UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

| ¨ | Preliminary Information Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| x | Definitive Information Statement |

Promotions on Wheels Holdings, Inc.

(Name of Registrant As Specified in Charter)

Nevada

(State or other Jurisdiction of Incorporation or Organization)

| 1 Hampshire Court | 20-5150818 |

| (Commission File Number) | Newport Beach, CA 92660 | (IRS Employer Identification No) |

| | (Address of Principal Executive Offices | |

| | and zip code) | |

Payment of Filing Fee (Check the appropriate box):

| x | No Fee Required. |

| | | |

| ¨ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | | |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| | | Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined: |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

PROMOTIONS ON WHEELS HOLDINGS, INC.

1 HAMPSHIRE COURT

NEWPORT BEACH, CA 92660

Notice of Action by Written Consent

of a

Majority of the Outstanding Common Shares

taken as of November 19, 2008

TO THE STOCKHOLDERS OF PROMOTIONS ON WHEELS HOLDINGS, INC.

Promotions on Wheels Holdings, Inc. (“we” “us” “our” or “Company”) hereby gives notice to its stockholders that the holders of a majority of the Company’s outstanding shares of common stock (“Common Stock”), have taken action by written consent to:

| 1. | Approve the amendments to the Company’s Articles of Incorporation to change the name of the Company from Promotions on Wheels Holdings, Inc. to Blindspot Alert, Inc |

| 2. | Approve the increase of the common shares to 300,000,000 and increase the preferred shares to 25,000,000. |

| 3. | Approve the adoption of the 2008 Incentive Compensation Plan. |

The stockholders have approved the corporate actions in lieu of a special meeting pursuant to Section 78.320 of the Nevada Revised Statues “NRS”, which permits any action that may be taken at a meeting of the stockholders to be taken by the written consent to the action by the holders of the number of shares of voting stock required to approve the action at a meeting. All necessary corporate approvals in connection with the matters referred to in this information statement have been obtained. This information statement is being furnished to all of our stockholders pursuant to Section 14(c) of the Securities and Exchange Act of 1934 (“Exchange Act”), and the rules thereunder, solely for the purpose of informing stockholders of these corporate actions before they take effect. In accordance with Rule 14c-2 under the Exchange Act, the stockholder consent will take effect 21 calendar days following the mailing of this information statement.

The details of the foregoing actions and other important information are set forth in the accompanying Information Statement.

This action has been approved by our Board of Directors and the holders of more than a majority of the Company’s common shares outstanding. Only stockholders of record at the close of business on November 17, 2008 are being given Notice of the Action by Written Consent. The Company is not soliciting proxies.

By Order of the Board of Directors of

PROMOTIONS ON WHEELS HOLDINGS, INC.

/s/ Rowland W. Day II

Chief Executive Officer

Newport Beach, CA

November 19, 2008

WE ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

PROMOTIONS ON WHEELS HOLDINGS, INC.

1 HAMPSHIRE COURT

NEWPORT BEACH, CA 92660

INFORMATION STATEMENT

1. GENERAL INFORMATION

ACTION BY THE HOLDERS OF A MAJORITY OF SHARES

We are furnishing this Information Statement to all holders of our Common Stock, to provide you with information regarding, and a description of an action which was taken by written consent in lieu of a special meeting of stockholders by the holders of a majority of our common stock on November 19, 2008, subject to the expiration of 20 days following the mailing of this Information Statement to our stockholders as required under Rule 14c-2 under the Exchange Act. Effective November 19, 2008, the holders of about 17,800,000 shares, or approximately 68% of the Company’s then outstanding voting securities, executed a written consent in accordance with Section 78.320 of the NRS, approving the amendment to the Articles of Incorporation to change the Company’s name to Blindspot Alert, Inc. and increase the authorized common shares to 300,000,000 and increase the preferred shares to 25,000,000.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This not a notice of a special meeting of stockholders and no stockholders meeting will be held to consider any matter described in this Information Statement.

Stockholders owning of record more than 68% of our outstanding voting securities have irrevocably consented to the amendment of Articles of Incorporation to change the Company’s name to Blindspot Alert, Inc. and adopt the 2008 Incentive Compensation Plan. The vote or consent of no other holders of our capital stock is required to approve this action. Accordingly, no additional votes will be needed to approve this action.

This Information Statement is being mailed on or about December 5, 2008 to stockholders of record on November 19, 2008 (the “Record Date”). This Information Statement is being delivered only to inform you of the corporate action described herein in accordance with Rule 14c-2 under the Exchange Act.

DISSENTER’S RIGHT OF APPRAISAL

Under Nevada law and our articles of incorporation and bylaws, no stockholder has any right to dissent to the adoption of stock option plan, or the proposed name change, and is not entitled to appraisal of or payment for their shares of our stock.

CORPORATE ACTIONS

AMENDMENT TO ARTICLES OF INCORPORATION

TO CHANGE NAME TO BLINDSPOT ALERT, INC.

(ITEM 1)

On November 19, 2008, the action to amend the Company’s Articles of Incorporation to change the Company’s name from Promotions on Wheels Holdings, Inc. to Blindspot Alert, Inc., (the “Amendment”) was approved by written consent of the holders representing approximately 68% of the outstanding voting securities of the Company.

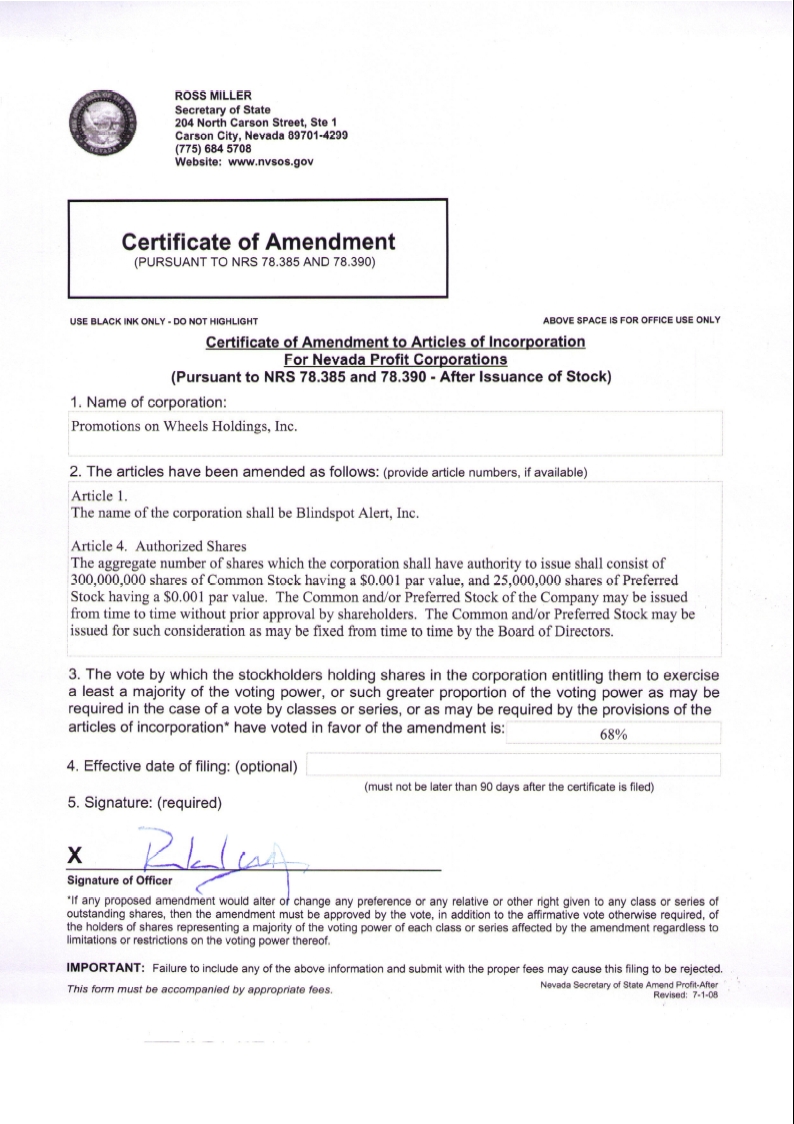

On November 19, 2008, the Board of Directors of the Company approved the Amendment. The Amendment to be filed with the Nevada Secretary of State is attached to this Information Statement as Exhibit A.

The approval of the Amendment requires the affirmative vote of a majority of the shares of voting securities outstanding and entitled to vote. On November 19, 2008, the action to approve the Amendment was approved by written consent of holders representing approximately 68% of the outstanding voting securities of the Company. As such, no vote or future action of the stockholders of the Company is required to approve the Amendment. You are hereby being provided with notice of the approval of the Amendment.

PURPOSE OF THE NAME CHANGE

The Board of Directors approved the Amendment to further the Company’s strategic business plan and ensure shareholder recognition of the Company. In order to pursue the Company’s business plan to protect children from unsavory internet sites and marketers and maintain shareholder recognition of the Company, the Board believes that the change of name is in the best interest of the Company.

AMENDMENT TO ARTICLES OF INCORPORATION

TO INCREASE AUTHORIZED COMMON SHARES TO 300,000,000 AND

INCREASE AUTHORIZED PREFERRED SHARES TO 25,000,000

(ITEM 2)

On November 19, 2008, the action to amend the Company’s Articles of Incorporation to increase the authorized common shares to 300,000 and increase the authorized preferred shares to 25,000,000 was approved by written consent of the holders representing approximately 68% of the outstanding voting securities of the Company.

On November 19, 2008, the Board of Directors of the Company approved the Amendment. The Amendment to be filed with the Nevada Secretary of State is attached to this Information Statement as Exhibit A.

PURPOSE OF INCREASE OF AUTHORIZED SHARES

The Board of Directors approved the Amendment to further the Company’s best interest to have additional authorized but unissued shares of common and preferred shares available in order to provide (a) flexibility for future corporate action; (b) raise additional capital by issuing additional shares of Common Stock or granting warrants for the future purchase of Common Stock; (c) the need to grant additional options to purchase Common Stock to attract qualified employees and consultants; and (d) the need to issue additional shares of common stock or securities convertible into Common Stock in connection with strategic corporate transactions, acquisitions, and other business arrangements and corporate purposes, is desirable to avoid repeated separate amendments to our Articles of Incorporation and the delay and expense incurred in amending the Articles of Incorporation. The Company intends to assess its need to issue securities for the corporate purposes described above and we believe that we need to be in a position to take advantage of opportunities when they arise or when we have a need. The Board of Directors believes that the currently available unissued shares do not provide sufficient flexibility for corporate action in the future.

Currently, there is no plan to issue any securities for the corporate purposes described above. In the event any securities are issued in the future, shareholders will suffer dilution to their ownership of the Company at the time of the issuance of the securities. No additional corporate action is needed to issue any additional securities. The Company may even issue securities as a defensive mechanism in order to attempt to stop a hostile take over by another company; there is no plan to do this at this time.

EFFECTIVE DATE OF AMENDMENT

The Amendment to our Articles of Incorporation will become effective upon the filing with the Nevada Secretary of State of a Certificate of Amendment to our Amended and Restated Articles of Incorporation. We intend to file the Certificates of Amendment twenty-one days after this Information Statement is first mailed to shareholders.

EFFECT ON CERTIFICATES EVIDENCING SHARES OF PROMOTION OF WHEELS HOLDINGS, INC.

The change in the name of Promotions on Wheels Holdings, Inc. to Blindspot Alert, Inc. will be reflected in its stock records by book-entry in Promotions on Wheels Holdings, Inc.’s books. For those shareholders that hold physical certificates, please do not destroy or send to Promotions on Wheels Holdings, Inc. your common stock certificates. Those certificates will remain valid for the number of shares shown thereon, and should be carefully preserved by you.

There will be no other effect on your rights or interest in shares of the Company that you hold. There are no material US Federal Income Tax consequence to either the Company or its shareholders from the Amendment.

ADOPTION OF 2008 INCENTIVE COMPENSATION PLAN

(ITEM 3)

On November 19, 2008, the action to adopt the Company’s 2008 Incentive Compensation Plan (the “2008 Plan”) was approved by written consent of the holders representing approximately 68% of the outstanding voting securities of the Company.

On November 19, 2008, the Board of Directors of the Company approved the 2008 Plan. The 2008 Plan is attached to this Information Statement as Exhibit B.

The approval of the 2008 Plan requires the affirmative vote of a majority of the shares of voting securities outstanding and entitled to vote. On November 19, 2008, the action to approve the 2008 Plan was approved by written consent of holders representing approximately 68% of the outstanding voting securities of the Company. As such, no vote or further action of the stockholders of the Company is required to approve the 2008 Plan. You are hereby being provided with notice of the approval of the 2008 Plan.

The Board of Directors approved the 2008 Plan to ensure that the Company has adequate ways in which to provide stock based compensation to its directors, offices, employees, and consultants. The Board believes that the ability to grant stock-based compensation, such as stock options, is important to the Company’s future success. The grant of stock-based compensation, such as stock options, can motivate high levels of performance and provide an effective means of recognizing employees and consultants contributions to the Company’s success. In addition, stock-based compensation can be valuable in recruiting and retaining highly qualified technical and other key personnel who are in great demand, as well as rewarding and providing incentives to the Company’s current employees and consultants.

A description of the 2008 Incentive Compensation Plan is set forth below.

There will be 10,000,000 shares of common stock authorized for issuance under the plan.

The purpose of the plan is to attract and retain the services of key management, employees, outside directors and consultants, and to align long-term pay-for-performance incentive compensation with shareholders’ interests. An equity compensation plan aligns employees’ interests with those of our shareholders, because an increase in stock price after the date of award results in increased value, thus rewarding employees for improved stock price performance. Stock option grants under the plan may be intended to qualify as incentive stock options under Section 422 of the Tax Code, may be non-qualified stock options governed by Section 83 of the Tax Code, restricted stock units, or other forms of equity compensation. Subject to earlier termination by our board of directors, the plan will remain in effect until all awards have been satisfied or terminated under the terms of the plan.

We believe that a broad-based incentive compensation plan is a valuable employee incentive and retention tool that benefits all of our shareholders, and that the plan is necessary in order to provide appropriate incentives for achievement of company performance objectives and to continue to attract and retain the most qualified employees, directors and consultants in light of our ongoing growth and expansion. Without sufficient equity incentives available for grant, we may be forced to consider cash replacement alternatives to provide a market-competitive total compensation package necessary to attract, retain and motivate the employee talent important to the future success of the company. These cash replacement alternatives would then reduce the cash available for operations.

While we believe that employee equity ownership is a significant contributing factor in achieving superior corporate performance, we recognize that increasing the number of available shares under our option plans may lead to an increase in our stock overhang and potential dilution. We believe that our 2008 Incentive Compensation Plan will be integral to our ability to achieve superior performance by attracting, retaining and motivating the employee talent important to attaining long-term improved company performance and shareholder returns.

Overview

The terms of the plan provide for grants of stock options, stock appreciation rights, restricted stock, deferred stock, bonus stock, dividend equivalents, other stock-related awards and performance awards that may be settled in cash, stock or other property.

Shares Available for Awards

The total number of shares of our common stock that will be subject to awards under the plan is equal to 10,000,000 shares Awards that are granted to replace awards assumed pursuant to the acquisition of a business are not subject to this limit.

Limitations on Awards

No more than 2,000,000 shares of stock may be granted to an individual during any fiscal year under the plan. The maximum amount that may be earned by any one participant for any fiscal year is $10,000,000 and the maximum amount that may be earned by any one participant for a performance period is $10,000,000.

Eligibility

Our employees, officers, directors and consultants are eligible for awards under the plan. However, incentive stock options may be granted only to our employees.

Plan Administrator

Our board of directors administers the plan, and has delegated authority to make grants under the plan to the compensation committee, whose members are “non-employee directors” as defined by Rule 16b-3 of the Exchange Act, “outside directors” for purposes of Section 162(m), and “independent” as defined by the rules and regulations promulgated by the NASD and SEC, the board and committee, referred to collectively as the administrator, determine the type, number, terms and conditions of awards granted under the plan.

Stock Options and Stock Appreciation Rights

The administrator may grant stock options, both incentive stock options, or ISOs, and non-qualified stock options, or NS0s. In addition, the administrator may grant stock appreciation rights, or SARs, which entitle the participant to receive the appreciation in our common stock between the grant date and the exercise date. These may include “limited” SARs exercisable for a period of time after a change in control or other event. The exercise price per share and the grant price are determined by the administrator, but must not be less than the fair market value of a share of our common stock on the grant date. The terms and conditions of options and SARs generally are fixed by the administrator, except that no stock option or SAR may have a term exceeding ten years. Stock options may be exercised by payment of the exercise price in cash, shares that have been held for at least six months, outstanding awards or other property having a fair market value equal to the exercise price.

Restricted and Deferred Stock

The administrator may grant restricted stock, which is a grant of shares of our common stock that may not be sold or disposed of, and may be forfeited if the recipient’s service ends before the restricted period. Restricted stockholders generally have all of the rights of a shareholder.

The administrator may grant deferred stock, which confers the right to receive shares of our common stock at the end of a specified deferral period, that may be forfeited if the recipient’s service ends before the restricted period. Prior to settlement, an award of deferred stock generally carries no rights associated with share ownership.

Dividend Equivalents

The administrator may grant dividend equivalents conferring the right to receive awards equal in value to dividends paid on a specific number of shares of our common stock. These may be granted alone or in connection with another award, subject to terms and conditions specified by the administrator.

Bonus Stock and Awards

The administrator may grant shares of our common stock free of restrictions as a bonus or in lieu of other obligations, subject to such terms as the administrator may specify.

Other Stock-Based Awards

The administrator may grant awards under the plan that are based on or related to shares of our common stock. These might include convertible or exchangeable debt securities, rights convertible into common stock, purchase rights, payment contingent upon our performance or other factors. The administrator determines the terms and conditions of such awards.

Performance Awards

The right to exercise or receive a grant or settlement of an award may be subject to performance goals and subjective individual goals specified by the administrator. In addition, performance awards may be granted upon achievement of pre-established performance goals and subjective individual goals during a fiscal year. Performance awards to our chief executive officer and four highest compensated officers, or covered employees, should qualify as deductible performance based compensation under Internal Revenue Code section 162(m). The administrator will determine the grant amount, terms and conditions for performance awards.

One or more of the following business criteria will be used by our Compensation Committee in establishing performance goals for performance awards and annual incentive awards to covered employees: (1) total shareholder return; (2) such total shareholder return as compared to total return (on a comparable basis) of a publicly available index such as, but not limited to, the Russell 2000 Small Cap Index; (3) net income; (4) pretax earnings; (5) pretax operating earnings after interest expense and before bonuses, service fees, and extraordinary or special items; (6) earnings per share; (7) operating earnings; and (8) ratio of debt to shareholders’ equity.

After the end of each performance period, the administrator (which will be the Compensation Committee for awards intended to qualify as performance based for purposes of section I62(m)) will determine the amount of any pools, the maximum amount of potential performance awards payable to each participant, and the amount of any other potential performance awards payable to participants in the plan.

Acceleration of Vesting; Change in Control

The administrator may accelerate vesting or other restrictions of any award, including if we undergo a change in control as defined in the plan. In addition, performance goals relating to any performance-based award may be deemed met upon a change in control. Stock options and limited stock appreciation rights may be cashed out based on a defined “change in control price.”

In the event of a “corporate transaction” (as defined in the plan), the acquiror may assume or substitute for each outstanding stock option.

Amendment and Termination

Our board of directors may amend, alter, suspend, discontinue or terminate the plan or the administrator’s authority to grant awards without further shareholder approval, except shareholder approval must be obtained for any amendment or alteration required by law, regulation or applicable exchange rules. Unless earlier terminated by our board of directors, the plan will terminate ten years after its adoption, or when no shares of our common stock remain available for issuance under the plan and we have no further rights or obligations with respect to outstanding awards under the plan. Amendments to any award that have a material adverse effect on a participant require their consent.

Federal Income Tax Consequences

The information set forth above is a summary only and does not purport to be complete. In addition, the information is based upon current Federal income tax rules and therefore is subject to change when those rules change. Moreover, because the tax consequences to any recipient may depend on his or her particular situation, each recipient should consult their tax adviser as to the Federal, state, local and other tax consequences of the grant or exercise of an award or the disposition of stock acquired as a result of an award. The plan is not qualified under the provisions of section 401(a) of the Internal Revenue Code and is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974 (ERISA).

Non qualified Stock Options

Generally, there is no taxation upon the grant of a nonqualified stock option. On exercise, an optionee will recognize ordinary income equal to the excess, if any, of the fair market value on the date of exercise of the stock over the exercise price. If the optionee is our employee or an employee of an affiliate, that income will be subject to withholding tax. The optionee’s tax basis in those shares will be equal to their fair market value on the date of exercise of the option, and his capital gain holding period for those shares will begin on that date.

Subject to the requirement of reasonableness, the provisions of Section 162(m) and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the optionee.

Incentive Stock Options

The plan provides for the grant of options that qualify as incentive stock options, or ISOs, as defined in Internal Revenue Code Section 422. An optionee generally is not subject to ordinary income tax upon the grant or exercise of an ISO. If the optionee holds a share received on exercise of an ISO for a required holding period of at least two years from the date the option was granted and at least one year from the date the option was exercised, the difference between the amount realized on disposition and the holder’s tax basis will be long-term capital gain.

If an optionee disposes of a share acquired on exercise of an ISO before the end of the required holding period, the optionee generally will recognize ordinary income equal to the excess of the fair market value of the share on the date the ISO was exercised over the exercise price. If the sales proceeds are less than the fair market value, the amount of ordinary income recognized will not exceed the gain realized on the sale. If the amount realized on a disqualifying disposition exceeds the fair market value of the share, the excess will be short-term or long-term capital gain, depending on whether the holding period for the share exceeds one year.

For purposes of the alternative minimum tax, or AMT, the amount by which the fair market value of a share of stock acquired on exercise of an ISO exceeds the exercise price generally will be an adjustment included in the optionee’s AMT income. If there is a disqualifying disposition of the share in the year in which the option is exercised, there will be no adjustment for AMT purposes with respect to that share. If there is a disqualifying disposition in a later year, no income is included in the optionee’s AMT income for that year. The tax basis of a share acquired on exercise of an ISO is increased by the amount of the adjustment taken into account with respect to that share for AMT purposes.

We are not allowed an income tax deduction with respect to the grant or exercise of an ISO or the disposition of a share acquired on exercise of an ISO after the required holding period. If there is a disqualifying disposition of a share, we are allowed a deduction in an amount equal to the ordinary income includible in income by the optionee, provided that amount constitutes an ordinary and necessary business expense for us and is reasonable in amount, and either the employee includes that amount in income or we timely satisfy our reporting requirements.

Stock Awards

Generally, the recipient of a stock award will recognize ordinary compensation income at the time the stock is received, equal to the excess of the fair market value over any amount paid for the stock. If the stock is not vested when received (for example, if the employee is required to work for a period of time in order to have the right to sell the stock), the recipient generally will not recognize income until the stock becomes vested, at which time the recipient will recognize ordinary compensation income equal to the excess of the fair market value of the stock over any amount paid for the stock. A recipient may file an election with the Internal Revenue Service within 30 days of receipt of the stock, to recognize ordinary compensation income as of the date the recipient receives the award, equal to the excess of the fair market value over any amount paid for the stock.

The recipient’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired as stock awards will be the amount paid for the shares plus any ordinary income recognized when the stock is received or becomes vested.

Subject to the requirement of reasonableness, the provisions of Section 162(m) and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the recipient of the stock award.

Stock Appreciation Rights

The administrator may grant stock appreciation rights, or SARs, separate or stand-alone of any other awards, or in tandem with options.

With respect to stand-alone SARs, if the recipient receives the appreciation inherent in the SARs in cash, it will be taxable as ordinary compensation income when received. If the recipient receives the appreciation in shares of stock, the recipient will recognize ordinary compensation income equal to the excess of the fair market value of the stock on the day it is received over any amounts paid for the stock.

With respect to tandem stock appreciation rights, if the recipient elects to surrender the underlying option in exchange for cash or shares of stock equal to the appreciation inherent in the underlying option, the tax consequences to the recipient will be the same as discussed above. If the recipient elects to exercise the underlying option, the holder will be taxed at the time of exercise as if he or she had exercised a nonqualified stock option.

Subject to the requirement of reasonableness, the provisions of Section 162(m) and the satisfaction of our tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the recipient of the SAR.

Dividend Equivalents

Generally, the recipient of a dividend equivalent award will recognize ordinary compensation income equal to the fair market value of the award when it is received. Subject to the requirement of reasonableness, the provisions of Section 162(m) and the satisfaction of our tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable income realized by the recipient of the dividend equivalent.

Section 162 Limitations

Internal Revenue Code Section 162(m) denies a deduction to any publicly held corporation for compensation paid to our chief executive officer and four highest compensated officers, to the extent that compensation exceeds $1 million. It is possible that compensation attributable to stock awards, when combined with all other types of compensation received by a covered employee may cause this limitation to be exceeded in any particular year.

Certain kinds of compensation, including qualified performance based compensation, are disregarded for purposes of the Section 162(m) deduction limitation. Compensation attributable to some stock awards will qualify as performance-based compensation if granted by a committee of the board of directors comprised solely of “outside directors” only upon the achievement of an objective performance goal established in writing by the committee while the outcome is substantially uncertain, and the material terms of the plan under which the award is granted is approved by stockholders.

A stock option or stock appreciation right may be considered performance based compensation if the plan contains a per-employee limitation on the number of shares for which stock options and stock appreciation rights may be granted during a specified period, the material terms of the plan are approved by the stockholders, and the exercise price of the option or right is no less than the fair market value of the stock on the date of grant.

2. INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

CHANGE IN CONTROL

On June 30, 2008, Texas Atlantic Partners, LLC obtained control of the Company by acquiring a 72% of the then outstanding common stock. Coincidental with this acquisition a cancellation of 35,500,000 shares of previously issued common stock was affected pursuant to the terms of the share acquisition agreement.

Beginning June 30, 2008, we agreed to the sell shares of Series A Convertible Preferred Stock at a price of $.30 per share in a private placement to accredited investors. As of November 1, 2008, we had received $925,000 pursuant to this offering. Each preferred share may be converted into 1.25 common shares.

Also, on June 30, 2008, we entered into a license agreement with WQN, Inc., whose common stock trades on the pink sheets under the symbol WQNI. The Company has the right to license its software technology on a nonexclusive worldwide basis and offer the software on an exclusive basis to: Home Shopping Network, QVC, Inc., Walgreens Drugstore, CVS Pharmacy and Walmart.

We have paid a one time payment of $300,000 and will pay a 35% royalty of the net licensing revenue collected by us. The software allows for the detection and the alerting of caregivers of unwanted internet advances by predators, cyberbullying and unsolicited pornography.

Prior to the change in Control, we had 37,000,000 common shares outstanding. After the change in control took place, new shareholders obtained 21,100,000 common shares and 35,500,000 previously issued common shares were cancelled. In addition, 3,083,334 preferred shares were sold in the private placement. These preferred shares are convertible on a 1 for 1.25 common share basis, and assuming all are converted will convert into 3,854,167 new common shares. On a fully converted basis, after conversion of the outstanding preferred shares, the new shareholders of the Company will own approximately 94.3% of the Company’s common stock and the pre change in control shareholders will own approximately 5.7% of the Company’s common stock. There are no options or warrants outstanding.

On July 21, 2008, the following persons were appointed as directors and officers:

1. Rusty Robertson, President, Chief Operating Officer and Director

2. Denton Jones, Director

3. Robert J. Salluzzo, Treasurer and interim Chief Financial Officer

4. Leonard Makowka, M.D., Ph.D. FRCS(c), FACS, Director

Dr. Makowka resigned as a director on October 7, 2008.

The issuance of the Company’s common stock to the new common shareholders and the preferred shareholders was exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(2).

Neither the Company, nor its director and officer, had any material relationship with any of the new or preferred shareholders.

The Company is headquartered in Dallas, Texas and will continue to trade under its current name and ticker symbol until the completion of the corporate name change to Blindspot Alert, Inc.

VOTING SECURITIES

The Company’s authorized capital consists of 70,000,000 shares of Common Stock, $0.001 par value, and 5,000,000 shares of Preferred Stock, $0.001 par value. Accordingly, after the change in control took place and the preferred shares were sold, the new shareholders on a fully converted basis own approximately 26,454,167 shares of the Company’s Common Stock and the pre-change in control Company shareholders own 1,500,000 shares of the Company’s Common Stock. On a percentage basis the new shareholders of the Company own approximately 94.3% of the Company’s Common Stock and the pre-change in control shareholders own approximately 5.7% of the Company’s Common Stock.

The holders of Common Stock are entitled to one vote for each share held of record on all matters submitted to a vote of the holders of Common Stock. Subject to preferences applicable to any outstanding preferred stock, if any, holders of Common Stock are entitled to receive ratably such dividends as may be declared by the Board of Directors out of funds legally available therefore. In the event of a liquidation, dissolution or winding up of Promotions on Wheels Holdings, Inc., the holders of Common Stock are entitled to share ratably all assets remaining after payment of liabilities and the liquidation preference of any preferred stock, if any. Holders of Common Stock have no preemptive or subscription rights, and there are no redemption or conversion rights with respect to such shares.

In the event of any liquidation, dissolution or winding up of Promotions on Wheels Holdings, Inc., the assets of Promotions on Wheels Holdings, Inc. available for distribution to shareholders will be distributed among the holders of preferred stock, if any, and the holders of any other class of equity securities of Promotions on Wheels Holdings, Inc., including its common stock, pro rata, on an as-converted-to-common-stock basis, after the payment to the holders of Promotions on Wheels Holdings, Inc. Common Stock of a di minimus par value amount.

The holders of Promotions on Wheels Holdings, Inc. Common Stock are entitled to dividends in the event that Promotions on Wheels Holdings, Inc. pays cash or other dividends in property to holders of outstanding shares of its common stock, which dividends would be made pro rata, on an as-converted-to-common-stock basis.

DIRECTORS AND EXECUTIVE OFFICERS

The following lists the name, age and business experience of each of the Promotions on Wheels Holdings, Inc. directors and executive officers.

Name | | Age | | Position |

| Rowland W. Day II | | 52 | | Chief Executive Officer and Director |

| Robert J. Salluzzo | | 60 | | Treasurer and interim Chief Financial Officer |

| Rusty Robertson | | 56 | | President, Chief Operating Officer and Director |

| Denton Jones | | 56 | | Director |

Rowland W. Day II, 52 years of age, Chief Executive Officer and Director.

Mr. Day is a business corporate lawyer. He has practiced law since 1983 and is currently self-employed. Mr. Day is the chairman of the Board of Clearant, Inc. (OTCBB-CLRA) and is a director of RE3W WorldWide and Restaurants on the Run.

Robert J. Salluzzo, 60 years of age, Treasurer and interim Chief Financial Officer.

Mr. Salluzzo has been the Chief Financial Officer of four public companies since 1997. Mr. Salluzzo is a Certified Public Accountant.

Rusty Robertson, 56 years of age, President, Chief Operating Officer and Director.

Ms. Robertson is a principal of the Robertson Schwartz Agency. Ms. Robertson specializes in marketing, sales, forecasting, literary, advertising and public relations. Advertising Age Magazine has honored Ms. Robertson as one of the top 100 Marketers and Success Magazine featured Ms. Robertson and her company as one of Americas Super 8 companies.

Denton Jones, 56 years of age, Director.

Mr. Jones has been a private investor for 30 years. He is the manager of Texas Atlantic Partners, LLC, the holder of 14,550,000 shares of common stock. Mr. Jones is a director of WQN, Inc.

Director Compensation. Directors are reimbursed any expenses incurred by attending Board of Directors’ meetings. They are not currently paid any other compensation for their services on the Board. The Company has entered into indemnification agreements with each of its directors.

DISCLOSURES

The Company is not aware of any current substantial interest, direct or indirect, by security holdings or otherwise, of: i) any of the Company’s current or prior officers or directors, ii) any nominee for election as a director of the Company, or iii) any associate of the persons mentioned in subsections i) and ii) above. The Company’s current and future directors and officers may have a substantial interest in the 2008 Incentive Compensation Plan, as they may be granted stock or stock options under the Plan; however, they do not have any current interests.

The Company is not aware of any director of the Company who has informed the Company in writing that he or she intends to oppose any action to be taken by the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the Company’s common stock beneficially owned on November 19, 2008, for (i) each stockholder known to be the beneficial owner of 5% or more of Company’s outstanding common stock, (ii) each executive officer and director, and (iii) all executive officers and directors as a group. In general, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of such security, or the power to dispose or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership within 60 days.

As of November 19, 2008, the Company has 22,600,000 shares of common stock outstanding and 3,083,334 shares of preferred stock outstanding.

Name of Beneficial Owner | | Amount | | Percent | |

Texas Atlantic Capital Partners, LLC(1) | | | 14,200,000 | | | 62.83 | % |

| | | | | | | | |

Robertson Schwartz Agency(2) | | | 2,400,000 | | | 10.62 | % |

| | | | | | | | |

| Rowland W. Day II | | | 1,200,000 | | | 5.31 | % |

| | | | | | | | |

Denton Jones(1) | | | — | | | 0 | % |

| | | | | | | | |

Rusty Robertson(2) | | | — | | | 0 | % |

| | | | | | | | |

All Executive Officers and Directors As a Group (3 persons) | | | 17,800,000 | | | 78.76 | % |

(1) Mr. Jones is the manager of Texas Atlantic Capital Partners, LLC.

(2) Mrs. Robertson owns 50% of the Robertson Schwartz Agency.

COPIES OF INFORMATION STATEMENT

Only one Information Statement is being delivered to multiple security holders sharing an address unless we have received contrary instructions from one or more of the security holders. We hereby undertake promptly to deliver, upon written or oral request, a separate copy of this Information Statement to a security holder at a shared address to which a single copy of the Information Statement was delivered. In order to request additional copies of this Information Statement or to request delivery of a single copy of this Information Statement if you are receiving multiple copies, please contact us by mail at 1 Hampshire Court, Newport Beach, California 92660.

ADDITIONAL INFORMATION

We file annual reports on Form 10-KSB, quarterly reports of Form 10-QSB, current reports on Form 8-K or Form 8-K/A, proxy statements and other information with the SEC under the Exchange Act. You may read and copy this information at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at (800) 732-0330 for further information on the operation of the SEC’s Public Reference Room. The SEC also maintains an internet site that contains reports, proxy statements and other information about issuers, like us, who file electronically with the SEC. The address of the SEC’s web site is www.sec.gov.

The following documents as filed with the Commission by the Company are incorporated herein by reference:

Annual Report on Form 10-KSB for the year ended December 31, 2007;

Quarterly Report on Form 10-QSB for the quarter ended March 31, 2008;

Quarterly Report on Form 10-QSB for the quarter ended June 30, 2008

Quarterly Report on Form 10-QSB for the quarter ended September 30, 2008;

Current Reports on Form 8-K dated as of March 26, 2008, July 25,, 2008 and October 10, 2008..

By Order of the Board of Directors,

/s/ Rowland W. Day II

Rowland W. Day II

Chief Executive Officer and Director

Dated: November 19, 2008

EXHIBIT A

Amended Articles of Incorporation

EXHIBIT B

Blindspot Alert, Inc.

2008 Incentive Compensation Plan

1 Purpose. The purpose of this Plan is to assist the Company and its Related Entities in attracting, motivating, retaining and rewarding high-quality Employees, officers, Directors and Consultants by enabling such persons to acquire or increase a proprietary interest in the Company in order to strengthen the mutuality of interests between such persons and the Company's shareholders, and providing such persons with annual and long-term performance incentives to expend their maximum efforts in the creation of shareholder value. The Plan is intended to qualify certain compensation awarded under the Plan for tax deductibility under Section 162(m) of the Code (as hereafter defined) to the extent deemed appropriate by the Plan Administrator.

2 Definitions. For purposes of the Plan, the following terms shall be defined as set forth below.

(a) "Applicable Laws" means the requirements relating to the administration of equity compensation plans under U.S. state corporate laws, U.S. federal and state securities laws, the Code, the rules and regulations of any stock exchange upon which the Common Stock is listed and the applicable laws of any foreign country or jurisdiction where Awards are granted under the Plan.

(b) "Award" means any award granted pursuant to the terms of this Plan, including an Option, Stock Appreciation Right, Restricted Stock, Stock Unit, Stock granted as a bonus or in lieu of another award. Dividend Equivalent, Other Stock-Based Award or Performance Award, together with any other right or interest, granted to a Participant under the Plan.

(c) "Award Agreement" means the written agreement evidencing an Award granted under the Plan.

(d) "Beneficiary" means the person, persons, trust or trusts which have been designated by a Participant in his or her most recent written beneficiary designation filed with the Plan Administrator to receive the benefits specified under the Plan upon such Participant's death or to which Awards or other rights are transferred if and to the extent permitted under Section 10(b) hereof. If, upon a Participant's death, there is no designated Beneficiary or surviving designated Beneficiary, then the term Beneficiary means the person. persons, trust or trusts entitled by will or the laws of descent and distribution to receive such benefits.

(e) Board" means the Company's Board of Directors.

(f) "Cause" shall, with respect to any Participant, have the meaning specified in the Award Agreement. In the absence of any definition in the Award Agreement, "Cause" shall have the equivalent meaning or the same meaning as "cause" or "for cause" set forth in any employment, consulting, change in control or other agreement for the performance of services between the Participant and the Company or a Related Entity or, in the absence of any such definition in such agreement, such term shall mean (i) the failure by the Participant to perform his or her duties as assigned by the Company (or a Related Entity) in a reasonable manner, (ii) any violation or breach by the Participant of his or her employment, consulting or other similar agreement with the Company (or a Related Entity), if any, (iii) any violation or breach by the Participant of his or her confidential information and invention assignment, non-competition, non-solicitation, non-disclosure and/or other similar agreement with the Company or a Related Entity, if any, (iv) any act by the Participant of dishonesty or bad faith with respect to the Company (or a Related Entity), (v) any material violation or breach by the Participant of the Company's or a Related Entity's policy for employee conduct, if any, (vi) use of alcohol, drugs or other similar substances in a manner that adversely affects the Participant's work performance, or (vii) the commission by the Participant of any act, misdemeanor, or crime reflecting unfavorably upon the Participant or the Company or any Related Entity. The good faith determination by the Plan Administrator of whether the Participant's Continuous Service was terminated by the Company for "Cause" shall be final and binding for all purposes hereunder.

(g) "Change in Control" means and shall be deemed to have occurred on the earliest of the following dates:

(i) the date on which any "person" (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) obtains "beneficial ownership" (as defined in Rule 13d-3 of the Exchange Act) or a pecuniary interest in fifty percent (50%) or more of the Voting Stock;

(ii) the consummation of a merger, consolidation, reorganization or similar transaction other than a transaction: (1) (a) in which substantially all of the holders of Company's Voting Stock hold or receive directly or indirectly fifty percent (50%) or more of the voting stock of the resulting entity or a parent company thereof, in substantially the same proportions as their ownership of the Company immediately prior to the transaction; or (2) in which the holders of Company's capital stock immediately before such transaction will, immediately after such transaction, hold as a group on a fully diluted basis the ability to elect at least a majority of the directors of the surviving corporation (or a parent company);

(iii) there is consummated a sale, lease, exclusive license or other disposition of all or substantially all of the consolidated assets of the Company and its Subsidiaries, other than a sale, lease, license or other disposition of all or substantially all of the consolidated assets of the Company and its Subsidiaries to an entity, fifty percent (50%) or more of the combined voting power of the voting securities of which are owned by shareholders of the Company in substantially the same proportions as their ownership of the Company immediately prior to such sale, lease, license or other disposition; or

(iv) individuals who, on the date this Plan is adopted by the Board, are Directors (the "Incumbent Board") cease for any reason to constitute at least a majority of the Directors; provided, however, that if the appointment or election (or nomination for election) of any new Director was approved or recommended by a majority vote of the members of the Incumbent Board then still in office, such new member shall, for purposes of this Plan, be considered as a member of the Incumbent Board.

For purposes of determining whether a Change in Control has occurred, a transaction includes all transactions in a series of related transactions, and terms used in this definition but not defined are used as defined in the Plan. The term Change in Control shall not include a sale of assets, merger or other transaction effected exclusively for the purpose of changing the domicile of the Company.

Notwithstanding the foregoing or any other provision of this Plan, the definition of Change in Control (or any analogous term) in an individual written agreement between the Company and the Participant shall supersede the foregoing definition with respect to Awards subject to such agreement (it being understood, however, that if no definition of Change in Control or any analogous term is set forth in such an individual written agreement, the foregoing definition shall apply).

(h) "Code" means the Internal Revenue Code of 1986, as amended from time to time, including regulations thereunder and successor provisions and regulations thereto.

(i) "Committee" means a committee designated by the Board to administer the Plan with respect to at least a group of Employees, Directors or Consultants.

(j) "Company" means Promotions on Wheels Holdings, Inc., a Nevada corporation.

(k) "Consultant" means any person (other than an Employee or a Director, solely with respect to rendering services in such person's capacity as a director) who is engaged by the Company or any Related Entity to render consulting or advisory services to the Company or such Related Entity.

(l) "Continuous Service" means uninterrupted provision of services to the Company or any Related Entity in the capacity as either an officer, Employee, Director or Consultant. Continuous Service shall not be considered to be interrupted in the case of (i) any approved leave of absence, (ii) transfers among the Company, any Related Entities, or any successor entities, in the capacity as either an officer, Employee, Director or Consultant or (iii) any change in status as long as the individual remains in the service of the Company or a Related Entity in the capacity as either an officer, Employee, Director, Consultant (except as otherwise provided in the Award Agreement). An approved leave of absence shall include sick leave, military leave, or any other authorized personal leave.

(m) "Corporate Transaction" means the occurrence, in a single transaction or in a series of related transactions, of any one or more of the following events:

(i) a sale, lease, exclusive license or other disposition of a substantial portion of the consolidated assets of the Company and its Subsidiaries, as determined by the Plan Administrator, in its discretion;

(ii) a sale or other disposition of more than twenty percent (20%) of the outstanding securities of the Company; or

(iii) a merger, consolidation, reorganization or similar transaction, whether or not the Company is the surviving corporation.

(n) "Covered Employee" means an Eligible Person who is a Covered Employee as specified in Section 7(d) of the Plan.

(o) "Director" means a member of the Board or the board of directors of any Related Entity.

(p) "Disability" means a permanent and total disability (within the meaning of Section 22(e) of the Code), as determined by a medical doctor satisfactory to the Plan Administrator.

(q) "Dividend Equivalent" means a right, granted to a Participant under Section 6(g) hereof, to receive cash, Shares, other Awards or other property equal in value to dividends paid with respect to a specified number of Shares or other periodic payments.

(r) "Effective Date" means the effective date of this Plan, which shall be the date this Plan is adopted by the Board, subject to the approval of the shareholders of the Company.

(s) "Eligible Person" means each officer, Director, Employee or Consultant. The foregoing notwithstanding, only employees of the Company, any Parent or any Subsidiary shall be Eligible Persons for purposes of receiving a grant of Incentive Stock Options. An Employee on leave of absence may be considered as still in the employ of the Company or a Related Entity for purposes of eligibility for participation in the Plan.

(t) "Employee" means any person, including an officer or Director, who is an employee of the Company or any Related Entity. The payment of a director's fee by the Company or a Related Entity shall not be sufficient to constitute "employment" by the Company.

(u) "Exchange Act" means the Securities Exchange Act of 1934, as amended from time to time, including rules thereunder and successor provisions and rules thereto.

(v) "Fair Market Value" means the fair market value of Shares, Awards or other property as determined by the Plan Administrator, or under procedures established by the Plan Administrator. Unless otherwise determined by the Plan Administrator, the Fair Market Value of Shares as of any given date, after which the Shares are publicly traded on a stock exchange or market, shall be the closing sale price per Share reported on a consolidated basis for stock listed on the principal stock exchange or market on which Shares is traded on the date as of which such value is being determined or, if there is no sale on that date, then on the last previous day on which a sale was reported.

(w) "Good Reason" shall, with respect to any Participant, have the meaning specified in the Award Agreement. In the absence of any definition in the Award Agreement, "Good Reason" shall have the equivalent meaning (or the same meaning as "good reason" or "for good reason") set forth in any employment, consulting, change in control or other agreement for the performance of services between the Participant and the Company or a Related Entity or, in the absence of any such definition in such agreement(s), such term shall mean (i) the assignment to the Participant of any duties inconsistent in any material respect with the Participant's position (including status, offices, titles and reporting requirements), authority, duties or responsibilities as assigned by the Company (or a Related Entity) or any other action by the Company (or a Related Entity) which results in a material diminution in such position, authority, duties or responsibilities, excluding for this purpose an isolated, insubstantial and inadvertent action not taken in bad faith and which is remedied by the Company (or a Related Entity) promptly after receipt of notice thereof given by the Participant; (ii) any failure by the Company (or a Related Entity) to comply with its obligations to the Participant as agreed upon, other than an isolated, insubstantial and inadvertent failure not occurring in bad faith and which is remedied by the Company (or a Related Entity) promptly after receipt of notice thereof given by the Participant; (iii) the Company's (or Related Entity's) requiring the Participant to be based at any office or location more than fifty (50) miles from the location of employment as of the date of Award, except for travel reasonably required in the performance of the Participant's responsibilities; (iv) any purported termination by the Company (or a Related Entity) of the Participant's Continuous Service otherwise than for Cause, as defined in Section 2(f), death, or by reason of the Participant's Disability as defined in Section 2(o); or (v) any reduction in the Participant's base salary (unless such reduction is part of Company-wide reduction that affects a majority of the persons of comparable level to the Participant).

(x) "Incentive Stock Option" means any Option intended to be designated as an incentive stock option within the meaning of Section 422 of the Code or any successor provision thereto.

(y) "Non-Employee Director" means a Director of the Company who is not an Employee.

(z) "Non-Qualified Stock Option" means any Option that is not intended to be designated as an incentive stock option within the meaning of Section 422 of the Code or any successor provision thereto.

(aa) "Option" means a right, granted to a Participant under Section 6(b) hereof, to purchase Shares or other Awards at a specified price during specified time periods.

(bb) "Other Stock-Based Awards" means Awards granted to a Participant pursuant to Section 6(h) hereof

(cc) "Parent" means any corporation (other than the Company), whether now or hereafter existing, in an unbroken chain of corporations ending with the Company, if each of the corporations in the chain (other than the Company) owns stock possessing fifty percent (50%) or more of the combined voting power of all classes of stock in one of the other corporations in the chain.

(dd) "Participant" means a person who has been granted an Award under the Plan which remains outstanding, including a person who is no longer an Eligible Person.

(ee) "Performance Award" means a right, granted to an Eligible Person under Sections 6(h) or 7 hereof, to receive Awards based upon performance criteria specified by the Plan Administrator.

(ff) "Performance Period" means that period established by the Plan Administrator at the time any Performance Award is granted or at any time thereafter during which any performance goals specified by the Plan Administrator with respect to such Award are to be measured.

(gg) "Plan" means this Promotions on Wheels Holdings, Inc. 2008 Incentive Compensation Plan.

(hh) "Plan Administrator" means the Board, its Compensation Committee, or any Committee delegated by the Board to administer the Plan. There may be different Plan Administrators with respect to different groups of Eligible Persons.

(ii) "Related Entity" means any Parent, Subsidiary and any business, corporation, partnership, limited liability company or other entity designated by the Plan Administrator in which the Company, a Parent or a Subsidiary, directly or indirectly, holds a substantial ownership interest.

(jj) "Restricted Stock" means Stock granted to a Participant under Section 6(d) hereof, that is subject to certain restrictions, including a risk of forfeiture.

(kk) "Rule 16b-3"and "Rule 16a-1(c)(3)" means Rule 16b-3 and Rule 16a-1(c)(3), as from time to time in effect and applicable to the Plan and Participants, promulgated by the Securities and Exchange Commission under Section 16 of the Exchange Act.

(ll) "Share" means a share of the Company's Common Stock, and the share(s) of such other securities as may be substituted (or resubstituted) for Stock pursuant to Section 10(c) hereof.

(mm) "Stock" means the Company's Common Stock, and such other securities as may be substituted (or resubstituted) for the Company's Common Stock pursuant to Section 10(c) hereof.

(nn) "Stock Appreciation Right" means a right granted to a Participant pursuant to Section 6(c) hereof.

(oo) "Stock Unit" means a right, granted to a Participant pursuant to Section 6(e) hereof, to receive Shares, cash or a combination thereof at the end of a specified period of time.

(pp) "Subsidiary" means any corporation (other than the Company), whether now or hereafter existing, in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other corporations in such chain.

(qq) "Voting Stock" means the stock of the Company with a right to vote for the election of Directors of the Company.

3. Administration.

(a) Administration by Board. The Board shall administer the Plan unless and until the Board delegates administration to a Committee, as provided in Section 3(c). The Board and/or Committee(s) administering the Plan shall be the "Plan Administrator."

(b) Powers of the Plan Administrator. The Plan Administrator shall have the power, subject to, and within the limitations of, the express provisions of the Plan:

(i) To determine from time to time which of the persons eligible under the Plan shall be granted Awards; when and how each Award shall be granted; what type or combination of types of Award shall be granted; the provisions of each Award granted (which need not be identical), including the time or times when a person shall be permitted to receive Shares or cash pursuant to an Award; and the number of Shares or amount of cash with respect to which an Award shall be granted to each such person.

(ii) To construe and interpret the Plan and Awards granted under it, and to establish, amend and revoke rules and regulations for its administration. The Plan Administrator, in the exercise of this power, may correct any defect, omission or inconsistency in the Plan or in any Award Agreement, in a manner and to the extent it shall deem necessary or expedient to make the Plan fully effective.

(iii) To amend the Plan or an Award as provided in Section 10(e).

(iv) To terminate or suspend the Plan as provided in Section 10(e).

(v) To adopt such modifications, procedures, and subplans as may be necessary or desirable to comply with provisions of the laws of foreign countries in which the Company or Related Entities may operate to assure the viability of the benefits from Awards granted to Participants performing services in such countries and to meet the objectives of the Plan.

(vi) To effect, at any time and from time to time, with the consent of any adversely affected Participant, ( 1 ) the reduction of the exercise price of any outstanding Award under the Plan, if any, (2) the cancellation of any outstanding Award and the grant in substitution therefor of (A) a new Award under the Plan or another equity plan of the Company covering the same or a different number of Shares, (B) cash and/or (C) other valuable consideration (as determined by the Plan Administrator, in its sole discretion) or (3) any other action that is treated as a repricing under generally accepted accounting principles.

(vii) Generally, to exercise such powers and to perform such acts as the Plan Administrator deems necessary or appropriate to promote the best interests of the Company and that are not in conflict with the provisions of the Plan.

(c) Delegation to Committee.

(i) General. The Board may delegate administration of the Plan to a Committee or Committees of more members of the Board, and the term "Committee" shall apply to any person or persons to whom such authority has been delegated. If administration is delegated to a Committee, the Committee shall have, in connection with the administration of the Plan, the powers theretofore possessed by the Board, to the extent delegated by the Board, including the power to delegate to a subcommittee any of the administrative powers the Committee is authorized to exercise, subject, however, to such resolutions, not inconsistent with the provisions of the Plan, as may be adopted from time to time by the Board. The Board may abolish the Committee at any time and revest in the Board the administration of the Plan.

(ii) Section 162(m) and Rule 16b-3 Compliance. In the discretion of the Board, the Committee may consist solely of two or more "Outside Directors", in accordance with Section 162(m) of the Code, and/or solely of two or more "Non-Employee Directors", in accordance with Rule 16b-3. In addition, the Plan Administrator may delegate to a committee of two or more members of the Board the authority to grant Awards to Eligible Persons who are either (a) not then Covered Employees and are not expected to be Covered Employees at the time of recognition of income resulting from such Award, (b) not persons with respect to whom the Company wishes to comply with Section 162(m) of the Code or (c) not then subject to Section 16 of the Exchange Act.

(d) Effect of Plan Administrator's Decision. All determinations, interpretations and constructions made by the Plan Administrator shall be made in good faith and shall not be subject to review by any person and shall be final, binding and conclusive on all persons.

(e) Arbitration. Any dispute or claim concerning any Award granted (or not granted) pursuant to the Plan or any disputes or claims relating to or arising out of the Plan shall be fully, finally and exclusively resolved by binding and confidential arbitration conducted before a retired judge pursuant to the rules of JAMS in either Los Angeles, California or Newport Beach, California at the election of the Company. The Company shall pay all arbitration fees. In addition to any other relief, the arbitrator may award to the prevailing party recovery of its attorneys' fees and costs. By accepting an Award, the Participant and the Company waive their respective rights to have any such disputes or claims tried by a judge or jury.

(f) Limitation of Liability. The Board and any Committee(s), and each member thereof, who act as the Plan Administrator, shall be entitled to, in good faith, rely or act upon any report or other information furnished to him or her by any officer or Employee, the Company's independent auditors, Consultants or any other agents assisting in the administration of the Plan. Members of the Board and any Committee(s), and any officer or Employee acting at the direction or on behalf of the Board and any Committee(s), shall not be personally liable for any action or determination taken or made in good faith with respect to the Plan, and shall, to the extent permitted by law, be fully indemnified and protected by the Company with respect to any such action or determination.

4. Shares Issuable Under the Plan.

(a) Number of Shares Available for Issuance Under Plan. Subject to adjustment as provided in Section 10(c) hereof, the total number of Shares reserved and available for issuance in connection with Awards shall be 10,000,000 Shares. Any Shares issued under the Plan may consist, in whole or in part, of authorized and unissued Shares or treasury Shares.

(b) Availability of Shares Not Issued pursuant to Awards.

(i) If any Shares subject to an Award are forfeited, expire or otherwise terminate without issuance of such Shares or any Award is settled for cash or otherwise does not result in the issuance of all or a portion of the Shares subject to such Award, the Shares shall, to the extent of such forfeiture, expiration, termination, cash settlement or non-issuance, be available for Awards under the Plan, subject to Section 4(b)(iv) below.

(ii) If any Shares issued pursuant to an Award are forfeited back to or repurchased by the Company, including, but not limited to, any repurchase or forfeiture caused by the failure to meet a contingency or condition required for the vesting of such Shares, then the Shares forfeited or repurchased shall revert to and become available for issuance under the Plan, subject to Section 4(b)(iv) below.

(iii) In the event that any Option or other Award granted hereunder is exercised through the withholding of Shares from the Award by the Company or withholding tax liabilities arising from such Option or other Award are satisfied by the withholding of Shares from the Award by the Company, then only the number of Shares issued net of the Shares withheld shall be counted as issued for purposes of determining the maximum number of Shares available for grant under the Plan, subject to Section 4(b)(iv) below.

(iv) Notwithstanding anything in this Section 4(b) to the contrary, solely for purposes of determining whether Shares are available for the grant of Incentive Stock Options, the maximum aggregate number of Shares that may be granted under this Plan through Incentive Stock Options shall be determined without regard to any Shares restored pursuant to this Section 4(b) that, if taken into account, would cause the Plan, for purposes of the grant of Incentive Stock Options, to fail the requirement under Code Section 422 that the Plan designate a maximum aggregate number of Shares that may be issued.

(c) Application of Limitations. The limitation contained in this Section 4 shall apply not only to Awards that are settled by the delivery of Shares but also to Awards relating to Shares but settled only in cash (such as cash-only Stock Appreciation Rights). The Plan Administrator may adopt reasonable counting procedures to ensure appropriate counting, avoid double counting (as, for example, in the case of tandem or substitute awards) and may make adjustments if the number of Shares actually delivered differs from the number of Shares previously counted in connection with an Award.

5. Eligibility; Per-Person Award Limitations.

(a) Eligibility. Awards may be granted under the Plan only to Eligible Persons.

(b) Per-Person Award Limitations. In any one calendar year, an Eligible Person may not be granted Options or Stock Appreciation Rights under which more than 2,000,000 Shares could be received by the Participant, subject to adjustment as provided in Section 10(c). In any one calendar year, an Eligible Person may not be granted Awards (other than an Option or Stock Appreciation Right) under which more than 2,000,000 Shares could be received by the Participant, subject to adjustment as provided in Section 10(c). In addition, in any one calendar year, an Eligible Person may not be granted Performance Awards (other than Options or Stock Appreciation Rights) under which more than $10,000,000 could be received by the Participant.

6. Terms of Awards.

(a) General. Awards may be granted on the terms and conditions set forth in this Section 6. In addition, the Plan Administrator may impose on any Award or the exercise thereof, at the date of grant or thereafter (subject to Section 10(e)), such additional terms and conditions, not inconsistent with the provisions of the Plan, as the Plan Administrator shall determine, including terms requiring forfeiture of Awards in the event of termination of the Participant's Continuous Service and terms permitting a Participant to make elections relating to his or her Award. The Plan Administrator shall retain full power and discretion to accelerate, waive or modify, at any time, any term or condition of an Award that is not mandatory under the Plan.

(b) Options. The Plan Administrator is authorized to grant Options to any Eligible Person on the following terms and conditions:

(i) Stock Option Agreement. Each grant of an Option shall be evidenced by an Award Agreement. Such Award Agreement shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions which are not inconsistent with the Plan and which the Plan Administrator deems appropriate for inclusion in the Award Agreement. The provisions of the various Award Agreements entered into under the Plan need not be identical.

(ii) Number of Shares. Each Award Agreement shall specify the number of Shares that are subject to the Option and shall provide for the adjustment of such number in accordance with Section 10(c) hereof. The Award Agreement shall also specify whether the Stock Option is an Incentive Stock Option or a Non-Qualified Stock Option.

(iii) Exercise Price.

(A) In General. Each Award Agreement shall state the price at which Shares subject to the Option may be purchased (the "Exercise Price"), which shall be, with respect to Incentive Stock Options, not less than 100% of the Fair Market Value of the Stock on the date of grant. In the case of Non-Qualified Stock Options, the Exercise Price shall be determined in the sole discretion of the Plan Administrator; provided, however, that notwithstanding any other provision of the Plan, any Non-Qualified Stock Option granted with a per Share exercise price less than the per Share Fair Market Value on the date of grant shall be structured to avoid the imposition of any excise tax under Code Section 409A, unless otherwise specifically determined by the Plan Administrator.

(B) Ten Percent Shareholder. If a Participant owns or is deemed to own (by reason of the attribution rules applicable under Section 424(d) of the Code) more than 10% of the combined voting power of all classes of stock of the Company or any Parent or Subsidiary, any Incentive Stock Option granted to such Employee must have an exercise price per Share of at least 110% of the Fair Market Value of a Share on the date of grant.

(iv) Time and Method of Exercise. The Plan Administrator shall determine the time or times at which or the circumstances under which an Option may be exercised in whole or in part (including based on achievement of performance goals and/or future service requirements), the time or times at which Options shall cease to be or become exercisable following termination of Continuous Service or upon other conditions, the methods by which the exercise price may be paid or deemed to be paid (including. in the discretion of the Plan Administrator, a cashless exercise procedure), the form of such payment, including, without limitation, cash, Stock, net exercise, other Awards or awards granted under other plans of the Company or a Related Entity, other property (including notes or other contractual obligations of Participants to make payment on a deferred basis) or any other form of consideration legally permissible, and the methods by or forms in which Stock will be delivered or deemed to be delivered to Participants.

(v) Termination of Service. Subject to earlier termination of the Option as otherwise provided in the Plan and unless otherwise provided by the Plan Administrator with respect to an Option and set forth in the Award Agreement, an Option shall be exercisable after a Participant's termination of Continuous Service only during the applicable time period determined in accordance with this Section and thereafter shall terminate and no longer be exercisable:

(A) Death or Disability. If the Participant's Continuous Service terminates because of the death or Disability of the Participant, the Option, to the extent unexercised and exercisable on the date on which the Participant's Continuous Service terminated, may be exercised by the Participant (or the Participant's legal representative or estate) at any time prior to the expiration of twelve (12) months (or such other period of time as determined by the Plan Administrator, in its discretion) after the date on which the Participant's Continuous Service terminated, but in any event only with respect to the vested portion of the Option and no later than the date of expiration of the Option's term as set forth in the Award Agreement evidencing such Option (the "Option Expiration Date").

(B) Termination for Cause. Notwithstanding any other provision of the Plan to the contrary, if the Participant's Continuous Service is terminated for Cause, the Option shall terminate and cease to be exercisable immediately upon such termination of Continuous Service.

(C) Other Termination of Service. If the Participant's Continuous Service terminates for any reason, except Disability, death or Cause, the Option, to the extent unexercised and exercisable by the Participant on the date on which the Participant's Continuous Service terminated, may be exercised by the Participant at any time prior to the expiration of three (3) months (or such longer period of time as determined by the Plan Administrator, in its discretion) after the date on which the Participant's Continuous Service terminated, but in any event only with respect to the vested portion of the Option and no later than the Option Expiration Date.

(vi) Incentive Stock Options. The terms of any Incentive Stock Option granted under the Plan shall comply in all respects with the provisions of Section 422 of the Code. If and to the extent required to comply with Section 422 of the Code, Options granted as Incentive Stock Options shall be subject to the following special terms and conditions: