SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 13, 2009

Sino Charter, Inc.

(Exact name of registrant as specified in Charter)

| NEVADA | | 000-53155 | | 20-8658254 |

(State or other jurisdiction of incorporation or organization) | | (Commission File No.) | | (IRS Employee Identification No.) |

No 1749-1751 Xiangjiang Road

Shishi City, Fujian Province

People’s Republic of China

(Address of Principal Executive Offices)

(561) 245-5155

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Forward Looking Statements

This Form 8-K and other reports filed by the Registrant from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to the Registrant or the Registrant’s management identify forward looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s pro forma financial statements and the related notes filed with this Form 8-K.

In this Form 8-K, references to “we,” “our,” “us,” “Sino Charter” the “Company” or the “Registrant” refer to Sino Charter, Inc., a Nevada corporation.

Explanatory Note

This Form 8-K/A is filed to amend and restate our current report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on February 13, 2009. Specifically, this Form 8-K/A removes the disclosures in the Form 8-K under Item 4.01 (Changes in Registrant’s Certifying Accountant) in their entirety, as such disclosures were inadvertently included in the Form 8-K due to a drafting error. The disclosures as required under Item 4.01 were previously included in a current report on Form 8-K filed with the SEC on June 26, 2008. Additionally, this Form 8-K/A removes the disclosures in the Form 8-K under Item 5.02 (Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers) in their entirety, and the disclosures relating to the effective date of Mr. Qingqing Wu’s appointment to the board of directors are revised, as such disclosures were inadvertently included in the Form 8-K due to a drafting error. Specifically, Mr. Wu’s appointment to the board of directors is to take place on the earlier of February 18, 2009 or the filing of the Company’s annual report on Form 10-K for fiscal 2008. The filing of this Form 8-K/A shall not be deemed an admission that the original filing, when made, intentionally included any known untrue statement of material fact or knowingly omitted to state a material fact necessary to make a statement not misleading.

| Item 1.01 | Entry into a Material Definitive Agreement |

On February 13, 2009 (the “Closing Date”), Sino Charter, Inc., a Nevada corporation (“Sino Charter” or the “Company”), closed a reverse acquisition by which it acquired a business engaged in the design, sourcing, marketing and distribution of casual apparel and clothing products in the People’s Republic of China (“China” or the “PRC”) pursuant to a Share Exchange Agreement (the “Exchange Agreement”) by and among the Company, Peng Xiang Peng Fei Investments Limited, a company incorporated in the British Virgin Islands (“Peng Xiang”), and the shareholders who, immediately prior to the closing of the transactions contemplated by the Exchange Agreement, collectively held 100% of Peng Xiang’s issued and outstanding share capital (the “BVI Shareholders”). Peng Xiang is a holding company that, through its wholly owned subsidiary, Korea Jinduren (International) Dress Limited, a company incorporated in Hong Kong Special Administrative Region (“Korea Jinduren”), controls Jinjiang Yinglin Jinduren Fashion Limited, a company organized in the PRC (“Yinglin Jinduren”), by a series of contractual arrangements. Throughout this current report on Form 8-K, Peng Xiang, Korea Jinduren and Yinglin Jinduren are sometimes collectively referred to as “V·LOV.”

Prior to the reverse acquisition under the Exchange Agreement, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result of the reverse acquisition transaction, the BVI Shareholders became our controlling shareholders and Peng Xiang became our wholly-owned subsidiary, and we acquired the business and operations of V·LOV.

The following is a brief description of the terms and conditions of the Exchange Agreement and the transactions contemplated thereunder that are material to the Company. A copy of the Exchange Agreement is filed herewith as Exhibit 2.1.

Issuance of Common Stock. At the closing of the Exchange Agreement on the Closing Date, the Company issued 14,560,000 restricted shares of its common stock to the BVI Shareholders in exchange for 100% of the issued and outstanding capital stock of Peng Xiang. Immediately prior to the Exchange Agreement transaction, the Company had 1,440,000 shares of common stock issued and outstanding. Immediately after the issuance of the shares to the BVI Shareholders, the Company had 16,000,000 shares of common stock issued and outstanding.

Change in Management .. As a condition to closing the Exchange Agreement and as more fully described in Item 5.02 below, Mr. Matthew Hayden will resign as the Company’s President, Chief Executive Officer, Chief Financial Officer and Secretary on February 18, 2009 or immediately after the Company files its annual report on Form 10-K for the year ended November 30, 2008, whichever occurs earlier, and two designees of Peng Xiang will be appointed as new officers of the Company concurrently with Mr. Hayden's resignation, as well as a designee of Peng Xiang to the Company’s board of directors, and upon the satisfaction of the requirements of Section 14(f) of the Exchange Act and Rule 14f-1 promulgated thereunder, the Company’s sole director immediately prior to the closing, Mr. Hayden, will resign from the board of directors, and three additional designees of Peng Xiang will be appointed to the board of directors.

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

On February 13, 2009, Sino Charter acquired Peng Xiang and its business operations in a reverse acquisition transaction. Reference is made to Item 1.01, which is incorporated herein, which summarizes the terms of the reverse acquisition transaction under the Exchange Agreement.

From and after the Closing Date, our primary operations consist of the business and operations of V·LOV, which are conducted in the PRC. Therefore, we disclose information about the business, financial condition, and management of V·LOV in this Form 8-K.

On the earlier of February 18, 2009 or immediately after the filing of the Company's annual report on Form 10-K for fiscal 2008, Mr. Matthew Hayden will resign as Chief Executive Officer, President, Chief Financial Officer and Secretary, and the following persons will be appointed as the Company’s new executive officers:

| Name: | | Officer Position/s held: |

| Qingqing Wu | | President, Chief Executive Officer, Chief Operating Officer and Secretary |

| Yushan Zheng | | Chief Financial Officer and Treasurer |

Concurrently, Mr. Wu will be appointed to the Company’s board of directors. In addition, upon the Company’s compliance with Section 14(f) of the Exchange Act, and Rule 14(f)-1 thereunder, the resignation of Mr. Hayden from, and the appointment of three Peng Xiang designees, namely Dr. Jianwei Shen, Mr. Zhifan Wu and Mr. Yuzhen Wu, to the Company’s board of directors, will become effective. The Company will file and mail the information statement required under Rule 14f-1 to its shareholders shortly following the filing of this Form 8-K. Additional information regarding the above-mentioned directors and executive officers is set forth below under the section titled “Management”.

DESCRIPTION OF BUSINESS

Overview

We are a leading apparel producer in People’s Republic of China (“PRC” or “China”) that designs, develops, manufactures, distributes and sells trendy casual apparel and cutting edge clothing products targeted toward fashion-conscious middle-class Chinese consumers under the brand name “V·LOV”. We seek to be a trendsetting leader in the design, marketing, distribution and sale of premium lifestyle apparel with affordable prices. Our products can be categorized as denim jeans, jackets, t-shirts, pants, sweaters, windbreakers, cotton wear, suits, and other clothing accessories.

We design and develop our apparel accessory products in our 120,000 square foot facility located in Yinlin in southeastern Fujian Province. As a part of our strategy, we plan to take full advantage of the robust consumer spending growth in China and the growth in the youth fashion market segment. According to the Chinese Statistical Yearbook 2006, the country’s retail sales of consumer goods increased from approximately US $535 billion in 2001 to approximately US $633 billion in 2003, and to approximately US $945 billion in 2005, representing a total growth rate of 76% in four years. We target consumers in the 15-34 year old, medium to medium high income group, which account for approximately 29.65% of China’s total population of 1.3 billion in 2005, a target demographic comprising a total of 388 million people.

With regards to apparel, Chinese consumers are highly brand conscious and the ability to wear branded apparel is seen as a status symbol. For many consumer segments, particularly younger consumers, foreign brands that are well known are still regarded as superior and are seen as a status symbol. However, in recent years attitudes to domestic brands have changed as state-owned companies have been privatized and better quality products are produced. Pride in the nation’s accomplishments has resulted in many consumers preferring local brands. Although Chinese consumers are price sensitive, consumers are also increasingly concerned about product quality and customer service, particularly with respect to apparel. V·LOV’s favorable brand recognition and affordable prices appeal to a broad base of Chinese consumers. For example, our coats and jackets ranging between RMB 300 (US$44) to RMB 600 (US$88) appeal to a wider range of consumers compared to our competitors such as Fairwhale and jack.jones whom also sell a comparable line but at the price of RMB 400 (US$59) to RMB 900 (US$132), while similar coats and jackets at G-STAR retail for over RMB1000 (US$146). V·LOV takes pride in the affordability and quality of its products and superior customer service.

We market and distribute our products through independent agents, each of whom is granted rights to market and sell our products in a defined market or territory through a distribution agreement. We currently have distribution agreements with 14 distributors throughout northern, central and southern China. Our distributors currently own and operate 689 point of sales (“POS”) across the PRC. We maintain and exercise control over brand advertising and marketing activities from our headquarters in Yinlin, a city of Fujian Province, where we set the tone for integrity, consistency and direction of the V·LOV brand image throughout China. We also have marketing staff travelling around the country to help us enforce our visions and provide support and guidelines for our distributors. We manufacture some of our apparel products at our Jinjiang production facility and outsource approximately 80% to 85% of manufacturing from third parties.

Peng Xiang is a holding company incorporated in the British Virgin Islands. Since incorporation, Peng Xiang has not conducted any substantive operations of its own except for holding 100% of the equity interests of Korea Jinduren.

Korea Jinduren is a holding company established in Hong Kong Special Administration Region on January 5, 2005. Korea Jinduren was formed by the owners of Yinglin Jinduren as a special purpose vehicle for purposes of raising capital. Other than activities relating to its contractual arrangements with Yinglin Jinduren as described below, Korea Jinduren has no other separate operations of its own.

Yinglin Jinduren is a limited liability company organized in the PRC on January 19, 2002. Yinglin Jinduren holds the government licenses and approvals necessary to operate the apparel manufacturing and distribution business in China. We do not own any equity interests in Yinglin Jinduren, but control and receive the economic benefits of its business operations through contractual arrangements. Through Korea Jinduren, we have contractual arrangements with Yinglin Jinduren and its owners pursuant to which we provide consulting and other general business operation services. Through these contractual arrangements, we also have the ability to substantially influence their daily operations and financial affairs, since we are able to appoint their senior executives and approve all matters requiring approval of the equity owners. As a result of these contractual arrangements, which enable us to control Yinglin Jinduren and to receive, through Korea Jinduren, all of its net profits, we are considered the primary beneficiary of Yinglin Jinduren. Accordingly, we consolidate its results, assets and liabilities in our financial statements.

For a description of these contractual arrangements, see “Contractual Arrangements with Yinglin Jinduren and its Owners.”

Contractual Arrangements with Yinglin Jinduren and its Owners

Our relationships with Yinglin Jinduren and its owners are governed by a series of contractual arrangements, as we (including our subsidiaries) do not own any equity interests in Yinglin Jinduren. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. Under Chinese laws, each of Korea Jinduren and Yinglin Jinduren is an independent legal entity and neither of them is exposed to liabilities incurred by the other party. Other than pursuant to the contractual arrangements between Korea Jinduren and Yinglin Jinduren, Yinglin Jinduren does not transfer any other funds generated from its operations to Korea Jinduren.

On December 28, 2005, Korea Jinduren entered into the following contractual arrangements with Yinglin Jinduren:

Consulting Services Agreement. Pursuant to the exclusive consulting services agreement between Korea Jinduren and Yinglin Jinduren, Korea Jinduren has the exclusive right to provide to Yinglin Jinduren general consulting services relating to the management and operations of Yinglin Jinduren’s apparel business (the “Services”). Additionally, Korea Jinduren owns any intellectual property rights developed through the Services provided to Yinglin Jinduren. Yinglin Jinduren pays a quarterly consulting service fee in Renminbi (“RMB”) to Korea Jinduren that is equal to all of Yinglin Jinduren’s net income for such quarter. The consulting services agreement is in effect unless and until terminated by written notice of either party in the event that: (a) the other party causes a material breach of this agreement, provided that if the breach does not relate to a financial obligation of the breaching party, that party may attempt to remedy the breach within 14 days following the receipt of the written notice; (b) the other party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Korea Jinduren terminates its operations; (d) Yinglin Jinduren’s business license or any other license or approval for its business operations is terminated, cancelled or revoked; or (e) circumstances arise which would materially and adversely affect the performance or the objectives of the consulting services agreement. Additionally, Korea Jinduren may terminate the consulting services agreement without cause.

Operating Agreement. Pursuant to the operating agreement among Korea Jinduren, Yinglin Jinduren and the owners of Yinglin Jinduren who collectively hold 100% of the outstanding equity interests of Yinglin Jinduren, Korea Jinduren provides guidance and instructions on Yinglin Jinduren’s daily operations, financial management and employment issues. The owners of Yinglin Jinduren must designate the candidates recommended by Korea Jinduren as their representatives on Yinglin Jinduren’s board of directors. Korea Jinduren has the right to appoint senior executives of Yinglin Jinduren. In addition, Korea Jinduren agrees to guarantee the performance of Yinglin Jinduren under any agreements or arrangements relating to Yinglin Jinduren’s business arrangements with any third party. Yinglin Jinduren, in return, agrees to pledge its accounts receivable and all of its assets to Korea Jinduren. Moreover, Yinglin Jinduren agrees that without the prior consent of Korea Jinduren, Yinglin Jinduren will not engage in any transactions that could materially affect the assets, liabilities, rights or operations of Yinglin Jinduren, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement is the maximum period of time permitted by law unless sooner terminated by any other agreements reached by all parties or upon a 30-day written notice from Korea Jinduren. The term may be extended only upon Korea Jinduren’s written confirmation prior to the expiration of the agreement, with the extended term to be mutually agreed upon by the parties.

Equity Pledge Agreement Under the equity pledge agreement between the owners of Yinglin Jinduren and Korea Jinduren, the stockholders of Yinglin Jinduren pledged all of their equity interests in Yinglin Jinduren to Korea Jinduren to guarantee Yinglin Jinduren’s performance of its obligations under the consulting services agreement. If Yinglin Jinduren or its owners breach their respective contractual obligations, Korea Jinduren, as pledgee, will be entitled to certain rights, including, but not limited to, the right to vote with, control and sell the pledged equity interests. The owners of Yinglin Jinduren also agreed, that upon occurrence of any event of default, Korea Jinduren shall be granted an exclusive, irrevocable power of attorney to take actions in the place and instead of the owners to carry out the security provisions of the equity pledge agreement, and take any action and execute any instrument as required by Korea Jinduren to accomplish the purposes of the equity pledge agreement. The owners of Yinglin Jinduren agreed not to dispose of the pledged equity interests or take any actions that would prejudice Korea Jinduren’s interest. The equity pledge agreement will expire two years from the fulfillment of Yinglin Jinduren’s obligations under the consulting services agreement.

Option Agreement. Under the option agreement between the owners of Yinglin Jinduren and Korea Jinduren, the owners irrevocably granted Korea Jinduren or its designee an exclusive option to purchase, to the extent permitted under Chinese law, all or part of the equity interests in Yinglin Jinduren for the cost of the owners’ initial contributions to Yinglin Jinduren’s registered capital or the minimum amount of consideration permitted by applicable Chinese law. Korea Jinduren or its designee has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten years from January 1, 2006 and may be extended prior to its expiration by written agreement of the parties.

Proxy Agreement. Pursuant to the proxy agreement between Korea Jinduren and the owners of Yinglin Jinduren, the owners agreed to irrevocably grant a designee of Korea Jinduren with the right to exercise the owners’ voting and other rights, including the rights to attend and vote at shareholders’ meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and Yinglin Jinduren’s governing charters. The proxy agreement may not be terminated without the unanimous consent of all parties, except that Korea Jinduren may terminate the proxy agreement with or without cause upon 30-day written notice to the owners.

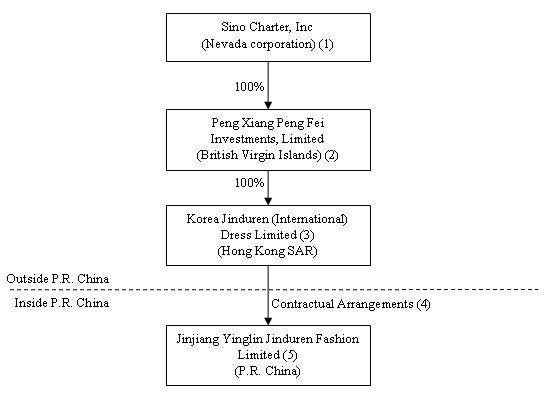

Our Current Corporate Structure

The following diagram illustrates our corporate structure from and after the closing of the Exchange Agreement:

| (1) | From and after the earlier of February 18, 2009 or the filing of the Company's 10-K for fiscal 2008, the management of Sino Charter will be: Mr. Qingqing Wu as Chairman and Chief Executive Officer, and Mr. Yushan Zheng as Chief Financial Officer. The appointments of Dr. Jianwei Shen, Mr. Zhifan Wu and Mr. Yuzhen Wu as members of the board of directors will become effective upon the expiration of the 10-day period following the delivery and/or mailing of the Schedule 14f-1 Information Statement to our stockholders as required under Rule 14(f)-1. As of the date of this current report: Mr. Qingqing Wu owns approximately 59.98% of Sino Charter’s issued and outstanding common stock; Mr. Yushan Zheng, Dr. Jianwei Shen, Mr. Zhifan Wu, and Mr. Yuzhan Wu do not own any shares of Sino Charter’s common stock as of the date of current report. |

| (2) | The management of BVI is comprised of Mr. Qingqing Wu as its sole director. Sino Charter is the sole shareholder of BVI. |

| (3) | The management of Korea Jinduren is comprised of Mr. Qingqing Wu as Chairman and Mr. Lileng Lin as Director. |

| (4) | Korea Jinduren controls Yinglin Jinduren through contractual arrangements designed to mimic equity ownership of Yinglin Jinduren by Korea Jinduren. These contracts include a consulting services agreement, operating agreement, equity pledge agreement, option agreement, and proxy agreement. |

| (5) | The management of Yinglin Jinduren is comprised of Mr. Qingqing Wu as Chairman and Executive Director, and Mr. Zhifan Wu as Executive Director. |

We design and distribute a broad array of products in various categories, of which 80% of our dedicated to men’s and 20% of our production is dedicated to women’s market. Our products lines include the following:

| Women’s Clothing: | | jeans, jackets, t-shirts, windbreakers, sweaters, cotton wear, knit wear and accessories |

| Men’s Clothing: | | jeans, jackets, undershirts, t-shirts, shirts, windbreakers, sweaters, cotton wear, knit wear and accessories |

The 2007 revenue breakdown per production was as follows: 25% jeans; 22% shirts, undershirts and windbreakers; 19% jackets; 11% t-shirts; 6% cotton wear; 17% other clothing and accessories.

Our Distribution Channel and Customers

We do not directly engage in retail sales of our products; we market and distribute our products through independent agents, each of whom is granted rights to market and sell our products in a defined market or territory through a distribution agreement. We currently have distribution agreements with 14 distributors throughout northern, central and southern China.

The following is a list of our top ten major distributors for fiscal 2007. None of our distributors accounted for more than 25% of our total sales in fiscal 2007.

| Company | | Geographical Location | | Fiscal 2007 Sales (RMB) | | Fiscal 2007 Sales (US$)* | | % of Sales | |

| Xinshiji Apparel City, Fengtai District, Beijing | | Beijing | | | 9,598,312 | | approx. $1,321,302 | | | 3.18 | % |

| Jinduren Store, Shenhe District, Shenyang | | Liaoning | | | 15,736,230 | | approx. $2,151,492 | | | 5.22 | % |

| Jinduren Store in Duocai Xintiandi, Shaanxi | | Shaanxi | | | 16,044,217 | | approx. $2,193,601 | | | 5.32 | % |

| Nachun Li | | Guangxi | | | 16,110,168 | | approx. $2,202,618 | | | 5.34 | % |

| Yinji Fuchun Apparel, Zhengzhou | | Henan | | | 16,674,023 | | approx. $2,279,710 | | | 5.53 | % |

| Yunfang Jingduren Store, Kunming | | Yunnan | | | 27,061,642 | | approx. $3,699,928 | | | 8.97 | % |

| Jingduren Store, Tianqiao District, Jinan | | Shandong | | | 30,937,647 | | approx. $4,229,864 | | | 10.25 | % |

| Jinyang Commerce Co., Ltd., Wuhan | | Hubei | | | 36,980,382 | | approx. $5,056,040 | | | 12.26 | % |

| Clothwork Apparel, Wanma Plaza, Jiangxi | | Jiangxi | | | 45,023,909 | | approx. $6,155,769 | | | 14.92 | % |

| C-002 of Mingzhu 100 Market, Hangzhou | | Zhejiang | | | 72,436,662 | | approx. $9,903,701 | | | 24.01 | % |

* Based on an exchange rate of 1US$ =7.3141 RMB as quoted on www.oanda.com on December 31, 2007.

Through our distributors, our products are currently sold at 689 V·LOV retail stores in China. These retail stores, also known as points of sales or POS, include counters, concessions, free standing stores and store-in-stores. We do not own or operate any V·LOV retail stores ourselves; the POS are established and owned by our distributors, each of whom operates its network of POS directly or through third party retail operators. V·LOV POS are currently spread over 10 provinces in the PRC. A breakdown of our POS by provinces is as follows:

| PROVINCES | | NUMBER OF POS | |

| Beijing | | | 39 | |

| Zhejiang | | | 78 | |

| Shandong | | | 153 | |

| Jiangxi | | | 105 | |

| Yunnan | | | 68 | |

| Shaanxi | | | 62 | |

| Liaoning | | | 38 | |

| Hubei | | | 45 | |

| Henan | | | 69 | |

| Guangxi | | | 32 | |

We believe that the sale of our products through distributors has enabled us to grow by leveraging on their regional retail expertise and economies of scale. We provide retail policies and guidelines, training, advertising and marketing support as well as advertising subsidies to assist our distributors in the management and expansion of the V·LOV retail sales network. To achieve consistency in our brand image, we set management and operational guidelines for all our distributors to follow at the V·LOV POS. These guidelines include inventory control, pricing and sale procedures, product and window display requirements and customer service standards. While our distributors currently do not share and our distributorship agreements do not require them to share sales information on each of their POS, our distributorship agreements require all POS to be V·LOV’s exclusive POS and our sales and marketing staff travel throughout China to monitor and advise our distributors. Distributors that maintain at least a three-year good standing relationship with us enjoy 30 to 60 days of credit while new distributors usually pay us upon the receipt of their orders. The bad debt has been less than 1% for V·LOV during the last three years.

Each year, we hold two sales fairs – in November and in April/May – to showcase our new designs to our distributors. At each sales fair, the distributors place orders for products based on designs that they believe will appeal to their specific geographical markets, and we manufacture and deliver our products to the distributors according with the specifications of their orders. We then monitor and oversee their operations of the V·LOV POS through our marketing and sales team. Our marketing and sales team advise and work closely with our distributors to renovate and update V·LOV POS as and when necessary to achieve maximum performance and expand their sales distribution network. Distributors are encouraged to hit performance targets in order to enjoy advertising rebate from us.

We are constantly looking for new distributors. We select distributors based on a range of criteria which we consider important for the operation of the V·LOV distribution sales network of cutting edge casual wear retail stores. We do not require our distributors to have any minimum number of years of relevant experience. We assess the suitability of a candidate to be our distributor based on, but not limited to, the following:

| · | the relevant experience in the management and operation of casual wear retail stores; |

| · | the ability to develop and operate a network of retail stores in its designated sales region; |

| · | the perceived ability to meet our sales targets; |

| · | the suitability of its store location and size; and |

| · | overall creditworthiness; |

We identify suitable distributors and enter into distributorship agreements, generally for a term of up to 12 months, renewable on a year to year basis upon satisfying certain criteria. We set guidelines for our distributors in respect of the location, store layout and product display of their V·LOV POS. We allow our distributors to use authorized third party retail store operators to operate V·LOV POS. Distributors must obtain our prior written approval before appointing such retail store operators.

We have contractual relationships only with our distributors and not with authorized third party retail store operators; thus we require our distributors to implement, monitor compliance with and enforce our retail store guidelines on the authorized third party retail store operators. Except for the provision of advertising subsidies to our distributors upon satisfying certain sales performances, we do not make any payment, give any sales incentives, or pay any fee to our distributors. Our distributors do not pay us any fee other than the purchase price for the purchase of our products.

Our Suppliers and Manufacturers

Although we have our own manufacturing capacity at our 120,000 square foot production facility located in Yinlin, the most important function of that facility is to support our research and development department in sample and prototype designs and other research and development activities. Instead, we currently outsource approximately 80% to 85% of our manufacturing to independent third-party factories as a part of our overall sourcing strategy. Outsourcing work allows us to maximize production flexibility while managing capital expenditures and costs of maintaining what would otherwise be a massive workforce.

The amount of manufacturing that we outsource varies seasonally depending upon such factors as current factory capacity and customer demand. We currently work with a select list of 10 manufacturers. We do not execute agreements with such manufacturers since there are many well-qualified clothing manufacturers to choose from and any of them can be readily replaced. However, we have established good working relationships with all of the manufacturers that we work with and do not expect to replace any of our manufacturers.

We select raw materials (including fabric, fasteners, thread, buttons, labels and related materials) directly from local fabric and accessory suppliers and identify imported specialty fabrics to meet requirements specially that may be requested by our distributors. Our contractors purchase these raw materials from these suppliers according with our manufacturing and design specifications. We currently work with a select list of more than 20 suppliers. We do not execute agreements with our suppliers since there are no shortages of suppliers and materials to choose from. At any given time, we can easily replace any of our current suppliers. However, we have good working relationships with all of our current suppliers and do not expect the replacement of any of our suppliers. For the fiscal year ended December 31, 2007, one supplier, Fujian Longzhizu Textile Development Co., Ltd., accounted for 14.5% of our total supply purchases. For the fiscal year ended December 31, 2006, two suppliers, Shishi City Jiexing Apparel Industry Development Co., Ltd. and Shishi Meilian Textile Co., Ltd., accounted for 11.88% and 13.81%, respectively, of our total supply purchases. For the nine months ended September 30, 2008, two suppliers, namely, Shishi City Jiexing Apparel Industry Development Co., Ltd. and Zhongshan City Luzhicheng Apparel Co., Ltd., accounted for 45.85% and 16.3%, respectively, of our total supply purchases. Up to the present we have not experienced any significant difficulty in obtaining materials that are essential to our business. We generally agree to pay our subcontractors within 30-60 days after dispatching the goods to our distributors. We typically place orders with our subcontractors when we receive orders from our distributors.

Our Sales and Marketing

The strength of the V·LOV brand name and image is not only contributable to our ability to design and produce trendy and high quality apparel; it is also largely dependent on the skill of our sales and marketing team to promote our products to our target group of young and fashion conscious consumers. We currently have 35 sales and marketing staff. The Sales and Marketing Director is in charge of four departments, including sales, marketing, strategic planning and logistics.

We have sales and marketing guidelines for all our distributors to follow at the V·LOV POS. These guidelines include pricing and sale procedures, product and window display requirements and customer service standards. We are in the process of employing a new database to learn more about our consumers’ spending behaviors and obtain more market feedback through our distributors in order to allocate our sales and marketing resources more efficiently.

We actively market our brand by placing print ads in local newspapers and fashion magazines. Our ads also appear in various outdoor venues, such as mass transit posters, exterior bus panels, bus stations and billboards, and indoor venues, such as in-mall kiosks. We also run televisions and radio ads for V·LOV brands. We promote our brand through sponsorship of movies, sporting events and television programs targeted at our customer demographic profile. In 2003, the Company appointed Yang Chengang, the number one internet pop singer in China, as the Company’s celebrity spokesperson. Mr. Yang’s contract expired in 2007, and we are in the process of pursuing another celebrity spokesperson to represent our brand. Additionally, our Chief Designer, Mr. Fengfei Zeng, who is renowned in the PRC, acts as our spokesperson. Under the terms of his employment agreement which expires on March 1, 2010, Mr. Zeng is required, in addition to being our Chief Designer, to appear at all V·LOV fashion shows and events as our spokesperson.

Our advertising expenses were RMB 10.99 million (US$1,380,015) and RMB 10.55 million (US$1,388,832) for the fiscal years ended 2006 and 2007 respectively. We spent approximately RMB 17.67 million (US$2,533,271) in advertising for the nine months ended September 30, 2008. Advertising expenses represented 42.97% to 58.70% of our operating costs for these periods and we expect that it will increase approximate 5% to 7% within the next two years.

We are always promoting our brand to new distributors to expand our POS. Management believes we continue to benefit from our solid reputation for providing high quality goods in the markets where we have a presence, which provides us further opportunities to work with desirable distributors in our business. Our marketing strategy aims to attract distributors with the strongest branding experience within the strongest markets in order to effectively promote our brand. Referrals from existing distributors have been and continue to be a fruitful source of new customers.

Production and Quality Control

We are committed to designing and manufacturing high quality garments. We have implemented strict quality control and craft discipline systems to ensure that our products meet certain quality and safety standards, which include:

| · | evaluate customers to make sure we produce middle to high-end products only; |

| · | evaluate suppliers to make sure the supplies could meet our standards; |

| · | inspect the manufacturing process and quality of the fabrics supplies by our trained employees; |

| · | run routine checks on the fabrics for flammability, durability, chemical content, static properties, color retention and various other properties in our advanced testing center; |

| · | conduct on-line inspection in the manufacturing process by our trained employees; and |

| · | final audit the products before products are delivered. |

In addition, we work closely with our distributors so that they understand our testing and inspection process. Due to our strict quality control and testing process, we have not undergone any product or merchandise recalls, and we generally do not receive any significant requests by our distributors to return finished goods. Product returns have not resulted in material operating expenses.

We require our contract manufacturers to comply with our manufacturing standards and specifications. We do not allow our manufacturers to sub-contract our production orders without our prior written consent. We inspect products manufactured by our contractors to ensure that they meet our rigorous quality standards and our specifications. The products are subject to our stringent quality control procedures; and we routinely perform continuous on-site inspections. Our policies and arrangements allow us to return defective products back to the relevant manufacturers. We inspect prototypes of each product prior to cutting by the contractors, and conduct a final inspection of finished products prior to shipment to ensure that they meet our high standards.

Logistics and Inventory

Beginning in 2008, the majority of our products are made by contract factories that ship finished goods directly to our distributors after final quality inspections. As a result, we experienced significant drop in inventory of finished goods beginning in September 2008. Products that we make at our facility are typically delivered to our distributors by truck or local couriers.

The high fashion apparel industry is quite competitive in China, including brand names and companies of all sizes, both within China and elsewhere in the world, many of which have greater financial and manufacturing resources than us. Nevertheless, we have been in the high fashion apparel business since 2004 and believe that we have earned a reputation for producing high fashion and high quality products and at competitive prices, with excellent customer service.

We believe that our chief competitive strength is our in-depth and thorough understanding of our targeted customer groups in China. Our design team led by our Chief Designer, Mr. Fengfei, Zeng, with the assistance of our distributors, formulates new design concepts by analyzing information on global and local fashion trends and market research. Then, our product samples are reviewed by distributors and marketing team. Then, the sample prototypes are further refined based on evaluations carried out by marketing personnel before showcasing the final designs at our sales fairs.

Currently, there are several companies in China that we consider to be direct competitors, including both state-owned and private companies of different sizes. Some of our local competitors include Fairwhale and Cabbeen. International brands such as G-STAR and jack.jones are also competing in the same space as V·LOV. We believe we differentiate ourselves from the competition due to persistent pursuit of quality control, a diversified casual wear product lineup and in-house design talent.

Intellectual Properties and Licenses

The following table describes the intellectual property currently owned by V·LOV:

Type | | Name | | Category Number and Description | | Issued By | | Duration | | Description |

| Trademark | | 劲都人 Jingduren | | 28 (entertainment products, toys, sports and athletic products, Christmas ornaments) | | Trademark Administration of the National Administration of Industry and Commerce (the “PRC Trademark Bureau”) | | January 7, 2009 to January 6, 2019 (10 years) | | Logo, brand name used in our products |

| | | | | | | | | | | |

| Trademark | | 劲都人 JINDUREN | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | January 7, 2009 to January 6, 2019 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | 劲都人 JINDUREN | | 18 (leather (work), artificial leather (work), fur, suitcase and travelling bag, umbrella and parasol, walking stick, saddle and harness etc.) | | PRC Trademark Bureau | | January 7, 2009 to January 6, 2019 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | 劲都人 JINDUREN | | 32 (beer, non-alcoholic drinks such as mineral water, soda, fruit drink, syrup, etc.) | | PRC Trademark Bureau | | November 14, 2008 to November 13, 2018 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | V.LOV | | 33 (alcoholic drinks (except beer)) | | PRC Trademark Bureau | | November 14, 2008 to November 13, 2018 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | V.BOLD | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | September 28, 2008 to September 27, 2018 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | V.LOV | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | September 28, 2008 to September 27, 2018 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | 劲都人 JINDUREN | | 33 (alcoholic drinks (except beer)) | | PRC Trademark Bureau | | February 28, 2008 to February 27, 2018 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | 劲都人 JINDUREN | | 34 (tobacco and cigarettes, smoking set, matches) | | PRC Trademark Bureau | | February 28, 2008 to February 27, 2018 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

| Trademark | | 劲都人 JINDUREN | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | September 14, 2007 to September 13, 2017 (10 years) | | Logo, brand name used in our products Logo, brand name used in our products |

The following table describes the intellectual property currently licensed by V·LOV from Mr. Qingqing Wu, our President and CEO. As of the date of this current report, we have not used any of the trademarks in connection with our products.

Type | | Name | | Category Number and Description | | Issued By | | Duration | | Description |

| Trademark | | 罗纳贝克 | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | March 14, 2007 to March 13, 2017 (10 years) | | Logo, brand name |

| | | | | | | | | | | |

Trademark | | 柏仕顿 | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | April 7, 2007 to April 6, 2017 (10 years) | | Logo, brand name |

| | | | | | | | | | | |

| Trademark | | 劲都龙 | | 25 (apparel, shoes and hats) | | PRC Trademark Bureau | | January 28, 2007 to January 27, 2017 (10 years) | | Logo, brand name |

| | | | | | | | | | | |

| Trademark | | 劲都人 | | 35 (advertisement, industry, industrial management, office business) | | PRC Trademark Bureau | | February 21, 2008 to February 20, 2018 (10 years) | | Logo, brand name |

We have also applied for registration of the following trademarks with the PRC Trademark Bureau, which approvals are still pending as of the date of this current report:

Trademark | | Category Number and Description | | Application No. | | Application Date | | Accepted by the PRC Trademark Bureau | | Description |

| 锐觉 | | 25 (apparel, shoes and hats) | | 5426659 | | June 19, 2006 | | November 9, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| 锐觉 | | 35 (advertisement, industry, industrial management, office business) | | 5426658 | | June 19, 2006 | | November 9, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| 锐觉 | | 41 (education, professional training, entertainment, cultural and sports activities) | | 5426660 | | June 19, 2006 | | November 9, 2006 | | Logo, brand name used in our products |

索锐 SHIIN | | 35 (advertisement, industry, industrial management, office business) | | 5154823 | | February 13, 2006 | | August 14, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| 狄索 | | 25 (apparel, shoes and hats) | | 4959565 | | October 24, 2005 | | January 19, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| DESIL | | 25 (apparel, shoes and hats) | | 4957882 | | October 24, 2005 | | January 19, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| J&D | | 25 (apparel, shoes and hats) | | 4957883 | | October 24, 2005 | | January 19, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| D.SO | | 25 (apparel, shoes and hats) | | 4957884 | | October 24, 2005 | | January 19, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| JD | | 25 (apparel, shoes and hats) | | 4957885 | | October 24, 2005 | | January 19, 2006 | | Logo, brand name used in our products |

| | | | | | | | | | | |

劲都JINDUREN | | 26 (lace and decorated border, embroidery, buttons, needles, artificial flowers) | | 4833668 | | August 12, 2005 | | October 25, 2005 | | Logo, brand name used in our products |

| | | | | | | | | | | |

| | 25 (apparel, shoes and hats) | | 4650774 | | May 12, 2005 | | July 29, 2005 | | Logo, brand name used in our products |

| | | | | | | | | | | |

劲都JINDUREN | | 318(leather (work), artificial leather (work), fur, suitcase and travelling bag, umbrella and parasol, walking stick, saddle and harness etc.) | | 5054599 | | May 12, 2005 | | July 29, 2005 | | Logo, brand name used in our products |

V·LOV takes all necessary precautions to protect our intellectual property. Aside from registering our trademarks with the PRC Trademark Bureau to protect our intellectual property, our marketing team also diligently conducts market research and patrols our POS stores and other marketplaces to ensure that our intellectual property are not being violated. In the event of any infringement upon our intellectual property rights, we will pursue all available legal rights and remedies.

Governmental Regulations

Dividend Distribution

The principal laws, rules and regulations governing dividends paid by Yinglin Jinduren are embodied in the Company Law of the PRC (1993), as amended in 2006 (the “Company Law”). Under the Company Law, Yinglin Jinduren may pay dividends only out of its accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, Yinglin Jinduren is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its statutory surplus reserve fund until the accumulative amount of such reserve reaches 50% of its respective registered capital. These reserves are not distributable as cash dividends. As of September 30, 2008, the accumulated balance of our statutory reserve funds reserves amounted to RMB 7.18 million (US$0.91 million) and the accumulated profits of our consolidated PRC entities that were available for dividend distribution amounted to RMB 49.12 million (US$7.03 million).

Fabric Safety

We are required to comply with central, provincial and local regulations governing fabric safety. In order to address these compliance issues, we have established an advanced fabric testing center to ensure that our products meet certain quality and safety standards established by the governmental authorities. Our testing center located in our Jinjiang facility runs routine checks on our products for flammability, durability, chemical content, static properties, color retention and various other properties. In addition, we work closely with our distributors so that they understand our testing and inspection process.

Enterprise Taxation

Pursuant to the PRC Enterprise Income Tax Law (the "New Tax Law") passed by the Tenth National People's Congress on 16 March 2007, the new PRC income tax rates for domestic and foreign enterprises are unified at 25% effective January 1, 2008. The enactment of the New Tax Law is not expected to have any significant financial effect on the amounts accrued in the balance sheet in respect of taxation payable and deferred taxation.

Value Added Tax

The Provisional Regulations of the People’s Republic of China Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994. Under these regulations and the Implementing Rules of the Provisional Regulations of the People’s Republic of China Concerning Value Added Tax, value added tax is imposed on goods sold in or imported into the PRC and on processing, repair and replacement services provided within the PRC.

Value added tax payable in the PRC is charged on an aggregated basis at a rate of 13 or 17% (depending on the type of goods involved) on the full price collected for the goods sold or, in the case of taxable services provided, at a rate of 17% on the charges for the taxable services provided but excluding, in respect of both goods and services, any amount paid in respect of value added tax included in the price or charges, and less any deductible value added tax already paid by the taxpayer on purchases of goods and service in the same financial year.

Business Tax

With effect from January 1, 1994, business that provides services, assigns intangible assets or sells immovable property became liable to business tax at a rate ranging from 3 to 5% of the charges of the services provided, intangible assets assigned or immovable property sold, as the case may be.

Environmental Protection Regulations

In accordance with the Environmental Protection Law of the PRC adopted by the Standing Committee of the NPC on 26th December, 1989, the bureau of environmental protection of the State Council sets the national guidelines for the discharge of pollutants. The provincial and municipal governments of provinces, autonomous regions and municipalities may also set their own guidelines for the discharge of pollutants within their own provinces or districts in the event that the national guidelines are inadequate.

A company or enterprise which causes environmental pollution and discharges other polluting materials which endanger the public should implement environmental protection methods and procedures into their business operations. This may be achieved by setting up a system of accountability within the company’s business structure for environmental protection; adopting effective procedures to prevent environmental hazards such as waste gases, water and residues, dust powder, radioactive materials and noise arising from production, construction and other activities from polluting and endangering the environment. The environmental protection system and procedures should be implemented simultaneously with the commencement of and during the operation of construction, production and other activities undertaken by the company. Any company or enterprise which discharges environmental pollutants should report and register such discharge with relevant bureaus of environmental protection and pay any fines imposed for the discharge. A fee may also be imposed on the company for the cost of any work required to restore the environment to its original state. Companies which have caused severe pollution to the environment are required to restore the environment or remedy the effects of the pollution within a prescribed time limit.

If a company fails to report and/or register the environmental pollution caused by it, it will receive a warning or be penalized. Companies which fail to restore the environment or remedy the effects of the pollution within the prescribed time will be penalized or have their business licenses terminated. Companies or enterprises which have polluted and endangered the environment must bear the responsibility for remedying the danger and effects of the pollution, as well as to compensate any losses or damages suffered as a result of such environmental pollution.

Foreign Exchange Controls

Major reforms have been introduced to the foreign exchange control system of the PRC since 1993.

On 28 December 1993, the People’s Bank of China (“PBOC”), with the authorization of the State Council issued the Notice on Further Reform of the Foreign Exchange Control System which came into effect on 1 January 1994. Other new regulations and implementation measures include the Regulations on the Foreign Exchange Settlement, Sale and Payments which were promulgated on 20 June 1996 and took effect on 1 July 1996 and which contain detailed provisions regulating the settlement, sale and payment of foreign exchange by enterprises, individuals, foreign organizations and visitors in the PRC and the regulations of the PRC on Foreign Exchange Control which were promulgated on 1 January 1996 and took effect on 1 April 1996 and which contain detailed provisions in relation to foreign exchange control.

The foreign exchange earnings of all PRC enterprises, other than those foreign investment enterprises (“FIE”), who are allowed to retain a part of their regular foreign exchange earnings or specifically exempted under the relevant regulations, are to be sold to designated banks. Foreign exchange earnings obtained from borrowings from foreign institutions or issues of shares or bonds denominated in foreign currency need not be sold to designated banks, but must be kept in foreign exchange bank accounts of designated banks unless specifically approved otherwise.

At present, control of the purchase of foreign exchange is relaxed. Enterprises within the PRC which require foreign exchange for their ordinary trading and non-trading activities, import activities and repayment of foreign debts may purchase foreign exchange from designated banks if the application is supported by the relevant documents. Furthermore, FIEs may distribute profit to their foreign investors with funds in their foreign exchange bank accounts kept with designated banks. Should such foreign exchange be insufficient, enterprises may purchase foreign exchange from designated banks upon the presentation of the resolutions of the directors on the profit distribution plan of the particular enterprise.

On January 24, 2005, the State Administration of Foreign Exchange (“SAFE”) promulgated the Circular of the State Administration of Foreign Exchange Concerning Relevant Issues on Improving Foreign Exchange Administration for Merger and Acquisitions with Foreign Entities (the “Circular”). The Circular provides for, inter alia, strict supervision and control by SAFE and its local branches/offices of capital contribution examination, foreign currency registration for share transfers, registration of shareholders’ loan, remittance of profits out of the PRC, re-investment of profits, and share transfers by foreign invested enterprises established in the manner of acquisitions of PRC enterprises by foreign enterprises with PRC residents as shareholders. On April 8, 2005, Notice concerning the Relevant Issues for the Registration of Overseas Investments by Domestic Residents and Foreign Exchange Registration for Foreign Acquisition was promulgated by SAFE which further requires that PRC residents who have contributed their domestic assets or shares into the overseas companies and thus hold the shares of such overseas companies directly or indirectly, shall conduct supplemental foreign exchange registration with the local foreign exchange authority, even if the relevant acquisition of the domestic company had been completed prior to 24 January 2005.

Without such supplemental registration, the PRC residents are prohibited to conduct foreign investment and conduct other foreign exchange business under capital item, and the foreign exchange registration for the foreign invested company will not be preceded by the local foreign exchange authority. If the foreign exchange registration for the foreign investment company was made by false or misleading information and representation, the foreign invested company shall be liable for the profits remitted out of the PRC and other transactions under the capital item since the registration date. The PRC resident who is the largest shareholder in the overseas invested companies directly or indirectly is also required to go through registration for modification or record with the local foreign exchange authority within 30 days from the date of any increase/decrease of capital, share transfer, merger/splitting, overseas share investment, and foreign guarantees concerning domestic assets of such overseas invested companies (“material issues”). Failure to conduct the above supplemental registration, registration for modification or record of the material issues with the local foreign exchange authority fully could adversely affect the foreign invested company’s ability to remit its profits, liquidation, share transfer and capital decreasing fees abroad, and could be punished as foreign exchange evasion.

Seasonality

Chinese consumers’ spending behaviors are typically stable year to year; they are typically affected by seasonal shopping patterns within the year. Sales are particularly higher before the Chinese New Year holiday in early spring, the Labor Day holiday in early May, the summer months and the National Day holiday in early October.

We have typically experienced seasonal fluctuations in sales volume due to the seasonal fluctuations experienced by the majority of our customers. These seasonal fluctuations typically result in sales increases in the first and second quarters and sales decreases in the third and fourth quarters of each year. The mix of product sales may vary considerably from time to time as a result of changes in seasonal and geographic demand for particular types of casual wear and accessories. In addition, unexpected and abnormal changes in climate may affect sales of our products that are timed for release during a particular season.

Fluctuations in our sales may also result from a number of other factors including:

| · | the timing of our competitors’ launch of new products; |

| · | consumer acceptance of our new and existing products; |

| · | changes in the overall clothing industry growth rates; |

| · | economic and demographic conditions that affect consumer spending and retail sales; |

| · | the mix of products ordered by our distributors; |

| · | the timing of the placement and delivery of distributor orders; and |

| · | variation in the expenditure necessary to support our business. |

As a result, we believe that comparisons of our operating results between any interim periods may not be meaningful and that these comparisons may not be an accurate indicator of our future performance.

The following table sets forth the number of our employees for each of our areas of operations and as a percentage of our total workforce as of December 31, 2008:

| | Number of Employees | | % of Employees | |

| Production Development | 230 | | | 62.33 | % |

| Sales & Marketing and Quality Assurance | 47 | | | 12.74 | % |

| Production Management | 40 | | | 10.84 | % |

| Purchasing | 7 | | | 1.90 | % |

| Finance | 10 | | | 2.70 | % |

| Management & Administration | 14 | | | 3.79 | % |

| Research & Development | 21 | | | 5.69 | |

| | | | | | |

| TOTAL | 369 | | | 100 | % |

We are in full compliance with Chinese labor laws and regulations and are committed to providing safe and comfortable working conditions and accommodations for our employees.

Labor Costs. The manufacture of garments is a labor-intensive business, and that is why we outsource most of our manufacturing to contract manufacturers. We rely on in-house skilled labor and talents to design, develop and sell our products. Generally, we offer one to three months of training to new workers to better understand our brand and improve their relevant skills during the training period. Management expects that our access to reasonably priced and competent labor will continue into the foreseeable future.

Working Conditions and Employee Benefits. We believe in the importance of maintaining our social responsibilities, and we are committed to providing employees with a safe, clean, comfortable working environment and accommodations. Our employees also are entitled to time off during public holidays. In addition, we frequently monitor contract manufacturers’ working conditions to ensure their compliance with related labor laws and regulations. We are in full compliance with our obligations to provide pension benefits to our workers, as mandated by the PRC government. We strictly comply with the Chinese labor laws and regulations, and offer reasonable wages, life insurance and medical insurance to our workers.

Compliance with Environmental Laws

Based on the present nature of our operations, we do not believe that environmental laws and the cost of compliance with those laws have or will have a material impact on us or our operations.

CORPORATE INFORMATION

Both of our principal executive offices are located in Fujian Province, China. The principal executive office for marketing and research and development is located at No 1749-1751 Xiangjiang Road in Shishi City, Fujian Province, China. The principal executive office for accounting and financial services is located at Fengsheng Mansion 9th Floor, Annan Road, Quanzhou City, Fujian Province, China. The Company’s main telephone number is 0595-88554555 and its fax number is 0595-88611838.

WHERE YOU CAN FIND MORE INFORMATION

Because we are subject to the requirements of the Securities Exchange Act, we file reports, proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the public reference room maintained by the SEC at its Public Reference Room, located at 100 F Street, N.E. Washington, D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at (800) SEC-0330. In addition, we are required to file electronic versions of those materials with the SEC through the SEC’s EDGAR system. The SEC also maintains a web site at http://www.sec.gov, which contains reports, proxy statements and other information regarding registrants that file electronically with the SEC.

You should carefully consider the risks described below together with all of the other information included in this prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Industry

Our sales are influenced by general economic cycles. A prolonged period of depressed consumer spending would have a material adverse effect on our profitability.

Apparel is a cyclical industry that is dependent upon the overall level of consumer spending. The global economy is currently experiencing a downturn. Purchases of trendy apparel and accessories tend to decline in periods of uncertainty regarding future economic prospects, when consumer spending, particularly on discretionary items, and disposable income decline. Many factors affect the level of consumer spending in the apparel industries, including, among others: prevailing economic conditions, levels of employment, salaries and wage rates, energy costs, interest rates, the availability of consumer credit, taxation and consumer confidence in future economic conditions. During periods of economic uncertainty, we may not be able to maintain or increase our sales to existing customers, make sales to new customers, maintain sales levels at our existing POS, or maintain or improve our margins from operations as a percentage of net sales. Our customers anticipate and respond to adverse changes in economic conditions and uncertainty by reducing inventories and canceling orders. A prolonged period of depressed consumer spending would have a material adverse effect on our profitability.

Intense competition in the worldwide apparel industry could reduce our sales and prices.

We face a variety of competitive challenges from other apparel producers both in China and other countries. Some of these competitors have greater financial and marketing resources than we do and may be able to adapt to changes in consumer preferences or retail requirements more quickly, devote greater resources to the marketing and sale of their products or adopt more aggressive pricing policies than we can. As a result, we may not be able to compete successfully with them if we cannot continue enhancing our marketing and management strategies, quality and value or responding appropriately to consumers needs.

Competition from companies with significantly greater resources than ours, and if we are unable to compete effectively with these companies, our market share may decline and our business could be harmed.

We face intense competition in the apparel industry from other established companies. A number of our competitors may have significantly greater financial, technological, manufacturing, sales, marketing and distribution resources than we do. Their greater capabilities in these areas may enable them to better withstand periodic downturns in the apparel industry, compete more effectively on the basis of price and production and more quickly develop new products. In addition, new companies may enter the markets in which we compete, further increasing competition in the industry. We believe that our ability to compete successfully depends on a number of factors, including the style and quality of our products and the strength of our brand name, as well as many factors beyond our control. We may not be able to compete successfully in the future, and increased competition may result in price reductions, reduced profit margins, loss of market share and an inability to generate cash flows that are sufficient to maintain or expand our development and marketing of new products, which would adversely impact the trading price of our common stock.

The worldwide apparel industry is subject to ongoing pricing pressure.

The apparel market is characterized by low barriers to entry for both suppliers and marketers, global sourcing through suppliers located throughout the world, trade liberalization, continuing movement of product sourcing to lower cost countries, ongoing emergence of new competitors with widely varying strategies and resources, and an increasing focus on apparel in the mass merchant channel of distribution. These factors contribute to ongoing pricing pressure throughout the supply chain. This pressure has and may continue to:

| · | require us to reduce wholesale prices on existing products; |

| · | result in reduced gross margins across our product lines; and |

| · | increase pressure on us to further reduce our production costs and our operating expenses. |

Any of these factors could adversely affect our business and financial condition.

Fluctuation in the price, availability and quality of raw materials could increase our cost of goods and decrease our profitability.

We purchase raw materials directly from local fabric and accessory suppliers. We may also import specialty fabrics to meet specific customer requirements. We also purchase finished goods from other contract manufacturers. The prices we charge for our products are dependent in part on the market price for raw materials used to produce them. The price, availability and quality of our raw materials may fluctuate substantially, depending on a variety of factors, including demand, supply conditions, transportation costs, government regulation, economic climates and other unpredictable factors. Any raw material price increases could increase our cost of goods and decrease our profitability unless we are able to pass higher prices on to our customers.

For the fiscal year ended December 31, 2007, we relied on one supplier for 14.5% of our total supply purchases. For the fiscal year ended December 31, 2006, we relied on two suppliers for 11.88% and 13.81%, respectively, of our total supply purchases. For the nine months ended September 30, 2008, we relied on two suppliers for 45.85% and 16.3%, respectively, of our total supply purchases. We do not have any long-term written agreements with any of our suppliers and do not anticipate entering into any such agreements in the near future. We do not believe that loss on any of these suppliers would have a material adverse effect on our ability to obtain finished goods or raw materials essential to our business because we believe we can locate other suppliers in a timely manner.

Our continued operations depend on current fashion trends. If our designs and products do not continue to be fashionable, our business could be adversely affected.

Our success depends in large part on our ability to develop, market and deliver innovative and stylish products that are consistent and build on our brand and image at a pace and intensity competitive with our competition. The novelty and the design of our VLOV apparel are critical to our success and competitive position, and the inability to continue to develop and offer unique products to our customers could harm our business. We cannot be certain that trendy apparel and related accessories will continue to be fashionable. Should the trend steer away from apparel and related accessories such as ours, our sales could decrease and our business could be adversely affected. In addition, our future designs and plans to expand our product offerings may not be successful, and any unsuccessful designs or product offerings could adversely affect our business.

Our success to date has been due in large part to the growth of our brand image. If we are unable to timely and appropriately respond to changing consumer demand, our brand name and brand image may be impaired. Even if we react appropriately to changes in consumer preferences, consumers may consider our brand image to be outdated or associate our brand with styles that are no longer popular. In the past, many apparel companies have experienced periods of rapid growth in revenues and earnings followed by periods of declining sales and losses. Our business may be similarly affected in the future.

Risks Relating to Our Business

Our limited operating history makes it difficult to evaluate our future prospects and results of operations.

We have a limited operating history. Yinglin Jinduren commenced business in 2004. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by early stage companies in evolving industries such as the apparel industry in China. Some of these risks and uncertainties relate to our ability to:

| · | maintain our market position; |

| · | attract additional customers and increase spending per customer; |

| · | respond to competitive market conditions; |

| · | increase awareness of our brand and continue to develop customer loyalty; |

| · | respond to changes in our regulatory environment; |

| · | maintain effective control of our costs and expenses; |

| · | raise sufficient capital to sustain and expand our business; and |

| · | attract, retain and motivate qualified personnel. |

If we are unsuccessful in addressing any of these risks and uncertainties, our business may be materially and adversely affected.

We may be unable to sustain our past growth or manage our future growth, which may have a material adverse effect on our future operating results.

We have experienced rapid growth since our inception, and have increased our net sales from $4.74 million in 2004 to $39.73 million in 2007. We anticipate that our future growth rate will depend upon various factors, including the strength of our brand image, the market success of our current and future products, the success or our growth strategies, competitive conditions and our ability to manage our future growth. Future growth may place a significant strain on our management and operations. As we continue to grow in our operations, our operational, administrative, financial and legal procedures and controls will need to be expanded. As a result, we may need to train and manage an increasing number of employees, which could distract our management team from our business. Our future success will depend substantially on the ability of our management team to manage our anticipated growth. If we are unable to anticipate or manage our growth effectively, our future operating results could be adversely affected.

Our business could be harmed if we fail to maintain proper inventory levels.

We place orders with our contract manufacturers for most of our products when we receive all of our customers’ orders. We do this to minimize purchasing costs, the time necessary to fill customer orders and the risk of non-delivery. We also maintain an inventory of certain products that we anticipate will be in greater demand. However, we may be unable to sell the products we have ordered in advance from manufacturers or that we have in our inventory. Inventory levels in excess of customer demand may result in inventory write-downs, and the sale of excess inventory at discounted prices could significantly impair our brand image and have a material adverse effect on our operating results and financial condition. Conversely, if we underestimate consumer demand for our products or if our manufacturers fail to supply the quality products that we require at the time we need them, we may experience inventory shortages. Inventory shortages might delay shipments to customers, negatively impact retailer and distributor relationships, and diminish brand loyalty.

We rely on our distributors to operate our retail network.

Our distributors operate, directly or indirectly via third parties, our V·LOV POS. We do not own or operate any V·LOV retail stores ourselves. We depend on our distributors’ regional retail experience and economies of scale. We may not be able to expand the geographical coverage of our existing distributors, or be able to engage new distributors who have strong network and retail experience, which may substantially impair our sales targets. We rely on our distributors in the management and expansion of the V·LOV retail sales network. Even though we provide retail policies and guidelines, training, advertising and marketing support, our distributors might not carry out our visions and satisfy the needs of our business. Our sales to distributors also may not correlate directly to the demand for our products by end customers. If our distributors mismanage and do not effectively expand our retail network, our business and our reputation can be adversely affected.

We rely on contract manufacturing of our products. Our inability to secure production sources meeting our quality, cost, working conditions and other requirements, or failures by our contractors to perform, could harm our sales, service levels and reputation.

We source our products from independent manufacturers who purchase fabric and other raw materials. As a result, we must locate and secure production capacity. We depend on independent manufacturers to maintain adequate financial resources, secure a sufficient supply of raw materials, and maintain sufficient development and manufacturing capacity in an environment characterized by continuing cost pressure and demands for product innovation and speed-to-market. In addition, we do not have material long-term contracts with any of our independent manufacturers, and these manufacturers generally may unilaterally terminate their relationship with us at any time.