CHINA DISCOVERY ACQUISITION CORP.

TOWER C, VAN TONE CENTRE,SUITE 1203, 6 CHAOWAI STREET,

CHAOYANG DISTRICT, BEIJING 100020

PEOPLE’S REPUBLIC OF CHINA

TO THE SHAREHOLDERS OF

CHINA DISCOVERY ACQUISITION CORP.:

You are cordially invited to attend an extraordinary general meeting of shareholders of China Discovery Acquisition Corp. (“China Discovery”) to be held on ____________________, 2009. At the meeting, you will be asked to consider proposals to approve the acquisition by China Discovery of all of the outstanding securities of the parent company of HeNan Smart Food Company Limited, referred to in this proxy statement as HeNan Smart Food, resulting in HeNan Smart Food becoming an indirect wholly owned subsidiary of China Discovery. HeNan Smart Food is a leading producer and distributor of instant noodles in the People’s Republic of China.

The extraordinary general meeting will be held at 10:00 a.m., local time, on ____________________, 2009, at the offices of China Discovery’s counsel, Loeb & Loeb LLP, 345 Park Ave., New York, NY 10154 . At this important meeting, you will be asked to consider and vote upon the following:

| | · | The proposed acquisition by China Discovery of all of the outstanding securities of the parent company of HeNan Smart Food, resulting in HeNan Smart Food becoming an indirect wholly owned subsidiary of China Discovery and the transactions contemplated by the stock purchase agreement, dated as of April 8, 2009 by and among HeNan Smart Food, Fenland Investments Limited, Calendar Profits Limited, Honest Joy Group Limited, Mr. Wang Youli, and China Discovery. This agreement is referred to as the stock purchase agreement and the acquisition of all of the outstanding shares of the parent company of HeNan Smart Food pursuant to the stock purchase agreement as the acquisition. This proposal is referred to as the acquisition proposal; |

| | · | To elect seven (7) directors to the Board of Directors of China Discovery each to serve until his or her term has expired and until his or her successor is duly elected and qualified. This proposal is referred to as the election proposal; |

| | · | Amending China Discovery’s Memorandum and Articles of Association and passing the required resolution to change China Discovery’s corporate name to [Si Mei Te Food Limited] as a special resolution. This proposal is referred to as the name change proposal; |

| | · | Amending China Discovery’s Memorandum and Articles of Association and passing the required resolution to increase the share capital of China Discovery from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 ordinary shares with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share as a special resolution. This proposal is referred to as the increased capital proposal; |

| | · | Amending China Discovery’s Memorandum and Articles of Association as described in this proxy statement as a special resolution. This proposal is referred to as the continuation proposal, and the name change proposal, increased capital proposal and continuation proposal are collectively referred to as the amendment proposals; and |

| | · | The approval of any adjournment or postponement of the extraordinary general meeting for the purpose of soliciting additional proxies. This proposal is referred to as the adjournment proposal. |

Pursuant to China Discovery’s Memorandum and Articles of Association, China Discovery is required to obtain shareholder approval of the acquisition. China Discovery’s initial shareholders have agreed to vote the 1,355,000 ordinary shares of China Discovery owned by them prior to China Discovery’s initial public offering in accordance with the majority of the votes cast by holders of shares sold in China Discovery’s initial public offering. The initial shareholders have agreed not to demand redemption rights with respect to any of their initial shares (nor will they seek appraisal rights with respect to such shares if appraisal rights would be available to them).

In addition, each shareholder (other than China Discovery’s initial shareholders) who votes against the acquisition has the right to concurrently demand that China Discovery redeem his or her shares for cash equal to a pro rata portion of the trust account in which the net proceeds of China Discovery’s initial public offering were deposited. China Discovery will not be permitted to consummate the acquisition if holders of 1,725,000 or more of the shares purchased in China Discovery’s initial public offering (such figure representing 30% of the shares sold in China Discovery’s initial public offering) vote against the acquisition and demand redemption of their shares.

To avoid being required to liquidate, as provided in its charter, China Discovery needs, by June 26, 2009, to consummate a business combination. Under its charter as currently in effect, if China Discovery does not acquire at least majority control of a target business by June 26, 2009, China Discovery will dissolve and distribute to its public shareholders the amount in the trust account plus any remaining net assets. Following dissolution, China Discovery would no longer exist as a corporation. In the event that the acquisition is not consummated, China Discovery will not have sufficient time to complete a different business combination and will dissolve and liquidate.

Upon the closing of the transactions contemplated in the stock purchase agreement, China Discovery will acquire 100% of the issued and outstanding shares of the parent company of HeNan Smart Food in exchange for an aggregate of 14,700,000 China Discovery ordinary shares and $3,000,000, of which 3,000,000 shares to be issued to one of HeNan Smart Food’s ultimate shareholders will be held back and placed in escrow and which may be used to satisfy HeNan Smart Food’s indemnification obligations in the stock purchase agreement. In addition, pursuant to an earn-out provision in the stock purchase agreement, China Discovery has agreed to issue to HeNan Smart Food’s current shareholders, pro rata, additional shares as follows: (i) 1,800,000 shares if the combined company achieves net income of at least $30,000,000 for the fiscal year ending December 31, 2009; (ii) 2,500,000 shares if the combined company achieves net income of at least $40,000,000 for the fiscal year ending December 31, 2010; and (iii) 2,500,000 shares if the combined company achieves net income of at least $52,000,000 for the fiscal year ending December 31, 2011. In the event 75% (4,312,500 warrants) or more of the public warrants are exercised, China Discovery will make a $2,500,000 payment to each of Fenland and Calendar (an aggregate of $5,000,000). Upon consummation of the acquisition, China Discovery will change its name to [Si Mei Te Food Limited].

Immediately after completion of the acquisition, if no shareholder exercises his or her redemption rights, China Discovery’s current shareholders will own approximately 32.6% of China Discovery’s outstanding ordinary shares (assuming no China Discovery warrants are exercised). China Discovery’s public shareholders alone will own approximately 26.4% of the combined company, its initial shareholders, including its officers and directors, will own approximately 6.2% of the combined company, and former HeNan Smart Food shareholders will own approximately 67.4% of the combined company. Following the acquisition, the officers and directors of China Discovery and HeNan Smart Food combined will beneficially own approximately 73.6% of China Discovery’s ordinary shares.

China Discovery’s ordinary shares, warrants and units are quoted on the OTC Bulletin Board under the symbols CADQE, CADWE and CADUE. HeNan Smart Food is a company organized under the laws of the People’s Republic of China. China Discovery expects its securities to continue to be quoted on the OTC Bulletin Board following consummation of the acquisition although the trading symbols will change.

After careful consideration of all relevant factors, China Discovery’s Board of Directors has determined that the foregoing are fair to and in the best interests of China Discovery and its shareholders, and has recommended that you vote or give instruction to vote “FOR” adoption of each of them.

Enclosed is a notice of extraordinary general meeting and proxy statement containing detailed information concerning the acquisition, the other proposals and the meeting. Whether or not you plan to attend the extraordinary general meeting, we urge you to read this material carefully and vote your shares.

I look forward to seeing you at the meeting.

| Sincerely, |

| |

| Li Wen Shi |

| Chairman of the Board |

YOUR VOTE IS IMPORTANT. WHETHER YOU PLAN TO ATTEND THE EXTRAORDINARY GENERAL MEETING OR NOT, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED AS SOON AS POSSIBLE.

CHINA DISCOVERY ACQUISITION CORP.

TOWER C, VAN TONE CENTRE,SUITE 1203, 6 CHAOWAI STREET,

CHAOYANG DISTRICT, BEIJING 100020

PEOPLE’S REPUBLIC OF CHINA

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ____________________, 2009

TO THE SHAREHOLDERS OF

CHINA DISCOVERY ACQUISITION CORP.:

NOTICE IS HEREBY GIVEN that an extraordinary general meeting of shareholders of China Discovery Acquisition Corp., a Cayman Islands company, will be held at 10:00 a.m., local time, on ____________________, 2009, at the offices of China Discovery’s counsel, Loeb & Loeb LLP, 345 Park Ave., New York, NY 10154 to consider and vote upon proposals to approve:

| | · | The proposed acquisition by China Discovery of all of the outstanding securities of the parent company of HeNan Smart Food, resulting in HeNan Smart Food becoming an indirect wholly owned subsidiary of China Discovery and the transactions contemplated by the stock purchase agreement, dated as of April 8, 2009 by and among HeNan Smart Food, Fenland Investments Limited, Calendar Profits Limited, Honest Joy Group Limited, Mr. Wang Youli, and China Discovery. This agreement is referred to as the stock purchase agreement and the acquisition of all of the outstanding shares of the parent company of HeNan Smart Food pursuant to the stock purchase agreement as the acquisition. This proposal is referred to as the acquisition proposal; |

| | · | To elect seven (7) directors to the Board of Directors of China Discovery each to serve until his or her term has expired and until his or her successor is duly elected and qualified. This proposal is referred to as the election proposal; |

| | · | Amending China Discovery’s Memorandum and Articles of Association and passing the required resolution to change China Discovery’s corporate name to [Si Mei Te Food Limited] as a special resolution. This proposal is referred to as the name change proposal; |

| | · | Amending China Discovery’s Memorandum and Articles of Association and passing the required resolution to increase the share capital of China Discovery from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 ordinary shares with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share as a special resolution. This proposal is referred to as the increased capital proposal; |

| | · | Amending China Discovery’s Memorandum and Articles of Association as described in this proxy statement as a special resolution; and |

| | · | The approval of any adjournment or postponement of the extraordinary general meeting for the purpose of soliciting additional proxies. |

Pursuant to China Discovery’s Memorandum and Articles of Association, China Discovery is required to obtain shareholder approval of the acquisition. China Discovery’s initial shareholders have agreed to vote the 1,355,000 ordinary shares of China Discovery owned by them prior to China Discovery’s initial public offering in accordance with the majority of the votes cast by holders of shares sold in China Discovery’s initial public offering. The initial shareholders have agreed not to demand redemption rights with respect to any of their initial shares (nor will they seek appraisal rights with respect to such shares if appraisal rights would be available to them).

The Board of Directors has fixed the record date as the close of business on _____________________, 2009, the date for determining China Discovery shareholders entitled to receive notice of and vote at the extraordinary general meeting and any adjournment thereof. Only holders of record of China Discovery ordinary shares on that date are entitled to have their votes counted at the extraordinary general meeting or any adjournment. These proxy materials are first being mailed to China Discovery’s shareholders on or about _____________________, 2009.

Your vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the extraordinary general meeting. If you are a shareholder of record, you may also cast your vote in person at the extraordinary general meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your vote in person at the extraordinary general meeting by obtaining a legal proxy from your brokerage firm or bank. Your failure to vote or instruct your broker or bank how to vote will have the same effect as voting against the acquisition proposal and will have no effect on the vote to approve the proposals to amend China Discovery’s Memorandum and Articles of Association, regarding the election of directors, or regarding the adjournment .

After careful consideration of all relevant factors, China Discovery’s Board of Directors has determined that the foregoing proposals are fair to and in the best interests of China Discovery and its shareholders, and has recommended that you vote or give instruction to vote “FOR” adoption of each of them.

Dated: _____________________, 2009

| By Order of the Board of Directors, |

| |

| Li Wen Shi |

| Chairman of the Board |

TABLE OF CONTENTS

| Summary of The Material Terms of The Acquisition | | | 1 | |

| | | | | |

| Questions and Answers About The Acquisition and The China Discovery Extraordinary General Meeting | | | 2 | |

| | | | | |

| Summary | | | 7 | |

| | | | | |

| Risk Factors | | | 14 | |

| | | | | |

| Price Range of Securities and Dividends | | | 32 | |

| | | | | |

| The China Discovery Extraordinary General Meeting | | | 34 | |

| | | | | |

| Proposal to Acquire HeNan Smart Food | | | 39 | |

| | | | | |

| Material United States Federal Income Tax Considerations | | | 47 | |

| | | | | |

| Proposal to Elect Directors | | | 54 | |

| | | | | |

| Proposal to Change Name to [Si Mei Te Food Limited] | | | 55 | |

| | | | | |

| Proposal to Increase Share Capital | | | 56 | |

| | | | | |

| Proposal to Amend China Discovery’s Memorandum and Articles of Association to Remove Certain Provisions That Are No Longer Applicable to China Discovery | | | 57 | |

| | | | | |

| Proposal to Adjourn or Postpone The Extraordinary General Meeting for the Purpose of Soliciting Additional Proxies | | | 58 | |

| | | | | |

| Information About HeNan Smart Food | | | 59 | |

| | | | | |

| HeNan Smart Food Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 72 | |

| | | | | |

| Information About China Discovery | | | 79 | |

| | | | | |

| China Discovery Management’s Discussion And Analysis or Plan of Operations | | | 82 | |

| | | | | |

| Unaudited Pro Forma Condensed Combined Financial Statements | | | 84 | |

| | | | | |

| Management, Corporate Governance and Compensation | | | 92 | |

| | | | | |

| Certain Relationships and Related Transactions | | | 100 | |

| | | | | |

| Beneficial Ownership of Securities | | | 104 | |

| Shares Eligible For Future Sale | | | 107 | |

| | | | | |

| China Discovery’s Securities | | | 109 | |

| | | | | |

| Shareholder Proposals | | | 114 | |

| | | | | |

| Delivery of Documents to Shareholders | | | 114 | |

| | | | | |

| Where You Can Find More Information | | | 114 | |

| | | | | |

| Index To Financial Statements | | | F-1 | |

Annexes

| A | - | Amended and Restated Memorandum and Articles of Association for China Discovery |

| | | |

| B | - | Stock purchase agreement |

| | | |

| C | - | Opinion of Jingtian & Gongcheng issued in connection with the restructuring |

If you would like additional copies of this proxy, or if you have questions about the acquisition, you should contact:

Karen Smith

Advantage Proxy

24925 13th Place South

Des Moines, Washington 98198

206-870-8565

To obtain timely delivery of requested materials, security holders must request the information no later than five business days before the date they submit their proxies or attend the extraordinary general meeting. The latest date to request the information to be received timely is _____________________, 2009.

SUMMARY OF THE MATERIAL TERMS OF THE ACQUISITION

This Proxy relates to the acquisition by China Discovery of all of the outstanding securities of the parent company of HeNan Smart Food, referred to in this proxy statement as HeNan Smart Food, resulting in HeNan Smart Food becoming an indirect wholly owned subsidiary of China Discovery. The most material terms of the acquisition are as follows:

| | · | China Discovery is a blank check company formed for the purpose of acquiring, through a stock exchange, asset acquisition or other similar business combination, an operating business, or control of such operating business, through contractual arrangements, that has its principal operations located in the People’s Republic of China. HeNan Smart Food is a leading producer and distributor of instant noodles in the People’s Republic of China. See the sections entitled “Information about China Discovery” and “Information about HeNan Smart Food.” |

| | · | China Discovery will acquire all the outstanding equity securities of the parent company of HeNan Smart Food. |

| | · | The consummation of the transaction is subject to certain conditions including the approval of the transaction by China Discovery’s shareholders and holders of fewer than 1,725,000 of China Discovery’s public shares exercising certain redemption rights they possess. See the sections entitled “The China Discovery Extraordinary General Meeting” and “Proposal to Acquire HeNan Smart Food.” |

| | · | Upon the closing of the transactions contemplated in the stock purchase agreement, China Discovery will acquire 100% of the issued and outstanding shares of the parent company of HeNan Smart Food in exchange for an aggregate of 14,700,000 China Discovery ordinary shares and $3,000,000, of which 3,000,000 shares to be issued to one of HeNan Smart Food’s ultimate shareholders will be held back and placed in escrow and which may be used to satisfy HeNan Smart Food’s indemnification obligations in the stock purchase agreement. |

| | · | Pursuant to an earn-out provision in the stock purchase agreement, China Discovery has agreed to issue to HeNan Smart Food’s current shareholders, pro rata, additional shares as follows: (i) 1,800,000 shares if the combined company achieves net income of at least $30,000,000 for the fiscal year ending December 31, 2009; (ii) 2,500,000 shares if the combined company achieves net income of at least $40,000,000 for the fiscal year ending December 31, 2010; and (iii) 2,500,000 shares if the combined company achieves net income of at least $52,000,000 for the fiscal year ending December 31, 2011. |

| | · | In the event 75% (4,312,500 warrants) or more of the public warrants are exercised, China Discovery will make a $2,500,000 payment to two of HeNan Smart Food’s ultimate shareholders (an aggregate of $5,000,000). |

| | · | Upon consummation of the acquisition, China Discovery will change its name to [Si Mei Te Food Limited]. |

| | · | It is a requirement that any business acquired by China Discovery have a fair market value equal to at least 80% of China Discovery’s net assets at the time of acquisition, which assets shall include the amount in the trust account. Based on the financial analysis of Smart Food generally used to approve the transaction, China Discovery’s Board of Directors determined that this requirement was met and exceeded. See the section entitled “Proposal to Acquire HeNan Smart Food—Satisfaction of 80% Test.” |

| | · | All current China Discovery shareholders together will own approximately 32.6% of the post-acquisition company, a reduction in percentage ownership of 67.4%. Current holders of China Discovery’s publicly traded ordinary shares will own approximately 26.4%, a reduction in their percentage ownership of approximately 54.5%. |

QUESTIONS AND ANSWERS ABOUT THE ACQUISITION

AND THE CHINA DISCOVERY EXTRAORDINARY GENERAL MEETING

These questions and answers are only summaries of the matters they discuss. Please read this entire proxy statement.

| Q. | What is being voted on? | | A. You are being asked to vote on six proposals: · The proposed acquisition by China Discovery of all of the outstanding securities of the parent company of HeNan Smart Food, resulting in HeNan Smart Food becoming an indirect wholly owned subsidiary of China Discovery and the transactions contemplated by the stock purchase agreement, dated as of April 8, 2009 by and among HeNan Smart Food, Fenland Investments Limited, Calendar Profits Limited, Honest Joy Group Limited, Mr. Wang Youli, and China Discovery. This agreement is referred to as the stock purchase agreement and the acquisition of all of the outstanding shares of the parent company of HeNan Smart Food pursuant to the stock purchase agreement as the acquisition. This proposal is referred to as the acquisition proposal; · To elect seven (7) directors to the Board of Directors of China Discovery each to serve until his or her term has expired and until his or her successor is duly elected and qualified. This proposal is referred to as the election proposal; · Amending China Discovery’s Memorandum and Articles of Association and passing the required resolution to change China Discovery’s corporate name to [Si Mei Te Food Limited] as a special resolution. This proposal is referred to as the name change proposal; · Amending China Discovery’s Memorandum and Articles of Association and passing the required resolution to increase the share capital of China Discovery from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 ordinary shares with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share as a special resolution. This proposal is referred to as the increased capital proposal; · Amending China Discovery’s Memorandum and Articles of Association as described in this proxy statement as a special resolution; and · The approval of any adjournment or postponement of the extraordinary general meeting for the purpose of soliciting additional proxies. Pursuant to China Discovery’s Memorandum and Articles of Association, China Discovery is required to obtain shareholder approval of the acquisition of HeNan Smart Food. |

| | | | |

| Q. | Why is China Discovery proposing to elect seven (7) directors to its Board of Directors? | | A. China Discovery is proposing to elect seven (7) members to its Board of Directors in connection with the acquisition as provided in the stock purchase agreement. |

| Q | Why is China Discovery proposing to amend its Memorandum and Articles of Association? | | A. China Discovery is proposing to amend its Memorandum and Articles of Association at the time of the acquisition to (1) change China Discovery’s corporate name to [Si Mei Te Food Limited], (2) increase the share capital of China Discovery from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 ordinary shares with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 and (3) revise the Memorandum and Articles of Association to remove certain provisions that are no longer applicable to China Discovery as specified on page 57. These changes will permit China Discovery to issue the shares necessary to consummate the acquisition and reflect that China Discovery would then be an operating company. |

| | | | |

| Q. | Why is China Discovery proposing to approve any adjournment or postponement of the extraordinary general meeting? | | A. China Discovery is proposing to approve any adjournment or postponement of the extraordinary general meeting so that it may delay the meeting in the event that it appears that the other proposals to be presented at the meeting will not be approved. This will provide China Discovery’s management and proxy solicitor more time to solicit shareholders to vote or change their votes. |

| | | | |

| Q. | Are any proposals conditioned on the approval of the other proposals? | | A. The proposals relating to the amendment of China Discovery’s Memorandum and Articles of Association and the election of directors will not be effected, even if approved, if the proposal relating to the acquisition of HeNan Smart Food is not approved. No other proposal is conditioned on the approval of any other proposal. |

| | | | |

| Q. | How do the China Discovery insiders intend to vote their shares? | | A. China Discovery’s initial shareholders have agreed to vote the 1,355,000 ordinary shares of China Discovery owned by them prior to China Discovery’s initial public offering in accordance with the majority of the votes cast by holders of shares sold in China Discovery’s initial public offering. The initial shareholders have agreed not to demand redemption rights with respect to any of their initial shares (nor will they seek appraisal rights with respect to such shares if appraisal rights would be available to them). |

| | | | |

| Q. | What vote is required to approve the acquisition? | | A. Under China Discovery’s Memorandum and Articles of Association, approval of the acquisition requires the affirmative vote of holders of a majority of China Discovery’s outstanding ordinary shares which are present and entitled to vote at the meeting. However, if the holders of 1,725,000 or more shares purchased in China Discovery’s initial public offering (public shareholders owning 30% or more of the ordinary shares sold in China Discovery’s initial public offering) vote against the acquisition and demand that China Discovery redeem their shares into pro rata portions of the trust account established at the time of the initial public offering (as described below), China Discovery will not be permitted to consummate the acquisition pursuant to its Memorandum and Articles of Association. |

| | | | As noted above, all of China Discovery’s founding shareholders, including all of its officers and directors, have agreed to vote their respective 1,355,000 initial shares in accordance with the majority of the ordinary shares voted by the public shareholders. As a result, if a majority of the ordinary shares voted by the public shareholders are voted in favor of the proposed acquisition of HeNan Smart Food, China Discovery’s founding shareholders, including all of its officers and directors, will vote all of their 1,355,000 initial shares in favor of such proposed acquisition. This voting arrangement does not apply to shares included in shares purchased in China Discovery’s initial public offering or purchased following China Discovery’s initial public offering in the aftermarket by any of China Discovery’s founding shareholders, officers and directors. Accordingly, they may vote those shares on a business combination any way they choose. China Discovery’s founding shareholders have agreed not to demand redemption rights with respect to any of their initial shares (nor will they seek appraisal rights with respect to such shares if appraisal rights would be available to them). |

| Q. | What vote is required to adopt the amendments to the Memorandum and Articles of Association and to change China Discovery’s name? | | A. Approval of the amendments to the Memorandum and Articles of Association will require the affirmative vote of the holders of two-thirds of the outstanding ordinary shares cast by the shareholders at the extraordinary general meeting, provided that there is a quorum. However, proposals relating to the amendment of China Discovery’s Memorandum and Articles of Association will not be effected, even if approved by shareholders in such manner, unless the acquisition proposal with HeNan Smart Food is also approved and consummated. |

| | | | |

| Q | What vote is required to elect the directors? | | A. The election of each director will require the affirmative vote of the holders of a majority of the outstanding ordinary shares cast by the shareholders at the extraordinary general meeting, provided that there is a quorum. However, the new directors will not be appointed and qualified as directors, even if approved by shareholders in such manner, unless the acquisition proposal with HeNan Smart Food is also approved and consummated. |

| | | | |

| Q | Who will manage China Discovery and HeNan Smart Food? | | A. Following the acquisition, the current members of the management of HeNan Smart Food will remain in place and China Discovery’s current management team will resign. |

| | | | |

| Q. | How much of China Discovery will its current shareholders own following the acquisition? | | A. Based on the consideration to be paid to the shareholders of HeNan Smart Food, if no China Discovery shareholders demand to redeem their shares into a pro rata portion of the IPO trust account, China Discovery’s pre-acquisition holders of ordinary shares will own in the aggregate approximately 32.6% (holders of shares purchased in China Discovery’s initial public offering will own approximately 26.4%) of China Discovery’s post-acquisition ordinary shares. |

| | | | |

Q. | How much dilution will China Discovery shareholders experience? | | A. There are 7,105,000 China Discovery ordinary shares currently outstanding, 5,750,000 (approximately 81%) of which are trading publicly. Up to 14,700,000 shares will be issued for the acquisition of HeNan Smart Food. Therefore, all current China Discovery shareholders together will own approximately 32.6% of the post-acquisition company, a reduction in percentage ownership of 67.4%. Current holders of China Discovery’s publicly traded ordinary shares will own approximately 26.4%, a reduction in their percentage ownership of approximately 54.5%. In addition, pursuant to an earn-out provision in the stock purchase agreement, China Discovery has agreed to issue to HeNan Smart Food’s current shareholders, pro rata, additional shares as follows: (i) 1,800,000 shares if the combined company achieves net income of at least $30,000,000 for the fiscal year ending December 31, 2009; (ii) 2,500,000 shares if the combined company achieves net income of at least $40,000,000 for the fiscal year ending December 31, 2010; and (iii) 2,500,000 shares if the combined company achieves net income of at least $52,000,000 for the fiscal year ending December 31, 2011. |

| | | | |

| Q. | Do China Discovery shareholders have redemption rights? | | A. If you hold ordinary shares purchased in China Discovery’s initial public offering and you vote against the acquisition, you will have the right to demand that China Discovery redeem your shares into a pro rata portion of the trust account. |

| Q | If I have redemption rights, how do I exercise them? | | A. If you wish to exercise your redemption rights, you must vote against the acquisition and at the same time demand that China Discovery redeem your shares for cash. If, notwithstanding your vote, the acquisition is completed, you will be entitled to receive a pro rata portion of the trust account, including any interest earned thereon until two business days prior to the consummation of the transaction (net of taxes payable). As of March 31, 2009, the amount in trust was approximately $33,678,745. Based on that number, a person exercising his or her redemption rights would be entitled to receive approximately $5.86 per share. You will be entitled to receive this cash only if you continue to hold your shares through the closing of the acquisition and tender your share certificate(s) per the instructions included on the proxy card. In connection with tendering your shares for conversion, you must elect either to physically tender your stock certificates to the Company’s transfer agent prior to the special meeting or to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, which election would likely be determined based on the manner in which you hold your shares. The requirement for physical or electronic delivery prior to the special meeting ensures that a converting holder’s election to convert is irrevocable once the proposal is approved. Upon redemption of your shares, you will no longer own them. You must follow the instructions on the proxy card and send your share certificate(s) with your proxy card in order to exercise your redemption rights. |

| | | | |

| Q. | Do China Discovery shareholders have dissenter or appraisal rights under Cayman Islands law? | | A. No. |

| | | | |

| Q. | What happens following the acquisition to the funds deposited in the trust account? | | A. China Discovery shareholders exercising redemption rights will receive their pro rata portions of the trust account. The balance of the funds in the account will be used to pay the deferred underwriter compensation or be retained by China Discovery for operating capital subsequent to the closing of the acquisition. |

| Q. | What happens if the acquisition is not consummated? | | A. In the event that the acquisition is not consummated, China Discovery will not have sufficient time to complete a different business combination and will dissolve and liquidate. To avoid being required to liquidate, as provided in its charter, China Discovery needs, by June 26, 2009, to consummate a business combination. Under its charter as currently in effect, if China Discovery does not acquire at least majority control of a target business by June 26, 2009, China Discovery will dissolve and distribute to its public shareholders the amount in the trust account plus any remaining net assets. Following dissolution, China Discovery would no longer exist as a corporation. In any liquidation, the funds then held in the trust account, together with any remaining out-of-trust net assets, will be distributed pro rata to China Discovery’s ordinary shareholders who hold shares issued in China Discovery’s initial public offering (other than the initial shareholders, each of whom has waived any right to any liquidation distribution with respect to their initial shares and the shares included within the insider units). See the risk factor on page 14 of this proxy statement relating to risks associated with the dissolution of China Discovery. |

| | | | |

| Q. | When do you expect the acquisition to be completed? | | A. If the acquisition is approved at the extraordinary general meeting, China Discovery expects to consummate the acquisition promptly thereafter. |

| Q. | If I am not going to attend the extraordinary general meeting in person, should I return my proxy card instead? | | A. Yes. After carefully reading and considering the information in this document, please fill out and sign your proxy card. Then return it in the return envelope as soon as possible, so that your shares may be represented at the extraordinary general meeting. A properly executed proxy will be counted for the purpose of determining the existence of a quorum. |

| | | | |

| Q. | What will happen if I abstain from voting or fail to vote? | | A. Abstaining from voting or not voting on the acquisition proposal, either in person or by proxy or voting instruction, will have the same effect as a vote against such proposal since the vote to approve the acquisition proposal requires affirmative vote of holders of a majority of China Discovery’s outstanding ordinary shares issued in the initial public offering which are present and entitled to vote at the meeting. Broker non-votes will have no effect on the vote to approve the acquisition. Abstaining from voting or not voting on the proposals to amend China Discovery’s Memorandum and Articles of Association, the election of directors and the adjournment proposal (including broker non-votes), either in person or by proxy or voting instruction, will have no effect on the vote to approve each such proposal since the vote to approve each of these proposals requires affirmative vote of the holders of a majority or two-thirds of the outstanding ordinary shares cast by the shareholders at the extraordinary general meeting, provided that there is a quorum. An abstention will not count toward the 30% “against and redeeming” vote that would result in the acquisition’s abandonment, and you would be unable to exercise any redemption rights upon approval of the acquisition. If the proposal relating to the acquisition is not approved, China Discovery will not consummate the acquisition of HeNan Smart Food, and not go forward with the amendments to China Discovery’s Memorandum and Articles of Association and the election of directors. To demand redemption, you must vote against the acquisition and elect to redeem your shares. |

| Q. | How do I change my vote? | | A. Send a later-dated, signed proxy card to China Discovery’s secretary prior to the date of the extraordinary general meeting or attend the extraordinary general meeting in person and vote. You also may revoke your proxy by sending a notice of revocation to Beatrice Hom, China Discovery Acquisition Corp., Tower C, Van Tone Centre, Suite 1203, 6 Chaowai Street, Chaoyang District, Beijing 100020, People’s Republic Of China. |

| | | | |

| Q. | If my shares are held in “street name,” will my broker automatically vote them for me? | | A. No. Your broker can vote your shares only if you provide instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how to provide these instructions. |

| | | | |

| Q. | Who can help answer my questions? | | A. If you have questions, you may write or call China Discovery’s proxy solicitor Advantage Proxy, 24925 13th Place South, Des Moines, Washington 98198, 206-870-8565, Attention: Karen Smith. |

| | | | |

| Q. | Where will the extraordinary general meeting be held? | | A. The meeting will be held at the offices of China Discovery’s counsel, Loeb & Loeb LLP, 345 Park Ave., New York, NY 10154 . |

SUMMARY

This section summarizes information related to the proposals to be voted on at the extraordinary general meeting and to the consideration to be offered to the HeNan Smart Food shareholders. These items are described in greater detail elsewhere in this proxy statement. You should carefully read this entire proxy statement and the other documents to which it refers you.

The Companies

China Discovery Acquisition Corp.

China Discovery is a Cayman Islands company organized on October 16, 2007 as a blank check company for the purpose of acquiring, through a stock exchange, asset acquisition or other similar business combination, an operating business, or control of such operating business, through contractual arrangements, that has its principal operations located in the People’s Republic of China.

China Discovery’s initial business combination must be with a target business or businesses with a collective fair market value of at least equal to 80% of its net assets (excluding any funds held in the trust account for the benefit of the underwriters) at the time of such acquisition. If China Discovery is unable to consummate a business combination within the allotted time periods set forth in its initial public offering prospectus, China Discovery will implement a plan of dissolution and distribution which will include the liquidation of the trust account to China Discovery’s public shareholders.

The mailing address of China Discovery’s principal executive office is Tower C, Van Tone Centre, Suite 1203, 6 Chaowai Street, Chaoyang District, Beijing 100020, People’s Republic of China, and its telephone number is (86) 106214-3561.

HeNan Smart Food

HeNan Smart Food is a leading producer and distributor of instant noodles in the People’s Republic of China.

The mailing address of HeNan Smart Food’s principal executive offices is No. 322 Zhongshan East Road, Shijiazhuang, Hebei Province, 050011, People’s Republic of China, and its telephone number is (86)311 83827688.

The Acquisition

On April 8, 2009, HeNan Smart Food, Fenland Investments Limited, Calendar Profits Limited, Honest Joy Group Limited, Mr. Wang Youli, and China Discovery entered into a stock purchase agreement pursuant to which China Discovery would acquire all of the outstanding ordinary shares of the parent company of HeNan Smart Food, and HeNan Smart Food would become China Discovery’s wholly owned subsidiary. Upon the closing of the transactions contemplated in the stock purchase agreement, China Discovery will acquire 100% of the issued and outstanding shares of the parent company of HeNan Smart Food in exchange for an aggregate of 14,700,000 China Discovery ordinary shares and $3,000,000, of which 3,000,000 shares to be issued to one of HeNan Smart Food’s ultimate shareholders will be held back and placed in escrow and which may be used to satisfy HeNan Smart Food’s indemnification obligations in the stock purchase agreement. In addition, pursuant to an earn-out provision in the stock purchase agreement, China Discovery has agreed to issue to HeNan Smart Food’s current shareholders, pro rata, additional shares as follows: (i) 1,800,000 shares if the combined company achieves net income of at least $30,000,000 for the fiscal year ending December 31, 2009; (ii) 2,500,000 shares if the combined company achieves net income of at least $40,000,000 for the fiscal year ending December 31, 2010; and (iii) 2,500,000 shares if the combined company achieves net income of at least $52,000,000 for the fiscal year ending December 31, 2011. In the event 75% (4,312,500 warrants) or more of the public warrants are exercised, China Discovery will make a $2,500,000 payment to two of HeNan Smart Food’s ultimate shareholders (an aggregate of $5,000,000). If the name change proposal is approved, upon consummation of the acquisition, China Discovery will change its name to [Si Mei Te Food Limited].

Procedure

Under China Discovery’s Memorandum and Articles of Association, a majority of the China Discovery ordinary shares issued in China Discovery’s initial public offering must approve the proposed acquisition. However, notwithstanding adoption of the acquisition proposal, the acquisition will only proceed if public shareholders owning less than 30% of the total ordinary shares sold in China Discovery’s initial public offering exercise their redemption rights and vote against the proposed acquisition. If holders of ordinary shares purchased in China Discovery’s initial public offering owning 30% or more of the ordinary shares sold in China Discovery’s initial public offering vote against the proposed acquisition and elect to exercise their redemption rights, China Discovery’s Board of Directors will abandon the acquisition, notwithstanding approval of a majority of its shareholders. If the maximum permissible number of shares elect redemption without China Discovery being required to abandon the acquisition, as of March 31, 2009, a total of approximately $10.1 million of the trust account would be disbursed, leaving approximately $23.6 million available for the acquisition of HeNan Smart Food and the payment of liabilities. Promptly after obtaining approval from China Discovery’s shareholders to proceed with the acquisition, China Discovery and HeNan Smart Food will consummate the acquisition. Each public shareholder has the right to vote against the proposed acquisition and elect to redeem his, her or its shares for their pro rata portion of the trust account.

In connection with the initial public offering, Beatrice Hom, Michael Hsu, Wing Yip, Vincent Shen and Xiong Yin have contractually agreed with us that they will be severally liable (on a pro rata basis relative to the number of initial shares owned by them prior to the completion of this offering) to ensure that the proceeds in the trust account are not reduced by the claims of target businesses or claims of vendors or other entities that are owed money by us for services rendered or contracted for or products sold to China Discovery. This obligation remains in effect and extends to transaction expenses to be incurred in connection with China Discovery’s seeking to complete the acquisition. Since these obligations were not collateralized or guaranteed, however, China Discovery cannot assure you that Beatrice Hom, Michael Hsu, Wing Yip, Vincent Shen and Xiong Yin would be able to satisfy these obligations if material liabilities are sought to be satisfied from the trust account. As of April 30, 2009, China Discovery believes that Beatrice Hom, Michael Hsu, Wing Yip, Vincent Shen and Xiong Yin do not have any risk of being required to provide indemnification since all persons who have had contractual obligations with China Discovery have either been paid in full (or will be paid in accordance with China Discovery’s past practices) or waived their ability to sue China Discovery’s trust account.

Satisfaction of the 80% Test

According to the agreements China Discovery entered into in connection with its initial public offering, China Discovery’s initial target business or businesses in the aggregate must have a fair market value, as determined by its board of directors, equal to at least 80% of China Discovery’s net assets at the time of the business combination. The fair market value of HeNan Smart Food was calculated by China Discovery’s management team to be $171,842,729, which represents 729% of our net assets as of December 31, 2008, which were $23.6 million.

China Discovery determined the enterprise value of HeNan Smart Food by comparing it to three public companies which were similar to HeNan Smart Food. These companies were selected because they are producers of instant noodles that distribute their products in China and are direct competitors of HeNan Smart Food. Although instant noodles are the main product offering for each of these companies all are larger and have a wider product offering than HeNan Smart Food. In addition, these companies’ products tend to target a higher or lower price point that HeNan Smart Food’s products. Two of the companies are listed on the Hong Kong Stock Exchange and one is on the Toronto Stock Exchange. China Discovery used the median of the following ratios and applied the ratio to HeNan Smart Food in order to determine its enterprise value: Enterprise Value/Revenue and Enterprise Value/EBITDA. In each case, the median of the ratio was less than the average and the results of such calculations were discounted by 10% due to the illiquidity of HeNan Smart Food’s securities. The average and median of each of the ratios for the year ended December 31, 2008 (which were calculated using estimated financial results for the year ended December 31, 2008 and the respective closing prices of their common equity as of April 1, 2009) are as follows:

| | | | | | |

| EV/R | | | 0.76 | | | | 0.99 | |

| EV/EBITDA | | | 8.0 | | | | 8.2 | |

HeNan Smart Food’s revenue for the year ended December 31, 2008 was $175,387,248, and its EBITDA was $32,722,878. Therefore, based on the median ratios specified above, the average enterprise value was determined to be $171,842,729, as further detailed in the following table:

| | | | | | | | | |

| EV/R | | $ | 133,294,308 | | | $ | 13,329,431 | | | $ | 119,964,877 | |

| EV/EBITDA | | $ | 261,783,024 | | | $ | 26,178,302 | | | $ | 235,604,722 | |

If the Acquisition is Not Approved

In the event that the acquisition is not consummated, China Discovery will not have sufficient time to complete a different business combination and will dissolve and liquidate. To avoid being required to liquidate, as provided in its charter, China Discovery needs, by June 26, 2009, to consummate a business combination. Under its charter as currently in effect, if China Discovery does not acquire at least majority control of a target business by June 26, 2009, China Discovery will dissolve and distribute to its public shareholders the amount in the trust account plus any remaining net assets. Following dissolution, China Discovery would no longer exist as a corporation.

Conditions; Termination .. Approval of the acquisition of HeNan Smart Food by a majority of the outstanding China Discovery ordinary shares is a condition to China Discovery’s consummating the acquisition. The holders of China Discovery ordinary shares issued prior to its initial public offering agreed to vote the 1,355,000 China Discovery ordinary shares owned by them in accordance with the majority of the votes cast by holders of shares sold in China Discovery’s initial public offering; this represents 20% of China Discovery’s outstanding ordinary shares. If holders of 1,725,000 or more of the shares purchased in China Discovery’s initial public offering (which number represents 30% or more of the China Discovery ordinary shares issued in China Discovery’s initial public offering) vote against the acquisition and exercise their right to redeem their shares for cash, the acquisition may not be consummated.

Amendments to the Memorandum and Articles of Association . The China Discovery Board of Directors has also determined that it is in China Discovery’s best interests to amend its Memorandum and Articles of Association (i) to change its name to HeNan Smart Food Limited], (ii) to increase the share capital of China Discovery from 26,000,000 shares to 101,000,000 shares consisting of 100,000,000 ordinary shares with a par value of $0.0001 per share and 1,000,000 shares of preferred stock with a par value of $0.0001 per share and (iii) to delete certain provisions which are no longer applicable once a business combination is consummated and which are not typical for a public company (a more complete description of the amendments can be found on page 57).

Election of Directors. The Board of Directors has nominated the following seven (7) persons for election to the Board of Directors at the Special Meeting: Wang Youli, Meng Feiyou, Francois Da Pan Shih, Ngan Man Kit, Cheng Yixue, Wang Huaijing and Wang Youing. See biographical information for each of the nominees in the section entitled “Directors and Management.”

The Stock purchase agreement and Related Documents . The stock purchase agreement, the form of the proposed Amended and Restated Memorandum and Articles of Association, are annexed to this proxy statement. We encourage you to read them in their entirety, as they are the key legal documents underlying the acquisition. They are also described in detail elsewhere in this document. The stock purchase agreement, which is attached as Annex C in this proxy statement, is incorporated by reference into this proxy statement.

Management .. Following the acquisition, the current members of the management of HeNan Smart Food will remain in place and China Discovery’s current management team will resign.

China Discovery Extraordinary General Meeting

Date, Time and Place . The extraordinary general meeting of China Discovery’s shareholders will be held at 10:00 a.m., local time, on ____________________ , 2009, at the offices of China Discovery’s counsel, Loeb & Loeb LLP, 345 Park Ave., New York, NY 10154.

Voting Power; Record Date .. You will be entitled to vote or direct votes to be cast at the extraordinary general meeting, if you owned China Discovery ordinary shares at the close of business on _____________________, 2009, the record date for the extraordinary general meeting. You will have one vote for each ordinary share of China Discovery you owned at that time. Warrants to purchase China Discovery ordinary shares do not have voting rights.

Votes Required .. Under China Discovery’s Memorandum and Articles of Association, approval of the acquisition requires the affirmative vote of holders of a majority of China Discovery’s outstanding ordinary shares issued in the initial public offering which are present and entitled to vote at the meeting. Approval of the amendments to the Amended and Restated Memorandum and Articles of Association will require the affirmative vote of the holders of two-thirds of the outstanding ordinary shares cast by the shareholders at the extraordinary general meeting, provided that there is a quorum. The election of each director will require the affirmative vote of the holders of a majority of the outstanding ordinary shares cast by the shareholders at the extraordinary general meeting, provided that there is a quorum.

China Discovery will not be authorized to complete the acquisition if holders of 1,725,000 or more China Discovery ordinary shares sold in its initial public offering (public shareholders owning 30% or more of the shares in the initial public offering) vote against the acquisition and demand that China Discovery redeem their shares into pro rata portions of the trust account. In addition, the amendments to China Discovery’s Memorandum and Articles of Association and the election of directors will not be effected, even if approved by shareholders, unless the acquisition proposal with HeNan Smart Food is also approved and consummated.

Abstaining from voting or not voting on the acquisition proposal, either in person or by proxy or voting instruction, will have the same effect as a vote against such proposal since the vote to approve the acquisition proposal requires affirmative vote of holders of a majority of China Discovery’s outstanding ordinary shares issued in the initial public offering which are present and entitled to vote at the meeting. Broker non-votes will have no effect on the vote to approve the acquisition. Abstaining from voting or not voting on the proposals, will have no effect on the vote to approve each such proposal since the vote to approve each of these proposals requires the affirmative vote of the holders of either two-thirds or a majority of the outstanding ordinary shares cast by the shareholders at the extraordinary general meeting, provided that there is a quorum. An abstention will not count toward the 30% “against and redeeming” vote that would result in the acquisition’s abandonment, and you would be unable to exercise any redemption rights upon approval of the acquisition. If the proposal relating to the acquisition is not approved, China Discovery will not consummate the acquisition of HeNan Smart Food, and not go forward with the amendments to China Discovery’s Memorandum and Articles of Association and the election of directors. To demand redemption, you must vote against the acquisition and elect to redeem your shares.

Under Cayman Islands law, no other business may be transacted at the extraordinary general meeting.

At the close of business on _____________________, 2009, there were 7,105,000 ordinary shares of China Discovery outstanding (including the 1,355,000 shares held by shareholders not purchased in China Discovery’s initial public offering). Each China Discovery ordinary share entitles its holder to cast one vote per proposal.

Redemption Rights .. Under its Memorandum and Articles of Association, a holder of China Discovery ordinary shares (other than an initial shareholder) who votes against the acquisition may demand that China Discovery redeem his or her shares for cash, but such shareholder will only receive the redemption amount if the acquisition is subsequently consummated. This demand must be made in writing at the same time the shareholder votes against the acquisition, on the form of proxy card voted against the acquisition. If you so demand, and the acquisition is approved and consummated, China Discovery will redeem your shares into a pro rata portion of the trust account, net of taxes payable, as of two business days prior to the consummation of the acquisition. You will be entitled to receive this cash only if you continue to hold your shares through the closing of the acquisition and tender your share certificate(s) per the instructions included on the proxy card. In connection with tendering your shares for conversion, you must elect either to physically tender your stock certificates to the Company’s transfer agent prior to the special meeting or to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, which election would likely be determined based on the manner in which you hold your shares. The requirement for physical or electronic delivery prior to the special meeting ensures that a converting holder’s election to convert is irrevocable once the proposal is approved. Upon redemption of your shares, you will no longer own them. You must follow the instructions on the proxy card and send your share certificate(s) with your proxy card in order to exercise your redemption rights.

The acquisition will not be consummated if holders of 1,725,000 or more ordinary shares of China Discovery sold in its initial public offering (which number represents 30% or more of the shares sold in the initial public offering) vote against the acquisition and exercise their redemption rights.

To avoid being required to liquidate, as provided in its charter, China Discovery needs, by June 26, 2009, to consummate a business combination. Under its charter as currently in effect, if China Discovery does not acquire at least majority control of a target business by June 26, 2009, China Discovery will dissolve and distribute to its public shareholders the amount in the trust account plus any remaining net assets. Following dissolution, China Discovery would no longer exist as a corporation. In the event that the acquisition is not consummated, China Discovery will not have sufficient time to complete a different business combination and will dissolve and liquidate.

Appraisal Rights. Under the law of the Cayman Islands, appraisal rights are not available to China Discovery’s shareholders in connection with the acquisition.

Proxies; Board Solicitation .. Your proxy is being solicited by the China Discovery Board of Directors on each proposal being presented to shareholders at the extraordinary general meeting. Proxies may be solicited in person or by mail, telephone or other electronic means. In addition, China Discovery has hired Advantage Proxy to assist it in soliciting proxies for the meeting of shareholders. China Discovery is paying Advantage Proxy approximately $15,000 for its services.

If you grant a proxy, you may still vote your shares in person, if you revoke your proxy before the extraordinary general meeting.

Significant Shareholdings. The holdings of China Discovery’s directors and significant shareholders are detailed in “Beneficial Ownership of Securities.”

China Discovery’s Recommendation; Interests of China Discovery’s Management

After careful consideration, China Discovery’s Board of Directors has determined that the acquisition and the other proposals presented at this meeting are fair to, and in the best interests of, China Discovery and its shareholders. The Board of Directors has approved and declared advisable the proposals, and recommends that you vote or direct that your vote to be cast “FOR” the adoption of each.

When you consider the recommendation of the Board of Directors, you should keep in mind that the members of the Board of Directors have interests in the acquisition that are different from, or in addition to, yours. These interests include the following:

| | · | If the proposed acquisition is not completed, and China Discovery is subsequently required to liquidate, the shares owned by China Discovery’s directors will be worthless because the shares will no longer have any value and the directors are not entitled to liquidation distributions from China Discovery. |

| | · | In connection with China Discovery’s initial public offering, China Discovery’s officers and directors, agreed to indemnify China Discovery for debts and obligations to potential target businesses or other persons for services rendered or contracted for or products sold to China Discovery, but only to the extent necessary to ensure that certain liabilities do not reduce funds in the trust account. If the acquisition is consummated, China Discovery’s officers and directors will not have to perform such obligation. If the acquisition is not consummated, however, China Discovery’s officers and directors could potentially be liable for any claims against the trust account by vendors who did not sign waivers. As of April 30, 2009, China Discovery believes that China Discovery’s officers and directors do not have any risk of being required to provide indemnification since all persons who have had contractual obligations with China Discovery have either been paid in full (or will be paid in accordance with China Discovery’s past practices) or waived their ability to sue China Discovery’s trust account. |

| | · | All rights of China Discovery’s officers and directors to be indemnified by China Discovery, and of China Discovery’s directors to be exculpated from monetary liability with respect to prior acts or omissions, will continue after the acquisition pursuant to provisions in China Discovery’s Memorandum and Articles of Association. However, if the acquisition is not approved and China Discovery subsequently liquidates, its ability to perform its obligations under those provisions will be substantially impaired since it will cease to exist. If the acquisition is ultimately completed, the combined company’s ability to perform such obligations will be substantially enhanced. |

Certain U.S. Federal Income Tax Consequences

For a discussion of certain U.S. federal income tax consequences of the acquisition and of owning and disposing of ordinary shares and warrants in China Discovery after the acquisition, see “Material United States Federal Income Tax Considerations,” below.

Quotation/Listing

China Discovery’s ordinary shares (CADQE), warrants (CADWE) and units (CADUE) are quoted on the OTC Bulletin Board. China Discovery expects to continue trading on the OTCBB following the acquisition, though the trading symbols may change.

Anticipated Accounting Treatment

The Business Combination will be accounted for as a “reverse acquisition” since, immediately following completion of the transaction, the shareholders of HeNan Smart Food immediately prior to the Business Combination will have effective control of China Discovery through (1) their approximately 67.4% shareholder interest in the combined entity, assuming no share redemptions (73.8% in the event of maximum share redemptions), (2) majority representation on the Board of Directors (initially 5 out of seven members), and (3) being named to all of the senior executive positions. For accounting purposes, HeNan Smart Food will be deemed to be the accounting acquirer in the transaction and, consequently, the transaction will be treated as a recapitalization of HeNan Smart Food, i.e., a capital transaction involving the issuance of stock by China Discovery for the stock of HeNan Smart Food. Accordingly, the combined assets, liabilities and results of operations of HeNan Smart Food will become the historical financial statements of China Discovery at the closing of the transaction, and China Discovery’s assets (primarily cash and cash equivalents), liabilities and results of operations will be consolidated with HeNan Smart Food beginning on the acquisition date. No step-up in basis or intangible assets or goodwill will be recorded in this transaction. As this transaction is being accounted for as a reverse acquisition, all direct costs of the transaction will be charged to additional paid-in capital.

Regulatory Matters

The acquisition and related transactions are not subject to any federal or state regulatory requirement or approval, including the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act).

RISK FACTORS

You should carefully consider the following risk factors, together with all of the other information included in this proxy statement, before you decide whether to vote or direct your vote to be cast to approve the acquisition.

Risks related to HeNan Smart Food and its Business

HeNan Smart Food may not be able to anticipate changes in consumer preferences, which may result in decreased demand for its instant noodle products.

HeNan Smart Food’s success depends in part on its ability to anticipate the tastes and dietary habits of consumers and to offer products that appeal to their preferences. Consumer preferences change and HeNan smart Food’s failure to anticipate, identify or react to these changes could result in reduced demand for its products, which would, in turn, cause its sales volume, revenue and operating income to suffer. HeNan Smart Food may be unable to introduce new products that are in faster-growing and more profitable categories or reduce its production of the products in the categories experiencing declining consumption. To the extent HeNan Smart Foods is unable to execute its strategy of continuously improving its portfolio of products and satisfying consumers’ changing preferences, its sales volume, revenue and operating income may not, accordingly, achieve its financial targets, which may have a material adverse effect on its financial condition and results of operations.

Price increases for the commodities that HeNan Smart Food uses for raw materials and packaging could adversely affect its profitability.

Most of the raw materials and packaging used in HeNan Smart Food’s instant noodle businesses are commodities that may experience price volatility caused by external conditions, commodity market fluctuations, currency fluctuations and changes in governmental agricultural programs. Unexpected commodity price increases may result in increases in raw material and packaging costs, and HeNan Smart Food may not be able to increase its product prices to offset these increased costs without suffering reduced sales volume, revenue and operating income. Raw material cost (including packaging cost) constituted approximately 92% of the total cost of sales relating to HeNan Smart Food’s instant noodle products in the year ended December 31, 2008. Any significant increase in the cost of raw materials which HeNan Smart Foods is unable to pass on to consumers could have a material adverse affect on its margins and overall profitability. During the three years ended December 31, 2006, 2007 and 2008, costs of certain HeNan’s major raw materials, particularly palm oil used to produce its instant noodle products, fluctuated significantly. Historically, HeNan Smart Food has not hedged against changes in commodity prices, and it does not intend to enter into such hedges in the future. See “Financial Information – Factors affecting HeNan Smart Food results of operation – Cost of raw materials” for a discussion on the historical price volatility of HeNan Smart Food‘s raw materials and packaging.

HeNan Smart Food may not be able to effectively manage its rapid expansion.

HeNan Smart Food has expanded its market reach within the PRC in recent years, and it expects to continue its expansion in terms of geography, customers and products on offer. To manage HeNan Smart Food’s growth, it must continue to improve its managerial, technical and operational capabilities and implement an effective management information system. HeNan Smart Food’s expansion strategy may require additional funding either through internal or external sources. There can be no assurance that any future expansion plans will not adversely affect HeNan Smart Food’s existing operations, since the execution of expansion plans often involves challenges. For example, HeNan Smart Food may need to deal with issues such as capacity constraints, upgrading or expanding existing facilities and training an increasing number of personnel to manage and operate those facilities. Such challenges could make it difficult to implement HeNan Smart Food’s expansion plans successfully or in a timely manner, which could, among other things, adversely affect its ability to manage the company, satisfy customer demands and maintain product quality, resulting in an adverse impact on its profitability.

HeNan Smart Food business is seasonal.

HeNan Smart Food experiences seasonal fluctuations in its revenue and operating income for its instant noodle products. HeNan Smart Food generally records higher turnover for its instant noodle products is generally higher during the autumn and winter months than during the spring and summer months. The seasonal nature of HeNan Smart Food’s products causes specific production lines to operate at levels approaching full capacity during certain times of year and at far less than full capacity at others, as the production lines for a particular product segment cannot be converted into production lines for another product segment. As a result of these fluctuations, sales and operating results for any particular period will not necessarily be indicative of our results for the full year or future periods. The seasonal nature of HeNan Smart Food’s products also affects the cash flows available to it. Any seasonal fluctuations reported in the future may not match the expectations of investors, which could cause the trading price of the combined company’s shares to fluctuate.

Our intellectual property rights could be challenged.

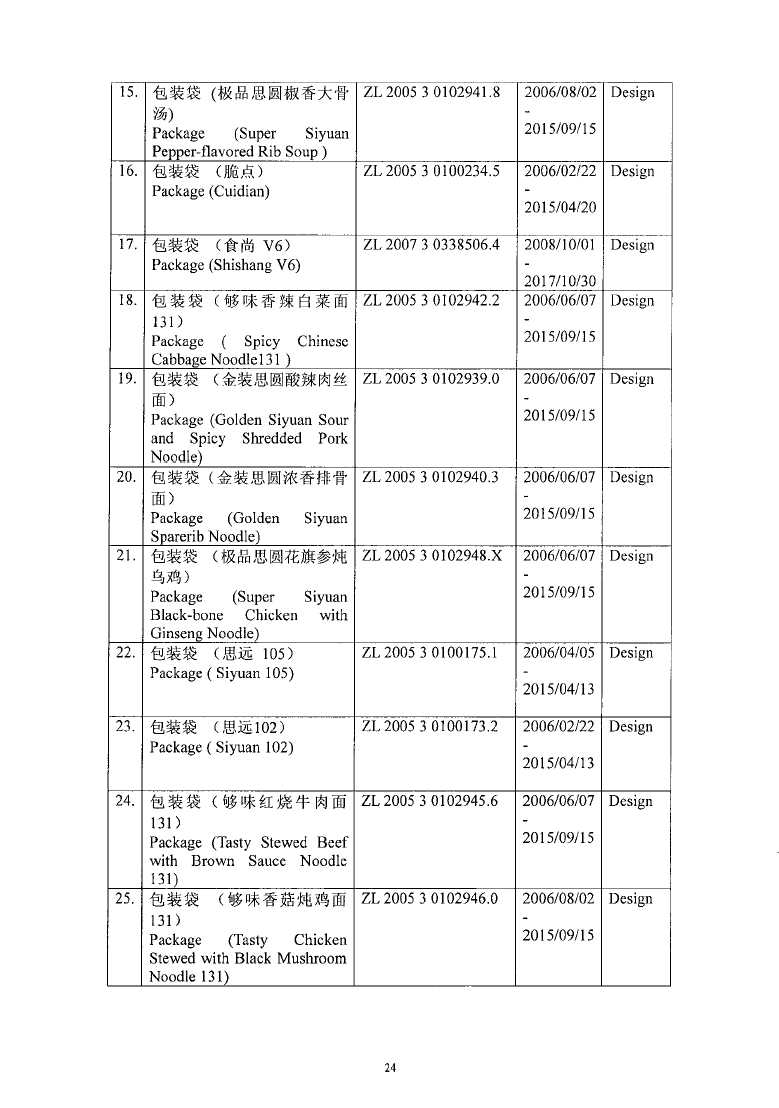

As of March 31, 2009, HeNan Smart Food had registered 26 patents and 22 trademarks in the PRC. Please see the sections headed “Business – Intellectual Property” below for further details on the intellectual property rights HeNan Smart Food owns. While HeNan Smart Food intends to enforce the trademarks it owns or licenses against infringement, there can be no assurance that its actions to establish and protect its trademarks are adequate to prevent imitation of its products by others or to prevent others from seeking to block sales of its products which they claim violate their trademarks and proprietary rights. If a competitor were to infringe on trademarks held by HeNan Smart Food, enforcing its rights would likely be costly and would divert funds and resources that could otherwise be used to operate its business. There can be no assurance that HeNan Smart Food would be successful in enforcing its intellectual property rights. If HeNan Smart Food is not successful in enforcing such rights, there may be a material adverse effect to its business.

HeNan Smart Food’s new products may not be successful.

HeNan Smart Food continues to seek opportunities to leverage its strong brand and existing distribution network to develop new products. HeNan Smart Food has in the past launched new products from time to time. HeNan Smart Food cannot assure you its new products will attract sufficient consumer demand or gain sufficient market share to be profitable. Failure to recover development, production and marketing costs of unsuccessful new products could adversely affect HeNan Smart Food’s overall profitability.

HeNan Smart Food depends on independent third party and related party suppliers to provide it with packaging materials for its products.

All of the packaging material used in the manufacture of HeNan Smart Food’s instant noodle products are supplied by independent third-party or related party suppliers. In the event these independent third-party or related party suppliers fail to continue to supply or cannot meet HeNan Smart Food’s demand for such packaging materials, or it is unable in the future to reach agreement upon reasonable terms with them in relation to such continued supply, HeNan Smart Food may be unable to find a comparable substitute supplier of packaging materials, which may lead to delays in the delivery of its products to customers. Such delays may affect HeNan Smart Food’s results of operations.

If HeNan Smart Foods products become adulterated or misbranded, it would need to recall those items and may experience product liability claims if consumers are harmed as a result.

HeNan Smart Food sells food products for human consumption, which involves risks such as product contamination or spoilage, product tampering and other adulteration. HeNan Smart Food may need to recall some of its products if they become adulterated or misbranded. A widespread product recall may cause HeNan Smart Food’s products to be unavailable for a period of time. HeNan Smart Food may also be subject to product liability claims if the consumption of its products causes injury or illness. A widespread recall or a significant product liability claim against HeNan Smart Food may cause customers to lose confidence in its food products which could affect its reputation and result in a material adverse effect on its business.

The occurrence of such problems could also result in serious damage to HeNan Smart Food’s brand and reputation. Adverse publicity, whether or not valid, could discourage consumers from buying HeNan Smart Food’s products, as a result of which its sales could materially decline, which would have an adverse impact on HeNan Smart Food’s profitability.

The interests of Mr. Wang Youli, who will continue to be HeNan Smart Food’s ultimate controlling shareholder, may differ from those of its other shareholders.

HeNan Smart Food will continue to be controlled by Mr. Wang Youli after the acquisition. Wang Youli will beneficially own approximately 56.9% of HeNan Smart Food’s outstanding shares, assuming no existing shareholders elect to exercise their redemption rights, and approximately 65.8%, if the maximum number of existing shareholders (30% of the shares issued in the IPO) execerise their redemption rights in connection with the acquisition, immediately following the consummation of the acquisition. Accordingly, Mr. Wang Youli will be able to influence HeNan Smart Food’s major policy decisions, including its overall strategic and investment decisions, dividend plans, issuances of securities and adjustments to its capital structure, and it will be able to control the election of its directors and, in turn, indirectly control the selection of its senior management in ways that may conflict with the best interests of HeNan Smart Food’s other shareholders.

If HeNan Smart Food fails to maintain effective internal controls, then its business, financial results and reputation could be materially and adversely affected.

In preparation for the acquisition, HeNan Smart Food has implemented various measures to improve its internal controls. HeNan Smart Food intends to continue to monitor and enhance, and take further steps to improve, its internal controls in the future. Upon completion of the acquisition, due to its limited experience with the internal control measures that it has recently implemented, HeNan Smart Food cannot assure you that all such measures taken to improve its internal controls will be effective or that material deficiencies in its internal controls will not be discovered in the future. HeNan Smart Food’s efforts to improve its internal controls have required, and in the future may require, increased costs and significant management time and commitment. If HeNan Smart Food fails to maintain effective internal controls in the future, then its business, financial results and reputation may be materially and adversely affected.

Pricing of HeNan Smart Food’s products may be subject to PRC Government intervention.

HeNan Smart Food is generally free to determine the pricing of its products and the PRC Government does not set any guidance or requirement on how it prices its products. However, the PRC Government has expressed concern with price-collusion between manufacturers of the types of products HeNan Smart Food’s manufacture and sell. For example, on August 16, 2007, the National Development and Reform Commission, or NDRC, issued a public notice (the “Notice”) in relation to its findings on possible price-collusion involving the International Ramen Manufacturers Association (China Branch) (“Noodle Association”) and certain manufacturers of instant noodles in the PRC. In the Notice, which was prompted by a general increase of instant noodle prices in July 2007, the NDRC made it clear that (i) price-collusion or price-fixing amongst manufacturers is prohibited; (ii) the Noodle Association and certain manufacturers had breached a number of PRC anti-unfair competition regulations; and (iii) investigations into this matter would continue and any violations would be dealt with in accordance with applicable law.