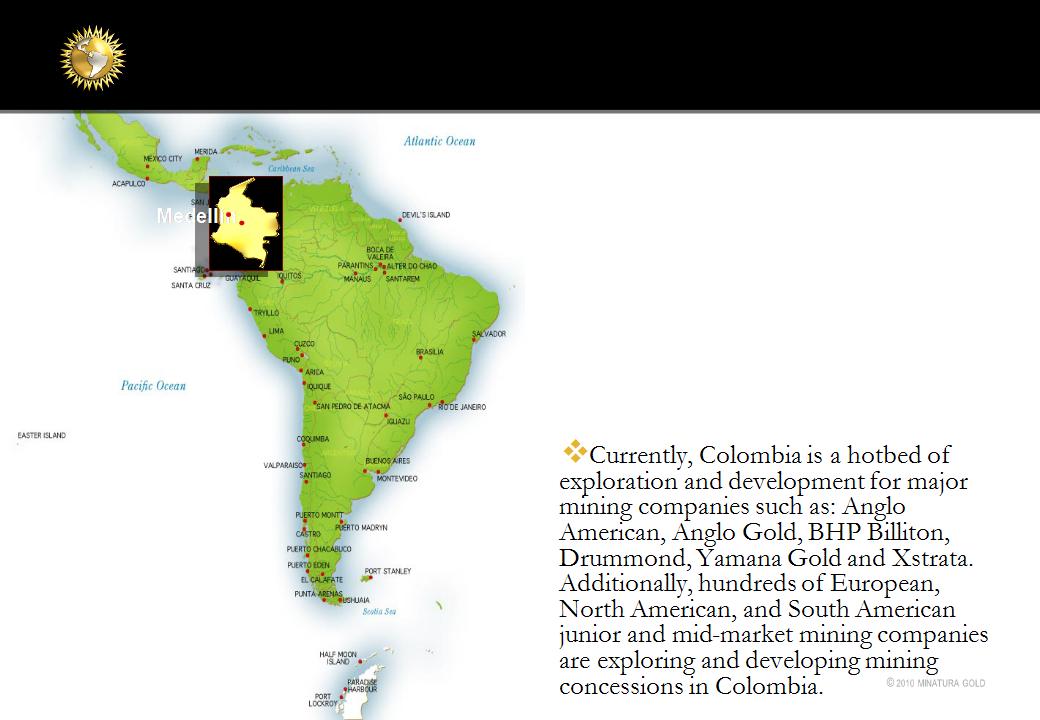

vRoyal Bank of Scotland recently reported that, “Colombia’s story is equally impressive but

perhaps understated, and we believe it will remain one of Latin America’s most attractive

investment opportunities over the next 5 years. We believe that in a new world of scarcer

capital and credit, Colombia stands relatively better positioned to be a winner among

Emerging Markets.”

vIntroduced in 2005, Colombia offers Legal Stability Contracts. These contracts offer

investors the opportunity to enter into a contract with the government guaranteeing that the

laws applicable to the investment at the time the investment is entered will remain in effect

for up to 20 yrs.

vPrudent economic policy, government investment in infrastructure, progress on

privatization, an attractive tax regime, liberalized capitol flow and investment rules have

resulted in an unprecedented investment in Colombia by foreign firms.

vColombia has become an FDI magnet, with annual FDI intake reaching +10.6bn in 2008

and averaging +5.6bn per year in the 2000’s. Much of this recent investment has been

generated by the mining and energy sectors.

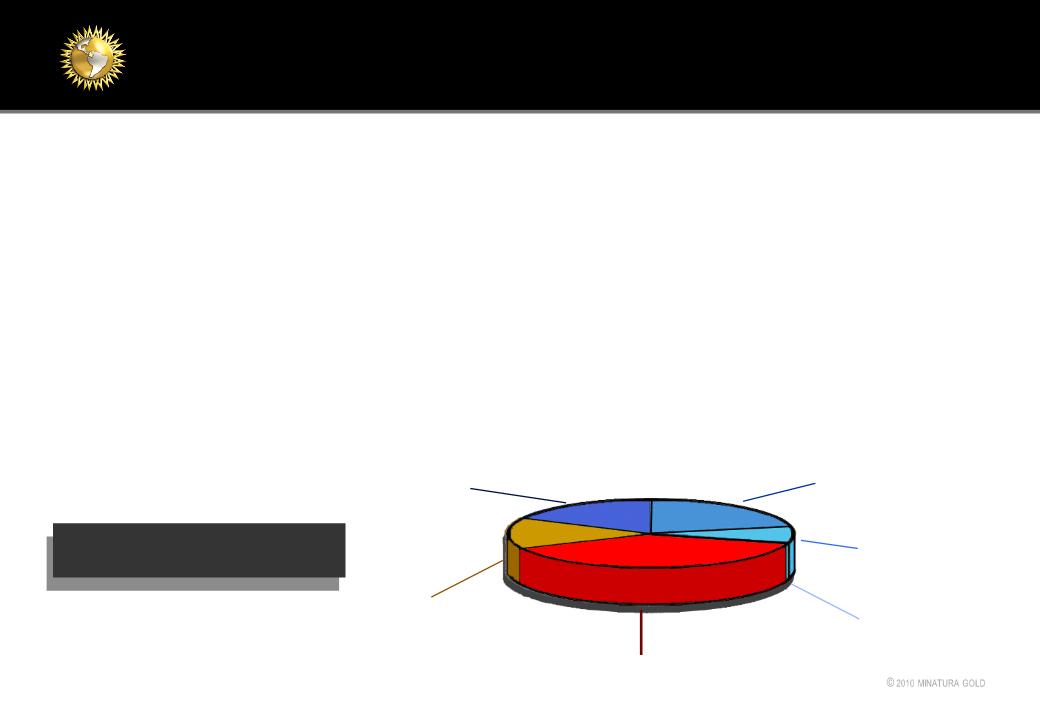

Source: Central Bank (Banco de Republica), calculations: UPME

* Excluding the sale of Bavaria

Foreign Direct Investment

in Colombia by sector-

2005*

Transportation

Warehousing

& Communications

17.7%

Oil & Gas

21.8%

Other Sectors

7.7%

Mining & Quarrying 38.3% (includes

coal)

Manufacturing

14.5%

Agriculture, Hunting,

Fishing & Fish

Farming

0.1%

Colombia's emerging market report.

8