To Engage in Business Combination with

To Engage in Business Combination with

KBL Healthcare Acquisition Corp. III (AMEX: KHA) Investor Presentation PRWT Services, Inc. April 30, 2009

2 Interests of the Parties in the Merger KBL HEALTHCARE ACQUISTION CORP. III (“KBL”) AND PRWT SERVICES, INC. (“PRWT”) ARE HOLDING PRESENTATIONS FOR CERTAIN OF KBL’S STOCKHOLDERS, AS WELL AS

2 Interests of the Parties in the Merger KBL HEALTHCARE ACQUISTION CORP. III (“KBL”) AND PRWT SERVICES, INC. (“PRWT”) ARE HOLDING PRESENTATIONS FOR CERTAIN OF KBL’S STOCKHOLDERS, AS WELL AS

OTHER PERSONS WHO MIGHT BE INTERESTED IN PURCHASING KBL SECURITIES, REGARDING THE BUSINESS COMBINATION BETWEEN KBL AND PRWT, AS DESCRIBED IN

THE PRELIMINARY PROXY STATEMENT/PROSPECTUS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 22, 2009, AS SAME IS AMENDED FROM TIME TO

TIME. SUCH PRELIMINARY PROXY STATEMENT/PROSPECTUS, INCLUDING SOME OR ALL OF THE EXHIBITS ATTACHED THERETO, AND THIS PRESENTATION WILL BE

DISTRIBUTED TO PARTICIPANTS AT SUCH PRESENTATIONS. CITIGROUP GLOBAL MARKETS, INC. (“CITIGROUP”), JEFFERIES & COMPANY, INC. (“JEFFERIES”) AND EARLYBIRDCAPITAL, INC. (“EBC”), EACH AN UNDERWRITER OF KBL’S

INITIAL PUBLIC OFFERING (“IPO”) CONSUMMATED IN JULY 2007, ARE ASSISTING KBL IN THESE EFFORTS WITHOUT CHARGE, OTHER THAN THE REIMBURSEMENT OF THEIR

OUT-OF-POCKET EXPENSES. ADDITIONALLY, THE UNDERWRITERS DEFERRED $4,140,000 OF THE COMMISSIONS OWED TO THEM IN CONNECTION WITH THE IPO UNTIL THE

CLOSING OF KBL’S BUSINESS COMBINATION. FURTHER, KBL HEALTHCARE MANAGEMENT, INC. (“KHMI”), AN AFFILIATE OF CERTAIN OF THE EXECUTIVE OFFICERS AND

DIRECTORS OF KBL, HAS ENTERED INTO A GENERAL ADVISORY AGREEMENT WITH PRWT, WHICH WILL BECOME EFFECTIVE UPON CONSUMMATION OF THE BUSINESS

COMBINATION BETWEEN KBL AND PRWT, UNDER WHICH KHMI WOULD BE PAID A FEE OF $250,000 PER YEAR IN CONNECTION WITH SERVICES TO BE RENDERED TO PRWT,

AND CERTAIN OF PRWT’S OFFICERS WILL ENTER INTO NEW EMPLOYMENT AGREEMENTS TO BE EFFECTIVE UPON CONSUMMATION OF THE BUSINESS COMBINATION. KBL AND ITS DIRECTORS AND EXECUTIVE OFFICERS, PRWT AND ITS STOCKHOLDERS, DIRECTORS AND EXECUTIVE OFFICERS, AND THEIR RESPECTIVE AFFILIATES, MAY

ENTER INTO ARRANGEMENTS TO PURCHASE SHARES OF COMMON STOCK AND/OR WARRANTS OF KBL IN OPEN MARKET OR PRIVATELY NEGOTIATED TRANSACTIONS

PRIOR TO THE CONSUMMATION OF THE BUSINESS COMBINATION. KBL AND ITS DIRECTORS AND EXECUTIVE OFFICERS, PRWT AND ITS STOCKHOLDERS, DIRECTORS AND EXECUTIVE OFFICERS, AND EACH OF CITIGROUP, JEFFERIES AND

EBC MAY BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF PROXIES FOR THE SPECIAL MEETING OF KBL STOCKHOLDERS TO BE HELD TO APPROVE THE MERGER. STOCKHOLDERS OF KBL AND OTHER INTERESTED PERSONS ARE ADVISED TO READ KBL’S AND PRWT’S PRELIMINARY PROXY STATEMENT/PROSPECTUS AND, WHEN

AVAILABLE, KBL’S AND PRWT’S DEFINITIVE PROXY STATEMENT/PROSPECTUS IN CONNECTION WITH KBL’S SOLICITATION OF PROXIES FOR THE SPECIAL MEETING BECAUSE

THESE PROXY STATEMENT/PROSPECTUSES WILL CONTAIN IMPORTANT INFORMATION. SUCH PERSONS CAN ALSO READ KBL’S FINAL PROSPECTUS, DATED JULY 19, 2007,

FOR A DESCRIPTION OF THE SECURITY HOLDINGS OF THE KBL OFFICERS AND DIRECTORS AND OF THE UNDERWRITERS AND THEIR RESPECTIVE INTERESTS IN THE

SUCCESSFUL CONSUMMATION OF THIS BUSINESS COMBINATION. THE DEFINITIVE PROXY STATEMENT/PROSPECTUS WILL BE MAILED TO KBL STOCKHOLDERS AS OF THE

RECORD DATE TO VOTE ON THE ACQUISITION. STOCKHOLDERS WILL ALSO BE ABLE TO OBTAIN A COPY OF THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, WITHOUT

CHARGE, BY DIRECTING A REQUEST TO: KBL HEALTHCARE ACQUISTION CORP. IIII, 380 LEXINGTON AVENUE, 31ST FLOOR, NEW YORK, NEW YORK 10168. THE DEFINITIVE

PROXY STATEMENT/PROSPECTUS CAN ALSO BE OBTAINED, WITHOUT CHARGE, AT THE SECURITIES AND EXCHANGE COMMISSION’S INTERNET SITE

(HTTP://WWW.SEC.GOV).

3 Forward-Looking Statements THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS REGARDING KBL’S

3 Forward-Looking Statements THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS REGARDING KBL’S

AND/OR PRWT’S OR THEIR RESPECTIVE MANAGEMENT’S EXPECTATIONS, HOPES, BELIEFS, INTENTIONS OR STRATEGIES REGARDING THE FUTURE. IN ADDITION, ANY

STATEMENTS THAT REFER TO PROJECTIONS, FORECASTS OR OTHER CHARACTERIZATIONS OF FUTURE EVENTS OR CIRCUMSTANCES, INCLUDING ANY UNDERLYING

ASSUMPTIONS, ARE FORWARD-LOOKING STATEMENTS. THE WORDS “ANTICIPATE,” “BELIEVE,” “CONTINUE,” “COULD,” “ESTIMATE,” “EXPECT,” “INTEND,” “MAY,” “MIGHT,” “PLAN,”

“POSSIBLE,” “POTENTIAL,” “PREDICT,” “SHOULD,” “WOULD” AND SIMILAR EXPRESSIONS MAY IDENTIFY FORWARD-LOOKING STATEMENTS, BUT THE ABSENCE OF THESE

WORDS DOES NOT MEAN THAT A STATEMENT IS NOT FORWARD-LOOKING. FORWARD-LOOKING STATEMENTS MAY INCLUDE, FOR EXAMPLE, STATEMENTS ABOUT OUR:

ABILITY TO COMPLETE A COMBINATION WITH ONE OR MORE TARGET BUSINESSES; SUCCESS IN RETAINING OR RECRUITING, OR CHANGES REQUIRED IN, OUR OFFICERS,

KEY EMPLOYEES OR DIRECTORS FOLLOWING A BUSINESS COMBINATION; OUR MANAGEMENT TEAM’S ALLOCATION OF THEIR TIME TO OTHER BUSINESSES AND

POTENTIALLY HAVING CONFLICTS OF INTEREST WITH OUR BUSINESS OR IN APPROVING A BUSINESS COMBINATION; POTENTIAL INABILITY TO OBTAIN ADDITIONAL

FINANCING TO COMPLETE A BUSINESS COMBINATION; AN INABILITY TO SATISFY THE CONDITIONS TO THE BUSINESS COMBINATION; LIMITED POOL OF PROSPECTIVE TARGET

BUSINESSES; POTENTIAL CHANGE IN CONTROL IF WE ACQUIRE ONE OR MORE TARGET BUSINESSES FOR STOCK; PUBLIC SECURITIES’ LIMITED LIQUIDITY AND TRADING;

FAILURE TO LIST OR DELISTING OF OUR SECURITIES FROM THE NYSE AMEX STOCK EXCHANGE OR AN INABILITY TO HAVE OUR SECURITIES LISTED ON THE NASDAQ STOCK

EXCHANGE FOLLOWING A BUSINESS COMBINATION; USE OF PROCEEDS NOT IN TRUST OR AVAILABLE TO US FROM INTEREST INCOME ON THE TRUST ACCOUNT BALANCE;

OUR FINANCIAL PERFORMANCE FOLLOWING THE BUSINESS COMBINATION; PRWT’S INABILITY TO ACHIEVE ITS BUSINESS OBJECTIVES OR IMPLEMENT ITS STRATEGIES OR

MAINTAIN ITS MINORITY COMPANY CERTIFCATIONS; OR AN INABILITY TO SECURE CONTRACTS CURRENTLY BEING NEGOTIATED OR TO BE NEGOTIATED IN THE FUTURE. THE FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION ARE BASED ON OUR CURRENT EXPECTATIONS AND BELIEFS CONCERNING FUTURE

DEVELOPMENTS AND THEIR POTENTIAL EFFECTS ON US. THERE CAN BE NO ASSURANCE THAT FUTURE DEVELOPMENTS AFFECTING US WILL BE THOSE THAT WE HAVE

ANTICIPATED. THESE FORWARD-LOOKING STATEMENTS INVOLVE A NUMBER OF RISKS, UNCERTAINTIES (SOME OF WHICH ARE BEYOND OUR CONTROL) OR OTHER

ASSUMPTIONS THAT MAY CAUSE ACTUAL RESULTS OR PERFORMANCE TO BE MATERIALLY DIFFERENT FROM THOSE EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING

STATEMENTS. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO, THOSE FACTORS DESCRIBED UNDER THE HEADING “RISK FACTORS.” SHOULD ONE OR

MORE OF THESE RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD ANY OF OUR ASSUMPTIONS PROVE INCORRECT, ACTUAL RESULTS MAY VARY IN MATERIAL

RESPECTS FROM THOSE PROJECTED IN THESE FORWARD-LOOKING STATEMENTS. WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING

STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS MAY BE REQUIRED UNDER APPLICABLE SECURITIES LAWS

AND/OR IF AND WHEN MANAGEMENT KNOWS OR HAS A REASONABLE BASIS ON WHICH TO CONCLUDE THAT PREVIOUSLY DISCLOSED PROJECTIONS ARE NO LONGER

REASONABLY ATTAINABLE. THIS CURRENT REPORT AND THE EXHIBITS HERETO INCLUDES CERTAIN FINANCIAL INFORMATION NOT DERIVED IN ACCORDANCE WITH GENERALLY ACCEPTED

ACCOUNTING PRINCIPLES ("GAAP"). KBL AND PRWT BELIEVE THAT THE PRESENTATION OF THESE NON-GAAP MEASURES PROVIDE INFORMATION THAT IS USEFUL TO

INVESTORS. WE HAVE INCLUDED A RECONCILIATION OF THIS INFORMATION TO THE MOST COMPARABLE GAAP MEASURES WHERE APPLICABLE.

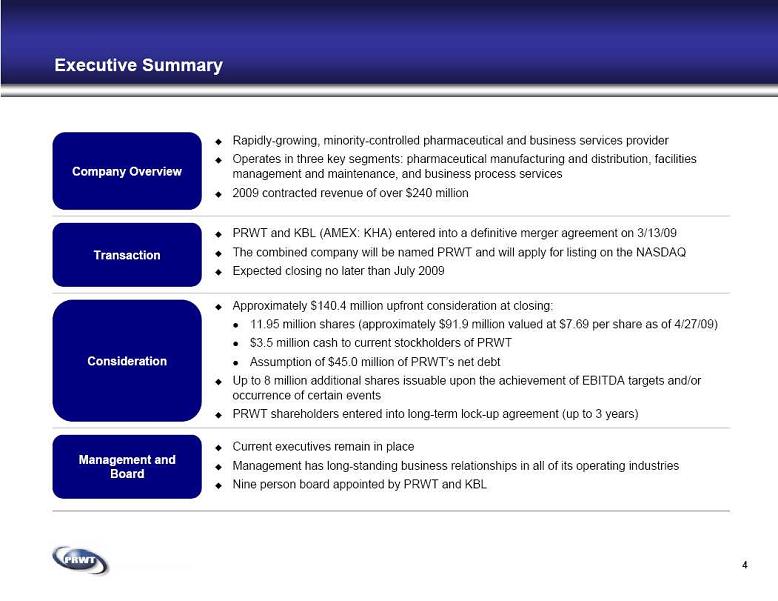

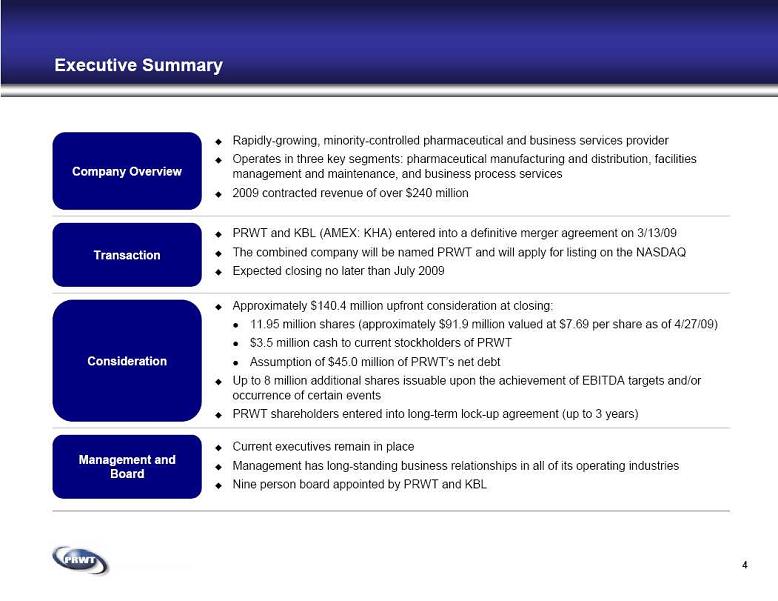

Executive Summary Transaction Consideration Management and

Executive Summary Transaction Consideration Management and

Board PRWT and KBL (AMEX: KHA) entered into a definitive merger agreement on 3/13/09 The combined company will be named PRWT and will apply for listing on the NASDAQ Expected closing no later than July 2009 Approximately $140.4 million upfront consideration at closing: 11.95 million shares (approximately $91.9 million valued at $7.69 per share as of 4/27/09) $3.5 million cash to current stockholders of PRWT Assumption of $45.0 million of PRWT’s net debt Up to 8 million additional shares issuable upon the achievement of EBITDA targets and/or

occurrence of certain events PRWT shareholders entered into long-term lock-up agreement (up to 3 years) Current executives remain in place Management has long-standing business relationships in all of its operating industries Nine person board appointed by PRWT and KBL Company Overview Rapidly-growing, minority-controlled pharmaceutical and business services provider Operates in three key segments: pharmaceutical manufacturing and distribution, facilities

management and maintenance, and business process services 2009 contracted revenue of over $240 million 4

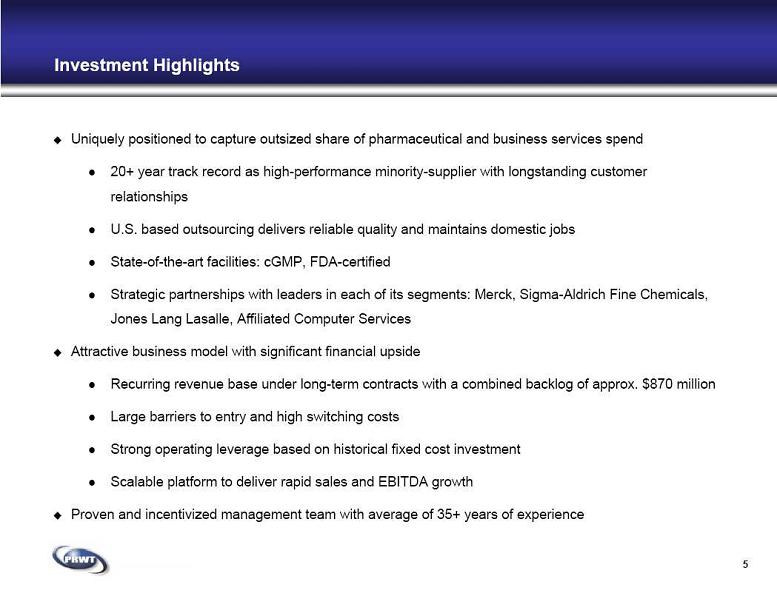

Investment Highlights Uniquely positioned to capture outsized share of pharmaceutical and business services spend 20+ year track record as high-performance minority-supplier with longstanding customer

Investment Highlights Uniquely positioned to capture outsized share of pharmaceutical and business services spend 20+ year track record as high-performance minority-supplier with longstanding customer

relationships U.S. based outsourcing delivers reliable quality and maintains domestic jobs State-of-the-art facilities: cGMP, FDA-certified Strategic partnerships with leaders in each of its segments: Merck, Sigma-Aldrich Fine Chemicals,

Jones Lang Lasalle, Affiliated Computer Services Attractive business model with significant financial upside Recurring revenue base under long-term contracts with a combined backlog of approx. $870 million Large barriers to entry and high switching costs Strong operating leverage based on historical fixed cost investment Scalable platform to deliver rapid sales and EBITDA growth Proven and incentivized management team with average of 35+ years of experience 5

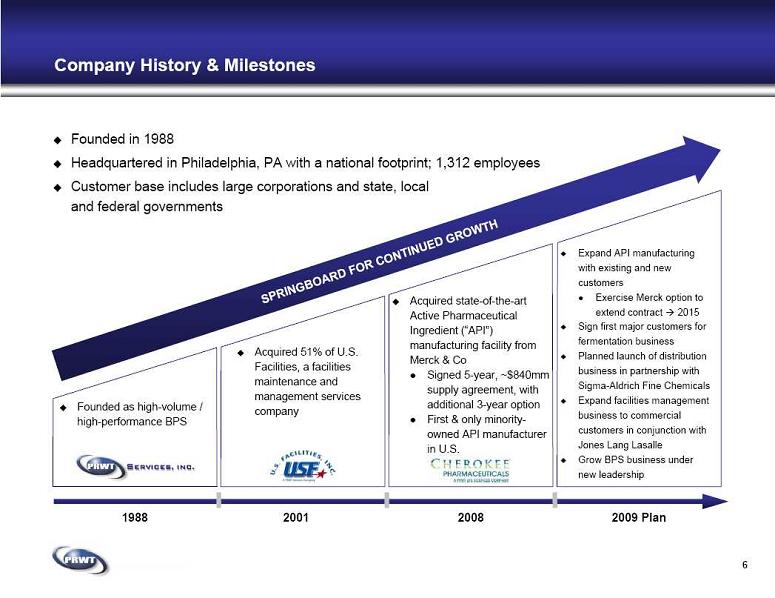

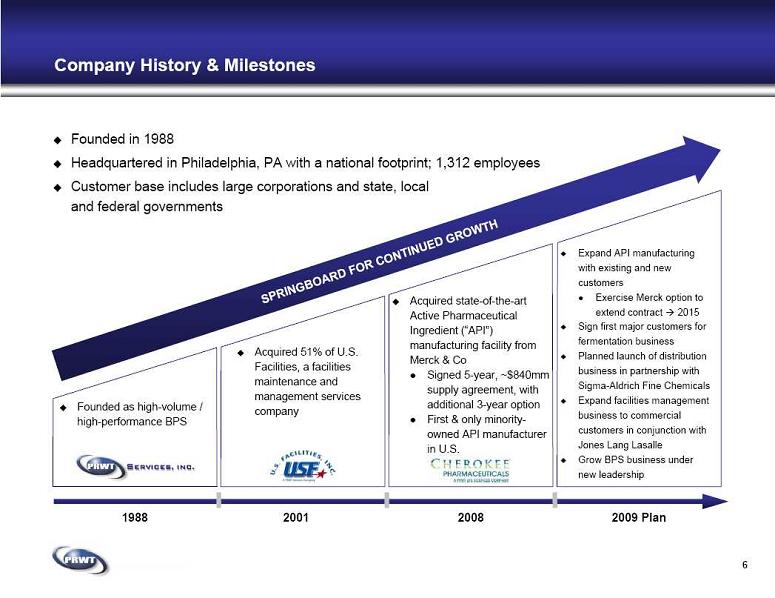

Company History & Milestones 1988 2008 Acquired 51% of U.S.

Company History & Milestones 1988 2008 Acquired 51% of U.S.

Facilities, a facilities

maintenance and

management services

company Acquired state-of-the-art

Active Pharmaceutical

Ingredient (“API”)

manufacturing facility from

Merck & Co Signed 5-year, ~$840mm

supply agreement, with

additional 3-year option First & only minority-

owned API manufacturer

in U.S. 2001 2009 Plan Founded as high-volume /

high-performance BPS 6 Expand API manufacturing

with existing and new

customers Exercise Merck option to

extend contract 2015 Sign first major customers for

fermentation business Planned launch of distribution

business in partnership with

Sigma-Aldrich Fine Chemicals Expand facilities management

business to commercial

customers in conjunction with

Jones Lang Lasalle Grow BPS business under

new leadership Founded in 1988 Headquartered in Philadelphia, PA with a national footprint; 1,312 employees Customer base includes large corporations and state, local

and federal governments

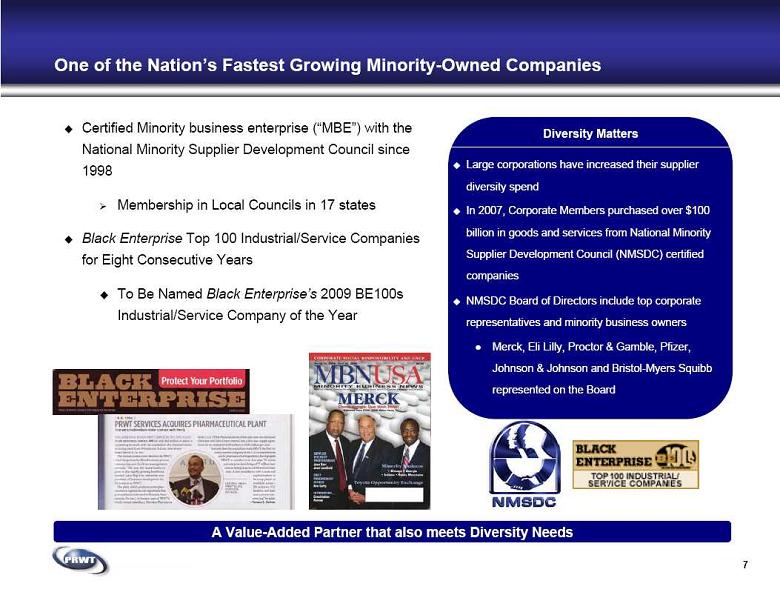

7 One of the Nation’s Fastest Growing Minority-Owned Companies Certified Minority business enterprise (“MBE”) with the

7 One of the Nation’s Fastest Growing Minority-Owned Companies Certified Minority business enterprise (“MBE”) with the

National Minority Supplier Development Council since

1998 Membership in Local Councils in 17 states Black Enterprise Top 100 Industrial/Service Companies

for Eight Consecutive Years To Be Named Black Enterprise’s 2009 BE100s

Industrial/Service Company of the Year A Value-Added Partner that also meets Diversity Needs Diversity Matters Large corporations have increased their supplier

diversity spend In 2007, Corporate Members purchased over $100

billion in goods and services from National Minority

Supplier Development Council (NMSDC) certified

companies NMSDC Board of Directors include top corporate

representatives and minority business owners Merck, Eli Lilly, Proctor & Gamble, Pfizer,

Johnson & Johnson and Bristol-Myers Squibb

represented on the Board

Financial Overview REVENUE Cherokee Pharmaceuticals U.S. Facilities BPS EBITDA ($ in millions) ($ in millions) Contingent EBITDA

Financial Overview REVENUE Cherokee Pharmaceuticals U.S. Facilities BPS EBITDA ($ in millions) ($ in millions) Contingent EBITDA

Payment Targets Adjusted EBITDA Note: See Appendix for reconciliation from net loss to Adjusted EBITDA. “Contingent EBITDA payment targets” means EBITDA adjusted to (i) exclude foreign exchange gains and losses and

extraordinary items, costs and expenses incurred in initially implementing and establishing compliance with the Sarbanes-Oxley Act of 2002 and income from debt forgiveness or cancellation

and (ii) to give effect to an imputed capital charge equal to 12.5% of the aggregate consideration paid in any acquisition of a business or assets subsequent to the merger (but shall exclude

certain other costs relating to any such acquisition). Contingent EBITDA payment targets are presented because they are being used to determine the release of escrowed shares to existing

PRWT stockholders based on the combined entity meeting these targets. 8 // // $241mm

contracted

revenue

9 Management Willie Johnson, Founder / Chairman 18 years Cmmr, PA Office of Social

9 Management Willie Johnson, Founder / Chairman 18 years Cmmr, PA Office of Social

Services Former owner / CEO, Fidelity Systems Jerry Johnson, Vice Chairman Chairman, Radnor Trust Holdings Former EVP, Safeguard Scientifics (NYSE:

SFE) Harold Epps, President & CEO President since Nov 2007;

CEO since Oct 2008 Former VP, Quadrant-EPP Murvin Lackey, President, Cherokee Distribution Former VP, GlaxoSmithKline Formerly held senior positions at AMOCO,

Digital Equipment Corp. Mark Schweiker, President, PRWT - BPS Former PA Governor & Lieutenant Gov. Former President & CEO, Greater

Philadelphia Chamber of Commerce George Burrell , EVP & General Counsel Former CEO, Innovation Philadelphia Former Secretary of External Affairs for the

City of Philadelphia John McCarey, EVP / CFO Former CFO, Lockheed Martin IMS Former corporate SVP of finance and EVP,

ACS Government Solutions John Elliot, President, Cherokee Pharma President of Cherokee since 2008 Prior 25-year career at GlaxoSmithKline, most

recently as Senior Vice President James Dobrowolski, President,

U.S. Facilities Former President, Halifax Technical

Services Skip Lee, EVP, Business Development Former SVP, TSS; Former SVP (M&A),

ACS; Former Senior positions at Lockheed

Martin IMS Note: Chairman Willie Johnson and Vice Chairman Jerry Johnson are not related. Mark Schweiker expected to begin in July 2009.

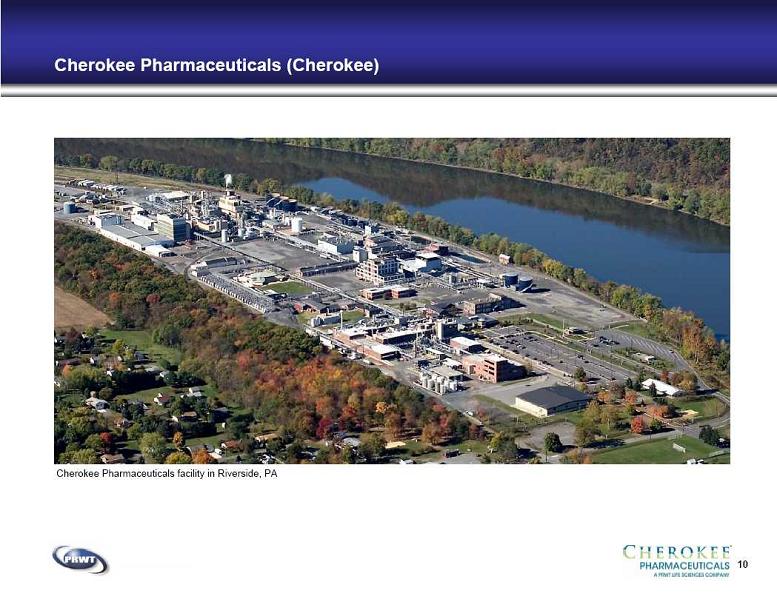

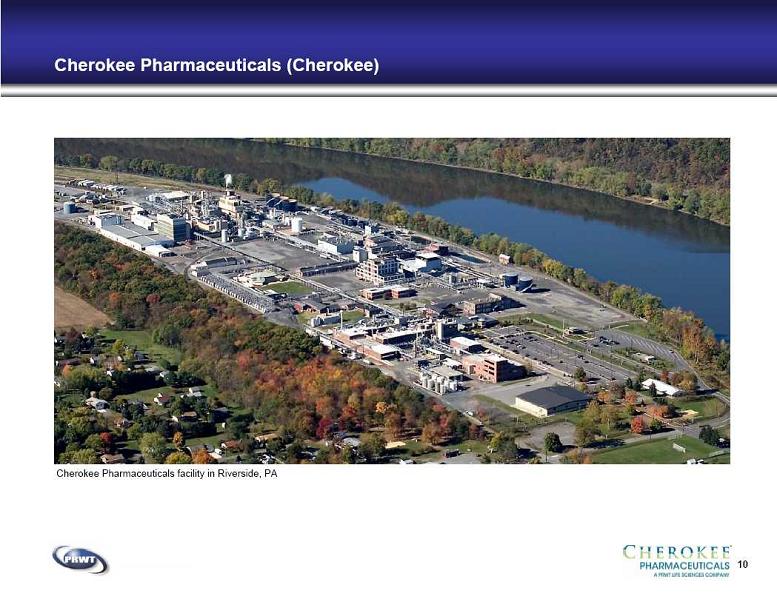

10 Cherokee Pharmaceuticals (Cherokee) Cherokee Pharmaceuticals facility in Riverside, PA

10 Cherokee Pharmaceuticals (Cherokee) Cherokee Pharmaceuticals facility in Riverside, PA

Three factories provide varied API manufacturing capabilities to pursue multiple products (antibiotics,

Three factories provide varied API manufacturing capabilities to pursue multiple products (antibiotics,

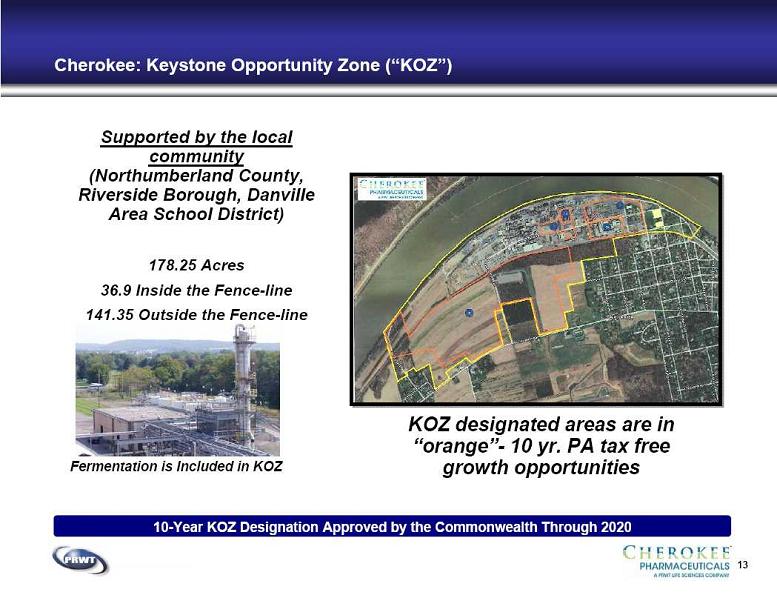

animal health & crop production, and multi-purpose APIs) Two factories produce APIs with complex chemistry, know-how and dedicated facilities not easily replicable; barrier to entry 11 Cherokee: Manufacturing and Distribution Facilities I. SCALE II. API MANUFACTURING III. KILO-SCALE MANUFACTURING IV. FERMENTATION V. DISTRIBUTION VI. RESEARCH & DEVELOPMENT 340 acres with 105 buildings Management team with 20+ years experience; 400+ workforce Producing cGMP APIs for 58 years with excellent FDA, environmental and safety compliance track record Keystone Opportunity Zone (“KOZ”) designation for PA tax free thru 2020 2 facilities to manufacture clinical scale supplies under full cGMP controls Completely built out fermentation facility with 43 fermentors, including 20 underutilized 20,000 gallon

fermentors (part of KOZ zone – PA tax free thru 2020) 10 underutilized warehouses with differing configurations Sophisticated capabilities for specialized handling, testing and storage Ample laboratory space and capacity from raw material testing, in process quality control, quality

control through final product release

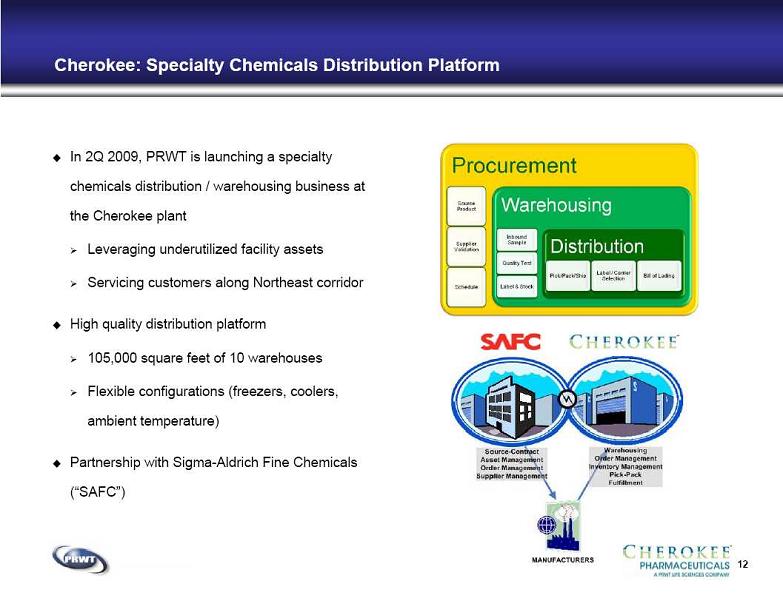

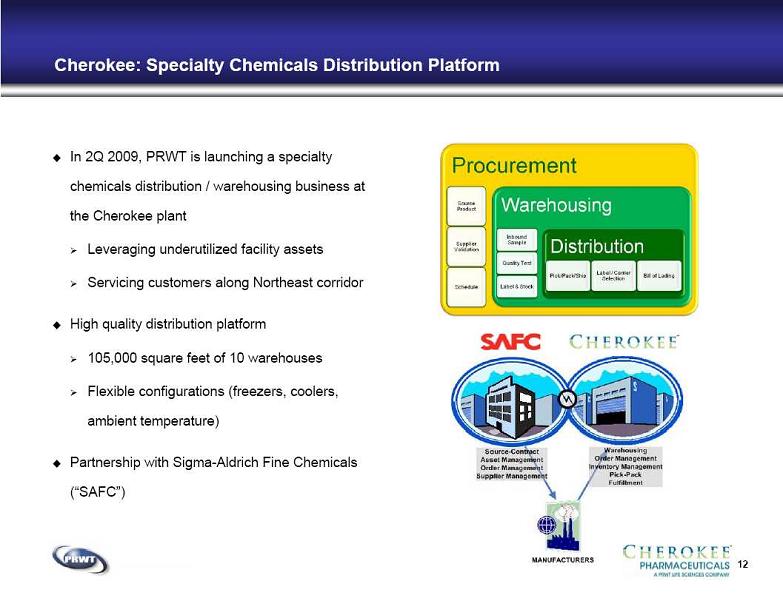

12 Cherokee: Specialty Chemicals Distribution Platform In 2Q 2009, PRWT is launching a specialty

12 Cherokee: Specialty Chemicals Distribution Platform In 2Q 2009, PRWT is launching a specialty

chemicals distribution / warehousing business at

the Cherokee plant Leveraging underutilized facility assets Servicing customers along Northeast corridor High quality distribution platform 105,000 square feet of 10 warehouses Flexible configurations (freezers, coolers,

ambient temperature) Partnership with Sigma-Aldrich Fine Chemicals

(“SAFC”)

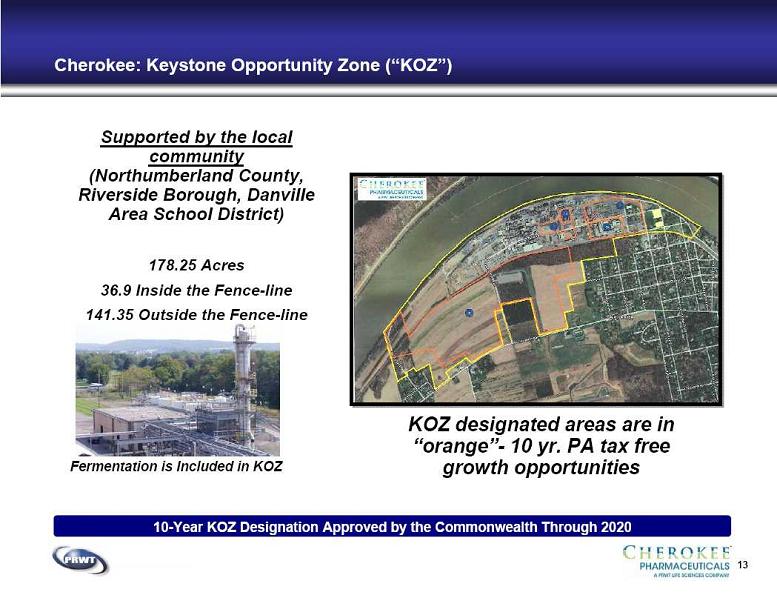

13 Cherokee: Keystone Opportunity Zone (“KOZ”) KOZ designated areas are in

13 Cherokee: Keystone Opportunity Zone (“KOZ”) KOZ designated areas are in

“orange”- 10 yr. PA tax free

growth opportunities Fermentation is Included in KOZ Supported by the local

community

(Northumberland County,

Riverside Borough, Danville

Area School District) 178.25 Acres 36.9 Inside the Fence-line 141.35 Outside the Fence-line 10-Year KOZ Designation Approved by the Commonwealth Through 2020

14 Cherokee: Growth Strategy Increase API

14 Cherokee: Growth Strategy Increase API

Manufacturing Volume Increase

Fermentation Volume Increase

Kilo-Scale Production Authorized Generics Launch Distribution

Business with SAFC Two kilo-scale facilities for complex investigational APIs Attract pharma / biotech customers for clinical scale R&D Longer term opportunity to acquire, re-label and produce off-patent products Requisite infrastructure in place to explore feasibility Large-scale, significantly underutilized fermentation facility (43 fermentors) Negotiating long-term contract from leading chemicals customer to utilize up to 35% capacity Expand into Other Supply

Chain Segments Expand into other segments of pharmaceutical contract manufacturing supply chain Fill / finish dosage forms, packaging, etc. are potential opportunities Increase API antibiotic production from Merck (Factory 7) Fill Factory 61 underutilized capacity and complete multi-campaign expansion Increase crop protection production from $19B global crop science company (Factory 6) –

(contract amendments in negotiation to triple volume thru 2016) Distribution partnership with Sigma-Aldrich Fine Chemicals (“SAFC”) – (launching in second

quarter 2009) 105,000 square feet of available space to service customers in Northeast corridor Multiple growth paths to rapidly expand scale and scope of pharmaceutical operations

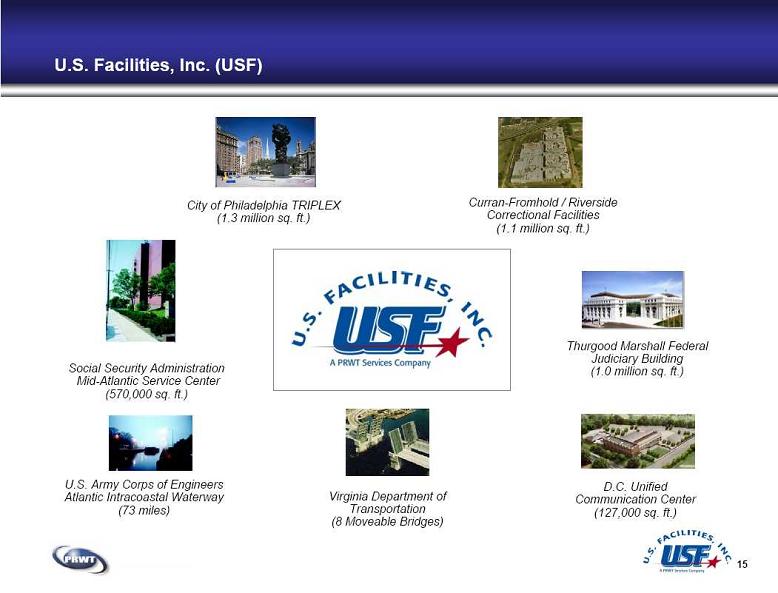

U.S. Facilities, Inc. (USF) City of Philadelphia TRIPLEX

U.S. Facilities, Inc. (USF) City of Philadelphia TRIPLEX

(1.3 million sq. ft.) Curran-Fromhold / Riverside

Correctional Facilities

(1.1 million sq. ft.) Social Security Administration

Mid-Atlantic Service Center

(570,000 sq. ft.) Thurgood Marshall Federal

Judiciary Building

(1.0 million sq. ft.) Virginia Department of

Transportation

(8 Moveable Bridges) D.C. Unified

Communication Center

(127,000 sq. ft.) U.S. Army Corps of Engineers

Atlantic Intracoastal Waterway

(73 miles)

15

16 USF: A Facilities Management Services Provider since 1967 Solid history of performance as the prime contractor – Maintaining over 4 million square feet OPERATIONS MAINTENANCE & REPAIR SUPPORT SERVICES Professional facilities management and maintenance services focusing on complex and highly secure

16 USF: A Facilities Management Services Provider since 1967 Solid history of performance as the prime contractor – Maintaining over 4 million square feet OPERATIONS MAINTENANCE & REPAIR SUPPORT SERVICES Professional facilities management and maintenance services focusing on complex and highly secure

maintenance and management projects Equipment Systems Boiler & Chiller Plants Bridges & Navigation Systems Warehouse & Logistics Facilities Facility Equipment Building Systems & Structures Security & Life-Safety Systems Pavements & Outdoor Structures Custodial & Related Services Physical & Electronic Security Trash Removal & Recycling Project Management Integrated Pest Management Mailroom & Messenger Services Building Alteration & Construction

USF: Growth Strategy Expand facilities management services to commercial/life sciences customers: Leverage Cherokee success to gain entrance into the life sciences market USF has been awarded its first commercial contract, teamed with Jones Lang Lasalle, a global

USF: Growth Strategy Expand facilities management services to commercial/life sciences customers: Leverage Cherokee success to gain entrance into the life sciences market USF has been awarded its first commercial contract, teamed with Jones Lang Lasalle, a global

facilities management company, for joint coverage of a major commercial account Expand facilities management services to federal government customers: Proven track record with federal clients as evidenced by its Social Security Administration and Army

Corp. of Engineer long-term contracts and relationships Recently placed on GSA schedules for facilities management services in late 2008 and will pursue

additional facilities management opportunities in the federal space Continue geographic growth with federal, state and local customers: Expanded Philadelphia and Virginia geographic base with entrance into the Washington D.C. market

(Thurgood Marshall Federal Judiciary Building and D.C. Communication Center awards in 2006) USF will seek to continue its growth geographically 17

18 PRWT Services, Inc. (BPS) Manual toll operations on 4 bridges Over $6 billion enterprise value BPS provider

18 PRWT Services, Inc. (BPS) Manual toll operations on 4 bridges Over $6 billion enterprise value BPS provider

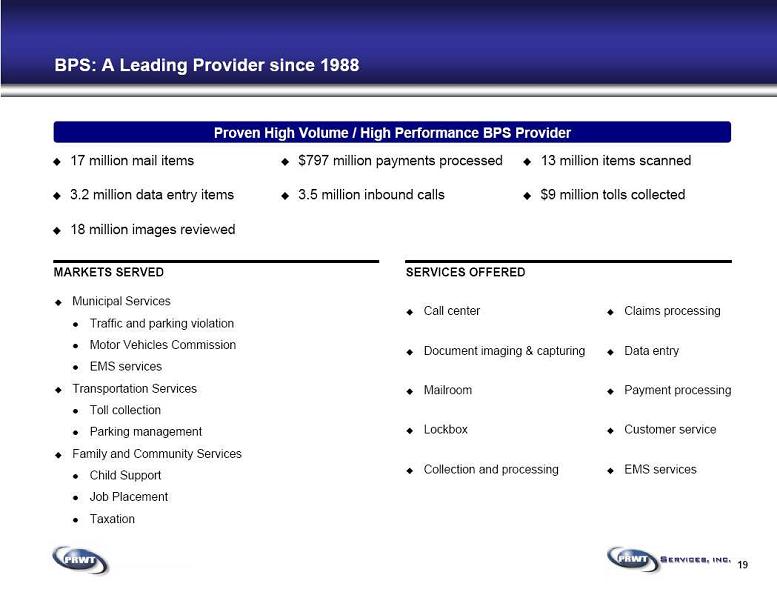

19 BPS: A Leading Provider since 1988 Proven High Volume / High Performance BPS Provider 17 million mail items 3.2 million data entry items 18 million images reviewed $797 million payments processed 3.5 million inbound calls 13 million items scanned $9 million tolls collected MARKETS SERVED SERVICES OFFERED Municipal Services Traffic and parking violation Motor Vehicles Commission EMS services Transportation Services Toll collection Parking management Family and Community Services Child Support Job Placement Taxation Call center Document imaging & capturing Mailroom Lockbox Collection and processing Claims processing Data entry Payment processing Customer service EMS services

19 BPS: A Leading Provider since 1988 Proven High Volume / High Performance BPS Provider 17 million mail items 3.2 million data entry items 18 million images reviewed $797 million payments processed 3.5 million inbound calls 13 million items scanned $9 million tolls collected MARKETS SERVED SERVICES OFFERED Municipal Services Traffic and parking violation Motor Vehicles Commission EMS services Transportation Services Toll collection Parking management Family and Community Services Child Support Job Placement Taxation Call center Document imaging & capturing Mailroom Lockbox Collection and processing Claims processing Data entry Payment processing Customer service EMS services

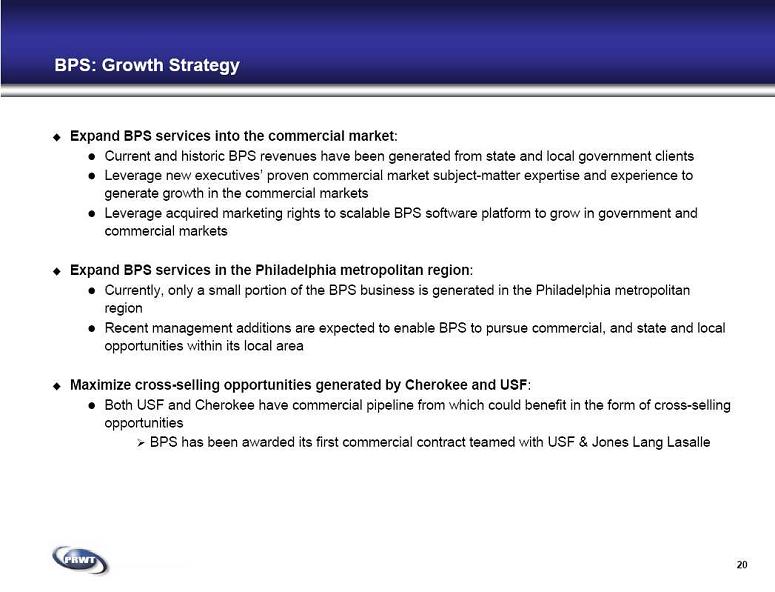

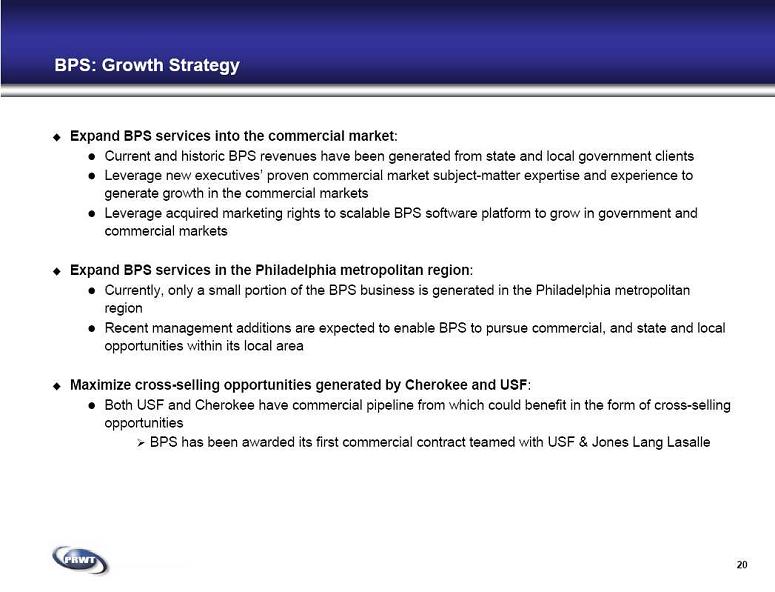

BPS: Growth Strategy Expand BPS services into the commercial market: Current and historic BPS revenues have been generated from state and local government clients Leverage new executives’ proven commercial market subject-matter expertise and experience to

BPS: Growth Strategy Expand BPS services into the commercial market: Current and historic BPS revenues have been generated from state and local government clients Leverage new executives’ proven commercial market subject-matter expertise and experience to

generate growth in the commercial markets Leverage acquired marketing rights to scalable BPS software platform to grow in government and

commercial markets Expand BPS services in the Philadelphia metropolitan region: Currently, only a small portion of the BPS business is generated in the Philadelphia metropolitan

region Recent management additions are expected to enable BPS to pursue commercial, and state and local

opportunities within its local area Maximize cross-selling opportunities generated by Cherokee and USF: Both USF and Cherokee have commercial pipeline from which could benefit in the form of cross-selling

opportunities BPS has been awarded its first commercial contract teamed with USF & Jones Lang Lasalle 20

Case Study: The PRWT Advantage 21 Global pharmaceutical company put management of all U.S. facilities out for competitive bid PRWT had several competitive advantages: Track record of service excellence at USF and BPS Successful experience managing pharmaceutical operations at Cherokee High level relationships at customer Ability for customer to earn minority spend credit PRWT partnered with Jones Lang Lasalle (“JLL”) on bid JLL chose PRWT as its preferred partner based on the above PRWT / JLL won contract – planned start date June 2009 USF to provide facilities management services BPS to provide mailroom and document services PRWT / JLL partnership positioned to capture future business

Case Study: The PRWT Advantage 21 Global pharmaceutical company put management of all U.S. facilities out for competitive bid PRWT had several competitive advantages: Track record of service excellence at USF and BPS Successful experience managing pharmaceutical operations at Cherokee High level relationships at customer Ability for customer to earn minority spend credit PRWT partnered with Jones Lang Lasalle (“JLL”) on bid JLL chose PRWT as its preferred partner based on the above PRWT / JLL won contract – planned start date June 2009 USF to provide facilities management services BPS to provide mailroom and document services PRWT / JLL partnership positioned to capture future business

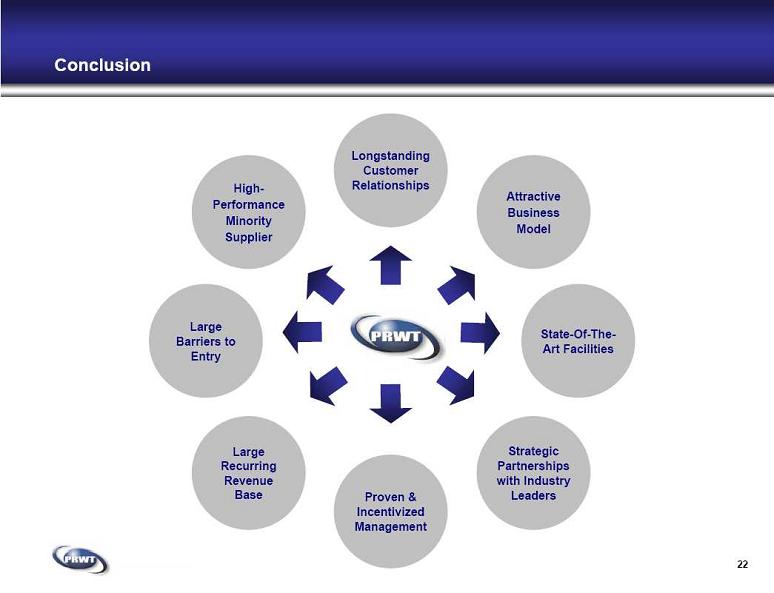

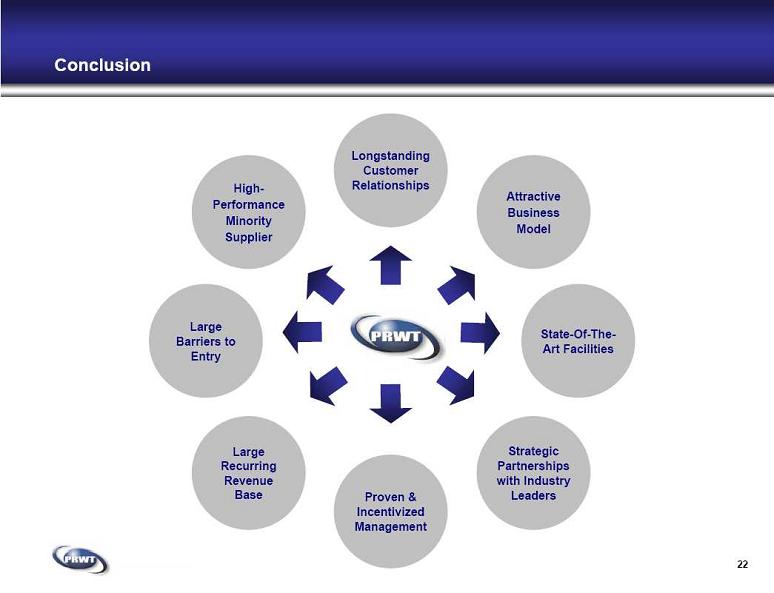

Conclusion Strategic

Conclusion Strategic

Partnerships

with Industry

Leaders Proven &

Incentivized

Management Large

Recurring

Revenue

Base Large

Barriers to

Entry Longstanding

Customer

Relationships State-Of-The-

Art Facilities High-

Performance

Minority

Supplier Attractive

Business

Model 22

23 Appendix PRWT Services, Inc.

23 Appendix PRWT Services, Inc.

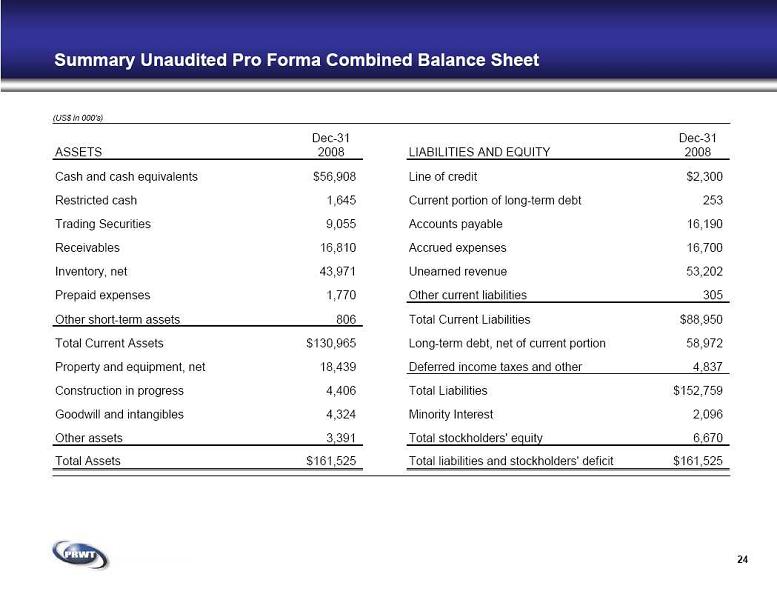

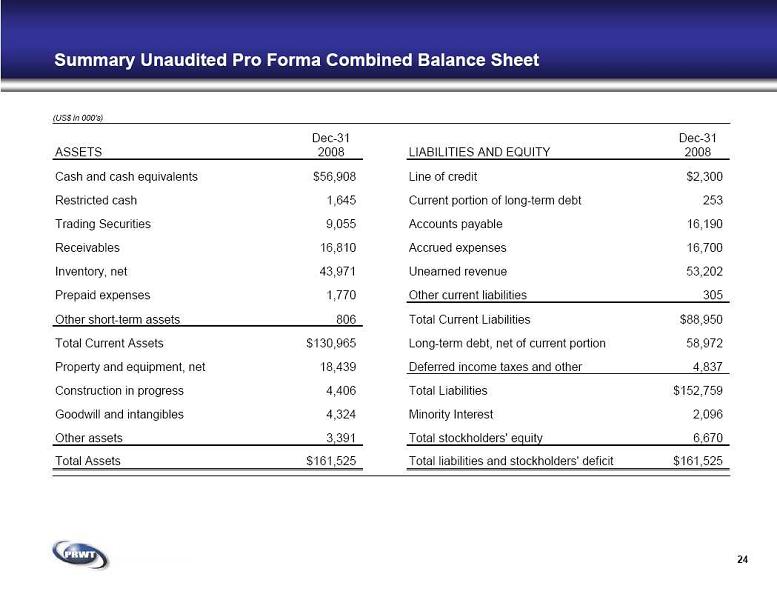

24 Summary Unaudited Pro Forma Combined Balance Sheet (US$ in 000’s) ASSETS Dec-31 2008 Cash and cash equivalents $56,908 Restricted cash 1,645 Trading Securities 9,055 Receivables 16,810 Inventory, net 43,971 Prepaid expenses 1,770 Other short-term assets 806 Total Current Assets $130,965 Property and equipment, net 18,439 Construction in progress 4,406 Goodwill and intangibles 4,324 Other assets 3,391 Total Assets $161,525 LIABILITIES AND EQUITY Dec-31 2008 Line of credit $2,300 Current portion of long-term debt 253 Accounts payable 16,190 Accrued expenses 16,700 Unearned revenue 53,202 Other current liabilities 305 Total Current Liabilities $88,950 Long-term debt, net of current portion 58,972 Deferred income taxes and other 4,837 Total Liabilities $152,759 Minority Interest 2,096 Total stockholders' equity 6,670 Total liabilities and stockholders' deficit $161,525

24 Summary Unaudited Pro Forma Combined Balance Sheet (US$ in 000’s) ASSETS Dec-31 2008 Cash and cash equivalents $56,908 Restricted cash 1,645 Trading Securities 9,055 Receivables 16,810 Inventory, net 43,971 Prepaid expenses 1,770 Other short-term assets 806 Total Current Assets $130,965 Property and equipment, net 18,439 Construction in progress 4,406 Goodwill and intangibles 4,324 Other assets 3,391 Total Assets $161,525 LIABILITIES AND EQUITY Dec-31 2008 Line of credit $2,300 Current portion of long-term debt 253 Accounts payable 16,190 Accrued expenses 16,700 Unearned revenue 53,202 Other current liabilities 305 Total Current Liabilities $88,950 Long-term debt, net of current portion 58,972 Deferred income taxes and other 4,837 Total Liabilities $152,759 Minority Interest 2,096 Total stockholders' equity 6,670 Total liabilities and stockholders' deficit $161,525

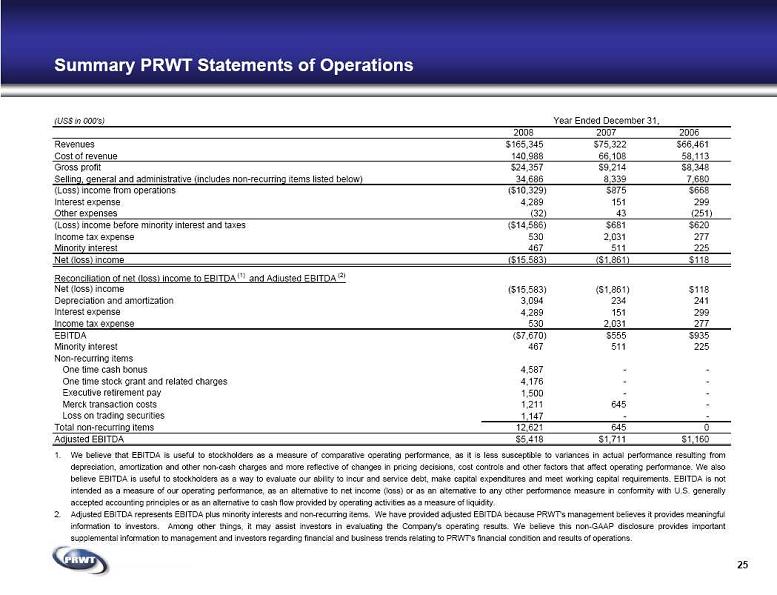

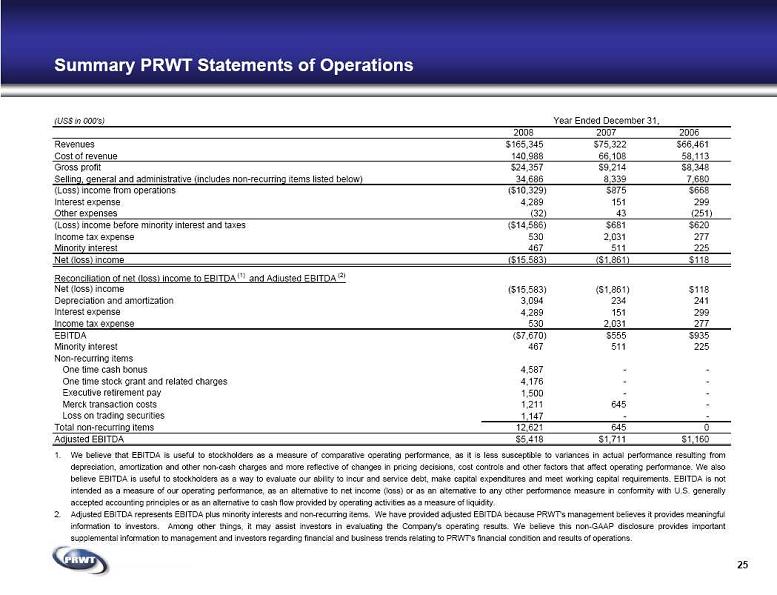

25 Summary PRWT Statements of Operations 1. We believe that EBITDA is useful to stockholders as a measure of comparative operating performance, as it is less susceptible to variances in actual performance resulting from

25 Summary PRWT Statements of Operations 1. We believe that EBITDA is useful to stockholders as a measure of comparative operating performance, as it is less susceptible to variances in actual performance resulting from

depreciation, amortization and other non-cash charges and more reflective of changes in pricing decisions, cost controls and other factors that affect operating performance. We also

believe EBITDA is useful to stockholders as a way to evaluate our ability to incur and service debt, make capital expenditures and meet working capital requirements. EBITDA is not

intended as a measure of our operating performance, as an alternative to net income (loss) or as an alternative to any other performance measure in conformity with U.S. generally

accepted accounting principles or as an alternative to cash flow provided by operating activities as a measure of liquidity. 2. Adjusted EBITDA represents EBITDA plus minority interests and non-recurring items. We have provided adjusted EBITDA because PRWT's management believes it provides meaningful

information to investors. Among other things, it may assist investors in evaluating the Company's operating results. We believe this non-GAAP disclosure provides important

supplemental information to management and investors regarding financial and business trends relating to PRWT's financial condition and results of operations. (US$ in 000's) Year Ended December 31, 2008 2007 2006 Revenues $165,345 $75,322 $66,461 Cost of revenue 140,988 66,108 58,113 Gross profit $24,357 $9,214 $8,348 Selling, general and administrative (includes non-recurring items listed below) 34,686 8,339 7,680 (Loss) income from operations ($10,329) $875 $668 Interest expense 4,289 151 299 Other expenses (32) 43 (251) (Loss) income before minority interest and taxes ($14,586) $681 $620 Income tax expense 530 2,031 277 Minority interest 467 511 225 Net (loss) income ($15,583) ($1,861) $118 Reconciliation of net (loss) income to EBITDA (1) and Adjusted EBITDA (2) Net (loss) income ($15,583) ($1,861) $118 Depreciation and amortization 3,094 234 241 Interest expense 4,289 151 299 Income tax expense 530 2,031 277 EBITDA ($7,670) $555 $935 Minority interest 467 511 225 Non-recurring items One time cash bonus 4,587 - - One time stock grant and related charges 4,176 - - Executive retirement pay 1,500 - - Merck transaction costs 1,211 645 - Loss on trading securities 1,147 - - Total non-recurring items 12,621 645 0 Adjusted EBITDA $5,418 $1,711 $1,160

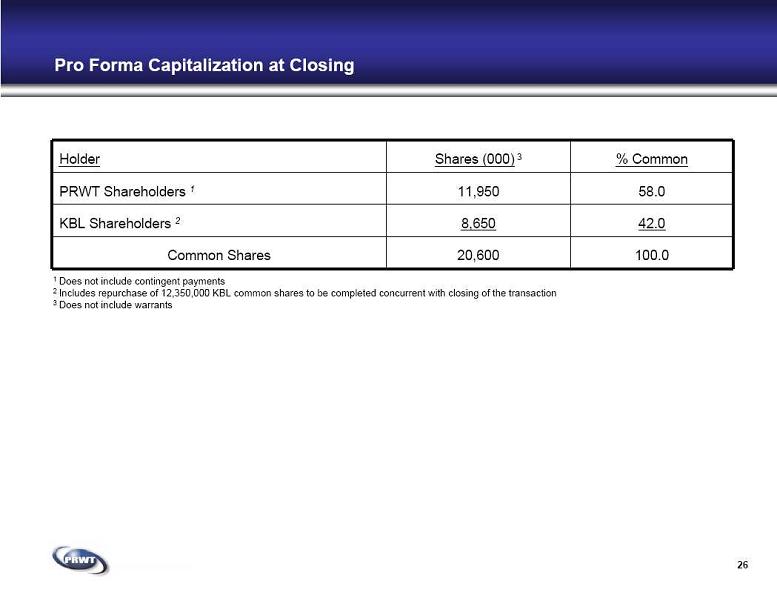

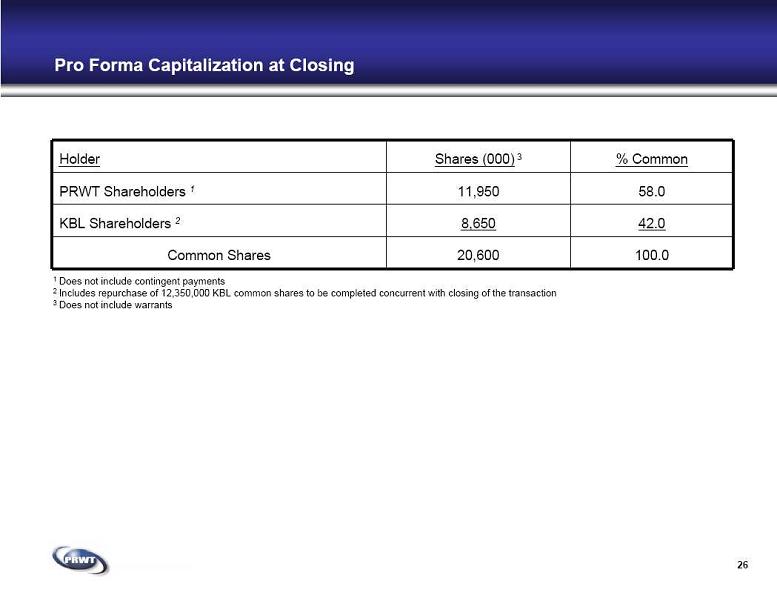

26 Pro Forma Capitalization at Closing Holder Shares (000) 3 % Common PRWT Shareholders 1 11,950 58.0 KBL Shareholders 2 8,650 42.0 Common Shares 20,600 100.0 1 Does not include contingent payments 2 Includes repurchase of 12,350,000 KBL common shares to be completed concurrent with closing of the transaction 3 Does not include warrants

26 Pro Forma Capitalization at Closing Holder Shares (000) 3 % Common PRWT Shareholders 1 11,950 58.0 KBL Shareholders 2 8,650 42.0 Common Shares 20,600 100.0 1 Does not include contingent payments 2 Includes repurchase of 12,350,000 KBL common shares to be completed concurrent with closing of the transaction 3 Does not include warrants

27 About KBL Healthcare Acquisition Corp. III KBL Healthcare Acquisition Corp. III, a special purpose acquisition company ( “SPAC”), was formed in 2007 solely to

27 About KBL Healthcare Acquisition Corp. III KBL Healthcare Acquisition Corp. III, a special purpose acquisition company ( “SPAC”), was formed in 2007 solely to

make an acquisition of a healthcare or healthcare-related company KBL’s third SPAC initial public offering (“IPO”) after completing two successful SPAC transactions July 2007 IPO led by Citi raised $138 million in capital: 17.25 million units (1 common share and 1 warrant) at $8.00 Units, common shares and warrants trade on AMEX under tickers “ KHA.U”, “KHA” and “KHA.WS”, respectively Three principal directors and shareholders: Marlene Krauss

CEO Zachary Berk

Chairman COO and Director of KBL II and III Managing Director of KBL Healthcare Ventures Board of Directors of Remon Medical Technologies and Chairman of Scandius BioMedical Co-founder of Lumenos BS University of Virginia, MBA Harvard Business School Michael Kaswan

COO Chairman and President of KBL II and III; VP, Treasurer of KBL I; Director of Concord Health Managing Director of KBL Healthcare Ventures Chairman and CEO of Prolong Pharmaceuticals Co-founder and director of Lumenos BS Pacific University, Doctorate of Optometry Pacific University CEO / Director of KBL I, II and III; Chairman of Concord Health and Summer Infant Managing Director of KBL Healthcare Ventures Board of Directors of CardioFocus, PneumRx, Prolong Pharmaceuticals Co-founder and director of Lumenos Co-founded / financed Candela, Summit Technology, Cambridge Heart, Neuromedical Systems BA Cornell University, MBA Harvard Business School, MD Harvard Medical School

To Engage in Business Combination with

To Engage in Business Combination with 2 Interests of the Parties in the Merger KBL HEALTHCARE ACQUISTION CORP. III (“KBL”) AND PRWT SERVICES, INC. (“PRWT”) ARE HOLDING PRESENTATIONS FOR CERTAIN OF KBL’S STOCKHOLDERS, AS WELL AS

2 Interests of the Parties in the Merger KBL HEALTHCARE ACQUISTION CORP. III (“KBL”) AND PRWT SERVICES, INC. (“PRWT”) ARE HOLDING PRESENTATIONS FOR CERTAIN OF KBL’S STOCKHOLDERS, AS WELL AS 3 Forward-Looking Statements THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS REGARDING KBL’S

3 Forward-Looking Statements THIS PRESENTATION CONTAINS FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS REGARDING KBL’S Executive Summary Transaction Consideration Management and

Executive Summary Transaction Consideration Management and Investment Highlights Uniquely positioned to capture outsized share of pharmaceutical and business services spend 20+ year track record as high-performance minority-supplier with longstanding customer

Investment Highlights Uniquely positioned to capture outsized share of pharmaceutical and business services spend 20+ year track record as high-performance minority-supplier with longstanding customer Company History & Milestones 1988 2008 Acquired 51% of U.S.

Company History & Milestones 1988 2008 Acquired 51% of U.S. 7 One of the Nation’s Fastest Growing Minority-Owned Companies Certified Minority business enterprise (“MBE”) with the

7 One of the Nation’s Fastest Growing Minority-Owned Companies Certified Minority business enterprise (“MBE”) with the Financial Overview REVENUE Cherokee Pharmaceuticals U.S. Facilities BPS EBITDA ($ in millions) ($ in millions) Contingent EBITDA

Financial Overview REVENUE Cherokee Pharmaceuticals U.S. Facilities BPS EBITDA ($ in millions) ($ in millions) Contingent EBITDA  9 Management Willie Johnson, Founder / Chairman 18 years Cmmr, PA Office of Social

9 Management Willie Johnson, Founder / Chairman 18 years Cmmr, PA Office of Social 10 Cherokee Pharmaceuticals (Cherokee) Cherokee Pharmaceuticals facility in Riverside, PA

10 Cherokee Pharmaceuticals (Cherokee) Cherokee Pharmaceuticals facility in Riverside, PA Three factories provide varied API manufacturing capabilities to pursue multiple products (antibiotics,

Three factories provide varied API manufacturing capabilities to pursue multiple products (antibiotics, 12 Cherokee: Specialty Chemicals Distribution Platform In 2Q 2009, PRWT is launching a specialty

12 Cherokee: Specialty Chemicals Distribution Platform In 2Q 2009, PRWT is launching a specialty 13 Cherokee: Keystone Opportunity Zone (“KOZ”) KOZ designated areas are in

13 Cherokee: Keystone Opportunity Zone (“KOZ”) KOZ designated areas are in 14 Cherokee: Growth Strategy Increase API

14 Cherokee: Growth Strategy Increase API U.S. Facilities, Inc. (USF) City of Philadelphia TRIPLEX

U.S. Facilities, Inc. (USF) City of Philadelphia TRIPLEX 16 USF: A Facilities Management Services Provider since 1967 Solid history of performance as the prime contractor – Maintaining over 4 million square feet OPERATIONS MAINTENANCE & REPAIR SUPPORT SERVICES Professional facilities management and maintenance services focusing on complex and highly secure

16 USF: A Facilities Management Services Provider since 1967 Solid history of performance as the prime contractor – Maintaining over 4 million square feet OPERATIONS MAINTENANCE & REPAIR SUPPORT SERVICES Professional facilities management and maintenance services focusing on complex and highly secure USF: Growth Strategy Expand facilities management services to commercial/life sciences customers: Leverage Cherokee success to gain entrance into the life sciences market USF has been awarded its first commercial contract, teamed with Jones Lang Lasalle, a global

USF: Growth Strategy Expand facilities management services to commercial/life sciences customers: Leverage Cherokee success to gain entrance into the life sciences market USF has been awarded its first commercial contract, teamed with Jones Lang Lasalle, a global 18 PRWT Services, Inc. (BPS) Manual toll operations on 4 bridges Over $6 billion enterprise value BPS provider

18 PRWT Services, Inc. (BPS) Manual toll operations on 4 bridges Over $6 billion enterprise value BPS provider 19 BPS: A Leading Provider since 1988 Proven High Volume / High Performance BPS Provider 17 million mail items 3.2 million data entry items 18 million images reviewed $797 million payments processed 3.5 million inbound calls 13 million items scanned $9 million tolls collected MARKETS SERVED SERVICES OFFERED Municipal Services Traffic and parking violation Motor Vehicles Commission EMS services Transportation Services Toll collection Parking management Family and Community Services Child Support Job Placement Taxation Call center Document imaging & capturing Mailroom Lockbox Collection and processing Claims processing Data entry Payment processing Customer service EMS services

19 BPS: A Leading Provider since 1988 Proven High Volume / High Performance BPS Provider 17 million mail items 3.2 million data entry items 18 million images reviewed $797 million payments processed 3.5 million inbound calls 13 million items scanned $9 million tolls collected MARKETS SERVED SERVICES OFFERED Municipal Services Traffic and parking violation Motor Vehicles Commission EMS services Transportation Services Toll collection Parking management Family and Community Services Child Support Job Placement Taxation Call center Document imaging & capturing Mailroom Lockbox Collection and processing Claims processing Data entry Payment processing Customer service EMS services BPS: Growth Strategy Expand BPS services into the commercial market: Current and historic BPS revenues have been generated from state and local government clients Leverage new executives’ proven commercial market subject-matter expertise and experience to

BPS: Growth Strategy Expand BPS services into the commercial market: Current and historic BPS revenues have been generated from state and local government clients Leverage new executives’ proven commercial market subject-matter expertise and experience to Case Study: The PRWT Advantage 21 Global pharmaceutical company put management of all U.S. facilities out for competitive bid PRWT had several competitive advantages: Track record of service excellence at USF and BPS Successful experience managing pharmaceutical operations at Cherokee High level relationships at customer Ability for customer to earn minority spend credit PRWT partnered with Jones Lang Lasalle (“JLL”) on bid JLL chose PRWT as its preferred partner based on the above PRWT / JLL won contract – planned start date June 2009 USF to provide facilities management services BPS to provide mailroom and document services PRWT / JLL partnership positioned to capture future business

Case Study: The PRWT Advantage 21 Global pharmaceutical company put management of all U.S. facilities out for competitive bid PRWT had several competitive advantages: Track record of service excellence at USF and BPS Successful experience managing pharmaceutical operations at Cherokee High level relationships at customer Ability for customer to earn minority spend credit PRWT partnered with Jones Lang Lasalle (“JLL”) on bid JLL chose PRWT as its preferred partner based on the above PRWT / JLL won contract – planned start date June 2009 USF to provide facilities management services BPS to provide mailroom and document services PRWT / JLL partnership positioned to capture future business Conclusion Strategic

Conclusion Strategic 23 Appendix PRWT Services, Inc.

23 Appendix PRWT Services, Inc. 24 Summary Unaudited Pro Forma Combined Balance Sheet (US$ in 000’s) ASSETS Dec-31 2008 Cash and cash equivalents $56,908 Restricted cash 1,645 Trading Securities 9,055 Receivables 16,810 Inventory, net 43,971 Prepaid expenses 1,770 Other short-term assets 806 Total Current Assets $130,965 Property and equipment, net 18,439 Construction in progress 4,406 Goodwill and intangibles 4,324 Other assets 3,391 Total Assets $161,525 LIABILITIES AND EQUITY Dec-31 2008 Line of credit $2,300 Current portion of long-term debt 253 Accounts payable 16,190 Accrued expenses 16,700 Unearned revenue 53,202 Other current liabilities 305 Total Current Liabilities $88,950 Long-term debt, net of current portion 58,972 Deferred income taxes and other 4,837 Total Liabilities $152,759 Minority Interest 2,096 Total stockholders' equity 6,670 Total liabilities and stockholders' deficit $161,525

24 Summary Unaudited Pro Forma Combined Balance Sheet (US$ in 000’s) ASSETS Dec-31 2008 Cash and cash equivalents $56,908 Restricted cash 1,645 Trading Securities 9,055 Receivables 16,810 Inventory, net 43,971 Prepaid expenses 1,770 Other short-term assets 806 Total Current Assets $130,965 Property and equipment, net 18,439 Construction in progress 4,406 Goodwill and intangibles 4,324 Other assets 3,391 Total Assets $161,525 LIABILITIES AND EQUITY Dec-31 2008 Line of credit $2,300 Current portion of long-term debt 253 Accounts payable 16,190 Accrued expenses 16,700 Unearned revenue 53,202 Other current liabilities 305 Total Current Liabilities $88,950 Long-term debt, net of current portion 58,972 Deferred income taxes and other 4,837 Total Liabilities $152,759 Minority Interest 2,096 Total stockholders' equity 6,670 Total liabilities and stockholders' deficit $161,525 25 Summary PRWT Statements of Operations 1. We believe that EBITDA is useful to stockholders as a measure of comparative operating performance, as it is less susceptible to variances in actual performance resulting from

25 Summary PRWT Statements of Operations 1. We believe that EBITDA is useful to stockholders as a measure of comparative operating performance, as it is less susceptible to variances in actual performance resulting from 26 Pro Forma Capitalization at Closing Holder Shares (000) 3 % Common PRWT Shareholders 1 11,950 58.0 KBL Shareholders 2 8,650 42.0 Common Shares 20,600 100.0 1 Does not include contingent payments 2 Includes repurchase of 12,350,000 KBL common shares to be completed concurrent with closing of the transaction 3 Does not include warrants

26 Pro Forma Capitalization at Closing Holder Shares (000) 3 % Common PRWT Shareholders 1 11,950 58.0 KBL Shareholders 2 8,650 42.0 Common Shares 20,600 100.0 1 Does not include contingent payments 2 Includes repurchase of 12,350,000 KBL common shares to be completed concurrent with closing of the transaction 3 Does not include warrants  27 About KBL Healthcare Acquisition Corp. III KBL Healthcare Acquisition Corp. III, a special purpose acquisition company ( “SPAC”), was formed in 2007 solely to

27 About KBL Healthcare Acquisition Corp. III KBL Healthcare Acquisition Corp. III, a special purpose acquisition company ( “SPAC”), was formed in 2007 solely to