SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

NeurogesX, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NeurogesX, Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

JUNE 2, 2010

To the Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of NeurogesX, Inc. (the “Company”), a Delaware corporation, will be held on Wednesday, June 2, 2010 at 2:00 p.m., local time, at 2207 Bridgepointe Parkway, Suite 150, San Mateo, California, 94404, for the following purposes:

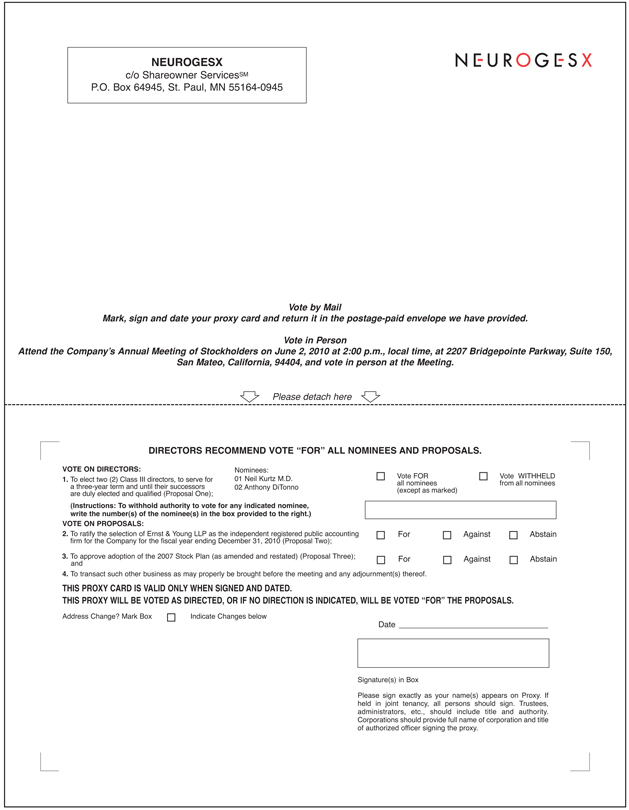

| | 1. | To elect Neil M. Kurtz M.D. and Anthony DiTonno as Class III directors to serve for a three-year term and until their successors are duly elected and qualified (Proposal One); |

| | 2. | To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2010 (Proposal Two); |

| | 3. | To approve the 2007 Stock Plan (as amended and restated) (Proposal Three); and |

| | 4. | | To transact such other business as may properly be brought before the meeting and any adjournment(s) thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on April 8, 2010 are entitled to notice of and to vote at the meeting.

|

| Sincerely, |

|

/s/ STEPHEN F. GHIGLIERI |

Stephen F. Ghiglieri Secretary |

San Mateo, California

April 19, 2010

YOUR VOTE IS IMPORTANT

THIS PROXY STATEMENT IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY THE COMPANY, ON BEHALF OF THE BOARD OF DIRECTORS, FOR THE 2010 ANNUAL MEETING OF STOCKHOLDERS. THE PROXY STATEMENT AND THE RELATED PROXY FORM ARE BEING DISTRIBUTED ON OR ABOUT MAY 5, 2010. YOU CAN VOTE YOUR SHARES USING ONE OF THE FOLLOWING METHODS:

| | • | | COMPLETE AND RETURN A WRITTEN PROXY CARD |

| | • | | ATTEND THE COMPANY’S 2010 ANNUAL MEETING OF STOCKHOLDERS AND VOTE |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING. HOWEVER, TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE URGED TO MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE POSTAGE-PREPAID ENVELOPE ENCLOSED FOR THAT PURPOSE. ANY STOCKHOLDER ATTENDING THE MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE HAS RETURNED A PROXY CARD.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD JUNE 2, 2010:

The Company’s Proxy Statement, form of proxy card, Annual Report and Annual Report on Form 10-K are available at www.neurogesx.com under the heading “Investor Relations” and the subheading “Annual Report and Proxy Materials”

NEUROGESX, INC.

2215 Bridgepointe Parkway, Suite 200

San Mateo, California 94404

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors (the “Board of Directors”) of NeurogesX, Inc. (the “Company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 2207 Bridgepointe Parkway, Suite 150, San Mateo, California, 94404, on Wednesday, June 2, 2010, at 2:00 p.m., local time, and at any adjournment(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Company’s principal executive offices are located at the address listed at the top of the page and the telephone number is (650) 358-3300.

The Company’s Annual Report and Annual Report on Form 10-K, containing financial statements for the fiscal year ended December 31, 2009, are being mailed together with these proxy solicitation materials to all stockholders entitled to vote. This Proxy Statement, the accompanying Proxy, the Company’s Annual Report and Annual Report on Form 10-K will first be mailed on or about May 5, 2010 to all stockholders entitled to vote at the meeting.

THE COMPANY SHALL PROVIDE WITHOUT CHARGE TO ANY STOCKHOLDER SOLICITED BY THESE PROXY SOLICITATION MATERIALS A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K, TOGETHER WITH THE FINANCIAL STATEMENTS REQUIRED TO BE FILED WITH THE ANNUAL REPORT ON FORM 10-K, UPON REQUEST OF A STOCKHOLDER MADE IN WRITING TO NEUROGESX, INC., 2215 BRIDGEPOINTE PARKWAY, SUITE 200, SAN MATEO, CALIFORNIA, 94404, ATTN: INVESTOR RELATIONS.

Record Date and Share Ownership

Stockholders of record at the close of business on April 8, 2010 (the “Record Date”) are entitled to notice of and to vote at the meeting and at any adjournment(s) thereof. The Company has one series of common shares issued and outstanding, designated as Common Stock, $0.001 par value per share (the “Common Stock”) and one series of undesignated Preferred Stock, $0.001 par value per share (the “Preferred Stock”). As of the Record Date, 100,000,000 shares of Common Stock were authorized and 11,864,851 shares were issued and outstanding. As of the Record Date, 10,000,000 shares of Preferred Stock were authorized and none were issued or outstanding.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by:

| | • | | delivering to the Company at its principal offices (Attention: Investor Relations) a written notice of revocation or a duly executed proxy bearing a later date; or |

| | • | | attending the meeting and voting in person. |

Solicitation of Proxies

The Company is making this solicitation and will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company’s Common Stock beneficially owned by

others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone or facsimile.

Voting

On all matters, each share has one vote. See “Vote Required” under Proposal One – Election of Two Class III Directors.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting (“Votes Cast”) will be tabulated by the Inspector of Elections (the “Inspector”) who will be a representative from Wells Fargo Shareowner Services, the Company’s Transfer Agent and Registrar. The Inspector will also determine whether or not a quorum is present. Except in certain specific circumstances, the affirmative vote of a majority of shares present in person or represented by proxy at a duly held meeting at which a quorum is present is required under Delaware law for approval of proposals presented to stockholders. In general, Delaware law provides that a quorum consists of a majority of shares entitled to vote and present or represented by proxy at the meeting.

The Inspector will treat shares that are voted WITHHELD or ABSTAIN as being present and entitled to vote for purposes of determining the presence of a quorum but will not be treated as votes in favor of approving any matter submitted to the stockholders for a vote. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted:

| | • | | for the election of the nominees for director set forth herein; |

| | • | | for the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm to the Company; |

| | • | | for the approval of the 2007 Stock Plan (as amended and restated); and |

| | • | | upon such other business as may properly come before the Annual Meeting or any adjournment thereof, but will not be voted other than as provided for the matters set forth above. |

If a broker indicates on the enclosed proxy or its substitute that such broker does not have discretionary authority as to certain shares to vote on a particular matter (“broker non-votes”), those shares will be considered as present with respect to establishing a quorum for the transaction of business. The Company believes that the tabulation procedures to be followed by the Inspector are consistent with the general statutory requirements in Delaware concerning voting of shares and determination of a quorum. Broker non-votes with respect to proposals set forth in this Proxy Statement will not be considered “Votes Cast” and, accordingly, will not affect the determination as to whether the requisite majority of Votes Cast has been obtained with respect to a particular matter.

Deadline for Receipt of Stockholder Proposals

Stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of the Company’s bylaws and the rules established by the Securities and Exchange Commission (the “SEC”), under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under these requirements, proposals of stockholders of the Company that are intended to be presented by such stockholders at the Company’s 2011 Annual Meeting of Stockholders must be received by the Company no later than December 28, 2010.

Internet Availability of Proxy Materials

This Proxy Statement, the form of proxy card, the Annual Report and the Annual Report on Form 10-K are available on our website at: www.neurogesx.com under the heading “Investor Relations” and the subheading “Annual Report and Proxy Materials”

2

PROPOSAL ONE

ELECTION OF TWO CLASS III DIRECTORS

Nominees

The Company’s Board of Directors currently has six authorized directors and currently consists of six members. The Company has a classified Board of Directors, which is divided into three classes of directors whose terms expire at different times. The three classes are currently comprised of the following directors:

| | • | | Class I consists of Bradford S. Goodwin and John A. Orwin who will serve until the 2011 Annual Meeting of Stockholders. |

| | • | | Class II consists of Robert T. Nelsen and Jean-Jacques Bienaimé who are to serve until the 2012 Annual Meeting of Stockholders. and |

| | • | | Class III consists of Neil M. Kurtz, M.D., and Anthony A. DiTonno, who are to serve until the 2010 Annual Meeting of Stockholders. If elected as Class III directors, Neil M. Kurtz M.D. and Anthony A. DiTonno are to serve until the 2013 Annual Meeting of Stockholders; |

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following election and until their successors have been duly elected and qualified.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s nominees named below, who are currently directors of the Company. The nominees have consented to be named as nominees in the proxy statement and to continue to serve as directors if elected. If the nominees become unable or decline to serve as directors or if additional persons are nominated at the meeting, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of the nominees listed below if possible (or, if new nominees have been designated by the Board of Directors, in such a manner as to elect such nominees), and the specific nominees to be voted for will be determined by the proxy holders.

The nominees for Class III director and their biographical information are as follows:

Biographical information for Dr. Kurtz and Mr. DiTonno can be found below in the “Directors and Executive Officers” section.

The Company is not aware of any reason that the nominees will be unable or will decline to serve as directors. If elected, Dr. Kurtz’s and Mr. DiTonno’s terms of office are to continue until the Company’s Annual Meeting of Stockholders held in 2013 or until successors have been elected and qualified. There are no arrangements or understandings between any director or named executive officer and any other person pursuant to which he is or was to be selected as a director or officer of the Company.

Vote Required

The directors will be elected by a plurality vote of the shares of the Company’s Common Stock present or represented and entitled to vote on this matter at the meeting. Accordingly, the candidates receiving the highest number of affirmative votes of shares represented and voting on this proposal at the meeting will be elected as directors of the Company. Votes withheld from nominees and broker non-votes will be counted for purposes of determining the presence or absence of a quorum but, because directors are elected by a plurality vote, will have no impact once a quorum is present. See “Quorum; Abstentions; Broker Non-Votes.”

THE CLASS I AND II DIRECTORS RECOMMEND THAT

STOCKHOLDERS VOTEFOR THE CLASS III NOMINEES LISTED ABOVE.

3

PROPOSAL TWO

RATIFICATION OF SELECTION OF ERNST & YOUNG LLP AS

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010

The Board of Directors and the Audit Committee have selected Ernst & Young LLP, independent registered public accounting firm, to audit the financial statements of the Company for the fiscal year ending December 31, 2010, and recommend that the stockholders vote for ratification of such selection. Although action by stockholders is not required by law, the Board of Directors has determined that it is desirable to request approval of this selection by the stockholders. Notwithstanding the selection or ratification, the Board of Directors and the Audit Committee, in their discretion, may direct the selection of a new independent registered public accounting firm at any time during the year, if the Board of Directors and the Audit Committee determine that such a change would be in the best interest of the Company.

A representative of Ernst & Young LLP is expected to be present at the meeting and will be afforded the opportunity to make a statement if he or she desires to do so, and is also expected to be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTEFOR RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010.

Principal Accountant Fees and Services

Fees for professional services provided by the Company’s independent registered public accounting firm in each of the last two fiscal years, in each of the following categories are:

| | | | | | |

| | | Years Ended December 31, |

| | | 2009 | | 2008 |

Audit Fees | | $ | 420,800 | | $ | 416,968 |

Audit-Related Fees | | | 34,250 | | | 13,500 |

Tax Fees | | | — | | | — |

All Other Fees | | | 2,000 | | | — |

| | | | | | |

Total | | $ | 457,050 | | $ | 430,468 |

| | | | | | |

Ernst & Young LLP served as the Company’s independent registered public accounting firm for the years ended December 31, 2009, 2008, 2007 and 2006.

Audit fees include fees associated with the annual audit, reviews of our quarterly reports on Form 10-Q, issuance of consents relating to registration statement filings with the SEC and all services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. Audit-related fees include fees associated with accounting consultations. Tax fees include tax compliance services. All other Fees consist of all other services provided by Ernst & Young that are not reported above. The services for the amounts disclosed under this category include an annual subscription fee to Ernst & Young for accounting literature.

All auditing services and non-audit services provided to the Company by our independent registered public accounting firm are required to be pre-approved by the Audit Committee. The pre-approval of non-audit services to be provided by Ernst & Young LLP includes making a determination that the provision of the services is compatible with maintaining the independence of Ernst & Young LLP as our independent registered public accounting firm. All non-audit services provided by Ernst & Young LLP since the Company became an issuer, within the meaning of Section 10A(f) of the Exchange Act, have been pre-approved in accordance with the SEC rules for maintaining auditor independence.

4

PROPOSAL THREE

APPROVAL OF THE 2007 STOCK PLAN (AS AMENDED)

Our 2007 Stock Plan was originally adopted by our board of directors in January 2007 and became effective upon our Registration Statement on Form S-1 on May 1, 2007. A total of 1,333,333 shares of common stock were initially authorized for issuance thereunder. The authorized amount was thereafter increased pursuant to the evergreen provisions of the 2007 Stock Plan as well as by shares subject to stock options or similar awards granted under the Company’s 2000 Incentive Stock Plan, or the 2000 Plan, that were returned and rolled into the 2007 Stock Plan pursuant to the terms of the 2007 Stock Plan. As of January 1, 2010, a total of 4,122,549 shares have been authorized for issuance under the 2007 Stock Plan.

Our Board of Directors is now requesting that our stockholders approve the 2007 Stock Plan, as amended, or the Amended 2007 Plan. In particular, we are seeking stockholder approval of the material terms of the Amended 2007 Plan for purposes of complying with Section 162(m) of the Internal Revenue Code of 1986, as amended, or Section 162(m). Our Board of Directors has approved the Amended 2007 Plan, subject to approval from our stockholders at the 2010 Annual Meeting. If our stockholders approve the Amended 2007 Plan, it will replace the current version of the 2007 Stock Plan and will continue in effect until January 2017 unless terminated earlier by our Board of Directors. Approval of the Amended 2007 Plan requires the affirmative vote of the holders of a majority of the shares of our common stock that are present in person or by proxy and entitled to vote at the 2010 Annual Meeting.

The Amended 2007 Plan was amended to allow the Company to continue to deduct in full for federal income tax purposes the compensation recognized by its named executive officers in connection with certain awards granted under the Amended 2007 Plan. Section 162(m) generally denies a corporate tax deduction for annual compensation exceeding $1 million paid to the chief executive officer and other “covered employees” as determined under Section 162(m) and applicable guidance. However, certain types of compensation, including performance-based compensation, are generally excluded from this deductibility limit. To enable compensation in connection with stock options, stock appreciation rights and certain restricted stock grants, restricted stock units, performance shares and performance units awarded under the Amended 2007 Plan to qualify as “performance-based” within the meaning of Section 162(m), the Amended 2007 Plan limits the sizes of such awards as further described below.

The following is a summary of some of the material differences between the Amended 2007 Plan and the 2007 Stock Plan. This comparative summary is qualified in its entirety by reference to the actual text of the Amended 2007 Plan, set forth as Appendix A.

| | • | | The Amended 2007 Plan has been drafted to include limitations to the number of shares that may be granted on an annual basis through individual awards, which is necessary to allow the Company to be eligible to receive income tax deductions under Section 162(m), as follows: |

| | | | |

Award Type | | General Fiscal Year Limit | | Additional Amount in Connection

with Initial Service as an

Employee |

Stock Options | | 1,000,000 shares | | 500,000 shares |

Stock Appreciation Rights | | 1,000,000 shares | | 500,000 shares |

Restricted Stock | | 300,000 shares | | 150,000 shares |

Restricted Stock Units | | 300,000 shares | | 150,000 shares |

Performance Shares | | 300,000 shares | | 150,000 shares |

Performance Units | | $1,000,000 | | N/A |

| | • | | Specific performance criteria have been added to the Amended 2007 Plan so that certain Awards may be granted subject to or conditioned upon the satisfaction of performance objectives, which in turn will allow the Company to be eligible to receive income tax deductions, notwithstanding the limitations, under |

5

| | Section 162(m). These performance criteria may include: attainment of research and development milestones, business divestitures and acquisitions, in license and out license activities, cash flow, cash position, collaboration arrangements, collaboration progression, earnings (which may include earnings before interest and taxes, earnings before taxes and net earnings), earnings per share, expense reduction, financing events, gross margin, growth with respect to any of the foregoing measures, growth in bookings, growth in revenues, growth in stockholder value relative to the moving average of the S&P 500 Index or another index, internal rate of return, market share, net income, net profit, net sales, new product development, new product invention or innovation, number of customers, operating cash flow, operating expenses, operating income, operating margin, pre-tax profit, product approvals, product sales, productivity, profit, projects in development, regulatory filings, return on assets, return on capital, return on stockholder equity, return on investment, return on sales, revenue, revenue growth, sales growth, sales results, stock price increase, time to market, total stockholder return, working capital, business development and commercial partnerships. |

Our Board of Directors believes that the approval of the Amended 2007 Plan is essential to our continued success. We believe that our employees are our most valuable assets and that the awards permitted under the Amended 2007 Plan are vital to our ability to attract and retain outstanding and highly skilled individuals in the competitive labor markets in which we compete. These awards also are crucial to our ability to motivate our employees to achieve our company goals.

Summary of the Amended 2007 Plan

The following is a summary of the principal features of the Amended 2007 Plan and its operation. The summary is qualified in its entirety by reference to the Amended 2007 Plan itself set forth in Appendix A.

The Amended 2007 Plan provides for the grant of the following types of incentive awards: (i) stock options, (ii) stock appreciation rights, (iii) restricted stock, (iv) restricted stock units, and (v) performance shares and performance units. Each of these is referred to individually as an “Award” or collectively as “Awards” and each holder of an Award is referred to as a “participant” or collectively as “participants.” Those eligible for Awards under the Amended 2007 Plan include employees and consultants who provide services to us or our parent or subsidiaries as well as directors of the Company. As of January 1, 2010, approximately 50 of our employees and directors would be eligible to participate in the Amended 2007 Plan.

Number of Shares of Common Stock Available Under the Amended 2007 Plan. The maximum aggregate number of shares that may be awarded and sold under the Amended 2007 Plan is (A) 4,122,549 shares, which includes shares returned to the Amended 2007 Plan prior to January 1, 2010 under (B) below and increases under (C) below for years prior to the 2011 fiscal year, plus (B) any shares subject to stock options or similar awards granted under our 2000 Plan that expire or otherwise terminate without having been exercised in full and shares issued pursuant to awards granted under our 2000 Plan that are forfeited to or repurchased by the Company, with the maximum number of shares to be added to the Amended 2007 Plan pursuant to this clause (B) equal to 866,666 shares (which is includes shares previously returned to the Amended 2007 Plan pursuant to clause (B)), plus (C) an annual increase to be added on the first day of each fiscal year beginning with the 2011 fiscal year, in an amount equal to the least of 1,333,333 shares, 5% of the outstanding shares on the last date of the immediately preceding fiscal year, or an amount determined by our board of directors. The shares may be authorized, but unissued, or reacquired common stock.

If an Award expires or becomes unexercisable without having been exercised in full, is surrendered pursuant to an exchange program, or, with respect to restricted stock, restricted stock units, performance shares or performance units, is forfeited to or repurchased by us, the unpurchased shares (or for Awards other than options and stock appreciation rights, the forfeited or repurchased shares) which were subject thereto will become available for future grant or sale under the Amended 2007 Plan. Upon exercise of a stock appreciation right settled in shares, only shares actually issued pursuant to the stock appreciation right will cease to be available

6

under the Amended 2007 Plan. Shares used to pay the exercise price of an Award or to satisfy the tax withholding obligations related to an Award will become available for future grant or sale under the Amended 2007 Plan. Shares that have actually been issued under the Amended 2007 Plan under any Award will not be returned to the Amended 2007 Plan and will not become available for future distribution under the Amended 2007 Plan; provided, however, that if shares of restricted stock, restricted stock units, performance shares or performance units are repurchased by us or are forfeited to us, such shares will become available for future grant under the Amended 2007 Plan. To the extent an Award is paid out in cash rather than stock, such cash payment will not reduce the number of shares available for issuance under the Amended 2007 Plan.

If we declare a dividend or other distribution or engage in a recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of shares or other securities of the Company, or other change in the corporate structure of the Company affecting our shares, the Administrator (defined below) will adjust the (i) number and class of shares available for issuance under the Amended 2007 Plan, (ii) number, class and price of shares subject to outstanding Awards, and (iii) specified per-person limits on Awards to reflect the change.

Administration of the Amended 2007 Plan. Our Board of Directors, or its compensation committee, or a committee of directors or of other individuals satisfying applicable laws and appointed by our Board of Directors, referred to as the “Administrator”, will administer the Amended 2007 Plan. To make grants to certain of our officers and key employees, the members of the committee must qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, or the Exchange Act. To the extent the Administrator determines it desirable to qualify awards granted under the Amended 2007 Plan as “performance-based compensation”, the members of the committee will consist of two or more “outside directors” under Section 162(m) (so that we can receive a federal tax deduction for certain compensation paid under the Amended 2007 Plan).

Subject to the terms of the Amended 2007 Plan, the Administrator has the sole discretion to select the employees, consultants, and directors who will receive Awards, to determine the terms and conditions of Awards, to modify or amend each Award (subject to the restrictions of the Amended 2007 Plan), and to interpret the provisions of the Amended 2007 Plan and outstanding Awards. The Administrator may implement an exchange program under which (i) outstanding Awards are surrendered or cancelled in exchange for Awards of the same type, Awards of a different type and/or cash, (ii) participants would have the opportunity to transfer any outstanding Awards to a financial institution or other person or entity selected by the Administrator, and/or (iii) the exercise price of an outstanding Award could be reduced.

Formula Awards to Outside Directors. The Amended 2007 Plan provides that each person who first becomes an outside director will automatically receive an option to purchase 20,000 shares on or about the date the person first becomes an outside director, referred to as an initial option, provided, that a director who is an employee, or an inside director, who ceases to be an inside director, but who remains a director will not receive an initial option. Outside directors, other than the Chairman of the Board of Directors, will also automatically receive an option to purchase 10,000 shares on the date of each annual meeting of stockholders, referred to as the annual option, provided he or she will have served on our board of directors for at least the preceding six months. The Chairman of the board of directors will be automatically granted an option to purchase 15,000 shares on the date of each annual meeting of the stockholders, referred to as the annual Chairman option, provided he or she will have served on our Board of Directors for at least the preceding six months. Each initial option will vest and become exercisable as to 25% of the shares subject to the initial option on each anniversary of its grant date and each annual option will vest and become exercisable as to 100% of the shares subject to the annual option on the day prior to the following year’s annual stockholder meeting (but in no event later than December 31 of the calendar year following the calendar year during which the annual option was granted), provided, in each case, the participant continues to serve as a director through such dates.

Options. The Administrator is able to grant nonstatutory stock options and incentive stock options under the Amended 2007 Plan. The Administrator determines the number of shares subject to each option, although the

7

Amended 2007 Plan provides that a participant may not receive options for more than 1,000,000 shares in any fiscal year, except in connection with his or her initial employment with us, in which case he or she may be granted an option covering up to an additional 500,000 shares.

The Administrator determines the exercise price of options granted under the Amended 2007 Plan, provided the exercise price of options must be at least equal to the fair market value of our common stock on the date of grant. In addition, the exercise price of an incentive stock option granted to any participant who owns more than 10% of the total voting power of all classes of our outstanding stock must be at least 110% of the fair market value of the common stock on the grant date.

The term of each option will be stated in the Award agreement. The term of an option may not exceed 10 years. In addition, with respect to any participant who owns more than 10% of the voting power of all classes of the Company’s outstanding capital stock, the term of an incentive stock option may not exceed 5 years.

After a termination of service with us, a participant will be able to exercise the vested portion of his or her option for the period of time stated in the Award agreement. If no such period of time is stated in the participant’s Award agreement, the participant will generally be able to exercise his or her option for (i) 3 months following his or her termination for reasons other than death or disability, and (ii) 12 months following his or her termination due to death or disability, but in no event later than the expiration of the option’s term.

Restricted Stock. Awards of restricted stock are rights to acquire or purchase shares of our common stock, which vest in accordance with the terms and conditions established by the Administrator in its sole discretion. For example, the Administrator may set restrictions based on the achievement of specific performance goals. The Administrator, in its discretion, may accelerate the time at which any restrictions will lapse or be removed. On the date set forth in the Award agreement, all unearned shares of restricted stock will be forfeited to us. The Administrator will determine the number of shares granted pursuant to an Award of restricted stock, but no participant will be granted a right to purchase or acquire more than 300,000 shares of restricted stock during any fiscal year, except that a participant may be granted up to an additional 150,000 shares of restricted stock in connection with his or her initial employment with us. Participants holding shares of restricted stock may exercise full voting rights with respect to those shares and generally will be entitled to receive all dividends and other distributions paid with respect to those shares, except that dividends or distributions paid in shares will be subject to the same restrictions on transferability and forfeiture as the shares of restricted stock with respect to which they were paid.

Restricted Stock Units. Awards of restricted stock units result in a payment to a participant only if the vesting criteria the Administrator establishes is satisfied. For example, the Administrator may set vesting criteria based on the achievement of specific performance goals. The restricted stock units will vest at a rate determined by the Administrator; provided, however, that after the grant of restricted stock units, the Administrator, in its sole discretion, may reduce or waive any vesting criteria for such restricted stock units. Upon satisfying the applicable vesting criteria, the participant will be entitled to the payout specified in the Award agreement. The Administrator, in its sole discretion, may only settle earned restricted stock units in cash, shares, or a combination of both. On the date set forth in the Award agreement, all unearned restricted stock units will be forfeited to us. The Administrator determines the number of restricted stock units granted to any participant, but no participant may be granted more than 300,000 restricted stock units during any fiscal year, except that the participant may be granted up to an additional 150,000 restricted stock units in connection with his or her initial employment with us.

Stock Appreciation Rights. The Administrator will be able to grant stock appreciation rights, which are the rights to receive the appreciation in fair market value of common stock between the exercise date and the date of grant. We can pay the appreciation in cash, shares of common stock, or a combination thereof. The Administrator, subject to the terms of the Amended 2007 Plan, will have complete discretion to determine the terms and conditions of stock appreciation rights granted under the Amended 2007 Plan; provided, however, that

8

the exercise price may not be less than 100% of the fair market value of a share on the date of grant. No participant will be granted stock appreciation rights covering more than 1,000,000 shares during any fiscal year, except that a participant may be granted stock appreciation rights covering up to an additional 500,000 shares in connection with his or her initial employment with us.

After termination of service with us, a participant will be able to exercise the vested portion of his or her stock appreciation right for the period of time stated in the Award agreement. If no such period of time is stated in a participant’s Award agreement, a participant will generally be able to exercise his or her vested stock appreciation rights for the same period of time as applies to stock options.

Performance Units and Performance Shares. The Administrator will be able to grant performance units and performance shares, which are Awards that will result in a payment to a participant only if the performance goals or other vesting criteria the Administrator may establish are achieved or the Awards otherwise vest. Earned performance units and performance shares will be paid, in the sole discretion of the Administrator, in the form of cash, shares, or in a combination thereof. The Administrator will establish performance or other vesting criteria in its discretion, which, depending on the extent to which they are met, will determine the number and/or the value of performance units and performance shares to be paid out to participants. The performance units and performance shares will vest as a function of the extent to which the corresponding performance objectives or other vesting provisions have been achieved; provided, however, that after the grant of a performance unit or performance share, the Administrator, in its sole discretion, may reduce or waive any performance objectives or other vesting provisions for such performance unit or performance share. During any fiscal year, no participant will receive more than 300,000 performance shares and no participant will receive performance units having an initial value greater than $1,000,000, except that in connection with his or her initial employment with the Company, a participant may be granted performance shares covering up to an additional 150,000 shares. Performance units will have an initial value established by the Administrator on or before the date of grant. Performance shares will have an initial value equal to the fair market value of a share of our common stock on the grant date.

Performance Goals. Awards of restricted stock, restricted stock units, performance shares, performance units and other incentives under the Amended 2007 Plan may be made subject to the attainment of performance goals relating to one or more business criteria within the meaning of Section 162(m) and may provide for a targeted level or levels of achievement including attainment of research and development milestones, business divestitures and acquisitions, in license and out license activities, cash flow, cash position, collaboration arrangements, collaboration progression, earnings (which may include earnings before interest and taxes, earnings before taxes and net earnings), earnings per share, expense reduction, financing events, gross margin, growth with respect to any of the foregoing measures, growth in bookings, growth in revenues, growth in stockholder value relative to the moving average of the S&P 500 Index or another index, internal rate of return, market share, net income, net profit, net sales, new product development, new product invention or innovation, number of customers, operating cash flow, operating expenses, operating income, operating margin, pre-tax profit, product approvals, product sales, productivity, profit, projects in development, regulatory filings, return on assets, return on capital, return on stockholder equity, return on investment, return on sales, revenue, revenue growth, sales growth, sales results, stock price increase, time to market, total stockholder return, working capital, business development and commercial partnerships. The performance goals may differ from participant to participant and from Award to Award, may be used alone or in combination, may be used to measure our performance as a whole or the performance of one of our business units, and may be measured relative to a peer group or index.

To the extent necessary to comply with the performance-based compensation provisions of Section 162(m), with respect to any Award granted subject to performance goals, within the first 25% of the performance period, but in no event more than ninety days following the commencement of any performance period (or such other time as may be required or permitted by Section 162(m)), the Administrator will, in writing: (i) designate one or more participants to whom an Award will be made, (ii) select the performance goals applicable to the

9

performance period, (iii) establish the performance goals, and amounts of such Awards, as applicable, which may be earned for such performance period, and (iv) specify the relationship between performance goals and the amounts of such Awards, as applicable, to be earned by each participant for such performance period. Following the completion of each performance period, the Administrator will certify in writing whether the applicable performance goals have been achieved for such performance period. In determining the amounts earned by a participant, the Administrator will have the right to reduce or eliminate (but not to increase) the amount payable at a given level of performance to take into account additional factors that the Administrator may deem relevant to the assessment of individual or corporate performance for the performance period. A participant will be eligible to receive payment pursuant to an Award for a performance period only if the performance goals for such period are achieved.

Transferability of Awards. Awards granted under the Amended 2007 Plan are generally not transferable, and all rights with respect to an Award granted to a participant generally will be available during a participant’s lifetime only to the participant.

Change in Control. In the event we experience a merger or change in control, each outstanding Award will be treated as the Administrator determines, including, without limitation, that each Award be assumed or an equivalent option or right substituted by the successor corporation or a parent or subsidiary of the successor corporation. The Administrator shall not be required to treat all Awards similarly in the transaction. In the event that the successor corporation does not assume or substitute for the Award, the participant will fully vest in and have the right to exercise all of his or her outstanding options and stock appreciation rights, including shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on restricted stock and restricted stock units will lapse, and, with respect to Awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels and all other terms and conditions met. In addition, if an option or stock appreciation right is not assumed or substituted in the event of a change in control, the Administrator will notify the participant in writing or electronically that the option or stock appreciation right will be fully vested and exercisable for a period of time determined by the Administrator in its sole discretion, and the option or stock appreciation right will terminate upon the expiration of such period

With respect to Awards granted to an outside director that are assumed or substituted for, if on the date of or following such assumption or substitution the participant’s status as a director or a director of the successor corporation, as applicable, is terminated other than upon a voluntary resignation by the participant (unless such resignation is at the request of the acquirer), then the participant will fully vest in and have the right to exercise his or her options and/or stock appreciation rights as to all of the shares subject to the Award, including shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on restricted stock and restricted stock units shall lapse, and, with respect to performance shares and performance units, all performance goals or other vesting criteria will be deemed achieved at 100% of target levels and all other terms and conditions met.

Amendment and Termination of the Amended 2007 Plan. Our Board of Directors will have the authority to amend, alter, suspend or terminate the Amended 2007 Plan, except that stockholder approval will be required for any amendment to the Amended 2007 Plan to the extent required by any applicable laws. No amendment, alteration, suspension or termination of the Amended 2007 Plan will impair the rights of any participant, unless mutually agreed otherwise between the participant and the Administrator and which agreement must be in writing and signed by the participant and us. The Amended 2007 Plan will terminate in January 2017, unless our Board of Directors terminates it earlier.

Number of Awards Granted to Employees, Consultants, and Directors

The number of Awards that an employee or consultant may receive under the Amended 2007 Plan is in the discretion of the Administrator and therefore cannot be determined in advance. As described above, stock options are granted to outside directors pursuant to a formula. The following table sets forth (a) the aggregate number of

10

shares of common stock subject to options granted under the 2007 Stock Plan during the last fiscal year and (b) the average per share exercise price of such options,

| | | | | |

Name of Individual or Group | | Number of

Options Granted | | Average Per

Share Exercise

Price |

Anthony A. DiTonno | | 166,000 | | $ | 2.82 |

Stephen F. Ghilieri | | 80,520 | | $ | 3.14 |

Jeffery Tobias, M.D. | | 91,000 | | $ | 1.31 |

Michael E. Markels | | 76,000 | | $ | 4.20 |

All named executive officers, as a group | | 593,892 | | $ | 2.67 |

All directors who are not named executive officers, as a group | | 80,000 | | $ | 7.31 |

All employees who are not named executive officers, as a group | | 387,750 | | $ | 4.69 |

Federal Tax Aspects

The following paragraphs are a summary of the general federal income tax consequences to U.S. taxpayers and the Company of Awards granted under the Amended 2007 Plan. Tax consequences for any particular individual may be different.

Nonstatutory Stock Options. No taxable income is reportable when a nonstatutory stock option with an exercise price at least equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the excess of the fair market value (on the exercise date) of the shares purchased over the exercise price of the option. Any taxable income recognized in connection with an option exercise by an employee of the Company is subject to tax withholding by the Company. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Incentive Stock Options. No taxable income is reportable when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax, in which case taxation is the same as for nonstatutory stock options). If the participant exercises the option and then later sells or otherwise disposes of the shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option.

Stock Appreciation Rights. No taxable income is reportable when a stock appreciation right with an exercise price equal to the fair market value of the underlying stock on the date of grant is granted to a participant. Upon exercise, the participant will recognize ordinary income in an amount equal to the amount of cash received and the fair market value of any shares received. Any additional gain or loss recognized upon any later disposition of the shares would be capital gain or loss.

Restricted Stock, Restricted StockUnits, Performance Units and Performance Shares. A participant generally will not have taxable income at the time an Award of restricted stock, restricted stock units, performance shares or performance units, are granted. Instead, he or she will recognize ordinary income in the first taxable year in which his or her interest in the shares underlying the Award becomes either (i) freely transferable, or (ii) no longer subject to substantial risk of forfeiture. However, the recipient of a restricted stock Award may elect to recognize income at the time he or she receives the Award in an amount equal to the fair market value of the shares underlying the Award (less any cash paid for the shares) on the date the Award is granted.

Tax Effect for the Company. We generally will be entitled to a tax deduction in connection with an Award under the Amended 2007 Plan in an amount equal to the ordinary income realized by a participant and at the time the participant recognizes such income (for example, the exercise of a nonstatutory stock option). Special rules

11

limit the deductibility of compensation paid to our Chief Executive Officer and to “covered employees” within the meaning of Section 162(m). Under Section 162(m), the annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000. However, we can preserve the deductibility of certain compensation in excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include stockholder approval of the Amended 2007 Plan, setting limits on the number of Awards that any individual may receive and for Awards other than certain stock options, establishing performance criteria that must be met before the Award actually will vest or be paid. The Amended 2007 Plan has been designed to permit the Administrator to grant Awards that qualify as performance-based for purposes of satisfying the conditions of Section 162(m), thereby permitting us to continue to receive a federal income tax deduction in connection with such Awards.

Section 409A. Section 409A of the Internal Revenue Code, or Section 409A, which was added by the American Jobs Creation Act of 2004, provides certain new requirements on non-qualified deferred compensation arrangements. These include requirements with respect to an individual’s election to defer compensation and the individual’s selection of the timing and form of distribution of the deferred compensation. Section 409A also generally provides that distributions must be made on or following the occurrence of certain events (e.g., the individual’s separation from service, a predetermined date, or the individual’s death). Section 409A imposes restrictions on an individual’s ability to change his or her distribution timing or form after the compensation has been deferred. For certain individuals who are officers, subject to certain exceptions, Section 409A requires that such individual’s distribution commence no earlier than six months after such officer’s separation from service.

Awards granted under the Amended 2007 Plan with a deferral feature, including nonstatutory stock options and stock appreciation rights granted with an exercise price below the fair market value of the underlying stock, will be subject to the requirements of Section 409A. If an Award is subject to and fails to satisfy the requirements of Section 409A, the recipient of that Award may recognize ordinary income on the amounts deferred under the Award, to the extent vested, which may be prior to when the compensation is actually or constructively received. Also, if an Award that is subject to Section 409A fails to comply with Section 409A’s provisions, Section 409A imposes an additional 20% federal income tax on compensation recognized as ordinary income, as well as possible interest charges and penalties. In addition, certain states such as California adopted similar provisions.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECTS OF FEDERAL INCOME TAXATION UPON PARTICIPANTS AND THE COMPANY WITH RESPECT TO AWARDS UNDER THE AMENDED 2007 PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF A PARTICIPANT’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH THE PARTICIPANT MAY RESIDE.

Purpose for recommending amendment of the Amended 2007 Plan and approval of its material terms

We believe that the amendments to the Amended 2007 Plan and the approval of its material terms is essential to our continued success. Our employees are our most valuable asset. Stock options and other awards such as those provided under the Amended 2007 Plan will substantially assist us in continuing to attract and retain employees and non-employee directors in the extremely competitive labor markets in which we compete. Such awards also are crucial to our ability to motivate employees to achieve our goals. We will benefit from increased stock ownership by selected executives, other employees and non-employee directors.

Vote Required

Approval of the Amended 2007 Plan requires the affirmative vote of the holders of a majority of the shares of our common stock that are present in person or by proxy and entitled to vote at the 2010 Annual Meeting of Stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE 2007 STOCK PLAN, AS AMENDED AND RESTATED.

12

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth for each Class I Director, each Class II Director, each Class III Director and the executive officers of the Company, their ages and present positions with the Company as of the Record Date.

| | | | |

Name | | Age | | Position |

Anthony A. DiTonno | | 61 | | President, Chief Executive Officer, Class III Director |

Stephen F. Ghiglieri | | 48 | | Executive Vice President, Chief Operating Officer, Chief Financial Officer |

Jeffrey K. Tobias, M.D. | | 55 | | Executive Vice President, Research and Development, Chief Medical Officer |

Michael E. Markels | | 44 | | Senior Vice President, Commercial and Business Development |

Jean-Jacques Bienaimé (1)(3) | | 56 | | Class II Director |

Bradford S. Goodwin (1)(2) | | 55 | | Class I Director |

Neil M. Kurtz, M.D. (2)(3) | | 59 | | Class III Director |

Robert T. Nelsen (2)(3) | | 46 | | Class II Director |

John A. Orwin (1)(3) | | 46 | | Class I Director |

| (1) | | Member of Audit Committee. |

| (2) | | Member of Compensation Committee. |

| (3) | | Member of Nominating and Governance Committee. |

There is no family relationship between any director or executive officer of the Company.

Anthony A. DiTonno has served as the Company’s Chief Executive Officer and President since August 2003 prior to which he served as the Company’s Chief Operating Officer beginning in April 2003. From October 2000 to November 2002, Mr. DiTonno served as Executive Vice President of Sales and Marketing for Enteric Medical Technologies, Inc., a medical device company. From 1997 to 2000, Mr. DiTonno served as Chief Executive Officer of LifeSleep Systems, Inc., a medical device company. From 1989 to 1997, Mr. DiTonno held various positions at Oclassen Pharmaceuticals, Inc., a pharmaceutical company, most recently as its Vice President and General Manager. Mr. DiTonno received a B.S. in business administration from St. Joseph’s University and an M.B.A. from Drexel University.

Stephen F. Ghiglieri has served as the Company’s Executive Vice President, Chief Operating Officer and Chief Financial Officer since January 2010. From October 2003 to January 2010 , he served as the Company’s Chief Financial Officer. From December 2002 to October 2003, Mr. Ghiglieri served as Chief Financial Officer of Hansen Medical, Inc., a medical device company. From March 2000 to April 2002, Mr. Ghiglieri served as Executive Vice President, Chief Financial Officer and Corporate Secretary of Avolent, Inc., a software company. From July 1999 to 2000, Mr. Ghiglieri served as Vice President, Finance, Chief Financial Officer and Corporate Secretary of Andromedia, Inc., a software company. From 1994 to 1999, Mr. Ghiglieri served as Vice President, Finance and Administration, Chief Financial Officer and Corporate Secretary of Oacis Healthcare Systems, Inc., a healthcare technology company. From 1992 to 1994, Mr. Ghiglieri served as Controller of Oclassen Pharmaceuticals, Inc., a pharmaceutical company. From 1984 to 1992, Mr. Ghiglieri served as an audit manager of PricewaterhouseCoopers, LLP. Mr. Ghiglieri received a B.A. in business administration from California State University, Hayward. Mr. Ghiglieri is also a Certified Public Accountant (inactive).

Jeffrey K. Tobias, M.D. has served as the Company’s Executive Vice President and Chief Medical Officer since January 2010. From November 2005 to January 2010, he served as the Company’s Chief Medical Officer. From September 1996 to November 2005, Dr. Tobias served as principal of the Aquila Consulting Group, a professional consulting firm. From June 1995 to September 1996, Dr. Tobias served as Director, New Product Discovery of Alza Corporation, a drug delivery solutions company. Dr. Tobias received a B.S. in biology and an M.D. from the University of Illinois.

13

Michael E. Markelshas served as the Company’s Senior Vice President, Commercial and Business Development, since January 2010. From May 2006 to January 2010, he served as the Company’s Vice President, Commercial Operations and Business Development, and prior to that served as the Company’s Senior Director, Marketing and Sales from September 2003 to November 2004. From May 2005 to May 2006, Mr. Markels served as Senior Director of Marketing of Biogen Idec., a biotechnology company. From February 2001 to October 2002, Mr. Markels served as Senior Director Infectious Disease/Oncology Business Unit Head of InterMune, a biopharmaceutical company. From September 1990 to February 2001, Mr. Markels held a variety of positions, most recently as Director, Global Commercial Strategy of Glaxo Wellcome (now GlaxoSmithKline), a pharmaceutical company. Mr. Markels received a B.S. in biological sciences from Colorado State University and an M.B.A. from the Fuqua School of Business at Duke University.

Susan P. Rinnehas served as Vice President of Regulatory Affairs since October 2007. Prior to joining NeurogesX, Ms. Rinne served as Vice President, Regulatory Affairs at ALZA Corporation from 1998 to 2006. From 1995 to 1998, Ms. Rinne served as Senior Director, Regulatory Affairs at ALZA Corporation. Ms. Rinne held positions of increasing responsibility in regulatory affairs at Syntex Corporation from 1983 to 1995. Ms. Rinne received an M.S. in Pharmacology and Toxicology and a B.S. in Biological Sciences from the University of California, Davis.

Jean-Jacques Bienaimé has served as a director of the Company since February 2004. Since May 2005, Mr. Bienaimé has served as Chief Executive Officer and director of BioMarin Pharmaceutical Inc., a publicly-held biopharmaceutical company. From November 2002 to April 2005, Mr. Bienaimé served as the Chairman, Chief Executive Officer and President of Genencor International, a biotechnology company acquired by Danisco A/S. From June 1998 to October 2002, Mr. Bienaimé was Chief Executive Officer and President of SangStat Medical, a biotechnology company. From October 1992 to May 1998, Mr. Bienaimé held various management positions, most recently as Senior Vice President of Corporate Marketing and Business Development, and Vice President and General Manager of the advanced therapeutic and oncology division of Rhône-Poulenc Rorer Pharmaceuticals (now The Sanofi-Aventis Group), a pharmaceutical company. Mr. Bienaimé received a B.S. in economics from the Ecole Supérieure de Commerce de Paris and an M.B.A. from the Wharton School at the University of Pennsylvania.

Bradford S. Goodwin has served as a director of the Company since August 2009. Since May 2008 he has served as President and Chief Executive Officer of Keren Pharmaceutical, Inc., a biotechnology company. From December 2001 to December 2006, Mr. Goodwin served as Chief Executive Officer and a member of the Board of Directors of Novacea, Inc., a publicly-held biopharmaceutical company (subsequently sold to Transcept Pharmaceuticals). From March 2000 to July 2001, Mr. Goodwin served as President, Chief Operating Officer and Founder of Collabra Pharma, a privately-held drug development company. From March 1987 to February 2000, Mr. Goodwin held various positions at Genentech, Inc., a publicly-held biotechnology company, including most recently Vice President of Finance. Mr. Goodwin is currently a member of the Board of Directors of Rigel Pharmaceuticals, Inc., a publicly held biotechnology company, and Facet Biotech Corp, a publicly-held biotechnology company where he is Chairperson of the Board (Facet Biotech is currently in the process of being acquired by Abbott Labs). In addition to his past directorship at Novacea, Mr. Goodwin was a director of PDL BioPharma, a publicly-held biotechnology company, from April 2006 to December 2008 (until the spin off of Facet Biotech Corp), and from January 2004 to January 2007 he was a director of CoTherix, a publicly-held biotechnology company (acquired by Actelion). Mr. Goodwin is a Certified Public Accountant (inactive). Mr. Goodwin received a B.S. in Business Administration from the University of California at Berkeley.

Neil M. Kurtz, M.D. has served as a director of the Company since January 2006. Since August 2008, Dr. Kurtz has served as President and Chief Executive Officer of Golden Living, a healthcare services company. From April 2002 to August 2008, Dr. Kurtz served as President and Chief Executive Officer and director of TorreyPines Therapeutics, Inc., a biopharmaceutical company. From March 1995 to April 2002, Dr. Kurtz was President of Worldwide Clinical Trials, a healthcare solutions company. From January 1991 to March 1995 Dr. Kurtz served as Senior Vice-President for Boots LTD, an interrnational biopharmaceutical company. From

14

April 1988 until December, 1990, Dr. Kurtz served as Vice-President for Bayer, an international biopharmaceutical company. Dr. Kurtz received a B.A. in psychology from New York University and an M.D. from the Medical College of Wisconsin.

Robert T.Nelsen has served as a director of the Company since July 2000. Since July 1994, Mr. Nelsen has served as a managing director of venture capital funds associated with ARCH Venture Partners, a venture capital firm. From April 1987 to July 1994, Mr. Nelsen served as a senior manager of ARCH Development Corporation, a technology transfer company associated with the University of Chicago. Mr. Nelsen received a B.S. in biology and economics from the University of Puget Sound and an M.B.A. from the University of Chicago.

John A. Orwinhas served as a director of the Company since November 2009. Since April 2010, Mr. Orwin has served as President and Chief Operating Officer for Affymax, a biopharmaceutical company. From September 2005 to April 2010, Mr. Orwin served as Senior Vice President, BioOncology Business Unit at Genentech, Inc., and before that, from January 2005 to September 2005, as Vice President, HER Franchise of Genentech ,Inc.. From July 2001 to March 2003, Mr. Orwin served as Marketing Director, Oncology at Ortho Biotech and from March 2003 to December 2004 as the Franchise Vice President of the Oncology Franchise at Tibotec Therapeutics, a division of Centocor Ortho Biotech Products, L.P. Mr Orwin served as the Senior Director, Oncology Marketing at Alza Pharmaceuticals from July 2000 to July 2001. In addition, Mr Orwin served as Vice President, Marketing at Sangstat Medical Corporation from August 1998 to August 2000; Marketing Director, Asthma at Rhone-Poulenc Rorer Pharmaceuticals from July 1994 to August 1998; and Product Manager, Schering Oncology/Biotech at Schering-Plough Corporation from July 1989 to July 1994. Mr. Orwin received a B.A. in economics from Rutgers University and an M.B.A. from the Stern School of Business, New York University.

Board Structure and Risk Oversight

The leadership structure of the Company’s Board of Directors currently consists of a non-executive Chairman of the Board, Jean-Jacques Bienaimé, who oversees Board of Directors meetings and works with the chief executive officer to establish meeting agendas. The Company believes that this structure enhances the independence of the Board of Directors and its ability to provide oversight of Company and its management. The Board of Directors also has three standing committees, the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, composed of independent directors, as discussed further below, to provide oversight of specific aspects of business operations and corporate governance. The chairpersons of each of these committees regularly report to the Board of Directors on such committee’s activities and decisions. The Company believes this leadership structure helps facilitate efficient decision-making and communication among the directors and fosters efficient Board of Directors function.

Management is primarily responsible for managing risks that the Company may face in the ordinary course of operating our business. The Board of Directors actively oversees potential risks and the Company’s risk management activities by receiving operational and strategic presentations from management which include discussions of key risks to the business. In addition, the Board of Directors has delegated risk oversight to each of its key committees within their areas of responsibility. For example, the Audit Committee assists the Board of Directors in its risk oversight function by reviewing and discussing with management the Company’s system of disclosure controls and the internal controls over financial reporting, and risks associated with the Company’s cash investment policies. The Nominating and Corporate Governance Committee assists the Board of Directors in its risk oversight function by periodically reviewing and discussing with management important governance and regulatory compliance issues. The Compensation Committee assists the Board of Directors in its risk oversight function by overseeing strategies with respect to the Company’s incentive compensation programs and key employee retention issues. The Company believes that the Board of Directors leadership structure facilitates the division of risk management oversight responsibilities among the Board committees and enhances the Board of Directors’ efficiency in fulfilling its oversight function with respect to different areas of the Company’s business risks and risk mitigation practices.

15

Board Meetings and Committees

The Board of Directors of the Company held a total of seven meetings during the fiscal year 2009. No director serving throughout fiscal year 2009 attended fewer than 75% of the aggregate of all meetings of the Board of Directors and the committees of the Board of Directors upon which such director served. The Board of Directors has a standing Audit Committee, a standing Compensation Committee and a standing Nominating and Corporate Governance Committee.

The Audit Committee consists of directors Mr. Goodwin, who serves as the chairman of the Audit Committee, Mr. Bienaimé and Mr Orwin. The Board of Directors has determined that Mr. Goodwin is an “audit committee financial expert” as defined in the SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors. The Company maintains a copy of the Audit Committee charter on its website:www.neurogesx.com. The Audit Committee oversees the accounting and financial reporting processes of the Company, audits of the financial statements of the Company, reviews the Company’s internal accounting procedures, consults and reviews the services provided by the Company’s independent registered public accounting firm and makes recommendations to the Board of Directors regarding the selection of the independent registered public accounting firm. The Audit Committee held ten meetings during fiscal 2009.

The Compensation Committee consists of directors Dr. Kurtz, who serves as the chairman of the Compensation Committee, Mr. Nelson and Mr. Goodwin. The Compensation Committee reviews and recommends to the Board of Directors the salaries, incentive compensation and benefits of the Company’s officers and administers the Company’s stock plans and employee benefit plans. Refer to the Compensation Discussion and Analysis for more information about the Company’s Compensation Committee and its processes and procedures. The Compensation Committee operates under a written charter adopted by the Board of Directors. The Company maintains a copy of the Compensation Committee charter on its website:www.neurogesx.com. The Compensation Committee held five meetings during fiscal 2009.

The Nominating and Corporate Governance Committee consists of directors Mr. Bienaimé , who serves as the chairman of the Nominating and Corporate Governance Committee, Dr. Kurtz, Mr. Orwin and Mr. Nelson. The Board of Directors has adopted a written charter for the Nominating and Corporate Governance Committee. The Company maintains a copy of the Nominating and Corporate Governance Committee charter on its website:www.neurogesx.com. The Nominating and Corporate Governance Committee is responsible for developing a Board of Directors capable of advising the Company’s management in fields related to current or future business directions of the Company, and regularly reviews issues and developments relating to corporate governance and formulates and recommends corporate governance standards to the Board of Directors. In addition, the Nominating and Corporate Governance Committee appoints directors to committees of the Board of Directors and suggests rotation for Chairpersons of committees of the Board of Directors as it deems desirable from time to time; and evaluates and recommends to the Board of Directors the termination of membership of individual directors in accordance with the Board of Directors’ corporate governance principles, for cause or other appropriate reasons (including, without limitation, as a result of changes in directors’ employment or consulting status). During fiscal year 2009 the Nominating and Corporate Governance Committee held two meetings concurrently with Board of Directors meetings.

Director Nominations and Qualifications

The Nominating and Corporate Governance Committee approves all nominees for membership on the Board of Directors, including the slate of Director nominees to be proposed by the Board of Directors to our stockholders for election or any Director nominees to be elected or appointed by the Board of Directors to fill interim Director vacancies on the Board of Directors.

The Nominating and Governance Committee assists the Board of Directors in identifying qualified persons to serve as directors of the Company. The Board of Directors, along with the Nominating and Corporate Governance Committee, utilizes its own resources to identify qualified candidates to join the Board of Directors

16

and has used an executive recruiting firm to assist in the identification and evaluation of qualified candidates. For these services, an executive recruiting firm would be paid a fee. The Nominating and Corporate Governance Committee evaluates all proposed director nominees, evaluates incumbent directors before recommending re-nomination, and recommends all approved candidates to the Board of Directors for appointment or nomination to Company stockholders. The Nominating and Corporate Governance Committee selects as candidates to the Board of Directors for appointment or nomination individuals of high personal and professional integrity and ability who can contribute to the Board of Directors’ effectiveness in serving the interests of the Company’s stockholders. Director nominees are expected to have considerable management experience that would be relevant to our current and expected future business directions, a track record of accomplishment and a commitment to ethical business practices. The particular experience, qualification or skills of each member of the Board of Directors that led the Nominating and Corporate Governance Committee to conclude that such director should serve on the Board of Directors are:

| | |

Director | | Key Qualifications |

Anthony A. DiTonno | | Mr DiTonno has more than 25 years experience in the pharmaceutical and health care industries including many executive leadership roles with responsibility for corporate partnering initiatives, product branding efforts and sales and marketing. |

| |

Jean-Jacques Bienaimé | | Mr Bienaimé has over 25 years of experience in the biotechnology and Healthcare industries, including many executive officer and chief executive officer roles in both publicly and privately held companies. His experience also includes leadership roles in executive management and sales and marketing. Mr Bienaimé also has director experience, including directorships on the board of other publicly held life science companies. |

| |

Bradford S Goodwin | | Mr Goodwin is the Company’s audit committee financial expert. Mr Goodwin has experience in executive and chief executive officer roles at both publicly and privately-held companies. Mr Goodwin also has director experience, including directorships on the board or other publicly held life science companies. |

| |

Neil M. Kurtz, M.D. | | Dr. Kurtz has experience in executive and chief executive officer roles at both publicly and privately-held companies. Dr. Kurtz also has director experience, including directorships on the board of other publicly-held life science companies. |

| |

Robert T. Nelsen | | Mr. Nelsen has extensive venture capital and investment experience as a managing director of ARCH Venture Partners. Mr. Nelsen also has director experience, including directorships on the board of other publicly-held life science companies, including companies in the pain management sector |

| |

John A. Orwin | | Mr. Orwin has experience in executive roles with both biotech and pharmaceutical companies, including extensive experience in sales and marketing and experience in the successful launch of new therapeutics |

The Nominating and Corporate Governance Committee has not established a procedure for considering nominees for director nominated by the Company’s stockholders. The Board of Directors and Nominating and Corporate Governance Committee believe that they can identify appropriate candidates to our Board of Directors. Stockholders may nominate candidates for director in accordance with the advance notice and other procedures contained in the Company’s bylaws.

17

Stockholder Communications with the Board of Directors

The Company does not have formal policies regarding attendance by members of the Board of Directors at our annual meetings of stockholders, but directors are encouraged to attend annual meetings of the Company’s stockholders. Two directors attended the 2009 annual meeting of stockholders. In addition, the Company does not have a formal policy regarding stockholder communication with the Board of Directors. However, stockholders may communicate with the Board of Directors by sending an e-mail to the Company’s Investor Relations at IR@neurogesx.com or by writing to the Company at NeurogesX, Inc., Attention: Investor Relations, 2215 Bridgepointe Parkway, Suite 200, San Mateo, CA 94404. Stockholders who would like their submissions directed to an individual member of the Board of Directors may so specify, and the communication will be forwarded, as appropriate.

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of the Company’s Common Stock as of February 26, 2010 for:

| | • | | each person known by the Company to beneficially own more than 5% of our outstanding shares of Common Stock, |

| | • | | each director and each nominee for director of the Company |

| | • | | each of the Company’s named executive officers, and |

| | • | | all such directors, nominees for director and executive officers of the Company as a group. |

The percentage of ownership is based on 17,725,959 shares of Common Stock outstanding on February 26, 2010, adjusted as required by the rules promulgated by the SEC. The Company does not know of any arrangements, including any pledge by any person of securities of the Company, the operation of which may at a subsequent date result in a change of control of the Company.

| | | | | |

| | | Beneficial Ownership (1) | |

Name and Address of Beneficial Owner | | Number of Shares | | Percent of Common

Stock Outstanding | |

5% Stockholders | | | | | |