UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-KT

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended _____ |

| þ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from January 1, 2014 through June 30, 2014 |

QUANTUMSPHERE, INC.

(Exact name of registrant as specified in its charter)

000-53913

(Commission File Number)

| Nevada | 20-3925307 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| Incorporation or organization) | |

2905 Tech Center Drive, Santa Ana, CA 92705

(Address of principal executive offices, with zip code)

714-545-6266

(Registrant’s telephone number, including area code)

Securities Registered pursuant to Section 12(b) of the Act:None.

Securities Registered pursuant to Section 12(g) of the Exchange Act:Common Stock, $.001 par Value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO þ

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-KT or any amendment to this Form 10-KT. þ

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filero | Accelerated filero | Non-accelerated filero | Smaller reporting companyþ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NOþ

The aggregate market value of the registrants common stock as of September 15, 2014 (based upon the average bid and asked price of the common stock on that date) held by non-affiliates of the registrant was approximately $32,380,820 (based on the last subscription price for our common stock of $2.00).

As of September 15, 2014, 21,560,217 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant's Schedule 14-A Definitive Proxy Statement as filed with the Securities and Exchange Commission on September 26, 2014, is incorporated by reference into Part III of this Form 10-KT.

TABLE OF CONTENTS

PART I

Overview

QuantumSphere, Inc., formerly known as Way Cool Imports, Inc., was incorporated in the State of Nevada on December 1, 2005 (referred to as the “Registrant”). On April 22, 2014, we entered into an Agreement and Plan of Merger with QuantumSphere, Inc., a California corporation (“QSI”), whereby, among other things, QSI would merge with a wholly-owned subsidiary of the Registrant. On April 22, 2014, the parties consummated the merger and QSI became a wholly-owned subsidiary of the Registrant. Subsequently, on April 25, 2014, we filed Articles of Merger with the Nevada Secretary of State for the purposes of effecting a short-form merger of QSI with and into the Registrant. As part of the short-form merger, we amended our Articles of Incorporation to changes our name from “Way Cool Imports, Inc.” to “QuantumSphere, Inc.” The Articles of Merger were effective upon filing. In June 2014, the Company elected to change its year end from December 31 to June 30. As used in this Annual Transitional Report on Form 10-KT, the references to “we” or “our” reflect the Registrant and its operations post-merger, i.e., inclusive of QSI and its operations.

We develop and manufacture proprietary high-performance catalysts, integrated components, and end-use products across a range of carefully selected energy storage and chemicals markets, typically in conjunction with the sector’s larger participants. Our proprietary high-performance products can be utilized in both electro-chemical (batteries) and thermo-chemical (chemical production) applications and have demonstrated the ability to reduce costs and increase efficiency in the generation, storage, and use of energy.

Platform Technology & Catalyst Market

Our high value, end use applications in the batteries and chemicals sectors emanate from our award winning, patented, nanocatalyst manufacturing platform technology. Our platform technology allows us to manufacture, in an automated manner, highly uniform, 99.99% pure, narrowly distributed, nano-particles with high catalytic activity. We view ourselves as a products company, rather than an advanced materials company, with the products we distribute being made possible through our break-through platform technology.

We spent the first several years following our inception, along with $15 million in investment capital, designing, fabricating, testing, refining, improving, automating, and scaling our closed-loop, proprietary nanocatalyst manufacturing platform technology. In terms of the production of advanced nanocatalyst materials, we have progressed from a few grams per day to multiple kilograms per day. This is essential as scale is required with each of the end use applications we are pursuing today and anticipate pursuing in the future.

Importantly, in 2007, we secured two broad patents on the QSI manufacturing technology process itself and, in 2010, we achieved ISO 9001:2008 certification for quality management systems related to our nanocatalyst manufacturing platform technology. With respect to our intellectual property relating to the platform technology, we have not disclosed all of the proprietary algorithms and software that are used in the manufacturing process. We treat the foregoing as our “Coca-Cola” trade secret that will remain proprietary. Other key features of our platform technology include the ability to rapidly scale the manufacturing process in a highly automated, modular fashion at low capital cost.

The following image depicts our nanocatalyst manufacturing platform technology and a portion of the periodic table of elements we convert and integrate into various commercial products.

By way of background, the catalyst market is a multi-billion dollar global industry. According to an industry study prepared by The Freedonia Group, the global catalyst markets exceeded $14 billion in 2013 with worldwide demand for catalysts to increase to $19.5 billion in 2016.1Of this amount, nanocatalysts are expected to play a critical role in reducing costs and increasing efficiency in the generation, storage, and usage of energy with an estimated market of $6.6 billion by 2018.2

A nanometer (nm) is one billionth of a meter, or 1,000 times smaller than the diameter of a human hair, or roughly the size of a marble when compared to the earth. QSI catalysts typically measure 5-25 nm in size with a very narrow particle size distribution, and have up to 100 meters squared per gram in surface area, covering the size of a soccer field with just a small amount of material. A catalyst is a material that helps facilitate chemical reactions and can make chemical reactions happen more efficiently. The greater the surface area of the catalyst, the more efficient the chemical reaction, resulting in lower cost, higher performance end-use applications (e.g., chemical synthesis and metal-air batteries).

1 World Catalysts: Industry Study with Forecasts for 2016 & 2021, February 2013 (The Freedonia Group).

2 “Need to Curb Automobile & Industrial Emissions Drives the Global Nanocatalysts Market, According to New Report by Global Industry Analysts, Inc.”, PRWEB, November 23, 2013 (http://www.benzinga.com/pressreleases/13/11/p4106559/need-to-curb-automobile-industrial-emissions-drives-the-global-nanocata).

Our advanced catalysts have superior properties including their spherical shape, controlled oxide layer, narrow particle size distribution, high purity, low agglomeration, and large surface area. We believe these combined physical characteristics translate into greater efficiency in the generation, storage, and use of energy. Leveraging our patented, automated, highly scalable, and environmentally safe nanocatalyst manufacturing process, we manufacture a number of high-quality metals, bi-metallic alloys, and catalysts at the nano-scale including iron, silver, copper, nickel, manganese, and cobalt. We also offer custom dispersions and several specialty metals and catalysts including gold, palladium, aluminum, and tin.

Presently, we have sixteen dedicated gas phase condensation reactors which we utilize in the manufacture of nanocatalysts. With sixteen reactors, our capacity is approximately 150-160 kilograms per month (the foregoing is based on nano-iron production, and the overall monthly kilogram production will depend on the catalysts being produced given varying production rates among catalysts we manufacture). Given the manner in which we have designed our production reactors, we are able to quickly scale and adjust production runs to satisfy our customers’ advanced material needs and delivery timelines. In addition, we leverage our technical knowledge and process chemistry expertise to offer custom dispersions, alloys and integrated catalytic solutions for the energy storage and chemical sectors. For example, we have a current customer based in Israel that is using a highly active catalyst blend of nano-silver and nano-palladium to increase performance and lower cost in a platinum-free alkaline fuel cell, used for back-up power applications.

Chemicals Opportunity

QSI catalysts have the potential to benefit multiple, multi-billion dollar process applications in the refining, petrochemical, chemical, and pharmaceutical industries. Currently, the lead application and commercialization focus is in the global ammonia synthesis market. Ammonia production is a highly critical and energy-intensive process that occurs by combining hydrogen and nitrogen under high pressure and temperature in the presence of an iron catalyst. Though many incremental improvements have been achieved in both process and catalyst technology over the last 100 years, the industry is ripe for a paradigm shift in ammonia synthesis efficiency.

The Critical Role of Catalysts within the Chemicals Industry

A multi-billion dollar global industry, catalysts are essential to the world’s industrial production. As much as 90% of all chemical processes utilize catalysts (e.g., petroleum refining, pollution abatement, and production of fuels and chemicals) and 60% of all consumer and industrial products (e.g., fertilizers, plastics, pharmaceuticals, and batteries) are made using catalysts.3Catalysts are now seen as a preferred way to improve process efficiency, lower costs, increase output, use less energy, and meet both performance and environmental standards. This is placing a strong emphasis on the development of new catalysts with higher activity, increased longevity, and reduced environmental and/or health impact. Our high surface area catalysts have demonstrated the ability to deliver much higher activity in multiple lab validations and, thus, greater efficiencies than existing commercial iron catalysts.

3“Wide Participation in the 21st Annual Saudi-Japan Symposium “Catalysts in Petroleum Refining & Petrochemicals” at KFUPM”, King Fahd University of Petroleum & Minerals Press Release dated November 29, 2011 (http://web.kfupm.edu.sa/SitePages/en/UniversityNewsDetails.aspx?CUSTOMID=147).

Ammonia Market Overview

Globally, the amount of ammonia produced annually consumes approximately 1-2% of the world’s energy supply.4Nearly 80% of the global ammonia output is used as agricultural fertilizer for both food and non-food crops including biofuel feedstock.5 In addition, ammonia plants produce nearly 1% of the world’s total carbon dioxide emissions.6 Annual world production is heavily concentrated in China, accounting for more than 33% of ammonia produced today.7

To date, we have spent five years testing internally and externally validating the increased efficiencies of our QSI-Nano® iron catalysts with several industry leaders in the UK, Switzerland, Germany, and more recently in China. In the last year, we have established a high value, sales agent relationship with Beijing Lucky Star Ltd. (BLS), an industrial chemicals and process plant consulting agency located in Beijing, China. BLS has relationships with many of the major ammonia producing conglomerates in China.

Our Competitive Advantage

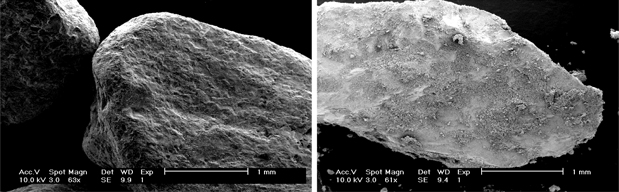

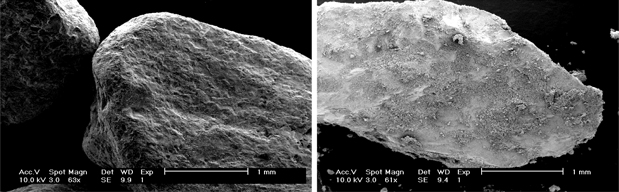

The figure below illustrates the performance difference between a QSI-Nano® coated and an uncoated commercial iron catalyst used in the production of ammonia. In sum, a 1.5% coating (by weight) of QSI-Nano® iron catalysts onto existing commercial iron catalysts produces up to a 20% increase in catalyst activity (per QSI in-house lab validation). In addition, our research and development indicates an ammonia plant may alternatively choose to decrease the pressure and heat required for ammonia production, and achieve the same ammonia production (output), saving up to 5% in energy costs along with reducing emissions in doing so.

4 “New Revelations in Ammonia Synthesis,” University of Cambridge Press Release, November 17, 2000 (http://www.cam.ac.uk/news/new-revelations-in-ammonia-synthesis).

5 “Ammonia Production,” Encyclopedia of Earth, March 15, 2012 (http://www.eoearth.org/view/article/170573).

6 “Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2012 – Executive Summary,” U.S. EPA, 2014, (http://www.epa.gov/climatechange/Downloads/ghgemissions/US-GHG-Inventory-2014-Chapter-Executive-Summary.pdf).

7“Biofuels Production, Improving Diets and Growing Economies in ‘BIC’ Countries Driving Global Demand for Ammonia, New IHS Study Says,” IHS, March 5, 2014 (http://press.ihs.com/press-release/ammonia/biofuels-production-improving-diets-and-growing-economies-bic-countries-drivin).

The TEM image on the left below represents a commercial iron catalyst (uncoated), while the TEM image on the right is the commercial iron catalyst coated with QSI-Nano® iron at a 1.5% loading.

Global Ammonia Market

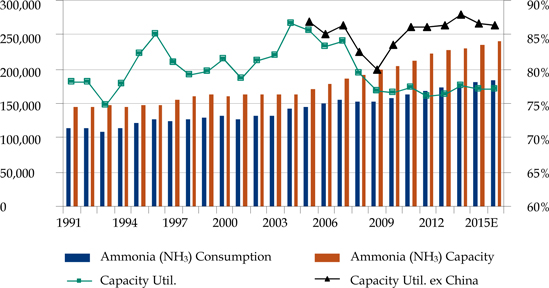

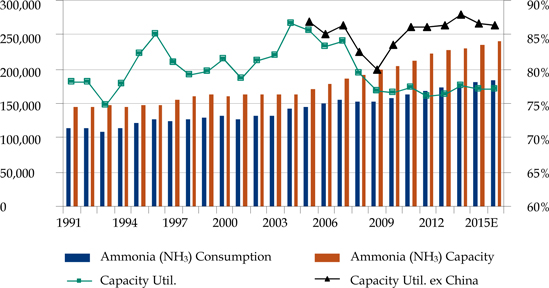

Ammonia is the building block of the global nitrogen industry. According to a January 9, 2014 research report by Bank of America Merrill Lynch,8approximately 78% of ammonia is used in fertilizer where it is processed into downstream products like urea or direct-applied. Ammonia is produced in anhydrous form by catalytic reaction between nitrogen and hydrogen from natural gas or coal. The same report states that the demand for ammonia has grown 2% per year since 2000 and is expected to grow 2.5% per year through 2016 due to higher fertilizer demand in Asia and Latin America, where the capacity for ammonia has grown 2.5% per year since 2000 and is expected to maintain that annual rate of growth through 2016. The chart below shows the global ammonia supply and demand in 1,000 metric tons from 1991 to 2016.

8Research report by Bank of America Merrill Lynch dated January 9, 2014 and entitled, “Move to Neutral from Buy; methanol surge priced in?” (citing Fertecon, Green Markets, FMC, CRU BofA Merrill Lynch Global Research estimates).

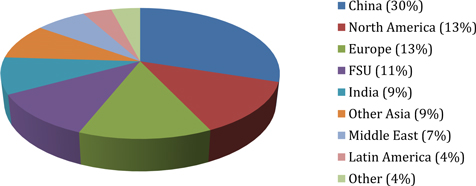

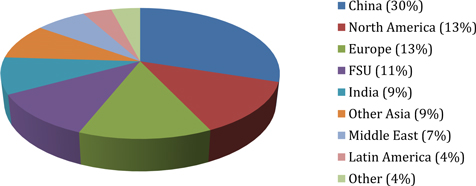

Ammonia Global Demand by Region – 2013E

In addition to the foregoing, Fertecon has estimated global ammonia production as follows for the period 2010 thru 2015, where the worldwide production capacity is estimated to increase from 177,230,000 metric tons in 2009/2010 to 310,542,000 metric tons in the foreseeable future. Of this increase, the production capacity in China is estimated to increase from 47,327,000 metric tons in 2009/2010 to 101,326,000 metric tons in the foreseeable future.

Ammonia Production Capacity by Region (in 1000 metric tons)9

| Region | | 2009/10 | | | 2010/11 | | | 2011/12 | | | 2012/13 | | | 2013/14 | | | 2014/15 | | | 2015/16 | | | 2016/17 | | | Indefinite | |

| North America | | | 16,425 | | | | 16,737 | | | | 17,013 | | | | 17,603 | | | | 17,807 | | | | 17,886 | | | | 19,146 | | | | 19,146 | | | | 26,461 | |

| Latin America | | | 11,737 | | | | 11,737 | | | | 11,011 | | | | 11,011 | | | | 11,442 | | | | 12,797 | | | | 13,623 | | | | 13,634 | | | | 18,539 | |

| Western Europe | | | 12,491 | | | | 12,391 | | | | 12,391 | | | | 12,391 | | | | 12,391 | | | | 12,391 | | | | 12,391 | | | | 12,391 | | | | 12,391 | |

| Central Europe | | | 8,385 | | | | 8,385 | | | | 7,785 | | | | 7,785 | | | | 7,785 | | | | 7,785 | | | | 7,785 | | | | 7,785 | | | | 9,804 | |

| Eurasia | | | 26,353 | | | | 26,223 | | | | 26,676 | | | | 26,920 | | | | 26,920 | | | | 27,320 | | | | 28,697 | | | | 29,093 | | | | 36,069 | |

| Africa | | | 6,966 | | | | 6,966 | | | | 7,466 | | | | 9,168 | | | | 11,346 | | | | 11,988 | | | | 12,748 | | | | 12,748 | | | | 21,801 | |

| West Asia | | | 15,407 | | | | 16,496 | | | | 17,596 | | | | 17,596 | | | | 19,827 | | | | 21,247 | | | | 21,632 | | | | 21,632 | | | | 25,993 | |

| South Asia | | | 18,907 | | | | 20,443 | | | | 20,443 | | | | 21,326 | | | | 22,052 | | | | 22,778 | | | | 22,778 | | | | 22,778 | | | | 35,800 | |

| East Asia | | | 58,534 | | | | 61,946 | | | | 68,903 | | | | 73,762 | | | | 88,235 | | | | 95,487 | | | | 98,005 | | | | 98,005 | | | | 119,550 | |

| — China | | | (47,327 | ) | | | (50,614 | ) | | | (57,571 | ) | | | (61,664 | ) | | | (76,137 | ) | | | (81,605 | ) | | | (83,463 | ) | | | (83,463 | ) | | | (101,326 | ) |

| Total Asia | | | 92,848 | | | | 98,885 | | | | 106,942 | | | | 112,684 | | | | 130,114 | | | | 139,512 | | | | 142,415 | | | | 142,415 | | | | 181,344 | |

| Oceania | | | 2,025 | | | | 2,025 | | | | 2,110 | | | | 2,110 | | | | 2,259 | | | | 2,259 | | | | 2,259 | | | | 2,259 | | | | 4,133 | |

| World Total | | | 177,230 | | | | 183,349 | | | | 191,394 | | | | 199,672 | | | | 220,064 | | | | 231,938 | | | | 239,064 | | | | 239,471 | | | | 310,542 | |

China Ammonia Market

After more than 60 years of development, China’s ammonia industry has the world’s largest capacity and output. Chinese domestic capacity accounts for slightly more than one-third of the global ammonia production. Both capacity and output of ammonia has maintained an ascending trend since the introduction of the Haber-Bosch ammonia synthesis process over 100 years ago.

Ammonia production occurs throughout China. There are an estimated 500 ammonia production enterprises, including ammonia plants, in China. The capacity of these enterprises differs significantly.

9See,Worldwide Ammonia Capacity Listing by Plant,International Fertilizer Development Center (June 2013).

Chinese ammonia plants are principally coal-fired. The output of coal-based ammonia and natural gas-based ammonia accounts for approximately 76% and 24%, respectively of the total ammonia production in China. Coal-fired ammonia plants typically adopt two processes: fixed bed intermittent gasification with rich oxygen at ambient pressure, and fixed bed continuous gasification with rich oxygen at ambient pressure. Natural gas-based ammonia plants generally use processes imported from other countries. More than 90% of domestic ammonia output in China is consumed within the fertilizer industry.

Chinese ammonia production capacity is estimated to continue expanding over the next several years, with the Chinese domestic supply of ammonia expected to continue to exceed domestic demand. As shown in the table below, the global ammonia capacity in 2013/2104 is approximately 220 million metric tons per annum with China representing just over 76 million metric tons per annum, or almost 35% of the world’s ammonia capacity.

According to “The Chemical Fertilizer Industry in China. A Review and its Outlook (May 2009)”, the China market consists of approximately:

| · | 29 ammonia plants with an average annual production capacity for synthetic ammonia of 300,000 tons/year per plant; |

| · | Two medium nitrogen fertilizer enterprises with an average annual production capacity of 60,000 to 180,000 tons of synthetic ammonia and an average annual production capacity of 120,000 tons to 300,000 tons of urea; and |

| · | More than 500 small nitrogen fertilizer enterprises and most of them produce less than 60,000 tons of synthetic ammonia annually. |

In the future, the development of the Chinese domestic ammonia industry is anticipated to focus on large-scale ammonia plants, integration and diversification. Even though 20% of the world’s population is in China, China has only about 7% of the world’s arable land.10The challenge is, therefore, to ensure adequate availability of food and fertilizer for the world’s most populated country given the limited availability of arable land.

Product Placement Opportunities in China

QSI, alongside with BLS, anticipate forming a joint venture with the Haohua Junhua Group Co. Ltd., or the JH Group, in Zhumadian, China, the eleventh largest Chinese ammonia producer, with the goal of producing the initial commercial validation of QSI-Nano® iron coating on JH Group’s commercial iron catalyst substrate. Pursuant to an executed memorandum of understanding, QSI and JH Group conducted a successful laboratory test in China in the fourth quarter of 2013. This laboratory testing was undertaken with the same equipment and parameters utilized at QSI’s California facility. A commercial validation test is scheduled to be undertaken at one of JH Group’s ammonia plants commencing in December 2014 and continuing for up to six months. Assuming a successful commercial validation result at JH Group in China, a formal joint venture production agreement will be entered into with JH Group, where we anticipate commencing fulfillment for the remaining 10 ammonia plants within JH Group. JH Group currently produces ammonia through the use of 629 metric tons of catalysts in its 10 plants, anticipated to increase to 869 metric tons in the second half of 2015 upon completion of the construction of one of the largest ammonia plants in the world.

10 Modern China: The Promise and Challenge of an Emerging Superpower, World Savvy Monitor, Issue 2, June 2008.

In addition, QSI has entered into a memorandum of understanding with the Luxi Chemical Group Co., Ltd., or LCG, the third largest ammonia production group in China. If the commercial validation with the JH Group is successful, QSI will provide the performance results to LCG and anticipates entering into a joint venture and production agreement with LCG to become QSI’s second commercial partner in the industrial coating of all catalysts used in their ammonia plants. LCG deploys approximately 2,385 metric tons of catalysts in its ammonia plants, which represents a significant opportunity for QSI assuming commercial validation is received from the JH Group. LCG also owns a catalyst manufacturing facility whereby it sells an approximate 523 metric tons per year to third party ammonia plants in China and abroad not operated by LCG. Beyond fulfillment of LCG’s internal requirements, the LCG opportunity also presents QSI with the ability to partner with a key manufacturer of ammonia catalysts for coating and distribution of the finished “turbo-charged” nano-coated product for fulfillment to customers of the LCG catalyst business.

In the fall of 2013, QSI executed a memorandum of understanding with Hubei Yihua Group Limited Liability Company, or Hubei, the largest ammonia producer (as ranked in total group ammonia capacity and production) in China, on terms similar to the memorandum of understanding with LCG. In sum, following a successful commercial validation with the JH Group, it is anticipated that Hubei will partner with QSI to purchase QSI-Nano® iron for coating of the commercial iron catalysts used by them within their ammonia plants.

Ammonia Production & Growth

Demand for fertilizer is escalating worldwide. As discussed, China in particular, as well as India and developing nations around the world, are aggressively increasing their agricultural output of both grains and livestock, and commodity crop prices are at record highs, encouraging farmers to fertilize heavily in search of higher yields. As fertilizer demand grows, supply is ramping up to meet it, and China and the U.S. are poised to capture some of that growth—in the case of the U.S., it has benefited from the rapid expansion of the nation’s natural gas sector over the past four years given historically low prices.

But unlike many of the industries capitalizing on the low price of natural gas, ammonia producers outside of China do not typically use it as a fuel source. They use it as an ingredient—a source of abundant, accessible hydrogen. Ammonia production is, relatively speaking, fairly simple. The inputs are nitrogen, hydrogen and energy used to stimulate a reaction understood by first year chemistry students:

N2 + 3H2 => 2NH3

The nitrogen used in the process is taken from the air, but hydrogen sources vary depending on when and where ammonia production is happening. When ammonia plants first came online in the 1940s, most used water as their source of hydrogen; energy-intensive electrolysis decoupled the hydrogen and oxygen. By adding a catalyst, pressure and air, then a cooling phase, you can generate hydrogen with some oxygen. However, electrolysis is an expensive proposition, and ammonia plants today have a far cheaper source of hydrogen: hydrocarbons.

According to Scientific American, no ammonia plants have broken ground in the U.S. in more than 20 years.11But in the next three to five years, that will be changing. Today, there are as many as 14 new ammonia plants proposed in the U.S., with nearly 12 million tons of new capacity and $10 billion of expected investment. Several older plants are also being recommissioned and upgraded. Oklahoma, Louisiana, Iowa, North Dakota, Texas and Indiana are among the planned or proposed sites. This boom, driven by low natural gas prices, the main ingredient in ammonia production, will drive a corresponding surge in the industry’s already substantial carbon footprint.

11 “Fertilizer Plants Spring Up to Take Advantage of U.S.’s Cheap Natural Gas,” Scientific American, April 25, 2013 (http://www.scientificamerican.com/article/fertilizer-plants-grow-thanks-to-cheap-natural-gas).

Ammonia’s Greenhouse Impact

In 2011, U.S. ammonia-producing facilities released 25 million tons of greenhouse gases (nearly all of it CO2)—just under 14% of the chemical-manufacturing sector’s total carbon footprint (and about 0.1% of total U.S. emissions).12Globally, ammonia production represents as much as 3% to 5% of carbon emissions, according to industry sources.13These figures do not take into account the supply chain of natural gas production, energy-related emissions in the production process, fertilizer application (and misapplication) or industrial use of urea and other ammonia products.

This larger footprint is a concern, particularly as the industry expands. Glen Buckley, an industry consultant at NPK Fertilizer Advisory Services (and former chief economist at U.S. fertilizer giant CF Industries), estimates that only about six million tons of the proposed U.S. capacity will actually get funding and get built—still, that’s a more than 50% increase in total ammonia capacity nationwide.

Metal-Air Batteries

Our battery technology consists of a high performance gas diffusion air electrode or cathode (i.e., the “engine inside” the battery) originally developed by QSI for Energizer and powered by high performance QSI-Nano® manganese catalyst material. In the past year, we have increased the manufacturing capacity of our battery electrode line to produce several hundred feet of our high rate air cathode material per shift. Today, we continue to build and deliver low volume demonstration prototype systems, for field use and evaluation purposes, to multiple government agencies including U.S. Forest Service and Department of Homeland Security, among others. Their valuable insights and feedback have been and will continue to be critical over the next several months for the final product design, functionality, shelf life, and overall power and performance requirements. By the end of the first quarter of 2015 we anticipate outsourcing zinc-air battery cell and system manufacturing and partner with key distributors in order to commercialize, in the second quarter of 2015, a portable power system (with a disposable, replaceable cartridge) based on metal-air battery technology that we have developed over the last several years.

12 Ibid.

13 Ibid.

Our initial form factor is the MetAir® Ranger Portable Power System (PPS) (see image above), a ~2.5kWh battery that is roughly half the weight of a single deep cycle lead acid battery, yet provides about ten times the equivalent specific energy (energy per kilogram mass) – a high energy-to-weight ratio. We believe the MetAir® Ranger PPS delivers the highest energy density of any commercially available disposable battery, at the lowest cost per kilowatt hour (by weight and volume). The MetAir® Ranger consists of 36 MetAir cells and will be priced at $399-499 per unit with a $299 replaceable power cartridge (pricing will vary depending upon volume). It will be followed by the MetAir® Solstice, later in 2015, consisting of four zinc-air battery cells and priced at $99-$119, with the replacement cartridge anticipated to be priced at $29-39. Prototype MetAir® Solstice systems will be available for demonstration and field trial in late 2014.

Through our metal-air battery technology, we propose to generate revenues four ways: (1) sale of Ranger and Solstice form factors (i.e., the complete portable power system via an outsourced manufacturing partner to be determined); (2) sale of replacement/disposable cartridges (via an outsourced manufacturing partner TBD); (3) sale of battery electrodes/cathode (the active layer or “engine inside”) to third parties who will incorporate our technology into their own battery systems (manufactured in-house at QSI); and (4) sale of individual battery cells for a variety of third party applications (via outsourced manufacturing partner to be determined).

MetAir® Ranger Portable Power.MetAir® Ranger is a lightweight “plug and play” box of portable energy using modular, replaceable power cartridges built using our proprietary prismatic shape zinc-air battery cells. The MetAir® Ranger PPS is a “primary” (non-rechargeable) power source; however, the power cartridge can be conveniently used, discarded, and replaced much like replacing the blade on a razor.

The MetAir® Ranger PPS has options for an integrated 100 watt/ 110 volt AC inverter, which provides an AC outlet and multiple USB charging ports. The AC inverter converts 12 volts of DC output from the MetAir® Power Cartridge into a convenient source of on-demand power. This system is a mini portable power plant capable of charging or powering emergency communications equipment and a myriad of portable, rechargeable consumer electronic devices such as cellular and satellite phones, radios, laptops, tablets, games, cameras, lights, oscillating fans, small refrigerators and low wattage TVs. Additionally, the modular electronics portion of the MetAir® Ranger PPS can be configured to meet a variety of customer needs including 220/240 volt AC power for European and Asian markets.

Independent tests have shown that the MetAir® Ranger PPS surpasses the emergency preparedness industry’s 72-hour benchmark, achieving a best-in-class 192 hours – over 8 days – of instantly accessible portable power for emergency communications equipment, based on actual field use and duty cycle testing that simulates standard ham radio equipment power needs.14

In addition, a pressing need for emergency communications equipment, widespread consumer use of portable, rechargeable electronic devices – smartphones, laptops, tablets, video cameras, games, and more – has created unprecedented growth in portable power demand. Prevalent technology available in today’s lithium ion, nickel metal hydride, and lead acid rechargeable batteries lacks the capacity to adequately address this vast need for on-demand portable power.

14 Validation tests by Tracy Lenocker (call sign WA6ERA), Mountain Division Chief, Office of Emergency Services, San Bernardino County Fire Department, incorporated both field testing and lab equipment running simulated duty cycle tests representing standard emergency communication uses.

MetAir® Cells and Power Cartridges.Inside the MetAir® Ranger PPS, primary (non-rechargeable) cells are assembled into a replaceable power cartridge. Multi-cell stacks of prismatic shaped zinc-air batteries comprise the “engine” powering the Ranger Portable Power System. These modular cells can be combined and connected in series or parallel, depending on voltage, capacity, and current requirements. Once discharged (completely utilized), the MetAir® Power Cartridge is replaceable and can be disposed of in the normal waste stream. The MetAir® Ranger can provide up to 205 amp hours (Ah) of stored capacity and a total energy output of up to 2.5 kilowatt hours (kWh) or 2,500 watt hours (Wh) in a compact 20-pound replaceable power cartridge.15

Target Markets.The MetAir® Ranger PPS delivers outstanding performance improvements for multiple applications within the $50 billion portable power market. The MetAir® Ranger PPS is the newest high-performance, low-cost, long-lasting, disposable zinc-air battery available. This system offers safe, lightweight, low-maintenance and non-polluting power for mission critical, emergency and recreational uses. It is also DOT-approved for air travel under special provision A123 for dry cells.

Until now, traditional back-up or off-grid power solutions for emergency response, tactical military operations, or power outages included rechargeable batteries, gas diesel generators or solar. These solutions are expensive, heavy, toxic, combustible, and require constant recharging with electricity or liquid fuel. Relying on combustible fuels, or solar- or wind-generated power in an “off-grid”, emergency power outage or military situation, can be dangerous, unpredictable, and inefficient.

MetAir® Ranger PPS is lightweight, safe, and reliable for emergency back-up power needs – day or night – when gas generators, solar, or wind energy sources are not available for recharging batteries. The low-cost, replaceable MetAir® Power Cartridge is designed for quick and easy replacement in emergency situations, offering convenience, safety, security, and peace of mind.

Designed for emergency or off-grid power needs, when traditional sources of electrical power may be unavailable, the MetAir® Ranger PPS is easily scalable and can be configured to provide portable power for various types of uses including:

| · | Powering first responder radio / communications equipment in disaster zones; |

| · | Emergency preparedness kits for home, school, business, and municipal power outages; |

| · | Powering or recharging portable electronic devices while camping, boating, fishing or hunting; |

| · | Tactical military applications; and |

| · | Back-up power for any other off-grid scenario. |

Key Safety and Performance Benefits.

| · | Reliable– In an emergency or off-grid situation, nothing is more important than knowing you can count on your back-up power source. The MetAir® Ranger PPS is available immediately, with no delay in recharging from an alternative power source, as with solar cells, and no hazard and inconvenience of refuelling, as with gas diesel generators. |

15 205 amp hour (Ah) capacity at C-30 rate.

| · | Long-Lasting Power - The MetAir® Ranger PPS received independent third party first responder validation that it surpasses the emergency preparedness industry’s 72-hour benchmark. The system achieved an unprecedented 192 hours – over 8 days – of instantly accessible emergency power based actual field use and standard use duty cycle testing. |

| · | 1-Year Target Shelf Life Ensures Readiness – Zinc-air primary batteries are typically known for offering a long, stable shelf life, in some cases up to five years. The first generation MetAir® Battery Systems / Replaceable Power Cartridges have a one year target shelf life (before initial use, sealed in the original airtight packaging). We anticipate achieving the target shelf life prior to commercial release. Typically, zinc-air batteries have a very low self-discharge rate, in most cases less than 5% per year (when un-activated/sealed in original packaging). Once activated (exposed to air), the MetAir battery should be completely utilized within the first two months. Rechargeable batteries, such as lead acid, suffer from very high self-discharge rates that decrease shelf life dramatically, usually lasting only 90 days on the shelf after a complete charge. Lead acid batteries also suffer from a permanent capacity loss over time and must be maintained (re-charged) every three months to ensure a full state of charge for operational readiness. |

| · | No Charging Required –Traditional back-up power solutions for emergency response, tactical military operations, or power outages must be constantly recharged using solar panels or liquid fuels for gas generators. Relying on combustible fuels, or solar- or wind-generated power in an off-grid situation can be dangerous, unpredictable, and inefficient. During critical times, fuel may not be available for gas diesel generators, and the sun and wind may not be available to charge traditional lead acid batteries with solar panels or wind turbines. The MetAir® Ranger PPS is maintenance free and requires no external energy sources to stay charged. |

| · | Portable and Lightweight – At 20 lbs. for the cartridge, the MetAir® Ranger PPS is fully-equipped as a self-contained “plug and play” portable power source designed to run or charge emergency communications equipment and portable electronic devices off the grid. It offers the highest energy-to-weight ratio of any commercially available primary disposable or rechargeable battery. |

| · | Low Cost per Kilowatt Hour – MetAir® Power Cartridges yield specific energy up to 300 Wh/Kg and will be priced at $499 per unit (on a retail basis) for 2,500 watt hours. The 20 lb. replaceable power cartridge will be priced at $299 per unit (on a retail basis). MetAir® Ranger PPS delivers on-demand portable power at a fraction of the cost and weight (i.e., $120/kWh) of traditional portable rechargeable batteries. |

| · | Safe and Non-combustible – Lead-acid batteries contain large amounts of lead and sulphuric acid, a highly corrosive and poisonous liquid that can cause severe chemical burns. MetAir® cells contain zinc, a non-combustible, non-toxic, non-polluting material. When a lead-acid battery is charged, hydrogen and oxygen gases are formed, which can cause it to explode.16 Lithium-ion batteries can rupture, ignite, or explode when punctured or exposed to high temperature. In the event of a fire, lithium-ion powered devices may emit dense irritating smoke.17 Lithium batteries have been implicated in at least two fatal cargo plane crashes since 2006.18Because the MetAir® zinc batteries contain no added mercury, cadmium, lead or lithium, they are generally considered safe for disposal in the normal waste stream with no special hazardous waste handling required. MetAir® cells also contain no liquids or fuels, making them safe for transport via air, land and sea. |

16 http://www.ehow.com/info_8139940_dangers-lead-acid-batteries.html

17 Electrochem Commercial Power (9 September 2006). “Safety and handling guidelines for Electrochem Lithium Batteries”(PDF). http://marine.rutgers.edu. Rutgers University. Retrieved 21 May 2009.

18 http://www.fastcompany.com/1836973/postal-service-usps-bans-lithium-batteries-ipad-kindle-iphone-smartphone-laptop

| · | Clean-Portable Power– The primary fuel source material in the anode of the MetAir® cells is zinc. The high purity zinc metal powder we utilize is safe, non-toxic, non-combustible, and environmentally friendly - delivering clean portable power in the MetAir® cells. |

| · | High Energy-to-Weight Ratio – The MetAir® Ranger PPS is about the size of a single deep cycle (heavy duty) lead acid marine battery, yet it weighs roughly half as much and provides about 10 times the specific energy. |

| · | Versatile- The MetAir® Ranger PPS can be configured to provide off-grid or emergency back-up power for all types of portable, rechargeable, consumer electronic devices. Accessories include a 100 watt AC power inverter, multiple USB charging ports, and emergency LED lights. |

Overview of Zinc-Air Batteries.Based on low cost, reliable, century-old zinc-air battery chemistry and our state-of-the-art nano technology, the unique MetAir® Ranger PPS offers high energy densities that are extremely safe and relatively inexpensive to produce. We have several patents issued and applications pending covering key aspects of our technology.

Unlike other common battery chemistries (such as lithium-ion, nickel metal hydride and lead acid), zinc-air batteries are electro-chemical batteries powered by exposing zinc metal to oxygen from the air to generate an electrical current. The user literally pulls a tab to break the hermetically sealed packaging, thereby activating airflow into the battery cartridge and generating an electrical current. Once activated, the oxygen from the air slowly turns the zinc into zinc-oxide. When an activated battery has been fully utilized, it is generally considered safe for disposal in the normal waste stream. This technology is similar to the hundreds of millions of small zinc-air button cell batteries consumed annually around the world in hearing aids and other small electronic devices.

How Zinc-Air Batteries Work.Batteries of all types have two main components, anodes and cathodes, along with other key ingredients such as an active catalyst and electrolyte to connect and activate them. For zinc-air battery operation, the fuel for the cathode is simply oxygen from the air we breathe and the fuel for the anode is zinc metal powder. Inside the battery, a mass of zinc particles form a porous anode that is saturated with an electrolyte to make it electrically conductive. Oxygen causes a reaction that forms hydroxyl ions, which in turn forms zincate, thereby releasing electrons to travel through an external load back to the cathode. Our patented nanotechnology production processes create the high surface area advanced catalysts that facilitate this electrochemical reaction with greater efficiencies, resulting in higher energy densities and power densities within the zinc-air battery.

Unlike a conventional battery that contains both cathode and anode material, oxygen from the atmosphere is one of the zinc-air battery reactants and is not packaged within the battery. Therefore, a cell can contain more zinc fuel in the anode to provide more capacity, or run time, than a conventional battery. As a result, the MetAir® Ranger PPS has higher energy capacity-to-volume and weight ratio than any other commercially available conventional battery.

Validation and Target Applications.

First Responder Need and Validation:According to the Public Safety and Homeland Security Bureau, disaster preparedness and recovery planning is designed to reduce the disruption of essential services when an emergency situation occurs. Emergency communications planning is a key component of any disaster plan.19 In an emergency, phones, gas, water, and electrical services may be unavailable for an extended period. Experts suggest being prepared for at least 72 hours (three full days) should a disaster occur. As a result, emergency responders, utilities and crisis management professionals need reliable tools to ensure on-going communication capabilities for at least 72 hours following an event. The MetAir® Ranger PPS has exceeded that threshold, delivering up to 192 hours of continuous, clean, quiet, safe, reliable, off-grid or emergency back-up power on a duty-cycle basis.

Field Test Validation:From Tracy Lenocker, WA6ERA, Mountain Division Chief, Office of Emergency Services, San Bernardino County Fire Department:

“In our field tests, QSI’s portable zinc-air power system far exceeded our performance expectations. For mission critical applications using amateur and commercial radios we need to have at least 72 hours of off-grid battery run-time. Testing during actual events and simulated duty cycle tests showed that the MetAir® Ranger battery life exceeded the 72-hour requirement by 120 hours, that’s 192 hours of duty cycle run time or over 8 days of reliable on-demand portable energy. With a target shelf life of one-year that guarantees readiness in emergency situations, this reliable back-up power source helps alleviate worries associated with the need for constant re-charging of traditional secondary batteries.”

Tactical Military Operations:MetAir® cells can be assembled into a custom lightweight wearable power pack and can help reduce soldier-worn battery weight by up to 30%, reducing the logistical burden while providing enhanced power access, safety, mobility, and reliability during 72+ hour tactical operations.

Emergency / First Responder Market:According to FEMA, major disaster declarations in the U.S. have grown 475% since 1953.20In 2013, there were 3,236 reported power outages across the U.S., affecting 14 million people and leading to costly service interruptions.21 In 2012 alone, 65 power outages each affected over 50,000 people.22 On average, 6543 people were affected for over three hours per outage in 2013.23 In October 2012, more than 8 million Americans went without power for up to two weeks due to northeast super storm, Hurricane Sandy.24

19 “Emergency Planning: First Responders,” Federal Communications Commission, Public Safety & Homeland Security Bureau, Emergency Information, Guidelines (http://transition.fcc.gov/pshs/emergency-information/guidelines/first-responders.html).

20 Disaster Declarations by Year, Federal Emergency Management Agency (http://www.fema.gov/disasters/grid/year).

21 “Eaton’s Blackout Tracker Annual Report Shows 14 Million People Affected by Power Outages in 2013,” Eaton, News Release, March 31, 2014.

22 “Blackout Tracker Shows 25 Million People Affected by Power Outages in 2012,” Eaton, News Release, March 6, 2013.

23“Eaton’s Blackout Tracker Annual Report Shows 14 Million People Affected by Power Outages in 2013,” Eaton, News Release, March 31, 2014.

24 http://www.huffingtonpost.com/2012/11/05/hurricane-sandy-rhode-island-connecticut_n_2080205.html. Huffington Post. Article accessed 2 April 2014.

Hurricane Sandy was not an anomaly. Neither were the Derecho storms in the mid-Atlantic or wildfires that ravaged the western U.S. in 2012. There were 11 weather disasters in the U.S. in 2012 that cost at least $1 billion, ranking second only to the number of billion-dollar storms in 2011, according to a paper from the White House,Economic Benefits of Increasing Electric Grid Resilience to Weather Outages. By assessing the value of electricity service to homes and businesses, the study found the average cost for weather-related outages has ranged from $18 billion to $33 billion annually in the last decade.

Emergency communications rank as a top priority for contingency planning. For businesses, schools, government agencies, homes, and communities alike, a communications failure can be a disaster in itself.

Communications are needed to report emergencies, to warn about dangers, to keep citizens informed about developments and coordinate response actions. The Centers for Disease Control and Prevention (CDC) lists batteries and access to battery-powered radios as top priorities for emergency preparedness kits.

Time is of the essence in emergency response situations, so reliable and immediately accessible back-up power is critical. The Department of Homeland Security’s Office of Emergency Communications (OEC) developed the National Emergency Communications Plan (NECP) as the nation’s first strategic plan for emergency communications guidance, setting goals for emergency response situations. 75% of all Urban Areas Security Initiative (UASI) jurisdictions must be able to demonstrate response-level emergency communications within three hours of a significant event as outlined in national planning scenarios.25

Outdoor Sports and Recreation:Outdoor sports and recreational enthusiasts can use MetAir® Ranger PPS for off-grid power during camping, fishing, hunting, or hiking trips, or endurance sporting events, such as off-road rallies that span several days in remote areas. Each application will benefit from the convenience of constant, reliable, safe, lightweight, on-demand, portable electric power. Additionally, the MetAir® Ranger PPS has multiple uses in the marine industry for recreational boaters. For small craft with electric motors, the MetAir® Ranger PPS can be a reserve battery in the event the lead acid battery becomes fully discharged and the craft still needs power to return to shore. Another application is powering ancillary lights, radios, navigation devices, and desalination systems on powerboats or sailboats when power is not available from the engine, generator, solar, or main battery bank.

Integration with Existing Technologies: Several technologies addressing the ever growing back-up power market including solar panels and gas generators currently exist. However, these technologies are not true on-demand power. Often times, there are logistical issues with transporting the heavy, bulky solar panels and equipment, and fuel to areas where it is needed. In addition, there are times when fuel is not available and, in the case of solar, the sun is not always shining. The MetAir® Ranger PPS offers augmentation to existing backup power infrastructure by providing a solution that is more easily and quickly deployed and more robust and reliable for immediate and short-term emergency power applications.

25 “National Emergency Communications Plan (NECP) Goals,” Department of Homeland Security (http://www.dhs.gov/files/publications/gc_1281645820543.shtm).

Sales, Marketing & Distribution.We anticipate marketing, selling and distributing our metal-air battery products in the following ways through an existing third party battery manufacturer and, in certain instances, on our own:

| · | Direct-to-consumer website; |

| · | Local, county, state and federal first responder/emergency & other agencies; |

| · | Large distributors of portable consumer electronics and peripherals; |

| · | Existing battery companies looking to extend product lines and/or recharge their rechargeable devices with MetAir® technology; |

| · | Geographical distributors around the globe with strong emergency/first responder ties. |

Raw Materials; Principal Suppliers

We engage a number of suppliers for our equipment and for our bulk raw materials and gases. In the manufacture of our nanocatalysts, we use a range of equipment from a number of suppliers in order to assemble our proprietary reactors. As for the bulk raw materials and gases used in our nanocatalyst manufacturing process, we contract with a number of companies and make our purchase decisions based on the prevailing market prices for such bulk raw materials and gases. We periodically audit these suppliers to ensure the quality of the bulk raw materials and gases provided. As for the form factor and packaging materials for our metal-air batteries, we use a variety of contract manufacturers located in the United States and abroad and continuously assess the quality of the materials manufactured on our behalf. We have not entered into any long-term supply agreements for any of our equipment and our bulk raw materials and gases.

Competition and Differentiation

Our value discipline combines safety, quality, price, service and an approach to doing business that customers reward with loyalty and appreciation. This value discipline is designed to create a two-way street of value and profitability between QSI and our customers. Our strategy is built on three central tenets:

| · | Increasing revenue growth by improving market focus; |

| · | Enhancing profitability through process development and the efficient use of assets; and |

| · | Creating and enhancing customer value through continued innovation. |

Our nanocatalyst manufacturing process is capable of delivering high surface area nanocatalysts to a wide array of industries. Specifically, our advanced materials and integrated catalytic solutions empower the metal-air battery and chemical synthesis industries sectors with the potential to transform and revolutionize their respective product offerings. We believe that our proprietary manufacturing technology offers measurable improvement over existing manufacturing processes and has the potential to transform nanoscale catalysts applications from costly, inefficient processes to feasible, dynamic, and profitable assets.

We believe that our state-of-the-art technology will compete based on its:

| · | Industry-low manufacturing costs; |

| · | Highly scalable, fully automated manufacturing process; |

| · | Consistent particle size distribution; |

| · | Low levels of agglomeration and impurities; |

| · | Highly uniform dispersion; and |

| · | Environmentally friendly process. |

In terms of the catalyst market, we will face potential worldwide competition from advanced materials and chemical companies, and suppliers of traditional materials. The actual or potential competitors are larger, more established and more diversified than we are. Although we are focusing on specific market segments and opportunities where our nanocatalysts have demonstrated increased efficiencies and performance, we will compete against lower priced traditional materials for certain customer applications. In some product or process applications, the benefits of using nanomaterials may not be viewed as justifying a process change or outweigh the additional costs of such a process change.

In terms of the battery market, we will be competing with traditional battery manufacturers, start-up companies and joint ventures between one or more of these parties. In addition, we will be competing with an established battery market based on lead-acid, nickel-cadmium, nickel metal hydride and lithium-ion technologies. Although our metal-air batteries are proprietary, we will need to displace existing battery technologies in order to successfully establish our products.

Many of our competitors have greater market presence, longer operating histories, stronger name recognition, larger customer bases and significantly greater financial, technical, sales and marketing, research and development, manufacturing and other resources than we have. In addition, the number of start-up and development-stage companies involved in nanomaterials continues to grow on a global basis, posing increasing competitive risks. Although a number of these companies are associated with university or national laboratories and may be engaged primarily in funded research rather than commercial production, they may represent competitive risks in the future. Moreover, if one or more of our competitors were to merge or partner with another of our competitors or develop alternatives to our nanocatalysts or our manufacturing process, our ability to compete effectively will be adversely affected. We anticipate that foreign competition will play a greater role in the nanomaterials arena in the future.

Research and Development

We maintain a disciplined approached to planning, tracking and conducting our research and development projects. Research and development ideas present themselves from both internal and external sources.

As depicted below, our science team meets frequently for brainstorming activities and maintains a master list of potential research and development ideas. In addition, our board of directors receives periodic briefings on all major research and development efforts and proposed initiatives.

To leverage our research and development capabilities, we have previously entered into and continue to discuss establishing research and development agreements with strategic parties in the chemical manufacturing industry and the battery industry.

Intellectual Property

Since our inception, our strategy has been to invest heavily in intellectual property protection and to build a strong IP portfolio around core nanocatalysts manufacturing, process integration technologies, as well as targeted end-use applications where our solutions add significant value and breakthrough results. This is done in such a way as to maximize the potential for prevailing in litigation and inhibiting competition from choosing to litigate. The QSI team includes an expert patent litigator with 20+ years of industry experience who has prevailed in multiple high profile patent cases, both in the U.S. and abroad. QSI maintains a patented production process and, as of September 15, 2014, has nine issued patents and three pending patent applications related to the manufacturing process and various end-use applications before the United States Patent and Trademark Office. In addition, we have three registered trademarks.

The patent for QSI’s platform gas phase condensation process was awarded on October 16, 2007, and includes broad claims on the manufacturing system that produces advanced metals and catalysts at the nano-scale. Additional patent applications have been filed covering QSI-Nano® catalysts in raw metal powder form, QSI-Nano® catalysts dispersed into custom liquid solutions / ink formulations used for coating various monolithic structures and membrane structures, QSI-Nano® catalysts integrated into physical electrode assemblies for other energy storage (battery) components, and QSI-Nano® iron catalysts used in the ammonia synthesis production process.

QSI’s patent portfolio protects the following principal areas:

| · | Advanced catalyst manufacturing; |

| · | Thermo-catalysis (highly efficient chemical production); and |

| · | Electro-catalysis (advanced metal-air battery electrodes, cells, portable power systems). |

Development results are formally vetted through a short list of criteria for assessing whether to seek to protect a “development” via a patent or whether to preserve it as a trade secret. This vetting process has produced a more efficient use of the capital QSI has allocated for its IP portfolio. Generally, if the development rests upon a methodology that is not likely to be either easily reverse engineered or invented independently by a competitor, then QSI elects to protect such methodology as a trade secret and preserve it with appropriate confidentiality procedures. QSI has relied on such confidentiality procedures for our software and algorithms that are associated with our nano-catalyst manufacturing process.

To the extent that the development has commercial value to QSI – either because it reflects a viable product in the future for QSI to manufacture and sell, or it reflects technology likely to be adopted by a competitor - then it is worthwhile to consider seeking patent protection. QSI believes that even in those cases where QSI is not going to market a product, it is wise to protect an invention that a competitor is likely to adopt. Thus far, this approach has resulted in nine high-value patents issued and three patent applications pending.

Depending upon the timeline for developing the technology at issue, or how well the development concept has been crystallized, it may be appropriate to simply file a provisional patent application rather than a non-provisional application. In the case where it is still early in development or concept, QSI will typically file what is essentially a white paper as a provisional application, which does not get examined, but secures an early priority date of invention. Where the technology at issue is fairly advanced in development, or the concept is sufficiently crystallized to know the full scope of the advantages over the prior art, QSI will typically file a non-provisional patent application. At that point, QSI develops a claim strategy that focuses on (1) highlighting the “gee whiz” that reflects the solution to the problem addressed while distinguishing the closest known prior art, and (2) addressing who the potential infringers might be (e.g., manufacturers, OEMs, distributors, customers, users, etc.). This claim strategy also takes into account the regions in which QSI intends to file for patent protection. All claims are formulated with an eye toward broad protection and litigation strategy. Active assessments are made as to how to prevail in cases in which QSI could choose to threaten potential infringers as well as to inhibit others from potentially challenging QSI.

Government Regulation

We are subject to federal, state and local laws and regulations applicable to businesses generally. Before we commercially introduce our products into certain markets, we may be required, or may voluntarily determine to obtain approval of our materials and/or products from one or more of the organizations engaged in regulating product safety. These approvals could require significant time and resources from our technical staff, and, if redesign were necessary, could result in a delay in the introduction of our products in those markets. Due to the continuous changes in the regulatory landscape, we cannot assure investors that federal, state or local laws, rules or regulations will not be amended or adopted in the future that could make compliance much more difficult or expensive.

For our metal-air battery products, we operate in an industry that is generally subject to national, state, local and foreign regulations that impose various environmental requirements on the transportation, importability, storage, use and disposal of certain batteries and certain chemicals used in the manufacture of certain batteries and energy storage systems. Although we believe that our operations are in material compliance with current applicable environmental regulations and are not subject to the same level of regulation as manufacturers of lithium, cadmium, mercury or lead-based batteries, there can be no assurance that changes in such laws and regulations will not impose costly compliance requirements on us or otherwise subject us to future obligations. Moreover, national, state, local and foreign governments may enact additional restrictions relating to the transportation, importability, storage, use and disposal of certain batteries used by our customers that could adversely affect the demand for our products. That being said, our strategy is to outsource the production of our battery cells to allow us the flexibility to intelligently select manufacturing locations that make sense from a cost and regulation perspective. Notwithstanding the foregoing, there can be no assurance that additional or modified regulations relating to the transportation, importability, storage, use and disposal of chemicals used to manufacture batteries, or restricting disposal of batteries will not be imposed.

The chemicals sector is governed by a variety of local, county, state, national and foreign rules and regulations. We are anticipating selling our nano-iron catalysts to ammonia plant operators for purposes of coating existing commercial iron catalysts to increase ammonia production yield and/or decrease energy consumption at these ammonia plants. Our ammonia plant customers will continue to handle all compliance with such laws, rules and regulations in their respective countries. With respect to the manufacture of the nano-iron catalysts, we have taken significant best practice measures in close coordination with various environmental agencies and advocate groups in relation to the manufacture and transport of catalysts. Despite the foregoing, there can be no assurance that additional or modified regulations relating to tariffs, as well as the transportation, importability, storage, use and disposal of nanomaterials, particularly nano-iron, will not be imposed by the U.S. or the countries into which our nano-iron catalysts may be shipped in the future.

Environmental, Health and Safety Policy

It is our environmental, health and safety, or EH&S, policy to ensure that our business practices continuously enhance the safety and health of all team members, the communities we operate in, and the environment. As a responsible corporate citizen, we observe strict compliance with all applicable laws, regulations, and responsible practices. In addition, we maintain an open partnership approach with regulatory agencies to develop guidance, regulations, and best practices for safely working with nanomaterials. We have a “Vision of Zero” –zero incidents, zero injuries and illnesses, zero accidents and zero environmental harm. Our EH&S policy is guided by our safety values of:

Leadership.We take an active leadership role in understanding and managing potential risks and hazards arising from working with nanomaterials. Our management provides the vision, the driving force, and resources needed to involve all employees in establishing a safe and healthy workplace environment.

Knowledge.As nanomaterials pose new challenges to understanding, predicting, and managing potential hazards and risks, we conduct periodic worksite analyses that study all working conditions to identify, prevent, and eliminate existing or potential hazards. The results of these studies are shared with all employees under a comprehensive EH&S training program as well as posted in product Material Safety Data Sheets (“MSDS”). We have also participated in various government-funded university research studies dealing with environmental safety and handling concerns. In addition, pertinent data is made available to customers, partners, industry groups, regulatory agencies, universities and community first responders.

Prevention.To prevent any harmful impact to the safety and health of the employees, the community, and the environment, we employ established safety systems in our operations, including, without limitation, administrative and engineering controls, personal protective equipment, safe work practices, preventive maintenance, and emergency preparedness programs.

Sustainability.We actively work to conserve resources and minimize or eliminate adverse EH&S effects and risks that may be associated with our products, services and operations. In addition, we will strive towards a “green supply chain” by the choice of suppliers, materials, services, and process and plant designs to ensure sustainability of operations and lifecycle product stewardship.

Continuous Improvement.We manages our business and operations with the goal of continuously upgrading our understanding of the EH&S impact of nanomaterials and systematically adapting our mode of operations to reach and maintain our policy of “Vision of Zero.”

Employees

As of September 15, 2014, we have 24 employees and 2 independent contractors. None of our employees are represented under a collective bargaining agreement.

Properties

We lease our principal offices located at 2905 Tech Center Dr., Santa Ana, California, consisting of 7,357 square feet of offices, laboratory and manufacturing space. Effective March 1, 2014, we entered into a new lease of our current facilities for a period of three years and concluding on February 28, 2017. We are not required to pay any rent during the first two months of the new lease, March 2014 and April 2014. Thereafter, the lease rate for the period May 1, 2014 through February 28, 2015 is $8,093 per month. The lease rate for the period March 1, 2015 through February 29, 2016 is $8,336 per month. The lease rate for the period March 1, 2016 through February 28, 2017 is $8,586 per month.

Item 1A. Risk Factors

The investment in our common stock involves a number of significant risks. You should consider carefully the following information about these risks before investing in our common stock. If any of the following risk events actually occur, the business, our results of operations, and our financial condition would likely suffer, and investors could lose part or all of their investment. It is impossible to accurately predict the results to investors, as we have no operating history as a public company. Prior to purchasing any of our common stock, you should carefully consider the following risks.

Risks Related to Our Business

We have a limited operating history and have experienced operating losses since our inception and may incur additional operating losses in the future. If we fail to generate significant revenue from the sale of our products, we may be unable to continue operations.

From inception through June 30, 2014, we have generated losses in excess of $36.8 million on revenues of approximately $2.1 million. As we have not yet generated substantive revenues, we will not be profitable until we establish a significant customer base and realize several million dollars in annual revenues. We expect to continue to lose money unless we are able to generate sufficient revenues and cash flows. If we are unable to generate sufficient revenues and cash flows to meet our costs of operations, we may be forced to cease our business. Our continued operations are dependent upon our ability to generate revenues from operations and obtain further financing. If we are unable to generate sufficient revenues and obtain sufficient financing, our current business plans could fail and we may be forced to close our business.

Our capitalization is limited and we may need additional funds to sustain our operations. If we are unable to raise additional capital, as needed, the future growth of our business and operations could be severely limited.

A limiting factor on our growth, including our ability to penetrate new markets such as the battery and chemicals sectors, attract new customers and deliver new products in a timely matter, is our limited capitalization compared to other companies in the industry. Our currently available capital resources are limited, and are only adequate to fund our operations and business objectives until the end of January of 2015 assuming no revenues are realized from our current business plan, no equity financing is procured, and no exercise of derivative securities (i.e., expiring options with a low exercise price per share) occurs. We will require additional financing in the form of debt or equity securities, or a combination thereof, and we are presently working with multiple interested prospective and existing investors in this regard. If additional financing is not procured, we may not achieve our revenue and profit objectives and may be forced to cease some or all of our operations. There can be no assurance that future debt or equity financing will be available to us on a timely basis, on acceptable terms, or at all. If we are unable to raise additional funds on acceptable terms, our business operations and business prospects may be adversely affected.

We have not generated significant revenue and may never be profitable.

Our ability to generate significant revenue and achieve profitability depends on our ability to successfully commercialize our MetAir® products and to complete the commercial validation of our nanocatalysts in chemical production. We do not anticipate generating measurable revenues from sales of our MetAir® products and from our nanocatalysts in chemical production until calendar Q2 of 2015 at the earliest. Our ability to generate future revenues from product sales depends heavily on our success:

| · | With respect to our chemical applications, successful completion of commercial validation testing with the JH Group, as well as the receipt of firm purchase orders; and |

| · | With respect to our battery business, completion of one-year shelf life development, selection of a third party battery manufacturing entity, and receipt of firm purchase orders. |

Because of the numerous risks and uncertainties associated with our product development and commercial validation, we are unable to predict the timing or amount of increased expenses, and when, or if, we will be able to achieve or maintain profitability. Even if we are able to generate significant revenues from the sale of our products, we may not become profitable and may need to obtain additional funding to continue operations.

We have not generated gross profit and may never generate gross profit.

Our ability to generate gross profit depends on our ability to achieve significant revenue to cover our fixed costs of goods sold and our variable costs of goods sold related to materials production. We do not anticipate generating gross profit until the second half of calendar 2015 at the earliest, and if at all, as we do not anticipate generating significant revenue until calendar Q2 2015 at the earliest. If we do not generate significant revenues, we may need to obtain additional funding to continue our operations.

We are dependent on our key personnel to operate our business, which could adversely affect our ability to operate if we are unable to retain or replace these persons. We may also require additional personnel, however, there can be no assurance that we will be able to hire or retain qualified personnel.

Our future performance will be substantially dependent on the continued services and on the performance of our senior management and other key personnel, particularly, Kevin D. Maloney, our Chief Executive Officer and President, Dr. Douglas Carpenter, our co-founder and Chief Technology Officer, and S.K. Park, our Vice President, Battery Manufacturing, among others. Our performance also depends on our ability to attract, retain and motivate other officers and key employees. The loss of the services of Messrs. Maloney, Carpenter, or Park, or any other key personnel could have a material adverse effect on our business, prospects, financial condition and results of operations. Our success will also depend upon our ability to recruit and retain additional qualified personnel.

There can be no assurance that sales, if any, of our metal-air battery products and nanocatalysts for use in the chemicals sector will result in profitability.

We have developed and patented a process to manufacture a variety of nanocatalysts, and have used these nanocatalysts to create metal-air battery products, that we anticipate introducing commercially in the second quarter of 2015, and to augment chemical production that we anticipate commencing a commercial validation test in the second half of 2014. However, there is no guarantee that the sales of metal-air battery products and use of nanocatalysts in chemicals applications will result in profitability or long-term viability. Our future success is a function of demand for our metal-air battery products and use of our nanocatalysts in the chemicals sector. There are no guarantees that large-scale commercial adoption of the metal-air battery products or use of one or more of our catalysts for one or more applications in the chemicals sector will occur. In the event this does not occur, our results of operations would be adversely affected and we may be forced to cease its business.

We only have one manufacturing facility.

We manufacture all of our nano-catalysts and MetAir battery components at our Santa Ana, California facility. In the event of a fire, flood, tornado, earthquake or other form of a catastrophic event, we would be unable to fulfill any then existing demand for our products, if any, and would not be able to do so for several quarters depending upon the severity of the event. While we carry what we believe to be sufficient property and casualty insurance, given the nature of our operations and our manufacturing equipment being of a bespoke nature, we will not be able to quickly replace our manufacturing and other equipment in a rapid fashion. As a result, should a catastrophic event occur which results in the loss of all or a measurable portion of our manufacturing equipment, our financial condition and results of operation would be materially adversely affected.

Our success in the battery sector is dependent upon finalization of a long-shelf life battery.

A key to achieving market success is long-shelf life. To this end, we continue to work on the battery anode chemistry to achieve our initial target goal of a one-year shelf life. We have achieved a nine-month shelf life and believe that we are close to achieving the requisite one-year shelf life required by prospective governmental agency customers. Over time, our ultimate objective is to achieve a 3-5 year shelf life. There can be no assurance that we will achieve our initial or longer-term target shelf life goals. In the event we are not successful in achieving our target shelf-life objectives, the market for our battery products will be reduced to applications where use of the battery is in close proximity to purchase thereof, the result of which could have a materially adverse effect on our battery revenues and overall results of operation.

We are dependent on and intend to use the majority of the proceeds from our most recent private placement for working capital.