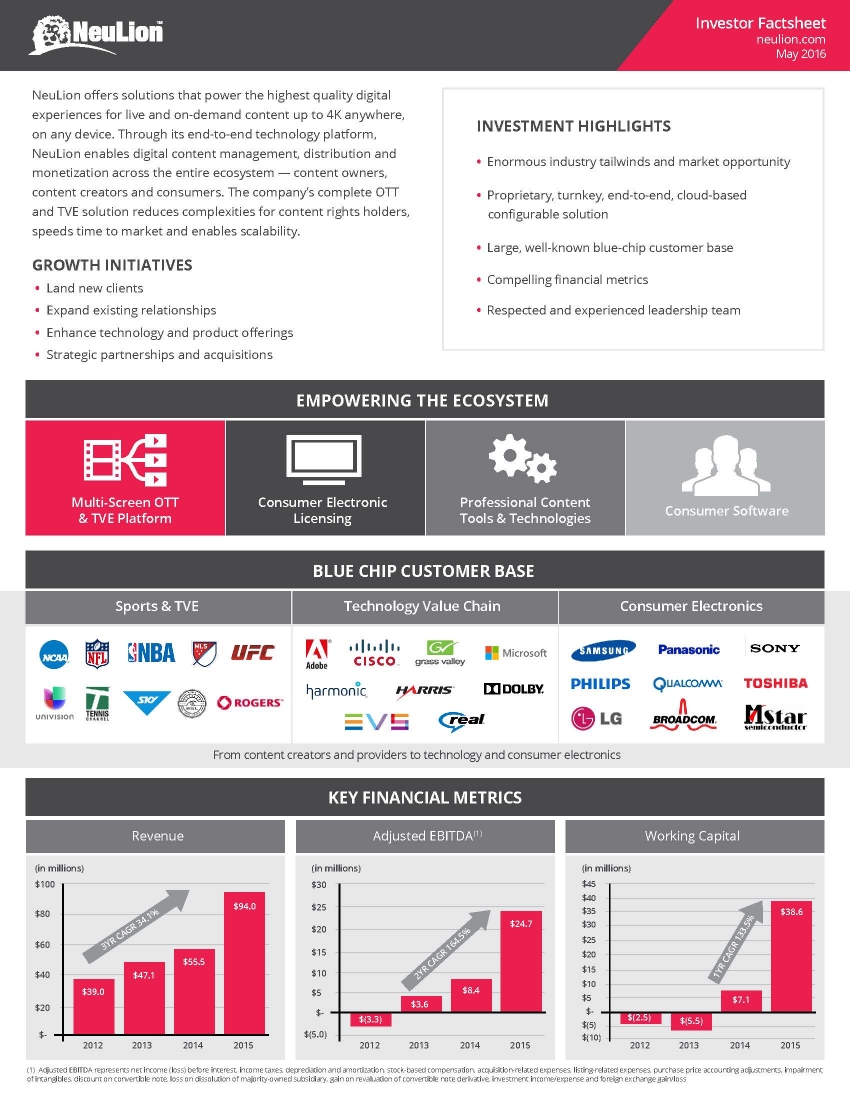

Investor Factsheet neulion.com May 2016 NeuLion offers solutions that power the highest quality digital experiences for live and on-demand content up to 4K anywhere, on any device. Through its end-to-end technology platform, NeuLion enables digital content management, distribution and monetization across the entire ecosystem — content owners, content creators and consumers. The company’s complete OTT and TVE solution reduces complexities for content rights holders, speeds time to market and enables scalability. GROWTH INITIATIVES • Land new clients • Expand existing relationships • Enhance technology and product offerings • Strategic partnerships and acquisitions INVESTMENT HIGHLIGHTS • Enormous industry tailwinds and market opportunity • Proprietary, turnkey, end-to-end, cloud-based configurable solution • Large, well-known blue-chip customer base • Compelling financial metrics • Respected and experienced leadership team EMPOWERING THE ECOSYSTEM Multi-Screen OTT Consumer Electronic Professional Content & TVE Platform Licensing Tools & Technologies BLUE CHIP CUSTOMER BASE Sports & TVE Technology Value Chain Consumer Software Consumer Electronics From content creators and providers to technology and consumer electronics KEY FINANCIAL METRICS Revenue (in millions) $100 $94.0 $80 $60 $55.5 $40 $47.1 $39.0 $20 Adjusted EBITDA(1) (in millions) $30 $25 $20 $15 $10 $5 $8.4 $3.6 $- $(3.3) Working Capital (in millions) $45 $40 $35 $38.6 $24.7 $30 $25 $20 $15 $10 $5 $7.1 $- $(2.5) $(5.5) $(5) $- 2012 2013 2014 $(5.0) 2015 2012 $(10) 2013 2014 2015 2012 2013 2014 2015 (1) Adjusted EBITDA represents net income (loss) before interest, income taxes, depreciation and amortization, stock-based compensation, acquisition-related expenses, listing-related expenses, purchase price accounting adjustments, impairment of intangibles, discount on convertible note, loss on dissolution of majority-owned subsidiary, gain on revaluation of convertible note derivative, investment income/expense and foreign exchange gain/loss DEVICE AGNOSTIC COMPETITIVE ADVANTAGES • Speeds time to market • Drives new revenue • Reduces complexities for content rights holders Smartphone & Tablets Smart TV’s Gaming Devices & 3rd Party STB Recurring Revenue Model • NeuLion Digital Platform • Combines software, technology and operational services • Increases monetization opportunities • Creates meaningful experiences that engage, retain and grow customers SCALABLE REVENUE MODEL Increasing NeuLion Customer Usage Petabytes Streamed 5% 40% 55% Setup • Subscription basis • # of channels, events • # of connected devices • Variable basis • Volume of digital video content • Level of advertising & ecommerce activity • Support Services • DivX & MainConcept • Subscription license agreements and variable per unit fees Fixed/License Fees Variable Usage has almost tripled since 2012 350 307PB 300 250 200 227PB 150 154PB 100 50 82PB 0 2012 2013 2014 2015 FINANCIALS Operating Results Q1’16 Q4’15 Q3’15 Q2’15 Q1’15 Total Revenue $26.3 $27.8 $21.9 $22.7 $21.7 Cost of Revenue as a % of Revenue 18% 19% 18% 19% 20% SG&A* $11.9 $13.2 $11.2 $11.4 $9.9 R&D $4.4 $5.5 $6.6 $7.5 $5.3 Non-GAAP Adjusted EBITDA $7.0 $8.8 $5.0 $4.2 $6.8 GAAP Net Income (Loss) $2.1 $32.8 $(3.1) $(3.2) $(0.5) Diluted EPS $0.01 $0.11 $(0.01) $(0.01) $0.00 • High margin business with increasing revenue momentum • Crossed over the GAAP profitablility in Q4 2013 • First and fourth quarters are seasonally strongest Balance Sheet (in $000) 3/31/2016 12/31/2015 12/31/2014 Cash & Equivalents 61,516 53,413 25,898 Receivables 11,363 12,967 8,056 Total Current Assets 77,093 70,415 36,287 Payables 9,558 10,006 14,362 Deferred Revenue 13,676 11,570 9,602 Total Current Liabilities 33,581 31,824 29,212 Working Capital 43,512 38,591 7,075 Other Long-Term Liabilities 4,333 4,268 2,673 Total Redeemable Preferred Stock* - - 14,955 Total Equity 110,938 108,058 5,099 Total Liabilities and Equity 148,852 144,150 51,938 * On November 19, 2015, the redeemable preferred stock were converted into 36,300 shares of common stock Stock Information Contact Information Toronto NLN.TO Research Coverage Company Contact Investor Contact Stock Price (CAD) 1.26 Beacon Securities Chris Wagner Tim Alavathil 52wk Range (CAD) 0.53 - 1.72 Cormark Securities NeuLion, Inc. Phone: 647-426-1254 Shares Outstanding 282,246,151 Wunderlich Securities 516-622-8300 tim.alavathil@neulion.com Market Cap (CAD) 355.6M [$276.4 USD] Cantor Fitzgerald Statements made in this presentation that are not historical in nature constitute forward-looking statements within the meaning of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Such statements are based on the current expectations and beliefs of the management of NeuLion and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a more detailed discussion of factors that affect NeuLion’s operations, please refer to the company’s Securities and Exchange Commission filings. The company undertakes no obligation to update this forward-looking information.