B | | | | | | | | | | | 783,364 | |

| | 3,872 | | | Interpublic Group of Cos Inc | | | | | | | | | | | 89,443 | |

| | 27,019 | | | News Corp, Class A | | | | | | | | | | | 382,049 | |

| | 11,736 | | | Omnicom Group Inc | | | | | | | | | | | 950,851 | |

| | | | Total Media | | | | | | | | | | | 5,687,182 | |

| |

| | | | Metals & Mining – 0.1% | |

| | | | |

| | 4,210 | | | Freeport-McMoRan Inc | | | | | | | | | | | 55,235 | |

| | 2,313 | | | Nucor Corp | | | | | | | | | | | 130,176 | |

| | | | Total Metals & Mining | | | | | | | | | | | 185,411 | |

| |

| | | | Multiline Retail – 2.5% | |

| | | | |

| | 10,300 | | | Dollar General Corp | | | | | | | | | | | 1,606,594 | |

| | 25,700 | | | Dollar Tree Inc, (3) | | | | | | | | | | | 2,417,085 | |

| | 14,600 | | | Kohl’s Corp | | | | | | | | | | | 743,870 | |

| | 9,846 | | | Macy’s Inc | | | | | | | | | | | 167,382 | |

| | 1,985 | | | Nordstrom Inc | | | | | | | | | | | 81,246 | |

| | 8,751 | | | Target Corp | | | | | | | | | | | 1,121,966 | |

| | | | Total Multiline Retail | | | | | | | | | | | 6,138,143 | |

| |

| | | | Multi-Utilities – 1.5% | |

| | | | |

| | 20,600 | | | Ameren Corp | | | | | | | | | | | 1,582,080 | |

| | 16,435 | | | CenterPoint Energy Inc | | | | | | | | | | | 448,183 | |

| | 13,600 | | | CMS Energy Corp | | | | | | | | | | | 854,624 | |

| | 409 | | | DTE Energy Co | | | | | | | | | | | 53,117 | |

| | 9,500 | | | NiSource Inc | | | | | | | | | | | 264,480 | |

| | 6,400 | | | Public Service Enterprise Group Inc | | | | | | | | | | | 377,920 | |

| | 1,067 | | | WEC Energy Group Inc | | | | | | | | | | | 98,409 | |

| | | | Total Multi-Utilities | | | | | | | | | | | 3,678,813 | |

| |

| | | | Oil, Gas & Consumable Fuels – 5.1% | |

| | | | |

| | 3,265 | | | Cimarex Energy Co | | | | | | | | | | | 171,380 | |

| | 48,633 | | | ConocoPhillips, (2) | | | | | | | | | | | 3,162,604 | |

| | 7,972 | | | Devon Energy Corp | | | | | | | | | | | 207,033 | |

| | 3,982 | | | Diamondback Energy Inc | | | | | | | | | | | 369,769 | |

| | 17,600 | | | Hess Corp | | | | | | | | | | | 1,175,856 | |

| | 5,330 | | | HollyFrontier Corp | | | | | | | | | | | 270,284 | |

| | 53,900 | | | Kinder Morgan Inc, (2) | | | | | | | | | | | 1,141,063 | |

20

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| |

| | | | Oil, Gas & Consumable Fuels(continued) | |

| | | | |

| | 61,381 | | | Marathon Oil Corp | | | | | | | | | | $ | 833,554 | |

| | 3,619 | | | Marathon Petroleum Corp | | | | | | | | | | | 218,045 | |

| | 11,018 | | | Noble Energy Inc | | | | | | | | | | | 273,687 | |

| | 6,911 | | | Occidental Petroleum Corp | | | | | | | | | | | 284,802 | |

| | 32,600 | | | ONEOK Inc, (2) | | | | | | | | | | | 2,466,842 | |

| | 1,282 | | | Phillips 66 | | | | | | | | | | | 142,828 | |

| | 583 | | | Pioneer Natural Resources Co | | | | | | | | | | | 88,249 | |

| | 7,682 | | | Valero Energy Corp | | | | | | | | | | | 719,419 | |

| | 28,360 | | | Williams Cos Inc | | | | | | | | | | | 672,699 | |

| | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | 12,198,114 | |

| |

| | | | Personal Products – 0.6% | |

| | | | |

| | 22,360 | | | Coty Inc, Class A | | | | | | | | | | | 251,550 | |

| | 5,803 | | | Estee Lauder Cos Inc, Class A | | | | | | | | | | | 1,198,552 | |

| | | | Total Personal Products | | | | | | | | | | | 1,450,102 | |

| |

| | | | Pharmaceuticals – 2.8% | |

| | | | |

| | 3,425 | | | Allergan PLC | | | | | | | | | | | 654,757 | |

| | 21,219 | | | Eli Lilly & Co | | | | | | | | | | | 2,788,813 | |

| | 11,286 | | | Merck & Co Inc | | | | | | | | | | | 1,026,462 | |

| | 15,866 | | | Mylan NV, (3) | | | | | | | | | | | 318,907 | |

| | 3,497 | | | Perrigo Co PLC | | | | | | | | | | | 180,655 | |

| | 5,720 | | | Pfizer Inc | | | | | | | | | | | 224,110 | |

| | 11,427 | | | Zoetis Inc | | | | | | | | | | | 1,512,363 | |

| | | | Total Pharmaceuticals | | | | | | | | | | | 6,706,067 | |

| |

| | | | Professional Services – 1.1% | |

| | | | |

| | 5,800 | | | IHS Markit Ltd | | | | | | | | | | | 437,030 | |

| | 11,943 | | | Nielsen Holdings PLC | | | | | | | | | | | 242,443 | |

| | 13,600 | | | Robert Half International Inc | | | | | | | | | | | 858,840 | |

| | 7,252 | | | Verisk Analytics Inc | | | | | | | | | | | 1,083,014 | |

| | | | Total Professional Services | | | | | | | | | | | 2,621,327 | |

| |

| | | | Real Estate Management & Development – 0.2% | |

| | | | |

| | 6,394 | | | CBRE Group Inc, Class A, (3) | | | | | | | | | | | 391,888 | |

| | |

| | | | Road & Rail – 2.6% | | | | |

| | | | |

| | 59,615 | | | CSX Corp, (2) | | | | | | | | | | | 4,313,741 | |

| | 4,411 | | | Kansas City Southern | | | | | | | | | | | 675,589 | |

| | 5,207 | | | Norfolk Southern Corp | | | | | | | | | | | 1,010,835 | |

| | 808 | | | Union Pacific Corp | | | | | | | | | | | 146,078 | |

| | | | Total Road & Rail | | | | | | | | | | | 6,146,243 | |

| |

| | | | Semiconductors & Semiconductor Equipment – 2.4% | |

| | | | |

| | 30,760 | | | Advanced Micro Devices Inc, (2), (3) | | | | | | | | | | | 1,410,654 | |

| | 2,605 | | | Analog Devices Inc | | | | | | | | | | | 309,578 | |

| | 6,910 | | | Applied Materials Inc | | | | | | | | | | | 421,786 | |

| | 5,126 | | | KLA Corp | | | | | | | | | | | 913,300 | |

| | 1,090 | | | Lam Research Corp | | | | | | | | | | | 318,716 | |

| | 2,050 | | | Maxim Integrated Products Inc | | | | | | | | | | | 126,096 | |

| | 1,718 | | | Microchip Technology Inc | | | | | | | | | | | 179,909 | |

| | 1,978 | | | Micron Technology Inc, (3) | | | | | | | | | | | 106,377 | |

| | 2,662 | | | Qorvo Inc, (3) | | | | | | | | | | | 309,404 | |

| | 3,506 | | | QUALCOMM Inc | | | | | | | | | | | 309,334 | |

| | 1,949 | | | Skyworks Solutions Inc | | | | | | | | | | | 235,595 | |

| | 12,605 | | | Xilinx Inc | | | | | | | | | | | 1,232,391 | |

| | | | Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | 5,873,140 | |

| |

| | | | Software – 5.0% | |

| | | | |

| | 3,900 | | | Adobe Inc, (3) | | | | | | | | | | | 1,286,259 | |

| | 7,427 | | | Cadence Design Systems Inc, (3) | | | | | | | | | | | 515,137 | |

| | 6,300 | | | Citrix Systems Inc | | | | | | | | | | | 698,670 | |

| | 13,300 | | | Fortinet Inc, (3) | | | | | | | | | | | 1,419,908 | |

21

| | |

| |

| JCE | | Nuveen Core Equity Alpha Fund(continued) |

| | Portfolio of Investments December 31, 2019 |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| |

| | | | Software(continued) | |

| | | | |

| | 9,145 | | | Intuit Inc | | | | | | | | | | $ | 2,395,350 | |

| | 14,419 | | | Microsoft Corp | | | | | | | | | | | 2,273,876 | |

| | 13,654 | | | NortonLifeLock Inc | | | | | | | | | | | 348,450 | |

| | 1,287 | | | Oracle Corp | | | | | | | | | | | 68,185 | |

| | 17,600 | | | salesforcecom Inc, (3) | | | | | | | | | | | 2,862,464 | |

| | 605 | | | Synopsys Inc, (3) | | | | | | | | | | | 84,216 | |

| | | | Total Software | | | | | | | | | | | 11,952,515 | |

| |

| | | | Specialty Retail – 5.2% | |

| | | | |

| | 1,057 | | | Advance Auto Parts Inc | | | | | | | | | | | 169,289 | |

| | 2,600 | | | AutoZone Inc, (3) | | | | | | | | | | | 3,097,406 | |

| | 2,373 | | | Best Buy Co Inc | | | | | | | | | | | 208,349 | |

| | 1,258 | | | CarMax Inc, (3) | | | | | | | | | | | 110,289 | |

| | 22,707 | | | Gap Inc | | | | | | | | | | | 401,460 | |

| | 8,137 | | | L Brands Inc | | | | | | | | | | | 147,443 | |

| | 5,545 | | | O’Reilly Automotive Inc, (3) | | | | | | | | | | | 2,430,152 | |

| | 18,155 | | | Ross Stores Inc | | | | | | | | | | | 2,113,605 | |

| | 366 | | | Tiffany & Co | | | | | | | | | | | 48,916 | |

| | 49,055 | | | TJX Cos Inc, (2) | | | | | | | | | | | 2,995,298 | |

| | 1,535 | | | Tractor Supply Co | | | | | | | | | | | 143,430 | |

| | 2,453 | | | Ulta Beauty Inc, (3) | | | | | | | | | | | 620,952 | |

| | | | Total Specialty Retail | | | | | | | | | | | 12,486,589 | |

| |

| | | | Technology Hardware, Storage & Peripherals – 2.0% | |

| | | | |

| | 5,993 | | | Apple Inc | | | | | | | | | | | 1,759,844 | |

| | 11,548 | | | Hewlett Packard Enterprise Co | | | | | | | | | | | 183,151 | |

| | 21,900 | | | NetApp Inc | | | | | | | | | | | 1,363,275 | |

| | 5,296 | | | Seagate Technology PLC | | | | | | | | | | | 315,112 | |

| | 13,106 | | | Western Digital Corp | | | | | | | | | | | 831,838 | |

| | 11,201 | | | Xerox Holdings Corp | | | | | | | | | | | 412,981 | |

| | | | Total Technology Hardware, Storage & Peripherals | | | | | | | | | | | 4,866,201 | |

| |

| | | | Textiles, Apparel & Luxury Goods – 1.4% | |

| | | | |

| | 3,978 | | | Capri Holdings Ltd, (3) | | | | | | | | | | | 151,761 | |

| | 5,000 | | | NIKE Inc, Class B | | | | | | | | | | | 506,550 | |

| | 2,953 | | | PVH Corp | | | | | | | | | | | 310,508 | |

| | 25,300 | | | VF Corp | | | | | | | | | | | 2,521,398 | |

| | | | Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | 3,490,217 | |

| |

| | | | Trading Companies & Distributors – 1.0% | |

| | | | |

| | 14,800 | | | Fastenal Co | | | | | | | | | | | 546,860 | |

| | 1,055 | | | United Rentals Inc, (3) | | | | | | | | | | | 175,942 | |

| | 5,000 | | | WW Grainger Inc | | | | | | | | | | | 1,692,600 | |

| | | | Total Trading Companies & Distributors | | | | | | | | | | | 2,415,402 | |

| |

| | | | Water Utilities – 0.3% | |

| | | | |

| | 6,471 | | | American Water Works Co Inc | | | | | | | | | | | 794,962 | |

| | | | Total Long-Term Investments (cost $191,425,748) | | | | | | | | | | | 240,698,103 | |

| | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Value | |

| |

| | | | SHORT-TERM INVESTMENTS – 0.5% | |

| |

| | | | REPURCHASE AGREEMENTS – 0.5% | |

| | | | |

| $ | 1,118 | | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/19,

repurchase price $1,118,313, collateralized by $1,010,000, U.S. Treasury Bonds,

3.000%, due 5/15/45, value $1,140,956 | | | 0.650% | | | | 1/02/20 | | | $ | 1,118,273 | |

| | | | Total Short-Term Investments (cost $1,118,273) | | | | | | | | | | | 1,118,273 | |

| | | | Total Investments (cost $192,544,021) – 100.3% | | | | | | | | | | | 241,816,376 | |

| | | | Other Assets Less Liabilities – (0.3)% (4) | | | | | | | | | | | (792,290 | ) |

| | | | Net Assets Applicable to Common Shares – 100% | | | | | | | | | | $ | 241,024,086 | |

22

Investments in Derivatives

Options Written

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description (5) | | Type | | | Number of

Contracts | | | Notional

Amount (6) | | | Exercise

Price | | | Expiration

Date | | | Value | |

Russell 2000® Index | | | Call | | | | (200 | ) | | $ | (33,000,000 | ) | | | 1,650 | | | | 1/17/20 | | | $ | (666,000 | ) |

Russell 2000® Index | | | Call | | | | (200 | ) | | | (33,200,000 | ) | | | 1,660 | | | | 1/17/20 | | | | (523,000 | ) |

Total Options Written (premiums received $950,984) | | | | | | | (400 | ) | | $ | (66,200,000 | ) | | | | | | | | | | $ | (1,189,000 | ) |

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industrysub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industrysub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | Investment, or portion of investment, has been pledged to collateralized the net payment obligations for investments in derivatives. |

| (3) | Non-income producing; issuer has not declared a dividend within the past twelve months. |

| (4) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC-cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. Other assets less liabilities also includes the value of options as presented on the Statement of Assets and Liabilities. |

| (5) | Exchange-traded, unless otherwise noted. |

| (6) | For disclosure purposes, Notional Amount is calculated by multiplying the Number of Contracts by the Exercise Price by 100. |

See accompanying notes to financial statements.

23

Statement of Assets and Liabilities

December 31, 2019

| | | | |

Assets | | | | |

Long-term investments, at value (cost $191,425,748) | | $ | 240,698,103 | |

Short-term investments, at value (cost approximates value) | | | 1,118,273 | |

Cash | | | 88,037 | |

Receivables for: | | | | |

Dividends | | | 390,350 | |

Interest | | | 20 | |

Deferred offering costs | | | 255,245 | |

Other assets | | | 32,475 | |

Total assets | | | 242,582,503 | |

Liabilities | | | | |

Options written, at value (premiums received $950,984) | | | 1,189,000 | |

Payable for Investments purchased – regular settlement | | | 67,977 | |

Accrued expenses: | | | | |