TransVideo provides its business partners with the following equipment and technology:

TransVideo currently operates through two business areas: international and domestic.

TransVideo is a private company formed under the laws of the British Virgin Islands with its principal place of business at 2nd Floor, Tower B, Bei Fa Plaza, No. 15, Xueyuan South Road, Haidian District, Beijing P.R. China 100088. The registered office of TransVideo is located at the offices of SHRM Trustees (BVI) Limited of Trinity Chambers, P.O. Box 4301, Road Town, Tortola, British Virgin Islands.

TransVideo has a 66% equity interest in China iMedia Enterprise Ltd., which operates its business through its wholly-owned subsidiary, Beijing iMedia Technology Co., Ltd. In addition, TransVideo intends to invest in a new joint venture called China Sports Media Technology. According to the current understanding between each of the parties to this joint venture, TransVideo will ultimately have a 10% equity interest in China Sports Media Technology, although there is no assurance that such investment will actually occur or occur on these terms.

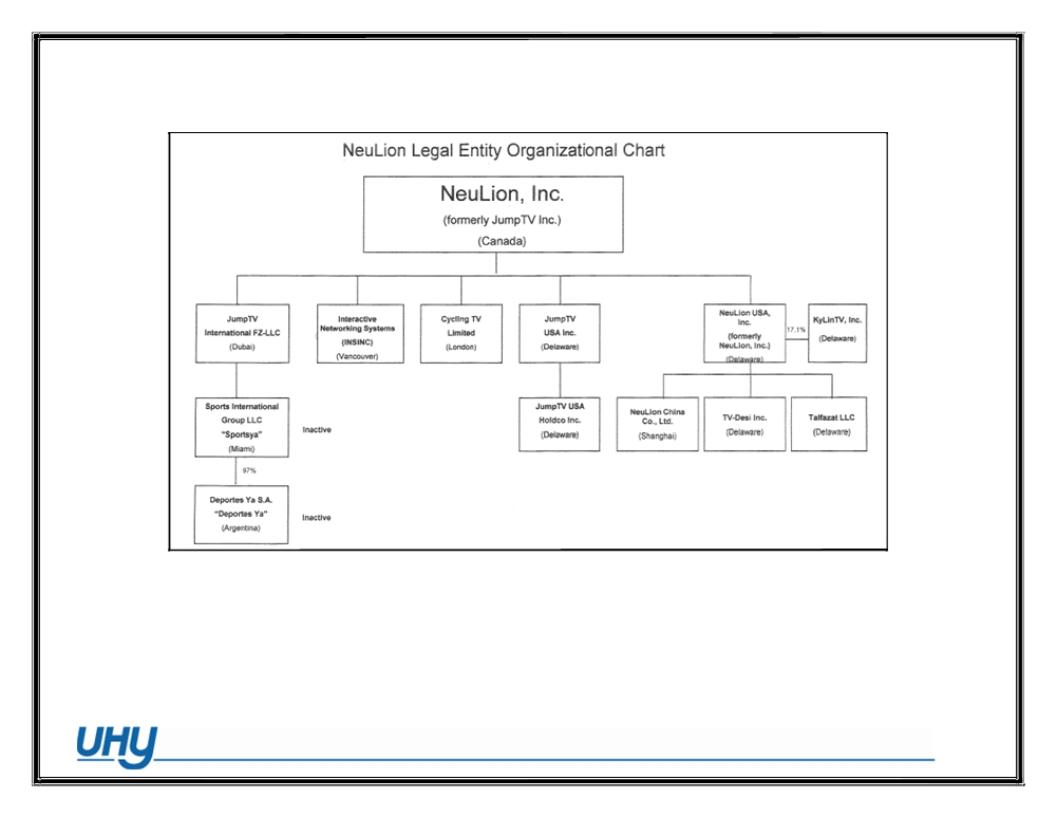

The chart below illustrates the corporate structure of TransVideo as of the date of this Circular.

TransVideo has neither declared nor paid any dividends on its common stock, and TransVideo does not currently anticipate paying any dividends. There are no restrictions in TransVideo’s constating documents that would restrict or prevent TransVideo from paying dividends.

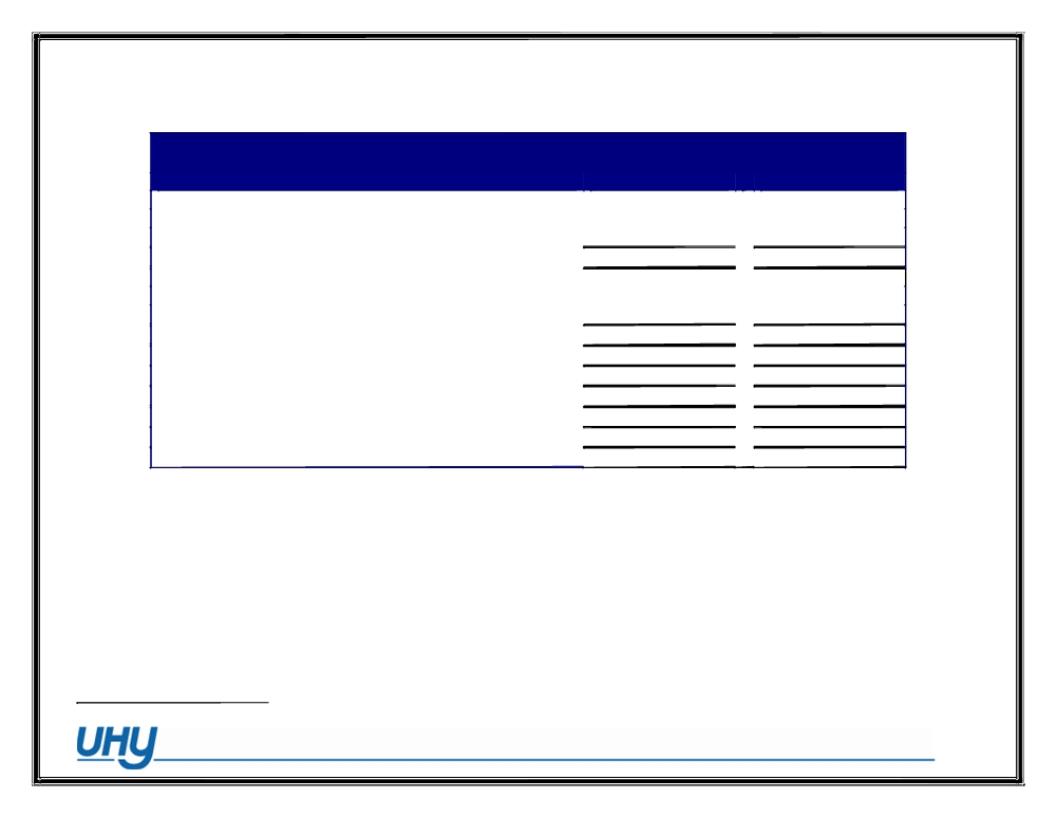

The following table sets forth certain selected consolidated financial information for TransVideo for the years ended December 31, 2009 and 2008, and for the three-month periods ended March 31, 2010 and 2009. This table should be read in conjunction with the TransVideo financial statements, including the notes thereto, attached as Schedules 1 and 2 to, and forming a part of, this Circular.

Management’s Discussion and Analysis

The following Management’s Discussion and Analysis (MD&A) includes financial information from, and should be read in conjunction with, TransVideo’s audited consolidated financial statements, including the notes thereto, for the years ended December 31, 2009 and 2008, attached as Schedule 1, and TransVideo’s unaudited consolidated financial statements, included the notes thereto, for the three months ended March 31, 2010 and 2009, attached as Schedule 2 forming a part of, this Information Circular and the disclosure contained throughout this Information Circular.

Cautions Regarding Forward-Looking Statements

This Management’s Discussion and Analysis contains certain forward-looking statements, which reflect management’s expectations regarding TransVideo’s growth, results of operations, performance and business prospects and opportunities.

Statements about TransVideo’s future plans and intentions, results, levels of activity, performance, goals or achievements or other future events constitute forward-looking statements. Wherever possible, words such as “may,” “will,” “should,” “could,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this Management’s Discussion and Analysis are based upon what management believes to be reasonable assumptions, TransVideo cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this Management’s Discussion and Analysis, and the TransVideo assumes n o obligation to update or revise them to reflect new events or circumstances, except as required by law. Many factors could cause the actual results, performance or achievements of TransVideo to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including: general economic and market segment conditions; competitor activity; product performance; capability and acceptance; international risk and currency exchange rates; and technology changes. More detailed assessment of the risks that could cause actual results to materially differ from current expectations is contained herein and in the “Risk Factors.”

Recent Development

Sale of Operating Interests

On May 19, 2010, TransVideo reached an agreement in principle to sell the operating interests of TransVideo, in exchange for 22,000,802 common shares of NeuLion. TransVideo shareholders will own approximately 15% of NeuLion on a fully diluted basis, upon the consummation of the transaction. TransVideo's passive investment in KyLinTV, will not be transferred as part of the transaction.

The closing of the transaction remains subject to the negotiation and execution of a definitive agreement and regulatory and Shareholder approvals, which are anticipated to occur during summer 2010.

Overview

TransVideo operates its business through its wholly-owned subsidiary, Beijing TransVideo. TransVideo is a leading public IPTV technology and solution provider with its principal place of business in the ZhongGuanCun Hi-Tech district of China. When TransVideo was established in 2004, its management team hired scientists from Chinese universities that developed technology to service the end-to-end IPTV market. In 2005, a year after its incorporation, the first version of the IPTV transmission was released, and TransVideo’s services were launched in Canada, Europe, Japan, Korea, the Middle East and Australia. Since 2005 TransVideo has continued to develop cutting edge IPTV technology and solutions for end-to-end IPTV service providers around the world.

TransVideo currently operates in two business areas:

| · | International Business. TransVideo’s international business is focused on providing end-to-end IPTV companies with Set Top Boxes and Transcoders, which are both used by IPTV companies to stream content to consumers. As of the date of this Information Circular, TransVideo has sold its products to two main partners in the international market: NeuLion Inc., or NeuLion, an IPTV service and technology provider that builds and manages private broadcasting networks for companies interested in reaching specific target audiences, and KyLinTV, Inc., a provider of live television broadcasting and on-demand movies from the PRC. |

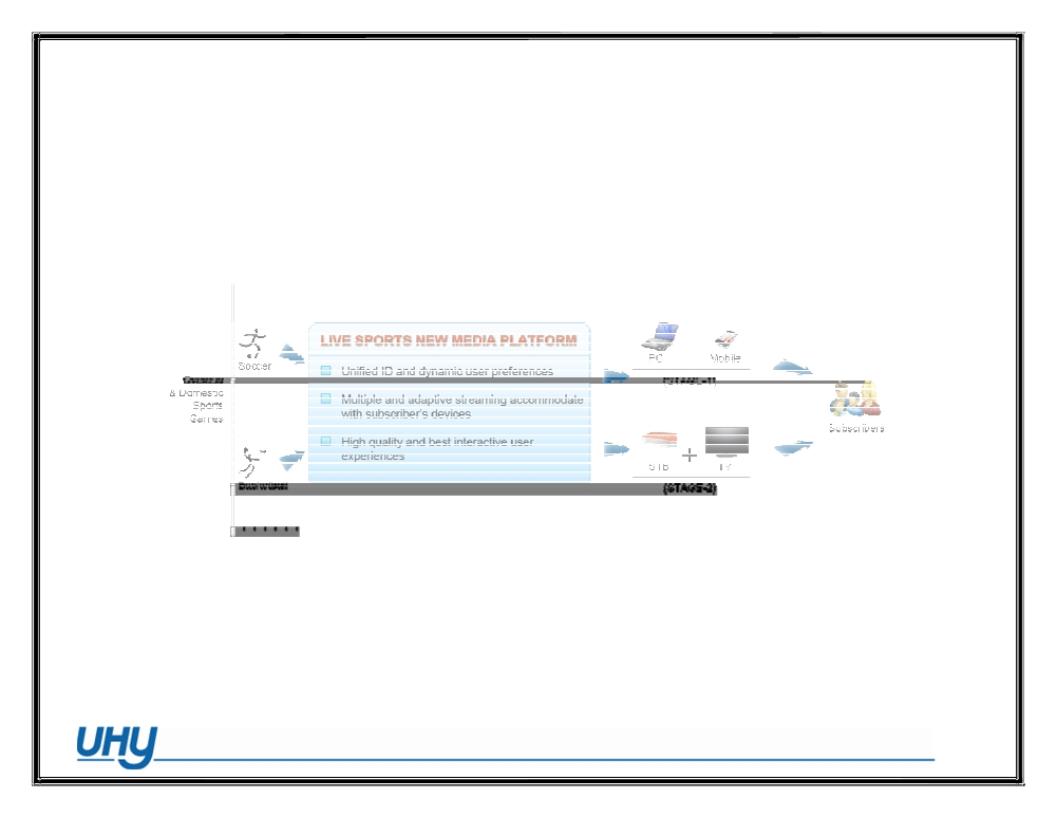

| · | Domestic Business. TransVideo’s domestic business consists of five sources: (i) China Sports Media Company (a future joint venture with China State General Administration of Sports in which TransVideo will have a 10% equity interest), an entity which will aggregate sports content from various associations in the PRC and will deliver to Chinese customers through the “New Sports Media” IPTV platform; (ii) Beijing iMedia Technology Co. Ltd. (a wholly-owned subsidiary of China IMedia Enterprise Ltd., an entity in which TransVideo holds a 66% equity interest), an entity which is focused on providing educational content to the domestic Chinese market through the iBaby brand name; (iii) Sales of Set Top Boxes; (iv) Sales of Transcoder technology; and (v) Site Licenses. |

Products and Services

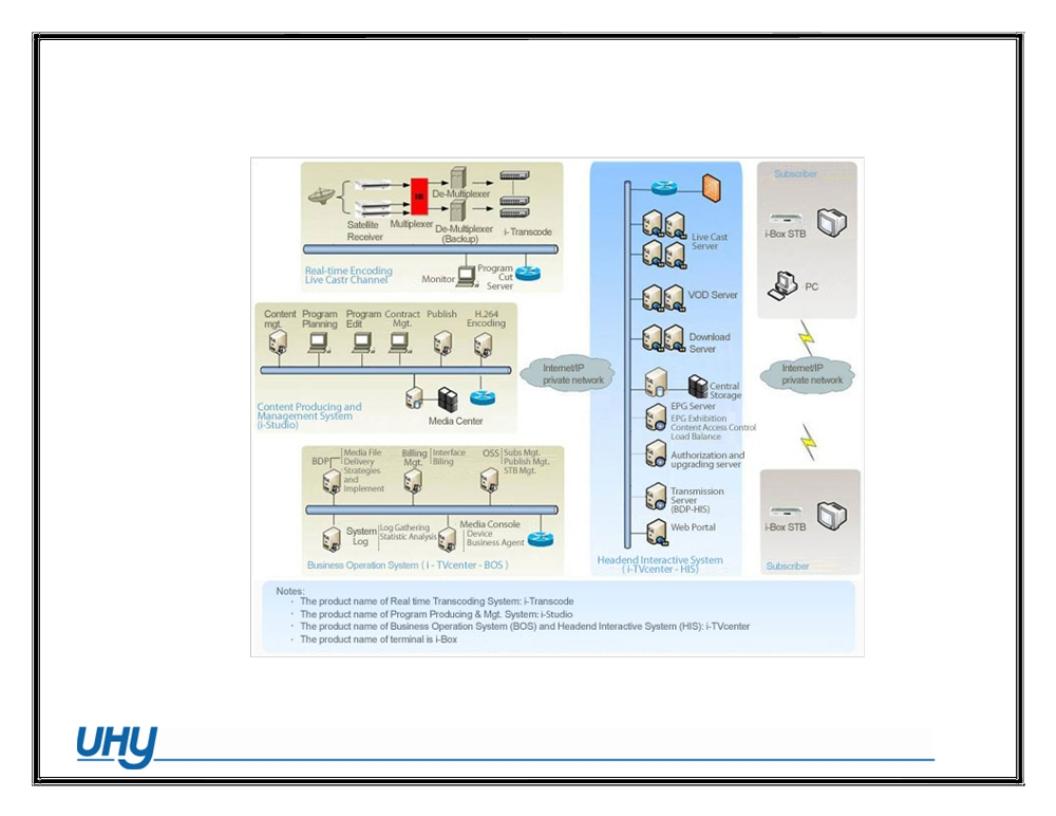

TransVideo provides its business partners with the following equipment and technology:

| § | Transcoding Devices: Transcoding Devices are high quality head-end products for view networks which are used in public internet or broadband network operations and provide key components for IP video applications. |

| § | Time Shift Systems: Time Shift Systems are online processing systems which enable customers to have control over channels’ time-shift and play back. This means that customers can have control over live television. |

| § | Set Top Boxes: TransVideo offers two different Set Top Boxes, including the i-Box 2000 and the i-Box 3000. |

| § | TV Center Rich-Media Services Platform: This is an efficient management services platform for multimedia services, providing a more flexible and dynamic service operation management capabilities for operators of IPTV networks. |

| § | Studio Content Production and Management: This is a network program production and audit/video information publication application system. The major functions include contract management, program management, program release and system management. |

TransVideo also offers its customers several services including:

| § | Cast Live TV Solution: This service is typically applied to TV broadcast platforms for broadband customers. The service offers a multi-channel broadcast with the look and feel of a typical television viewing experience. |

| § | Video On-Demand: This service allows a viewer to watch any content, at any time and as many times as they would like. |

| § | Push Network Pushing Solution: This service is designed to address the needs of enterprises that wish to broadcast internal content such as company news. This systems ensures the timely broadcast of information for public areas. |

| § | Download Home Media Center: This service utilizes the TV Center Rich-Media Services Platform and the Studio Content Production and Management products described above to download audio/video content, photo sharing, voice over internet protocol and the sharing of audio/video messages between family members. |

Operations

Revenue

TransVideo earns revenue from 3 areas:

| (i) | Retailed packaged goods, which are recognized when products are shipped; |

| (ii) | License fees, which are recognized over the life of the contract; and |

| (iii) | Maintenance fees, which are recognized as the service is performed. |

Operating Expenses

Cost of revenue includes manufacturing and distribution costs sold and programs licensed, operating costs related to product support service centers and product distribution centers, costs incurred to support and maintain Source Code IPTV products and services, inventory valuation adjustments, and the amortization of capitalized research and development costs associated with software products that have reached technological feasibility. Capitalized research and development costs are amortized over the estimated lives of the products.

| (ii) | Research and Development |

Research and development expenses include payroll, employee benefits and other headcount-related expenses associated with product development. Research and development costs also include third-party development and programming costs, localization costs incurred to translate software for international markets, the amortization of purchased software code and services content, and in-process research and development. Such costs related to software development are included in research and development expense until the point of technological feasibility is reached, which for software products, is generally shortly before the products are released to manufacturing. Once technological feasibility is reached, such costs are capitalized and amortized to cost of revenue over the estimated lives of the products.

| (iii) | Sales and Marketing |

Sales and marketing expenses include payroll, employee benefits and other headcount-related expenses associated with sales and marketing personnel, and the costs of advertising, promotions, tradeshows, seminars and other programs. Advertising costs are expenses as incurred. TransVideo did not incur any advertising expenses in fiscal years 2009 and 2008.

| (iv) | General and Administrative |

General and administrative expenses are comprised of executive compensation, general overhead such as finance department and administrative staff, depreciation expenses, travel and lodging, meals and entertainment, utilities, and research and development expenses.

Other Income

Other income primarily represents interest income earned on bank account balances held with various financial institutions.

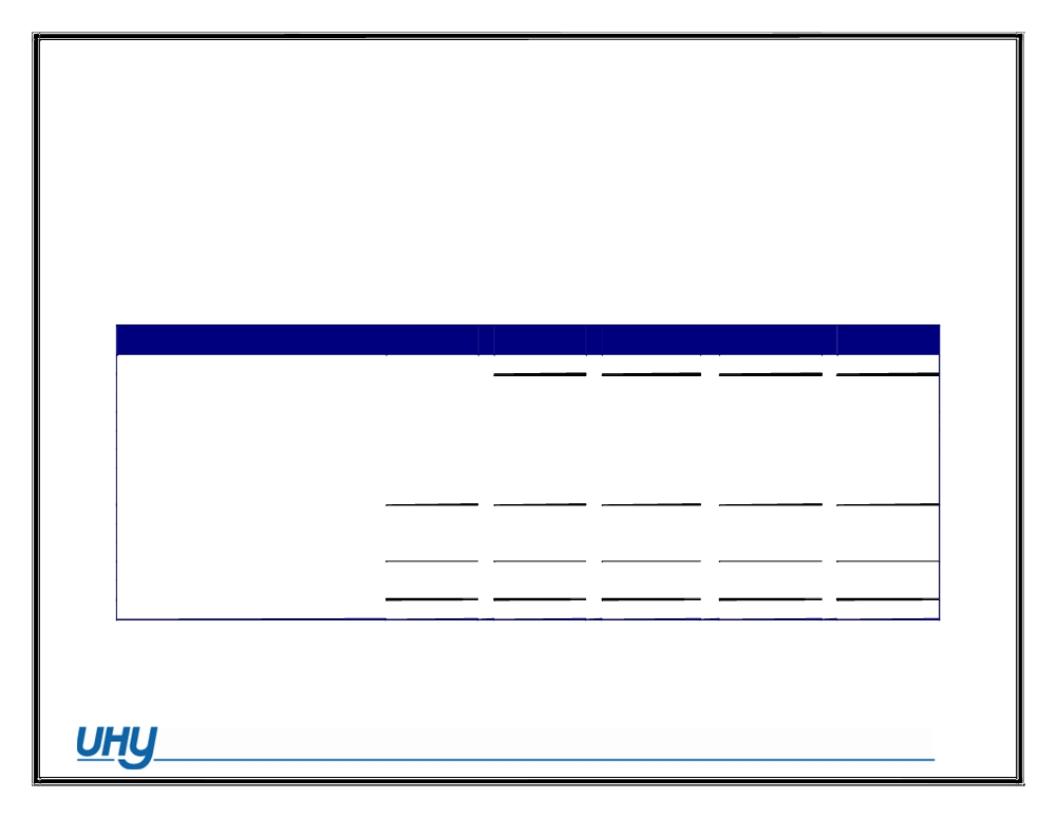

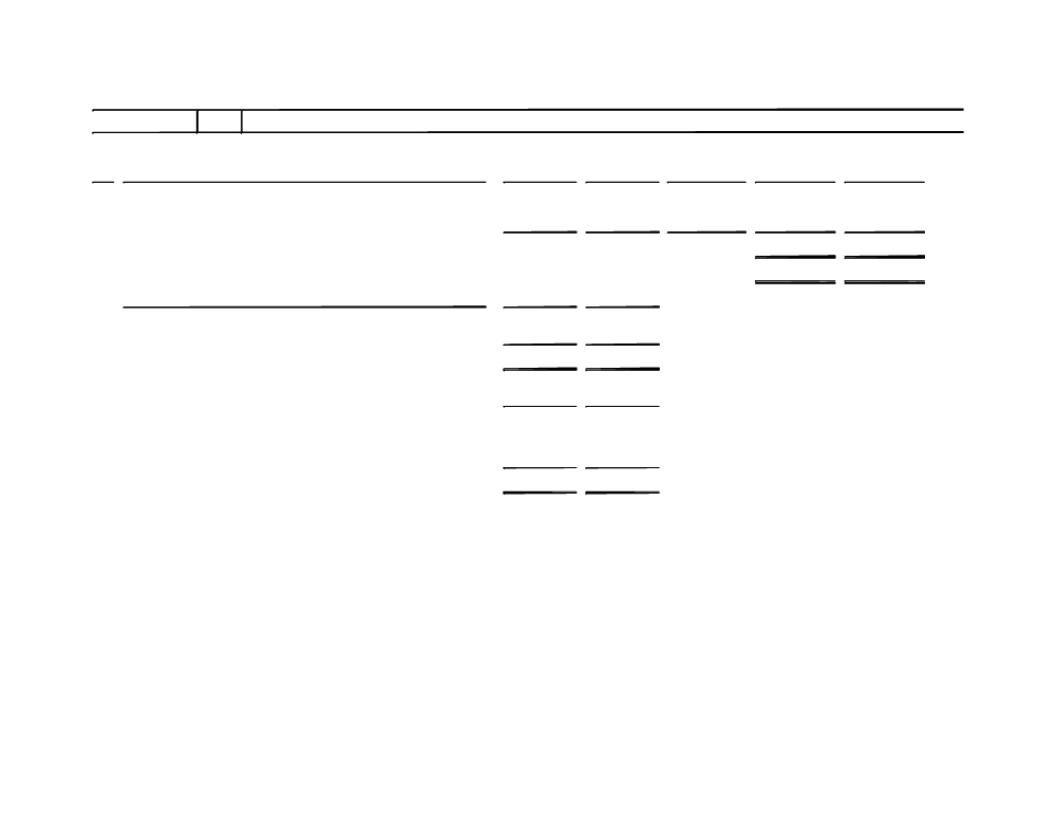

Selected Annual Information

The selected consolidated annual information set out below for the years ended December 31, 2009 and 2008 and as at December 31, 2009 and 2008 has been derived from TransVideo’s audited consolidated financial statements and accompanying notes. Readers should read the following information in conjunction with those statements and related notes.

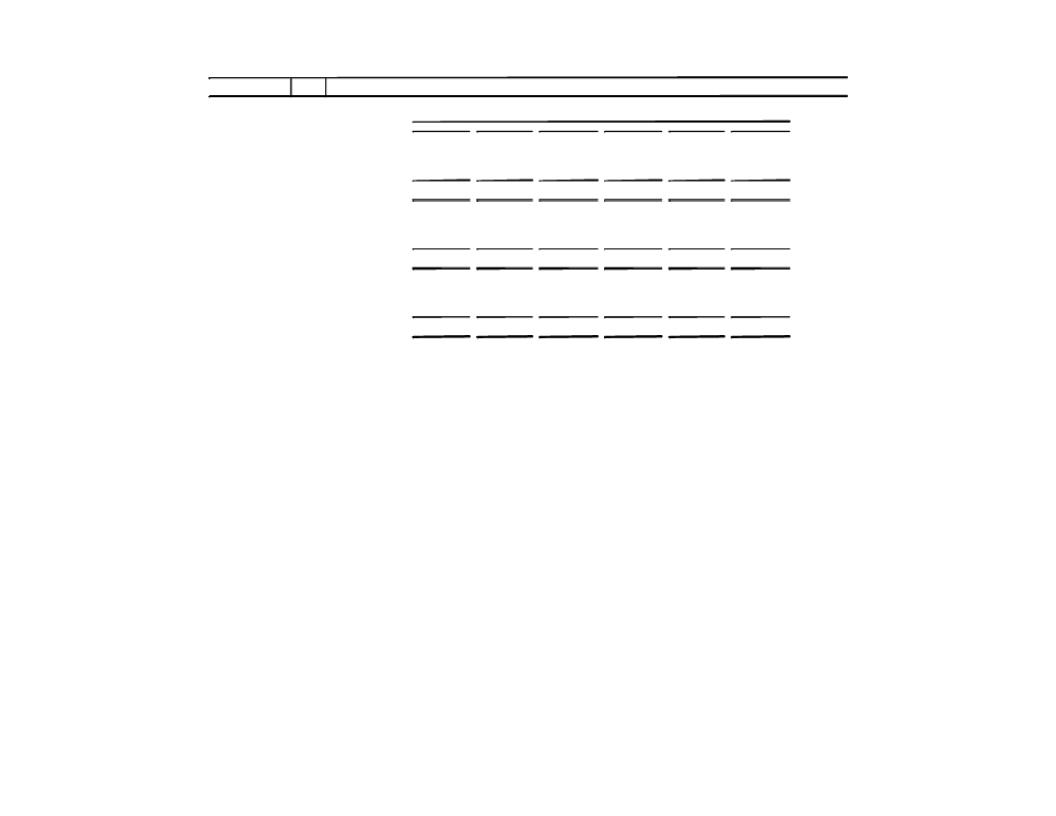

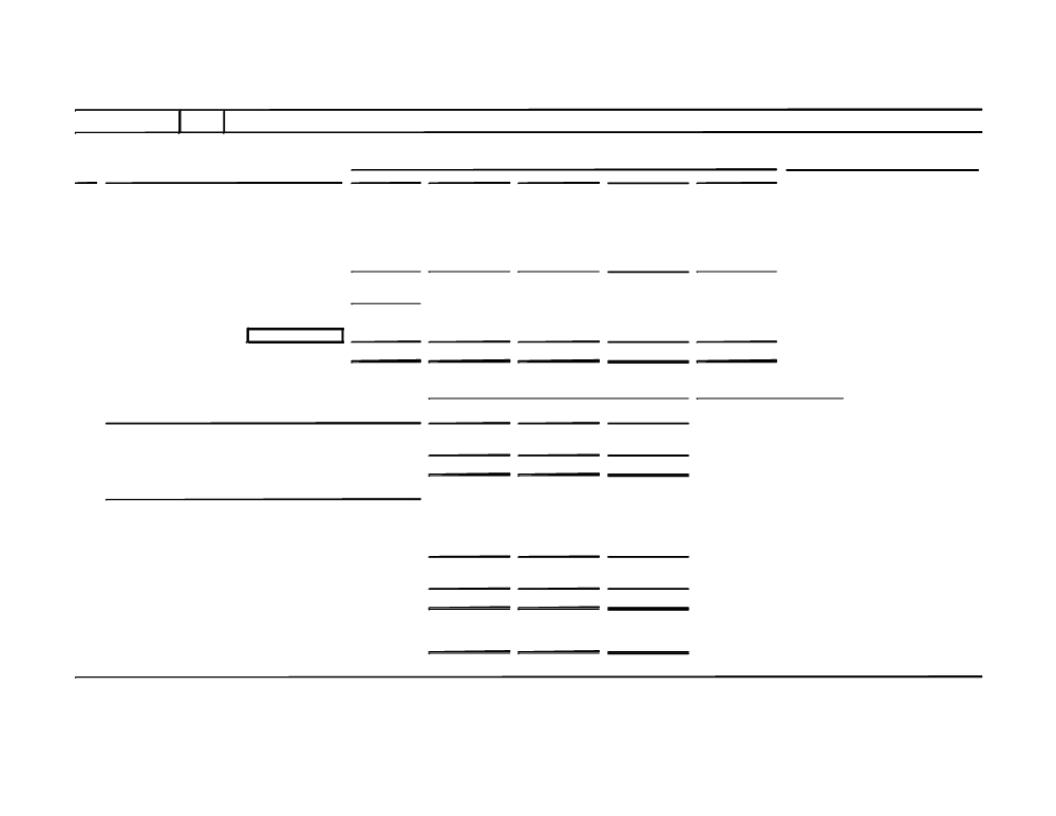

Consolidated Statement of Operations Data:

| | | |

| | 2009 | 2008 | |

| | $ | $ | |

| Revenue | 2,274,779 | 9,062,627 | |

| Cost of revenue | (1,184,435) | (6,160,579) | |

| Other operating expenses | (1,994,161) | (2,398,583) | |

| Operating income (loss) | (903,817) | 503,465 | |

| Net income (loss) | (828,755) | 524,214 | |

| Basic and diluted loss per share | (0.24) | 0.21 | |

Consolidated Balance Sheet Data:

| | | |

| | 2009 | 2008 | |

| | $ | $ | |

| Cash | 1,521,168 | 4,284,829 | |

| Inventory | 634,492 | 897,800 | |

| Total assets | 6,071,510 | 6,993,493 | |

| Total liabilities | 1,109,119 | 1,238,590 | |

| Total shareholders’ equity | 4,962,391 | 5,754,903 | |

The impact of the financial crisis led to a decrease in revenue in fiscal 2009 as compared to fiscal 2008, as customers reduced their inventory and dramatically slowed or reduced their purchases of STB products from TransVideo. This in turn forced TransVideo to decrease expenses in all other areas of the business.

Additionally, a customer of TransVideo, KylinTV established a WOFE in Beijing to fund its operation in China whereas in fiscal 2008, KylinTV paid Transvideo service revenue to outsource its operation in China to Beijing TransVideo.

Results of Operations

Comparison of Fiscal Year Ended December 31, 2009 to Fiscal Year Ended December 31, 2008

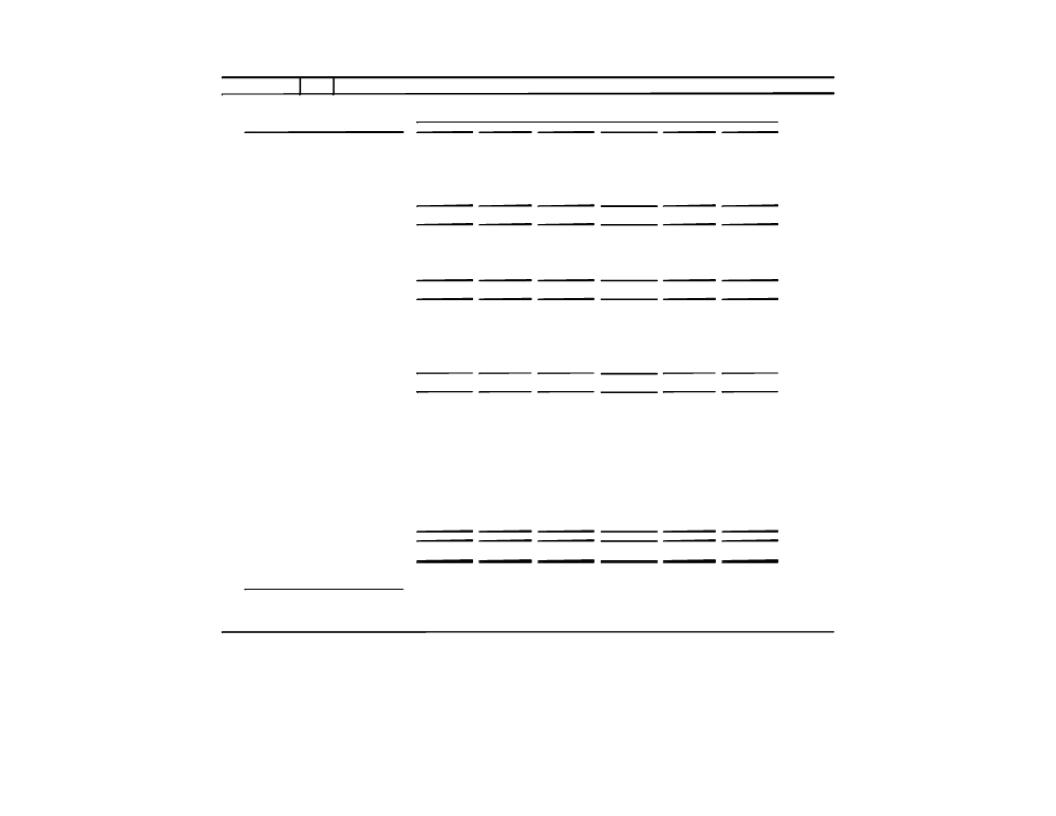

| | | | | | | |

| | | 2009 | | | 2008 | | | Change | |

| | | $ | | | $ | | | % | |

| Revenue | | | 2,274,779 | | | | 9,062,627 | | | | (75%) | |

| | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | |

| Cost of revenue | | | 1,184,435 | | | | 6,160,579 | | | | (81%) | |

| Research and development | | | 635,316 | | | | 431,894 | | | | 47% | |

| Sales and marketing | | | 284,531 | | | | 316,079 | | | | (10%) | |

| General and administrative | | | 1,074,314 | | | | 1,650,610 | | | | (35%) | |

| | | | 3,178,596 | | | | 8,559,162 | | | | (63%) | |

| Operating income (loss) | | | (903,817 | ) | | | 503,465 | | | | - | |

| | | | | | | | | | | | | |

| Other income | | | 75,062 | | | | 22,226 | | | | 238% | |

| Earnings (loss) before income taxes | | | (828,755 | ) | | | 525,691 | | | | - | |

| Provision for income taxes | | | - | | | | (1,477 | ) | | | - | |

| Net income (loss) | | | (828,755 | ) | | | 524,214 | | | | - | |

Revenue

Revenue decreased from $9.1 million for the year ended December 31, 2008 to $2.3 million for the year ended December 31, 2009. The decrease was due to the impact of the financial crisis as customers reduced their inventory and dramatically slowed or reduced their purchases of STB products from TransVideo. The other factor that contributed to the decrease was that in January 2009, KylinTV established a WOFE in Beijing to fund its operation in China whereas in fiscal 2008, KylinTV paid Transvideo service revenue to outsource its operation in China to Beijing TransVideo.

Costs and Expenses

Cost of revenue decreased from $6.2 million or 68% of revenue for the year ended December 31, 2008 to $1.2 million or 52% of revenue for the year ended December 31, 2009. The decrease of $5.0 million was due to the decrease in revenue. The improvement of 16% as a percentage of revenue was due to the fact that outsourcing KylinTV’s China operation had a much lower margin rate than the rest of the business. Once this line of business ceased in January 2009, margins improved.

| (ii) | Research and Development |

Research and development increased from $0.4 million for the year ended December 31, 2008 to $0.6 million for the year ended December 31, 2009. The increase of $0.2 million was due to more research and development efforts invested by TransVideo into the new version of the STBs as well as the new IPTV head-end system and platforms to support high definition and other new standards.

| (iii) | Sales and Marketing |

Sales and marketing was $0.3 million for the years ended December 31, 2008 and 2009.

| (iv) | General and Administrative |

General and administrative decreased from $1.7 million for the year ended December 31, 2008 to $1.1 million for the year ended December 31, 2009. The decrease of $0.6 million was due to reducing facility leasing and certain personnel and expenses in the administration and support functions.

Other Income

Other income increased from a nominal amount for the year ended December 31, 2008 to $0.1 million for the year ended December 31, 2009. The increase of $0.1 million was due to interest earned on higher cash balances during the year.

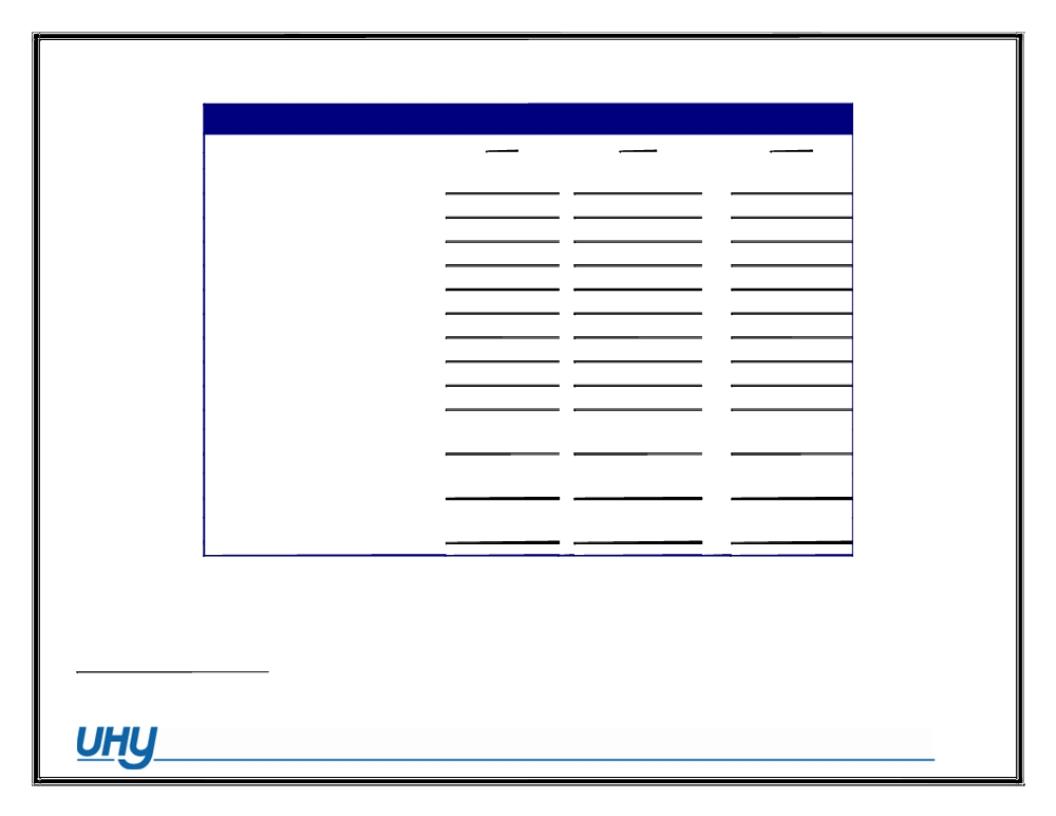

Comparison of Three months Ended March 31, 2010 to Three months Ended March 31, 2009

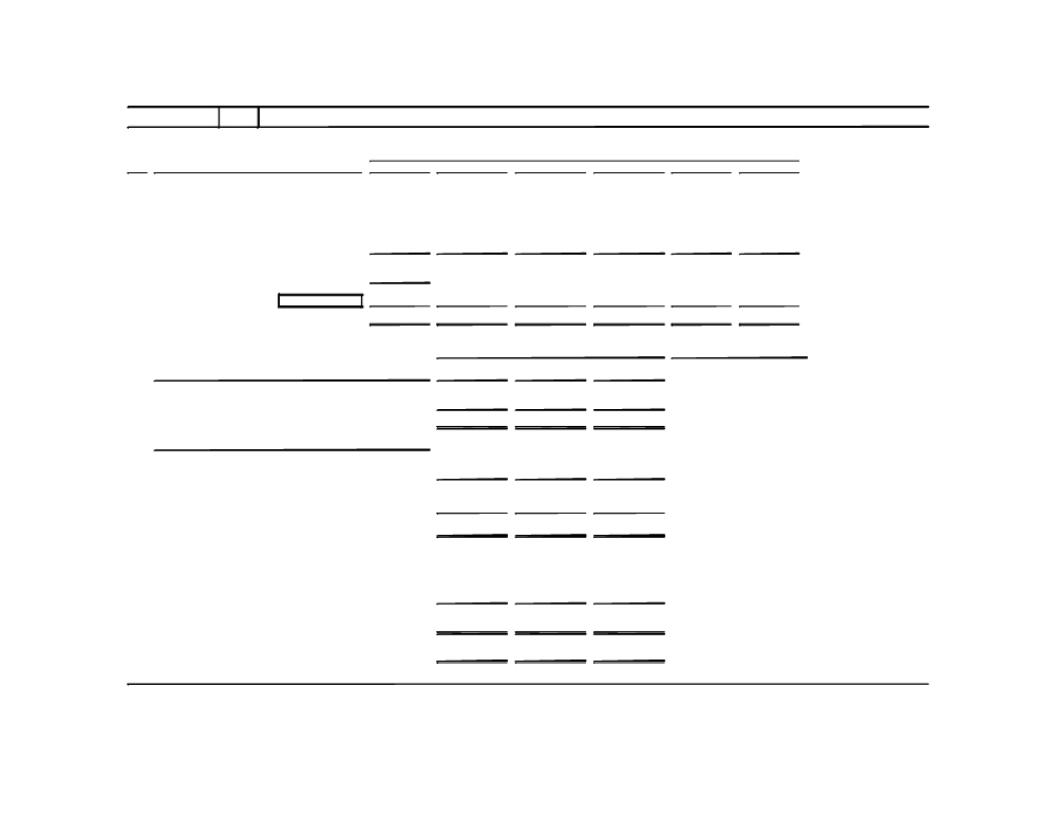

| | | | | | | |

| | | 2010 | | | 2009 | | | Change | |

| | | $ | | | $ | | | % | |

| Revenue | | | 409,205 | | | | 1,150,389 | | | | (64%) | |

| | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | |

| Cost of revenue | | | 308,832 | | | | 406,036 | | | | (24%) | |

| Research and development | | | 184,210 | | | | 158,829 | | | | 16 | |

| Sales and marketing | | | 58,124 | | | | 80,653 | | | | (28%) | |

| General and administrative | | | 195,343 | | | | 331,430 | | | | (41%) | |

| | | | 437,677 | | | | 570,912 | | | | | |

| Operating income (loss) | | | (337,304 | ) | | | 173,441 | | | | | |

| | | | | | | | | | | | | |

| Other income (loss) | | | (606,751 | ) | | | 37,905 | | | | - | |

| Earnings (loss) before income taxes | | | (944,055 | ) | | | 211,346 | | | | - | |

| Provision for income taxes | | | - | | | | - | | | | - | |

| Net income (loss) | | | (944,055 | ) | | | 211,346 | | | | - | |

Revenue

Revenue decreased from $1.2 million for the three months ended March 31, 2009 to $0.4 million for the three months ended March 31, 2010. The decrease of $0.8 million was due to the impact of the international financial crisis. The STB sales revenue in the three months ended March 31, 2009 was most delivery of international orders made during early Q4 of 2008. During the three months ended March 31, 2010, the international STB revenue has not recovered to the previous level.

Costs and Expenses

Cost of revenue decreased from $0.4 million or 35% of revenue for the three months ended March 31, 2009 to $0.3 million or 75% of revenue for the three months ended March 31, 2010. The decrease of $0.1 million was due to decrease of sales and changes to the sales structure.

| (ii) | Research and Development |

Research and development was $0.2 million for the three months ended March 31, 2009 and 2010.

Sales and Marketing

Sales and marketing was $0.1 million for the three months ended March 31, 2009 and 2010.

| (iii) | General and Administrative |

General and administrative decreased from $0.3 million for the three months ended March 31, 2009 to $0.2 million for the three months ended March 31, 2010. The decrease of $0.1 million was due to the decrease of office rental expenses as well as organizational changes that reduced headcount on manufacturing and support functions.

Other Income (loss)

Other income decreased from a nominal amount for the three months ended March 31, 2009 to a loss of $0.6 million for the three months ended March 31, 2010. The decrease was due to a non-cash loss on the investment in KyLinTV.

Liquidity and Capital Resources

During the year ended December 31, 2009, TransVideo’s cash position decreased by $2.8 million. TransVideo used $2.8 million to fund operations which included $2.1 million in working capital changes.

As of December 31, 2009, TransVideo’s principal sources of liquidity included $1.5 million in cash and $0.4 million in accounts receivable.

TransVideos’s cash balance of $1.5 million at December 31, 2009, represent cash on hand, demand deposits placed with bank or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments. TransVideo believes that their cash balances are secure notwithstanding the current global economy. TransVideo’s investment policy is to invest in low-risk short-term investments which are primarily term deposits. TransVideo has not had a history of any defaults on these term deposits, nor does it expect any in the future given the short term to maturity of these investments.

TransVideo’s business is still in the early stages, with only a few years of operating history. From TransVideo’s inception, it has incurred net losses and has an accumulated deficit of $0.3 million. TransVideo continues to review its operating structure to maximize revenue opportunity and further reduce costs. Based on its current business plan and internal forecasts, and considering the risks that are present in the current global economy, TransVideo believes that its cash on hand will be sufficient to meet its working capital and operating cash requirements for the next twelve months. Cash from operations could be affected by various risks and uncertainties, including, but not limited to, the risks detailed herein in the section titled “Risk Factors.” If TransVideo’s actual cash needs are greater than forecasted and if cash on hand is insufficient to meet its working capital and cash requirements for the next twelve months, TransVideo will require outside capital in addition to cash flow from operations in order to fund its business. TransVideo’s short operating history, its current lack of profitability and the prolonged upheaval in the capital markets could each or all be factors that might negatively impact its ability to obtain outside capital on reasonable terms, or at all. If TransVideo were ever unable to obtain needed capital, it would reevaluate and reprioritize its planned capital expenditures and operating activities. It cannot be assured that TransVideo will ultimately be able to generate sufficient revenue or reduce its costs in the anticipated time frame to become profitable and have sustainable cash flows.

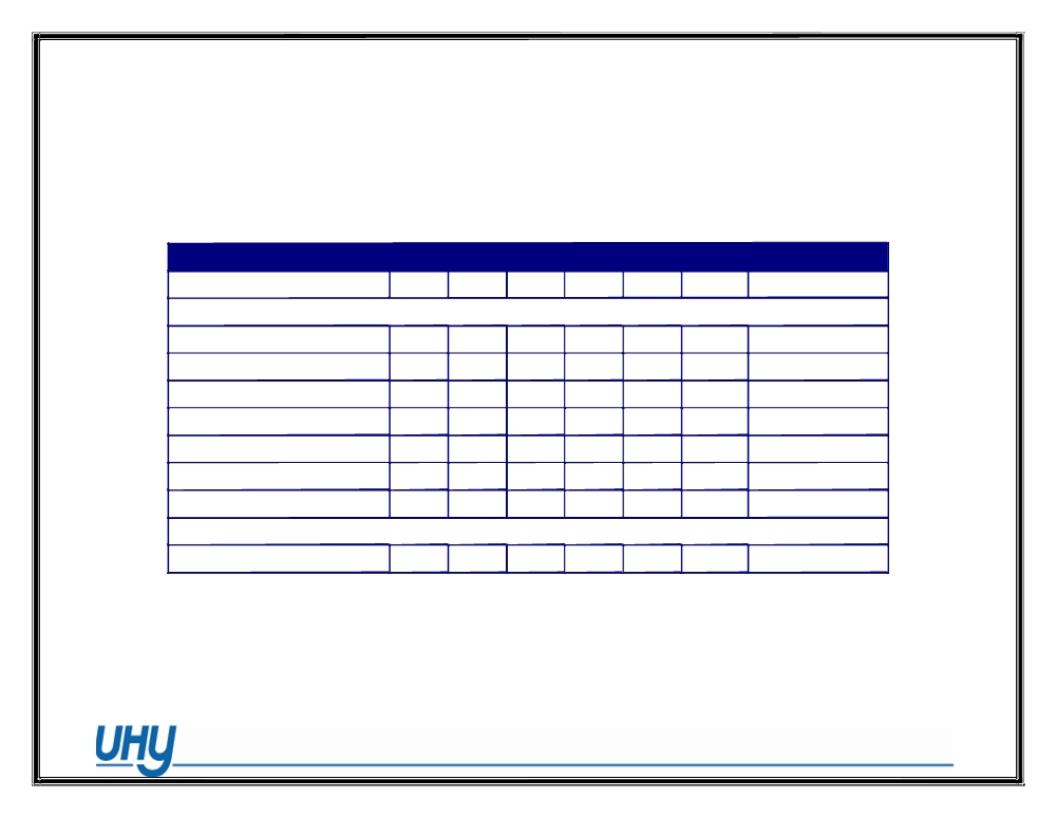

Working Capital Requirements

The net working capital at December 31, 2009 was $4.6 million, a decrease of $0.7 million from the December 31, 2008 net working capital of $5.3. The decreased working capital is primarily due to a decrease in cash of $2.8 million offset by an increase in due from related parties of $2.2 million.

Current assets at December 31, 2009 were $5.7 million, a decrease of $0.8 million from the December 31, 2008 balance of $6.5 million. The change is primarily due to a decrease in cash of $2.8 million offset by an increase in due from related parties of $2.2 million.

Current liabilities at December 31, 2009 were $1.1 million, a decrease of $0.1 million from the December 31, 2008 balance of $1.2 million.

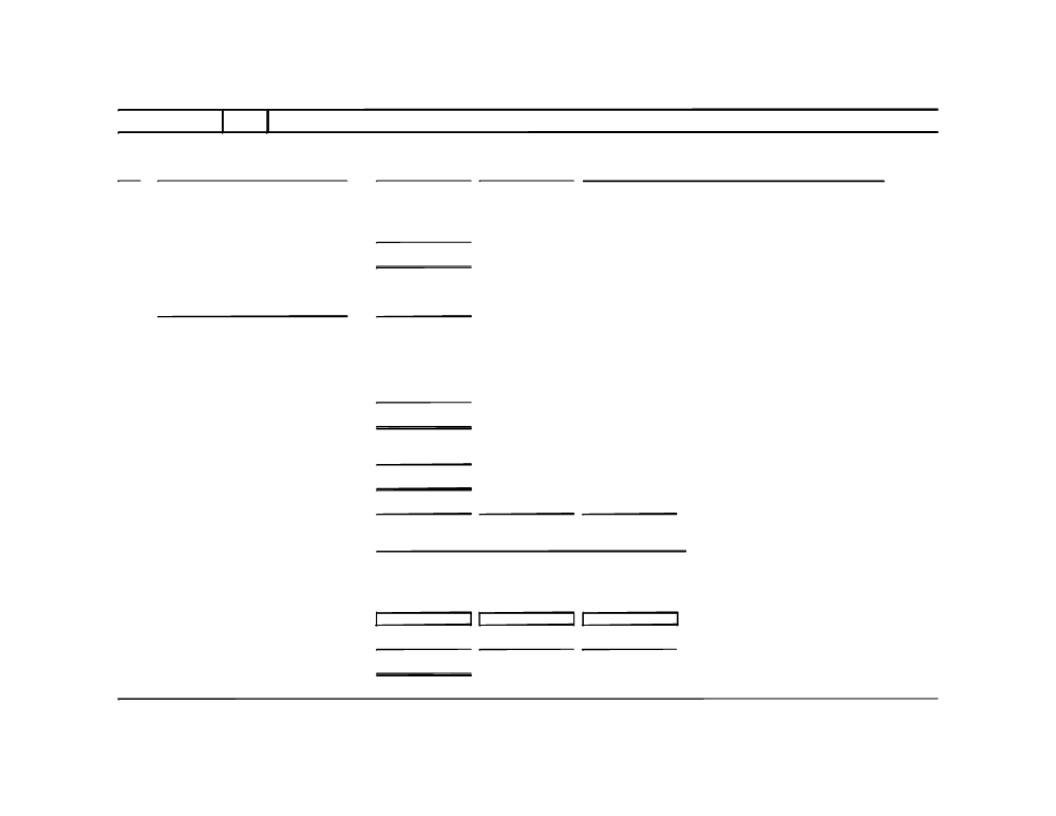

Summarized Balance Sheet Data:

| | | | | | | |

| | | 2009 | | | 2008 | | | | |

| | | $ | | | $ | | | | | |

| Current Assets | | | | | | | | | | | |

| Cash | | | 1,521,168 | | | | 4,284,829 | | | | | |

| Accounts receivable | | | 426,825 | | | | 301,636 | | | | | |

| Other receivable | | | 261,786 | | | | 372,860 | | | | | |

| Due from related parties | | | 2,724,822 | | | | 513,514 | | | | | |

| Inventory | | | 634,492 | | | | 897,800 | | | | | |

| Prepaid taxes and expenses | | | 117,993 | | | | 130,265 | | | | | |

| Total current assets | | | 5,687,086 | | | | 6,500,904 | | | | | |

Current Liabilities | | | | | | | | | | | | |

| Accounts and other payables | | | 452,048 | | | | 602,452 | | | | | |

| Taxes payable | | | 49,939 | | | | 58,417 | | | | | |

| Due to related parties | | | 115,000 | | | | 13,577 | | | | | |

| Deferred revenue | | | - | | | | 50,000 | | | | | |

| Accrued liabilities | | | 55,987 | | | | 44,443 | | | | | |

| Customer deposits | | | 436,143 | | | | 469,701 | | | | | |

| Total current liabilities | | | 1,109,119 | | | | 1,238,590 | | | | | |

| | | | | | | | | | | | | |

| Working capital ratio | | | 5.13 | | | | 5.25 | | | | | |

Off-Balance Sheet Arrangements

TransVideo did not have any off-balance sheet arrangements as of December 31, 2009.

Contractual Obligations and Commitments

The following table summarizes TransVideo’s contractual commitments as at December 31, 2009, and the effect those commitments are expected to have on liquidity and cash flow in future periods:

| (a) | Operating Lease Commitments |

| | | | $ | |

| 2010 | | | 67,745 | |

| 2011 | | | 67,745 | |

| 2012 | | | 40,254 | |

| | | | 175,744 | |

| (b) | Statutory Reserve Commitments |

In compliance with PRC laws, TransVideo is required to appropriate a portion of its net income to its statutory reserve up to a maximum of 50% of an enterprise’s registered capital in the PRC. TransVideo had future unfunded commitments, as provided below.

| | | | $ | |

| PRC Subsidiaries registered capital | | | | |

| Beijing TransVideo | | | 2,922,660 | |

| Beijing iMedia | | | 3,000,000 | |

| Statutory reserve ceiling based | | | | |

| on 50% of PRC registered capital | | | 2,961,330 | |

| Less: retained earnings appropriated to statutory reserve | | | (535 | ) |

| | | | 2,960,795 | |

Related Party Transactions

In the normal course of business of selling its products and purchasing of raw materials, TransVideo conducts transactions with the following related parties: (a) Avantalion, (b) KyLinTV, (c) Beijing KyLinTV Co., Ltd. (“BJ KyLinTV”) and (d) NeuLion. Avantalion owns 90% of TransVideo. Avantalion represents a 39% stake ownership in KyLinTV. BJ KyLinTV is a subsidiary of KyLinTV. At December31, 2009, NeuLion held 17.1% ownership of KyLinTV; subsequently, Neulion reduced its investment in KylinTV. At April 25, 2010, Neulion held 12.2% of KylinTV.

In the event that TransVideo has both receivables from, and payables to the related parties it will, in accordance with FIN 39 (FASB ASC 210-20), setoff the balances in order to arrive at a single balance that is either due from, or due to the related parties. TransVideo outstanding related party receivables and payables at December 31, 2009 and 2008 are detailed in the following table.

| As of December 31, 2009 |

| Ref. | | Subsidiary | Nature of Balance | Related Party | | Balance | | Description of Transaction |

| | A | | BJ Transvideo | Sale of Products resulting in Trade Receivable from | KyLinTV | | $ | 14,279 | | BJ TransVideo licensed content to KyLinTV in December 2009 |

| | B | | TVI | Sale of Products resulting in Trade Receivable from | KyLinTV | | | 34,700 | | TVI licensed content to KyLinTV in December 2009 |

| | C | | TVI | Sale of Products resulting in Trade Receivable from | NeuLion | | | 298,291 | | TVI sold set top boxes to NeuLion in November 2009 on credit |

| | | | | Subtotal of related party sales | | | 347,270 | | |

| | | | | | | | | | |

| | D | | BJ i-Media | Loan Receivable from | BJ KyLinTV | | | 877,552 | | BJ i-Media lent funds to BJ KyLinTV in May 2009 |

| | E | | TVI | Loan Receivable from | KyLinTV | | | 1,500,000 | | TVI lent funds to KyLinTV in May 2009 |

| | | | | Subtotal loans to related parties | | | 2,377,552 | | |

| | | | | | | | | | |

| | | | | Gross related party receivables | | $ | 2,724,822 | | |

| Ref. | | Subsidiary: | Nature of Balance | Related Party | | Balance | | Description of Transaction |

| | F | | TVI | Future sales of product resulting in a liability | KyLinTV | | $ | 105,000 | | KyLinTV issued an advance to TransVideo in December 2009 as a deposit for the purchase of products |

| | G | | TVI | Loan Payable to | Avantalion | | | 10,000 | | TransVideo borrowed fund from Avantalion in June 2009 |

| | | | | Subtotal loans from related party | | | 115,000 | | |

| | | | | | | | | | |

| | | | | Gross related party payables | | $ | 115,000 | | |

| A. | BJ Transvideo licensed $14,279 worth of content to KyLinTV in December 2009. |

| B. | TVI licensed $34,700 worth of content to KyLinTV in December 2009. |

| C. | TVI sold $298,291 worth of products to NeuLion on credit. |

| D. | BJ i-Media loaned $877,552 to BJ KyLinTV. The loan is unsecured, interest free and has no fixed payment terms. |

| E. | TransVideo loaned $1,500,000 to KyLinTV. The loan is unsecured, interest free and has no fixed payment terms. |

| F. | KyLinTV advanced $105,000 to TransVideo for the purchase of products. |

| G. | TransVideo borrowed $10,000 from Avantalion in June 2009. |

| As of December 31, 2008 |

| Ref. | | Subsidiary | Nature of Balance | Related Party | | Balance | | Description of Transaction |

| | A | | BJ Transvideo | Sale of services resulting in Trade Receivable from | KyLinTV | | $ | 457,834 | | BJ Transvideo provided services to KyLinTV in November 2008 |

| | B | | TransVideo | Sale of services resulting in Trade Receivable from | NeuLion | | | 55,680 | | TransVideo performed transcoding services to NeuLion in March 2008 |

| | | | | Subtotal of related party sales | | | 513,514 | | |

| | | | | | | | | | |

| | | | | Gross related party receivables | | | 513,514 | | |

| Ref. | | Subsidiary: | Nature of Balance | Related Party | | Balance | | Description of Transaction |

| | C | | BJ Transvideo | Trade payable for services provided by | BJ KyLinTV | | | 13,577 | | BJ KyLinTV provided services to BJ Transvideo in December 2008 |

| | | | | Subtotal sales from related party | | | 13,577 | | |

| | | | | | | | | | |

| | | | | Gross related party payables | | $ | 13,577 | | |

| A. | BJ Transvideo provided $457,834 worth of service to KyLinTV in November 2008. |

| B. | TransVideo performed $55,680 worth of transcoding service to NeuLion in March 2008. |

| C. | BJ KyLinTV provided $13,577 services to BJ TransVideo in December 2008. |

The related party receivable balance detailed above, and the related transactions that comprise that balance were integral and material to TransVideo’s operations. TransVideo was reliant on transactions with the above related parties in order to conduct its business normally. TransVideo acknowledges that it has the responsibility to comply with paragraph c of SFAS 57 (FASB ASC 850) which calls for the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period.

TransVideo's related party receivables and payables in the period presented were in the form of either short-term loans bearing no interest, or trade payables and receivables relating to the purchase of products, materials, and services for which payment was due within a short period of time. Management believes that the net receivables from related parties are fully recoverable.

TransVideo believes that related party transactions have in the past, had a significant bearing on TransVideo’s financial statements. As of December 31, 2009, approximately 68% of TransVideo’s sales were with related parties.

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States consistently applied throughout all periods. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to inventory allowances, bad debts, long-lived assets, income taxes, contingencies and litigation, the determination of the useful lives of long-lived assets and the assumptions used in determining the fair value of share and stock based compensation. & #160;We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our consolidated financial statements:

Long-Lived Assets

TransVideo amortizes their long-lived assets over the estimated useful life of the asset. TransVideo evaluates all of our long-lived assets, excluding goodwill, periodically for impairment when events or changes in facts and circumstances indicate that their carrying value may not be recoverable. Events or changes in facts and circumstances can include a significant adverse change in the business climate, strategic change in business direction, decline or discontinuance of a product line or service, a reduction in our customer base or a restructuring. If one of these events or circumstances indicates that the carrying value of an asset may not be recoverable, or that our estimated amortization period was not appropriate, we would record an impairment charge against our long lived assets. The amount of impairment would be measured as the difference between the carrying value and the fair value of the impaired asset as calculated using a net realizable value methodology. An impairment charge would be recorded as an operating expense in the period of the impairment and as a reduction in the carrying value of that asset.

At December 31, 2009, TransVideo determined that no events or changes in facts existed such that a further analysis for impairment was required.

Accounts Receivable

Accounts receivable are carried at original invoice amount. TransVideo maintains a provision for estimated losses resulting from the inability of its customers to make required payments. Management considers the following factors when determining the collectability of specific customer accounts: customer credit-worthiness; past transaction history with the customer; current economic industry trends; and changes in customer payment terms. If the financial conditions of the TransVideo's customers were to deteriorate, adversely affecting their ability to make payments, additional allowances would be required.

Inventory

Inventory consists of STBs and is recorded at the lower of cost or market value and consists of raw materials, work in progress and finished goods. Cost is accounted for on a weighted average method and includes all costs of purchase and other costs incurred in bringing the inventories to their present location and condition. TransVideo evaluates its ending inventories for estimated excess quantities and obsolescence. This evaluation includes analyses of sales levels and projections of future demand within specific time horizons. Inventories in excess of future demand are reserved. In addition, TransVideo assesses the impact of changing technology and market conditions on its inventory-on-hand and writes off inventories that are considered obsolete.

Amortization Policies and Useful Lives

TransVideo amortizes the cost of property, plant and equipment and intangible assets over the estimated useful service lives of these items. The determinations of estimated useful lives of these long-lived assets involve considerable judgment. In determining these estimates, TransVideo takes into account industry trends and company specific factors including changing technologies and expectations for the in-service period of these assets. On an annual basis, TransVideo reassesses its existing estimates of useful lives to ensure they match the anticipated life of the technology from a revenue producing perspective. If technological change happens more quickly than anticipated, TransVideo might have to shorten its estimate of the useful life of certain equipment which could result in higher amortization expense in future periods or an i mpairment charge to write down the value of this equipment.

Recent Accounting Pronouncements

In June 2009, FASB issued Statement No. 166, Accounting for Transfers for Financial Assets (FASB ACE 860 Transfers and Servicing) and FASB Statement No. 167 (FASB No. 167 (FASB ASC 810, Consolidation), a revision to FASB Interpretation No. 46 (Revised December 2003), Consolidation of Variable Interest Entities (FASB ASC 810 Consolidation). TransVideo is still evaluating the impact of this pronouncement.

Statement 166 is a revision to FASB Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (FASB ASC 860 Transfers and Servicing), and will require more information about transfers of financial assets, including securitization transactions, and where entities have continuing exposure to the risks related to transferred financial assets. It eliminates the concept of “qualifying special-purpose entity,” changes the requirements for derecognizing financial assets, and requires additional disclosures. Statement No. 166 (FASB ASC 860 Transfers and Servicing) must be applied as of t he beginning of each reporting entities first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period and for interim and annual reporting periods thereafter. Earlier application is prohibited. This Statement must be applied to transfer occurring on or after the effective date. TransVideo is still evaluating the impact of this pronouncement.

Statement 167 is a revision of FASB Interpretation No. 46 (Revised December 2003), Consolidation of Variable Interest Entities (FASB ASC 810 Consolidation), and changes how a reporting entity determines when an entity is insufficiently capitalized or is not controlled through voting (or similar rights) should be consolidated. The determination of whether a reporting entity is required to consolidate another entity is based on, among other things, the other entity’s purpose and design and the reporting entity’s ability to direct the activities of the other entity that most significantly impact the other entity’s economic performance. Statement No. 167 (FASB ASC 810 Consolidation) shall be effective as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. Earlier application is prohibited. TransVideo is still evaluating the impact of this pronouncement.

On June 30, 2009, FASB issued FASB Statement No. 168, Accounting Standards Codification (FASB ASC 105 Generally Accepted Accounting Principles) a replacement of FASB Statement No. 162, the Hierarchy of Generally Accepted Accounting Principles. On the effective date of this standard, FASB Accounting Standards Codification (ASC) became the source of authoritative U.S. accounting and reporting standards for nongovernmental entities, in addition to the guidance issued by the Securities and Exchange Commission (SEC). This statement is effective for financial statements issued for interim and annual periods ending after September 15, 2009. If an accounting change results from the application of t his guidance, an entity should disclose the nature and reason for the change in accounting principle in their financial statements. This new standard flattens the GAAP hierarchy to two levels; one that is authoritative (in FASB ASC) and one that is non-authoritative (not in FASB ASC). Exceptions include all rules and interpretive releases of the SEC under the authority of federal securities laws, which are sources of authoritative GAAP for SEC registrants, and certain grandfathered guidance having an effective date before March 15, 1992. Statement No. 168 is the final standard that will be issued by FASB in that form. There will no longer be, for example, accounting standards in the form of statements, staff positions, Emerging Issues Task Force (EITF) abstracts, or AICPA Accounting Statements of Position. TransVideo is still evaluating the impact of this pronouncement.

Capitalization and Description of Share Capital

The following table sets forth the capitalization of TransVideo as of December 31, 2009, the date of its most recent year-end balance sheet, and as at March 31, 2010. See Schedule 2.

| Security | Amount Outstanding as of

December 31, 2009 | Amount Outstanding as at March

31, 2010 |

| TransVideo Shares | 3,200,000 | 3,200,000 |

As at the date hereof, the authorized capital of TransVideo consists of US$50,000, which is made up of one class and one series of shares divided into 5,000,000 shares, US$0.01 par value per share. Of the outstanding authorized shares of TransVideo, 3,200,000 shares are issued and outstanding. Each outstanding TransVideo share has been duly and validly authorized and issued, is fully paid and non-assessable, was issued in compliance with all applicable securities laws, is free of any liens and is not subject to pre-emptive rights or rights of first refusal created by statute, the TransVideo articles and memorandum of association, or any agreement to which TransVideo is a party or by which it is bound.

Options to Purchase Securities

There are no outstanding or authorized options, warrants, calls, exchange rights or other securities convertible into capital stock of TransVideo.

Principal Security Holders

To the knowledge of the directors and officers of TransVideo, as at the date hereof, no person or company beneficially owns, or controls or directs, directly or indirectly, voting securities carrying more than 10% of the voting rights attached to any class of outstanding voting securities of TransVideo, other than the TransVideo common stock owned beneficially and of record as set forth below:

| Name of Shareholder | Number of TransVideo Common

Stock | Percentage of TransVideo

Common Stock |

| AvantaLion (1) | 2,592,000 | 81% |

(1) AvantaLion is an entity controlled by Charles B. Wang, the Chairman of the board of directors of NeuLion.

Directors and Executive Officers

The following table sets forth the names and municipalities of residence of those individuals who are directors and officers of TransVideo as at the date hereof, their current positions or offices with TransVideo, the date when they first became a director and/or officer of TransVideo, the number of TransVideo common stock beneficially owned, directly or indirectly, or under their direction or control and their principal occupations during the past five years:

Name and

Municipality of

Residence | Office or

Position Held | Director/Officer

Since | Number of

TransVideo

Common Stock

Beneficially

Owned, Directly or

Indirectly, or under

Direction or

Control | Principal Occupation During

the Past Five Years |

Jianbing Duan, Beijing, China | Chairman of the Board | 2004 | 7,854,545 | Executive Manager of TransVideo |

Yunchan Wang,

Beijing, China | General Manager and President | 2004 | 232,000 | Executive Business Manager of TransVideo |

Name and

Municipality of

Residence | Office or

Position Held | Director/Officer

Since | Number of

TransVideo

Common Stock

Beneficially

Owned, Directly or

Indirectly, or under

Direction or

Control | Principal Occupation During

the Past Five Years |

Jingfang Hao,

Beijing Province,

China | Senior Vice

President,

Business

Development | 2004 | 232,000 | Executive Manager of TransVideo |

Xiahong Wang,

Beijing, China | Director,

Research and

Development | 2004 | 40,000 | Research and Development Manager of TransVideo |

Wei Shu,

Beijing,

Province, China | Director,

Research and

Development | 2004 | 40,000 | Research and Development Manager of TransVideo |

Yun Zhao, Beijing, China | Vice

President,

Sales and

Marketing | 2004 | 8,000 | Sales and Marketing Manager of TransVideo |

The directors and executive officers of TransVideo, as a group, beneficially own as at the date hereof, directly or indirectly, or exercise control or direction over 608,000 TransVideo common stock, representing approximately 19% of the TransVideo common stock as at the date hereof.

No TransVideo directors or officers will become officers or directors of NeuLion.

Indebtedness of Directors and Officers

No person who is now, or was at any time during 2009, a director or executive officer of TransVideo, or associate thereof, is, or at any time since the beginning of the most recently completed financial year of TransVideo has been, indebted to TransVideo, or had indebtedness during that period which was the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by TransVideo other than such loans to Wang Yunchuan RMB300,000 and Hao Jingfang RMB250,000 in 2006 by Beijing TransVideo, which shall be waived by Beijing TransVideo. Those loans have been included in the balance sheet of Beijing TransVideo and the audited report.

You should carefully consider all of the information in this Circular, including various changing regulatory, competitive, economic, political and social risks and conditions described below, before making a decision to approve the TransVideo Acquisition. One or more of a combination of these risks could materially impact TransVideo’s business, results of operations and financial condition.

Risks Related to Our Business

TransVideo may need additional capital to fund continued growth, which may not be available on acceptable terms or at all.

TransVideo’s ability to increase revenue will depend in part on its ability to continue growing the business by developing IPTV platforms for new customers as well as maintaining and increasing its private networks’ subscriber bases, which may require significant additional capital that may not be available to us. TransVideo may need additional financing due to future developments, changes in its business plan or failure of its current business plan to succeed, which could result from increased marketing, distribution or programming costs. TransVideo’s actual funding requirements could vary materially from its current estimates. If additional financing is needed, TransVideo may not be able to raise sufficient funds on favorable terms or at all. Recent developments in the fi nancial markets such as the scarcity of capital have made it more difficult for early stage companies such as TransVideo to access capital markets on acceptable terms or at all. If TransVideo fails to obtain any necessary financing on a timely basis, then its ability to execute the current business plan may be limited, and the business of TransVideo could be adversely affected.

The global economic crisis could result in decreases in customer traffic and otherwise adversely affect TransVideo’s business and financial results and have a material adverse effect on its liquidity and capital resources.

The global economy, including the Chinese economy, is experiencing a severe recession. As a business that is dependent upon consumer discretionary spending, TransVideo faces a challenging fiscal 2010 because our IPTV platform customers’ subscribers and our private network subscribers may have less money for discretionary spending as a result of job losses, foreclosures, bankruptcies, reduced access to credit and sharply falling home prices. Any resulting decreases in customer traffic and revenue will negatively impact its financial performance because reduced revenue results and smaller profit margins. Additionally, many of the long-term effects and consequences of the economic recession are currently unknown; any one or all of them could potentially have a material adverse effect on TransVideo&# 8217;s liquidity and capital resources, including its ability to raise additional capital if needed, or otherwise negatively impact its business and financial results.

TransVideo is an early-stage enterprise with a short operating history, which makes it difficult to evaluate its prospects.

TransVideo is still in the early stage of building out its business. Many of the expenses, problems and delays encountered by an enterprise in its early stage may be beyond its control. As an early-stage enterprise, TransVideo expends significant funds on:

| | · | programming and website development; |

| | · | maintaining adequate video-streaming and database software; |

| | · | building subscriber management systems; |

| | · | pursuing and maintaining distribution agreements with our content partners and channel partners; and |

| | · | acquiring and maintaining Internet distribution rights to our content. |

From its inception, TransVideo has incurred substantial net losses, and it expects to continue operating at a loss in the near future. If TransVideo is ultimately unable to generate sufficient revenue to become profitable and have sustainable positive cash flows, NeuLion could lose its investment.

TransVideo may also encounter certain problems or delays in building our business, including those related to:

| | · | regulatory policies and compliance; |

| | · | consumer acceptance of Internet-based television; |

| | · | unsuccessful commercial launches of new programming content; |

| | · | costs and expenses that exceed current estimates; and |

Delays in the timely design, construction, deployment and commercial operation of TransVideo’s business, and consequently the achievement of positive cash flow, could result from a variety of causes, many of which are beyond its control. Substantial delays in any of these matters could delay or prevent TransVideo from achieving profitable operations.

Demand for set top boxes may be insufficient for TransVideo to achieve and sustain profitability.

IPTV is an emerging service. Potential TransVideo IPTV platform customers may be slow to adopt the Internet as a medium through which they distribute their own content, and their and its subscribers may be slow or refuse to adopt IPTV as a preferred method of viewing content. TransVideo cannot estimate with any certainty the potential demand for its set top boxes or its ability to satisfy that demand. Among other things, acceptance of TransVideo’s services will depend upon:

| | · | its ability to develop and introduce new services that offer enhanced performance and functionality, in a timely manner, in response to changing market conditions, customer and subscriber requirements or its competitors’ technological advances; |

| | · | the cost and availability of technology, such as computer hardware and high-speed Internet connections, that are required to utilize TransVideo’s service; |

| | · | the marketing and pricing strategies that we employ relative to those of TransVideo’s competitors; |

| | · | the acceptance of TransVideo’s subscriber management systems; |

| | · | whether TransVideo acquires, markets and distributes high-quality programming consistent with subscribers’ tastes; and |

| | · | the willingness of subscribers to pay pay-per-view or subscription fees to obtain NeuLion’s service via set top boxes. |

TransVideo’s results of operations will depend in part upon TransVideo’s ability and that of TransVideo’s IPTV platform customers to increase TransVideo’s respective subscriber bases while maintaining its preferred pricing structures, managing costs and controlling subscriber churn rates. If demand does not develop as expected, then it may not be able to generate enough revenue to generate positive cash flow or achieve and sustain profitability.

One of TransVideo’s objectives is to acquire and maintain programming that sustains loyal audiences in or across various demographic groups. The attractiveness of TransVideo’s content offerings and TransVideo’s ability to retain and grow the audiences for TransVideo’s programs will be an important factor in its ability to sell subscriptions and advertising. TransVideo’s content offerings may not attract or retain the number of subscribers that it anticipates and some content may offend or alienate subscribers that are outside of the target audience for that content. There can be no assurance that TransVideo’s content offerings will enable it to retain its various audiences. If TransVideo loses the rights to distribute any specific programming or channels and fail to attract comparable programming with similar audience loyalty, the attractiveness of TransVideo’s service to subscribers or advertisers could decline and TransVideo’s business could be adversely affected.

TransVideo may have difficulty and incur substantial costs in scaling and adapting its existing systems architecture to accommodate increased traffic, technology advances or customer requirements.

TransVideo’s future success will depend on its ability to adapt to rapidly changing technologies, to adapt its services to evolving industry standards and to improve the performance and reliability of its services. The IPTV industry and the Internet and the video entertainment industries in general are characterized by rapid technological change, frequent new product innovations, changes in customer requirements and expectations and evolving industry standards. There is no assurance that one or more of the technologies utilized by TransVideo will not become obsolete or that its services will be in demand at the time they are offered. If TransVideo or its suppliers are unable to keep pace with technological and industry changes, TransVideo’s business may be unsuccessful.

In the future, TransVideo may be required to make changes to its systems architecture or move to a completely new architecture. To the extent that demand for TransVideo’s services, content and other media offerings increases, it will need to expand its infrastructure, including the capacity of TransVideo’s hardware servers and the sophistication of TransVideo’s software. If TransVideo is required to switch architectures, it may incur substantial costs and experience delays or interruptions in its service. These delays or interruptions in service may cause users and customers to become dissatisfied and move to competing providers of IPTV services. An unanticipated loss of traffic, increased costs, inefficiencies or failures to adapt to new technologies or user requirements a nd the associated adjustments to TransVideo’s systems architecture could harm its operating results and financial condition.

TransVideo depends on third parties to develop technologies used in key elements of its IPTV services. More advanced technologies that it may wish to use may not be available to us on reasonable terms or in a timely manner. Further, TransVideo’s competitors may have access to technologies not available to us, which may enable these competitors to offer entertainment products of greater interest to consumers or at more competitive costs.

TransVideo could suffer failures or damage due to events that are beyond its control, which could adversely affect its brand and operating results.

TransVideo’s success as a business depends, in part, on its ability to provide consistently high-quality video streams to its customers’ and to its own subscribers via its distribution infrastructure and IPTV technology on a consistent basis. TransVideo’s distribution infrastructure is susceptible to natural or man-made disasters such as earthquakes, floods, fires, power loss and sabotage, as well as interruptions from technology malfunctions, computer viruses and hacker attacks. Other potential service interruptions may result from unanticipated demands on network infrastructure, increased traffic or problems in customer service. TransVideo’s ability to control technical and customer service issues is further limited by its dependence on channel partners for technical integrati on of its distribution infrastructure. Significant disruptions in the TransVideo distribution infrastructure would likely affect the quality and continuity of TransVideo’s service, could harm TransVideo’s goodwill and the TransVideo brand and ultimately could significantly and negatively impact the amount of revenue it may earn. TransVideo may not carry sufficient business interruption insurance to compensate for losses that could occur as a result of an interruption in its services.

TransVideo depends upon third parties for:

| | · | the provision of programming in connection with TransVideo’s service, including TransVideo’s channel partners and other third-party content providers; and |

| | · | the availability and performance of STBs. |

Any failure by third parties to provide these services could significantly harm TransVideo’s ability to conduct TransVideo’s business. Furthermore, financial difficulties experienced by TransVideo’s third-party providers — such as bankruptcy, insolvency, liquidation or winding up of daily operations — for any reason whatsoever could also have negative consequences on TransVideo’s business.

TransVideo operates in competitive and evolving markets.

TransVideo operates in competitive and evolving markets locally, nationally and globally. These markets are subject to rapid technological change and changes in customer preferences and demand. In seeking market acceptance, TransVideo will encounter competition for both subscribers and advertising revenue from many sources, including other IPTV services, direct broadcast satellite television services and digital and traditional cable systems that carry sports and ethnic programming. Traditional cable and satellite television already has a well-established and dominant market presence for its services, and Internet portals, video file-sharing service providers and other third-party providers of video content over the Internet may distribute ethnic video content. Many of these competitors have substantially greater financial, marketing and other resources than we do. As the IPTV market grows (resulting from higher bandwidths, faster modems and wider programming selections), an increasing number of Internet-based video program offerings will be available to TransVideo’s current and potential customers. In addition, TransVideo’s competitors, in both the traditional satellite and cable television broadcasting and IPTV markets, could exclusively contract with sports and ethnic content providers that are not under contract with us, creating significant competition in both the sports and ethnic programming and IPTV markets. TransVideo’s revenue could be materially adversely affected if we are unable to compete successfully with traditional and other emerging providers of video programming services.

TransVideo does not have exclusive Internet distribution rights to all of its content and the cost of renewing such rights or obtaining such rights for new content may be higher than expected.

Many of TransVideo’s content and channel partner agreements give it the exclusive Internet distribution rights to the related content and channels. If this content or these channels are offered elsewhere on the Internet on more attractive terms, TransVideo could lose these subscribers, which would have an adverse effect on its results of operations.

TransVideo must negotiate with potential partners to acquire the Internet distribution rights for TransVideo’s programming. In addition, TransVideo will need to renew its agreements with existing partners. TransVideo anticipates that, as the IPTV market grows, license fees relating to Internet distribution rights for programming (including sports and ethnic programming), or for the rights to substitute advertising into the live video streamers of the content, will increase. License fees payable under the partner agreements may be significantly more costly to renew than anticipated.

In addition, some of the existing partner agreements that give TransVideo exclusive Internet distribution rights have renewal mechanisms that are tied to its ability to generate specified revenue share amounts or specified subscriber numbers in respect of particular channels. If TransVideo is unable to meet these targets, then we may have to renegotiate the agreements when they come up for renewal or may lose one or more of its exclusive licenses. Renegotiated license fees may be more expensive than anticipated. TransVideo may be unable to obtain its programming consistently at a cost that is reasonable or appealing to its customers, which may adversely affect its marketing efforts, reputation, brand and revenue.

There is uncertainty relating to TransVideo’s ability to enforce its rights under its channel and content partner agreements.

Many of TransVideo’s channel and content partner agreements for ethnic programming are with foreign entities and are governed by the laws of foreign jurisdictions. If a partner breaches an agreement with it, then it will incur the additional costs of determining its rights and obligations under the agreement under applicable foreign laws and enforcing the agreement in a foreign jurisdiction. Many of the jurisdictions to which TransVideo’s partner agreements are subject do not have sophisticated and/or impartial legal systems and we may face practical difficulties in enforcing any of TransVideo’s rights in such jurisdictions. TransVideo may not be able to enforce such rights or may determine that it would be too costly to enforce such rights. In addition, many of TransVideo& #8217;s partner agreements contain arbitration provisions that govern disputes under the agreements and there is uncertainty with respect to the enforceability of such arbitration provisions under the laws of related foreign jurisdictions. If a dispute were to arise under an agreement and the related arbitration provision was not effective, then TransVideo would be exposed to the additional costs of settling the dispute through traditional legal avenues rather than through an arbitration process.

TransVideo’s business may be impaired by third-party intellectual property rights in the programming content of TransVideo’s channel and content partners.

TransVideo relies on its channel and content partners to secure the primary rights to redistribute programming and other content over the Internet. There is no assurance that TransVideo’s partners have successfully licensed all relevant programming components that are necessary for Internet redistribution. Other parties may claim certain intellectual property rights in the content that TransVideo licenses from its partners. For example, TransVideo’s partners may not have sufficient rights in the underlying content to license distribution rights to their content to us, or a given partner may not identify programming that we are not permitted to distribute in time for us to stop distribution of the offending programming. In addition, as the IPTV market grows, advertisers may begin to attempt to enforce intellectual property rights in advertisements included in TransVideo’s partners’ programming, and we may inadvertently infringe the intellectual property rights of such advertisers by distributing such advertisements over the Internet or by inserting TransVideo’s own advertising in replacement of such advertisements.

In the event that TransVideo’s partners are in breach of the distribution rights related to specific programming and other content, it may be required to cease distributing or marketing the relevant content to prevent any infringement of related rights, and may be subject to claims of damages for infringement of such rights. TransVideo may also be required to file a claim against a given partner if the distribution rights related to specific programming are breached, and there is no assurance that we would be successful in any such claim.

TransVideo may be subject to other third-party intellectual property rights claims.

Companies in the Internet, technology and media industries often own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. As TransVideo faces increasing competition, the possibility of intellectual property rights claims against us grows. TransVideo’s technologies may not be able to withstand third-party claims or rights against their use. Intellectual property claims, whether having merit or otherwise, could be time consuming and expensive to litigate or settle and could divert management resources and attention. In addition, many of TransVideo’s agreements with network service providers require us to indemnify these providers for third-par ty intellectual property infringement claims, which could increase TransVideo’s costs as a result of defending such claims and may require that we pay the network service providers’ damages if there were an adverse ruling in any such claims.

If litigation is successfully brought by a third party against us in respect of intellectual property, TransVideo may be required to cease distributing or marketing certain products or services, obtain licenses from the holders of the intellectual property at material cost, redesign affected products in such a way as to avoid infringing intellectual property rights or seek alternative licenses from other third parties which may offer inferior programming, any or all of which could materially adversely affect TransVideo’s business, financial condition and results of operations. If those intellectual property rights are held by a competitor, we may be unable to obtain the intellectual property at any price, which could also adversely affect TransVideo’s competitive position. An adverse determination cou ld also prevent us from offering its services and could require that we procure substitute products or services. Any of these results could harm TransVideo’s business, financial condition and results of operations.

TransVideo relies on its channel and content partners to ensure intellectual property rights compliance globally.

TransVideo is exposed to liability risk in respect of the content that it redistributes over the Internet, relating to both infringement of third-party rights to the content and infringement of the laws of various jurisdictions governing the type and/or nature of the content. TransVideo relies in large part on its channel and content partners’ obligations under its partner agreements to advise it of any potential or actual infringement so that it may take appropriate action if such content is not intellectual property rights-compliant or is otherwise obscene, defamatory or indecent. There is a risk that TransVideo’s partners will not advise it in time, or at all, in respect of such content, and expose it to liability for its redistribution of such content over the Internet. Any alleged liability could harm TransVideo’s business by damaging its reputation, requiring it to incur legal costs in defense of any such claim, exposing it to significant awards of damages and costs and diverting management’s attention, any of which could have an adverse effect on TransVideo’s business, results of operations and financial condition.

Increased subscriber turnover could adversely affect TransVideo’s financial performance.

Customer subscriber churn has a significant financial impact on TransVideo’s results of operations, and it cannot reliably predict the amount of churn that we will experience over the long term. Given the increasingly competitive nature of the IPTV industry, it may not be able to reduce churn without significantly increasing TransVideo’s spending on customer acquisition and retention incentives, which would have a negative effect on TransVideo’s earnings and free cash flow. There can be no assurance that an increase in competition from other IPTV providers, new technology entrants, programming theft and other factors will not contribute to a relatively higher churn than we have experienced historically. To the extent that TransVideo’s churn is greater than currently anticipated, it may be more costly for us to acquire a sufficient customer base to generate revenue.

Current economic conditions have led certain consumers to reduce their spending on non-essential items. A reduction in consumer discretionary spending or an inability to pay for subscribed services could result in a decrease in or loss of subscribers, which would reduce TransVideo’s future revenue and negatively impact TransVideo's business, financial condition and results of operations.

Increased subscriber acquisition costs could adversely affect TransVideo’s financial performance.

TransVideo anticipates spending substantial funds on advertising and other marketing to attract new subscribers and maintain TransVideo’s subscriber base. TransVideo’s ability to achieve break-even cash flows depends in part on its ability to achieve and maintain lower subscriber acquisition costs over time. TransVideo’s subscriber acquisition costs, both in the aggregate and on a per-new-subscriber basis, may materially increase in the future to the extent that we introduce new promotions, whether in response to competition or otherwise. Any material increase in subscriber acquisition or retention costs from current levels could have a material adverse effect on TransVideo’s business, financial condition and results of operations.

TransVideo may not be successful in developing a version of its service that will gain widespread adoption by users of alternate devices to access the Internet.

In the coming years, the number of individuals who access the Internet through devices other than a personal computer, such as personal digital assistants, mobile telephones and television set top devices, is expected to increase dramatically. TransVideo’s services are designed for rich, graphical environments such as those available on personal and laptop computers. The lower resolution, functionality and memory associated with alternative devices may make the distribution of content through such devices difficult, and we may be unsuccessful in TransVideo’s efforts to provide a compelling service for users of alternative devices. If TransVideo is unable to attract and retain a substantial number of alternative device users to its services, we will fail to capture a sufficient share of an i ncreasingly important portion of the market for online media.

In addition, TransVideo intends to introduce new services and/or functionalities to increase its customers’ and subscriber bases and long-term profitability, such as targeted advertising insertion and personal video recording. These services are dependent on successful integration of new technologies into the TransVideo distribution infrastructure, negotiations with third-party content and network system providers, subscriber acceptance and the maintenance of future technologies to support these services. If TransVideo is unsuccessful in implementing such services, or the economic attractiveness of these services is lower than anticipated, then TransVideo’s business and operating results could be adversely affected.

TransVideo may be unable to manage rapidly expanding operations.

TransVideo is continuing to grow and diversify its business both domestically and internationally. As a result, it will need to expand and adapt its operational infrastructure. If TransVideo is unable to manage its growth effectively, it could have a material adverse effect on its business, financial condition and results of operations. To manage growth effectively, TransVideo must, among other things, continue to develop its internal and external sales forces, the distribution infrastructure capability, customer service operations and information systems, maintain its relationships with content and channel partners, effectively enter new areas of the sports and ethnic programming markets and effectively manage the demands of day-to-day operations in new areas while attempting to execute TransVideoR 17;s business strategy and realize the projected growth and revenue targets developed by TransVideo’s management. TransVideo will also need to continue to expand, train and manage its employee base, and its management must assume even greater levels of responsibility. If we are unable to manage growth effectively, we may experience a decrease in subscriber growth and an increase in subscriber churn, which could have a material adverse effect on TransVideo’s financial condition, profitability and cash flows.

Internet transmissions may be subject to theft and malicious attacks, which could cause us to lose subscribers and revenue.

Like all Internet transmissions, TransVideo’s streaming content may be subject to interception and malicious attack. Pirates may be able to obtain or redistribute TransVideo’s programs without paying fees to us. The TransVideo distribution infrastructure is exposed to spam, viruses, worms, spyware, denial of service or other attacks by hackers and other acts of malice. Theft of TransVideo’s content or attacks on the TransVideo distribution infrastructure would reduce future potential revenue and increase TransVideo’s net subscriber acquisition costs.

If TransVideo’s security technology is compromised, it could adversely affect TransVideo’s ability to contract for licenses to distribute programming over the Internet. TransVideo uses security measures intended to make theft of its content more difficult. However, if it is required to upgrade or replace existing security technology, the cost of such security upgrades or replacements could have a material adverse effect on TransVideo’s financial condition, profitability and cash flows. In addition, other illegal methods that compromise Internet transmissions may be developed in the future. If TransVideo cannot control compromises of its channels, then TransVideo’s revenue, net subscriber acquisition costs, churn and ability to contract for licenses to distribute progr amming over the Internet could be materially adversely affected.

There is no assurance that the current costs of Internet connections and network access will not rise with increasing popularity of IPTV services, which would adversely affect TransVideo’s business.

TransVideo relies on Internet service providers for its principal connections and network access and to stream audio and video content to subscribers. As demand for IPTV services increases, there can be no assurance that Internet service providers will continue to price their network access services on reasonable terms. The distribution of streaming media requires distribution of large content files and providers of network access may change their business model and increase their prices significantly, which could slow the widespread acceptance of such services. In order for TransVideo’s media content services to be successful, there must be a reasonable price model in place to allow for the continuous distribution of large streaming media files. TransVideo has limited or no control ov er the extent to which any of these circumstances may occur, and if network access prices rise significantly, then TransVideo’s business and operating results would likely be adversely affected.

TransVideo’s business depends on the continued growth and maintenance of the Internet infrastructure.

The success and the availability of Internet-based products and services depends in part upon the continued growth and maintenance of the Internet infrastructure itself, including its protocols, architecture, network backbone, data capacity and security. Spam, viruses, worms, spyware, denial of service or other attacks by hackers and other acts of malice may affect not only the Internet’s speed, reliability and availability but also its continued desirability as a vehicle for commerce, information and user engagement. If the Internet proves unable to meet the new threats and increased demands placed upon it, TransVideo’s business plans, user and advertiser relationships, site traffic and revenues could be adversely affected.

Privacy concerns relating to elements of TransVideo’s service could damage its reputation and deter current and potential users from using its products and services.

From time to time, concerns may be expressed about whether TransVideo’s products and services compromise the privacy of users and others. Concerns about TransVideo’s collection, use or sharing of personal information or other privacy-related matters, even if unfounded, could damage TransVideo’s reputation and result in a loss of user confidence and ultimately in a loss of users, partners or advertisers, which could adversely affect TransVideo’s business and operating results.

TransVideo may have exposure to greater than anticipated tax liabilities.