UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22005

Allspring Global Dividend Opportunity Fund

(Exact name of registrant as specified in charter)

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Address of principal executive offices) (Zip code)

Matthew Prasse

Allspring Funds Management, LLC

1415 Vantage Park Drive, 3rd Floor, Charlotte, NC 28203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

ITEM 1. REPORT TO STOCKHOLDERS

2 | |

6 | |

12 | |

20 | |

33 | |

34 | |

35 | |

36 | |

37 | |

38 | |

44 | |

45 | |

53 |

Allspring Funds

second-quarter gross

domestic

product (GDP)

growth—initially

estimated at 2.4%—and

U.S. annual inflation

easing steadily to 3.2%

in July, hopes for a soft

economic landing grew. ”

President

Allspring Funds

Notice to Shareholders |

• On November 15, 2023, the Fund announced a renewal of its open-market share repurchase program (the “Buyback Program”). Under the renewed Buyback Program, the Fund may repurchase up to 5% of its outstanding shares in open market transactions during the period beginning on January 1, 2024 and ending on December 31, 2024. The Fund’s Board of Trustees has delegated to Allspring Funds Management, LLC, the Fund’s adviser, discretion to administer the Buyback Program, including the determination of the amount and timing of repurchases in accordance with the best interests of the Fund and subject to applicable legal limitations. |

• The Fund’s managed distribution plan provides for the declaration of quarterly distributions to common shareholders of the Fund at an annual minimum fixed rate of 9% based on the Fund’s average monthly net asset value per share over the prior 12 months. Under the managed distribution plan, quarterly distributions may be sourced from income, paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a quarterly basis, the Fund may distribute long-term capital gains and/or return of capital to its shareholders in order to maintain its managed distribution level. You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the managed distribution plan. Shareholders may elect to reinvest distributions received pursuant to the managed distribution plan in the Fund under the existing dividend reinvestment plan, which is described later in this report. |

Investment objective | The Fund’s primary investment objective is to seek a high level of current income. The Fund’s secondary objective is long-term growth of capital. |

Strategy summary | The Fund allocates its assets between two separate investment strategies, or sleeves. Under normal market conditions, the Fund allocates approximately 80% of its total assets to an equity sleeve comprised primarily of common stocks and other equity securities that offer above-average potential for current and/or future dividends. This sleeve invests normally in approximately 60 to 80 securities, broadly diversified among major sectors and regions. The sector and region weights are typically within+/- 5 percent of weights in the MSCI ACWI (Net)†. The remaining approximately 20% of the Fund’s total assets is allocated to a sleeve consisting of below investment grade (high yield) debt, loans, and preferred stocks. The Fund also employs an option strategy in an attempt to generate gains on call options written by the Fund. |

Adviser | Allspring Funds Management, LLC |

Subadviser | Allspring Global Investments, LLC |

Portfolio managers | Justin P. Carr, CFA, Harindra de Silva, Ph.D, CFA, Vince Fioramonti, CFA, Chris Lee, CFA, Megan Miller, CFA, Michael J. Schueller, CFA |

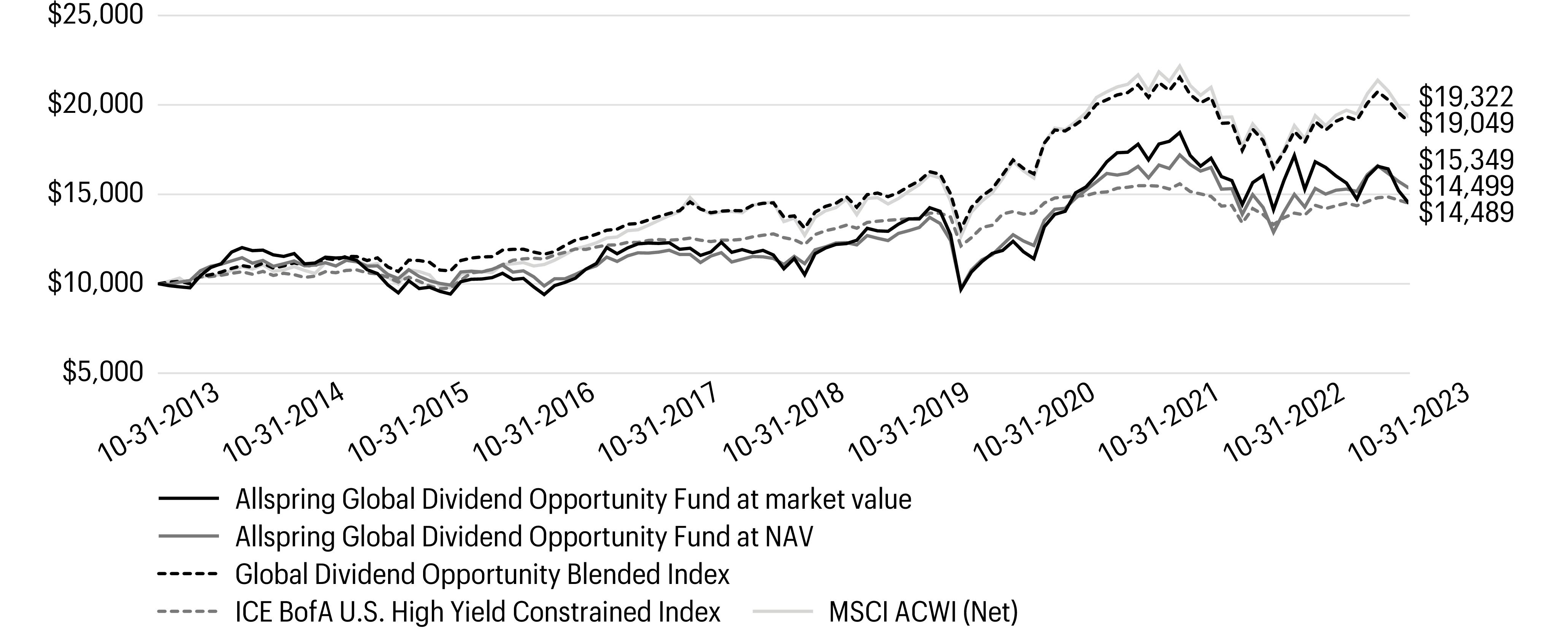

Average annual total returns (%) as of October 31, 20231 | |||

1 year | 5 year | 10 year | |

Based on market value | -8.16 | 5.97 | 3.78 |

Based on net asset value (NAV) | 9.52 | 6.74 | 4.38 |

Global Dividend Opportunity Blended Index2 | 9.65 | 6.76 | 6.66 |

ICE BofA U.S. High Yield Constrained Index3 | 5.89 | 2.88 | 3.78 |

MSCI ACWI (Net)† | 10.50 | 7.47 | 6.81 |

1 | Total returns based on market value are calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Total returns based on NAV are calculated based on the NAV at the beginning of the period and at the end of the period. Dividends and distributions, if any, are assumed for the purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan. |

2 | Source: Allspring Funds Management, LLC. The Global Dividend Opportunity Blended Index is composed of 80% Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) (Net) and 20% ICE BofA U.S. High Yield Constrained Index. Prior to October 15, 2019, the Global Dividend Opportunity Blended Index was composed 65% of the MSCI ACWI (Net), 20% of the ICE BofA U.S. High Yield Constrained Index, and 15% of the ICE BofA Core Fixed Rate Preferred Securities Index. Prior to May 1, 2017, the Global Dividend Opportunity Blended Index was composed 65% of the MSCI ACWI (Net) and 35% of the ICE BofA Core Fixed Rate Preferred Securities Index. You cannot invest directly in an index. |

3 | The ICE BofA U.S. High Yield Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3 but are not in default. The ICE BofA U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure. You cannot invest directly in an index. Copyright 2023. ICE Data Indices, LLC. All rights reserved. |

† | The MSCI ACWI (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. | |

Growth of $10,000 investment as of October 31, 20231 |

1 | The chart compares the performance of the Fund for the most recent ten years with the Global Dividend Opportunity Blended Index, ICE BofA U.S. High Yield Constrained Index and MSCI ACWI (Net). The chart assumes a hypothetical investment of $10,000 investment and reflects all operating expenses of the Fund. |

Comparison of NAV vs. market value1 |

1 | This chart does not reflect any brokerage commissions charged on the purchase and sale of the Fund’s common stock. Dividends and distributions paid by the Fund are included in the Fund’s average annual total returns but have the effect of reducing the Fund’s NAV. |

Ten largest holdings (%) as of October 31, 20231 | |

Microsoft Corp. | 4.59 |

Apple, Inc. | 3.46 |

ConocoPhillips | 2.23 |

Broadcom, Inc. | 2.19 |

Coca-Cola Co. | 2.13 |

Alphabet, Inc. Class A | 2.03 |

Amazon.com, Inc. | 1.96 |

Walmart, Inc. | 1.88 |

NVIDIA Corp. | 1.78 |

Oaktree Specialty Lending Corp. | 1.68 |

1 | Figures represent the percentage of the Fund’s net assets. Holdings are subject to change and may have changed since the date specified. |

The option overlay* is a short-call strategy written on a portion of the Fund’s global equity allocation. The combined global equity and short option portfolio create a global covered call portfolio. Over the long run, a covered call strategy aims to add yield and lower risk compared with a passive allocation to equity. The option overlay is expected to add value in flat-to-down global equity markets and in above-average volatility environments.

Sector allocation as of October 31, 20231 |

1 | Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

Credit quality as of October 31, 20231 |

1 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the portfolio with the ratings depicted in the chart are calculated based on the market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of the three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

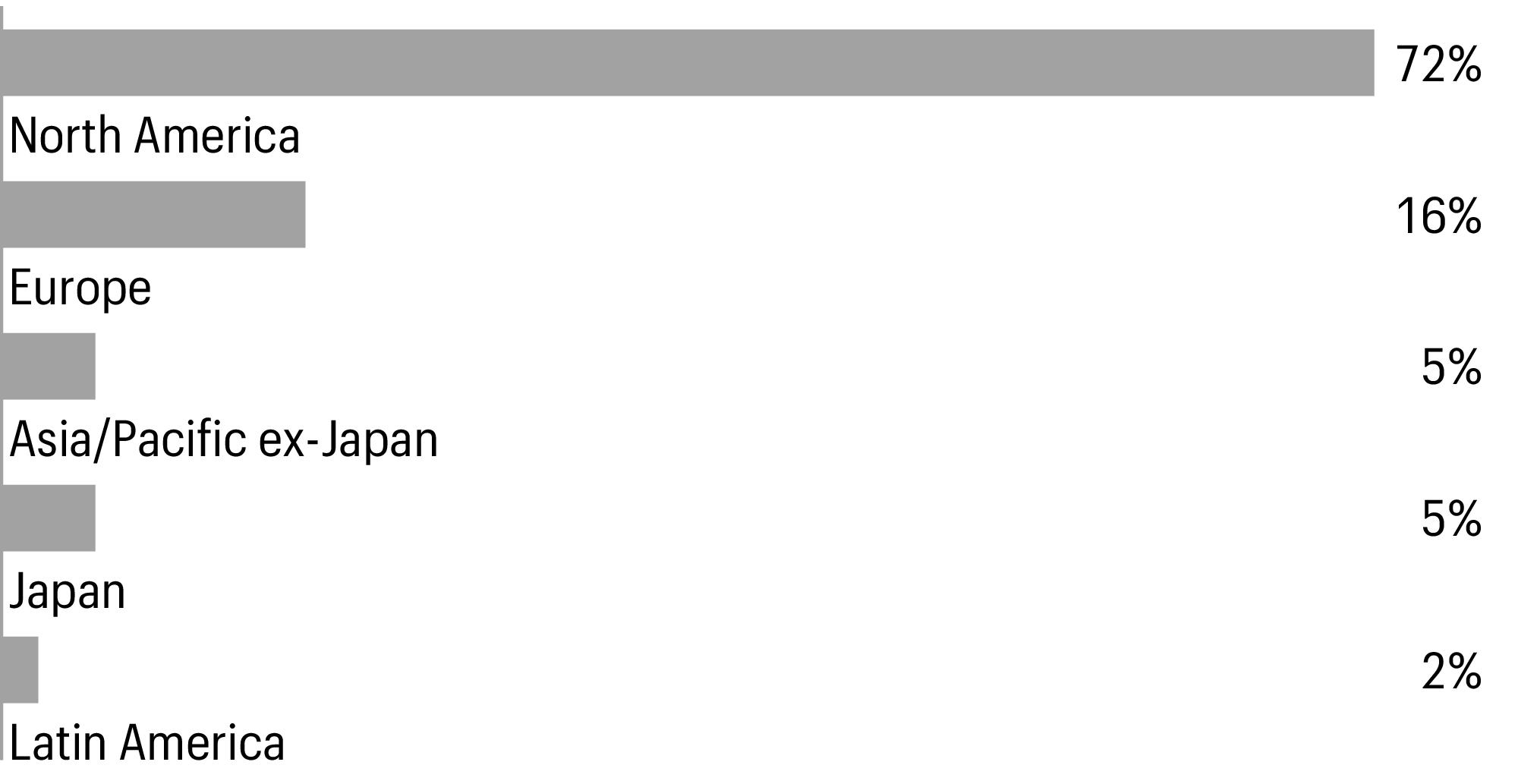

Geographic allocation as of October 31, 20231 |

1 | Figures represent the percentage of the Fund’s long-term investments. Allocations are subject to change and may have changed since the date specified. |

Shares | Value | |||||

Common stocks: 96.76% | ||||||

Australia: 0.80% | ||||||

Fortescue Metals Group Ltd. (Materials, Metals & mining) | 109,381 | $1,556,034 | ||||

Brazil: 1.22% | ||||||

BB Seguridade Participacoes SA (Financials, Insurance) | 392,369 | 2,393,865 | ||||

Canada: 2.49% | ||||||

Open Text Corp. (Information technology, Software) | 69,726 | 2,327,971 | ||||

Pembina Pipeline Corp. (Energy, Oil, gas & consumable fuels) | 82,720 | 2,545,873 | ||||

4,873,844 | ||||||

China: 1.81% | ||||||

China Construction Bank Corp. Class H (Financials, Banks) | 2,823,000 | 1,596,570 | ||||

China Medical System Holdings Ltd. (Health care, Pharmaceuticals) | 1,212,000 | 1,938,106 | ||||

3,534,676 | ||||||

France: 4.08% | ||||||

AXA SA (Financials, Insurance) | 91,035 | 2,697,406 | ||||

BNP Paribas SA (Financials, Banks) | 41,752 | 2,400,907 | ||||

Publicis Groupe SA (Communication services, Media) | 37,819 | 2,879,663 | ||||

7,977,976 | ||||||

Germany: 0.86% | ||||||

Bayerische Motoren Werke AG (Consumer discretionary, Automobiles) | 17,993 | 1,673,427 | ||||

Hong Kong: 0.89% | ||||||

Lenovo Group Ltd. (Information technology, Technology hardware, storage & peripherals) | 1,504,000 | 1,750,252 | ||||

Ireland: 1.30% | ||||||

nVent Electric PLC (Industrials, Electrical equipment) | 52,891 | 2,545,644 | ||||

Japan: 5.54% | ||||||

Hitachi Ltd. (Industrials, Industrial conglomerates) | 50,600 | 3,207,361 | ||||

Honda Motor Co. Ltd. (Consumer discretionary, Automobiles) | 292,800 | 3,000,840 | ||||

Panasonic Holdings Corp. (Consumer discretionary, Household durables) | 228,800 | 2,007,375 | ||||

Sompo Holdings, Inc. (Financials, Insurance) | 60,600 | 2,625,189 | ||||

10,840,765 | ||||||

Luxembourg: 0.00% | ||||||

Intelsat Emergence SA (Communication services, Diversified telecommunication services)♦† | 13 | 0 | ||||

Netherlands: 3.41% | ||||||

ING Groep NV (Financials, Banks) | 166,682 | 2,136,950 | ||||

Signify NV (Industrials, Electrical equipment)144A | 80,329 | 2,082,355 | ||||

Stellantis NV (Consumer discretionary, Automobiles) | 131,177 | 2,450,694 | ||||

6,669,999 | ||||||

Shares | Value | |||||

South Korea: 2.26% | ||||||

Samsung Electronics Co. Ltd. (Information technology, Technology hardware, storage & peripherals) | 34,130 | $1,698,816 | ||||

SK Telecom Co. Ltd. (Communication services, Wireless telecommunication services) | 74,394 | 2,712,921 | ||||

4,411,737 | ||||||

Spain: 1.07% | ||||||

CaixaBank SA (Financials, Banks) | 515,618 | 2,096,266 | ||||

Switzerland: 2.21% | ||||||

Novartis AG (Health care, Pharmaceuticals) | 28,371 | 2,656,080 | ||||

Sandoz Group AG (Health care, Pharmaceuticals)† | 63,768 | 1,657,905 | ||||

4,313,985 | ||||||

Taiwan: 0.79% | ||||||

Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Information technology, Semiconductors & semiconductor equipment) | 18,017 | 1,555,047 | ||||

United Kingdom: 6.41% | ||||||

3i Group PLC (Financials, Capital markets) | 103,137 | 2,431,720 | ||||

Barratt Developments PLC (Consumer discretionary, Household durables) | 315,854 | 1,592,913 | ||||

HSBC Holdings PLC (Financials, Banks) | 255,180 | 1,842,506 | ||||

Man Group PLC (Financials, Capital markets) | 830,824 | 2,221,321 | ||||

Shell PLC (Energy, Oil, gas & consumable fuels) | 78,548 | 2,531,353 | ||||

SSE PLC (Utilities, Electric utilities) | 96,517 | 1,918,136 | ||||

12,537,949 | ||||||

United States: 61.62% | ||||||

Adobe, Inc. (Information technology, Software)†# | 5,280 | 2,809,277 | ||||

AGCO Corp. (Industrials, Machinery)# | 17,579 | 2,015,608 | ||||

Alphabet, Inc. Class A (Communication services, Interactive media & services)†# | 31,950 | 3,964,356 | ||||

Amazon.com, Inc. (Consumer discretionary, Broadline retail)†# | 28,775 | 3,829,665 | ||||

Amgen, Inc. (Health care, Biotechnology)# | 6,952 | 1,777,626 | ||||

Apple, Inc. (Information technology, Technology hardware, storage & peripherals)# | 39,680 | 6,776,154 | ||||

Ares Capital Corp. (Financials, Capital markets)# | 139,927 | 2,653,016 | ||||

AT&T, Inc. (Communication services, Diversified telecommunication services)# | 160,782 | 2,476,043 | ||||

Blackstone Secured Lending Fund (Financials, Capital markets)# | 59,088 | 1,617,239 | ||||

Bristow Group, Inc. (Energy, Energy equipment & services)† | 3,653 | 95,489 | ||||

Brixmor Property Group, Inc. (Real estate, Retail REITs)# | 101,320 | 2,106,443 | ||||

Broadcom, Inc. (Information technology, Semiconductors & semiconductor equipment)# | 5,101 | 4,291,828 | ||||

Cencora, Inc. (Health care, Health care providers & services)# | 10,758 | 1,991,844 | ||||

Cisco Systems, Inc. (Information technology, Communications equipment)# | 44,931 | 2,342,253 | ||||

Citigroup, Inc. (Financials, Banks)# | 64,062 | 2,529,808 | ||||

Coca-Cola Co. (Consumer staples, Beverages)# | 73,817 | 4,169,922 | ||||

Shares | Value | |||||

United States(continued) | ||||||

Comcast Corp. Class A (Communication services, Media)# | 46,872 | $1,935,345 | ||||

ConocoPhillips (Energy, Oil, gas & consumable fuels)# | 36,785 | 4,370,058 | ||||

Corebridge Financial, Inc. (Financials, Financial services)# | 108,981 | 2,179,620 | ||||

Dell Technologies, Inc. Class C (Information technology, Technology hardware, storage & peripherals)# | 28,802 | 1,927,142 | ||||

Devon Energy Corp. (Energy, Oil, gas & consumable fuels)# | 58,360 | 2,717,825 | ||||

Eli Lilly & Co. (Health care, Pharmaceuticals) | 4,864 | 2,694,316 | ||||

Ferguson PLC (Industrials, Trading companies & distributors) | 16,476 | 2,474,695 | ||||

General Motors Co. (Consumer discretionary, Automobiles)# | 78,378 | 2,210,260 | ||||

Gilead Sciences, Inc. (Health care, Biotechnology)# | 28,289 | 2,221,818 | ||||

Intuitive Surgical, Inc. (Health care, Health care equipment & supplies)† | 8,736 | 2,290,754 | ||||

Johnson & Johnson (Health care, Pharmaceuticals) | 16,996 | 2,521,187 | ||||

KLA Corp. (Information technology, Semiconductors & semiconductor equipment) | 6,865 | 3,224,490 | ||||

McDonald’s Corp. (Consumer discretionary, Hotels, restaurants & leisure) | 7,849 | 2,057,772 | ||||

Microsoft Corp. (Information technology, Software) | 26,566 | 8,982,230 | ||||

NVIDIA Corp. (Information technology, Semiconductors & semiconductor equipment) | 8,560 | 3,490,768 | ||||

Oaktree Specialty Lending Corp. (Financials, Capital markets) | 173,273 | 3,292,187 | ||||

Owens Corning (Industrials, Building products) | 13,271 | 1,504,533 | ||||

Pfizer, Inc. (Health care, Pharmaceuticals) | 76,286 | 2,331,300 | ||||

Procter & Gamble Co. (Consumer staples, Household products) | 19,423 | 2,914,033 | ||||

Reliance Steel & Aluminum Co. (Materials, Metals & mining) | 8,253 | 2,099,398 | ||||

Simon Property Group, Inc. (Real estate, Retail REITs) | 23,812 | 2,616,701 | ||||

Tesla, Inc. (Consumer discretionary, Automobiles)† | 6,690 | 1,343,620 | ||||

U.S. Bancorp (Financials, Banks) | 74,884 | 2,387,302 | ||||

UnitedHealth Group, Inc. (Health care, Health care providers & services) | 5,875 | 3,146,415 | ||||

VICI Properties, Inc. (Real estate, Specialized REITs) | 87,182 | 2,432,378 | ||||

Walmart, Inc. (Consumer staples, Consumer staples distribution & retail) | 22,462 | 3,670,515 | ||||

Weyerhaeuser Co. (Real estate, Specialized REITs) | 70,525 | 2,023,362 | ||||

120,506,595 | ||||||

Total common stocks (Cost $169,550,809) | 189,238,061 | |||||

Interest rate | Maturity date | Principal | ||||

Corporate bonds and notes: 19.34% | ||||||

United States: 19.34% | ||||||

Aethon United BR LP/Aethon United Finance Corp. (Energy, Oil & gas)144A | 8.25 % | 2-15-2026 | $ | 365,000 | 362,569 | |

Allied Universal Holdco LLC/Allied Universal Finance Corp. (Consumer, non-cyclical, Commercial services)144A | 6.00 | 6-1-2029 | 355,000 | 256,487 | ||

Allied Universal Holdco LLC/Allied Universal Finance Corp. (Consumer, non-cyclical, Commercial services)144A | 6.63 | 7-15-2026 | 200,000 | 187,300 | ||

AmWINS Group, Inc. (Financial, Insurance)144A | 4.88 | 6-30-2029 | 315,000 | 269,653 | ||

Interest rate | Maturity date | Principal | Value | |||

United States(continued) | ||||||

Arches Buyer, Inc. (Communications, Internet)144A | 4.25 % | 6-1-2028 | $ | 175,000 | $144,952 | |

Arches Buyer, Inc. (Communications, Internet)144A | 6.13 | 12-1-2028 | 290,000 | 234,239 | ||

AssuredPartners, Inc. (Financial, Insurance)144A | 5.63 | 1-15-2029 | 270,000 | 229,049 | ||

AthenaHealth Group, Inc. (Technology, Software)144A | 6.50 | 2-15-2030 | 160,000 | 130,759 | ||

B&G Foods, Inc. (Consumer, non-cyclical, Food) | 5.25 | 9-15-2027 | 90,000 | 74,071 | ||

B&G Foods, Inc. (Consumer, non-cyclical, Food)144A | 8.00 | 9-15-2028 | 390,000 | 380,052 | ||

Bath & Body Works, Inc. (Consumer, cyclical, Retail)144A | 6.63 | 10-1-2030 | 175,000 | 162,014 | ||

Berry Global, Inc. (Industrial, Packaging & containers)144A | 5.63 | 7-15-2027 | 310,000 | 295,903 | ||

Bristow Group, Inc. (Energy, Oil & gas services)144A | 6.88 | 3-1-2028 | 380,000 | 351,975 | ||

BroadStreet Partners, Inc. (Financial, Insurance)144A | 5.88 | 4-15-2029 | 455,000 | 396,693 | ||

Buckeye Partners LP (Energy, Pipelines) | 5.85 | 11-15-2043 | 200,000 | 141,336 | ||

Cablevision Lightpath LLC (Communications, Internet)144A | 3.88 | 9-15-2027 | 145,000 | 117,952 | ||

Cablevision Lightpath LLC (Communications, Internet)144A | 5.63 | 9-15-2028 | 130,000 | 97,277 | ||

Camelot Return Merger Sub, Inc. (Industrial, Building materials)144A | 8.75 | 8-1-2028 | 415,000 | 387,498 | ||

Carnival Holdings Bermuda Ltd. (Consumer, cyclical, Leisure time)144A | 10.38 | 5-1-2028 | 335,000 | 357,182 | ||

Catalent Pharma Solutions, Inc. (Consumer, non-cyclical, Healthcare- services)144A | 5.00 | 7-15-2027 | 245,000 | 218,626 | ||

CCM Merger, Inc. (Consumer, cyclical, Entertainment)144A | 6.38 | 5-1-2026 | 660,000 | 624,741 | ||

CCO Holdings LLC/CCO Holdings Capital Corp. (Communications, Media)144A | 4.25 | 1-15-2034 | 760,000 | 548,950 | ||

CCO Holdings LLC/CCO Holdings Capital Corp. (Communications, Media)144A | 4.50 | 8-15-2030 | 825,000 | 661,514 | ||

CCO Holdings LLC/CCO Holdings Capital Corp. (Communications, Media) | 4.50 | 5-1-2032 | 75,000 | 57,412 | ||

CCO Holdings LLC/CCO Holdings Capital Corp. (Communications, Media)144A | 5.00 | 2-1-2028 | 25,000 | 22,448 | ||

Chart Industries, Inc. (Industrial, Machinery-diversified)144A | 7.50 | 1-1-2030 | 50,000 | 49,099 | ||

Chart Industries, Inc. (Industrial, Machinery-diversified)144A | 9.50 | 1-1-2031 | 85,000 | 87,547 | ||

CHS/Community Health Systems, Inc. (Consumer, non-cyclical, Healthcare-services)144A | 5.25 | 5-15-2030 | 165,000 | 117,175 | ||

CHS/Community Health Systems, Inc. (Consumer, non-cyclical, Healthcare-services)144A | 6.00 | 1-15-2029 | 10,000 | 7,575 | ||

CHS/Community Health Systems, Inc. (Consumer, non-cyclical, Healthcare-services)144A | 8.00 | 3-15-2026 | 125,000 | 114,257 | ||

Churchill Downs, Inc. (Consumer, cyclical, Entertainment)144A | 4.75 | 1-15-2028 | 390,000 | 349,255 | ||

Churchill Downs, Inc. (Consumer, cyclical, Entertainment)144A | 6.75 | 5-1-2031 | 50,000 | 46,125 | ||

Cinemark USA, Inc. (Consumer, cyclical, Entertainment)144A | 5.25 | 7-15-2028 | 140,000 | 120,915 | ||

Cinemark USA, Inc. (Consumer, cyclical, Entertainment)144A | 5.88 | 3-15-2026 | 75,000 | 71,215 | ||

Cinemark USA, Inc. (Consumer, cyclical, Entertainment)144A | 8.75 | 5-1-2025 | 135,000 | 136,423 | ||

Clear Channel Outdoor Holdings, Inc. (Communications, Advertising)144A | 7.50 | 6-1-2029 | 170,000 | 123,741 | ||

Clear Channel Outdoor Holdings, Inc. (Communications, Advertising)144A | 9.00 | 9-15-2028 | 160,000 | 155,837 | ||

Clearwater Paper Corp. (Industrial, Packaging & containers)144A | 5.38 | 2-1-2025 | 380,000 | 383,420 | ||

Cloud Software Group, Inc. (Technology, Software)144A | 6.50 | 3-31-2029 | 180,000 | 158,031 | ||

Cloud Software Group, Inc. (Technology, Software)144A | 9.00 | 9-30-2029 | 190,000 | 161,801 | ||

Clydesdale Acquisition Holdings, Inc. (Industrial, Packaging & containers)144A | 8.75 | 4-15-2030 | 340,000 | 271,007 | ||

Interest rate | Maturity date | Principal | Value | |||

United States(continued) | ||||||

CommScope, Inc. (Communications, Telecommunications)144A | 4.75 % | 9-1-2029 | $ | 100,000 | $68,250 | |

CommScope, Inc. (Communications, Telecommunications)144A | 6.00 | 3-1-2026 | 255,000 | 214,195 | ||

Cooper Tire & Rubber Co. (Consumer, cyclical, Auto parts & equipment) | 7.63 | 3-15-2027 | 190,000 | 184,659 | ||

CoreCivic, Inc. (Consumer, non-cyclical, Commercial services) | 8.25 | 4-15-2026 | 675,000 | 683,389 | ||

CQP Holdco LP/BIP-V Chinook Holdco LLC (Energy, Pipelines)144A | 5.50 | 6-15-2031 | 340,000 | 295,715 | ||

Crocs, Inc. (Consumer, cyclical, Apparel)144A | 4.13 | 8-15-2031 | 100,000 | 75,996 | ||

Crocs, Inc. (Consumer, cyclical, Apparel)144A | 4.25 | 3-15-2029 | 270,000 | 221,400 | ||

CSC Holdings LLC (Communications, Media)144A | 4.63 | 12-1-2030 | 225,000 | 114,102 | ||

CSC Holdings LLC (Communications, Media)144A | 5.75 | 1-15-2030 | 175,000 | 91,555 | ||

CSC Holdings LLC (Communications, Media)144A | 11.25 | 5-15-2028 | 200,000 | 190,763 | ||

Dave & Buster’s, Inc. (Consumer, cyclical, Retail)144A | 7.63 | 11-1-2025 | 75,000 | 74,438 | ||

Directv Financing LLC/Directv Financing Co.-Obligor, Inc. (Communications, Media)144A | 5.88 | 8-15-2027 | 95,000 | 83,242 | ||

DISH Network Corp. (Communications, Media)144A | 11.75 | 11-15-2027 | 140,000 | 138,678 | ||

DT Midstream, Inc. (Energy, Pipelines)144A | 4.13 | 6-15-2029 | 75,000 | 64,486 | ||

DT Midstream, Inc. (Energy, Pipelines)144A | 4.38 | 6-15-2031 | 275,000 | 228,376 | ||

Emerald Debt Merger Sub LLC (Industrial, Building materials)144A | 6.63 | 12-15-2030 | 255,000 | 242,569 | ||

Enact Holdings, Inc. (Financial, Diversified financial services)144A | 6.50 | 8-15-2025 | 585,000 | 574,622 | ||

Encino Acquisition Partners Holdings LLC (Energy, Oil & gas)144A | 8.50 | 5-1-2028 | 475,000 | 463,125 | ||

EnLink Midstream LLC (Energy, Pipelines)144A | 6.50 | 9-1-2030 | 270,000 | 259,165 | ||

EnLink Midstream Partners LP (Energy, Pipelines) | 5.05 | 4-1-2045 | 180,000 | 129,041 | ||

EnLink Midstream Partners LP (Energy, Pipelines) | 5.60 | 4-1-2044 | 200,000 | 157,250 | ||

Enviva Partners LP/Enviva Partners Finance Corp. (Energy, Energy- alternate sources)144A | 6.50 | 1-15-2026 | 913,000 | 641,382 | ||

FirstCash, Inc. (Consumer, cyclical, Retail)144A | 4.63 | 9-1-2028 | 225,000 | 197,348 | ||

Ford Motor Co. (Consumer, cyclical, Auto manufacturers) | 3.25 | 2-12-2032 | 125,000 | 94,344 | ||

Ford Motor Co. (Consumer, cyclical, Auto manufacturers) | 4.75 | 1-15-2043 | 190,000 | 131,980 | ||

Ford Motor Credit Co. LLC (Consumer, cyclical, Auto manufacturers) | 4.39 | 1-8-2026 | 285,000 | 270,152 | ||

Fortress Transportation & Infrastructure Investors LLC (Industrial, Trucking & leasing)144A | 5.50 | 5-1-2028 | 245,000 | 222,782 | ||

Fortress Transportation & Infrastructure Investors LLC (Industrial, Trucking & leasing)144A | 6.50 | 10-1-2025 | 242,000 | 239,608 | ||

G-III Apparel Group Ltd. (Consumer, cyclical, Distribution/wholesale)144A | 7.88 | 8-15-2025 | 375,000 | 371,570 | ||

Gray Escrow II, Inc. (Communications, Media)144A | 5.38 | 11-15-2031 | 675,000 | 425,420 | ||

Gray Television, Inc. (Communications, Media)144A | 4.75 | 10-15-2030 | 275,000 | 176,313 | ||

Hanesbrands, Inc. (Consumer, cyclical, Apparel)144A | 4.88 | 5-15-2026 | 125,000 | 114,852 | ||

Harvest Midstream I LP (Energy, Pipelines)144A | 7.50 | 9-1-2028 | 150,000 | 142,133 | ||

HAT Holdings I LLC/HAT Holdings II LLC (Financial, REITS)144A | 3.38 | 6-15-2026 | 80,000 | 70,417 | ||

HAT Holdings I LLC/HAT Holdings II LLC (Financial, REITS)144A | 6.00 | 4-15-2025 | 65,000 | 63,161 | ||

Hawaiian Airlines Pass-Through Certificates Series 2013-1 Class A (Consumer, cyclical, Airlines) | 3.90 | 1-15-2026 | 149,420 | 135,530 | ||

Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty Ltd. (Consumer, cyclical, Airlines)144A | 5.75 | 1-20-2026 | 210,000 | 155,163 | ||

Hess Midstream Operations LP (Energy, Pipelines)144A | 5.50 | 10-15-2030 | 85,000 | 77,163 | ||

Hilcorp Energy I LP/Hilcorp Finance Co. (Energy, Oil & gas)144A | 5.75 | 2-1-2029 | 215,000 | 193,560 | ||

Hilcorp Energy I LP/Hilcorp Finance Co. (Energy, Oil & gas)144A | 6.00 | 4-15-2030 | 30,000 | 26,633 | ||

Interest rate | Maturity date | Principal | Value | |||

United States(continued) | ||||||

Hilcorp Energy I LP/Hilcorp Finance Co. (Energy, Oil & gas)144A | 6.00 % | 2-1-2031 | $ | 100,000 | $87,597 | |

Hilcorp Energy I LP/Hilcorp Finance Co. (Energy, Oil & gas)144A | 6.25 | 11-1-2028 | 150,000 | 140,241 | ||

Hilcorp Energy I LP/Hilcorp Finance Co. (Energy, Oil & gas)144A | 6.25 | 4-15-2032 | 30,000 | 26,199 | ||

HUB International Ltd. (Financial, Insurance)144A | 5.63 | 12-1-2029 | 105,000 | 90,428 | ||

HUB International Ltd. (Financial, Insurance)144A | 7.25 | 6-15-2030 | 35,000 | 34,141 | ||

IQVIA, Inc. (Consumer, non-cyclical, Healthcare-services)144A | 6.50 | 5-15-2030 | 430,000 | 417,100 | ||

Iron Mountain, Inc. (Financial, REITS)144A | 4.50 | 2-15-2031 | 230,000 | 188,136 | ||

Iron Mountain, Inc. (Financial, REITS)144A | 5.25 | 7-15-2030 | 270,000 | 234,380 | ||

Kinetik Holdings LP (Energy, Pipelines)144A | 5.88 | 6-15-2030 | 245,000 | 224,800 | ||

Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp. (Financial, REITS)144A | 4.25 | 2-1-2027 | 155,000 | 135,406 | ||

Ladder Capital Finance Holdings LLLP/Ladder Capital Finance Corp. (Financial, REITS)144A | 5.25 | 10-1-2025 | 265,000 | 251,902 | ||

LBM Acquisition LLC (Consumer, cyclical, Retail)144A | 6.25 | 1-15-2029 | 95,000 | 75,050 | ||

Live Nation Entertainment, Inc. (Consumer, cyclical, Entertainment)144A | 3.75 | 1-15-2028 | 140,000 | 122,360 | ||

Live Nation Entertainment, Inc. (Consumer, cyclical, Entertainment)144A | 5.63 | 3-15-2026 | 135,000 | 129,288 | ||

LPL Holdings, Inc. (Financial, Diversified financial services)144A | 4.38 | 5-15-2031 | 135,000 | 113,066 | ||

LSF9 Atlantis Holdings LLC/Victra Finance Corp. (Consumer, cyclical, Retail)144A | 7.75 | 2-15-2026 | 400,000 | 361,031 | ||

Macy’s Retail Holdings LLC (Consumer, cyclical, Retail)144A | 5.88 | 4-1-2029 | 255,000 | 224,808 | ||

Macy’s Retail Holdings LLC (Consumer, cyclical, Retail)144A | 6.13 | 3-15-2032 | 265,000 | 218,853 | ||

Match Group Holdings II LLC (Communications, Internet)144A | 5.63 | 2-15-2029 | 695,000 | 627,350 | ||

McAfee Corp. (Technology, Computers)144A | 7.38 | 2-15-2030 | 110,000 | 87,997 | ||

Michaels Cos., Inc. (Consumer, cyclical, Retail)144A | 7.88 | 5-1-2029 | 260,000 | 144,950 | ||

MPH Acquisition Holdings LLC (Consumer, non-cyclical, Commercial services)144A | 5.75 | 11-1-2028 | 370,000 | 275,805 | ||

MPT Operating Partnership LP/MPT Finance Corp. (Financial, REITS) | 3.50 | 3-15-2031 | 75,000 | 45,469 | ||

Nabors Industries Ltd. (Energy, Oil & gas)144A | 7.50 | 1-15-2028 | 205,000 | 181,056 | ||

Nabors Industries, Inc. (Energy, Oil & gas)144A | 7.38 | 5-15-2027 | 245,000 | 227,779 | ||

Nationstar Mortgage Holdings, Inc. (Financial, Diversified financial services)144A | 5.00 | 2-1-2026 | 240,000 | 223,079 | ||

Nationstar Mortgage Holdings, Inc. (Financial, Diversified financial services)144A | 6.00 | 1-15-2027 | 165,000 | 153,371 | ||

Navient Corp. (Financial, Diversified financial services) | 5.00 | 3-15-2027 | 135,000 | 118,575 | ||

Navient Corp. (Financial, Diversified financial services) | 5.88 | 10-25-2024 | 85,000 | 82,998 | ||

Navient Corp. (Financial, Diversified financial services)%% | 11.50 | 3-15-2031 | 20,000 | 19,962 | ||

NCL Corp. Ltd. (Consumer, cyclical, Leisure time)144A | 5.88 | 3-15-2026 | 170,000 | 152,575 | ||

NCL Corp. Ltd. (Consumer, cyclical, Leisure time)144A | 5.88 | 2-15-2027 | 140,000 | 128,866 | ||

NCL Corp. Ltd. (Consumer, cyclical, Leisure time)144A | 7.75 | 2-15-2029 | 130,000 | 113,463 | ||

Newell Brands, Inc. (Consumer, cyclical, Housewares) | 5.20 | 4-1-2026 | 260,000 | 245,480 | ||

Nexstar Media, Inc. (Communications, Media)144A | 5.63 | 7-15-2027 | 140,000 | 125,994 | ||

NextEra Energy Operating Partners LP (Utilities, Electric)144A | 4.25 | 9-15-2024 | 2,000 | 1,890 | ||

NextEra Energy Operating Partners LP (Utilities, Electric)144A | 4.50 | 9-15-2027 | 140,000 | 125,355 | ||

NMG Holding Co., Inc./Neiman Marcus Group LLC (Consumer, cyclical, Retail)144A | 7.13 | 4-1-2026 | 310,000 | 289,978 | ||

NSG Holdings LLC/NSG Holdings, Inc. (Utilities, Electric)144A | 7.75 | 12-15-2025 | 189,987 | 188,562 | ||

Oceaneering International, Inc. (Energy, Oil & gas services) | 6.00 | 2-1-2028 | 275,000 | 252,313 | ||

Interest rate | Maturity date | Principal | Value | |||

United States(continued) | ||||||

Oceaneering International, Inc. (Energy, Oil & gas services)144A | 6.00 % | 2-1-2028 | $ | 45,000 | $41,288 | |

OneMain Finance Corp. (Financial, Diversified financial services) | 5.38 | 11-15-2029 | 100,000 | 82,224 | ||

OneMain Finance Corp. (Financial, Diversified financial services) | 7.13 | 3-15-2026 | 125,000 | 121,400 | ||

Oppenheimer Holdings, Inc. (Financial, Diversified financial services) | 5.50 | 10-1-2025 | 300,000 | 285,000 | ||

Outfront Media Capital LLC/Outfront Media Capital Corp. (Communications, Advertising)144A | 4.63 | 3-15-2030 | 360,000 | 288,900 | ||

Outfront Media Capital LLC/Outfront Media Capital Corp. (Communications, Advertising)144A | 5.00 | 8-15-2027 | 75,000 | 66,621 | ||

Owens-Brockway Glass Container, Inc. (Industrial, Packaging & containers)144A | 7.25 | 5-15-2031 | 170,000 | 155,550 | ||

Pattern Energy Operations LP/Pattern Energy Operations, Inc. (Utilities, Electric)144A | 4.50 | 8-15-2028 | 575,000 | 501,215 | ||

PECF USS Intermediate Holding III Corp. (Consumer, non-cyclical, Commercial services)144A | 8.00 | 11-15-2029 | 360,000 | 170,777 | ||

Pediatrix Medical Group, Inc. (Consumer, non-cyclical, Healthcare- services)144A | 5.38 | 2-15-2030 | 130,000 | 112,117 | ||

PetSmart, Inc./PetSmart Finance Corp. (Consumer, cyclical, Retail)144A | 4.75 | 2-15-2028 | 215,000 | 190,249 | ||

PetSmart, Inc./PetSmart Finance Corp. (Consumer, cyclical, Retail)144A | 7.75 | 2-15-2029 | 260,000 | 239,367 | ||

PG&E Corp. (Utilities, Electric) | 5.25 | 7-1-2030 | 785,000 | 687,582 | ||

PRA Group, Inc. (Financial, Diversified financial services)144A | 5.00 | 10-1-2029 | 445,000 | 295,247 | ||

Prime Security Services Borrower LLC/Prime Finance, Inc. (Consumer, non-cyclical, Commercial services)144A | 6.25 | 1-15-2028 | 175,000 | 162,278 | ||

Rocket Mortgage LLC/Rocket Mortgage Co.-Issuer, Inc. (Financial, Diversified financial services)144A | 4.00 | 10-15-2033 | 120,000 | 88,200 | ||

Rockies Express Pipeline LLC (Energy, Pipelines)144A | 4.95 | 7-15-2029 | 65,000 | 57,286 | ||

Rockies Express Pipeline LLC (Energy, Pipelines)144A | 6.88 | 4-15-2040 | 300,000 | 249,694 | ||

Sabre Global, Inc. (Consumer, non-cyclical, Commercial services)144A | 8.63 | 6-1-2027 | 50,000 | 41,468 | ||

Sabre Global, Inc. (Consumer, non-cyclical, Commercial services)144A | 11.25 | 12-15-2027 | 485,000 | 431,886 | ||

Scripps Escrow II, Inc. (Communications, Media)144A | 5.38 | 1-15-2031 | 525,000 | 325,983 | ||

Scripps Escrow, Inc. (Communications, Media)144A | 5.88 | 7-15-2027 | 160,000 | 119,600 | ||

Seagate HDD (Technology, Computers) | 4.13 | 1-15-2031 | 226,000 | 179,066 | ||

Seagate HDD (Technology, Computers)144A | 8.25 | 12-15-2029 | 35,000 | 35,568 | ||

Seagate HDD (Technology, Computers)144A | 8.50 | 7-15-2031 | 220,000 | 223,864 | ||

Select Medical Corp. (Consumer, non-cyclical, Healthcare- services)144A | 6.25 | 8-15-2026 | 200,000 | 194,524 | ||

Service Corp. International (Consumer, non-cyclical, Commercial services) | 7.50 | 4-1-2027 | 10,000 | 10,056 | ||

Service Properties Trust (Financial, REITS) | 4.35 | 10-1-2024 | 135,000 | 129,408 | ||

Service Properties Trust (Financial, REITS) | 5.25 | 2-15-2026 | 33,000 | 29,514 | ||

Service Properties Trust (Financial, REITS) | 7.50 | 9-15-2025 | 70,000 | 68,010 | ||

Sirius XM Radio, Inc. (Communications, Media)144A | 4.13 | 7-1-2030 | 425,000 | 337,456 | ||

Southwestern Energy Co. (Energy, Oil & gas) | 4.75 | 2-1-2032 | 155,000 | 133,298 | ||

Southwestern Energy Co. (Energy, Oil & gas) | 8.38 | 9-15-2028 | 125,000 | 129,066 | ||

Spirit AeroSystems, Inc. (Industrial, Aerospace/defense)144A | 7.50 | 4-15-2025 | 370,000 | 369,087 | ||

Spirit AeroSystems, Inc. (Industrial, Aerospace/defense)144A | 9.38 | 11-30-2029 | 180,000 | 184,848 | ||

Spirit Loyalty Cayman Ltd./Spirit IP Cayman Ltd. (Consumer, cyclical, Airlines)144A | 8.00 | 9-20-2025 | 130,000 | 95,875 | ||

Interest rate | Maturity date | Principal | Value | |||

United States(continued) | ||||||

SS&C Technologies, Inc. (Technology, Software)144A | 5.50 % | 9-30-2027 | $ | 175,000 | $164,198 | |

Star Parent, Inc. (Consumer, non-cyclical, Healthcare-services)144A | 9.00 | 10-1-2030 | 255,000 | 253,058 | ||

Starwood Property Trust, Inc. (Financial, REITS)144A | 4.38 | 1-15-2027 | 250,000 | 214,478 | ||

Starwood Property Trust, Inc. (Financial, REITS) | 4.75 | 3-15-2025 | 90,000 | 86,121 | ||

Tallgrass Energy Partners LP/Tallgrass Energy Finance Corp. (Energy, Pipelines)144A | 6.00 | 12-31-2030 | 315,000 | 265,178 | ||

Tallgrass Energy Partners LP/Tallgrass Energy Finance Corp. (Energy, Pipelines)144A | 6.00 | 9-1-2031 | 85,000 | 71,525 | ||

Taylor Morrison Communities, Inc. (Consumer, cyclical, Home builders)144A | 5.13 | 8-1-2030 | 60,000 | 50,424 | ||

Tenet Healthcare Corp. (Consumer, non-cyclical, Healthcare-services) | 4.88 | 1-1-2026 | 150,000 | 143,761 | ||

Tenet Healthcare Corp. (Consumer, non-cyclical, Healthcare- services)144A | 6.75 | 5-15-2031 | 410,000 | 389,350 | ||

TerraForm Power Operating LLC (Energy, Energy-alternate sources)144A | 4.75 | 1-15-2030 | 175,000 | 147,875 | ||

TerraForm Power Operating LLC (Energy, Energy-alternate sources)144A | 5.00 | 1-31-2028 | 625,000 | 572,575 | ||

TK Elevator U.S. Newco, Inc. (Industrial, Machinery-diversified)144A | 5.25 | 7-15-2027 | 345,000 | 314,104 | ||

Townsquare Media, Inc. (Communications, Media)144A | 6.88 | 2-1-2026 | 455,000 | 420,628 | ||

TransDigm, Inc. (Industrial, Aerospace/defense) | 7.50 | 3-15-2027 | 375,000 | 374,541 | ||

Tri Pointe Group, Inc./Tri Pointe Homes, Inc. (Consumer, cyclical, Home builders) | 5.88 | 6-15-2024 | 130,000 | 128,696 | ||

Tri Pointe Homes, Inc. (Consumer, cyclical, Home builders) | 5.70 | 6-15-2028 | 190,000 | 169,167 | ||

Uber Technologies, Inc. (Communications, Internet)144A | 4.50 | 8-15-2029 | 380,000 | 335,135 | ||

Uber Technologies, Inc. (Communications, Internet)144A | 8.00 | 11-1-2026 | 175,000 | 176,234 | ||

United Wholesale Mortgage LLC (Financial, Diversified financial services)144A | 5.50 | 11-15-2025 | 100,000 | 95,048 | ||

United Wholesale Mortgage LLC (Financial, Diversified financial services)144A | 5.50 | 4-15-2029 | 130,000 | 108,875 | ||

Upbound Group, Inc. (Consumer, non-cyclical, Commercial services)144A | 6.38 | 2-15-2029 | 360,000 | 309,600 | ||

Venture Global Calcasieu Pass LLC (Energy, Pipelines)144A | 6.25 | 1-15-2030 | 360,000 | 339,609 | ||

Venture Global LNG, Inc. (Energy, Pipelines)144A | 8.38 | 6-1-2031 | 330,000 | 314,904 | ||

Vistra Corp. (5 Year Treasury Constant Maturity+5.74%) (Utilities, Electric)144Aʊ± | 7.00 | 12-15-2026 | 275,000 | 250,250 | ||

Vistra Operations Co. LLC (Utilities, Electric)144A | 5.63 | 2-15-2027 | 210,000 | 197,613 | ||

Vistra Operations Co. LLC (Utilities, Electric)144A | 7.75 | 10-15-2031 | 170,000 | 164,087 | ||

Werner FinCo LP/Werner FinCo, Inc. (Industrial, Hand/machine tools)144A | 11.50 | 6-15-2028 | 315,000 | 318,065 | ||

Werner FinCo LP/Werner FinCo, Inc. (PIK at 14.50%) (Industrial, Hand/machine tools)144A¥ | 14.50 | 10-15-2028 | 427,244 | 348,204 | ||

Total corporate bonds and notes (Cost $41,394,009) | 37,813,130 | |||||

Loans: 1.58% | ||||||

Asurion LLC (U.S. SOFR 1 Month+5.25%) (Financial, Insurance)± | 10.69 | 1-31-2028 | 45,000 | 38,973 | ||

Asurion LLC (U.S. SOFR 1 Month+3.25%) (Financial, Insurance)± | 8.69 | 12-23-2026 | 447,803 | 432,130 | ||

Carnival Corp. (U.S. SOFR 1 Month+3.00%) (Consumer, cyclical, Leisure time)ౠ| 8.34 | 8-8-2027 | 24,938 | 24,470 | ||

Interest rate | Maturity date | Principal | Value | |||

Loans(continued) | ||||||

Clear Channel Outdoor Holdings, Inc. (U.S. SOFR 3 Month+3.50%) (Communications, Advertising)± | 9.14 % | 8-21-2026 | 94,023 | $90,105 | ||

Geo Group, Inc. (U.S. SOFR 1 Month+7.13%) (Consumer, non-cyclical, Commercial services)± | 12.45 | 3-23-2027 | 722,718 | 734,462 | ||

GIP II Blue Holding LP (U.S. SOFR 1 Month+4.50%) (Energy, Pipelines)± | 9.82 | 9-29-2028 | 146,395 | 146,368 | ||

GIP III Stetson I LP (U.S. SOFR 1 Month+4.25%) (Energy, Pipelines)± | 9.57 | 10-5-2028 | 267,395 | 265,473 | ||

HUB International Ltd. (U.S. SOFR 3 Month+4.25%) (Financial, Insurance)± | 9.66 | 6-20-2030 | 120,000 | 119,915 | ||

Hubbard Radio LLC (1 Month LIBOR+4.25%) (Communications, Media)± | 9.69 | 3-28-2025 | 136,633 | 114,943 | ||

M6 ETX Holdings II MidCo LLC (U.S. SOFR 1 Month+4.50%) (Energy, Pipelines)± | 9.92 | 9-19-2029 | 169,100 | 167,862 | ||

Mileage Plus Holdings LLC (U.S. SOFR 3 Month+5.25%) (Consumer, cyclical, Airlines)± | 10.80 | 6-21-2027 | 221,250 | 227,675 | ||

MPH Acquisition Holdings LLC (U.S. SOFR 3 Month+4.25%) (Consumer, non-cyclical, Commercial services)± | 9.92 | 9-1-2028 | 145,000 | 134,286 | ||

PECF USS Intermediate Holding III Corp. (U.S. SOFR 3 Month+4.25%) (Consumer, non-cyclical, Commercial services)± | 9.89 | 12-15-2028 | 64,835 | 48,813 | ||

Resolute Investment Managers, Inc. (3 Month LIBOR+4.25%) (Financial, Diversified financial services)± | 9.79 | 4-30-2024 | 164,031 | 101,289 | ||

Resolute Investment Managers, Inc. (U.S. SOFR 3 Month+8.00%) (Financial, Diversified financial services)ౠ| 13.38 | 4-30-2025 | 148,199 | 22,230 | ||

SkyMiles IP Ltd. (U.S. SOFR 3 Month+3.75%) (Consumer, cyclical, Airlines)± | 9.17 | 10-20-2027 | 151,579 | 155,085 | ||

Sotheby’s (U.S. SOFR 3 Month+4.50%) (Consumer, non-cyclical, Commercial services)± | 10.16 | 1-15-2027 | 174,554 | 168,498 | ||

Surgery Center Holdings, Inc. (U.S. SOFR 1 Month+3.75%) (Consumer, non-cyclical, Healthcare-services)± | 9.20 | 8-31-2026 | 60,868 | 60,775 | ||

TK Elevator U.S. Newco, Inc. (6 Month LIBOR+3.50%) (Industrial, Machinery-diversified)± | 9.38 | 7-30-2027 | 46,357 | 46,004 | ||

Total loans (Cost $3,282,341) | 3,099,356 | |||||

Dividend rate | Shares | |||||

Preferred stocks: 1.34% | ||||||

Brazil: 1.04% | ||||||

Cia Energetica de Minas Gerais (Utilities, Electric utilities) | 0.02 | 875,003 | 2,037,494 | |||

United States: 0.30% | ||||||

CoBank ACB (U.S. SOFR 3 Month+1.44%) (Financials, Banks)144A± | 6.85 | 750 | 581,250 | |||

Total preferred stocks (Cost $2,751,079) | 2,618,744 | |||||

Expiration date | Shares | Value | ||||

Rights: 0.00% | ||||||

Luxembourg: 0.00% | ||||||

Intelsat Jackson Holdings SA Series A Contingent Value Rights (Communication services, Diversified telecommunication services)♦† | 12-5-2025 | 637 | $0 | |||

Intelsat Jackson Holdings SA Series B Contingent Value Rights (Communication services, Diversified telecommunication services)♦† | 12-5-2025 | 637 | 0 | |||

Total rights (Cost $0) | 0 | |||||

Interest rate | Maturity date | Principal | ||||

Yankee corporate bonds and notes: 2.90% | ||||||

Canada: 0.52% | ||||||

Air Canada Pass-Through Trust Series 2020-1 Class C (Consumer, cyclical, Airlines)144A | 10.50 % | 7-15-2026 | $ | 405,000 | 429,806 | |

Bombardier, Inc. (Industrial, Aerospace/defense)144A | 7.13 | 6-15-2026 | 235,000 | 226,114 | ||

Northriver Midstream Finance LP (Energy, Pipelines)144A | 5.63 | 2-15-2026 | 385,000 | 363,825 | ||

1,019,745 | ||||||

France: 0.23% | ||||||

Altice France SA (Communications, Telecommunications)144A | 8.13 | 2-1-2027 | 295,000 | 248,675 | ||

Banijay Entertainment SASU (Consumer, cyclical, Entertainment)144A | 8.13 | 5-1-2029 | 200,000 | 194,997 | ||

443,672 | ||||||

India: 0.16% | ||||||

Fly Leasing Ltd. (Industrial, Trucking & leasing)144A | 7.00 | 10-15-2024 | 340,000 | 312,800 | ||

Ireland: 0.17% | ||||||

Castlelake Aviation Finance DAC (Financial, Diversified financial services)144A | 5.00 | 4-15-2027 | 385,000 | 339,683 | ||

Liberia: 0.48% | ||||||

Royal Caribbean Cruises Ltd. (Consumer, cyclical, Leisure time)144A | 5.38 | 7-15-2027 | 30,000 | 27,647 | ||

Royal Caribbean Cruises Ltd. (Consumer, cyclical, Leisure time)144A | 5.50 | 4-1-2028 | 430,000 | 392,096 | ||

Royal Caribbean Cruises Ltd. (Consumer, cyclical, Leisure time)144A | 9.25 | 1-15-2029 | 155,000 | 161,795 | ||

Royal Caribbean Cruises Ltd. (Consumer, cyclical, Leisure time)144A | 11.63 | 8-15-2027 | 325,000 | 352,484 | ||

934,022 | ||||||

Luxembourg: 0.00% | ||||||

Intelsat Jackson Holdings SA (Communications, Telecommunications)♦† | 5.50 | 8-1-2023 | 650,000 | 0 | ||

Marshall Islands: 0.10% | ||||||

Navios Maritime Holdings, Inc. (Industrial, Transportation)♦‡ | 9.75 | 4-15-2024 | 244,225 | 193,048 | ||

Mexico: 0.10% | ||||||

Borr IHC Ltd./Borr Finance LLC (Energy, Oil & gas)144A%% | 10.00 | 11-15-2028 | 200,000 | 199,046 | ||

Interest rate | Maturity date | Principal | Value | |||

Netherlands: 0.21% | ||||||

Sensata Technologies BV (Industrial, Electronics)144A | 4.00 % | 4-15-2029 | $ | 160,000 | $136,017 | |

Sensata Technologies BV (Industrial, Electronics)144A | 5.88 | 9-1-2030 | 170,000 | 155,267 | ||

Teva Pharmaceutical Finance Netherlands III BV (Consumer, non- cyclical, Pharmaceuticals) | 6.75 | 3-1-2028 | 115,000 | 109,945 | ||

401,229 | ||||||

Panama: 0.29% | ||||||

Carnival Corp. (Consumer, cyclical, Leisure time)144A | 4.00 | 8-1-2028 | 170,000 | 147,869 | ||

Carnival Corp. (Consumer, cyclical, Leisure time)144A | 6.00 | 5-1-2029 | 300,000 | 253,439 | ||

Carnival Corp. (Consumer, cyclical, Leisure time)144A | 7.00 | 8-15-2029 | 70,000 | 68,638 | ||

Carnival Corp. (Consumer, cyclical, Leisure time)144A | 7.63 | 3-1-2026 | 95,000 | 92,377 | ||

562,323 | ||||||

Switzerland: 0.07% | ||||||

VistaJet Malta Finance PLC/Vista Management Holding, Inc. (Consumer, cyclical, Airlines)144A | 9.50 | 6-1-2028 | 190,000 | 145,573 | ||

United Kingdom: 0.34% | ||||||

Drax Finco PLC (Utilities, Electric)144A | 6.63 | 11-1-2025 | 435,000 | 418,688 | ||

Macquarie Airfinance Holdings Ltd. (Financial, Diversified financial services)144A | 8.38 | 5-1-2028 | 240,000 | 239,220 | ||

657,908 | ||||||

United States: 0.23% | ||||||

American Airlines, Inc./AAdvantage Loyalty IP Ltd. (Consumer, cyclical, Airlines)144A | 5.50 | 4-20-2026 | 70,833 | 68,882 | ||

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC (Industrial, Packaging & containers)144A | 4.00 | 9-1-2029 | 150,000 | 112,510 | ||

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC (Industrial, Packaging & containers)144A | 6.00 | 6-15-2027 | 225,000 | 212,629 | ||

NCL Corp. Ltd. (Consumer, cyclical, Leisure time)144A | 8.13 | 1-15-2029 | 60,000 | 58,620 | ||

452,641 | ||||||

Total yankee corporate bonds and notes (Cost $5,960,294) | 5,661,690 | |||||

Yield | Shares | |||||

Short-term investments: 2.55% | ||||||

Investment companies: 2.55% | ||||||

Allspring Government Money Market Fund Select Class♠∞## | 5.29 | 4,982,016 | 4,982,016 | |||

Total short-term investments (Cost $4,982,016) | 4,982,016 | |||||

Total investments in securities (Cost $227,920,548) | 124.47 % | 243,412,997 | ||||

Other assets and liabilities, net | (24.47 ) | (47,848,029 ) | ||||

Total net assets | 100.00 % | $195,564,968 | ||||

♦ | The security is fair valued in accordance with procedures approved by the Board of Trustees. |

† | Non-income-earning security |

144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

# | All or a portion of this security is segregated as collateral for investments in derivative instruments. |

%% | The security is purchased on a when-issued basis. |

ʊ | Security is perpetual in nature and has no stated maturity date. The date shown reflects the next call date. |

± | Variable rate investment. The rate shown is the rate in effect at period end. |

¥ | A payment-in-kind (PIK) security is a security in which the issuer may make interest or dividend payments in cash or additional securities or a combination of both. The rate shown is the rate in effect at period end. |

‡ | Security is valued using significant unobservable inputs. |

♠ | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

∞ | The rate represents the 7-day annualized yield at period end. |

## | All or a portion of this security is segregated as collateral for when-issued securities. |

Abbreviations: | |

ADR | American depositary receipt |

LIBOR | London Interbank Offered Rate |

REIT | Real estate investment trust |

SOFR | Secured Overnight Financing Rate |

Value, beginning of period | Purchases | Sales proceeds | Net realized gains (losses) | Net change in unrealized gains (losses) | Value, end of period | Shares, end of period | Income from affiliated securities | |

Short-term investments | ||||||||

Allspring Government Money Market Fund Select Class | $4,000,944 | $63,159,508 | $(62,178,436 ) | $0 | $0 | $4,982,016 | 4,982,016 | $186,334 |

Description | Counterparty | Number of contracts | Notional amount | Exercise price | Expiration date | Value |

Call | ||||||

Dow Jones Industrial Average | Morgan Stanley Co. | (13 ) | $(487,500 ) | $375.00 | 12-15-2023 | $(1 ) |

Dow Jones Industrial Average | Morgan Stanley Co. | (18 ) | (657,000 ) | 365.00 | 12-15-2023 | (23 ) |

iShares MSCI EAFE ETF | Morgan Stanley Co. | (148 ) | (976,800 ) | 66.00 | 11-3-2023 | (17,168 ) |

iShares MSCI EAFE ETF | Morgan Stanley Co. | (110 ) | (737,000 ) | 67.00 | 11-10-2023 | (25,850 ) |

iShares MSCI EAFE ETF | Morgan Stanley Co. | (304 ) | (2,067,200 ) | 68.00 | 11-17-2023 | (15,504 ) |

iShares MSCI EAFE ETF | Morgan Stanley Co. | (19 ) | (121,600 ) | 64.00 | 11-24-2023 | (7,742 ) |

iShares MSCI EAFE ETF | Morgan Stanley Co. | (238 ) | (1,547,000 ) | 65.00 | 12-29-2023 | (73,185 ) |

iShares MSCI EAFE ETF | Morgan Stanley Co. | (520 ) | (3,952,000 ) | 76.00 | 1-19-2024 | (1,828 ) |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (168 ) | (663,600 ) | 39.50 | 11-3-2023 | 0 |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (91 ) | (341,250 ) | 37.50 | 11-3-2023 | (455 ) |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (175 ) | (665,000 ) | 38.00 | 11-17-2023 | (2,625 ) |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (343 ) | (1,457,750 ) | 42.50 | 11-17-2023 | 0 |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (52 ) | (192,400 ) | 37.00 | 11-17-2023 | (2,444 ) |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (978 ) | (3,814,200 ) | 39.00 | 11-24-2023 | (6,357 ) |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (283 ) | (1,018,800 ) | 36.00 | 12-29-2023 | (43,582 ) |

iShares MSCI Emerging Markets ETF | Morgan Stanley Co. | (211 ) | (738,500 ) | 35.00 | 12-29-2023 | (46,947 ) |

Nasdaq 100 Stock Index | Morgan Stanley Co. | (1 ) | (1,592,500 ) | 15,925.00 | 11-10-2023 | (21 ) |

Russell 2000 Index | Morgan Stanley Co. | (51 ) | (9,358,500 ) | 1,835.00 | 11-3-2023 | 0 |

Russell 2000 Index | Morgan Stanley Co. | (43 ) | (7,890,500 ) | 1,835.00 | 11-10-2023 | (64 ) |

Description | Counterparty | Number of contracts | Notional amount | Exercise price | Expiration date | Value |

Call (continued) | ||||||

Russell 2000 Index | Morgan Stanley Co. | (1 ) | $(183,000 ) | $1,830.00 | 11-17-2023 | $(18 ) |

Russell 2000 Index | Morgan Stanley Co. | (46 ) | (9,844,000 ) | 2,140.00 | 11-17-2023 | 0 |

Russell 2000 Index | Morgan Stanley Co. | (8 ) | (1,472,000 ) | 1,840.00 | 11-17-2023 | (114 ) |

Russell 2000 Index | Morgan Stanley Co. | (31 ) | (5,564,500 ) | 1,795.00 | 11-24-2023 | (4,573 ) |

S&P 500 Index | Morgan Stanley Co. | (3 ) | (1,252,500 ) | 4,175.00 | 11-3-2023 | (11,970 ) |

S&P 500 Index | Morgan Stanley Co. | (5 ) | (2,167,500 ) | 4,335.00 | 11-10-2023 | (2,000 ) |

S&P 500 Index | Morgan Stanley Co. | (8 ) | (3,372,000 ) | 4,215.00 | 11-17-2023 | (39,840 ) |

S&P 500 Index | Morgan Stanley Co. | (17 ) | (7,650,000 ) | 4,500.00 | 11-17-2023 | (765 ) |

S&P 500 Index | Morgan Stanley Co. | (4 ) | (1,594,000 ) | 3,985.00 | 11-24-2023 | (91,540 ) |

S&P 500 Index | Morgan Stanley Co. | (1 ) | (444,000 ) | 4,440.00 | 11-24-2023 | (270 ) |

S&P 500 Index | Morgan Stanley Co. | (4 ) | (1,730,000 ) | 4,325.00 | 11-30-2023 | (9,300 ) |

S&P 500 Index | Morgan Stanley Co. | (25 ) | (12,375,000 ) | 4,950.00 | 12-15-2023 | (500 ) |

S&P 500 Index | Morgan Stanley Co. | (13 ) | (6,370,000 ) | 4,900.00 | 12-15-2023 | (325 ) |

S&P 500 Index | Morgan Stanley Co. | (1 ) | (481,500 ) | 4,815.00 | 12-29-2023 | (63 ) |

S&P 500 Index | Morgan Stanley Co. | (2 ) | (820,000 ) | 4,100.00 | 12-29-2023 | (36,660 ) |

SPDR Euro STOXX 50 ETF | Morgan Stanley Co. | (114 ) | (444,600 ) | 39.00 | 11-17-2023 | (27,132 ) |

SPDR Euro STOXX 50 ETF | Morgan Stanley Co. | (116 ) | (458,200 ) | 39.50 | 11-24-2023 | (23,722 ) |

$(492,588 ) |

Assets | |

Investments in unaffiliated securities, at value (cost $222,938,532) | $238,430,981 |

Investments in affiliated securities, at value (cost $4,982,016) | 4,982,016 |

Foreign currency, at value (cost $769) | 765 |

Receivable for dividends and interest | 1,710,060 |

Receivable for investments sold | 92,342 |

Prepaid expenses and other assets | 99,552 |

Total assets | 245,315,716 |

Liabilities | |

Secured borrowing payable | 47,500,000 |

Payable for investments purchased | 869,586 |

Written options, at value (premiums received $1,148,767) | 492,588 |

Payable for when-issued transactions | 217,712 |

Advisory fee payable | 177,508 |

Payable for Fund shares repurchased | 52,129 |

Overdraft due to custodian bank | 14,129 |

Administration fee payable | 10,442 |

Trustees’ fees and expenses payable | 4,417 |

Accrued expenses and other liabilities | 412,237 |

Total liabilities | 49,750,748 |

Total net assets | $195,564,968 |

Net assets consist of | |

Paid-in capital | $339,600,763 |

Total distributable loss | (144,035,795 ) |

Total net assets | $195,564,968 |

Net asset value per share | |

Based on $195,564,968 divided by 43,243,393 shares issued and outstanding (unlimited number of shares authorized) | $4.52 |

Investment income | |

Dividends (net of foreign withholdings taxes of $504,749) | $8,934,902 |

Interest (net of foreign withholding taxes of $149) | 3,504,137 |

Income from affiliated securities | 186,334 |

Total investment income | 12,625,373 |

Expenses | |

Advisory fee | 2,148,027 |

Administration fee | 126,354 |

Custody and accounting fees | 87,161 |

Professional fees | 150,278 |

Shareholder report expenses | 134,549 |

Trustees’ fees and expenses | 28,974 |

Transfer agent fees | 39,460 |

Interest expense | 2,660,950 |

Dividends on securities sold short | 719,407 |

Other fees and expenses | 14,295 |

Total expenses | 6,109,455 |

Net investment income | 6,515,918 |

Realized and unrealized gains (losses) on investments | |

Net realized gains (losses) on | |

Unaffiliated securities | (6,050,908 ) |

Foreign currency and foreign currency translations | (35,732 ) |

Written options | 3,154,592 |

Net realized losses on investments | (2,932,048 ) |

Net change in unrealized gains (losses) on | |

Unaffiliated securities | 12,626,998 |

Foreign currency and foreign currency translations | 2,370 |

Written options | 1,122,419 |

Net change in unrealized gains (losses) on investments | 13,751,787 |

Net realized and unrealized gains (losses) on investments | 10,819,739 |

Net increase in net assets resulting from operations | $17,335,657 |

Year ended October 31, 2023 | Year ended October 31, 2022 | |||

Operations | ||||

Net investment income | $6,515,918 | $5,831,672 | ||

Net realized gains (losses) on investments | (2,932,048 ) | 3,078,005 | ||

Net change in unrealized gains (losses) on investments | 13,751,787 | (49,254,431 ) | ||

Net increase (decrease) in net assets resulting from operations | 17,335,657 | (40,344,754 ) | ||

Distributions to shareholders from | ||||

Net investment income and net realized gains | (8,928,910 ) | (7,579,228 ) | ||

Tax basis return of capital | (10,388,558 ) | (15,180,253 ) | ||

Total distributions to shareholders | (19,317,468 ) | (22,759,481 ) | ||

Capital share transactions | ||||

Net asset value of common shares issued under the Automatic Dividend Reinvestment Plan | 65,308 | 56,803 | ||

Cost of shares repurchased | (105,054 ) | 0 | ||

Net increase (decrease) from capital share transactions | (39,746 ) | 56,803 | ||

Total decrease in net assets | (2,021,557 ) | (63,047,432 ) | ||

Net assets | ||||

Beginning of period | 197,586,525 | 260,633,957 | ||

End of period | $195,564,968 | $197,586,525 | ||

Cash flows from operating activities | |

Net increase in net assets resulting from operations | $17,335,657 |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities | |

Purchases of long-term securities | (191,059,602 ) |

Proceeds from the sales of long-term securities | 201,415,869 |

Amortization, net | (198,545 ) |

Purchases and sales of short-term securities, net | (981,072 ) |

Proceeds from premiums received from written options | 11,409,057 |

Payment to close written options | (9,089,098 ) |

Decrease in receivable for investments sold | 141,962 |

Increase in receivable for dividends and interest | (141,399 ) |

Increase in prepaid expenses and other assets | (44,585 ) |

Increase in payable for investments purchased | 872,270 |

Increase in trustees’ fees and expenses payable | 4,417 |

Increase in advisory fee payable | 6,777 |

Increase in administration fee payable | 399 |

Increase in accrued expenses and other liabilities | 371,628 |

Payments on foreign currency transactions | (33,362 ) |

Net realized losses on unaffiliated securities | 6,050,908 |

Net realized losses on foreign currency and foreign currency translations | 35,732 |

Net realized gains from written options | (3,154,592 ) |

Net change in unrealized gains (losses) on unaffiliated securities | (12,626,998 ) |

Net change in unrealized gain (losses) on foreign currency and foreign currency translations | (2,370 ) |

Net change in unrealized gains (losses) on written options | (1,122,419 ) |

Net cash provided by operating activities | 19,190,634 |

Cash flows from financing activities | |

Due to custodian bank | 14,129 |

Cost of shares repurchased | (52,925 ) |

Cash distributions paid | (19,252,160 ) |

Net cash used in financing activities | (19,290,956 ) |

Net decrease in cash | (100,322 ) |

Cash (including foreign currency) | |

Beginning of period | 101,087 |

End of period | $765 |

Supplemental cash disclosure | |

Cash paid for dividends and interest expense on securities sold short | $3,103,842 |

Supplemental non-cash financing disclosure | |

Reinvestment of dividends | $65,308 |

Year ended October 31 | |||||

2023 | 2022 | 2021 | 2020 | 2019 | |

Net asset value, beginning of period | $4.57 | $6.03 | $4.84 | $5.87 | $5.61 |

Net investment income | 0.15 1 | 0.13 | 0.20 1 | 0.16 | 0.17 |

Net realized and unrealized gains (losses) on investments | 0.25 | (1.06 ) | 1.51 | (0.63 ) | 0.68 |

Total from investment operations | 0.40 | (0.93 ) | 1.71 | (0.47 ) | 0.85 |

Distributions to shareholders from | |||||

Net investment income | (0.21 ) | (0.18 ) | (0.26 ) | (0.18 ) | (0.20 ) |

Tax basis return of capital | (0.24 ) | (0.35 ) | (0.26 ) | (0.39 ) | (0.40 ) |

Total distributions to shareholders | (0.45 ) | (0.53 ) | (0.52 ) | (0.57 ) | (0.60 ) |

Anti-dilutive effect of shares repurchased | 0.00 2 | 0.00 | 0.00 2 | 0.01 | 0.01 |

Net asset value, end of period | $4.52 | $4.57 | $6.03 | $4.84 | $5.87 |

Market value, end of period | $3.84 | $4.63 | $5.81 | $4.09 | $5.55 |

Total return based on market value3 | (8.16 )% | (11.43 )% | 56.27 % | (16.35 )% | 25.71 % |

Ratios to average net assets (annualized) | |||||

Expenses* | 2.98 % | 1.86 % | 1.37 % | 1.60 % | 1.89 % |

Net investment income* | 3.18 % | 2.52 % | 3.57 % | 3.17 % | 2.96 % |

Supplemental data | |||||

Portfolio turnover rate | 97 % | 97 % | 105 % | 108 % | 109 % |

Net assets, end of period (000s omitted) | $195,565 | $197,587 | $260,634 | $211,166 | $257,990 |

Borrowings outstanding, end of period (000s omitted) | $47,500 | $47,500 | $47,500 | $47,500 | $47,500 |

Asset coverage per $1,000 of borrowing, end of period | $5,117 | $5,160 | $6,487 | $5,446 | $6,431 |

* | Ratios include dividends on securities sold short and/or interest expense relating to interest associated with borrowings and/or leverage transactions as follows: |

Year ended October 31, 2023 | 1.65% |

Year ended October 31, 2022 | 0.63% |

Year ended October 31, 2021 | 0.15% |

Year ended October 31, 2020 | 0.38% |

Year ended October 31, 2019 | 0.57% |

1 | Calculated based upon average shares outstanding |

2 | Amount is less than $0.005. |

3 | Total return is calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Dividends and distributions, if any, are assumed for purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan. Total return does not reflect brokerage commissions that a shareholder would pay on the purchase and sale of shares. |

Gross unrealized gains | $31,616,657 |

Gross unrealized losses | (18,476,767 ) |

Net unrealized gains | $13,139,890 |

Quoted prices (Level 1) | Other significant observable inputs (Level 2) | Significant unobservable inputs (Level 3) | Total | |

Assets | ||||

Investments in: | ||||

Common stocks | ||||

Australia | $0 | $1,556,034 | $0 | $1,556,034 |

Brazil | 2,393,865 | 0 | 0 | 2,393,865 |

Canada | 4,873,844 | 0 | 0 | 4,873,844 |

China | 0 | 3,534,676 | 0 | 3,534,676 |

France | 0 | 7,977,976 | 0 | 7,977,976 |

Germany | 0 | 1,673,427 | 0 | 1,673,427 |

Hong Kong | 0 | 1,750,252 | 0 | 1,750,252 |

Ireland | 2,545,644 | 0 | 0 | 2,545,644 |

Japan | 0 | 10,840,765 | 0 | 10,840,765 |

Luxembourg | 0 | 0 | 0 | 0 |

Netherlands | 0 | 6,669,999 | 0 | 6,669,999 |

South Korea | 0 | 4,411,737 | 0 | 4,411,737 |

Spain | 0 | 2,096,266 | 0 | 2,096,266 |

Switzerland | 1,657,905 | 2,656,080 | 0 | 4,313,985 |

Taiwan | 1,555,047 | 0 | 0 | 1,555,047 |

United Kingdom | 0 | 12,537,949 | 0 | 12,537,949 |

United States | 120,506,595 | 0 | 0 | 120,506,595 |

Corporate bonds and notes | 0 | 37,813,130 | 0 | 37,813,130 |

Loans | 0 | 3,052,656 | 46,700 | 3,099,356 |

Preferred stocks | ||||

Brazil | 2,037,494 | 0 | 0 | 2,037,494 |

United States | 0 | 581,250 | 0 | 581,250 |

Rights | ||||

Luxembourg | 0 | 0 | 0 | 0 |

Yankee corporate bonds and notes | 0 | 5,468,642 | 193,048 | 5,661,690 |

Short-term investments | ||||

Investment companies | 4,982,016 | 0 | 0 | 4,982,016 |

Total assets | $140,552,410 | $102,620,839 | $239,748 | $243,412,997 |

Liabilities | ||||

Written options | $490,537 | $2,051 | $0 | $492,588 |

Total liabilities | $490,537 | $2,051 | $0 | $492,588 |

Counterparty | Gross amounts of liabilities in the Statement of Assets and Liabilities | Amounts subject to netting agreements | Collateral pledged1 | Net amount of liabilities |

Morgan Stanley Co. | $492,588 | $0 | $(492,588 ) | $0 |

1 | Collateral pledged within this table is limited to the collateral for the net transaction with the counterparty. |

Year ended October 31 | ||

2023 | 2022 | |

Ordinary income | $8,928,910 | $7,579,228 |

Tax basis return of capital | 10,388,558 | 15,180,253 |

Unrealized gains | Capital loss carryforward |

$13,127,041 | $(157,162,677 ) |

Allspring Global Dividend Opportunity Fund:

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

Class I - Non-Interested Trustees to serve until 2026 Annual Meeting of Shareholders | |||

Isaiah Harris, Jr. (Born 1952) | Trustee, since 2010; Audit Committee Chair, since 2019 | Retired. Member of the Advisory Board of CEF of East Central Florida. Chairman of the Board of CIGNA Corporation from 2009 to 2021, and Director from 2005 to 2008. From 2003 to 2011, Director of Deluxe Corporation. Prior thereto, President and CEO of BellSouth Advertising and Publishing Corp. from 2005 to 2007, President and CEO of BellSouth Enterprises from 2004 to 2005 and President of BellSouth Consumer Services from 2000 to 2003. Emeritus member of the Iowa State University Foundation Board of Governors. Emeritus Member of the Advisory board of Iowa State University School of Business. Advisory Board Member, Palm Harbor Academy (private school). Advisory Board Member, Fellowship of Christian Athletes. Mr. Harris is a certified public accountant (inactive status). | N/A |

David F. Larcker (Born 1950) | Trustee, since 2010 | Distinguished Visiting Fellow at the Hoover Institution since 2022. James Irvin Miller Professor of Accounting at the Graduate School of Business (Emeritus), Stanford University, Director of the Corporate Governance Research Initiative and Senior Faculty of The Rock Center for Corporate Governance since 2006. From 2005 to 2008, Professor of Accounting at the Graduate School of Business, Stanford University. Prior thereto, Ernst & Young Professor of Accounting at The Wharton School, University of Pennsylvania from 1985 to 2005. | N/A |

Olivia S. Mitchell (Born 1953) | Trustee, since 2010; Nominating and Governance Committee Chair, since 2018 | International Foundation of Employee Benefit Plans Professor since 1993, Wharton School of the University of Pennsylvania. Director of Wharton’s Pension Research Council and Boettner Center on Pensions & Retirement Research, and Research Associate at the National Bureau of Economic Research. Previously taught at Cornell University from 1978 to 1993. | N/A |

Class II - Non-Interested Trustees to serve until 2024 Annual Meeting of Shareholders | |||

William R. Ebsworth (Born 1957) | Trustee, since 2015 | Retired. From 1984 to 2013, equities analyst, portfolio manager, research director and chief investment officer at Fidelity Management and Research Company in Boston, Tokyo, and Hong Kong, and retired in 2013 as Chief Investment Officer of Fidelity Strategic Advisers, Inc. where he led a team of investment professionals managing client assets. Prior thereto, Board member of Hong Kong Securities Clearing Co., Hong Kong Options Clearing Corp., the Thailand International Fund, Ltd., Fidelity Investments Life Insurance Company, and Empire Fidelity Investments Life Insurance Company. Audit Committee Chair and Investment Committee Chair of the Vincent Memorial Hospital Foundation (non-profit organization). Mr. Ebsworth is a CFA charterholder. | N/A |

Jane A. Freeman (Born 1953) | Trustee, since 2015; Chair Liaison, since 2018 | Retired. From 2012 to 2014 and 1999 to 2008, Chief Financial Officer of Scientific Learning Corporation. From 2008 to 2012, Ms. Freeman provided consulting services related to strategic business projects. Prior to 1999, Portfolio Manager at Rockefeller & Co. and Scudder, Stevens & Clark. Board member of the Harding Loevner Funds from 1996 to 2014, serving as both Lead Independent Director and chair of the Audit Committee. Board member of the Russell Exchange Traded Funds Trust from 2011 to 2012 and the chair of the Audit Committee. Ms. Freeman is also an inactive Chartered Financial Analyst. | N/A |

Name and year of birth | Position held and length of service* | Principal occupations during past five years or longer | Current other public company or investment company directorships |

Class III - Non-Interested Trustees to serve until 2025 Annual Meeting of Shareholders | |||

Timothy J. Penny (Born 1951) | Trustee, since 2010; Chair, since 2018 | President and Chief Executive Officer of Southern Minnesota Initiative Foundation, a non-profit organization, since 2007. Vice Chair of the Economic Club of Minnesota, since 2007. Co-Chair of the Committee for a Responsible Federal Budget, since 1995. Member of the Board of Trustees of NorthStar Education Finance, Inc., a non-profit organization, from 2007-2022. Senior Fellow of the University of Minnesota Humphrey Institute from 1995 to 2017. | N/A |

James G. Polisson (Born 1959) | Trustee, since 2018 | Retired. Chief Marketing Officer, Source (ETF) UK Services, Ltd, from 2015 to 2017. From 2012 to 2015, Principal of The Polisson Group, LLC, a management consulting, corporate advisory and principal investing company. Chief Executive Officer and Managing Director at Russell Investments, Global Exchange Traded Funds from 2010 to 2012. Managing Director of Barclays Global Investors from 1998 to 2010 and Global Chief Marketing Officer for iShares and Barclays Global Investors from 2000 to 2010. Trustee of the San Francisco Mechanics’ Institute, a non- profit organization, from 2013 to 2015. Board member of the Russell Exchange Traded Fund Trust from 2011 to 2012. Director of Barclays Global Investors Holdings Deutschland GmbH from 2006 to 2009. Mr. Polisson is an attorney and has a retired status with the Massachusetts and District of Columbia Bar Associations. | N/A |

Pamela Wheelock (Born 1959) | Trustee, since January 2020; previously Trustee from January 2018 to July 2019 | Retired. Executive and Senior Financial leadership positions in the public, private and nonprofit sectors. Interim President and CEO, McKnight Foundation, 2020. Interim Commissioner, Minnesota Department of Human Services, 2019. Chief Operating Officer, Twin Cities Habitat for Humanity, 2017-2019. Vice President for University Services, University of Minnesota, 2012- 2016. Interim President and CEO, Blue Cross and Blue Shield of Minnesota, 2011-2012. Executive Vice-President and Chief Financial Officer, Minnesota Wild, 2002-2008. Commissioner, Minnesota Department of Finance, 1999-2002. Chair of the Board of Directors of Destination Medical Center Corporation. Board member of the Minnesota Wild Foundation. | N/A |

* | Length of service dates reflect the Trustee’s commencement of service with the Trust’s predecessor entities, where applicable. |

Name and year of birth | Position held and length of service | Principal occupations during past five years or longer |

Andrew Owen (Born 1960) | President, since 2017 | President and Chief Executive Officer of Allspring Funds Management, LLC since 2017 and Head of Global Fund Governance of Allspring Global Investments since 2022. Prior thereto, co-president of Galliard Capital Management, LLC, an affiliate of Allspring Funds Management, LLC, from 2019 to 2022 and Head of Affiliated Managers, Allspring Global Investments, from 2014 to 2019 and Executive Vice President responsible for marketing, investments and product development for Allspring Funds Management, LLC, from 2009 to 2014. |

Jeremy DePalma (Born 1974) | Treasurer, since 2012 (for certain funds in the Fund Complex); since 2021 (for the remaining funds in the Complex) | Senior Vice President of Allspring Funds Management, LLC since 2009. Senior Vice President of Evergreen Investment Management Company, LLC from 2008 to 2010 and head of the Fund Reporting and Control Team within Fund Administration from 2005 to 2010. |

Christopher Baker (Born 1976) | Chief Compliance Officer, since 2022 | Global Chief Compliance Officer for Allspring Global Investments since 2022. Prior thereto, Chief Compliance Officer for State Street Global Advisors from 2018 to 2021. Senior Compliance Officer for the State Street divisions of Alternative Investment Solutions, Sector Solutions, and Global Marketing from 2015 to 2018. From 2010 to 2015 Vice President, Global Head of Investment and Marketing Compliance for State Street Global Advisors. |

Matthew Prasse (Born 1983) | Chief Legal Officer, since 2022; Secretary, since 2021 | Senior Counsel of the Allspring Legal Department since 2021. Senior Counsel of the Wells Fargo Legal Department from 2018 to 2021. Previously, Counsel for Barings LLC from 2015 to 2018. Prior to joining Barings, Associate at Morgan, Lewis & Bockius LLP from 2008 to 2015. |

Agent & Dividend Disbursing Agent

P.O. Box 505000

Louisville, Kentucky 40233

1-800-730-6001

AR142 10-23

ITEM 2. CODE OF ETHICS

(a) As of the end of the period covered by the report, Allspring Global Dividend Opportunity Fund has adopted a code of ethics that applies to its President and Treasurer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

(c) During the period covered by this report, there were no amendments to the provisions of the code of ethics adopted in Item 2(a) above.

(d) During the period covered by this report, there were no implicit or explicit waivers to the provisions of the code of ethics adopted in Item 2(a) above.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT

The Board of Trustees of Allspring Global Dividend Opportunity Fund has determined that that Isaiah Harris is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Harris is independent for purposes of Item 3 of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES

(a), (b), (c), (d) The following table presents aggregate fees billed in each of the last two fiscal years for services rendered to the Registrant by the Registrant’s principal accountant. These fees were billed to the registrant and were approved by the Registrant’s audit committee.

| Fiscal year ended October 31, 2023 | Fiscal year ended October 31, 2022 | |||||||

Audit fees | $ | 59,260 | $ | 57,810 | ||||

Audit-related fees | — | — | ||||||

Tax fees (1) | $ | 6,290 | $ | 6,105 | ||||

All other fees | — | — | ||||||

|

|

|

| |||||

| $ | 65,550 | $ | 63,195 | |||||

| (1) | Tax fees consist of fees for tax compliance, tax advice, tax planning and excise tax. |

(e)(1) The Chair of the Audit Committees is authorized to pre-approve: (1) audit services for the Allspring Global Dividend Opportunity Fund; (2) non-audit tax or compliance consulting or training services provided to the Allspring Global Dividend Opportunity Fund by the independent auditors (“Auditors”) if the fees for any particular engagement are not anticipated to exceed $50,000; and (3) non-audit tax or compliance consulting or training services provided by the Auditors to a Allspring Global Dividend Opportunity Fund’s investment adviser and its controlling entities (where pre-approval is required because the engagement relates directly to the operations and financial reporting of the Allspring Global Dividend Opportunity Fund) if the fee to the Auditors for any particular engagement is not anticipated to exceed $50,000. For any such pre-approval sought from the Chair, Management shall prepare a brief description of the proposed services. If the Chair approves of such service, he or she shall sign the statement prepared by Management. Such written statement shall be presented to the full Committees at their next regularly scheduled meetings.

(e)(2) Not applicable.

(f) Not applicable.

(g) Not applicable.

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS

The registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee is comprised of:

William R. Ebsworth

Jane A. Freeman

Isaiah Harris, Jr.

David F. Larcker

Olivia S. Mitchell

Timothy J. Penny

James G. Polisson

Pamela Wheelock

ITEM 6. INVESTMENTS

A Portfolio of Investments for Allspring Global Dividend Opportunity Fund is included as part of the report to shareholders filed under Item 1 of this Form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES

PROXY VOTING POLICIES AND PROCEDURES

EFFECTIVE March 2023