UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| | EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended November 30, 2008 |

| | |

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934 |

| | |

| | For the transition period from _____ to __________ |

Commission file number 000-53155

SINO CHARTER, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 20-8658254 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

No 1749-1751 Xiangjiang Road

Shishi City, Fujian Province

People’s Republic of China

(Address of principal executive offices, including zip code.)

(561) 245-5155

(Registrant's telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: x Yes No ¨

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy ir information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

| Large Accelerated filer | ¨ | | Accelerated filer ¨ |

| Non-accelerated filer | ¨ | | Smaller reporting company x |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). x Yes ¨ No

The aggregate market value of the registrant's common stock, $0.00001 par value, held by non-affiliates was $1.86 million based on approximately 6,403,504 shares and the last sale price was $0.29 for the common stock on February 20, 2009. The company had a total of 16,014,421 shares outstanding as of February 20, 2009.

TABLE OF CONTENTS

| | | Page |

| PART I | | |

| | | |

| Item 1. | Business. | 3 |

| Item 1A. | Risk Factors. | 5 |

| Item 1B. | Unresolved Staff Comments. | 5 |

| Item 2. | Properties. | 5 |

| Item 3. | Legal Proceedings. | 5 |

| Item 4. | Submission of Matters to a Vote of Security Holders. | 5 |

| | | |

| PART II | | |

| | | |

| Item 5. | Market For Common Stock and Related Stockholder Matters. | 6 |

| Item 6. | Selected Financial Data | 6 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 7 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. | 10 |

| Item 8. | Financial Statements and Supplementary Data. | 11 |

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial | 12 |

| | Disclosure | |

| Item 9A(T). | Controls and Procedures | 12 |

| Item 9B. | Other Information | 13 |

| | | |

| PART III | | |

| | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 14 |

| Item 11. | Executive Compensation | 16 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 19 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 20 |

| Item 14 | Principal Accountant Fees and Services | 20 |

| | | |

| PART IV | | |

| | | |

| Item 15. | Exhibits, Financial Statement Schedules. | 22 |

PART I

ITEM 1. BUSINESS

General

Sino Charter Inc. (hereinafter “the Company” or “Sino”) was incorporated on October 30, 2006 in the State of Nevada. The Company originally planned to provide internet-based aircraft charter booking for East Asia. Because the Company has not generated expected revenue, the Company decided to pursue other business opportunities. We have been in the development stage since inception and have no operations to date, other than issuing shares to our original shareholders.

On August 1, 2008, the Company’s former President and sole director entered into a stock purchase agreement with MMH Group, LLC (an entity owned by our current President Matthew Hayden). Pursuant to the terms and conditions of the Stock Purchase Agreement, MMH acquired 10,000,000 shares of our common stock, or approximately 91.1% of our issued and outstanding shares of common stock resulting in a change of control. The transaction contemplated by the Stock Purchase Agreement closed on August 4, 2008. Simultaneously with the closing of this transaction, MMH sold 2,400,000 of the shares to Ancora Greater China Fund, L.P., and sold 5,600,000 of the shares to Pope Investments II, LLC. As a result of the foregoing MMH owns 2,000,000 shares of our common stock, representing 18.2% of our outstanding common stock.

Subsequent Events

On January 7, 2009 we received authorization from our shareholders to effect a reverse split of our common stock (which would have the effect of decreasing the number of shares outstanding and, thereby, increase the number of shares available for issuance) at a ratio of 1:100 and filed an Amendment to the Articles of Incorporation with the Nevada Secretary of State, thereby decreasing the number of issued and outstanding shares. The disclosures hereafter in this annual report, as well as the financial statements and footnotes accompanying this annual report, have been retroactively adjusted to reflect the reverse stock split.

On February 12, 2009, we completed an offering of 514,000 shares of our common stock at a price of $0.10 per share to three purchasers. The total amount received from this offering was $51,400. The issuance of these securities was exempt from registration under Section 4(2) of the Securities Act. The Company made this determination based on the representations of Investors, which included, in pertinent part, that such shareholders were either (a) “accredited investors” within the meaning of Rule 501 of Regulation D promulgated under the Securities Act, or (b) not a “U.S. person” as that term is defined in Rule 902(k) of Regulation S under the Act, and that such Investor was acquiring our common stock, for investment purposes for their own respective accounts and not as nominees or agents, and not with a view to the resale or distribution thereof, and that each Investor understood that the shares of our common stock may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

On February 13, 2009, we completed an offering of 814,500 shares of our common stock at a price of $0.001 per share to 4 purchasers. The total amount received from this offering was $814.50. The issuance of these securities was exempt from registration under Section 4(2) of the Securities Act. The Company made this determination based on the representations of Investors, which included, in pertinent part, that such shareholders were either (a) “accredited investors” within the meaning of Rule 501 of Regulation D promulgated under the Securities Act, or (b) not a “U.S. person” as that term is defined in Rule 902(k) of Regulation S under the Act, and that such Investor was acquiring our common stock, for investment purposes for their own respective accounts and not as nominees or agents, and not with a view to the resale or distribution thereof, and that each Investor understood that the shares of our common stock may not be sold or otherwise disposed of without registration under the Securities Act or an applicable exemption therefrom.

On February 13, 2009, we closed a reverse acquisition by which we acquired a business engaged in the design, sourcing, marketing and distribution of casual apparel and clothing products in the People’s Republic of China (“China” or the “PRC”) pursuant to a Share Exchange Agreement (the “Exchange Agreement”) by and among the Company, Peng Xiang Peng Fei Investments Limited, a company incorporated in the British Virgin Islands (“Peng Xiang”), and the shareholders who, immediately prior to the closing of the transactions contemplated by the Exchange Agreement, collectively held 100% of Peng Xiang’s issued and outstanding share capital (the “BVI Shareholders”). Peng Xiang is a holding company that, through its wholly owned subsidiary, Korea Jinduren (International) Dress Limited, a company incorporated in Hong Kong Special Administrative Region (“Korea Jinduren”), controls Jinjiang Yinglin Jinduren Fashion Limited, a company organized in the PRC (“Yinglin Jinduren”, and along with Peng Xiang and Korea Jinduren are collectively referred to as “V·LOV”), by a series of contractual arrangements. The terms of the Share Exchange Agreement and the transactions thereunder, as well as a description of the business operations of V·LOV, were previously disclosed in our current report on Form 8-K/A filed with the SEC on February 18, 2009, and are incorporated by reference hereby.

EMPLOYEES

As of November 30, 2008, we had no full time employees. Our president agreed to allocate a portion of his time to the activities of the Company, without compensation. The president anticipates that our business plan can be implemented by his devoting no more than 10 hours per month to the business affairs of the Company and, consequently, conflicts of interest may arise with respect to the limited time commitment by such officer.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

As of the fiscal year ended November 30, 2008, the Company maintained a mailing address at 2888 Spring Lakes Drive, Davidsonville, MD 21035, and paid no rent or other fees for the use of the mailing address. The Company did not maintain any other office facilities.

Subsequent Event

The Company continued to maintained the mailing address described above through February 13, 2009, when the Company completed the reverse acquisition of Peng Xiang and acquired the business operations of V·LOV, which are based in China. A description of the offices and facilities of V·LOV were previously disclosed in our current report on Form 8-K/A filed with the SEC on February 18, 2009, and are incorporated by reference hereby.

ITEM 3. LEGAL PROCEEDINGS

We are not presently a party to any litigation.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

During the fiscal quarter ended November 30, 2008, there were no matters submitted to a vote of our shareholders.

PART II

ITEM 5. MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS AND PURCHASES OF EQUITY SECURITIES

There is very limited public trading market for our common stock.

Holders

As of February 20, 2009, there were 66 holders of record for our common stock.

Capital Stock

Common Stock

As of February 20, 2009, there were 66 shareholders of record holding a total of 16,014,421 shares of fully paid and non-assessable common stock of the 100,000,000 shares of common stock, par value $0.00001, authorized. The holders of the common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of the common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to the common stock.

Preferred Stock

As of February 20, 2009 there were no shares issued and outstanding of the 100,000,000 shares of preferred stock authorized. The par value of the preferred stock is $0.00001 per share. The Company’s preferred stock may have such rights, preferences and designations and may be issued in such series as determined by the board of directors.

Dividends

As of the date of this annual report, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our board of directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This section of the annual report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Overview

During the fiscal year which ended November 30, 2008, we continued to be a start-up stage corporation, and we have not generated or realized any revenues from our business operations since inception. As a result, our auditors have issued a going concern opinion that there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our operating expenses.

Plan of Operation

Given that we have not generated any revenues since our inception, our plan of operations for the next twelve months is to raise capital to fund our immediate working capital needs and to seek a merger or acquisition candidate for a reverse acquisition transaction.

Subsequent Event

As disclosed elsewhere in this annual report, on February 13, 2009, we completed the reverse acquisition of Peng Xiang and thus acquired the business of V·LOV, which designs, sources, markets and distributes casual apparel and clothing products in the PRC. We cannot, however, guarantee that V·LOV will be successful in its business operations. For full disclosure on all the risk factors involved in the business operations of V·LOV, please refer to our current report on Form 8-K/A filed with the SEC on February 18, 2009.

Results of operations

From Inception on October 30, 2006 to November 30, 2008

Revenues

For the fiscal year ended November 30, 2008, the Company did not generate any revenues, and has not done so since inception. Unless we are able to identify a suitable business opportunity in the near future, we expect to continue to incur losses through the 2009 fiscal year.

Net Losses

From our inception on October 30, 2006 to November 30, 2008, the Company incurred net losses of $143,005. Net losses for the fiscal year ended November 30, 2008 were $66,049 as compared to $66,367 for the fiscal year ended November 30, 2007. The Company’s net losses are primarily attributable to general and administrative expenses. General and administrative expenses include professional and consulting fees, travel expenses, and costs associated with the preparation of disclosure documentation. The slight decrease in net losses over the comparative periods can be attributed to the decrease in travel expenses.

Income Tax Expense (Benefit)

The Company has a prospective income tax benefit resulting from a net operating loss carryforward and start up costs that will offset any future operating profit.

Capital Expenditures

The Company expended no significant amounts on capital expenditures for the period from inception to November 30, 2008.

Liquidity and capital resources

As of November 30, 2008, the Company had no assets and a working capital deficit of $26,488. The Company had current and total liabilities of $26,488, consisting of $250 in accounts payable and accrued expenses and $26,238 in advances from related party. Net stockholders’ deficit in the Company was $26,488 at November 30, 2008.

Cash flow used in operating activities was $142,755 for the period from inception to November 30, 2008. Cash flow used in operating activities for the year ended November 30, 2008 was $74,310 as compared to $68,320 for the year ended November 30, 2007. The increase in cash flow used in operating activities was due to net losses and an increase in other assets.

Cash flow provided by financing activities was $142,755 for the period from inception to November 30, 2008. Cash flow provided by financing activities for the year ended November 30, 2008 was $44,905 as compared to $96,750 for the year ended November 30, 2007. Cash flow provided by financing activities during fiscall year 2008 was due to advances from related party.

As of November 30, 2008, The Company’s current assets were insufficient to continue as a going concern over the next twelve months unless it can realize debt or equity financing to fund its operations. At November 30, 2007, we had no current commitments or arrangements with respect to funding or immediate sources of funding. Further, no assurances can be given that funding would be available or available to us on acceptable terms. Therefore, our stockholders would be the most likely source of new funding in the form of loans or equity placements, though none have made any commitment for future investment. Our inability to obtain funding would have a material adverse affect on our plan of operation.

The Company had no formal long term lines of credit or other bank financing arrangements as of November 30, 2008. As of November 30, 2008:

The Company did not expect to pay cash dividends in the foreseeable future.

The Company had no defined benefit plan or contractual commitment with any of its officers or directors.

The Company had no current plans for any significant purchase or sale of any plant or equipment.

The Company had no current plans to make any changes in the number of employees.

Off Balance Sheet Arrangements

As of November 30, 2008, we had no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to stockholders.

Going Concern

The Company’s auditors have noted substantial doubt as to the Company’s ability to continue as a going concern as a result of our dependence on raising capital to sustain operations, our failure to establish profitable operations, and an accumulated deficit of $143,005 as of November 30, 2008. Our ability to continue as a going concern requires that we either realize net income from operations or obtain funding from outside sources. Management’s plan to address our ability to continue as a going concern includes (i) obtaining funding from private placement sources, (ii) obtaining additional funding from the sale of the Company’s securities, (iii) establishing revenues from prospective business opportunities, and (iv) obtaining loans and grants from various financial institutions where possible. Although management are optimistic about obtaining the funding necessary for us to continue as a going concern, there can be no assurances that the means for maintaining this objective will be successful.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Sino Charter, Inc

(A Development Stage Company)

November 30, 2007

| | Index |

| | |

| Report of Independent Registered Public Accounting Firms | F-1 and F-2 |

| | |

| Balance Sheets | F-3 |

| | |

| Statements of Expenses | F-4 |

| | |

| Statements of Stockholders’ Equity (Deficit) | F-5 |

| | |

| Statements of Cash Flows | F-6 |

| | |

| Notes to the Financial Statements | F-7 |

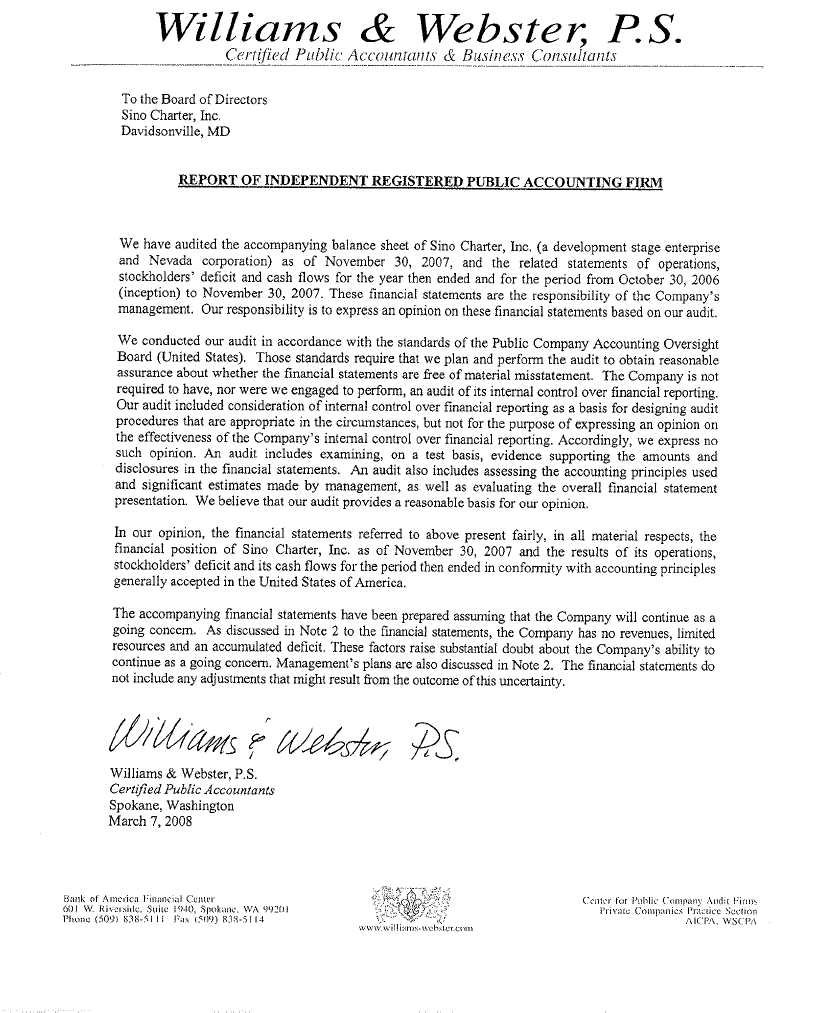

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Sino Charter, Inc.

(A Development Stage Company)

Davidsonville, MD

We have audited the accompanying balance sheet of Sino Charter, Inc. as of November 30, 2008 and the related statements of expenses, stockholders' equity (deficit), and cash flows for the year then ended and the period from October 30, 2006 (inception) through November 30, 2008. The financial statements for the period from October 30, 2006 (inception) through November 30, 2007 were audited by other auditors whose report expressed unqualified opinion on those financial statements. The financial statements for the period from October 30, 2006 (inception) through November 30, 2007 include no revenue and a net loss of $76,956. Our opinion on the statement of expenses, stockholders’ equity (deficit) and cash flows for the period from October 30, 2006 (inception) through November 30, 2008, insofar as it relates to amounts for prior periods through November 30, 2007 is based soley on the report of the other auditor. These financial statements are the responsibility of Sino Charter, Inc. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the Public Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. Sino Charter, Inc. is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Sino Charter, Inc.’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sino Charter, Inc. as of November 30, 2008 and the results of its operations and its cash flows for the year then ended and the period from October 30, 2006 (inception) through November 30, 2008 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Sino Charter, Inc. will continue as a going concern. As discussed in Note 2 to the financial statements, Sino Charter, Inc. has no operations and an accumulated deficit, which raises substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

MALONE & BAILEY, PC

www.malone-bailey.com

Houston, Texas

February 18, 2009

SINO CHARTER INC.

(A DEVELOPMENT STAGE ENTERPRISE)

BALANCE SHEETS

| | | November 30, | | | November 30, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| ASSETS | | | | | | |

| | | | | | | |

| CURRENT ASSETS | | | | | | |

| Cash | | $ | - | | | $ | 29,405 | |

| TOTAL CURRENT ASSETS | | | - | | | | 29,405 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | - | | | $ | 29,405 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDER'S DEFICIT | | | | | | | | |

| | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accured Interest | | $ | - | | | $ | 475 | |

| Accounts payable and accrued expenses | | | 250 | | | | 8,036 | |

| Advances due to shareholder | | | 26,238 | | | | - | |

| TOTAL CURRENT LIABILITIES | | | 26,488 | | | | 8,511 | |

| | | | | | | | | |

| STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| Preferred stock, $0.00001 par value; 100,000,000 shares authorized, | | | | | | | | |

| no shares issued and outstanding | | | - | | | | - | |

| Common stock, $0.00001 par value; 100,000,000 shares authorized, | | | | | | | | |

| 111,600 shares issued and outstanding | | | 1 | | | | 1 | |

| Additional paid-in capital | | | 116,516 | | | | 97,849 | |

| Deficit accumulated during the development stage | | | (143,005 | ) | | | (76,956 | ) |

| TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) | | | (26,488 | ) | | | 20,894 | |

| | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | $ | - | | | $ | 29,405 | |

The accompanying notes are an integral part of these financial statements.

SINO CHARTER INC.

(A DEVELOPMENT STAGE ENTERPRISE)

STATEMENTS OF EXPENSES

| | | | | | | | | From October 30, | |

| | | For the year ended | | | 2006 (Inception) | |

| | | November 30, | | | November 30, | | | to November 30, | |

| | | 2008 | | | 2007 | | | 2008 | |

| | | | | | | | | | |

| REVENUES | | $ | | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | |

| Legal and accounting | | | 54,484 | | | | 33,685 | | | | 98,582 | |

| Travel | | | 4,506 | | | | 11,671 | | | | 16,177 | |

| License expense | | | - | | | | 300 | | | | 425 | |

| Management contracts | | | - | | | | 18,500 | | | | 18,500 | |

| Bank fees | | | 54 | | | | 142 | | | | 196 | |

| Filing fees | | | 2,902 | | | | - | | | | 2,902 | |

| Office expense | | | 4,103 | | | | 1,157 | | | | 5,310 | |

| Total Expenses | | | 66,049 | | | | 65,455 | | | | 142,092 | |

| | | | | | | | | | | | | |

| LOSS FROM OPERATIONS | | | (66,049 | ) | | | (65,455 | ) | | | (142,092 | ) |

| | | | | | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | | | | | |

| Interest expense | | | - | | | | (912 | ) | | | (913 | ) |

| Total Other Income (Expense) | | | - | | | | (912 | ) | | | (913 | ) |

| | | | | | | | | | | | | |

| LOSS BEFORE TAXES | | | (66,049 | ) | | | (66,367 | ) | | | (143,005 | ) |

| | | | | | | | | | | | | |

| INCOME TAX EXPENSE | | | - | | | | - | | | | | |

| | | | | | | | | | | | | |

| NET LOSS | | | (66,049 | ) | | $ | (66,367 | ) | | $ | (143,005 | ) |

| | | | | | | | | | | | | |

| BASIC AND DILUTED NET LOSS PER SHARE | | | (0.59 | ) | | $ | (0.65 | ) | | | | |

| | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF | | | | | | | | | | | | |

| COMMON SHARES OUTSTANDING, | | | | | | | | | | | | |

| BASIC AND DILUTED | | | 111,600 | | | | 101,629 | | | | | |

The accompanying notes are an integral part of these financial statements.

SINO CHARTER INC.

(A DEVELOPMENT STAGE ENTERPRISE)

STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

| | | | | | | | | Additional | | | | | | Total | |

| | | Common Stock | | | Paid-in | | | Accumulated | | | Stockholder's | |

| | | Shares | | | Amount | | | Capital | | | Deficit | | | Deficit | |

| | | | | | | | | | | | | | | | |

| Balance, October 30, 2006 | | | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Common stock issued in private placement for cash | | | 100,000 | | | | 1 | | | | 99 | | | | - | | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss for the year ended November 30, 2006 | | | - | | | | - | | | | - | | | | (10,589 | ) | | | (10,589 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, November 30, 2006 | | | 100,000 | | | | 1 | | | | 99 | | | | (10,589 | ) | | | (10,489 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Common stock issued in placement for cash | | | 9,775 | | | | - | | | | 97,750 | | | | - | | | | 97,750 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss for the year ended November 30, 2007 | | | - | | | | - | | | | - | | | | (66,367 | ) | | | (66,367 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, November 30, 2007 | | | 109,775 | | | | 1 | | | | 97,849 | | | | (76,956 | ) | | | 20,894 | |

| | | | | | | | | | | | | | | | | | | | | |

| Capital contribution by former director | | | | | | | | | | | 18,667 | | | | | | | | 18,667 | |

| | | | | | | | | | | | | | | | | | | | | |

| Common stock issued as a result of fractional shares due to reverse stock split | | | 1,825 | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | |

| Net loss for the year ended November 30, 2008 | | | | | | | | | | | | | | | (66,049 | ) | | | (66,049 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Balance, November 30, 2008 (Unaudited) | | | 111,600 | | | $ | 1 | | | $ | 116,516 | | | $ | (143,005 | ) | | $ | (26,488 | ) |

The accompanying notes are an integral part of these financial statements.

SINO CHARTER INC.

(A DEVELOPMENT STAGE ENTERPRISE)

STATEMENTS OF CASH FLOWS

| | | | | | | | | From October 30, | |

| | | For The Year Ended | | | 2006 (Inception) | |

| | November 30, | | | November 30, | | | to November 30, | |

| | 2008 | | | 2007 | | | 2008 | |

| | (unaudited) | | | (unaudited) | | | (unaudited) | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net loss | | $ | (66,049 | ) | | $ | (66,367 | ) | | $ | (143,005 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | | | | |

| used by operations: | | | | | | | | | | | | |

| Increase(decrease) in accrued interest, related party | | | (475 | ) | | | 474 | | | | - | |

| Increase (decrease) in accounts payable and accrued expenses | | | (7,786 | ) | | | (2,427 | ) | | | 250 | |

| Net cash used by operating activities | | | (74,310 | ) | | | (68,320 | ) | | | (142,755 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | |

| Proceeds from borrowing, related party | | | 26,238 | | | | (1,000 | ) | | | 26,238 | |

| Capital contribution by former director | | | 18,667 | | | | - | | | | 18,667 | |

| Proceeds from sale of stock | | | | | | | 97,750 | | | | 97,850 | |

| Net cash provided by financing activities | | | 44,905 | | | | 96,750 | | | | 142,755 | |

| | | | | | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH | | | (29,405 | ) | | | 28,430 | | | | - | |

| | | | | | | | | | | | | |

| CASH - Beginning of period | | | 29,405 | | | | 975 | | | | - | |

| | | | | | | | | | | | | |

| CASH - End of period | | $ | - | | | $ | 29,405 | | | $ | - | |

| | | | | | | | | | | | | |

| SUPPLEMENTAL CASH FLOW DISCLOSURES: | | | | | | | | | | | | |

| Interest paid | | $ | - | | | $ | - | | | $ | - | |

| Income taxes paid | | $ | - | | | $ | - | | | $ | - | |

The accompanying notes are an integral part of these financial statements.

SINO CHARTER INC.

(A DEVELOPMENT STAGE ENTERPRISE)

NOTES TO THE FINANCIAL STATEMENTS

NOVEMBER 30, 2008

NOTE 1 - Summary of Significant Accounting Policies

Basis of Presentation and Description of Business

Sino Charter Inc. (hereinafter “the Company” or “Sino”) was incorporated on October 30, 2006 in the State of Nevada. The Company originally planned to provide internet-based aircraft charter booking for East Asia. The Company has not generated expected revenue and has decided to pursue other business opportunities.

The Company is defined by the SEC as a shell company. A shell company, (other than an asset-backed issuer), is a company with no or nominal operations and either no or nominal assets, or assets consisting solely of cash and cash equivalents, or assets consisting of any amount of cash and cash equivalents and nominal other assets.

On August 1, 2008, the Company’s former President and sole director entered into a stock purchase agreement with MMH Group, LLC (an entity owned by our current President Matthew Hayden). Pursuant to the terms and conditions of the Stock Purchase Agreement, MMH acquired 100,000 shares of our common stock, or approximately 91.1% of our issued and outstanding shares of common stock resulting in a change of control. The transaction contemplated by the Stock Purchase Agreement closed on August 4, 2008. Simultaneously with the closing of this transaction, MMH sold 24,000 of the shares to Ancora Greater China Fund, L.P., and sold 56,000 of the shares to Pope Investments II, LLC. As a result of the foregoing MMH owns 20,000 shares of our common stock, representing 18.2% of our outstanding common stock. (All share information has been adjusted to reflect the January 7, 2009 reverse stock split.)

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid investments and short-term debt instruments with original maturities of three months or less to be cash equivalents.

Loss per Common Share

Basic loss per share is computed by dividing the net loss attributable to the common stockholders by the weighted average number of shares of common stock outstanding during the period. Fully diluted loss per share is computed similar to basic loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. There were no dilutive financial instruments issued or outstanding for the period ended November 30, 2008.

Income Taxes

The Company accounts for income taxes pursuant to SFAS No. 109, Accounting for Income Taxes (“SFAS 109”). Under SFAS 109, deferred tax assets and liabilities are determined based on temporary differences between the bases of certain assets and liabilities for income tax and financial reporting purposes. The deferred tax assets and liabilities are classified according to the financial statement classification of the assets and liabilities generating the differences.

The Company maintains a valuation allowance with respect to deferred tax assets. The Company establishes a valuation allowance based upon the potential likelihood of realizing the deferred tax asset and taking into consideration the Company’s financial position and results of operations for the current period. Future realization of the deferred tax benefit depends on the existence of sufficient taxable income within the carry forward period under the Federal tax laws.

Changes in circumstances, such as the Company generating taxable income, could cause a change in judgment about the realizability of the related deferred tax asset. Any change in the valuation allowance will be included in income in the year of the change in estimate.

Fair Value of Financial Instruments

The Company estimates the fair value of financial instruments using the available market information and valuation methods. Considerable judgment is required in estimating fair value. Accordingly, the estimates of fair value may not be indicative of the amounts the Company could realize in a current market exchange. As of November 30, 2008, the carrying value of accrued liabilities, and loans from directors and stockholders approximated fair value due to the short-term nature and maturity of these instruments.

Use of Estimates and Assumptions

The financial statements are prepared on the basis of accounting principles generally accepted in the United States. The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of November 30, 2008, and expenses for the period ended November 30, 2008, and cumulative from inception. Actual results could differ from those estimates made by management.

NOTE 2 - GOING CONCERN

As shown in the accompanying financial statements, the Company had negative working capital of $26,488 and an accumulated deficit of $143,005 incurred through November 30, 2008. These factors raise substantial doubt regarding the Company's ability to continue as a going concern. Management is in the process of raising capital. These plans, if successful, will mitigate the factors which raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments in the event the Company cannot continue in existence.

NOTE 3 - RELATED PARTY TRANSACTIONS

As of November 30, 2008, advances from shareholder amounted to $26,238 and represented working capital advances. The advances are unsecured, non-interest bearing, and due on demand.

NOTE 4 - - COMMON STOCK

In November of 2006 the Company issued 100,000 shares of common stock for a total of $100 cash to its sole director.

In October 2007 the Company completed its SEC registered offering and issued an additional 9,775 shares of common stock for $97,750 in cash, which takes the following reverse split into account.

On January 7, 2009, the Company filed an Amendment to the Certificate of Incorporation with the Nevada Secretary of State, pursuant to which the Company effectuated a 100 to 1 reverse split, thereby decreasing the number of issued and outstanding shares. The company issued an additional 1,825 shares of common stock to resolve fractional shareholders. The accompanying financial statements and footnotes have been retroactively stated to reflect the reverse stock split.

In February 2009, the Company issued an additional 1,328,500 shares of common shares for $52,215 in cash through subscription agreements with various investors.

On February 13, 2009, the Company entered into a Share Exchange Agreement with Peng Xiang Peng Fei Investments Limited, a British Virgin Islands company, pursuant to which Peng Xiang Shareholders transferred collectively 100% equity ownership interests in exchange for issuance of 14,560,000 common shares of Sino Charter, Inc’s common stock. Full details on the entire exchange, the operating company, capital structure can be found on form 8-K filed under Sino Charter, Inc. with the Securities and Exchange Commission on February 13, 2009. Post all transactions the company had 16,014,421 shares outstanding.

NOTE 5 - CHANGE IN CONTROL

On August 1, 2008, the Company’s former President and sole director entered into a stock purchase agreement with MMH Group, LLC (an entity owned by our current President Matthew Hayden). Pursuant to the terms and conditions of the Stock Purchase Agreement, MMH acquired 100,000 shares of our common stock, or approximately 91.1% of our issued and outstanding shares of common stock resulting in a change of control. The transaction contemplated by the Stock Purchase Agreement closed on August 4, 2008. Simultaneously with the closing of this transaction, MMH sold 24,000 of the shares to Ancora Greater China Fund, L.P., and sold 56,000 of the shares to Pope Investments II, LLC. As a result of the foregoing MMH owns 20,000 shares of our common stock, representing 18.2% of our outstanding common stock.

NOTE 6 - INCOME TAXES

Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilites and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilites are adjusted for the effects of changes in tax laws and rates on the date of enactment.

Significant components of the Company’s deferred income tax assets are as follows:

| | | November 30, 2008 | | | November 30, 2007 | |

| | | | | | | |

| Net operating loss carry forward | | $ | 48,622 | | | | 26,165 | |

| Valuation allowance | | | (48,622 | ) | | | (26,165 | ) |

| | | | | | | | | |

| Net deferred tax assets | | $ | - | | | | - | |

Based on management’s present assessment, the Company has not yet determined it to be more likely than not that the deferred tax asset attributable to the future utilization of the net operating loss carry forward of $143,005 will be realized. Accordingly, the Company has provided a 100% allowance against the deferred tax asset in the financial statements. The Company will continue to review this valuation allowance and make adjustments as appropriate.

Current United States income tax laws limit the amount of loss available to offset against future taxable income when a substantial change in ownership occurs. Therefore, the amount available to offset future taxable income may be limited.

NOTE 7 - RECENT ACCOUNTING PRONOUNCEMENTS

The Company does not expect that adoption of recently issued accounting pronouncements will have a material impact on its financial position, results of operations or cash flows

NOTE 8 - SUBSEQUENT EVENTS

On January 7, 2009, the Company filed an Amendment to the Articles of Incorporation with the Nevada Secretary of State, pursuant to which the Company effectuated a 100 to 1 reverse stock split, thereby decreasing the number of issued and outstanding shares. The accompanying financial statements and footnotes have been retroactively stated to reflect the reverse stock split.

On February 13, 2009, Sino Charter issued 1,328,500 shares of common stock for cash in the amount of $52,215.

Effective February 13, 2009, Sino Charter, Inc. entered into a share exchange agreement by issuing 14,560,000 shares of common stock for 100% of the equity ownership in Peng Xiang Peng Fei Investments Limited, a British Virgin Islands company. The transaction is treated as a reverse acquisition with Peng Xiang Peng Fei Investments Limited deemed as the accounting acquirer. The specifics of this transaction are available on the Form 8-K filed with the Securities and Exchange Commission on February 13, 2009.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None

ITEM 9A. CONTROLS AND PROCEDURES (ITEM 9A(T))

Evaluation of Disclosure Controls and Procedures

In connection with the preparation of this annual report, an evaluation was carried out by the Company’s management, with the participation of the chief executive officer and the chief financial officer, of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (“Exchange Act”)) as of November 30, 2008. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the Commission’s rules and forms, and that such information is accumulated and communicated to management, including the chief executive officer and the chief financial officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company’s management concluded, as of the end of the period covered by this report, that the Company’s disclosure controls and procedures were not effective in recording, processing, summarizing, and reporting information required to be disclosed, within the time periods specified in the Commission’s rules and forms, and that such information was not accumulated and communicated to management, including the chief executive officer and the chief financial officer, to allow timely decisions regarding required disclosures. Our ineffectiveness in disclosure controls and procedures led to the untimely filing of this current annual report.

Management’s Report on Internal Control over Financial Reporting

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The Company’s internal control over financial reporting is a process, under the supervision of the chief executive officer and the chief financial officer, designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company’s financial statements for external purposes in accordance with United States generally accepted accounting principles (GAAP). Internal control over financial reporting includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company’s assets; |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of the financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of management and the board of directors; and |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies or procedures may deteriorate.

The Company’s management conducted an assessment of the effectiveness of our internal control over financial reporting as of November 30, 2008, based on criteria established in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, which assessment identified a material weakness in internal control over financial reporting. A material weakness is a control deficiency, or a combination of deficiencies in internal control over financial reporting that creates a reasonable possibility that a material misstatement in annual or interim financial statements will not be prevented or detected on a timely basis. Since the assessment of the effectiveness of our internal control over financial reporting did identify a material weakness, management considers its internal control over financial reporting to be ineffective.

Management has concluded that our internal control over financial reporting had the following deficiency:

| ● | We were unable to maintain any segregation of duties within our business operations due to our reliance on a single individual fulfilling the role of sole officer and director. While this control deficiency did not result in any audit adjustments to our 2007 or 2008 interim or annual financial statements, it could have resulted in a material misstatement that might have been prevented or detected by a segregation of duties. Accordingly we have determined that this control deficiency constitutes a material weakness. |

To the extent reasonably possible, given our limited resources, we will seek to separate the responsibilities of chief executive officer and chief financial officer, intending to rely on two or more individuals. We will also seek to expand our current board of directors to include additional individuals willing to perform directorial functions. Since the recited remedial actions will require that we hire or engage additional personnel, this material weakness may not be overcome in the near term due to our limited financial resources. Until such remedial actions can be realized, we will continue to rely on the advice of outside professionals and consultants.

This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. We were not required to have, nor have we, engaged our independent registered public accounting firm to perform an audit of internal control over financial reporting pursuant to the rules of the Commission that permit us to provide only management’s report in this annual report.

Changes in Internal Controls over Financial Reporting

During the period ended November 30, 2008, there has been no change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None.

PART III

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT. |

Officers and Directors

Our sole director will serve until his successor is elected and qualified. Our sole officer is elected by the board of directors to a term of one (1) year and serves until his successor is duly elected and qualified, or until he is removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, address, age and position of our present officer and director is set forth below:

| Name and Address | | Age | | Year Elected/Appointed | | Position(s) |

Matthew Hayden 7582 Windermere Ct. Lake Worth, FL 33467 | | 37 | | August 2008 | | Chief Executive Officer Chief Financial Officer Chairman of the Board |

The person named above has held his offices/positions since our inception and is expected to hold his offices/positions until the next annual meeting of our stockholders.

Background of officers and directors

Matthew Hayden

Mr. Hayden, born in August 1971, age 37, was President and Founder of Hayden Communications Inc. from January 2000 until it was sold in June, 2006. From July 2006 until present Mr. Hayden serves as President of Hayden Communications International, Inc. (HC International). Mr. Hayden performs corporate consulting and communications for companies located in the United States and Worldwide.

Mr. Hayden was appointed as Chairman of the Board on September 23, 2008.

Significant Employees

We have no significant employees other than our sole officer and director, Mr. Hayden.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past five years, none of the following occurred with respect to a present or former director, executive officer, or employee: (i) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (ii) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences); (iii) being subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (iv) being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Audit Committee and Charter

We do not currently have a separately-designated audit committee of the board. The audit committee functions are performed by our board of directors. Our director is not deemed independent. Our director also holds positions as our officers. Our audit committee is responsible for: (1) selection and oversight of our independent accountant; (2) engaging outside advisors; and, (3) funding for the outside auditory and any outside advisors engagement by the audit committee.

Audit Committee Financial Expert

We do not have an audit committee financial expert. We do not have an audit committee financial expert because we believe the cost related to retaining a financial expert at this time is prohibitive. Further, because we have no operations, at the present time, we believe the services of a financial expert are not warranted.

Code of Ethics

We have adopted a corporate code of ethics. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code. A copy of the code of ethics is attached hereto.

Disclosure Committee and Charter

We have a disclosure committee and disclosure committee charter. Our disclosure committee is comprised of our sole officer and director. The purpose of the committee is to provide assistance to the Chief Executive Officer in fulfilling their responsibilities regarding the identification and disclosure of material information about us and the accuracy, completeness and timeliness of our financial reports.

Section 16(a) of the Securities Exchange Act of 1934

As of the date of this report, we are not subject to section 16(a) of the Securities Exchange Act of 1934.

Conflicts of Interest

There are no conflicts of interest. Further, we have not established any policies to deal with possible future conflicts of interest.

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth information with respect to compensation paid by us to our officers and directors during the three most recent fiscal years. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any.

Summary Compensation Table

| | | | | | | | | | | | | | Long Term Compensation | | | | |

| | | Annual Compensation | | | Awards | | | Payouts | | | | |

| (a) | | (b) | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | |

| | | | | | | | | | | Other | | | | | | | | | | | | | |

| | | | | | | | | | | Annual | | | Restricted | | | Securities | | | | | | | |

| | | | | | | | | | | Compen | | | Stock | | | Underlying | | | LTIP | | | All Other | |

| Name and Principal | | | | Salary Bonus | | | sation | | | Award(s) | | | Options / | | | Payouts | | | Compens | |

| Position [1] | | Year | | ($) | | | ($) | | | ($) | | | ($) | | | SARs (#) | | | ($) | | | ation ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Matthew Hayden | | 2008 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| President | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bradley W. Miller | | 2008 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| President | | 2007 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | 2006 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

The following table sets forth information with respect to compensation paid by us to our directors during the last completed fiscal year. Our fiscal year end is November 30, 2008.

Director Compensation Table

| (a) | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | |

| | | | | | | | | | | | | | | Change in | | | | | | | |

| | | | | | | | | | | | | | | Pension | | | | | | | |

| | | Fees | | | | | | | | | | | | Value and | | | | | | | |

| | | Earned | | | | | | | | | Non-Equity | | | Nonqualified | | | All | | | | |

| | | or | | | | | | | | | Incentive | | | Deferred | | | Other | | | | |

| | | Paid in | | | Stock | | | Option | | | Plan | | | Compensation | | | Compen- | | | | |

| | | Cash | | | Awards | | | Awards | | | Compensation | | | Earnings | | | sation | | | Total | |

| Name | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Matthew Hayden | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Bradley W. Miller | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Our directors do not receive any compensation for serving as a member of the board of directors.

There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officers and directors other than as described herein.

Long-Term Incentive Plan Awards

We not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

As of the date hereof, we have not entered into employment contracts with any of our officers and do not intend to enter into any employment contracts until such time as it profitable to do so.

Indemnification

Under our Bylaws, we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney's fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of the date of this annual report, the total number of shares owned beneficially by our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The stockholders listed below have direct ownership of their shares and possesses sole voting and dispositive power with respect to the shares.

| Name and Address | | Number of | | | Percentage of | |

| Beneficial Owner | | Shares Owned | | | Ownership (1) | |

| | | | | | | |

| Matt Hayden | | | 122,800 | | | | .76 | % |

| Bestgrain Limited | | | 9,596,496 | | | | 60.0 | % |

| | | | | | | | | |

| All Officers and Directors | | | 122,800 | | | | .76 | % |

| as a Group (1 person) | | | | | | | | |

[1] The person named above may be deemed to be a "parent" and "promoter" of our company, within the meaning of such terms under the Securities Act of 1933, as amended, by virtue of his direct and indirect stock holdings. Mr. Miller is the only "promoter" of our company.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

None

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

(1) Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for our audit of annual financial statements and review of financial statements included in our quarterly reports or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were:

| 2008 | $ | 9,500 | Malone and Bailey, P.C |

| 2007 | $ | 18,379 | Williams & Webster, P.S., C.P.A. |

(2) Audit-Related Fees

The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountants that are reasonably related to the performance of the audit or review of our financial statements and are not reported in the preceding paragraph:

| | 2008 | $ | -0- | Malone and Bailey, P.C |

| | 2007 | $ | -0- | Williams & Webster, P.S., C.P.A. |

(3) Tax Fees

The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were:

| | 2008 | $ | -0- | Malone and Bailey P.C |

| | 2007 | $ | -0- | Williams & Webster, P.S., C.P.A. |

(4) All Other Fees

The aggregate fees billed in each of the last tow fiscal yeas for the products and services provided by the principal accountant, other than the services reported in paragraphs (1), (2), and (3) was:

| | 2008 | $ | -0- | Malone and Bailey, P.C |

| | 2007 | $ | -0- | Williams & Webster, P.S., C.P.A. |

Our audit committee’s pre-approval policies and procedures described in paragraph (c)(7)(i) of Rule 2-01 of Regulation S-X were that the audit committee pre-approve all accounting related activities prior to the performance of any services by any accountant or auditor.

The percentage of hours expended on the principal accountant’s engagement to audit our financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full time, permanent employees was 0%.

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

| | | | | Incorporated by reference | | |

| | | | | | | | | | | Filed |

| Exhibit | | Document Description | | Form | | Date | | Number | | herewith |

| 3.1 | | Articles of Incorporation. | | SB-2 | | 02-09-07 | | 3.1 | | |

| |

| 3.2 | | Certificate of Amendment to Articles of Incorporation | | | | | | | | X |

| | | | | | | | | | | |

| 3.3 | | Bylaws. | | SB-2 | | 02-09-07 | | 3.2 | | |

| |

| 4.1 | | Specimen Stock Certificate. | | SB-2 | | 02-09-07 | | 4.1 | | |

| |

| 14.1 | | Code of Ethics. | | 10-K | | 03-07-08 | | 14.1 | | |

| |

| 31.1 | | Certification of Principal Executive Officer and Principal | | | | | | | | X |

| | | Financial Officer pursuant to 15d-15(e), promulgated | | | | | | | | |

| | | under the Securities and Exchange Act of 1934, as | | | | | | | | |

| | | amended. | | | | | | | | |

| |

| 32.1 | | Certification pursuant to 18 U.S.C. Section 1350, as | | | | | | | | X |

| | | adopted pursuant to Section 906 of the Sarbanes-Oxley | | | | | | | | |

| | | Act of 2002 (Chief Executive Office and Chief Financial | | | | | | | | |

| | | Officer). | | | | | | | | |

| |

| 99.1 | | Audit Committee Charter. | | 10-K | | 03-07-08 | | 99.1 | | |

| |

| 99.2 | | Disclosure Committee Charter. | | 10-K | | 03-07-08 | | 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing of this Form 10-K and has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on this 20th day of February, 2009.

| SINO CHARTER, INC. | |

| | |

| BY: | /s/ Matthew Hayden | |

| | Matthew Hayden, President, Principal Executive | |

| | Officer, Secretary/Treasurer, Principal Financial | |

| | Officer, Principal Accounting Officer and a member | |

| | of the Board of Directors. | |