Exhibit 99.1

Lightstone Value Plus Real Estate Investment Trust V Recent Events Update February 2020 1

Forward - Looking Statements Forward - Looking Statements This presentation includes forward - looking statements. These statements include statements regarding the intent, belief or current expectations of the company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as ‘‘ may,’’ ‘‘ will,’’ ‘‘ seeks,’’ ‘‘ anticipates,’’ ‘‘ believes,’’ ‘‘ estimates,’’ ‘‘ expects,’’ ‘‘ plans,’’ ‘‘ intends,’’ ‘‘ should’’ or similar expressions. Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date they are made. The company undertakes no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward - looking statements. The company makes no representation or warranty (express or implied) about the accuracy of any such forward - looking statements. These statements are based on a number of assumptions involving the judgment of management. In particular, the methodology used to determine the NAV is based upon a number of estimates and assumptions that may prove later not to be accurate or incomplete. Forward - looking statements also depend on factors such as: future economic, competitive and market conditions; the company’s ability to maintain occupancy levels and rental rates at its real estate properties. The presentation should be read in conjunction with our public filings filed with the United States Securities and Exchange Commission. 2

Agenda • Asset Performance Summary • Key Accomplishments • Self Tender Offer to Buy Back Shares • Extension of the REIT 3

Asset Performance Summary 4

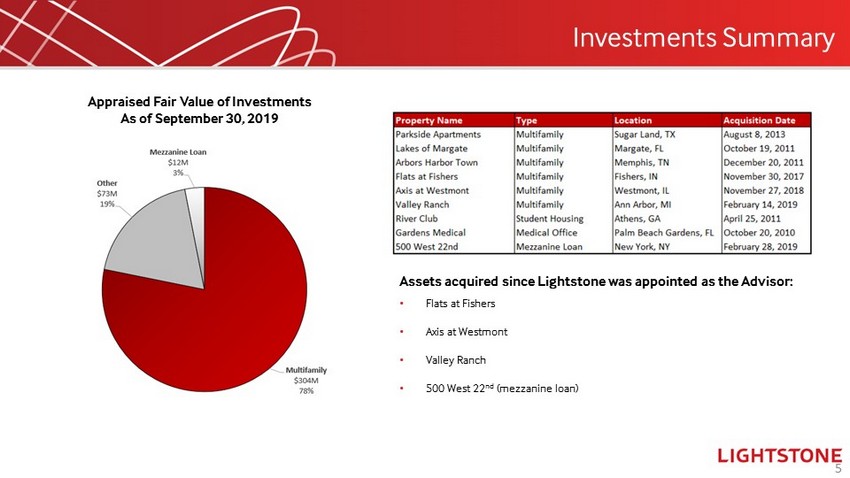

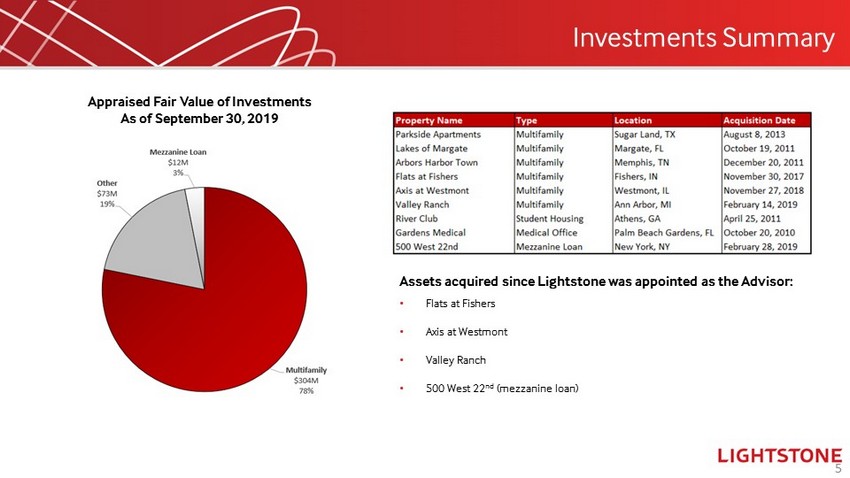

Investments Summary 5 Appraised Fair Value of Investments As of September 30, 2019 Assets acquired since Lightstone was appointed as the Advisor: • Flats at Fishers • Axis at Westmont • Valley Ranch • 500 West 22 nd (mezzanine loan)

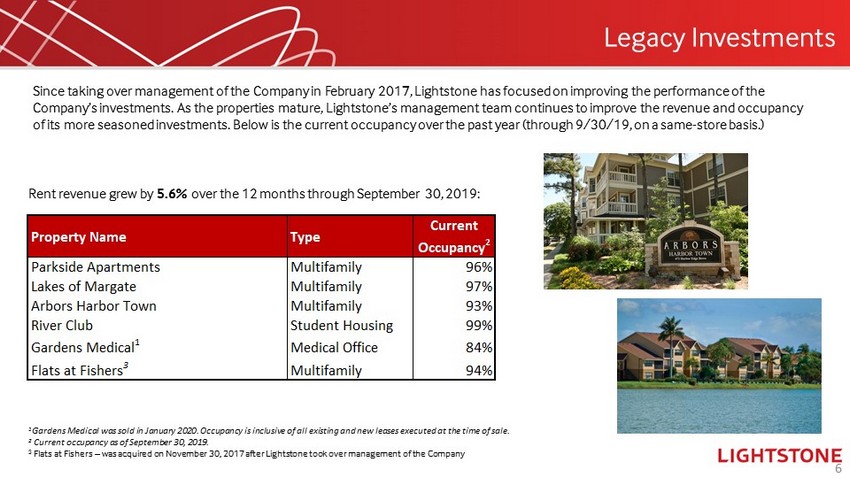

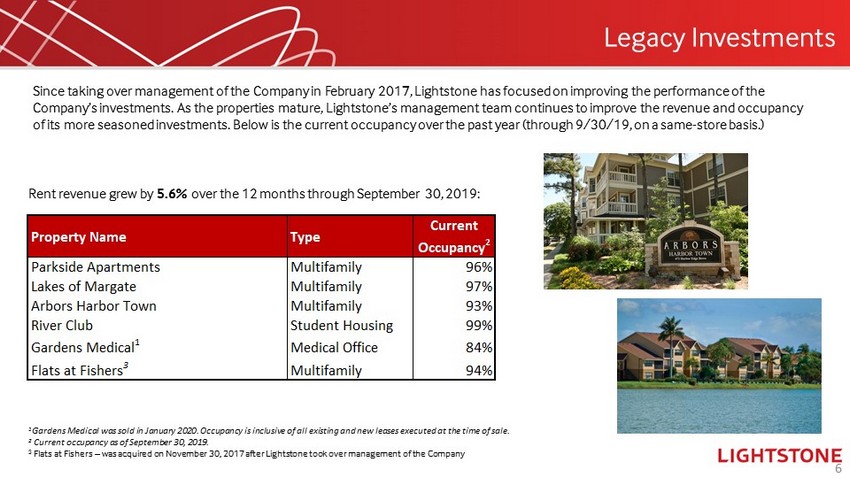

Legacy Investments 6 1 Gardens Medical was sold in January 2020. O ccupancy is inclusive of all existing and new leases executed at the time of sale. 2 Current occupancy as of September 30, 2019. 3 Flats at Fishers – was acquired on November 30, 2017 after Lightstone took over management of the Company Since taking over management of the Company in February 2017, Lightstone has focused on improving the performance of the Company’s investments. As the properties mature, Lightstone’s management team continues to improve the revenue and occupancy of its more seasoned investments. Below is the current occupancy over the past year (through 9/30/19, on a same - store basis.) Rent revenue grew by 5.6% over the 12 months through September 30, 2019:

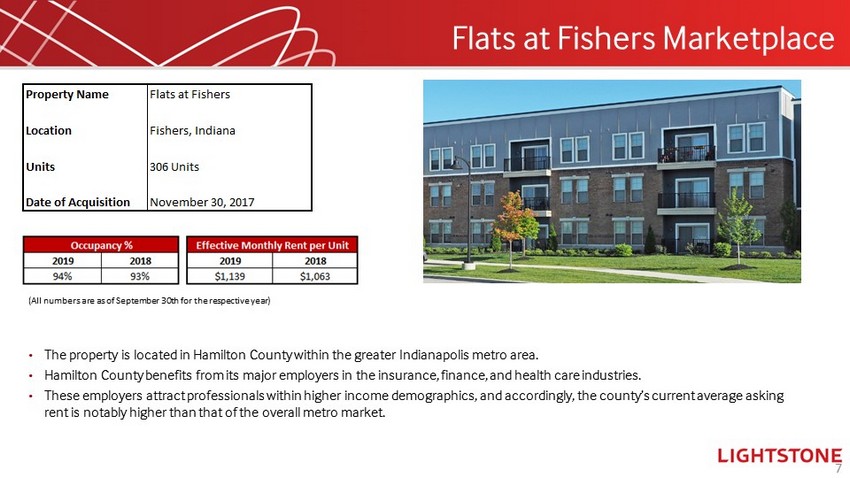

Flats at Fishers Marketplace 7 • The property is located in Hamilton County within the greater Indianapolis metro area. • Hamilton County benefits from its major employers in the insurance, finance, and health care industries . • These employers attract professionals within higher income demographics, and accordingly, the county’s current average asking rent is notably higher than that of the overall metro market. (All numbers are as of September 30th for the respective year)

Axis at Westmont 8 • The property is located within DuPage County, a part of the greater Chicago area, and is the second most populous county in Illinois. The property is within convenient commuting distance to downtown Chicago. • DuPage County is one of the largest and most diverse employment centers in Illinois. • Inventory growth in the market has been nominal in recent years and is forecasted to continue going forward. (All numbers are as of September 30th for the respective year)

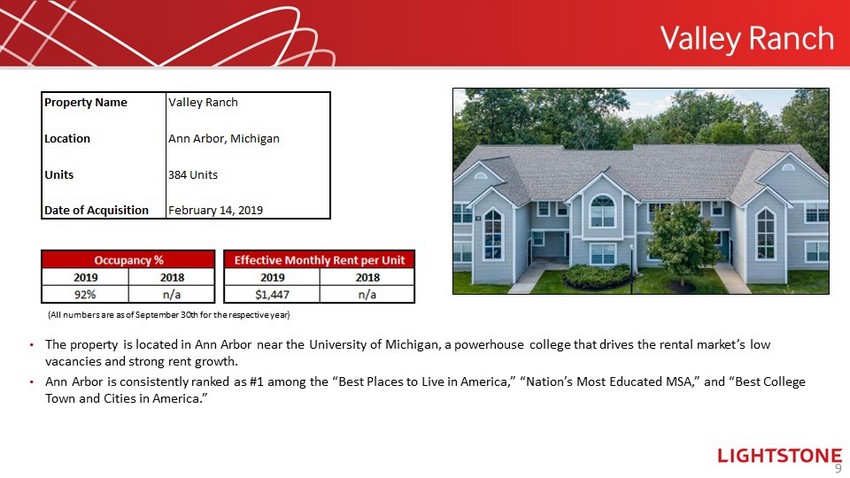

Valley Ranch 9 • The property is located in Ann Arbor near the University of Michigan, a powerhouse college that drives the rental market’s low vacancies and strong rent growth . • Ann Arbor is consistently ranked as #1 among the “Best Places to Live in America,” “ Nation’s Most Educated MSA,” and “Best College Town and Cities in America.” (All numbers are as of September 30th for the respective year)

500 West 22 nd Mezzanine Loan 10 Mezzanine Loan Investment • Provided a $12M loan amount for a ground up 10 - unit condo building with corner retail, in a prime West Chelsea area of Manhattan. • Date of Loan: April 2019 • Term: 30 months plus two six - month extension options. • Borrower is currently in compliance with the terms of the loan.

Gardens Medical 11 The Company sold the property in January 2020 for $24.3M , after Lightstone successfully executed on its strategy to significantly increase the occupancy of the building and improve the value of the property. – Originally acquired in 2010, the historical occupancy ranged between 60% - 70%. – Management signed four new leases with a combined 12,600 sq. ft. ( 16% of total building area), and addressed all lease expirations, effectively bringing the occupancy to approximately 84% .

Key Accomplishments 12

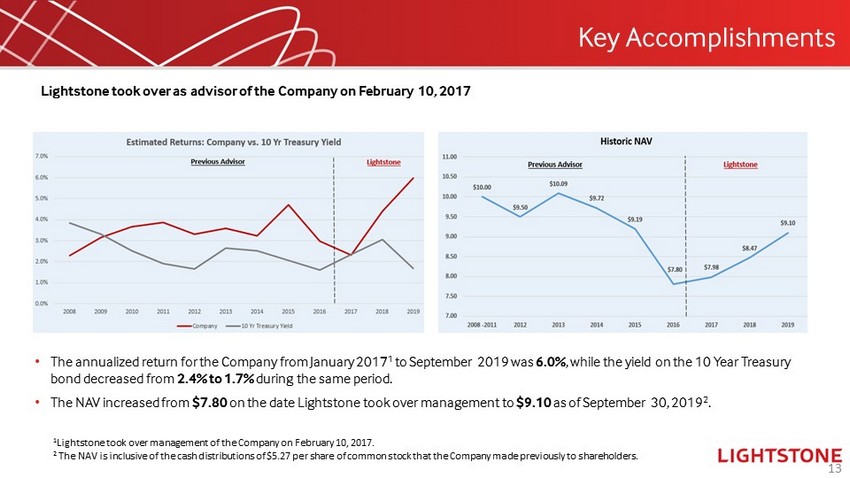

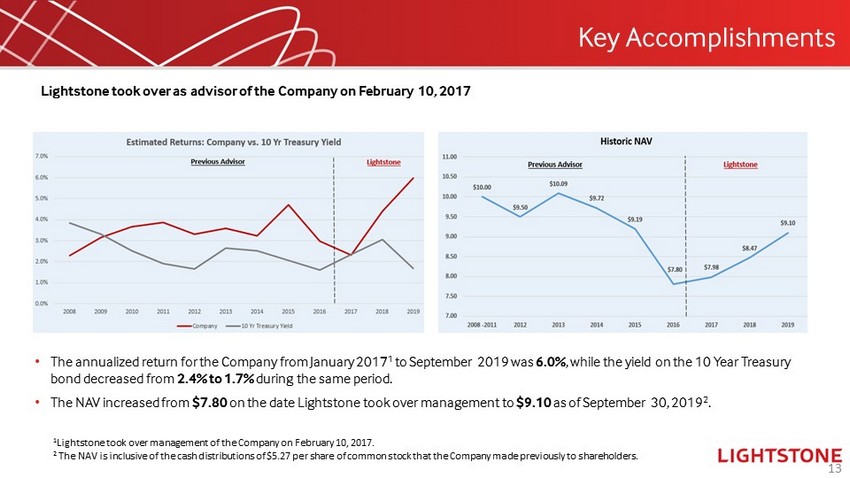

Key Accomplishments Lightstone took over as advisor of the Company on February 10, 2017 13 • The annualized return for the Company from January 2017 1 to September 2019 was 6.0% , while the yield on the 10 Year Treasury bond decreased from 2.4% to 1.7% during the same period. • The NAV increased from $7.80 on the date Lightstone took over management to $9.10 as of September 30, 2019 2 . 1 Lightstone took over management of the Company on February 10, 2017. 2 The NAV is inclusive of the cash distributions of $5.27 per share of common stock that the Company made previously to shareho lde rs.

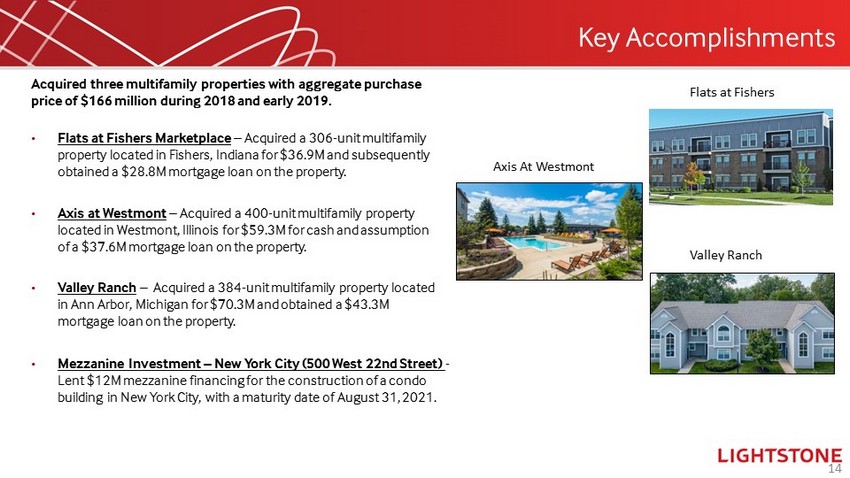

Key Accomplishments 14 Acquired three multifamily properties with aggregate purchase price of $166 million during 2018 and early 2019. • Flats at Fishers Marketplace – Acquired a 306 - unit multifamily property located in Fishers, Indiana for $36.9M and subsequently obtained a $28.8M mortgage loan on the property. • Axis at Westmont – Acquired a 400 - unit multifamily property located in Westmont, Illinois for $59.3M for cash and assumption of a $37.6M mortgage loan on the property. • Valley Ranch – Acquired a 384 - unit multifamily property located in Ann Arbor, Michigan for $70.3M and obtained a $43.3M mortgage loan on the property. Flats at Fishers Axis At Westmont Valley Ranch • Mezzanine Investment – New York City (500 West 22nd Street) - Lent $12M mezzanine financing for the construction of a condo building in New York City, with a maturity date of August 31, 2021.

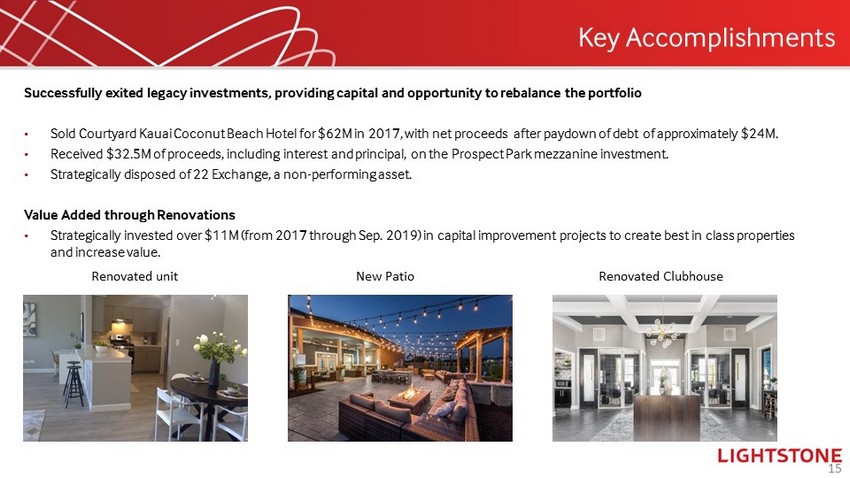

Key Accomplishments 15 S uccessfully exited legacy investments, providing capital and opportunity to rebalance the portfolio • Sold Courtyard Kauai Coconut Beach Hotel for $62M in 2017, with net proceeds after paydown of debt of approximately $24M. • Received $32.5M of proceeds, including interest and principal, on the Prospect Park mezzanine investment. • Strategically disposed of 22 Exchange, a non - performing asset . Value Added through Renovations • Strategically invested over $11M (from 2017 through Sep. 2019) in capital improvement projects to create best in class properties and increase value. New Patio Renovated unit Renovated Clubhouse

Self Tender Offer to Buy Back Shares 16

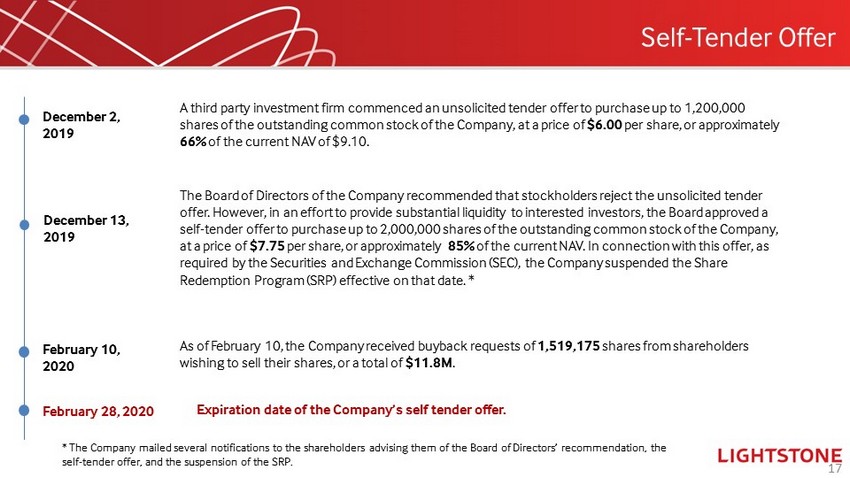

Self - Tender Offer 17 December 2, 2019 A third party investment firm commenced an unsolicited tender offer to purchase up to 1,200,000 shares of the outstanding common stock of the Company, at a price of $6.00 per share, or approximately 66% of the current NAV of $9.10. December 13, 2019 The Board of Directors of the Company recommended that stockholders reject the unsolicited tender offer. However, in an effort to provide substantial liquidity to interested investors, the Board approved a self - tender offer to purchase up to 2,000,000 shares of the outstanding common stock of the Company, at a price of $7.75 per share, or approximately 85% of the current NAV. In connection with this offer, as required by the Securities and Exchange Commission (SEC), the Company suspended the Share Redemption Program (SRP) effective on that date. * February 10, 2020 As of February 10, the Company received buyback requests of 1,519,175 shares from shareholders wishing to sell their shares, or a total of $11.8M . February 28, 2020 Expiration date of the Company’s self tender offer. * The Company mailed several notifications to the shareholders advising them of the Board of Directors’ recommendation, the self - tender offer, and the suspension of the SRP.

Extension of the REIT 18

Extension of the REIT • On January 9, 2020, the Board of Directors elected to extend the targeted timeline to commence liquidation of the REIT until June 30, 2028 based on their assessment of the Company’s investment objectives and liquidity options for stockholders . • The Company had previously extended the targeted timeline of the REIT to June 30, 2023. The Company was challenged by this time horizon to make decisions that management believes will be accretive to the performance of the Company going forward. These challenges included: – The time horizon did not provide management with sufficient opportunity to implement effective strategies to maximize value in new and existing investment opportunities. – Refinancing options were limited with less than four years remaining in the Company’s life before potential liquidation. – Balancing the long - term capital appreciation goals of the Company with the goal of providing liquidity to current stockholders . • The Company will continue to consider liquidity available to stockholders going forward. It is possible that in the future, additional liquidity will be made available by the Company through the share redemption program (“SRP ”), issuer tender offers, or other methods, though the Company can make no assurances as to whether that will happen, or the timing or terms of any such liquidity. 19

Extension of the REIT Key benefits of extending the life of the REIT • Superior performance achieved by Lightstone Advisor to date as evidenced by the NAV growth and other key accomplishments. • The Board of Directors and management believe that the forward - looking IRRs are accretive to investors. • Management continues to target opportunities to cycle out of lower - performing assets and redeploy the cash into higher - yielding investments. This is expected to further increase value to the stockholders . 20

Investor Services: 888 - 808 - 7348 investorservices@lightstonegroup.com Questions 21