BEYOND COMMERCE

CONDENSED CONSOLIDATED BALANCE SHEET

Unaudited

| | | September 30, 2009 | | | December 31, 2008 as adjusted, (Note 16) | |

| ASSETS | | | | | | |

| Current assets : | | | | | | |

| Cash | | $ | - | | | $ | 100,086 | |

| Accounts receivable | | | 10,697 | | | | 226,091 | |

| Prepaid loan cost | | | 1,079,633 | | | | 562,665 | |

| Prepaid commissions | | | 736,274 | | | | 260,055 | |

| Other current assets | | | 931,265 | | | | 46,230 | |

| Total current assets | | $ | 2,757,869 | | | $ | 1,195,127 | |

| | | | | | | | | |

| Property, Web site and computer equipment | | | 1,392,447 | | | | 871,180 | |

| Less: Accumulated depreciation and amortization | | | (515,898 | ) | | | (320,366 | ) |

| Property, Web site and computer equipment – net | | $ | 876,549 | | | $ | 550,814 | |

| | | | | | | | | |

| Other Assets | | | 75,656 | | | | 60,067 | |

| | | | | | | | | |

| Total assets | | $ | 3,710,074 | | | $ | 1,806,008 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Short term borrowings, net of discount | | $ | 7,079,079 | | | $ | 2,400,555 | |

| Short term borrowings, net of discount – related party | | | 1,160,305 | | | | - | |

| Accounts payable | | | 1,962,157 | | | | 1,490,590 | |

| Accounts payable - related party | | | 135,302 | | | | 19,552 | |

| Checks Written In Excess of Cash | | | 134,217 | | | | - | |

| Note derivative liability | | | 3,451,215 | | | | 3,396,935 | |

| Other current liabilities | | | 2,299,685 | | | | 1,374,534 | |

| Deferred Revenue | | | 1,809,130 | | | | 609,987 | |

| Total current liabilities | | $ | 18,031,090 | | | $ | 9,292,153 | |

| | | | | | | | | |

| Stockholders’ Deficit : | | | | | | | | |

| Common stock, $0.001 par value, 200,000,000 and 75,000,000 shares authorized as of September 30, 2009 and December 31, 2008, respectively, and 46,640,941and 40,936,143 issued and outstanding at September 30, 2009 and December 31, 2008, respectively | | $ | 46,641 | | | $ | 40,936 | |

| Additional paid in capital | | | 21,370,934 | | | | 11,096,604 | |

| Accumulated deficit | | | (35,738,591 | ) | | | (18,623,685 | ) |

| Total stockholders' deficit | | $ | (14,321,016 | ) | | $ | (7,486,145 | ) |

| | | | | | | | | |

| Total Liabilities and Stockholders' Deficit | | $ | 3,710,074 | | | $ | 1,806,008 | |

See accompanying notes of these unaudited condensed financial statements.

BEYOND COMMERCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For the three month period ended September 30,

Unaudited

| | | 2009 | | | 2008 | |

| Revenues | | | | | | | | |

| Advertising Revenue | | $ | 1,811,788 | | | $ | 57,562 | |

| Merchandising Revenue | | | 240,078 | | | | 147,248 | |

| Total Revenue | | | 2,051,866 | | | | 204,810 | |

| Operating expenses | | | | | | | | |

| Cost of advertising | | $ | 1,441,623 | | | $ | - | |

| Cost of merchandising | | | 42,942 | | | | 165,630 | |

| Selling general & administrative | | | 2,106,072 | | | | 2,261,636 | |

| Selling general & administrative - related party | | | 90,412 | | | | - | |

| Professional fees | | | 725,559 | | | | 470,603 | |

| Professional fees - related party | | | 9,240 | | | | 24,616 | |

| Depreciation and amortization | | | 88,759 | | | | 47,762 | |

| Total costs and operating expenses | | $ | 4,504,607 | | | $ | 2,970,247 | |

| | | | | | | | | |

| Loss from operations | | | (2,452,741 | ) | | | (2,765,437 | ) |

| | | | | | | | | |

| Non-operating income (expense) | | | | | | | | |

| Interest expense, net | | | (3,077,517 | ) | | | (1,266,619 | ) |

| Interest expense – related party | | | (62,800 | ) | | | - | |

| Change in derivative liability | | | (2,942,287 | ) | | | - | |

| Total non-operating expense | | $ | (6,082,604 | ) | | $ | (1,266,619 | ) |

| | | | | | | | | |

| Loss from operations before income taxes | | | (8,535,345 | ) | | | (4,032,056 | ) |

| | | | | | | | | |

| Provision for income tax | | | - | | | | - | |

| | | | | | | | | |

| Net loss | | $ | (8,535,345 | ) | | $ | (4,032,056 | ) |

| | | | | | | | | |

| Net loss available to common stockholders | | $ | (8,535,345 | ) | | $ | (4,032,056 | ) |

| | | | | | | | | |

| Basic and diluted net loss per common share | | $ | (0.18 | ) | | $ | (0.10 | ) |

| | | | | | | | | |

| Weighted average shares of common stock outstanding - basic | | | 46,619,719 | | | | 39,481,833 | |

See accompanying notes of these unaudited condensed financial statements.

BEYOND COMMERCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For the nine month period ended September 30,

Unaudited

| | | 2009 | | | 2008 | |

| Revenues | | | | | | | | |

| Advertising Revenue | | $ | 12,299,017 | | | $ | 57,562 | |

| Merchandising Revenue | | | 409,051 | | | | 967,461 | |

| Total Revenue | | | 12,708,068 | | | | 1,025,023 | |

| Operating expenses | | | | | | | | |

| Cost of advertising | | $ | 11,464,512 | | | $ | - | |

| Cost of merchandising | | | 63,437 | | | | 1,050,113 | |

| Selling general & administrative | | | 8,444,784 | | | | 5,128,603 | |

| Selling general & administrative - related party | | | 246,052 | | | | 76,650 | |

| Professional fees | | | 2,764,040 | | | | 1,141,854 | |

| Professional fees - related party | | | 39,578 | | | | 102,673 | |

| Depreciation and amortization | | | 195,533 | | | | 134,343 | |

| Total costs and operating expenses | | $ | 23,217,936 | | | $ | 7,634,236 | |

| | | | | | | | | |

| Loss from operations | | | (10,509,868 | ) | | | (6,609,213 | ) |

| | | | | | | | | |

| Non-operating income (expense) | | | | | | | | |

| Interest expense, net | | | (7,565,985 | ) | | | (2,378,091 | ) |

| Interest expense – related party | | | (94,800 | ) | | | - | |

| Change in derivative liability | | | 1,055,747 | | | | - | |

| Total non-operating expense | | $ | (6,605,038 | ) | | $ | (2,378,091 | ) |

| | | | | | | | | |

| Loss from operations before income taxes | | | (17,114,906 | ) | | | (8,987,304 | ) |

| | | | | | | | | |

| Provision for income tax | | | - | | | | - | |

| | | | | | | | | |

| Net loss | | $ | (17,114,906 | ) | | $ | (8,987,304 | ) |

| | | | | | | | | |

| Net loss available to common stockholders | | $ | (17,114,906 | ) | | $ | (8,987,304 | ) |

| | | | | | | | | |

| Basic and diluted net loss per common share | | $ | (0.39 | ) | | $ | (0.23 | ) |

| | | | | | | | | |

| Weighted average shares of common stock outstanding - basic | | | 43,737,435 | | | | 37,805,466 | |

See accompanying notes of these unaudited condensed financial statements.

BEYOND COMMERCE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the nine month period ended September 30,

Unaudited

| | | 2009 | | | 2008 | |

| Net cash used in operating activities | | $ | (6,200,151) | | | $ | (5,590,315 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Cash paid to purchase property and equipment | | | (521,268 | ) | | | (121,882 | ) |

| Net cash used in investing activities | | $ | (521,268 | ) | | $ | (121,882 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Issuance of stock - net of offering costs | | | 20,000 | | | | 530,927 | |

| Cash received from short term borrowings | | | 9,158,000 | | | | 5,733,232 | |

| Cash Paid for debt financing fees | | | (826,500) | | | | - | |

| Payment on short term borrowings - related party | | | - | | | | (635,000) | |

| Payment on short term borrowings | | | (1,730,167 | ) | | | - | |

| Net cash provided by financing activities | | $ | 6,621,333 | | | $ | 5,629,159 | |

| | | | | | | | | |

| Net increase (decrease) in cash & cash equivalents | | | (100,086 | ) | | | (83,038 | ) |

| | | | | | | | | |

| Cash & cash equivalents, beginning balance | | | 100,086 | | | | 111,247 | |

| Cash & cash equivalents, ending balance | | $ | - | | | $ | 28,209 | |

See accompanying notes of these unaudited condensed financial statements.

BEYOND COMMERCE, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Beyond Commerce, Inc., formerly known as BOOMj, Inc. (the “Company”, and “we”), is an Internet company that has two interrelated business models aimed at generating revenues primarily from Web site advertising and E-commerce transactions. Our initial business was BOOMj.com, Inc., www.BOOMj.com, a niche portal and social networking site for Baby Boomers and Generation Jones. Our BOOMj.com Web site provides social, political, financial, and lifestyle content to the Baby Boomer/Generation Jones target audience as a platform for our advertising and E-commerce businesses. Our LocalAdLink subsidiary operates a website, a local search directory and advertising network that brings local advertising to geo-targeted consumers. On October 9, 2009, LocalAdLink Inc., a wholly-owned subsidiary of the Company sold its LocalAdLink Software (the “Software”) and all of their assets related to the Software including the rights to the name LocalAdLink, the LocalAdLink trademark, the Web site, www.LocalAdLink.com , and a local search directory and advertising network that brings local advertising to geo-targeted consumers, (see Note 15). The Company will continue to sell advertising as it had prior to inception of Local Ad Link, Inc., however on a different scale with a greater emphasis on business to business sales.

During the second quarter we relaunched i-SUPPLY, www.i-SUPPLY.com, an online storefront that offers easy to use, fully customizable E-commerce services, and revenue solutions for any third party Web site large or small, and hosts local ads, providing extensive reach for our proprietary advertising partner network platform. During the third quarter of 2009 the Company started another subsidiary, KaChing KaChing, which is an E-commerce platform that provides a complete turn-key E-commerce solution. Individual KaChing KaChing on line store owners have the ability to create, manage and earn money from product sales generated from their individual Web stores.

The condensed consolidated financial statements and the notes thereto for the periods ended September 30, 2009 and 2008 included herein have been prepared by management and are unaudited. Such condensed financial statements reflect, in the opinion of management, all adjustments necessary to present fairly the financial position and results of operations as of and for the periods indicated and in order to make the financial statements not misleading. All such adjustments are of a normal recurring nature except for those described in Note 16 and related to the derivatives in Note 7. These interim results are not necessarily indicative of the results for any subsequent period or for the fiscal year ending December 31, 2009.

Certain information and footnote disclosures normally included in the financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission. These consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto for the fiscal year ended December 31, 2008 in the Form 10-K, filed with the SEC on April 3, 2009.

History of the Company

The Company, formerly known as Reel Estate Services, Inc. (“RES”), was incorporated in Nevada on January 12, 2006. As of December 28, 2007, RES was a public shell company, defined by the Securities and Exchange Commission as an inactive, publicly quoted company with nominal assets and liabilities.

In December 2008, the Company changed its name from BOOMj, Inc. to Beyond Commerce, Inc. to more accurately reflect the new structure of the Company consisting of two operating divisions: BOOMj.com dba i-SUPPLY and until its assets were sold, LocalAdLink, Inc. (see Note 15).

The Company currently maintains its corporate office in Henderson, Nevada.

NOTE 2 - SELECTED ACCOUNTING POLICIES

Reclassifications

Certain comparative amounts from prior periods have been reclassified to conform to the current year's presentation. These changes did not affect previously reported net loss.

Employee Benefits

The Company currently offers employees vacation benefits and during the second quarter began offering a healthcare plan. During 2008, the Company implemented the 2008 Equity Incentive Plan.

Accounting Pronouncements

On January 1, 2009, the Company adopted SFAS No. 157, Fair Value Measurements (“SFAS 157”), for financial assets and financial liabilities. SFAS 157 defines fair value, establishes a framework for measuring fair value under GAAP, and expands disclosures about fair value measurements.

NOTE 3 – GOING CONCERN

The Company's financial statements are prepared using generally accepted accounting principles, which contemplate the realization of assets and liquidation of liabilities in the normal course of business. However, even though the Company has some degree of sales, it reflected a loss of $17,114,906 for the nine months ended September 30, 2009 and it will need to accelerate its business model implementation otherwise there is a need to raise additional capital and or obtain financing to continue operations into 2010. The failure to realize the improvement in the business model presents conditions that raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management has taken steps to improve the business operations along with raising additional funds to address its operating and financial cash requirements to continue operations in the next twelve months (see Notes 8 and 15). Management continues to devote a significant amount of time in the raising of capital from additional debt and equity financing. However, the Company’s ability to continue as a going concern is dependent upon raising additional funds through debt and equity financing and generating revenue. There are no assurances the Company will receive the necessary funding or generate revenue necessary to fund operations.

NOTE 4 - PROPERTY, WEB SITE AND COMPUTER EQUIPMENT

Property and equipment at September 30, 2009 and December 31, 2008 consisted of the following:

| | | 2009 | | | 2008 | |

| Office and computer equipment | | $ | 307,542 | | | $ | 186,614 | |

| Web site and software | | | 1,084,905 | | | | 684,566 | |

| Total property, Web site and computer equipment | | | 1,392,447 | | | | 871,180 | |

| Less: accumulated depreciation and amortization | | | (515,898 | ) | | | (320,366 | ) |

| | | $ | 876,549 | | | $ | 550,814 | |

Depreciation and amortization expense for the three months and nine months ended September 30, 2009 were $88,759 and $195,533, respectively compared to $47,762 and $134,343 for the same periods in 2008.

NOTE 5 – OTHER CURRENT ASSETS

Other current assets consist of the following at September 30, 2009 and December 31, 2008

| | | 2009 | | | 2008 | |

| Credit Card processor retention | | $ | 728,255 | | | $ | 1,362 | |

| Prepaid Insurance, legal, rent and advertising | | | 8,356 | | | | - | |

| Other | | | 194,654 | | | | 44,868 | |

| TOTAL | | $ | 931,265 | | | $ | 46,230 | |

OTHER ASSETS

Other assets consist of the following at September 30, 2009 and December 31, 2008

| | | 2009 | | | 2008 | |

| Rent Deposits | | $ | 49,904 | | | $ | 20,828 | |

| Credit Card Reserve | | | | | | | 33,387 | |

| Vendor Deposit | | | 25,752 | | | | 5,852 | |

| TOTAL | | $ | 75,656 | | | $ | 60,067 | |

NOTE 6 - ACCRUED EXPENSES

Accrued expenses consist of the following at September 30, 2009 and December 31, 2008:

| | | 2009 | | | 2008 | |

| Accrued interest | | | 522,163 | | | | 388,783 | |

| Accrued commission | | | - | | | | 220,869 | |

| Accrued payroll and related expenses | | | 1,460,517 | | | | 625,997 | |

| Other | | | 317,005 | | | | 138,885 | |

| | | $ | 2,299,685 | | | $ | 1,374,534 | |

See Note 14 for related parties.

NOTE 7 – DERIVATIVE INSTRUMENTS

Several of the notes contain provisions which if triggered would reset the conversion price of the Notes including; (1) In the event the Company failed to timely convert or deliver the conversion shares, the Notes went into default as defined under the agreement or a change of control event; (2) a reset provision in the conversion and exercise prices, should the Company subsequently issue any common stock or instruments convertible or exchangeable into common stock of the Company at a per share price lower than the then-in-effect conversion price which, would automatically reset the conversion price of the Notes to that lower price. Because of these provisions, the Company determined that the conversion feature was not clearly and closely related to the Note host contract and under the guidance of Emerging Issues Task Force (“EITF”) 05-2 “The Meaning of Conventional Convertible Debt Instrument Under EITF 00-19” and SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” (“SFAS 133”) it has bifurcated the conversion feature. Because the conversion feature is not considered to be conventional convertible and note holders have the ability to demand cash settlement of the conversion feature, the amount recorded has been shown as a liability at September 30, 2009 of $3,451,215. This liability was $3,396,935, as adjusted at December 31, 2008. Under the requirements of SFAS 133, the Company has remeasured the fair value of the conversion feature at each reporting period after inception, with those changes in fair value being recorded in the statement of operations.

NOTE 8 – SHORT TERM BORROWINGS

| | | 9/30/2009 | | | 12/31/2008 | |

| Note payable to Carole Harder bearing an annual interest rate of 12%, unsecured, due 10/6/2009 | | $ | 140,000 | | | $ | 140,000 | |

| Convertible Promissory Notes, bearing an annual interest rate of 12%, secured, due 1/31/10 | | | 2,280,000 | | | | 4,280,000 | |

| Convertible Promissory Notes, bearing an annual interest rate of 18%, secured, due 11/16/09 | | | 1,333,333 | | | | - | |

| Convertible Promissory Notes due 6/26/2010 (original note discount of $83,330) | | | 583,330 | | | | - | |

| Convertible Promissory Notes due 7/2/2010 (original note discount of $83,330) | | | 583,330 | | | | - | |

| Convertible Promissory Notes due 7/10/2010 (original note discount of $83,330) | | | 583,330 | | | | - | |

| Convertible Promissory Notes due 7/21/2010 (original note discount of $250,010) | | | 1,750,010 | | | | - | |

| Convertible Promissory Notes due 7/29/2010 (original note discount of $98,145) | | | 641,663 | | | | - | |

| Convertible Promissory Notes due 8/11/2010 (original note discount of $41,665) | | | 291,665 | | | | - | |

| Convertible Promissory Notes due 8/20/2010 (original note discount of $11,666) | | | 116,666 | | | | - | |

| Convertible Promissory Notes due 8/27/2010 (original note discount of $53,332) | | | 373,332 | | | | - | |

| Convertible Promissory Notes due 9/3/2010 (original note discount of $99,996) | | | 699,996 | | | | - | |

| Sundry Bridge Notes, bearing an annual interest rate 12%, unsecured, due between 10/6/09-1/4/2010 | | | 1,280,000 | | | | 508,500 | |

| Total principal | | $ | 10,656,655 | | | $ | 4,928,500 | |

| Less debt discount | | | (2,417,271 | ) | | | (2,527,945 | ) |

| Net balance | | $ | 8,239,384 | | | $ | 2,400,555 | |

The above notes listed as Convertible Promissory Note Holders, except for $1,333,333, have a lien on all the assets of the Company,

On January 7, 2009 and February 10, 2009 the Company raised $100,000 and $60,000 respectively in a private offering from accredited investors. The securities sold by the Company consisted of its 12% secured convertible promissory notes and warrants to purchase 100,000 and 60,000 shares of the Company’s common stock, respectively at an exercise price of $1.00. The warrants were valued using the Black–Scholes method. This resulted in a total value of $117,885 assuming a fair value per share of $1.00, risk-free interest rates ranging of 1.50% to 1.74% respectively, based on the note issuance and 100% volatility index. Under EITF 00-27 and APB No. 14, we allocated the proceeds from issuance of these notes and warrants based on the proportional fair value for each item. Consequently, we recorded a discount of $131,894 which is being amortized over the term of these notes using an effective periodic interest rate of between 46 and 63,146%,. A beneficial conversion discount was recorded on these convertible notes since these notes were convertible into shares of common stock at an effective conversion price lower than the fair value of the common stock. The beneficial conversion amount was limited to the portion of the cash proceeds allocated to those convertible notes.

On January 30 and February 25 and March 9, 2009, three of our 12% convertible note holders converted their notes of $50,000, $105,000 and $50,000 respectively, into shares of common stock at a conversion rate of $0.70. This resulted in an issuance of 71,429, 150,000 and 71,429 shares of common stock, respectively. In addition the three note holders also converted their accumulated interest on their respective notes into shares of the Company’s common stock at a conversion rate of $0.70. The total interest converted was $6,283, $13,727 and $3,617 respectively and converted into 8,976, 19,609 and 5,167 of the Company’s common shares, respectively.

During March 2009, the holders of $2,025,000 of our secured convertible promissory notes that were scheduled to mature on March 31, 2009 agreed to extend the maturity date to July 31, 2009. As consideration for their agreement to extend the maturity date, we issued three-year warrants to the note holders granting them the right to purchase an aggregate of 600,000 shares of our common stock, at an exercise price of $1.00 per share. The Company recorded these warrants at a value of $149,675 which is being amortized over the term of the loan extensions. During July 2009, the note holders, who had not yet converted their notes into common shares, along with our July and August noteholders having this same July 31st maturity date agreed to extend the maturity date to January 31, 2010. These holders have an aggregate of $2,380,000 of our secured convertible promissory notes. We issued three-year warrants to the note holders granting them the right to purchase an aggregate of 680,000 shares of our common stock, at an exercise price of $1.00 per share. The Company recorded these warrants at a value of $115,600 which is being amortized over the term of the loan extensions.

On April 9, 2009, the Company entered into financing with OmniReliant Holdings, Inc. (“Omni”) pursuant to a purchase agreement whereby it sold to Omni a convertible original issue discount promissory note in the principal amount of $550,000 (the “First Note”), with the Company receiving proceeds of $500,000. The First Note is convertible at any time at the option of Omni at a conversion price of $1.00 and is due on May 9, 2009. Omni also received warrants to purchase up to 500,000 shares of the Company’s Common Stock with an exercise price of $1.00. There was a reset provision associated with the note in regards to subsequent equity sales affecting the note and warrants. Based on subsequent financing transactions, the exercise price of the warrants and the conversion price of the debt was reset to $0.70. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $92,000. At June 30, 2009 the value of the derivative related to the warrants was approximately $10,000. The value of this derivative at September 30, 2009 was $55,000.The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $216,000 related to the value of the warrants to be amortized over the term of the note. Since this note was paid off on May 7, 2009, this discount was expensed and the derivative related to the note was removed during the quarter ended June 30, 2009.

During April 2009, eight of our note holders converted the principal and interest of their convertible promissory notes into shares of the Company common stock at a conversion rate of $0.70 per share. Total principal converted was $665,000, which was converted into 950,000 of the Company common shares. Total accrued interest of $77,137 was converted into 110,580 of the Company common shares.

On May 1, 2009, the Company issued a 120 day promissory note at 12% interest to an accredited investor for $800,000. As a condition of the note, the company issued the lender 400,000 warrants to purchase the Company's common shares at a price of $1.00 per share. The warrants were valued using the Black–Scholes method. This resulted in a total value of $363,965, assuming a fair value per share of $1.00, risk-free interest rate of 1.98% and, based on the note issuance and 100% volatility index. Under EITF 00-27 and APB No. 14, we allocated the proceeds from issuance of this note and warrants based on the proportional fair value for each item. The relative fair value of the warrant was $250,160. A beneficial conversion discount was recorded on the convertible note since the note is convertible into shares of common stock at an effective conversion price lower than the fair value of the common stock. Consequently, we recorded a total discount of $772,160 which is being amortized over the term of these notes using an effective periodic interest rate of 436%. The note was extended on July 15, 2009 in return for monthly cash interest payments with the maturity date being moved to January 28, 2010. The broker received a cash fee of $80,000

On May 7, 2009 one of our note holders converted the principal and interest of their convertible promissory note into shares of the Company common stock at a conversion rate of $1.00 per share. Total principal converted was $100,000, which was converted into 100,000 shares of the Company common stock. Total accrued interest converted was $4,000 into 4,000 of the Company common shares.

On May 20, 2009, the Company executed a convertible promissory note (the “Note”) in the principal amount of $1,600,000 payable to Linlithgow Holdings, LLC (“Linlithgow”). Pursuant to the Note, the Company promises to pay to Linlithgow $1,600,000 in cash on November 20, 2009. The Note is convertible at any time at a conversion price of $1.00 per share which was reset to $0.70 due to a subsequent offering. The Note bears an initial interest rate of 1.5% for the first month and increases by 1.5% per month until maturity. After the maturity date, the default rate of interest becomes 18% per month or the highest rate allowed by law, whichever is lower, until the date the Note amount is actually paid. Further, as part of the consideration provided to the Holder for the Note, the Holder also received a warrant for the purchase of up to 1,782,000 shares of the Company’s common stock at an exercise price of $0.90 per share. The warrants are exercisable, in whole or in part, any time from and after the date of issuance of the warrant. Due to a subsequent ratchet adjustment based on the issuance of warrants at a lower per share price, the exercise price of these warrants has been adjusted to $0.70. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $618,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $182,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded the discount on this note of approximately $465,000 related to the value of the warrants and derivative liability to be amortized over the term of the note at an effective rate 12%. Additionally, the warrants issued as costs of this financing were valued at approximately $1,125,000 and are being amortized over the term of the note. The broker also received a cash fee of $120,000 from the proceeds of this note.

During May 2009, seven of our note holders converted the principal and interest of their convertible promissory notes into shares of the Company common stock at a conversion rate of $.70 per share. Total principal converted was $920,000, which was converted into 1,314,285 of the Company common shares. Total accrued interest of $105,340 was converted into 150,487 of the Company common shares.

On June 4, 2009 the Company sold a Convertible Original Issue Discounted (OID) promissory note for $526,316 to an accredited investor which is due 1/15/2010. The Company paid the broker a cash fee of $50,000. However, on June 19, 2009, the average trading volume of the common stock of the Company was under $80,000 for the ten prior consecutive trading days, which constituted a technical “Event of Default” under the Company’s Series 2009 Secured Convertible Original Issue Discount Note Due January 15, 2010, dated June 4, 2009 (the “Note”), made by the Company, in favor of St. George Investments, LLC (St. George). As a result of the Event of Default, the principal amount of the Note, equal to $714,286, plus a penalty of $71,428.60 (equal to 10% of the principal amount), became immediately due and payable. At any time following either the Maturity Date or occurrence of an Event of Default, the note may be convertible into shares of the Common Stock of the Company valued at the Market Price which is hundred percent (100%) of the lower of (a) the closing bid price on the trading day on which the Share Conversion Request is made or (b) the average of the volume weighted average prices as reported by Bloomberg, L.P. during the ten (10) trading days in the primary trading market for Common Shares prior to and including the trading day on which the Share Conversion Request is made.

The St. George Note was secured by an aggregate of 4,020,000 shares of the Company’s common stock pledged by affiliates of the Company, pursuant to stock pledge agreements entered into by the affiliates in favor of St. George, including 2,020,000 shares pledged by Mark Noffke, the Company’s chief financial officer. Pursuant to the pledge agreement entered into by Mr. Noffke, shares pledged by Mr. Noffke may be transferred to St. George and sold in full satisfaction of the Company’s obligations under the Note.

Subsequently, the Company and St. George Investments, LLC, entered into an agreement dated July 30, 2009 (the “Agreement”) pursuant to which the Company would satisfy the remaining outstanding balance of $420,593.40 on its Series 2009 Secured Convertible Original Issue Discount Note, due June 15, 2010, issued to St. George (the “Note”). Pursuant to the Agreement, the Company was to make the following payments (the “Scheduled Payments”) on the Note: (i) $100,000 paid on July 30, 2009, (ii) $50,000 was to be paid by August 6, 2009, (iii) 50,000 was to be paid by August 13, 2009, (iv) $50,000 was to be paid by August 20, 2009, (v) $50,000 shall be paid by August 27, 2009, (vi) $50,000 was to be paid on or before September 3, 2009, (vii) $50,000 was to be paid on or before September 10, 2009 and (viii) $20,995.40 was to be paid on or before September 17, 2009. The Company settled the first two payments of the Agreement. In addition, when the note was deemed in default, St. George took collateral and monetized it towards payment of the note. Provided the Scheduled Payments continued to be made in accordance with the Agreement, the Note would be deemed paid in full and St. George would return the remaining 3,015,424 shares of the Company’s common stock not previously monetized which had been pledged as security for repayment of the Note, and would not hold any other shares pledged in connection with the Note. The August payments were not made and St. George monetized 1,988,592 of the 2,020,000 shares pledged by Mark Noffke for full payment of the note. The average sale price of these shares range from $0.70 to $0.16 over a three month period ending September 9, 2009 when the Company used $95,000 to pay off the balance of the note.

On June 16, 2009, the Company entered into another financing with Omni pursuant to a second purchase agreement whereby it sold Omni a convertible original issue discount promissory note (the “Second Note”) in the principal amount of $575,000, with the Company receiving proceeds of $500,000. Pursuant to the terms of the Second Note, the Company must pay to the Holder $575,000 in cash on August 1, 2009. The Second Note is convertible at any time at a conversion price of $0.70 per share. In addition, the Company gave the lender 700,000 and the broker 121,714 warrants to purchase the Company stock, respectively, both with an exercise price of $0.70. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $24,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $77,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $175,000 related to the value of the warrants and derivative liabilities to be amortized over the term of the note at an effective rate of 24%. Additionally, the warrants and related derivative liability issued as costs of this financing were valued at approximately $25,000 and are being amortized over the term of the note. The Broker received a cash payment of $40,000 from the proceeds of the note. The note was paid in full on July 20, 2009.

On June 29, 2009, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Omni. Additionally, on July 2, 2009, the Company and Omni entered into an amended and restated Securities Purchase Agreement (the Purchase Agreement as amended and restated is referred to herein as the “Securities Purchase Agreement”). Pursuant to the Securities Purchase Agreement, Omni agreed to purchase up to $3,500,000 in principal amount of the Company’s Original Issue Discount Secured Convertible Debentures (the “Debentures”) for a purchase price of up to $3,000,000. As part of this Agreement 5,000,000 shares of the Company’s Common Stock held by Linlithgow Holdings, LLC was pledged as collateral.

Pursuant to the Securities Purchase Agreement, the Company sold Omni an aggregate of $1,166,660 of Debentures and received gross proceeds of $1,000,000 and Omni agreed to purchase an additional Debenture with a face value of up to $2,333,340 on or before July 30, 2009. Omni was also issued warrants to purchase 4,999,972 shares of the Company’s Common Stock with an exercise price of $0.70 per share subject to a reset provision. The warrants are exercisable, for five years from the date of issuance. The Debentures are convertible into shares of the Company’s Common Stock at any time at the option of the Holder at a conversion price of $0.70 per share, subject to adjustment (the “Conversion Price”). Interest on the Debenture is 10% per annum. The first Debenture was issued on June 29, 2009 and the second Debenture to be issued on July 2, 2009. The principal amount of each of the Debentures is $583,350 and each has a maturity date of twelve months from the date of issuance. The Debentures cannot be converted to common stock to the extent such conversion would cause the holder of the Debenture, together with such holder’s affiliates, to beneficially own in excess of 4.99% (or a maximum 9.99% in certain cases) of the Company’s outstanding common stock immediately following such conversion. As part of the Agreement, 2,499,986 five year warrants to purchase the Company stock at $0.70 were issued to Omni at a value of $270,000.

Beginning six months from the original issue date of the Debentures, on the 1st of each month (the “Monthly Redemption Date”) the Company must redeem the Monthly Redemption Amount ($97,221.66 for each $583,330 Debenture, plus accrued but unpaid interest, liquidated damages and any other amounts then owing to the Holder under the Debenture). The Monthly Redemption Amount payable on each Monthly Redemption Date shall be paid in cash at a rate of 110% of the Monthly Redemption Amount or upon 30 trading days’ notice the Company may in lieu of cash pay all or part of the Monthly Redemption Amount in conversion shares.

Payment of the Debentures issued to Omni is secured pursuant to a security interest and pledge agreement (the “Security Interest and Pledge Agreement”) whereby, on June 29, 2009, Linlithgow Holdings LLC pledged 2,500,000 shares of BYOC common stock. On July 2, 2009, the Company and Omni amended the Security Interest and Pledge Agreement so that additional pledgors could pledge their respective unpledged shares of BYOC Common Stock (the Security Interest and Pledge Agreement, as amended and restated, is referred to herein as the “Security Interest and Pledge Agreement”). Pursuant to the terms of the Security Interest and Pledge Agreement, Linlithgow Holdings, LLC pledged an additional 3,982,000 shares of BYOC Common Stock, Wendy Borow-Johnson, the President of Brand Management pledged 480,000 shares BYOC Common Stock, and Robert McNulty, the Chief Executive Officer of the Company, pledged 505,000 shares of BYOC Common Stock.

On June 29, 2009, the Company issued Omni the first Debenture in the amount of $583,350 and received gross proceeds of $500,000. There is a reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 2,499,986 and the broker 266,669 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $74,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $287,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $298,000 related to the value of the warrants and derivative liability to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $65,000 and are being amortized over the term of the note. The Company also paid the broker a $40,000 cash fee.

Also, during June 2009, two of our note holders converted the principal and interest of their convertible promissory notes into shares of the Company common stock at a conversion rate of $.70 per share. Total principal converted was $110,000, which was converted into 157,143 of the Company common shares. Total accrued interest of $12,940 was converted into 18,485 of the Company common shares.

On July 2, 2009, the Company issued Omni the second Debenture in the amount of $583,350 and received gross proceeds of $500,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 2,499,986 and the broker 266,669 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $46,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $286,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $325,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $51,000 and are being amortized over the term of the note. The Company also paid the broker a $40,000 cash fee.

On July 10, 2009, the Company issued Omni the third Debenture in the amount of $583,350 and received gross proceeds of $500,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 2,499,986 and the broker 266,669 warrants to purchase the Company’s common stock at a price of $0.70. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $46,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $288,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $319,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $49,000 and are being amortized over the term of the note. The Company also paid the broker a $40,000 cash fee.

On July 21, 2009, the Company issued Omni the fourth Debenture in the amount of $1,750,010 and received gross proceeds of $1,500,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 7,500,042 and the broker 800,001 warrants to purchase the company common stock at a price of $0.70. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $112,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $863,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $853,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $112,000 and are being amortized over the term of the note. The Company also paid the broker a $120,000 cash fee.

On July 21, 2009, the Company paid Omni in full an OID promissory note dated June16, 2009 in the amount of $575,000. Also on this date, the Company paid on behalf of Linlithgow Holdings, Inc, Debt Opportunity Fund a payment of $266,667 on a promissory note dated 5/20/09.

On July 29, 2009, the Company issued Omni the fifth Debenture in the amount of $641,663 and received gross proceeds of $550,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 2,777,764 and the broker 293,333 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $43,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $319,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $324,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $44,000 and are being amortized over the term of the note. The Company also paid the broker a $44,000 cash fee.

On August 4, 2009, one of our 12% convertible note holders converted their note of $100,000 into shares of common stock at a conversion rate of $0.35. This resulted in an issuance of 285,714 shares of common stock. In addition the note holder also converted their accumulated interest on their note into shares of the Company’s common stock at a conversion rate of $0.35. The total interest converted was $18,567 and converted into 53,048 of the Company’s common shares.

On August 11, 2009 the Company issued Omni the sixth Debenture in the amount of $291,665 and received gross proceeds of $250,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 1,250,000 and the broker 133,333 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $19,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $139,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $142,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $19,000 and are being amortized over the term of the note. The Company also paid the broker a $20,000 cash fee.

On August 20, 2009, the Company issued Omni the seventh Debenture in the amount of $116,666 and received gross proceeds of $100,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 500,000and the broker 53,333 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $3,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $55,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $43,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $5,000 and are being amortized over the term of the note.

On August 27, 2009 the Company issued Omni the eighth Debenture in the amount of $373,332 and received gross proceeds of $320,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 1,600,000 and the broker 170,667 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $10,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $178,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $138,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $13,000 and are being amortized over the term of the note.

On September 3, 2009 the Company issued Omni the ninth Debenture in the amount of $699,996 and received gross proceeds of $600,000. There is reset provision associated with the note in regards to the payment date. Additionally, there is a provision in the agreement, whereby, if there is a change in control of the Company, the holder has the right to accelerate payment which is based off a formula which could result in a payment greater than the principal and interest amount owing before the change of control. In addition for the receipt of funds, the company issued the lender 3,000,000 and the broker 266,669 warrants to purchase the Company’s common stock at a price of $0.70, respectively. In accordance with EITF 07-5, “Determining Whether an Instrument (or Embedded Feature) is Indexed to an Entity’s Own Stock”, related to the valuation of convertible notes and warrants with conversion features and/or exercise features that can reset the conversion and/or exercise price based on future equity transactions, the Company valued the warrants and conversion feature of this note and bifurcated them from the host contract as a derivative under SFAS 133 “Accounting for Derivative Instruments and Hedging Activities” by recognizing an additional liability for the fair value assigned to those derivative features of approximately $22,000 at inception of the agreement. At September 30, 2009 the value of the derivative was approximately $329,000. The change in the derivative was reported in the statement of operations for the period ended September 30, 2009. The company recorded a discount on this note of approximately $275,000 related to the value of the warrants, derivative liability and OID to be amortized over the term of the note at an effective rate of 20%. Additionally, the warrants issued and related derivative liability as costs of this financing were valued at approximately $23,000 and are being amortized over the term of the note. The Company also paid the broker a $40,000 cash fee.

The Company recorded $7,608,178 and $3,136,792 as interest expense on the above notes for nine month period ended September 30, 2009 and 2008, respectively. Included in the interest expense amount noted above is the amortization of $6,723,076 and $2,909,890 of loan origination fees and discount associated with these notes for the Nine months ended September 30, 2009 and 2008 respectively.

NOTE 9 - COMMON STOCK, WARRANTS AND PAID IN CAPITAL

Common Stock

On January 5, 2009, we issued 1,000 shares of common stock to an individual for services rendered with setting up our debit card program used for paying our sales representatives valued at $1.00 per share

On January 12, 2009 we issued 25,000 shares of common stock for cash at $0.80 per share to an accredited investor.

On January 30, February 25 and March 9, 2009, three of our 12% convertible note holders converted their notes of $50,000, $105,000 and $50,000 respectively, into shares of common stock at a conversion rate of $0.70. This resulted in an issuance of 71,429, 150,000 and 71,429 shares of common stock, respectively. In addition these three note holders also converted their accumulated interest on their respective notes into shares of the Company’s common stock at a conversion rate of $0.70. The total interest converted was $6,283, $13,727 and $3,617 respectively and converted into 8,976, 19,609 and 5,167 of the Company’s common shares, respectively.

In January 2009, we issued 10,000 shares of our common stock for services provided as a commission for assisting the Company with fund raising. The shares were valued at $1.00.

On February 11, 2009, we issued 52,000 shares of our common stock for services rendered in connection with our convertible bridge loans procured during the fourth quarter 2008. This amount had been accrued for at $1.00 per share when the service was provided in 2008.

On February 18, 2009, we issued 5,000 shares of stock as compensation to an employee with a value of $1.00 per share.

On April 6, 2009 three individual warrant holders exercised the cashless option and converted their warrants into 189,086; 47,276 and 48,504 of Company common stock.

On April 14 and April 24, 2009 two individual warrant holders exercised the cashless option and converted their warrants into 36,160 and 39,920 shares of Company common stock, respectively.

On April 15, 2009, the Company issued 25,000 shares of common stock at $1.44 per share value for professional services received.

On April 30, 2009, the Company issued 126,988 unrestricted shares of common stock in lieu of $198,101 of cash commissions earned by 16 different independent sales representatives.

On May 1, 2009, the Company issued 70,000 unrestricted shares of common stock in payment of $101,100 of professional services received.

On May 21, 2009, the Company issued 2,500 shares of common stock valued at $1.00 as compensation to an employee.

On May 22, 2009, the Company issued 14,514 unrestricted shares of common stock in lieu of $14,514 of cash commissions earned by 16 different independent sales representatives.

On June 1, 2009, the Company issued 15,000 unrestricted shares of common stock and 40,000 shares of restricted common stock in lieu of $55,000 of cash commissions earned by 4 different independent sales representatives.

On June 2, 2009, the Company issued 200,000 shares of unrestricted common stock for professional services received with a value of $202,000.

On June 9, 2009, the Company issued 15,000 unrestricted shares of common stock and 35,000 shares of restricted common stock in lieu of $61,000 of cash commissions earned by 2 different independent sales representatives.

On June 25, 2009, the Company issued 2,000 unrestricted shares of common stock and 7,500 shares of restricted common stock in lieu of $9,500 of cash commissions earned by 2 different independent sales representatives.

On June 25, 2009, the Company issued 100,000 unrestricted common stock valued at $84,000 for professional services received.

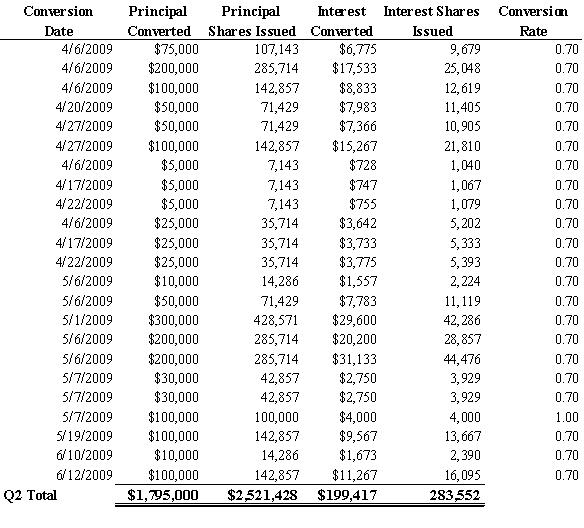

During the three months ended June 30, 2009, the Company had 17 of our 12% convertible notes converted into shares of our common stock by 16 individual note holders as follows:

Conversion Date | | Principal Converted | | | Principal Shares Issued | | | Interest Converted | | | Interest Shares Issued | | | Conversion Rate | |

| 4/6/2009 | | $ | 75,000 | | | | 107,143 | | | $ | 6,775 | | | | 9,679 | | | | 0.70 | |

| 4/6/2009 | | $ | 200,000 | | | | 285,714 | | | $ | 17,533 | | | | 25,048 | | | | 0.70 | |

| 4/6/2009 | | $ | 100,000 | | | | 142,857 | | | $ | 8,833 | | | | 12,619 | | | | 0.70 | |

| 4/20/2009 | | $ | 50,000 | | | | 71,429 | | | $ | 7,983 | | | | 11,405 | | | | 0.70 | |

| 4/27/2009 | | $ | 50,000 | | | | 71,429 | | | $ | 7,366 | | | | 10,905 | | | | 0.70 | |

| 4/27/2009 | | $ | 100,000 | | | | 142,857 | | | $ | 15,267 | | | | 21,810 | | | | 0.70 | |

| 4/6/2009 | | $ | 5,000 | | | | 7,143 | | | $ | 728 | | | | 1,040 | | | | 0.70 | |

| 4/17/2009 | | $ | 5,000 | | | | 7,143 | | | $ | 747 | | | | 1,067 | | | | 0.70 | |

| 4/22/2009 | | $ | 5,000 | | | | 7,143 | | | $ | 755 | | | | 1,079 | | | | 0.70 | |

| 4/6/2009 | | $ | 25,000 | | | | 35,714 | | | $ | 3,642 | | | | 5,202 | | | | 0.70 | |

| 4/17/2009 | | $ | 25,000 | | | | 35,714 | | | $ | 3,733 | | | | 5,333 | | | | 0.70 | |

| 4/22/2009 | | $ | 25,000 | | | | 35,714 | | | $ | 3,775 | | | | 5,393 | | | | 0.70 | |

| 5/6/2009 | | $ | 10,000 | | | | 14,286 | | | $ | 1,557 | | | | 2,224 | | | | 0.70 | |

| 5/6/2009 | | $ | 50,000 | | | | 71,429 | | | $ | 7,783 | | | | 11,119 | | | | 0.70 | |

| 5/1/2009 | | $ | 300,000 | | | | 428,571 | | | $ | 29,600 | | | | 42,286 | | | | 0.70 | |

| 5/6/2009 | | $ | 200,000 | | | | 285,714 | | | $ | 20,200 | | | | 28,857 | | | | 0.70 | |

| 5/6/2009 | | $ | 200,000 | | | | 285,714 | | | $ | 31,133 | | | | 44,476 | | | | 0.70 | |

| 5/7/2009 | | $ | 30,000 | | | | 42,857 | | | $ | 2,750 | | | | 3,929 | | | | 0.70 | |

| 5/7/2009 | | $ | 30,000 | | | | 42,857 | | | $ | 2,750 | | | | 3,929 | | | | 0.70 | |

| 5/7/2009 | | $ | 100,000 | | | | 100,000 | | | $ | 4,000 | | | | 4,000 | | | | 1.00 | |

| 5/19/2009 | | $ | 100,000 | | | | 142,857 | | | $ | 9,567 | | | | 13,667 | | | | 0.70 | |

| 6/10/2009 | | $ | 10,000 | | | | 14,286 | | | $ | 1,673 | | | | 2,390 | | | | 0.70 | |

| 6/12/2009 | | $ | 100,000 | | | | 142,857 | | | $ | 11,267 | | | | 16,095 | | | | 0.70 | |

| 2nd Quarter Total | | $ | 1,795,000 | | | $ | 2,521,428 | | | $ | 199,417 | | | | 283,552 | | | | | |

On July 6, 2009, the Company issued 60,000 restricted shares of the Company’s common stock valued at $13,162 for professional services received.

On July 8, 2009, the Company issued 350,000 unrestricted shares of the Company’s common stock valued at $96,520 for professional services received.

On July 8, 2009, the Company issued 5,000 restricted shares of the Company’s common stock valued at $1,016 for professional services received.

On August 4, 2009, one of our 12% convertible note holders converted their notes of $100,000 into shares of common stock at a conversion rate of $0.35. This resulted in an issuance of 285,714 shares of common stock. In addition the note holder also converted their accumulated interest on their note into shares of the Company’s common stock at a conversion rate of $0.35. The total interest converted was $18,566.67 and converted into 53,048 of the Company’s common shares.

On August 7, 2009, the Company issued 100,000 shares of the Company’s unrestricted common stock valued at $20,715 for professional services received.

On August 10, 2009, the Company issued 250,000 shares of the Company’s unrestricted common stock valued at $47,079 for professional services received.

On August 18, 2009, the Company issued 1,000 shares of the Company’s restricted common stock valued at $180 to a current shareholder for compensation.

On August 20, 2009, the Company issued 100,000 shares of the Company’s unrestricted common stock valued at $16,000 for professional services received.

On September 1, 2009, the Company issued 250,000 shares of the Company’s unrestricted common stock valued at $47,500 for professional services received.

Warrants

The following is a summary of the Company’s outstanding common stock purchase warrants:

| | | | Outstanding | | | Issued 9 months | | | | | | Outstanding | |

| Exercise Price | | | December 31, 2008 | | | Ended September 30, 2009 | | | Exercised | | | September30, 2009 | |

| $ | 0.01 | | | | 153,920 | (1) | | | - | | | | (40,400 | ) | | | 113,520 | (1) |

| $ | 0.30 | | | | 30,300 | | | | - | | | | - | | | | 30,300 | |

| $ | 0.50 | | | | 101,000 | (1) | | | - | | | | - | | | | 101,000 | (1) |

| $ | 0.70 | | | | 5,087,484 | | | | 30,288,821 | | | | - | | | | 35,376,305 | |

| $ | 0.93 | | | | 4,026,646 | | | | - | | | | (898,786 | ) | | | 3,127,860 | |

| $ | 1.00 | | | | 503,247 | | | | 2,239,999 | | | | - | | | | 2,743,246 | |

| $ | 2.40 | | | | 132,310 | (1) | | | - | | | | - | | | | 132,310 | (1) |

| | | | | | 10,034,907 | | | | 32,528,820 | | | | (939,186 | ) | | | 41,624,541 | |

| | (1) | The outstanding warrants as of December 31, 2008, include an additional 260,442 warrants issued to replace the warrants previously issued by BOOMj.com, Inc., which new warrants were issued at a rate of 2.02 shares of the Company common stock for each warrant share of BOOMj.com. The Company has reserved a sufficient number of shares of authorized common stock for issuance upon exercise of the outstanding warrants. |

2008 Stock Option Plan

In September 2008, the Company's Board of Directors approved the 2008 Equity Incentive Plan of Beyond Commerce (the "Plan"). On June 12, 2009, the Company’s Board of Directors amended and approved increasing the plan from 3,500,000 available options to 7,000,000. This amendment was approved by the shareholders on July 24, 2009 at the Company’s annual shareholder meeting.

Stock Options Granted

On September 11, 2008, the Board of Directors approved the issuance of stock options as described below in accordance with the 2008 Equity Incentive Plan. The employee options have a cliff vesting schedule over a three year period that vest one third after one year of service and then 4.2% per month over the remaining twenty-four months. Options issued to non-employees for meeting performance-based goals vest immediately.

| | | | Outstanding | | | Issued 9 months | | | Cancelled or | | | Outstanding | |

| Option Group | | | December 31, 2008 | | | Ended September 30, 2009 | | | Exercised | | | September 30, 2009 | |

| $ | 0.35-0.49 | | | | | | | | 173,000 | | | | (21,000 | ) | | | 152,000 | |

| $ | 0.50-0.69 | | | | - | | | | 991,658 | | | | (223,384 | ) | | | 868,274 | |

| $ | 0.70-0.89 | | | | 505,000 | | | | 890,574 | | | | (119,445 | ) | | | 1,276,102 | |

| $ | 0.90-0.99 | | | | 478,289 | | | | 505,201 | | | | (286,646 | ) | | | 696,844 | |

| $ | 1.00-1.25 | | | | 73,271 | | | | 1,377,500 | | | | (350,577 | ) | | | 1,100,194 | |

| $ | 1.26-1.70 | | | | 120,000 | | | | 410,170 | | | | (185,533 | ) | | | 344,637 | |

| | | | | | 1,176,560 | | | | 4,390,316 | | | | (1,066,585 | ) | | | 4,438,051 | |

The estimated fair value of the aforementioned options was calculated using the Black-Scholes model. Consequently, the Company recorded a share-based compensation expense of $213,814 and $1,718,290 for the three and Nine months ended September 30, 2009, respectively. The credit for the three months ended September 30, 2009 is due to the cancellation of options for independent representatives no longer working with the Company. Total compensation costs to be recognized over the next three years will be $1,514,812 for all non-vested options as of September 30, 2009. Expense will equal or exceed the vested amount of the options.

Dividends

The Company has never issued dividends.

NOTE 10 – COMMITMENTS AND CONTINGENCIES

Operating Lease

The Company leases certain office space, under operating leases which generally require the Company to pay taxes, insurance and maintenance expenses related to the leased property. The leases for office space have lease extension renewal options for an added two to three years at fair market rent values. The Company believes that in the normal course of business, leases will be renewed or replaced by other leases. In December 2007 the Company entered into a four year lease for 4,560 square feet in Henderson, Nevada which houses its corporate office. The Company also leases a fully furnished three bedroom apartment in the Henderson, Nevada area effective June 11, 2009 through July 30, 2010. The monthly rent expense is $4,250 plus utilities. The Company rented the apartment for executives and consultants to alleviate hotel expenses for these individuals that work in our Henderson office but are not residents of the area. The Company closed its Irvine, CA office on May 31, 2009.

Total rent expense incurred by the Company, which includes the leases above and sundry month to month rental expenditures was $220,533 and $164,643 for the nine month period ended September 30th 2009 and 2008, respectively. The Company signed an amendment to its lease in Henderson, Nevada in February 2009, effective March 16, 2009 for an additional 5,634 square feet of office space adjacent to the current office. This amendment ties to the expiration of the present lease and will expire January 31, 2012. The Company has future minimum lease obligations as follows:

Twelve months ending September 30, | | 2009 | |

| 2010 | | $ | 553,271 | |

| 2011 | | | 326,970 | |

| 2012 | | | 94,536 | |

| Total | | $ | 974,777 | |

NOTE 11 – SEGMENT REPORTING

Beyond Commerce, Inc manages its operations through two business segments: BOOMj.com dba i-Supply and LocalAdLink. Each unit owns and operates the segments under the respective names.

The Company evaluates performance based on net operating profit. Administrative functions such as finance, treasury, and information systems are centralized and although they are not considered operating segments are presented below for informative purposes. However, where applicable, portions of the administrative function expenses are allocated between the operating segments. The operating segments do share facilities in Henderson NV. In the event any supplies and/or services are provided to one operating segment by the other, the transaction is valued according to the company’s transfer policy, which approximates market price. The costs of operating the segments are captured discretely within each segment. The Company’s leasehold improvements, property, computer equipment, inventory, and results of operations are captured and reported discretely within each operating segment.

Summary financial information for the two reportable segments as of the Nine months ended September 30 is as follows:

| | | 2009 | | | 2008 | |

| Operations: BOOMj.com dba i-Supply | | | | | | |

| Net sales | | $ | 409,051 | | | $ | 1,025,023 | |

| Gross Margin | | | 345,614 | | | | (25,090 | ) |

| Depreciation | | | (145,041 | ) | | | (133,509 | ) |

| Assets | | | 517,802 | | | | 755,703 | |

| Capital Expenditures | | | 11,333 | | | | 111,882 | |

| | | | | | | | | |

| Operations: LocalAdLink | | | | | | | | |

| Net sales | | $ | 12,299,017 | | | | - | |

| Gross Margin | | | 834,504 | | | | - | |

| Depreciation | | | (50,492 | ) | | | (834 | ) |

| Assets | | | 2,088,816 | | | | 9,186 | |

| Capital Expenditures | | | 509,935 | | | | 10,000 | |

| Net Loss | | | (4,734,251 | ) | | | (42,939 | ) |

| Basic and Diluted Loss Per Share | | | (0.11) | | | | 0.00 | |

| | | | | | | | | |

| | | | | | | | | |

Consolidated Operations: | | | | | | |

| Net sales | | $ | 12,708,068 | | | | 1,025,023 | |

| Gross Margin | | | 1,180,118 | | | | (25,090 | ) |

| Other operating expenses | | | (11,494,453 | ) | | | (6,449,780 | ) |

| Depreciation | | | (195,533 | ) | | | (134,343 | ) |

| Non-operating income (expense) | | | (6,605,038 | ) | | | (2,378,091 | ) |

| Loss from operations before income taxes | | | (17,114,906 | ) | | | (8,987,304 | ) |

| Assets | | | 3,710,074 | | | | 1,737,747 | |

| Capital Expenditures | | | 521,268 | | | | 121,882 | |

Summary financial information for the two reportable segments as of the three months ended September 30 is as follows:

| | | 2009 | | | 2008 | |

| Operations: BOOMj.com dba i-Supply | | | | | | |

| Net sales | | $ | 240,078 | | | $ | 204,810 | |

| Gross Margin | | | 197,903 | | | | (39,180 | ) |

| Depreciation | | | (48,473 | ) | | | (46,928 | ) |

| Assets | | | 517,802 | | | | 755,703 | |

| Capital Expenditures | | | - | | | | 33,659 | |

| | | | | | | | | |

| Operations: LocalAdLink | | | | | | | | |

| Net sales | | $ | 1,811,788 | | | | - | |

| Gross Margin | | | 369,396 | | | | - | |

| Depreciation | | | (40,286 | ) | | | (834) | |

| Assets | | | 2,088,816 | | | | 9,186 | |

| Capital Expenditures | | | 400,339 | | | | 10,000 | |

| Net Loss | | | (410,070 | ) | | | (42,939 | ) |

| Basic and Diluted Loss Per Share | | | (0.01 | ) | | | 0.00 | |

| | | | | | | | | |

| Consolidated Operations: | | | | | | |

| Net sales | | $ | 2,051,866 | | | | 204,810 | |

| Gross Margin | | | 567,299 | | | | 39,180 | |

| Other operating expenses | | | (2,931,281 | ) | | | (2,756,856 | ) |

| Depreciation | | | (88,759 | ) | | | (47,762 | ) |

| Non-operating income (expense) | | | (6,082,604 | ) | | | (1,267,047 | ) |

| Loss from operations before income taxes | | | (8,535,345 | ) | | | (4,032,056 | ) |

| Assets | | | 3,710,074 | | | | 1,737,747 | |

| Capital Expenditures | | | 400,339 | | | | 43,659 | |

NOTE 12 – NET LOSS PER SHARE OF COMMON STOCK

The Company has adopted Financial Accounting Standards Board ("FASB") Statement Number 128, "Earnings per Share," which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic loss per share of common stock is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the year. Basic net loss per common share is based upon the weighted average number of common shares outstanding during the period. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period. However, shares associated with convertible debt, stock options and stock warrants are not included because the inclusion would be anti-dilutive (i.e. reduce the net loss per common share). The total number of such stock option warrant shares and potential shares to be issued upon conversion of debt excluded from the diluted net loss per common share presentation was 46,619,719 and 14,634,396 at September 30, 2009 and 2008, respectively.